Exhibit 99.1

A Leading Independent Streaming Entertainment Company 24th Annual Needham Growth Conference January 10, 2021 Erick Opeka Chief Strategy Officer and President, Cinedigm Networks Investor Presentation

Forward looking statements Investors are cautioned that certain statements contained in this document, as well as some statements in press releases and some oral statements of Cinedigm officials during presentations about Cinedigm, along with Cinedigm's filings with the Securities and Exchange Commission, including Cinedigm's current reports on Form 8 - K, quarterly reports on Form 10 - Q and annual report on Form 10 - K, are "forward - looking'' statements within the meaning of the Private Securities Litigation Reform Act of 1995 (the "Act‘’) . Forward - looking statements include statements that are predictive in nature, which depend upon or refer to future events or conditions, which include words such as "expects," "anticipates,'' "intends,'' "plans,'' "could," "might," "believes,'' "seeks," "estimates'' or similar expressions . In addition, any statements concerning future financial performance (including future revenues, earnings or growth rates), ongoing business strategies or prospects, and possible future actions, which may be provided by Cinedigm's management, are also forward - looking statements as defined by the Act . Forward - looking statements are based on current expectations and projections about future events and are subject to various risks, uncertainties and assumptions about Cinedigm, its technology, economic and market factors and the industries in which Cinedigm does business, among other things . These statements are not guarantees of future performance and Cinedigm undertakes no specific obligation or intention to update these statements after the date of this release . 2

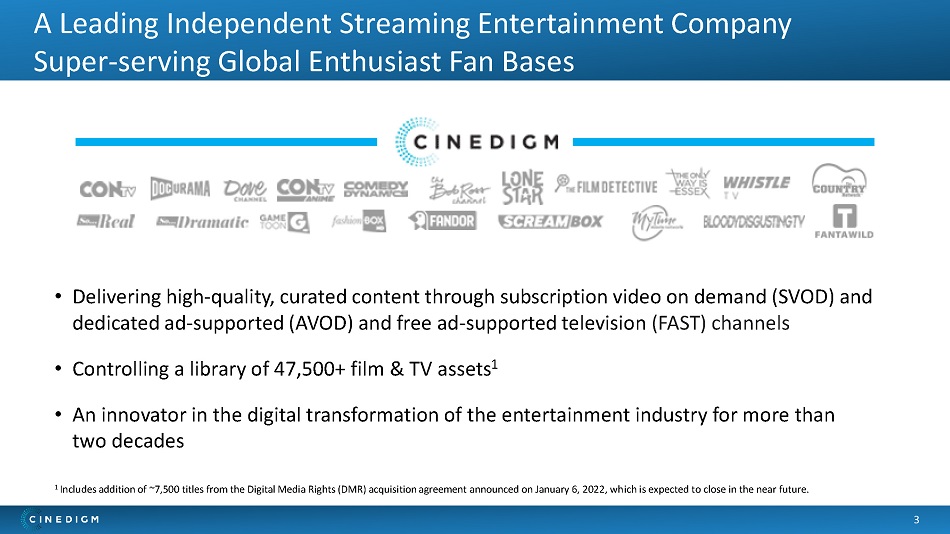

A Leading Independent Streaming E ntertainment C ompany Super - serving Global E nthusiast F an B ases 3 • Delivering high - quality, curated content through subscription video on demand (SVOD) and dedicated ad - supported (AVOD) and free ad - supported television (FAST) channels • Controlling a library of 47,500+ film & TV assets 1 • An innovator in the digital transformation of the entertainment industry for more than two decades 1 Includes addition of ~7,500 titles from the Digital Media Rights (DMR) acquisition agreement announced on January 6, 2022, wh ich is expected to close in the near future.

Poised for considerable growth driven by technological innovation 4 Innovative Fan - Centric Expected revenue growth High - Growth Streaming & digital business World - class proprietary streaming platform Focusing on Enthusiast audience

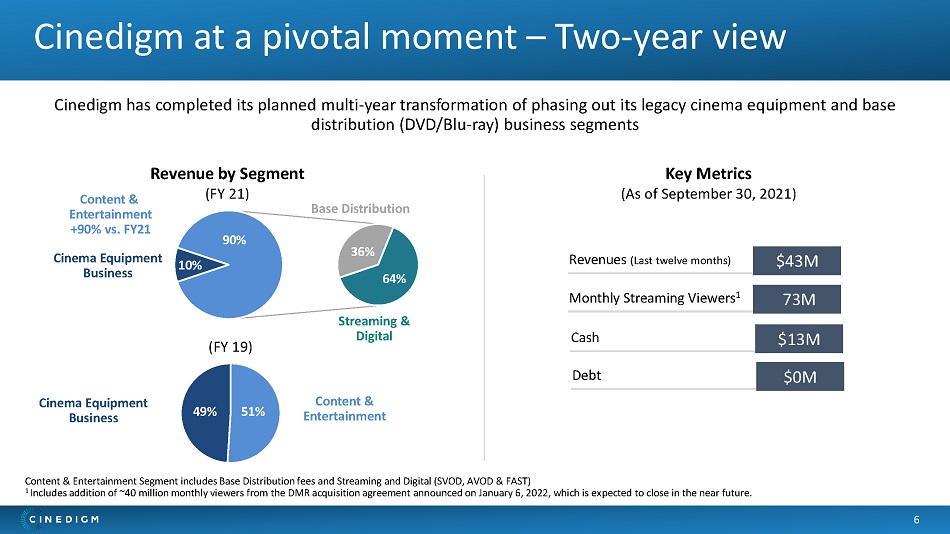

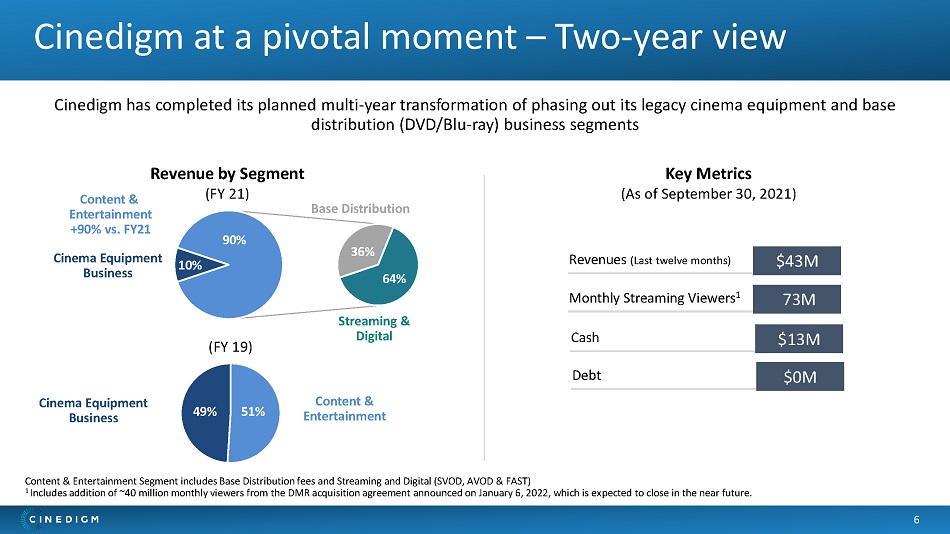

Cinedigm at a pivotal moment – Two - year view 5 Content & Entertainment Segment includes Base Distribution fees and Streaming and Digital (SVOD, AVOD & FAST) 1 Includes addition of ~40 million monthly viewers from the DMR acquisition agreement announced on January 6, 2022, which is ex pec ted to close in the near future. Revenues (Last twelve months) Monthly Streaming Viewers 1 Key Metrics (As of September 30, 2021) $43M 73M Cash $13M Debt $0M Revenue by Segment ( FY 21) Cinema Equipment Business Content & Entertainment +90% vs. FY21 10% 90% 36% 64% (FY 19) Cinema Equipment Business Content & Entertainment 49% 51% Streaming & Digital Base Distribution Cinedigm has completed its planned multi - year transformation of phasing out its legacy cinema equipment and base distribution (DVD/Blu - ray) business segments

6 Investment highlights Diverse portfolio focused on large Total Addressable Market ( TAM) Leveraging enthusiast c ontent portfolio Well positioned in a changing landscape Delivering sustained growth Executing key initiatives Driving growth through technological innovation A rapidly growing streaming business that is:

Diverse portfolio of fan - centric content 7 • Cinedigm’s streaming advantage broadens consumer reach and drives revenue • Narrowcast Streaming Channels that generate recurring revenue streams

• Indie film ( Fandor ) • Horror ( Screambox and Bloody Disgusting) • Family entertainment (Dove Channel) • Iconic entertainers (The Bob Ross Channel and The Elvis Presley Channel) 8 Focused on enthusiast audiences globally Targeting sought - after verticals with loyal fan - base

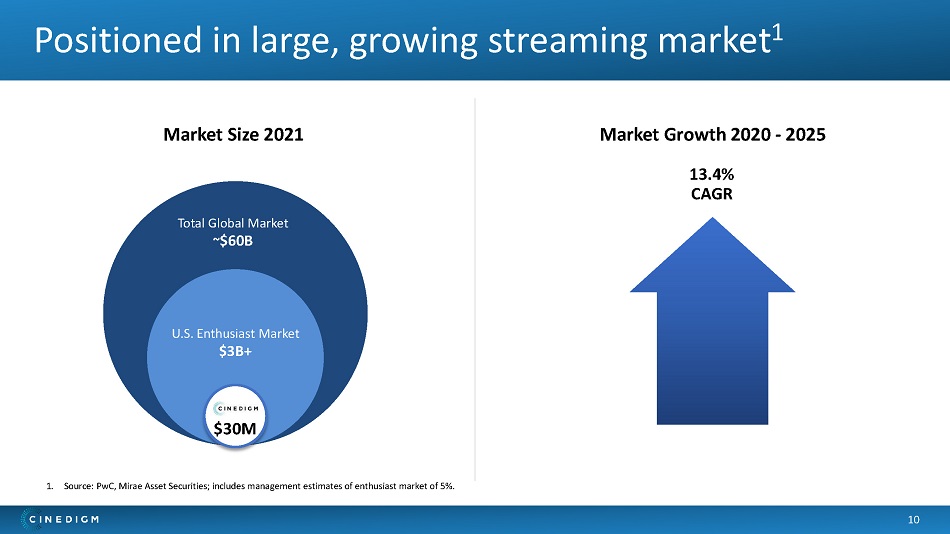

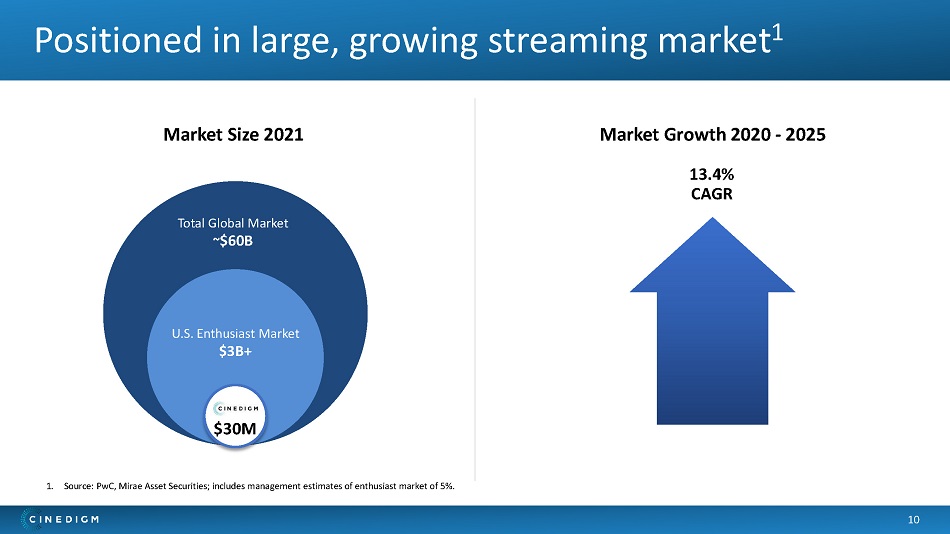

Positioned in large, growing streaming market 1 9 Market Size 2021 $30M U.S. Enthusiast Market $3B+ Total Global Market ~ $60B Market Growth 2020 - 2025 13.4% CAGR 1. Source: PwC, Mirae Asset Securities; includes management estimates of enthusiast market of 5%.

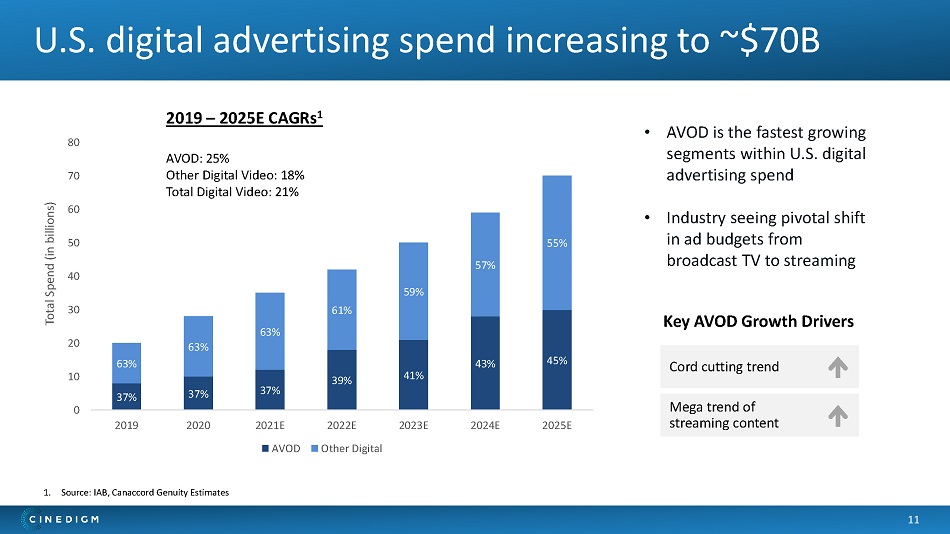

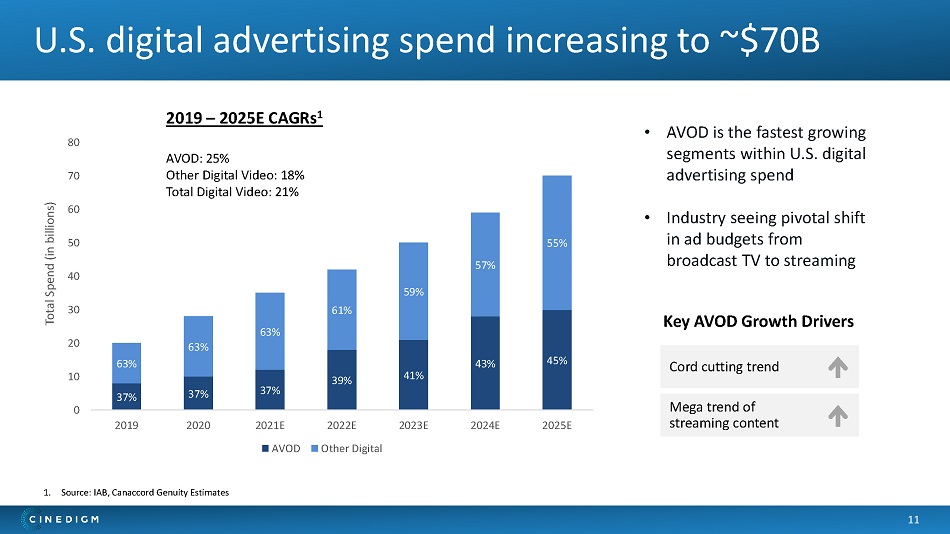

U.S. digital advertising spend increasing to ~$70B 10 • AVOD is the fastest growing segments within U.S. digital advertising spend • Industry seeing pivotal shift in ad budgets from broadcast TV to streaming 37% 37% 37% 39% 41% 43% 45% 63% 63% 63% 61% 59% 57% 55% 0 10 20 30 40 50 60 70 80 2019 2020 2021E 2022E 2023E 2024E 2025E Total Spend (in billions) AVOD Other Digital 2019 – 2025E CAGRs 1 AVOD: 25% Other Digital Video: 18% Total Digital Video: 21% Key AVOD Growth Drivers Cord cutting trend Mega trend of streaming content 1. Source: IAB, Canaccord Genuity Estimates

11 Investment highlights Diverse portfolio focused on large TAM Leveraging Enthusiast Content Portfolio Well positioned in a changing landscape Delivering sustained growth Executing key initiatives Driving growth through technological innovation A rapidly growing streaming business that is:

Capitalizing on evolving consumer habits 12 Continued “cord - cutting” resulting in rise in SVOD & AVOD migration Preference towards third - party channels and content platforms Rapid rise in consumption of free ad - supported content Increasing demand for underserved content Trend in youth (kids) media consumption across multiple devices and brands Global Consumer habits continue to trend away from traditional media channels

Unique competitive position 13 Multi - channel, enthusiast portfolio is complementary to general entertainment subscription services • Not directly competing with big general entertainment subscription services such as Disney+ and Netflix . O ffers complementary channels, serving - super enthusiast viewers on every key streaming device and platform • Portfolio approach allows for adjusting to market response efficiently and reduces risk versus one mega channel • Multi - year track record as a digital technology innovator with demonstrated capability as a force in launching and managing streaming channels and distributing digital content to the entire streaming ecosystem • Strong track record and developed relationships with long term partners with every major media and technology player involved in streaming

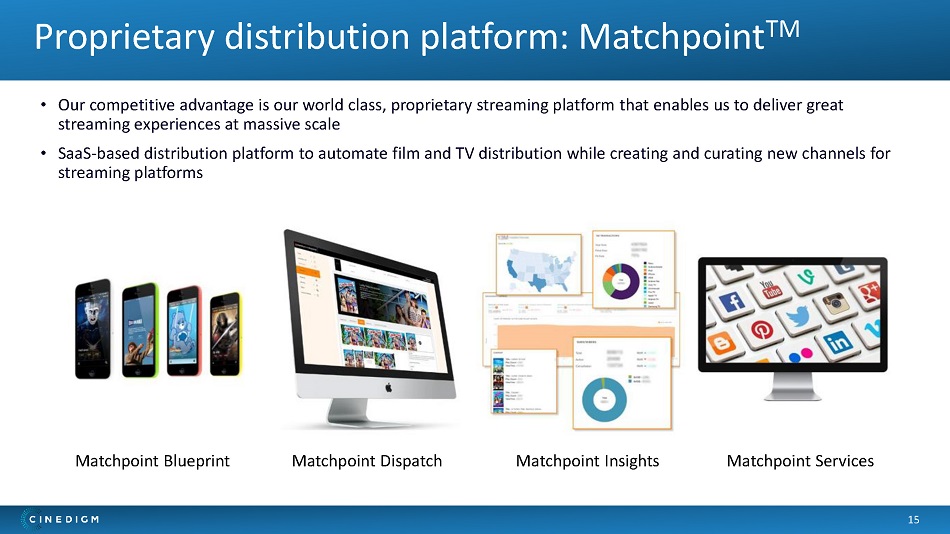

Proprietary distribution platform: Matchpoint TM • Our competitive advantage is our world class, proprietary streaming platform that enables us to deliver great streaming experiences at massive scale • SaaS - based distribution platform to automate film and TV distribution while creating and curating new channels for streaming platforms 14 Matchpoint Blueprint Matchpoint Dispatch Matchpoint Insights Matchpoint Services

15 Investment highlights Diverse portfolio focused on large TAM Leveraging Enthusiast Content Portfolio Well positioned in a changing landscape Delivering sustained growth Executing key initiatives Driving growth through technological innovation A rapidly growing streaming business that is:

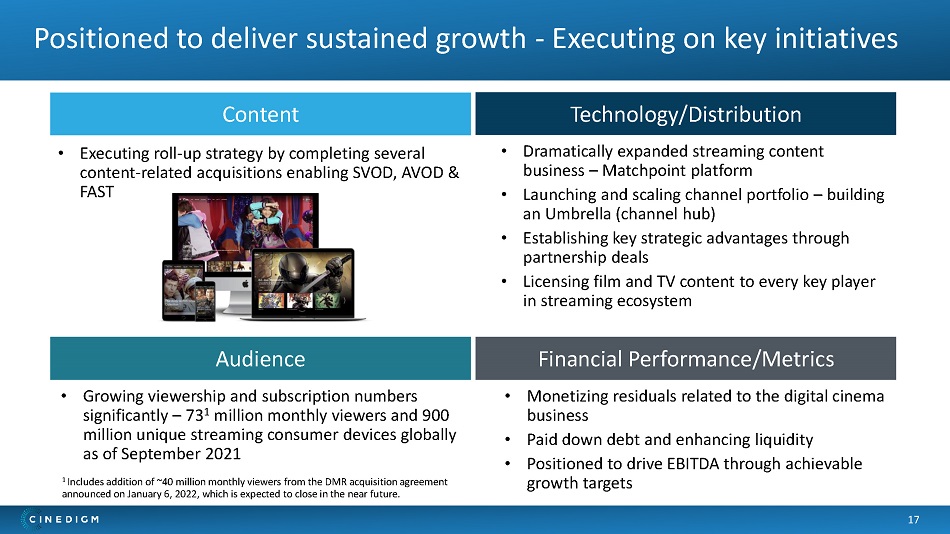

Positioned to deliver sustained growth - Executing on key initiatives 16 • Growing viewership and subscription numbers significantly – 73 1 million monthly viewers and 900 million unique streaming consumer devices globally as of September 2021 • Executing roll - up strategy by completing several content - related acquisitions enabling SVOD, AVOD & FAST • Dramatically expanded streaming content business – Matchpoint platform • Launching and scaling channel portfolio – building an Umbrella (channel hub) • Establishing key strategic advantages through partnership deals • Licensing film and TV content to every key player in streaming ecosystem • Monetizing residuals related to the digital cinema business • Paid down debt and enhancing liquidity • Positioned to drive EBITDA through achievable growth targets Content Technology/Distribution Audience Financial Performance/Metrics 1 Includes addition of ~40 million monthly viewers from the DMR acquisition agreement announced on January 6, 2022, which is expected to close in the near future.

Pursuing accretive M&A strategy - Building competitive advantage 17 Completed & integrated five accretive acquisitions from December 2020 to September 2021 with ongoing active M&A pipeline • Focused on acquiring higher quality content and streaming channels • Active pipeline with key industry players • Opportunity for new technology and other revenue channels: NFTs, ecommerce, podcasts and merchandise x x x x • Proprietary tech platform ( Matchpoint ) allows for on - boarding several acquisitions concurrently • Executing on roll - up strategy by completing several content - related acquisitions enabling monetization • Setting the stage for significant annual revenue growth Films Around The World x • Acquisition of FoundationTV allows for expansion into South Asian markets

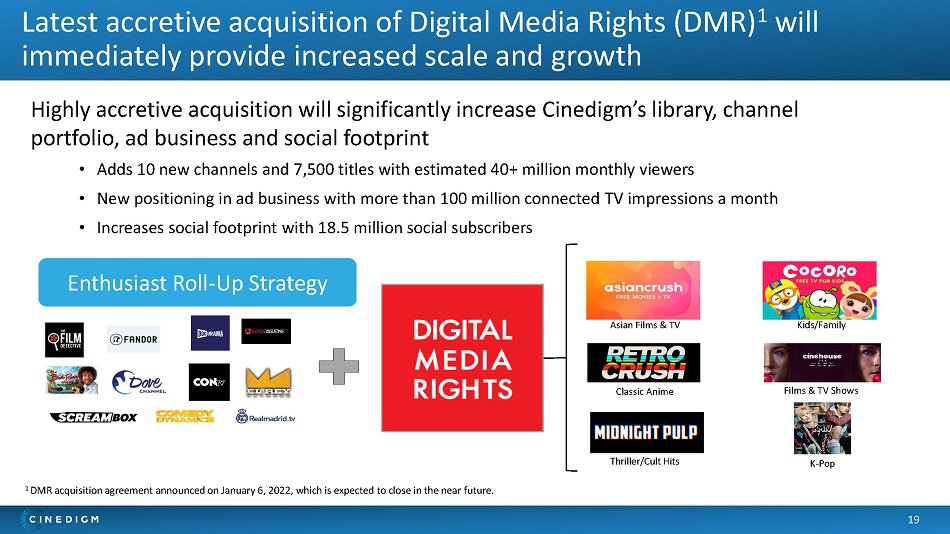

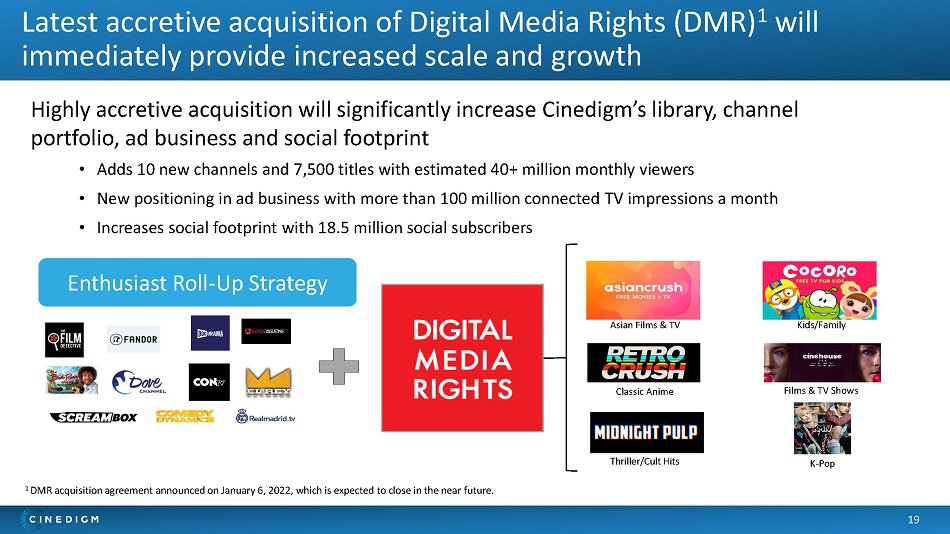

18 • Adds 10 new channels and 7,500 titles with estimated 40+ million monthly viewers • New positioning in ad business with more than 100 million connected TV impressions a month • Increases social footprint with 18.5 million social subscribers Enthusiast Roll - Up Strategy Asian Films & TV Classic Anime Thriller/Cult Hits K - Pop Films & TV Shows Kids/Family Highly accretive acquisition will significantly increase Cinedigm’s library, channel portfolio, ad business and social footprint Latest accretive acquisition of Digital Media Rights (DMR) 1 will immediately provide increased scale and growth 1 DMR acquisition agreement announced on January 6, 2022, which is expected to close in the near future.

Dramatically expanding streaming content business Building an Umbrella/Channel Hub to drive engagement 19 • Launching and scaling SVOD, AVOD, and FAST channel portfolio – building an Umbrella (channel hub)

Establishing key strategic advantages through partnership deals 20 • Connected streaming TV including Samsung, LG, Roku and Vizio • Large OEMs, cable companies and technology platforms including Sinclair Broadcast Group, Samsung, Comcast Xfinity, Roku, Amazon, Tubi, Vewd and Vizio • Licensed film and TV content to key players in streaming ecosystem with Amazon, Apple, Netflix, YouTube TV and Google Establishing key strategic advantages by structuring deals with:

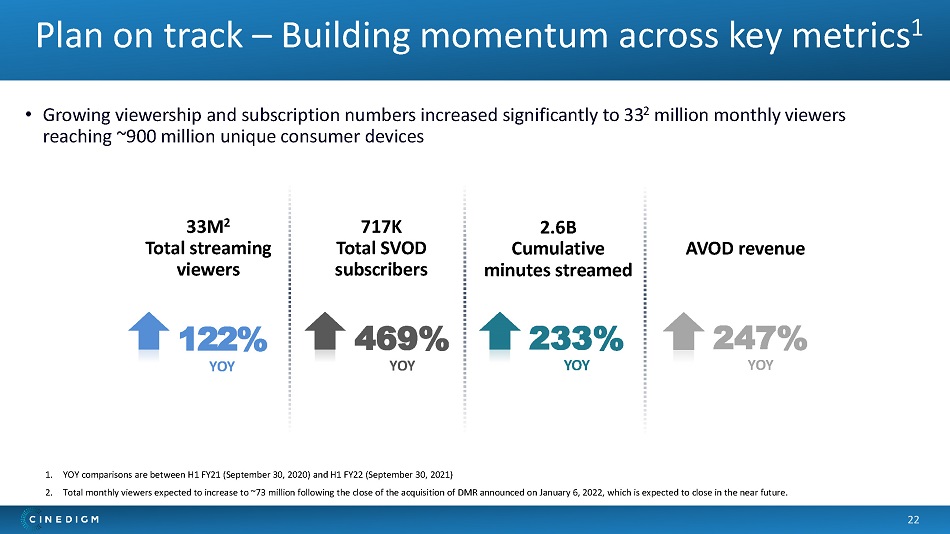

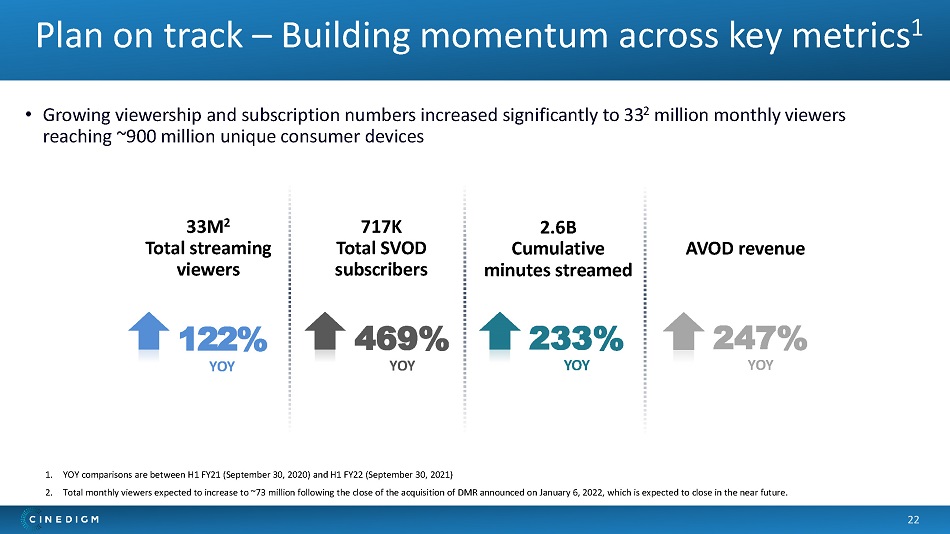

Plan on track – Building momentum across key metrics 1 21 1. YOY comparisons are between H1 FY21 (September 30, 2020) and H1 FY22 (September 30, 2021) 2. Total monthly viewers expected to increase to ~73 million following the close of the acquisition of DMR announced on January 6, 2022, which is expected to close in the near future. • Growing viewership and subscription numbers increased significantly to 33 2 million monthly viewers reaching ~ 900 million unique consumer devices 122% YOY 469% YOY 33M 2 Total streaming viewers 717K T otal SVOD subscribers 233% YOY AVOD revenue 247% YOY 2.6B Cumulative minutes streamed

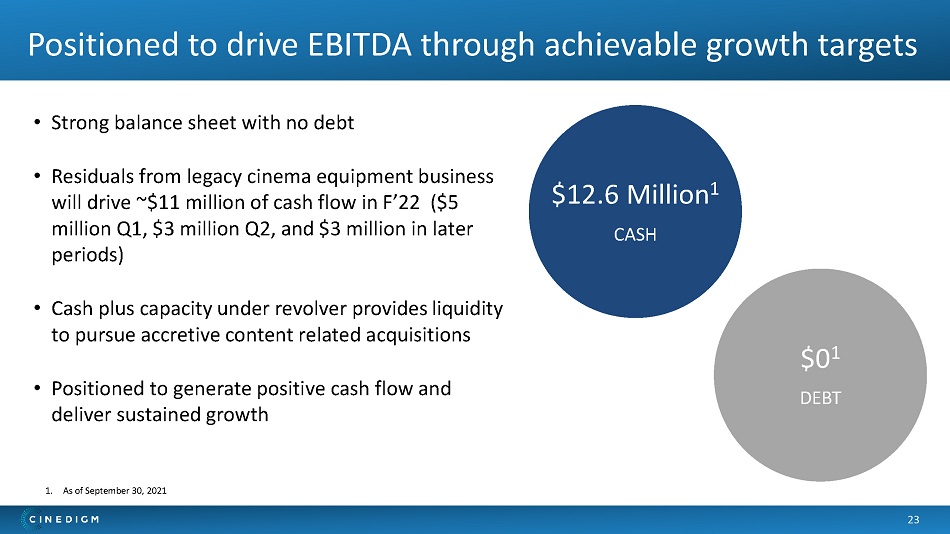

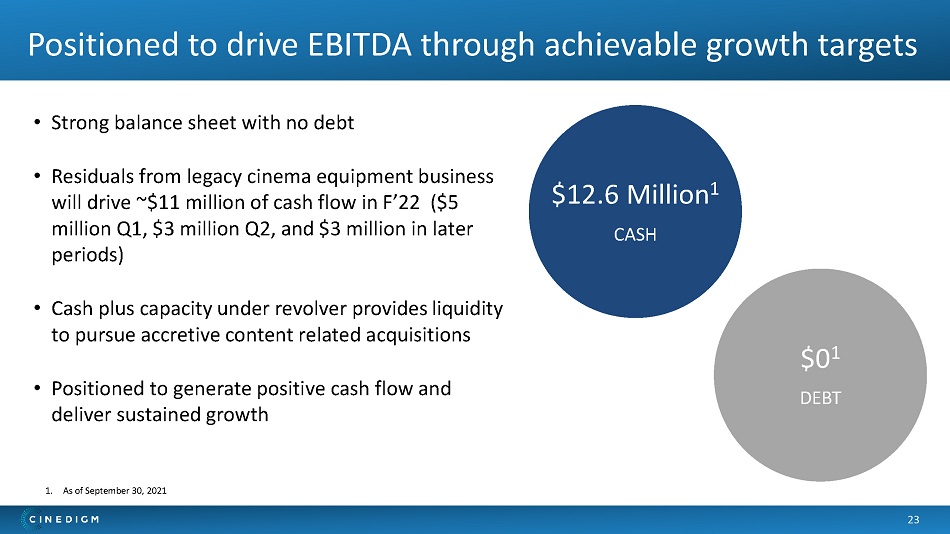

Positioned to drive EBITDA through achievable growth targets 22 • Strong balance sheet with no debt • Residuals from legacy cinema equipment business will drive ~$11 million of cash flow in F’22 ($5 million Q1, $3 million Q2, and $3 million in later periods) • Cash plus capacity under revolver provides liquidity to pursue accretive content related acquisitions • Positioned to generate positive cash flow and deliver sustained growth CASH $12.6 Million 1 DEBT $0 1 1. As of September 30 , 2021

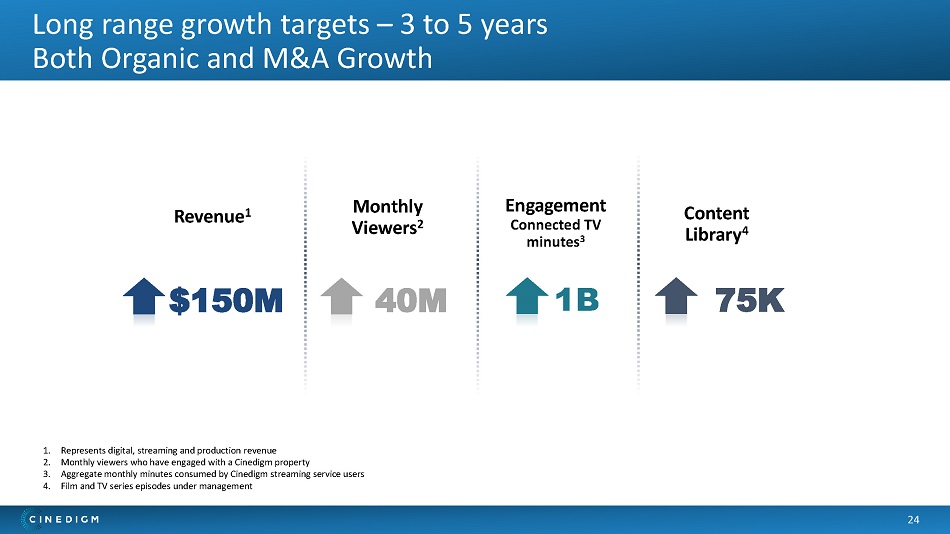

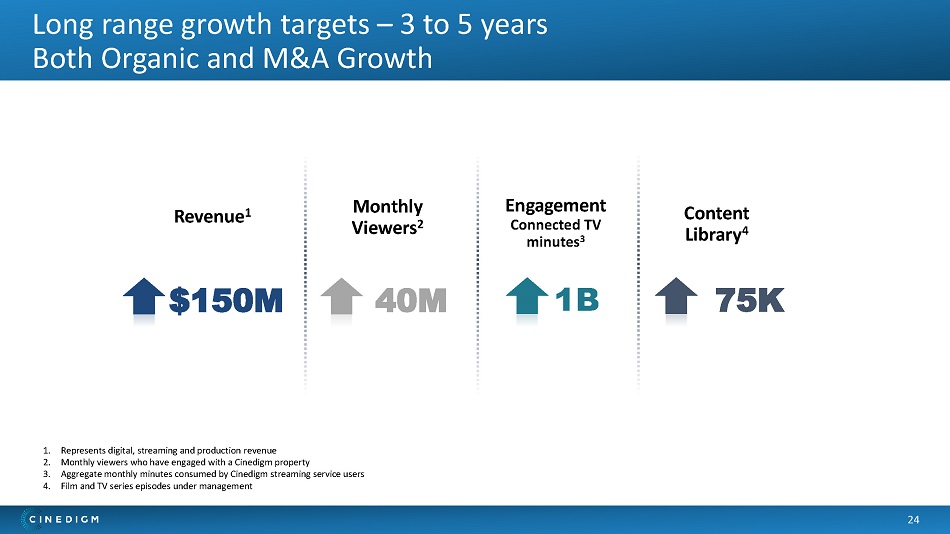

Long range growth targets – 3 to 5 years Both Organic and M&A Growth 23 $150M 40M Revenue 1 Monthly Viewers 2 Engagement Connected TV minutes 3 1. Represents digital, streaming and production revenue 2. Monthly viewers who have engaged with a Cinedigm property 3. Aggregate monthly minutes consumed by Cinedigm streaming service users 4. F ilm and TV series episodes under management 1B 75K Content Library 4

24 A Leading Independent Streaming E ntertainment C ompany Super - serving Global E nthusiast F an B ases Diverse portfolio focused on large TAM Leveraging Enthusiast Content Portfolio Well positioned in a changing landscape Delivering sustained growth Executing key initiatives Driving growth through technological innovation A rapidly growing streaming business that is: IN SUMMARY

A Leading Independent Streaming Entertainment Company Appendix

Experienced management team 26 With deep industry knowledge and relationships Chris McGurk Chairman & CEO ▪ Founder & CEO, Overture Films ▪ CEO, Anchor Bay Entertainment ▪ Vice Chair & COO, MGM ▪ President & COO, Universal ▪ President, Disney Motion Pictures Erick Opeka Chief Strategy Officer & President, Cinedigm Networks ▪ SVP & Co - Founder, New Video Digital ▪ NCO, US Army ▪ Vice Chair, Entertainment Merchant’s Assn. ▪ Member, Producers Guild & TV Academy Yolanda Macias Chief Content Officer ▪ EVP, Vivendi Entertainment ▪ VP, DIRECTV Spanish language and international services ▪ Honoree & Board Member, C5LA 25+ years of experience 25+ years of experience 25+ years of experience Tony Huidor Chief Technology & Product Officer ▪ VP, Universal Music Group ▪ Director, Walt Disney Internet Group 25+ years of experience John Canning Chief Financial Officer ▪ CFO, Firefly Systems Inc. ▪ Group VP of Finance for Discovery Channel ▪ Finance leadership roles at Clear Channel Outdoor and The Walt Disney Company 25+ years of experience Gary Loffredo COO, General Counsel & President/Cinema Equipment Business, President Cinedigm ▪ Founding executive of Cinedigm ▪ VP, General Counsel, Cablevison Cinemas 20+ years of experience