Exhibit 13

Botetourt Bankshares, Inc.

Dear Stockholder,

This past year will be remembered as a year filled with unprecedented challenges for Botetourt Bankshares, Inc., as well as for the entire financial services industry. In 2010, our Company experienced a third consecutive year of sub-par earnings, mirroring the performance of the majority of banks since the onset of our nation’s economic downturn. The Company experienced a net loss for 2010 amounting to $117,417, representing a decrease of 115.31% from the previous year’s earnings. Net income was adversely impacted primarily due to a higher provision for loan losses, as the Company has continued to respond to increases in loan delinquencies, impaired loans and exposure in the real estate development market. The loan loss provision for 2010 amounted to $4,045,000, compared to $1,790,000 in 2009. Actual net charge-offs for the year amounted to 1.10% of average total loans, compared to 0.63% of average total loans for the prior year.

H. Watts Steger, III

As a result of the poor earnings performance experienced in 2010, the quarterly dividend payment to stockholders was reduced to $0.04 per share, effective with the February 2011 dividend payment. This decision by your Company’s management and board of directors was both appropriate and prudent, recognizing the need to maintain adequate capital levels, while at the same time delivering an adequate return on stockholder investment.

Total assets at year-end 2010 amounted to $309,484,731, an increase of 0.31% above 2009. Total deposits at December 31, 2010 amounted to $281,047,765, an increase of 0.43% above the prior year. With sluggish loan demand resulting from the current economic climate, your Company’s management made a conscious and strategic decision to control the rate of asset growth during the year. As a result, risk-based capital ratios improved from 2009 levels and both the bank and the Company remain well-capitalized according to regulatory standards.

During 2010, Congress passed the Dodd-Frank Wall Street Reform and Consumer Protection Act, representing the most comprehensive financial regulatory reform measures enacted since the Great Depression. This legislation will result in many additional regulatory burdens being placed upon all financial institutions, although it also will provide some benefits to most community banks as well. One of the beneficial provisions of the legislation for community banks provides for a reform in FDIC deposit insurance coverage and the assessment of fees to all banks, which should ultimately reduce your Company’s costs in this area.

G. Lyn Hayth, III

In July 2010, G. Lyn Hayth, III was elected by your board of directors to the position of chief executive officer of Bank of Botetourt, with the previously announced retirement of H. Watts Steger, III from active management of the bank. Mr. Hayth has been involved in senior management of the bank since 1986, a period of twenty-five years, and provides strong management continuity in this transition of leadership of the bank. Mr. Steger will continue as chairman and chief executive officer of the Company and will advise on bank activities and concentrate on strategic matters of the Company.

We anticipate that 2011 will continue to be filled with challenges and economic uncertainty, although we are hopeful that recent positive trends will lead to a sustained economic recovery. Unemployment rates, although still very high, are showing signs of improvement. Inflation remains under control. Our Congress faces the monumental task of bringing deficit spending under control with a still deeply divided legislature. Turmoil is rampant in several countries in the Middle East. Interest rates continue to remain at historic low levels. Despite these many challenges facing our nation as well as our industry, your Company’s management is confident that better days are ahead and that both the Company and the nation will remain resilient through this turbulent period.

Your Company’s management team and your board of directors remain committed to “Taking Care of You,” the Company’s mission of both professionally and personally serving our customers, employees, stockholders and communities. Thank you for your continued support of Botetourt Bankshares, Inc. and community banking.

Sincerely,

H. Watts Steger, III Chairman & CEO

G. Lyn Hayth, III President & CEO Bank of Botetourt

Financial Highlights Summary

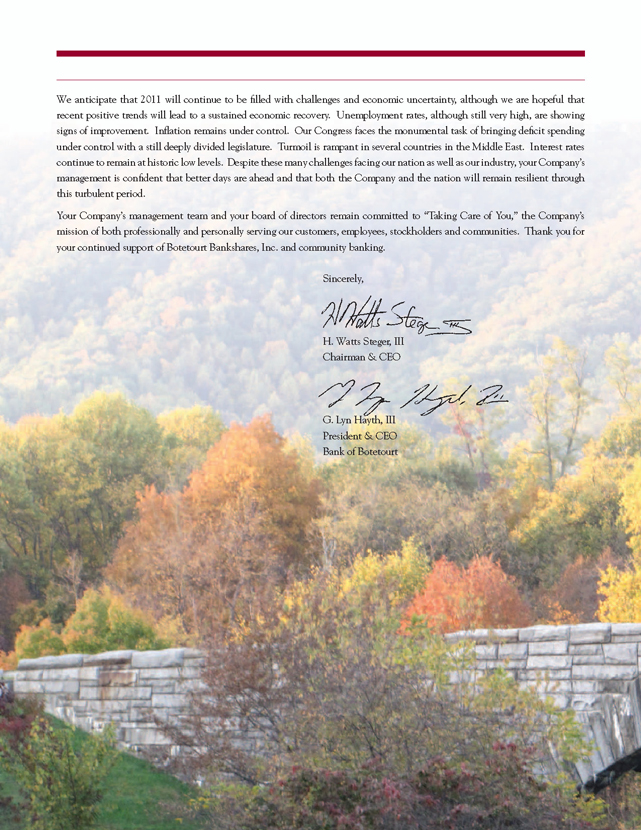

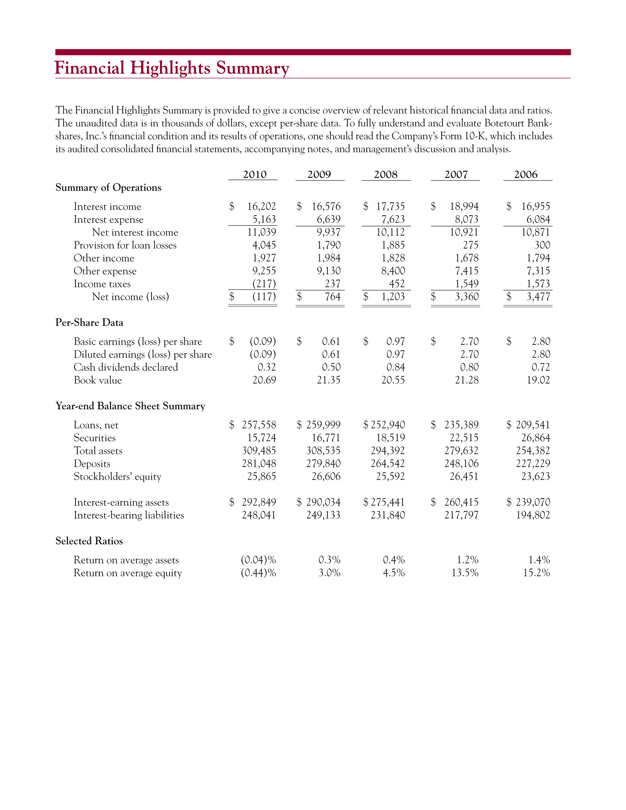

The Financial Highlights Summary is provided to give a concise overview of relevant historical financial data and ratios. The unaudited data is in thousands of dollars, except per-share data. To fully understand and evaluate Botetourt Bank-shares, Inc.’s financial condition and its results of operations, one should read the Company’s Form 10-K, which includes its audited consolidated financial statements, accompanying notes, and management’s discussion and analysis.

2010 2009 2008 2007 2006

Summary of Operations

Interest income $16,202 $16,576 $17,735 $18,994 $16,955

Interest expense 5,163 6,639 7,623 8,073 6,084

Net interest income 11,039 9,937 10,112 10,921 10,871

Provision for loan losses 4,045 1,790 1,885 275 300

Other income 1,927 1,984 1,828 1,678 1,794

Other expense 9,255 9,130 8,400 7,415 7,315

Income taxes (217) 237 452 1,549 1,573

Net income (loss) $(117) $764 $1,203 $3,360 $3,477

Per-Share Data

Basic earnings (loss) per share $(0.09) $0.61 $0.97 $2.70 $2.80

Diluted earnings (loss) per share (0.09) 0.61 0.97 2.70 2.80

Cash dividends declared 0.32 0.50 0.84 0.80 0.72

Book value 20.69 21.35 20.55 21.28 19.02

Year-end Balance Sheet Summary

Loans, net $257,558 $259,999 $252,940 $235,389 $209,541

Securities 15,724 16,771 18,519 22,515 26,864

Total assets 309,485 308,535 294,392 279,632 254,382

Deposits 281,048 279,840 264,542 248,106 227,229

Stockholders’ equity 25,865 26,606 25,592 26,451 23,623

Interest-earning assets $292,849 $290,034 $275,441 $260,415 $239,070

Interest-bearing liabilities 248,041 249,133 231,840 217,797 194,802

Selected Ratios

Return on average assets (0.04)% 0.3% 0.4% 1.2% 1.4%

Return on average equity (0.44)% 3.0% 4.5% 13.5% 15.2%

Board of Directors

S J Carter Photography Sitting – Joyce R. Kessinger, H. Watts Steger, III, G. Lyn Hayth, III, F. Lindsey Stinnett Standing – Edgar K. Baker, Tommy L. Moore, D. Bruce Patterson, John B. Williamson, III, Gerald A. Marshall

Senior Management

S J Carter Photography

Jennifer S. Theimer, Andrew T. Shotwell, Vicky M. Wheeler, G. Lyn Hayth, III, Michelle A. Alexander, George E. Honts, IV, P. Duaine Fitzgerald

Bank of Botetourt Officers

G. Lyn Hayth, III Vicky M. Wheeler Paul M. Murphy Tammy S. Talbott Deborah W. Plogger

President & CEO Senior Vice President Vice President Assistant Vice President Manager, Rockbridge Branch Administration Credit Analyst & Branch Manager Title Services, LLC

Michelle A. Alexander Karen R. Thrasher

Barbara G. Anderson Stephanie D. Ponton

Senior Vice President Garland L. Humphries

Assistant Vice President Branch Manager Chief Financial Officer Vice President Vice President

& Branch Manager Compliance & Training Credit Administration

Paula A. Rhodes P. Duaine Fitzgerald Jason M. Bishop Duane L. Burks Cindy K. Pierson Operations Officer Senior Vice President Human Resources Officer Financial Services Vice President Vice President Retail Development Controller Officer

Paula E. Bussey Amanda L. Robinson

Branch Manager Financial Advisor

George E. Honts, IV

Senior Vice President Cindy H. Bower Commercial Lending Brenda G. DeHaven Assistant Vice President

& Business Banking Vice President Branch Manager Internal Auditor

Edna W. Hazelwood Tina M. Simpson

Branch Manager Branch Manager

Andrew T. Shotwell Kathy M. Caldwell

Senior Vice President Linda R. Doolittle Assistant Vice President Bank Operations Vice President Commercial Lender Business Development

Shelley M. Martin Debbie K. Thurman

Branch Manager Mortgage Loan Officer

Cari J. Humphries Jennifer S. Theimer Assistant Vice President

Marty R. Francis

Senior Vice President Marketing Officer Vice President Chief Risk Officer

Commercial Lending Cheryl A. Ward Branch Manager

Employees

Passing the Torch

H. Watts Steger, III concluded his term as Chairman of the Virginia Bankers Association. He now serves as its Immediate Past Chairman. Steger, Chairman and CEO, of Botetourt Bankshares, Inc. was elected June 22, 2010 at the VBA annual meeting held at The Homestead.

A native of Pulaski, VA, Steger is an alumnus of Hampden-Sydney College. He is also a graduate of the Virginia Bankers School of Bank Management at the University of Virginia and the Graduate School of Banking of the South at Louisiana State University and currently serves as a faculty member for both programs. Steger began his banking career at Bank of Botetourt in 1971 as a Management Trainee and became Chief Executive Officer in 1976, President in 1984, and Chairman of the Board in 2001. Steger retired as Chief G. Lyn Hayth, III & H. Watts Steger, III Executive Officer of Bank of Botetourt in June 2010, but continues serving as Chairman and CEO of Botetourt Bankshares, Inc. In addition to his work with the Virginia Bankers Association, Steger has devoted his time to numerous community organizations.

Bank of Botetourt held a “Passing the Torch Reception” on June 23, 2010 at the Buchanan Community House. The event was a celebration for G. Lyn Hayth, III as he is appointed Chief Executive Officer of Bank of Botetourt, effective July 1st. H. Watts Steger, III was also honored for serving as CEO of Bank of Botetourt since 1976 and for his future continued service as Chairman & CEO of Botetourt Bankshares, Inc.

G. Lyn Hayth, III was officially named Chief Executive Officer of Bank of Botetourt on July 1, 2010. Mr. Hayth has been employed by Bank of Botetourt for twenty-four years in numerous capacities, primarily involved in the lending function for the Bank. Hayth began his banking career with the Farm Credit System prior to his employment with the Bank. He has been involved in banking associations in the Commonwealth of Virginia, having served as a past director of the Virginia Association of Community Banks and is a current director of Community Bankers Bank in Richmond, Virginia. Hayth is a member and director of the Kiwanis Club of Botetourt County and also a past board member of the Botetourt County Public Schools Education Foundation. He is also a past president of the Botetourt County Chamber of Commerce. Hayth is a native of the Springwood area of Botetourt County and graduated from James River High School. Hayth was inducted into the “Knights of Distinction” honoring James River alumni who have excelled. He received both a Bachelor of Science degree in Agricultural Economics and a Master of Science degree from Virginia Polytechnic Institute and State University. He is also a graduate of the Virginia Bankers School of Bank Management at University of Virginia and the Graduate School of Banking of the South at Louisiana State University.

Retirement

Bank of Botetourt would like to announce the retirement of head teller, Katherine (Kitty) B. Bryant from its Eagle Rock Office after 17 years of service. Bryant worked in the banking industry for approximately 40 years.

Bryant is a native of Eagle Rock, she attended Eagle Rock High School and graduated from James River High School. After high school, Bryant began her banking career working for Eagle Rock Bank, Inc. as a teller under Mr. G.G. Burgess, her father and the bank’s president at the time. She joined Bank of Botetourt in 1993 along with her two sisters, Pat and Betty, when the branch was purchased from Dominion Bank. Bryant’s retirement marks the end of an era for her family, as one or more of their family members have worked in the bank’s Eagle Rock office for the past 84 years.

In retirement, Bryant hopes to read and spend some time relaxing with her family. She is looking forward to spending some quality time with both of her sisters who retired in previous years. Bryant currently resides in Eagle Rock with her husband, Danny. She also has two children in the area, her sons, Danny Jr. and Keith Bryant.

Employees

Promotions

George E. “Ned” Honts, IV has been has been promoted to the position of Senior Vice President on July 1, 2010. Honts, a Botetourt native, joined Bank of Botetourt in 1994 after graduating from Hampden-Sydney College the same year. He graduated from the Virginia Bankers Association School of Bank Management in 1997. He went on to complete the Graduate School of Banking program at Louisiana State University in 2004. Honts has worked in the commercial lending and business banking departments for Bank of Botetourt. He currently resides in Botetourt with his wife, Stephanie, and his son, Garrett.

George E. Honts, IV

Paul M. Murphy has been promoted to Vice President of Loan Processing at Bank of Botetourt’s Loan Administration office in Troutville. A Roanoke native, Murphy graduated from Virginia Military Institute in 2002 with a Bachelor of Arts degree in Business & Economics. Murphy joined Bank of Botetourt in 2002, shortly after his graduation from VMI. Murphy graduated from the Virginia Bankers School of Bank Management at the University of Virginia in Charlottesville in 2007. He currently resides in the Roanoke area.

Paul M. Murphy

Bank School Graduate & Promotion

Cynthia H. Bower, Branch Manager at Bank of Botetourt’s Bonsack office, was among the 63 Virginia bankers who graduated August 6, 2010 from the Virginia Bankers School of Bank Management at the University of Virginia in Charlottesville.

Bower, Branch Manager of Bank of Botetourt’s office in Bonsack, has been promoted to the position of Assistant Vice President. Bower has been with Bank of Botetourt since 1998 and has previously held the positions of Teller, Head Teller and Consumer Banker. She began her banking career in 1983 and had previously worked for Dominion First Union and First National Bank of Rocky Mount. A native of Roanoke, Bower graduated from William Fleming High School. Bower resides in Botetourt County with her husband, Jeff.

Cynthia H. Bower

New Branch Manager

On September 1, 2010 Bank of Botetourt announced that Cheryl A. Ward was hired as the new Branch Manager of the bank’s LakeWatch office in Moneta.

Ward has worked in banking for over 20 years, most recently, at StellarOne Bank. Born in Upstate New York, Ward graduated from Cayuga Community College with an Associate’s Degree in Retail Business Management. Ward has lived in the Franklin County area for the past 6 years. She is an Ambassador for the Smith Mountain Lake Regional Chamber of Commerce and a member of the Smith Mountain Lake Lions Club. Ward currently resides in Moneta with her husband, Frank.

Cheryl A. Ward

Stockholder Information

Annual Meeting

The annual meeting of stockholders will be held at 2:30 p.m. on Wednesday, May 18, 2011, at the Buchanan Theatre, Main

Street, Buchanan, Virginia.

Requests for Information

Requests for information should be directed to Mr. H. Watts Steger, III at Botetourt Bankshares, Inc., Post Office Box 339,

Buchanan, Virginia, 24066; telephone (540) 591-5000.

Independent Auditors Stock Transfer Agent

Elliott Davis, LLC Registrar and Transfer Company

Certified Public Accountants 10 Commerce Drive

Post Office Box 760 Cranford, New Jersey 07016

Galax, Virginia 24333

Federal Deposit Insurance Corporation

The Bank is a member of the FDIC. This statement has not been reviewed, or confirmed for accuracy or relevance, by the

Federal Deposit Insurance Corporation.

Banking Offices

Buchanan Office Loan Administration Center

19747 Main Street—Buchanan 21 Stoney Battery Road—Troutville

(540) 254-1721 (540) 966-3850

Daleville Office Peters Creek Office

670 Roanoke Road—Daleville 3130 Peters Creek Road—Roanoke

(540) 992-4777 (540) 777-2010

Eagle Rock Office Fairfield Office

58 Railroad Avenue—Eagle Rock 5905 North Lee Highway—Fairfield

(540) 884-2265 (540) 377-5270

Troutville Office Investment Securities

5462 Lee Highway—Troutville 5462 Lee Highway—Troutville

(540) 966-3850 (540) 473-1224

Bonsack Office Mortgage Centers

3801 Challenger Avenue—Roanoke (540) 591-5000—(540) 966-5626

(540) 777-2265 (540) 463-5626

Lexington Office Operations Center

65 East Midland Trail—Lexington 19800 Main Street—Buchanan

(540) 463-7224 (540) 473-1173

LakeWatch Office Natural Bridge Office

51 Firstwatch Drive—Moneta 9 Lloyd Tolley Road—Natural Bridge Station

(540) 719-1880 (540) 291-1881

www.bankofbotetourt.com

info@bankofbotetourt.com