Exhibit 99.2

MANAGEMENT INFORMATION CIRCULAR

SOLICITATION OF PROXIES

This management information circular (the “Circular”) is furnished in connection with the solicitation by management (the “Management”) of Novadaq Technologies Inc. (the “Corporation” or “Novadaq”) of proxies to be used at the annual meeting of holders of common shares (“Shareholders”) of the Corporation (the “Meeting”) to be held at the time and place and for the purposes set out in the Notice of Annual Meeting of Shareholders accompanying this Circular (the “Notice of Meeting”). Unless otherwise stated, all information contained in this Circular is presented as at April 18, 2013 and, unless otherwise indicated, all references to $ in this Circular are to Canadian dollars.

The form of proxy accompanying this Circular is solicited by, or on behalf of, Management of the Corporation. It is expected that the solicitation will be primarily by mail, but proxies may be solicited personally, by telephone or by other forms of electronic communication, by directors, officers and employees of the Corporation, none of whom have been specifically engaged for this purpose. The costs of solicitation will be borne by the Corporation.

APPOINTMENT AND REVOCATION OF PROXIES

A Shareholder has the right to appoint a person (who need not be a Shareholder) other than the persons designated in the enclosed form of proxy to attend and to vote and act for, and on behalf of, such Shareholder at the Meeting, and any adjournment or postponement thereof. Such right may be exercised by striking out the names of persons designated in the enclosed form of proxy and by inserting in the blank space provided for that purpose the name of the desired person or by completing another proper form of proxy.

A Shareholder who wishes to be represented by proxy at the Meeting, or any adjournment or postponement thereof, must deposit the accompanying form of proxy, duly executed, not later than 48 hours (excluding Saturdays, Sundays and statutory holidays) preceding the time of the Meeting, or any adjournment or postponement thereof, with Computershare Investor Services Inc. at the address set forth in the accompanying Notice of Meeting.

The common shares represented by the proxy which is hereby solicited will be voted or withheld from voting in accordance with the instructions of the Shareholder on any ballot that may be called for, and, where the Shareholder whose proxy is solicited specifies a choice with respect to any matter to be acted upon, the common shares shall be voted by the appointee accordingly.Where a Shareholder fails to specify a choice with respect to a matter referred to in the Notice of Meeting, the common shares represented by such proxy will be voted for or in favor of such matter or voted against or withheld if so indicated on the form of proxy.

The enclosed proxy confers discretionary authority upon the proxy nominee with respect to any amendments or variations to the matters referred to in the Notice of Meeting and any other matters which may properly come before the Meeting, or any adjournment or postponement thereof. At the time of printing of this Circular, Management of the Corporation knows of no such amendments, variations or other matters to come before the Meeting, other than the matters referred to in the Notice of Meeting. However, if any other matters which at present are not known to Management of the Corporation should properly come before the Meeting, proxies will be voted on such matters in accordance with the best judgment of the named proxy holders.

A Shareholder executing a proxy has the power to revoke it as to any matter on which a vote shall not already have been cast:

| | (a) | by depositing an instrument in writing executed by such Shareholder or by such Shareholder’s attorney authorized in writing, or, if the Shareholder is a corporation, by an officer or attorney thereof duly authorized indicating the capacity under which such officer or attorney is signing: |

| | (i) | at the registered office of the Corporation, Novadaq Technologies Inc., 2585 Skymark Avenue, Suite 306, Mississauga, Ontario, L4W 4L5, Attention: CFO, at any time up to and including the last business day preceding the day of the Meeting, or any adjournments or postponements thereof; or |

| | (ii) | with the Chairman of the Meeting on the day of the Meeting, or any adjournment or postponement thereof; or |

| | (b) | in any other manner permitted by law. |

ADVICE TO BENEFICIAL SHAREHOLDERS

Only registered Shareholders of the Corporation or the persons they appoint as their proxies are permitted to vote at the Meeting. However, in many cases, common shares beneficially owned by a person (a “Non-Registered Holder”) are registered either:

| | (i) | in the name of an intermediary (an “Intermediary”) that the Non-Registered Holder deals with in respect of the common shares of the Corporation (Intermediaries include, among others, banks, trust companies, securities dealers or brokers and trustees or administrators of self-administered RRSPs, RRIFs, TFSAs, RESPs and similar plans); or |

| | (ii) | in the name of a depository (a “Depository”, such as CDS Clearing and Depository Services Inc.) of which the Intermediary is a participant. |

In accordance with the requirements ofNational Instrument 54-101 Communication with Beneficial Owners of Securities of a Reporting Issuer, the Corporation will have distributed copies of the Notice of Meeting, this Circular and the form of proxy (collectively, the “Meeting Materials”) to the Depositories and Intermediaries for onward distribution to Non-Registered Holders. Intermediaries are required to forward the Meeting Materials to Non-Registered Holders, unless a Non-Registered Holder has waived the right to receive them. Intermediaries often use service companies to forward the Meeting Materials to Non-Registered Holders. Generally, Non-Registered Holders who have not waived the right to receive Meeting Materials will either:

| | (i) | be given a form of proxy which has already been signed by the Intermediary (typically by a facsimile, stamped signature), which is restricted as to the number of common shares beneficially owned by the Non-Registered Holder but which is otherwise not completed. In this |

- 3 -

| | case, the Non-Registered Holder who wishes to submit a proxy should properly complete the form of proxy and submit it to the Corporation, c/o Computershare Investor Services Inc. at the address set forth in the Notice of Meeting; or |

| | (ii) | more typically, be given a voting instruction form which is not signed by the Intermediary and which must be properly completed and signed by the Non-Registered Holder and returned to the Intermediary in accordance with the instructions of the Intermediary or Depository. |

The purpose of these procedures is to permit Non-Registered Holders to direct the voting of the common shares of the Corporation they beneficially own.Should a Non-Registered Holder wish to attend and vote at the Meeting, or any adjournment or postponement thereof, in person (or to have another person appointed as proxy holder to attend and vote on behalf of the Non-Registered Holder), the Non-Registered Holder should follow the procedure in the request for voting instructions provided by or on behalf of the Intermediary and request a form of legal proxy which will grant the Non-Registered Holders the right to attend the Meeting, and any adjournment or postponement thereof, and vote in person. Non-Registered Holders should carefully follow the instructions of their Intermediary or Depository, including those regarding when and where the proxy or voting information form is to be delivered. A Non-Registered Holder may revoke a proxy or voting information form which has been given to an Intermediary or Depository by written notice to the Intermediary or Depository or by submitting a proxy or voting instruction form bearing a later date. In order to ensure that an Intermediary or Depository acts upon a revocation of a proxy or voting information form, the written notice should be received by the Intermediary or Depository well in advance of the Meeting.

Notice to United States Shareholders

The solicitation of proxies by the Corporation is not subject to the requirements of Section 14(a) of theUnited States Securities Exchange Act of 1934, as amended (the “US Exchange Act”), by virtue of an exemption applicable to proxy solicitations by “foreign private issuers” as defined in Rule 3b-4 under theUS Exchange Act. Accordingly, this Circular has been prepared in accordance with the applicable disclosure requirements in Canada. Shareholders in the United States should be aware that such requirements are different than those of the United States applicable to proxy statements under theUS Exchange Act.

The reporting issuer does not intend to pay for intermediaries to forward to objecting beneficial owners under NI 54-101 the proxy-related materials and Form 54-101F7 – Request for Voting Instructions Made by Intermediary, and that in the case of an objecting beneficial owner, the objecting beneficial owner will not receive the materials unless the objecting beneficial owner’s intermediary assumes the cost of delivery.

VOTING SHARES AND PRINCIPAL HOLDERS

As at the close of business on April 18, 2013 there were 43,123,071 common shares in the capital of the Corporation issued and outstanding, being the only class of shares outstanding and entitled to vote at the Meeting. Each common share entitles the holder thereof to one vote on all matters to be acted upon at the Meeting.

- 4 -

The Corporation has fixed April 18, 2013 as the record date for the purposes of determining holders of common shares entitled to receive notice of and vote at the Meeting.

In accordance with the provisions of theCanada Business Corporations Act, the Corporation has prepared a list of registered holders of common shares as at the close of business on the record date. Each holder of common shares named in the list will be entitled to vote at the Meeting the common shares shown opposite the Shareholders’ name on such list.

To the knowledge of the directors and executive officers of the Corporation, there are no persons, firms or corporations who beneficially own or exercise control or direction over, directly or indirectly, voting shares of the Corporation carrying 10% or more of the voting rights attaching to the total number of issued and outstanding common shares of the Corporation. Information as to the shareholdings has been obtained by the Corporation from SEDI filings.

MATTERS TO BE ACTED UPON BY THE SHAREHOLDERS AT THE MEETING

(AS ITEMIZED IN THE NOTICE OF MEETING)

ITEM 1: Consolidated Financial Statements

A copy of the consolidated financial statements of the Corporation for the year ended December 31, 2012 and the report of the auditors on the consolidated financial statements accompanying this Circular will be submitted to Shareholders at the Meeting. Copies of the consolidated financial statements and management discussion and analysis can also be obtained on SEDAR at www.sedar.com, by contacting the Corporation’s Corporate Secretary at 2585 Skymark Avenue, Suite 306, Mississauga, Ontario, L4W 4L5, or by telephone at 905-629-3822.

ITEM 2: Election of Directors

Six (6) nominees have been proposed by the Corporation’s board of directors (the “Board”) for election as directors of the Corporation. The six nominees are listed on page 7. All nominees are currently directors of the Corporation. It is not anticipated that any of the nominees will be unable to serve as directors, but if that should occur for any reason prior to the Meeting, or any adjournment or postponement thereof, the persons named in the enclosed form of proxy shall be entitled to vote for any other nominee(s) in their discretion.

Each director elected will hold office until the next annual meeting of Shareholders or until his or her successor is duly elected or appointed. The current members of the Audit Committee, the Compensation Committee and the Governance Committee are indicated in the table and notes thereto on pages 7 through 10.

If you complete and return the attached form of proxy, your representatives at the Meeting, or any adjournment or postponement thereof, will vote your shares FOR the election of the nominees set out herein unless you specifically direct that your vote be withheld.

ITEM 3: Appointment of Auditor

The Board and Management propose that the firm of Ernst & Young LLP, Chartered Accountants, be re-appointed as auditors of the Corporation to hold office until the next annual meeting of Shareholders, and that the Board be authorized to fix the auditors’ remuneration. Ernst & Young LLP, Chartered Accountants, were first appointed as auditors of the Corporation for the year 2002. In order to be effective, the resolution must receive the affirmative vote of a majority of the votes cast by Shareholders present in person or represented by proxy at the Meeting.

- 5 -

If you complete and return the attached form of proxy, the persons named in the enclosed proxy will vote your shares FOR the re-appointment of Ernst & Young LLP, Chartered Accountants, as auditors of the Corporation at remuneration to be fixed by the Board, unless you specifically indicate on the form that your vote be withheld.

BOARD OF DIRECTORS - NOMINEES

Majority Voting

Effective April 12, 2013, the Board adopted a majority voting policy with respect to the election of the directors of the Corporation. In an uncontested election of directors of the Corporation, each director shall be elected by the vote of a majority of the shares represented in person or by proxy at the shareholder’s meeting convened for such election of directors. If any nominee for director receives a greater number of votes “withheld” from his or her election than votes “for” such election, that director shall promptly tender his or her resignation to the chair of the Board following the meeting.

The Corporate Governance Committee shall consider any such offer of resignation and recommend to the Board whether or not to accept it. In its deliberations the Corporate Governance Committee may consider any stated reasons as to why shareholders “withheld” votes from the election of the relevant director, the length of service and the qualifications of the director, the director’s contributions to the Corporation, the effect such resignation may have on the Corporation’s ability to comply with any applicable governance rules and policies, the dynamics of the Board, and any other factors that the members of the Corporate Governance Committee considers relevant.

The Board shall act on the Corporate Governance Committee’s recommendation within 90 days following the applicable shareholders’ meeting and announce its decision through a press release, after considering the factors identified by the Corporate Governance Committee and any other factors that the members of the Board consider relevant. Subject to any applicable corporate law restrictions or requirements, if a resignation is accepted, the Board may leave the resulting vacancy unfilled until the next annual general meeting. Alternatively, it may fill the vacancy through the appointment of a new director whom the Board considers to merit the confidence of the shareholders, or it may call a special meeting of shareholders at which there would be presented a management nominee or nominees to fill the vacant position or positions.

Nominees

The table and notes below set out, in respect of each nominee to the Board, the name and municipality of residence of each person proposed to be nominated for election as a director, the period or periods during which the nominee has served as a director of the Corporation, the nominee’s principal occupation or employment during the last five years and all other positions with the Corporation and any affiliate thereof now held by the nominee, if any, and the number of common shares beneficially owned by the nominee or over which the nominee exercises control or direction (in all cases, whether directly or indirectly) as of April 18, 2013. The statement as to share ownership, control and direction is, in each instance, based upon information furnished by said nominee.

- 6 -

| | | | | | | | | | |

Name and Municipality of Residence | | Position with the Corporation | | Principal Occupation | | Director

since | | Number of Shares

beneficially

owned, controlled

or directed,

directly or

indirectly, by

Nominee(5) | |

DR. ARUN MENAWAT Oakville, Ontario, Canada | | Director, President and Chief Executive Officer | | President and Chief Executive Officer, Novadaq | | July 2003 | | | 625,709 | |

| | | | |

AARON DAVIDSON(1) (2) (3) Caledon, Ontario, Canada | | Director | | Managing Director, H.I.G. Capital Management Inc. | | July 2004 | | | 36,930 | |

| | | | |

ANTHONY GRIFFITHS(2) Toronto, Ontario, Canada | | Chairman, Director | | Corporate Director | | June 2002 | | | 61,565 | |

| | | | |

| HAROLD O. KOCH, JR.(4) Mandeville, Louisiana, United States of America | | Director | | Executive Vice President and Chief Scientific Officer, Pamlab, Inc. | | September 2003 | | | 17,488 | |

| | | | |

| WILLIAM A. MACKINNON(4) Toronto, Ontario, Canada | | Director | | Corporate Director | | May 2009 | | | — | |

| | | | |

G. STEVEN BURRILL(2) San Francisco, California, United States of America | | Director | | President, Burrill & Company | | May 2011 | | | 2,326,499 | |

| (1) | Denotes member of the Compensation Committee. |

| (2) | Denotes member of the Governance Committee. |

| (3) | Mr. Davidson is the board nominee of H.I.G. Horizons Corp., an investment vehicle of H.I.G. Ventures which divested itself of all Novadaq Common Shares as at March 15, 2013. Mr. Davidson does not directly or indirectly control or exercise any direction over these shares. |

| (4) | Denotes member of the Audit Committee. |

| (5) | Information as to shareholdings has been provided to the Corporation from SEDI filings. |

- 7 -

The following is a brief profile of the nominee directors of the Corporation:

Arun Menawat. Dr. Menawat has been the President and Chief Executive Officer of Novadaq since 2003. From 1999 to 2003, Dr. Menawat held increasing executive responsibilities including President and Chief Operating Officer of Cedara Software Corporation, a publicly traded medical imaging software company. Prior to joining Cedara, Dr. Menawat was Vice President, Operations at Tenneco Inc., a diversified business conglomerate, now separated into multiple companies. He also served as business manager and research & development manager at Hercules Incorporated, a specialty chemicals company. Dr. Menawat holds B.S. in biology from the University of District of Columbia and an M.S. and Ph.D. in Chemical (Bio) Engineering from the University of Maryland. Dr. Menawat completed a fellowship in biomedical engineering at the National Institute of Health. He also holds an Executive MBA from the J.L. Kellogg School of Management, Northwestern University.

Aaron Davidson. Mr. Davidson is a Managing Director of H.I.G. BioVentures and focuses on investment opportunities in the life sciences sector. Prior to joining H.I.G. in 2004, he was a Vice President with Ventures West with a focus on venture investing in life science companies. Mr. Davidson began his career with Eli Lilly Company, one of the largest global pharmaceutical companies. He spent a decade with Lilly in various management roles in the United States and Canada including business development, strategic planning, market research, and financial planning. Mr. Davidson currently serves on the boards of Alder Biopharmaceuticals, HyperBranch Medical Technology, Intact Vascular Inc., NeurAxon Inc., and Novadaq. He served on the board of Salmedix Inc. prior to Cephalon’s acquisition of Salmedix in June 2005 and the board of Oncogenex Pharmaceuticals prior to their public listing. Mr. Davidson earned his MBA from Harvard Business School and a Bachelor of Commerce degree from McGill University.

Anthony Griffiths. Mr. Griffiths is Chairman of the Board of Directors of the Corporation and is currently an independent business consultant and corporate director. Mr. Griffiths became the Chairman of Mitel Corporation, a telecommunications company, in 1987, and also assumed the positions of President and Chief Executive Officer in addition to that of Chairman from 1991 to 1993. Mr. Griffiths is also the Chairman of Russel Metals Inc., and a director of Vitran Corporation, Fairfax Financial Holdings Limited, and Jaguar Mining Inc.

Harold O. Koch, Jr.For the past 38 years Mr. Koch has held senior management positions in research and development, regulatory, and business development in the pharmaceutical and Class III medical device fields. Mr. Koch was the Vice President of Business Development & Scientific Affairs and later Senior Vice President at Pamlab L.L.C., a developer, licensor and marketer of pharmaceutical products since July 2002, and effective January 1, 2012, became the Executive Vice President and Chief Scientific Officer of Pamlab. Prior to joining Pamlab, Mr. Koch held senior management positions with Rorer Group, Cooper Companies, Akorn, Inc., Santen, Inc. and has consulted for various ophthalmic biotechnology companies. Mr. Koch holds 3 US patents in ophthalmology, one of which is the leading viscoelastic product in the US (Viscoat), with annual sales in excess of US$100 million. Mr. Koch holds a Bachelor of Science degree in medical microbiology from Texas A&M University and is an active member of the Licensing Executives Society.

William A. Mackinnon. Mr. Mackinnon was Chief Executive Officer of KPMG Canada from April, 1999 until his retirement in December 2008. Mr. Mackinnon joined KPMG Canada

- 8 -

in 1971, became a partner in 1977, the Toronto Managing Partner in 1988 and the Greater Toronto Managing Partner in 1992. He obtained the FCA designation from the Institute of Chartered Accountants of Ontario in 1994 and, during the period between 1999 and 2002, became a member of the Board of Directors of each of KPMG Canada, KMPG International and KMPG Americas. He is an active volunteer and currently serves as Chair of the Board of Directors and Executive Committee member of the Toronto East General Hospital and as a member of the board of The Toronto Community Foundation and Roy Thomson Hall. Mr. Mackinnon is also a director of Telus Corp., Pioneer Petroleum, Osisko Mining Corporation and the Public Service Pension Investment Board. Mr. Mackinnon holds a Bachelor of Commerce from the University of Manitoba.

G. Steven Burrill. Mr. Burrill is the Chief Executive Officer of Burrill & Company, a diversified global financial services firm focused on the life sciences industry. Prior to founding the firm in 1994, Mr. Burrill spent 28 years with Ernst & Young, directing and coordinating the firm’s services to clients in the biotechnology/life sciences/high technology/manufacturing industries worldwide. In addition to Novadaq, he currently serves on the Boards of Directors of AliveCor, Catalyst Biosciences, Depomed (NASDAQ: DEPO), NewBridge, Targacept (NASDAQ: TRGT) and XDx. Previously he served as Chairman of the Boards of BioImagene, Abunda Nutrition and Pharmasset. Mr. Burrill is a founder and currently serves as Chairman of the Board of the National Science and Technology Medals Foundation (NSTMF). Additionally, he serves as Chairman of the San Francisco Mayor’s Biotech Advisory Committee (MAYBAC). Mr. Burrill chaired the National Research Council study on linkages in biotechnology between Japan and the United States, and was also involved with the US-Japan Science and Technology Agreement Study of Technology Transfer Mechanisms between the United States and Japan. Other not-for-profit activities include serving on the Boards of Directors of the Life Science Foundation (Chairman), the World Council for Ethical Standards (Chairman), the Vilas County (Wisconsin) Economic Development Corporation (VCEDC) (Chairman), the National Health Museum (Vice Chairman), the Bay Area Science Infrastructure Consortium, BayBio (Emeritus), The Buck Institute for Research on Aging, California Healthcare Institute (Emeritus), The Exploratorium (Emeritus), Gladstone Foundation, Global Virus Network (GVN), The Kellogg Center for Biotechnology, the MIT Center for Biomedical Innovation, BIO Ventures for Global Health (BVGH), the Harvard Medical School Genetics Advisory Council and the NIH Scientific Management Review Board. He serves on the editorial boards of Scientific American, the Journal of Commercial Biotechnology and Life Science Leader, and also serves on the advisory boards of the Center for Policy on Emerging Technologies (C-PET) and BioAg Gateway, City of Madison. He is an advisor to the University of Illinois Institute for Genomic Biology, the University of Wisconsin-College of Agriculture and Life Sciences, the University of Minnesota College of Biological Sciences, University of California, Davis and Duke University, and is an adjunct professor at the University of California, San Francisco. He also serves on the Advisory Boards for the Department of Biology at San Francisco State University and the Biotechnology Master’s Program in the Department of Biology at the University of San Francisco. He serves on the BioNJ Diagnostics and Personalized Medicine Committee.

Cease Trade Orders, Bankruptcies, Penalties or Sanctions

Mr. Griffiths was a director of Brazilian Resources Inc. until June, 2004. The company was subject to a cease trade order issued by the BCSC due to the late filing of financial statements on June 10, 2003, which was revoked on July 8, 2003. The company was also subject to a cease trade order issued by the Ontario Securities Commission on June 12, 2003. All required documents were filed by the company and the cease trade order was revoked by the BCSC on July 8, 2003 and by the OSC on July 29, 2003.

- 9 -

Mr. Griffiths was a director of AbitibiBowater Inc. until June 2010. The company and certain of its U.S. and Canadian subsidiaries filed for protection in Canada under the CCAA and in the United States under Chapter 11 of the United States Bankruptcy Code in April 2009. On December 9, 2010 the company emerged from creditor protection under the CCAA in Canada and Chapter 11 in the United States.

Mr. Griffiths was formerly a director of PreMD Inc. until February 2010, and, in connection with the voluntary delisting of the company’s shares from the TSX, cease trade orders were issued in April 2009 requiring all trading in and all acquisitions of securities of the company to cease permanently due to the company’s failure to file continuous disclosure materials requires by Ontario securities law. The cease trade orders are still in effect.

Mr. Griffiths was also a director of Slater Steel Inc. until August 2004, which operated under the protection of the CCAA in an orderly wind-down in June 2003. In addition, the company and the Canadian court ordered monitor filed voluntary petitions for relief under chapter 11 of the United States Bankruptcy Code with respect to the company’s United States and Canadian subsidiaries.

Other than as noted above, no director or executive officer of the Corporation is, or within the past ten years has (i) been a director, chief executive officer or chief financial officer of a company that was subject to a cease trade order or similar order or an order that denied the company access to any exemption under securities legislation for a period of more than 30 consecutive days; or (ii) been a director of a company that, while the nominee was acting in that capacity, made a proposal under legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, trustee or receiver manager appointed to hold its assets; or (iii) was subject to a cease trade order or similar order or an order that denied the company access to any exemption under securities legislation for a period of more than 30 consecutive days that was issued after the director or executive officer ceased to be a director, chief executive officer or chief financial officer and which resulted from an event that occurred while that person was acting in that capacity.

STATEMENT ON CORPORATE GOVERNANCE PRACTICES

The statement on corporate governance practices prepared by the Governance Committee is attached hereto as Appendix “A”.

COMPENSATION DISCUSSION AND ANALYSIS

Introduction

This compensation discussion and analysis (“CD&A”) describes and explains the Corporation’s policies and practices with respect to the 2012 compensation of its named executive officers, being its Chief Executive Officer (“CEO”) and Chief Financial Officer (“CFO”) and the three most highly compensated executive officers other than the CEO and CFO (collectively with the CEO and CFO, the“NEOs”).

- 10 -

The Corporation’s executive compensation program is administered by the Compensation Committee. The Compensation Committee has, as a part of its mandate, responsibility to review the remuneration of the officers of the Corporation, including the NEOs. The Compensation Committee also evaluates the performance of the Corporation’s executive officers and reviews the design and competitiveness of the Corporation’s incentive compensation programs. The compensation of the NEOs in 2012 was consistent with the Corporation’s historical practices and in accordance with its compensation philosophy and objectives, as set forth below.

Overview of Compensation Philosophy

The Corporation’s executive compensation philosophy is to provide competitive compensation to attract and retain talented high-achievers capable of achieving the Corporation’s strategic and performance objectives. Consistent with this philosophy, the primary objectives of the Corporation’s compensation program for its NEOs are:

| • | | to attract and retain talented, high-achieving executives critical to the success of the Corporation and the creation and protection of long-term Shareholder value; |

| • | | to motivate the Corporation’s Management team to meet operating, strategic, financial and non-financial objectives; and |

| • | | to align the interests of Management and the Corporation’s Shareholders by emphasizing performance based compensation that recognizes individual and the Corporation’s performance, which help to create long-term Shareholder value. |

Recruiting and Retention

The Corporation believes that providing competitive overall compensation enables the Corporation to attract and retain qualified executives and other personnel. A competitive, fixed base salary is essential for this purpose. In addition, grants of long-term incentives, in the form of time-vested stock options, serve to further encourage the retention of the Corporation’s NEOs while incenting Management to create and protect Shareholder value.

Aligning Management and Shareholders

The Corporation’s compensation program seeks to align Management interests with Shareholder interests through both short-term and long-term incentives linking compensation to performance. The short-term incentive is an annual cash bonus which is linked to individual performance and the Corporation’s performance. Further, long-term incentives of stock option grants comprise a significant portion of overall compensation for the Corporation’s NEOs. The Compensation Committee believes this is appropriate because it creates a direct correlation between variations in the Corporation’s share price (which is based in part on the Corporation’s financial performance) and the compensation of its NEOs, thereby aligning the interests of the Corporation’s executives and Shareholders.

The current members of the Compensation Committee are Mr. Aaron Davidson, Dr. Joseph Sobota and Dr. Julia Levy. If the proposed slate of directors is elected, Mr. Aaron Davidson, Mr. William Mackinnon, and Mr. Anthony Griffiths will serve on the Compensation Committee. Each member of the current and proposed Compensation Committee is independent within the meaning of National Instrument 58-101 -Disclosure of Corporate Governance Practices. Committee members have direct experience relevant to their

- 11 -

responsibilities based on the senior positions held from both current and previous employment positions which provide the skill and experience to make decisions on the suitability of the Company’s compensation policies and practices.

Among the responsibilities of the Compensation Committee are the following:

| • | | reviewing and making recommendations to the Board with respect to the Corporation’s overall compensation and benefits philosophies; |

| • | | reviewing and making recommendations to the Board with respect to the Corporation’s overall compensation for its NEOs and each element of such compensation, including base salary, annual bonus, long-term incentive grants, and other benefits and perquisites; |

| • | | reviewing and approving corporate goals and objectives relevant to the CEO and other members of senior management and evaluating their performance in light of such goals and objectives; |

| • | | reviewing and making recommendations to the Board with respect to option grants and bonus allocations to eligible non-executive employees; and |

| • | | administering the Corporation’s employee share stock option plan. |

In making its annual recommendations and determinations as to the Corporation’s executive compensation, the Compensation Committee receives input from Management, but decisions made by the Compensation Committee in determining compensation for the Corporation’s officers and directors are the responsibility of the Compensation Committee and may reflect factors and considerations other than the information and recommendations provided by Management.

Role of Management in Determining Compensation

Although the Compensation Committee is responsible for determining and, where necessary, making recommendations to the Board on the compensation of the Corporation’s NEOs, the CEO and other members of Management assist the Compensation Committee in this process by compiling information to be used by the Compensation Committee in its compensation determinations, reporting on historical compensation levels and methods within the Corporation, reviewing and reporting on the performance of the non-CEO executive officers and compiling and assessing information respecting compensation levels of officers having similar positions at companies with similar revenues and businesses. Management also assists in advising as to the NEOs’ performance in relation to their respective entitlements to an annual bonus. See below under “Elements of Executive Compensation — Base Salary and Annual Cash Bonus”.

The Compensation Committee believes the CEO provides useful input in advising on recommended levels of compensation for the other NEOs because, due to his frequent interaction with these officers, the CEO is best positioned to assess their performance and their contribution to the Corporation. While the CEO may attend meetings of the Compensation Committee to provide such advice and recommendations, he is not a member of the Compensation Committee and he is not entitled to vote on matters before the Compensation

- 12 -

Committee. The CEO also is not present during in-camera sessions of the Compensation Committee and during discussion of his own compensation, whether at the Compensation Committee or Board level.

The Compensation Committee retained Radford, an Aon Hewitt Company (“Radford”) in January 2012 as its external independent compensation advisor to review the Corporation’s current executive compensation program. Radford provided a preliminary report on March 15, 2012 which was reviewed by the Board and Compensation Committee on April 3, 2012. The preliminary report was included in the Compensation Committee’s analysis in developing the compensation guidelines for 2012, beginning on page 10 of this Circular. The table below lists the fees paid to Radford over the last two fiscal years:

| | | | | | | | |

Services Performed | | Fees Paid in 2012(1) | | | Fees Paid in 2011 | |

Executive Compensation-Related Fees | | $ | 35,000 | | | | Nil | |

All other Fees | | | Nil | | | | Nil | |

| (1) | Amounts exclude taxes paid. |

Radford assembled a benchmark group of the following 19 companies to serve as a comparator for compensation purposes, which was approved by the Compensation Committee in December, 2011. The selection criteria for the benchmark group were companies in comparable industries with similar market capitalizations.

| | |

Company | | Industry |

| |

| Antares Pharma | | Surgical and medical instruments |

| |

AtriCure | | Surgical and medical instruments |

| |

Bacterin International Holdings | | Biologic Products |

| |

Cerus | | Surgical and medical instruments |

| |

Cutera | | Surgical and medical instruments |

| |

Cytori Therapeutics | | Surgical and medical instruments |

| |

DexCom | | Electromedical equipment |

| |

Endologix | | Surgical and medical instruments |

| |

IMRIS Inc. | | Analytical instruments |

| |

Kensey Nash | | Surgical and medical instruments |

| |

Neovasc | | Surgical and medical instruments |

| |

Nordion | | Electromedical equipment |

| |

Palomar Medical Technologies | | Electromedical equipment |

- 13 -

| | |

Company | | Industry |

ProMetic | | Biotechnology Research Services |

| |

Pure Technologies | | Analytical instruments |

| |

STAAR Surgical | | Electromedical equipment |

| |

Synergetics USA | | Surgical and medical instruments |

| |

Synovis Life Technologies | | Surgical and medical instruments |

| |

Vision-Sciences | | Surgical and medical instruments |

Since January 2012 there was no further employment of external consultants relating to executive employee compensation review.

Elements of Executive Compensation

Compensation of the Corporation’s NEOs for the fiscal year ended December 31, 2012 included the following components:

| • | | employee share purchase plan. |

The Corporation believes these elements of compensation, when combined, form an appropriate mix of compensation because they provide for stable income, in the case of base salary, as well as an appropriate balance between short-term (annual bonus) and long-term incentives (option grants) to induce and reward behavior that creates value for Shareholders.

Base Salary and Annual Cash Bonus

The Compensation Committee recommends the compensation of the Corporation’s senior executives, including the President and CEO, for approval by the Board. The Compensation Committee sets the compensation for senior executive officers (other than the President and CEO) on the recommendation of the Chairman of the Board, and the President and CEO. The objective of the Compensation Committee is to set compensation which is competitive for the markets in which the Corporation operates. Compensation is intended to approximate competitive levels for similar positions in similar organizations of comparable size. In making its determinations, the Compensation Committee considers the executive’s experience and established or expected performance.

In the first quarter of each fiscal year the Board and Compensation Committee approve written qualitative and quantitative goals, based on certain financial operating metrics. These goals form the basis for the review of the management team and the determination of compensation, including bonuses, at the end of each year. The Corporation does not disclose financial performance targets or performance goals in respect of specific qualitative performance-related factors on the basis that this information is confidential and sensitive and its disclosure would seriously prejudice the Corporation’s business interests.

- 14 -

The compensation balance between salary and bonus is increasingly weighted towards bonus. This has the benefit of maintaining greater operating leverage while ensuring that we reward performers and encourage underperformers to accomplish more. The Compensation Committee and Management will annually establish stretch goals that have clear objective measures. The goals, while challenging to meet, should be achievable for high performing employees. The intention is to pay 100% of bonus when the objectives are achieved as this is an important part of cash compensation for the management team. It is also intended that if the company has performed well financially, exceeding the financial plans of the company, that individual high performers should be able to earn more than 100% of bonus.

Stock Options

The Corporation’s stock option plan (the “Option Plan”) is intended to serve as a long-term incentive plan that will align the interests of the Corporation’s directors, officers, employees and consultants with the interests of the Shareholders. Once annually, the CEO develops a list of options to be granted to executives based on company performance, personal performance and industry benchmarks. The CEO submits this list to the Compensation Committee who reviews in Committee and further recommends to the Board for approval. For further information regarding the Option Plan, please see the section entitled “Equity Compensation Plans” found elsewhere in this Circular.

Perquisites and Other Benefits

The perquisites provided to the Corporation’s NEOs in 2012 were limited to car allowances. None of the NEOs received perquisites that amounted to greater than $10,000.

Compensation payable to each NEO is largely based on the achievement of certain performance goals. Performance goals affect option grants and annual cash bonuses, and are considered in assessing annual salary adjustments. Performance goals are established annually and designed to align with the Corporation’s strategic objectives. Performance goals for the financial year ended December 31, 2012 included a number of internal targets relating to revenue, research & development, corporate development and personal goals established between the NEOs and the Board of the Corporation. Given the Corporation’s stage of operations, these performance goals are generally based on achieving specified milestones within time and budget parameters. Compensation payable to a NEO may be adjusted up or down based on attainment of performance goals and broader conditions.

The Corporation does not engage in nor permit any NEO or director to purchase financial instruments, including prepaid variable forward contracts, equity swaps, collars, or units of exchange funds that are designed to hedge or offset a decrease in market value of equity securities granted as compensation or held, directly or indirectly, by the NEO or director.

Risks

The Compensation Committee meets annually to review and recommend to the Board the CEO’s plan for compensation of directors and officers. The Committee also meets periodically throughout the year to address issues of stock option grants, compensation for new senior employees, and to review any reports provided by compensation consultants. In order to identify and mitigate compensation policies and practices that could encourage an NEO at a

- 15 -

principal business unit or division to take inappropriate or excessive risks, the Corporation ensures that its Board of Directors has oversight, through the Compensation Committee, regarding compensation metrics that are aligned with long term value growth of the Company. The Corporation has hired an external compensation consultant to ensure that its compensation policies and practices are aligned with industry standards, and are reasonably unlikely to have a material adverse effect on the Company.

- 16 -

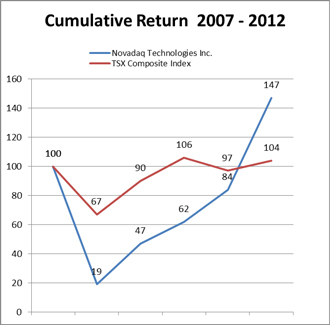

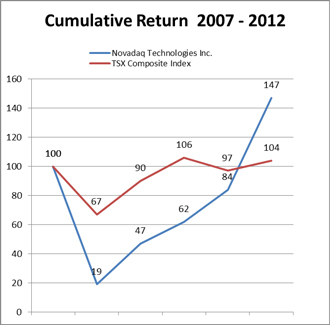

SHAREHOLDER RETURN PERFORMANCE GRAPH

Below is a line graph that compares (a) the yearly cumulative total Shareholder return on the Corporation’s common shares with (b) the cumulative total return of the TSX Composite Index for the period of time indicated, assuming an initial investment of $100, from 2007-2012.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Dec. 31,

2007 | | | Dec. 31,

2008 | | | Dec. 31,

2009 | | | Dec. 31,

2010 | | | Dec 31.,

2011 | | | Dec 31.,

2012 | |

Novadaq Technologies Inc. | | | 100 | | | | 19 | | | | 47 | | | | 62 | | | | 84 | | | | 147 | |

| | | | | | |

TSX Composite Index | | | 100 | | | | 67 | | | | 90 | | | | 106 | | | | 97 | | | | 104 | |

The trend shown in the above graph does not necessarily correspond to the Corporation’s compensation to its NEOs for the financial year ended December 31, 2012 or for any prior fiscal periods. The trading price of the Corporation’s common shares is subject to fluctuation based on several factors, many of which are outside the control of the Corporation. In determining compensation, the Corporation strives to be competitive in order to attract and retain talented high-achievers capable of achieving the Corporation’s strategic and performance objectives. See “Overview of Compensation Philosophy”.

- 17 -

SUMMARY COMPENSATION TABLE

The following tables provide information respecting compensation received in or in respect of the financial year ended December 31, 2012 by each of the Corporation’s NEOs, who are the following executive officers of the Corporation: (a) the CEO, (b) the CFO and (c) the other three most highly compensated executive officers during the financial year ended December 31, 2012.

All values shown in the table below are stated in U.S. dollars.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name and Principal Position | | Year | | | Salary

$ | | | Option

Based

Awards

$ | | | Employee

Share

Purchase

Plan

$ | | | Annual

Incentive

Plans

$ | | | All Other

Compensation

$ | | | Total

Compensation

$ | |

| | | | | | | |

Dr. Arun Menawat

President and Chief Executive Officer(1) | |

| 2010

2011 2012 |

| |

| 328,032

356,764 365,856 |

| |

| 105,500

74,250 371,700 |

| |

| 32,803

35,234 36,372 |

| |

| 63,113

151,668 175,070 |

| |

| 8,739

9,100 9,004 |

| |

| 538,187

627,016 958,002 |

|

Dr. Rick Mangat

Founder(2) | |

| 2010

2011 2012 |

| |

| 174,774

207,280 222,589 |

| |

| 63,300

74,250 206,500 |

| |

| Nil

Nil Nil |

| |

| 38,839

101,112 100,040 |

| |

| 7,282

7,583 7,503 |

| |

| 284,195

390,226 536,632 |

|

Mr. Stephen Purcell

Chief Financial Officer | |

| 2010

2011 2012 |

| |

| 128,653

161,780 171,319 |

| |

| 63,300

74,250 144,550 |

| |

| 3,768

3,182 Nil |

| |

| 24,274

60,667 67,527 |

| |

| 5,826

6,067 6,002 |

| |

| 225,821

305,946 389,398 |

|

Mr. Roger Deck

Vice President, Operations | |

| 2010

2011 2012 |

| |

| 145,645

161,780 171,319 |

| |

| 63,300

74,250 144,550 |

| |

| 14,565

11,838 Nil |

| |

| 24,274

75,834 65,026 |

| |

| 5,826

6,067 6,002 |

| |

| 253,609

329,769 386,897 |

|

Ms. Mary Kay Baggs

Senior Vice President, Marketing | |

| 2010

2011 2012 |

| |

| 150,000

160,000 171,250 |

| |

| 63,300

74,250 144,550 |

| |

| Nil

Nil Nil |

| |

| 24,274

75,000 65,000 |

| |

| 7,800

7,800 7,800 |

| |

| 245,374

317,050 388,600 |

|

| (1) | Dr. Menawat’s compensation is derived solely from his role as President and Chief Executive Officer of the Corporation. Dr. Menawat does not receive compensation for his role as a Director of the Corporation. |

| (2) | Effective January 1, 2013, Dr. Mangat’s title has changed from Senior Vice President and General Manager to Founder and is no longer a NEO. |

| (3) | Amounts are shown in U.S. dollars, the Corporation’s reporting currency. For the five listed NEOs above, the change in salary from 2010 to 2011 reflects a change in the exchange rate and not an actual increase in salaries. All amounts have been actually paid and those amounts paid in Canadian dollars have been translated at the average exchange rate during 2012 of 0.9996 Canadian dollars per USD$1.00. |

| (4) | “All Other Compensation” comprises car allowances paid to NEOs. |

Option Based Awards

Executive option based awards, granted on May 23, 2012, utilized the Black-Scholes model to determine the fair market value of USD$4.13 per option. The Black-Scholes model was used to determine the fair market value of executive option-based rewards because the Corporation’s option based award plan has standard structure and vesting conditions and the Black-Scholes model is the standard model used within the industry for accounting for equity based payments. The input factors to determine the value were volatility of 63%, exercise price of USD$6.29, interest rate of 1.63%, and an expected life of 8.5 years. In converting values from Canadian dollars to U.S. dollars the Corporation utilized an exchange rate of 0.959.

- 18 -

The Corporation did not, at any time during the 2012 financial year, adjust, amend, cancel, replace or significantly modify the exercise price of options previously awarded to, earned by, paid to, or payable to, an NEO.

Annual Incentive Payments

Annual incentive payments were based upon the Corporation’s performance, personal performance, industry benchmarks, recommended by the CEO and approved by the Compensation Committee for further approval by the Board. Incentive payments occurred no later than December 31, 2012.

The Summary Compensation Table reports all amounts earned for financial year, 2012. All amounts included in the annual incentive plans were paid before year-end, 2012.

Annual incentive payments were cash bonuses paid in full during the financial year, to NEOs based on corporate and individual performance, as recommended by the CEO and approved by the Board of Directors.

All Other Compensation

All other compensation comprises car allowances for business use of personal vehicles.

Pension Plan Benefits

The Corporation does not offer pension plans including defined benefit or defined contribution plans to employees nor does it provide compensation related to any type of pension plan.

- 19 -

INCENTIVE PLAN AWARDS

Outstanding Option-Based Awards

The following table provides information regarding the option based awards for each NEO outstanding as of December 31, 2012.

The process the Corporation uses to grant option-based awards to executive officers is described in the “Stock Options” section of the CD&A.

All values shown in the table below are in stated in Canadian dollars.

| | | | | | | | | | | | | | |

Name | | Number of

Securities

underlying

unexercised

options | | | Option

exercise

price | | | Option expiration

date | | Value of

unexercised

in-the-money

options | |

* | | (#) | | | ($) | | | * | | ($) | |

Dr. Arun Menawat,

President and Chief Executive Officer(1) | |

| 199,535

233,178 10,000 50,000 90,000 50,000 25,000 90,000 |

| |

| 1.07

1.07 9.50 6.50 2.50 2.75 4.15 6.47 |

| | 13-Apr-2013 29-Mar-2015 13-Dec-2015 17-Aug-2017 19-Mar-2019 2-Apr-2020 20-May-2021 23-May-2022 | | $

$ $ $ $ $ $ | 1,540,410

1,800,134 Nil 114,500 566,100 302,000 116,000 208,800 |

|

Dr. Rick Mangat,

Founder(2) | |

| 16,322

25,000 60,000 30,000 25,000 50,000 |

| |

| 1.07

6.50 2.50 2.75 4.15 6.47 |

| | 29-Mar-2015 17-Aug-2017 19-Mar-2019 02-Apr-2020 20-May-2021 23-May-2022 | | $

$ $ $ $ $ | 126,006

57,250 377,400 181,200 116,000 116,000 |

|

Mr. Stephen Purcell,

Chief Financial Officer | |

| 7,500

12,500 30,000 30,000 25,000 35,000 |

| |

| 4.01

1.76 2.50 2.75 4.15 6.47 |

| | 15-May-2018 1-Aug-2018 19-Mar-2019 2-Apr-2020 20-May-2021 23-May-2022 | | $

$ $ $ $ $ | 35,850

87,875 188,700 181,200 116,000 81,200 |

|

Mr. Roger Deck,

Vice President, Operations | |

| 93,271

15,000 25,000 40,000 30,000 25,000 35,000 |

| |

| 1.07

9.50 6.50 2.50 2.75 4.15 6.47 |

| | 16-Feb-2014 13-Dec-2015 17-Aug-2017 19-Mar-2019 2-Apr-2020 20-May-2021 23-May-2022 | | $

$ $ $ $ $ | 720,052

Nil 57,250 251,600 181,200 116,000 81,200 |

|

Ms. Mary Kay Baggs

Senior Vice President, Marketing | |

| 20,986

10,000 25,000 50,000 30,000 25,000 35000 |

| |

| 1.07

9.50 6.50 2.50 2.75 4.15 6.47 |

| | 29-Mar-2015 13-Dec-2015 17-Aug-2017 19-Mar-2019 2-Apr-2020 20-May-2021 23-May-2022 | | $

$ $ $ $ $ | 162,012

Nil 57,250 314,500 181,200 116,000 81,200 |

|

| (1) | Dr. Menawat’s compensation is derived solely from his role as President and Chief Executive Officer of the Corporation. Dr. Menawat does not receive compensation for his role as a Director of the Corporation. |

| (2) | Effective January 1, 2013, Dr. Mangat’s title has changed from Senior Vice President and General Manager to Founder and is no longer a NEO. |

- 20 -

Incentive Plan Awards Value Vested or Earned in 2012

The following table provides information regarding the value on vesting of incentive plan awards for the financial year ended December 31, 2012.

All values shown in the table below are in stated in Canadian dollars.

| | | | | | | | |

Name | | Option Awards

Value(1)

($)(2) | | | Non-equity

incentive plan

($)(2) | |

Dr. Arun Menawat

President and Chief Executive Officer | | | 211,267 | | | | Nil | |

Dr. Rick Mangat

Founder | | | 142,333 | | | | Nil | |

Mr. Stephen Purcell

Chief Financial Officer | | | 98,133 | | | | Nil | |

Mr. Roger Deck

Vice President, Operations | | | 112,867 | | | | Nil | |

Ms. Mary Kay Baggs

Senior Vice President, Marketing | | | 127,600 | | | | Nil | |

| (1) | Options which vested in 2012 were “in-the-money” at year-end. The amount is based on the difference between the market price of the underlying security on the date it vested during 2012 and the exercise price of the option times the number of options that vested. |

| (2) | The amount is based on the difference between the market price of the underlying security on the day it vested during 2012 and the exercise price of the option times the number of options that vested. |

TERMINATION AND CHANGE OF CONTROL BENEFITS

Each of the Corporation’s NEOs, as of December 31, 2012, is a party to an employment agreement with the Corporation that sets forth certain instances where payments and other obligations arise on the termination of their employment (whether voluntary, involuntary, or constructive), or upon a change of control. Such obligations and other significant factors for each contract are summarized as:

Dr. Arun Menawat. The employment agreement with Dr. Menawat is for an indefinite term, subject to the termination provisions within the agreement. The agreement provides for a base salary of CDN$280,000, which is subject to annual review and adjustment, and eligibility to receive an annual bonus based on a target of 40% of the amount of Dr. Menawat’s base salary, which amount may be increased by the Board in its sole discretion. As at January 1, 2013, Dr. Menawat’s annual salary was CDN$375,000 and will remain effective going forward. The agreement contains non-solicitation and non-competition covenants in favour of the Corporation which apply during the term of Dr. Menawat’s employment and for a period of two years following the termination of his employment (one year for his non-competition covenant if terminated otherwise than for cause), and confidentiality covenants in favour of the Corporation which apply indefinitely. In addition, if Dr. Menawat is terminated for any reason other than for cause, Dr. Menawat will receive an amount equal to the aggregate of his base salary and bonus in respect of the current fiscal year. If Dr. Menawat is terminated or resigns for good reason (as defined therein) upon a change of control, Dr. Menawat will receive an amount equal to two times the sum of his base salary in respect of the current fiscal year and the average of his bonus in respect of the past and current year and all of his outstanding options will vest,

- 21 -

to the extent that they were previously unvested. In such circumstances, Dr. Menawat will also receive benefits for two years following termination or resignation for good reason or alternatively, he shall receive the costs of replacing the benefits for the same period.

Dr. Rick Mangat.The employment agreement with Dr. Mangat is for an indefinite term, subject to the termination provisions within the agreement. The agreement provides for a base salary of CDN$120,000 which is subject to annual review and adjustment. On April 1, 2012, Dr. Mangat’s annual salary was increased to CDN$225,000. The agreement contains non-solicitation and non-competition covenants in favour of the Corporation which apply during the term of Dr. Mangat’s employment and for a period of two years following the termination of his employment, and confidentiality covenants in favour of the Corporation which apply indefinitely. In addition, if Dr. Mangat is terminated for any reason other than for cause, Dr. Mangat will receive his base salary and benefits for six months following his termination. As at January 1, 2013, Dr. Mangat’s title has changed to Founder and his responsibilities has changed to special projects as assigned by the President and Chief Executive Officer.

Stephen Purcell.The employment agreement with Mr. Purcell is for an indefinite term, subject to the termination provisions within the agreement. The agreement provides for a base salary of CDN$125,000 which is subject to annual review and adjustment. As at January 1, 2013, Mr. Purcell’s annual salary was CDN$180,000. The agreement contains non-solicitation and non-competition covenants in favour of the Corporation which apply during the term of Mr. Purcell’s employment and for a period of two years following the termination of his employment, and confidentiality covenants in favour of the Corporation which apply indefinitely. In addition, if Mr. Purcell is terminated for any reason other than for cause, Mr. Purcell will receive his base salary and benefits for six months following his termination.

Roger Deck. The employment agreement with Mr. Deck is for an indefinite term, subject to the termination provisions within the agreement. The agreement provides for a base salary of CDN $110,000 which is subject to annual review and adjustment. As at January 1, 2013, Mr. Deck’s annual salary was CDN$180,000. The agreement contains non-solicitation and non-competition covenants in favour of the Corporation which apply during the term of Mr. Deck’s employment and for a period of two years following the termination of his employment, and confidentiality covenants in favour of the Corporation which apply indefinitely. In addition, if Mr. Deck is terminated for any reason other than for cause, Mr. Deck will receive his base salary and benefits for six months following his termination.

Mary Kay Baggs.The employment agreement with Ms. Baggs is for an indefinite term, subject to the termination provisions within the agreement. The agreement provides for a base salary of CDN$125,000 which is subject to annual review and adjustment. As at January 1, 2013, Ms. Baggs’ annual salary was CDN$ 182,427. The agreement contains non-solicitation and non-competition covenants in favour of the Corporation which apply during the term of Ms. Baggs’ employment and for a period of two years following the termination of her employment, and confidentiality covenants in favour of the Corporation which apply indefinitely. In addition, if Ms. Baggs is terminated for any reason other than for cause, Ms. Baggs will receive her base salary and benefits for six months following her termination.

- 22 -

Payments on Termination or Change of Control

The following table provides details regarding the estimated incremental payments, payables and benefits from the Corporation to each of the NEOs assuming termination on December 31, 2012:

All values shown in the table below are in stated in U.S. dollars.

| | | | | | | | | | | | | | | | |

Name | | Severance

(Base Salary)

($)(2) | | | Severance

(Bonus)

($)(2) | | | Severance

(Value of

Benefits)

($)(2) | | | Total

($)(2) | |

Dr. Arun Menawat(1)

President and Chief Executive Officer | | | 375,150 | | | | 175,070 | | | | 386,958 | | | | 937,178 | |

Dr. Rick Mangat

Founder | | | 112,545 | | | | Nil | | | | Nil | | | | 112,545 | |

Mr. Stephen Purcell

Chief Financial Officer | | | 90,036 | | | | Nil | | | | Nil | | | | 90,036 | |

Mr. Roger Deck

Vice President, Operations | | | 90,036 | | | | Nil | | | | Nil | | | | 90,036 | |

Ms. Mary Kay Baggs

Senior Vice President, Marketing and Business Development | | | 91,214 | | | | Nil | | | | Nil | | | | 91,214 | |

| (1) | In the event of a change of control, the employment agreement with Dr. Menawat provides that he would be entitled to twice the amounts reflected, for base salary and severance, for a total amount of $1,487,398. Also, in the event of a change of control, the agreement provides for the 123,334 options with a “in-the-money” value of USD$386,958 as at December 31, 2012 subject to the accelerated vesting entitlement. |

| (2) | Amounts are shown in US dollars, the Corporation’s reporting currency. Amounts actually paid in Canadian dollars have been translated at the average exchange rate during 2012 of 0.9996 Canadian dollars per USD$1.00. |

Director Compensation

The directors of the Corporation, other than the President and CEO, were paid in respect of the financial year-ended December 31, 2012 an annual fee of $10,000 for their services, as well as a fee of $1,000 for each meeting of the Board attended ($500 if attended by teleconference). In addition, each member of any Committee of the Board received $500 for each meeting of such Committee attended (whether in person or by teleconference), provided however that if any such meeting was held coincidentally or directly after another meeting of either the Board or other committee of the Board, such fee was $250.

Directors of the Corporation are also eligible to receive stock option grants. During the fiscal year 2012, each of Mr. Aaron Davidson, Mr. Anthony Griffiths, Mr. Harold Koch, Jr., Dr. Joseph Sobota, Dr. Julia Levy, Dr. Joel Shalowitz, Mr. William Mackinnon and Mr. G. Steven Burrill were granted 8,500 stock options under the Corporation’s Option Plan. Options are granted to directors on an ad hoc basis so as to ensure that all directors have, from time to time, unvested options of the Corporation. The Corporation believes that the unvested options help align the interests of the directors with those of the Corporation. Except as set out above, directors are not eligible to receive other compensation.

- 23 -

Director Compensation Table

The following table provides information regarding compensation paid to the Corporation’s non-executive directors during the financial year ended December 31, 2012.

All values shown in the table below are in stated in U.S. dollars.

| | | | | | | | | | | | | | | | |

Name | | Fees earned

($) | | | Option based

awards

($)(1) | | | All other

compensation

($) | | | Total

($) | |

Mr. Aaron Davidson | | | Nil | | | | 35,105 | | | | Nil | | | | 35,105 | |

Mr. Anthony Griffiths | | | 17,507 | | | | 35,105 | | | | Nil | | | | 52,612 | |

Mr. Harold O. Koch, Jr. | | | 15,280 | | | | 35,105 | | | | Nil | | | | 50,385 | |

Dr. Joseph Sobota | | | 15,280 | | | | 35,105 | | | | Nil | | | | 50,385 | |

Mr. William Mackinnon | | | 20,008 | | | | 35,105 | | | | Nil | | | | 55,113 | |

Dr. Julia Levy | | | 18,007 | | | | 35,105 | | | | Nil | | | | 53,112 | |

Dr. Joel Shalowitz | | | 13,834 | | | | 35,105 | | | | Nil | | | | 48,939 | |

G. Steven Burrill | | | 14,635 | | | | 35,105 | | | | Nil | | | | 49,740 | |

| (1) | Directors’ services to the Corporation include attendance during Board and Committee meetings, and the provision of governance and oversight. The level of compensation is determined by benchmarking peer companies within our industry. |

| (2) | The amounts in this column represent the grant date fair value of options granted during 2012 and may not represent the amounts the Directors will actually realize from the awards. The grant date fair value of the options granted during 2012 has been estimated at the date of grant in accordance with the International Financial Reporting Standard 2 using a Black-Scholes option pricing model. |

- 24 -

Incentive Plan Awards

The following table provides information regarding the incentive plan awards for each Director outstanding as of December 31, 2012.

All values shown in the table below are in stated in Canadian dollars.

| | | | | | | | | | | | | | |

Name | | Number of

Securities

underlying

unexercised

options

(#) | | | Option

exercise

price

($) | | | Option expiration date | | Value of

unexercised

in-the-money

options

($) | |

Mr. Aaron Davidson | |

| 6,250

5,100

5,500

7,500

7,500

8,500 |

| |

| 6.50

4.01

3.09

4.26

4.15

6.47 |

| | August 17, 2017 May 15, 2018 May 21, 2019 May 20, 2020 May 20, 2021 May 23, 2022 | |

| 14,313

24,378

31,350

33,975

34,800

19,720 |

|

Mr. Anthony Griffiths | |

| 27,981

7,500

3,400

5,100

5,500

7,500

7,500

8,500 |

| |

| 1.07

8.07

6.50

4.01

3.09

4.26

4.15

6.47 |

| | September 30, 2013 September 5, 2016 August 17, 2017 May 15, 2018 May 21, 2019 May 20, 2020 May 20, 2021 May 23, 2022 | |

| 216,013

5,400

7,786

24,378

31,350

33,975

34,800

19,720 |

|

Mr. Harold O. Koch, Jr. | |

| 7,500

3,400

5,100

5,500

7,500

7,500

8,500 |

| |

| 7.74

6.50

4.01

3.09

4.26

4.15

6.47 |

| | May 24, 2017 August 17, 2017 May 15, 2018 May 21, 2019 May 20, 2020 May 20, 2021 May 23, 2022 | |

| 7,875

7,786

24,378

31,350

33,975

34,800

19,720 |

|

Dr. Joel Shalowitz | |

| 15,000

7,500

8,500 |

| |

| 3.82

4.15

6.47 |

| | August 31, 2020 May 20, 2021 May 23, 2022 | |

| 74,550

34,800

19,720 |

|

Dr. Joseph Sobota | |

| 7,500

3,400

5,100

5,500

7,500

7,500

8,500 |

| |

| 7.74

6.50

4.01

3.09

4.26

4.15

6.47 |

| | May 24, 2017 August 17, 2017 May 15, 2018 May 21, 2019 May 20, 2020 May 20, 2021 May 23, 2022 | |

| 7,875

7,786

24,378

31,350

33,975

34,800

19,720 |

|

Dr. Julia Levy | |

| 15,000

5,500

7,500

7,500

8,500 |

| |

| 1.76

3.09

4.26

4.15

6.47 |

| | August 1, 2018 May 21, 2019 May 20, 2020 May 20, 2021 May 23, 2022 | |

| 105,450

31,350

33,975

34,800

19,720 |

|

- 25 -

| | | | | | | | | | | | | | |

Name | | Number of

Securities

underlying

unexercised

options

(#) | | | Option

exercise

price

($) | | | Option expiration date | | Value of

unexercised

in-the-money

options

($) | |

Mr. William Mackinnon | |

| 15,000

7,500

7,500

8,500 |

| |

| 3.09

4.26

4.15

6.47 |

| | May 21, 2019 May 20, 2020 May 20, 2021 May 23, 2022 | |

| 85,500

33,975

34,800

19,720 |

|

Mr. G. Steven Burrill | |

| 15,000

8,500 |

| |

| 4.15

6.47 |

| | May 20, 2021 May 23, 2022 | |

| 69,600

19,720 |

|

Incentive Plan Awards Vested or Earned in 2012

The following table provides information regarding the value on vesting of incentive plan awards for the financial year ended December 31, 2012.

All values shown in the table below are in stated in Canadian dollars.

| | | | |

Name | | Option based awards (1)

($) | |

Mr. William Mackinnon | | | 9,825 | |

Mr. Aaron Davidson | | | 15,472 | |

Mr. Anthony Griffiths | | | 15,472 | |

Mr. Harold O. Koch, Jr. | | | 15,472 | |

Dr. Joseph Sobota | | | 15,472 | |

Dr. Julia Levy | | | 15,472 | |

Dr. Joel Shalowitz | | | 24,900 | |

G. Steven Burrill | | | 10,100 | |

| (1) | The amount is based on the difference between the market price of the underlying security on the date it vested during 2012 and the exercise price of the option times the number of options that vested. |

COMPOSITION OF THE COMPENSATION COMMITTEE

None of the members of the Compensation Committee are currently, or were during the financial year ended December 31, 2012, an officer or employee of the Corporation. No member of the Compensation Committee is, or during the financial year ended December 31, 2012 was, indebted to the Corporation or any of its subsidiaries, or to any other entity where such debt is supported by a guarantee, support agreement, letter of credit or other similar arrangement or

- 26 -

understanding, provided by the Corporation or its subsidiaries. Except as described or referred to in this Circular, no member of the Compensation Committee has, or had during the financial year ended December 31, 2012, any material interest in any transaction that has materially affected or would materially affect the Corporation or any of its subsidiaries.

EQUITY COMPENSATION PLANS

Description of Corporation’s Stock Option Plan

Effective as of March 29, 2005, and as amended and restated (as discussed below), the Board approved the Option Plan whereby options are granted at the current fair market value of the underlying common shares of the Corporation, in accordance with the terms of the Option Plan applicable to all employees, senior officers, directors and consultants of the Corporation. The maximum number of common shares that may be issued under the Option Plan may not exceed 10% of the number of outstanding common shares of the Corporation from time to time. As at April 18, 2013, 3,148,635 options have been granted under the Option Plan and based upon 43,123,071 common shares being issued and outstanding as of the date hereof, there remain 1,163,672 common shares that have not been allocated under the Option Plan.

At the meeting of Shareholders of the Corporation held on May 15, 2008, the Shareholders ratified, confirmed and approved an amendment to the then existing Option Plan extending the maximum term of the options from five (5) years to ten (10) years. The extension applied to all options which were outstanding as of March 17, 2007, being the date the board amended the Option Plan, subject to shareholder ratification. The Option Plan was ratified at the Annual and Special Shareholder Meeting held on May 20, 2011.

The Option Plan is administered by the Board and the committees of the Board to which it may delegate authority. The Board is responsible for determining the terms relating to each option, including the number of common shares subject to each option, the exercise price and the expiration date of each option, and the extent to which each option is exercisable during the term of the option. Pursuant to the Option Plan, the price at which the options are granted is equal to the weighted average trading price of the common shares on the exchange where they are listed on the five trading days immediately preceding the date of grant or such greater amount as the Board may determine, provided however that the exercise price of the options shall not be less than the minimum exercise price required by applicable rules of the Toronto Stock Exchange. Options generally vest over a period of three years and must be exercised no later than ten years from the date granted.

Certain restrictions on grants apply, including that the number of common shares reserved for issuance to insiders under the Option Plan and any other securities based compensation arrangements shall not exceed 10% of the outstanding issue of common shares of the Corporation, and the number of common shares issued to insiders, within any one-year period, under the Option Plan and any other securities based compensation arrangements cannot exceed 10% of the outstanding issue of common shares.

The Corporation does not provide financial assistance to option holders in connection with their participation in the Option Plan. Unless otherwise provided for, upon an option holders employment with the Corporation being terminated by the Corporation, whether with cause or without cause, or upon the option holders resignation (other than for retirement), the expiry date of any vested stock option granted to him or her shall be the earlier of (i) the expiry

- 27 -

date shown on the relevant notice of grant and (ii) the date that is thirty (30) days following the date such option holder ceased to be an employee of the Corporation; all stock options granted that are outstanding but not vested on such date of termination or resignation immediately terminate. If the option holder dies, retires, ceases to be a director (in the case where an option holder is not an employee or consultant of the Corporation), or ceases to be eligible under the Option Plan due to disability, the expiry date of any vested stock option granted to him or her is the earlier of (i) the expiry date shown on the relevant notice of grant or (ii) the date that is one hundred and eighty (180) days following the date such option holder retired or ceased to be a director (as the case may be). All stock options granted that are outstanding but not vested on such date immediately terminate.

Each option is non-transferable except by will or by laws of succession in the domicile of the deceased option holder.

Shares Authorized for Issuance under Equity Compensation Plans

The following table shows information, as of December 31, 2012, on compensation plans under which shares are authorized for issuance.

| | | | | | | | | | | | |

Plan Category | | Number of shares

issuable upon exercise

of outstanding options

(a) | | | Weighted-average

exercise price of

outstanding options

($)

(b) | | | Number of shares

available for future

issuance under equity

compensation plans

(excluding shares

reflected in column (a))

(c) | |

Plans approved by Shareholders: Stock Option Plan | | | 3,066,295 | | | | 3.98 | | | | 956,329 | |

Plans not previously approved by Shareholders | | | N/A | | | | N/A | | | | N/A | |

| | | | | | | | | | | | |

Total | | | 3,066,295 | | | | 3.98 | | | | 956,329 | |

| | | | | | | | | | | | |

| (1) | Under the Option Plan, the maximum aggregate number of common shares which may be subject to options under the Option Plan is 10% of the common shares of the Corporation outstanding from time to time. |

Description of Corporation’s Employee Share Purchase Plan

Effective as of July 1, 2008, the Board approved an Employee Share Purchase Plan (“ESPP”) for the purpose of encouraging and facilitating common share ownership by employees, to further align the interests of employees with the success of the Corporation, and to attract and retain employees. All full-time employees who have worked at least three consecutive complete months for the Corporation are eligible to be participants (“Participants”). Under the ESPP, a plan administrator was appointed to receive Participant contributions up to 10% of the Participants’ annual base salary, the Corporation matching contributions equal to 15% of Participant contributions, and to use total contributions to purchase common shares on behalf of Participants through the facilities of the primary exchange on which the common shares are listed for trading, being currently the Toronto Stock Exchange and the NASDAQ. Common shares purchased under the ESPP are subject to a transfer restriction for six months after the date of purchase. Purchase expenses are paid by the Corporation, sale expenses are paid by the Participant. The Corporation may amend, suspend, or terminate the ESPP at any time.

- 28 -

The Corporation confirms there are no other equity compensation plans.

INDEBTEDNESS OF DIRECTORS AND EXECUTIVE OFFICERS

As at April 18, 2013, no individual who is, or at any time during the most recently completed financial year was, a director or executive officer of the Corporation, and no proposed nominee for election as a director for the Corporation, and no associate of any such director, executive officer or proposed nominee is, or at any time since the beginning of the most recently completed financial year of the Corporation has been, indebted to the Corporation or any of its subsidiaries.

INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS

OR MATTERS TO BE ACTED UPON