Exhibit 99.1

| | |

| | Press Release |

For immediate release

Company contact: Jennifer Martin, Vice President of Investor Relations, 303-312-8155

Bill Barrett Corporation Announces

88% Proved Reserve Growth at Three Active Oil Programs

and Provides 2014 Guidance and Updated Well Results

DENVER – February 4, 2014 – Bill Barrett Corporation (the “Company”) (NYSE: BBG) announced today certain unaudited 2013 operating results, estimated reserves for year-end 2013 and certain operating guidance for 2014. Highlights from 2013 include (unaudited):

| | • | | Total production of 14.5 MMBoe (86.9 Bcfe) |

| | • | | Oil production up 30% in 2013 over 2012 |

| | • | | Proved reserves of 197 MMBoe, including 88% growth in proved reserves at three active oil programs |

| | • | | DJ Basin proved reserves up more than 50 MMBoe, or 355%, to 65.8 MMBoe |

| | • | | Proved reserves plus risked resources of 587 MMBoe, up 80% at oil programs |

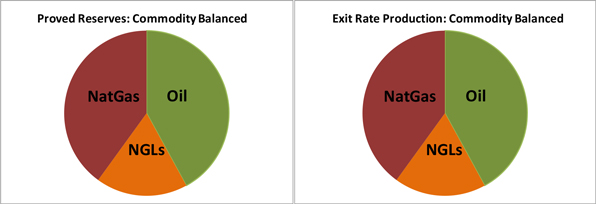

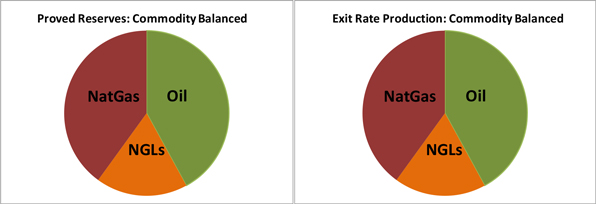

| | • | | Achieved a better balanced commodity mix with exit rate production 40% oil, 58% liquids including NGLs, and year-end 2013 reserves 42% oil, 61% liquids including NGLs |

| | • | | Increased oil drilling locations to 5,390 gross/2,329 net for long-lived, scalable programs |

| | • | | Reduced total debt by $189 million year-end 2013 from year-end 2012 |

Chief Executive Officer and President Scot Woodall commented, “Execution was our theme for 2013, and we delivered on our key objectives. For 2013, we realized our goal of 30% growth in oil production, delineated approximately 70% of our Northeast Wattenberg position in the Denver-Julesburg (“DJ”) Basin and increased proved reserves in the area by 355%, completed the sale of certain natural gas assets, reduced year-end debt by $189 million and exited the year with oil comprising 40% of total production. Our team did a tremendous job executing on our objectives and completing a significant transition to achieve a well balanced portfolio. Based on both reserves and production, we have achieved commodity balance.”

“In 2014, we will continue to focus investment capital in our most profitable programs. We anticipate attractive returns and well payback economics on drilling and completion costs in each of the DJ Basin, East Bluebell and Powder Deep. The profitability of these programs is exemplified by steeply improving cash margins and shorter payback, and is expected to generate strong quarterly cash flow growth through the year as we drive increasing oil production. Our 2014 capital budget is planned at $500 million-$550 million and is expected to deliver total production between 11.0 million-12.2 million barrels of oil equivalent (“MMBoe”), which includes more than tripling production from the DJ Basin. We are well hedged in 2014 to support our

expected cash flows with 8,800 barrels per day (“Bbls/d”) of West Texas Intermediate (“WTI”) oil at $94.08 per barrel and 63 million cubic feet per day (“MMcf/d”) of natural gas at $4.20 per thousand cubic feet (“Mcf”).”

See below for details on 2014 guidance.

2013 YEAR-END ESTIMATED RESERVES, PRODUCTION AND CAPITAL EXPENDITURES

(The following information is unaudited, preliminary and subject to change. Audited and final results will be provided in our Annual Report on Form 10-K for the year ended December 31, 2013 currently planned to be filed with the Securities and Exchange Commission (“SEC”) by the end of February 2014.)

2013 Year-End Reserves

2013 year-end estimated proved reserves of 197.0 MMBoe reflect 88% growth in proved reserves at the Company’s three active oil programs in the DJ Basin, Uinta Basin and Powder River Basin, largely offset by the sale of the West Tavaputs natural gas assets and production declines in the Piceance Basin.

Table: Reserve Reconciliation 2012 to 2013

(As of January 1, 2013 the Company revised its reserve and production reporting to three-streams, which separately reports natural gas liquids (“NGLs”) rather than including NGLs with the natural gas stream. 2012 data is converted to a three-stream basis for comparability. In addition, as of January 1, 2014, the Company is reporting reserves and production volumes and metrics in barrels of oil equivalent (“Boe”) because more than one-half of production is liquids production.)

| | | | |

Reserves | | MMBoe | |

2012 year-end estimated proved reserves (converted to 3-stream) | | | 195.0 | |

2013 Estimated production | | | (14.5 | ) |

2013 Reserve dispositions | | | (40.5 | ) |

2013 Reserve additions and revisions | | | 57.0 | |

| | | | |

2013 year-end estimated proved reserves | | | 197.0 | |

| | | | |

Production replacement percentage | | | 393 | % |

| | | | |

Year-end estimated proved reserves were 42% oil, 18% NGLs and 40% natural gas and were 42% developed and 58% undeveloped. Estimated total proved oil reserves increased by 65% in 2013 compared with 2012.

The pre-tax present value of proved reserves, or PV10, was estimated at $1.75 billion, which is up $348 million from year-end 2012, primarily due to oil reserve additions and higher commodity prices. The present value calculation is before income taxes and is based on a Henry Hub natural gas price of $3.67 per MMBtu, WTI oil price of $96.91 per barrel, NGLs priced per barrel at 31% of WTI, and a 10% per annum discount rate. PV10 information is provided because it is a

2

commonly used metric in the exploration and production industry. PV10 sensitivity to commodity prices below considers a $1.00 increase in natural gas prices and a $10.00 increase in WTI oil prices:

Table: PV10 Sensitivity

| | | | | | | | |

Commodity Price | | Reserves

(MMBoe) | | | PV10

(Millions) | |

2013: $96.91 oil, $3.67 gas | | | 197 | | | $ | 1,749 | |

+$1.00 gas: $96.91 oil, $4.67 gas | | | 197 | | | $ | 1,958 | |

+$10.00 oil: $106.91 oil, $3.67 gas | | | 198 | | | $ | 2,144 | |

2013 Year-End Risked Resources

In addition to estimated proved reserves, the Company estimates it had risked resources of 390 MMBoe at December 31, 2013, for total proved reserves plus risked resources of approximately 587 MMBoe. Risked resources at the Company’s three oil programs increased by 217 MMBoe, or 80%, compared with year-end 2012. See “Reserve and Resource Disclosure” note below.

At December 31, 2013, the Company had 5,390 gross/2,329 net drilling locations. Drilling locations at the Company’s three oil programs increased by 1,977 gross/736 net, or more than 60%, establishing long-lived development assets.

Table: Proved Reserves, Risked Resources and Drilling Locations

| | | | | | | | | | | | | | | | |

| | | Proved

Reserves

MMBoe | | | Percent

Oil | | | Proved Plus

Risked

Resources

MMBoe | | | Gross/Net

Drilling

Locations | |

DJ Basin, Colorado1 | | | 66 | | | | 51 | % | | | 221 | | | | 1,697/844 | |

Uinta Oil Program, Utah2 | | | 53 | | | | 81 | % | | | 171 | | | | 1,795/785 | |

Gibson Gulch, Colorado | | | 73 | | | | 4 | % | | | 100 | | | | 528/416 | |

Powder Deep Oil, Wyoming3 | | | 5 | | | | 79 | % | | | 95 | | | | 1,370/284 | |

| | | | | | | | | | | | | | | | |

Total | | | 197 | | | | 42 | % | | | 587 | | | | 5,390/2,329 | |

| | | | | | | | | | | | | | | | |

Notes:

| 1. | Assumes 8-20 wells per section; majority based on standard length horizontal drilling |

| 2. | Includes 80-acre resource in Blacktail Ridge-Lake Canyon and East Bluebell areas |

| 3. | Includes both 4,000 and 9,000 foot laterals and drilling locations spread over six different formations |

3

2013 Production

Estimated production for 2013 was 14.5 MMBoe (86.9 billion cubic feet equivalent) (“Bcfe”). Oil production increased by 30% to 3.5 million barrels (“MMBbls”) from 2.7 MMBbls in 2012, while total production declined as a result of asset sales. The Company’s 2013 production guidance of 85-87 Bcfe was before the effect of asset sales. The December 10, 2013 sale of West Tavaputs reduced December production by approximately 1.1 Bcfe.

Fourth quarter 2013 production was 3.3 MMBoe (20.0 Bcfe) and included 0.6 MMBoe (3.8 Bcfe) from West Tavaputs.

Table: 2013 Sales Volumes and Prices by Quarter

| | | | | | | | | | | | | | | | | | | | |

| | | 1Q13 | | | 2Q13 | | | 3Q13 | | | 4Q13 | | | 2013 | |

Volumes | | | | | | | | | | | | | | | | | | | | |

Oil (Bbls/d) | | | 8,827 | | | | 9,060 | | | | 9,880 | | | | 10,514 | | | | 9,576 | |

Natural gas (MMcf/d) | | | 163 | | | | 157 | | | | 141 | | | | 117 | | | | 144 | |

NGLs (Bbls/d) | | | 6,469 | | | | 5,979 | | | | 5,438 | | | | 6,224 | | | | 6,025 | |

| | | | | |

Realized Prices: | | | | | | | | | | | | | | | | | | | | |

Oil (per Bbl) | | $ | 81.74 | | | $ | 82.11 | | | $ | 83.51 | | | $ | 82.05 | | | $ | 82.38 | |

Natural gas (per Mcf) | | $ | 4.10 | | | $ | 3.92 | | | $ | 4.30 | | | $ | 4.42 | | | $ | 4.16 | |

NGLs (per Bbl) | | $ | 25.01 | | | $ | 29.90 | | | $ | 28.74 | | | $ | 29.79 | | | $ | 28.31 | |

Entering 2014, production is affected by the sale of the West Tavaputs natural gas assets and the reduced working interest in Gibson Gulch as our partner’s interest increased from 18% to 21% as of January 1, 2014. Adjusted for asset sales, exit rate production is estimated at approximately 10,900 Bbls/d oil, 71 MMcf/d natural gas and 5,100 Bbls/d NGLs.

2013 Capital Expenditures

Preliminary, unaudited capital expenditures for 2013 were $474 million and included drilling 123 gross/87 net operated wells and participating in 44 non-operated wells. Capital expenditures included $435 million for drilling at development programs, $16 million for leaseholds to expand development programs, and $23 million for infrastructure and corporate. The following is a summary of unaudited capital expenditures by area and wells spud for 2013:

Table: Capital Expenditures and Wells Spud by Area

| | | | | | | | |

Area | | Operated

Wells Spud

(gross) | | | Capital

Expenditures

(millions)* | |

Uinta Oil Program, Utah | | | 57 | | | $ | 204 | |

DJ Basin, Colorado | | | 61 | | | | 210 | |

Powder Deep Oil, Wyoming | | | 5 | | | | 52 | |

Other including corporate | | | — | | | | 8 | |

| | | | | | | | |

Total | | | 123 | | | $ | 474 | |

| | | | | | | | |

(*Includes non-operated wells)

4

Other

In the fourth quarter of 2013, the Company expects to record an expense of approximately $11.1 million related to the sale of West Tavaputs and additional charges associated with 2012 property sales. This amount is unaudited and subject to further review by management and independent auditors.

2013 YEAR-END DEBT AND LIQUIDITY

At December 31, 2013, the Company had borrowing capacity of $484 million and total debt outstanding of $984 million. The Company had $115 million drawn on its revolving credit facility. The facility has a borrowing base of $625 million that is reduced by $26 million for an outstanding letter of credit. Debt outstanding included $25 million of convertible senior notes, $400 million in 7.625% senior notes, $400 million in 7.000% senior notes and $43 million for a capitalized lease financing obligation.

OPERATIONS BRIEF

DJ Basin

In 2013, the Company drilled 61 wells and completed 44 wells. The 2013 drilling program increased proved reserves by an estimated 51 MMBoe in the DJ Basin and delineated 70% of the Company’s 40,000 acre Northeast Wattenberg position. The 2013 drilling program included:

| | • | | 44 wells in the Niobrara B Bench, 11 in the Niobrara C Bench and 6 in the Codell |

| | • | | 51 wells located in the 40,000 acre Northeast Wattenberg area (14 of which are in the southern section) and 10 located in the core Wattenberg |

| | • | | 32 wells to date with recorded 30-day production rates. The wells had 24-hour peak initial production (“IP”) rates that averaged 776 Boe/d each and 30-day IP rates that averaged 433 Boe/d each. This includes 14 additional wells to date since the Company’s last update in early November. Individual well IP rates have varied as the Company has drilled in different areas that have varying levels of oil and natural gas, tested different fracture stimulation techniques and sizes, applied different artificial lift technologies and been impacted by line pressures and the timing of infrastructure in place as the development program is largely in undeveloped areas |

DJ Basin fourth quarter of 2013 estimated production averaged 5,125 Boe/d. The Company currently has three rigs active in the DJ Basin.

The success of the 2013 Northeast Wattenberg delineation program positions the Company for a larger program and continued growth going forward. In 2014, the Company will expand its drilling program to realize value from its 75,000 acre position including Northeast Wattenberg, Core Wattenberg and Chalk Bluffs as well as to demonstrate further upside through downspacing and extended reach laterals. The 2014 drilling program will be predominantly pad drilling, employ an average of three rigs for approximately 85 gross/60 net operated wells plus approximately 45 non-operated wells. The 2014 drilling program includes a combination of standard length and extended reach (9,000 foot) laterals, and downspacing to 40-acres. The 2014 program is projected to have an approximate 40% return on drilling and completion costs and more than triple DJ Basin production.

5

Uinta Oil Program

In 2013, the Company drilled and completed 57 wells, including 20 wells in the East Bluebell area of the Uinta Oil Program. The Company also conducted two 80-acre spacing pilot projects, one each in the southern and northern portions of the Blacktail Ridge area. Results to date indicate minimal, if any, interference with appropriate well orientation. As a result, the Company anticipates development on at least 80-acre well spacing in the Blacktail Ridge and Lake Canyon areas. Accordingly, the future development inventory at Blacktail Ridge-Lake Canyon increased by approximately 33% to 352 gross locations and estimated risked resources as of December 31, 2013 increased by approximately 30 MMBoe.

Uinta Oil Program fourth quarter of 2013 production averaged 7,300 Boe/d. The Company currently has one rig running in the East Bluebell area of the Uinta.

In 2014, the Company will concentrate on development in the East Bluebell area, which offers excellent returns of approximately 40% and further upside through capital efficiencies and downspacing. The 2014 drilling program will employ an average of two rigs for approximately 35 wells.

Powder Deep Oil Program

In the early stage Powder Deep Oil Program, 2013 included drilling 5 producing Shannon wells and participating in 15 non-operated wells. Powder Deep Oil fourth quarter of 2013 production averaged 1,500 Boe/d. In 2014, the Company will continue to participate in a number of non-operated wells while focusing efforts to better consolidate its acreage positions.

2014 OPERATING GUIDANCE

The Company plans to spend between $500 million and $550 million for capital expenditures in 2014. The Company expects to participate in approximately 200 gross/100 net development wells, including approximately 85 gross operated wells in the DJ Basin, 35 gross operated wells in the Uinta Oil Program and approximately 80 non-operated wells. The program will run an average of 5 rigs to drill operated wells. Approximately 75% of total capital will be directed to the DJ Basin. The Company intends to fund its capital expenditure program with cash flows and borrowings from its revolving credit facility.

The Company is providing the following guidance for its 2014 activities. See “Forward-Looking Statements” below.

Table: Guidance for 2014 Capital Expenditures, Production and Costs

| | | | |

Capital expenditures ($millions) | | $ | 500 – $550 | |

Production (3-stream basis; MMBoe) | | | 11.0 – 12.2 | |

Operating costs: Lease operating ($millions) | | $ | 62 – $67 | |

Operating costs: Gathering, processing and transportation ($millions) | | $ | 43 – $48 | |

General and administrative, before non-cash, stock based compensation ($millions) | | $ | 48 – $52 | |

6

Production guidance for 2014 includes 30% growth in oil production compared with 2013. The 2014 production estimate incorporates uncertainty regarding factors such as the actual timing of completions, final locations to be drilled, actual commodity mix of wells drilled and successful application of new technology including extended reach laterals.

COMMODITY HEDGES UPDATE

The Company has hedges in place for 60%-70% of forecast 2014 production. Natural gas hedges are all tied to Rocky Mountain regional pricing. Generally, it is the Company’s strategy to hedge 50%-70% of production on a forward 12-month basis in order to reduce the risks associated with unpredictable future commodity prices and to provide certainty for a portion of its cash flow to support its capital expenditure program.

The following table summarizes hedge positions as of January 28, 2014:

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Oil (WTI) | | | Natural Gas | | | NGLs | |

Period | | Volume

Bbls | | | Price

$/Bbl | | | Volume

MMBtu/d | | | Price

$/MMBtu | | | Volume

Bbls/d | | | Price

$/Bbl | |

1Q14 | | | 9,000 | | | | 94.27 | | | | 65.0 | | | | 4.02 | | | | 866 | | | | 54.84 | |

2Q14 | | | 9,000 | | | | 94.27 | | | | 65.0 | | | | 4.02 | | | | 883 | | | | 54.93 | |

3Q14 | | | 8,600 | | | | 93.89 | | | | 65.0 | | | | 4.02 | | | | 873 | | | | 54.93 | |

4Q14 | | | 8,600 | | | | 93.89 | | | | 71.6 | | | | 3.89 | | | | 873 | | | | 54.93 | |

1Q15 | | | 4,300 | | | | 89.27 | | | | 10.0 | | | | 4.25 | | | | — | | | | — | |

2Q15 | | | 4,300 | | | | 89.27 | | | | 10.0 | | | | 4.25 | | | | — | | | | — | |

3Q15 | | | 3,100 | | | | 88.72 | | | | 10.0 | | | | 4.25 | | | | — | | | | — | |

4Q15 | | | 3,100 | | | | 88.72 | | | | 10.0 | | | | 4.25 | | | | — | | | | — | |

UPCOMING EVENTS

Credit Suisse Conference

Management will participate in investor meetings February 12-13, 2014 at the Credit Suisse Energy Summit 2014. The Company will post an updated investor presentation to be used for this event on Tuesday, February 11, 2014 at 5:00 p.m. Mountain time.

2013 Fourth Quarter and Year-end Earnings Release and Webcast

The Company plans to release its fourth quarter and year-end results after the market close on Thursday, February 20, 2014 and to host a conference to discuss results at 11:00 a.m. Eastern time (9:00 a.m. Mountain time) on February 21, 2014. Please join the webcast conference call live or for replay via the Internet atwww.billbarrettcorp.com. To join by telephone, call 866-713-8563(617-597-5311 international callers) with passcode 54178378. The webcast will remain on the Company’s website for approximately 30 days and a replay of the call will be available through February 28, 2014 at 888-286-8010 (617-801-6888 international) with passcode 62359572.

7

DISCLOSURE STATEMENTS

Year-end 2013 Financial Results Presented are Preliminary and Unaudited

Results for 2013 presented in this press release are preliminary, unaudited and subject to change. These unaudited amounts are subject to further review and revision by management and independent auditors.

Presentation of Natural Gas Liquids Volumes

Effective January 1, 2013, the Company began reporting its production volumes on a three-stream basis, which separately reports NGLs extracted from the natural gas stream and sold as a distinct product.

2013 year-end reserves are presented on a three-stream basis, and year-end 2012 reserves are recalculated to reflect three-stream volumes for comparability. NGL volumes are converted to an oil equivalent based on 42 gallons per barrel and compared to overall gas equivalent production based on a 1 barrel to 6 Mcf ratio.

Reserve and Resource Disclosure

The SEC permits oil and gas companies to disclose proved, probable and possible reserves in their filings with the SEC. The Company does not plan to include probable and possible reserve estimates in its filings with the SEC.

We may use certain terms in this release, such as “risked resources,” that the SEC’s guidelines strictly prohibit us from including in filings with the SEC. The calculation of risked resources, and any other estimates of reserves and resources that are not proved, probable or possible reserves are not necessarily calculated in accordance with SEC guidelines. Our estimate of risked resources is not prepared or reviewed by third party engineers, is determined using strip pricing, which we use internally for planning and budgeting purposes, and may differ from an un-risked estimate of proved, probable and possible reserves. The Company’s estimate of risked resources is provided in this release because management believes it is useful, additional information that is widely used by the investment community in the valuation, comparison and analysis of companies; however, the Company’s estimate of risked resources may not be comparable to similar metrics provided by other companies. Investors are urged to consider closely the disclosure in our Annual Report on Form 10-K for the year ended December 31, 2012, available on the Company’s website atwww.billbarrettcorp.com or from the corporate offices at 1099 18th Street, Suite 2300, Denver, CO 80202. You can also obtain this form from the SEC by calling 1-800-SEC-0330 or atwww.sec.gov. The Company expects to file its Form 10-K for the year ended December 31, 2013 in late February 2014.

Forward-Looking Statements

This press release contains forward-looking statements. Forward-looking statements include statements as to the Company’s future plans, estimates, beliefs and expected performance. These forward-looking statements are identified by their use of terms and phrases such as “may,” “expect,” “estimate,” “project,” “plan,” “believe,” “intend,” “achievable,” “anticipate,” “will,” “continue,” “potential,” “should,” “could,” “guidance” and similar terms and phrases. Forward-looking statements are dependent upon events, risks and uncertainties that may be outside the Company’s control. Our actual results could differ materially from those discussed in these forward-looking statements In particular, the Company is providing “2014 Operating Guidance,”

8

which contains projections for certain 2014 operational and financial metrics. These forward-looking statements are based on management’s judgment as of the date of this press release and include certain risks and uncertainties. Among a number of factors, operations plans are subject to change during the year and such changes can materially affect projected results provided in the Company’s guidance. Please refer to the Company’s Annual Report on Form 10-K for the year ended December 31, 2012 filed with the SEC, and other filings including our Current Reports on Form 8-K and Quarterly Reports on Form 10-Q, for a list of certain risk factors that may affect these forward-looking statements.

Actual results may differ materially from Company projections and can be affected by a variety of factors outside the control of the Company including, among other things: oil, NGL and natural gas price volatility, including regional price differentials; costs, availability and timing of build-out of third party facilities for gathering, processing, refining and transportation; the ability to receive drilling and other permits and rights-of-way in a timely manner; development drilling and testing results; the potential for production decline rates to be greater than expected; legislative or regulatory changes, including initiatives related to hydraulic fracturing; regulatory approvals, including regulatory restrictions on federal lands; exploration risks such as drilling unsuccessful wells; higher than expected costs and expenses, including the availability and cost of services and materials; unexpected future capital expenditures; economic and competitive conditions; debt and equity market conditions, including the availability and costs of financing to fund the Company’s operations; the ability to obtain industry partners to jointly explore certain prospects, and the willingness and ability of those partners to meet capital obligations when requested; declines in the values of our oil and gas properties resulting in impairments; changes in estimates of proved reserves; compliance with environmental and other regulations; derivative and hedging activities; risks associated with operating in one major geographic area; the success of the Company’s risk management activities; title to properties; litigation; environmental liabilities; and, other factors discussed in the Company’s reports filed with the SEC. Bill Barrett Corporation encourages readers to consider the risks and uncertainties associated with projections and other forward-looking statements and to not place undue reliance on any such statements. In addition, the Company assumes no obligation to publicly revise or update any forward-looking statements based on future events or circumstances.

ABOUT BILL BARRETT CORPORATION

Bill Barrett Corporation (NYSE: BBG), headquartered in Denver, Colorado, develops oil and natural gas in the Rocky Mountain region of the United States. Additional information about the Company may be found on its websitewww.billbarrettcorp.com.

9