- CIT Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Cit (CIT) 8-KCIT Announces Third Quarter 2018 Results

Filed: 23 Oct 18, 7:04am

Third Quarter 2018 Earnings October 23, 2018 Exhibit 99.2

This presentation contains forward-looking statements within the meaning of applicable federal securities laws that are based upon our current expectations and assumptions concerning future events, which are subject to a number of risks and uncertainties that could cause actual results to differ materially from those anticipated. The words “expect,” “anticipate,” “estimate,” “forecast,” “initiative,” “objective,” “plan,” “goal,” “project,” “outlook,” “priorities,” “target,” “intend,” “evaluate,” “pursue,” “commence,” “seek,” “may,” “would,” “could,” “should,” “believe,” “potential,” “continue,” or the negative of any of those words or similar expressions are intended to identify forward-looking statements. All statements contained in this presentation, other than statements of historical fact, including without limitation, statements about our plans, strategies, prospects and expectations regarding future events and our financial performance, are forward-looking statements that involve certain risks and uncertainties. While these statements represent our current judgment on what the future may hold, and we believe these judgments are reasonable, these statements are not guarantees of any events or financial results, and our actual results may differ materially. Important factors that could cause our actual results to be materially different from our expectations include, among others, the risk that (i) CIT is unsuccessful in implementing its strategy and business plan, (ii) CIT is unable to react to and address key business and regulatory issues, (iii) CIT is unable to achieve the projected revenue growth from its new business initiatives or the projected expense reductions from efficiency improvements, (iv) CIT becomes subject to liquidity constraints and higher funding costs, or (v) the parties to a transaction do not receive or satisfy regulatory or other approvals and conditions on a timely basis or approvals are subject to conditions that are not anticipated. We describe these and other risks that could affect our results in Item 1A, “Risk Factors,” of our latest Annual Report on Form 10-K for the year ended December 31, 2017, which was filed with the Securities and Exchange Commission. Information regarding CIT’s capital ratios consists of preliminary estimates. These estimates are forward-looking statements and are subject to change, possibly materially, as CIT completes its financial statements. Accordingly, you should not place undue reliance on the forward-looking statements contained in this presentation. These forward-looking statements speak only as of the date on which the statements were made. CIT undertakes no obligation to update publicly or otherwise revise any forward-looking statements, except where expressly required by law. Non-GAAP Financial Measures This presentation contains references to non-GAAP financial measures, which provide additional information and insight regarding operating results and financial position of the business, including financial information that is presented to rating agencies and other users of financial information. These non-GAAP measures are not in accordance with, or a substitute for, GAAP and may be different from or inconsistent with non-GAAP financial measures used by other companies. The definitions of these measures and reconciliations of non-GAAP to GAAP financial information are available in our press release dated October 23, 2018, which is posted on the Investor Relations page of our website at http://ir.cit.com. This presentation is to be used solely as part of CIT management’s continuing investor communications program. This presentation shall not constitute an offer or solicitation in connection with any securities. Important Notice

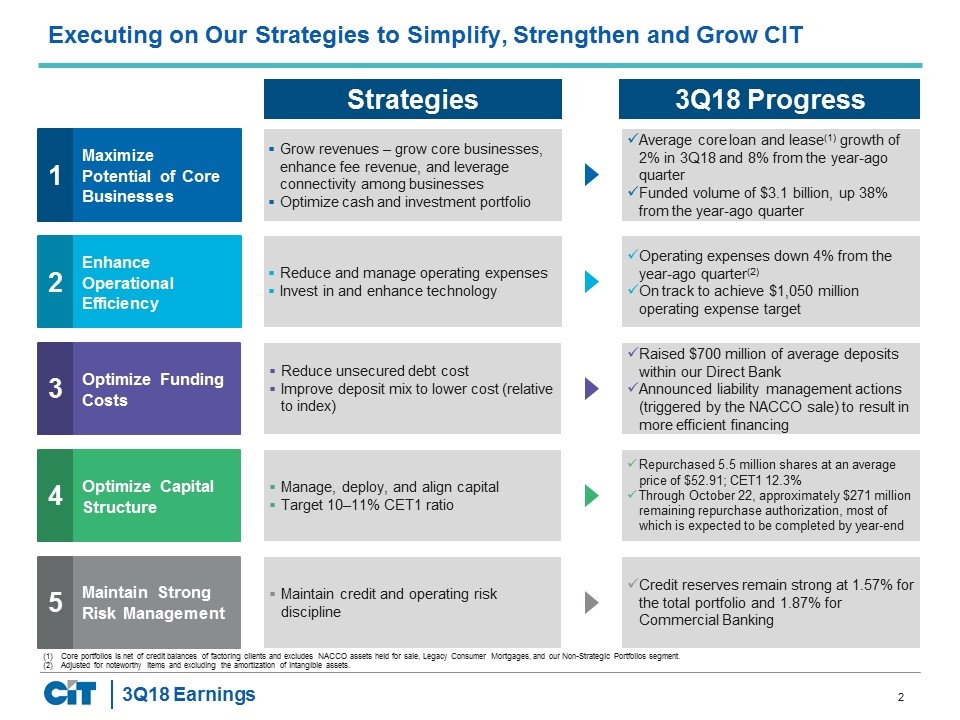

Executing on Our Strategies to Simplify, Strengthen and Grow CIT Maximize Potential of Core Businesses Enhance Operational Efficiency 2 Maintain Strong Risk Management 5 Optimize Capital Structure 4 Optimize Funding Costs 3Q18 Progress Strategies Grow revenues – grow core businesses, enhance fee revenue, and leverage connectivity among businesses Optimize cash and investment portfolio Average core loan and lease(1) growth of 2% in 3Q18 and 8% from the year-ago quarter Funded volume of $3.1 billion, up 38% from the year-ago quarter Reduce and manage operating expenses Invest in and enhance technology Operating expenses down 4% from the year-ago quarter(2) On track to achieve $1,050 million operating expense target Reduce unsecured debt cost Improve deposit mix to lower cost (relative to index) Raised $700 million of average deposits within our Direct Bank Announced liability management actions (triggered by the NACCO sale) to result in more efficient financing Manage, deploy, and align capital Target 10–11% CET1 ratio Repurchased 5.5 million shares at an average price of $52.91; CET1 12.3% Through October 22, approximately $271 million remaining repurchase authorization, most of which is expected to be completed by year-end Maintain credit and operating risk discipline Credit reserves remain strong at 1.57% for the total portfolio and 1.87% for Commercial Banking 1 3 Core portfolios is net of credit balances of factoring clients and excludes NACCO assets held for sale, Legacy Consumer Mortgages, and our Non-Strategic Portfolios segment. Adjusted for noteworthy items and excluding the amortization of intangible assets.

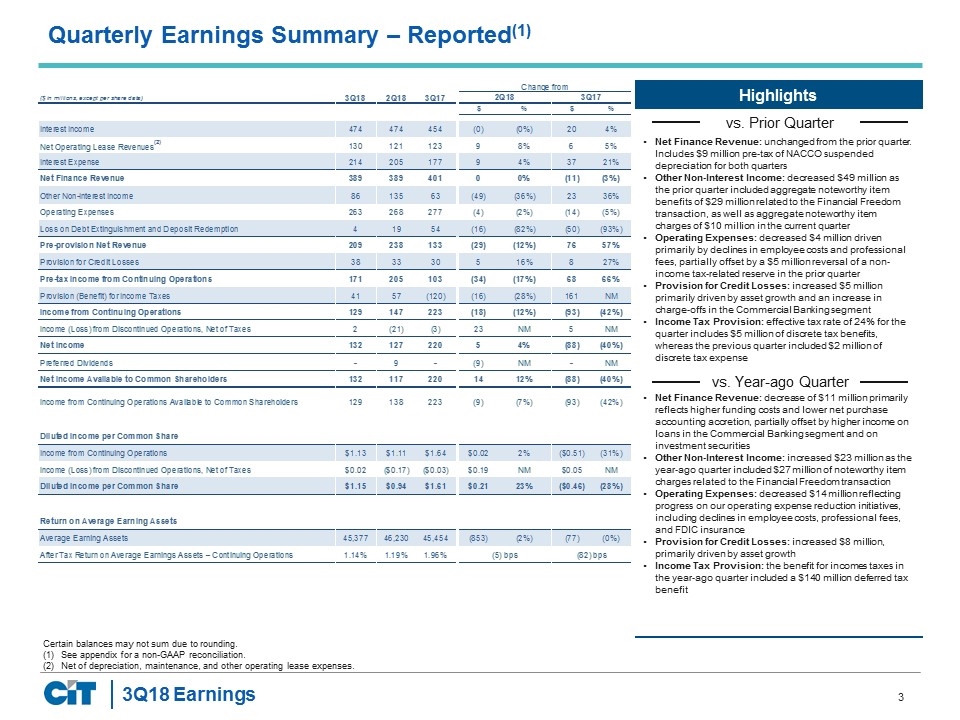

Net Finance Revenue: unchanged from the prior quarter. Includes $9 million pre-tax of NACCO suspended depreciation for both quarters Other Non-Interest Income: decreased $49 million as the prior quarter included aggregate noteworthy item benefits of $29 million related to the Financial Freedom transaction, as well as aggregate noteworthy item charges of $10 million in the current quarter Operating Expenses: decreased $4 million driven primarily by declines in employee costs and professional fees, partially offset by a $5 million reversal of a non-income tax-related reserve in the prior quarter Provision for Credit Losses: increased $5 million primarily driven by asset growth and an increase in charge-offs in the Commercial Banking segment Income Tax Provision: effective tax rate of 24% for the quarter includes $5 million of discrete tax benefits, whereas the previous quarter included $2 million of discrete tax expense Certain balances may not sum due to rounding. See appendix for a non-GAAP reconciliation. Net of depreciation, maintenance, and other operating lease expenses. Quarterly Earnings Summary – Reported(1) Net Finance Revenue: decrease of $11 million primarily reflects higher funding costs and lower net purchase accounting accretion, partially offset by higher income on loans in the Commercial Banking segment and on investment securities Other Non-Interest Income: increased $23 million as the year-ago quarter included $27 million of noteworthy item charges related to the Financial Freedom transaction Operating Expenses: decreased $14 million reflecting progress on our operating expense reduction initiatives, including declines in employee costs, professional fees, and FDIC insurance Provision for Credit Losses: increased $8 million, primarily driven by asset growth Income Tax Provision: the benefit for incomes taxes in the year-ago quarter included a $140 million deferred tax benefit vs. Year-ago Quarter

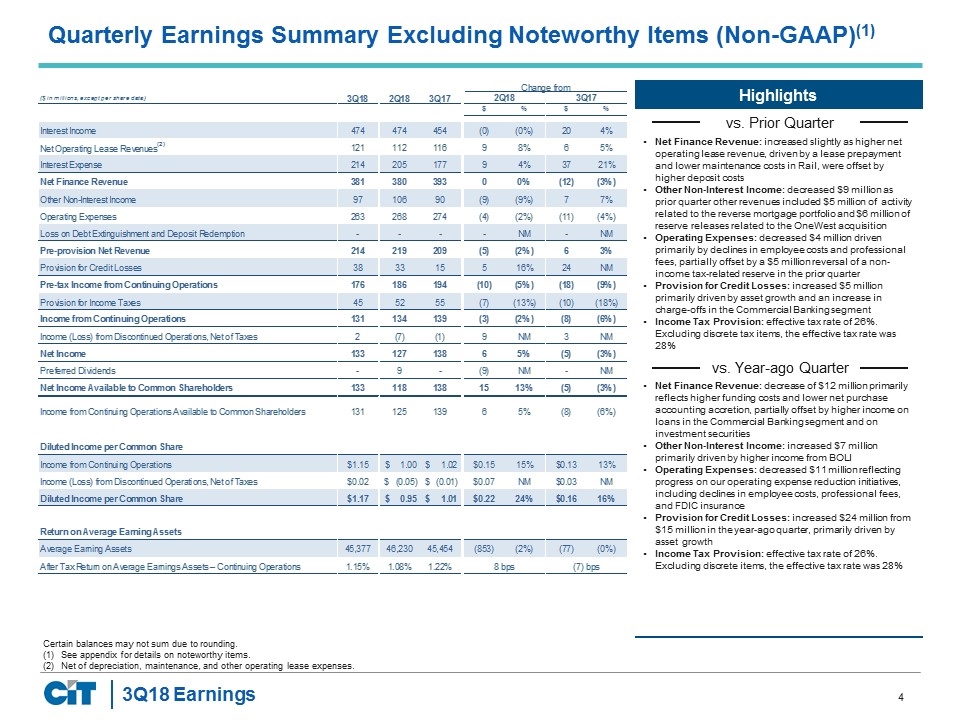

Net Finance Revenue: increased slightly as higher net operating lease revenue, driven by a lease prepayment and lower maintenance costs in Rail, were offset by higher deposit costs Other Non-Interest Income: decreased $9 million as prior quarter other revenues included $5 million of activity related to the reverse mortgage portfolio and $6 million of reserve releases related to the OneWest acquisition Operating Expenses: decreased $4 million driven primarily by declines in employee costs and professional fees, partially offset by a $5 million reversal of a non-income tax-related reserve in the prior quarter Provision for Credit Losses: increased $5 million primarily driven by asset growth and an increase in charge-offs in the Commercial Banking segment Income Tax Provision: effective tax rate of 26%. Excluding discrete tax items, the effective tax rate was 28% Certain balances may not sum due to rounding. See appendix for details on noteworthy items. Net of depreciation, maintenance, and other operating lease expenses. Quarterly Earnings Summary Excluding Noteworthy Items (Non-GAAP)(1) vs. Year-ago Quarter Net Finance Revenue: decrease of $12 million primarily reflects higher funding costs and lower net purchase accounting accretion, partially offset by higher income on loans in the Commercial Banking segment and on investment securities Other Non-Interest Income: increased $7 million primarily driven by higher income from BOLI Operating Expenses: decreased $11 million reflecting progress on our operating expense reduction initiatives, including declines in employee costs, professional fees, and FDIC insurance Provision for Credit Losses: increased $24 million from $15 million in the year-ago quarter, primarily driven by asset growth Income Tax Provision: effective tax rate of 26%. Excluding discrete items, the effective tax rate was 28%

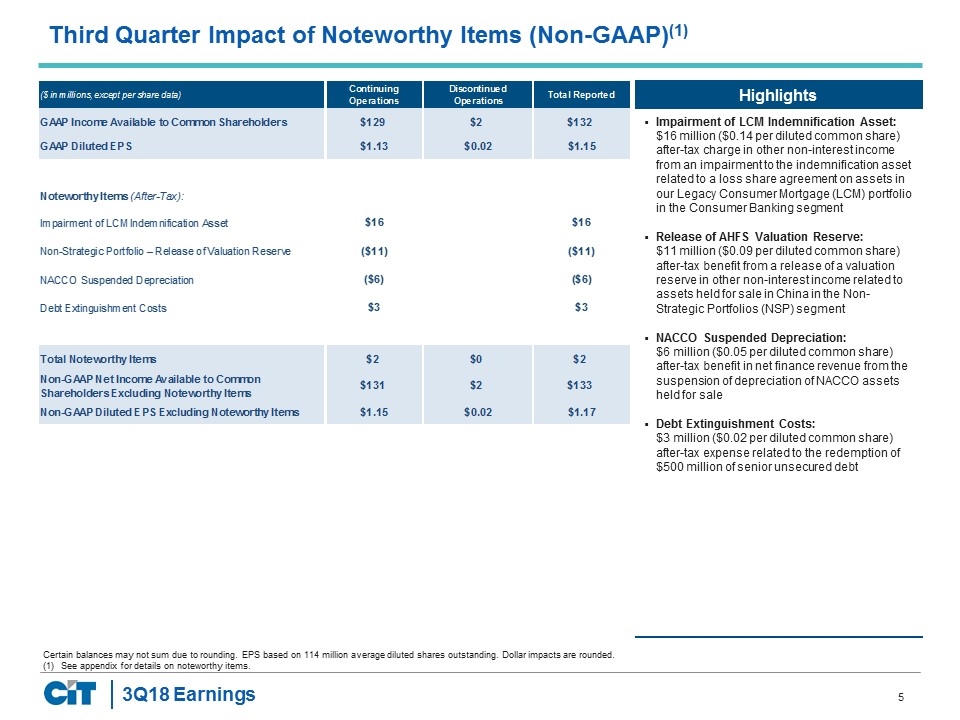

Impairment of LCM Indemnification Asset: $16 million ($0.14 per diluted common share) after-tax charge in other non-interest income from an impairment to the indemnification asset related to a loss share agreement on assets in our Legacy Consumer Mortgage (LCM) portfolio in the Consumer Banking segment Release of AHFS Valuation Reserve: $11 million ($0.09 per diluted common share) after-tax benefit from a release of a valuation reserve in other non-interest income related to assets held for sale in China in the Non-Strategic Portfolios (NSP) segment NACCO Suspended Depreciation: $6 million ($0.05 per diluted common share) after-tax benefit in net finance revenue from the suspension of depreciation of NACCO assets held for sale Debt Extinguishment Costs: $3 million ($0.02 per diluted common share) after-tax expense related to the redemption of $500 million of senior unsecured debt Certain balances may not sum due to rounding. EPS based on 114 million average diluted shares outstanding. Dollar impacts are rounded. See appendix for details on noteworthy items. Third Quarter Impact of Noteworthy Items (Non-GAAP)(1)

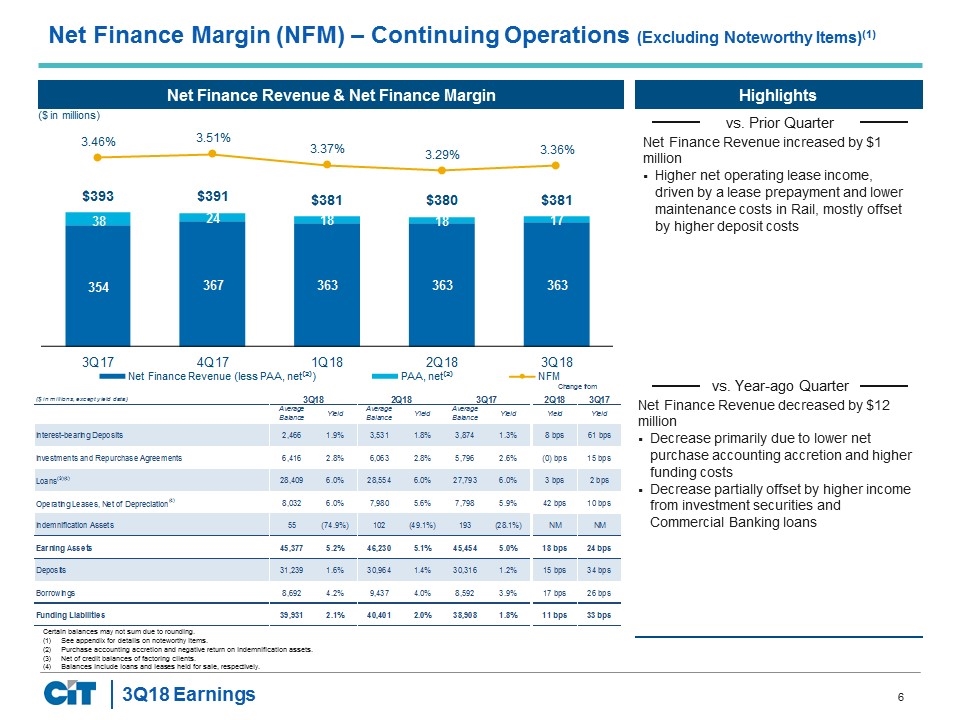

Net Finance Revenue decreased by $12 million Decrease primarily due to lower net purchase accounting accretion and higher funding costs Decrease partially offset by higher income from investment securities and Commercial Banking loans Net Finance Margin (NFM) – Continuing Operations (Excluding Noteworthy Items)(1) Net Finance Revenue & Net Finance Margin Certain balances may not sum due to rounding. See appendix for details on noteworthy items. Purchase accounting accretion and negative return on indemnification assets. Net of credit balances of factoring clients. Balances include loans and leases held for sale, respectively. Net Finance Revenue increased by $1 million Higher net operating lease income, driven by a lease prepayment and lower maintenance costs in Rail, mostly offset by higher deposit costs ($ in millions)

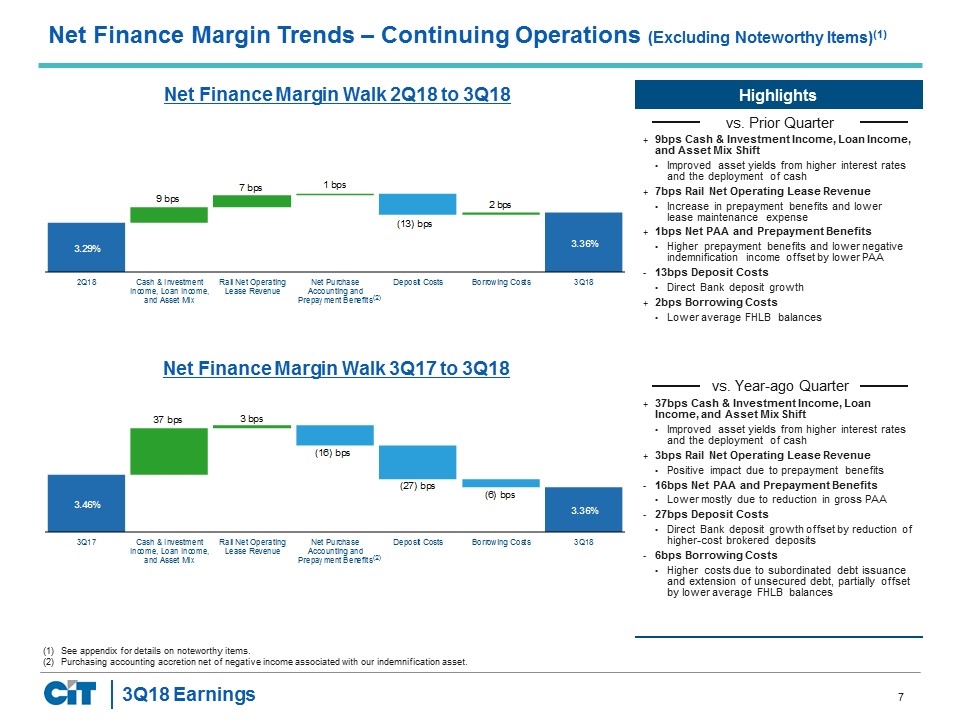

Net Finance Margin Walk 2Q18 to 3Q18 Net Finance Margin Walk 3Q17 to 3Q18 Net Finance Margin Trends – Continuing Operations (Excluding Noteworthy Items)(1) See appendix for details on noteworthy items. Purchasing accounting accretion net of negative income associated with our indemnification asset. 9bps Cash & Investment Income, Loan Income, and Asset Mix Shift Improved asset yields from higher interest rates and the deployment of cash 7bps Rail Net Operating Lease Revenue Increase in prepayment benefits and lower lease maintenance expense 1bps Net PAA and Prepayment Benefits Higher prepayment benefits and lower negative indemnification income offset by lower PAA 13bps Deposit Costs Direct Bank deposit growth 2bps Borrowing Costs Lower average FHLB balances 37bps Cash & Investment Income, Loan Income, and Asset Mix Shift Improved asset yields from higher interest rates and the deployment of cash 3bps Rail Net Operating Lease Revenue Positive impact due to prepayment benefits 16bps Net PAA and Prepayment Benefits Lower mostly due to reduction in gross PAA 27bps Deposit Costs Direct Bank deposit growth offset by reduction of higher-cost brokered deposits 6bps Borrowing Costs Higher costs due to subordinated debt issuance and extension of unsecured debt, partially offset by lower average FHLB balances (2) (2)

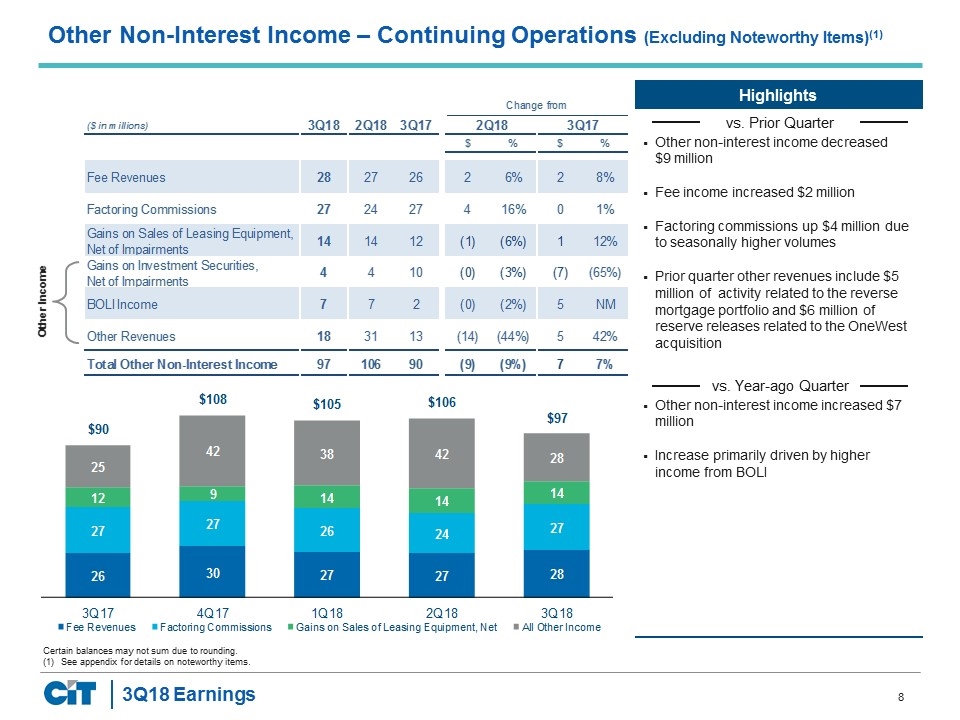

Certain balances may not sum due to rounding. See appendix for details on noteworthy items. Other non-interest income decreased $9 million Fee income increased $2 million Factoring commissions up $4 million due to seasonally higher volumes Prior quarter other revenues include $5 million of activity related to the reverse mortgage portfolio and $6 million of reserve releases related to the OneWest acquisition Other non-interest income increased $7 million Increase primarily driven by higher income from BOLI Other Income Other Non-Interest Income – Continuing Operations (Excluding Noteworthy Items)(1)

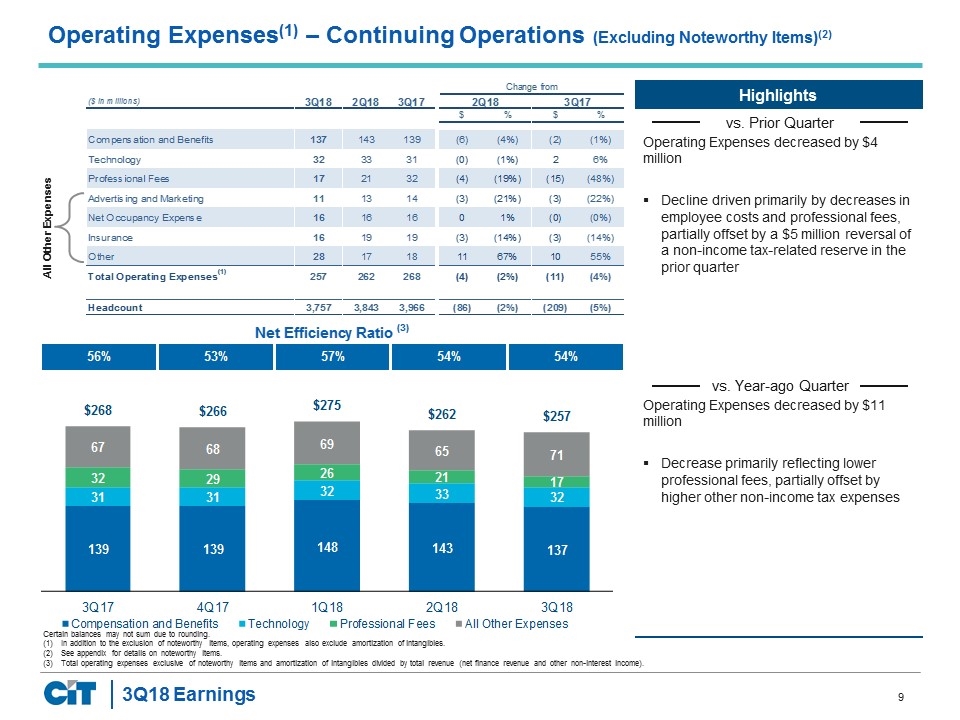

Operating Expenses decreased by $4 million Decline driven primarily by decreases in employee costs and professional fees, partially offset by a $5 million reversal of a non-income tax-related reserve in the prior quarter Operating Expenses decreased by $11 million Decrease primarily reflecting lower professional fees, partially offset by higher other non-income tax expenses Certain balances may not sum due to rounding. In addition to the exclusion of noteworthy items, operating expenses also exclude amortization of intangibles. See appendix for details on noteworthy items. Total operating expenses exclusive of noteworthy items and amortization of intangibles divided by total revenue (net finance revenue and other non-interest income). All Other Expenses Operating Expenses(1) – Continuing Operations (Excluding Noteworthy Items)(2)

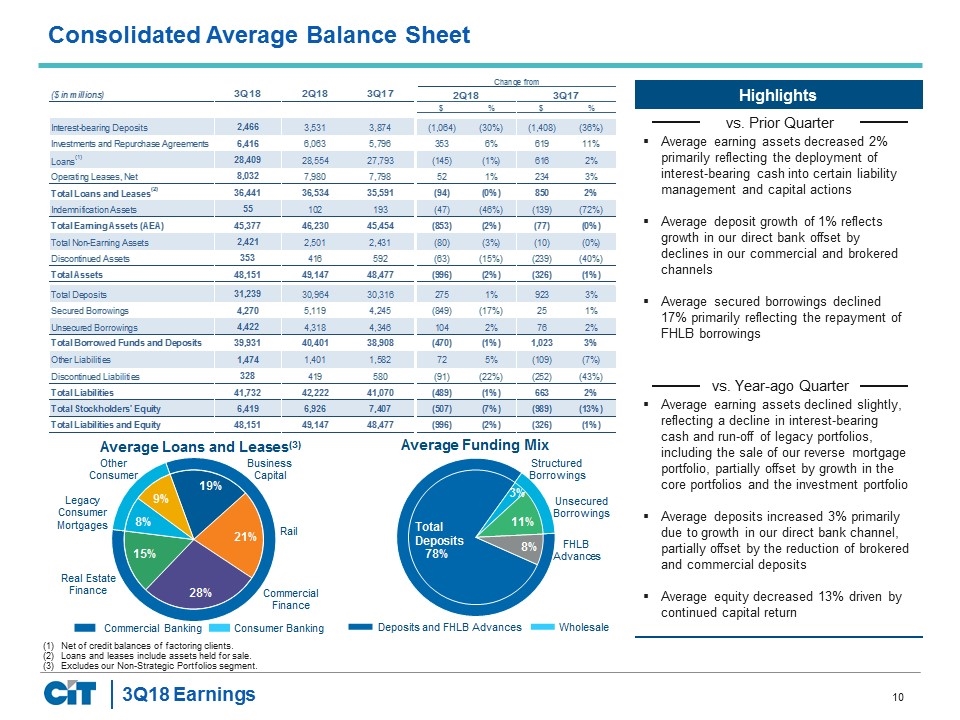

Average earning assets decreased 2% primarily reflecting the deployment of interest-bearing cash into certain liability management and capital actions Average deposit growth of 1% reflects growth in our direct bank offset by declines in our commercial and brokered channels Average secured borrowings declined 17% primarily reflecting the repayment of FHLB borrowings Average earning assets declined slightly, reflecting a decline in interest-bearing cash and run-off of legacy portfolios, including the sale of our reverse mortgage portfolio, partially offset by growth in the core portfolios and the investment portfolio Average deposits increased 3% primarily due to growth in our direct bank channel, partially offset by the reduction of brokered and commercial deposits Average equity decreased 13% driven by continued capital return Net of credit balances of factoring clients. Loans and leases include assets held for sale. Excludes our Non-Strategic Portfolios segment. Consolidated Average Balance Sheet

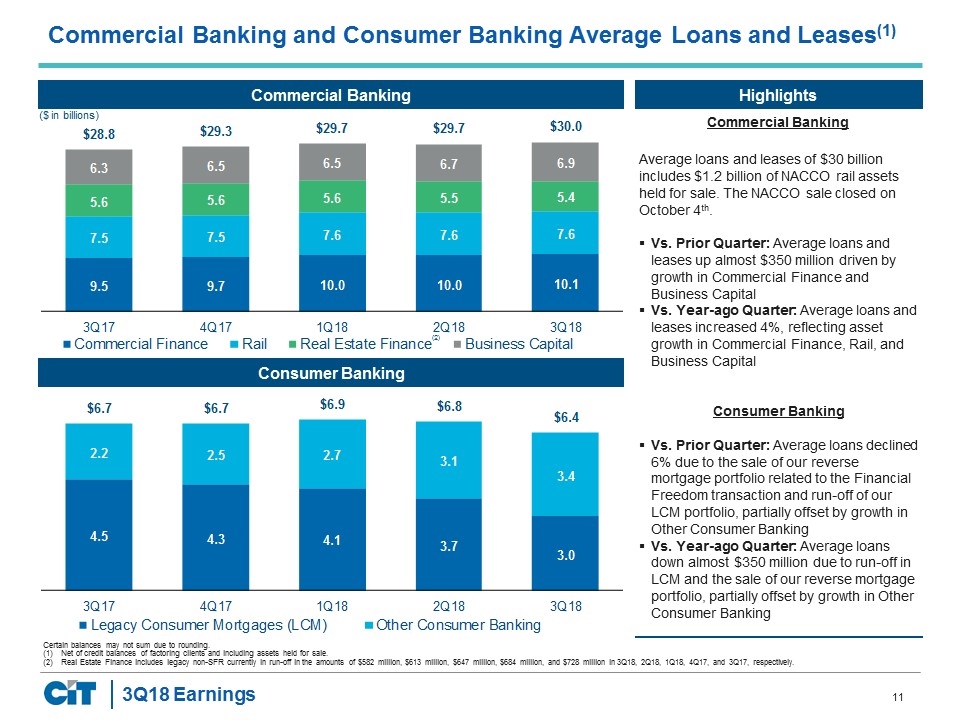

Commercial Banking and Consumer Banking Average Loans and Leases(1) Commercial Banking Average loans and leases of $30 billion includes $1.2 billion of NACCO rail assets held for sale. The NACCO sale closed on October 4th. Vs. Prior Quarter: Average loans and leases up almost $350 million driven by growth in Commercial Finance and Business Capital Vs. Year-ago Quarter: Average loans and leases increased 4%, reflecting asset growth in Commercial Finance, Rail, and Business Capital Consumer Banking Vs. Prior Quarter: Average loans declined 6% due to the sale of our reverse mortgage portfolio related to the Financial Freedom transaction and run-off of our LCM portfolio, partially offset by growth in Other Consumer Banking Vs. Year-ago Quarter: Average loans down almost $350 million due to run-off in LCM and the sale of our reverse mortgage portfolio, partially offset by growth in Other Consumer Banking Certain balances may not sum due to rounding. Net of credit balances of factoring clients and including assets held for sale. Real Estate Finance includes legacy non-SFR currently in run-off in the amounts of $582 million, $613 million, $647 million, $684 million, and $728 million in 3Q18, 2Q18, 1Q18, 4Q17, and 3Q17, respectively. Commercial Banking Consumer Banking ($ in billions) (2)

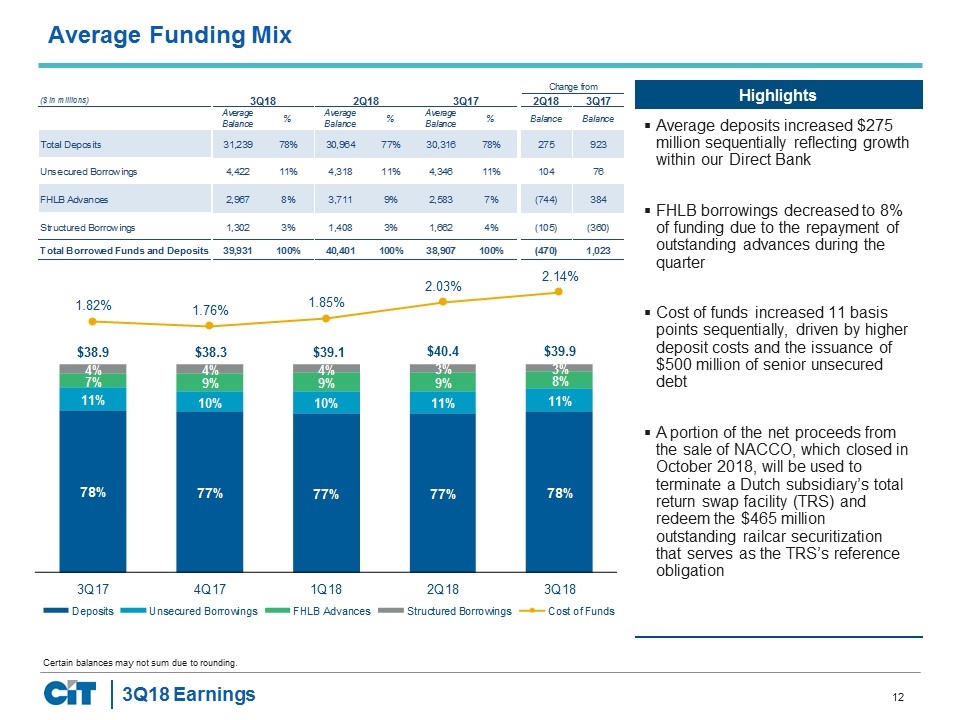

Average deposits increased $275 million sequentially reflecting growth within our Direct Bank FHLB borrowings decreased to 8% of funding due to the repayment of outstanding advances during the quarter Cost of funds increased 11 basis points sequentially, driven by higher deposit costs and the issuance of $500 million of senior unsecured debt A portion of the net proceeds from the sale of NACCO, which closed in October 2018, will be used to terminate a Dutch subsidiary’s total return swap facility (TRS) and redeem the $465 million outstanding railcar securitization that serves as the TRS’s reference obligation Certain balances may not sum due to rounding. Average Funding Mix $38.9 $38.3 $39.1 $40.4 $39.9

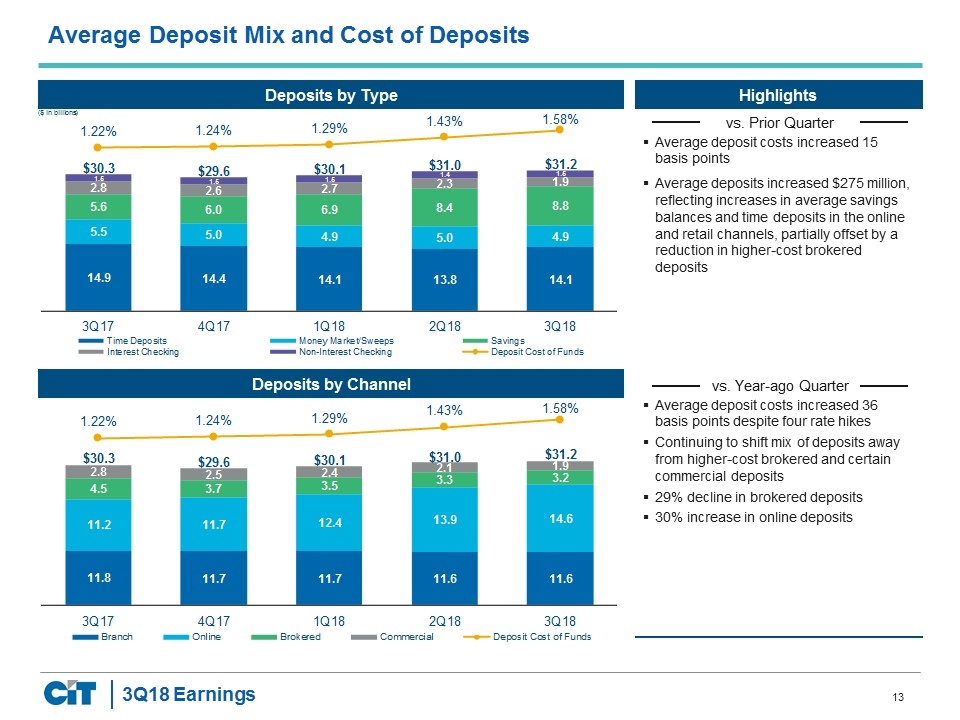

Average Deposit Mix and Cost of Deposits Deposits by Type Deposits by Channel Average deposit costs increased 15 basis points Average deposits increased $275 million, reflecting increases in average savings balances and time deposits in the online and retail channels, partially offset by a reduction in higher-cost brokered deposits Average deposit costs increased 36 basis points despite four rate hikes Continuing to shift mix of deposits away from higher-cost brokered and certain commercial deposits 29% decline in brokered deposits 30% increase in online deposits ($ in billions)

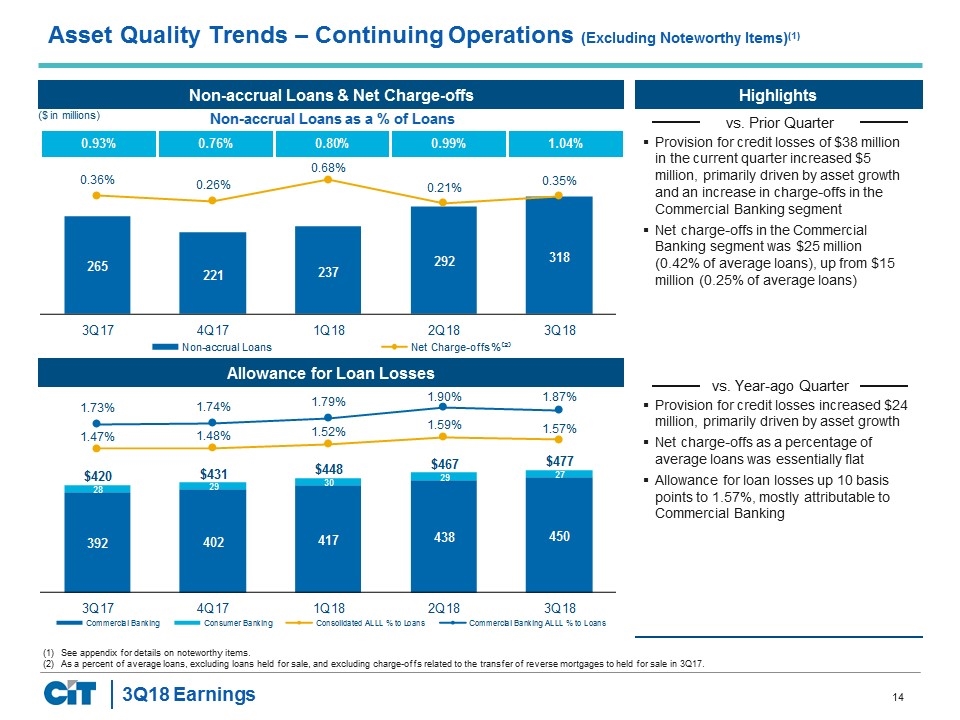

Asset Quality Trends – Continuing Operations (Excluding Noteworthy Items)(1) Non-accrual Loans & Net Charge-offs Allowance for Loan Losses Provision for credit losses of $38 million in the current quarter increased $5 million, primarily driven by asset growth and an increase in charge-offs in the Commercial Banking segment Net charge-offs in the Commercial Banking segment was $25 million (0.42% of average loans), up from $15 million (0.25% of average loans) See appendix for details on noteworthy items. As a percent of average loans, excluding loans held for sale, and excluding charge-offs related to the transfer of reverse mortgages to held for sale in 3Q17. Provision for credit losses increased $24 million, primarily driven by asset growth Net charge-offs as a percentage of average loans was essentially flat Allowance for loan losses up 10 basis points to 1.57%, mostly attributable to Commercial Banking ($ in millions)

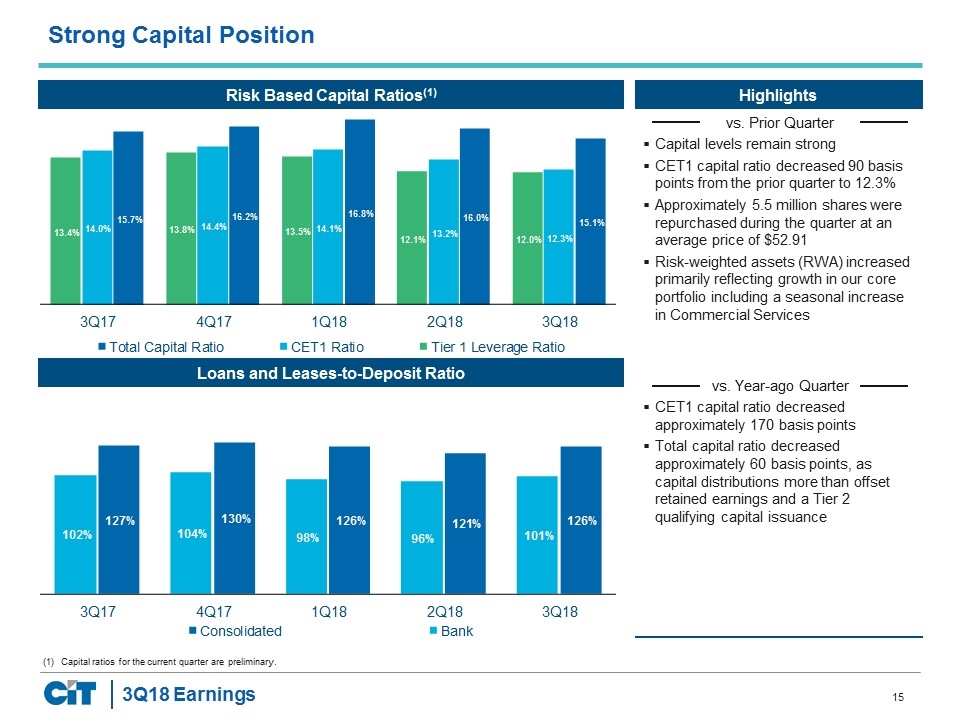

Strong Capital Position Risk Based Capital Ratios(1) Loans and Leases-to-Deposit Ratio Capital levels remain strong CET1 capital ratio decreased 90 basis points from the prior quarter to 12.3% Approximately 5.5 million shares were repurchased during the quarter at an average price of $52.91 Risk-weighted assets (RWA) increased primarily reflecting growth in our core portfolio including a seasonal increase in Commercial Services Capital ratios for the current quarter are preliminary. CET1 capital ratio decreased approximately 170 basis points Total capital ratio decreased approximately 60 basis points, as capital distributions more than offset retained earnings and a Tier 2 qualifying capital issuance

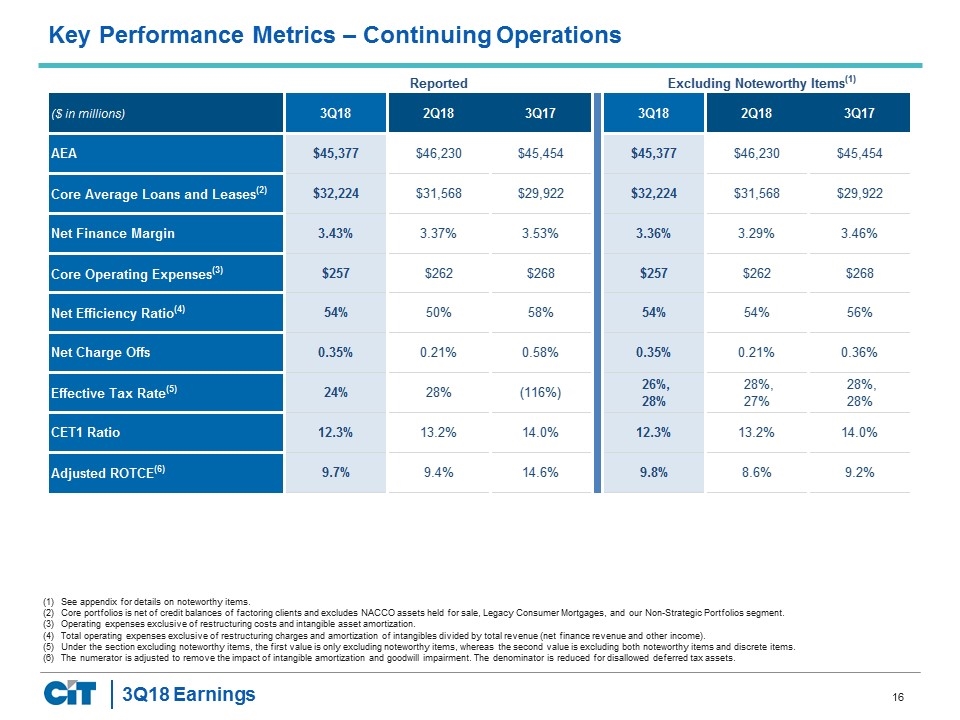

See appendix for details on noteworthy items. Core portfolios is net of credit balances of factoring clients and excludes NACCO assets held for sale, Legacy Consumer Mortgages, and our Non-Strategic Portfolios segment. Operating expenses exclusive of restructuring costs and intangible asset amortization. Total operating expenses exclusive of restructuring charges and amortization of intangibles divided by total revenue (net finance revenue and other income). Under the section excluding noteworthy items, the first value is only excluding noteworthy items, whereas the second value is excluding both noteworthy items and discrete items. The numerator is adjusted to remove the impact of intangible amortization and goodwill impairment. The denominator is reduced for disallowed deferred tax assets. Key Performance Metrics – Continuing Operations

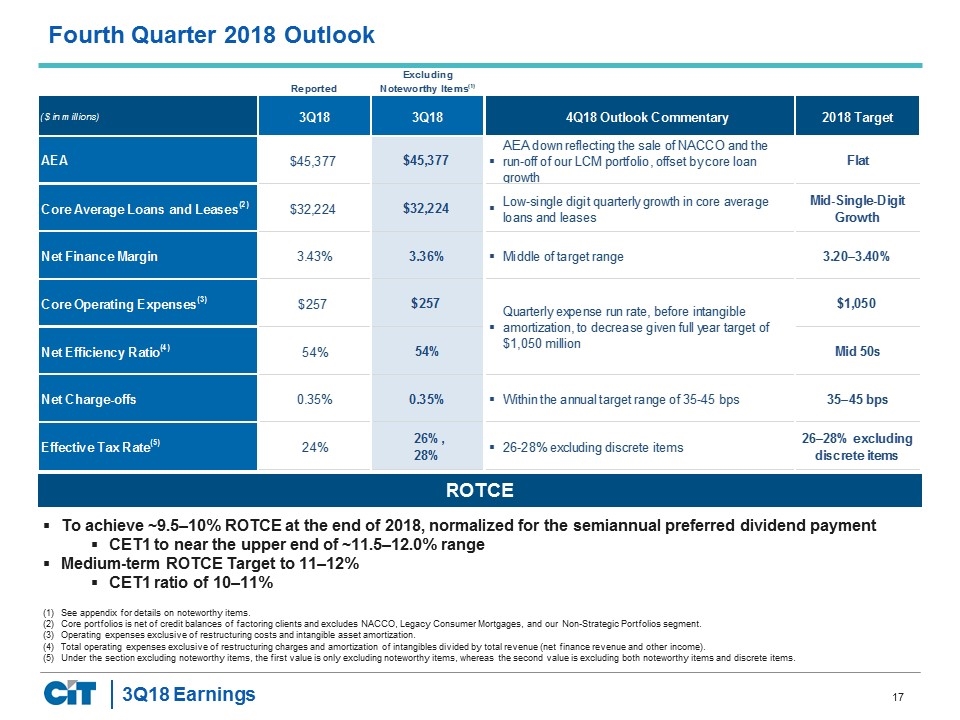

Fourth Quarter 2018 Outlook See appendix for details on noteworthy items. Core portfolios is net of credit balances of factoring clients and excludes NACCO, Legacy Consumer Mortgages, and our Non-Strategic Portfolios segment. Operating expenses exclusive of restructuring costs and intangible asset amortization. Total operating expenses exclusive of restructuring charges and amortization of intangibles divided by total revenue (net finance revenue and other income). Under the section excluding noteworthy items, the first value is only excluding noteworthy items, whereas the second value is excluding both noteworthy items and discrete items. To achieve ~9.5–10% ROTCE at the end of 2018, normalized for the semiannual preferred dividend payment CET1 to near the upper end of ~11.5–12.0% range Medium-term ROTCE Target to 11–12% CET1 ratio of 10–11% ROTCE

Executing on Our Strategies to Simplify, Strengthen and Grow CIT Enhance Operational Efficiency 2 Maintain Strong Risk Management 5 Optimize Capital Structure 4 Maximize Potential of Core Businesses 1 Optimize Funding Costs 3 A Leading National Bank Focused on Lending and Leasing to the Middle Market and Small Businesses Strategic Priorities

APPENDIX

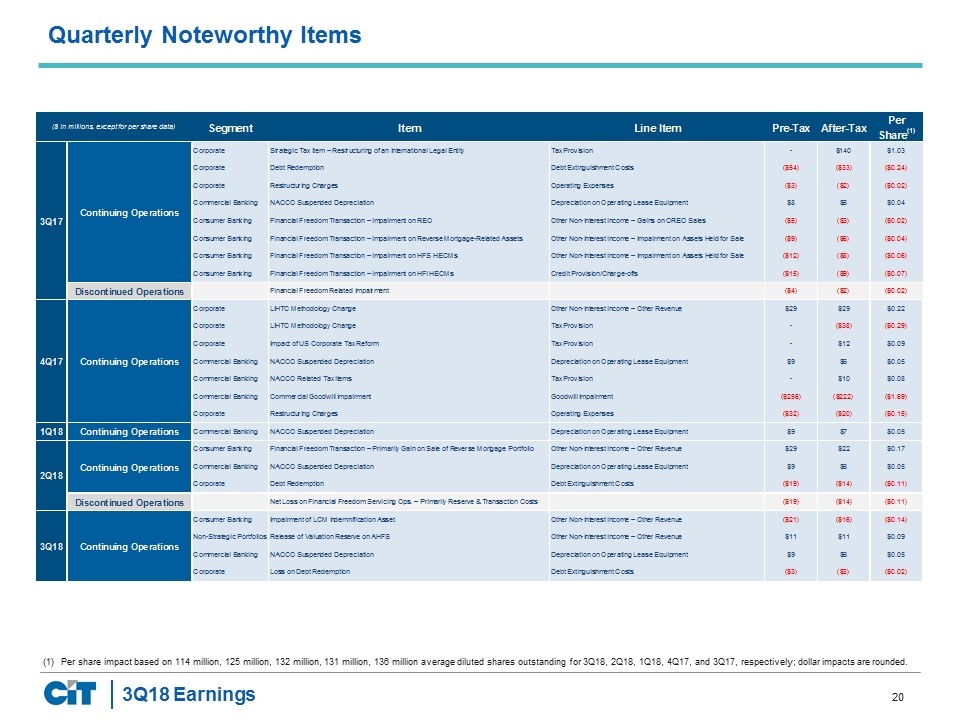

Per share impact based on 114 million, 125 million, 132 million, 131 million, 136 million average diluted shares outstanding for 3Q18, 2Q18, 1Q18, 4Q17, and 3Q17, respectively; dollar impacts are rounded. Quarterly Noteworthy Items

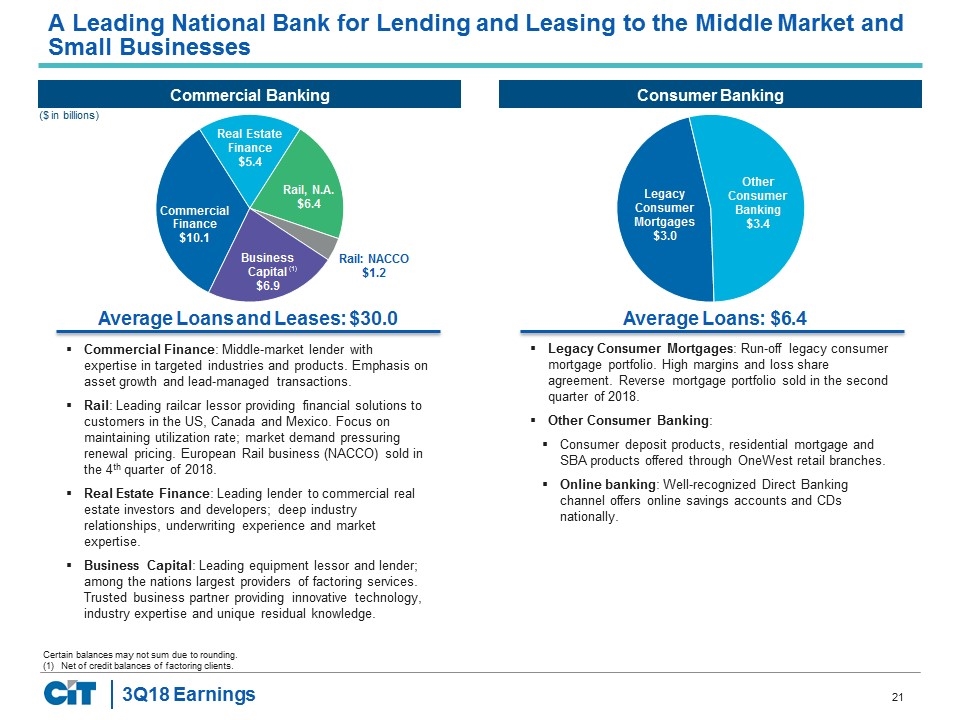

Commercial Banking Consumer Banking Certain balances may not sum due to rounding. Net of credit balances of factoring clients. A Leading National Bank for Lending and Leasing to the Middle Market and Small Businesses Commercial Finance: Middle-market lender with expertise in targeted industries and products. Emphasis on asset growth and lead-managed transactions. Rail: Leading railcar lessor providing financial solutions to customers in the US, Canada and Mexico. Focus on maintaining utilization rate; market demand pressuring renewal pricing. European Rail business (NACCO) sold in the 4th quarter of 2018. Real Estate Finance: Leading lender to commercial real estate investors and developers; deep industry relationships, underwriting experience and market expertise. Business Capital: Leading equipment lessor and lender; among the nations largest providers of factoring services. Trusted business partner providing innovative technology, industry expertise and unique residual knowledge. Legacy Consumer Mortgages: Run-off legacy consumer mortgage portfolio. High margins and loss share agreement. Reverse mortgage portfolio sold in the second quarter of 2018. Other Consumer Banking: Consumer deposit products, residential mortgage and SBA products offered through OneWest retail branches. Online banking: Well-recognized Direct Banking channel offers online savings accounts and CDs nationally. ($ in billions) (1)

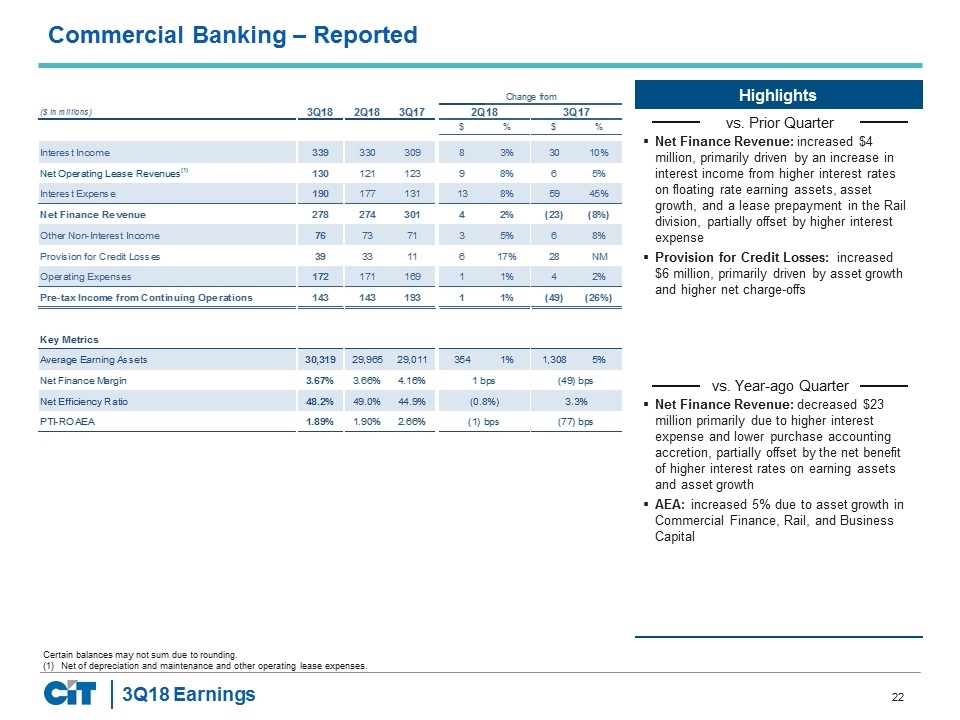

Commercial Banking – Reported Net Finance Revenue: increased $4 million, primarily driven by an increase in interest income from higher interest rates on floating rate earning assets, asset growth, and a lease prepayment in the Rail division, partially offset by higher interest expense Provision for Credit Losses: increased $6 million, primarily driven by asset growth and higher net charge-offs Net Finance Revenue: decreased $23 million primarily due to higher interest expense and lower purchase accounting accretion, partially offset by the net benefit of higher interest rates on earning assets and asset growth AEA: increased 5% due to asset growth in Commercial Finance, Rail, and Business Capital Certain balances may not sum due to rounding. Net of depreciation and maintenance and other operating lease expenses.

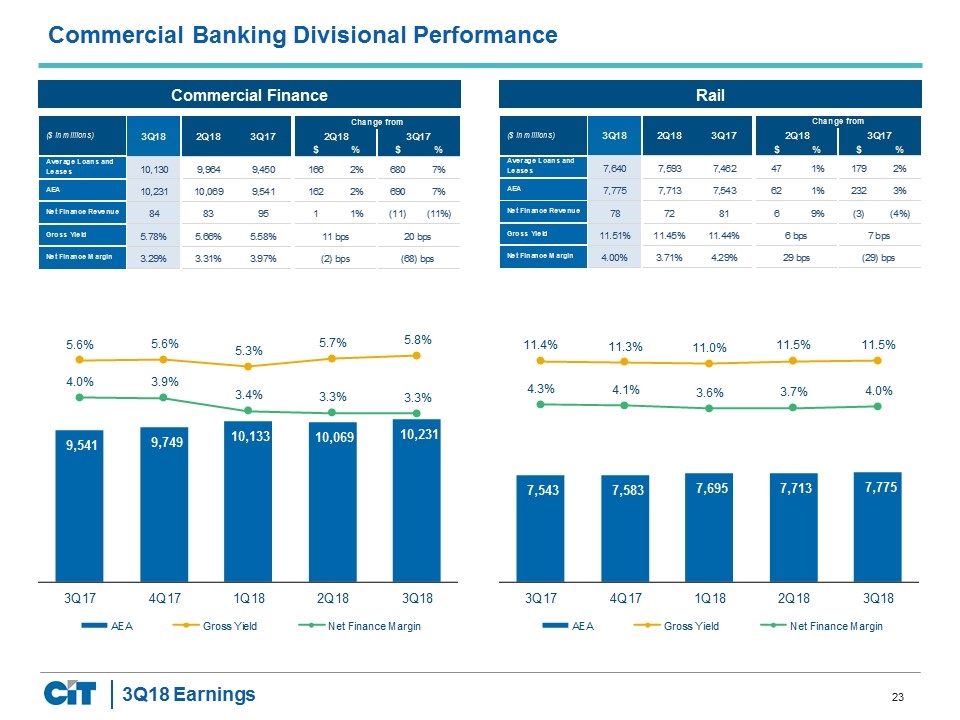

Commercial Banking Divisional Performance Commercial Finance Rail

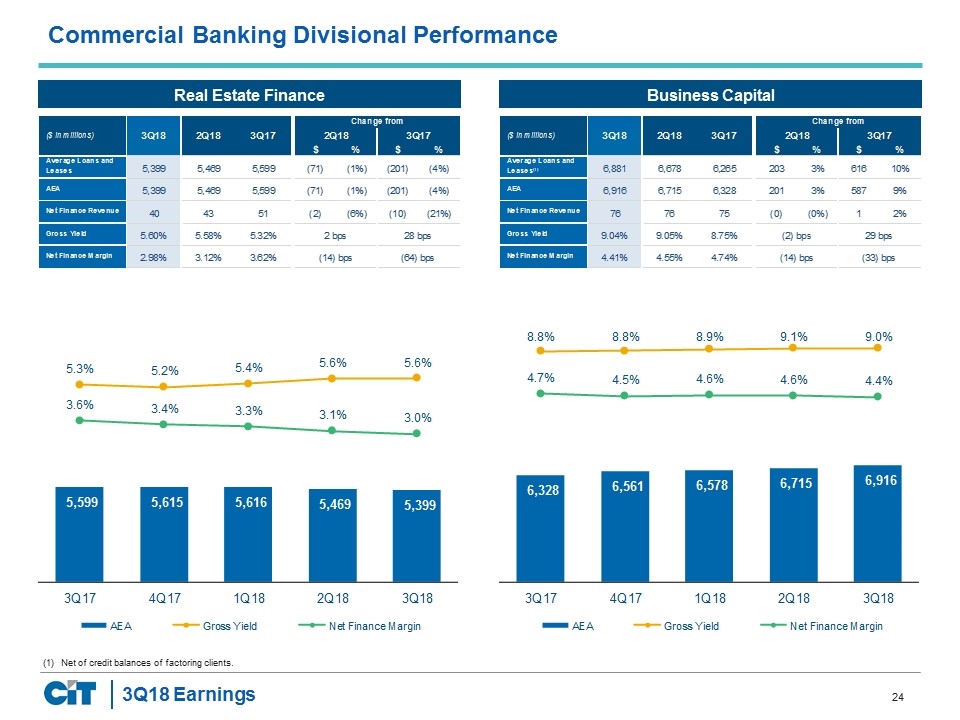

Commercial Banking Divisional Performance Real Estate Finance Business Capital Net of credit balances of factoring clients.

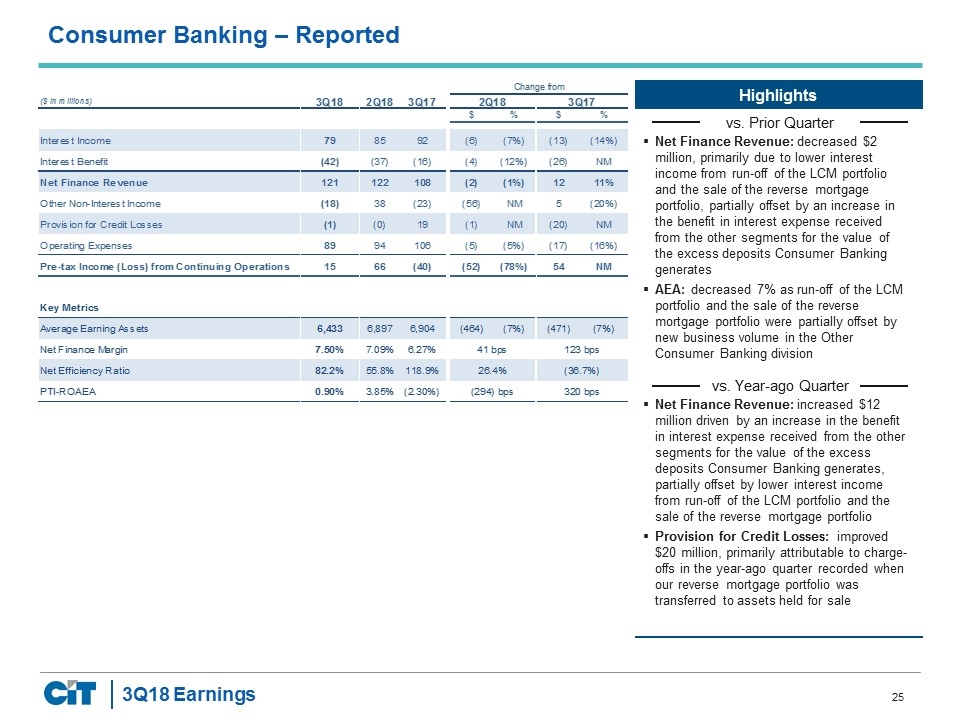

Consumer Banking – Reported Net Finance Revenue: decreased $2 million, primarily due to lower interest income from run-off of the LCM portfolio and the sale of the reverse mortgage portfolio, partially offset by an increase in the benefit in interest expense received from the other segments for the value of the excess deposits Consumer Banking generates AEA: decreased 7% as run-off of the LCM portfolio and the sale of the reverse mortgage portfolio were partially offset by new business volume in the Other Consumer Banking division Net Finance Revenue: increased $12 million driven by an increase in the benefit in interest expense received from the other segments for the value of the excess deposits Consumer Banking generates, partially offset by lower interest income from run-off of the LCM portfolio and the sale of the reverse mortgage portfolio Provision for Credit Losses: improved $20 million, primarily attributable to charge-offs in the year-ago quarter recorded when our reverse mortgage portfolio was transferred to assets held for sale

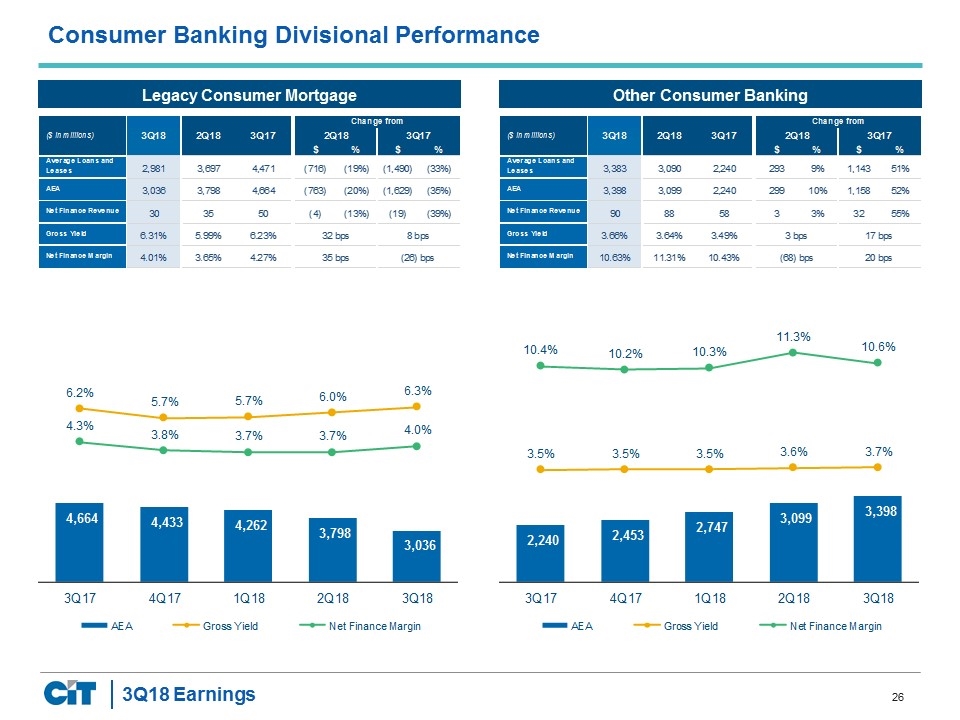

Consumer Banking Divisional Performance Legacy Consumer Mortgage Other Consumer Banking

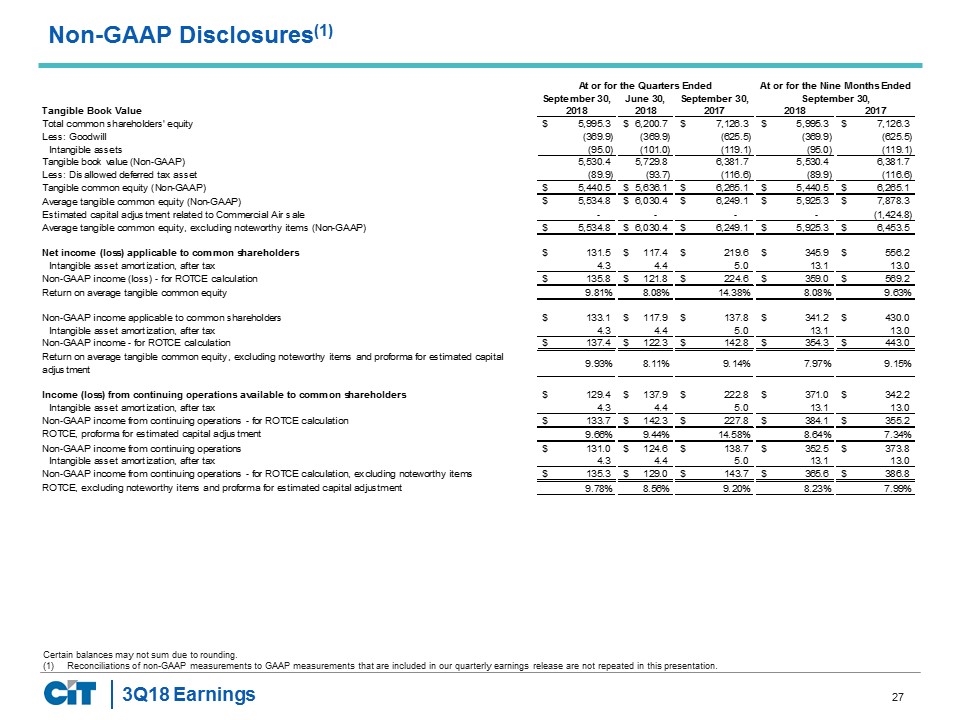

Certain balances may not sum due to rounding. Reconciliations of non-GAAP measurements to GAAP measurements that are included in our quarterly earnings release are not repeated in this presentation. Non-GAAP Disclosures(1)

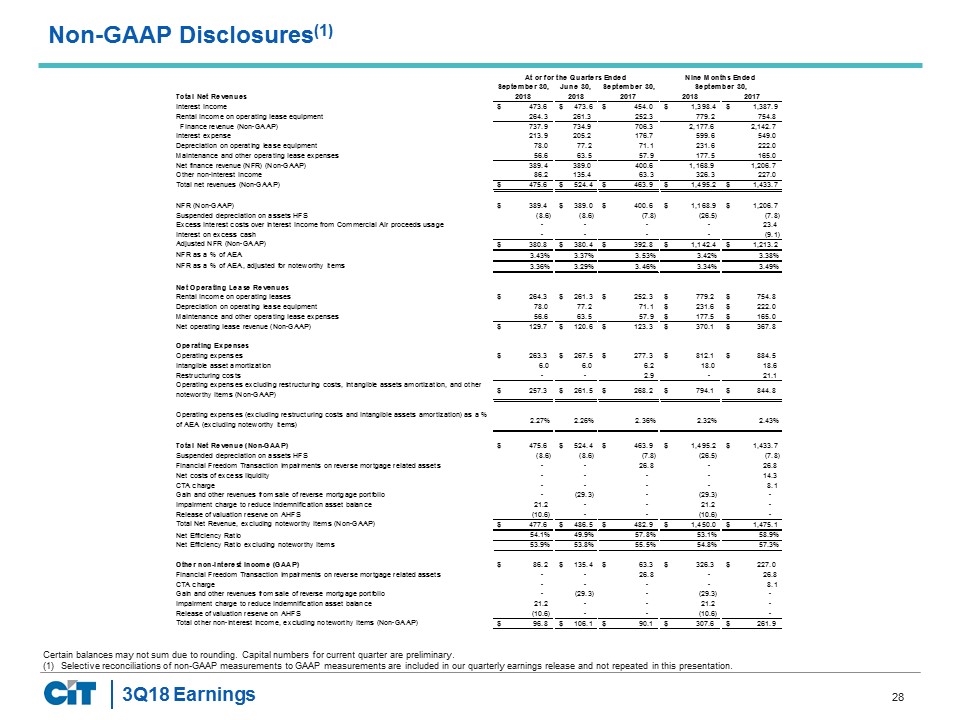

Certain balances may not sum due to rounding. Capital numbers for current quarter are preliminary. Selective reconciliations of non-GAAP measurements to GAAP measurements are included in our quarterly earnings release and not repeated in this presentation. Non-GAAP Disclosures(1)