UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by Registrant [X]

Filed by a Party other than the Registrant [ ]

| Check the appropriate box: | |

| [ ] | Preliminary Proxy Statement |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [X] | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [ ] | Soliciting Material Under Rule 14a-12 |

NOVAGOLD RESOURCES INC.

(Name of Registrant as Specified In Its Charter)

___________________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| [X] | No fee required. |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: |

| [ ] | Fee paid previously with preliminary materials: |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: |

Notice Of

Annual General Meeting

Of Shareholders

&

Management

Information Circular

MEETING TO BE HELD MAY 18, 2022

NOVAGOLD RESOURCES INC.

Website: www.novagold.com

|

Dated March 25, 2022

NOVAGOLD RESOURCES INC.

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

| Date: | May 18, 2022 |

| Time: | 1:00 p.m. Pacific Time |

| Location: | Live Webcast at: www.virtualshareholdermeeting.com/NG2022

|

| Record Date: | March 21, 2022

|

The purposes of the annual meeting (the “Meeting”) are to:

| 1. | receive the Annual Report of the Directors of the Company (the “Directors”) containing the consolidated financial statements of the Company for the year ended November 30, 2021, together with the Report of the Auditors thereon; |

| 2. | set the number of Directors of the Company; |

| 3. | elect Directors of the Company for the forthcoming year; |

| 4. | appoint the Auditors of the Company for the forthcoming year and to authorize the Directors through the Audit Committee to fix the Auditors’ remuneration; |

| 5. | consider and, if deemed advisable, pass a non-binding resolution approving the compensation of the Company’s Named Executive Officers; and |

| 6. | transact such further and other business as may properly come before the Meeting or any adjournment thereof. |

The specific details of the matters currently proposed to be put before the Meeting are set forth in the Circular accompanying and forming part of this Notice.

Only Shareholders of record at the close of business on March 21, 2022 are entitled to receive notice of the Meeting and to vote at the Meeting.

To assure your representation at the Meeting, please complete, sign, date and return your voted proxy which will be delivered to you separately, whether or not you plan to attend. Sending your proxy will not prevent you from voting in person at the Meeting.

All proxies completed by registered shareholders must be returned to the Company:

| · | by online proxy via the following website: www.proxyvote.com no later than May 16, 2022 at 4:00 p.m. Eastern time (1:00 p.m. Pacific time); |

| · | by telephone by calling (800) 690-6903 and following the instructions, no later than May 16, 2022 at 4:00 p.m. Eastern time (1:00 p.m. Pacific time); or |

| · | by requesting a paper copy of the proxy materials and mailing a completed proxy card to Broadridge at 51 Mercedes Way, Edgewood, NY 11717, Attn: Proxy Department, for receipt no later than May 16, 2022, at 4:00 p.m. Eastern time (1:00 p.m. Pacific time). |

Non-registered shareholders whose shares are registered in the name of an intermediary should carefully follow voting instructions provided by the intermediary. A more detailed description on returning proxies by non-registered shareholders can be found on page 4 of the attached Circular.

Kingsdale Advisors (“Kingsdale”) is acting as the Company’s strategic shareholder advisor and proxy solicitation agent. If you have any questions, please contact Kingsdale in one of the following ways:

| · | call toll free in North America at 1-866-228-8818 |

| · | call collect from outside of North America at 416-867-2272, or |

| · | send an email to Kingsdale at contactus@kingsdaleadvisors.com. |

Your vote is important. We encourage you to vote promptly.

Internet and telephone voting are available through 4:00 p.m. Eastern Time on May 16, 2022.

By Order of the Board of Directors of

NOVAGOLD RESOURCES INC.

Gregory A. Lang

President and Chief Executive Officer

Vancouver, British Columbia

March 25, 2022

LETTER TO SHAREHOLDERS

Dear Fellow Shareholders,

We are pleased to invite you to NOVAGOLD’s 2022 Annual General Meeting of Shareholders.

Please read this Circular as it contains important, detailed information about the meeting agenda, who is eligible to vote, how to vote, the Director nominees, our governance practices, and compensation of our executives and Directors.

NOVAGOLD RESOURCES INC. (the “Company,” or “NOVAGOLD”) values engagement with our shareholders, whether at the annual meeting, at investment conferences, in one-on-one meetings, or via the Company’s electronic and social media communication channels. The Company’s Circular provides an important opportunity to reach every shareholder. This year, we thought it would be helpful to:

| 1. | summarize the items in this Circular being presented to shareholders for their vote, |

| 2. | highlight NOVAGOLD’s corporate governance practices, and |

| 3. | describe the Company’s shareholder engagement program. |

We are providing these materials in connection with the solicitation by the NOVAGOLD Board of Directors of proxies to be voted at our 2022 annual meeting of shareholders and at any adjournment or postponement of that meeting. The annual meeting of shareholders will be held in a virtual format on May 18, 2022 at 1:00 p.m. Pacific Time.

In light of COVID-19 and for the safety of our shareholders, employees, and other members of the community, our 2022 annual meeting of shareholders will be held in a virtual format only. Shareholders are encouraged to cast their vote in advance by proxy and participate from any geographic location with internet connectivity or by telephone. We believe this is an important step to enhancing accessibility to our annual meeting for all of our shareholders, reducing the carbon footprint of our activities, and is particularly important this year taking into account public health and safety considerations posed by COVID-19. Shareholders may view a live webcast of the annual meeting and registered shareholders and duly appointed proxyholders may submit questions digitally during the meeting at www.virtualshareholdermeeting.com/NG2022. Questions may also be submitted to management and the Board prior to the meeting via email at info@novagold.com.

MATTERS FOR SHAREHOLDER VOTING

At this year’s annual general meeting, we are asking our shareholders to vote on the following matters:

Proposal 1: Setting the Number of Directors

The Board of Directors recommends a vote FOR this proposal. See pages 6-7 for details.

Proposal 2: Election of Directors

The Board of Directors recommends a vote FOR the election of the director nominees named in this proxy statement. See pages 12-24 for further information on the nominees.

Proposal 3: Appointment of PricewaterhouseCoopers LLP as independent auditor for 2022

The Board of Directors recommends a vote FOR this proposal. See pages 9-10 for details.

Proposal 4: Advisory Approval of Executive Compensation

The Board of Directors recommends a vote FOR this proposal. See page 11 for details.

The Board of Directors knows of no other matters to be presented for action at the annual meeting. If any matter is presented from the floor of the annual meeting, the individuals serving as proxies intend to vote on these matters in the best interest of all shareholders. Your signed proxy gives this authority to Gregory Lang or Tricia Pannier.

Please refer to the material on pages 3-6 for information about how to cast your vote, how to attend the meeting virtually, and other frequently asked questions.

GOVERNANCE HIGHLIGHTS

NOVAGOLD is committed to maintaining robust corporate governance practices. Strong corporate governance helps us achieve our performance goals and maintain the trust and confidence of our investors, employees, regulatory agencies and other stakeholders. Our corporate governance practices are described in more detail on pages 91-104 and on the Governance page of our website at www.novagold.com.

| Director Independence | • Nine of our eleven nominees are independent • All of our key Board committees (Audit, Compensation, and Corporate Governance and Nominations) are composed exclusively of independent Directors • Our CEO is the only executive Director |

| Board Leadership | • The positions of Chairman and CEO are separate • Our Board has appointed an independent Lead Director |

| Accountability and Shareholder Rights | • Extensive shareholder engagement involved reaching out to holders of approximately 90% of our shares in 2021 • All Directors stand for election annually • In uncontested elections, Directors must be elected by a majority of votes cast • Eligible shareholders may nominate Directors and submit other proposals for consideration at annual meetings; see "Shareholder Proposals" on pages 104-105 below for details on timing and other requirements for submitting shareholder proposals |

| Board Practices and Governance | • Our Board regularly reviews its effectiveness • In January 2022 the Board adopted a Diversity, Equity and Inclusion Policy • In 2021 the Board adopted a written Board Charter to formalize its practices and responsibilities • The independent Directors meet in executive session without the presence of management or the non-independent Directors immediately following each Board meeting |

| Share Ownership | • In August 2020, our Board increased the share ownership requirements for our Directors and our CEO • Our Directors must hold at least $128,400 (3 times their annual retainer) worth of NOVAGOLD common stock within five years of joining the Board (increased from C$50,000) • Our CEO must, within five years of commencement of employment, hold NOVAGOLD common stock valued in an amount at least equal to five times his annual base pay (increased from three times his annual base pay) • Our CFO must, within five years of commencement of employment, hold NOVAGOLD common stock valued at an amount at least equal to two times his annual base pay • Hedging or pledging of NOVAGOLD stock is prohibited for Directors as well as employees • NOVAGOLD encourages its employees to be shareholders in the Company by making share-based compensation and employee stock purchase programs available to all employees |

| Board Oversight of Risk Management | • Our Board reviews NOVAGOLD’s systematic approach to identifying and assessing risks faced by NOVAGOLD and its projects • See the chart on the following page for a description of the Board’s allocation of risk assessment oversight |

SHAREHOLDER ENGAGEMENT

Maintaining an active shareholder engagement program continues to be a high priority for the Company and is an integral part of our corporate governance practices. The Board Chair, CEO, and Vice President of Corporate Communications meet regularly with large shareholders, and the Company’s Corporate Communications team is very responsive to shareholder inquiries regardless of ownership level.

In 2021, NOVAGOLD placed calls to or met in person with all its shareholders owning 40,000 shares or more; in other words, NOVAGOLD contacted or attempted to contact its owners holding approximately 90% of the Company’s issued and outstanding Common Shares entitled to vote at NOVAGOLD’s 2021 annual meeting of shareholders. We plan to continue to regularly engage with our shareholders.

ENVIRONMENTAL, SOCIAL AND GOVERNANCE DISCLOSURES

In 2021 NOVAGOLD published its inaugural Sustainability Summary Report and posted detailed environmental, social and governance (“ESG”) information about NOVAGOLD and its flagship Donlin Gold project on NOVAGOLD’s website at www.novagold.com/sustainability. We plan to issue a Sustainability Summary in the first half of 2022 reporting on the Company’s ESG goals, activities, and performance during fiscal year 2021. NOVAGOLD will update the ESG information on its website regularly and will continue to issue annual reports on NOVAGOLD’s ESG goals and performance. We hope you find this information useful and informative.1

More information about NOVAGOLD can be found in the Annual Report on Form 10-K for the fiscal year ended November 30, 2021, which is available on the Company’s website at www.novagold.com, on SEDAR at www.sedar.com and on EDGAR at www.sec.gov.

The Board and management team wish to thank you for your continued confidence in NOVAGOLD.

Sincerely,

| Gregory A. Lang | Anthony P. Walsh | |

| President and Chief Executive Officer | Independent Lead Director, Audit Committee Chair |

_____________________________

1 The contents of our website and our Sustainability Summary Report are referenced for general information only and are not incorporated by reference in this Proxy Circular.

| -i- |

| -ii- |

MANAGEMENT INFORMATION CIRCULAR

INFORMATION REGARDING ORGANIZATION AND CONDUCT OF MEETING

THIS MANAGEMENT INFORMATION CIRCULAR (this “Circular”) IS FURNISHED IN CONNECTION WITH THE SOLICITATION OF PROXIES BY OR ON BEHALF OF THE MANAGEMENT AND THE BOARD OF DIRECTORS (THE “BOARD OF DIRECTORS” OR THE “BOARD”) OF NOVAGOLD RESOURCES INC. (“NOVAGOLD” or the “Company”) for use at the Annual General Meeting of the Shareholders (the “Shareholders”) of the Company to be held virtually at www.virtualshareholdermeeting/NG2022 on Wednesday, May 18, 2022 at 1:00 p.m. Pacific time (the “Meeting”) or at any adjournment thereof, for the purposes set forth in the accompanying Notice of Meeting. This Circular, the accompanying Notice of Meeting and the form of proxy were first made available to Shareholders on March 25, 2022.

Solicitation of proxies from registered Shareholders will primarily be by mail or courier, supplemented by telephone or other personal contact by employees or agents of the Company at nominal cost, and all costs thereof will be paid by the Company. The Company has retained the services of Kingsdale Advisors (“Kingsdale”) as its strategic shareholder advisor and proxy solicitation agent to assist the Company in soliciting proxies. The Company estimates the fees for Kingsdale associated with this year’s proxy solicitation will be C$52,500 plus disbursements.

There are two kinds of non-registered, or beneficial, Shareholders – those who object to their name being made known to the issuers of securities which they own (called “OBOs” for Objecting Beneficial Owners) and those who do not object to the issuers of the securities they own knowing who they are (called “NOBOs” for Non-Objecting Beneficial Owners). In accordance with National Instrument 54-101 - Communication with Beneficial Owners of Securities of a Reporting Issuer (“NI 54-101”), the Company has elected to send the Notice of Meeting, this Circular and the related form of proxy or voting instruction form indirectly to the NOBOs and to the OBOs through their intermediaries. Unless required by the rules of the NYSE American, the Company does not intend to pay for intermediaries to forward to OBOs, under NI 54-101, the Notice Package (as defined below), and in the case of an OBO, the OBO will not receive these materials unless the OBO’s intermediary assumes the cost of delivery.

If you have any questions or need assistance completing your form of proxy or voting instruction form, please contact our strategic shareholder advisor and proxy solicitation agent, Kingsdale, toll free in North America at 1-866-228-8818, or call collect from outside North America at 416-867-2272, or by email at contactus@kingsdaleadvisors.com.

Notice and Access

The Company uses the “Notice and Access” provisions in securities laws that permit the Company to forego mailing paper copies of this Circular and proxy-related materials to Shareholders and instead make them available for review, print and download via the Internet. Registered and non-registered Shareholders have received a Notice Package (as defined below) but will not receive a paper copy of this Circular or the proxy-related materials unless they request such documents as described in the Notice Package.

In accordance with U.S. Securities and Exchange Commission (“SEC”) rules, the Company has distributed a notice (the “Notice Package”) in the form prescribed by SEC rules to the clearing agencies and intermediaries for onward distribution to non-registered Shareholders of the website location where non-registered Shareholders may access the Notice of Meeting, this Circular, the instrument of proxy (collectively, the “Meeting Materials”) and an annual report for the Company’s fiscal year ended November 30, 2021. Intermediaries are required to forward the Notice Package to non-registered Shareholders unless a non-registered Shareholder has waived the right to receive Meeting Materials. Typically, intermediaries will use a service company (such as Broadridge Financial Services Inc. (“Broadridge”)) to forward the Notice Package to non-registered Shareholders.

If you have any questions or need assistance completing your form of proxy or voting instruction form, please call Kingsdale Advisors at 1-866-228-8818 or email them at contactus@kingsdaleadvisors.com.

| -1- |

General

Unless otherwise specified, the information in this Circular is current as of March 10, 2022. Unless otherwise indicated, all references to “$” or “US$” in this Circular refer to United States dollars. References to “C$” in this Circular refer to Canadian dollars. The Bank of Canada exchange rate of a U.S. dollar to a Canadian dollar on November 30, 2021 was 1.2792.

Copies of the Meeting Materials, as well as the Company’s annual report containing the financial statements to be presented at the Meeting and related MD&A, can be obtained under the Company’s profile at www.sedar.com, at www.sec.gov, at www.novagold.com or by entering your 16-digit control number provided in your Notice Package at www.proxyvote.com.

Record Date and Quorum

The Board of Directors of the Company has fixed the record date for the Meeting as the close of business on March 21, 2022 (the “Record Date”). If a person acquires ownership of shares subsequent to the Record Date such person may establish a right to vote by delivering evidence of ownership of common shares of the Company (“Common Shares”) satisfactory to the Board and a request to be placed on the voting list to Blake, Cassels & Graydon LLP, the Company’s legal counsel, at Suite 2600, 595 Burrard Street, Three Bentall Centre, Vancouver, BC, V7X 1L3, Attention: Trisha Robertson. Subject to the above, all registered holders of Common Shares at the close of business on the Record Date will be entitled to vote at the Meeting. No cumulative rights are authorized, and dissenter’s rights are not applicable to any matters being voted upon. Each registered Shareholder will be entitled to one vote per Common Share.

Two or more persons present in person or by proxy representing at least 25% of the Common Shares entitled to vote at the Meeting will constitute a quorum at the Meeting.

Voting Standards

Broker non-votes occur when a beneficial owner who holds company stock through a broker does not provide the broker with voting instructions as to any matter on which the broker is not permitted to exercise its discretion and vote without specific instruction. As a result, the broker will inform the inspector of election that it does not have the authority to vote on the matter with respect to those shares. Broker non-votes may exist in connection with the election of directors and all proposals other than setting the number of directors and the appointment of auditors.

The following chart describes the proposals to be considered at the meeting, the voting options, the vote required for each matter, and the manner in which votes will be counted:

If you have any questions or need assistance completing your form of proxy or voting instruction form, please call Kingsdale Advisors at 1-866-228-8818 or email them at contactus@kingsdaleadvisors.com.

| -2- |

| Matter | Voting Options | Required Vote | Impact of Abstentions or Broker Non-Votes |

| Setting the Number of Directors | For; Against; Abstain | Simple majority of votes cast

| No effect (Brokers are permitted to exercise their discretion and vote without specific instruction on this matter. Accordingly, there are no broker non-votes.)

|

| Election of Directors | For; Withhold | Plurality of votes – the nominees receiving the highest number of votes, up to eleven, at the meeting will be elected*

| No effect |

| Appointment of Auditors | For; Withhold | Simple majority of votes cast (only votes “for” are considered votes cast) | No effect (Brokers are permitted to exercise their discretion and vote without specific instruction on this matter. Accordingly, there are no broker non-votes.)

|

Approval of Non-Binding Advisory Vote on Executive Compensation

| For; Against; Abstain | Simple majority of votes cast (only votes “for” and “against” are considered votes cast) | No effect |

* In an uncontested election, if the number of votes “withheld” for any nominee exceeds the number of votes “for” the nominee, then the Majority Voting Policy requires that the nominee shall tender their written resignation to the Chair of the Board. See “Election of Directors” for a description of the Company’s Majority Voting Policy.

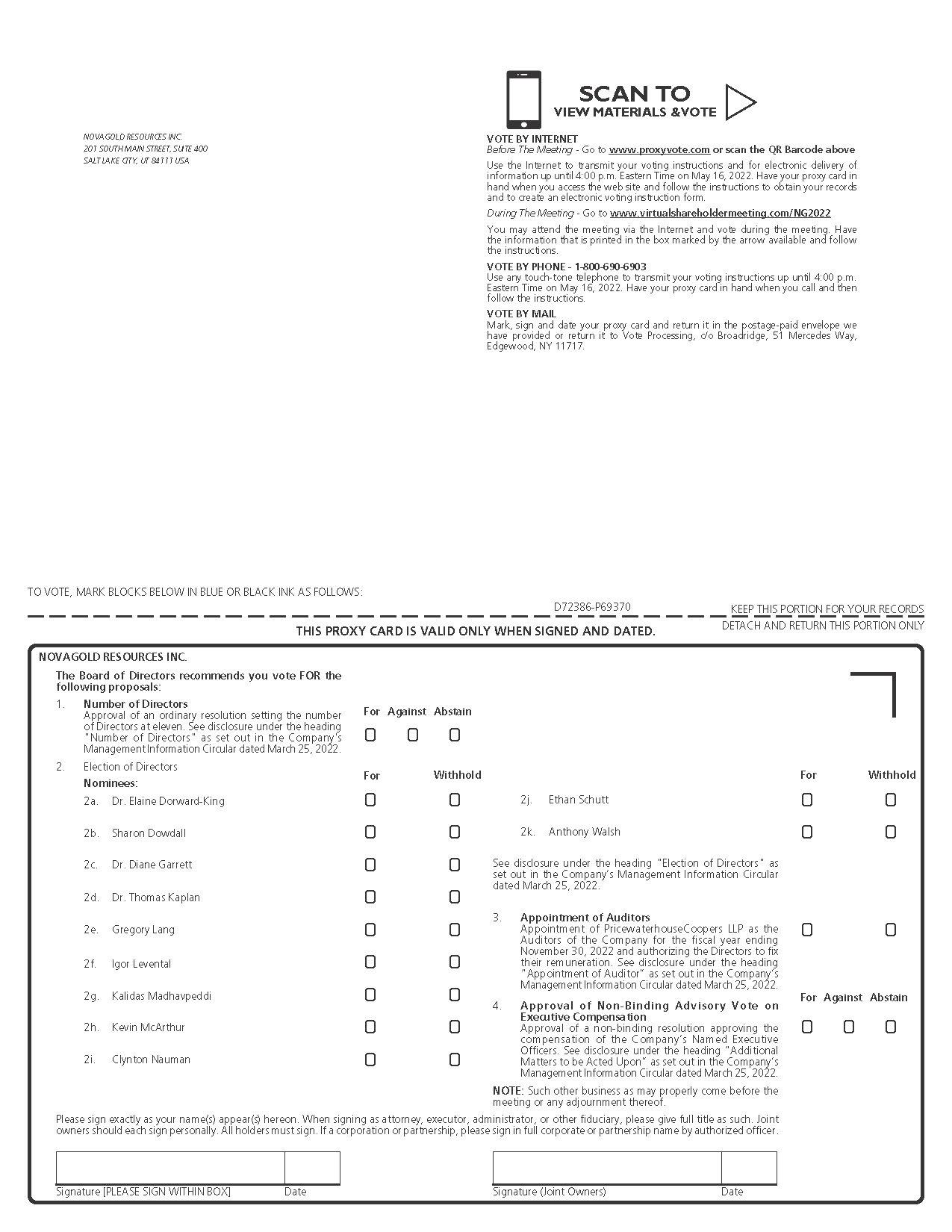

Registered Shareholders

Registered Shareholders can vote their shares before the meeting online at www.proxyvote.com, by calling the phone number included on the voting card, or by mailing a completed voting card. Registered Shareholders may also vote online during the virtual meeting at www.virtualshareholdermeeting.com/NG2022. Have the 16-digit control number from your voting materials available when casting your vote.

Shareholders who do not wish to attend the Meeting or do not wish to vote at the Meeting can vote by proxy. A registered Shareholder must return the completed proxy to the Company:

If you have any questions or need assistance completing your form of proxy or voting instruction form, please call Kingsdale Advisors at 1-866-228-8818 or email them at contactus@kingsdaleadvisors.com.

| -3- |

| · | by online proxy via the following website: www.proxyvote.com no later than May 16, 2022 at 4:00 p.m. Eastern time (1:00 p.m. Pacific time); |

| · | by telephone by calling (800) 690-6903 and following the instructions, no later than May 16, 2022 at 4:00 p.m. Eastern time (1:00 p.m. Pacific time); or |

| · | by requesting a paper copy of the proxy materials and mailing a completed proxy card to Broadridge at 51 Mercedes Way, Edgewood, NY 11717, Attn: Proxy Department, for receipt no later than May 16, 2022, at 4:00 p.m. Eastern time (1:00 p.m. Pacific time). |

The persons named in the form of proxy are officers or directors of the Company (“Directors”). Each Shareholder has the right to appoint a person or a company (who need not be a Shareholder) to attend and act for them and on their behalf at the Meeting other than the persons designated in the form of proxy. Such right may be exercised by striking out the names of the persons designated on the form of proxy and by inserting such appointed person’s name in the blank space provided for that purpose or by completing another form of proxy acceptable to the Board.

Non-Registered Shareholders

The information set forth in this section is of significant importance to many Shareholders of the Company, as a substantial number of Shareholders do not hold Common Shares in their own name. Shareholders who do not hold their Common Shares in their own name (i.e. non-registered or beneficial Shareholders) should note that only proxies deposited by Shareholders whose names appear on the records of the Company as the registered holders of Common Shares can be recognized and acted upon at the Meeting. If Common Shares are listed in an account statement provided to a Shareholder by a broker, then, in almost all cases, those Common Shares will not be registered in the Shareholder’s name on the records of the Company. Such Common Shares will more likely be registered under the name of the Shareholder’s broker or an agent of that broker. In Canada and the United States, the vast majority of such Common Shares are registered under the name of CDS & Co. (the registration name for The Canadian Depository for Securities, which acts as nominee for many Canadian brokerage firms) or Cede & Co. (operated by The Depository Trust Company), respectively. Common Shares held by brokers or their agents or nominees can only be voted upon the instructions of the non-registered Shareholder except in limited cases for certain “routine” matters. An example of a “routine” matter includes the appointment of the Auditors, which is considered the only “routine” matter to be voted upon at the Meeting. Otherwise, without specific instructions, a broker and its agents and nominees are prohibited from voting Common Shares for the broker’s clients, which is generally referred to as a “broker non-vote.” Therefore, non-registered Shareholders should ensure that instructions respecting the voting of their Common Shares are communicated to the appropriate person if such Shareholders want their votes to count on all matters to be decided at the Meeting.

Applicable regulatory policy requires intermediaries/brokers to seek voting instructions from non-registered Shareholders in advance of shareholders’ meetings. Every intermediary/broker has its own mailing procedures and provides its own return instructions to clients, which should be carefully followed by non-registered Shareholders in order to ensure that their shares are voted at the Meeting. Most brokers now delegate responsibility for obtaining instructions from clients to Broadridge.

Although a non-registered Shareholder may not be recognized directly at the Meeting for the purposes of voting Common Shares registered in the name of their broker (or an agent of the broker), a non-registered Shareholder may attend the Meeting as the proxyholder for a registered Shareholder and vote the Common Shares in that capacity. Non-registered Shareholders who wish to attend the Meeting and indirectly vote their Common Shares as the proxyholder for a registered Shareholder should follow the voting instructions provided by the broker, bank or other nominee.

NOVAGOLD may utilize the Broadridge QuickVote™ service to assist non-registered Shareholders with voting their Common Shares over the telephone. Alternatively, Kingsdale Advisors may contact such non-registered Shareholders to assist them with conveniently voting their Common Shares directly over the phone. If you have any questions about the Meeting, please contact Kingsdale Advisors by telephone at (866) 228-8818 (toll-free in North America) or (416) 867-2272 (collect outside North America) or by email at contactus@kingsdaleadvisors.com.

If you have any questions or need assistance completing your form of proxy or voting instruction form, please call Kingsdale Advisors at 1-866-228-8818 or email them at contactus@kingsdaleadvisors.com.

| -4- |

On any ballot that may be called for, the Common Shares represented by a properly executed proxy given in favor of the person(s) designated in the form of proxy will be voted or withheld from voting in accordance with the instructions given on the form of proxy and, if the Shareholder specifies a choice with respect to any matter to be acted upon, the Common Shares will be voted accordingly. Where no choice is specified, the proxy will confer discretionary authority and will be voted in favor of all matters referred to on the form of proxy.

The proxy also confers discretionary authority to vote for, withhold or abstain from voting, or vote against, amendments or variations to matters identified in the Notice of Meeting and with respect to other matters not specifically mentioned in the Notice of Meeting but which may properly come before the Meeting. Management has no present knowledge of any amendments or variations to matters identified in the Notice of Meeting or any business other than that referred to in the accompanying Notice of Meeting which will be presented at the Meeting. However, if any other matters properly come before the Meeting, it is the intention of the management designees named in the proxy to vote in accordance with the recommendations of the Company’s management.

Proxies must be received by Broadridge no later than May 16, 2022 at 4:00 p.m. Eastern time (1:00 p.m. Pacific time). The time limit for deposit of proxies may be waived or extended by the Chair of the Meeting at their discretion, without notice.

Participating in the Annual Meeting

Due to health concerns posed by COVID-19, the Company is conducting a virtual Meeting so Shareholders can safely participate from any geographic location with Internet connectivity.

| · | To participate in the Meeting, including to vote, Registered Shareholders must access the Meeting website at www.virtualshareholdermeeting.com/NG2022 and enter the 16-digit control number found on the voting materials provided to you with this Circular. Shareholders wishing to appoint themselves or another person as their proxyholder to vote at the virtual Meeting must complete the proxy appointment process by following the instructions provided on www.proxyvote.com or the instructions from their bank or broker. If you appoint someone else as your proxyholder, the online appointment process will enable you to set up your proxyholder’s login credentials for the Meeting. Shareholders and others may view the Meeting by logging in as a guest. |

| · | Whether or not you plan to participate in the Meeting, it is important that your shares be represented and voted. We encourage you to access www.proxyvote.com or follow the instructions on your Notice of Internet Availability of Proxy Materials or proxy card to vote by telephone or mail in advance of the Meeting. |

| · | Shareholders can submit appropriate questions during the Meeting through www.virtualshareholdermeeting.com/NG2022 which will be addressed as practical in the question-and-answer session following the formal business portion of the Meeting. Additionally, Shareholders may submit appropriate questions prior to the Meeting via email at info@novagold.com. Submitting questions ahead of the Meeting ensures thoughtful responses from management and the Board. Additional information regarding the rules and procedures for participating in the Meeting will be set forth in our Meeting rules of conduct, which Shareholders can view during the Meeting at www.virtualshareholdermeeting.com/NG2022. |

| · | We encourage you to access the Meeting before it begins. Online check-in will be available at www.virtualshareholdermeeting.com/NG2022 approximately 15 minutes before the meeting starts on May 18, 2022. |

If you have any questions or need assistance completing your form of proxy or voting instruction form, please call Kingsdale Advisors at 1-866-228-8818 or email them at contactus@kingsdaleadvisors.com.

| -5- |

| · | Shareholders who encounter any difficulties accessing the Meeting at www.virtualshareholdermeeting.com/NG2022 during the online check-in or Meeting time are invited to call the technical support number that will be posted on the Meeting log in page for assistance. |

Revocation of Proxies

A Shareholder who has given a proxy may revoke it at any time insofar as it has not been exercised. In addition to any other manner permitted by law, a Shareholder who has given an instrument of proxy may revoke it before it is voted by: i) delivering a later-dated proxy, or ii) providing written notice to the Company’s legal counsel, Blake, Cassels & Graydon LLP, at Suite 2600, 595 Burrard Street, Three Bentall Centre, Vancouver, BC, V7X 1L3, Canada, Attention: Trisha Robertson, at any time up to and including the last business day preceding the Meeting at which the proxy is to be used, or any adjournment thereof. In the case of registered Shareholders, their previously delivered proxy may also be revoked before it is exercised by voting virtually at the Meeting.

Voting Shares and Principal Holders Thereof

As of March 21, 2022, the Company had 333,192,571 Common Shares issued and outstanding without nominal or par value. Each Common Share is entitled to one vote. Except as otherwise noted in this Circular, a simple majority of votes cast at the Meeting, whether in person or by proxy, will constitute approval of any matter submitted to a vote.

The following table sets forth certain information regarding the ownership of the Company’s Common Shares as of March 10, 2022, by each Shareholder known to the Company who beneficially owns, or exercises control or direction over, directly or indirectly, more than 5% of the outstanding Common Shares of the Company as of that date, based solely on such person’s most recent Schedules 13D or 13G or Form 4 filed with the SEC.

| Name of Shareholder | Number of Shares Beneficially Owned | Percentage of Outstanding Voting Securities (3) |

| Electrum Strategic Resources LP (“Electrum”) (1) | 84,569,479 (2) | 25.39% |

| FMR LLC | 24,142,044 | 7.25% |

| Paulson & Co. Inc. | 22,226,300 | 6.67% |

| BlackRock, Inc. | 19,661,519 | 5.90% |

| (1) | Dr. Thomas Kaplan (Chairman of the Board) and Igor Levental (a Director) also serve as the Chairman and Chief Executive Officer, and the President, respectively, of The Electrum Group LLC (“The Electrum Group”), a privately-held global natural resources investment management company which manages the portfolio of Electrum. Mr. Levental has no voting or dispositive power over shares of the Company held by Electrum and its affiliates. | |

| (2) | Includes 5,000,000 Common Shares held by affiliates of Electrum. | |

| (3) | As of March 10, 2022, the Company had 333,133,927 common shares issued and outstanding. |

MATTERS TO BE ACTED UPON AT MEETING

According to the Articles of the Company, the Board shall consist of not less than three and no more than such number of Directors to be determined by resolution of Shareholders. Shareholders of the Company will be asked to consider and, if thought appropriate, to approve and adopt an ordinary resolution setting the number of Directors at eleven.

If you have any questions or need assistance completing your form of proxy or voting instruction form, please call Kingsdale Advisors at 1-866-228-8818 or email them at contactus@kingsdaleadvisors.com.

| -6- |

In the absence of a contrary instruction, it is intended that all proxies received will be voted FOR setting the number of Directors at eleven.

The proposed nominees in the list that follows, in the opinion of management, are well qualified to direct the Company’s activities for the ensuing year and have confirmed their willingness to serve as Directors, if elected. The term of office of each Director elected will be until the next annual meeting of the Shareholders of the Company or until a successor is elected or appointed, unless the Director’s office is vacated earlier, in accordance with the Articles of the Company and the provisions of the Business Corporations Act (British Columbia).

The Board has adopted a Majority Voting Policy stipulating that Shareholders shall be entitled to vote in favor of, or withhold from voting for, each individual director nominee at a Shareholders’ meeting. If the number of Common Shares “withheld” for any nominee exceeds the number of Common Shares voted “for” the nominee, then, notwithstanding that such Director was duly elected as a matter of corporate law, the Director shall immediately tender their written resignation to the Chair of the Board. The Corporate Governance and Nominations Committee will consider such offer of resignation and will make a recommendation to the Board concerning the acceptance or rejection of the resignation. No Director who is required to tender their resignation pursuant to this policy shall participate in the Corporate Governance and Nominations Committee’s deliberations or recommendations or in the Board’s deliberations or determination. The Board must take formal action on the Corporate Governance and Nominations Committee’s recommendation within 90 days of the date of the applicable Shareholders’ meeting and shall announce its decision promptly by press release, including the reasons for its decision. The resignation will be effective when accepted by the Board. The Board will be expected to accept the resignations tendered pursuant to this policy absent exceptional circumstances. If the Board declines to accept a resignation tendered pursuant to this policy, it will include in the press release the reason or reasons for its decision. See “Statement of Corporate Governance Policies – Majority Voting Policy.”

In the absence of a contrary instruction, the person(s) designated in the form of proxy by the Company intend to vote FOR the election of the nominees whose names are set forth below. If, prior to the Meeting, any of the listed nominees shall become unavailable to serve, the persons designated in the proxy form will have the right to use their discretion in voting for a properly qualified substitute. Management does not contemplate presenting for election any person other than these nominees but, if for any reason management does present another nominee for election, the proxy holders named in the accompanying form of proxy reserve the right to vote for such other nominee at their discretion unless the Shareholder has specified otherwise in the form of proxy.

If you have any questions or need assistance completing your form of proxy or voting instruction form, please call Kingsdale Advisors at 1-866-228-8818 or email them at contactus@kingsdaleadvisors.com.

| -7- |

| Name, Province or State and Country of Residence | Age | Independence | Principal Occupation | Director Since | 2021 AGM Votes in Favor (11) (%) | Meets Share Ownership Guidelines (12) |

Dr. Elaine Dorward-King Utah, USA (1) (3) | 64 | Independent | Corporate Director | 2020 | 94.71 | On Track (8) |

| Sharon Dowdall (1) (2) Ontario, Canada | 69 | Independent | Corporate Director | 2012 | 99.04 | Yes |

Dr. Diane Garrett (2) (3) Texas, USA | 62 | Independent | President and CEO of Hycroft Mining Holding Corporation | 2018 | 99.31 | Yes |

Dr. Thomas Kaplan (4) New York, USA | 59 | Non- Independent | Chairman and Chief Executive Officer of The Electrum Group | 2011 | 99.19 | Yes |

Gregory Lang (3) (5) Utah, USA | 67 | Non- Independent | President and Chief Executive Officer of NOVAGOLD RESOURCES INC. | 2012 | 99.63 | Yes (9) |

Igor Levental (2) (5) Colorado, USA | 66 | Independent | President of The Electrum Group | 2010 | 98.46 | Yes |

| Kalidas Madhavpeddi (1) (3) Arizona, USA | 66 | Independent | President of Azteca Consulting LLC | 2007 | 97.95 | Yes |

Kevin McArthur Nevada, USA | 67 | Independent | Corporate Director | N/A | N/A | N/A |

| Clynton Nauman (3) (6) Washington, USA | 73 | Independent | President and Chief Executive Officer of Alexco Resource Corp. | 1999 | 98.80 | Yes |

Ethan Schutt (2) (5) (6) Alaska, USA | 48 | Independent | Executive Vice President and General Counsel of Bristol Bay Native Corporation | 2019 | 99.32 | On Track (10) |

| Anthony Walsh (1) (6) (7) British Columbia, Canada | 70 | Independent | Corporate Director | 2012 | 99.53 | Yes |

| (1) | Member of the Compensation Committee. | |

| (2) | Member of the Corporate Governance and Nominations Committee. |

If you have any questions or need assistance completing your form of proxy or voting instruction form, please call Kingsdale Advisors at 1-866-228-8818 or email them at contactus@kingsdaleadvisors.com.

| -8- |

| (3) | Member of the Environment, Health, Safety, Sustainability (“EHSS”) and Technical Committee. | |

| (4) | Chairman of the Board. | |

| (5) | Member of the Corporate Communications Committee. | |

| (6) | Member of the Audit Committee. | |

| (7) | Independent Lead Director. | |

| (8) | Dr. Dorward-King was elected to the Board in May 2020 and has until August 2025 to meet the Share Ownership Guidelines. | |

| (9) | Mr. Lang has met his share ownership requirements as President and Chief Executive Officer as of November 30, 2021. See “Executive Share Ownership” beginning on page 57 for details on share ownership guidelines for Executive Officers. | |

| (10) | Mr. Schutt was elected to the Board in May 2019 and has until August 2025 to meet the Share Ownership Guidelines. | |

| (11) | See NOVAGOLD’s news release and Report of Voting Results filed on SEDAR May 13, 2021. | |

| (12) | Based on share ownership as of November 30, 2021. The Board adopted a policy requiring each Director to maintain a minimum holding of Common Shares and/or DSUs equal to $128,400. See “Directors' Share Ownership” beginning on page 74 for details on the number of securities beneficially owned, or controlled or directed, directly or indirectly, by each proposed Director. |

Refer to the Section titled “Information Concerning the Board of Directors, Director Nominees, and Executive Officers” beginning on page 12 of this Circular for further information regarding the above Directors and Director nominees.

The independent auditors of the Company are PricewaterhouseCoopers LLP, Chartered Professional Accountants (“PwC”), located at 250 Howe Street, Suite 1400, Vancouver, British Columbia, Canada. PwC were last appointed auditors of the Company (“Auditors”) on May 12, 2021 by the Shareholders. The Shareholders will be asked at the Meeting to vote for the appointment of PwC as Auditors until the next annual meeting of the Shareholders of the Company or until a successor is appointed, at a remuneration to be fixed by the Directors through the Audit Committee. To the Company's knowledge, a representative from PwC will be present virtually at the Meeting and will be available to respond to appropriate questions. PwC will also be permitted to make a statement if it so desires.

Principal Accountant Fees and Services

PwC fees for the fiscal years ended November 30, 2021 and 2020 were as follows:

| Year Ended November 30 | ||

| 2021 | 2020 | |

| Audit Fees (1) | C$303,000 | C$300,000 |

| Audit Related Fees (2) | Nil | Nil |

| Tax Fees (3) | Nil | Nil |

| All Other Fees (4) | 3,000 | 4,000 |

| Total | C$306,000 | C$304,000 |

| (1) | “Audit Fees” are the aggregate fees billed or expected to be billed by PwC for the audit of the Company’s consolidated annual financial statements, reviews of interim financial statements and attestation services that are provided in connection with statutory and regulatory filings or engagements. | |

| (2) | “Audit-Related Fees” are fees charged by PwC for assurance and related services that are reasonably related to the performance of the audit or review of the Company’s financial statements and are not reported under “Audit Fees.” This category comprises fees billed for review and advisory services associated with the Company’s financial reporting. | |

| (3) | “Tax Fees” are fees billed by PwC for tax compliance, tax advice and tax planning. | |

| (4) | “All Other Fees” are fees charged by PwC for services not described above. The fees billed by PwC in this category were for software licensing. |

Pre-Approval Policies and Procedures

All services to be performed by the Company’s Auditors must be approved in advance by the Audit Committee. The Audit Committee has considered whether the provision of services other than audit services is compatible with maintaining the Auditors’ independence and has adopted a charter governing its conduct. The charter is reviewed annually and requires the pre-approval of all auditing services and permitted non-audit services (including the fees and terms thereof) to be performed for the Company by its Auditors, subject to the de minimis exceptions for non-audit services as allowed by applicable law or regulation. The Audit Committee may form and delegate authority to subcommittees consisting of one or more members when appropriate, including the authority to grant pre-approvals of audit and permitted non-audit services, provided that decisions of such a subcommittee to grant pre-approvals shall be presented to the full Audit Committee at its next scheduled meeting. Pursuant to these procedures, all services and related fees reported were pre-approved by the Audit Committee.

If you have any questions or need assistance completing your form of proxy or voting instruction form, please call Kingsdale Advisors at 1-866-228-8818 or email them at contactus@kingsdaleadvisors.com.

| -9- |

The Audit Committee (referred to in this section as the “Committee”) reviewed and discussed with management and the Company's Auditors the audited consolidated financial statements included in the Company's Annual Report on Form 10-K for the year ended November 30, 2021. Management and PwC indicated that the Company’s consolidated financial statements were fairly stated in accordance with generally accepted accounting principles. The Committee discussed significant accounting policies applied by the Company in its financial statements, as well as alternative treatments. The Committee discussed with PwC matters covered by Public Company Accounting Oversight Board (PCAOB) standards, including PCAOB AS 16 Communication with Audit Committees and the Critical Audit Matter (CAM) reported in the Company’s fiscal year 2021 audit. In addition, the Committee reviewed and discussed management’s report on internal control over financial reporting, which includes internal controls over cybersecurity and information technology systems, and the related audits performed by PwC, which confirmed the effectiveness of the Company’s internal control over financial reporting. In fiscal year 2021 there was one significant deficiency identified and remediated. There were no material weaknesses in the Company’s internal control over financial reporting, and the Company had no information security breaches in fiscal year 2021. The Committee also discussed with PwC its independence from the Company and management, including the communications PwC is required to provide to the Committee under applicable PCAOB rules. The PwC partner currently assigned to oversee the Company’s audit has done so since fiscal year 2018; therefore, in accordance with SEC rules requiring a change in audit partner every five years, PwC will assign a new partner to oversee the Company’s audit beginning with fiscal year 2023. The Committee considered the non-audit services provided by PwC to the Company and concluded that the auditors’ independence has been maintained. Based on the foregoing reviews and discussions, the Committee recommended to the Board that the audited financial statements be included in the Annual Report on Form 10-K for the year ended November 30, 2021, for filing with the SEC, which Annual Report is available on the Company’s website at www.novagold.com, under the Company’s profile on EDGAR at www.sec.gov, and on SEDAR at www.sedar.com. Finally, the Committee conducted a comprehensive review of PwC’s overall performance and determined PwC should serve as the Company’s Auditor for fiscal year 2022 and made such recommendation to the Board. The Board agreed and is asking Shareholders to approve PwC as the Company’s Auditor for fiscal year 2022.

Audit Committee of the Board

Anthony Walsh, Chair

Clynton Nauman

Ethan Schutt

In the absence of a contrary instruction, the person(s) designated in the form of proxy by the Company intend to vote FOR the appointment of PwC as auditors of the Company until the next annual meeting of Shareholders or until a successor is appointed, at a remuneration to be fixed by the Directors through the Audit Committee.

If you have any questions or need assistance completing your form of proxy or voting instruction form, please call Kingsdale Advisors at 1-866-228-8818 or email them at contactus@kingsdaleadvisors.com.

| -10- |

Additional Matters to be Acted Upon

Non-Binding Advisory Vote on Executive Compensation

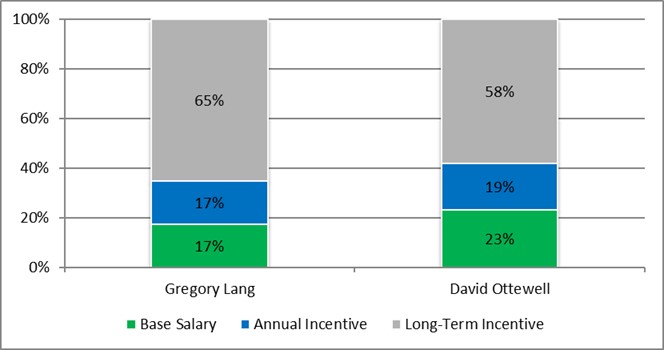

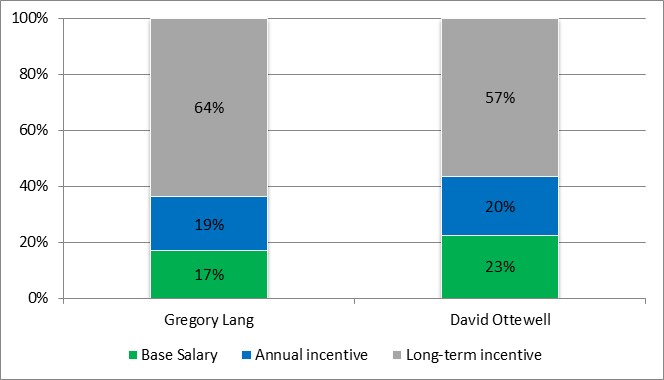

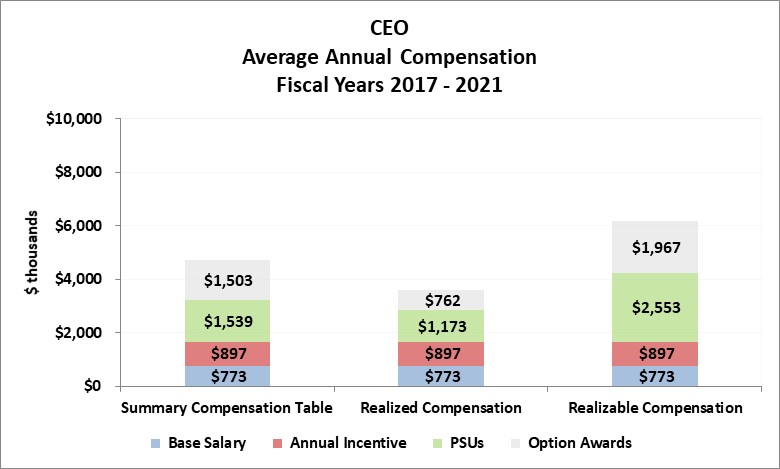

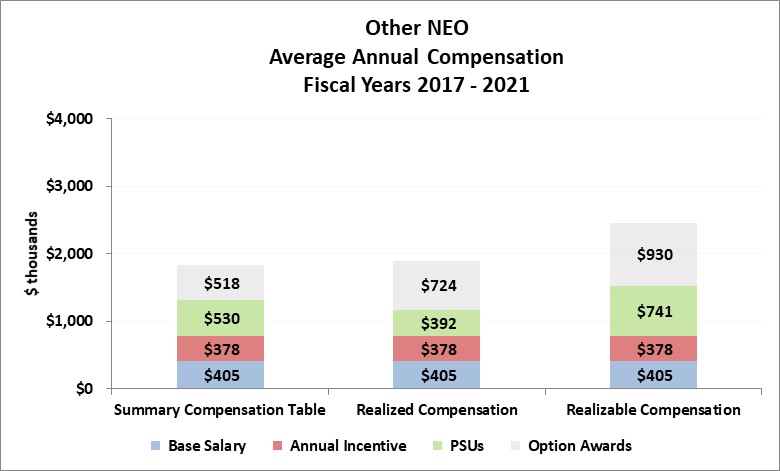

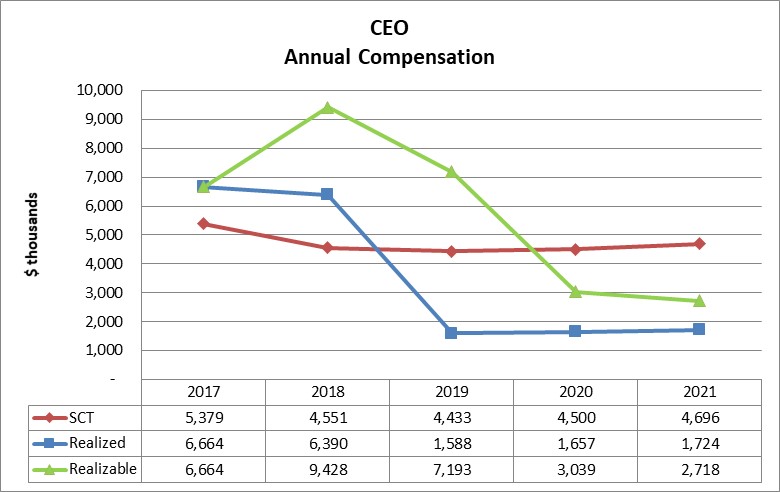

In accordance with Section 951 of the Dodd-Frank Wall Street Reform and Consumer Protection Act and Section 14A of the Exchange Act, the following proposal, commonly known as a “Say on Pay” proposal, gives our Shareholders the opportunity to vote to approve or not approve, on an advisory basis, the compensation received by Gregory Lang and David Ottewell (together, the “Named Executive Officers” or “NEOs”) during fiscal year 2021. This vote is not intended to address any specific item of compensation, but rather the overall compensation of our NEOs and our compensation philosophy, policies and practices, as disclosed under the “Compensation Discussion and Analysis” section of this Circular.

Our executive compensation program is designed to recruit and retain key individuals and reward them with compensation that has long-term growth potential while recognizing that the executives work as a team to achieve corporate results and should be rewarded accordingly. In order to align executive pay with both the Company’s performance and the creation of sustainable shareholder value, a significant portion of compensation paid to our NEOs is allocated to performance-based, short-term and long-term incentive programs to make executive pay dependent on the Company’s performance (also known as “at-risk compensation”). In addition, as an executive officer’s responsibility and ability to affect the financial results of the Company increases, the portion of their total compensation deemed “at-risk” increases. Shareholders are urged to read the “Compensation Discussion and Analysis” section of this Circular, which more thoroughly discusses how our compensation policies and procedures are aligned with our compensation philosophy.

We are asking our Shareholders to indicate their support for our NEO compensation as described in this Circular by voting FOR the following resolution:

BE IT RESOLVED, as an ordinary resolution, that the compensation paid to the named executive officers in fiscal year 2021, as disclosed in the Company’s 2022 Circular pursuant to the SEC’s executive compensation disclosure rules (which disclosure includes the Compensation Discussion and Analysis, the compensation tables and the narrative discussion that accompanies the compensation tables), is hereby approved.

While we intend to carefully consider the voting results of this proposal, the final vote is advisory in nature and therefore not binding on us, our Board or the Compensation Committee. Our Board and Compensation Committee value the opinions of our Shareholders and will consider the outcome of this vote when making future compensation decisions for our NEOs. The Board believes that submitting the non-binding vote on compensation of the Company’s NEOs to Shareholders on an annual basis is appropriate for the Company and its Shareholders at this time.

In the absence of a contrary instruction, the person(s) designated in the form of proxy by the Company intend to vote FOR the approval of the non-binding resolution approving the compensation paid to the NEOs as disclosed in this Circular.

If you have any questions or need assistance completing your form of proxy or voting instruction form, please call Kingsdale Advisors at 1-866-228-8818 or email them at contactus@kingsdaleadvisors.com.

| -11- |

INFORMATION CONCERNING THE BOARD OF DIRECTORS, DIRECTOR NOMINEES, AND EXECUTIVE OFFICERS

The following table sets forth certain information with respect to our Directors, Director nominees and executive officers. The term for each Director expires at the next annual meeting of Shareholders or at such time as a qualified successor is appointed, upon ceasing to meet the qualifications for election as a director, upon death, upon removal by the Shareholders or upon delivery or submission to the Company of the Director's written resignation, unless the resignation specifies a later time of resignation. Each executive officer shall hold office until the earliest of the date the officer’s resignation becomes effective, the date a successor is appointed or the officer ceases to be qualified for that office, or the date the officer is terminated by the Board of Directors of the Company. The name, location of residence, age, and office held by each Director, Director nominee and executive officer, current as of March 10, 2022, has been furnished by each of them and is presented in the following table. Unless otherwise indicated, the address of each current Director, and executive officer in the table set forth on the following page is care of NOVAGOLD, 201 South Main Street, Suite 400, Salt Lake City, Utah 84111, United States.

If you have any questions or need assistance completing your form of proxy or voting instruction form, please call Kingsdale Advisors at 1-866-228-8818 or email them at contactus@kingsdaleadvisors.com.

| -12- |

| Committee Memberships | |||||||

| Name and Municipality of Residence | Position Held | Independent

| AC | CC | CCC | CGN | EHSS |

Dr. Elaine Dorward-King Utah, USA Age: 64, Director Since: 2020 | Director | ✔ | ✔ | ✔ | |||

Sharon Dowdall Ontario, Canada Age: 69, Director Since: 2012 | Director | ✔ | ✔ | ✔C | |||

Dr. Diane Garrett Texas, USA Age: 62, Director Since: 2017 | Director | ✔ | ✔ | ✔ | |||

Dr. Thomas Kaplan New York, USA Age: 59, Director Since: 2011 | Board Chair | ||||||

Gregory Lang Utah, USA Age: 67, Director Since: 2012 | Director, President and CEO | ✔ | ✔ | ||||

Igor Levental Colorado, USA Age: 66, Director Since: 2010 | Director | ✔ | ✔C | ✔ | |||

Kalidas Madhavpeddi Arizona, USA Age: 66, Director Since: 2007 | Director | ✔ | ✔C | ✔ | |||

Kevin McArthur (1) Nevada, USA Age: 67, Director Since: N/A

| Director Nominee | ✔ | |||||

Clynton Nauman Washington, USA Age: 73, Director Since: 1999 | Director | ✔ | ✔ | ✔C | |||

Ethan Schutt Alaska, USA Age: 48, Director Since: 2019 | Director | ✔ | ✔ | ✔ | ✔ | ||

Anthony Walsh British Columbia, Canada Age: 70, Director Since: 2012 | Lead Director | ✔ | ✔C | ✔ | |||

David Ottewell Arizona, USA Age: 61, Officer Since: 2012 | Vice President and CFO | n/a | n/a | n/a | n/a | n/a | n/a |

| (1) | Mr. McArthur, if elected, will be appointed to committee assignments at a Board meeting following the 2022 Meeting. |

| C | Committee Chair | CCC | Corporate Communications Committee | |

| AC | Audit Committee | CGN | Corporate Governance and Nominations Committee | |

| CC | Compensation Committee | EHSS | EHSS and Technical Committee |

| -13- |

The Securities Held listed below for each Director nominee and NEO are as of November 30, 2021. Determination of whether each person meets the share ownership guidelines is determined by calculating the number of Common Shares and DSUs, if applicable, owned by each person, multiplied by the closing price of the Common Shares on November 30, 2021 on the NYSE American.

| Elaine Dorward-King, Ph.D. | ||||||

Independent

Director Since 2020

| Dr. Elaine Dorward-King has spent the majority of her career in mining, most recently serving as a non-executive director of four listed mining companies. From March 2013 until June 2019, she served as Newmont Mining Corporation’s (“Newmont”) Executive Vice President of Sustainability and External Relations, and from June 2019 until January 2020 she served as Newmont’s Executive Vice President of Environmental, Social and Governance Strategy. Prior to joining Newmont, Dr. Dorward-King spent 20 years with Rio Tinto, one of the world’s largest diversified producers of metals and minerals, in general management and Environmental Health and Safety leadership roles. Dr. Dorward-King has over 30 years of leadership experience in creating and implementing sustainable development, safety, health and environmental strategy, and programs in mining, chemical, and engineering consulting sectors. Currently Dr. Dorward-King serves on the Board of Directors of Kenmare Resources plc, one of the world’s largest producers of mineral sands products, Great Lakes Dredge and Dock Company, LLC, the largest provider of dredging services in the United States, and Sibanye-Stillwater, a leading international precious metals mining company. Dr. Dorward-King holds a Bachelor’s Degree from Maryville College and received a PhD in Analytical Chemistry from Colorado State University.

The Board has determined that Dr. Dorward-King should serve as a Director so the Company can benefit from her experience as an industry leader in the development and implementation of environmental health, safety and sustainability strategies, community relations, governmental affairs, external relations and her experience as a senior mining executive.

Dr. Dorward-King’s principal occupation for the last five years has been serving as a non-executive director (December 2019 – present) and Executive Vice President, Sustainability and External Relations at Newmont (2013 – January 2020). She served as a non-exectuive director of Bond Resources Inc. from January 2020 until April 2021.

Areas of expertise include health, safety and sustainability, community relations, and corporate leadership.

| |||||

| Board / Committee Membership | Overall Attendance 100% | Securities Held | Share Ownership Guidelines | |||

Regular Meeting | Common Shares | DSUs | Value of Securities Held as of 11/30/2021 $ | Total | % Met | |

Board Compensation EHSS & Technical | 4/4 4/4 | Nil | 3,684 | $24,867 | $128,400 | 19% (1) |

| (1) | Dr. Dorward-King was first elected to the Board in May 2020 and has until August 2025 to meet the Share Ownership Guidelines. |

| -14- |

Sharon Dowdall | ||||||

Independent

Director Since 2012

| Ms. Dowdall, a Director of the Company, worked in the mining industry for over 30 years. Ms. Dowdall served in senior legal capacities for Franco-Nevada Corporation (“Franco-Nevada”), a major gold-focused royalty company, and Newmont Mining Corporation, one of the world’s largest gold producers. During her 20-year tenure with Franco-Nevada, Ms. Dowdall served in various capacities, including Chief Legal Officer and Corporate Secretary and Vice President, Special Projects. Ms. Dowdall was one of the principals who transformed Franco-Nevada from an industry pioneer into one of the most successful precious metals enterprises in the world. Prior to joining Franco-Nevada, she practiced law as a partner with Smith Lyons in Toronto, a major Canadian legal firm specializing in natural resources. Ms. Dowdall is the recipient of the 2011 Canadian General Counsel Award for Business Achievement. She currently serves on the board of Olivut Resources Limited. Ms. Dowdall holds an Honours B.A. in Economics from the University of Calgary and an LLB, from Osgoode Hall Law School at York University. The Board has determined that Ms. Dowdall should serve as a Director due to her significant experience: as a natural resources lawyer, moving a precious-metals mining company from the development stage to the successful producer stage, and as a senior executive in a large international mining company.

Ms. Dowdall joined the Board in April 2012.

Ms. Dowdall has been retired since 2012. During the last five years she has served, and continues to serve, as a member of the board of Olivut Resources Limited. Ms. Dowdall was a member of the board of Foran Mining Corporation from February 2011 until May 28, 2019.

Areas of expertise include legal, corporate governance, finance, investment, valuation, securities, human resources, corporate strategy, corporate leadership, and mining industry.

| |||||

| Board / Committee Membership | Overall Attendance 100% | Securities Held | Share Ownership Guidelines | |||

Regular Meeting | Common Shares | DSUs | Value of Securities Held as of 11/30/2021 $ | Total | % Met | |

Board Compensation Governance & Nominations (Chair) | 4/4 5/5 | Nil | 38,487 | $259,787 | $128,400 | 202% |

| -15- |

| Diane Garrett, Ph.D. | ||||||

Independent

Director Since 2018

| Dr. Garrett, a Director of the Company, is the President and CEO of Hycroft Mining Holding Corporation (“Hycroft”), owner operator of the gold-silver Hycroft Mine in Northern Nevada. She has more than 20 years of senior management and financial expertise in natural resources. Prior to joining Hycroft, Dr. Garrett was the President and CEO of Nickel Creek Platinum Corp. (“NCP”). Before that, Dr. Garrett held the position of President and CEO of Romarco Minerals Inc. (“Romarco”), taking the multi-million-ounce Haile Gold Mine project from discovery to construction. Prior to that, she held numerous senior positions in public mining companies including VP of Corporate Development at Dayton Mining Corporation and VP of Corporate Development at Beartooth Platinum Corporation. Early in her career, Dr. Garrett was the Senior Mining Analyst and Portfolio Manager in the precious metals sector with US Global Investors. Dr. Garrett received her Ph.D. in Engineering and her Masters in Mineral Economics from the University of Texas at Austin. The Board has determined that Dr. Garrett should serve as a Director due to her significant experience: permitting, developing, and constructing gold mines, moving a precious-metals mining company from the development stage to the successful producer stage, as a senior executive in mining companies, and her technical expertise.

Dr. Garrett currently serves as the President and CEO of Hycroft and has held that position since September 2020. She also currently serves as a director of Hycroft. From 2012 to 2018 Dr. Garrett served as a director of TriStar Gold. From June 2016 until September 2020, Dr. Garrett served as a director and as President and CEO of NCP. Dr. Garrett served as the President, CEO and as a director of Romarco from November 2002 until October 2015. Romarco was acquired by OceanaGold in 2015, at which time Dr. Garrett became a director and consultant to OceanaGold before joining NCP in June 2016. Dr. Garrett also served as Chair of the board of directors of Revival Gold from January 2018 until December 31, 2019.

Areas of expertise include engineering, mining, finance and corporate leadership.

| |||||

Board / Committee Membership | Overall Attendance 92% | Securities Held | Share Ownership Guidelines | |||

Regular Meeting | Common Shares | DSUs | Value of Securities Held as of 11/30/2021 $ | Total | % Met | |

Board EHSS & Technical | 4/4 5/5 | 7,100 | 10,157 | $116,485 | $128,400 (3) | 100% (3) |

| (2) | Dr. Garrett missed one EHSS & Technical Committee meeting due to a telecommunications systems failure while she was at a third-party remote location. | |

| (3) | Dr. Garrett exceeded the Share Ownership Guidelines as of November 30, 2020, and since her share ownership has not decreased (and has, in fact, increased) since that date, she is deemed to meet the Company’s Share Ownership Guidelines for Directors. |

| -16- |

| Thomas Kaplan, Ph.D. | ||||||

Non-Independent

Director Since 2011

| Dr. Kaplan is Chairman of the Board of the Company and is also Chairman, Chief Investment Officer and Chief Executive Officer of The Electrum Group, a privately held global natural resources investment management company which manages the portfolio of Electrum. Electrum and its affiliates are collectively the largest Shareholder of the Company. Dr. Kaplan is an entrepreneur and investor with a track record of both creating and unlocking shareholder value in public and private companies. Dr. Kaplan served as Chairman of Leor Exploration & Production LLC, a natural gas exploration and development company founded by Dr. Kaplan in 2003. In 2007, Leor’s natural gas assets were sold to EnCana Oil & Gas USA Inc., a subsidiary of Encana Corporation, for $2.55 billion. Dr. Kaplan holds Bachelors, Masters and Doctoral Degrees in History from Oxford University. The Board has determined that Dr. Kaplan should serve as the Director and Chairman to gain from his experience as a developer of and investor in mining companies as well as oil and gas companies, and because of his significant beneficial ownership in the Company.

Dr. Kaplan’s principal occupation is Chairman and Chief Executive Officer of The Electrum Group. From March 2011 to January 2018, Dr. Kaplan served as the Chairman and Chief Investment Officer of The Electrum Group. In January 2018, Dr. Kaplan became the Chairman, Chief Investment Officer and Chief Executive Officer of The Electrum Group. Dr. Kaplan served as Chair of the Board of Sunshine Silver Mines Corporation (now known as Gatos Silver, Inc.), a privately held company, from January 2020 through October 2020.

Areas of expertise include: finance, mergers and acquisitions, mining industry.

| |||||

| Board / Committee Membership | Overall Attendance 100% | Securities Held | Share Ownership Guidelines | |||

Regular Meeting | Common Shares | DSUs | Value of Securities Held as of 11/30/2021 $ | Total | % Met | |

| Board (Chair) | 4/4 | 254,787 (4) | 76,824 | $2,238,374 | 128,400 | 1,743% |

| (4) | See description of Electrum’s holdings and Dr. Kaplan’s relationship with Electrum under “Voting Shares and Principal Holders Thereof.” |

| -17- |

| Gregory Lang | |||||||

Non-Independent

Director Since 2012

| Mr. Lang is President and Chief Executive Officer of the Company. Mr. Lang has over 35 years of diverse experience in mine operations, project development and evaluation, including time as President of Barrick Gold North America, a wholly-owned subsidiary of Barrick Gold Corporation (“Barrick”). Mr. Lang held progressively responsible operating and project development positions over his 10-year tenure with Barrick and, prior to that, with Homestake Mining Company and International Corona Corporation, both of which are now part of Barrick. He holds a Bachelor of Science in Mining Engineering from the University of Missouri-Rolla and is a Graduate of the Stanford University Executive Program. The Board has determined that Mr. Lang should continue to serve as a Director to gain his insight as an experienced mine engineer, as well as his expertise in permitting, developing and operating large-scale assets, and as a successful senior executive of other large gold-mining companies.

Mr. Lang served as the President of Barrick Gold North America until December 2011 and has served as the Company’s President and Chief Executive Officer since January 2012.

During the most recent five years, Mr. Lang has served, and continues to serve, as a director of Trilogy Metals Inc. He served as a director of Sunward Resources Limited until June 2015.

Areas of expertise include: mining operations, mine development and evaluation, mine permitting, corporate leadership and mining industry.

| ||||||

| Board / Committee Membership | Overall Attendance 100% | Securities Held | Share Ownership Guidelines | ||||

| Regular Meeting | Common Shares # | DSUs # | PSUs # | Value of Common Shares Held as of 11/30/2021 $ | Total $ | % Met | |

| Board EHSS & Technical Corporate Communications | 4/4 4/4 2/2 | 1,992,015 | Nil | 740,200 | $13,446,101 | $4,031,500 | 334% (5) |

| (5) | Mr. Lang has exceeded his share ownership requirement as President and Chief Executive Officer as of November 30, 2021 based upon an amount equal to five times his annual salary as of November 30, 2021. See “Executive Share Ownership” for details on the share ownership guidelines applicable to Mr. Lang. PSUs are not included in determining whether an NEO meets the Share Ownership Guidelines. |

| -18- |

| Igor Levental | ||||||

Independent

Director Since 2010

| Mr. Levental, a Director of the Company, is President of The Electrum Group, a privately held global natural resources investment management company which manages the portfolio of Electrum. Electrum and its affiliates are collectively the largest Shareholder of the Company. Mr. Levental has more than 30 years of international experience in the mining industry and has held senior positions with major mining companies including Homestake Mining Company and International Corona Corporation. Mr. Levental is a Professional Engineer with a BSc in Chemical Engineering and an MBA from the University of Alberta. The Board has determined that Mr. Levental should serve as a Director for the Company to benefit from his extensive experience as an executive of large mining companies.

Mr. Levental’s primary occupation during the last five years has been President of The Electrum Group. Mr. Levental also currently serves as a director of Gatos Silver, Inc., formerly known as Sunshine Silver Mines Corporation, a position he has held since March 2019. During the most recent five years, Mr. Levental served as a director of Gabriel Resources Limited until June 2016, as a director of Trilogy Metals Inc. until June 2016, and as a director of Taung Gold International Limited until September 2017.

Areas of expertise include: corporate development, finance, mergers and acquisitions, communications, corporate governance and mining industry.

| |||||

| Board / Committee Membership | Overall Attendance 100% | Securities Held | Share Ownership Guidelines | |||

Regular Meeting | Common Shares | DSUs | Value of Securities Held as of 11/30/2021 $ | Total | % Met | |

Board Corporate Communications (Chair) | 4/4 | 99,999 | 50,333 | $1,014,741 | $128,400 | 790% |

| -19- |

| Kalidas Madhavpeddi | ||||||

Independent

Director Since 2007

| Mr. Madhavpeddi, a Director of the Company, has 40 years of international experience in corporate strategy, mergers and acquisitions, government relations, marketing, mining engineering and capital. He is currently the President of Azteca Consulting LLC, an advisory firm to the metals and mining sector, a position he has held since 2006. From 2010 to 2018 he was CEO of China Molybdenum International, the overseas arm of a HK listed global producer of copper, gold, cobalt, phosphates, niobium and molybdenum. His extensive career in the mining industry includes over 25 years at Phelps Dodge Corporation (now Freeport-McMoRan), as Senior Vice President and contemporaneously the President of Phelps Dodge Wire & Cable. Mr. Madhavpeddi is an alumnus of the Indian Institute of Technology, Madras, India; the University of Iowa and the Harvard Business School. The Board has determined that Mr. Madhavpeddi should serve as a Director to benefit from his long-term experience in the mining industry working as an executive in global corporate development, exploration, mergers and acquisitions, joint ventures and finance.

Mr. Madhavpeddi currently serves as a director of Dundee Precious Metals (since February 1, 2021), Glencore plc (since February 4, 2020) and Trilogy Metals Inc. (since 2012). Mr. Madhavpeddi previously served as the CEO of China Molybdenum International from September 2008 until April 2018, as Chairman of the Board of Namibia Rare Earths from 2010 until 2016, and as a director of Capstone Mining from 2012 until April 2019.

Areas of expertise include: corporate strategy, mergers and acquisitions, mining operations, exploration and capital, marketing and sales, corporate leadership and human resources/compensation.

| |||||

| Board / Committee Membership | Overall Attendance 100% | Securities Held | Share Ownership Guidelines | |||

Regular Meeting | Common Shares | DSUs | Value of Securities Held as of 11/30/2021 $ | Total | % Met | |

Board EHSS | 4/4 4/4 | 114,629 | 42,060 | $1,057,651 | $128,400 | 824% |

| -20- |

| Kevin McArthur | |||||

Independent

Director Nominee

| Mr. McArthur has over 40 years of experience focused on mining operations, corporate development and executive management. He currently serves as a non-executive director of Royal Gold, Inc. and First Quantum Minerals Ltd. Mr. McArthur recently served as non-executive Chair of Boart Longyear Limited from 2019 to 2021, non-executive director of Pan American Silver Corporation from 2019 to 2020, Chief Executive Officer of Tahoe Resources Inc. from 2009 to 2015 and as Executive Chair from 2015 to 2019. His prior experience includes serving as CEO of Goldcorp Inc. from 2006 to 2008 and CEO of Glamis Gold Ltd. from 1999 to 2006. His earlier career focused on mine operations and project development with Glamis Gold, BP Minerals and Homestake Mining Company. Mr. McArthur obtained a degree in Mining Engineering from the University of Nevada in 1979.

The Board has determined that Mr. McArthur should serve as a Director to gain from his experience with the design, construction and start up of some of the largest and most innovative projects in the mining industry, his corporate development experience, and his experience as a senior mining executive.

Areas of expertise include: mine development and operations, corporate leadership, business development, corporate governance, human resources and compensation.

| ||||

| Securities Held | Share Ownership Guidelines | ||||

Common Shares | DSUs | Value of Securities Held as of 11/30/2021 $ | Total | % Met | |

| Nil | Nil | Nil | N/A | N/A | |

| -21- |

| Clynton Nauman | ||||||

Independent

Director Since 1999

| Mr. Nauman, a Director of the Company, is the Chief Executive Officer of Alexco Resource Corp. and Asset Liability Management Group ULC. He was formerly President of Viceroy Gold Corporation and Viceroy Minerals Corporation and a director of Viceroy Resource Corporation, positions he held from February 1998 until February 2003. Previously, Mr. Nauman was the General Manager of Kennecott Minerals from 1993 to 1998. Mr. Nauman has over 35 years of diversified experience in the mining industry ranging from exploration and business development to operations and business management in the precious metals, base metals and coal sectors. The Board has determined that Mr. Nauman should serve as a Director to gain from his significant experience as a senior mining executive working in the areas of environment, engineering and operations.

Mr. Nauman’s principal occupation for the last five years has been CEO of Alexco Resource Corp. and of Asset Liability Management Group ULC. Mr. Nauman has served as a director of Alexco Resource Corp. since 2006.

Areas of expertise include: environmental, geology, exploration, operations, mining industry and corporate leadership.

| |||||

| Board / Committee Membership | Overall Attendance 100% | Securities Held | Share Ownership Guidelines | |||

Regular Meeting | Common Shares | DSUs | Value of Securities Held as of 11/30/2021 $ | Total | % Met | |

Board EHSS & Technical (Chair) | 4/4 4/4 | 129,445 | 42,060 | $1,157,659 | $128,400 | 902% |

| -22- |

| Ethan Schutt | ||||||

Independent

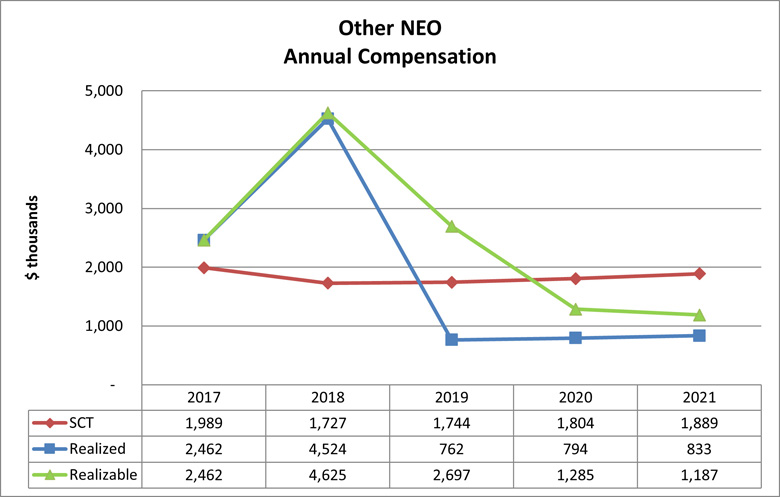

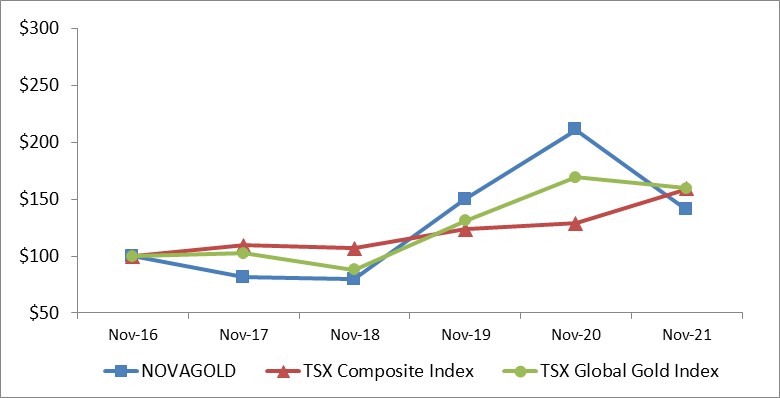

Director Since 2019