Exhibit 99.1

| | |

| | Press Release |

For immediate release

Company contact: Jennifer Martin, Director of Investor Relations, 303-312-8155

Bill Barrett Corporation Announces

18% Increase in 2009 Proved Reserves, 16% Increase in 2009 Production

and Provides 2010 Guidance

DENVER – January 21, 2010 – Bill Barrett Corporation (NYSE: BBG) announced today certain unaudited operating results for year-end 2009 and certain operating guidance for 2010. Highlights from 2009 include (unaudited):

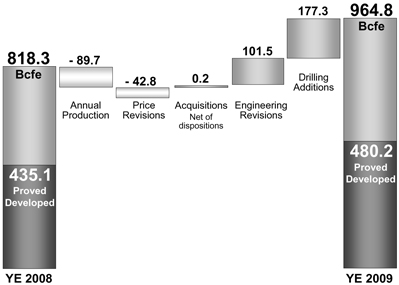

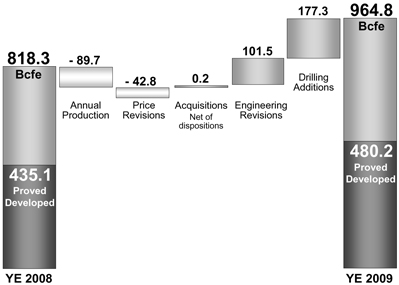

| | • | | Proved reserve growth of 18% to 964.8 Bcfe |

| | • | | Production growth of 16% to 89.7 Bcfe |

| | • | | Total estimated capital expenditures of $406 million, within cash flow |

| | • | | Maintained flat long-term debt while increasing availability on line of credit to $588 million |

Chairman and Chief Executive Officer, Fred Barrett, commented: “2009 was another year in which our team demonstrated excellent execution as a low cost operator. Given a back-drop of poor economic conditions and particularly low natural gas prices, we delivered strong reserve and production growth, generated cash flow in excess of our capital program, as well as ended the year with a strong balance sheet and $588 million in available liquidity. Our reserve growth under a low commodity price scenario reflects the quality of our assets and these results translate into a fourth consecutive year of lower finding and development costs (see “Disclosure Statements” section below), which were approximately $1.69 per thousand cubic feet equivalent (“Mcfe”) for 2009, including the $60 million Cottonwood Gulch acquisition, or $1.44 per Mcfe excluding this acquisition. Record production along with our hedging program drove solid revenue that, combined with lower per unit costs for lease operating and general and administrative expenses, supported solid cash flow despite the low price environment.

“Looking to 2010, we have a capital expenditure budget of $400 to $425 million, before acquisitions, which we plan to allocate approximately 95% to our development programs and approximately 5% towards exploration. However, spending will remain flexible should circumstances allow us to increase activity at West Tavaputs, Cottonwood Gulch or Yellow Jacket. Capital expenditures will again be aligned with cash flows. We are projecting production of 97 to 100 billion cubic feet equivalent (“Bcfe”) for 2010, which reflects an 8% to 12% increase over 2009. Currently, the Company has approximately 60% of 2010 projected production hedged at an average floor price of approximately $7.55 per Mcfe and may continue to layer on hedges up to 70% of production in order to ensure predictable cash flows in 2010. We are well positioned to have another great year, to be opportunistic and to drive operational excellence that delivers continued growth and higher returns throughout 2010.”

2009 Year-end Estimated Reserves, Production and Capital Expenditures

(The following information is unaudited and preliminary. Audited and final results will be provided in our Annual Report on Form 10-K for the year ended December 31, 2009 currently planned to be filed with the Securities and Exchange Commission (“SEC”) by the end of February 2010.)

The sizable increase in 2009 reserves primarily reflects continued development at our key programs at Gibson Gulch and West Tavaputs, including continued success with 20-acre development at West Tavaputs.

| | | |

Reserves | | Bcfe | |

2008 year-end estimated proved reserves | | 818.3 | |

2009 estimated production | | (89.7 | ) |

2009 acquisitions net of dispositions | | .2 | |

2009 reserve additions, including revisions | | 236.0 | |

| | | |

2009 year-end estimated proved reserves | | 964.8 | |

| | | |

| |

Reserve replacement ratio | | 264 | % |

| | | |

Year-end estimated proved reserves of 964.8 Bcfe were 95% natural gas and 5% oil. Further, estimated proved reserves were 50% developed and 50% undeveloped. The present value of proved reserves was estimated at $685 million, before the effect of income taxes, based on a Colorado Interstate Gas (“CIG”) natural gas price of $3.04 per million British thermal units (“MMBtu”), a West Texas Intermediate (“WTI”) oil price of $57.65 per barrel and a 10% per annum discount rate.

2

Revised SEC Guidelines

Proved reserves are calculated based on SEC guidelines that went into effect for the Company’s year-end 2009 reserve reporting. The revisions to the guidelines were intended to modernize and update the oil and gas requirements to align them with current practices and changes in technology. Changes in the Company’s reserve estimates, compared with the methodology used in 2008 based on the prior SEC rules, include:

| | • | | Commodity prices used to calculate reserves apply the simple 12-month average of the 2009 first day of the month CIG natural gas price, or $3.04 per MMbtu, and 12-month average WTI oil price, or $57.65 per barrel, rather than the year-end prices prescribed by the old method. Under the old method, commodity prices used to calculate reserves would have been $5.54 per MMBtu for CIG natural gas and $76.00 per barrel for WTI oil. |

| | • | | The new guidelines have expanded the definition of proved undeveloped reserves that can be booked from a proved developed well location. The Williams Fork Formation in Gibson Gulch is a basin-centered continuous accumulation of gas that supports with reasonable certainty proved undeveloped reserves located more than one direct offset from an economically producing well. Where the opportunity exists, the Company included one additional offsetting location, increasing the proved undeveloped reserves for the field by 64 Bcfe. |

| | • | | The new guidelines also limit the booking of proved undeveloped reserves to those reserves that are scheduled to be developed within five years, which had a nominal impact of reducing the Company’s reserves by 7 Bcfe. |

Pricing Sensitivities

Due to the change in guidelines and the particularly low natural gas price used to calculate reserves compared with prior years, the Company believes it would be helpful to consider price sensitivities to the proved reserve calculation as follows, with “PV10” representing the present value of our proved reserves using a 10% discount rate. For context, the five year strip price as of December 31, 2009 averaged $5.80 per MMBtu CIG natural gas and $86.47 per barrel WTI oil:

| | | | | | | | | |

Commodity Price | | Natural Gas | | Oil | | Bcfe | | PV10 |

| | | (Bcf) | | (MMbbls) | | | | (in millions) |

2009: $3.04 gas, $57.65 oil | | 918 | | 7.8 | | 965 | | $ | 685 |

+$1.00/$10: $4.04 gas, $67.65 oil | | 962 | | 8.2 | | 1,012 | | $ | 1,336 |

+$2.00/$20: $5.04 gas, $77.65 oil | | 971 | | 8.7 | | 1,023 | | $ | 2,021 |

| | • | | Commodity prices up $1.00 per MMBtu and $10.00 per barrel to $4.04 per MMBtu and $67.65 per barrel, respectively: Applying these modified commodity prices to 2009 reserves, proved reserves would have been 1,012 Bcfe with a present value of $1.3 billion, before the effect of income taxes. |

| | • | | Commodity prices up $2.00 per MMBtu and $20.00 per barrel to $5.04 per MMBtu and $77.65 per barrel, respectively: Applying these modified commodity prices to 2009 reserves, proved reserves would have been 1,023 Bcfe with a present value of $2.0 billion, before the effect of income taxes. |

Production

Estimated production for 2009 was 89.7 Bcfe and was comprised of 95% natural gas and 5% oil. Estimated fourth quarter 2009 production was 22.8 Bcfe, up 11% from 20.6 Bcfe in the fourth quarter 2008 and flat sequentially.

3

Capital Expenditures

Preliminary, unaudited capital expenditures, including acquisitions, for 2009 were $406.4 million, in line with guidance. The Company did not have material divestitures in 2009. The following is a summary of proved reserves at December 31, 2009 and unaudited production and capital expenditures for 2009 for each of our primary development areas:

| | | | | | | | |

| | | Year-ended December 31, 2009 | |

Basin | | Reserves | | Production | | Capital

Expenditures | |

| | | (Bcfe) | | (Bcfe) | | (in millions) | |

Piceance | | 532.0 | | 36.5 | | $ | 255 | * |

Uinta | | 338.6 | | 32.2 | | | 94 | |

Powder River-CBM | | 62.8 | | 12.1 | | | 14 | |

Wind River | | 29.7 | | 8.4 | | | 5 | |

Other | | 1.7 | | 0.5 | | | 38 | |

| | | | | | | | |

Totals | | 964.8 | | 89.7 | | $ | 406 | |

| | | | | | | | |

| * | Includes $60 million Cottonwood Gulch acquisition |

Other

Under successful efforts accounting, in the fourth quarter of 2009 the Company expects to record impairment, dry hole and abandonment expenses of approximately $23 million (pre-tax), of which approximately $2 million relates to dry holes. The expenses are primarily the result of sub-economic performing wells in the Yellow Jacket prospect that were completed using a less optimal fracture technology.

2009 Year-End Debt and Liquidity

The Company had $5.0 million in outstanding borrowings on its revolving credit facility at December 31, 2009. The revolving credit facility has commitments totaling $592.8 million and a borrowing base of $630.0 million, which provided the Company with $587.8 million of borrowing capacity at December 31, 2009. The Company’s borrowing base is subject to redetermination during or before the second quarter of 2010 based on year-end 2009 proved reserves and hedge position. The Company also had $172.5 million of convertible senior notes and $250.0 million in 9.875% senior notes outstanding at December 31, 2009.

2010 Operating Guidance

The Company intends to generally align 2010 capital expenditures with cash flow from operations. Based on the 2010 commodity price outlook and hedge positions, the Company plans a $400 to $425 million exploration and development expenditure program and expects to drill approximately 220 wells in 2010. Capital expenditures are expected to be allocated approximately 95% for development and 5% for delineation and exploration and include approximately 120 to 130 wells at Gibson Gulch, 8 wells at West Tavaputs, 60 to 70 wells at Powder River and 17 wells at Blacktail Ridge-Lake Canyon. At year-end 2009, the Company had 64 wells at its Gibson Gulch and West Tavaputs projects to be completed during 2010.

4

| | |

2010 Capital Expenditures, Production and Costs Guidance | | |

Capital expenditures before the effect of significant acquisitions or divestitures (in millions) | | $400 - $425 |

| |

Production (Bcfe) | | 97 - 100 |

| |

Operating costs per unit (per Mcfe) | | |

Lease operating | | $0.57 - $0.61 |

Gathering, processing & transportation | | $0.75 - $0.80 |

| |

General & administrative (in millions) | | |

Excluding non-cash stock-based compensation | | $40 - $43 |

Brief Updates

The Company will provide more detailed operations updates in its upcoming year-end results release and Form 10-K filing.

| | • | | The Company currently is operating four conventional rigs (two in Gibson Gulch, one at West Tavaputs and one at Blacktail Ridge.) |

| | • | | Gibson Gulch, Piceance Basin, Colorado – Returns from our key, low-risk Gibson Gulch project continue to improve, driven by both drilling and operating efficiencies as well as the benefit from natural gas liquids sales. The Company is adding a third rig to the area in late January 2010 and expects production growth from the area of more than 30% for 2010. Spud-to-spud drilling times have been reduced to as low as four days. |

| | • | | West Tavaputs, Uinta Basin, Utah – On January 6, 2010, the Company signed what may be described as a landmark agreement among the State of Utah, the Bureau of Land Management and groups representing archeological and cultural interests. The agreement details the provisions for protections and enhancements to be provided by the Company during full field development at West Tavaputs for the cultural artifacts lining Nine Mile Canyon Road, the route used to access our project. The Company is pleased to come to a conclusion with the archeological and cultural interest groups. In addition, the Company has similarly reached agreement with wildlife interest groups in addressing their issues and concerns. The Company looks forward to resolution of final matters with interests representing wilderness groups in order to assist in obtaining the final Environmental Impact Statement and Record of Decision for full field development of the project, which is expected during the first half of 2010. |

| | • | | Yellow Jacket, Paradox Basin, Colorado – At Yellow Jacket (working interest 55%), the Company continues to have encouraging results from the most recent fracture technique applied to its Koskie 13H-27 well. The well has flowed for 120 days and is currently producing approximately 1.4 MMcfe/d, consistent with a decline curve associated with a 2 to 3 Bcfe well. The Company will continue to monitor the well and plans to commence its 2010 exploration program in the second quarter of 2010 with a minimum of two wells. |

5

| | • | | Cottonwood Gulch, Piceance Basin, Colorado – The Company continues to participate in the mediation process concerning a lawsuit by environmental groups challenging the issuance of the oil and gas leases at its Cottonwood Gulch exploration area. The property was acquired in June 2009 and has a signed Record of Decision and Resource Management Plan in effect from the Bureau of Land Management. The Company agreed to delay oil and gas activities during the mediation process. |

Commodity Hedges

The Company has hedges in place for approximately 60% of forecast 2010 production. Natural gas hedges are predominantly tied to Rocky Mountain regional pricing. Generally, it is the Company’s strategy to hedge 50% to 70% of production through basis at regional sales points on a forward 12-month basis in order to reduce the risks associated with unpredictable future natural gas and oil prices and to provide certainty for a portion of its cash flow to support its capital expenditure program.

The following table summarizes hedge positions as of January 15, 2010:

Swaps and Collars

| | | | | | | | | | |

| | | Natural Gas | | Oil |

Period | | Volume

(MMBtu/d) | | Price

($/MMBtu) | | Volume

(bopd) | | Price

($/bbl) |

1Q10 | | 174,000 | | $ | 6.48 | | 966 | | $ | 79.65 |

2Q10 | | 184,000 | | $ | 6.65 | | 1,000 | | $ | 79.88 |

3Q10 | | 184,000 | | $ | 6.65 | | 1,000 | | $ | 79.88 |

4Q10 | | 129,962 | | $ | 6.51 | | 1,000 | | $ | 79.88 |

| | | | |

1Q11 | | 112,500 | | $ | 6.34 | | — | | | — |

2Q11 | | 112,500 | | $ | 5.98 | | — | | | — |

3Q11 | | 112,500 | | $ | 5.98 | | — | | | — |

4Q11 | | 72,717 | | $ | 6.18 | | — | | | — |

Not included above:

Basis only swaps (out of the money):

| | |

2010: | | 12.9 MMBtu ($2.42) |

2011: | | 7.3 MMBtu ($1.72) |

NGL swaps:

2010: The Company has elected to process its Piceance natural gas production, which will result in a portion of its natural gas being sold as natural gas liquids. The Company has 8.75 million gallons (estimated 712,000 MMBtu equivalent) of natural gas liquids hedged at $1.06 per gallon on average (or approximately $13.03/MMBtu equivalent.) Of this, approximately 74% is hedged in the first quarter of 2010.

6

Upcoming Events

Investor Presentation Update

The Company intends to post an updated investor presentation on Friday, January 22, 2010 at 5:00 pm Mountain time. Updated investor presentations are posted on the homepage of the Company’s website atwww.billbarrettcorp.com.

Credit Suisse Conference

Chairman and CEO Fred Barrett plans to present at the Credit Suisse Annual Energy Summit on February 5, 2010 at 8:10 am Mountain time. The event will be webcast and may be accessed live and for replay on the Company’s website.

2009 Fourth Quarter and Full Year Results Release

The Company intends to release its fourth quarter and full year 2009 results on February 23, 2010 before the market opens and host a webcast and conference call at noon eastern time the same day. Please join Bill Barrett Corporation executive management for the webcast and call for an update on operations and strategy for 2010. The webcast may be accessed atwww.billbarrettcorp.com or the call-in number is 866-713-8566 (617-597-5325) with passcode 11510914. A replay of the call will also be available through February 26, 2010 at call-in number 888-286-8010 (617-801-6888) with passcode 79944965.

Disclosure Statements

Finding and Development Cost

Finding and development cost is a non-GAAP metric commonly used in the exploration and production industry. Calculations presented by the Company are based on costs incurred, as adjusted by the Company, divided by reserve additions. Reconciliation of adjustments to costs incurred is provided in the Company’s earnings release and Form 8-K issued February 24, 2009. The 2009 year-end estimate provided in this release is based on the same calculation method and preliminary results.

Forward-Looking Statements:

This press release contains forward-looking statements, including statements regarding projected results and future events. In particular, the Company is providing “2010 Guidance,” which contain projections for certain 2010 operational and financial results. These forward-looking statements are based on management’s judgment as of this date and include certain risks and uncertainties. Please refer to the Company’s Annual Report on Form 10-K for the year-ended December 31, 2008 filed with the Securities and Exchange Commission (“SEC”), and subsequent filings including our Current Reports on Form 8-K, for a list of certain risk factors. The Company also provides unaudited estimates of certain year-end results, which are subject to revision in our audited financial statements to be included in our Annual Report on Form 10-K to be filed in February 2010.

Actual results may differ materially from Company projections and can be affected by a variety of factors outside the control of the Company including, among other things, exploration drilling and testing results, the ability to receive drilling and other permits and regulatory approvals, the outcome of negotiation with the wilderness and other groups and government approval for development projects, governmental regulations, availability and costs of financing to fund the Company’s operations, availability of third party gathering, transportation and processing, market conditions, oil and gas price volatility, risks related to hedging activities including counterparty viability, the availability and cost of services and materials, the ability to obtain industry partners to jointly explore certain prospects and the willingness and ability of those partners to meet capital

7

obligations when requested, surface access and costs, uncertainties inherent in oil and gas production operations and estimating reserves, unexpected future capital expenditures, competition, risks associated with operating in one major geographic area, the success of the Company’s risk management activities, the speculative actual recovery of estimated potential volumes, and other factors discussed in the Company’s reports filed with the SEC. Bill Barrett Corporation encourages readers to consider the risks and uncertainties associated with projections. In addition, the Company assumes no obligation to publicly revise or update any forward-looking statements based on future events or circumstances.

About Bill Barrett Corporation

Bill Barrett Corporation (NYSE: BBG), headquartered in Denver, Colorado, explores for and develops natural gas and oil in the Rocky Mountain region of the United States. Additional information about the Company may be found on its websitewww.billbarrettcorp.com.

8