UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

Amendment No. 1

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended November 30, 2013

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Transition Period from to

Commission File Number: 001-31913

NOVAGOLD RESOURCES INC.

(Exact Name of Registrant as Specified in Its Charter)

| British Columbia | N/A |

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) |

| | |

789 West Pender Street, Suite 720 Vancouver, British Columbia, Canada | V6C 1H2 |

(Address of Principal Executive Offices) | (Zip Code) |

| | |

(604) 669-6227 (Registrant’s Telephone Number, Including Area Code) |

| | |

Securities registered pursuant to Section 12(b) of the Act: |

| | |

Title of Each Class | Name of Each Exchange on Which Registered |

| | | |

Common Shares, no par value | NYSE MKT |

| | |

Securities registered pursuant to Section 12(g) of the Act: None |

| | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o | | (Do not check if a smaller reporting company) | Smaller reporting company o |

| | | | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes oNo x

Based on the last sale price on the NYSE-MKT of the registrant’s Common Shares on May 31, 2013 (the last business day of the registrant’s most recently completed second fiscal quarter) of $2.52 per share, the aggregate market value of the voting Common Shares held by non-affiliates was approximately $494,525,075.

As of March 14, 2014, the registrant had 317,297,868 Common Shares, no par value, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

NOVAGOLD RESOURCES INC.

TABLE OF CONTENTS

| | | Page |

| | | |

| Explanatory Note | 4 |

| | | |

| PART III | 5 |

| | | |

| | Item 10. Directors, Executive Officers and Corporate Governance | 5 |

| | Item 11. Executive Compensation | 19 |

| | Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 42 |

| | Item 13. Certain Relationships and Related Transactions, and Director Independence | 44 |

| | Item 14. Principal Accountant Fees and Services | 45 |

| | | |

| PART IV | 47 |

| | |

| | Item 15. Exhibits and Financial Statement Schedules | 47 |

| | | |

EXPLANATORY NOTE

This Amendment No. 1 to the Annual Report on Form 10-K of NOVAGOLD RESOURCES INC. (“NOVAGOLD”, “we”, “our”, “us”, or the “Company”) for the year ended November 30, 2013, which was originally filed with the U.S. Securities and Exchange Commission (“SEC”) on February 12, 2014, is being filed to include the responses to the items required by Part III that we previously intended to incorporate by reference to the proxy statement for our 2014 annual meeting of shareholders. Additionally, pursuant to Rule 12b-15 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the Company has filed the certifications required by Rule 13a-14(a) or 15d-14(a) of the Exchange Act. Except as specifically provided otherwise herein, this Amendment No. 1 does not reflect events occurring after February 12, 2014, the date of the filing of our original Form 10-K, or modify or update those disclosures that may have been affected by subsequent events. Accordingly, this Amendment No. 1 should be read in conjunction with the Form 10-K originally filed on February 12, 2014.

Unless the context otherwise requires, the words “we,” “us,” “our,” the “Company” and “NOVAGOLD” refer to NOVAGOLD RESOURCES INC., a British Columbia corporation, and its subsidiaries as of November 30, 2013.

PART III

Item 10. Directors, Executive Officers and Corporate Governance

The following table sets forth certain information with respect to our current Directors and executive officers. The term for each Director expires at the next annual meeting of Shareholders or at such time as a qualified successor is appointed, upon ceasing to meet the qualifications for election as a director, upon death, upon removal by the Shareholders or upon delivery or submission to the Company of the Director's written resignation, unless the resignation specifies a later time of resignation. Each executive officer shall hold office until the earliest of the date the officer’s resignation becomes effective, the date a successor is appointed or the officer ceases to be qualified for that office, or the date the officer is terminated by the Board of Directors of the Company. The name, location of residence, age, and office held by each Director and executive officer, current as of March 14, 2014, has been furnished by each of them and is presented in the following table. Unless otherwise indicated, the address of each Director and executive officer in the table set forth below is care of NOVAGOLD RESOURCES INC., 201 South Main, Suite 400, Salt Lake City, Utah 84111, United States.

| Name and Municipality of Residence | Position and Office Held | Director/Officer Since | Age |

Sharon Dowdall(2)(3) Ontario, Canada | Director | April 16, 2012 | 61 |

Dr. Marc Faber(5) Chiang Mai, Thailand | Director | July 5, 2010 | 68 |

Dr. Thomas Kaplan(1) New York, USA | Chairman | November 15, 2011 | 51 |

Gregory Lang(4)(6) Utah, USA | President and CEO / Director | April 16, 2012 / January 9, 2012 | 59 |

Gillyeard Leathley(4) British Columbia, Canada | Director | November 15, 2011 | 76 |

Igor Levental(5)(6) Colorado, USA | Director | July 5, 2010 | 58 |

Kalidas Madhavpeddi(2)(3) Arizona, USA | Director | July 31, 2007 | 58 |

Gerald McConnell(3)(5)(6) Nova Scotia, Canada | Lead Director | 1984 | 69 |

Clynton Nauman(2)(4) Washington, USA | Director | 1999 | 65 |

Rick Van Nieuwenhuyse(6) British Columbia, Canada | Director | 1999 | 58 |

Anthony Walsh(2)(5) British Columbia, Canada | Director | March 19, 2012 | 62 |

David Deisley Utah, USA | Executive Vice President, General Counsel and Corporate Secretary | November 1, 2012 | 57 |

David Ottewell Utah, USA | Vice President and CFO | November 13, 2012 | 53 |

| (1) Chairman of the Board. (2) Member of the Audit Committee. (3) Member of the Compensation Committee. (4) Member of the EHSS and Technical Committee. (5) Member of the Corporate Governance and Nominations Committee. (6) Member of the Corporate Communications Committee. |

The Securities Held listed below for each Director and NEO are as of November 30, 2013. Determination of whether each person meets the share ownership guidelines is determined by calculating the number of Common Shares and DSUs, if applicable, owned by each person, multiplied by the closing price of the Common Shares on November 29, 2013 on the TSX (if a Director), or on the NYSE-MKT (if a NEO).

| Sharon Dowdall |

Ms. Dowdall, a Director of the Company, has a 30-year career in the mining industry. Ms. Dowdall served in senior legal capacities for Franco-Nevada Corporation (“Franco-Nevada”), a major gold-focused royalty company, and Newmont Mining Company, one of the world’s largest gold producers. During her 20-year tenure with Franco-Nevada, Ms. Dowdall served in various capacities, including Chief Legal Officer and Corporate Secretary and Vice President, Special Projects. Ms. Dowdall was one of the principals who transformed Franco-Nevada from an industry pioneer into one of the most successful precious metals enterprises in the world. Prior to joining Franco-Nevada, she practiced law as a partner with Smith Lyons in Toronto, a major Canadian legal firm specializing in natural resources. Ms. Dowdall is the recipient of the 2011 Canadian General Counsel Award for Business Achievement. She currently serves on the boards of several Canadian exploration and development companies. Ms. Dowdall holds an Honours B.A. in Economics from the University of Calgary and an LLB, from Osgoode Hall Law School at York University. The Board has determined that Ms. Dowdall should serve as a Director due to her significant experience: 1) as a natural resources lawyer, 2) moving a precious-metals mining company from the development stage to the successful producer stage, and 3) working in a senior executive position at large international mining company. Ms. Dowdall joined the Board on April 16, 2012. During the past five years, Ms. Dowdall was employed with Franco-Nevada as Chief Legal Officer and Corporate Secretary (December 2007-May 2010), and as Vice President, Special Projects (May 2010-December 2011). She currently consults for Franco-Nevada. During the last five years Ms. Dowdall has served, and continues to serve, on the boards of Olivut Resources Ltd and Foran Resources Ltd. Areas of expertise include: legal, corporate governance, finance, investment, valuation, securities, human resources, corporate strategy, corporate leadership and mining industry. |

| Board / Committee Membership | Overall Attendance 100% | Securities Held | Share Ownership Guidelines |

| Regular Meeting | Common Shares # | DSUs # | Total C$ | % Met |

Board Audit(1) Compensation | 6/6 3/3 6/6 | Nil | 6,021 | 50,000 | 30% |

| (1) | Ms. Dowdall joined the Audit Committee March 1, 2013. |

| Dr. Marc Faber |

Dr. Faber, a Director of the Company, has over 35 years of experience in the finance industry and is the Managing Director of Marc Faber Ltd., an investment advisory and fund management firm. He is an advisor to a number of private investment funds and serves as a director of Ivanplats Limited and Sprott Inc. Dr. Faber publishes a widely read monthly investment newsletter entitled The Gloom, Boom & Doom Report and is the author of several books including Tomorrow’s Gold – Asia’s Age of Discovery. A renowned commentator on global market trends and developments, he is also a regular contributor to several leading financial publications around the world, including Barron’s, where he is a member of the Barron’s Roundtable. Dr. Faber received his PhD in Economics magna cum laude from the University of Zurich. The Board has determined that Dr. Faber should serve as a Director for the Company to benefit from his vast knowledge of economics, global market trends, precious metals and commodities in general. Dr. Faber’s principal occupation over the last five years is Managing Director of Marc Faber Ltd. During the last five years, Dr. Faber has served, and continues to serve, on the boards of Ivanplats Limited and Sprott Inc. Areas of expertise include: global economics and market dynamics, finance and mining industry. |

| Board / Committee Membership | Overall Attendance 100% | Securities Held | Share Ownership Guidelines |

| Regular Meeting | Common Shares # | DSUs # | Total C$ | % Met |

Board Corporate Governance | 6/6 4/4 | Nil | 9,359 | 50,000 | 46% |

| Dr. Thomas Kaplan |

Dr. Kaplan is Chairman of the Board of the Company as well as NovaCopper Inc. He is also Chairman and Chief Investment Officer of The Electrum Group LLC, a privately-held global natural resources investment management company which manages the portfolio of Electrum, the single largest Shareholder of the Company. Dr. Kaplan is an entrepreneur and investor with a track record of both creating and unlocking Shareholder value in public and private companies. Most recently, Dr. Kaplan served as Chairman of Leor Exploration & Production LLC, a natural gas exploration and development company founded by Dr. Kaplan in 2003. In 2007, Leor’s natural gas assets were sold to EnCana Oil & Gas USA Inc., a subsidiary of Encana Corporation, for $2.55 billion. Dr. Kaplan holds Bachelors, Masters and Doctoral Degrees in History from Oxford University. The Board has determined that Dr. Kaplan should serve as the Director and Chairman to gain from his experience as a developer of and investor in mining and oil and gas companies, as well as his significant beneficial ownership in the Company. Dr. Kaplan’s principal occupation during the last five years has been Chairman and Chief Investment Officer of The Electrum Group LLC. During the last five years Dr. Kaplan has served, and continues to serve, on the board of NovaCopper Inc. Areas of expertise include: finance, mergers and acquisitions, mining industry. |

| Board / Committee Membership | Overall Attendance 83% | Securities Held | Share Ownership Guidelines |

| Regular Meeting | Common Shares # | DSUs # | Total C$ | % Met |

| Board | 5/6(2) | Nil(3) | 14,444 | 50,000 | 71% |

| (2) | Dr. Kaplan missed the August 1, 2013 Board Meeting to attend a funeral. |

| (3) | See description of Electrum’s holdings and Dr. Kaplan’s relationship with Electrum under “Voting Shares and Principal Holders Thereof.” |

| Gregory Lang |

Mr. Lang is President and Chief Executive Officer of the Company. Mr. Lang has over 35 years of diverse experience in mine operations, project development and evaluations, including time as President of Barrick Gold North America, a wholly-owned subsidiary of Barrick Gold Corporation (“Barrick”). Mr. Lang has held progressively responsible operating and project development positions over his 10-year tenure with Barrick and, prior to that, with Homestake Mining Company and International Corona Corporation, both of which are now part of Barrick. He holds a Bachelor of Science in Mining Engineering from University of Missouri-Rolla and is a Graduate of the Stanford University Executive Program. The Board has determined that Mr. Lang should continue to serve as a Director to gain his insight as an experienced mine engineer, as well as his expertise in permitting, developing and operating large-scale assets, and as a successful senior executive of other large gold-mining companies. Mr. Lang joined the Board on April 16, 2012. During the last five years, Mr. Lang served as the President of Barrick until December 2011, and has served as the Company’s President and Chief Executive Officer since January 2012. Mr. Lang has served, and continues to serve, as a director of NovaCopper Inc. and Sunward Resources during the last five years. Areas of expertise include: mining operations, mine development and evaluation and corporate leadership. |

| Board / Committee Membership | Overall Attendance 100% | Securities Held | Share Ownership Guidelines |

| Regular Meeting | Common Shares # | DSUs # | PSUs # | Total $ | % Met |

Board EHSS & Technical Corporate Communications | 6/6 4/4 2/2 | 138,444 | Nil | 560,000 | $1,800,000 | 18%(4) |

| (4) | Mr. Lang has met 18% of his share ownership requirements as President and Chief Executive Officer as of November 30, 2013. See “Executive Share Ownership” for details on the share ownership guidelines applicable to Mr. Lang. PSUs are not included in determining whether a NEO meets the Share Ownership Guidelines. |

| Gillyeard Leathley |

Mr. Leathley joined the Company in January 2010 and served as Senior Vice President and Chief Operating Officer of the Company from November 2010 to November 2012. In February 2013, Mr. Leathley was named Chief Operating Officer of Sunward Resources Ltd. Mr. Leathley was instrumental in advancing the Company's Donlin Gold and Galore Creek projects. He trained as a mine surveyor and industrial engineer with the Scottish National Coal Board, working in coal, bauxite, gold and copper mines. Mr. Leathley has over 25 years of experience overseeing the development of several major operating mines. Additionally, Mr. Leathley has over 55 years of experience working in the mining industry worldwide in positions of increasing responsibility ranging from Engineer to Chief Operating Officer. The Board has determined that Mr. Leathley should serve as a Director to benefit from his substantial international mine engineering experience and from his knowledge of the Company and its projects related to his previous employment as a Company executive. Mr. Leathley’s principal occupations during the last five years have been Advisor to the CEO of the Company (consultant from April 2009-January 2010, employee from January 2010-November 2010), Senior Vice President and Chief Operating Officer of the Company (November 2010-November 2012), and Chief Operating Officer of Sunward Resources (February 2013-present). During the last five years, Mr. Leathley has served, and continues to serve, as a director of the following companies: Mawson Resources, Tasman Resources, Lariat Resources and Sunward Resources Limited. Mr. Leathley also served as a director of Golden Peak Resources from October 2001 until February 2012. Areas of expertise include: mining operations. |

| Board / Committee Membership | Overall Attendance 89% | Securities Held | Share Ownership Guidelines |

| Regular Meeting | Common Shares # | DSUs # | Total C$ | % Met |

Board EHSS | 6/6 2/3(5) | 84,167 | 8,321 | 50,000 | 100% |

| (5) | Mr. Leathley joined the EHSS Committee on March 1, 2013. Mr. Leathley missed the November 18, 2013 EHSS meeting due to illness. |

| Igor Levental |

Mr. Levental, a Director of the Company, is President of The Electrum Group, a privately-held global natural resources investment management company. Affiliates of The Electrum Group are currently the largest Shareholders of the Company. Mr. Levental is a director of Gabriel Resources Ltd., which is engaged in the development of major precious metals deposits in Romania; he is also a director of NovaCopper Inc., a TSX and NYSE Market-listed company involved in the exploration and development of major copper-dominant deposits in Alaska, and Sunward Resources Ltd., a TSX-listed company engaged in the exploration and development of a large porphyry gold-copper project in Colombia. With more than 30 years of experience across a broad cross-section of the international mining industry, Mr. Levental has held senior positions with major mining companies including Homestake Mining Company and International Corona Corporation. Mr. Levental is a Professional Engineer with a BSc in Chemical Engineering and an MBA from the University of Alberta. The Board has determined that Mr. Levental should serve as a Director for the Company to benefit from his 30-plus years of experience as a chemical engineer and executive of large mining companies. Mr. Levental’s primary occupation during the last five years has been President of The Electrum Group. During the last five years, Mr. Levental has served, and continues to serve, as a director of Gabriel Resources Limited, Sunward Resources Limited and NovaCopper Inc. Areas of expertise include: corporate development, finance, mergers and acquisitions, corporate governance and mining industry. |

| Board / Committee Membership | Overall Attendance 100% | Securities Held | Share Ownership Guidelines |

| Regular Meeting | Common Shares # | DSUs # | Total C$ | % Met |

Board Corporate Governance Corporate Communications | 6/6 4/4 2/2 | 1,000 | 16,082 | 50,000 | 84% |

| Kalidas Madhavpeddi |

Mr. Madhavpeddi, a Director of the Company, has over 30 years of international experience in business development, corporate strategy, global mergers and acquisitions, exploration, government relations, marketing, trading and sales, and mining engineering and capital. He is President of Azteca Consulting LLC, an advisory firm to the metals and mining sector. He is also Overseas CEO of China Molybdenum Co. Ltd. His extensive career in the mining industry spans over 30 years including Phelps Dodge Corporation (“Phelps Dodge”) from 1980 to 2006, starting as a Systems Engineer and ultimately becoming Senior Vice President for Phelps Dodge, a Fortune 500 company, responsible for the company’s global business development, acquisitions and divestments, including joint ventures, as well as its global exploration programs. He was contemporaneously President of Phelps Dodge Wire and Cable, a copper and aluminum cable manufacturer with international operations in over ten countries, including Brazil and China. Mr. Madhavpeddi is an alumnus of the Indian Institute of Technology, Madras, India; the University of Iowa and the Harvard Business School. The Board has determined that Mr. Madhavpeddi should serve as a Director to benefit from his long-term experience in the mining industry working as an executive in global corporate development, exploration, mergers and acquisitions, joint ventures and finance. Mr. Madhavpeddi has served as the President of Azteca Consulting LLC and the Overseas CEO of China Molybdenum Co. Ltd. as his principal occupations during the last five years. Mr. Madhavpeddi has been a director of Namibia Rare Earths since 2010, a director of Capstone Mining since 2012 and a director of NovaCopper Inc. since 2012. Areas of expertise include: corporate strategy, mergers and acquisitions, mining operations and capital, marketing and sales. |

| Board / Committee Membership | Overall Attendance 100% | Securities Held | Share Ownership Guidelines |

| Regular Meeting | Common Shares # | DSUs # | Total C$ | % Met |

Board Audit Compensation Corporate Governance EHSS & Technical | 6/6 4/4 6/6 3/3(6) 1/1(7) | 6,066 | 10,870 | 50,000 | 100% |

| (6) | Mr. Madhavpeddi was no longer a member of the Corporate Governance & Nominations Committee effective August 1, 2013. |

| (7) | Mr. Madhavpeddi was no longer a member of the EHSS and Technical Committee effective March 1, 2013. |

| Gerald McConnell, Q.C. |

Mr. McConnell, a Director of the Company, has over 25 years of experience in the resource sector. Mr. McConnell is a director and the Chief Executive Officer of Namibia Rare Earths Inc., a public Canadian company focused on the development of rare earth opportunities in Namibia. From 1990 to 2010, he was President and Chief Executive Officer, as well as a director, of Etruscan Resources Inc., a West African junior gold producer. From December 1984 to January 1998, Mr. McConnell was the President of the Company and from January 1998 to May 1999 he was the Chairman and Chief Executive Officer of the Company. Mr. McConnell is a graduate of Dalhousie Law School and was called to the bar of Nova Scotia in 1971 and received his Queen’s Counsel designation in 1986. The Board has determined that Mr. McConnell should serve as a Director as he was one of the original founders of the Company and has remained involved with the Company in some capacity ever since, and because of his wide experience working in legal and executive positions at a variety of mining companies. Mr. McConnell’s principal occupations over the last five years have been President and CEO of Etruscan Resources Inc. (1990-2010) and CEO of Namibia Rare Earths Inc. (2010-present). Mr. McConnell served as a director of Etruscan Resources Inc. from 1990 to 2010, and has been a director of Namibia Rare Earths and NovaCopper Inc. since 2010 and 2012, respectively. Areas of expertise include: legal, compensation, operations, mining industry, senior officer and board governance. |

| Board / Committee Membership | Overall Attendance 89% | Securities Held | Share Ownership Guidelines |

| Regular Meeting | Common Shares # | DSUs # | Total C$ | % Met |

Board Compensation Corporate Governance Corporate Communications | 5/6 6/6 4/4 1/2 | 33,882 | 19,568 | 50,000 | 100% |

| Clynton Nauman |

Mr. Nauman, a Director of the Company, is the Chief Executive Officer of Alexco Resource Corp. and Asset Liability Management Group ULC, and was formerly President of Viceroy Gold Corporation and Viceroy Minerals Corporation and a director of Viceroy Resource Corporation, positions he held from February 1998 until February 2003. Previously, Mr. Nauman was the General Manager of Kennecott Minerals from 1993 to 1998. Mr. Nauman has 25 years of diversified experience in the mining industry ranging from exploration and business development to operations and business management in the precious metals, base metals and coal sectors. The Board has determined that Mr. Nauman should serve as a Director to gain from his significant experience as a senior mining executive working in the areas of environment, engineering and operations. Mr. Nauman’s principal occupation for the last five years has been CEO of Alexco Resource Corp. and of Asset Liability Management Group ULC. Mr. Nauman has served as a director of Alexco Resource Corp. since 2006 and has served as a director of NovaCopper Inc. since 2011. Areas of expertise include: environmental, geology, exploration, operations, mining industry and senior officer. |

| Board / Committee Membership | Overall Attendance 100% | Securities Held | Share Ownership Guidelines |

| Regular Meeting | Common Shares # | DSUs # | Total C$ | % Met |

Board Audit EHSS | 6/6 1/1(8) 4/4 | 129,443 | 10,870 | 50,000 | 100% |

| (8) | Mr. Nauman joined the Audit Committee effective August 1, 2013. |

| Rick Van Nieuwenhuyse |

Mr. Van Nieuwenhuyse joined the Company as President and Chief Operating Officer in January 1998 and was appointed as Chief Executive Officer in May 1999. He resigned as President and Chief Executive Officer of the Company in January of 2012 in order to assume his current role of President and Chief Executive Officer of NovaCopper Inc. Mr. Van Nieuwenhuyse has more than 30 years of experience in the natural resource sector including as Vice President of Exploration for Placer Dome Inc. In addition to his international exploration perspective, Mr. Van Nieuwenhuyse brings years of working experience in and knowledge of Alaska to the Company. Mr. Van Nieuwenhuyse has managed projects from grassroots discovery through to advanced feasibility studies, production and mine closure. Mr. Van Nieuwenhuyse holds a Candidature degree in Science from the Université de Louvain, Belgium, and a Masters of Science degree in geology from the University of Arizona. The Board has determined that Mr. Van Nieuwenhuyse should serve as a Director to benefit from his experience as a geologist, his extensive knowledge of the Company, its projects and its history as the former President and Chief Executive Officer of the Company, due to his extensive experience in discovering, exploring, and developing large mining projects, and due to his significant experience in Alaska. Mr. Van Nieuwenhuyse served as a director of Mantra Capital until April 2011, and currently serves as a director of NovaCopper Inc., Alexco Resource Corp., Tintina Resources and AsiaBaseMetals. Areas of experience include: exploration, geology, resource and reserve assessment, feasibility studies, government relations, mining industry, senior officer and board governance. |

| Board / Committee Membership | Overall Attendance 100% | Securities Held | Share Ownership Guidelines |

| Regular Meeting | Common Shares # | DSUs # | Total C$ | % Met |

Board Corporate Communications | 6/6 2/2 | 699,993 | 6,021 | 50,000 | 100% |

| Anthony Walsh, CA |

Mr. Walsh has over 20 years of international experience in the field of exploration, mining and development and was the President and CEO of Sabina Gold & Silver Corp. (“Sabina”) (2008-2011). Prior to joining Sabina, Mr. Walsh was President and CEO of Miramar Mining Corporation (1999-2007), Vice-President and CFO of Miramar Mining Corporation (1995-1999), the Senior Vice-President and CFO of a computer leasing company (1993-1995) and the CFO and Senior Vice-President, Finance of International Corona Mines Ltd., a major North American gold producer (1989-1992). From 1985 to 1989 he was Vice-President, Finance of International Corona Mines Ltd., and from 1973 to 1985 Mr. Walsh held various positions at Deloitte, Haskins & Sells, a firm of Chartered Accountants. Mr. Walsh graduated from Queen's University (Canada) in 1973 and became a member of The Canadian Institute of Chartered Accountants in 1976. Mr. Walsh joined the Board on March 19, 2012. The Board has determined that Mr. Walsh should serve as a Director to benefit from his experience as a senior executive in a variety of global mining companies and international accounting firms. Mr. Walsh lends the Board his expertise in finance, international accounting and corporate governance. Mr. Walsh has been retired since 2011, but currently serves as a director of the following companies: Sabina, Avala Resources Ltd., TMX Group Inc., Dundee Precious Metals Ltd. and Quaterra Resources Ltd. Mr. Walsh previously served on the board of Stolnoway Diamonds Limited (September 2004 - November 2012) and on the board of Dunav Resources Limited (July 2010 - March 2013). Areas of expertise include: corporate development, finance, accounting, mergers and acquisitions, corporate governance, corporate regulation, and mining industry. |

| Board / Committee Membership | Overall Attendance 100% | Securities Held | Share Ownership Guidelines |

| Regular Meeting | Common Shares # | DSUs # | Total C$ | % Met |

Board Audit Corporate Governance | 6/6 4/4 1/1(9) | Nil | 6,021 | 50,000 | 30% |

| (9) | Mr. Walsh joined the Corporate Governance and Nominations Committee effective August 1, 2013. |

| David Deisley |

Mr. Deisley joined the Company November 1, 2012 as Executive Vice President, General Counsel and Corporate Secretary, responsible for all aspects of the Company’s legal governance and corporate affairs. With over 25 years of experience in the mining industry in the Americas, Mr. Deisley has an extensive track record in project permitting, corporate social responsibility, mergers and acquisitions and corporate development. Prior to joining the Company, Mr. Deisley served in positions of increasing responsibility with Goldcorp Inc. from September 2007 to October 2012. At the time he resigned from Goldcorp Inc., Mr. Deisley held the position of Executive Vice President, Corporate Affairs and General Counsel for Goldcorp Inc. Prior to his tenure at Goldcorp Inc., Mr. Deisley served in several progressively responsible capacities with Barrick Gold Corporation, including Regional General Counsel for Barrick Gold North America. Mr. Deisley received his Juris Doctor from the University of Utah S.J. Quinney College of Law, and his Bachelor of Arts from Brown University. Areas of expertise include: sustainability and corporate social responsibility, environmental permitting and compliance, corporate development, corporate and project financing, mergers and acquisitions, corporate governance, corporate regulation, and mining industry. |

| | Securities Held | Share Ownership Guidelines |

Common Shares # | PSUs # | Total $ | % Met |

| 111,752 | 280,000 | 850,000 | 31% |

| David Ottewell |

Mr. Ottewell joined the Company on November 13, 2012, as its Vice President and Chief Financial Officer. In this role, Mr. Ottewell is responsible for all aspects of the Company’s financial management. Mr. Ottewell is a highly accomplished financial executive, with over 25 years of mining industry experience. Prior to joining the Company, he served as Vice President and Controller for Newmont Mining Corporation where he was employed since 2005, and prior to that, had a 16-year career with Echo Bay Mines Ltd., a prominent precious metals mining company with multiple operations in the Americas. Mr. Ottewell holds a Bachelor of Commerce degree from the University of Alberta and is a member of the Canadian Institute of Chartered Accountants. Areas of expertise include: global accounting and finance, corporate disclosure and financial regulation, and mining industry. |

| | Securities Held | Share Ownership Guidelines |

Common Shares # | PSUs # | Total $ | % Met |

| 49,314 | 200,000 | 650,000 | 18% |

Meetings of the Board and Board Member Attendance at Annual Meeting

During the fiscal year ended November 30, 2013, the Board held six meetings. None of the incumbent Directors attended fewer than 75% of the aggregate of the total number of Board meetings and meetings of the committees on which he or she serves.

Board members are not required to attend the annual general meeting; however, the following eight Directors attended the Company’s annual meeting of shareholders held on May 29, 2013: Sharon Dowdall, Thomas Kaplan, Gregory Lang, Gillyeard Leathley, Igor Levental, Clynton Nauman, Rick Van Nieuwenhuyse, and Anthony Walsh.

Legal Proceedings

Neither the Company nor any of its property is currently subject to any material legal proceedings or other adverse regulatory proceedings. We do not currently know of any legal proceedings against us involving our Directors, proposed Directors, executive officers or Shareholders of more than 5% of our voting shares. None of our Directors, proposed Directors or executive officers has, during the past ten years, been involved in any material bankruptcy, criminal or securities law proceedings.

Family and Certain Other Relationships

There are no family relationships among the members of the Board or the members of senior management of the Company. There are no arrangements or understandings with customers, suppliers or others, pursuant to which any member of the Board or member of senior management was selected. As of November 30, 2013, Electrum held 84,569,479 Common Shares, representing approximately 27.2% of the Company’s outstanding shares. Pursuant to the Unit Purchase Agreement dated December 31, 2008 between the Company and Electrum, the Company provided Electrum with the right to designate an observer at all meetings of the Company’s Board and any committee thereof so long as Electrum and its affiliates hold not less than 15% of the Company’s common shares. Electrum designated Igor Levental as its observer at the Company’s Board meetings. In July 2010, the Company appointed Igor Levental as a Director of the Company. In November 2011, Dr. Thomas Kaplan, was appointed the Chairman of the Company’s Board. Dr. Kaplan is also the Chairman and Chief Investment Officer of The Electrum Group.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires the Company's officers and Directors and persons who own more than 10% of a registered class of the Company's equity securities, to file reports of ownership and changes in ownership on Forms 3, 4 and 5 with the SEC. Officers, Directors and such 10% Shareholders are required to furnish the Company with copies of all Forms 3, 4 and 5 they file.

The Company was a “foreign private issuer” (as defined in Rule 3b-4 under the Exchange Act) during the entirety of the fiscal year ended November 30, 2013 and was not subject to the reporting requirements of Section 16(a). Effective as of December 1, 2013, the Company no longer qualified as a “foreign private issuer.” Accordingly, the Company will be required in its management information circular for the fiscal years ending November 30, 2014 and thereafter to make a determination of whether it believes all transactions required to be reported pursuant to Section 16(a) were timely reported by the Company's officers, Directors and greater than 10% Shareholders.

Ethical Business Conduct

We have adopted a Code of Ethics that applies to our Chief Executive Officer, Chief Financial Officer and Corporate Controller or persons performing similar functions. This Code of Ethics is posted on our website (www.novagold.com). We intend to satisfy the disclosure requirement under Item 5.05 of Form 8-K regarding an amendment to, or waiver from, a provision of the Code of Ethics that applies to our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, by posting such information on the our website, at the address specified above.

Our Code of Business Conduct and Ethics, and charters for each Committee of our Board are also available on our website. The Code of Ethics, Code of Business Conduct and Ethics and charters are also available in print to any stockholder who submits a request to: Corporate Secretary, NOVAGOLD RESOURCES INC., 789 West Pender Street, Suite 720, Vancouver, British Columbia, Canada V6C 1H2.

Information on our website is not deemed to be incorporated by reference into this Annual Report on Form 10-K.

Board Mandate

The Board is responsible for the overall stewardship of the Company. The Board discharges this responsibility directly and through the delegation of specific responsibilities to committees of the Board. The Board works with management to establish the goals and strategies of the Company, to identify principal risks, to select and assess senior management and to review significant operational and financial matters. The Board does not have a written mandate. The Board delineates its role and responsibilities based on the statutory and common law applicable to the Company.

The Board has appointed an Audit Committee to assist the Board in monitoring (i) the integrity of the financial statements of the Company, (ii) the independent auditors’ qualifications and independence, (iii) the performance of the Company’s internal financial controls and audit function and the independent auditors, and (iv) the compliance by the Company with legal and regulatory requirements. The members of the Audit Committee are elected annually by the Board at the annual organizational meeting. The members of the Audit Committee are required to meet the independence and experience requirements of the NYSE-MKT and Section 10A(m)(3) of the Exchange Act, and the rules and regulations of the SEC. At least one member of the Audit Committee shall be an “audit committee financial expert” as defined by the SEC. The Company’s Audit Committee consists of fully independent members and the Company’s “audit committee financial expert” is Anthony Walsh. The Audit Committee meetings are held quarterly at a minimum. The Company’s Audit Committee Charter is available on the Company’s website at www.novagold.com under the Corporate Governance tab.

Position Descriptions

The position descriptions for the chairs of each Board committee are contained in the committee charters. The chair of each of the Audit Committee, Corporate Governance and Nominating Committee, EHSS and Technical Committee, Compensation Committee, and the Corporate Communications Committee is required to ensure the Committee meets regularly and performs the duties as set forth in its charter, and reports to the Board on the activities of the Committee. The Board has developed a written position description for the Chair of the Board and this position is presently held by Dr. Thomas Kaplan. The Chair of the Board is principally responsible for overseeing the operations and affairs of the Board.

The Board has also developed a written position description for the CEO. The CEO is primarily responsible for the overall management of the business and affairs of the Company. In this capacity, the CEO shall establish the strategic and operational priorities of the Company and provide leadership to the management team. The CEO is directly responsible to the Board for all activities of the Company.

Orientation and Continuing Education

The Company provides an orientation and education program to new directors. This program consists of providing education regarding directors’ responsibilities, corporate governance issues, committee charters and recent and developing issues related to corporate governance and regulatory reporting. The Company provides orientation in matters material to the Company’s business and in areas outside of the specific expertise of the Board members. All new members of the Board have historically been experienced in the mining sector; therefore general mining orientation has not been necessary.

Continuing education helps Directors keep up to date on changing governance issues and requirements and legislation or regulations in their field of experience. The Board recognizes the importance of ongoing education for the Directors and senior management of the Company and the need for each Director and officer to take personal responsibility for this process. To facilitate ongoing education, the CEO or the Board may from time to time, as required:

| | · | Request that Directors or officers determine their training and education needs; |

| | · | Arrange visits to the Company’s projects or operations; |

| | · | Arrange funding for the attendance at seminars or conferences of interest and relevance to their position; and |

| | · | Encourage participation or facilitate presentations by members of management or outside experts on matters of particular importance or emerging significance. |

During the 2013 fiscal year, Directors participated in educational sessions and received educational materials on the topics outlined below.

| Educational Programs | Date | Audience |

Considerations for determining Directors’ status as independent or non-independent | April 2013 | Corporate Governance and Nominations Committee |

| Compensation strategies | August 2013 | Compensation Committee |

| Executive and Director’s Compensation Update | September 2013 | Compensation Committee |

| U.S. GAAP Reporting Standards Update | October 2013 | Audit Committee |

U.S. Domestic Filer Matters -Section 16 -SEC Industry Guide 7 | November 2013 | Board of Directors |

The Board also encourages senior management to participate in professional development programs and courses and supports management’s commitment to training and developing employees.

Item 11. Executive Compensation

Compensation Discussion and Analysis

This Compensation Discussion and Analysis describes and explains the significant elements of the Company’s executive compensation program which was implemented during the 2013 fiscal year to attract, retain and incentivize the Company’s NEOs.

The Company’s current NEOs are:

| | · | Mr. Gregory Lang, President and CEO (“CEO”); |

| | · | Mr. David Deisley, Executive Vice President, General Counsel and Corporate Secretary (“EVP”); and |

| | · | Mr. David Ottewell, Vice President and CFO (“CFO”). |

Objectives of Compensation Program

The Company has a pay-for-performance philosophy and the compensation programs of the Company are designed to attract and retain executive officers with the talent and experience necessary for the success of the Company. A significant portion of total direct compensation is dependent on actual performance measured against short-term and long-term goals of the Company and the individual, as approved by the CEO and the Board.

The Compensation Committee of the Board evaluates each officer position to establish skill requirements and levels of responsibility. The Compensation Committee, after referring to market information provided by its outside compensation advisor, Mercer (Canada) Limited (“Mercer” or the “Compensation Consultant”), determines compensation for the officers. As directed by the Compensation Committee, the Company has a compensation philosophy to pay above the median of its peer group companies. Factors which influence this policy include the size of the Company’s precious metals deposits as compared to other peer group companies and the acknowledgement that managing these resources requires an executive team with extensive experience and skills in advancing significant deposits into production. Additionally, the Company is working with senior mining partners to advance two of its projects and needs to attract and retain executives with specialized skills, knowledge and experience which come from working for and with large mining companies to advance these substantial projects. Such skills and knowledge include the areas of geology, engineering, logistical planning, preparation of feasibility studies, permitting, mine construction and operation, government and community affairs, marketing, financing and accounting.

The Company regularly meets directly with its major Shareholders to discuss a variety of matters relevant to the Company. At the request of the Compensation Committee, the Company includes the issue of executive compensation in such discussions and provides feedback from the Shareholders to the Compensation Committee.

The Compensation Committee currently targets NEO compensation as follows:

Base Salary – 62.5th percentile of the market

Total Cash Compensation – 62.5th percentile of the market

Total Direct Compensation – 75th percentile of the market

Total cash compensation includes base salary and annual incentive compensation. Total direct compensation includes base salary, annual incentive compensation and long-term incentive compensation.

Executive Compensation Policies and Programs

In establishing compensation objectives for NEOs, the Compensation Committee seeks to accomplish the following goals:

| | · | incentivize executives to achieve important corporate and personal performance objectives and reward them when such objectives are met; |

| | · | recruit and subsequently retain highly qualified executive officers by offering overall compensation that is competitive with that offered for comparable positions at Peer Group companies (as defined in the “Peer Group” section below); and |

| | · | align the interests of executive officers with the long-term interests of Shareholders through participation in the Company’s stock-based compensation plans. |

During 2013, the Company’s executive compensation package consisted of the following principal components: base salary, annual incentive cash bonus, various welfare plan benefits, individual retirement account (“IRA”) matching for U.S. NEOs, and long-term incentives in the form of stock options and PSUs. Effective as of January 1, 2014, the IRA matching terminated, and 401(k) retirement savings matching commenced for U.S. NEOs.

The following table summarizes the different elements of the Company’s total compensation package:

| COMPENSATION ELEMENT | OBJECTIVE | KEY FEATURE |

| Base Salary | Provide a fixed level of cash compensation for performing day-to-day responsibilities. | Base salary bands were created and are reviewed annually based on the 62.5th percentile of the Peer Group market data for base salary. Actual increases are based on individual performance. |

| Annual Incentive Plan | Reward for short-term performance against corporate and individual goals. | Cash payments based on a formula. Each NEO has a target opportunity based on the 62.5th percentile of the Peer Group market data for total cash. Actual payout depends on performance against corporate and individual goals. |

| Stock Options | Align management interests with those of Shareholders, encourage retention and reward long-term Company performance. | Calculations are based on targets for each NEO determined by targeting the 75th percentile of the Peer Group market data for total direct compensation. Stock option grants generally vest over 2 years and have a 5-year life. |

| Performance Share Units | Align management interests with those of Shareholders, encourage retention and reward long-term Company performance. | Calculations are based on targets for each NEO determined by targeting the 75th percentile of the Peer Group market data for total direct compensation. PSU grants cliff vest (typically two years from the grant date) and actual payout depends upon the performance against corporate and individual goals as established in the grant. |

| Employee Share Purchase Plan | Encourage ownership in the Company through the regular purchase of Company shares from the open market. | Employees may contribute up to 5% of base salary and the Company matches 50% of the employee’s contribution. |

Retirement Plans: RRSP (Canadian employees), IRA and 401(k) Plan (U.S. employees)(1) | Provide retirement savings. | RRSP – Company matches 100% of the employee’s contribution up to 5% of base salary. IRA – Company matched 100% of the employee’s contribution up to 3% of base salary. 401(k) – Company matches 100% of the employee’s contribution up to 5% of base salary, subject to applicable IRS limitations. |

| Welfare Plan Benefits | Provide security to employees and their dependents pertaining to health and welfare risks. | Coverage includes medical, dental and vision benefits, short- and long-term disability insurance, life and AD&D insurance and employee assistance plan. |

(1) The IRA was replaced with a 401(k) Plan for the Company’s U.S. employees, including the NEOs, effective January 1, 2014.

Annual Compensation Decision-Making Process

Each year, the executive team establishes goals and objectives for the upcoming year that include key priorities and initiatives. The CEO presents these goals and objectives to the Board for approval. Similarly, the CEO and the Chair of the Compensation Committee work together to establish individual goals and objectives for the CEO for the upcoming fiscal year and the CEO follows a similar process with the other NEOs.

The Company’s 2014 corporate goals include:

| | · | Advance permitting of the Donlin Gold project. |

| | · | Maintain a healthy balance sheet. |

| | · | Undertake Galore Creek technical studies to build on successful 2012 and 2013 drill results. |

| | · | Evaluate opportunities to monetize the value of Galore Creek. |

| | · | Maintain an effective corporate social responsibility program. |

Performance relative to the corporate goals is reviewed at year-end and performance ratings are determined for the Company by the Board, for the CEO by the Compensation Committee and for each of the other NEOs by the CEO. These performance ratings are used in making decisions and calculations related to base salary increases, annual incentive payouts and stock option and PSU-based grants.

The Board can exercise discretion in determining the appropriate performance rating for the Company and executive officers based on their evaluation of performance against goals set at the beginning of the year. The size of any payout or award is dependent on the performance rating as determined by the Board. The rating can be 0% to 150%.

The Compensation Committee makes a recommendation to the Board regarding the CEO’s base salary, annual incentive payout and stock option and PSU-based grants. The Compensation Committee also reviews the performance and compensation recommendations for the NEOs by the CEO and makes the final determination regarding the same.

Base salary increases are effective January 1st of each year and annual incentive payments are usually paid out shortly after the end of each performance cycle. The Company’s performance cycle is aligned with its fiscal year end.

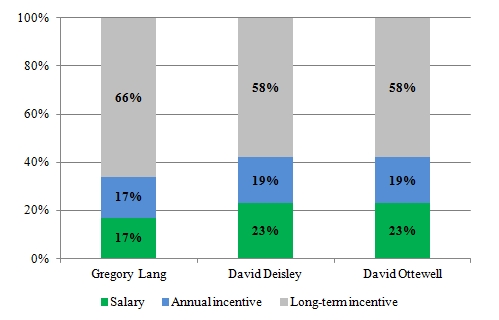

The bar graph below illustrates how much of compensation is cash versus non-cash based on the salary guidepost for each NEO and his annual incentive and long-term incentive targets for 2013. The actual pay mix may vary depending on whether goals are met since performance factors are used in the calculation of annual incentive pay and long-term incentive pay. Following the compensation review that was completed in 2013, the total direct compensation pay mix targets for 2014 will remain unchanged from 2013, as shown in the graph below:

The bar graph below illustrates the actual pay mix for each NEO for compensation earned in 2013, although the annual incentive amounts were paid in fiscal 2014 and the long-term incentive amounts were awarded in fiscal 2014 in the form of stock option and PSU grants.

Risk Assessment of Compensation Policies and Practices

Annually, the Compensation Committee conducts a risk assessment of the Company’s compensation policies and practices as they apply to all employees, including all executive officers. The design features and performance metrics of the Company’s cash and stock-based incentive programs, along with the approval mechanisms associated with each, are evaluated to determine whether any of these policies and practices would create risks that are reasonably likely to have a material adverse effect on the Company.

As part of the review, the following characteristics of the Company’s compensation policies and practices were noted as being characteristics that the Company believes reduce the likelihood of risk-taking by the Company’s employees, including the Company’s officers and non-officers:

| | · | The Company’s compensation mix is balanced among fixed components such as salary and benefits, annual incentive payments and long-term incentives, including PSUs and stock options. |

| | · | The Compensation Committee, under its charter, has the authority to retain any advisor it deems necessary to fulfill its obligations and has engaged the Compensation Consultant. The Compensation Consultant assists the Compensation Committee in reviewing executive compensation and provides advice to the Committee on an as needed basis. |

| | · | The annual incentive program for the executive management team, which includes each of the NEOs, is approved by the Board. Individual payouts are based on a combination of quantitative metrics as well as qualitative and discretionary factors. |

| | · | Stock-based awards are all recommended by the Compensation Committee and approved by the Board. |

| | · | The Board approves the compensation for the President and CEO based upon a recommendation by the Compensation Committee, which is comprised entirely of independent Directors. |

| | · | The nature of the business in which the Company operates requires some level of risk taking to achieve reserves and development of mining operations in the best interest of all stakeholders. Consequently, the executive compensation policies and practices have been designed to encourage actions and behaviors directed towards increasing long-term value while limiting incentives that promote excessive risk taking. |

Based on this assessment, the Compensation Committee concluded that the Company’s compensation policies and practices do not create risks that are reasonably likely to have a material adverse effect on the Company.

NEOs and Directors are not permitted to purchase financial instruments, including, for greater certainty, prepaid variable forward contracts, equity swaps, collars, or units of exchange funds that are designed to hedge or offset a decrease in market value of equity securities granted as compensation or held, directly or indirectly, by the NEO or Director. Additionally, the Company does not permit NEOs or Directors to pledge Company securities to secure personal debts or loans.

Peer Group

On May 8, 2013, the Compensation Committee retained the Compensation Consultant to assist the Compensation Committee in determining appropriate levels for each of the three main components of total direct compensation for the Company’s Directors and NEOs. The Compensation Consultant’s work encompasses a review of the Company’s executive compensation philosophies against a comparable peer group of mining companies using the publicly available filings of the peer companies.

A compensation peer group of mining companies has been developed using the following selection criteria:

| | · | Canadian and/or U.S. listed companies; |

| | · | market capitalization and total assets similar to the Company; |

| | · | gold, diversified metals and mining, or precious metals/minerals industry; |

| | · | complexity of operation/business strategy relative to the Company; and |

| | · | experienced, full-time executive team |

The Company considers the above selection criteria to be relevant because the criteria reflect the types of companies and the market in which the Company primarily competes for talent.

Based upon considerations of company size, stage of development and operating jurisdictions, the following peer group companies were selected:

| | |

| Alacer Gold Corp | Hecla Mining Co. |

| Alamos Gold Inc. | IAMGOLD Corp. |

| Allied Nevada Gold Corp | Lake Shore Gold Corp. |

| Argonaut Gold Inc. | New Gold Inc. |

| Aurico Gold Inc. | Osisko Mining Corp. |

| Centerra Gold Inc. | Silver Standard Resources Inc. |

| Detour Gold Corp. | Stillwater Mining Co. |

| Gabriel Resources Ltd. | Taseko Mines Ltd. |

(collectively, the “Peer Group”).

Compensation Elements

After compiling information based on salaries, bonuses and other types of cash and equity based compensation programs obtained from the public disclosure records of the Peer Group, the Compensation Consultant reported its findings to the Compensation Committee and made recommendations to the Compensation Committee regarding compensation targets for Directors and NEOs.

The Compensation Committee has set the following compensation targets for the Company’s NEOs for the 2014 fiscal year:

| | o | Base Salary – 62.5th percentile of Peer Group |

| | o | Annual Incentive Target – 100% of base salary |

| | o | Long Term Incentive Target– 375% of base salary |

| | o | Base Salary – 62.5th percentile of Peer Group |

| | o | Annual Incentive Target – 80% of base salary |

| | o | Long Term Incentive Target – 250% of base salary |

Base Salary

Salaries for officers are determined by evaluating the responsibilities inherent in the position held and each individual’s experience and past performance, as well as by reference to the competitive marketplace for management talent at the Peer Group companies. The Compensation Committee refers to market information provided by the Compensation Consultant. The Compensation Consultant matches the executives to those individuals performing similar functions at the Peer Group companies. For the 2013 fiscal year, the Company set the 62.5th percentile of this market data as a target to determine the salary bands for the NEOs.

As a result of the compensation review conducted in 2013, the Compensation Committee has recommended leaving the current salary bands unchanged for 2014.

The Company targets base salaries above the median of salaries paid by the Peer Group companies to assist in attracting and retaining the highly experienced people that the Company needs to be successful.

The Company will conduct a Peer Group review for its NEOs annually.

When determining base salary increases for the NEOs, the CEO and Compensation Committee look at the targets or guideposts (currently 62.5th percentile of the market data) for the salary bands and determine an increase based on each NEO’s performance. Individual performance is evaluated based on goals and initiatives set at the beginning of the year. The CEO determines a salary increase budget for each year based on market data from consulting companies and considering the Company’s financial resources. Using this budget, and taking into account individual performance and each individual’s position in his or her salary band, the CEO may recommend an increase for one or all NEOs. The Compensation Committee makes a recommendation for the CEO’s base salary increase, also taking into account the budget set and the CEO’s individual performance.

If an NEO is fully competent in their position, the NEO will be paid between 95% and 105% of the guidepost. Developing NEOs would be paid between 80% and 94% of the guidepost and NEOs who consistently perform above expectation can be paid between 106% and 120% of the guidepost.

NEO’s Base Salary Compared to Salary Band Guideposts

| NEO | 2014 Base Salary Compared to Salary Band Guidepost | Reason |

| Gregory Lang | Above: 104% of guidepost | Mr. Lang’s base salary is above the salary range guidepost for his role and level due to his past and current performance, specifically with his previous experience as President & CEO of Barrick U.S. Gold, his mine engineering and operations experience and his excellent relationships with the stakeholders in the Company’s two primary assets. |

| David Deisley | Above: 109% of guidepost | Mr. Deisley’s base salary is above the salary range guidepost for his role and level due to his past and current performance, his significant previous experience as Executive Vice President and General Counsel of Goldcorp, as in-house and General Counsel of Barrick U.S. Gold, and his cultivation of good relationships with the Alaskan stakeholders in the Company’s Donlin Gold project. |

| David Ottewell | Below: 85% of guidepost | Mr. Ottewell’s base salary is below the salary range guidepost for his role and level due to the fact that this is Mr. Ottewell’s first position at the CFO level. His past and current performance has been excellent, and his previous experience as the Vice President and Controller for Newmont Mining has prepared him for the additional responsibilities incumbent upon the Vice President and CFO position at the Company. |

Base Salary Increases for 2014

The Compensation Committee approved the following base salary increases for 2014:

| NEO | Title | 2013 Base Salary | 2014 Base Salary | % Change |

| Gregory Lang | President & CEO | $675,000 | $695,250 | 3% |

| David Deisley | EVP, General Counsel and Corporate Secretary | $425,000 | $437,750 | 3% |

| David Ottewell | VP & CFO | $325,000 | $341,250 | 5% |

| | | | | |

Annual Incentive Plan

At the end of each fiscal year, the Compensation Committee reviews actual performance against the objectives set by the Company and the NEOs for such fiscal year. The assessment of whether the Company’s objectives for the year have been met includes, but is not limited to, considering the quality and measured progress of the Company’s development stage projects, protection of the Company’s treasury, corporate alliances and similar achievements.

The Company considers the 75th percentile for annual incentive targets for NEOs.

The annual incentive formula for NEOs is as follows:

[(Corporate performance x 80%) + (Individual performance x 20%)] x target % x annual base salary = annual incentive payout

The corporate performance component is weighted more heavily than the individual performance component in the formula above for each of the NEOs.

Annual Incentive Payout for 2013

Actual incentive awards for 2013 were based on performance relative to goals and initiatives set for 2013. Performance is measured in two areas: corporate and individual. Performance ratings for each area range from 0% to 150%.

Discussions around corporate goals for the following year are started during a strategy session held in the fall of the preceding year. All NEOs, the other officers and some managers are involved in the strategy session. During the session, goals and initiatives are set in the following areas: Corporate Goals and Project Goals. These corporate goals and objectives are approved by the Board. Individual goals and objectives flow from the corporate goals and objectives to ensure that everyone’s efforts are linked to the success of the Company.

The Company also focuses on setting goals and objectives around its core values which include safety, sustainability, accountability, communication, empowerment, integrity, respect and teamwork.

The following table describes the 2013 annual incentive calculation for NEOs made in 2014 based on performance in 2013:

| NEO | Annual Incentive Target (as a % of annual base salary) | 2013 Annual Incentive Payout | 2013 Corporate Weight/Rating | 2013 Individual Weight/Rating |

| Gregory Lang | 100% | $864,000 | 80% / 125% | 20% / 140% |

| David Deisley | 80% | $435,200 | 80% / 125% | 20% / 140% |

| David Ottewell | 80% | $330,200 | 80% / 125% | 20% / 135% |

| | | | | |

The 2013 Corporate Goals included:

| | · | Advance the permitting of Donlin Gold on time and on budget. |

| | · | Optimize the Donlin Gold Project by lowering upfront capital requirements and increasing the rate of return. |

| | · | Maintain a healthy balance sheet. |

| | · | Further evaluate opportunities to monetize the value of Galore Creek and increase its reserves and resources. |

| | · | Continue an effective corporate social responsibility program. |

The Compensation Committee determined that these goals generally were successfully achieved. In establishing the corporate weighting percentage, the Compensation Committee specifically considered the following results that were achieved during 2013.

Permitting at the Donlin Gold project proceeded according to the schedule adopted by the Corps and total Donlin Gold expenses during 2013 were under budget. During the public scoping process more than 14 public meetings took place in various Yukon-Kuskokwim villages and Anchorage. Subsequently, the Corps prepared a Scoping Summary Report which included comments from the scoping meetings that will be addressed in the Draft EIS. Throughout the year, the Donlin Gold project team collaborated with the cooperating agencies as part of the permitting process and the Corps hosted a number of workshops to review important components of the baseline data that had been submitted to the permitting agencies. The development of Donlin Gold is at a key juncture and in 2013 the Company established the foundation needed for a successful permitting outcome. The Company’s executives and employees were actively involved in supporting the Donlin Gold project team in all of these areas.

The Company’s balance sheet was strengthened during the year by the exercise of all outstanding warrants, the redemption of $79 million of the Company’s $95 million outstanding convertible debt, and the lowering of corporate general and administration costs by streamlining the Company’s structure and processes, improving efficiency, and lowering costs. The Company ended the fiscal year with more than $190 million in cash and term deposits, which is believed to be sufficient to repay the balance of the Company’s debt and advance the Donlin Gold project through the remaining expected permitting process.

The Galore Creek 2013 exploration and in-fill drilling program was completed ahead of schedule, under budget, and with zero lost-time injuries. The results from the more than 11,600 meters drilled demonstrated that the copper mineralization extends in and adjacent to the Legacy zone; increased drilling density in the Legacy zone to a level sufficient to support an inferred resource estimate; and provided additional data needed for mine planning and design. The results from the 2013 drilling campaign should enhance the value of Galore Creek and its marketability as we continue to evaluate opportunities to monetize our interest in the project.

During 2013, NOVAGOLD and Donlin Gold engaged with Alaska Native corporations and other local stakeholders on community initiatives, workforce development and local outreach. In recognition of its efforts, Donlin Gold was awarded the Employer of the Year award from the National Association of State Workforce Agencies. Also, during the 2013 Galore Creek field program, ten local Tahltan businesses provided a significant portion of the on-site contract services.

In establishing the individual performance percentages, the Compensation Committee considered the following factors with respect to each of the NEOs.

Mr. Lang was awarded his annual bonus in recognition of his leadership skills and personal performance, as well as the significant contributions he made to the Company in 2013. Specifically, his leadership led to the successful completion of the transition to the Company’s new leadership team, streamlining Company processes which resulted in significant cost savings to the Company, and advancement of the permitting process at the Donlin Gold Project.

Mr. Deisley was awarded his annual bonus in recognition of his leadership of the legal team and his significant contributions to the Company’s community relations and permitting efforts. Specifically, he is recognized for his efforts with respect to cost saving measures resulting from the transition of legal matters in-house as well as the savings associated with completion of the continuance of the Company into British Columbia in 2013. Mr. Deisley has also developed excellent relationships with the stakeholders as well as the state and federal entities involved in the Donlin Gold Project.

Mr. Ottewell was awarded his annual bonus in recognition of his leadership of the Company’s finance and accounting team, including the transition of the finance and accounting functions from Vancouver, B.C., to the new accounting and finance team in Salt Lake City, Utah. Due in part to efforts by him and of his team, the Company found ways to make its programs and processes more efficient and cost effective. Additionally, a successful tender offer was completed for most of the Company’s convertible notes resulting in interest savings for the Company.

The following table outlines the annual incentive calculation for 2014:

| NEO | Annual Incentive Target (as a % of base salary) | 2014 Corporate Rating Weight | 2014 Individual Rating Weight |

| Gregory Lang | 100% | 80% | 20% |

| David Deisley | 80% | 80% | 20% |

| David Ottewell | 80% | 80% | 20% |

| | | | |

Stock-Based Incentive Plans

Stock-based grants are generally awarded to officers at the commencement of their employment and periodically thereafter. Annual grants of stock options and/or PSUs are made based on a target percentage of base salary for each NEO. The purpose of granting stock options and/or PSUs is to assist the Company in compensating, attracting, retaining and motivating directors, officers, employees and consultants of the Company and to closely align the personal interests of such persons to that of the Shareholders. These equity vehicles were chosen because the Company believes that these vehicles best incentivize the team to focus their efforts on increasing Shareholder value.

The Company targeted the 75th percentile of the total direct compensation data provided by the Compensation Consultant for the NEOs. Based on the results of the 2013 compensation review, no changes are being made to the stock based compensation targets for 2014. The Company uses two different plans for stock-based grants for its NEOs, the Stock Award Plan and the PSU Plan. The percentage of stock options versus PSUs granted is determined by the Compensation Committee for each grant. The Company’s Stock Award Plan was adopted on May 11, 2004, and the PSU Plan was adopted on May 26, 2009. The Stock Award Plan is for the benefit of the officers, Directors, employees and consultants of the Company or any subsidiary company, and the PSU Plan is for the benefit of the officers, employees and consultants of the Company or any subsidiary company. Stock options granted to the NEOs pursuant to the Stock Award Plan as of the date hereof each have a five-year life and vest over two years: 1/3 on the grant date, 1/3 on the first anniversary of the grant and 1/3 on the second anniversary of the grant date. PSUs granted to the NEOs pursuant to the PSU Plan as at the date hereof generally have a two-year period between the grant date and the payout date, when a vesting determination is made.

Stock-Based Grants for 2013

In 2014 the Board of Directors approved the grant of a total of 3,225,350 stock options and 1,303,900 PSUs to Mr. Lang, Mr. Deisley and Mr. Ottewell in recognition of their performance during 2013. These grants represent awarding 50% of each NEO’s long-term incentive award in stock options and 50% in PSUs. The value of each NEO’s long-term incentive award is calculated as follows:

[(Individual Performance Rating % x Long Term Incentive (“LTI”) Target %) x Base Salary] = LTI $ Value

Half of the resulting LTI $ Value is then divided by the Black-Scholes value of the Company’s Common Shares at fiscal year-end to arrive at a number of stock options to be granted. The remaining half of the LTI $ Value is divided by the closing price of the Company’s Common Shares on the TSX at fiscal year-end to determine the number of PSUs to be granted.

The PSUs granted to the NEOs listed below will vest on December 1, 2015. The number of PSUs vesting for each NEO will be based on the performance of the Company’s Common Share price relative to the share price of the Peer Group companies between the PSU grant date and December 1, 2015. The Compensation Committee has determined that applying performance criteria to the PSUs based upon Company revenues is inappropriate at this time as the Company’s assets are in the development stage.

These stock options and PSUs granted to the NEOs in 2014 based on performance in 2013 represent approximately 1.4% of the total Common Shares issued and outstanding as of March 14, 2014.

The following table describes the 2013 long-term incentive grants to NEOs made in 2014 based on performance in 2013:

| NEO | Long-term Incentive Target (as a % of Base Pay) | Stock Option Grant # | Exercise Price (C$) | PSU Grant # |

| Gregory Lang | 375% | 1,865,150 | 2.90 | 754,000 |

| David Deisley | 250% | 782,900 | 2.90 | 316,500 |

| David Ottewell | 250% | 577,300 | 2.90 | 233,400 |

Retirement Plans

The purpose of the Company’s retirement plans is to assist eligible employees with accumulating capital toward their retirement. The Company has an RRSP plan for Canadian employees whereby employees are able to contribute a portion of their pay and receive a dollar for dollar Company match up to 5% of pay. During 2013 the Company had a Simple IRA plan for U.S. employees whereby employees were able to contribute a portion of their pay and receive a dollar for dollar Company match up to 3% of their pay. The Simple IRA was discontinued as of December 31, 2013. Effective January 1, 2014, the Company opened a 401(k) retirement savings plan for U.S. employees whereby employees are able to contribute a portion of their pay and receive a dollar for dollar Company match up to 5% of their pay, subject to IRS limitations.

Benefits

The Company’s benefit programs provide employees with health and welfare benefits. The programs consist of medical, dental and vision benefits, life insurance, disability insurance, accidental death and dismemberment insurance, and an employee assistance plan. The only benefit that NEOs receive beyond those provided to other employees is eligibility for a paid annual executive physical.

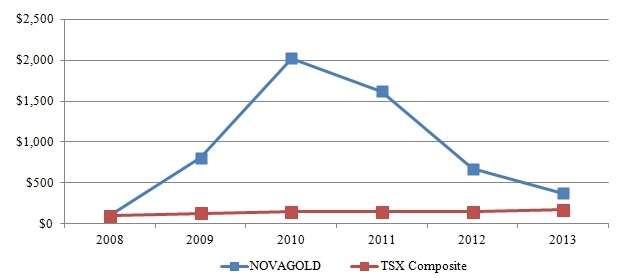

Performance Graph

The following graph depicts the Company’s cumulative total Shareholder returns over the five most recently completed fiscal years assuming a C$100 investment in Common Shares on November 30, 2008, compared to an equal investment in the S&P/TSX Composite Index. The Company does not currently issue dividends. The Common Share performance as set out in the graph is not indicative of future price performance.

| (C$) | 2009 | 2010 | 2011 | 2012 | 2013 |

Value based on C$100 invested in the Company on November 30, 2008(1) | 810 | 2,025 | 1,621 | 671 | 373 |

| Value based on C$100 invested in S&P/TSX Composite Index on November 30, 2008 | 128 | 149 | 144 | 148 | 168 |

| (1) | Excludes the value of NovaCopper shares distributed to Shareholders in 2012. |

While total Shareholder returns were negative in 2013, the Company achieved all of its goals and objectives and the Compensation Committee approved base salary increases for the Company’s executive officers effective January 1, 2014, and an annual incentive plan payout based on target amounts, the goal achievement and the actual performance of the Company and each individual during 2013.

While total Shareholder returns were negative in 2012, the Company achieved all of its goals and objectives and the Compensation Committee approved base salary increases effective January 1, 2013, and an annual incentive plan payout based on target amounts and the actual performance of the Company, the group and each individual for 2012.

Total Shareholder returns were negative in 2011. However, the Company achieved all of its goals and objectives and the Compensation Committee approved base salary increases for the Company’s executive officers for January 1, 2012. They also approved an annual incentive payout based on target amounts and the actual performance of the Company, the group and each individual.

Total Shareholder returns were positive in 2010. Based on this performance, the Compensation Committee approved base salary increases for the Company’s executive officers effective January 1, 2011, and an annual incentive plan payout and stock-based grant for that year.

Total Shareholder returns were positive in 2009. Based on this performance, the Compensation Committee approved base salary increases for the Company’s executive officers effective January 1, 2010, and an annual incentive plan payout and a stock-based long-term incentive grant in 2010, comprised of 50% stock options and 50% PSUs.

Realized and Realizable Pay