Table of Contents

Letter to the Shareholders from the Chair of the Board and the President and CEO i

Company overview iv

Proxy Circular Summary vii

About CAE ix

Useful Information xiv

Notice of 2024 Annual Shareholders’ Meeting xv

Section 1 About Voting Your Shares 1

Section 2 Business of the Meeting 7

Section 3 About the Nominated Directors 13

Section 4 Corporate Governance 31

Section 5 Board Committee Reports 47

Section 6 Director Compensation 53

Section 7 Executive Compensation 58

Compensation Discussion and Analysis 61

Executive Summary 62

Shareholder Engagement 67

Compensation Philosophy 68

Executive Compensation Programs 70

FY2024 Compensation Outcome 83

Determination of NEOs’ Individual Performance 89

Compensation Governance 94

Alignment of Compensation and Performance 101

Compensation of our Named Executive Officers 104

Summary Compensation Table 104

Outstanding Share-Based Awards and Option-Based Awards 106

Incentive Plan Awards – Value Vested or Earned During the Year 107

Pension Arrangements 108

Termination and Change of Control Benefits 109

CAE INC. | 2024 | Management Proxy Circular

Section 8 Other Important Information 114

Appendix A – Board of Directors’ Charter 116

Appendix B – Non-IFRS and Other Financial Measures 120

Appendix C – Summary of the Employee Stock Option Plan 127

Appendix D – Summary of the Omnibus Incentive Plan 131

Appendix E – Summary of the Rights Plan 138

CAE INC. | 2024 | Management Proxy Circular

Letter to the Shareholders from the Chair of the Board and the President and CEO

June 14, 2024

Dear fellow Shareholders,

It is our pleasure to invite you to attend CAE’s 2024 Annual Shareholders’ Meeting (the “Meeting”). This year, we continued to work as One CAE to foster innovation and excellence for our customers and one another. We have a positive outlook for FY2025, following a year where we worked hard to retire Legacy Contracts (as defined herein) in our Defense and Security business. While Defense and Security fell below expectations, we saw continued robust performance in our Civil Aviation segment.

This was a year of meaningful progress for our Company, both in terms of addressing challenges as well as continuing to grow and invest in our core markets. As we have for years, we further strengthened our competitive position and demonstrated market leadership with the introduction of new technologies and solutions for our customers around the globe. Our Civil business continued to perform exceptionally well with continued growth in revenues, record margins, and strong order intake.

During the year, we took decisive actions to re-baseline our Defense business, with the acceleration of risk recognition on the Legacy Contracts. These actions, paired with leadership changes, organizational structure simplification, and the installation of a Chief Operating Officer, give us confidence in an improved performance profile for the segment. Additionally, we completed the sale of CAE Healthcare, a decision that reflects our commitment to streamline our portfolio to focus on our core businesses. The sale of Healthcare accelerates CAE’s deleveraging process and enables us to focus on securing growth opportunities in our larger core markets.

Board Leadership

CAE continues to focus on Board renewal to ensure that the Company and Shareholders benefit from fresh perspectives. Five new directors have joined the Board since 2022, with a sixth new nominee up for election at the Meeting. This is the result of a regular evaluation by the Board to ensure it reflects the appropriate skills and experience necessary to effectively oversee execution of CAE’s strategy today and into the future.

Our two most recent director additions are Sophie Brochu, who joined in August 2023, and Patrick Decostre, who joined in May 2024. Sophie and Patrick impart extensive executive leadership and operational experience in companies with international exposure and external acquisition growth journeys.

Sophie has held the position of President and CEO at two major companies in Quebec’s energy sector – Hydro-Québec and Energir. She brings significant experience to the Board in vital areas, including strategic leadership and management, government relations, human resources, executive compensation and sustainability, among others.

Patrick is President, CEO and a director of Boralex Inc., a provider of affordable renewable energy in North America and Europe. He brings to the Board several years of experience as a CEO and nearly two decades of experience building Boralex’s business from the ground up in Europe.

With these changes, 38% of CAE’s Board of Directors are now women, enabling us to reach our 2025 target of the Board’s Diversity Policy ahead of schedule.

We wish to extend a warm thank you to Michael E. Roach, who recently retired from the Board of Directors, and to Andrew J. Stevens, who is retiring this August. Mike and Andrew have both made significant contributions during their time on the Board, and we will miss their valuable input.

i | CAE INC. | 2024 | Management Proxy Circular

Stakeholder Outreach

The Board continued its commitment to shareholder engagement, offering to meet with shareholders who together account for approximately 50% of our ownership. The Shareholders with whom we met provided valuable feedback, including on our executive compensation programs. We remain focused on aligning our performance and compensation outcomes with the interests of our Shareholders.

Commitment to Sustainability

Over the past 12 months, CAE has made substantial progress on its sustainability mandate. Our aim is to continue delivering long-term business value across our strategy, through built-in environmental, social and governance pillars. Climate change is one of the biggest global challenges of our time and CAE is committed to supporting the decarbonization of our customers and our industry. We submitted our near-term science-based reduction targets for approval to the Science Based Targets initiative, which solidly positions CAE on its net zero trajectory.

To cite a few examples of our efforts in this area, our training analytics capabilities allow for more efficient training, which reduces energy consumption. Our Flight Operations Solutions support the decarbonization of the aviation industry through the optimization of airlines’ flight plans and catering services, reducing fuel consumption, generating significant carbon savings and reducing waste. Our development of training capabilities adapted to Advanced Air Mobility (AAM) challenges enables the development of a new, all-electric industry that contributes to making air transportation more sustainable.

CAE’s sustainability strategy is also driven by our commitment to create social value and foster an inclusive and diverse culture. In fiscal 2024, we increased the percentage of women and other underrepresented groups in leadership positions, achieving a key target of our multi-year sustainability roadmap. More information regarding our sustainability efforts can be found at https://www.cae.com/sustainability/.

Closing words

This year, CAE took the appropriate measures to reset conditions for enhancing profitability and operational efficiency. We have streamlined our portfolio and invested in new technologies that will allow us to capture an extended share of our core markets. The appointment of Nick Leontidis, Civil Group President over the last decade and a 36-year CAE veteran, to Chief Operating Officer will drive additional synergies between our Defense & Security and Civil Aviation business segments and increase operational efficiency. These actions, along with CAE’s excellent reputation, customer-centric approach, strong technical capabilities, long-standing customer relationships and global presence position us for long-term success and value creation.

To our Shareholders — thank you for your ongoing support and confidence in our noble mission to make the world a safer place. Your trust becomes even more paramount in periods of turbulence. The Board values your input and insights, and we look forward to continued dialogue.

And, to CAE employees, we extend our appreciation for their commitment to the company’s core values and strategy which help ensure the continued satisfaction of our customers.

We will once again hold our Meeting in virtual format via live webcast available at https://web.lumiagm.com/461348319. Shareholders are encouraged to cast their vote in advance by proxy and participate from any geographic location in real time through a web-based platform or by telephone. We believe this is an important step to enhancing accessibility to our annual meeting for all our Shareholders and reducing the carbon footprint of our activities.

As in prior years, important matters affecting our Company will be considered at the Meeting. We will, as always, review CAE’s financial position, including business operations and the value delivered to Shareholders. We will also respond to your comments and questions.

ii | CAE INC. | 2024 | Management Proxy Circular

This Circular gives you details about all the items for consideration and how to vote. It also contains profiles of the nominated Directors, information on the auditors, and sections on the Board committees and CAE corporate governance practices. Whether or not you plan to attend the Meeting, we encourage you to review the enclosed information, consider the resolutions put forth by the Board and vote your Shares.

The Board remains committed to acting in the best interests of the Company and all its Shareholders.

We thank you for your continued confidence in and support of CAE and look forward to hearing from you at this year’s Meeting.

| | | | | | | | | | | |

| | | |

Alan N. MacGibbon, P.C., O.C. Chair of the Board | Marc Parent, C.M. President and Chief Executive Officer |

iii | CAE INC. | 2024 | Management Proxy Circular

iv | CAE INC. | 2024 | Management Proxy Circular

v | CAE INC. | 2024 | Management Proxy Circular

vi | CAE INC. | 2024 | Management Proxy Circular

Proxy Circular Summary

This summary highlights some of the important information you will find in this Management Proxy Circular (“Circular”). These highlights do not contain all the information that you should consider, and you should read this entire Circular before voting your Shares.

Shareholder Voting Matters

| | | | | | | | |

| Voting Matter | Board Vote Recommendation | Page Reference for More Information |

| Election of 13 Directors | FOR each nominee | 8 |

Appointing PricewaterhouseCoopers LLP (PwC)

as Auditors | FOR | 10 |

| Advisory Vote on Executive Compensation | FOR | 11 |

| Approving the Reconfirmation of CAE’s Rights Plan | FOR | 12 |

vii | CAE INC. | 2024 | Management Proxy Circular

Review this Proxy Circular and Vote in One

of the Following Ways

Voting by Proxy is the Easiest Way

Below are the different ways in which you can give your voting instructions, details of which are found in the enclosed proxy form or your voting instruction form, as applicable. Please also refer to Section 1 – About Voting Your Shares for more information on the voting methods available to you:

by mail: sign, date and return your proxy form in the envelope provided.

by mail: sign, date and return your proxy form in the envelope provided. by telephone: call the telephone number on your proxy form.

by telephone: call the telephone number on your proxy form. on the Internet: visit the website listed on your proxy form.

on the Internet: visit the website listed on your proxy form. by appointing another person to attend and vote at the Meeting online on your behalf.

by appointing another person to attend and vote at the Meeting online on your behalf.Voting Online at the Meeting

Log in online at https://web.lumiagm.com/461348319 and follow the steps listed in the Section “Attending and Participating.”

Log in online at https://web.lumiagm.com/461348319 and follow the steps listed in the Section “Attending and Participating.”

viii | CAE INC. | 2024 | Management Proxy Circular

About CAE

Who We Are

At CAE, we equip people in critical roles with the expertise and solutions to create a safer world. As a technology company, we digitalize the physical world, deploying software-based simulation training and critical operations support solutions. Above all else, we empower pilots, cabin crew, maintenance technicians, airlines, business aviation operators and defence and security forces to perform at their best every day and when the stakes are the highest. Around the globe, we are everywhere customers need us to be with approximately 13,000 employees in more than 240 sites and training locations in over 40 countries. CAE represents more than 75 years of industry firsts—the highest fidelity flight and mission simulators as well as training programs powered by digital technologies. We embed sustainability in everything we do. Today and tomorrow, we’ll make sure our customers are ready for the moments that matter.

Founded in 1947 and headquartered in Montreal, Canada, CAE has built an excellent reputation and long-standing customer relationships based on experience, strong technical capabilities, a highly trained workforce and global reach. CAE’s common shares are listed on the Toronto and New York stock exchanges (TSX / NYSE) under the symbol CAE.

Our Mission

Our mission is to lead at the frontier of digital immersion with high-tech training and operational support solutions to make the world a safer place.

Our Vision

Our vision is to be the worldwide partner of choice in civil aviation and defence and security by revolutionizing our customers’ training and critical operations with digitally immersive solutions to elevate safety, efficiency and readiness.

Our Operations

Our operations are managed through two segments:

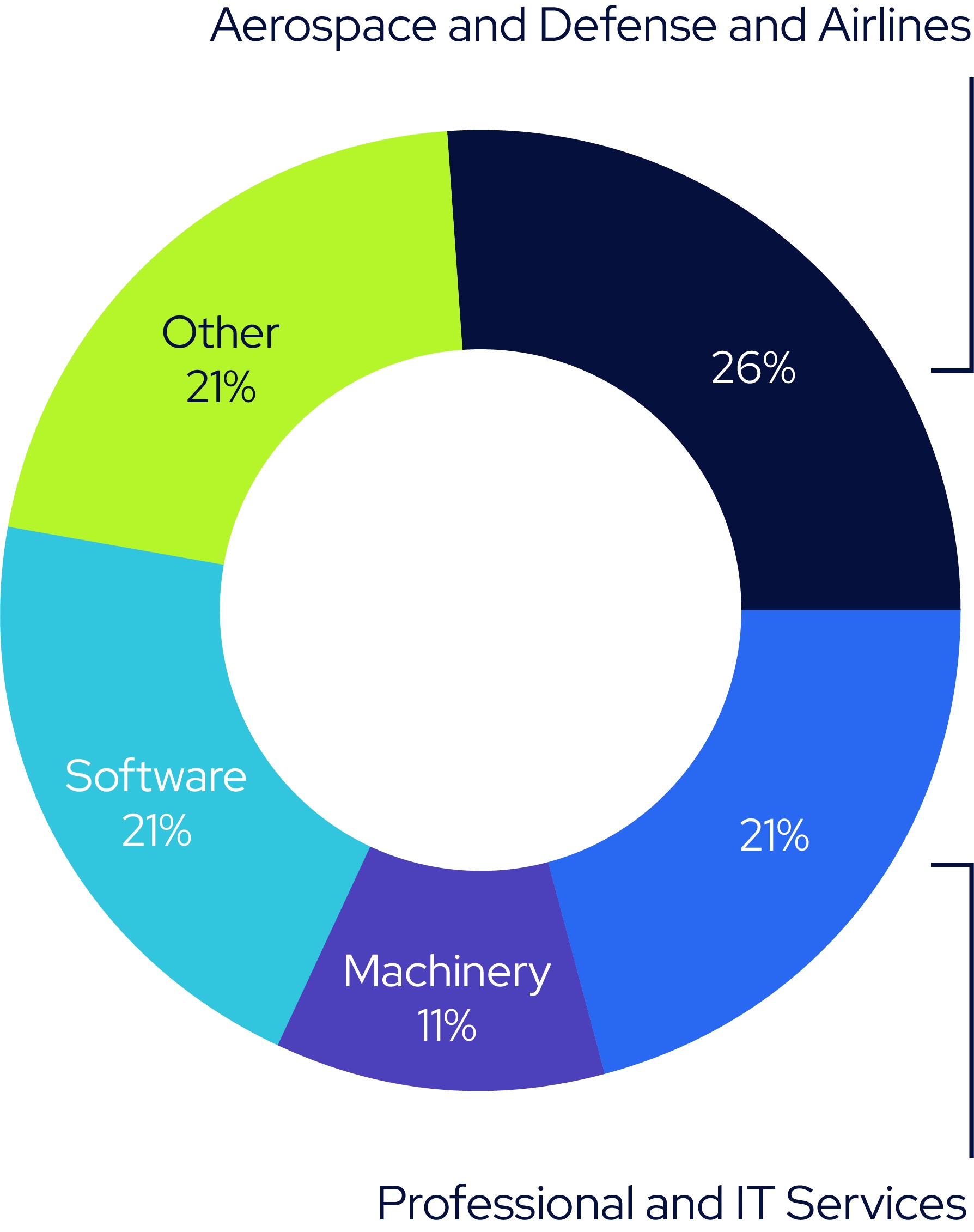

Civil Aviation: We provide comprehensive training solutions for flight, cabin, maintenance and ground personnel in commercial, business and helicopter aviation, a complete range of flight simulation training devices, ab initio pilot training and crew sourcing services, as well as aircraft flight operations solutions. The civil aviation market includes major commercial airlines, regional airlines, business aircraft operators, civil helicopter operators, aircraft manufacturers, third-party training centres, flight training organizations, maintenance, repair and overhaul organizations (MRO) and aircraft finance leasing companies.

Defense & Security: We are a global training and simulation provider delivering scalable, platform-independent solutions that enable and enhance force readiness and security. The defence and security market includes defence forces, OEMs, government agencies and public safety organizations worldwide.

ix | CAE INC. | 2024 | Management Proxy Circular

Our Strategy

CAE’s Four Strategic Pillars

| | | | | |

| Efficient Growth Our business features a high degree of recurring revenues due to the underlying characteristics of our technology-enabled solutions and regulatory requirements across our markets. We seek to maximize the benefits of our strong competitive position to deliver premium growth and profitability through a focus on operational rigour, cost optimization, capital efficiency, and a disciplined approach to pursuing organic and inorganic growth. |

| Technology and Market Leadership We have a long rich and long-dated history of customer centricity, innovation and delivering state-of-the-art technology solutions that define the forefront of the industries we operate in. As a result, we constantly seek new ways to enhance the performance of our customers by fostering a culture of continuous improvement and innovation. This drives technology leadership, deeper customer partnerships, and new customer development, enabling us to capitalize on the ample headroom in our large, growing addressable markets. |

| Revolutionizing Training and Critical Operations We are a global thought leader in the application of training, digital immersion, critical operations, and modelling and simulation technologies. We seek to use data-driven applications and advanced analytics to produce measurable and demonstrated outcomes in our markets. The efficacy of our technology solutions enables customized, collaborative, and multi-domain offerings. Furthermore, our technologies are deployed with a focus on driving sustainability. |

| Skills & Culture Our core values are innovation, integrity, empowerment, excellence and One CAE. We employ these values across a diverse global team to drive a unique social impact. We seek to create an employee experience and environment that values teamwork, professional growth, and engagement. As a result, our employees across the globe share a passion to prepare our customers for the moments that matter. |

x | CAE INC. | 2024 | Management Proxy Circular

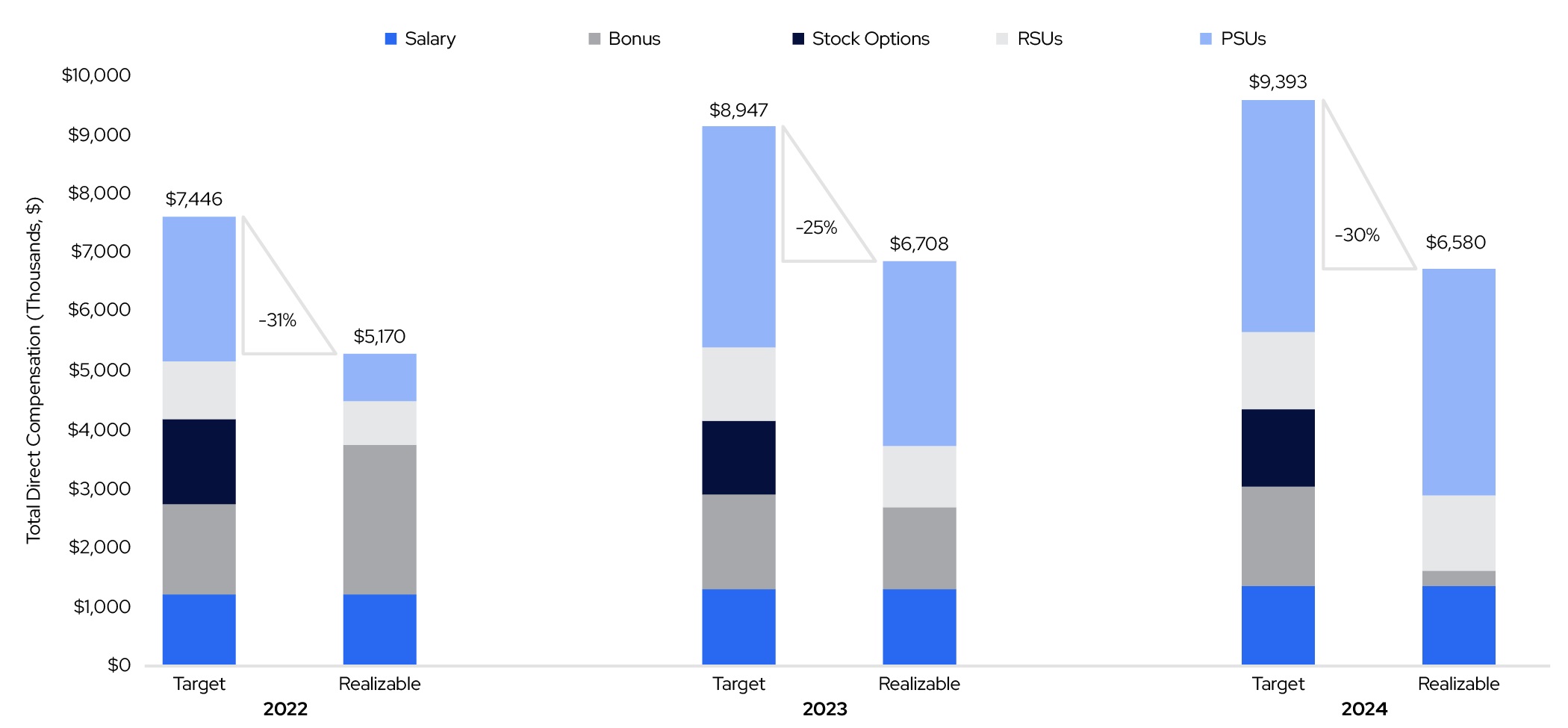

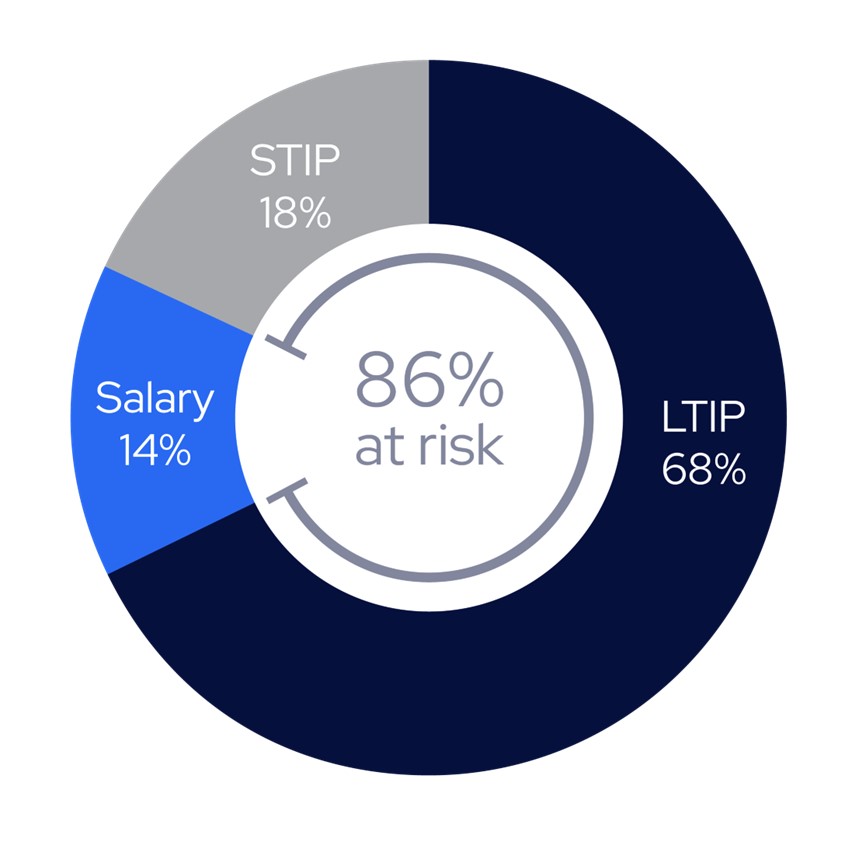

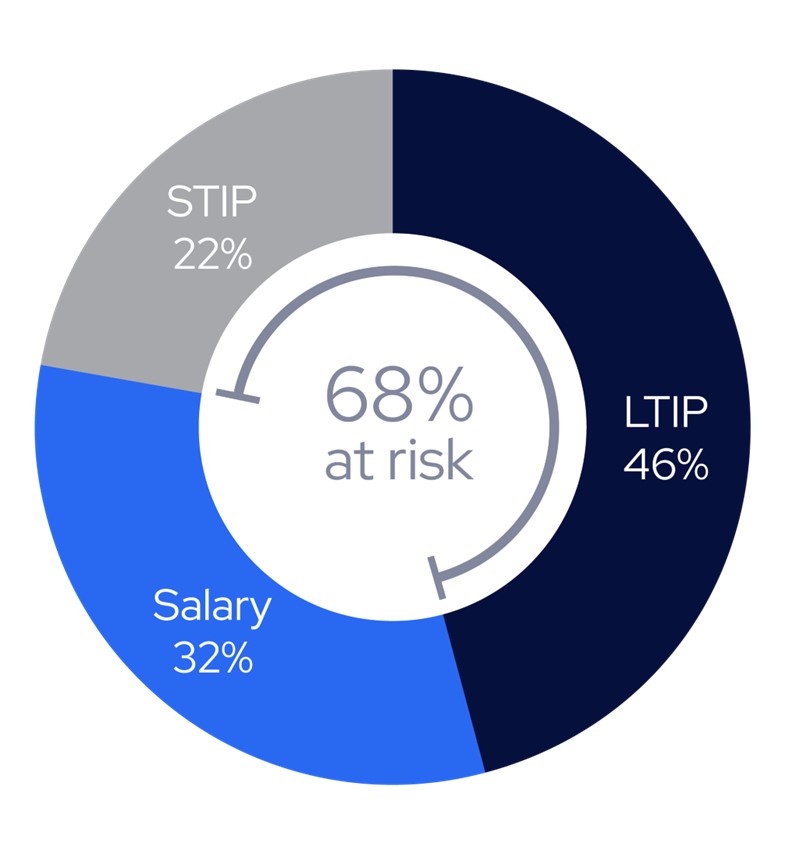

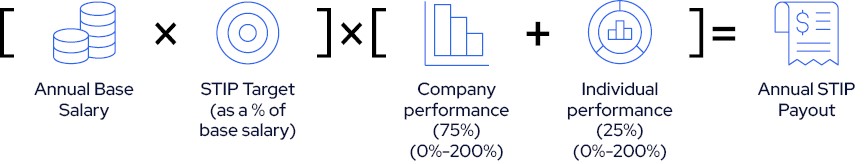

Executive Compensation Highlights

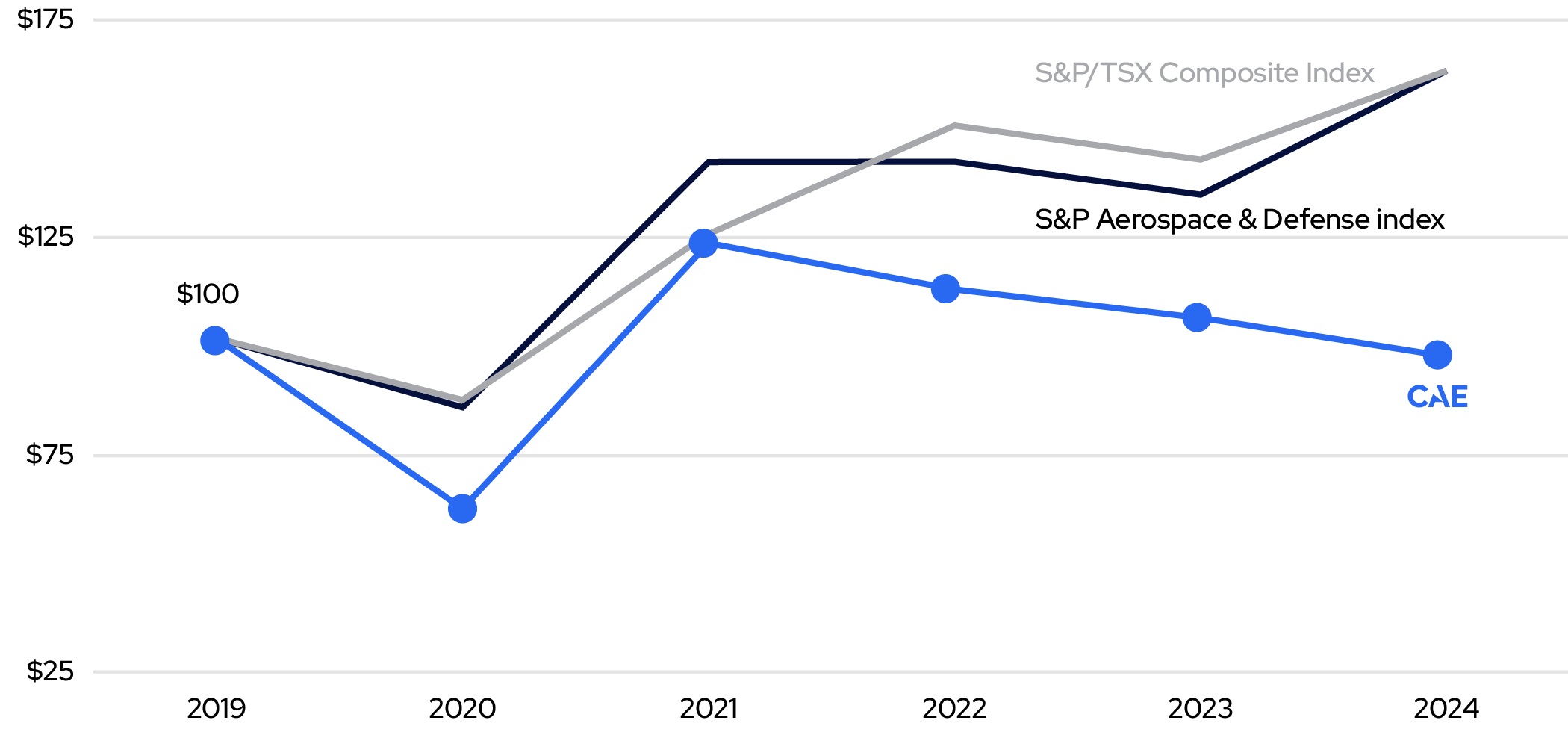

—Executive short-term incentive payout based on a corporate performance factor of 4% reflective of strong performance in Civil Aviation, but with Defense & Security results impacted by the accelerated risk recognition on eight contracts that were entered into prior to the COVID-19 pandemic that are fixed-price in structure, with little to no provision for cost escalation (the “Legacy Contracts”)

—43% payout factor for Performance Share Units that vested in FY2024 (with a performance measurement period from FY2022 to FY2024), aligned with shareholder experience over the period

| | | | | |

| Our Executive Compensation Best Practices |

|

Minimum threshold levels of corporate performance to be met to allow for payments under

the annual and long-term incentives | |

| Caps on annual bonuses and Performance Share Units (“PSU”) payout factors | |

| Balanced mix of short, medium and long-term compensation | |

| Pensionable earnings based on actual years served | |

| Change of control severance limited to two times salary and bonuses | |

| Robust clawback policy, including a market-leading ability to clawback incentive-based compensation in circumstances of misconduct without the need for a financial restatement | |

| Minimum share ownership and option profit retention guidelines | |

| Anti-hedging policy | |

| Post-employment Share ownership requirement for CEO | |

| Double trigger vesting of equity in case of change of control | |

xi | CAE INC. | 2024 | Management Proxy Circular

Governance Highlights

The following table shows some of the ways CAE continues to adhere to the highest standards in corporate governance.

| | | | | |

| Our Corporate Governance Best Practices |

|

| Number of Director nominees | 13 |

| Number of non-employee Independent Director nominees | 12/13 |

| Board Committee members (including the Governance Committee, which is responsible for recommending new Directors to join the Board) are all independent. | |

| Average age of Director nominees | 61 |

| Annual election of Directors | |

| Other Board commitments and interlocks policy | |

| Separate Chair and CEO roles | |

| Director tenure and age term limits | |

| Share ownership requirements for Directors and executives | |

| Board orientation/education program | |

| Number of Board meetings held during FY2024 | 8 |

| Number of financial experts on the Audit Committee | 2 |

| Code of Business Conduct | |

| Annual advisory vote on executive compensation | |

| Formal Board and Committee evaluation processes | |

| No dual-class shares | |

| Diversity targets on the Board and in executive officer positions | |

| Enterprise risk management oversight including sustainability matters | |

xii | CAE INC. | 2024 | Management Proxy Circular

Our Director Nominees

| | | | | | | | | | | | | | | | | | | | | | | |

| Name | Age | Director Since | Position | Independent | Committee Memberships | Board and Committee Attendance FY2024 | Other Public Boards |

| Ayman Antoun | 58 | 2022 | Corporate Director | YES | Audit, HRC | 100% | 1 |

| Margaret S. (Peg) Billson | 62 | 2015 | Corporate Director | YES | GC (Chair), HRC | 94% | 1 |

| Sophie Brochu | 61 | 2023 | Corporate Director | YES | Audit, HRC | 100% | 1 |

Patrick Decostre1 | 51 | 2024 | President and CEO, Boralex Inc. | YES | N/A | N/A | 1 |

| Elise Eberwein | 59 | 2022 | Corporate Director | YES | Audit, HRC | 100% | N/A |

Ian L. Edwards2 | 62 | N/A | President and CEO, AtkinsRéalis | YES | N/A | N/A | 1 |

| Marianne Harrison | 60 | 2019 | Corporate Director | YES | Audit (Chair), GC | 100% | N/A |

| Alan N. MacGibbon | 68 | 2015 | Corporate Director | YES | N/A | 100% | 1 |

| Mary Lou Maher | 64 | 2021 | Corporate Director | YES | Audit, HRC (Chair) | 100% | 2 |

| François Olivier | 59 | 2017 | Corporate Director | YES | Audit, GC | 93% | 1 |

| Marc Parent | 63 | 2008 | President and CEO, CAE | NO | N/A | 100% | 1 |

| Gen. David G. Perkins, USA (Ret.) | 66 | 2020 | Corporate Director | YES | GC, HRC | 100% | 1 |

| Patrick M. Shanahan | 62 | 2022 | President and CEO, Spirit AeroSystems Inc. | YES | Audit, GC | 100% | 2 |

1.Mr. Decostre was appointed to the Board of CAE on May 16, 2024.

2.Mr. Edwards does not currently serve as a Director on the Board of CAE and will become a Director following his election at the Meeting.

xiii | CAE INC. | 2024 | Management Proxy Circular

Useful Information

Certain Defined Terms

| | |

| In this document, referred to as this “Circular”, the terms “you” and “your” refer to the Shareholder, while “we”, “us”, “our”, “Company” and “CAE” refer to CAE Inc. and where applicable, its subsidiaries. |

Currency, Exchange Rates and Share Prices

| | |

| All amounts referred to in this Circular are presented in Canadian dollars, unless otherwise stated. In a number of instances in this Circular, including with respect to calculation of the in-the-money value of stock options denominated in Canadian dollars, information based on our Share price has been calculated on the basis of the Canadian dollar. |

Discontinued Operations and Reclassification of Comparative Figures

| | |

| On February 16, 2024, we announced the closing of the sale of our Healthcare business. Consequently, certain comparative figures contained in this Circular have been reclassified as a result of our Healthcare segment being presented as discontinued operations in CAE’s Management’s Discussion and Analysis and Consolidated Financial Statements for the year ended March 31, 2024. |

Non-IFRS and Other Financial Measures

| | |

This document includes non-IFRS financial measures, non-IFRS ratios, capital management measures and supplementary financial measures. These measures are not standardized financial measures prescribed under IFRS and therefore should not be confused with, or used as an alternative for, performance measures calculated according to IFRS. Furthermore, these measures should not be compared with similarly titled measures provided or used by other issuers. Management believes that these measures provide additional insight into our operating performance and trends and facilitate comparisons across reporting periods. Definitions of all non-IFRS and other financial measures are provided in Appendix B of this document to give the reader a better understanding of the indicators used by management. In addition, when applicable, this document may include a quantitative reconciliation of the non-IFRS and other financial measures to the most directly comparable measure under IFRS. Refer to Appendix B of this document for references where these reconciliations are provided. |

Information Currency

| | |

| The information in this Circular is current as of June 14, 2024 unless otherwise stated. |

xiv | CAE INC. | 2024 | Management Proxy Circular

Notice of 2024

Annual Shareholders’ Meeting

What the Meeting is About

1.Receive CAE Consolidated Financial Statements and the auditors’ report for the fiscal year ended March 31, 2024;

2.Elect Directors who will serve until the end of the next annual Shareholders' meeting;

3.Reappoint PricewaterhouseCoopers LLP as our auditors who will serve until the end of the next annual Shareholders' meeting and to authorize the Company’s Board to fix the auditors’ remuneration;

4.Vote, in an advisory, non-binding manner, on CAE’s approach to executive compensation described in this Circular;

5.Approve the reconfirmation of CAE’s Amended and Restated Shareholder Protection Rights Plan Agreement (“Rights Plan”); and

6.Transact any other business that may properly come before the Meeting.

You have the Right to Vote

As a holder of record of common shares of CAE (“Shares”) at the close of business on June 21, 2024, you are entitled to receive notice of and vote at the Meeting.

You are asked to consider and to vote your Shares on items 2 to 5 and any other items that may properly come before the Meeting or any adjournment or postponement thereof.

If you are unable to attend the Meeting online and want to ensure that your Shares are voted, please submit your votes by proxy as described under “How to Vote Your Shares” in the accompanying Circular. To be valid, our transfer agent, Computershare Trust Company of Canada, must receive your proxy by 11:00 a.m. (Eastern Time) on August 12, 2024. If the Meeting is adjourned or postponed, Computershare must receive your proxy no later than 24 hours (excluding Saturdays, Sundays and holidays) prior to any such adjournment or postponement.

Accompanying this Notice of Annual Meeting is the Circular, which contains more information on the matters to be addressed at the Meeting.

xv | CAE INC. | 2024 | Management Proxy Circular

Attending and Participating

Our Meeting will be held in virtual-only format, which will be conducted via live webcast. Shareholders will have an equal opportunity to participate in real time and vote at the Meeting online through a web-based platform regardless of their geographic location.

Participating in the Meeting online allows registered Shareholders and duly appointed Proxyholders, including non-registered (beneficial) Shareholders who have appointed themselves or another person as a Proxyholder, to participate at the Meeting and ask questions, all in real time. Registered Shareholders and duly appointed Proxyholders can vote at the appropriate time during the Meeting. Voting will be conducted by virtual ballot.

Guests, including non-registered Shareholders who have not duly appointed themselves or another person as a Proxyholder, can log in to the Meeting as set out below. Guests will be able to participate in the Meeting but cannot vote.

To access the Meeting, follow the instructions below, as applicable to you:

1.Log in online at https://web.lumiagm.com/461348319. The platform is compatible with all major browsers except for Internet Explorer.

2.Click “I have a Login” and then enter your Control Number (see below) and Password “CAE2024” (note the password is case sensitive); OR

3.Click “I am a guest” and then complete the online form.

In order to find the 15-digit Control Number to access the Meeting:

—Registered Shareholders: The control number located on the form of proxy or in the email notification you received is your Control Number.

—Proxyholders: Duly appointed Proxyholders, including non- registered (beneficial) Shareholders that have appointed themselves or another person as a Proxyholder, will receive the Control Number from Computershare by e-mail after the proxy voting deadline has passed.

If you attend the Meeting online, it is important that you are connected to the Internet at all times during the Meeting in order to vote when balloting commences. It is your responsibility to ensure connectivity for the duration of the Meeting. You should allow

ample time to check into the Meeting online and complete the related procedure. For additional details on accessing and participating in the Meeting online from your tablet, smartphone or computer, please see the Virtual AGM User Guide provided by Computershare and accompanying this proxy circular.

Notice-and-Access

As part of an effort to reduce environmental impacts of excessive printing, and to save postage costs, CAE is opting to use the “Notice-and-Access” provisions of Canadian securities rules.

The “Notice-and-Access” provisions allow Canadian companies to post electronic versions of Shareholder meeting materials in lieu of mailing physical copies of such documents to Shareholder. Shareholders will instead only receive a paper notification with information on how they may obtain a copy of the meeting materials electronically or request a paper copy (Notification). Shareholders who have already signed up for electronic delivery of Shareholder materials will continue to receive them by email.

Non-registered Shareholders who have not objected to their intermediary disclosing certain ownership information about themselves to CAE are referred to as “NOBOs”. The non-registered Shareholders who have objected to their intermediary disclosing ownership information about themselves to CAE are referred to as “OBOs”. CAE has distributed the Notification in connection with the Meeting to intermediaries and clearing agencies for onward distribution to non-registered Shareholders. CAE will not be paying for intermediaries to deliver to OBOs (who have not otherwise waived their right to receive proxy-related materials) copies of proxy related materials and related documents (including the Notification). Accordingly, an OBO will not receive copies of proxy-related materials and related documents unless the OBO’s intermediary assumes the costs of delivery.

How to Access Meeting Materials

On Computershare Investor Services Inc.’s (“Computershare”) website: www.envisionreports.com/CAE2024e

On SEDAR+: www.sedarplus.ca

On CAE’s website: www.cae.com/investors/financial-reports/

Shareholders are reminded to read the Circular and other Meeting materials carefully before voting their Shares.

xvi | CAE INC. | 2024 | Management Proxy Circular

How to Request a Paper Copy of the Meeting Materials

Before the Meeting

If your name appears on a Share certificate, you are considered as a “registered Shareholder”. You may request paper copies of the Meeting materials at no cost to you by calling Computershare toll-free, within North America at 1-866-962-0498 or direct, from outside of North America, at 514-982-8716 and entering your control number as indicated on your form of proxy.

If your Shares are listed in an account statement provided to you by an intermediary, you are considered as a “non-registered Shareholder”. You may request paper copies of the Meeting materials from Broadridge at no cost to you up to one year from the date the Circular was filed on SEDAR through the Internet by going to www.proxyvote.com or by telephone at 1-877-907-7643 and entering the 16-digit control number provided on the voting instruction form and following the instructions provided.

Please note that you will not receive another form of proxy or voting instruction form; please retain your current one to vote your Shares.

In any case, requests should be received at least five (5) business days prior to the proxy deposit date and time set out in the accompanying proxy or voting instruction form in order to receive the Meeting materials in advance of such date and the Meeting date.

After the Meeting

By telephone at 1-866-964-0492 or online at investor.relations@cae.com. A copy of the Meeting materials will be sent to you within ten (10) calendar days of receiving your request.

By order of the Board of Directors,

June 14, 2024

Montréal, Québec

| | | | | |

| |

Mark Hounsell

General Counsel, Chief Compliance Officer and Corporate Secretary |

xvii | CAE INC. | 2024 | Management Proxy Circular

1 | CAE INC. | 2024 | Management Proxy Circular

Section 1 – About Voting Your Shares

Record Date

June 21, 2024 is the record date for the Meeting.

Who can vote

Only holders of our Shares at the close of business on the Record Date are entitled to receive notice of and to attend, including by proxy, and vote at the Meeting or any adjournment or postponement thereof. The list of Shareholders on the Record Date is available for inspection by appointment during usual business hours at Computershare Trust Company of Canada, 650 de Maisonneuve west 7th floor, Montreal, QC H3A 3T2, and at the Meeting. As of June 14, 2024, 319,266,100 Shares are issued and outstanding. Each Share is entitled to one vote.

Principal Shareholders

To the knowledge of the Directors and executive officers of CAE (from records and publicly filed reports), there is no person who beneficially owns or exercises control or direction over more than 10% of the Shares.

All Directors and executive officers as a group (23 persons) beneficially owned or exercised control or direction over 623,272 Shares representing 0.20% of the class as at June 14, 2024.

Your Vote is Important

Your vote is important. Please read the information below to ensure your Shares are properly voted.

How do I participate in the Meeting?

The Meeting will be held in a virtual only format that will be conducted via live webcast online. Shareholders will not be able to attend the Meeting in person.

Participating in the Meeting online allows registered Shareholders and duly appointed Proxyholders, including non-registered (beneficial) Shareholders who have appointed themselves or another person as a Proxyholder, to participate at the Meeting and ask questions, all in real time, including verbally through a phone conference. Registered Shareholders and duly appointed Proxyholders can vote at the appropriate time during the Meeting.

Guests, including non-registered beneficial Shareholders who have not duly appointed themselves or another person as a Proxyholder, can log in to the Meeting as set out below. Guests will be able to participate in the Meeting but cannot vote.

To access the Meeting, follow the instructions below, as applicable to you:

1.Log in online at https://web.lumiagm.com/461348319. The platform is compatible with all major browsers except for Internet Explorer.

2.Click “I have a Login” and then enter your Control Number (see below) and Password “CAE2024” (note the password is case sensitive); OR

3.Click “I am a guest” and then complete the online form.

In order to find the 15-digit Control Number to access the Meeting:

—Registered Shareholders: The control number located on the form of proxy or in the email notification you received is your Control Number.

—Proxyholders: Duly appointed Proxyholders, including non-registered (beneficial) Shareholders that have appointed themselves or another person as a Proxyholder, will receive the Control Number from Computershare by e-mail after the proxy voting deadline has passed.

We recommend that you log in at least one hour before the start time of the Meeting. It is important to ensure you are connected to the Internet at all times if you participate in the Meeting online in order to vote when balloting commences. You are responsible for ensuring Internet connectivity for the duration of the Meeting. For additional details and instructions on accessing the Meeting online from your tablet, smartphone or computer, voting and asking questions during the Meeting, see the Virtual AGM User Guide provided by Computershare and accompanying this Circular.

For additional information regarding voting by proxy before the meeting, voting online, attending the virtual meeting or other general proxy matters, please contact Computershare at 1-800-564-6253 (Canada/U.S.) or 1-514-982-7555 (international/direct dial).

2 | CAE INC. | 2024 | Management Proxy Circular

Section 1 – About Voting Your Shares

How to Vote your Shares

You may vote your Shares in one of the following ways:

1. By proxy using all the voting channels that have been available in the past; this has not changed. Voting at the Meeting remains in the virtual-only form, without any possibility for in-person attendance.

by mail: sign, date and return your proxy form in the envelope provided.

by mail: sign, date and return your proxy form in the envelope provided. by telephone: call the telephone number on your proxy form.

by telephone: call the telephone number on your proxy form. on the Internet: visit the website listed on your proxy form.

on the Internet: visit the website listed on your proxy form. by appointing another person to attend and vote at the Meeting online on your behalf.

by appointing another person to attend and vote at the Meeting online on your behalf.Refer to the enclosed proxy form for instructions.

2. Virtually at the Meeting online by following the instructions below. The voting process is different for registered or non-registered (beneficial) Shareholders:

(a) if you are a registered Shareholder, you may vote at the Meeting by completing a ballot online during the Meeting. Follow the instructions above to access the Meeting and cast your ballot online during the designated time.

(b) if you are a non-registered Shareholder (including a participant in the employee plan) AND you wish to vote online at the Meeting, you must appoint yourself as Proxyholder in order to vote at the Meeting. You MUST complete and return a voting instruction form no later than 11:00 a.m. (Eastern Time) on August 12, 2024 appointing yourself as Proxyholder. Follow the instructions above to access the Meeting and cast your ballot online during the designated time. You will receive the Control Number for the Meeting from Computershare by e-mail after the proxy voting deadline has passed.

United States Beneficial holders: To vote at the Meeting, you must first obtain a valid legal proxy from your broker, bank or other agent and then register in advance of the Meeting. Follow the instructions from your broker or bank included with this Circular, or contact your broker or bank to request a legal proxy form. To register to attend the Meeting online, you must submit a copy of your legal proxy form to Computershare. Requests for registration should be directed to Computershare at 100 University Avenue, 8th Floor, Toronto, Ontario M5J 2Y1, or by e-mail at uslegalproxy@computershare.com. Requests for registration must be labelled as “Legal Proxy” and be received no later than 11:00 a.m. (EDT) on August 12, 2024. You will receive a confirmation of your registration after Computershare receives your registration materials. Please note that you are required to register your appointment as Proxyholder at https://www.computershare.com/CAE.

If you have any questions or need assistance voting, you may contact Kingsdale Advisors, CAE’s strategic advisor, by telephone at 1-877-659-1819 (toll-free in North America) or 1-437-561-4996 (text and call enabled outside North America), or by email at contactus@kingsdaleadvisors.com.

3 | CAE INC. | 2024 | Management Proxy Circular

Section 1 – About Voting Your Shares

Voting by Proxy

If you choose to vote by proxy, you are giving the person or people named on your proxy form (referred to as a “Proxyholder”) the authority to vote your Shares on your behalf online at the Meeting or any adjournment or postponement thereof.

Proxies are being solicited by management

Through this Circular, management is soliciting your proxy in connection with the matters to be addressed at the Meeting (or any adjournment(s) or postponements(s) thereof) to be held at the time and place and for the purposes set forth in the accompanying Notice of the Meeting.

The solicitation is being made primarily by mail, but you may also be contacted by telephone or other means. We have retained Kingsdale Advisors to provide a broad array of strategic advisory, governance, strategic communications, digital and investor campaign services on a global retainer basis in addition to certain fees accrued during the life of the engagement upon the discretion and direction of the Company. The Company may also reimburse brokers and other persons holding Shares in their name or in the name of nominees for their costs incurred in sending proxy material to their principals in order to obtain their proxies. | | |

Proxyholders other than management Shareholders desiring to appoint some person other than Alan N. MacGibbon, Marc Parent and Margaret S. (Peg) Billson as their representative at the Meeting may do so either by inserting such other person’s name in the blank space provided or by completing another proper proxy form and, in either case, delivering the completed proxy to CAE’s Corporate Secretary at 8585 Côte-de-Liesse, Saint-Laurent, Québec, H4T 1G6 or to Computershare Trust Company of Canada, 100 University Avenue, 8th Floor, Toronto, Ontario, M5J 2Y1 no later than 11:00 a.m. (Eastern Time) on August 12, 2024 (or, in the case of an adjournment or postponement, no later than 11:00 a.m. (Eastern Time) on the last business day preceding the day of such adjournment or postponement thereof).

|

Unless you specify a different Proxyholder, the CAE officers and/or Directors whose names are pre-printed on the enclosed form of proxy (Alan N. MacGibbon, Marc Parent and Margaret S. (Peg) Billson) will vote your Shares. The Company may utilize the Broadridge QuickVoteTM system, which involves NOBOs being contacted by Kingsdale, which is soliciting proxies on behalf of management, to obtain voting instructions over the telephone and relaying them to Broadridge (on behalf of the NOBO’s intermediary). While representatives of Kingsdale are soliciting proxies on behalf of management, Shareholders are not required to vote in the manner recommended by the Board. The QuickVoteTM system is intended to assist Shareholders in placing their votes, however, there is no obligation for any Shareholders to vote using the QuickVoteTM system, and Shareholders may vote (or change or revoke their votes) at any other time and in any other applicable manner described in this Circular. Any voting instructions provided by a Shareholder will be recorded and such Shareholder will receive a letter from Broadridge (on behalf of the Shareholder’s intermediary) as confirmation that their voting instructions have been accepted.

4 | CAE INC. | 2024 | Management Proxy Circular

Section 1 – About Voting Your Shares

Voting of Proxies

You may indicate on the proxy form how you want your Proxyholder to vote your Shares, in which case the Proxyholder will vote in accordance with your instructions. You can also let your Proxyholder decide for you. If you do not specify on the proxy form how you want your Shares to be voted, your Proxyholder will have the discretion to vote your Shares as they see fit.

The enclosed proxy form gives the Proxyholder discretion with respect to any amendments or variations to matters described in the Notice of Annual Meeting and with respect to any other matters which may properly come before the Meeting (including any adjournment or postponement thereof), in each instance, to the extent permitted by law, whether or not the amendment, variation, or other matter that comes before the Meeting is routine and whether or not the amendment, variation, or other matter that comes before the Meeting is contested.

At the time of printing this Circular, the management of CAE knows of no such amendments, variations or other matters to come before the Meeting. However, if you have not specified how to vote on a particular matter, or if any amendments or variations to matters identified in the Notice of Annual Meeting, or any other matters that are not now known to management of CAE, should properly come before the Meeting or any adjournment or postponement thereof, the Shares represented by properly submitted proxies given in favour of the persons designated by management of CAE in the form of proxy will be voted on such matters pursuant to such discretionary authority.

Unless you specify a different Proxyholder or specify how you want your Shares to be voted, Alan N. MacGibbon, Marc Parent and Margaret S. (Peg) Billson will vote your Shares:

(a) FOR electing the nominated Directors who are listed in this Circular;

(b) FOR appointing PwC as auditors and for the authorization of the Directors to fix their remuneration;

(c) FOR approving the advisory resolution on executive compensation; and

(d) FOR approving the reconfirmation of the Rights Plan.

Registered Shareholders who wish to appoint a third-party Proxyholder to represent them at the Meeting must first use the form of proxy to appoint the Proxyholder and then must register their Proxyholder online. Failure to register the Proxyholder will result in the Proxyholder not receiving a Control Number and therefore being unable to participate in the Meeting.

To register a third-party Proxyholder, Shareholders must visit https://www. computershare.com/CAE by August 12, 2024 at 11:00 a.m. (Eastern Time) and provide Computershare with the Proxyholder’s contact information required. Computershare needs this information so they can confirm their registration and send an email notification with a Control Number. Your Proxyholder needs the Control Number in order to participate in the meeting and vote your Shares. Your third-party Proxyholder should receive the email notification after 11:00 a.m. (Eastern Time) on August 12, 2024.

To be effective, your proxy must be received before 11:00 a.m. (Eastern Time) on August 12, 2024 or not less than 48 hours (excluding Saturdays, Sundays and holidays) prior to the time fixed for holding any adjournment or postponement of the Meeting.

If you have any questions or need assistance voting, please contact Kingsdale Advisors at 1-877-659-1819 (toll-free in North America) or 1-437-561-4996 (text and call enabled outside North America) or by email at contactus@kingsdaleadvisors.com. Late proxies may be accepted or rejected by the Chair of the Meeting at his or her discretion and the Chair of the Meeting is under no obligation to accept or reject any particular late proxy. The time limit for deposit of proxies may be waived or extended by the Chair of the Meeting at his or her discretion, without notice.

Revocation of Proxies

You have the right to revoke a proxy by any of the following methods:

(a) Vote again by phone or Internet no later than 11:00 a.m. (Eastern Time) on August 12, 2024 (or not less than 48 hours (excluding Saturdays, Sundays and holidays) prior to the date of any adjourned or postponed Meeting); or

(b) Deliver another completed and signed proxy form, dated later than the first proxy form, by mail or fax such that it is received by CAE’s Corporate Secretary at 8585 Côte-de-Liesse, Saint-Laurent, Québec, H4T 1G6 or by Computershare Trust Company of Canada, 100 University Avenue, 8th Floor, Toronto, Ontario, M5J 2Y1 no later than 11:00 a.m. (Eastern Time) on August 12, 2024 (or not less than 48 hours (excluding Saturdays, Sundays and holidays) prior to the date of any adjourned or postponed Meeting.

5 | CAE INC. | 2024 | Management Proxy Circular

Section 1 – About Voting Your Shares

Electronic Access to Proxy-Related Materials and Annual and Quarterly Reports

We offer our Shareholders the opportunity to view management proxy circulars, annual reports and quarterly reports through the Internet instead of receiving paper copies in the mail. You will find more information on this matter in the Notice-and-Access section above.

Electronic Delivery in Future

Shareholders are asked to consider signing up for electronic delivery of meeting materials. Electronic delivery is a convenient way to make distribution of materials more efficient and is an

environmentally responsible alternative by eliminating the use of printed paper and the carbon footprint of the associated mail delivery process. Signing up is quick and easy, and can be done by visiting www.proxyvote.com and signing in with your control number. After voting on the matters to be addressed at the Meeting and following your vote confirmation, you will be able to select the electronic delivery box and provide an email address. Having registered for electronic delivery, going forward you will receive your meeting materials by email and will be able to vote on your device by simply following a link in the email sent by your financial intermediary, provided your intermediary supports this service.

6 | CAE INC. | 2024 | Management Proxy Circular

7 | CAE INC. | 2024 | Management Proxy Circular

Section 2 – Business of the Meeting

1 Receive CAE’s Consolidated Financial Statements

CAE’s consolidated financial statements including the auditors’ report, for the year ended on March 31, 2024 will be presented to Shareholders at the Meeting. They can also be accessed on CAE’s website at www.cae.com, on SEDAR+ at www.sedarplus.ca, or on EDGAR at www.sec.gov. No Shareholder vote is required in connection with the consolidated financial statements.

2 Elect 13 Directors

| | | | | | | | | | | | | | |

13 Nominees | 92.3%1 Independent | 61 Average Age | 98.5% % Votes FOR

in 2023 | 98.7% Average Board Meeting Attendance |

| | | | |

1.The only non-Independent Director is CAE’s President and CEO. “Independent Directors” refers to the standards of independence established by CAE’s Corporate Governance Guidelines, applicable corporate governance rules of the New York Stock Exchange and SEC, and under the Canadian Securities Administrators’ National Instrument 58-101 – Disclosure of Corporate Governance Practices and National Policy 58-201.

You will be electing a board of directors (“Board”) of 13 members. Each Director is elected annually for a term which expires no later than the next annual meeting of Shareholders.

| | | | | | | | |

| All of the following nominees, except Ian L. Edwards, are currently members of the Board of Directors, and all have been recommended by the GC and the Board for election at the Meeting. Mr. Edwards will become a Director following his election at the Meeting. |

—Ayman Antoun —Margaret S. (Peg) Billson —Sophie Brochu —Patrick Decostre —Elise Eberwein | —Ian L. Edwards —Marianne Harrison —Alan N. MacGibbon —Mary Lou Maher —François Olivier | —Marc Parent, C.M. —Gen. David G. Perkins —Patrick M. Shanahan |

8 | CAE INC. | 2024 | Management Proxy Circular

Section 2 – Business of the Meeting

Each nominee was elected at our 2023 annual Shareholders’ meeting held on August 9, 2023, by a majority of the votes cast (average of 98.5% of votes cast in favour), except for Messrs. Decostre and Edwards who are first-time nominees.

Please refer to Section 3 – About the Nominated Directors for further information regarding the experience, the selection process and other relevant information you should consider in casting your vote for each nominee.

Management has been informed that, if elected, each of such nominees would be willing to serve as a Director. However, in the event any proposed nominee advises that he or she is unable or unwilling to act for any reason prior to the Meeting, proxies held by the persons designated as proxyholders on the form of proxy will be voted in favour of the remaining nominees and for such other substitute nominee in their discretion unless the Shareholder has specified in the form of proxy that such Shareholder’s Shares are to be withheld from voting in the election of Directors.

Self-imposed term and age limits ensure CAE benefits from a combination of experience and fresh perspectives

The Board of Directors has passed a resolution establishing term limits comprising the following:

—up to three four-year periods of service, to aggregate twelve years maximum;

—no nominee may be proposed past their attaining 75 years of age; and

—the Chair of the Board may be in the role for a full five-year term regardless of his or her age or the number of years the individual has been a Director.

The Board of Directors believes these limits, subject to reasoned exceptions, are appropriate to ensure fresh skill sets and perspectives are periodically brought to the oversight of CAE’s business.

Majority voting requirement

Each Director of the Company must be elected by a majority (50% +1 vote) of the votes cast with respect to his or her election, other than at contested meetings.

In accordance with our Corporate Governance Guidelines, any nominee who receives a greater number of votes cast “against” him or her than votes “for” will not be elected as a Director. Notwithstanding the foregoing, if the nominee is an incumbent Director, such Director may continue in office until the earlier of (i) the 90th day after the election, or (ii) the day on which his or her successor is appointed or elected. In accordance with the provisions of the Canada Business Corporations Act and its regulations, the Board may reappoint an incumbent Director even if he or she does not receive majority support in the following circumstances:

—to satisfy Canadian residency requirements; or

—to satisfy the requirement that at least two Directors are not also officers or employees of the Company or its affiliates.

Detailed voting results will be disclosed after the Meeting

Promptly, after the Meeting, we will publicly disclose the number and percentage of votes cast for and withheld in respect of each nominee, as well as those cast for and against each other matter voted on by Shareholders at the Meeting.

| | |

The Board of Directors recommends that Shareholders vote FOR the election of the 13 nominated members of the Board. |

9 | CAE INC. | 2024 | Management Proxy Circular

Section 2 – Business of the Meeting

3 Appoint the Auditors

The Board, on recommendation by the Audit Committee, proposes that PricewaterhouseCoopers LLP (PwC), Chartered Accountants, Montréal, Québec be re-appointed as auditors of CAE to hold office until the close of the next annual meeting of Shareholders and that the Directors of CAE be authorized to fix their remuneration.

PwC has served as auditors of CAE since 1991.

PwC provides three types of services to CAE and its subsidiaries

1.Audit Services: fees billed for professional services for the audit of CAE’s annual consolidated financial statements and services that are normally provided by PwC in connection with statutory and regulatory filings, including the audit of the internal controls and financial reporting as required by the Sarbanes-Oxley Act of 2002 (“SOX”).

2.Audit-related Services: fees relating to work performed in connection with CAE’s acquisitions/divestitures, financings/prospectuses, translation and other miscellaneous accounting-related services.

3.Tax Services: fees relating to tax compliance, tax planning and tax advice.

Auditors’ independence

The Audit Committee has discussed with PwC its independence from management and CAE, has considered and concluded that the provision of non-audit services is compatible with maintaining such independence.

Furthermore, as per its policy, the Audit Committee reviews and pre-approves all non-audit services provided by the external auditors above a specified level.

Fees Paid by CAE to PwC in FY2024

The following chart shows all fees paid to PwC by CAE and its subsidiaries in the most recent and prior fiscal year.

| | | | | | | | |

| Fee Type | 2024

($ millions) | 2023

($ millions) |

| 1. Audit services | 6.7 | 6.5 |

| 2. Audit-related services | 0.6 | 0.2 |

| 3. Tax services | 0.4 | 0.4 |

| Total | 7.7 | 7.1 |

In order to further support PwC’s independence, the Audit Committee has set a policy concerning CAE’s hiring of current and former partners and employees of PwC who were engaged on CAE’s account in the recent years. Pursuant to this policy, CAE will not initiate nor pursue any discussion with any former partner, principal, Shareholder or professional employee(s) of PwC regarding potential or future employment in a reporting oversight role with CAE if they are in a position to influence the audit firm’s operations or financial policies, has ownership or partnership interests or financial participation in the audit firm or was a member of the CAE external audit team during the one-year period preceding the date that audit procedures commenced.

| | |

The Board of Directors recommends that Shareholders vote FOR the appointment of PwC as CAE’s auditors. |

10 | CAE INC. | 2024 | Management Proxy Circular

Section 2 – Business of the Meeting

4 Advisory Vote on Executive Compensation

As detailed in Section 7 – Executive Compensation, CAE’s executive compensation philosophy and programs are based on the fundamental principle of pay-for-performance to align the interests of our executives with those of our Shareholders. This compensation approach allows CAE to attract and retain high-performing executives who are strongly incentivized to create value for CAE’s Shareholders on a sustainable basis.

Section 7 of the Circular describes our overall approach to executive compensation, the objectives of our executive compensation program, how compensation decisions are made and the compensation paid to our most highly paid executive officers in the last three years. Section 7 also describes the continued Shareholder outreach conducted in FY2024, seeking input on our compensation programs.

At the Meeting, Shareholders will be asked to consider and to cast an advisory, non-binding vote on CAE’s approach to executive compensation – this is often referred to as “say on pay”.

The text of the “say on pay” resolution reads as follows:

‘‘Resolved that the Shareholders accept the approach to executive compensation

disclosed in this Management Proxy Circular’’.

Because your vote is advisory, it will not be binding upon the Board. However, the Human Resources Committee (“HRC”) will review and analyze the results of the vote and take into consideration such results when reviewing executive compensation philosophy and programs.

If a significant proportion of the Shares represented, including by proxy, at the Meeting are voted against the above non-binding advisory resolution, the Board Chair or the HRC Chair will oversee a process to engage with Shareholders to give Shareholders the opportunity to express their specific concerns. The Board of Directors and the HRC will consider the results of this process and, if appropriate, review the Company’s approach to executive compensation in the context of Shareholders’ specific concerns.

Our approach to executive compensation was approved by 92.5% of the votes cast on the resolution during our August 9, 2023 annual meeting of Shareholders. Please refer to Section 7 – Executive Compensation – Compensation Discussion and Analysis – Shareholder Engagement, which describes our significant engagement initiatives with investors in FY2024, including with respect to our executive compensation programs.

| | |

The Board of Directors recommends that Shareholders vote FOR the resolution set out above. |

11 | CAE INC. | 2024 | Management Proxy Circular

Section 2 – Business of the Meeting

5 Approval of the Reconfirmation of the Rights Plan

CAE is a party to the Rights Plan, initially adopted on March 7, 1990, and last amended, restated and renewed on August 11, 2021. To remain effective, the Rights Plan must be reconfirmed every third annual meeting of Shareholders, including at the Meeting, by resolution passed by a majority of the votes cast by the Shareholders except those who do not qualify as Independent Shareholders (as defined in Appendix E). To the Company’s knowledge, there is no Shareholder who would not qualify as an Independent Shareholder for purposes of the Meeting. If it is not reconfirmed at the Meeting, the Rights Plan will terminate on August 14, 2024 and the rights issued under it will be void.

CAE believes that the Rights Plan preserves the fair treatment of Shareholders, is consistent with current best Canadian corporate governance practices and addresses institutional investor guidelines. The Rights Plan was not adopted in response to any actual or threatened take-over bid or other proposal from a third party to acquire control of CAE. It does not reduce the duty of the Board to act honestly, in good faith and in the best interests of CAE, and to act on that basis if any offer is made for the Shares of CAE. The Rights Plan is not intended to and will not entrench the Board.

At the Meeting, Shareholders will be asked to consider and vote to approve the reconfirmation of the Rights Plan, a summary of which is set forth in the attached Appendix E. This summary is qualified in its entirety by reference to the text of the Rights Plan, which is available upon request from the General Counsel, Chief Compliance Officer and Corporate Secretary of CAE at CAE Inc., 8585 Côte-de-Liesse, Saint-Laurent, Québec, H4T 1G6. The Rights Plan may also be accessed on CAE’s website (www.cae.com). Capitalized terms used in such summary without express definition have the meanings attributed thereto in the Rights Plan.

The text of the resolution approving the reconfirmation of the Rights Plan (the “Rights Plan Resolution”) is set forth below.

BE IT RESOLVED TO ADOPT THE FOLLOWING RESOLUTION:

THAT the reconfirmation of the Amended and Restated Shareholder Protection Rights Plan Agreement between CAE Inc. (the “Corporation”) and Computershare Trust Company of Canada, as rights agent, dated August 11, 2021, as may be further amended and restated from time to time, a summary of which is set forth in CAE’s Management Proxy Circular dated June 14, 2024, be and is hereby approved; and

THAT any officer of the Corporation be, and is hereby authorized and directed, for and on behalf of the Corporation, to finalize, sign or deliver all documents, to enter into any agreements and to do and perform all acts and things as such individual, in his or her discretion, deems necessary or advisable in order to give effect to the intent of this resolution and the matters authorized hereby, including compliance with all securities laws and regulations and the rules and requirements of the Toronto Stock Exchange, such determination to be conclusively evidenced by the finalizing, signing or delivery of such document or agreement or the performing of such act or thing.

| | |

The Board of Directors recommends that Shareholders vote FOR the Rights Plan Resolution. |

6 Other Business

We will also transact any other business that may properly come before the Meeting. At the time of printing of this Circular, the management of CAE knows of no such amendments, variations or other matters to come before the Meeting.

12 | CAE INC. | 2024 | Management Proxy Circular

13 | CAE INC. | 2024 | Management Proxy Circular

Section 3 – About the Nominated Directors

This Section presents a profile of each nominated Director, including an explanation of each nominated Director’s experience, languages, education, skills, qualifications and core competencies, attendance at Board and Committee meetings from April 1, 2023 to March 31, 2024, total value of compensation received in FY2024, Share ownership information, the extent of fulfillment of the Minimum Ownership requirements, previous voting results, as well as participation on the boards of other public companies. A description of the Director Selection and Nomination Process, Board Attributes and Demographics and a tabular summary of our Directors’ Skills and Experiences follows the individual tables. “Market Value” refers to the product of the sum of the Shares and DSUs held by a Director multiplied by the closing price on the TSX of a Share on June 5, 2023 and June 6, 2024.

Management has been informed that, if elected, each of such nominees would be willing to serve as a Director. However, in the event any proposed nominee advises that he or she is unable or unwilling to act for any reason prior to the Meeting, proxies held by the persons designated as proxyholders on the form of proxy will be voted in favour of the remaining nominees and for such other substitute nominee in their discretion unless the Shareholder has specified in the form of proxy that such Shareholder’s Shares are to be withheld from voting in the election of directors.

Effective January 1, 2024, non-Canadian resident Directors are paid in U.S. dollars on the basis of a one-for-one exchange rate of Canadian dollars to U.S. dollars, and their share ownership requirements are now in U.S. dollars. As such, for these Directors the “Total Value of Compensation Received in FY2024” includes payments made in U.S. dollars for the fourth quarter of FY2024, which were converted to Canadian dollars using the exchange rate on the last business day of the quarter (March 28, 2024), being $1.36 for each U.S. dollar. In addition, the “Market Value” of their securities held on June 6, 2024 has been converted to U.S. dollars using the Bank of Canada daily exchange rate on such date, being 0.73 U.S. dollars per Canadian dollar.

Footnotes specific to each nominee are presented immediately below their biography.

| | | | | | | | | | | | | | |

| 98.5% | 92.3%1 | 61 | 3.67 | 98.7% |

Average 2023 Votes FOR | Independent Directors | Average Age | Average Tenure2 (years) | Average Board Attendance |

| | | | |

1.The only non-Independent Director is CAE’s President and CEO.

2.For non-executive Directors.

14 | CAE INC. | 2024 | Management Proxy Circular

Section 3 – About the Nominated Directors

| | |

| Ayman Antoun |

Age: 58 Oakville, Ontario, Canada Independent Director since: 2022 Committees: Audit, Human Resources Total Value of Compensation Received in FY2024: $246,847 Languages: English, Arabic |

Experience IBM–General Manager, Americas, which includes Canada, the United States and Latin America, and member of IBM’s Performance Team consisting of IBM’s top 50 executives globally (2020 – 2023); President, IBM Canada (2018 – 2020); held various senior executive sales leadership roles in Canada and the United States spanning Global Technology Services, Systems & Technology Group, Education Industry, Business Partners, and Global Sales Transformation (1988 – 2018) |

Skills, Qualifications and Core Competencies Knowledge of Industry developed while at IBM where he gained experience in software development, which is essential to CAE Strategic Leadership and Management skills and experience obtained during his 35 years at IBM holding executive roles, including running IBM’s largest geography (Americas) which covered all twelve major industries across fourteen countries Information Technology / Cybersecurity / Digital expertise developed during his time at IBM where his roles had a focus on Infrastructure, Cloud, Cognitive Solutions, Security and Digital Reinvention software and hardware Government Relations experience gained by leading IBM’s public sector unit for more than eight years, serving as IBM Canada President, where he engaged with local, provincial and federal governments on a regular basis, and while serving as the partnership executive for the Canadian government for over ten years |

|

Education BS, Electrical Engineering, University of Waterloo Graduate, Executive program in financial analysis, business management and strategic planning, Harvard Business School |

| | | | | | | | |

|

|

| 2023 Voting Results |

| Votes For | 98.77% | 216,728,272 |

| Votes Against | 1.23% | 2,692,284 |

| | |

| Other Public Company Boards |

| TD Bank (2024 – present) |

|

Board and Committee Attendance1 |

| Board of Directors | 8 of 8 | 100% |

| Audit Committee | 2 of 2 | 100% |

| Human Resources Committee | 5 of 5 | 100% |

| Total | 15 of 15 | 100% |

1.Mr. Antoun joined the Audit Committee on August 9, 2023. |

| Share Ownership |

| June 6, 2024 | June 5, 2023 |

| Shares | 1,725 | - |

| DSUs | 14,362 | 5,820 |

| Total | 16,087 | 5,820 |

| Market Value | $414,723 | $168,082 |

| Minimum Ownership Requirement | $425,000 | $400,000 |

% of Achievement1 | 98% | 42% |

1.Mr. Antoun joined the Board on August 10, 2022 and must meet his required holdings over the five-year period from such date. |

15 | CAE INC. | 2024 | Management Proxy Circular

Section 3 – About the Nominated Directors

| | |

| Margaret S. (Peg) Billson |

Age: 62 Albuquerque, New Mexico, U.S. Independent Director since: 2015 Committees: Governance (Chair), Human Resources Total Value of Compensation Received in FY2024: $283,801 Languages: English |

Experience BBA Aviation–President & CEO, Aftermarket Services (2013 – 2016); President, Legacy Support (2009 – 2012) Eclipse Aviation–President & General Manager of the Airplane Division (2005 – 2008) Honeywell International–Vice-President & General Manager of Airframe Systems (2004 – 2005); Vice President & General Manager, Landing Systems (2002 – 2004); Vice President, Engine Systems Engineering and Program Management (1998 – 2001) Douglas Aircraft Company–Vice President Program Manager (1995 – 1997); Vice President Technical Services (1993 – 1995); held various quality assurance, engineering, and program management roles of increasing responsibility (1984 – 1993) |

Skills, Qualifications and Core Competencies Knowledge of Industry gained as a veteran aviation business leader with over 35 years of experience leading technology rich companies and engineering sectors for BBA Aviation, Eclipse Aviation, Honeywell and Boeing (McDonnell Douglas) Strategic Leadership and Management experience and Human Resources / Compensation expertise gained while holding executive roles at Honeywell, Boeing (McDonnell Douglas) and BBA Aviation, and such roles have provided her with significant insight into human resources and compensation issues encountered by companies conducting business within the aerospace sector R&D expertise developed while overseeing multiple full scale aircraft design and development programs such as the MD-11 at McDonnell Douglas and the EA-500 at Eclipse Aviation, as well as her responsibilities in product development at Honeywell Manufacturing / Supply Chain expertise obtained through her extensive experience being accountable for the on-time manufacturing of airplanes and components |

|

Education BS, Aeronautical Engineering, Embry-Riddle Aeronautical University MS, Engineering Aerospace, California State University Long Beach |

| | | | | | | | |

|

|

| 2023 Voting Results |

| Votes For | 97.34% | 213,578,735 |

| Votes Against | 2.66% | 5,841,823 |

| | |

| Other Public Company Boards |

| GE Aerospace (2023 – present) |

| Arconic Corp. (2020 – 2023) |

|

| Board and Committee Attendance |

| Board of Directors | 8 of 8 | 100% |

| Governance Committee (Chair) | 3 of 3 | 100% |

| Human Resources Committee | 4 of 5 | 80% |

| Total | 15 of 16 | 94% |

|

| Share Ownership |

| June 6, 2024 | June 5, 2023 |

| Shares | - | - |

| DSUs | 71,024 | 61,168 |

| Total | 71,024 | 61,168 |

| Market Value | US$1,337,911 | $1,766,532 |

| Minimum Ownership Requirement | US$425,000 | $400,000 |

| % of Achievement | 315% | 442% |

16 | CAE INC. | 2024 | Management Proxy Circular

Section 3 – About the Nominated Directors

| | |

| Sophie Brochu |

Age: 61 Bromont, Quebec, Canada Independent Director since: 2023 Committees: Audit, Human Resources Total Value of Compensation Received in FY2024: $163,105 Languages: English, French |

Experience Hydro-Québec–President and Chief Executive Officer (2020 – 2023) Énergir (formerly Gaz-Métro)–President and Chief Executive Officer (2007 – 2019); Vice-President, Business Development and other executive roles (1997 – 2007) Began her career as a financial analyst at Société québécoise d’initiatives pétrolières (SOQUIP) in 1987 |

Skills, Qualifications and Core Competencies Strategic Leadership and Management experience gained while serving as CEO at Energir and Hydro Quebec Human Resources / Compensation expertise gained during her service in CEO roles where she had ultimate oversight for succession planning, talent management and retention, and alignment of HR compensation programs with strategic orientations, as well as during her service on HR/Compensation committees of various public boards Government Relations expertise gained from her over 35 years of deep experience with energy utilities and regulated entities, both in Canada and the US, which involve various and complex governmental relations, both at the political and administrative levels, which resulted in her extensive strategic understanding of public policies Sustainability expertise through her over 25 years of experience in the deployment of health and safety programs, establishment of environmental frameworks, fostering of deep relationships with various stakeholders, and advancing of diversity and inclusion practices at the organizations that she oversaw |

|

Education BA, Economics, Université Laval |

| | | | | | | | |

|

|

| 2023 Voting Results |

| Votes For | 99.69% | 218,731,614 |

| Votes Against | 0.31% | 688,944 |

| | |

| Other Public Company Boards |

| Compagnie de Saint-Gobain S.A. (2024 – present) |

| CGI Inc. (2019 – 2020; 2023 – present) |

| Bank of Montreal (2011 – 2023) |

| BCE Inc. and Bell Canada (2010 – 2020) |

| Valener Inc. (2000 – 2019) |

| Énergir (formerly Gaz Metro) (2007 – 2019) |

|

Board and Committee Attendance1 |

| Board of Directors | 5 of 5 | 100% |

| Audit Committee | 2 of 2 | 100% |

| Human Resources Committee | 2 of 2 | 100% |

| Total | 9 of 9 | 100% |

1.Ms. Brochu joined the Board, Audit Committee and Human Resources Committee on August 9, 2023. |

|

Share Ownership2 |

| June 6, 2024 | June 5, 2023 |

| Shares | - | - |

| DSUs | 5,667 | - |

| Total | 5,667 | - |

| Market Value | $146,095 | - |

| Minimum Ownership Requirement | $425,000 | N/A |

| % of Achievement | 34% | N/A |

2.Ms. Brochu joined the Board on August 9, 2023 and must meet her required holdings over the five-year period from such date. |

17 | CAE INC. | 2024 | Management Proxy Circular

Section 3 – About the Nominated Directors

| | |

| Patrick Decostre |

Age: 51 Montreal, Quebec, Canada Independent Director since: 2024 Committees: N/A Total Value of Compensation Received in FY2024: N/A Languages: English, French |

Experience Boralex Inc.–President and Chief Executive Officer (2020 – present); Vice President and Chief Operating Officer (2019 – 2020); Vice President and General Manager of Boralex’s European subsidiaries (2001 – 2019) |

Skills, Qualifications and Core Competencies Strategic Leadership and Management experience gained in this role as CEO of Boralex since 2020, and during 20+ years in leadership positions in Europe for Boralex while building and growing the company Human Resources / Compensation expertise gained while serving as General Manager, COO and CEO of Boralex, dealing with human resources, organizational design, transformation and compensation Risk Management experience gained while serving as COO and CEO of Boralex, working with the board to set up new identification and risk management systems, including sustainability risks Capital Markets / M&A expertise gained through equity markets investor relations experience, as well as debt financing and refinancing, acquisitions and divestitures, and acquisitions integration throughout his time at Boralex |

|

Education BSc, Civil Engineering in Physics, Université Libre de Bruxelles – École Polytechnique de Bruxelles Masters in Technological & Industrial Management, Université Libre de Bruxelles – Solvey Brussels School of Economics and Management |

| | | | | | | | |

|

|

| 2023 Voting Results |

| Votes For | N/A | N/A |

| Votes Against | N/A | N/A |

| | |

| Other Public Company Boards |

| Boralex Inc. (2020 – present) |

|

| Board and Committee Attendance |

| Board of Directors | N/A | N/A |

| Total | N/A | N/A |

|

Share Ownership1 |

|

| June 6, 2024 |

| Shares |

| - |

| DSUs |

| - |

| Total |

| - |

| Market Value |

| - |

| Minimum Ownership Requirement |

| $425,000 |

| % of Achievement |

| - |

1Mr. Decostre joined the Board on May 16, 2024 and must meet his required holdings over the five-year period from such date. |

18 | CAE INC. | 2024 | Management Proxy Circular

Section 3 – About the Nominated Directors

| | |

| Elise Eberwein |

Age: 59 Scottsdale, Arizona, U.S. Independent Director since: 2022 Committees: Audit, Human Resources Total Value of Compensation Received in FY2024: $274,003 Languages: English |

Experience American Airlines, Inc.–Executive Vice President, People and Communications (2013 – 2022) US Airways–Executive Vice President, People, Communications and Public Affairs (2005 – 2013) America West Airlines–Vice President, Corporate Communications (2003 – 2005) Served in key executive roles with Frontier Airlines and Western Pacific Airlines Began her aviation career as a flight attendant |