Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO FINANCIAL STATEMENTS

As filed with the Securities and Exchange Commission on June 16, 2003

Registration Nos. 333-[ • ], 333-[ • ]

SECURITIES AND EXCHANGE COMMISSION

Washington D.C., 20549

| |

|

|---|

| |

|

FORM F-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933 |

|

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933 |

| |

|

Bluewater Finance Limited

(and the Guarantors identified in footnote 1 below)

(Exact Name of Registrant as Specified in Its Charter) |

|

Bluewater Offshore Production

Systems (U.S.A.), Inc.

(Exact Name of Registrant as Specified in Its Charter) |

Cayman Islands

(Jurisdiction of Incorporation or Organization) |

|

Delaware

(Jurisdiction of Incorporation or Organization) |

3812

(Primary Standard Industrial Classification Code Number) |

|

3812

(Primary Standard Industrial Classification Code Number) |

Not Applicable

(IRS Employer Identification Number) |

|

76-0672438

(IRS Employer Identification Number) |

Marsstraat 33

2132 Hoofddorp

The Netherlands

(31) 23 568 2800

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant's Principal Executive Offices) |

|

8554 Katy Freeway

Houston

Texas

(713) 722 8131

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant's Principal Executive Offices) |

Watson, Farley & Williams

380 Madison Avenue

New York, New York 10017

(212) 922 2200

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

Copies to:

Kees Voormolen

Director

Bluewater Finance Limited

Marsstraat 33

2132 Hoofddorp

The Netherlands | | Cecil D. Quillen III

John B. Duer

Linklaters

One Silk Street

London EC2Y 8HQ

England |

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earliest effective registration statement for the same offering. o

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of

Securities to be Registered

| | Amount to

be Registered

| | Proposed Maximum

Offering Price

Per Senior Note(2)

| | Proposed Maximum

Aggregate

Offering Price(2)

| | Amount of

Registration Fee

|

|---|

|

| 101/4% Senior Notes due 2012 | | U.S.$75,000,000 | | 100% | | U.S.$75,000,000 | | U.S.$6,067.50 |

|

| Senior Subordinated Guarantees(3) | | — | | — | | — | | — |

|

- (1)

- Aurelia Energy N.V., a limited liability company incorporated under the laws of the Netherlands Antilles, and each of the following direct and indirect subsidiaries are Co-Registrants, each of which is organized under the laws of the jurisdiction indicated: Bleo Holm Standby Purchaser N.V. (Netherlands Antilles), Bluewater (Bleo Holm) N.V. (Netherlands Antilles), Bluewater Brasil Ltda. (Brazil), Bluewater Energy N.V. (Netherlands Antilles), Bluewater Energy Services B.V. (Netherlands), Bluewater Equipment Leasing Ltd. (Malta), Bluewater Floating Production B.V. (Netherlands), Bluewater (Floating Production) Ltd. (England), Bluewater (Glas Dowr) N.V. (Netherlands Antilles), Bluewater (Haewene Brim) N.V. (Netherlands Antilles), Bluewater Holding B.V. (Netherlands), Bluewater International B.V. (Netherlands), Bluewater (Malta) Ltd. (Malta), Bluewater (Munin) N.V. (Netherlands Antilles), Bluewater (New Hull) N.V. (Netherlands Antilles), Bluewater (Norway) ANS (Norway), Bluewater Offshore Production Systems Ltd. (Malta), Bluewater Offshore Production Systems Nigeria Ltd. (Nigeria), Bluewater Offshore Production Systems N.V. (Netherlands Antilles), Bluewater Operations (UK) Ltd. (England), Bluewater Services (UK) Ltd. (England), Bluewater (UK) Ltd. (England), Bluewater Terminal Systems N.V. (Netherlands Antilles), Lufeng Development Company ANS (Norway) and Pierce Production Company Ltd. (England).

- (2)

- Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457 under the Securities Act of 1933.

- (3)

- The 101/4% Senior Notes due 2012 are unconditionally guaranteed, on a joint and several basis, by the Guarantors on an unsecured, senior subordinated basis. No separate consideration will be paid in respect of these guarantees.

The Registrants hereby amend this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrants will file a further amendment which specifically states that this Registration Statement will thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement will become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Bluewater Finance Limited

Offer to Exchange All Outstanding Unregistered

101/4% Senior Notes due 2012

Fully and Unconditionally Guaranteed on a Senior Subordinated Basis

by Aurelia Energy N.V. and its Subsidiaries

(U.S.$75,000,000 aggregate principal amount outstanding)

for Registered

101/4% Senior Notes due 2012

Fully and Unconditionally Guaranteed on a Senior Subordinated Basis

by Aurelia Energy N.V. and its Subsidiaries

Our wholly-owned finance subsidiary, Bluewater Finance Limited, is offering to exchange all of its unregistered 101/4% Senior Notes due 2012 for new registered 101/4% Senior Notes due 2012. We refer to the unregistered 101/4% Senior Notes due 2012 as "unregistered notes" and to the new registered 101/4% Senior Notes due 2012 as "new notes". The terms of the new notes will be identical to the terms of the unregistered notes except that the new notes will have been registered under the Securities Act of 1933 (the "Securities Act") and, therefore, will be freely transferable. The new notes will be fungible for trading purposes with U.S.$260,000,000 aggregate principal amount of 101/4% Senior Notes due 2012 that were previously registered by Bluewater Finance Limited. The previously registered notes, which we refer to as the "registered notes", the new notes and the unregistered notes are sometimes collectively referred to as the "notes".

Please consider the following:

Information about the notes:

- •

- You should carefully review the Risk Factors beginning on page 23 of this prospectus.

- •

- Our offer to exchange unregistered notes for new notes will be open until 5:00 p.m., New York City time, on [ • ], 2003, unless we extend the exchange offer.

- •

- The exchange offer is not conditional upon any minimum aggregate principal amount of unregistered notes being tendered.

- •

- Tenders of unregistered notes may be withdrawn at any time prior to the expiration of the exchange offer.

- •

- The exchange of unregistered notes for new notes will not be a taxable event for U.S. federal income tax purposes.

- •

- You should also carefully review the procedures for tendering unregistered notes beginning on page 110 of this prospectus.

- •

- If you fail to tender your unregistered notes, you will continue to hold unregistered securities and your ability to transfer them could be adversely affected.

- •

- No public market currently exists for the new notes. Application has been made to list the new notes on the Luxembourg Stock Exchange.

- •

- The new notes will mature on February 15, 2012.

- •

- Interest payments will be made on each February 15 and August 15, beginning, with respect to the new notes, on August 15, 2003.

- •

- If Bluewater Finance Limited fails to make payments on the new notes when they are due, the guarantors will be required to make them.

- •

- The new notes will be general unsecured obligations of Bluewater Finance Limited and will rank equally in right of payment with all future unsecured and unsubordinated obligations of Bluewater Finance Limited.

- •

- The guarantees of the new notes will be general unsecured obligations of the guarantors, will be subordinated in right of payment to certain senior indebtedness of the guarantors and will rank equally in right of payment with all existing and future trade payables and senior subordinated obligations of the guarantors. On an adjusted basis giving effect to the issuance of the unregistered notes and the use of proceeds therefrom, as of March 31, 2003, the guarantors had U.S.$611.4 million of senior indebtedness outstanding.

- •

- Other than out of the proceeds of certain public equity offerings prior to February 15, 2005, or for certain tax reasons, Bluewater Finance Limited may not redeem the notes prior to February 15, 2007. On or after February 15, 2007, Bluewater Finance Limited may redeem all or a portion of the notes at the prices set forth under "Description of the Notes—Redemption".

- •

- You may require Bluewater Finance Limited to repurchase your new notes with the proceeds from sales of certain assets. In addition, you may require Bluewater Finance Limited to repurchase your new notes if we experience a change of control.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is June 16, 2003.

TABLE OF CONTENTS

This prospectus is part of a registration statement we filed with the Securities and Exchange Commission. You should rely only on the information or representations provided in this prospectus. We have not authorized any person to provide information other than that provided in this prospectus. We have not authorized anyone to provide you with different information. We are not making an offer of these securities in any jurisdiction where the offer is not permitted. You should not assume that the information in this prospectus is accurate as of any date other than the date on the front of this document.

2

We, having made all reasonable inquiries, confirm to the best of our knowledge, information and belief that the information contained in this prospectus with respect to the group companies taken as a whole, the new notes and the guarantees thereof is true and accurate in all material respects and is not misleading in any material respect, that the opinions and intentions expressed in this document are honestly held and that there are no other facts, the omission of which in connection with the issue and offering of the new notes would make this prospectus as a whole misleading in any material respect.

WHERE YOU CAN FIND MORE INFORMATION

We file reports, including annual reports on Form 20-F and current reports on Form 6-K, with the U.S. Securities and Exchange Commission (the "Commission"). As a foreign private issuer, we are not subject to the proxy rules under Section 14 or the short-swing insider profit disclosure rules under Section 16 of the U.S. Securities Exchange Act of 1934 (the "Exchange Act"). You may obtain copies of the reports that we file with the Commission and other information by sending a written request to Bluewater Finance Limited, c/o Bluewater Holding B.V., Marsstraat 33, 2132 HR Hoofddorp, the Netherlands, Attn: Vice President, Finance & Administration, Telephone: (31) 23 568 2800. You may also inspect and copy these reports at the Public Reference Room of the Commission at 450 Fifth Street, N.W., Washington, D.C. 20549 and may obtain copies of these materials at prescribed rates by calling the Commission at (1) 800 SEC 0330. Some of our filings may also be viewed on the Commission's website at www.sec.gov. All information referred to above will, for so long as our notes are listed on the Luxembourg Stock Exchange and the rules of the Luxembourg Stock Exchange so require, also be available, without charge, at the specified office of our paying agent in Luxembourg during usual business hours on any weekday that is not a public holiday. The Bank of New York (Luxembourg) S.A. currently acts as our paying agent in Luxembourg and maintains offices at Aerogolf Centre, 1A, Hoehenhof, L-1736, Senningerberg, Luxembourg.

CERTAIN DEFINITIONS

We have prepared this prospectus using a number of conventions, which you should consider when reading the information contained herein. When we use the terms "we", "us", "our" and words of similar import, we are referring to Aurelia Energy N.V., itself, or to Aurelia Energy N.V. and its consolidated subsidiaries, as the context requires. When we refer to "Aurelia Holding N.V.", the registered shareholder of 100.0% of our outstanding voting shares, with respect to dates on or after January 28, 2003, we are referring to Aurelia Holding N.V. in liquidation. When we use the terms "own" and "owns", with respect to our FPSOs and FPSO hulls, we are referring to:

- •

- legal (title) and economic ownership of both the hull and the topsides in the case of theUisge Gorm, theGlas Dowr and theMunin,

- •

- legal (title) and economic ownership of the hull and economic ownership of the topsides in the case of theBleo Holm and theHaewene Brim, and

- •

- legal (title) and economic ownership of the hull in the case of theAoka Mizu and theParadise.

References to "dollars", "U.S. dollars" and "U.S.$" are to the currency of the United States, references to "euro" and "€" are to the single currency of the member states of the European Communities that have adopted the euro as their lawful currency under the legislation of the European Community relating to the Economic and Monetary Union and references to "£" and "sterling" are to the currency of the United Kingdom. In this prospectus, we have translated certain euro amounts into U.S. dollars at exchange rates of €1.00 to U.S.$1.0485 and €1.00 to U.S.$1.0900, which were the noon buying rates in New York City for cable transfers in those currencies as certified for customs purposes by the Federal Reserve Bank of New York on December 31, 2002 and March 31, 2003, respectively, and we have translated certain sterling amounts into U.S. dollars at exchange rates of £1.00 to U.S.$1.6095 and £1.00 to U.S.$1.5790, which were the noon buying rates in New York City for cable

3

transfers in those foreign currencies as certified for customs purposes by the Federal Reserve Bank of New York on December 31, 2002 and March 31, 2003, respectively, in each case, solely for the convenience of the reader. You should not construe these translations as representations that the euro or sterling amounts actually represent such U.S. dollar amounts or that we could convert these amounts into U.S. dollars at the rates indicated. On June 16, 2003 the applicable noon buying rates were €1.00 to U.S.$1.1843 and £1.00 to U.S.$1.6815.

FORWARD-LOOKING STATEMENTS

This prospectus includes forward-looking statements within the meaning of, and which have been made pursuant to, the U.S. Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact contained in this prospectus, including, without limitation, those regarding our future financial position and results of operations, our strategy, plans, objectives, goals and targets, future developments in the markets where we participate or are seeking to participate, and any statements preceded by, followed by or that include the words "believe", "expect", "aim", "intend", "will", "may", "anticipate", "seek" or similar expressions or the negative thereof, are forward-looking statements. These forward-looking statements involve known and unknown risks, uncertainties and other factors, some of which are beyond our control, which may cause our actual results, performance or achievements, or industry results, to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. These forward-looking statements are based on numerous assumptions regarding our present and future business strategies and the environment in which we will operate in the future. Important factors that could cause our actual results, performance or achievements to differ materially from those in the forward-looking statements include, among others:

- •

- the level of oil reserves contained in the oil fields on which we operate our FPSOs and the performance of those fields in general;

- •

- levels of capital expenditures by the oil industry on offshore exploration and production activities;

- •

- our future capital needs;

- •

- our ability to enter into new service agreements for our FPSOs, including theMunin, upon the termination of their existing service agreements;

- •

- the extent and nature of, and the efficacy of measures that we have implemented to limit, the delays and cost overruns associated with our redeployment of theGlas Dowr;

- •

- the outcome of our discussions with tax authorities with respect to our internal restructuring and our 1997, 1998 and 1999 tax years;

- •

- our ability to manage currency risks;

- •

- our ability to comply with existing or newly implemented environmental regimes in the countries in which we operate;

- •

- our ability to obtain, maintain and renew the permits and other governmental authorizations required to conduct our operations;

- •

- our liability for violations, known and unknown, under environmental laws;

- •

- our ability to complete existing and future projects on schedule and within budget;

- •

- our ability to comply with health and safety regulations at our facilities;

- •

- our ability to remain competitive and profitable;

4

- •

- the performance of oil companies to whom we contract our FPSOs;

- •

- the efficacy of modifications to our FPSOs;

- •

- our ability to compete in a competitive and changing marketplace;

- •

- our losses from operational hazards and uninsured risks;

- •

- our ability to minimize the downtime of FPSOs during periods of repair, maintenance, inclement weather and turnarounds;

- •

- our ability to protect our know-how and intellectual property;

- •

- the adverse impact of strikes, lock-outs and other industrial actions;

- •

- the possible extensions of our service agreements and certain of our material contracts;

- •

- our ability to tie-back additional oil fields that neighbor the oil fields on which our FPSOs operate; and

- •

- limitations on our operational flexibility arising under agreements governing our debt.

Additional factors that could cause actual results, performance or achievements to differ materially include, but are not limited to, those discussed under "Risk Factors" and elsewhere in this prospectus. We caution you not to place undue reliance on these forward-looking statements which reflect our management's view only as of the date of this prospectus. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. In light of these risks, uncertainties and assumptions, the forward-looking events discussed in this prospectus might not occur.

INDUSTRY DATA

The industry data contained in this prospectus has been taken from industry sources available to us. Industry data has been sourced from reports by Infield Systems Douglas Westwood, the International Maritime Association and Simmons & Company International. Neither we nor any of our affiliates or advisors has independently verified this third party information or can assure you as to its correctness or accuracy. This information is based on estimates and assumptions that, while considered reasonable by us, are inherently subject to significant business, economic, competitive and other uncertainties, many of which are beyond our control. However, we accept responsibility for accurately extracting and transcribing such industry data from such sources and believe, after due inquiry, that such data represents the most current available information and statistics from such sources at and for the period with respect to which they have been represented.

ENFORCEMENT OF JUDGMENTS

With the exception of Bluewater Offshore Production Systems (U.S.A.), Inc., we are comprised of companies that have been incorporated under the laws of countries outside the United States, and all of the board members of each of our member companies, and certain of the experts named herein, are residents of the Netherlands, the Netherlands Antilles, Malta or other countries outside the United States. Substantially all of our assets and the assets of such other persons are located outside the United States. Consequently, it may not be possible for investors to effect service of process within the United States upon us or such other persons, or to enforce outside the United States judgments obtained against us or such other persons in courts of the United States in any action, including actions predicated upon the civil liability provisions of U.S. federal securities laws.

We have been advised by our Cayman Islands legal advisers, Maples and Calder Europe, that the courts of the Cayman Islands are unlikely (i) to recognize or enforce against us judgments of U.S.

5

courts predicated upon the civil liability provisions of the securities laws of the United States or of any state and (ii) in original actions brought in the Cayman Islands, to impose liabilities predicated upon the civil liability provisions of the securities laws of the United States or of any state, on the grounds that such provisions are penal in nature. However, in the case of laws that are not penal in nature, although there is no statutory enforcement in the Cayman Islands of judgments obtained in the United States, the courts of the Cayman Islands will recognize and enforce a judgment of a foreign court of competent jurisdiction without retrial on the merits based on the principle that a judgment of a competent foreign court imposes upon the judgment debtor an obligation to pay the sum for which judgment has been given; provided that such judgment is final and conclusive, for a liquidated sum, not in respect of taxes or a fine or penalty, is not inconsistent with a Cayman Islands judgment in respect of the same matter, and was not obtained in a manner, and is not of a kind the enforcement of which is, contrary to the public policy of the Cayman Islands (awards of punitive or multiple damages may well be held to be contrary to public policy). A Cayman Islands court may stay proceedings if concurrent proceedings are being brought elsewhere.

We have been advised by our Dutch and Netherlands Antilles legal advisers, De Brauw Blackstone Westbroek N.V. and De Brauw Blackstone Westbroek P.C., that neither the United States and the Netherlands nor the United States and the Netherlands Antilles currently have a treaty providing for reciprocal recognition and enforcement of judgments (other than arbitration awards) in civil and commercial matters. Therefore, a final judgment rendered by a court of the United States will not be directly enforceable in the Netherlands or the Netherlands Antilles. In order to obtain a judgment which is enforceable in the Netherlands or the Netherlands Antilles, the party in whose favor a final judgment of the U.S. court has been rendered will be required to file its claim with the court of competent jurisdiction of the Netherlands or the Netherlands Antilles. Such party may submit to the Dutch or Netherlands Antilles court the final judgment rendered by the U.S. court. If and to the extent that the Dutch or Netherlands Antilles court finds that the jurisdiction of the U.S. court has been based on grounds which are internationally acceptable and that proper legal procedures have been observed, the court of the Netherlands or the Netherlands Antilles will, in principle, give binding effect to the judgment of the court of the United States, unless such judgment contravenes principles of public policy of the Netherlands or the Netherlands Antilles.

The following discussion with respect to the enforceability of certain United States court judgments in England is based upon advice provided to us by our English legal advisers, Linklaters. The United States and England currently do not have a treaty providing for the reciprocal recognition and enforcement of judgments (other than arbitration awards) in civil and commercial matters. Consequently, a final judgment for payment rendered by any federal or state court in the United States based on civil liability, whether or not predicated solely upon U.S. federal securities law, would not automatically be enforceable in England. In order to enforce any U.S. judgment in England, proceedings must be initiated by way of common law action before a court of competent jurisdiction in England. In such common law action, an English court generally will not (subject to the following sentence) reinvestigate the merits of the original matter decided by a U.S. court and will order summary judgment on the basis that there is no defense to the claim for payment. The enforcement of a U.S. court judgment by an English court is conditional upon the following:

- •

- the U.S. court had jurisdiction over the original proceeding on a basis recognized by English private international law;

- •

- the judgment is final and conclusive on the merits and is for a definite sum of money (not being a sum payable in respect of taxes or other charges of a like nature or in respect of a fine or other penalty);

- •

- enforcement of the judgment would not contravene English public policy;

6

- •

- the judgment is not for a tax, penalty or fine arrived at by doubling, trebling or otherwise multiplying a sum assessed as compensation for the loss or damage sustained; and

- •

- the judgment has not been obtained by fraud or in breach of the principles of natural justice.

Subject to the foregoing, investors may be able to enforce in England judgments in civil and commercial matters obtained from U.S. federal or state courts.

There can be no assurance that investors will be able to enforce against us, our board members or the experts named herein, any judgments in civil and commercial matters, including judgments under the U.S. federal securities laws. In addition, it is uncertain whether a court in the Cayman Islands, the Netherlands, the Netherlands Antilles or England would impose civil liability on us or such other persons in an original action predicated upon the U.S. federal securities laws brought in a court of competent jurisdiction in the Cayman Islands, the Netherlands, the Netherlands Antilles or England, as applicable, against us or such persons.

Bluewater Finance Limited and each of the guarantors of the notes has appointed Watson, Farley & Williams, 380 Madison Avenue, New York, New York 10017 as its agent for service of process in any suit, action or proceeding with respect to the notes, the guarantees, the indenture and the registration rights agreement and for actions under U.S. federal or state securities laws brought in any U.S. federal or state court located in the City of New York, Borough of Manhattan, and each of the member companies will submit to that jurisdiction.

PRESENTATION OF FINANCIAL INFORMATION

We prepare our financial statements on a consolidated basis in accordance with accounting principles generally accepted in the United States ("U.S. GAAP"). Our auditors conduct their audit of our audited financial statements in accordance with auditing standards generally accepted in the United States. We have included in this prospectus selected consolidated financial information as of and for the years ended December 31, 1998, 1999, 2000, 2001 and 2002 and audited consolidated financial statements as of and for the years ended December 31, 2000, 2001 and 2002. We have also included unaudited interim condensed consolidated financial information and unaudited interim condensed consolidated financial statements as of March 31, 2003 and for the three months ended March 31, 2002 and 2003.

We have included in this prospectus EBITDA amounts for certain periods, because we believe that EBITDA is a useful measure for certain investors to determine our operating cash flow and historical ability to meet debt service and capital expenditure requirements, and because we believe that it provides a useful measure of the level of profitability we achieve with our asset base. EBITDA is not a measure of financial performance under U.S. GAAP and should not be considered as an alternative to cash flow from operating activities, a measure of liquidity or an alternative to net income as indicators of our operating performance or any other measures of performance derived in accordance with U.S. GAAP. A reconciliation of the EBITDA amounts included herein to net income and net cash provided by operating activities (which are U.S. GAAP measures) is set forth under "Summary—Summary Financial Information—Notes" and "Selected Financial Data—Notes".

Certain monetary amounts and other figures included in this prospectus have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables may not be the arithmetic aggregation of the figures which precede them, and figures expressed as percentages in the text may not total 100.0% when aggregated.

7

PROSPECTUS SUMMARY

This summary highlights selected information from this prospectus to help you understand our business and the terms of the new notes. You should carefully read all of this prospectus to understand fully our business and the terms of the new notes, as well as some of the other considerations that may be important to you in making your investment decision. You should pay special attention to the "Risk Factors" section of this prospectus to determine whether an investment in the new notes is appropriate for you.

THE COMPANY

Overview

We are Aurelia Energy N.V., a holding company with no independent operations, and its subsidiaries, a group of companies that comprise a specialized service provider to and operator in the offshore oil industry. We operate under the name "Bluewater" and are a leader in the design, development, ownership and operation of FPSOs, which we operate for oil companies under medium- and long-term service agreements, and the design, development, project management and delivery of SPM systems.

An FPSO is a type of floating production unit used by oil companies to produce, process, store and offload hydrocarbons from offshore fields. FPSOs are either newly built or converted tanker hulls upon which production equipment is mounted. Fluids (oil, gas and water) are processed onboard an FPSO, and treated crude oil is stored before being exported by an offtake system utilizing shuttle tankers. FPSOs are generally involved in the production, rather than the exploration or drilling, of oil.

SPM systems are used to secure a floating production unit (including an FPSO), floating storage and offloading vessel or tanker to the ocean floor while allowing the unit, vessel or tanker to weathervane freely. Most SPM systems consist of an anchoring system that is connected to the ocean floor and a fluid transfer system that permits the transfer of fluids between fixed and rotating parts of the mooring system. Most SPM systems are developed for sale to oil companies and contractors under SPM delivery contracts.

We earn revenues on a worldwide basis from the payments that we receive from the operation of our FPSOs pursuant to our service agreements with oil companies and from the payments that we receive from the design, development, project management and delivery of SPM systems under our SPM delivery contracts. While we manage FPSO and SPM projects from the initial design and engineering phase to final installation, we do not engage in the fabrication of FPSOs or SPM systems. Rather, we outsource these requirements to qualified subcontractors. In 2000, 2001, 2002 and the first quarter of 2003, we had revenues of U.S.$200.2 million, U.S.$197.3 million, U.S.$262.8 million and U.S.$56.1 million, respectively, operating income of U.S.$64.3 million, U.S.$49.1 million, U.S.$57.8 million and U.S.$12.3 million, respectively, net income of U.S.$59.8 million, U.S.$63.9 million, U.S.$37.4 million and U.S.$7.8 million, respectively, and EBITDA of U.S.$128.4 million, U.S.$107.4 million, U.S.$111.8 million and U.S.$25.2 million, respectively.

FPSO Business

Our FPSO fleet currently consists of five high specification FPSOs (theUisge Gorm, theBleo Holm, theGlas Dowr, theHaewene Brim and theMunin) that have been contracted to oil companies under service agreements and two FPSO hulls (theAoka Mizu and theParadise) that we are marketing worldwide. The medium- to long-term profile of our service agreements provides us with stable and predictable revenues. During the term of these agreements, the revenues from our FPSO business are generally significantly insulated from fluctuations in the price of oil and changes in the levels of exploration and production activities of oil companies. In 2000, 2001, 2002 and the first quarter of 2003, our FPSO business generated 91.3%, 90.3%, 83.4% and 90.5% of our revenues, respectively,

8

100.8%, 111.7%, 134.9% and 141.6% of our net income, respectively, and 99.8%, 106.9%, 113.1% and 114.4% of our EBITDA, respectively.

Uisge Gorm

We developed theUisge Gorm after entering into a service agreement with Amerada Hess Ltd. ("Amerada Hess") providing for the operation of an FPSO on the Fife Field in the North Sea. TheUisge Gorm began operating and produced first oil in August 1995. Since then, the Fergus, Flora and Angus Fields have been tied back to the FPSO. Each of these fields is operated by Amerada Hess. We are currently operating theUisge Gorm (at our pre-agreed rates) pursuant to an automatic extension of our existing service agreement that has no specific duration, but which can be terminated with six months' notice. We believe that it is reasonably likely that the combined production profile of the Fife, Flora, Fergus and Angus Fields will extend until 2005 (subject to certain factors, including the price of oil and overall production rates) and that theUisge Gorm may operate under the service agreement until that time.

Bleo Holm

We developed theBleo Holm after entering into a service agreement with Talisman Energy (UK) Ltd. ("Talisman") providing for the operation of an FPSO on the Ross Field in the North Sea. The FPSO commenced operations and produced first oil in April 1999. TheBleo Holm has recently been tied back to the neighboring Blake Field, which Talisman, BG Group and Paladin Resources own and which BG Group operates, and is expected to be tied back to the Blake Flank Field in September 2003. Under the terms of our existing service agreement, Talisman is obligated to continue to make contract payments until July 2004, after which time it may extend the contract period at pre-agreed rates. We believe that the combined production profile of the Ross, Blake and Blake Flank Fields will extend beyond 2015 (subject to certain factors, including the price of oil and overall production rates) and that theBleo Holm may continue to operate under extensions of the existing service agreement until that time.

Glas Dowr

We developed theGlas Dowr after entering into a service agreement with Amerada Hess providing for the operation of an FPSO on the Durward and Dauntless Fields in the North Sea. In June 2001, we entered into a new service agreement with PetroSA (formerly Soekor E&P (PTY) Limited) pursuant to which we will operate theGlas Dowr on the Sable Field in the Bredasdorp Basin off the coast of South Africa. The Sable Field is principally owned by PetroSA and Pioneer Natural Resources South Africa (Proprietary). To prepare theGlas Dowr for operation on the Sable Field, we have modified the vessel's topsides and mooring system and are developing the field's subsea infrastructure in accordance with requirements set forth in our service agreement with PetroSA. The project is currently behind schedule and over-budget and has resulted in an upward revision of our estimated commitments for expenditures relating to the redeployment. Nevertheless, theGlas Dowr has been towed to the Sable Field and is expected to achieve first oil in August 2003. For additional information concerning the redeployment of theGlas Dowr, see "Management's Discussion and Analysis of Financial Condition and Results of Operations—Redeployment of The Glas Dowr", "Management's Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—Capital Expenditures" and "Business—FPSO Business—FPSO Fleet and FPSO Hulls—Glas Dowr". The service agreement will run for a period of ten years, unless terminated, and has a minimum contract period of three years from the date of first oil. There are several tie-back opportunities at the Sable Field that may extend the life of the service agreement.

9

Haewene Brim

In January 2002, we acquired theHaewene Brim from Aurelia Holding N.V. TheHaewene Brim has been operating on the Pierce Field in the North Sea since March 1999 pursuant to a service agreement with Enterprise Oil plc ("Enterprise Oil"), the field operator. Under the terms of the existing service agreement, Enterprise Oil is obligated to make payments to us until March 2004, after which time it may extend the service agreement pursuant to unlimited successive extension options at rates which are pre-agreed until March 2014. Based upon a public announcement by Enterprise Oil of a substantial increase in the level of estimated oil reserves at the Pierce Field, we believe that it is reasonably likely that the production profile of the Pierce Field will extend beyond 2010 (subject to certain factors, including the price of oil and overall production rates) and that theHaewene Brim may operate under extensions of its existing service agreement until that time. The Pierce Field also contains substantial gas reserves, which could also be exported from theHaewene Brim through a tie-back to a neighboring fixed platform. Because the service agreement with Enterprise Oil stipulates that the production of gas may commence after the start of commercial oil production, and because theHaewene Brim's topsides and the existing subsea systems are designed for gas export, we believe that it is reasonably likely that significant gas production will commence in the future if economically viable. We also believe that new drilling activities in fields owned by Enterprise Oil surrounding the vessel could further extend the deployment of the vessel through the use of tie-backs to neighboring fields, including the Blane Field.

Munin

In January 2002, we also acquired theMunin from Aurelia Holding N.V. TheMunin has been operating on the Lufeng Field in the South China Sea since January 1998 pursuant to a service agreement with Statoil (Orient) Inc. ("SOI"), the field operator and a wholly-owned subsidiary of Statoil. While the minimum contract period under the existing service agreement has expired, SOI has extended the life of the service agreement until February 2004 pursuant to an extension option. The Lufeng Field is a relatively marginal field and is not expected to produce oil at economically viable levels beyond February 2004. As a result, we expect to redeploy theMunin at that time following appropriate modifications. We believe that there may be several options for the redeployment of theMunin in the South China Sea, the Gulf of Mexico, the North Sea and offshore Australia.

SPM Business

Our SPM business earns revenues from the design, development, project management and delivery of SPM systems under our SPM delivery contracts. We have developed a number of different types of SPM systems for oil companies and contractors around the world, resulting in the delivery of 3 SPM systems since 1999 and more than 50 SPM systems since our founding. Because SPM systems are integral to the operation of FPSOs in harsh environments, and because they form an important link in the oil production chain, we believe that it is important to preserve our core SPM capabilities for use in connection with future FPSO projects. In 2000, 2001, 2002 and the first quarter of 2003, our SPM business generated 8.7%, 9.7%, 16.6% and 9.5% of our revenues, respectively, (0.8)%, (11.7)%, (34.9)% and (41.6%) of our net income, respectively, and 0.2%, (6.9)%, (13.1)% and (14.4)% of our EBITDA, respectively.

STRENGTHS

We believe that we have the following strengths:

- •

- Our FPSOs provide essential infrastructure to the fields on which they operate, facilitating extended production lives for the FPSOs. We believe that this infrastructural capacity links our FPSOs to the lives of the fields, providing our FPSO business with long-term earnings stability. This earnings stability is further strengthened by the economic incentive for field operators to

10

11

STRATEGY

The primary elements of our strategy are to:

- •

- Maintain our earnings stability by focusing on our FPSO business. We will continue to focus on maintaining high operating standards so as to ensure profit maximization from our existing service agreements by achieving high production uptimes. We will also continue to work in partnership with our field operators by aligning our production assets with their reservoir strategies.

- •

- Maximize our return on FPSO service agreements. Our strategy is to develop FPSOs with long design lives and to operate those vessels pursuant to medium- or long-term service agreements with oil companies and on fields that maximize the potential for high day rates, extensions of contract periods and tie-backs to neighboring fields. In seeking new service agreements for our FPSOs, we aim to balance these criteria in order to optimize our asset value.

- •

- Continue to develop our SPM business and capture synergies with our FPSO development activity. We will continue to develop SPM systems for delivery to our customers, utilizing our proprietary designs where appropriate. We will do this with a view to increase profits, maintain our market share and continue to take advantage of the synergies with our FPSO development activities for which SPM turret design is an integral component.

- •

- Selectively develop or acquire new FPSOs under service agreements over the medium-term. In due course, and after we have entered into a new service agreement for theMunin, we intend to continue to selectively add to our FPSO fleet through the development or acquisition of additional vessels. We will do so on the basis of securing medium- to long-term service agreements with oil companies.

- •

- Continue to outsource fabrication of FPSOs that we operate and SPM systems that we sell. We are not involved in the fabrication of the hulls, topsides or any other equipment related to the construction or modification of FPSOs. By concentrating our operations on design, engineering, project management and marketing, we believe we are able to preserve the flexibility of our organization and reduce our vulnerability to the cyclicality of the oil industry.

- •

- Preserve our strong engineering culture. We believe that our strong engineering capabilities have enabled us to compete effectively in the FPSO and SPM markets. Given the trend in the offshore oil industry of expanding production in deepwater environments and other areas that require the use of high specification FPSOs, we aim to continue to promote the strong engineering culture within our organization.

THE ISSUER

Bluewater Finance Limited was established as an exempted company with limited liability under the laws of the Cayman Islands on June 8, 2001 to act as a financing company in connection with the issuance of the notes. Bluewater Finance Limited is the indirect, wholly-owned finance subsidiary of Aurelia Energy N.V. and is managed and controlled by Bluewater Holding B.V. from the Netherlands. The Jacaranda Trust, of which Mr. Hugo Heerema and certain members of his immediate family are beneficiaries, is the beneficial owner of 100.0% of the outstanding share capital of Bluewater Finance Limited. See "Principal Shareholder". Other than issuing notes, conducting exchange offers for notes and loaning the gross proceeds from the issuance of notes to Bluewater Holding B.V., Bluewater Finance Limited does not engage in any business. The principal executive offices of Bluewater Finance Limited are located at Marsstraat 33, 2132 HR Hoofddorp, the Netherlands. The telephone number is (31) 23 568 2800.

12

THE GUARANTORS

The guarantors are: Aurelia Energy N.V., Bleo Holm Standby Purchaser N.V., Bluewater (Bleo Holm) N.V., Bluewater Brasil Ltda., Bluewater Energy N.V., Bluewater Energy Services B.V., Bluewater Equipment Leasing Ltd., Bluewater Floating Production B.V., Bluewater (Floating Production) Ltd., Bluewater (Glas Dowr) N.V., Bluewater (Haewene Brim) N.V., Bluewater Holding B.V., Bluewater International B.V., Bluewater (Malta) Ltd., Bluewater (Munin) N.V., Bluewater (New Hull) N.V., Bluewater (Norway) ANS, Bluewater Offshore Production Systems Ltd., Bluewater Offshore Production Systems Nigeria Ltd., Bluewater Offshore Production Systems N.V., Bluewater Offshore Production Systems (U.S.A.), Inc., Bluewater Operations (UK) Ltd., Bluewater Services (UK) Ltd., Bluewater (UK) Ltd., Bluewater Terminal Systems N.V., Lufeng Development Company ANS and Pierce Production Company Ltd.

The mailing address for Aurelia Energy N.V., Bleo Holm Standby Purchaser N.V., Bluewater (Bleo Holm) N.V., Bluewater Energy N.V., Bluewater (Glas Dowr) N.V., Bluewater (Haewene Brim) N.V., Bluewater (Munin) N.V., Bluewater (New Hull) N.V., Bluewater Offshore Production Systems N.V. and Bluewater Terminal Systems N.V. is Landhuis Joonchi, Kaya Richard J. Beaujon z/n Curaçao, the Netherlands Antilles. The telephone number is (599) 9736 6277.

The mailing address for Bluewater Brasil Ltda. is Rua de Gloria 290, 2nd Floor, Rio de Janeiro, Brazil. The telephone number is (55) 21 2210 3233.

The mailing address for Bluewater Energy Services B.V., Bluewater Floating Production B.V., Bluewater Holding B.V. and Bluewater International B.V. is Marsstraat 33, 2132 HR Hoofddorp, the Netherlands. The telephone number is (31) 23 568 2800.

The mailing address for Bluewater Equipment Leasing Ltd., Bluewater (Malta) Ltd. and Bluewater Offshore Production Systems Ltd. is Paramount Building, Eucharistic Congress Road, PO Box 14, Mosta MST 01, Malta. The telephone number is (356) 21 438 170.

The mailing address for Bluewater (Floating Production) Ltd., Bluewater Operations (UK) Ltd., Bluewater Services (UK) Ltd., and Bluewater (UK) Ltd. is Noskab House, Badentoy Crescent, Portlethen, Aberdeen AB12 4NH, Scotland. The telephone number is (44) 122 440 3300.

The mailing address for Pierce Production Company Ltd. is St. Magnus House, 22 Guilt Street, Aberdeen AB11 6NJ, Scotland. The telephone number is (44) 122 428 8307.

The mailing address for Bluewater Offshore Production Systems Nigeria Ltd. is 864A Bishop Aboyade Cole Street, Victoria Island, Lagos, Nigeria. The telephone number is (234) 1 775 0640.

The mailing address for Bluewater Offshore Production Systems (U.S.A.), Inc. is 8554 Katy Freeway, Suite 327, Houston, TX 77024. The telephone number is (1) 713 722 8131.

The mailing address for Bluewater (Norway) ANS and Lufeng Development Company ANS is c/o Advokatfirmaet Schjødt AS, Dronning Mauds Gate 11, 0250/0301 Oslo, Norway. The telephone number is (47) 2201 8800.

For additional information concerning these companies, see "Aurelia Energy N.V. and Its Subsidiaries".

13

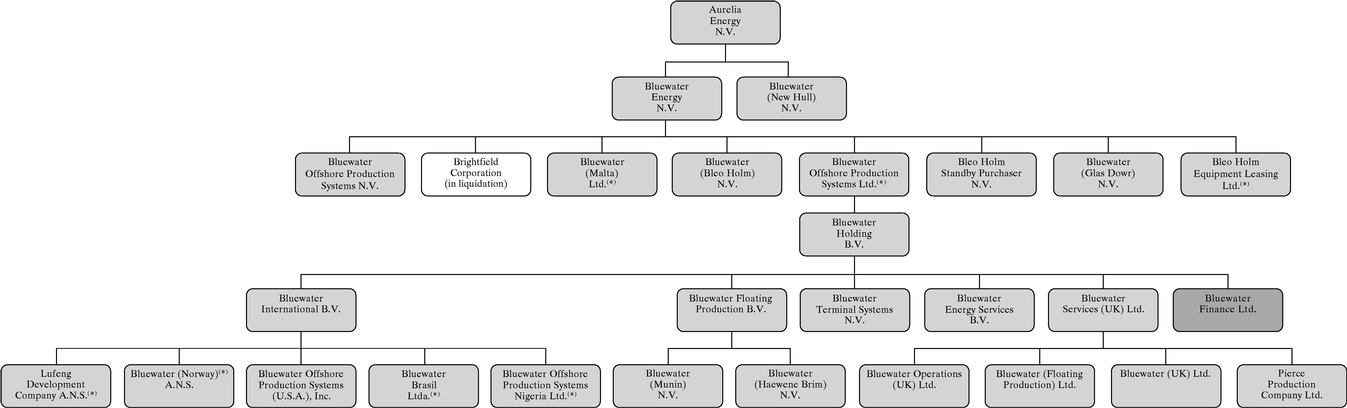

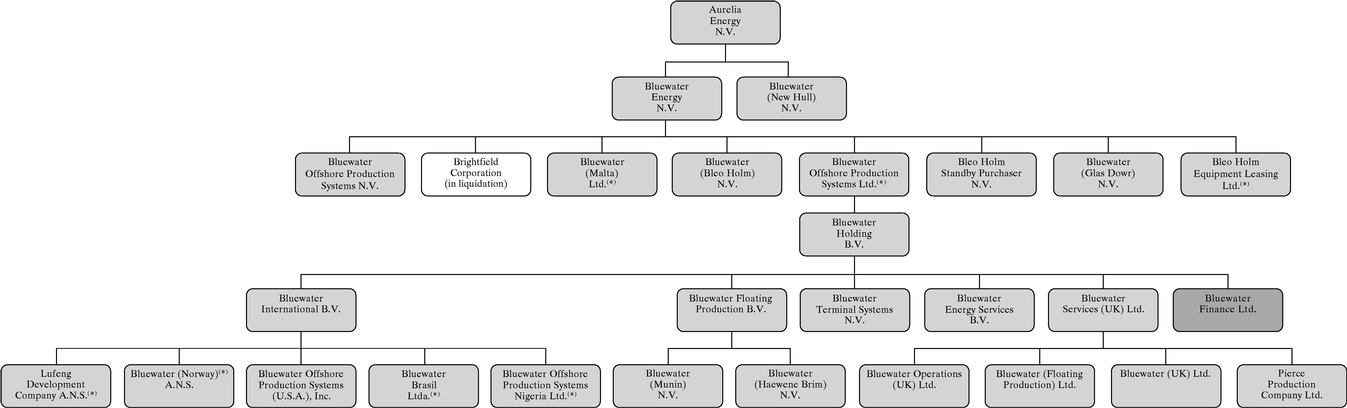

ORGANIZATIONAL STRUCTURE

The following diagram illustrates our current organizational structure. Ownership of each entity is 100% unless otherwise indicated. Bluewater Finance Limited is the issuer of the notes. Except for Brightfield Corporation (which is in liquidation and has no material assets, liabilities or operations), each other member of the group will provide, on a joint and several basis, a full and unconditional senior subordinated guarantee of the notes.

Key:

(*) |

Bluewater Holding B.V. holds one share. |

|

| | Issuer of the notes. |

|

| | Guarantor of the notes. |

|

| | Subsidiary in liquidation with no material assets, liabilities or operations. |

14

THE EXCHANGE OFFER

On April 30, 2003, we issued and sold the unregistered notes outside the United States in reliance on Regulation S under the Securities Act and to certain qualified institutional buyers within the United States in reliance on Rule 144A under the Securities Act. In connection therewith, we entered into a registration rights agreement with the initial purchasers in the private offering in which we agreed to file with the Commission a registration statement within 90 days following the issuance of the unregistered notes, to use our reasonable best efforts to have the registration statement declared effective within 180 following the issuance of the unregistered notes and to use our reasonable best efforts to complete the exchange offer within 40 days from the date on which the registration statement is declared effective. You are entitled to exchange in the exchange offer your unregistered notes for new notes with substantially identical terms.

We summarize the terms of the exchange offer below. You should read the discussion under the heading "The Exchange Offer" beginning on page 106 for further information regarding the exchange offer and resale of the new notes. You should read the discussion under the headings "—Terms of the New Notes" beginning on page 18 and "Description of the Notes" beginning on page 117 for further information regarding the new notes.

| The Exchange Offer | | We are offering to exchange up to U.S.$75.0 million aggregate principal amount of new notes for up to U.S.$75.0 million aggregate principal amount of unregistered notes. Unregistered notes may be exchanged only in integral multiples of U.S.$1,000. |

Expiration Date |

|

The exchange offer will expire at 5:00 p.m., New York City time, on [•], 2003, or such later date and time to which we extend it. |

Withdrawal of Tenders |

|

You may withdraw your tender of unregistered notes prior to the expiration date, unless previously accepted for exchange. We will return to you, without charge, promptly after the expiration or termination of the exchange offer any unregistered notes that you tendered but that were not accepted for exchange. |

Conditions to the Exchange Offer |

|

We will not be required to accept unregistered notes for exchange if the exchange offer would be unlawful or would violate any interpretation of the staff of the Commission. The exchange offer is not conditioned upon any minimum aggregate principal amount of unregistered notes being tendered. Please read the section "The Exchange Offer—Conditions to the Exchange Offer" beginning on page 109 for more information regarding the conditions to the exchange offer. |

Procedures for Tendering Outstanding Notes |

|

If your unregistered notes are held through The Depository Trust Company ("DTC") and you wish to participate in the exchange offer, you may do so through the automated tender offer program of DTC. If you tender under this program, you will agree to be bound by the letter of transmittal that we are providing with this prospectus as though you had signed the letter of transmittal. By signing |

| | | |

15

|

|

or agreeing to be bound by the letter of transmittal, you will represent to us that, among other things: |

|

|

• any new notes you receive will be acquired in the ordinary course of your business; |

|

|

• you have no arrangement or understanding with any person to participate in a distribution of the new notes; |

|

|

• if you are not a broker-dealer or are a broker-dealer but will not receive new notes for your own account in exchange for unregistered notes, you are not engaged in and do not intend to engage in a distribution of the new notes; |

|

|

• if you are a broker-dealer that will receive new notes for your own account in exchange for unregistered notes that were acquired by you as a result of market-making or other trading activities, that you will deliver a prospectus, as required by law, in connection with any resale of such new notes; and |

|

|

• you are not our "affiliate", as defined in Rule 405 of the Securities Act, nor a broker-dealer tendering unregistered notes acquired directly from us for your own account. |

Special Procedures for Beneficial Owners |

|

If you own a beneficial interest in unregistered notes that are registered in the name of a broker, dealer, commercial bank, trust company or other nominee, and you wish to tender unregistered notes in the exchange offer, you should contact the registered holder promptly and instruct the registered holder to tender on your behalf. |

Guaranteed Delivery Procedures |

|

If you wish to tender your unregistered notes and cannot comply, prior to the expiration date, with the applicable procedures under the automated tender program of DTC, you must tender your unregistered notes according to the guaranteed delivery procedures described in "The Exchange Offer—Guaranteed Delivery Procedures" beginning on page 113. |

Certain U.S. Federal Income Tax Considerations |

|

The exchange of unregistered notes for new notes in the exchange offer will not be a taxable event for U.S. federal income tax purposes. Please read "Certain U.S. Federal Income Tax Consequences of the Exchange Offer" beginning on page 169. |

| | | |

16

Use of Proceeds |

|

We will not receive any cash proceeds from the issuance of new notes. |

The Exchange Agent |

|

We have appointed The Bank of New York as exchange agent for the exchange offer. You should direct questions and requests for assistance, requests for additional copies of this prospectus or of the letter of transmittal and requests for the notice of guaranteed delivery to the exchange agent addressed as follows: |

|

|

For Delivery by Mail, Overnight Delivery or Delivery By Hand: |

|

|

The Bank of New York

101 Barclay Street 7E

New York, New York 10286

Attn: Carolle Montreuil |

|

|

For Facsimile Transmission

(for eligible institutions only): |

|

|

(1) 212 298 1915 |

|

|

To Confirm Receipt: |

|

|

(1) 212 815 5920 |

17

TERMS OF THE NEW NOTES

Issuer |

|

Bluewater Finance Limited. |

Notes |

|

U.S.$75.0 million aggregate principal amount of 101/4% Senior Notes due 2012. |

Guarantors |

|

Aurelia Energy N.V. and each of its direct and indirect subsidiaries other than Bluewater Finance Limited and Brightfield Corporation (a subsidiary in liquidation with no material assets, liabilities or operations). |

Guarantees |

|

The guarantors will fully and unconditionally guarantee, on a joint and several basis, the payment of all interest, principal and other amounts, if any, under the new notes and the indenture. |

Maturity Date |

|

February 15, 2012. |

Interest |

|

101/4% per annum, payable semi-annually in arrears on each February 15 and August 15, beginning, with respect to the new notes, on August 15, 2003. Interest on the new notes will accrue from the most recent interest payment date. |

Ranking |

|

The new notes will be general unsecured obligations of Bluewater Finance Limited and will rank equally in right of payment with all future unsecured and unsubordinated obligations of Bluewater Finance Limited. |

|

|

The guarantees of the new notes will be unsecured senior subordinated obligations of each guarantor, will be subordinated in right of payment to certain senior indebtedness of such guarantor and will be effectively subordinated to existing and future secured obligations of such guarantor. The guarantees of the new notes will rank equally in right of payment with all existing and future trade payables and senior subordinated obligations of each guarantor. On an adjusted basis giving effect to the issuance of the unregistered notes and the use of proceeds therefrom, as of March 31, 2003, the guarantors on a consolidated basis had U.S.$611.4 million of outstanding indebtedness (including secured indebtedness) that would have ranked senior to the guarantees of the new notes. |

Change of Control |

|

If we experience a Change of Control (as defined in "Description of the Notes—Certain Definitions"), each holder will have the right to require Bluewater Finance Limited to repurchase its new notes at 101% of their principal amount plus accrued and unpaid interest, if any, and any other amounts due. |

Optional Redemption |

|

Other than out of the proceeds of certain public equity offerings prior to February 15, 2005, or for certain tax reasons discussed below, Bluewater Finance Limited may not redeem the notes prior to February 15, 2007. On or after February 15, 2007, Bluewater Finance Limited may redeem all or a portion of the notes at the prices set forth under "Description of the Notes—Redemption". |

| | | |

18

Redemption for Certain Changes in Tax Laws |

|

The notes may be redeemed at the option of Bluewater Finance Limited in whole, but not in part, at any time at a price equal to the principal amount thereof, together with accrued and unpaid interest, if any, and other amounts due to the date of redemption, if Bluewater Finance Limited has or will become obligated to pay certain additional amounts as a result of any change in, or amendment to, the laws (or any regulations or rulings promulgated thereunder) of any "relevant taxing jurisdiction", or any change in the application or official interpretation of such laws, regulations or rulings, which change or amendment becomes effective on or after the date on which we first issued our notes. See "Description of the Notes—Additional Amounts" and "Description of the Notes—Redemption—Redemption for Taxation Reasons". |

Certain Covenants |

|

The indenture contains certain covenants that, among other things, limit our ability to: |

|

|

• incur additional indebtedness; |

|

|

• make certain payments, including dividends or other distributions, with respect to our share capital and the share capital of our subsidiaries; |

|

|

• make certain investments; |

|

|

• prepay subordinated debt; |

|

|

• create certain liens; |

|

|

• make certain sale and leaseback transactions; |

|

|

• engage in certain transactions with affiliates; |

|

|

• issue or sell the share capital of certain subsidiaries; |

|

|

• engage in certain asset sales; |

|

|

• consolidate, merge or transfer all or substantially all our assets; and |

|

|

• enter into other lines of business. |

|

|

In addition, other than with respect to maintaining its corporate existence and fulfilling its obligation under the notes, the indenture prohibits Bluewater Finance Limited from engaging in any business activity other than entering into the intercompany loan with Bluewater Holding B.V. These covenants are subject to a number of important limitations and exceptions. See "Description of the Notes". |

Registration Rights |

|

If we fail to complete the exchange offer as required by the registration rights agreement, we will be obligated to pay additional interest to holders of unregistered notes. Please read "Registration Rights Agreement" beginning on page 165 for more information regarding your rights as a holder of unregistered notes. |

| | | |

19

Listing |

|

Application has been made to list the new notes on the Luxembourg Stock Exchange. |

Governing Law |

|

New York. |

Trustee and Principal Paying Agent |

|

The Bank of New York. |

Luxembourg Paying Agent |

|

The Bank of New York (Luxembourg) S.A. |

Risk Factors |

|

See "Risk Factors" beginning on page 23 for a discussion of certain factors to be considered in connection with an investment in the new notes. |

For further information regarding the new notes, see "Description of the Notes".

20

SUMMARY FINANCIAL INFORMATION

The summary financial information as of and for the three years ended December 31, 2000, 2001 and 2002 in this section has been derived from our audited consolidated financial statements prepared in accordance with U.S. GAAP and audited by Deloitte & Touche Accountants. The data as of March 31, 2003 and for the three months ended March 31, 2002 and 2003 has been derived from our unaudited interim condensed consolidated financial statements prepared in accordance with U.S. GAAP and included elsewhere in this prospectus and include all adjustments (consisting only of normal recurring adjustments) which we consider necessary for a fair presentation of the financial information included therein. You should read the following summary financial data in conjunction with the information contained in "Management's Discussion and Analysis of Financial Condition and Results of Operations" and the audited consolidated financial statements and unaudited interim condensed consolidated financial statements and the related notes thereto included elsewhere in this prospectus.

| | As at and for the year ended December 31,

| | As at and for the three months ended March 31,

| |

|---|

| | 2000

| | 2001

| | 2002

| | 2002

| | 2003

| |

|---|

| | (in U.S.$ thousands, except ratios)

| |

|---|

| Income Statement Data: | | | | | | | | | | | |

| Revenues | | 200,197 | | 197,317 | | 262,799 | | 56,062 | | 56,100 | |

| | |

| |

| |

| |

| |

| |

| Operations expenses | | 67,847 | | 83,795 | | 145,309 | | 27,164 | | 29,414 | |

| Selling, general and administrative expenses | | 7,834 | | 9,467 | | 9,736 | | 2,542 | | 2,431 | |

| Other operating income | | (3,847 | ) | (3,375 | ) | (4,046 | ) | (397 | ) | (993 | ) |

| Depreciation of tangible fixed assets and amortization of intangible fixed assets | | 64,058 | | 58,335 | | 54,038 | | 13,803 | | 12,952 | |

| | |

| |

| |

| |

| |

| |

| Total operating expenses | | 135,892 | | 148,222 | | 205,037 | | 43,112 | | 43,804 | |

| | |

| |

| |

| |

| |

| |

| Operating income | | 64,305 | | 49,095 | | 57,762 | | 12,950 | | 12,296 | |

| | |

| |

| |

| |

| |

| |

| Net income | | 59,839 | | 63,880 | | 37,378 | | 9,299 | | 7,802 | |

| | |

| |

| |

| |

| |

| |

| Balance Sheet Data: | | | | | | | | | | | |

| Cash and cash equivalents | | 25,295 | | 15,713 | | 23,024 | | 15,881 | | 15,407 | |

| Fixed assets(1) | | 741,050 | | 977,700 | | 1,018,785 | | 974,668 | | 1,039,729 | |

| Total assets | | 910,022 | | 1,189,187 | | 1,279,820 | | 1,185,325 | | 1,301,694 | |

| Total debt(2) | | 347,754 | | 546,577 | | 581,103 | | 540,364 | | 609,431 | |

| Subordinated Marenco loan | | 116,350 | | 117,616 | | 125,849 | | 119,646 | | 128,022 | |

| Shareholder's equity (net assets) | | 366,951 | | 424,704 | | 460,191 | | 434,633 | | 468,750 | |

Cash Flow Data: |

|

|

|

|

|

|

|

|

|

|

|

| Net cash provided by (used in) operating activities | | 103,835 | | 73,719 | | 84,420 | | 31,138 | | (3,752 | ) |

| Net cash (used in) investing activities | | (11,884 | ) | (285,102 | ) | (95,105 | ) | (10,771 | ) | (33,895 | ) |

| Net cash provided by (used in) financing activities | | (87,047 | ) | 203,275 | | 20,018 | | (20,081 | ) | 29,984 | |

| | | | | | | | | | | | |

21

Other Financial Data and Ratios: |

|

|

|

|

|

|

|

|

|

|

|

| EBITDA(3) | | | | | | | | | | | |

| | FPSO business | | 128,061 | | 114,842 | | 126,470 | | 31,777 | | 28,882 | |

| | SPM business | | 302 | | (7,412 | ) | (14,670 | ) | (5,024 | ) | (3,634 | ) |

| | |

| |

| |

| |

| |

| |

| | Total | | 128,363 | | 107,430 | | 111,800 | | 26,753 | | 25,248 | |

| | |

| |

| |

| |

| |

| |

| Capital expenditures, net(4) | | 11,911 | | 13,647 | | 95,105 | | 10,774 | | 34,147 | |

| Cash interest paid(5) | | 28,232 | | 20,738 | | 41,829 | | 8,201 | | 10,575 | |

| Ratio of EBITDA to cash interest paid | | 4.55 | x | 5.18 | x | 2.67 | x | 3.26 | x | 2.39 | x |

| Ratio of net debt to EBITDA(6) | | 2.54 | x | 4.94 | x | 4.99 | x | — | | — | |

| Ratio of earnings to fixed charges(7) | | 2.10 | x | 2.15 | x | 1.25 | x | 1.35 | x | 0.94 | x |

Notes:

- (1)

- "Fixed assets" includes tangible fixed assets.

- (2)

- "Total debt" includes all indebtedness other than the subordinated Marenco loan.

- (3)

- "EBITDA" is defined as operating income (loss) plus depreciation and amortization. EBITDA is presented as additional information because we believe that it is a useful measure for certain investors to determine our operating cash flow and historical ability to meet debt service and capital expenditure requirements. We also believe that it provides a useful measure of the level of profitability we achieve with our asset base. EBITDA is not a measure of financial performance under U.S. GAAP and should not be considered as an alternative to cash flow from operating activities, a measure of liquidity or an alternative to net income as indicators of our operating performance or any other measures of performance derived in accordance with U.S. GAAP. The following table presents a reconciliation of our EBITDA to net income and net cash provided by operating activities for the periods indicated.

| | For the year ended December 31,

| | For the

three months ended

March 31,

| |

|---|

| | 2000

| | 2001

| | 2002

| | 2002

| | 2003

| |

|---|

| | (in U.S.$ thousands)

| |

|---|

| EBITDA | | 128,363 | | 107,430 | | 111,800 | | 26,753 | | 25,248 | |

| Depreciation of tangible fixed assets and amortization of intangible assets | | (64,058 | ) | (58,335 | ) | (54,038 | ) | 13,803 | | 12,952 | |

| Financial income and expense | | (26,376 | ) | (17,829 | ) | (43,999 | ) | (9,832 | ) | (11,692 | ) |

| Income taxes | | 21,910 | | 32,614 | | 23,615 | | (6,181 | ) | (7,198 | ) |

| | |

| |

| |

| |

| |

| |

| Net income | | 59,839 | | 63,880 | | 37,378 | | 9,299 | | 7,802 | |

| Adjustments to reconcile net income to cash provided | | 44,114 | | 28,495 | | 41,087 | | 9,767 | | 8,366 | |

| Changes in operating assets and liabilities, net of effect of acquisitions | | (118 | ) | (18,656 | ) | 5,955 | | 12,072 | | (19,920 | ) |

| | |

| |

| |

| |

| |

| |

| Net cash provided by (used in) operating activities | | 103,835 | | 73,719 | | 84,420 | | 31,138 | | (3,752 | ) |

| | |

| |

| |

| |

| |

| |

- (4)

- "Capital expenditures, net" represents additions to fixed assets less disposals of fixed assets and excludes our acquisitions of theHaewene Brim, theMunin and their related operating companies.

- (5)

- "Cash interest paid" is defined as interest expense, plus capitalized interest, less accrued interest on the subordinated and unsubordinated Marenco loans and less amortization of debt arrangement fees.

- (6)

- "Net debt" is defined as total debt less cash and cash equivalents.

- (7)

- The term "earnings" is the amount of pre-tax income from continuing operations before adjustment for minority interests in consolidated subsidiaries or income or loss from equity investees, plus fixed charges, plus amortization of capitalized interest, plus distributed income to equity investees, plus the share of pre-tax losses of equity investees for which charges arising from guarantees are included in fixed charges, less interest capitalized, less preference security dividend requirements of consolidated subsidiaries, less the minority interest in pre-tax income of subsidiaries that have not incurred fixed charges. The term "fixed charges" means the sum of the following: (a) interest expensed or capitalized, (b) amortized premiums, discounts and capitalized expenses related to indebtedness, (c) an estimate of the interest within rental expense, and (d) preference security dividend requirements of consolidated subsidiaries. The term "preference security dividend" is the amount of pre-tax earnings that is required to pay the dividends on outstanding preference securities, computed as the amount of the dividend divided by one minus the effective income tax rate applicable to continuing operations.

22

RISK FACTORS

In addition to the other information contained in prospectus, you should carefully consider the following risk factors before investing in the new notes. If any of the possible events described below occur, our business, financial condition or results of operations could be materially and adversely affected. If that happens, we may not be able to satisfy our obligations under the new notes and the guarantees thereof, and you could lose all or part of your investment.

Risks Related to Our Business

We depend on capital expenditures by the offshore oil industry and reductions in such expenditures have had and may continue to have a material adverse impact on our business.

Demand for our products and services depends to a large extent on the level of offshore exploration and production activity by oil companies and the level of capital expenditures by the oil industry that is devoted to offshore operations. These factors in turn depend in part on prevailing oil prices, expectations about future prices, the cost of exploring for, producing and delivering oil, the discovery rate of new oil reserves in offshore areas, domestic and international political, military, regulatory and economic conditions, technological advances and the ability of oil companies to generate funds for capital expenditures. Prices for oil historically have been extremely volatile and have reacted to changes in the supply of and demand for oil (including changes resulting from the ability of the Organization of Petroleum Exporting Countries to establish and maintain production quotas) and domestic and worldwide economic conditions and political instability in oil producing countries. In particular, uncertainties with respect to international political, military and economic conditions, expectations with respect to oil prices that have followed the terrorist attacks in New York City and Washington, D.C. on September 11, 2001 and international developments concerning Iraq may exacerbate the risk of change with respect to the foregoing.

Although our service agreements are designed to minimize the effect of fluctuations in the price of oil and levels of exploration and production activities by oil companies, changes in the price of oil and decreases in the level of exploration and production could affect the decisions of oil companies to extend our existing contract periods or to enter into new service agreements, particularly in marginal fields and fields that are near the end of their productive lives. Changes in oil prices that impact levels of production could also affect the amount of tariff or bonus payments we earn under our service agreements. Furthermore, our SPM business is particularly susceptible to fluctuations in the price of oil and levels of exploration and production activity by oil companies, because SPM systems are typically sold rather than leased. Historically, oil companies have reduced their capital expenditures on SPM systems during periods of depressed oil prices and decreased levels of exploration and production activities. For instance, our SPM business generated revenues of U.S.$193.8 million and EBITDA of U.S.$26.2 million in 1998 when exploration and production activities reached comparatively high levels, but generated revenues of only U.S.$17.4 million and EBITDA of only U.S.$0.3 million in 2000 when exploration and production activities reached relatively low levels.

No assurance can be given that current levels of exploration and production activity and capital expenditures on offshore oil operations will continue or that demand for our products and services will continue at the same level relative to the level of those activities. We anticipate that prices for oil will continue to be volatile and affect the demand for and pricing of our products and services. While we believe that having a flexible and scalable workforce is an important factor in managing business cycles, a material decline in oil prices or offshore exploration and production activities could materially adversely affect our ability to extend existing contract periods, enter into new service agreements or secure new SPM development contracts.

23

We generate the majority of our revenues from a limited number of FPSOs and customers and the loss of revenues from any of these vessels or customers could have a material adverse effect on our financial condition and business prospects.

We generate the majority of our revenues from the contract payments that we receive for the provision of FPSOs and related services under our existing service agreements. Our FPSO fleet currently consists of five high specification FPSOs: theBleo Holm, theUisge Gorm, theGlas Dowr, theHaewene Brim and theMunin. While each of the FPSOs has been contracted to an oil company, we currently receive contract payments for only theBleo Holm, theUisge Gorm, theHaewene Brim and theMunin. Further, while we expect to begin receiving contract payments for the operation of theGlas Dowr in June 2003, we expect to stop receiving contract payments for theMunin under its existing service agreement in February 2004. The loss of revenues from any of these FPSOs or customers, whether as a result of damage or destruction of the vessel, our inability to meet production uptime requirements, the depletion of any of the oil fields on which they operate, the termination of their service agreements for any reason after the expiration of the minimum contract period, the inability or unwillingness of customers to make payments under any of their service agreements, or our inability to obtain new service agreements (particularly with respect to theMunin) could have a material adverse effect on our financial condition and results of operation.

Our projects may be subject to delays and cost overruns.