Exhibit 99.2

Pro Forma Financials Presentation Reflecting the Acquisition of OneWest Bank October 16, 2015

2 Disclaimer This Presentation contains forward - looking statements within the meaning of applicable federal securities laws with respect to the re cent acquisition of IMB Holdco LLC and its subsidiaries (“ OneWest ”), OneWest’s future performance, the costs to be incurred in connection with the acquisition, integration with CIT, and the impact of the transaction on CIT’s future performance . Forward - looking statements are based upon our current expectations and assumptions concerning future events, which are subject t o a number of risks and uncertainties that could cause actual results to differ materially from those anticipated. The words “expect,” “anticipate,” “estimate,” “f ore cast,” “initiative,” “objective,” “plan,” “goal,” “project,” “outlook,” “priorities,” “target,” “intend,” “evaluate,” “pursue,” “commence,” “seek,” “may,” “would,” “could,” “s hou ld,” “believe,” “potential,” “continue,” or the negative of any of those words or similar expressions is intended to identify forward - looking statements. All statements contained in thi s Presentation, other than statements of historical fact, including without limitation, statements about our plans, strategies, prospects and expectations regarding f utu re events and our financial performance, are forward - looking statements that involve certain risks and uncertainties. While these statements represent our current judgment o n what the future may hold, and we believe these judgments are reasonable, these statements are not guarantees of any events or financial results, and our actual result s m ay differ materially . In addition, forward - looking statements in this Presentation are subject to certain risks and uncertainties related both to the acquisition transaction itself and to the integration of the acquired business with CIT after closing, including difficulty and delays in integrating OneWest with CIT or fully realizing projected cost savings and other projected benefits of the transaction; business disruption following the transaction; the inability to sustain revenue and earnings gro wth ; changes in general economic conditions, including changes in interest rates and capital markets; changes in law or regulations; diversion of management time on trans act ion - related issues; reputational risks and the reaction of customers and counterparties to the transaction; and changes in asset quality and risk as a result of the transac tio n . This Presentation contains unaudited pro forma condensed combined financial information, which is a summary of the unaudited pro forma condensed combined financial information contained in Exhibit 99.1 to CIT’s Form 8 - K/A filed October 16, 2015 with the Securities and Exchange Commission. Th e unaudited pro forma condensed combined financial information is provided for informational purposes only and is not necessarily, and should not be assumed to be, an indication of the results that would have been achieved had the acquisition of OneWest been completed as of the dates indicated or that may be achieved in the future. The preparation of the unaudited pro forma condensed combined financial information and related adjustments required management to make certain assumptions and es tim ates. The unaudited pro forma condensed combined financial information should be read together with : ▪ The accompanying notes to the unaudited pro forma condensed combined financial information; ▪ CIT’s audited consolidated financial statements at and for the years ended December 31, 2014 and 2013, included in CIT’s Annu al Report on Form 10 - K for the year ended December 31, 2014; ▪ CIT's unaudited consolidated financial statements at and for the three and six months ended June 30, 2015, included in CIT's Qua rterly Report on Form 10 - Q for the quarter ended June 30, 2015; ▪ the audited consolidated financial statements of IMB HoldCo LLC and Subsidiaries at and for the years ended December 31, 2014 and 2013, which are attached as Exhibit 99.2 to CIT’s Form 8 - K/A filed October 16, 2015; and ▪ the unaudited condensed consolidated financial statements of IMB HoldCo LLC and Subsidiaries at and for the quarters and six months ended June 30, 2015 and 2014, which are attached as Exhibit 99.3 to CIT’s Form 8 - K/A filed October 16, 2015 . The actual amounts recorded may differ materially from the information presented in this pro forma condensed combined statement of operations as a result of : ▪ the methodology required to be used to prepare the pro forma financial statements; and ▪ revenue enhancements and/or expense savings achieved by the combined company . We describe other risks that are applicable to our businesses generally that could affect our results in Item 1A, “Risk Facto rs, ” of our latest Annual Report on Form 10 - K for the year ended December 31, 2014, which was filed with the Securities and Exchange Commission. Accordingly, you should not pl ace undue reliance on the forward - looking statements contained in this Presentation. These forward - looking statements speak only as of the date on which the statements we re made. CIT undertakes no obligation to update publicly or otherwise revise any forward - looking statements, except where expressly required by law.

3 Summary ▪ The unaudited pro forma financial statements are required by the SEC to illustrate the estimated effects of the acquisition of OneWest without consideration of any strategic actions the Company may take or any change in market conditions at the time of the acquisition ▪ Adjustments are estimates and are further described in the 8 - K/A filed on October 16, 2015 ▪ The unaudited pro forma balance sheet as of June 30, 2015 assumes the acquisition of OneWest occurred on June 30, 2015 ▪ Actual combination adjustments will be as of the August 3, 2015 closing date ▪ The unaudited pro forma statement of operations for the fiscal year ended December 31, 2014 and the six month period ended June 30, 2015 assumes the transaction occurred on January 1, 2014 ▪ Purchase accounting adjustments are based on preliminary fair value marks and applied to assets and liabilities during the applicable period ▪ Actual purchase accounting impacts as of August 3, 2015 will be provided with the third quarter earnings release ▪ Per page seven of the 2Q ‘14 earnings presentation, we have updated the 2016 projected adjustment to OneWest’s earnings from the purchase accounting marks and it is estimated to be slightly positive in 2016 (1) ▪ Net accretion and other impacts to the financial statements will differ over time (1) Adjustment are based on the analysis of the purchase accounting impact, including CIT’s modeling of the expected run - off of assets and liabilities as well as other impacts expected to continue as a result of the combination

4 Pro Forma Summary of Adjustments Pro Forma Balance Sheet ▪ CIT Adjustments ▪ Cash and equity disbursed for the acquisition of OneWest . Assumes actual share price of CIT stock issued at $47.04 per share ▪ Reversed $690 million of the valuation allowance on the net DTA ▪ Accrued estimated remaining transaction costs of $60 million ▪ Recorded fair value of expected payment on holdback of $61 million ▪ OneWest Adjustments ▪ Assets and liabilities recorded at fair value based on estimated values as of closing date and applied to the June 30, 2015 pro forma balance sheet resulting in net discount of $374 million ▪ Established intangibles primarily related to core deposits, customer relationships and trade name of $184 million ▪ Goodwill of $617 million based on excess of purchase price (reflecting the actual stock price at closing of $ 47.04) over fair value of assets and liabilities Pro Forma Income Statements ▪ Purchase accounting adjustments and continuing impacts: ▪ For loans and indemnification assets accounted for by OneWest under the fair value method, removed fair value adjustments and recorded accretion based on assumed CIT purchase accounting marks and accounting policies ▪ Removed mark - to - market impact from derivatives unwound prior to closing ▪ For assets and liabilities accounted for by OneWest under the accrual method, recorded net accretion based on CIT’s purchase accounting marks (including amortization of intangibles) ▪ Increased provision for loan losses from change in accounting policy and other purchase accounting adjustments ▪ Recorded increase in FDIC insurance expense on OneWest’s deposits to reflect the go - forward assessment rate ▪ Assumed 40% effective tax rate (‘ETR’) on purchase accounting and on - going adjustments ▪ Other adjustments: ▪ Eliminated transaction costs included in OneWest’s and CIT’s results during the period ▪ Removed impact of CIT’s valuation allowance reversal in 2014 ▪ Adjusted for discrete tax items and ~40% ETR on fair value and other combination adjustments resulting in an assumed combined ETR of ~33%

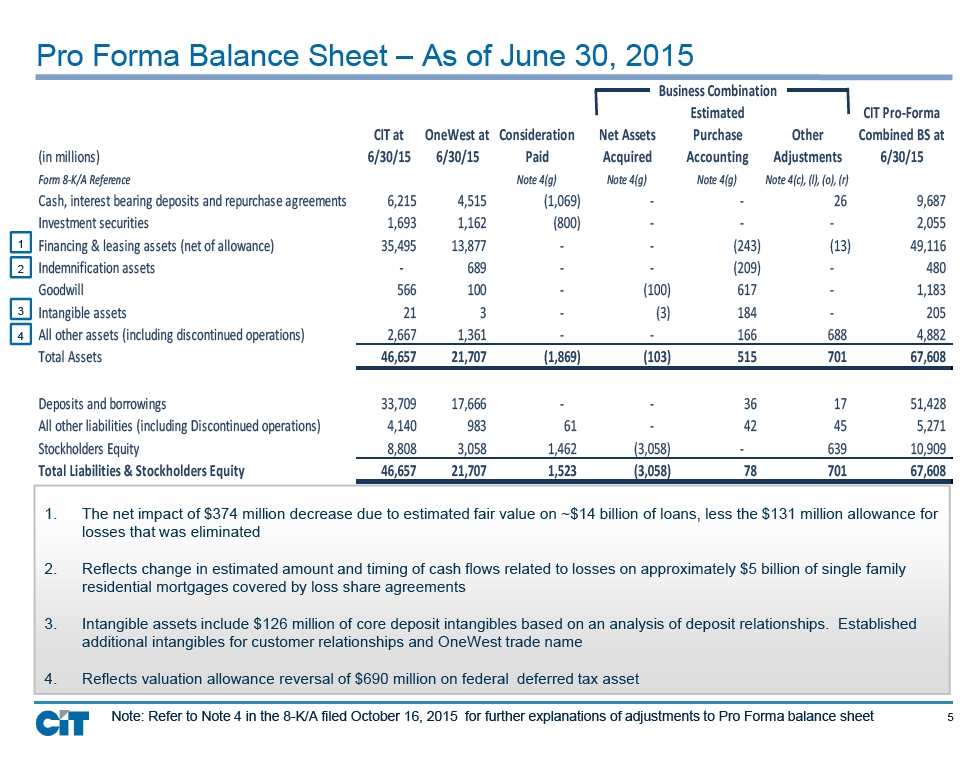

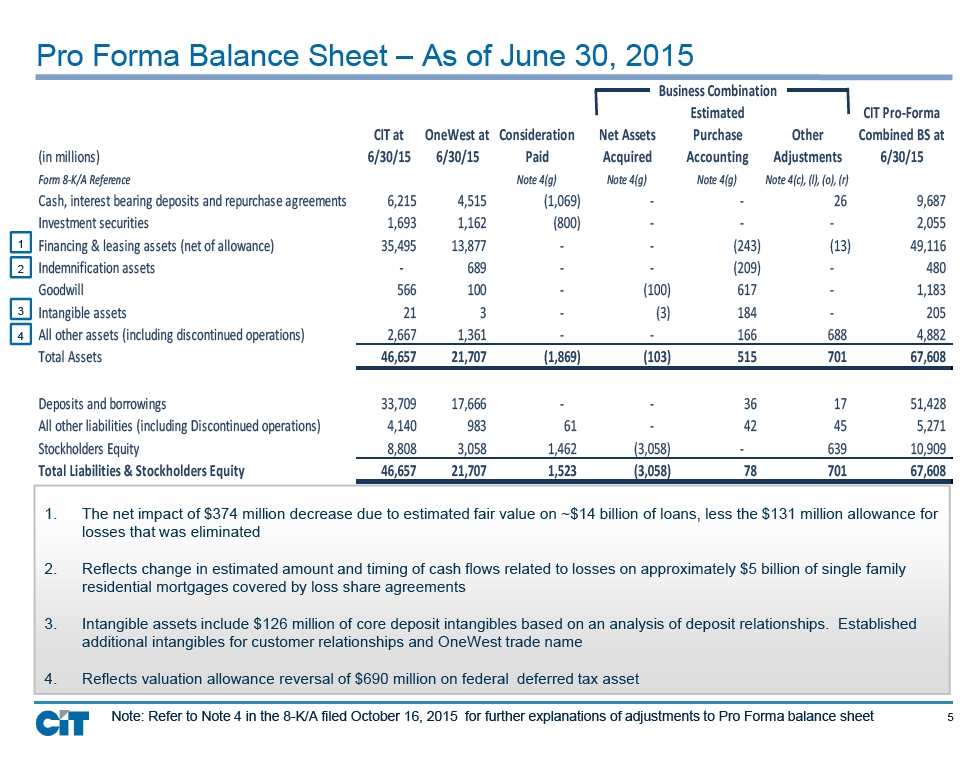

5 Pro Forma Balance Sheet – As of June 30, 2015 1. The net impact of $374 million decrease due to estimated fair value on ~$14 billion of loans, less the $131 million allowance fo r losses that was eliminated 2. Reflects change in estimated amount and timing of cash flows related to losses on approximately $ 5 billion of single family residential mortgages covered by loss share agreements 3. Intangible assets include $126 million of core deposit intangibles based on an analysis of deposit relationships. Establishe d additional intangibles for customer relationships and OneWest trade name 4. Reflects valuation allowance reversal of $690 million on federal deferred tax asset 1 2 3 4 Note: Refer to Note 4 in the 8 - K/A filed October 16, 2015 for further explanations of adjustments to Pro Forma balance sheet Business Combination (in millions) CIT at 6/30/15 OneWest at 6/30/15 Consideration Paid Net Assets Acquired Estimated Purchase Accounting Other Adjustments CIT Pro-Forma Combined BS at 6/30/15 Form 8-K/A Reference Note 4(g) Note 4(g) Note 4(g) Note 4(c), (l), (o), (r) Cash, interest bearing deposits and repurchase agreements 6,215 4,515 (1,069) - - 26 9,687 Investment securities 1,693 1,162 (800) - - - 2,055 Financing & leasing assets (net of allowance) 35,495 13,877 - - (243) (13) 49,116 Indemnification assets - 689 - - (209) - 480 Goodwill 566 100 - (100) 617 - 1,183 Intangible assets 21 3 - (3) 184 - 205 All other assets (including discontinued operations) 2,667 1,361 - - 166 688 4,882 Total Assets 46,657 21,707 (1,869) (103) 515 701 67,608 Deposits and borrowings 33,709 17,666 - - 36 17 51,428 All other liabilities (including Discontinued operations) 4,140 983 61 - 42 45 5,271 Stockholders Equity 8,808 3,058 1,462 (3,058) - 639 10,909 Total Liabilities & Stockholders Equity 46,657 21,707 1,523 (3,058) 78 701 67,608

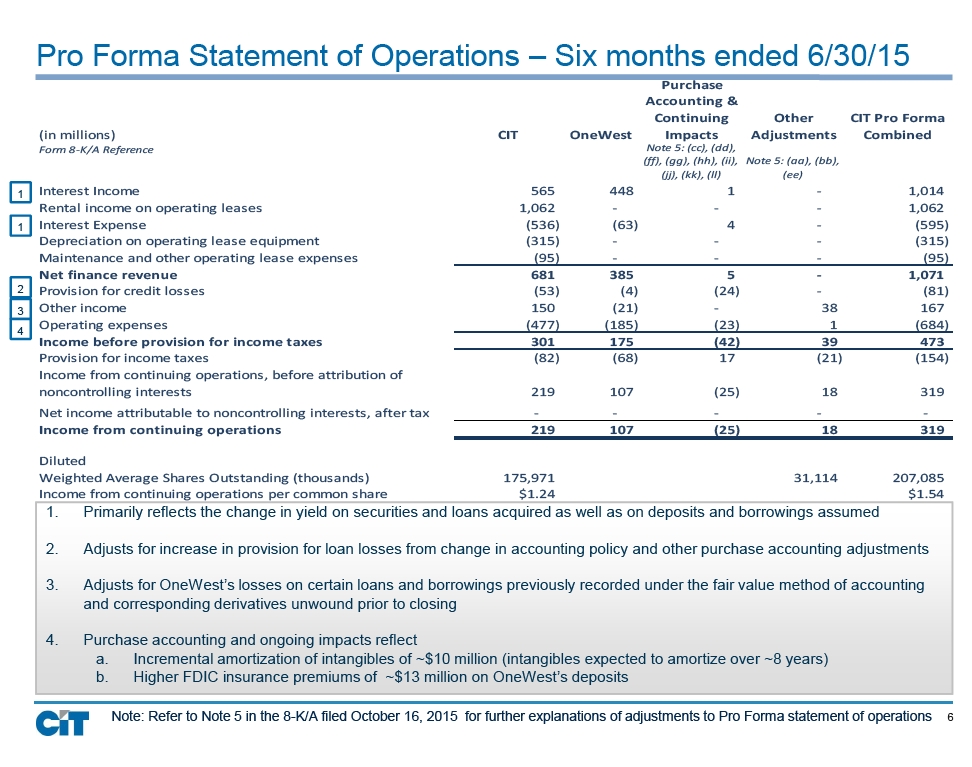

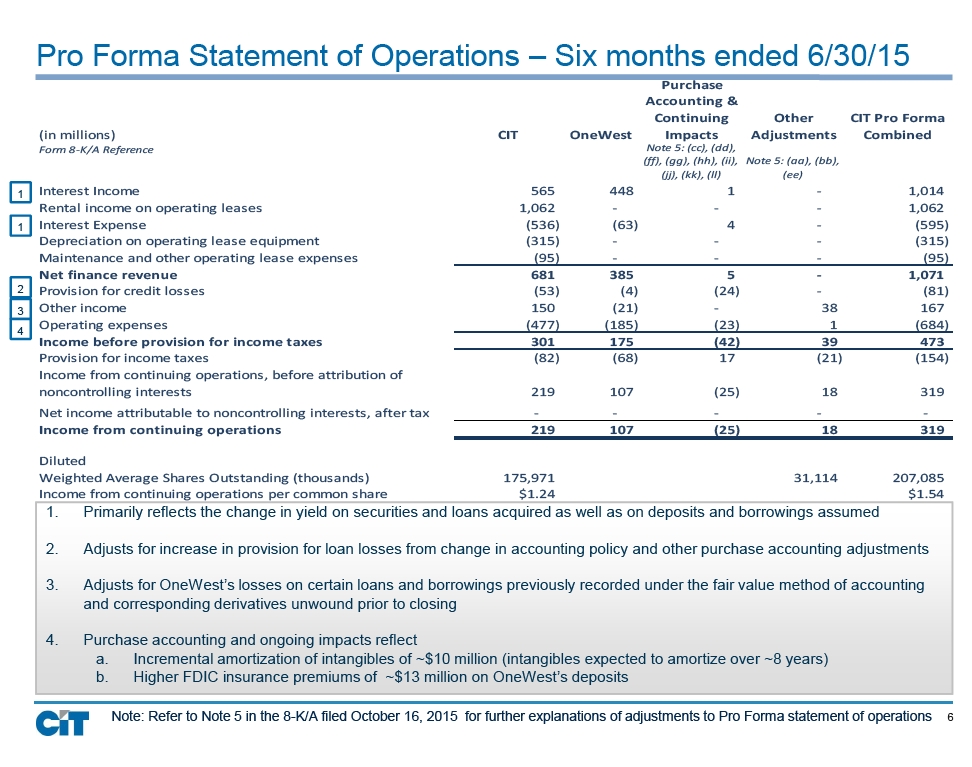

6 Pro Forma Statement of Operations – Six months ended 6/30/15 1. Primarily reflects the change in yield on securities and loans acquired as well as on deposits and borrowings assumed 2. Adjusts for increase in provision for loan losses from change in accounting policy and other purchase accounting adjustments 3. Adjusts for OneWest’s losses on certain loans and borrowings previously recorded under the fair value method of accounting and corresponding derivatives unwound prior to closing 4. Purchase accounting and ongoing impacts reflect a. Incremental amortization of intangibles of ~$10 million (intangibles expected to amortize over ~8 years) b. Higher FDIC insurance premiums of ~$ 13 million on OneWest’s deposits 2 3 Note: Refer to Note 5 in the 8 - K/A filed October 16, 2015 for further explanations of adjustments to Pro Forma statement of ope rations 1 1 4 (in millions) CIT OneWest Purchase Accounting & Continuing Impacts Other Adjustments CIT Pro Forma Combined Form 8-K/A Reference Note 5: (cc), (dd), (ff), (gg), (hh), (ii), (jj), (kk), (ll) Note 5: (aa), (bb), (ee) Interest Income 565 448 1 - 1,014 Rental income on operating leases 1,062 - - - 1,062 Interest Expense (536) (63) 4 - (595) Depreciation on operating lease equipment (315) - - - (315) Maintenance and other operating lease expenses (95) - - - (95) Net finance revenue 681 385 5 - 1,071 Provision for credit losses (53) (4) (24) - (81) Other income 150 (21) - 38 167 Operating expenses (477) (185) (23) 1 (684) Income before provision for income taxes 301 175 (42) 39 473 Provision for income taxes (82) (68) 17 (21) (154) Income from continuing operations, before attribution of noncontrolling interests 219 107 (25) 18 319 Net income attributable to noncontrolling interests, after tax - - - - - Income from continuing operations 219 107 (25) 18 319 Diluted Weighted Average Shares Outstanding (thousands) 175,971 31,114 207,085 Income from continuing operations per common share $1.24 $1.54

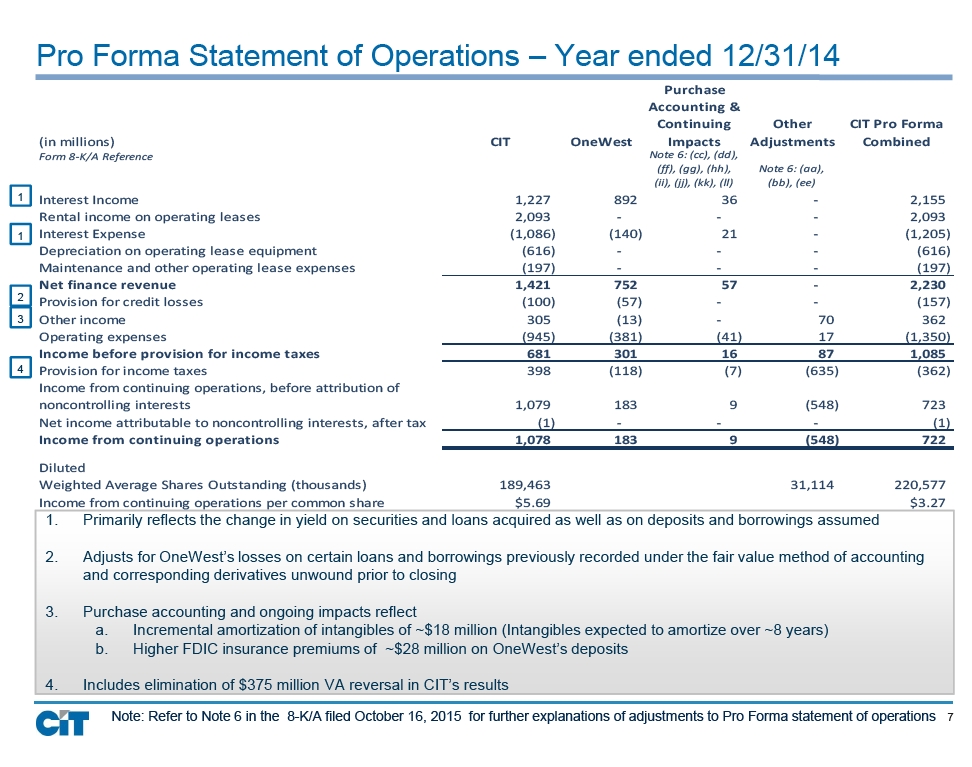

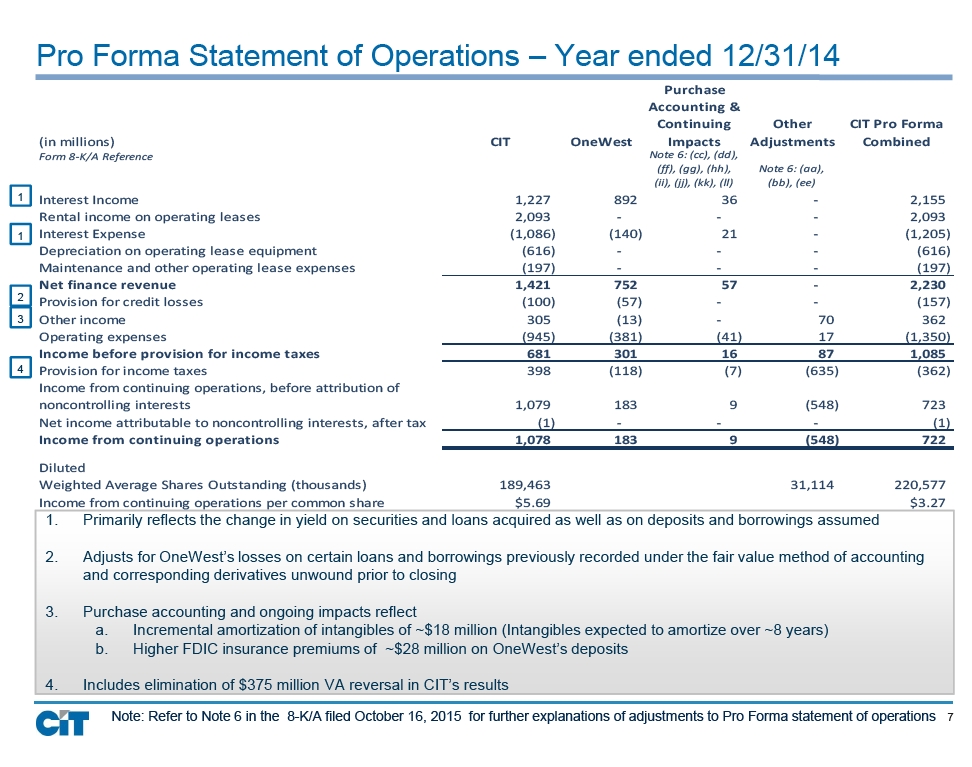

7 Pro Forma Statement of Operations – Year ended 12/31/14 1 2 3 1. Primarily reflects the change in yield on securities and loans acquired as well as on deposits and borrowings assumed 2. Adjusts for OneWest’s losses on certain loans and borrowings previously recorded under the fair value method of accounting and corresponding derivatives unwound prior to closing 3. Purchase accounting and ongoing impacts reflect a. Incremental amortization of intangibles of ~$18 million (Intangibles expected to amortize over ~8 years) b. Higher FDIC insurance premiums of ~$28 million on OneWest’s deposits 4. Includes elimination of $375 million VA reversal in CIT’s results Note: Refer to Note 6 in the 8 - K/A filed October 16, 2015 for further explanations of adjustments to Pro Forma statement of op erations 1 4 (in millions) CIT OneWest Purchase Accounting & Continuing Impacts Other Adjustments CIT Pro Forma Combined Form 8-K/A Reference Note 6: (cc), (dd), (ff), (gg), (hh), (ii), (jj), (kk), (ll) Note 6: (aa), (bb), (ee) Interest Income 1,227 892 36 - 2,155 Rental income on operating leases 2,093 - - - 2,093 Interest Expense (1,086) (140) 21 - (1,205) Depreciation on operating lease equipment (616) - - - (616) Maintenance and other operating lease expenses (197) - - - (197) Net finance revenue 1,421 752 57 - 2,230 Provision for credit losses (100) (57) - - (157) Other income 305 (13) - 70 362 Operating expenses (945) (381) (41) 17 (1,350) Income before provision for income taxes 681 301 16 87 1,085 Provision for income taxes 398 (118) (7) (635) (362) Income from continuing operations, before attribution of noncontrolling interests 1,079 183 9 (548) 723 Net income attributable to noncontrolling interests, after tax (1) - - - (1) Income from continuing operations 1,078 183 9 (548) 722 Diluted Weighted Average Shares Outstanding (thousands) 189,463 31,114 220,577 Income from continuing operations per common share $5.69 $3.27