EXHIBIT 99.2

Bill Barrett Corporation

February 2006

Fred Barrett, President and Chief Operating Officer

1099 18th Street, Suite 2300 Denver, Colorado 80202 303.293.9100, fax 303.291.0420 www.billbarrettcorp.com NYSE: BBG

Forward-Looking Statements

Except for the historical information contained herein, the matters discussed in this presentation are forward-looking statements. These forward-looking statements reflect our current views with respect to future events, based on what we believe are reasonable assumptions. These statements, however, are subject to risks and uncertainties that could cause actual results to differ materially including, among other things, exploration results, market conditions, oil and gas price levels and volatility, the availability and cost of services and drilling rigs, the ability to obtain industry partners to jointly explore certain prospects, uncertainties inherent in oil and gas production operations and estimating reserves, unexpected future capital expenditures, competition, the success of our risk management activities, governmental regulations and other factors discussed in our definitive prospectus dated August 17, 2005 filed with the Securities and Exchange Commission (SEC). We refer you to the “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors” sections of that filing.

Key Highlights

Pure Rockies oil and gas exploration and production company

Time-Honored Strategy

Proven, experienced Rocky Mountain management team

and technical staff

Develop extensive multi-year development drilling inventory

Exposure to multiple high impact, high return exploration plays

Heavily weighted towards unconventional projects

Solid record of development growth and exploration discoveries

Strong balance sheet positioned for growth

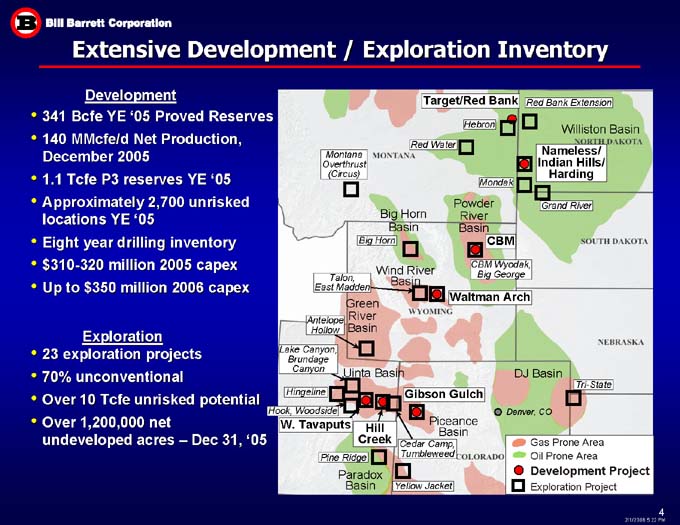

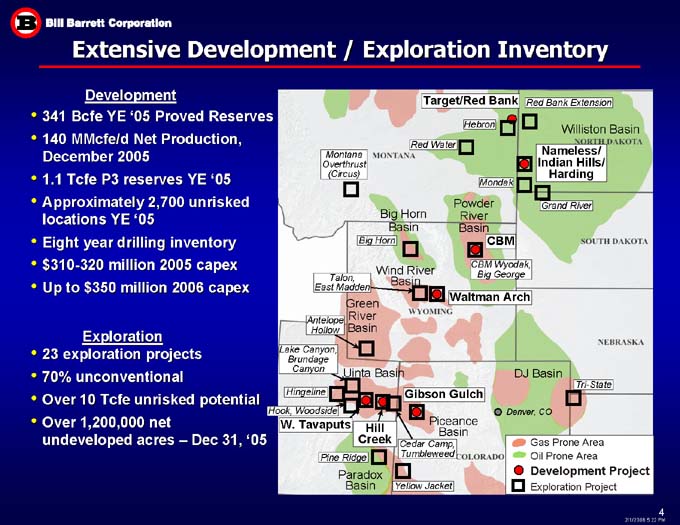

Extensive Development / Exploration Inventory

Development

341 Bcfe YE ‘05 Proved Reserves

140 MMcfe/d Net Production, December 2005

1.1 Tcfe P3 reserves YE ‘05

Approximately 2,700 unrisked locations YE ‘05

Eight year drilling inventory

$310-320 million 2005 capex

Up to $350 million 2006 capex

Red Bank Extension

Target/Red Bank Hebron Williston Basin Nameless/ Indian Hills/ Harding Red Water Montana Overthrust (Circus)

Mondak Grand River Powder River Basin Big Horn Basin Big Horn CBM Wind River Basin CBM Wyodak,

Big George Talon, East Madden Waltman Arch Green River Basin Antelope Hollow Exploration

23 exploration projects

70% unconventional

Over 10 Tcfe unrisked potential

Over 1,200,000 net

undeveloped acres – Dec 31, ‘05

Lake Canyon,

Brundage Canyon

DJ Basin

Uinta Basin

Tri-State

Gibson Gulch

Hingeline

Hook, Woodside

Denver, CO

W. Tavaputs

Hill Creek

Piceance

Basin

Cedar Camp,

Tumbleweed

Gas Prone Area

Oil Prone Area

Development Project

Pine Ridge

Paradox Basin

Yellow Jacket

Exploration Project

NORTH DAKOTA

SOUTH DAKOTA

WYOMING

NEBRASKA

COLORADO

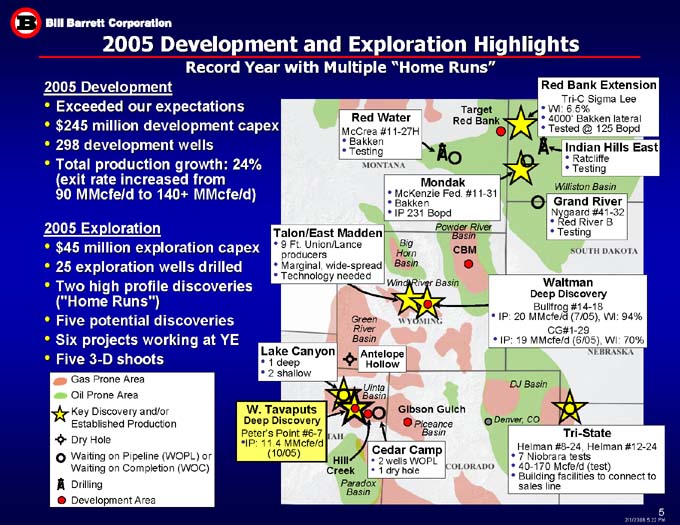

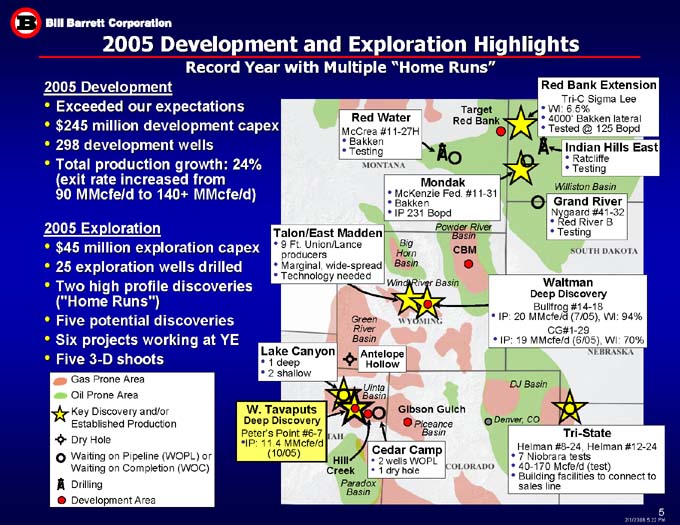

2005 Development and Exploration Highlights

Record Year with Multiple “Home Runs”

2005 Development

Exceeded our expectations

$245 million development capex

298 development wells

Total production growth: 24%

(exit rate increased from

90 MMcfe/d to 140+ MMcfe/d)

2005 Exploration

$45 million exploration capex

25 exploration wells drilled

Two high profile discoveries

(“Home Runs”)

Five potential discoveries

Six projects working at YE

Five 3-D shoots

Red Bank Extension

Tri-C Sigma Lee WI: 6.5% 4000’ Bakken lateral Tested @ 125 Bopd Target Red Bank Red Water McCrea #11-27H Bakken Testing

Indian Hills East Ratcliffe Testing Mondak McKenzie Fed. #11-31 Bakken IP 231 Bopd Mondak Williston Basin

Grand River Nygaard #41-32 Red River B Testing Talon/East Madden 9 Ft. Union/Lance producers Marginal, wide-spread

Technology needed Powder River Basin Big Horn Basin CBM Wind River Basin Waltman

Deep Discovery Bullfrog #14-18 IP: 20 MMcfe/d (7/05), WI: 94% CG#1-29 IP: 19 MMcfe/d (6/05), WI: 70%

Green River Basin Antelope Hollow Lake Canyon 1 deep 2 shallow

Gas Prone Area Oil Prone Area Key Discovery and/or Established Production Dry Hole Waiting on Pipeline (WOPL) or

Waiting on Completion (WOC)

Drilling

Development Area

Uinta Basin

DJ Basin

W. Tavaputs

Deep Discovery

Peter’s Point #6-7

IP: 11.4 MMcfe/d

(10/05)

Gibson Gulch

West Tavaputs

Piceance

Basin

Denver, CO

Tri-State

Helman #8-24, Helman #12-24

7 Niobrara tests

40-170 Mcfe/d (test)

Building facilities to connect to sales line

Cedar Camp

2 wells WOPL

1 dry hole

Hill Creek

Paradox Basin

MONTANA

WYOMING

TAH

COLORADO

NEBRASKA

SOUTH DAKOTA

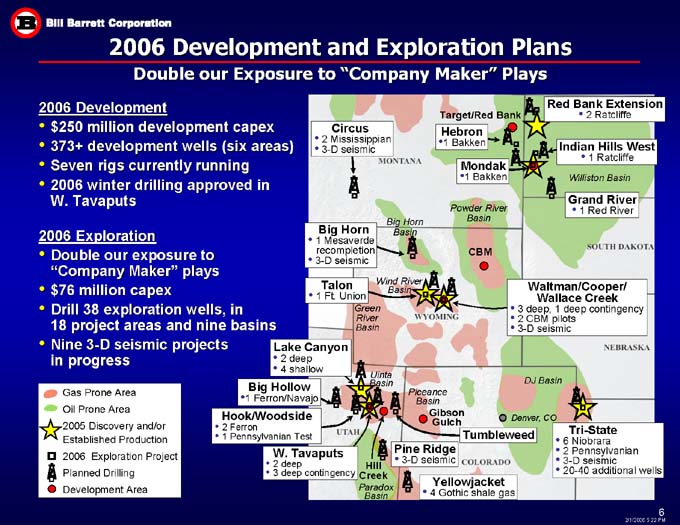

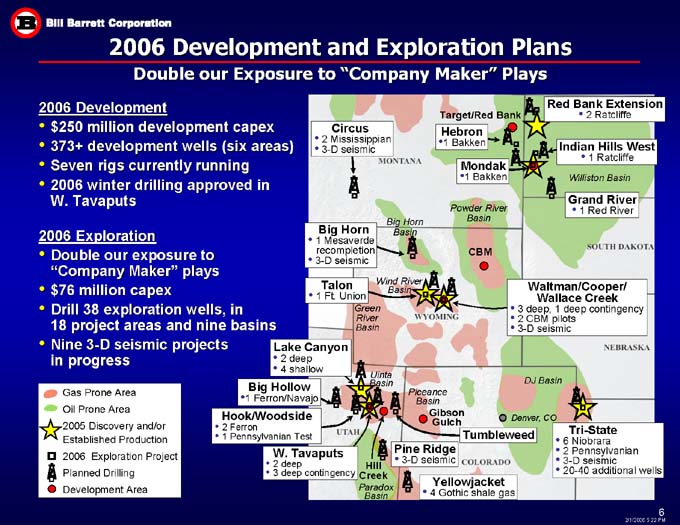

2006 Development and Exploration Plans

Double our Exposure to “Company Maker” Plays

2006 Development

$250 million development capex

373+ development wells (six areas)

Seven rigs currently running

2006 winter drilling approved in

W. Tavaputs

2006 Exploration

Double our exposure to

“Company Maker” plays

$76 million capex

Drill 38 exploration wells, in

18 project areas and nine basins

Nine 3-D seismic projects

in progress

Target/Red Bank

Red Bank Extension

Williston Basin

Powder River

Basin

Big Horn

Basin

CBM

Wind River Basin

Green

River

Basin

DJ Basin

Uinta Basin

Piceance

Basin

Gibson Gulch

Tri-State

W

Tavaputs

Hill Creek

Paradox Basin

Gas prone Area Oil Prone Area 2005 Discovery and/or Established Production 2006 Exploration Project Planned Drilling Development Area

Circus 2 Mississippian 3-D seismic

Big Horn 1 Mesaverde recompletion 3-D seismic

Talon 1Ft. Union

Lake Canyon 2 deep 4 shallow

Big Hollow 1 Ferron/Navajo

Hook/Woodside 2 Ferron 1 Pennsylvanian Test

W. Tavaputs 2 deep 3 deep contingency

Pine Ridge 3-D seismic

Yellojacket 4 Gothic shale gas

Tumbleweed

6 Niobrara 2 Pennsylvanian 3-D seismic 20-40 additional wells

NEBRASKA

Waltman/Cooper/ Wallace Creek 3 deep, 1 deep contigency 2 CBM pilots 3-D seismic

Grand River 1 Red River

Indian Hills West 1 Ratcliffe

2 Ratcliffe

Mondak 1 Bakken

Hebron 1 Bakken

CBM SOUTH DAKOTA WYOMING MONTANA

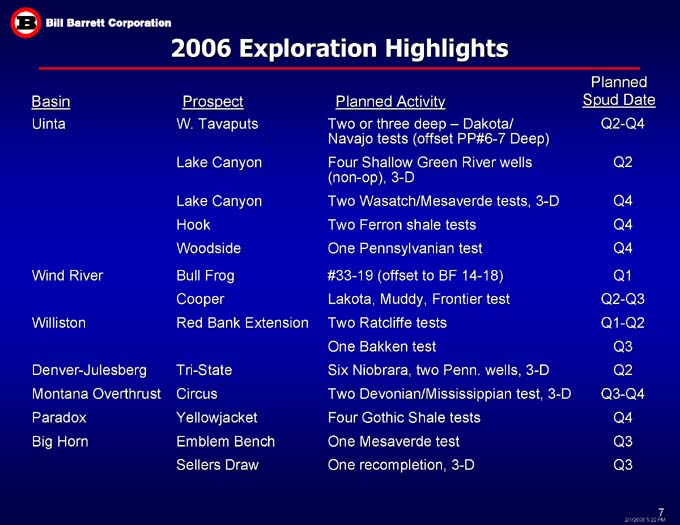

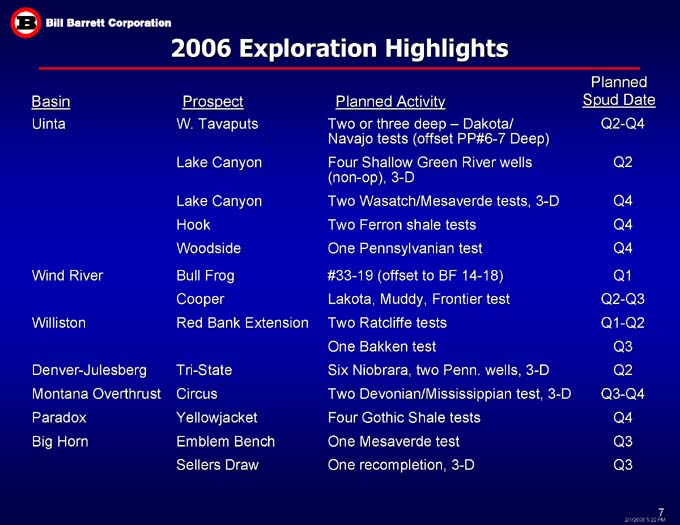

2006 Exploration Highlights Planned

Spud Date

Prospect

Basin

Planned Activity

Uinta

W. Tavaputs

Lake Canyon

Lake Canyon

Hook

Woodside

Two or three deep – Dakota/ Navajo tests (offset PP#6-7 Deep)

Four Shallow Green River wells (non-op), 3-D

Two Wasatch/Mesaverde tests, 3-D

Two Ferron shale tests

One Pennsylvanian test

Q2-Q4

Q2

Q4

Q4

Q4

#33-19 (offset to BF 14-18)

Lakota, Muddy, Frontier test

Two Ratcliffe tests

One Bakken test

Six Niobrara, two Penn. wells, 3-D

Two Devonian/Mississippian test, 3-D

Four Gothic Shale tests

One Mesaverde test

One recompletion, 3-D

Q1

Q2-Q3

Q1-Q2

Q3

Q2

Q3-Q4

Q4

Q3

Q3

Bull Frog

Cooper

Red Bank Extension

Tri-State

Circus

Yellowjacket

Emblem Bench

Sellers Draw

Wind River

Williston

Denver-Julesberg

Montana Overthrust

Paradox

Big Horn

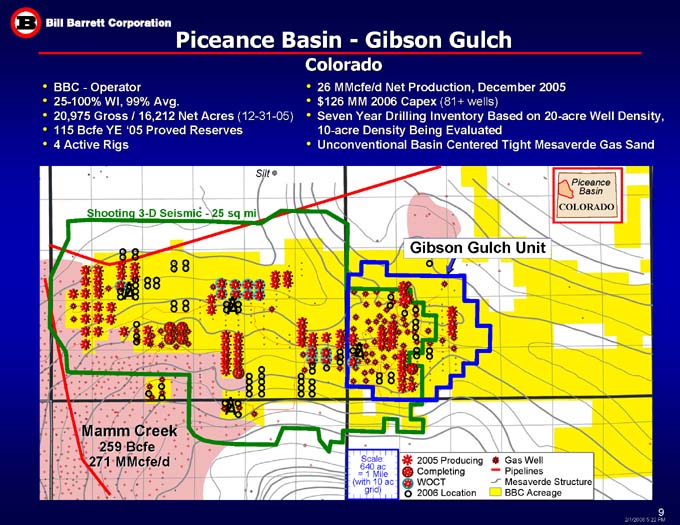

Southern Division Update

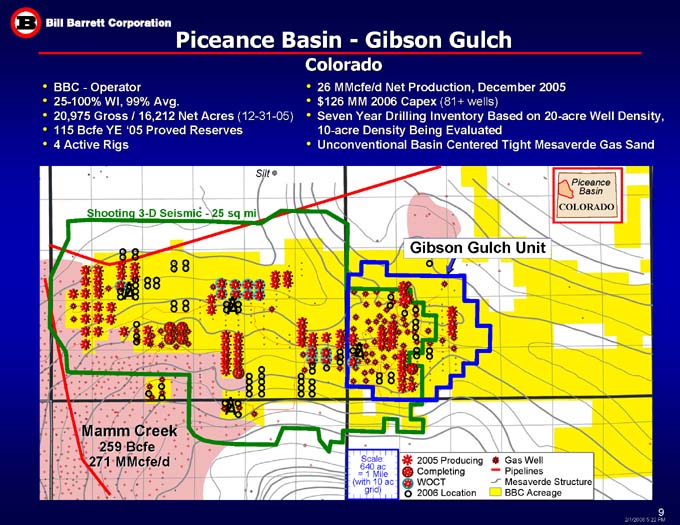

Silt

Shooting 3-D Seismic - 25 sq mi

Gibson Gulch Unit

Mamm Creek

259 Bcfe

271 MMcfe/d

Scale:

640 ac

= 1 Mile

(with 10 ac grid)

BBC - Operator

25-100% WI, 99% Avg.

20,975 Gross / 16,212 Net Acres (12-31-05)

115 Bcfe YE ‘05 Proved Reserves

4 Active Rigs

26 MMcfe/d Net Production, December 2005

$126 MM 2006 Capex (81+ wells)

Seven Year Drilling Inventory Based on 20-acre Well Density, 10-acre Density Being Evaluated

Unconventional Basin Centered Tight Mesaverde Gas Sand

COLORADO

Piceance

Basin

Gas Well

Pipelines

Mesaverde Structure BBC Acreage

2005 Producing

Completing

WOCT

2006 Location

Piceance Basin - Gibson Gulch

Colorado

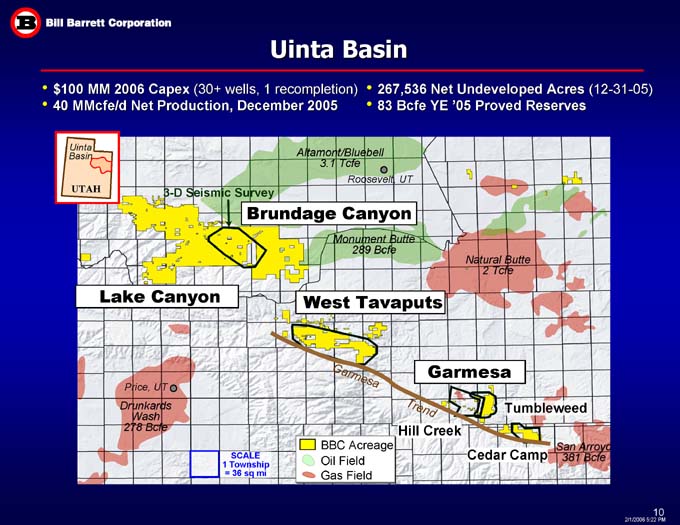

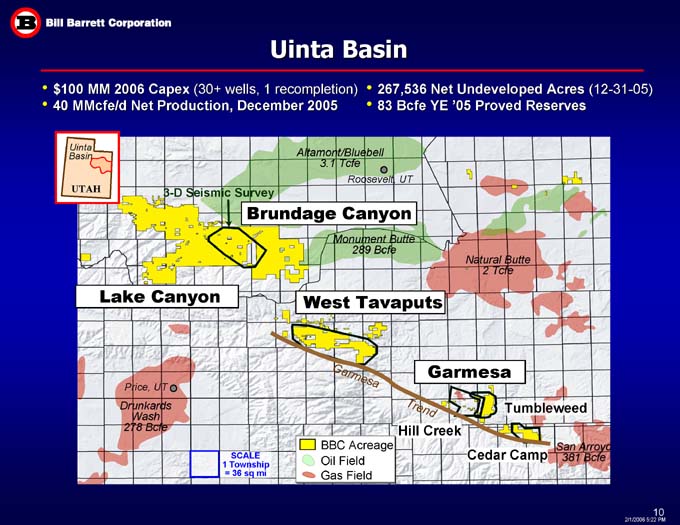

Uinta Basin

$100 MM 2006 Capex (30+ wells, 1 recompletion)

40 MMcfe/d Net Production, December 2005

267,536 Net Undeveloped Acres (12-31-05)

83 Bcfe YE ‘05 Proved Reserves

Altamont/Bluebell

3.1 Tcfe

Uinta

Basin

Roosevelt, UT

3-D Seismic Survey

UTAH

Brundage Canyon

Monument Butte

289 Bcfe

Natural Butte

2 Tcfe

West Tavaputs

Lake Canyon

Garmesa

Garmesa

Price, UT

Drunkards

Wash

278 Bcfe

Trend

Tumbleweed

Hill Creek

BBC Acreage

Oil Field

Gas Field

Cedar Camp

San Arroyo

381 Bcfe

SCALE

1 Township

= 36 sq mi

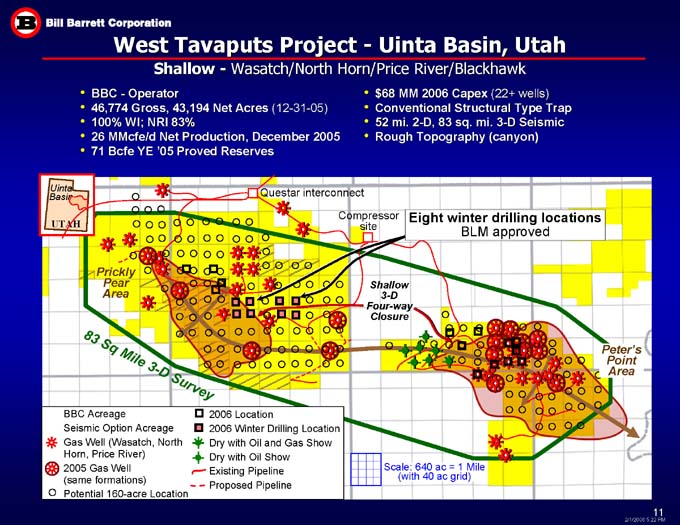

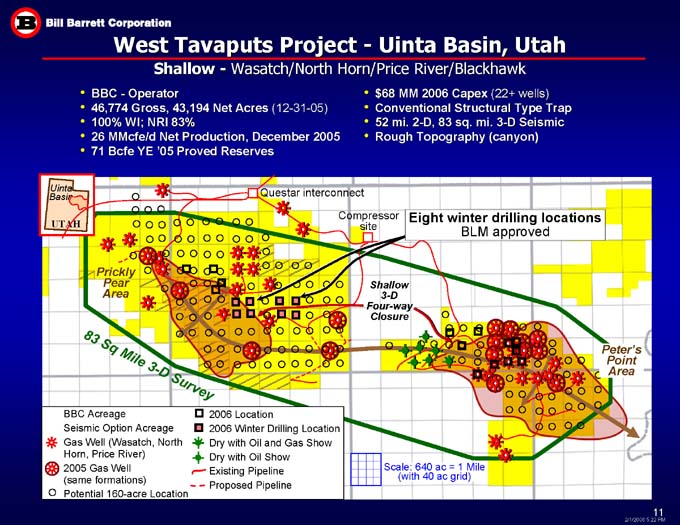

West Tavaputs Project - Uinta Basin, Utah

Shallow - Wasatch/North Horn/Price River/Blackhawk

$68 MM 2006 Capex (22+ wells)

Conventional Structural Type Trap

52 mi. 2-D, 83 sq. mi. 3-D Seismic

Rough Topography (canyon)

BBC - Operator

46,774 Gross, 43,194 Net Acres (12-31-05)

100% WI; NRI 83%

26 MMcfe/d Net Production, December 2005

71 Bcfe YE ‘05 Proved Reserves

Questar interconnect

Uinta

Basin

Eight winter drilling locations

BLM approved

Compressor site

UTAH

Prickly Pear Area

Shallow

3-D

Four-way Closure

Peter’s Point Area

83 Sq Mile 3-D Survey

BBC Acreage

Seismic Option Acreage

Gas Well (Wasatch, North

Horn, Price River)

2005 Gas Well

(same formations)

Potential 160-acre Location

2006 Location

2006 Winter Drilling Location

Dry with Oil and Gas Show

Dry with Oil Show

Existing Pipeline

Proposed Pipeline

Scale: 640 ac = 1 Mile

(with 40 ac grid)

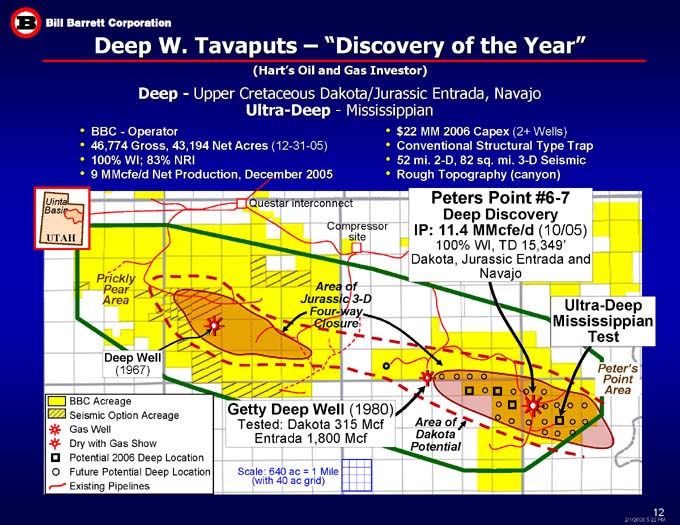

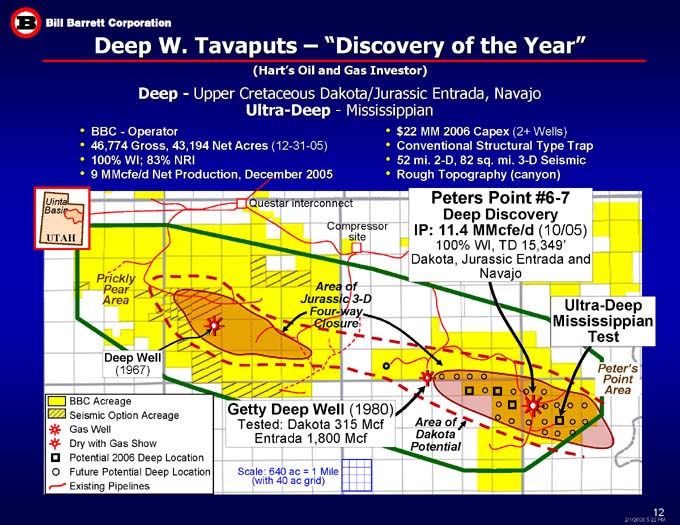

Deep W. Tavaputs – “Discovery of the Year”

(Hart’s Oil and Gas Investor)

Deep - Upper Cretaceous Dakota/Jurassic Entrada, Navajo

Ultra-Deep - Mississippian

$22 MM 2006 Capex (2+ Wells)

Conventional Structural Type Trap

52 mi. 2-D, 82 sq. mi. 3-D Seismic

Rough Topography (canyon)

BBC - Operator

46,774 Gross, 43,194 Net Acres (12-31-05)

100% WI; 83% NRI

9 MMcfe/d Net Production, December 2005

Peters Point #6-7 Deep Discovery

IP: 11.4 MMcfe/d (10/05)

100% WI, TD 15,349’

Dakota, Jurassic Entrada and Navajo

Questar interconnect

Uinta

Basin

Compressor site

UTAH

Prickly Pear Area

Area of Jurassic 3-D

Four-way Closure

Ultra-Deep

Mississippian Test

Deep Well

(1967)

Peter’s Point Area

BBC Acreage

Seismic Option Acreage

Gas Well

Dry with Gas Show

Potential 2006 Deep Location

Future Potential Deep Location

Existing Pipelines

Getty Deep Well (1980)

Tested: Dakota 315 Mcf

Entrada 1,800 Mcf

Area of Dakota Potential

Scale: 640 ac = 1 Mile

(with 40 ac grid)

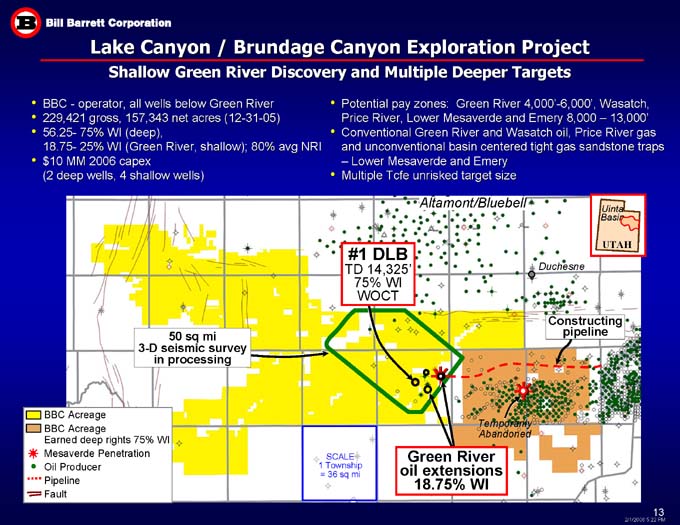

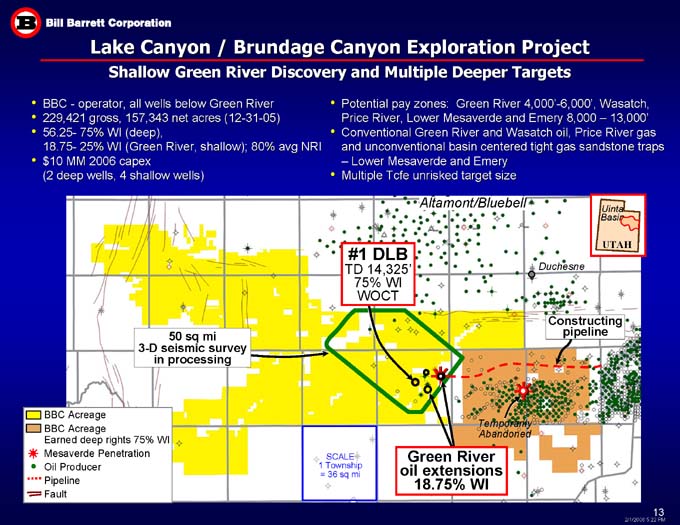

Lake Canyon / Brundage Canyon Exploration Project

Shallow Green River Discovery and Multiple Deeper Targets

BBC - operator, all wells below Green River

229,421 gross, 157,343 net acres (12-31-05)

56.25- 75% WI (deep),

18.75- 25% WI (Green River, shallow); 80% avg NRI

$10 MM 2006 capex

(2 deep wells, 4 shallow wells)

Potential pay zones: Green River 4,000’-6,000’, Wasatch, Price River, Lower Mesaverde and Emery 8,000 – 13,000’

Conventional Green River and Wasatch oil, Price River gas and unconventional basin centered tight gas sandstone traps – Lower Mesaverde and Emery

Multiple Tcfe unrisked target size

Altamont/Bluebell

Uinta

Basin

#1 DLB

TD 14,325’

75% WI WOCT

UTAH

Duchesne

Constructing pipeline

50 sq mi

3-D seismic survey

in processing

BBC Acreage

BBC Acreage

Earned deep rights 75% WI

Mesaverde Penetration

Oil Producer

Pipeline

Fault

Temporarily

Abandoned

SCALE

1 Township

= 36 sq mi

Green River

oil extensions

18.75% WI

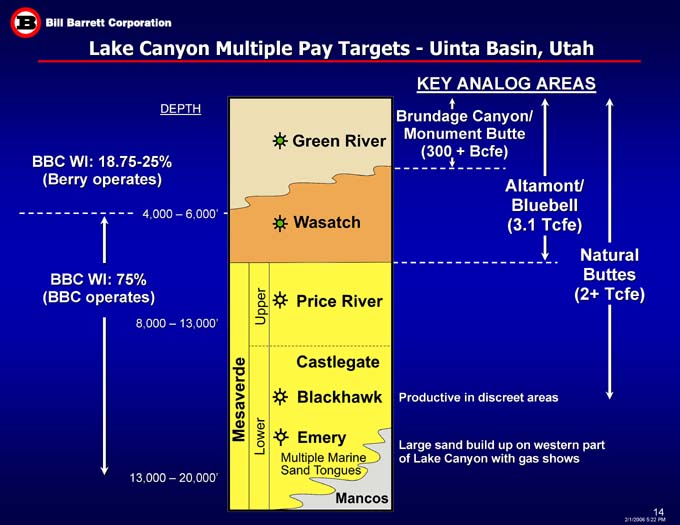

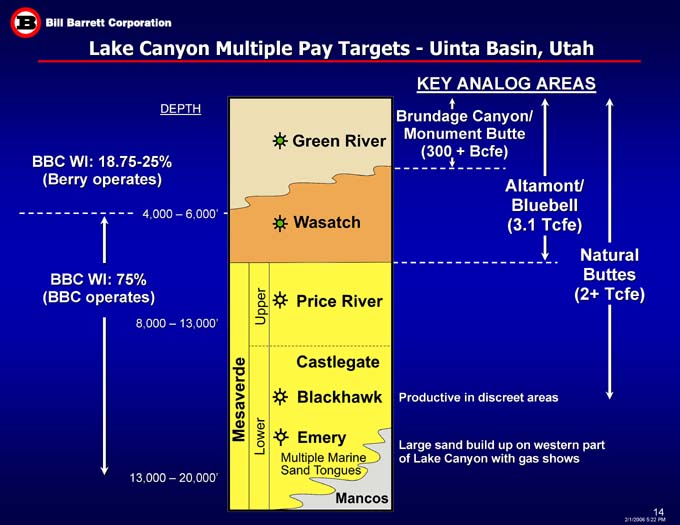

Lake Canyon Multiple Pay Targets - Uinta Basin, Utah

KEY ANALOG AREAS

DEPTH

Brundage Canyon/

Monument Butte

(300 + Bcfe)

BBC WI: 18.75-25%

(Berry operates)

Altamont/

Bluebell

(3.1 Tcfe)

4,000 – 6,000’

Natural

Buttes

(2+ Tcfe)

BBC WI: 75%

(BBC operates)

8,000 – 13,000’

Productive in discreet areas

Large sand build up on western part of Lake Canyon with gas shows

13,000 – 20,000’

Mesaverde

Lower Upper

Green River Wasatch Price River Castlegate Blackhawk Emery Multiple Marine Sand Tongues Mancos

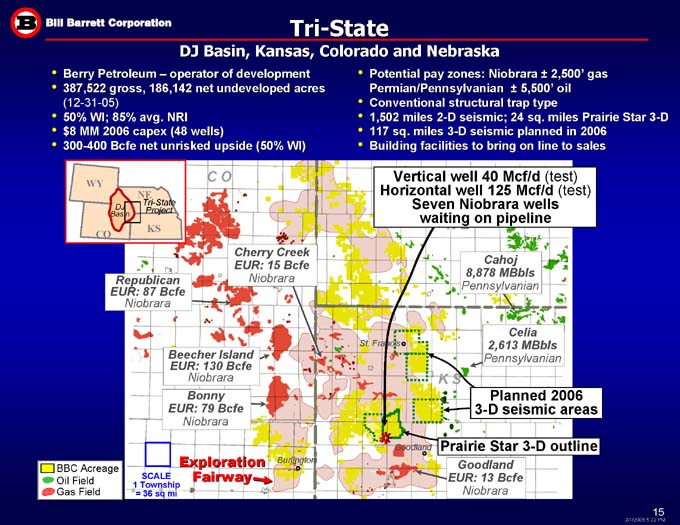

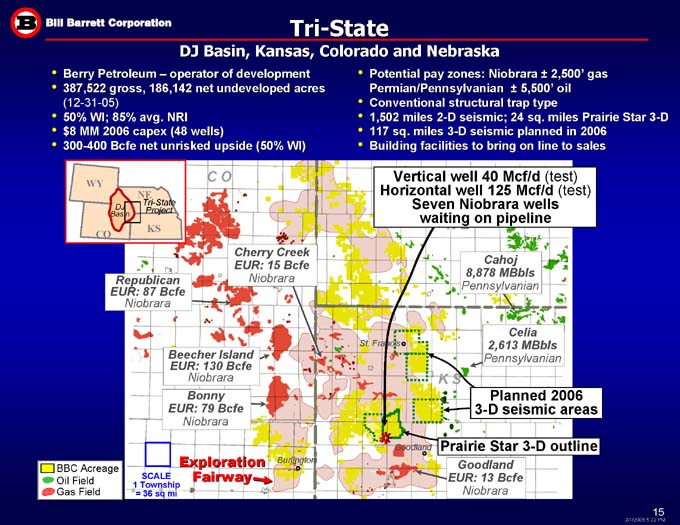

Tri-State

DJ Basin, Kansas, Colorado and Nebraska

Berry Petroleum – operator of development

387,522 gross, 186,142 net undeveloped acres (12-31-05)

50% WI; 85% avg. NRI

$8 MM 2006 capex (48 wells)

300-400 Bcfe net unrisked upside (50% WI)

Potential pay zones: Niobrara ± 2,500’ gas

Permian/Pennsylvanian ± 5,500’ oil

Conventional structural trap type

1,502 miles 2-D seismic; 24 sq. miles Prairie Star 3-D

117 sq. miles 3-D seismic planned in 2006

Building facilities to bring on line to sales

C O

Vertical well 40 Mcf/d (test)

Horizontal well 125 Mcf/d (test)

Seven Niobrara wells

waiting on pipeline

WY NE DJ Basin Tri-State Project KS N E CO

Cherry Creek EUR: 15 Bcfe

Niobrara

Cahoj

8,878 MBbls

Pennsylvanian

Republican

EUR: 87 Bcfe

Niobrara

Celia

2,613 MBbls

Pennsylvanian

St. Francis

Beecher Island

EUR: 130 Bcfe

Niobrara

K S

Bonny

EUR: 79 Bcfe

Niobrara

Planned 2006

3-D seismic areas

Prairie Star 3-D outline

Goodland

Exploration Fairway

Burlington

Goodland

EUR: 13 Bcfe

Niobrara

BBC Acreage

Oil Field

Gas Field

SCALE

1 Township

= 36 sq mi

Northern Division Update

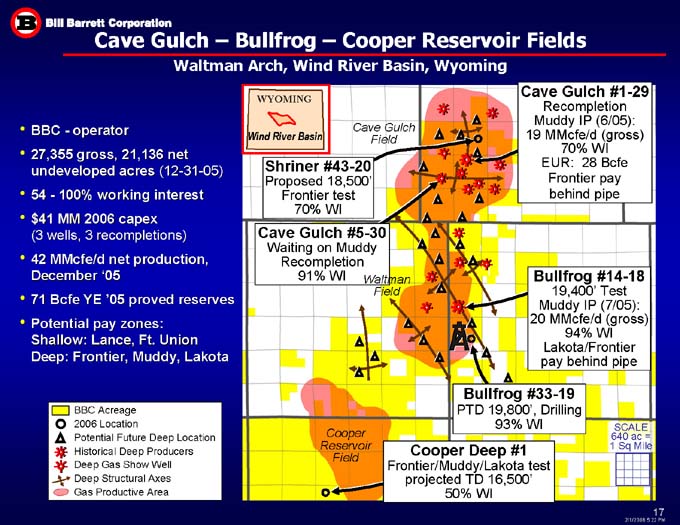

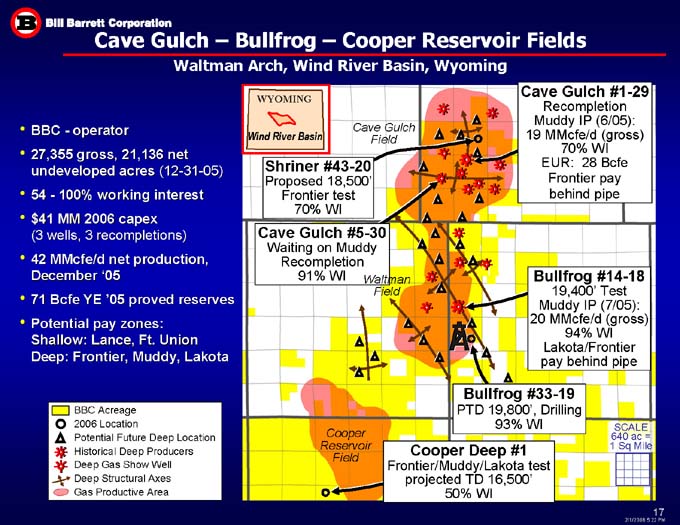

Cave Gulch – Bullfrog – Cooper Reservoir Fields

Waltman Arch, Wind River Basin, Wyoming

Cave Gulch #1-29

Recompletion

Muddy IP (6/05):

19 MMcfe/d (gross)

70% WI

EUR: 28 Bcfe

Frontier pay

behind pipe

WYOMING

Cave Gulch

Field

BBC - operator

27,355 gross, 21,136 net undeveloped acres (12-31-05)

54 - 100% working interest

$41 MM 2006 capex

(3 wells, 3 recompletions)

42 MMcfe/d net production, December ‘05

71 Bcfe YE ‘05 proved reserves

Potential pay zones:

Shallow: Lance, Ft. Union

Deep: Frontier, Muddy, Lakota

Wind River Basin

Shriner #43-20

Proposed 18,500’

Frontier test

70% WI

Cave Gulch #5-30

Waiting on Muddy Recompletion

91% WI

Bullfrog #14-18 19,400’ Test

Muddy IP (7/05):

20 MMcfe/d (gross)

94% WI

Lakota/Frontier

pay behind pipe

Waltman

Field

Bullfrog #33-19

PTD 19,800’, Drilling

93% WI

BBC Acreage

2006 Location

Potential Future Deep Location

Historical Deep Producers

Deep Gas Show Well

Deep Structural Axes

Gas Productive Area

SCALE

640 ac =

1 Sq Mile

Cooper Reservoir

Field

Cooper Deep #1

Frontier/Muddy/Lakota test

projected TD 16,500’

50% WI

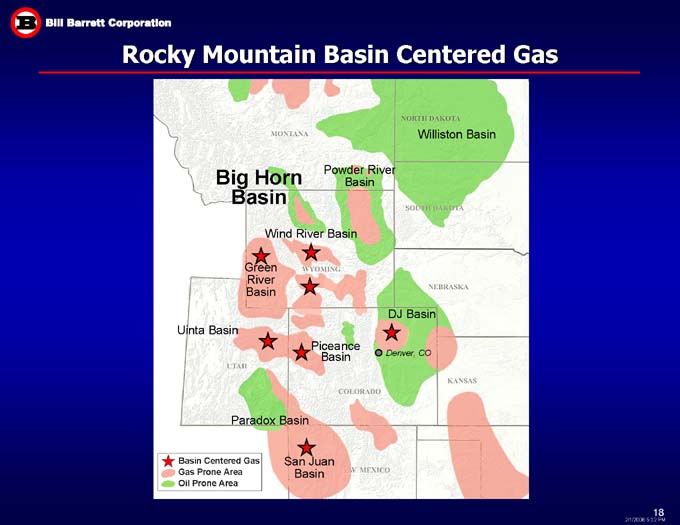

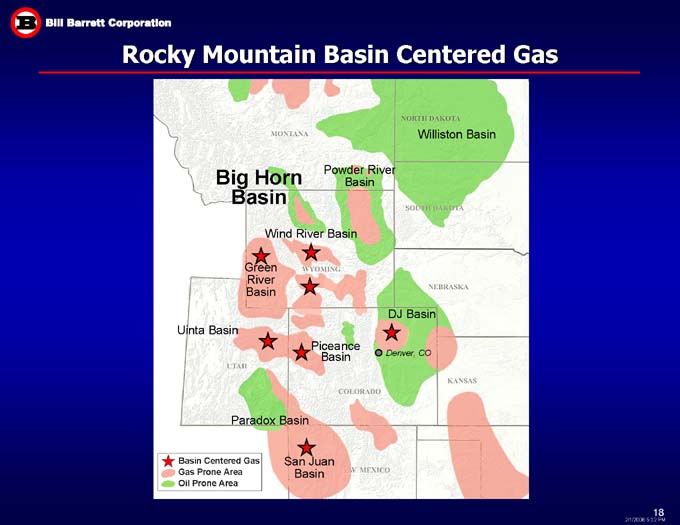

Rocky Mountain Basin Centered Gas

Williston Basin

Big Horn

Basin

Powder River

Basin

Wind River Basin

Green

River

Basin

DJ Basin

Uinta Basin

Piceance Basin

Paradox Basin

San Juan

Basin

MONTANA

NORTH DAKOTA

SOUTH DAKOTA

WYOMING

NEBRASKA

UTAH

Denever, Co

COLORADO

KANSAS

NEW MEXICO

Basin Centered Gas Gas Prone Area Oil Prone Area

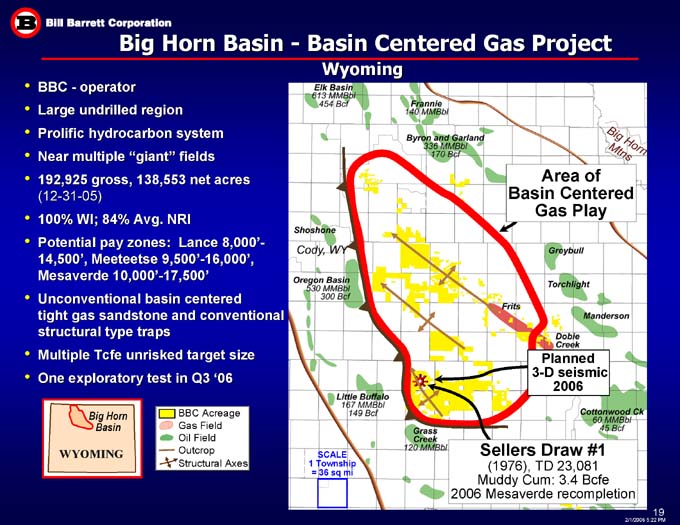

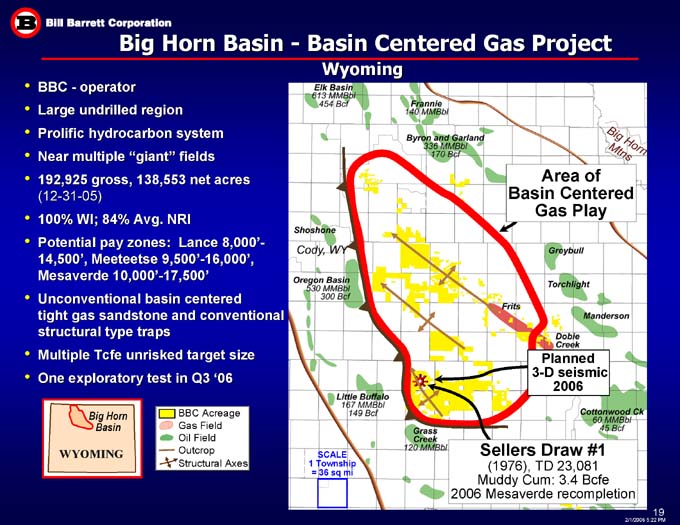

Big Horn Basin - Basin Centered Gas Project

Wyoming

BBC - operator

Large undrilled region

Prolific hydrocarbon system

Near multiple “giant” fields

192,925 gross, 138,553 net acres

(12-31-05)

100% WI; 84% Avg. NRI

Potential pay zones: Lance 8,000’-14,500’, Meeteetse 9,500’-16,000’, Mesaverde 10,000’-17,500’

Unconventional basin centered

tight gas sandstone and conventional structural type traps

Multiple Tcfe unrisked target size

One exploratory test in Q3 ‘06

Area of

Basin Centered

Gas Play

Planned

3-D seismic

2006

Big Horn Basin

BBC Acreage

Gas Field

Oil Field

Outcrop

Structural Axes

Sellers Draw #1

(1976), TD 23,081

Muddy Cum: 3.4 Bcfe

2006 Mesaverde recompletion

SCALE

1 Township = 36 sq mi

Eik Basin 613 MMBbl 454 Bcf

Frannie 140 MMBbl

Byron and Garland 336 MMBbl 170 Bcf

Big Horn Mtns

Shoshone Cody, WY

Oregon Basin 530 MMBbl 300 Bcf

Little Buffalo 167 MMBbl 149Bcf

Grass Creek 120 MMBbl

Cottonwood Ck 60 MMBbl 45 Bcf

Frits Greybull Torchlight Manderson Dobie Creek

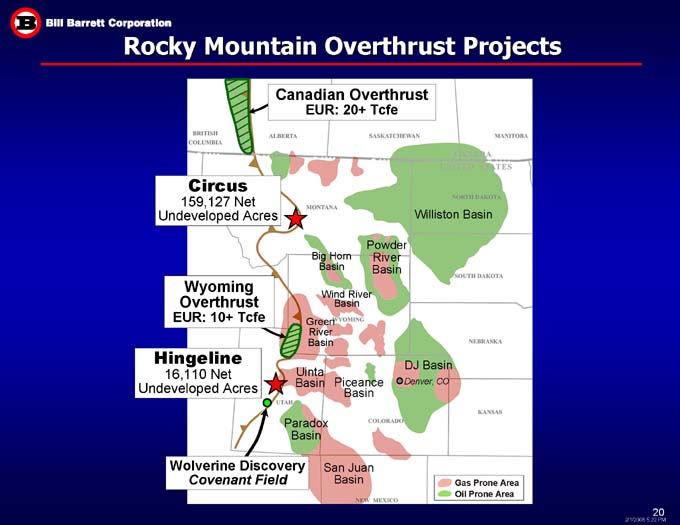

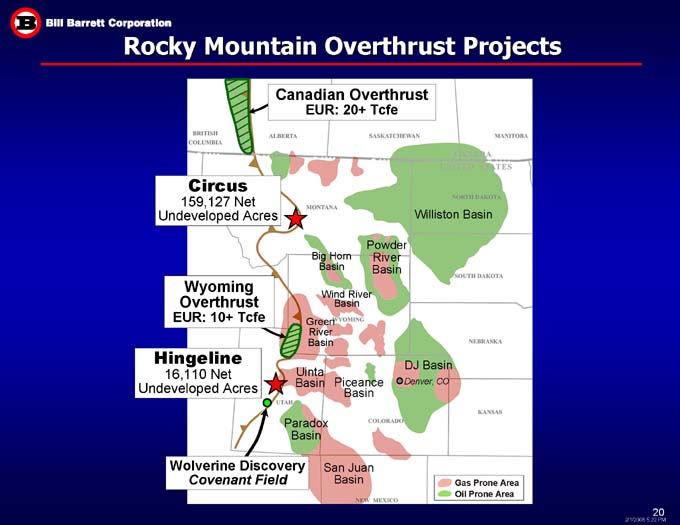

Rocky Mountain Overthrust Projects

Canadian Overthrust

EUR: 20+ Tcfe

Circus

159,127 Net Undeveloped Acres

Williston Basin

Powder River

Basin

Big Horn

Basin

Wyoming Overthrust

EUR: 10+ Tcfe

Wind River Basin

Green

River

Basin

Hingeline

16,110 Net Undeveloped Acres

DJ Basin

Uinta Basin

Piceance Basin

Denver, CO

Paradox Basin

San Juan

Basin

Wolverine Discovery

Covenant Field

Gas Prone Area

Oil Prone Area

BRITISH

COLUMBA

ALBERTA

MONTANA

WYOMIG

UTAH

COLORADO

KANASAS

NEBRASKA

SOUTH DAKOTA

NORTH DAKOTA

CANADA UNITED STATES

MANITOBA

SASKATCHEWAN

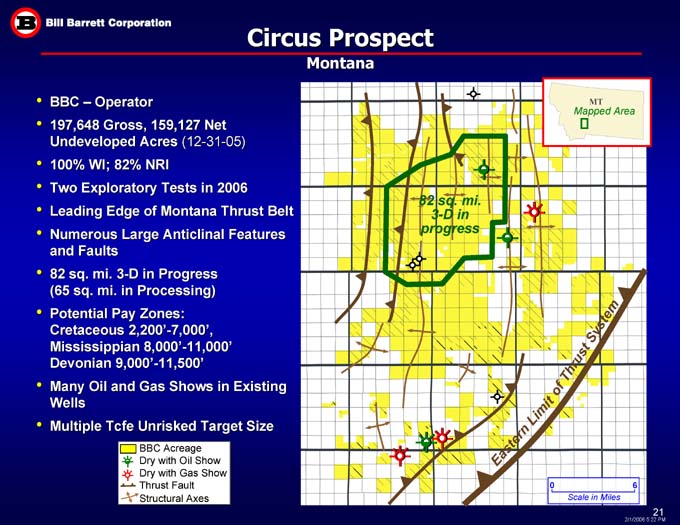

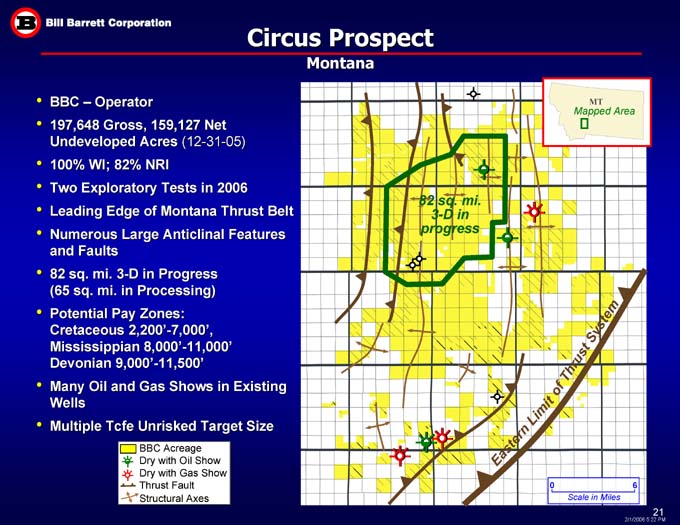

Circus Prospect

Montana

BBC – Operator

197,648 Gross, 159,127 Net Undeveloped Acres (12-31-05)

100% WI; 82% NRI

Two Exploratory Tests in 2006

Leading Edge of Montana Thrust Belt

Numerous Large Anticlinal Features and Faults

82 sq. mi. 3-D in Progress

(65 sq. mi. in Processing)

Potential Pay Zones:

Cretaceous 2,200’-7,000’,

Mississippian 8,000’-11,000’

Devonian 9,000’-11,500’

Many Oil and Gas Shows in Existing Wells

Multiple Tcfe Unrisked Target Size

MT

Mapped Area

82 sq. mi.

3-D in progress

of Thrust System

Eastern Limit

BBC Acreage

Dry with Oil Show

Dry with Gas Show

Thrust Fault

Structural Axes

6

0

Scale in Miles

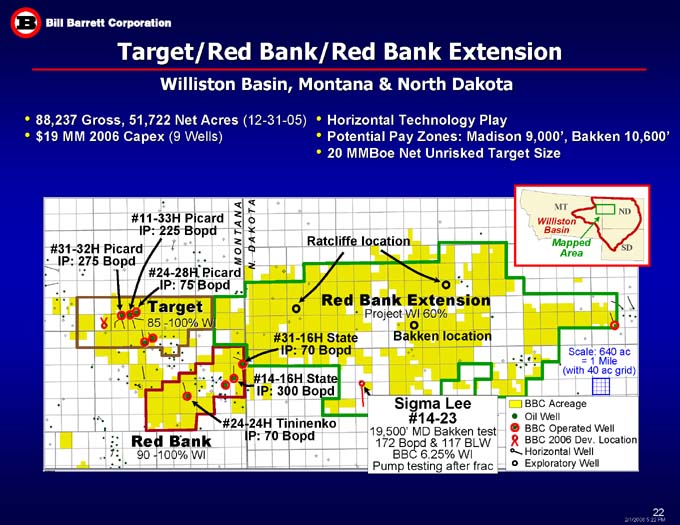

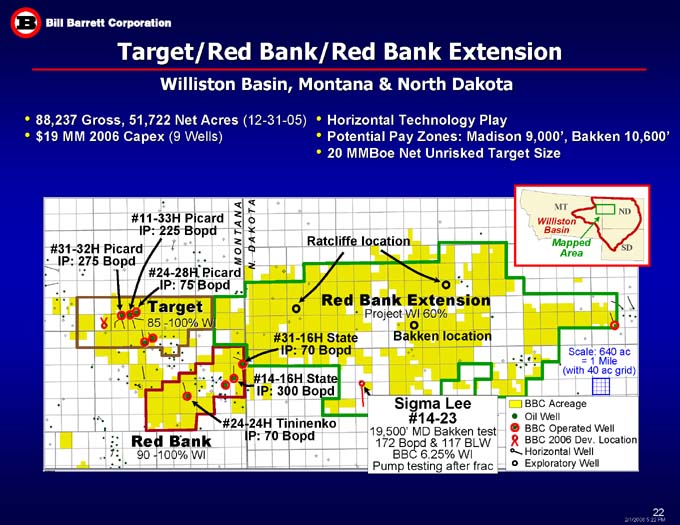

Target/Red Bank/Red Bank Extension

Williston Basin, Montana & North Dakota

Horizontal Technology Play

Potential Pay Zones: Madison 9,000’, Bakken 10,600’

20 MMBoe Net Unrisked Target Size

88,237 Gross, 51,722 Net Acres (12-31-05)

$19 MM 2006 Capex (9 Wells)

MT

ND

#11-33H Picard

IP: 225 Bopd

Williston

Basin

N. D A K O T A

Ratcliffe location

M O N T A N A

#31-32H Picard

IP: 275 Bopd

SD

Mapped

Area

#24-28H Picard

IP: 75 Bopd

Target

85 -100% WI

Red Bank Extension

Project WI 60%

#31-16H State

IP: 70 Bopd

Bakken location

Scale: 640 ac

= 1 Mile

(with 40 ac grid)

#14-16H State

IP: 300 Bopd

Sigma Lee

#14-23

19,500’ MD Bakken test

172 Bopd & 117 BLW

BBC 6.25% WI

Pump testing after frac

BBC Acreage

Oil Well

BBC Operated Well

BBC 2006 Dev. Location

Horizontal Well

Exploratory Well

#24-24H Tininenko

IP: 70 Bopd

Red Bank

90 -100% WI

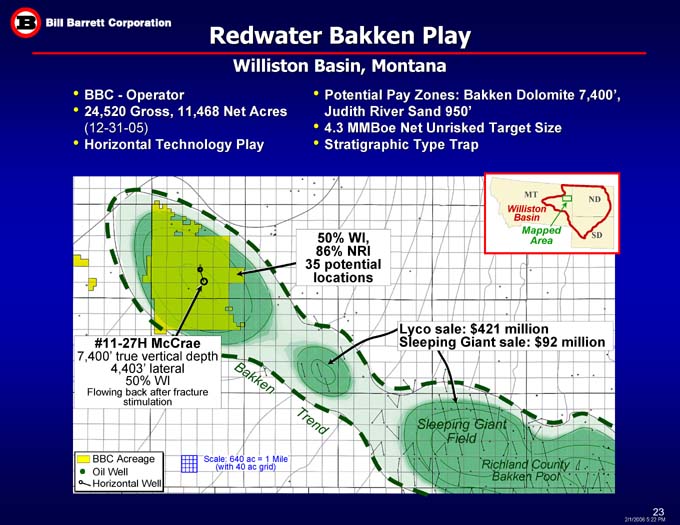

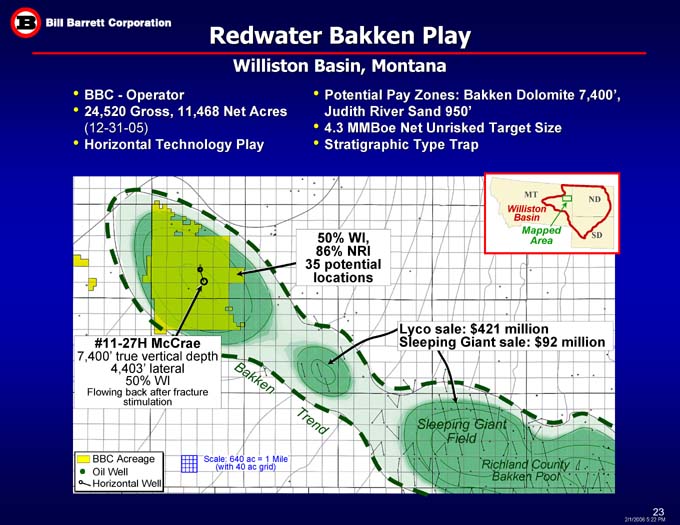

Redwater Bakken Play

Williston Basin, Montana

Potential Pay Zones: Bakken Dolomite 7,400’,

Judith River Sand 950’

4.3 MMBoe Net Unrisked Target Size

Stratigraphic Type Trap

BBC—Operator

24,520 Gross, 11,468 Net Acres

(12-31-05)

Horizontal Technology Play

MT

ND

Williston

Basin

50% WI,

86% NRI

35 potential locations

SD

Mapped

Area

Lyco sale: $421 million

Sleeping Giant sale: $92 million

#11-27H McCrae

7,400’ true vertical depth

4,403’ lateral

50% WI

Flowing back after fracture stimulation

Bakken

Sleeping Giant Field

Trend

BBC Acreage

Oil Well

Horizontal Well

Scale: 640 ac = 1 Mile

(with 40 ac grid)

Richland County Bakken Pool

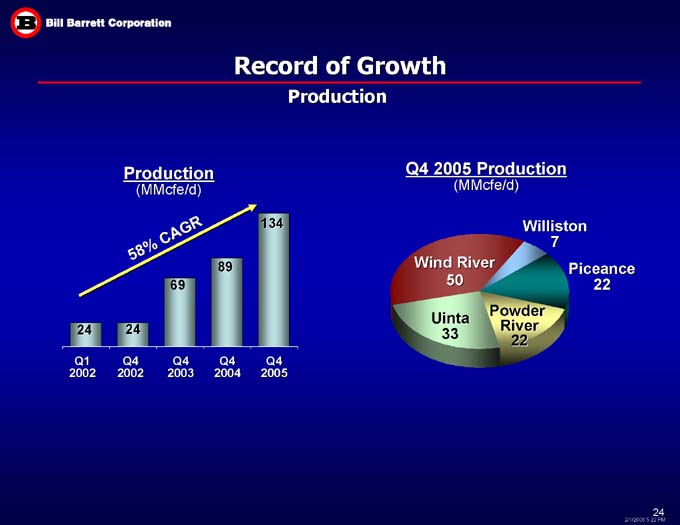

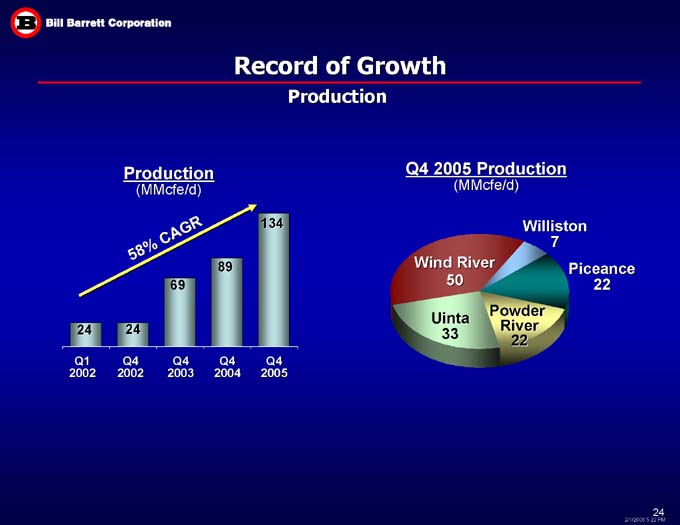

Record of Growth

Production

Q4 2005 Production

(MMcfe/d)

Production

(MMcfe/d)

134

Williston

7

58% CAGR

89

Wind River

50

Piceance

22

69

Uinta

33

Powder

River

22

24

24

Q4

2003

Q1

2002

Q4

2005

Q4

2004

Q4

2002

2002 2003 2004 2005E 2006E

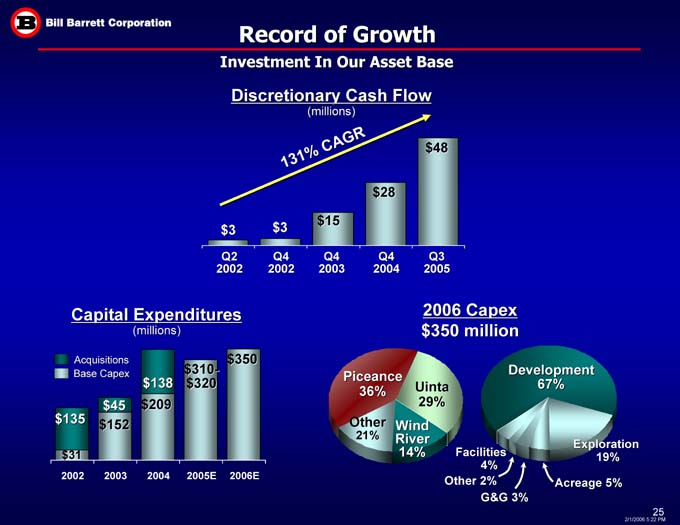

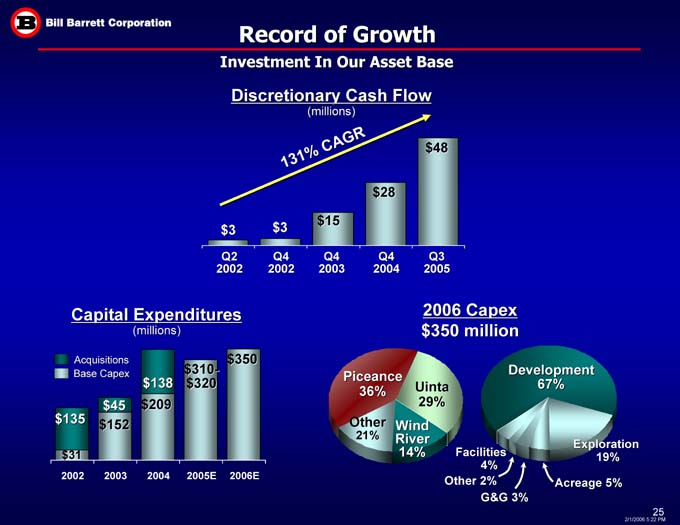

Record of Growth

Investment In Our Asset Base

Discretionary Cash Flow

(millions)

$48

131% CAGR

$28

$3

$15

$3

Q3 2005

Q4 2004

Q4 2002

Q2 2002

Q4 2003

Capital Expenditures

(millions)

2006 Capex

$350 million

$350

Acquisitions

Base Capex

Development

67%

Piceance

36%

$310-

$320

$138

Uinta

29%

$45

Exploration

$209

Other

21%

$152

$135

Wind

River

14%

Exploration

19%

$31

Facilities

4%

Other 2%

Acreage 5%

G&G 3%

Record Of Growth

Investment In Our Asset Base

Net Undeveloped Acres

(thousands)

Net Proved Reserves

(Bcfe)

1,205

341

139% CAGR

60% CAGR

959

292

204

667

130

160

58

46

Dec

2004

Dec

2003

Dec

2002

Mar

2002

Mar

2002

Dec

2002

Dec

2003

Dec

2004

Dec

2005

Dec

2005

Appendix

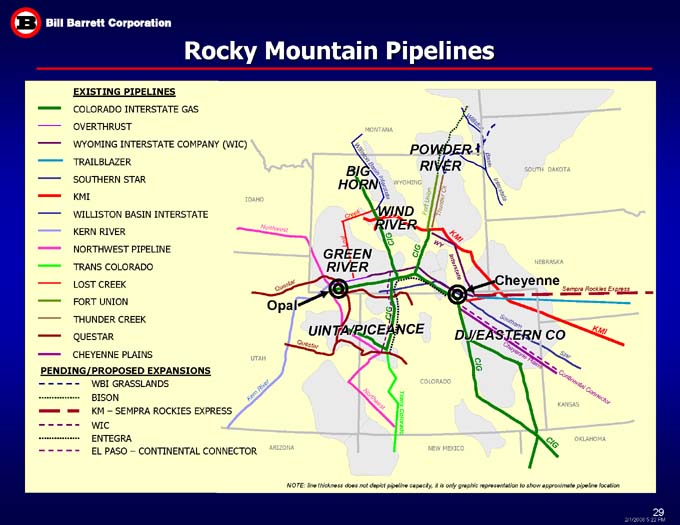

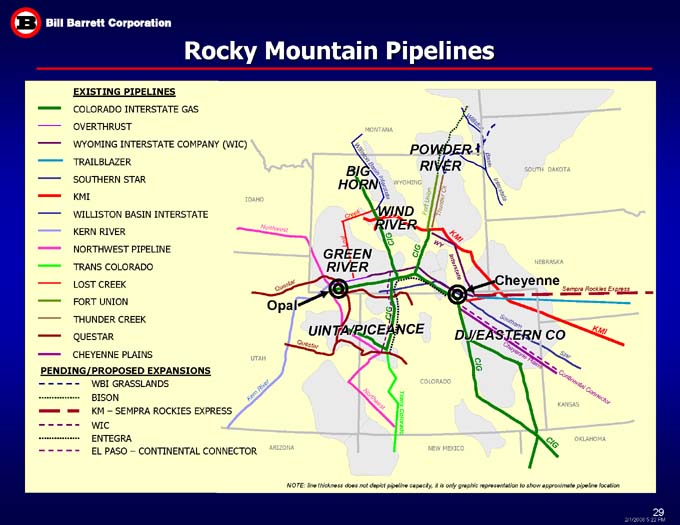

Rocky Mountain Pipelines

EXISTING PIPELINES

COLORADO INTERSTATE GAS

Williston MONTANA OVERTHRUST POWDER RIVER

WYOMING INTERSTATE COMPANY (WIC)

TRAILBLAZER Williston Basin Basin SOUTH DAKOTA SOUTHERN STAR BIG

HORN WYOMING Interstate KMI Interstate Thunder Ck Fort Union IDAHO WIND RIVER Creek

WILLISTON BASIN INTERSTATE

KERN RIVER

Northwest

KMI CIG

NORTHWEST PIPELINE

WY CIG GREEN

RIVER Lost

NEBRASKA

TRANS COLORADO

Interstate

Cheyenne

LOST CREEK

Questar

Sempra Rockies Express

FORT UNION

Opal

THUNDER CREEK

CIG

UINTA/PICEANCE

Southern

DJ/EASTERN CO

QUESTAR

KMI

Questar

CHEYENNE PLAINS

Star

Cheyenne Plains

CIG

UTAH

PENDING/PROPOSED EXPANSIONS

WBI GRASSLANDS

COLORADO

Kern River

BISON

Continental Connector

KANSAS

KM – SEMPRA ROCKIES EXPRESS

Northwest

Trans Colorado

WIC

ENTEGRA

OKLAHOMA

CIG

NEW MEXICO

EL PASO – CONTINENTAL CONNECTOR

ARIZONA

NOTE: line thickness does not depict pipeline capacity, it is only graphic representation to show approximate pipeline location

KMI CHEYENNE PLAINS WYOMING

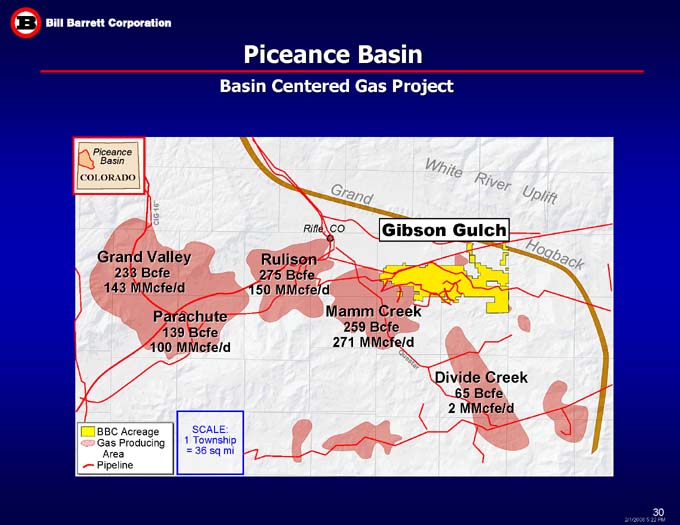

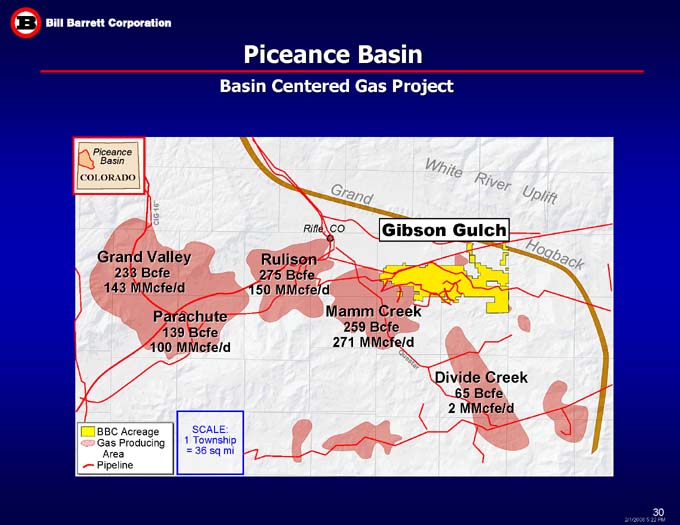

Piceance Basin

Basin Centered Gas Project

Piceance

Basin

White River Uplift

COLORADO

Grand

CIG 16”

Gibson Gulch

Rifle, CO

Grand Valley

233 Bcfe

143 MMcfe/d

Rulison

275 Bcfe

150 MMcfe/d

Hogback

Parachute

139 Bcfe

100 MMcfe/d

Mamm Creek

259 Bcfe

271 MMcfe/d

Questar

Divide Creek

65 Bcfe

BBC Acreage

Gas Producing

Area

Pipeline

SCALE:

1 Township = 36 sq mi

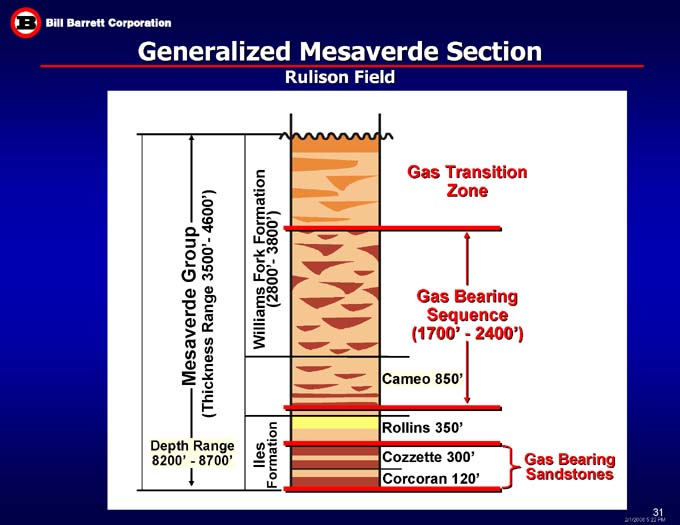

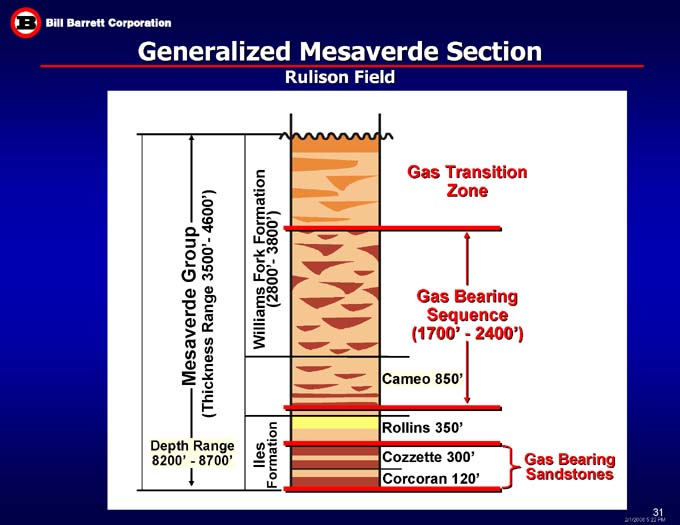

Generalized Mesaverde Section

Rulison Field

Gas Transition

Zone

Williams Fork Formation

(2800’- 3800’)

Gas Bearing

Sequence

(1700’ - 2400’)

Mesaverde Group

(Thickness Range 3500’- 4600’)

Cameo 850’

Rollins 350’

Iles

Formation

Depth Range

8200’ - 8700’

Cozzette 300’

Gas Bearing

Sandstones

Corcoran 120’

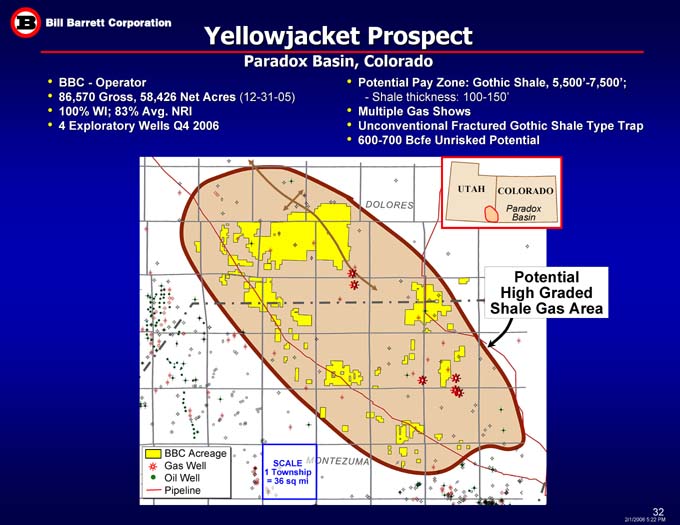

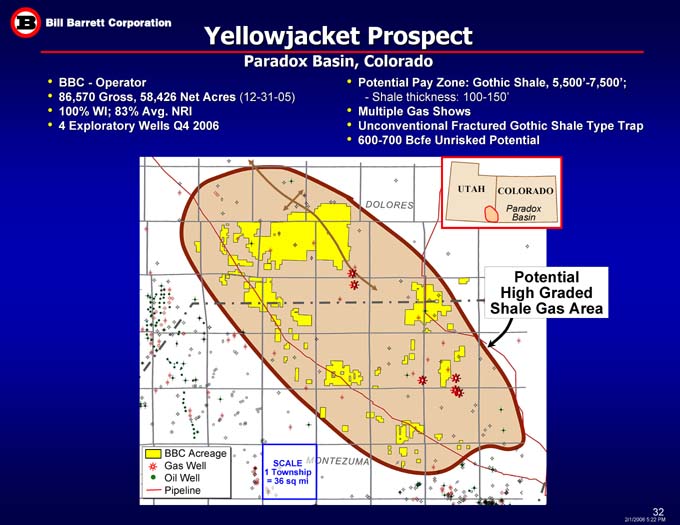

Yellowjacket Prospect

Paradox Basin, Colorado

BBC - Operator

86,570 Gross, 58,426 Net Acres (12-31-05)

100% WI; 83% Avg. NRI

4 Exploratory Wells Q4 2006

Potential Pay Zone: Gothic Shale, 5,500’-7,500’; - Shale thickness: 100-150’

Multiple Gas Shows

Unconventional Fractured Gothic Shale Type Trap

600-700 Bcfe Unrisked Potential

COLORADO

UTAH

Paradox

Basin

Potential

High Graded

Shale Gas Area

BBC Acreage

Gas Well

Oil Well

Pipeline

SCALE

1 Township = 36 sq mi

DOLORES

MONTEZUMA

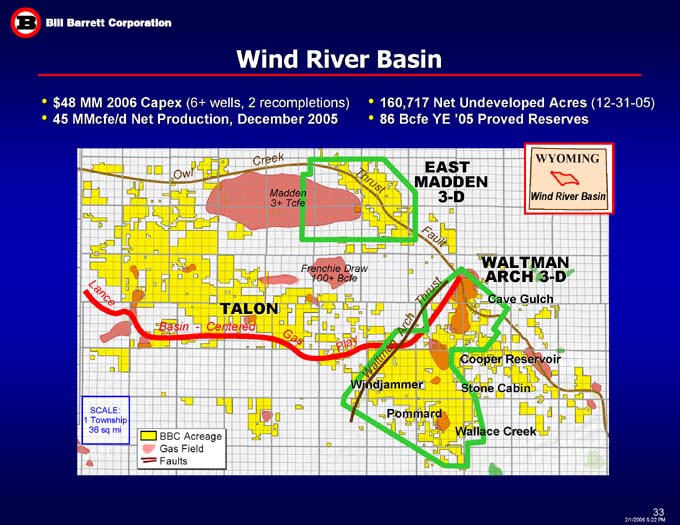

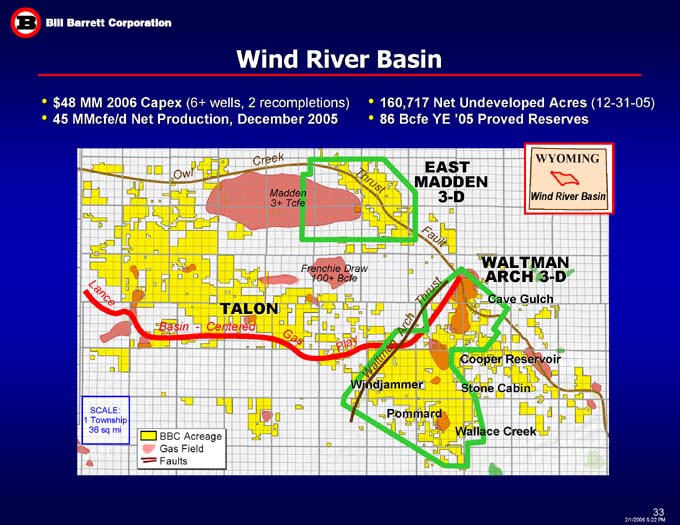

Wind River Basin

160,717 Net Undeveloped Acres (12-31-05)

86 Bcfe YE ‘05 Proved Reserves

$48 MM 2006 Capex (6+ wells, 2 recompletions)

45 MMcfe/d Net Production, December 2005

EAST MADDEN 3-D

Owl Creek

Thrust

Madden

3+ Tcfe

Fault

WALTMAN ARCH 3-D

Frenchie Draw

100+ Bcfe

Lance

Thrust

Cave Gulch

TALON

Basin - Centered

Arch

Gas

Play

Waltman

Cooper Reservoir

Stone Cabin

Windjammer

SCALE:

1 Township

36 sq mi

Pommard

Wallace Creek

BBC Acreage

Gas Field

Faults

WYOMING

WIND RIVER BASIN

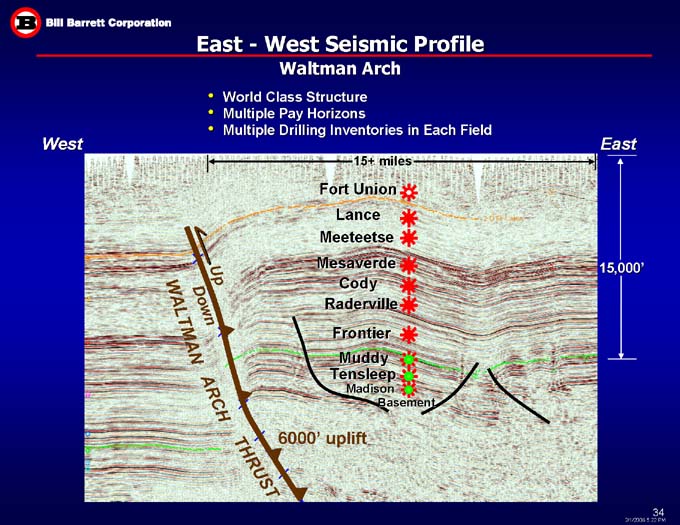

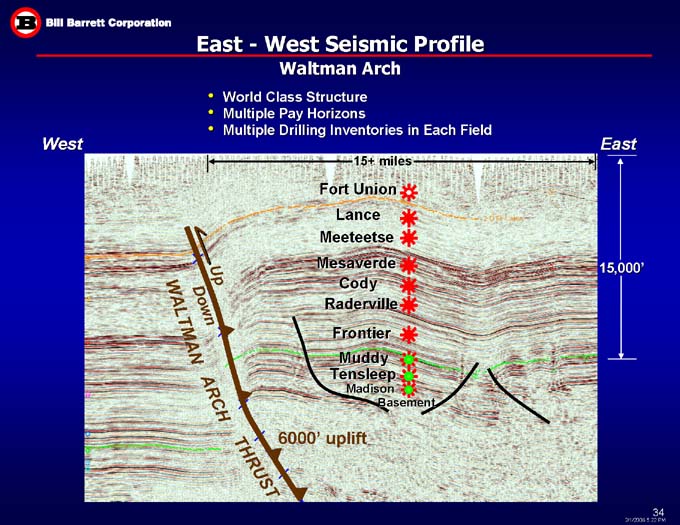

East - West Seismic Profile

Waltman Arch

World Class Structure

Multiple Pay Horizons

Multiple Drilling Inventories in Each Field

West

East

15+ miles

Fort Union

Lance

Meeteetse

15,000’

Mesaverde

Up

Cody

Down

Raderville

WALTMAN

Frontier

Muddy

Tensleep

Madison

ARCH

Basement

6000’ uplift

THRUST

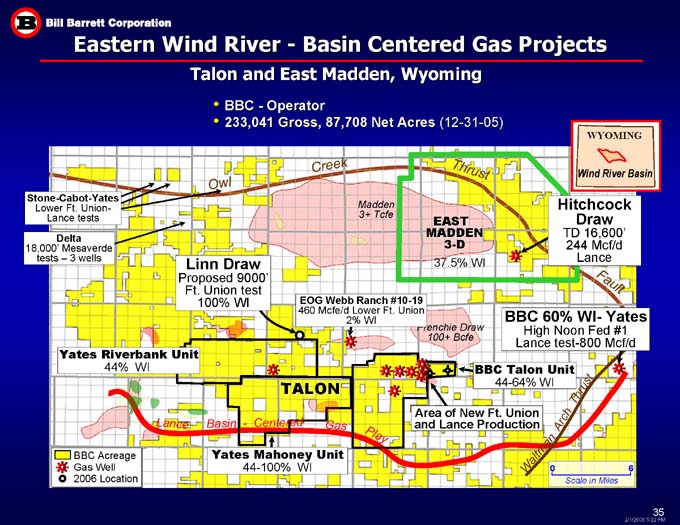

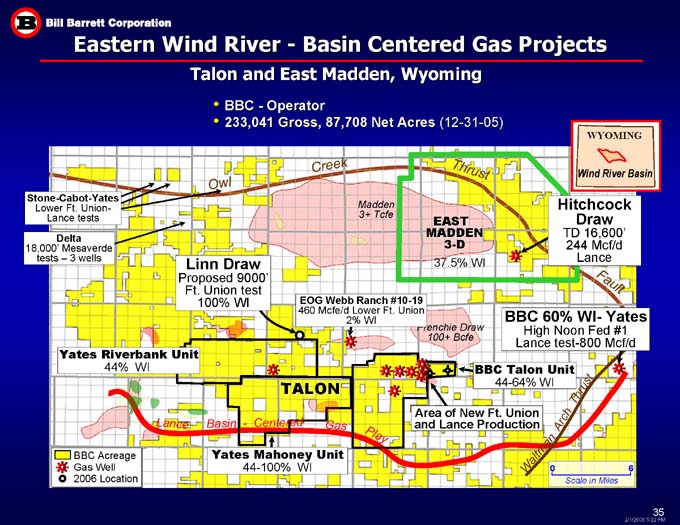

Eastern Wind River - - Basin Centered Gas Projects

Talon and East Madden, Wyoming

BBC - Operator

233,041 Gross, 87,708 Net Acres (12-31-05)

WYOMING

Owl Creek

Thrust

Wind River Basin

Stone-Cabot-Yates

Lower Ft. Union-Lance tests

Hitchcock Draw

TD 16,600’

244 Mcf/d Lance

Madden

3+ Tcfe

EAST MADDEN

3-D

Delta

18,000’ Mesaverde tests – 3 wells

Linn Draw

Proposed 9000’

Ft. Union test

100% WI

37.5% WI

Fault

EOG Webb Ranch #10-19

460 Mcfe/d Lower Ft. Union

2% WI

BBC 60% WI- Yates

High Noon Fed #1

Lance test-800 Mcf/d

Frenchie Draw

100+ Bcfe

Yates Riverbank Unit

44% WI

BBC Talon Unit

44-64% WI

Thrust

TALON

Arch

Area of New Ft. Union

and Lance Production

Lance

Gas

Basin - Centered

Play

Yates Mahoney Unit

44-100% WI

BBC Acreage

Gas Well

2006 Location

Waltman

6

0

Scale in Miles

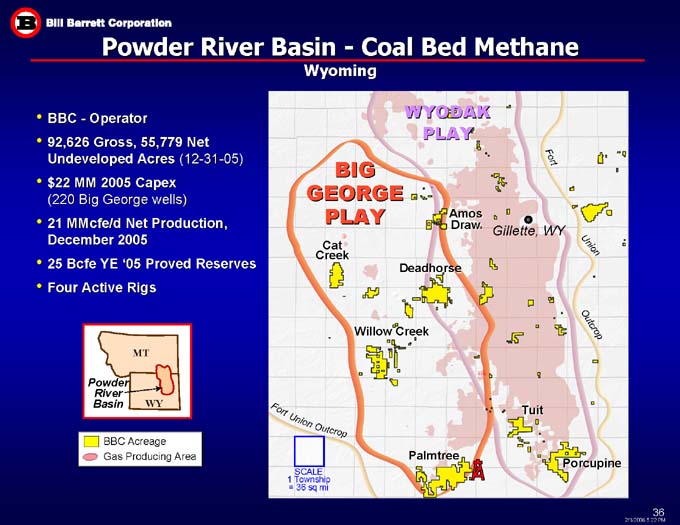

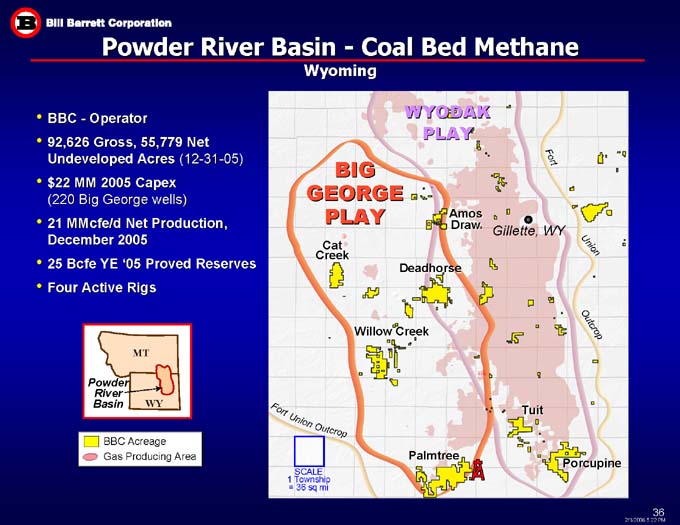

Powder River Basin - - Coal Bed Methane

Wyoming

WYODAK

PLAY

BBC - Operator

92,626 Gross, 55,779 Net Undeveloped Acres (12-31-05)

$22 MM 2005 Capex

(220 Big George wells)

21 MMcfe/d Net Production, December 2005

25 Bcfe YE ‘05 Proved Reserves

Four Active Rigs

BIG

GEORGE

PLAY

Fort

Amos

Draw

Gillette, WY

Cat

Creek

Union

Deadhorse

Willow Creek

Outcrop

MT

Powder

River

Basin

Tuit

WY

Fort

Union

BBC Acreage

Gas Producing Area

Outcrop

Palmtree

Porcupine

SCALE

1 Township

= 36 sq mi

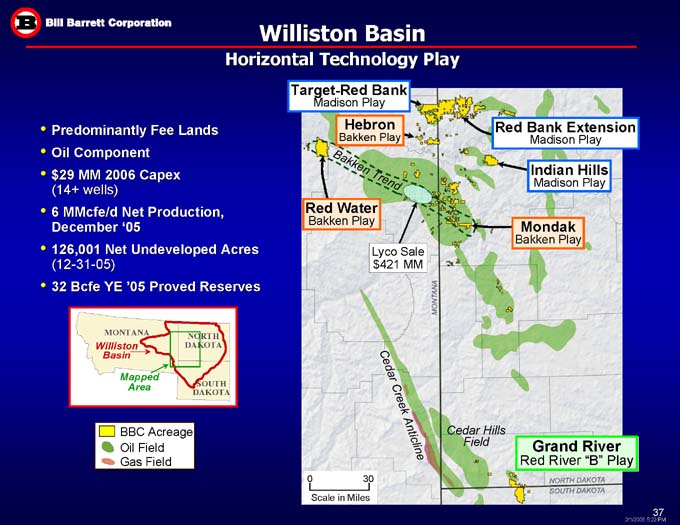

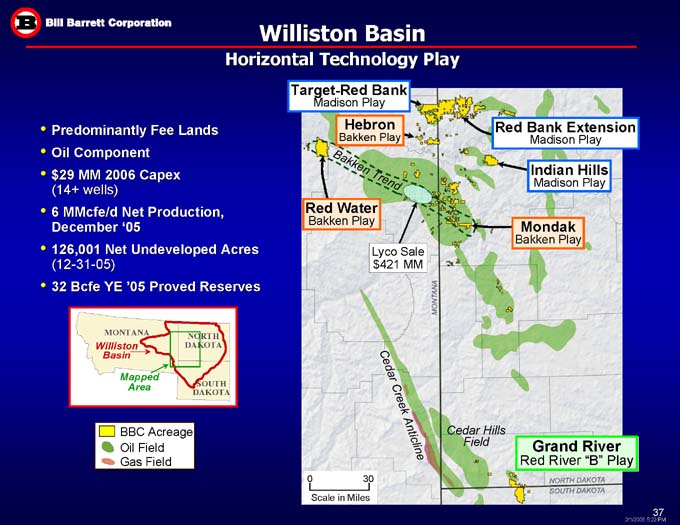

Williston Basin

Horizontal Technology Play

Target-Red Bank

Madison Play

Red Bank Extension

Madison Play

Predominantly Fee Lands

Oil Component

$29 MM 2006 Capex

(14+ wells)

6 MMcfe/d Net Production, December ‘05

126,001 Net Undeveloped Acres

(12-31-05)

32 Bcfe YE ‘05 Proved Reserves

Hebron

Bakken Play

Indian Hills

Madison Play

Bakken Trend

Red Water

Bakken Play

Mondak

Bakken Play

Lyco Sale

$421 MM

MONTANA

NORTH

DAKOTA

Williston

Basin

Mapped

Area

SOUTH

DAKOTA

Cedar Creek Anticline

Cedar Hills Field

BBC Acreage

Oil Field

Gas Field

Grand River

Red River “B” Play

30

0

Scale in Miles

MONTANA

NORTH DAKOTA

SOUTH DAKOTA

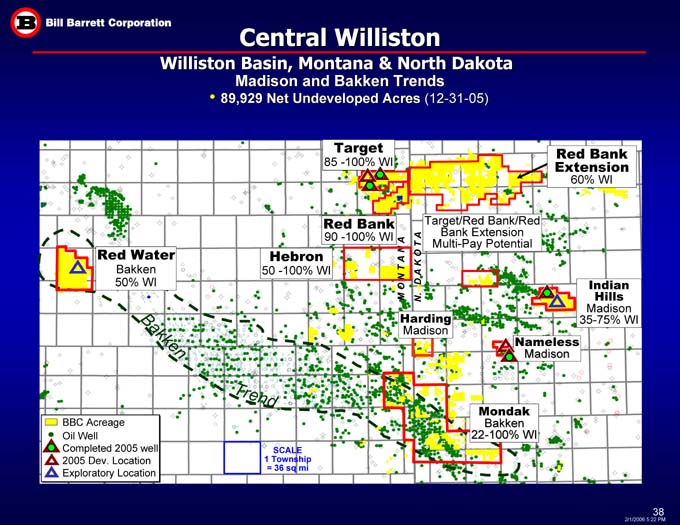

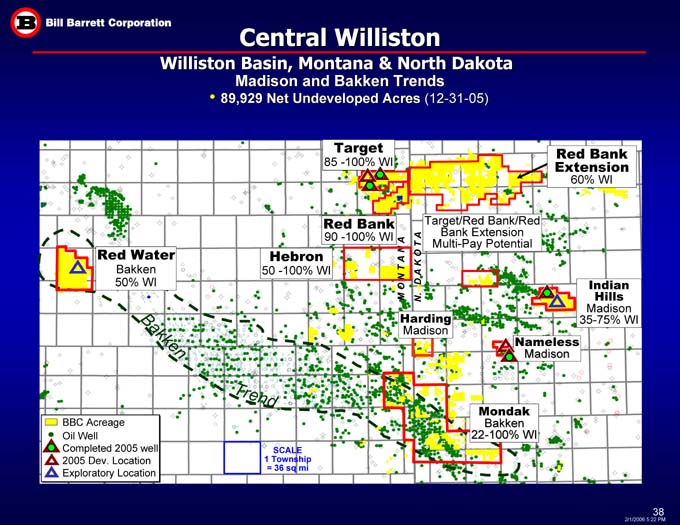

Central Williston

Williston Basin, Montana & North Dakota

Madison and Bakken Trends

89,929 Net Undeveloped Acres (12-31-05)

Red Bank Extension

60% WI

Target

85 -100% WI

Red Bank

90 -100% WI

Target/Red Bank/Red Bank Extension

Multi-Pay Potential

Red Water

Bakken

50% WI

Hebron

50 -100% WI

N. D A K O T A

M O N T A N A

Indian Hills

Madison

35-75% WI

Harding

Madison

Bakken

Nameless

Madison

Trend

Mondak

Bakken

22-100% WI

BBC Acreage

Oil Well

Completed 2005 well

2005 Dev. Location

Exploratory Location

SCALE

1 Township

= 36 sq mi

Grand River

Williston Basin, North & South Dakota

BBC – Operator

26,304 Gross, 11,805 Net Acres (12-31-05)

60% WI; 84% NRI

$1 MM 2006 Capex (1 Well)

10 MMBoe Net Unrisked Target Size

NORTH

DAKOTA

MONTANA

Williston

Basin

Horizontal

Red River “B” producer

Mapped

Area

SOUTH

DAKOTA

60% WI (84% NRI)

N O R T H D A K O T A

S O U T H D A K O T A

High potential

Red River “B” zone

Horizontal Exploration Trend

#14-32H Nygaard,

60% WI

9,200’ true vertical depth

5,000’ lateral

Pump testing

BBC Acreage

Oil Well

Luff operated Red River B Well

Horizontal Well

Exploratory Well

Scale: 640 ac = 1 Mile

(with 40 ac grid)

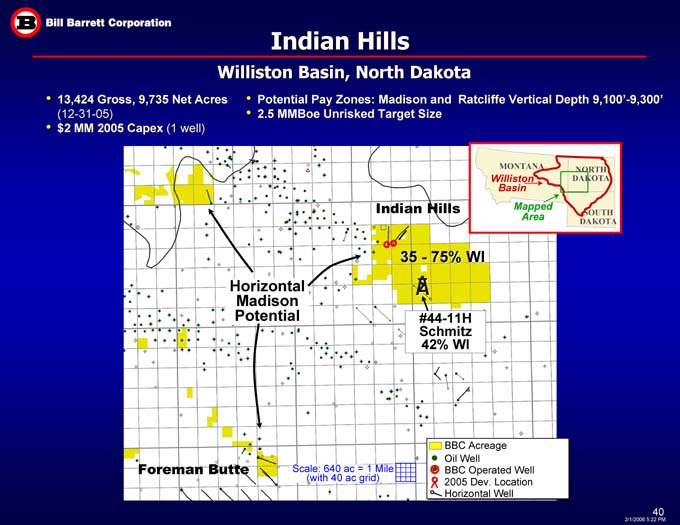

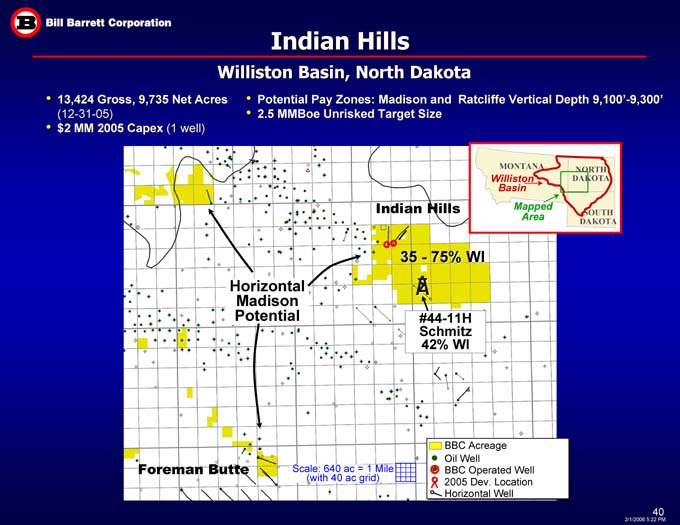

Indian Hills

Williston Basin, North Dakota

13,424 Gross, 9,735 Net Acres (12-31-05)

$2 MM 2005 Capex (1 well)

Potential Pay Zones: Madison and Ratcliffe Vertical Depth 9,100’-9,300’

2.5 MMBoe Unrisked Target Size

NORTH

DAKOTA

MONTANA

Williston

Basin

Mapped

Area

Indian Hills

SOUTH

DAKOTA

35 - 75% WI

Horizontal Madison Potential

#44-11H Schmitz

42% WI

BBC Acreage

Oil Well

BBC Operated Well

2005 Dev. Location

Horizontal Well

Foreman Butte

Scale: 640 ac = 1 Mile

(with 40 ac grid)

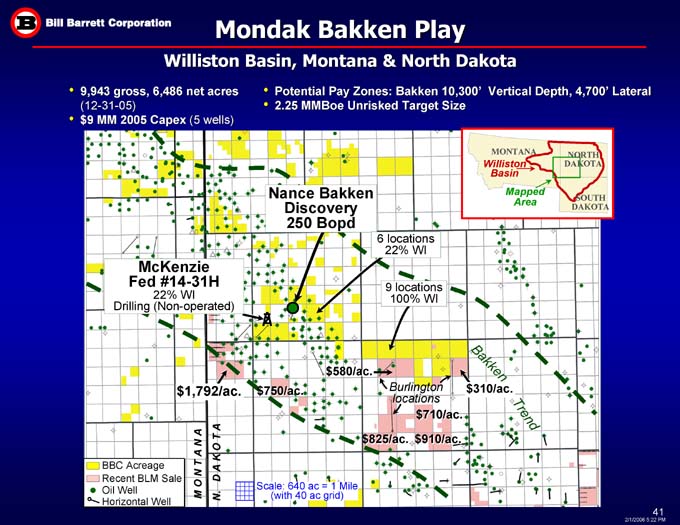

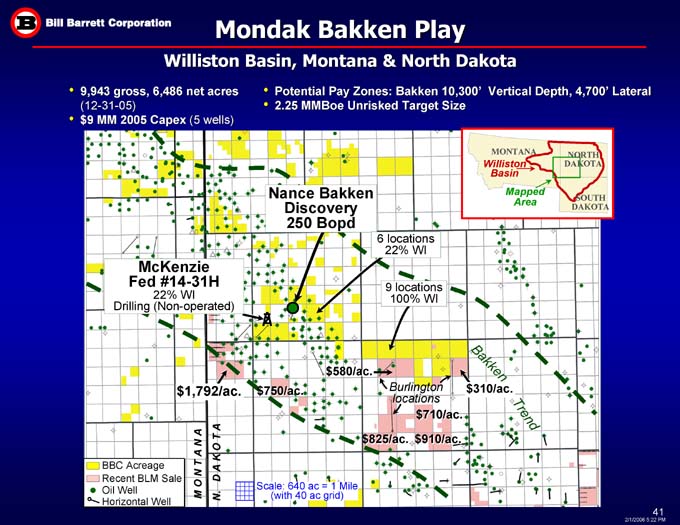

Mondak Bakken Play

Williston Basin, Montana & North Dakota

Potential Pay Zones: Bakken 10,300’ Vertical Depth, 4,700’ Lateral

2.25 MMBoe Unrisked Target Size

9,943 gross, 6,486 net acres (12-31-05)

$9 MM 2005 Capex (5 wells)

Barrett Operator, all wells below 6000’

234,973 Gross, 175,615 Net Acres

$8 MM 2005 Capex

Multiple Tcfe Unrisked Target Size

MONTANA

NORTH

DAKOTA

Williston

Basin

Total leasehold

Mapped

Area

Nance Bakken Discovery

250 Bopd

SOUTH

DAKOTA

6 locations

22% WI

McKenzie

Fed #14-31H

22% WI

Drilling (Non-operated)

9 locations

100% WI

Bakken

$580/ac.

$310/ac.

$1,792/ac.

$750/ac.

Burlington locations

Trend

$710/ac.

$825/ac.

$910/ac.

M O N T A N A

BBC Acreage

Recent BLM Sale

Oil Well

Horizontal Well

N. D A K O T A

Scale: 640 ac = 1 Mile

(with 40 ac grid)