| |

|

Reply Attention of

Direct Tel.

EMail Address

Our File No.

|

Jonathan C. Lotz

604.643.3150

jcl@cwilson.com

32051-03 / CW1599303.2

|

| | |

| December 31, 2007 | |

| | |

| VIA COURIER AND EDGAR | |

| | |

| | |

| Securities and Exchange Commission | |

100 F Street, N.E.

Washington, D.C. 20549

USA

| Attention: | Donna Levy, Esq. |

| | Division of Corporation Finance |

Dear Sirs:

| | Re: | MegaWest Energy Corp. (the "Company") |

| | | Amendment No. 1 to Form F-1 |

| | | File No. 333-145870 |

| | | Filed November 7, 2007 |

| | | (the "Form F-1") |

| | | |

| | | Form 20-F, as amended |

| | | Filed August 10, 2007 |

| | | File No. 0-49760 |

| | | (the "Form 20-F/A") |

We write further to the letter of the Securities and Exchange Commission (the "Commission"), dated December 4, 2007, in respect of the Form F-1 and the Form 20-F/A (the "Comment Letter").

We have reviewed your comments and have made various revisions to the Form F-1 and enclose herewith four blacklined copies of Amendment No. 2 to the Form F-1 (the "Form F-1/A").

For ease of reference, we have reproduced below (in italics) the applicable comments from the Comment Letter. The Company’s response to each comment is set out below each comment.

| |

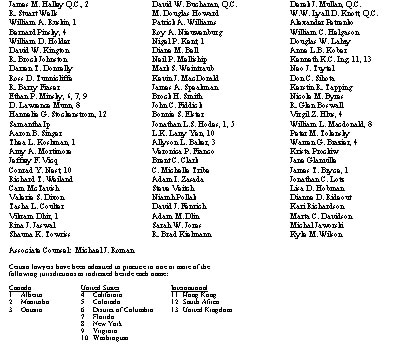

| HSBC Building 800 – 885 West Georgia Street Vancouver BC V6C 3H1 Canada Tel.: 604.687.5700 Fax: 604.687.6314 www.cwilson.com |

| Some lawyers at Clark Wilson LLP practice through law corporations. |

- 2 -

Form F-l

General

| 1. | We note your response to our prior comment 2 and that you are registering for resale 832,500 shares of common stock underlying 555,000 unit rights. These unit rights entitle the holders to buy units that consist of shares of common stock and warrants to purchase additional shares of common stock. We note that the holders have a "right to purchase" the units, and that the units have not yet been purchased. As a result, the holders are not yet at market risk for the stock that they are seeking to resell. As a result, you cannot register for resale the common stock underlying the units. |

The unit rights were issued to PowerOne Capital Markets Limited pursuant to the terms of a Consulting Agreement, dated effective December 20, 2006 (a copy of which is attached as Exhibit 10.36 to the Form F-1/A).

At the time of the negotiation by the Company and PowerOne of the terms of the Consulting Agreement, the terms of the unit rights were already determined, including the exercise price and the number and kind of securities for which each unit right was exercisable. The number of units issued was negotiated in an arms length manner between PowerOne and the Company on the basis of PowerOne’s estimation of the then present value of the underlying common stock and the Company’s estimation of the services to be provided. Thus, the entire investment decision of PowerOne in respect of the common stock underlying the unit rights was made at the time the Consulting Agreement was entered into, and PowerOne in accepting the unit rights issued under the Consulting Agreement, was in effect also agreeing to provide services in exchange for the right to acquire the underlying common stock.

Furthermore, the Company valued the common shares underlying the units rights, as of the date of the issuance of the unit rights, using the Black-Scholes option pricing model and has booked the expense of the units rights.

An explanation of the terms of the Consulting Agreement has been added to page 81 of the Form F-1/A under the heading entitled "Material Contracts".

Prospectus Summary

Our Business, page 7

| 2. | We note your response to our prior comment 8 and that your shareholders have approved your continuance under the Business Corporations Act (Alberta). Please state when you anticipate applying for a certificate of continuance and when the continuance will be effective. |

At a meeting of the shareholders of the Company on October 29, 2007, the shareholders approved the continuance of the Company from the Province of British Columbia to the Province of Alberta under the Business Corporations Act (Alberta).

As of the date hereof, the directors of the Company have determined that it is not in the Company’s best interests to apply for a certificate of continuance to effect the continuance and

- 3 -

the Company does not intend to apply for such a certificate for the foreseeable future. Accordingly, until the Company is continued to Alberta, it will continue to be organized under the Business Corporations Act (British Columbia).

The delay in the continuance of the Company from British Columbia to Alberta is disclosed on page 7 of the Form F-1/A.

Information on MegaWest Energy Corp., page 20

| 3. | We note that you describe the properties acquired in 2007 as being undeveloped. Please clarify that they were unproved, and revise your Note 2 to your consolidated financial statements to state that the properties were exploration stage, not development stage. |

The Form F-1/A has been revised throughout to clarify that all properties acquired in 2007 were unproved and were exploration stage companies prior to their acquisition.

History and Development, page 20

| 4. | We note your description of the Big Sky project. Please file as exhibit(s) the contract(s) related to your purchase of your interests in the Big Sky project. |

The contracts in respect of the Big Sky project are attached as Exhibits No. 10.29 – 10.32 to the Form F-1/A.

Directors, Senior Management and Employees

Directors and Senior Management, page 34

| 5. | We note your response to our prior comment 16 and reissue it in part. We note that in the Form 6-K you filed on October 5, 2007, you indicated that Mr. Kitchen is also affiliated with the public companies Yankee Hat Minerals Ltd. and Eagle Hill Exploration Corp. In addition in the Form 6-K you indicate that Mr. Bloomer is also affiliated with the public company CCS, Inc. Please advise. |

The summary of Mr. Kitchen’s education and work experience on page 36 of the Form F-1/A has been revised to reference Mr. Kitchen’s involvement with Yankee Hat Minerals Ltd. and Eagle Hill Exploration Corporation.

We advise that the Form 6-K filed by the Company on October 5, 2007 contains no reference of Mr. Bloomer’s involvement with CCS Inc. and believe that the comment was intended to be directed at the disclosure in respect of Brian J. Evans. Accordingly, we advise that since 1997 Mr. Evans has been a director of: CCS Income Trust, an income trust (providing energy and environmental waste management services) that was until November 20, 2007 (when it ceased to be a public company) listed on the Toronto Stock Exchange; and CCS Inc. (the predecessor of CCS Income Trust). This revised disclosure is set out on page 36 of the Form F-1/A.

- 4 -

Stock Ownership, page 42

| 6. | We note your disclosure in footnote 4 to the table that you have extended the expiration date for the incentive warrants granted to affiliates of Messrs. Thornton and Bloomer. We also note your disclosure in paragraph numbered 6 in the related party section on page 47 regarding these warrants and that you refer to them in that section as "assignable warrants." Please describe fully in the related party section all of the material terms of the incentive warrants, and use consistent terminology. Identify the other entity that received the warrants. Explain why the exercise date was extended and whether any consideration was paid for such extension. State who approved the extension. Identify to whom the warrants were assigned by Endurance Energy and Gladrock Energy. Finally, file as an exhibit the agreement regarding the extension. |

To increase consistency, references in the Form F-1/A to the "assignable warrants" or "assignable incentive warrants" granted to Messrs. Thornton (Endurance Energy Consulting Ltd.) and Bloomer (Gladrock Energy LLC) and 1187016 Alberta Ltd. have been replaced with the term "incentive warrants". The fact that the incentive warrants are assignable is stated in the description of the material terms of the warrants set out in paragraph 6 under the heading entitled "Related Party Transactions" on page 45 of the Form F-1/A.

The identities of the three parties that received the incentive warrants, Endurance Energy Consulting Ltd., Gladrock Energy LLC and 1187016 Alberta Ltd. has been set out in the Form F-1/A, where required.

The expiration dates of the incentive warrants was extended from December 21, 2007 to January 15, 2009 to delay the triggering of tax liabilities for certain of the incentive warrant holders which would have necessitated them selling their shares of the Company’s common stock to pay for their tax liabilities, thereby putting downward pressure on the Company’s stock price. This extension (and amendment to the terms of the Warrant Issuance Agreement dated December 20, 2006) was approved by written consent resolution of the directors of the Company, effective September 18, 2007, in respect of which R. William Thornton and Dr. Gail Bloomer disclosed their interests and abstained from voting. No consideration was given by the Company or received by the warrant holders in respect of the extension of the expiration date.

Effective June 25, 2007, Endurance Energy Consulting Ltd. assigned 10,000,000 of the incentive warrants to various officers and directors of the Company (including 1,750,000 warrants to R. William Thornton, a control person of Endurance and a senior officer and director of the Company).

Effective October 18, 2007, Gladrock Energy LLC assigned 4,500,000 of the incentive warrants to West Peak Ventures of Canada Ltd.

Details of these assignments is set out in paragraph 6 under the heading entitled "Related Party Transactions" on pages 48 and 49 of the Form F-1/A.

Attached as Exhibits 10.33 to 10.35 to the Form F-1/A are the Amendment to Warrant Issuance Agreements that change the expiry date of the incentive warrants from December 21, 2007 to January 15, 2009.

- 5 -

| 7. | We note the table in the Form 6-K filed on October 5, 2007 entitled "Aggregated Options Exercised During the Year Ended April 30, 2007 and Year End Option Values." Please provide this same information in the Form F-1. |

The table from the Form 6-K filed by the Company on October 5, 2007 entitled "Aggregated Options Exercised During the Year Ended April 30, 2007 and Year End Option Value." has been added to the Form F-1/A on pages 44 and 45.

Major Shareholders and Related Party Transactions

Major Shareholders, page 45

| 8. | We note that Pinetree Resources Partnership has filed a Schedule 13G showing that it owns 7.6% of your stock. Please update your table accordingly. |

The disclosure of major shareholders on page 46 of the Form F-1/A has been revised to reference Pinetree Resource Partnership.

We note that the difference between the ownership percentage set out in the Form F-1 and Pinetree Resources Partnership’s Schedule 13G is the result of two factors, namely: (i) Pinetree calculated its ownership percentage on a fully diluted basis that included warrants potentially issuable into shares; and (ii) the Pinetree calculation was based on the shares outstanding as of August 27, 2007 (72,561,050 shares) compared to October 25, 2007 (77,936,050) in the most recent Form F-1/A.

The Form F-1/A has been revised to include the following footnotes to the Major Shareholder table on page 46 that disclose the number of warrants owned, namely:

| "(1) | Excludes 1,180,000 shares of our common stock potentially issuable upon the conversion of warrants at prices between US$1.00 and US$1.30 per warrant. |

| (2) | Excludes 1,450,000 shares of our common stock potentially issuable upon the conversion of warrants at prices between US$1.00 and US$1.30 per share. |

| (3) | Excludes 2,000,000 shares of our common stock potentially issuable upon the conversion of warrants at US$1.30 per share." |

Related Party Transactions, page 46

| 9. | We note your disclosure of the conflict policy under British Columbia law. Please add a comparison of what the policy will be under Alberta law. Please also add a risk factor that discusses the risk to investors due to the fact that you do not have a written conflicts policy. |

A comparison of the conflicts of interest provisions under the Business Corporations Act (British Columbia) and Business Corporations Act (Alberta) has been added under the heading entitled "Related Party Transactions" on page 45 of the Form F-1/A.

- 6 -

A risk factor that discusses the risk to investors due to the fact that the Company does not have a written conflicts policy has been added to page 13 of the Form F-1/A.

Selling Shareholders, page 52

| 10. | We note your response to our prior comment 28 and reissue it in part. Identify the selling shareholder broker-dealers as underwriters unless you can state that they obtained the securities being registered for resale as compensation for investment banking services. |

The Company has clarified its disclosure in respect of selling shareholders who are broker dealers and/or affiliates of broker-dealers.

The Company hereby confirms that none of the selling shareholders are broker-dealers. However, set out in Note 6 to the Selling Shareholders table on page 72 of the Form F-1/A are the names of individuals who, by virtue of their employment with broker-dealers, are deemed to be affiliates of broker-dealers. In respect of each of these individuals, the Company confirms that each has indicated to the Company that he purchased the securities being offered for resale in the ordinary course of business and at the time of purchase, had no agreements or understandings, directly or indirectly, with any party to distribute the securities. As such, none of the affiliates will be deemed to be "underwriters" within the meaning of the Securities Act of 1933 in connection with the sale of these securities being offered for resale under the Form F-1/A.

Note 6 to the Selling Shareholder table on page 72 of the Form F-1/A has been revised to disclose that: (i) none of the selling shareholders are broker-dealers; (ii) to confirm that of the affiliates of broker-dealers identified, each has indicated to the Company that he purchased the securities being offered for resale under the Form F-1/A in the ordinary course of business and at the time of purchase, had no agreements or understandings, directly or indirectly, with any party to distribute the securities; and (iii) to confirm that none of the affiliates own more than one percent of the Company’s outstanding common stock before or after the offering under the Form F-1/A.

| 11. | We note your list of affiliate selling shareholders in footnote 7 on page 74. Ensure that you have listed all of your affiliates who are selling shareholders. It appears that Brian J. Evans, a director, is also a selling shareholder and he is not listed in the footnote. Please advise. |

The disclosure of affiliate selling shareholders in Note 7 to the Selling Shareholders table on page 73 of the Form F-1/A has been revised to include Brian J. Evans.

Memorandum and Articles of Association, page 75

| 12. | Provide corresponding disclosure for Alberta law, or state that for the items you discuss there is no difference. For example, the ensuing comparison does not address any material differences in voting procedures. |

The disclosure under the heading entitled "Memorandum and Articles of Association" beginning on page 74 of the Form F-1/A has been revised to include reference to the by-laws adopted by

- 7 -

the shareholders of the Company at a meeting on October 29, 2007 (which by-laws are not yet in effect).

Differences between British Columbia and Alberta Business Corporations Acts, page 78

| 13. | We note that in a Form 6-K you filed on November 9, 2007 you stated that you adopted new bylaws in regard to your continuance under Alberta law. Please revise your disclosure accordingly to discuss the material provisions of these new bylaws. |

A description of the material provisions of the proposed by-laws is set out in the Form F-1/A under the heading entitled "Proposed By-Laws" beginning on page 78.

| 14. | We note your statement that the summary of certain differences between British Columbia and Alberta Business Corporation Acts is not an exhaustive review and is of a general nature only. Revise your disclosure so that it is a summary of all of the material differences between the two acts, and eliminate the suggestion that the disclosure is only of a general nature. |

The Company has revised the disclosure on pages 76 through 78 of the Form F-1/A to provide a summary of the material differences between the Business Corporations Act (Alberta) and the Business Corporations Act (British Columbia).

| 15. | To aid the reader, revise your discussion under each topic to consistently refer to the ABCA first and the BCBCA second. |

The discussion of the material differences between the British Columbia and Alberta statutes on pages 76 through 78 of the Form F-1/A has been re-ordered to consistently refer to the Business Corporations Act (Alberta) first and the Business Corporations Act (British Columbia) second.

Passive Foreign Investment Company, page 85

| 16. | We note the disclosure you added in this section. Note that Item 601(b)(8) of Regulation S-K requires a tax opinion to be filed "where the tax consequences are material to an investor and a representation as to tax consequences is set forth in the filing." In the staff’s view, your status as a PFIC and the tax consequences thereof would be material to an investor. If you are unable to obtain an opinion regarding the PFIC status, revise to make clear why that is the case. We may have further comment once you file the opinion as an exhibit and revise the disclosure accordingly. |

The Company has revised its disclosure on pages 85 and 86 of the Form F-1/A in respect of its possible status as a passive foreign investment corporation (a "PFIC"). The revised disclosure removes the representation that the Company does not believe that it is a PFIC and clarifies that the Company’s status as a PFIC depends upon the composition of the Company’s income and assets and the market value of its assets and shares from time to time.

The Form F-1/A provides disclosure that there is no assurance that the Company will not be considered a PFIC for any taxable year and states that if the Company were treated as a PFIC for any taxable year during which a U.S. Holder held shares, certain adverse tax consequences could

- 8 -

apply to the U.S. Holder. Furthermore, the Form F-1/A sets out in greater detail the consequences to a U.S. Holder of the Company being treated as a PFIC for any taxable year.

Financial Statements, page 92

| 17. | We note your response to comment 37 of our letter dated October 4, 2007. Since you continue to believe the presentation of two sets of financial statements covering the same periods ending April 30, 2006 and 2005 is appropriate, please revise your filing to include additional disclosure explaining why you have presented the financial statements of Brockton Capital Corp. separately. This disclosure should include discussion of the change in the registrant’s name and change in business activities. |

The Form F-1/A has been revised to disclose why the Company has presented the financial statements for Brockton Capital Corp. separately. In particular, the Form F-1/A states on pages 49 and 92:

"The Company has included two sets of annual financial statements to satisfy the Form F-1 requirements for audited financial statements to be included in a registration statement.

The financial statements for the year ended April 30, 2007 and 2006 are those that were filed by the Company to comply with Canadian regulatory reporting requirements. These financial statements reflect the Company’s change in focus to an oil and gas company, completely new management and a new auditor who reported on the year ended April 30, 2007 financial statements. The financial statements as at April 30, 2006 and prior are not representative of the Company’s current operations and were included in the Form F-1 to provide the required auditor’s report on the 2006 and 2005 comparative consolidated financial statements as required in this registration statement."

| 18. | Your response to comment 40 of our letter dated October 4, 2007, implies that you are presenting the financial statement information in accordance with Item 18 of Form 20-F and therefore, have identified the financial statements as in the exploration stage on the cover sheet to the annual and interim statements. Please identify each financial statement in the header as an exploration stage company in accordance with paragraph 12 of SFAS 7. |

The header of each page of financial statements included in the Form F-1/A has been amended to identify the Company as an exploration stage company.

Interim Consolidated Financial Statements

| 19. | We note from your response to comment 40 of our letter dated October 4, 2007, that you did not present cumulative information as you began exploration activities during fiscal 2007. Please expand your interim financial statements to provide cumulative information now that the cumulative period expanses over more than one period. |

The interim financial statements for the period ended October 31, 2007 included in the Form F-1/A include the cumulative information as required by SFAS 7.

- 9 -

| 20. | Please expand your interim financial statement footnotes to include a narrative explanation of differences in accounting under U.S. and Canadian GAAP or a cross reference to annual reconciliation footnotes with discussion of any new differences occurring during the interim period. |

The Form F-1/A includes a Schedule of Reconciliation between Canadian and U.S. GAAP as at and for the three and six months ended October 31, 2007.

Note 2. Acquisitions, page 119

| 21. | We note your response to comment 46 of our letter dated October 4, 2007. Sections 3840.08 and 3840.29 of the CICA Handbook stipulate that a related party transaction should be measured at the carrying amount, except when the transaction that is not in the normal course of operations has commercial substance, in which case it should be measured at the exchange amount when the change in ownership interests is substantive and the exchange amount is supported by independent evidence. Please explain to us in detail how you considered the guidance in paragraphs 3840.29 to 2840.41 in determining how to treat the property acquisition under Canadian GAAP. Revise your consolidated financial statements as necessary. |

Paragraph 3840.38 indicates that independent evidence would include at least one of the following:

| | (a) | independent appraisals, valuations or approvals, by appropriately qualified parties that are not related to the enterprise, carried out to determine the exchange amount; |

| | | |

| | (b) | comparable recently quoted market prices, in an open and unrestricted market; |

| | | |

| | (c) | comparable independent bids on the same transaction; or |

| | | |

| | (d) | comparable amounts of similar transactions actually undertaken with unrelated parties. |

The Company did not have independent evidence, as described by paragraph 3840.38, to support recording the assets acquired at their exchange amounts and as a result, the transactions were recorded at their carrying amount under Canadian GAAP. Specifically:

| | (i) | The Company did not have independent appraisals or valuations completed for the oil and gas properties acquired. |

| | | |

| | (ii) | The market for the Company’s common shares on the OTC Bulletin Board exchange was determined by the Company to be inactive and illiquid. A significant portion (over 90%) of the outstanding common shares were subject to hold periods before they could be sold. |

| | | |

| | | The Company based this determination by looking at the common shares available for trade and the trading volumes around the time of the acquisitions. |

- 10 -

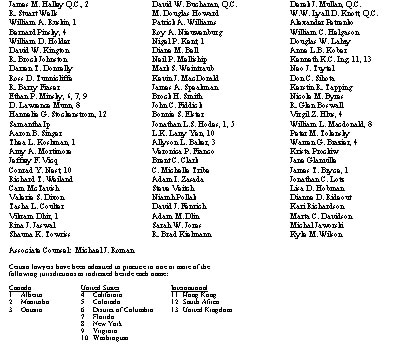

| | Total | | | | | |

| | Monthly | Daily Ave | Low | High | Dollar Value | |

| Month | Volume | Volume | (US$) | (US$) | of Trades | |

| April 2007 | 314,621 | 15,731 | $ 2.00 | $2.35 | $ 669,439 | |

| March 2007 | 215,294 | 9,786 | $ 2.00 | $2.38 | $ 471,619 | |

| February 2007 | 411,300 | 21,647 | $ 1.80 | $2.15 | $ 823,525 | |

| January 2007 | 511,900 | 25,595 | $ 1.15 | $1.90 | $ 781,834 | |

| December 2006 | 101,500 | 5,075 | $ 0.70 | $1.05 | $ 91,000 | 11 trade days |

| Jan – Apr | | | | | | |

| Average | 363,280 | 18,190 | | | | |

| | | Note that 6,337,500 shares out of 66,811,050 were available to trade, representing 9 percent of the issued and outstanding common shares of the Company prior to the acquisitions (March 2007). As an illustration, if the vendors of the Kentucky Reserves project wanted to liquidate their 5,000,000 common shares on the OTC market (ignoring the one year hold period), it would take over 14 months (using the average monthly trading volumes of January through April). |

| | | |

| | | Specific guidance under Canadian GAAP to support using alternative measures of fair value for common shares issued for acquisitions includes: |

| | | |

| | | HB 1581.24 requires that the cost of a purchase should be determined by using the more reliably measured fair value of the consideration given or the fair value of the net assets acquired. |

| | | |

| | | HB 1581.A3 indicates that while the quoted market price of consideration given is generally used to estimate the fair value of an acquired business, adjustments for the possible effects of price fluctuations and quantities traded can be considered. |

| | | |

| | | HB 3840.58 indicates that representations that the exchange amount is equivalent to fair value are not made unless they can be substantiated. |

| | | |

| | | HB 1581.A5 provides that when the market price of a share is not representative of their fair value, the net assets received and the extent of the adjustment of the quoted market price are to be assessed to determine the cost of the purchase. It further indicates that when quoted market prices are not representative of fair value, estimates of fair value are based on the best information available including other valuation techniques that are consistent with measuring fair value. |

| | | |

| | (iii) | The properties acquired were not subject to an auction, therefore there were no comparable bids on the same transaction. |

| | | |

| | (iv) | The Company did not have clear comparable amounts of similar transactions. |

| | | |

| | | MegaWest Energy Corp. is a Canadian company applying oil recovery technologies to tar sands properties in the United States. The Company is a ‘first- mover" in the United States market, and as a result it is very difficult to obtain |

- 11 -

information on similar transactions. The closest proxy is the tar sands activity in Canada, however the fiscal regime and reservoir characteristics make the economics of these projects significantly different.

As we did not have independence evidence of the fair value of the net assets acquired, we used the fair value of the consideration given to record the acquisitions. The share price of the consideration given was primarily based on the cash consideration received by the Company on the private placement of shares that were completed with independent third parties around the acquisition closing dates. The Company viewed this to be the most reliably measured fair value of the shares issued due to its significance (27,448,500 share offering) and an acceptable measure under Canadian GAAP.

| 22. | We understand from your response to comment 46 that you recorded the exchange transactions described in Note 2 under U.S. GAAP in the same manner as that under Canadian GAAP due to the absence of specific U.S. GAAP accounting guidance. We believe there is specific accounting guidance under U.S. GAAP, stating these transactions should be accounted for at fair value. From your response to comment 38, we note you believe the acquisitions should not be treated as a business combination under SFAS 141 because they do not constitute a business under EITF 98-3. Therefore, the guidance of paragraph 11 of SF AS 141 and EITF 02-05 regarding common control does not apply. Furthermore, even if applicable, we do not believe common control existed in these acquisitions as the guidance states common control exists between separate entities only when an individual holds more than 50 percent of the voting ownership interests of each entity. We note that your President and CEO owned less than 50% of the acquired entities. Under U.S. GAAP, we continue to believe the acquisitions of Deerfield Missouri, Trinity and the assets of Deerfield Kansas should be measured based on the fair value of the consideration given or the fair value of the assets acquired, whichever is more clearly evident and, thus, more reliably measurable. Please revise your U.S. GAAP reconciliation in Note 19 accordingly. Refer to paragraphs 3 through 8 of SFAS 141 for additional guidance. |

The Company believes that the acquisition transactions are related party transactions for both Canadian and U.S. GAAP purposes as Mr. Stapleton was the Chief Executive Officer, a director and had ownership interests in both transacting entities. The U.S. guidance from SFAS 57, Related Party Disclosures, Appendix B 24.f identifies related parties as "principal owners of the enterprise and its management . . . other parties with which the enterprise may deal if one party controls or can significantly influence the management or operating policies of the other to an extent that one of the transacting parties might be prevented from fully pursuing its own separate interests". Mr. Stapleton was a principal owner (as he owned greater than 10% of the outstanding shares) in each of the entities acquired by the Company. While he was not a principal owner of the Company (as he only owned approximately 3% of the Company’s outstanding shares at the time of acquisition), it is the Company’s view that he could significantly influence the management and operating policies of the Company as its Chief Executive Officer and a director.

The Company agrees that Mr. Stapleton did not have common control. Accordingly, for U.S. GAAP the acquisitions of Deerfield Missouri, Trinity and the assets of Deerfield Kansas should

- 12 -

be recorded at their fair market value. The U.S. GAAP reconciliation in the financial statements for the year ended April 30, 2007 has been re-stated for this GAAP difference.

| 23. | Based on your disclosure in Note 19(a)(vii), we note that you used the cash consideration received for recent private placements of common shares to determine the fair value of common shares given as consolidation in certain of your acquisitions under Canadian GAAP. It appears that the most recent private placement was in March 2007 where you issued common shares for US$0.76 per share (or US$1.00 offering price less the value of the warrants of US$0.24). Please compare for us the value per share in the most recent private placement against the value per share used in determining the consideration given for each of your acquisitions in which you issued common shares and exchange shares, and explain the reasons for any differences in value. In addition, please expand your disclosure in Note 2 to explain the basis for determining the fair value of the consideration given for each acquisition. |

The March 1, 2007 private placement was US$1.00 per unit, with each unit consisting of one common share and one half-purchase warrant. The Black-Scholes option pricing model yielded a value of US$0.24 per whole warrant, or US$0.12 per half warrant, resulting in a residual value of US$0.88 per share.

The Company used US$1.00 as a fair value proxy for MegaWest shares, slightly higher than the residual US$0.88 per share outcome from using the Black-Scholes option pricing model.

Management believes that US$1.00 per share is a better fair value estimate of the Company’s shares because the shares underlying the warrants are restricted (subject to a holding period of at least one year after they are exercised) thereby reducing the value of the warrants. Management believes that the Black-Scholes option pricing model does not take into account the holding period of restricted shares and is subjective to assumptions (i.e. volatility) on a newly created business. It should also be recognized that the Company issued stock options with an exercise price of US$1.00 during the time of the March 2007 private placement.

Had the Company used US$0.88 as the fair market value for the Company’s shares, the Canadian GAAP net loss for the year of $6,893,052 would be reduced by approximately $260,000 (3.8%) and the Canadian GAAP shareholders’ equity of $48,148,521 would be reduced by approximately $1,270,000 (2.6%) . It is the Company’s view that this is not a material difference.

You will note that the U.S. GAAP reported amounts are not affected by this difference.

| 24. | We note that you issued as consideration for the acquisition of Trinity 95,000 shares of a subsidiary that are exchangeable into 9,500,000 common shares of MegaWest Energy Corp. Related to your exchangeable shares, please address the following: |

| | | |

| (a) | Expand your disclosure in Note 2 to include a reference to your disclosure in Note 8, which includes a full description of the features of these exchange shares issued. |

The Form F-1/A has been amended to include a reference to Note 8 in Note 2 to the consolidated financial statements for the year ended April 30, 2007.

- 13 -

| �� | (b) | We note your disclosure in Note 8 regarding your accounting for these exchange shares under Canadian GAAP, which we believe may require the recognition of differences in accounting under U.S. GAAP in Note 19. As these shares of MegaWest USA are redeemable for cash, tell us how you considered the guidance of ASR 268 and EITF Topic D-98 in accounting for their issuance and at the balance sheet date at the consolidated level, considering these shares represent minority interest in a subsidiary. Additionally, as the exchange shares of MegaWest USA are convertible into shares of MegaWest, the parent, tell us how you considered the guidance of EITF 00-04 and SFAS 150, including other related guidance such as SFAS 133 and EITF 00-19. Based on this guidance, it appears revisions are required to the reconciliation to U.S. GAAP presented in Note 19. Please revise your reconciliation and related disclosures to clarify how these shares were accounted for at issuance and as of each balance sheet date, as applicable. |

The Company has revised its U.S. GAAP reconciliation to include a GAAP difference for the accounting of exchange shares. For U.S. GAAP, the exchange shares are recorded as temporary equity at their fair value on the date of issuance, using the OTC Bulletin Board quoted prices, then subsequently remeasured to redemption value (US$950,000), with the reduction from fair value to redemption value recorded as a change to retained earnings (deficit). The Company based its conclusions on the following analysis:

| | 1) | Each Class B share in the capital of MegaWest Energy USA Corp. has the following special rights attached to it: |

| | | | |

| | | a. | Each Class B share can be converted into 100 shares of the Company’s common stock before July 31, 2008, and if not so converted on July 31, 2008, they will automatically convert to 100 shares of the Company’s common stock (at the direction of the Company); and |

| | | | |

| | | b. | Each MegaWest USA Corp. Class B share can be put to the Company for US$10 on or before July 31, 2008. |

| | | | |

| | 2) | The put option attached to the Class B shares is not legally separable and is therefore not a freestanding derivative within FAS 150. Further, the Class B shares which have a stated redemption date but are also convertible into a fixed number of shares of the Company’s common stock prior to the redemption date are not mandatorily redeemable because redemption is conditional; contingent upon the holder's not exercising its option to convert into shares of the Company’s common stock. Reference is made to FAS 150, paragraph A9. Accordingly, the Class B shares are not within the scope of FAS 150 and are, accordingly, not a liability. |

| | | | |

| | 3) | The Class B shares contain an embedded put option that allows the holder of the shares to put the shares back to the Company for US$10 per share. The Class B shares should be accounted for in accordance with ASR 268 since the redemption of these shares is outside the control of the Company. |

- 14 -

| | 4) | The Company has followed the guidance in EITF Issue D-98 paragraph 15 in accounting for the Class B shares. The Class B shares were initially recorded at their carrying amount and then were adjusted to their redemption amount since they are redeemable currently. The difference between the fair value and the redemption amount was charged to retained earnings as discussed in EITF D-98 paragraph 18. In accordance with paragraph 18, this amount has also been excluded from the determination of earnings per share. |

| | | | |

| | 5) | The Class B share was not issued with a free standing derivative of the type described in EITF Issue 00-4 and so, accordingly, is excluded from analysis under that issue. |

| | | | |

| | 6) | Analysis of this instrument under FAS 133. The Class B shares qualify for exemption under paragraph 11(a) since they are indexed to their own stock and classified in stockholders equity. They also meet the conditions of EITF 00-19 paragraph 9 describes the conditions under which the Class B shares would be considered to be equity instruments - temporary equity. The Company only has a physical settlement option under the Class B share put option. The Company must deliver US$10 cash for each share put to it. In the Company’s case, section (c) of that section applies. The Company initially measured the transaction at fair value and reported the cash redemption amount required under the physical settlement as temporary equity. Further, the Company meets the requirements of EITF 00-19 paragraphs 12 - 32 as follows: |

| | | | |

| | | • | The contract permits the Company to settle in unregistered shares. The put option does not specify that the Company has to deliver registered shares to settle. |

| | | | |

| | | • | The Company has sufficient authorized and unissued shares available to settle the contract. As a Canadian company, the Company has unlimited shares of common stock which can be issued. |

| | | | |

| | | • | The contract contains an explicit limit on the number of shares to be delivered in a share settlement. The Class B shares are each convertible into 10 shares of the Company’s common stock. |

| | | | |

| | | • | There are no required cash payments to the counterparty in the event the Company fails to make timely filings with the SEC. The Class B shares do not contain any such requirement. |

| | | | |

| | | • | There are no required cash payments to the counterparty if the shares initialled delivered upon settlement are subsequently sold by the counter party and the sales proceeds are insufficient to provide the counter party with full return of the amount due. No such provision exists. |

| | | | |

| | | • | The contract requires net cash settlement only in specific circumstances in which holders of shares underlying the contract also would receive cash in exchange for their shares. There are no such items such as a change in control provision that would trigger a net cash settlement of the Class B shares. |

| | | | |

| | | • | There are no provisions in the contract that indicate that the counterparty has rights that rank higher than those of a shareholder of the stock underlying the |

- 15 -

| | contract. The Class B holders have no rights as a creditor in the event of bankruptcy. |

| | | |

| • | There is no requirement in the contract to post collateral at any point or for any reason. The Company is not required to post any collateral. |

The following is in response to the December 27, 2007, conference call request to include business reasons for issuing the exchange shares.

The primary reason for issuing subsidiary exchange shares as consideration instead of common shares of the parent company was to satisfy cross-border tax issues for the vendor and therefore enable the acquisition to close at its initial level of consideration. Originally, the Company and the vendor agreed to a letter of intent, whereby the Company would issue 9,500,000 common shares as part of the consideration for Trinity Sands. However, to satisfy tax issues, instead of issuing shares of a Canadian company, Class B exchange shares of the Company’s US subsidiary were issued.

| | (c) | Tell us how you treated these exchange shares in calculating your earnings per share under U.S. GAAP. |

As the Company has experienced losses in each reporting period, basic loss per share has equalled diluted loss per share. The exchange of the exchange shares for common shares would be anti-dilutive (reduce the loss per share), the exchange shares were not included in the loss per share calculations.

Note 19. Additional Disclosures Required under U.S. Generally Accepted Accounting Principles,page 128

| 25. | We have reviewed your response to comment 49 of our letter dated October 4, 2007 in which you state the impairment tests performed for unproved oil and gas properties resulted in no impairments under both U.S. and Canadian GAAP. We also note that under U.S. GAAP, the value of the Kentucky assets acquired was recorded using the OTC trading price of MegaWest shares issued and cash given as consideration, which appears to be more than two times larger (or $21.8 million) than the value used to record these same assets under Canadian GAAP, which uses recent private placements as an indicator of your stock’s fair value. Your critical accounting policy disclosures state you have assessed the carrying amounts of the unproved properties for impairment by comparing the amount recorded to estimates of market value for similar unproven oil and gas assets. It is unclear why the estimated market value of similar properties used in your impairment analysis results in an amount that is more than double the value of the properties recorded under Canadian GAAP. In other words, it is unclear why the market value of your recently acquired unproved properties is more than double the value of the shares issued under Canadian GAAP. Please explain this difference. |

For U.S. GAAP purposes, the quoted market price of a traded equity security issued to effect an acquisition is used to estimate fair value of the consideration issued. As a result, the Company used OTC Bulletin Board quoted prices for U.S. GAAP purposes as the basis for valuing the equity consideration paid.

- 16 -

For Canadian GAAP purposes, the quoted market price of a traded equity security issued to effect an acquisition is used to estimate fair value of the consideration issued when there is an active and liquid market for the security. As there was not an active and liquid market for the common shares issued, the quoted market price was not representative of fair value of the shares issued. Accordingly, the Company used the price of the shares issued in recent private placement transactions and exercise prices from stock option grants to record the acquisition of the property. The Company did not have independent evidence of the fair value of the net assets acquired.

As planned principal operations in the oil and gas cost centre have not commenced, the cost centre is in a "development stage" as defined by SFAS 7 (U.S. GAAP) and Accounting Guideline 11 (Canadian GAAP). The Company’s status as a development stage company continues through the October 31, 2007 interim financial statements that will be included in the F-1/A. To date, the Company’s only oil producing property is the Chetopa Kansas project. The Company continues to classify the Chetopa Kansas project as in the development stage, as the Company is still commissioning the project facilities for their intended use.

For Canadian GAAP purposes, it was the Company’s assessment that none of the capitalized costs were considered unlikely to be recovered (impairment test as prescribed by Accounting Guideline 11, paragraph 19). It is the Company’s understanding that U.S. GAAP has a similar assessment criteria.

At April 30, 2007 and October 31, 2007, the Company performed cost recovery assessments for each project by projecting future cash flows. The future cash flow projections used internal and independent best estimates of resources (P50), recovery factors, oil prices, operating and capital costs. The Company based its impairment assessments on these projections. For example, the Company assessed the recoverability of the Kentucky project using recoverable resource estimates of 90 million to 155 million barrels, on a P50 and P10 probability case. The Company projects to recover US$15 per barrel in net future cash flows from the ultimate development of the project. It is the Company’s assessment that its U.S. GAAP carrying amount for the Kentucky project will be recoverable from the production of 5 million barrels out of the estimated 90 million to 155 million barrels.

The independent and management resource and reserve estimates were disclosed in a Form 6-K on December 18, 2007.

You have pointed out that the Company’s critical accounting policy disclosure stated that the Company assessed the carrying amounts of the unproved properties for impairment by comparing the amount recorded to estimates of market value for similar unproven oil and gas assets. Since the Company assessed cost recovery through cash flow projections, the Company will amend its critical accounting policy disclosure accordingly.

Recent Sales of Unregistered Securities, page 151

| 26. | Update your disclosure in footnote one to reflect the revised exercise date of the incentive warrants. |

Footnote 1 to the Recent Sales of Unregistered Securities Table in the Form F-1 contains the revised expiry date of the incentive warrants and states as follows:

- 17 -

"Each warrant is exercisable to purchase common shares at US$0.10 per share for a period of six months after vesting, which occurs if the holder brings a project with a potential economic value in the amount of at least US$1.00 multiplied by the total number of warrants issued to the holder to our company by January 15, 2009."

However, for further clarity, the following sentence has been added to Footnote 1 on page 163 of the Form F-1/A:

"The original expiry date of these warrants was December 21, 2007, but that this date was extended to January 15, 2009 by resolution of our directors dated effective September 18, 2007."

Exhibits

Articles

| 27. | We note that in a Form 6-K you filed on November 9, 2007 you stated that you adopted new bylaws in regard to your continuance under Alberta law. Please file these revised bylaws as an exhibit. |

The proposed by-laws approved by the Company’s shareholders on October 29, 2007 are attached as Exhibit No. 3.8 to the Form F-1/A.

Exhibit 5.1

| 28. | Obtain and refile an opinion of counsel. Counsel must opine on all of the shares registered for resale. In addition, counsel provides an opinion based on British Columbia law. The opinion must be provided based on Alberta law if the conversion occurs prior to the effectiveness of the F-1. |

An opinion of counsel based on British Columbia law in respect of all shares registered for resale is attached as Exhibit 5.1 to the Form F-1/A.

We trust that you will find the above and enclosed in order. If you have any questions, please do not hesitate to contact the writer.

Yours truly,

CLARK WILSON LLP

Per: /s/ Jonathan C. Lotz

Jonathan C. Lotz

JCL/jcl

Encls.

cc: MegaWest Energy Corp.

Attention: George T. Stapleton, II