Exhibit 99.3

Company Profile

Bill Barrett Corporation is a Rocky Mountain exploration and production company that seeks to enhance shareholder value by executing a long-term growth strategy. Specifically, we endeavor to:

| | • | | Build multiple, diverse exploration plays that have high-impact, high-return potential |

| | • | | Develop low-risk, multi-year drilling inventories |

| | • | | Focus on long-term reserve and production growth through active drilling |

| | • | | Apply existing and emerging technologies to reduce exploration risk and enhance recoveries |

Contents

| | |

Letters to Shareholders | | 1 |

Summary Operating and Financial Data | | 4 |

Balanced Exploration and Development Programs | | 5 |

Environmental Awareness | | 14 |

Officers and Board of Directors | | 16 |

Annual Report on Form 10-K | | — |

Corporate Information | | inside back cover |

Our Values | | back cover |

Cover photo of our deep gas discovery, Peter’s Point 6-7D at West Tavaputs, Uinta Basin, Utah

Dear Shareholders,

We formed Bill Barrett Corporation four years ago to position ourselves to take advantage of the unique opportunity that presented itself in the Rocky Mountain oil and gas sector. Our experienced management and technical teams have been making the most of this opportunity and I am proud to say that 2005 was another successful year executing our strategy.

One of our strategic objectives is to build a portfolio of high-quality, high-potential prospects with multi-year drilling inventories. We identify regional geologic prospects, assemble a large leasehold position, conduct detailed geologic analysis, and deal with complex environmental regulations, all before we drill an exploratory well. This process may take several years, but the payoff can be a Company-maker discovery such as West Tavaputs, which we believe has reserve potential of 500 to 1,000 Bcfe based on our deep exploratory success last year.

Building quality prospects is important, but people are even more critical to long-term success. Most of the people at our company have worked in oil and gas in the Rockies for their entire careers. These are the individuals primarily responsible for building our robust portfolio of exploration prospects and these are the same people who will lead the company that bears my name into what I see as a very bright future for the industry.

I have enjoyed working with this group of professionals to build the foundation of Bill Barrett Corporation. My decision to retire stemmed from having accomplished several goals that I had established for both the Company and me, including building a strong team to execute our strategy and helping guide a successful initial public offering. I thank our team for all of their hard work and I thank you, our shareholders, for your support over these last four years.

|

Sincerely, |

|

|

William J. Barrett |

February 28, 2006 |

Dear Shareholders,

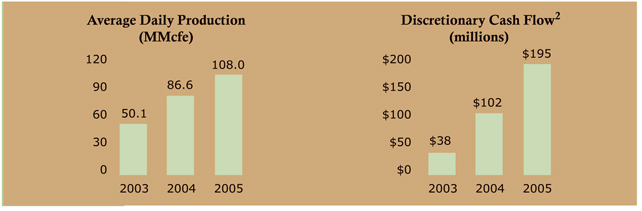

We are proud of our accomplishments in 2005. In our first full year as a public company, we executed on every aspect of our growth plan. We drilled 323 wells; we added to our portfolio of high-quality, high-potential Rockies exploration prospects; we organically grew production by 24% and reserves by 17%; and we increased our cash flow by 90%. In short, we delivered on our strategy, which is to increase shareholder value by pursuing an aggressive drilling program led by an experienced management team focused on natural gas in the Rockies. We expect this momentum to continue in 2006.

Exploration in the Rocky Mountains is one of our key competitive advantages. We established production in 80% of 20 exploration wells we drilled in 2005. Five additional exploration wells are still being tested. We are especially proud that our West Tavaputs discovery, the Peter’s Point 6-7D, was recognized byOil and Gas Investormagazine as the Best Discovery for 2005. This deep gas discovery, located in Utah’s Uinta Basin, combined with our successful shallower development in the area culminated from several years of hard work by our exploration team.

Another successful deep exploration well was drilled and completed in 2005 in the Cave Gulch/Bullfrog area of the Wind River Basin in Wyoming. The Bullfrog 14-18 had an initial production rate of nearly 20 MMcfed from the Muddy formation, while the Frontier formation is behind pipe awaiting completion. We are currently drilling an offset delineation test to this discovery. Five miles north of the Bullfrog 14-18 discovery, also in the Cave Gulch field, we successfully recompleted the Cave Gulch 1-29, which produced at rates as high as 19 MMcfed from the Muddy formation.

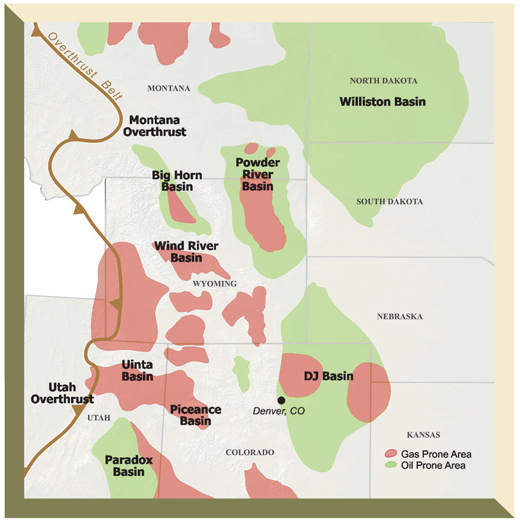

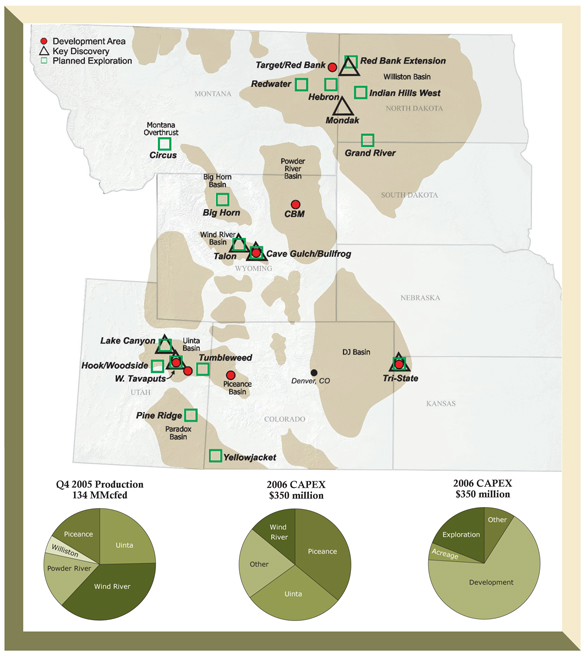

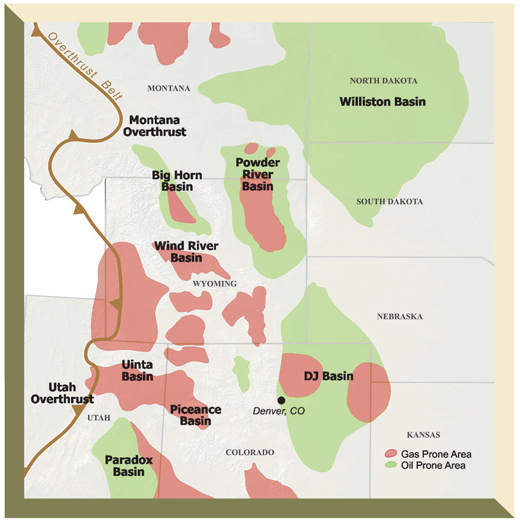

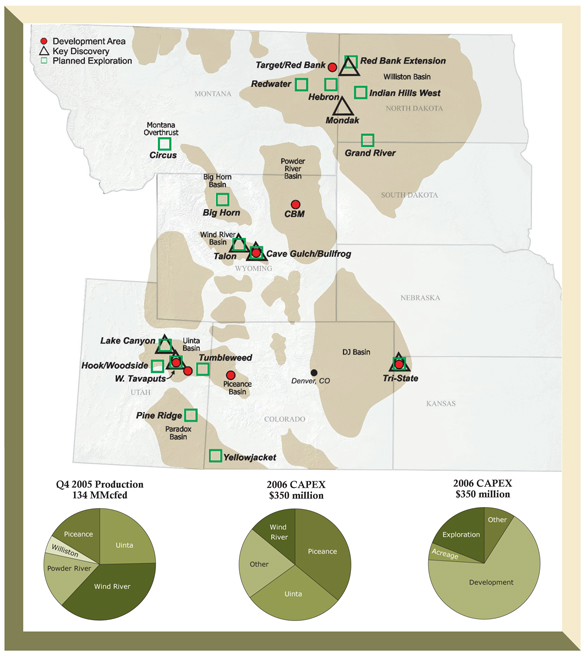

In other areas, we continue to build our exploration portfolio. Last year, we added significant acreage to our positions in our Tri-State prospect in the Denver-Julesburg Basin; our Circus prospect, a conventional 3-D seismic play in the Montana Overthrust; our basin-centered tight gas sandstone play in the Big Horn Basin; our Williston Basin horizontal drilling oil project; and our Hook and Yellowjacket fractured shale plays in the Uinta and Paradox Basins of Utah and Colorado, respectively. We now have over 1.2 million net undeveloped acres with 26 distinct exploration projects, which have a combined unrisked reserve potential in excess of 10 Tcfe.

Our exploration complements our diverse development program. We have established production in five distinct basins in the Rocky Mountains and built an eight-year inventory of identified drilling locations. Since forming the Company in 2002, we have grown production at a 58% compound annual growth rate, and our reserves have increased to 341 Bcfe with a present value of more than $1 billion. In addition to our proved reserves, we have 327 Bcfe of probable reserves and 400 Bcfe of possible reserves.

Williston Basin sunrise

| | |

Bill Barrett Corporation 2 | | |

Our capital budget for 2006 is $350 million and includes drilling offsets to our deep discovery wells and tests on 18 of our exploration prospects. Our development plans include a three rig program in the Piceance Basin, increased drilling in the Williston Basin, Big George development in the Powder River Basin, and continued development in the shallower Mesaverde formation in the West Tavaputs area of the Uinta Basin. We also will continue to seek partners for several of our exploration prospects, a strategy that reduces our exposure on any one project while providing us the ability to test a greater number of opportunities.

Rising global demand, lack of excess capacity, and insecurity about foreign energy supplies pushed commodity prices to record highs in late 2005 and there has been renewed political focus to develop domestic reserves, particularly after last year’s devastating hurricane season. We are encouraged by the Energy Policy Act of 2005 and its provisions to improve the system for developing resources on public lands, especially in the Rockies. Natural gas production from the Rocky Mountain region, as forecasted by the Department of Energy, is expected to increase faster than any other area in the country. We believe the Company is well-positioned to help drive this growth and capture a significant share of the reserves in the Rocky Mountain region.

High commodity prices have been a mixed blessing for our company. We generated record cash flow of $195 million last year and executed an active, diverse capital program, while maintaining a strong balance sheet. However, high commodity prices brought more competition for oilfield equipment and services along with significant increases in costs. Fortunately, we are able to leverage our Rockies expertise and our vendor relationships to mitigate the impact of shortages and higher costs, thus maximizing the value of our assets.

Bill Barrett, with his fifty-plus years of experience, has been a mentor to many in our management ranks for over 20 years. We will all miss him; however, we share, nurture, and understand the vision for the immense potential in the Rocky Mountain region. Over the last four years our current management team has built what we believe to be a premier oil and gas exploration company based on this vision. We have achieved solid growth and an unparalleled track record, which we intend to continue. I look forward to leading Bill Barrett Corporation through this exciting time and, on behalf of our employees, I appreciate your continued support.

|

Sincerely, |

|

|

Fredrick J. Barrett |

Chairman of the Board, Chief Executive Officer and President |

March 1, 2006 |

Fred Barrettand Bill Barrett

“In the long run, we believe the Rocky Mountain region provides the best opportunity to increase shareholder value with production and reserve growth. Natural gas production from the Rockies, as forecasted by the Department of Energy, is expected to increase faster than any other area in the country and eventually surpass the Gulf Coast as the largest producing region. We believe the Company is well-positioned to capitalize on these trends.”

Fred Barrett, Chairman, CEO and President

Summary Operating and Financial Data

| | | | | | | | | | | | |

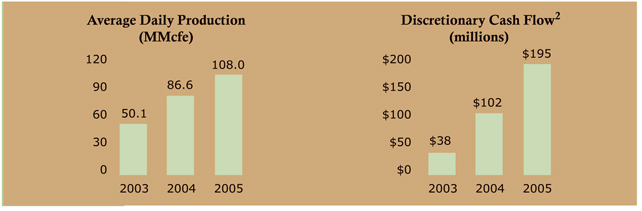

| | | 2003 | | | 2004 | | | 2005 | |

Proved Reserves and Acreage | | | | | | | | | | | | |

Natural Gas, Bcf | | | 180.9 | | | | 257.8 | | | | 306.0 | |

Oil, MMBbls | | | 3.9 | | | | 5.7 | | | | 5.8 | |

Natural Gas Equivalents, Bcfe1 | | | 204.2 | | | | 292.3 | | | | 341.0 | |

Percent Developed | | | 63 | % | | | 61 | % | | | 61 | % |

Percent Natural Gas | | | 89 | % | | | 88 | % | | | 90 | % |

Pre-Tax PV-10, millions | | $ | 521 | | | $ | 592 | | | $ | 1,050 | |

Net Undeveloped Acreage (rounded) | | | 667,000 | | | | 971,000 | | | | 1,210,000 | |

Production | | | | | | | | | | | | |

Average Daily Production, MMcfe | | | 50.1 | | | | 86.6 | | | | 108.0 | |

Percent Natural Gas | | | 89 | % | | | 91 | % | | | 92 | % |

Average Realized Prices | | | | | | | | | | | | |

Natural Gas Prices, net of hedges, $/Mcf | | $ | 4.03 | | | $ | 5.10 | | | $ | 7.16 | |

Oil Prices, net of hedges, $/Bbl | | $ | 28.85 | | | $ | 39.49 | | | $ | 46.68 | |

Operating Statistics | | | | | | | | | | | | |

Reserve Replacement | | | 565 | % | | | 378 | % | | | 224 | % |

Net Capital Expenditures and Acquisitions, millions | | $ | 186 | | | $ | 347 | | | $ | 334 | |

Producing Wells, gross/net | | | 540/343 | | | | 743/553 | | | | 940/738 | |

Wells Drilled, gross/net | | | 180/154 | | | | 287/259 | | | | 323/233 | |

Financial Data | | | | | | | | | | | | |

Net Income (Loss), millions | | | ($4 | ) | | | ($5 | ) | | $ | 24 | |

Earnings Per Share (diluted) | | | N/A | | | | N/A | | | $ | 0.55 | |

Discretionary Cash Flow2, millions | | $ | 38 | | | $ | 102 | | | $ | 195 | |

Production Revenue ($/Mcfe) | | $ | 4.12 | | | $ | 5.23 | | | $ | 7.21 | |

Lease Operating Expenses and Gathering and Transportation ($/Mcfe) | | $ | 0.66 | | | $ | 0.65 | | | $ | 0.80 | |

Production Taxes ($/Mcfe) | | $ | 0.54 | | | $ | 0.63 | | | $ | 0.85 | |

G&A, excluding non-cash stock-based compensation ($/Mcfe) | | $ | 0.78 | | | $ | 0.57 | | | $ | 0.62 | |

Depletion, Depreciation, and Amortization ($/Mcfe) | | $ | 1.68 | | | $ | 2.15 | | | $ | 2.27 | |

Discretionary Cash Flow2 ($/Mcfe) | | $ | 2.09 | | | $ | 3.23 | | | $ | 4.96 | |

| 1 | One Barrel of oil is the energy equivalent of six Mcf of natural gas |

| 2 | A Non-GAAP Measure - see inside back cover |

| | |

Bill Barrett Corporation 4 | | |

Fred Barrett andTom Tyree

“Our finance and administrative function is committed to supporting our growth strategy and our active investment program. It is our responsibility to ensure that we have the financial flexibility to fund not only our current development plan, but also the new projects that evolve from our successful exploration and acquisition activities.”

Tom Tyree, Chief Financial Officer

Balanced Exploration and Development Programs

Southern Division

Uinta Basin

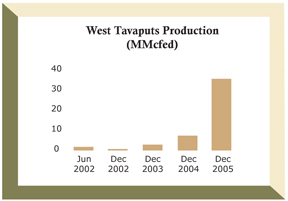

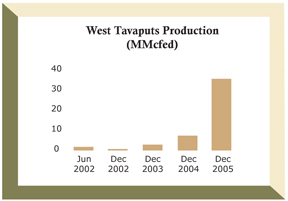

| | • | | 40 MMcfed of Production in December 2005 |

| | • | | 83 Bcfe of Proved Reserves at December 31, 2005 |

| | • | | 268,110 Net Undeveloped Acres at December 31, 2005 |

The Uinta Basin, in northeastern Utah, contains established producing fields, including Altamont/ Bluebell, Drunkards Wash, Natural Buttes, and Monument Buttes. However, much of the basin is under-explored and has untapped productive potential in the shallow Green River, Wasatch and Mesaverde formations, and the deeper Dakota, Entrada and Navajo formations. Bill Barrett Corporation has extensive acreage positions in seven project areas that represent significant exploration and development opportunities for both oil and natural gas.

One of the Company’s most exciting projects is the West Tavaputs area, which is productive in both shallow and deep horizons. BBC acquired its West Tavaputs properties in April 2002, and began drilling wells targeting the shallow Wasatch, North Horn, and Price River (Mesaverde) formations. After acquiring 3-D seismic in 2004, the Company interpreted two structural closures that cover approximately 7,500 acres and successfully drilled its first deep exploratory test well in 2005. The Peter’s Point 6-7D was directionally drilled to 15,349 feet and initially produced more than 11 MMcfed from the Dakota, Entrada and Navajo formations. This was the first production in the Uinta Basin from the Navajo formation and earned the CompanyOil and Gas Investor’sExcellence Award for Best Discovery for 2005.

Continued improvement in completion techniques and the information provided by 3-D seismic has greatly enhanced the Company’s development of this field. BBC drilled 16 wells in 2005, all of which were productive. By December 2005, the field was producing nearly 35 MMcfed (net), a significant increase from the 1 MMcfed it produced in April 2002 when the field was acquired. In fact, based on data reported by the State of Utah in September 2005, two of the top ten highest producing wells in the Uinta Basin were BBC wells at West Tavaputs.

BBC increased production while overcoming several operational challenges, including the remoteness of the area, rugged terrain, and environmental regulations that limit drilling and other activities during the winter months. An Environmental Impact Statement is being prepared, which may allow for year-round operations; however, the preparation of this document is expected to take another two years.

Roy Roux,SVP – Geophysica andKurt Reinecke

“Our experienced team of exploration geoscientists and landmen has generated multiple opportunities, including underdeveloped gas properties, sizable unexplored acreage blocks, as well as shale gas and structural projects. It usually takes several years to complete a regional geologic analysis, lease acreage, acquire seismic, and address regulatory issues before we can begin drilling a prospect. Some of our project inventory will be ready to drill in 2006, as we continue to refine other projects for the future.”

Kurt Reinecke, Senior Vice President – Exploration, Southern Division

| | |

Bill Barrett Corporation 6 | | |

At West Tavaputs, BBC is evaluating development of the shallower formations on 80-acre spacing and the deeper formations on 160-acre spacing. The Company also is evaluating ultra-deep Weber and Mississippian potential in the area at about 17,500 feet. Ninety million dollars of the 2006 capital budget is planned for West Tavaputs development and exploration activities, including upgrading the facilities, drilling two deep delineation wells and drilling 17 shallow development wells.

Southeast of West Tavaputs, BBC has interests in three other project areas: Hill Creek, Tumbleweed, and Cedar Camp. Similar to West Tavaputs, BBC is targeting the Dakota, Entrada, Navajo, and Wingate formations in each of these areas. The Company established production from these formations in 10 wells in the Hill Creek area, one of which was the highest producing well in the Uinta Basin in September 2005. A 3-D seismic survey was completed in the Tumbleweed area and two wells are waiting on pipeline connection in the Cedar Camp area. BBC is not planning further activity in these areas until the 3-D seismic data is interpreted and production from the two Cedar Camp wells is established and evaluated.

Northwest of West Tavaputs lies the Lake Canyon project, the Company’s largest contiguous acreage position. BBC has varying working interests in nearly 340 square miles and operates with a joint venture partner. One exploratory test, targeting deep Wasatch and Mesaverde horizons, was drilled in 2005 and is being tested. Our partner drilled two additional wells targeting the shallower Green River oil horizons, and successfully extended production seven miles westward from the Brundage Canyon field. In late 2005, a 50-square-mile, 3-Component, 3-D seismic survey was completed and is currently being interpreted. This experimental seismic acquisition technique is designed to highlight naturally fractured areas that are key to enhancing gas production. BBC plans to drill two deep exploratory tests and participate in at least four shallow wells in Lake Canyon in 2006. The Company has a 56% to 75% working interest in the deeper horizons and a 19% to 25% working interest in the shallower formations.

Our final two project areas in the Uinta Basin are Hook and Woodside, which are located southwest of West Tavaputs. At Hook, we are targeting shale gas from the Ferron formation at depths of 1,000 to 4,000 feet. At Woodside, we are targeting a seismically defined structural closure where gas shows have been observed in several Pennsylvanian-age sandstone reservoirs at a depth of 6,000 feet. Exploratory test wells are planned for 2006 in both of these areas.

Best Discovery Award

Oil and Gas Investormagazine presented Bill Barrett Corporation its 2005 Excellence Award for Best Discovery for its successful deep discovery at West Tavaputs in the Uinta Basin, Utah.

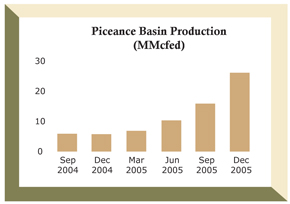

Piceance Basin

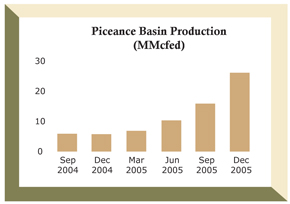

| | • | | 27 MMcfed of Production in December 2005 |

| | • | | 115 Bcfe of Proved Reserves at December 31, 2005 |

| | • | | 14,302 Net Undeveloped Acres at December 31, 2005 |

The Piceance Basin is located in northwestern Colorado and is one of the most active gas development areas in the country. Our Gibson Gulch project area is part of the same prolific trend as the Grand Valley, Parachute, Rulison, and Mamm Creek fields that have been under development for over 20 years. The primary targets are the sandstones in the Williams Fork formation of the Mesaverde Group at depths of 7,000 to 8,000 feet, including gas reservoirs in the Cameo, Rollins, Cozzette, and Corcoran formations.

Several of the Company’s employees have more than 20 years of experience working in the Piceance Basin. This experience is essential when operating in an unconventional, basin-centered gas prospect such as this. Finding the gas is only part of the challenge. Applying state-of-the-art oilfield technology and constantly reassessing the program to economically produce the hydrocarbons is the real key to success. In 2005, the Company improved its well performance by changing its completion techniques by exclusively using slickwater fracture designs, increasing stimulation volumes and injection rates, targeting non-traditional gas horizons, consistently using high quality proppant, and increasing the time the well was allowed to flow back after the stimulation for clean-up operations. After making these changes, initial production rates nearly doubled and the estimated ultimate recovery improved significantly. BBC drilled 86 wells in the Piceance in 2005 and increased production in the area more than fourfold since acquiring the property in September 2004.

BBC plans a three rig program in the area and to spend $126 million of its 2006 capital budget in the Piceance Basin. We typically directionally drill up to four wellbores from one surface pad before completion operations begin. This is advantageous as it minimizes the impact to the environment and reduces costly rig moves. The current development program is based on 20-acre subsurface well density, but

Fred Barrett, Dominic Bazile, Kenneth Kuhn, Piceance Basin

Production Superintendent, and third party employee

“Leading oilfield technologies are needed to drill and develop unconventional resources. In the Piceance Basin, we improved our completion techniques to utilize slickwater fracture stimulation, changing proppant, and increasing the amount of time to flowback the wells, which significantly increased recoverable reserves and nearly doubled our initial production rates.”

Dominic Bazile,Senior Vice President – Operations and Engineering

| | |

Bill Barrett Corporation 8 | | |

the Company does have approval to downspace to 10-acre well density. We have considered 10-acre well spacing when choosing drilling locations for our 20-acre development program to ensure maximum efficiency. The Company plans to assess 10-acre drilling potential in the next several years once it has progressed further in the 20-acre development program and assessed the results of its 25-square mile, 3-Component, 3-D seismic acquired late in 2005. This experimental survey, the only one of its kind in the Piceance, should highlight areas with increased natural fracturing and hence improved gas recoverability.

Denver-Julesberg Basin

| | • | | 182,856 Net Undeveloped Acres at December 31, 2005 |

The Denver-Julesburg Basin covers portions of northeastern Colorado, southwestern Nebraska, and northwestern Kansas, and is home to the giant Wattenberg field. BBC has a 50% working interest in nearly 380,000 gross acres in its Tri-State area, an area where Colorado, Nebraska, and Kansas meet. Our targets at Tri-State are shallow, biogenic gas reservoirs in the Niobrara formation at depths of less than 2,500 feet and deeper oil horizons in Pennsylvanian formations at depths of up to 5,500 feet. The Niobrara formation, in particular, can be evaluated using 3-D seismic technology, which historically has not been acquired in this area.

In early 2005, BBC brought in an industry partner to jointly explore Tri-State. Nearly 1,500 linear miles of 2-D seismic were acquired, and subsequent interpretation indicated an extensive area with gas potential. We conducted a 3-D seismic survey over a small part of this area known as Prairie Star and then drilled seven wells in 2005, including one horizontal well, to evaluate the best drilling and completion techniques for the Niobrara formation. All of these wells were connected to the sales line in February 2006 adding 450 Mcfe (gross) of daily production. For the remainder of 2006, BBC and its joint venture partner plan to acquire additional 3-D seismic and drill up to 26 additional Niobrara wells.

Paradox Basin

| | • | | 63,986 Net Undeveloped Acres at December 31, 2005 |

The Paradox Basin is located in southeastern Utah and southwestern Colorado. BBC has built a sizable leasehold position and, in 2006, intends to drill four exploratory tests for shale gas at depths of approximately 5,500 feet.

Mike Fitzmaurice,Geophysical Operations Manager,

Roy Roux andRon Morgenstern, Landman

“Our application of seismic technologies gives us a competitive advantage in our exploration and development programs. We are industry leaders in our usage of 3-D seismic surveys in the Rockies, including using evolving state-of-the-art, 3-Component, 3-D surveys with the objective of mapping fracture density. Last year, we acquired 160 square miles of 3-D seismic and 515 miles of 2-D seismic in 5 areas, which our geoscientists utilize to optimize drilling locations. The benefit of 3-D seismic is demonstrated with the discovery in the deep structures in West Tavaputs and early potential in the shallow formations in Tri-State.”

Roy Roux, Senior Vice President–Geophysics

Northern Division

Wind River Basin

| | • | | 46 MMcfed of Production in December 2005 |

| | • | | 86 Bcfe of Proved Reserves at December 31, 2005 |

| | • | | 159,426 Net Undeveloped Acres at December 31, 2005 |

The Wind River Basin is located in central Wyoming and contains established producing fields such as Madden and Frenchie Draw. The Wind River Basin has many productive horizons extending from 3,500 feet to more than 23,000 feet, including the Fort Union, Lance, Frontier, Muddy, Lakota, and Tensleep formations. BBC has four development project areas and eight distinct exploration areas in the Wind River Basin, primarily on the eastern portion. The Wind River Basin has historically been the highest producing area for the Company and we plan to continue to reinvest and explore in both shallow and deep horizons. The total budget for 2006 is expected to be nearly $48 million.

The Cave Gulch/Bullfrog area represents shallower development prospects in the Lance and Fort Union formations along with deep exploration and development potential in the Frontier, Muddy, and Lakota formations. In 2005, the Company drilled four successful shallow wells, drilled one successful deep exploration well and recompleted a second deep well. Our deep exploratory well, the Bullfrog 14-18, was drilled to a depth of 19,349 feet and completed in the Muddy formation. The initial production rate of this well was 20 MMcfed. The Lakota formation tested productive and the Frontier formation had gas shows on logs. Both formations remain behind pipe awaiting completion once the Muddy production declines. BBC recently spud an offset to this well and plans to drill between one and three deep wells per year from 31 identified locations. A reservoir engineering study completed in 2005 identified the need for a stimulation program in our existing deep wells. The first well to be recompleted was the Cave Gulch 1-29, in which the Muddy formation was stimulated and production grew from less than 1 MMcfed prior to stimulation to as high as 19 MMcfed after stimulation. The Company plans three additional recompletions in 2006.

South of the Cave Gulch/Bullfrog area, along the Waltman arch, lies the Cooper Reservoir project area. This area was actively drilled in shallow formations in the first years of the Company’s history, but further infill drilling was deemed uneconomic and the Company curtailed shallow drilling in the area in 2005. Regional geologic analysis shows that the productive deep horizons in the Cave Gulch/Bullfrog extend into Cooper Reservoir and plans are underway to drill a deep test well in 2006. Further south and west along the Waltman

Steve Reinert,Senior Geologist,Terry Barrettand

Tracy Galloway,Senior Geologist

“Drilling deep, exploratory tests to more than 19,000 feet that cost $11 million may be a daunting task for many companies, but our experience and skill at finding and drilling this type of prospect mitigates much of the risk. The payoff is wells that have estimated ultimate recoveries of 5-10+ Bcfe. Our initial evaluation of the area surrounding our Bullfrog 14-18 discovery has identified 31 potential deep locations. We look forward to drilling one to three of these wells each year.”

Terry Barrett, Senior Vice President – Exploration, Northern Division

| | |

Bill Barrett Corporation 10 | | |

arch are the Stone Cabin and Wallace Creek areas, where BBC has established production from the Raderville and Muddy formations. In our Windjammer and Pommard prospect areas, located on the south and west side of the arch, the Company is evaluating 3-D seismic for exploration potential. Along the southern end of the Waltman arch, we are evaluating the potential for coalbed methane in the Meteetsee coals.

East of the prolific Madden Field in the Wind River Basin, BBC has interests in an exploratory prospect known as East Madden. In 2004, the Company and its partner drilled the Hitchcock Draw 32-17, a 16,600-foot test of the Lance formation. The wellbore had mechanical problems while drilling and could not be properly cemented or tested. The well, completed in 2005, is currently producing dry gas, albeit at rates insufficient to justify the drilling costs. The Company is currently evaluating this production and the possibility of testing additional uphole formations that have not yet been tested.

The Company’s Talon project area lies in the north central portion of the Wind River Basin. BBC has drilled 14 wells in this expansive exploration play. Five wells were drilled to the tight gas sands in the Lance formation and nine wells were drilled targeting the Fort Union formation with mixed results. Our Talon wells typically had strong initial production rates, but declined more rapidly than expected. We currently are evaluating the production on these wells and the need to optimize drilling and stimulation techniques in order to make the Talon an economically viable project. BBC plans to drill one Fort Union test in 2006 utilizing some of these techniques.

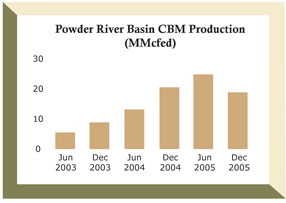

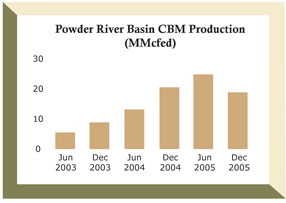

Powder River Basin-Coalbed Methane

| | • | | 20 MMcfed of Production in December 2005 |

| | • | | 26 Bcfe of Proved Reserves at December 31, 2005 |

| | • | | 53,040 Net Undeveloped Acres at December 31, 2005 |

The Powder River Basin, in northeast Wyoming, contains coalbed methane (CBM), an unconventional gas play characterized by shallow, low-risk production. The Company’s acreage overlies two major coal seams, the Wyodak and the Big George. Our most recent drilling activity targets the Big George coal. The Big George is typically 80 to 90 feet thick at depths of approximately 900 to 1,200 feet across BBC’s acreage position. The Company drilled 182 CBM wells in 2005 and plans to drill approximately 220 in 2006. Production has grown to 20 MMcfed from 6 MMcfed when the majority of the properties were acquired in 2003.

Fred LeGrand, Reservoir Engineering Advisor,

Lynn Boone Henry, VP – Reservoir Engineering,

andNezhone Bandmann, Reservoir Engineer

When developing a Big George CBM prospect, several pilot wells are initially drilled, typically on 80-acre spacing. The wells will produce water for the first 12 to 18 months while the pressure in the wellbore declines, a process called de-watering. Once the pressure declines sufficiently, gas begins to dislodge from the coal and flow into the wellbore, a process called desorption. Gas production then generally increases over the next 12 to 18 months reaching a peak rate that is typically sustained for approximately two years after which the wells slowly decline for five to six years.

A number of BBC personnel have extensive experience in the Powder River Basin, having been involved with CBM technology since its inception in the mid-1990s. This experience is essential to addressing the regulatory issues and operating challenges associated with CBM production.

Williston Basin

| | • | | 7 MMcfed of Production in December 2005 |

| | • | | 32 Bcfe of Proved Reserves at December 31, 2005 |

| | • | | 126,807 Net Undeveloped Acres at December 31, 2005 |

The Williston Basin is a large oil-prone province covering North Dakota, northeast South Dakota, and eastern Montana with established oil production from 11 major formations. Operating in the Williston Basin exposes the Company to oil development and significant exploration potential in three of the higher potential formations, the Bakken, Red River, and Madison formations, across seven project areas.

In the Williston, the vast majority of our new wells are horizontally drilled. With horizontal drilling, the wellbore is typically drilled vertically to the target reservoir and then laterally through the formation. The advantage of this technique is that one horizontal well can drain the reservoir more economically and efficiently than multiple vertical wells.

Much of the Company’s activity is centered in our Target, Red Bank, and Red Bank Extension areas located along the North Dakota and Montana border approximately 50 miles south of the Canadian border. BBC

Monty Shed, District Production Superintendent,

and third party employee

| | |

Bill Barrett Corporation 12 | | |

has drilled seven productive horizontal Madison wells in the Target and Red Bank areas and identified 14 offset locations. In the Red Bank Extension exploration area, we have identified both Madison and Bakken potential. BBC participated in one successful Bakken exploration well in this area in 2005 and recently spud its first exploratory test to the Madison formation. We plan to increase our activity from previous levels and drill nine wells in these areas in 2006.

Additional Madison potential exists in our Indian Hills prospect, an area 20 miles southeast of Red Bank Extension. Our first exploratory test in this area is producing oil. BBC plans to drill one additional exploratory test in Indian Hills in 2006 and evaluate the potential for additional drilling.

The Company also has acreage positions in our Redwater and Mondak project areas where the Bakken formation is the main target. Both areas are adjacent to the main Bakken production trend of Richland County, Montana. We currently are completing and testing a Bakken exploratory well drilled in Redwater and plan to participate in drilling three Bakken development wells in Mondak.

Big Horn Basin

| | • | | 140,959 Net Undeveloped Acres at December 31, 2005 |

The Big Horn Basin is located in north central Wyoming and is primarily known for its giant oilfields. BBC has assembled a significant leasehold position to test an unconventional basin-centered gas concept. Nearly every other basin along the Rockies from the San Juan Basin in the south to the Wind River Basin in the north has demonstrated that unconventional basin-centered gas is economic, but basin-centered gas in the Big Horn Basin has yet to be proven. BBC plans to acquire 3-D seismic and drill a minimum of one exploratory test in 2006 to assess the potential.

Montana Overthrust

| | • | | 159,127 Net Undeveloped Acres at December 31, 2005 |

The Rocky Mountain Overthrust Belt extends from Alberta, Canada to southern Utah. The overthrust is characterized by complex geologic structure and faulting with the potential for large four-way closures. We believe that with 3-D seismic, we can better identify structural closures that may contain hydrocarbons. In late 2005, BBC acquired 68 square miles of 3-D seismic data, which is currently being processed. Two exploration wells are planned for 2006 to test the potential in Cretaceous, Mississippian, and Devonian targets.

Montana Overthrust Area

Environmental Awareness

We strive to provide for the nation’s growing demand for energy in a manner that minimizes impacts that are inherent in any human endeavor. We are a company staffed by hikers, skiers, hunters and other recreationalists with a sense of personal and professional pride toward the environment. We live in the communities where we operate.

While our strategic objective is to increase shareholder value by exploring for and producing natural gas and oil, our first core value reads:

| | • | | INTEGRITY in the way we conduct our business, respect the environment, and analyze our opportunities. |

We acknowledge and accept our responsibility for the health and safety of employees. We actively partner in the communities that host us. We work to mitigate our impacts to the environment. Our values direct how we operate; in fact, we believe it is significantly more difficult to deliver shareholder value without incorporating these principles into our management practices.

Interstate Oil and Gas Compact Commission’s national

“Chairman’s Stewardship Award”

Our success in West Tavaputs in 2005 is a prime example of responsible energy development. Not only was exploration successful atop the West Tavaputs plateau in Utah, but the care with which we pursued our program garnered Bill Barrett Corporation the Interstate Oil and Gas Compact Commission’s national “Chairman’s Stewardship Award”,recognizing Company efforts to protect the environment and archeological assets in the area. At our West Tavaputs area Bill Barrett Corporation has spent more than $900,000 to clean up well sites neglected by previous owners, reroute and realign roads to better protect artifacts and fund a cultural artifact inventory project.

Duane Zavadil, VP – Government and Regulatory

Affairs, andHunt Walker, SVP – Land

| | |

Bill Barrett Corporation 14 | | |

While we are justifiably proud of this recognition, it is more important to prove that exploring for natural gas and environmental stewardship are not mutually exclusive. We employ technologies, such as heliportable seismic surveying, multiple wellbores from single pad drilling, and horizontal drilling to minimize the impact to the environment, yet enhance recoverability.

We also adopt and support technologies that help protect wildlife habitat, air and water quality, and scenic vistas. For example, the Utah Division of Wildlife Resources was able to use the Company’s start-up grant of $25,000 to study a little-known population of the greater sage grouse, a species of bird that has seen its numbers decline around the globe. A total of $100,000 was raised to support the work of a biologist and several technicians to trap, radio collar, and track grouse in order to better identify and protect wintering habitat, migration and predation trends and leks, which is a type of habitat grouse require for mating and nesting. We supported a similar effort with elk on the Ute Indian reservation in eastern Utah. The Company helped support the Tribe’s Fish and Game department efforts to better understand the behavior and risks to the local elk population critical to Ute traditions and the Tribe’s economy through a collaring and surveying effort.

The western United States, with its wealth of public lands and great scenic and recreational value, is a growing source for domestic supplies of natural gas. State-of-the art environmental practices and public education are essential to minimize potential conflicts between stakeholders. Public lands belong to every American, including the natural resources below the surface. These subsurface resources provide a great return to the American people. Every dollar spent administering the oil and gas program returns twenty dollars to the public coffers in the form of royalties and taxes. More importantly, domestically produced energy sources increase energy security, which is something we here at Bill Barrett Corporation take great pride in.

Francis Barron, SVP – General Counsel and Secretary, and

Bob Howard, EVP – Finance and Investor Relations

Officers

Fredrick J. Barrett

Chairman, Chief Executive Officer and President

Thomas B. Tyree, Jr.

Chief Financial Officer

Robert W. Howard

Executive Vice President—Finance and Investor Relations

Terry R. Barrett

Senior Vice President—Exploration, Northern Division

Francis B. Barron

Senior Vice President—General Counsel and Secretary

Dominic J. Bazile II

Senior Vice President—Operations and Engineering

Kurt M. Reinecke

Senior Vice President—Exploration, Southern Division

Wilfred R. Roux

Senior Vice President—Geophysics

Huntington T. Walker

Senior Vice President—Land

Kevin Finnegan

Vice President—Information Systems

Lynn Boone Henry

Vice President—Reservoir Engineering

Duane J. Zavadil

Vice President—Government and Regulatory Affairs

Board of Directors

Fredrick J. Barrett

Chairman, Chief Executive Officer and President of Bill Barrett Corporation

William J. Barrett

Former Chairman and Chief Executive Officer of Bill Barrett Corporation

Henry Cornell

Managing Director, Goldman, Sachs & Co.

James M. Fitzgibbons

Retired Chairman of the Board, Davidson Cotton Company

Jeffrey A. Harris

Managing Director, Warburg Pincus LLC

Roger L. Jarvis

Former Chairman of the Board and Chief Executive Officer, Spinnaker Exploration Company

Philippe S.E. Schreiber

Business Consultant and Attorney

Randy Stein

Tax and Business Consultant

Michael E. Wiley

Retired Chairman of the Board and Chief Executive Officer, Baker Hughes Incorporated

Frank Keller (retired February 1, 2006)

We thank Frank for coming out of retirement to help form BBC and guide our operations for our first four years. His leadership, professionalism, breadth of operational and financial expertise, and calm demeanor were instrumental in setting the tone and culture to achieve our operational excellence. He provided a strong mentoring role to many of us here at Bill Barrett Corporation. We all wish him and his wife, Carolyn, a highly enjoyable retirement.

| | |

Bill Barrett Corporation 16 | | |

Corporate Information

Corporate Office

1099 Eighteenth Street, Suite 2300

Denver, Colorado 80202

Telephone: 303-293-9100

Fax: 303-291-0420

Internet: www.billbarrettcorp.com

Annual Stockholders’ Meeting

Our annual stockholders’ meeting

will be held at 9:30 a.m. (MST)

on Wednesday, May 17, 2006 at the

Westin Tabor Center

1672 Lawrence Street

Denver, Colorado 80202

Transfer Agent

Mellon Investor Services LLC

Ridgefield Park, New Jersey 07660

Independent Auditors

Deloitte & Touche LLP

Denver, Colorado 80202

Reservoir Engineers

Ryder Scott Company, L.P.

Denver, Colorado

Netherland Sewell & Associates, Inc.

Dallas, Texas

Non-GAAP Measure

Discretionary cash flow is computed as net loss plus depreciation, depletion, amortization and impairment expenses, deferred income taxes, exploration expenses, non-cash stock-based compensation, losses (gains) on sale of properties, and certain other non-cash charges. The non-GAAP measure of discretionary cash flow is presented because management believes that it provides useful additional information to investors for analysis of the Company’s ability to internally generate funds for exploration, development and acquisitions. In addition, discretionary cash flow is widely used by professional research analysts and others in the valuation, comparison and investment recommendations of companies in the oil and gas exploration and production industry, and many investors use the published research of industry research analysts in making investment decisions. Discretionary cash flow should not be considered in isolation or as a substitute for net income, income from operations, net cash provided by operating activities or other income, profitability, cash flow or liquidity measures prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”). Because discretionary cash flow excludes some, but not all, items that affect net income and net cash provided by operating activities and may vary among companies, the discretionary cash flow amounts presented may not be comparable to similarly titled measures of other companies. For a reconciliation of discretionary cash flow to net income (loss) refer to our various Forms 8-K filed with the SEC.

Forward Looking Statements and Other Notices

This report contains forward-looking statements regarding Bill Barrett Corporation’s future plans and expected performance based on assumptions the Company believes to be reasonable. A number of risks and uncertainties could cause actual results to differ materially from these statements, including, without limitation, the success rate of exploration efforts and the timeliness of development activities, fluctuations in oil and gas prices, and other risk factors described in the Company’s accompanying Form 10-K for the year ended December 31, 2005.

The United States Securities and Exchange Commission (SEC) permits oil and gas companies, in their filings with the SEC, to disclose only proved reserves that a company has demonstrated by actual production or conclusive formation tests to be economically and legally producible under existing economic and operating conditions. Bill Barrett Corporation may use certain terms in this report and other communications relating to reserves and production that the SEC’s guidelines strictly prohibit the Company from including in filings with the SEC. It is recommended that U.S. investors closely consider the Company’s disclosures in Bill Barrett Corporation’s Annual Report on Form 10-K for the year ended December 31, 2005 filed with the SEC. This document is available through the SEC by calling 1-800-SEC-0330 (U.S.) and on the SEC website at www.sec.gov.

The New York Stock Exchange’s Rule 303A.12(a) requires chief executive officers of listed companies to certify that they are not aware of any violations by their company of the exchange’s corporate governance listing standards. This annual certification by the chief executive officer of Bill Barrett Corporation has been filed with the New York Stock Exchange. In addition, Bill BarrettCorporation has filed, as exhibits to its most recently filed Form 10-K, the SEC certifications required for the chief executive officerand chief financial officer under Section 302 of the Sarbanes-Oxley Act.

Photo of Bill Barrett on page 1 by Eric Bakke, all other photos by Bill Barrett Corporation employees.

Bill Barrett Corporation

OUR VALUES

INTEGRITY in the way we conduct our business, respect the environment, and analyze our opportunities

GROWTH in production, reserves, and our share price

TEAMWORK in the way we manage our business and work with our partners

ALLEGIANCE to our investors, employees, suppliers, and the communities in which we operate