Exhibit 99.1

|  |

| | |

| Company Contact: | Company Contact: |

| | |

| Michael J. Fitzpatrick | James S. Vaccaro |

| Executive Vice President/Chief Financial Officer | President and Chief Executive Officer |

| OceanFirst Financial Corp. | Central Jersey Bancorp |

| Tel: (732) 240-4500, Ext. 7506 | Tel: (732) 663-4040 |

| E-Mail: Mfitzpatrick@oceanfirst.com | E-Mail: jvaccaro@CJBNA.com |

FOR IMMEDIATE RELEASE

OCEANFIRST FINANCIAL CORP. ANNOUNCES

STRATEGIC COMBINATION OF CENTRAL JERSEY BANCORP –

ENHANCING COMMUNITY BANK FRANCHISE AT THE JERSEY SHORE

TOMS RIVER, NEW JERSEY, MAY 26, 2009…OceanFirst Financial Corp. [NASDAQ: OCFC] (“OceanFirst”) and Central Jersey Bancorp [NASDAQ: CJBK] (“Central Jersey”) today announced the signing of an agreement and plan of merger, pursuant to which Central Jersey will merge with and into OceanFirst in an all stock transaction. Under the terms of the agreement, Central Jersey common stockholders will receive 0.50 shares of OceanFirst common stock for each common share of Central Jersey. Based on OceanFirst’s closing price as of May 26, 2009, the transaction is valued at approximately $7.12 per share or $68.4 million in the aggregate. The transaction value represents 90% of Central Jersey’s book value, 149% of its tangible book value, a core deposit premium of 7.2% and a market premium of 9.9% relative to OceanFirst and Central Jersey’s trailing 30-day average closing price.

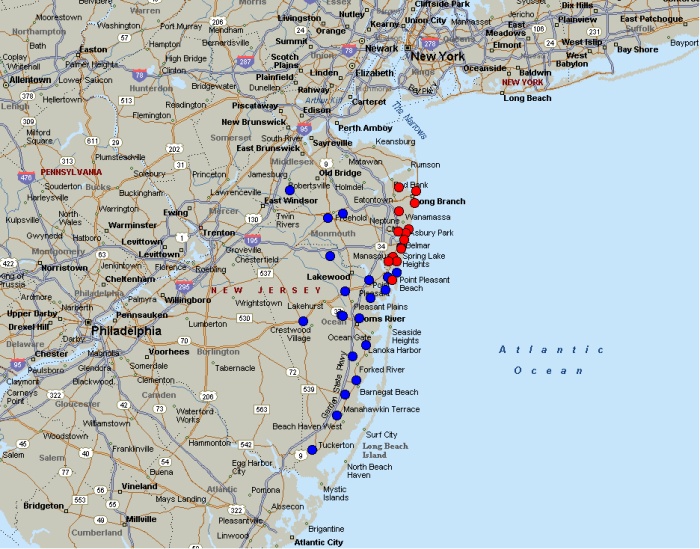

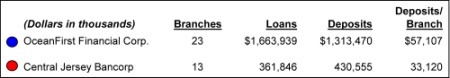

OceanFirst, the parent company of OceanFirst Bank, with $1.9 billion in assets, operates 23 branches in New Jersey throughout the counties of Ocean, Monmouth and Middlesex. Central Jersey, a publicly traded bank holding company with $576 million in assets, operates 12 branches throughout Monmouth County and one branch in Ocean County. Central Jersey Bank’s $431 million in deposits and 12 branches in Monmouth County will result in an increase of OceanFirst Bank’s market share ranking from 18th to 9th in the county. Upon completion of the transaction, OceanFirst Bank will also have the 5th largest deposit market share in Ocean County. OceanFirst will become the 7th largest publicly traded banking institution headquartered in New Jersey.

Central Jersey Bank’s deposit base is primarily located in the attractive Monmouth County banking market. The median household income in Monmouth County is currently $83,784 vs. the national average of $54,749. In addition, household income is projected to grow by 22.2% by 2013 vs. the national projection of 17.0% (according to SNL Financial).

Pro Forma Franchise Footprint:

Source: SNL Financial

Microsoft MapPoint 20

Financial Data as of March 31, 2009

John R. Garbarino, Chairman, President and CEO of OceanFirst, will continue in that capacity for the combined company and James S. Vaccaro, currently Chairman, President and CEO of Central Jersey, will become an Executive Vice President and a member of the senior executive management team at OceanFirst Bank. The Board of Directors of OceanFirst and OceanFirst Bank will be expanded by two members that will include two current independent members of Central Jersey’s Board.

“This combination is a natural extension of our franchise. Central Jersey Bank’s branch network logically expands our footprint into adjacent and attractive markets, allowing us to better serve the coastal area of New Jersey,” said Mr. Garbarino. “We have known Central Jersey and its senior management for a long time and feel confident that the integration of our two companies will go seamlessly. We feel that this combination will help us improve our near and long-term earnings prospects and position us to compete effectively as a larger, stronger Community Bank, with enhanced franchise value and growth potential.”

Central Jersey CEO, James S. Vaccaro, noted: “Central Jersey’s Board of Directors determined that combining with OceanFirst is the right partnership for our shareholders and franchise. We have a great relationship with their management and we view the transaction not as a sale, but instead as a significant investment in the combined organization.”

The pro forma company will have approximately $2.5 billion in combined assets, approximately $1.7 billion in deposits, and with more than $151 million of tangible common equity will be well capitalized and better positioned to take advantage of other future growth opportunities. OceanFirst expects the in-market nature of the transaction and the familiarity with Central Jersey will provide for manageable integration risk, achievable synergies, and overall, improved operational efficiency for the combined institution. It is anticipated that this transaction will be accretive to 2010 operating earnings per share, assuming cost savings of 35% of Central Jersey operating expenses. OceanFirst projects a mid-teen internal rate of return on the transaction and expects to record a restructuring charge of approximately $3.9 million after related tax benefits.

The companies expect to consummate the transaction by year end, subject to customary closing conditions, including regulatory and shareholder approvals. The holding company will remain headquartered in Toms River, NJ and Central Jersey will be merged into OceanFirst.

Keefe, Bruyette and Woods, Inc. acted as financial advisor to OceanFirst, and Locke Lord Bissell & Liddell, LLP acted as its legal advisor in the transaction. Sandler O’Neill & Partners, L.P. acted as financial advisor to Central Jersey, and Giordano, Halleran & Ciesla, P.C. acted as its legal advisor.

About OceanFirst

OceanFirst Financial Corp. is the parent holding company for OceanFirst Bank. OceanFirst Bank, founded in 1902 is the largest and oldest community-based financial institution headquartered in Ocean County, New Jersey. The Bank is located in the central coastal area of New Jersey between the major metropolitan cities of New York and Philadelphia. With administrative offices in Toms River, New Jersey, OceanFirst Bank provides financial services to retail and business customers throughout the Jersey Shore market.

Additional information is available on the OceanFirst's website at www.oceanfirst.com. The shares of OceanFirst are traded on the NASDAQ [Global Market] under the symbol "OCFC."

About Central Jersey

Central Jersey Bancorp is a bank holding company headquartered in Oakhurst, New Jersey. The holding company was incorporated in New Jersey on March 7, 2000, and became an active bank holding company on August 1, 2000 through the acquisition of Monmouth Community Bank, N.A. On January 1, 2005, Monmouth Community Bancorp changed its name to Central Jersey Bancorp and completed its strategic business combination transaction with Allaire Community Bank, a New Jersey state chartered bank, pursuant to which Allaire Community Bank became a wholly-owned bank subsidiary of Central Jersey Bancorp. In August 2005, Central Jersey Bancorp’s two operating subsidiaries, Monmouth Community Bank, N.A. and Allaire Community Bank, combined to form Central Jersey Bank, N.A. Central Jersey Bank, N.A. provides a full range of banking services to individual and banking customers located primarily in Monmouth and Ocean Counties.

Additional information is available on the Central Jersey's website at www.cjbna.com. The shares of Central Jersey are traded on the NASDAQ Global Market under the symbol "CJBK."

Forward-Looking Statements

This news release contains certain forward-looking statements which are based on certain assumptions and describe future plans, strategies and expectations of the Company. These forward-looking statements are generally identified by use of the words "believe," "expect," "intend," "anticipate," "estimate," "project," or similar expressions. The Company's ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Factors which could have a material adverse effect on the operations of the Company and the subsidiaries include, but are not limited to, changes in interest rates, general economic conditions, legislative/regulatory changes, monetary and fiscal policies of the U.S. Government, including policies of the U.S. Treasury and the Federal Reserve Board, the quality or composition of the loan or investment portfolios, demand for loan products, deposit flows, competition, demand for financial services in the Company's market area and accounting principles and guidelines. These risks and uncertainties should be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. The Company does not undertake – and specifically disclaims any obligation – to publicly release the result of any revisions which may be made to any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.