- SAFT Dashboard

- Financials

- Filings

-

Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Safety Insurance (SAFT) DEF 14ADefinitive proxy

Filed: 16 Apr 03, 12:00am

Use these links to rapidly review the document

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

| o | Preliminary Proxy Statement | |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ý | Definitive Proxy Statement | |

| o | Definitive Additional Materials | |

| o | Soliciting Material Pursuant to §240.14a-12 | |

SAFETY INSURANCE GROUP, INC. | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| ý | No fee required | |||

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

| o | Fee paid previously with preliminary materials. | |||

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

![]()

SAFETY INSURANCE GROUP, INC.

20 Custom House Street, Boston, Massachusetts 02110

April 16, 2003

To Our Stockholders:

I am pleased to invite you to attend the 2003 Annual Meeting of Stockholders of Safety Insurance Group, Inc., which will be held at 9:00 a.m. on Friday, May 23, 2003, at the Company's headquarters, 20 Custom House Street, Boston, Massachusetts.

The accompanying Notice of the Annual Meeting of Stockholders and Proxy Statement describe in detail the matters to be acted on at this year's Annual Meeting.

If you plan to attend the meeting, please bring a form of personal identification with you and, if you are acting as proxy for another stockholder, please bring written confirmation from the stockholder for whom you are acting as proxy.

Whether or not you expect to attend the meeting, please sign and return the enclosed proxy card in the envelope provided. Your cooperation will assure that your shares are voted and will also greatly assist our officers in preparing for the meeting. If you attend the meeting, you may withdraw any proxy previously given and vote your shares in person if you so desire.

| Sincerely, | ||

| ||

DAVID F. BRUSSARD President and Chief Executive Officer |

![]()

SAFETY INSURANCE GROUP, INC.

20 Custom House Street, Boston, Massachusetts 02110

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD MAY 23, 2003

April 16, 2003

To Our Stockholders:

The 2003 Annual Meeting of Stockholders of Safety Insurance Group, Inc. (the "Company") will be held on Friday, May 23, 2003 at 9:00 a.m. Eastern Standard Time at the Company's headquarters, 20 Custom House Street, Boston, Massachusetts. At this meeting you will be asked to consider and vote upon the following:

The Board of Directors has fixed April 7, 2003 as the Record Date for determining the stockholders of the Company entitled to notice of and to vote at this Annual Meeting and any adjournment thereof.

The Company's 2002 Annual Report to Stockholders is enclosed with the mailing of this Notice of Annual Meeting of Stockholders, Proxy Statement and proxy card.

We urge you to attend and to participate at the meeting, no matter how many shares you own. Even if you do not expect to attend the meeting personally, we urge you to please vote, and then sign, date and return the enclosed proxy card in the postpaid envelope provided.

| By Order of the Board of Directors, | ||

| ||

WILLIAM J. BEGLEY, JR. Chief Financial Officer, Vice President and Secretary |

1

![]()

SAFETY INSURANCE GROUP, INC.

20 Custom House Street, Boston, Massachusetts 02110

PROXY STATEMENT

FOR ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD MAY 23, 2003

This Proxy Statement is being furnished in connection with the solicitation of proxies on behalf of Safety Insurance Group, Inc.'s (the "Company") Board of Directors (the "Board") for the 2003 Annual Meeting of Stockholders to be held on May 23, 2003 at 9:00 a.m. EST at the Company's headquarters located at 20 Custom House Street, Boston, Massachusetts 02110 (the "2003 Annual Meeting").

The record date for determining stockholders entitled to vote at this Annual Meeting has been fixed at the close of business on April 7, 2003 (the "Record Date"). As of the Record Date, 15,259,991 shares of the Company's common stock, par value $0.01 per share (the "Common Stock"), were outstanding and entitled to be voted. Every stockholder will be entitled to one vote for each share of Common Stock recorded in his or her name on the Company's books as of the Record Date. The Company mailed this Proxy Statement and the related form of proxy on or about April 16, 2003.

The shares of Common Stock represented by the enclosed Proxy will be voted as directed by the stockholder or, in the absence of such direction, in favor of the election of the nominees for director designated herein. The enclosed Proxy confers discretionary authority with respect to any other proposals that may properly be brought before this Annual Meeting. As of the date hereof, management is not aware of any other matters to be presented for action at this Annual Meeting. If any other matters properly come before this Annual Meeting, however, the Proxies solicited hereby will be voted in accordance with the recommendation of the Board.

So long as a quorum (a majority of issued and outstanding shares of Common Stock entitled to vote at this Annual Meeting) is present at this Annual Meeting either in person or by proxy, a plurality of the votes properly cast is required to elect the directors. Votes withheld from a director nominee, abstentions and broker non-votes (when a registered broker holding a customer's shares in the name of the broker has not received voting instructions on a matter from the customer and is barred from exercising discretionary authority to vote on the matter, which the broker indicates on the proxy) will be treated as present at this Annual Meeting for the purpose of determining a quorum but will not be counted as votes cast.

Any stockholder giving a Proxy may revoke it at any time before it is exercised by delivering written notice thereof to the Secretary. Any stockholder attending this Annual Meeting may vote in person whether or not the stockholder has previously filed a Proxy. Presence at this Annual Meeting by a stockholder who has signed a Proxy, however, does not in itself revoke the Proxy.

The enclosed Proxy is being solicited by the Board. The cost of soliciting proxies will be borne by the Company, and will consist primarily of preparing and mailing the Proxies and Proxy Statements. The Company will also request persons, firms and corporations holding shares of Common Stock in their names, or in the names of their nominees, which shares are beneficially owned by others, to send this Proxy material to and obtain Proxies from such beneficial owners and will reimburse such holders for their reasonable expenses in so doing.

The Company's Annual Report to Stockholders for the fiscal year ended December 31, 2002, including financial statements and the report of the Company's independent accountants PricewaterhouseCoopers LLP thereon, accompanies this Proxy Statement. The Annual Report to Stockholders is neither a part of this Proxy Statement nor incorporated herein by reference.

2

PROPOSAL 1

ELECTION OF THE COMPANY'S DIRECTORS

The Board has six members and consists of three equal classes, whose terms end in successive years. The Company's directors are elected annually by the stockholders and hold office for an initial term of one year or until their successors, if any, are elected and duly qualified for staggered three-year terms.

Each of the two Directors whose term expire at this year's Annual Meeting, John W. Jordan II and David K. McKown, has been nominated for re-election to a three year term ending at the 2006 Annual Meeting of Stockholders. The remaining four directors will continue to serve in accordance with their terms. THE BOARD RECOMMENDS A VOTE FOR PROPOSAL 1 WHICH CALLS FOR THE ELECTION OF THE 2003 NOMINEES.

| Director | Age | Director since | |||

|---|---|---|---|---|---|

| Initial Class I—Term ending in 2003* | |||||

| John W. Jordan II(2) | 55 | 2001 | |||

| David K. McKown(1)(2) | 65 | 2002 | |||

Initial Class II—Term ending in 2004 | |||||

| Bruce R. Berkowitz(1)(2)(3) | 44 | 2002 | |||

| David K. Zalaznick | 48 | 2001 | |||

Initial Class III—Term ending in 2005 | |||||

| David F. Brussard(3) | 51 | 2001 | |||

| A. Richard Caputo, Jr.(1)(2)(3) | 37 | 2001 | |||

The following information with respect to the principal occupation, business experience, recent business activities involving the Company and other affiliations of the nominees and directors has been furnished to the Company by the nominees and directors.

Nominees for Director

John W. Jordan II has served as a director of the Company since October 2001. Mr. Jordan has been a managing partner of The Jordan Company L.P. and its predecessors since 1982. Mr. Jordan is also a director of AmeriKing, Inc., Carmike Cinemas, Inc., GSFI, Inc., GSFI Holdings, Inc., Jackson Products, Inc., Jordan Industries, Inc., and Kinetek, Inc. (formerly known as Motors and Gears, Inc.), as well as other privately held companies.

David K. McKown has served as director of the Company since November 2002. Mr. McKown has been a Senior Advisor to Eaton Vance Management since 2000, focusing on business origination in real estate and asset-based loans. Mr. McKown retired in March 2000 having served as a Group Executive with BankBoston since 1993, where he focused on acquisitions and high-yield bank debt financings. Mr. McKown worked for BankBoston for over 40 years and had previously been the head of BankBoston's real estate department, corporate finance department and a director of BankBoston's private equity unit. Mr. McKown is currently a director of Equity Office Properties Trust and Newcastle Investment, as well as other privately held companies.

3

Directors Continuing in Office

Bruce R. Berkowitz has served as a director of the Company since November 2002. In December 2001, Mr. Berkowitz became a Deputy Chairman and a director of Olympus Re Holdings, Ltd. Mr. Berkowitz has been a member of the board of trustees of First Union Real Estate Equity and Mortgage Investments since 2000, President and a director of Fairholme Funds, Inc. since 1999, and managing member of Fairholme Capital Management, L.L.C. since 1997. Mr. Berkowitz was a managing director of Salomon Smith Barney Inc. from 1993 to 1997.

David W. Zalaznick has served as a director of the Company since October 2001. Mr. Zalaznick has been a managing partner of The Jordan Company L.P. and its predecessors since 1982. Mr. Zalaznick is also a director of AmeriKing, Inc., Carmike Cinemas, Inc., GFSI, Inc., GSFI Holdings, Inc., Jackson Products, Inc., Jordan Industries, Inc., Marisa Christina, Inc., and Kinetek, Inc. (formerly Motors and Gears, Inc.), as well as other privately held companies.

David F. Brussard was appointed President and Chief Executive Officer ("CEO") in June 2001 and has served as a director of the Company since October 2001. Since January 1999, Mr. Brussard has been the CEO and President of the Company's two insurance subsidiaries, Safety Insurance Company and Safety Indemnity Insurance Company (the "Insurance Subsidiaries"). Previously, Mr. Brussard served as Executive Vice President of the Insurance Subsidiaries from 1985 to 1999 and as Chief Financial Officer and Treasurer of the Insurance Subsidiaries from 1979 to 1999. Mr. Brussard is also a member of the governing committee, budget committee, executive committee and nominating committee of the Automobile Insurers Bureau and is a member of the governing, actuarial and defaulted broker committees of Commonwealth Automobile Reinsurers. Mr. Brussard is also on the Board of Trustees of the Insurance Library Association of Boston.

A. Richard Caputo, Jr. has served as a director of the Company since June 2001. Mr. Caputo has been a managing director of The Jordan Company L.P. and its predecessors, a private merchant banking firm, since 1990. Mr. Caputo is also a director of AmeriKing, Inc., GSFI, Inc., GSFI Holdings, Inc., and Jackson Products, Inc., as well as other privately held companies. AmeriKing, Inc., is currently the subject of Chapter 11 proceedings, and prior to commencement of those proceedings Mr. Caputo was appointed a Vice President of that company.

Certain Information Regarding the Board of Directors

Meetings of the Board of Directors

During 2002, the following meetings of the Board were held: two meetings of the full Board, four meetings of the Investment Committee and one meeting of the Audit Committee. All of the incumbent Directors attended at least 75% of the Board and committee meetings held while they were members during 2002. There was only one meeting of the Audit Committee in 2002 as this committee was elected by the Board in late 2002. Further, the Board performed compensation-related responsibilities until the Compensation Committee was formally elected in 2003.

Board Committees

The Investment Committee is comprised of the Company's Chief Financial Officer, William J. Begley, Jr. ("CFO"), and David F. Brussard, A. Richard Caputo, Jr., and Bruce R. Berkowitz (the "Investment Committee"). The Investment Committee reviews and evaluates, as may be appropriate, information relating to the Company's invested assets, its investment policies, strategies, objectives and activities.

The Audit Committee is comprised of Bruce R. Berkowitz (Chairman), A. Richard Caputo, Jr., and David K. McKown (the "Audit Committee"). For information regarding the functions performed by the Audit Committee, please refer to the "Report of the Audit Committee" included on page 5 of this

4

proxy statement, as well as the Charter of the Audit Committee, attached hereto in Appendix A to this Proxy Statement.

The entire Board, except Mr. Brussard, performed the Company's compensation-related responsibilities in 2002 until the Compensation Committee was elected in 2003. David F. Brussard, CEO of the Company, is the only member of the Board who is an officer of the Company and therefore abstained from compensation-related discussions of the Board in 2002. The Compensation Committee is comprised of Bruce R. Berkowitz, A. Richard Caputo, Jr., John W. Jordan II and David K. McKown (the "Compensation Committee"). The Compensation Committee administers the Company's stock plans and makes recommendations concerning salaries and incentive compensation for the Company's employees. No member of this committee has any interlocking or other relationships with the Company that would call into question his independence as a member of the committee.

The Board performs nominating duties as it does not have, nor plans to have, a standing Nominating Committee.

Board Compensation

The Company's bylaws provide that at the discretion of the Board, the directors may be paid their expenses, if any, at each meeting of the Board and may be paid a fixed sum for attendance at each meeting of the Board or a stated salary as a director. From the Company's incorporation in June 2001 until the Company completed its initial public offering of Common Stock on November 27, 2002 (the "IPO"), none of the Company's directors have received compensation for his services as a Board or committee member. Since the IPO, directors who are employees of the Company will not receive any compensation for serving as directors and those directors who are not employees of the Company will receive an annual retainer of $20,000 per year, paid in quarterly installments. In addition, in consideration for serving as a director, Mr. McKown received a grant of options to purchase 10,000 shares of Common Stock.

The primary purpose of the Audit Committee is to assist the Board in its general oversight of the Company's financial reporting process, and is more fully described in its charter which the Board and the Audit Committee have adopted and is included as Appendix A to this proxy statement.

Each member of the Audit Committee satisfies the definition of an "independent director" as established by Rule 4200 of the Marketplace Rules promulgated by the National Association of Securities Dealers, Inc., except A. Richard Caputo, Jr., who may not be an "independent director" because he formerly held unpaid positions at the Company's holding company, formed for the sole purpose of acquiring Thomas Black Corporation, as well as at all the Company's other subsidiaries. The Board has determined that the best interests of the Company and its stockholders require Mr. Caputo's membership on the Audit Committee. In making such determination, the Board has considered Mr. Caputo's knowledge of the Company and its business, his significant financial expertise and his independence from the Company's management.

In connection with the audit of the Company's consolidated financial statements for the year ended December 31, 2002, the Audit Committee has:

5

Based on the review and discussions referred to above, the Audit Committee recommended to the Board that the audited consolidated financial statements be included in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2002 and be filed with the U.S. Securities and Exchange Commission ("SEC").

Respectfully submitted,

BRUCE R. BERKOWITZ

A. RICHARD CAPUTO, JR.

DAVID K. MCKOWN

REPORT OF THE BOARD ON COMPENSATION

The Board, except Mr. Brussard, performed the Company's compensation-related responsibilities in 2002 until the Board elected a Compensation Committee in 2003. David F. Brussard, CEO of the Company, is the only member of the Board who is an officer of the Company and therefore abstained from compensation-related discussions of the Board in 2002. The Compensation Committee is comprised of Bruce R. Berkowitz, A. Richard Caputo, Jr., John W. Jordan II and David K. McKown. No member of this committee has any interlocking or other relationships with the Company that would call into question his independence as a member of the committee.

The primary purpose of the Board's compensation-related responsibilities is to establish and review the Company's compensation practices and policies, make recommendations concerning salaries and incentive compensation for the Company's employees and administer the Company's stock plans.

The Company's compensation program objective is to attract and retain individuals key to the future success of the Company, to motivate and reward employees in achieving the Company's business goals and to align the long-term interests of employees with those of stockholders.

The principal components of the Company's compensation program are base salary, performance-based annual incentive compensation and long-term incentive compensation. Annual base salaries of the Company's CEO and four most highly compensated executive officers ("the Named Executive Officers") and other key executives are set at levels considered to be competitive with amounts paid to executive officers with comparable qualifications, experience and responsibilities at competing companies, based on published surveys, proxy and other information. The 2002 base salaries for the Named Executive Officers, including the Company's CEO, increased approximately 3.0% from their 2001 base salaries. The Company maintains an annual executive incentive compensation plan providing bonuses to key employees who contribute materially to the success of the Company. During 2002, annual incentive compensation under this plan was tied to the achievement of significant individual performance goals. Long-term incentive compensation is provided under the Company's 2002 Management Omnibus Incentive Plan (the "Incentive Plan"), which provides for a variety of stock-based compensation awards including nonqualified stock options, incentive stock options, stock appreciation rights ("SARs") and restricted stock awards intended to attract, retain and motivate selected officers, key employees, directors and consultants to provide superior performance over a longer period of time as well as encourage stock ownership of the Company. A factor considered in determining the grant of awards under the Incentive Plan is the contribution of each employee to the long-term performance of the Company.

In approving the 2002 compensation package for the Company's CEO, Mr. Brussard, the Board compared Mr. Brussard's compensation against the comparative base salaries, annual and long-term

6

incentives and other compensation of chief executives of a peer group of property and casualty insurance companies of similar size. This review also included, but was not limited to, an assessment of the performance of the Company and its subsidiaries in terms of profitability and growth, an evaluation of its capital position and the implementation of significant cost controls and other initiatives. Mr. Brussard's base salary and potential for incentive compensation as a percentage of base salary were within the median market range. To further align Mr. Brussard's interests with those of the Company's stockholders, and as an incentive for future performance goals, the Board approved the grant of 166,050 stock options to Mr. Brussard on November 27, 2002 pursuant to the Incentive Plan.

The Board and the newly elected Compensation Committee will continue during 2003 to carefully consider employee compensation, and the components thereof, in relation to the Company's performance compared to that of industry performance levels for comparable companies and the performance history of the Company itself.

Respectfully submitted,

BRUCE R. BERKOWITZ

A. RICHARD CAPUTO, JR.

JOHN W. JORDAN II

DAVID K. MCKOWN

DAVID W. ZALAZNICK

7

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information as of April 16, 2003 with respect to the beneficial ownership of shares of Common Stock by the following individuals: (a) each person who is known to the Company to be the beneficial owner of more than 5% of the outstanding shares of such stock; (b) each of the Company's directors and director nominees; (c) each of the Company's Named Executive Officers; and (d) all of the Company's directors, director nominees and executive officers as a group. Except as stated below, each holder listed below has sole or shared investment and/or voting power with respect to the shares of Common Stock beneficially owned by the holder, subject to community property laws where applicable. The information in the tables and in the related notes has been furnished by or on behalf of the indicated owners.

| Name and address of beneficial owner | Amount of shares beneficially owned | Percentage of class (%) | ||||

|---|---|---|---|---|---|---|

| (a) Security ownership of certain beneficial owners: | ||||||

| Fairholme Partners, L.P.(1) | 1,238,649 | 8.1 | ||||

| 51 JFK Parkway Short Hills, NJ 07078 | ||||||

| JZ Equity Partners plc(2) | 1,984,004 | 13.0 | ||||

| 17a Curzon Street London, England W1J 5HS | ||||||

| TCW/Crescent Mezzanine Partners III, L.P.(3) | 891,137 | 5.8 | ||||

| 11100 Santa Monica Blvd. Suite 2000 Los Angeles, CA 90025 | ||||||

| Gilder, Gagnon, Howe & Co. LLC(4) | 2,335,294 | 15.3 | ||||

| 1775 Broadway, 26th Floor New York, NY 10019-1995 | ||||||

| Wellington Management Company, LLP(5) 75 State Street Boston, MA 02109 | 974,200 | 6.4 | ||||

(b) Security ownership of directors and director nominees: | ||||||

| David F. Brussard | 569,090 | 3.7 | ||||

| A. Richard Caputo, Jr.(6) | 302,028 | 2.0 | ||||

| John W. Jordan II(7)* | 320,149 | 2.1 | ||||

| David W. Zalaznick(6) | 320,149 | 2.1 | ||||

| Bruce R. Berkowitz(8) | 1,238,649 | 8.1 | ||||

| David K. McKown* | 0 | 0 | ||||

(c) Security ownership of Named Executive Officers: | ||||||

| David F. Brussard | 569,090 | 3.7 | ||||

| William J. Begley, Jr. | 104,871 | 0.7 | ||||

| Daniel F. Crimmins | 154,546 | 1.0 | ||||

| Daniel D. Loranger | 284,400 | 1.9 | ||||

| Edward N. Patrick, Jr. | 220,780 | 1.4 | ||||

(d) All directors, director nominees and executive officers as a group (12 persons) | 3,796,157 | 24.9 | ||||

8

9

Prior to the IPO, the Company's principal stockholders were certain investors assembled by The Jordan Company L.P., the investment firm that sponsored the management's buyout of the Company in 2001, which beneficially owned directly or indirectly, on a fully diluted basis, 72.2% of the Common Stock. This group of investors includes JZ Equity Partners plc, a publicly-traded investment trust listed on the London Stock Exchange with an independent board of directors whose investment advisor is affiliated with The Jordan Company, as well as Fairholme Partners, L.P., which consummated a purchase of 350,000 shares of Common Stock simultaneously with the IPO (the "Investors"). Messrs. Brussard, Caputo, Jordan and Zalaznick are currently serving as directors pursuant to rights granted under a stockholder agreement to the Investors and the seven members of the Company's executive management team comprised of the five Named Executive Officers, Robert J. Kerton and David E. Krupa (the "Management Team"). These provisions of the stockholders agreement terminated upon completion of the IPO. See "Certain Relationships and Related Transactions."

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires the Company's directors, executive officers and persons who own more than ten percent of the common stock to file with the SEC initial reports of ownership and reports of changes in ownership of the Common Stock and other equity securities, if any. Executive officers, directors and greater than ten percent beneficial owners are required to furnish the Company with copies of all Section 16(a) forms they file.

To the Company's knowledge, based solely on the Company's review of the copies of such reports furnished to the Company and written representations that no other reports were required during the fiscal year ended December 31, 2002, all Section 16(a) filing requirements applicable to its executive officers, directors and greater than ten percent beneficial owners were complied with except that A. Richard Caputo, Jr., John W. Jordan II and David W. Zalaznick each filed one late Form 4 regarding their acquisition of shares of the Common Stock in connection with the IPO. In addition, with respect to the Form 3s applicable to the Company's executive officers, directors and greater than ten percent beneficial owners, the Company reviewed copies of these reports and evidence of their timely submission to the SEC. However, these reports were submitted in paper and their receipt was not initially reflected by the SEC. These reports were subsequently refiled with the SEC.

10

EXECUTIVE COMPENSATION AND OTHER TRANSACTIONS

Summary Compensation Table

The following table sets forth all plan and non-plan compensation awarded to, earned by or paid to the Company's CEO and its four most highly compensated executive officers at the end of fiscal year December 31, 2002 (collectively, the "Named Executive Officers").

| | | | | | Long-Term Compensation Awards | | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | Annual Compensation | | |||||||||||||

| | | Securities Underlying Options/ SARs (#)(2) | | |||||||||||||

| Name and Principal Position | Year | Salary | Bonus | Other Annual Compensation (1) | All Other Compensation (3) | |||||||||||

| David F. Brussard President and Chief Executive Officer | 2002 2001 | $ $ | 513,338 500,460 | $ $ | 391,933 758,750 | $ $ | 186,518 — | 166,050 36,463 | $ $ | 162,394 1,062,477 | ||||||

William J. Begley, Jr. Chief Financial Officer, Vice President and Secretary | 2002 2001 | $ $ | 148,088 127,056 | $ $ | 101,188 151,750 | $ $ | 34,371 — | 36,900 6,719 | $ $ | 53,573 265,288 | ||||||

Daniel F. Crimmins Vice President | 2002 2001 | $ $ | 166,927 162,756 | $ $ | 112,630 — | $ $ | 50,652 — | 29,520 9,902 | $ $ | 55,289 361,737 | ||||||

Daniel D. Loranger Vice President | 2002 2001 | $ $ | 242,314 236,256 | $ $ | 157,220 151,750 | $ $ | 93,211 — | 55,350 18,222 | $ $ | 64,181 543,005 | ||||||

Edward N. Patrick, Jr. Vice President | 2002 2001 | $ $ | 231,545 225,756 | $ $ | 136,051 151,750 | $ $ | 72,360 — | 36,900 14,146 | $ $ | 57,587 533,889 | ||||||

11

Option Grants in 2002

The following table contains information concerning certain options to purchase shares of Common Stock ("Options") granted to the CEO and the other Named Executive Officers in 2002. No stock appreciation rights were granted during 2002.

| | Individual Grants | | | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Number of Securities Underlying Option Granted (#)(1) | Percent of Total Options Granted to Employees in 2002 | | | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Ten Year Term (4) | ||||||||

| Name | Exercise Price per Share (2) | Expiration Date (3) | |||||||||||

| 5% | 10% | ||||||||||||

| David F. Brussard | 166,050 | 43.8 | % | $ | 12.00 | 11/27/2012 | 1,253,135 | 3,175,691 | |||||

| William J. Begley, Jr. | 36,900 | 9.7 | % | $ | 12.00 | 11/27/2012 | 278,475 | 705,709 | |||||

| Daniel F. Crimmins | 29,520 | 7.8 | % | $ | 12.00 | 11/27/2012 | 222,780 | 564,567 | |||||

| Daniel D. Loranger | 55,350 | 14.6 | % | $ | 12.00 | 11/27/2012 | 417,712 | 1,058,564 | |||||

| Edward N. Patrick, Jr. | 36,900 | 9.7 | % | $ | 12.00 | 11/27/2012 | 278,475 | 705,709 | |||||

SAR Exercises in 2002 and Option Values at December 31, 2002

The following table sets forth information with respect to each Named Executive Officer concerning the number of SARs redeemed and the value realized upon redemption in 2002, and number and value of options held as of December 31, 2002.

| | | | Number of Securities Underlying Unexercised Options at December 31, 2002 (#)(2) | Value of Unexercised In-the-Money Options at December 31, 2002 (3) | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Number of SARs Redeemed in 2002 (#)(1) | Value of SARs Realized in 2002 | |||||||||||||

| Name | |||||||||||||||

| Exerciseable | Unexerciseable | Exerciseable | Unexerciseable | ||||||||||||

| David F. Brussard | 36,463 | $ | 186,518 | — | 166,050 | $ | — | $ | 395,199 | ||||||

| William J. Begley, Jr. | 6,719 | $ | 34,371 | — | 36,900 | $ | — | $ | 87,822 | ||||||

| Daniel F. Crimmins | 9,902 | $ | 50,652 | — | 29,520 | $ | — | $ | 70,258 | ||||||

| Daniel D. Loranger | 18,222 | $ | 93,211 | — | 55,350 | $ | — | $ | 131,733 | ||||||

| Edward N. Patrick, Jr. | 14,146 | $ | 72,360 | — | 36,900 | $ | — | $ | 87,822 | ||||||

12

Employment-Related Agreements

The Company has entered into certain agreements with the Named Executive Officers and with a number of other key executives.

David F. Brussard. Under his employment agreement with the Company, Mr. Brussard has agreed to serve as CEO and President of the Company for an initial term ending December 31, 2006 and automatically renewing for successive one-year terms thereafter, subject to at least 180 days' advance notice by either party of a decision not to renew the employment agreement. Under the terms of the employment agreement, Mr. Brussard is entitled to receive an annual salary of $514,473, as increased on an annual basis to reflect increases in the cost of living index specified therein. As determined in the sole discretion of the Board, Mr. Brussard will also be paid an annual bonus of not less than 35% of the total amount of bonuses paid in such year to persons that were high-ranking officers of the Company on October 16, 2001. In addition, Mr. Brussard was paid a transaction bonus of $217,863 on March 31, 2002 and was paid a transaction bonus of $200,000 on March 31, 2003, respectively, as a result of the consummation of the Acquisition. Mr. Brussard is also entitled to certain perquisites, including reimbursement of expenses, paid vacations, health, life and other similar insurance benefits and a car, all as determined by the Board.

Other Named Executive Officers. On October 16, 2001, the Company entered into employment contracts with each of Mr. Begley, Mr. Crimmins, Mr. Loranger and Mr. Patrick. Each of these employment agreements has an initial term ending December 31, 2004 and automatically renews for successive one-year terms unless either party provides written notice not to renew at least 180 days prior to the scheduled expiration date.

Under their respective employment agreements, Messrs. Begley, Crimmins, Loranger and Patrick are paid annual salaries of $150,000, $167,307, $242,865, and $232,071, respectively, as increased on an annual basis to reflect increases in the cost of living index specified therein. As determined in the sole discretion of the Board, Messrs. Begley, Crimmins, Loranger and Patrick are paid an annual bonus based on their performance. In addition, Messrs. Begley, Crimmins, Loranger and Patrick were paid transaction bonuses of $39,644, $53,699, $80,634 and $80,634, respectively, on March 31, 2002 as a result of the consummation of the Acquisition, and are also entitled to certain perquisites, including reimbursement of expenses, paid vacations, health, life and other similar insurance benefits. Mr. Crimmins will also be provided the use of a car of such make and model and upon such terms and conditions as the Board shall determine.

Provisions Common to Each Named Executive Officer's Employment Agreement. Certain provisions are common to each of the Named Executive Officers' employment agreements. These common provisions include, among other things, the following:

13

Executive Incentive Compensation Plan

The Company established its Executive Incentive Compensation Plan so that it and related companies may provide executive and management employees selected by the Board, including the Named Executive Officers, with an opportunity to build additional financial security, thereby attracting and retaining key employees. All of the Named Executive Officers are eligible for this plan. Under this plan, an annual allocation amount is made to a bonus pool as of the last day of each calendar year, beginning with calendar year 2002 and ending with the calendar year before the calendar year in which a change of control occurs. The annual allocation amount for each year is based on a percentage of the combined statutory net income of the Insurance Subsidiaries.

At the end of each calendar year, the Board reviews the performance of eligible individuals, and in its sole discretion, allocates the entire amount in the bonus pool among such eligible individuals. The portion of the bonus pool allocated to an eligible individual is credited to an account established for the individual. Amounts credited to individual accounts do not accrue interest or earn income of any kind. The balance of an individual's account is distributed in a lump sum as soon as practicable after the first day on which the individual is no longer employed by the Company or any related company, regardless of the reason for termination of employment. The plan may be amended or terminated by the Board at any time, provided that no amendment or termination may materially adversely affect the rights of any participant with respect to the calendar years ended prior to the date on which such amendment or termination is adopted by the Board.

The Named Executive Officers earned the first annual bonus in 2002 under the Executive Incentive Compensation Plan of $336,773, consisting of Messrs. Brussard, Begley, Crimmins, Loranger and Patrick who earned $148,729, $44,913, $44,133, $50,969 and $48,029, respectively.

Stock Appreciation Right ("SARs") Agreements

The Company entered into SARs agreements with our Named Executive Officers and a limited number of other employees of the Company on October 16, 2001. The agreements designate the number of "covered shares" for each Named Executive Officer. The number of covered shares granted to the Named Executive Officers is 36,463 for Mr. Brussard, 6,719 for Mr. Begley, 9,902 for Mr. Crimmins, 18,222 for Mr. Loranger and 14,146 for Mr. Patrick. The exercise price for each stock appreciation right is $6.88 per share. The number of covered shares and the exercise price of such shares is subject to adjustment to reflect stock splits, stock dividends, and other changes in the Company's capital structure. The SARs do not entitle their holders to acquire actual shares of Common Stock, but instead only to receive payments based on any appreciation of the Company's share price.

The SARs became fully vested and were automatically exercised at the close of the Company's IPO in November 2002. Each of the Named Executive Officers received a cash payment from the Company equal to the $12.00 IPO price per share less the SAR exercise price of approximately $6.88 per share, as follows: $186,518 to Mr. Brussard, $34,371 to Mr. Begley, $50,652 to Mr. Crimmins, $93,211 to Mr. Loranger and $72,360 to Mr. Patrick. There were no SARs granted in 2002.

2001 Restricted Stock Plan

On October 16, 2001, we adopted the 2001 Restricted Stock Plan for select employees of the Company and any related company. The purpose of the plan is to promote our success and to attract and retain valuable employees by linking the personal interests of such persons to those of our stockholders. The maximum number of shares of common stock with respect to which awards may be granted or sold under the plan is 290,500; provided, however, that this limitation is subject to adjustment to reflect stock splits, stock dividends, and other changes in the Company's capital structure.

14

Our Board has the authority to determine the persons to whom restricted shares are granted or sold, the times when such shares will be granted or sold, the number of shares to be granted or sold and the terms and conditions of each award, including, without limitation, those related to dividends. Participants may vote the restricted shares granted or sold under the plan. Restricted share awards will vest according to the terms established by the Board at the time restricted shares are granted or sold. Vesting, however, is contingent upon continuous employment. Unless otherwise determined by the Board, upon a participant's termination of employment, all of the participant's restricted shares not yet vested will be forfeited. The Board has the right to amend or terminate this plan at any time, subject to certain limitations, but no amendment or termination may alter the rights of a participant under any awards previously granted or sold.

On October 16, 2001, the Company entered into restricted stock award agreements for 290,500 restricted shares of common stock, the maximum number that could be sold or granted under the plan, with Mr. Brussard and Mr. Loranger. These agreements provided that the restricted stock would be forfeited unless the holders of the restricted stock remained employed with the Company. If any portion of the restricted stock was forfeited, those officers were still obligated to pay that portion of the loan relating to such forfeited stock. Under the Restricted Stock Plan and these restricted stock award agreements, 232,400 and 58,100 shares at a cost of $0.43 per share, which approximated the fair value of the shares at the date of the grant.

Also on October 16, 2001, the Company entered into management subscription agreements with members of the Company's Management Team, who purchased an aggregate of 1,615,180 shares of Common Stock, representing 27.8% of outstanding Common Stock as of the closing of the Acquisition. The aggregate cash consideration for the shares purchased was $695,000, which the Company loaned to them pursuant to the arrangements described below. Of these 1,615,180 shares, 232,400 shares were subject to a restricted stock agreement between Mr. Brussard and the Company and 58,100 shares are subject to a restricted stock agreement between Mr. Loranger and the Company. Under these management subscription agreements certain call and employee put options allowed the employee to put the stock owned by the employee at the time of exercise back to the Company under certain circumstances outside the Company's control and within the employee's control (e.g., employee retirement or resignation).

The restricted shares vested in full and the related put and call provisions under the management subscription agreements terminated upon the IPO. See "Certain Relationships and Related Transactions."

2002 Management Omnibus Incentive Plan

Our Board has adopted the Incentive Plan to attract, retain and motivate selected officers, key employees, directors and consultants of the Company through the granting of stock-based compensation awards. The Incentive Plan provides for a variety of awards, including nonqualified stock options, incentive stock options (within the meaning of Section 422 of the Internal Revenue Code), SARs and restricted stock awards. The maximum number of shares of Common Stock with respect to which awards may be granted under the Incentive Plan is 1,250,000 after adjustment for the stock dividend declared in connection with the IPO. This share limitation and the per-share price of such shares are subject to adjustment to reflect stock splits, stock dividends and changes in the Company's capital structure. Shares of stock covered by an award under the Incentive Plan that are forfeited will again be available for issuance in connection with future grants of awards under the plan.

The Compensation Committee of the Board will have broad authority to administer the Incentive Plan, including the authority to select plan participants, determine when awards will be made, determine the type and amount of awards, determine the exercise price of options and SARs, determine any limitations, restrictions or conditions applicable to each award, determine the terms of

15

any instrument that evidences an award, determine the manner in which awards may be exercised and interpret the Incentive Plan's provisions. Awards under the Incentive Plan are generally granted for a ten-year term, but may terminate earlier if the participant's employment terminates before the end of such term. The exercise price for each option granted under the Incentive Plan will be the fair market value of a share of Common Stock on the date of grant. The exercise price of options granted under the Incentive Plan may be paid (i) in cash, (ii) by delivery of previously-acquired shares of Common Stock, (iii) by any combination of (i) and (ii), (iv) pursuant to a cashless exercise program through an independent broker (as permitted by applicable law), or (v) by any other means the committee approves, in its discretion.

If, while any award granted under the Incentive Plan remains outstanding, a change of control of the Company occurs, then all stock options and SARs outstanding at the time of the change of control will become exercisable in full immediately prior to the change of control and all restrictions with respect to restricted stock awards settled by a payment in cash or shares (at the Compensation Committee's discretion) to each holder.

The Incentive Plan may be suspended, amended or terminated at any time by the Board, including amending any form of award agreement or instrument to be executed pursuant to the Incentive Plan. However, no amendment or termination of the Incentive Plan may, without the affected individual's consent, alter or impair any rights or obligations under any award previously granted under the Incentive Plan.

The Compensation Committee administers the stock plans and determines the terms of awards granted, including the exercise price, the number of shares subject to individual awards and the vesting period of awards. In the case of options intended to qualify as "performance-based compensation" within the meaning of Section 162(m) of the Internal Revenue Code granted under the Incentive Plan, the Compensation Committee will consist of two or more "outside directors" within the meaning of Section 162(m). In addition, before such performance-based compensation is paid, the material terms of the Company's stock plans will be presented to and approved by a majority vote of the Company's stockholders. The Compensation Committee determines the exercise price of options granted under the Incentive Plan.

On July 1, 2002, the Board approved the grant of options to purchase 379,000 shares of Common Stock upon the IPO at the IPO price to each of the Company's seven member Management Team and one director. These option grants were made to each of the Named Executive Officers, to purchase the following number of shares of Common Stock: of 166,050 to Mr. Brussard, 36,900 to Mr. Begley, 29,520 to Mr. Crimmins, 55,350 to Mr. Loranger and 36,900 to Mr. Patrick. These grants were effective upon the IPO date at an exercise price equal to the $12.00 per share IPO price, have a ten year term and vest in five equal annual installments beginning on the first anniversary date of these grants.

These options will have a term of ten years and will vest in five equal annual installments beginning on the first anniversary of the date of grant.

Safety Insurance 401(k) Retirement Plan

In 1995, upon the inception of the employee stock ownership plan ("ESOP"), the Company discontinued all employer and employee contributions to its then existing qualified defined contribution profit-sharing/retirement plan (the "Retirement Plan"). As a result, the rights of each participant to their account under the Retirement Plan became fully vested and nonforfeitable on the date of discontinuance of contributions. With the termination of the ESOP on October 16, 2001 in connection with the Acquisition, the Company re-established the previously frozen Retirement Plan, effective January 1, 2002, to be a 401(k) retirement plan only and renamed it the Safety Insurance 401(k) Retirement Plan (the "401k Plan"). This new 401k Plan is a defined contribution plan which is available to all eligible employees of the Company and provides that an employee must be 21 years of

16

age to be eligible to participate and is allowed to contribute up to 15% of eligible compensation. The Company shall make a matching contribution on behalf of each participant who is employed by the Company on the last day of the year in an amount equal to 50% of the first 8% of each participant's compensation contributed to the plan for each year including 2002. Matching contributions by the Company starting in 2003 will increase to 75% of the first 8% of each participant's contribution to the plan. Matching contributions vest ratably over a five-year period. Contributions by participants or by the Company to the plan, and income earned on contributions, are generally not taxable until withdrawn from the plan.

Section 162(m)

Section 162(m) of the Internal Revenue Code limits publicly-held companies to an annual deduction for federal income tax purposes of $1.0 million for compensation paid to the Company's Named Executive Officers determined at the end of each year. Under a special rule that applies to corporations that become public through an IPO, this limitation in Section 162(m) generally will not apply to compensation that is paid under the Company's Executive Incentive Compensation Plan, 2001 Restricted Stock Plan and Incentive Plan before the first meeting of the Company's stockholders in 2006 at which directors will be elected.

Performance-based compensation that meets certain requirements, including stockholder approval, is excluded from this limitation under Section 162(m). In general, compensation qualifies as performance-based compensation under Section 162(m) if (1) it is conditioned on the achievement of one or more pre-established, objective performance goals, (2) such goal or goals are established by a committee of the Board consisting solely of two or more outside directors and (3) material terms of the performance goals under which the compensation is payable are disclosed to, and subsequently approved by, the corporation's stockholders prior to payment. Although awards granted under the Incentive Plan are temporarily exempt from the limitations of Section 162(m), the plan is designed to permit the Compensation Committee to grant awards that qualify as performance-based compensation for purposes of satisfying the conditions of Section 162(m) once the exemption expires. The Compensation Committee consists of two or more "outside directors" within the meaning of Section 162(m) and before such performance-based compensation is paid, the material terms of the Company's stock plans will be presented to and approved by a majority vote of the Company's stockholders.

17

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

The Company's Management Team and the Investors organized by The Jordan Company consummated the Acquisition of Thomas Black Corporation, the holding company for Safety Insurance Company, on October 16, 2001 (the "Acquisition"). The following discussion summarizes material agreements the Company entered into in connection with the Acquisition. Also see "Executive Compensation and Other Transactions."

The Company entered into a subscription agreement with the Management Team. Under the subscription agreement, the members of the team purchased an aggregate of 1,615,180 shares of Common Stock, representing 27.8% of outstanding Common Stock as of the closing of the Acquisition. The aggregate cash consideration for the shares purchased was $695,000, which the Company loaned to them pursuant to the arrangements described below. Of these 1,615,180 shares, 232,400 shares were subject to a restricted stock agreement between the Company and Mr. Brussard and 58,100 shares are subject to a restricted stock agreement between the Company and Mr. Loranger. These agreements provided that the restricted stock would be forfeited unless the holders of the restricted stock remained employed with the Company. If any portion of the restricted stock was forfeited, those officers were still obligated to pay that portion of the loan relating to such forfeited stock. Under these restricted stock agreements, the restricted shares vested at the IPO.

Each member of the Management Team issued a recourse promissory note to, and entered into a pledge agreement with the Company. Pursuant to the notes, the Company loaned these officers an aggregate of $695,000 on October 16, 2001 in order for them to purchase our common stock in connection with the Acquisition, as follows: $244,875 to Mr. Brussard, $45,125 to Mr. Begley, $66,500 to Mr. Crimmins, $64,125 to Mr. Kerton, $57,000 to Mr. Krupa, $122,375 to Mr. Loranger and $95,000 to Mr. Patrick. Pursuant to the pledge agreements, the Management Team pledged the Common Stock to the Company as security for the loans made under the notes. Each note bears interest at a rate of 5% annually and is due and payable on the earlier of December 31, 2011 or 90 days after the Management Team member ceases to be the Company's employee. Each employee may prepay his note at any time without penalty. At April 16, 2003, there was an aggregate of $212,533, including accrued interest, outstanding under these loans. The largest aggregate amount of indebtedness, including interest, outstanding at any time since the inception of these loans is as follows for each officer as of April 16, 2003: $48,400 for Mr. Begley, $71,325 for Mr. Crimmins, $68,807 to Mr. Kerton, and $61,127 to Mr. Krupa. During 2003, the following loans were paid off in full: $261,396 from Mr. Brussard, $130,970 from Mr. Loranger and $101,285 from Mr. Patrick.

Also at the Acquisition, each member of the Management Team entered into an agreement under which he agreed not to receive certain bonuses to which he would have been entitled following the closing. These bonuses, which would have been payable over the three years following the closing assuming the members of the Management Team remained employed by the Company or left employment for good reason, would have totaled $16.0 million in the aggregate.

In connection with the Acquisition, the Company entered into an agreement with members of the Management Team to indemnify them for any tax loss they may incur in connection with the purchase of the Common Stock at the time that the Company acquired Thomas Black Corporation, due to a determination by the Internal Revenue Service that the value of such stock was higher than the purchase price agreed upon by the Company and the Management Team. The agreement provides that in such case the Company would pay the executives an amount such that, after payment of taxes on the payment, they would retain an amount equal to (i) the excess value of the Common Stock multiplied by a percentage equal to the difference between the combined U.S. federal, state and local tax rate on ordinary income and the combined U.S. federal, state and local tax rate on long-term capital gains, plus (ii) related interest, penalties or additions, and the executive's portion of applicable payroll taxes, if any. Under the agreement, the Company would also loan to members of the Management Team an

18

amount equal to the excess value of the Common Stock (as determined by the Internal Revenue Service) multiplied by the applicable capital gains tax rate, which loan would be secured by the Common Stock owned by such executive.

The Company also entered into a subscription agreement with certain of its other stockholders in connection with the Acquisition. The parties included, among others, Leucadia Investors, Inc., and Messrs. Jordan, Zalaznick and Caputo, who are directors on the Board. Under these agreements, these stockholders purchased an aggregate of 2,111,935 shares of the Common Stock for an aggregate purchase price of $0.9 million. The Company also entered into a purchase agreement with JZ Equity Partners plc, an investment trust listed on the London Stock Exchange which is advised by an affiliate of The Jordan Company L.P. Under this agreement, JZ Equity Partners purchased 2,082,885 shares of the Common Stock for an aggregate purchase price of $0.9 million, 22,400 shares of the preferred stock for a purchase price of $22.4 million, and $30.0 million aggregate principal amount of subordinated notes for $30.0 million. JZ Equity Partners subsequently sold a portion of the Common Stock, preferred stock and subordinated notes it purchased to other third parties. Concurrently with the IPO, the Company converted all of the outstanding redeemable preferred shares into shares of Common Stock. Further, the Company repaid in full the subordinated notes with a portion of the net proceeds of the IPO.

At the closing of the Acquisition, the Company entered into a stockholders agreement with the Management Team and the other Investors. Under the stockholders agreement, the parties agreed to vote for the Board nominated in the agreement. The stockholders agreement restricts each stockholder's ability to transfer or otherwise dispose of shares of the Common Stock, except to certain of their affiliates, charitable organizations or the Company, or pursuant to a public offering or a Rule 144 sale under the Securities Act of 1933. The stockholders agreement entitles the parties to certain other rights in connection with the shares of Common Stock, including rights of first refusal and rights to participate in sales made by other stockholders. Further, the stockholders agreement provides that a change of control of the Company requires the consent of the Management Team's representative on the Board. In the event such consent has not been obtained, the Company may repurchase the Common Stock held by the Management Team for an aggregate price of $10.2 million. The stockholders agreement also entitles the parties to rights to register their Common Stock in specified circumstances. All the foregoing provisions of the stockholders agreement terminated upon the IPO, other than the registration rights.

In consideration for services The Jordan Company rendered in connection with the Acquisition and related financings, the Company paid TJC Management a $2.5 million fee and entered into a management consulting agreement to pay TJC Management a management fee in installments of $1.0 million per year for ten years. TJC Management Corporation is an affiliate of The Jordan Company. TJC Management may be considered the Company's affiliate because three of the Company's directors are executives of The Jordan Company, and executives of and consultants to The Jordan Company own an aggregate of approximately 15.8% of the Company's Common Stock outstanding. Under the management consulting agreement, TJC Management renders consulting services to the Company in connection with the Company's financial and business affairs, the Company's relationships with lenders, stockholders and other third parties, and the expansion of the Company's business. The management consulting agreement continues until December 31, 2011, after which it will renew automatically for successive one-year terms unless terminated pursuant to its provisions. The Company agreed with TJC Management to amend the management consulting agreement as of the IPO. Under the agreement as amended, the Company is no longer obligated to pay the $1.0 million annual management fee and TJC Management is no longer obligated to provide consulting services to the Company other than in connection with the acquisition, sale or financing transactions described below. In consideration for its agreement to terminate the annual fee and its services to the Company under the agreement prior to the IPO, we paid TJC Management $4.0 million

19

upon the closing of our IPO. TJC Management did not receive any other fee upon the closing of the IPO or of the Company's new bank credit facility or in respect of the portion of the annual management fee accrued and unpaid through the closing.

Under the amended agreement, the Company paid TJC Management a $4.0 million termination fee upon closing. The amended agreement also provides for:

From October 16, 2001 through our IPO, the Company has paid TJC Management approximately $5,032,637 under the management consulting agreement for services rendered and the above mentioned termination fee.

Certain of the Company's stockholders who are, with one exception, individuals who work for The Jordan Company, purchased 333,334 shares of Common Stock in the IPO at the IPO price of $12.00 per share. All of these shares are subject to a lock-up agreement for 180 days from the date of the November 21, 2002 prospectus. We also agreed to sell directly to Fairholme Partners, L.P., one of the Investors, on a non-underwritten basis 350,000 shares of the Common Stock at the IPO price.

20

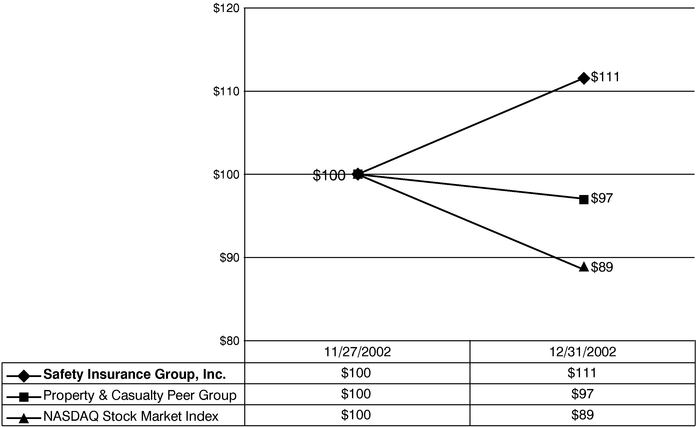

COMMON STOCK PERFORMANCE GRAPH

Set forth below is a line graph comparing the dollar change in the cumulative total stockholder return on the Company's Common Stock, for the period beginning on November 27, 2002 (the close of the Company's IPO and first trade date for the Company's common stock) and ending on December 31, 2002, as compared to the cumulative total return of the NASDAQ Stock Market Index and a group of six peer property & casualty insurance companies. The peer group consists of Baldwin & Lyons, Inc., the Commerce Group, Inc., Mercury General Corp., State Auto Financial Corp., Selective Insurance Group, Inc., and 21st Century Insurance Group, which has been weighted according to each peer's respective aggregate market capitalization on the November 27, 2002 measurement point. The graph shows the change in value of an initial $100 investment on November 27, 2002, assuming re-investment of dividends.

Comparison of Cumulative Total Return since IPO Among

Safety Insurance Group, Inc.,

Property & Casualty Insurance Peer Group and the NASDAQ Stock Market Index

INDEPENDENT PUBLIC ACCOUNTANTS

The Audit Committee of the Board has not selected an independent auditor for 2003 as of the date of this Proxy Statement. Management anticipates that the Audit Committee will consider the selection of an independent auditor later in 2003.

PricewaterhouseCoopers LLP are the Company's principal accountants for the most recently completed fiscal year ended December 31, 2002. Representatives of PricewaterhouseCoopers LLP are expected to be present at the Annual Meeting, will have the opportunity to make a statement if they desire to do so and will be available to respond to appropriate questions.

21

Independent Auditor Fees Billed for Services Performed Related to 2002 Services

Audit Fees Aggregate fees billed for the 2002 year-end audit of the Company's consolidated financial statements including the Company's quarterly reviews totaled $259,839.

Financial Information Systems Design and Implementation Fees No such services were performed during 2002.

All Other Fees Aggregate fees billed for all other services performed in 2002 totaled $903,776. These fees consisted of: $753,756 for audit services related to the IPO and capital raising activities, $133,620 for tax compliance and consulting services for existing companies, and $16,400 for other miscellaneous fees. The Audit Committee has considered and determined that these non-audit fees are compatible with maintaining PricewaterhouseCoopers LLP's independence.

Inspectors of Election

EquiServe Trust Company, N.A., P.O. Box 43023, Providence, Rhode Island 02940-3023, has been appointed as Inspectors of Election for the Company's 2003 Annual Meeting. Representatives of EquiServe will attend the 2003 Annual Meeting to receive votes and ballots, supervise the counting and tabulating of all votes and ballots, and determine the results of the vote.

Available Information

The Company is subject to the informational reporting requirements of the Exchange Act of 1934. In accordance therewith, the Company files reports, proxy statements and other information with the SEC. The Company will provide to any stockholder, upon request and without charge, copies of all documents (excluding exhibits unless specifically requested) filed with the SEC. Written, telephone, fax or e-mail requests should be directed to the Office of Investor Relations, Safety Insurance Group Inc., 20 Custom House Street, Boston, MA 02110, Tel: 877-951-2522, Fax: 617-603-4837, or e-Mail to InvestorRelations@SafetyInsurance.com. These documents are also made available on the Company's website, www.SafetyInsurance.com, as soon as reasonably practicable after each press release and SEC Report is filed with, or furnished, to the SEC.

Stockholder Proposals for the 2004 Annual Meeting of Stockholders

Stockholder proposals (other than those proposals to nominate persons as directors) must be received in writing by the Chief Financial Officer of the Company no later than December 11, 2003 and must comply with the requirements of the SEC in order to be considered for inclusion in the Company's proxy statement relating to the Annual Meeting to be held in 2004.

| By Order of the Board of Directors, | ||

| ||

WILLIAM J. BEGLEY, JR. Chief Financial Officer, Vice President and Secretary |

22

Safety Insurance Group, Inc.

AUDIT COMMITTEE CHARTER

As approved by the Audit Committee on March 20, 2003

I. General Statement of Purpose

The Audit Committee of the Board of Directors (the "Audit Committee") of Safety Insurance Group, Inc. (the "Company") assists the Board of Directors (the "Board") in general oversight and monitoring of: (i) the integrity of financial statements of the Company; (ii) the independent auditor's qualifications and independence; (iii) the performance of the Company's internal audit function and independent auditors; and (iv) the Company's procedures for compliance with legal and regulatory requirements.

II. Audit Committee Composition

The Committee shall be comprised of a minimum of three directors as appointed by the Board, who shall meet the independence and audit committee composition requirements of the Marketplace Rules promulgated by the National Association of Securities Dealers, Inc., as may be modified or supplemented (the "Marketplace Rules"), Section 10A(m)(3) of the Securities Exchange Act of 1934, as amended, (the "Exchange Act"), the rules and regulations of the U.S. Securities and Exchange Commission (the "Commission") and any applicable requirements of state law. Each member of the Audit Committee shall be able to read and understand fundamental financial statements, including a balance sheet and statements of operations, comprehensive income and cash flows, and to the extent required, at least one member shall be an "Audit Committee Financial Expert" as such term is defined by the Commission.

The members of the Audit Committee shall be elected by the Board and shall continue to serve as such until the next annual meeting of the Board or until their respective successors are designated. Any vacancy that might arise in the membership of the Audit Committee shall be filled by appointment of the Board.

III. Meetings

The Audit Committee will meet as often as may be deemed necessary or appropriate and at such times and places as it shall determine, but not less frequently than quarterly. The Audit Committee will meet periodically with management, the internal auditors and the independent auditor in separate executive sessions. The Audit Committee will record the actions taken at such meetings and will report to the Board with respect to its meetings.

IV. Responsibilities and Authority

The Audit Committee shall have the sole authority to appoint, replace, determine funding for, and oversee the independent auditor. The Audit Committee shall be directly responsible for the compensation and oversight of the work of the independent auditor (including resolution of disagreements between management and the independent auditor regarding financial reporting) for the purpose of preparing or issuing an audit report or related work, or performing other audit, review or attest services for the Company. The independent auditor shall report directly to the Audit Committee.

The Audit Committee shall preapprove all auditing and review services and permitted non-audit services (including the fees and terms thereof) to be performed for the Company by its independent auditor in accordance with applicable rules and regulations.

A-1

The Audit Committee shall have the authority, to the extent it deems necessary or appropriate, to retain independent legal, accounting or other advisors. The Company shall provide for appropriate funding, as determined by the Audit Committee, for payment of compensation to the independent auditor for the purpose of rendering or issuing an audit report and to any advisors employed by the Audit Committee.

The Audit Committee shall be responsible for (i) ensuring its receipt of a formal written statement delineating all relationships between the independent auditor and the Company from the independent auditors, consistent with Independence Standards Board Standard No. 1., as may be modified or supplemented; (ii) actively engaging in a dialogue with the independent auditors with respect to any disclosed relationships or services that may impact the objectivity and independence of the independent auditors; and (iii) taking, or recommending that the Board take, appropriate action to oversee the independence of the independent auditor.

The Audit Committee shall establish procedures for the receipt, retention, and treatment of complaints received by the Company regarding accounting, internal accounting controls, or auditing matters, and the confidential, anonymous submission by employees of the Company of concerns regarding questionable accounting or auditing matters.

V. Audit Committee Principal Processes

The principal processes of the Audit Committee will generally include the following which are set forth as a guide with the understanding that the Audit Committee may supplement them as appropriate:

A-2

activities or access to requested information, and any significant disagreements with management.

Notwithstanding the responsibilities and powers of the Audit Committee set forth in this Charter, the Audit Committee does not have the responsibility of planning or conducting audits of the Company's financial statements or determining whether or not the Company's financial statements are complete, accurate and in accordance with generally accepted accounting principles or the rules of the Commission. Such responsibilities are the duty of management and the independent auditor.

A-3

DETACH HERE

PROXY

SAFETY INSURANCE GROUP, INC.

20 CUSTOM HOUSE STREET

BOSTON, MASSACHUSETTS 02110

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

The undersigned stockholder of Safety Insurance Group, Inc. hereby appoints David F. Brussard and William J. Begley, Jr. (each with power to act without the other and with power of substitution) as proxies to represent the undersigned at the annual meeting of the common stockholders of Safety Insurance Group, Inc. to be held at 9:00 a.m. EST on Friday, May 23, 2003 and at any adjournment thereof, with all the power the undersigned would possess if personally present, and to vote all shares of common stock which the undersigned may be entitled to vote at said meeting, hereby revoking any proxy heretofore given.

THIS PROXY, WHEN PROPERLY EXECUTED, WILL BE VOTED AS SPECIFIED ON THE REVERSE SIDE. IF NO SPECIFICATION IS MADE, IT IS THE INTENTION OF THE PROXIES TO VOTE FOR ALL NOMINEES FOR DIRECTOR LISTED ON THE REVERSE SIDE.

| SEE REVERSE SIDE | CONTINUED AND TO BE SIGNED ON REVERSE SIDE | SEE REVERSE SIDE |

SAFETY INSURANCE GROUP, INC.

C/O EQUISERVE TRUST COMPANY, N.A.

P.O. BOX 8694

EDISON, NJ 08818-8694

DETACH HERE IF YOU ARE RETURNING YOUR PROXY CARD BY MAIL.

| ý | Please mark votes as in this example |

| THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" THE FOLLOWING: | ||

SAFETY INSURANCE GROUP, INC. |

| 1. | ELECTION OF TWO CLASS I DIRECTORS TO SERVE A THREE YEAR TERM EXPIRING IN 2006. | |||||

| Nominees: (01) John W. Jordan II (02) David K. McKown |

| FOR ALL NOMINEES | o | o | WITHHELD FROM ALL NOMINEES |

| FOR ALL NOMINEES EXCEPT | o | |||||

| To withhold authority to vote for a nominee, mark "FOR ALL NOMINEES EXCEPT" and write the nominee's number on the line above. | ||||||

Mark box at right for address change and note at lefto | ||||||

THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED | ||||||

Please date and sign exactly as your name or names appear herein. Corporate or partnership proxies should be signed in full corporate or partnership name by an authorized person. Persons signing in a fiduciary capacity should indicate their full title in such capacity. |

| Signature: ________________________ | Date:_____________ | Signature (Joint Owner): ________________________ | Date:_____________ |