QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

ORBITZ, INC. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

April 15, 2004

Dear Shareholders:

You are cordially invited to attend the 2004 Annual Meeting of Shareholders of Orbitz, Inc. We will hold the meeting on Wednesday, June 2, 2004 at 9:00 a.m. Central Time at the Swissôtel Chicago, 323 East Wacker Drive, Chicago, Illinois.

Details of the business to be presented at the meeting can be found in the accompanying Notice of Annual Meeting of Shareholders and Proxy Statement. We hope you will be able to attend the Annual Meeting. Your vote is important. Whether or not you are able to attend, it is important that your shares are represented at the meeting. Please sign, date and return the proxy card at your earliest convenience. Certain shareholders also have the option to vote shares by telephone or Internet as well as by mail. Please refer to the proxy card or voting form to see which options are available to you.

ORBITZ, INC.

200 SOUTH WACKER DRIVE, SUITE 1900

CHICAGO, ILLINOIS 60606

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON JUNE 2, 2004

To the Shareholders:

The Annual Meeting of Shareholders of Orbitz, Inc. (the "Company") will be held on Wednesday, June 2, 2004, at 9:00 a.m. Central Time at the Swissôtel Chicago, 323 East Wacker Drive, Chicago, Illinois, for the following purposes:

- 1.

- For the holders of Class A common stock and Class B common stock to elect one Class A Director to serve until the 2007 Annual Meeting of Shareholders and until her successor is duly elected and qualified.

- 2.

- For the holders of the Class B common stock to elect five Class B Directors to serve until the 2005 Annual Meeting of Shareholders and until their respective successors are duly elected and qualified.

- 3.

- For the holders of the Class B common stock to elect the Management Director to serve until the 2005 Annual Meeting of Shareholders and until his successor is duly elected and qualified.

- 4.

- To ratify the appointment of KPMG LLP as auditors of the Company for 2004.

- 5.

- To transact such other business as may properly come before the meeting.

The Board of Directors fixed the close of business on April 7, 2004 as the record date for determining the shareholders entitled to notice of and to vote at the Annual Meeting.

Please note that attendance at the Annual Meeting will be limited to shareholders as of the record date (or their authorized representatives) holding evidence of their ownership and presenting valid photo identification. If your shares are held by a bank or broker, you will need to bring to the Annual Meeting a bank or broker statement evidencing your beneficial ownership of our common stock.

April 15, 2004

Chicago, Illinois

ORBITZ, INC.

200 SOUTH WACKER DRIVE, SUITE 1900

CHICAGO, ILLINOIS 60606

PROXY STATEMENT FOR ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON JUNE 2, 2004

GENERAL INSTRUCTIONS

We prepared this Proxy Statement in connection with the solicitation by our Board of Directors of proxies for the Annual Meeting of Shareholders of Orbitz, Inc. to be held on Wednesday, June 2, 2004, at 9:00 a.m. Central Time at the Swissôtel Chicago, 323 East Wacker Drive, Chicago, Illinois. This Proxy Statement and the accompanying proxy card are being first mailed to shareholders on or about April 15, 2004.

The Company has two classes of common stock, Class A common stock and Class B common stock, each of which is entitled to vote at the Annual Meeting. Only shareholders of record at the close of business on April 7, 2004 will be entitled to notice of and to vote at the Annual Meeting. As of April 7, 2004, 13,105,402 shares of our Class A common stock were outstanding and entitled to vote. The Class A common stock is entitled to one vote per share, which represents an aggregate of 13,105,402 votes. Our Class B common stock consists of the following five series: Series B-AA common stock, Series B-CO common stock, Series B-DL common stock, Series B-NW common stock, and Series B-UA common stock. As of April 7, 2004, 27,269,809 shares of our Class B common stock were outstanding and entitled to vote. The Class B common stock is entitled to ten votes per share on matters submitted to a vote of the holders of our common stock voting together as a single class, which represents an aggregate of 272,698,090 votes. The Class B common stock is entitled to one vote per share on matters submitted to a separate vote of the holders of our Class B common stock, or a series within such class, which represents an aggregate of 27,269,809 votes. No other securities are entitled to be voted at the Annual Meeting. The presence at the Annual Meeting, either in person or by proxy, of holders of record of a majority of the outstanding shares of our common stock will constitute a quorum.

Holders of our Class A common stock and Class B common stock will vote together as a single class to elect one Class A Director to serve until the 2007 Annual Meeting. Holders of each of our five series of Class B common stock will be entitled to separately elect one Class B Director for the corresponding series of our Class B common stock to serve until the 2005 Annual Meeting. Holders of our Class B common stock will vote together as a single class to elect the Management Director to serve until the 2005 Annual Meeting. Pursuant to our Amended and Restated Bylaws, the nominee for Management Director shall be our chief executive officer. Pursuant to our Amended and Restated Stockholders Agreement, the holders of our Class B common stock have agreed to cast all of their votes to elect our chief executive officer as the Management Director.

Pursuant to our Amended and Restated Bylaws, the nominee for each specified director position receiving a plurality of votes of the shareholders entitled to vote for such position shall be elected.

The ratification of the appointment of KPMG LLP as auditors of the Company for 2004 requires the vote of a majority of the shares of our common stock, voting together as a single class, present in person or represented by proxy at the Annual Meeting.

If a shareholder is the beneficial owner of shares held by a broker or other nominee, such broker or other nominee will request instructions from the beneficial owner with respect to each proposal to be voted on at the Annual Meeting. A broker non-vote occurs when a broker submits a proxy card with respect to shares of common stock held by it on behalf of the beneficial owner, but declines to vote on

1

a particular matter because the broker has not received voting instructions from the beneficial owner. We will treat broker non-votes as present and entitled to vote for purposes of determining the presence of a quorum. Broker non-votes will have no effect on the election of directors, because directors are elected by the highest number of votes cast. However, broker non-votes will not be counted, and therefore will have the same effect as votes against, the proposal to ratify the appointment of KPMG LLP as auditors of the Company for 2004. Under certain circumstances, a broker or other nominee may have discretionary authority to vote shares on routine matters even if instructions have not been received from the beneficial owner.

A shareholder may withhold votes in the election of directors and may abstain from voting on the proposal to ratify the appointment of KPMG as auditors of the Company for 2004. We will treat directions to withhold authority and abstentions as present and entitled to vote for purposes of determining the presence of a quorum. Directions to withhold authority will have no effect on the election of directors, because directors are elected by the highest number of votes cast. Abstentions will not be counted, and therefore will have the same effect as votes against, the proposal to ratify the appointment of KPMG LLP as auditors of the Company for 2004.

We request that you mark the accompanying proxy card to indicate your votes, sign and date it, and return it to the Company in the enclosed envelope. If your completed proxy card is received prior to or at the Annual Meeting, your shares will be voted in accordance with your voting instructions. If you sign and return your proxy card but do not give voting instructions, your shares will be voted FOR the election of the Company's nominee as a Class A Director and FOR the ratification of the appointment of KPMG LLP as auditors of the Company for 2004, and in the discretion of the proxy holders as to any other business which may properly come before the meeting. Any proxy solicited hereby may be revoked by the person or persons giving it at any time before it has been exercised at the Annual Meeting by giving notice of revocation to the Company in writing. We request that all such written notices of revocation to the Company be addressed to Richard Buchband, Vice President, Senior Corporate Counsel and Secretary, Orbitz, Inc., 200 South Wacker Drive, Suite 1900, Chicago, Illinois 60606.

The Company will bear the costs of preparing and mailing this Proxy Statement and other costs of the proxy solicitation made by our Board of Directors. Certain of our officers and employees may solicit the submission of proxies authorizing the voting of shares in accordance with the Board of Directors' recommendations, but no additional remuneration will be paid by the Company for the solicitation of those proxies. Such solicitations may be made by personal interview, telephone, facsimile and electronic mail transmission. Arrangements have also been made with brokerage firms and others for the forwarding of proxy solicitation materials to the beneficial owners of common stock held of record by such persons, and we will reimburse such brokerage firms and others for reasonable out-of-pocket expenses incurred by them in connection therewith. The Company has engaged D. F. King & Co., Inc. to assist in proxy solicitation and collection, and has agreed to pay such firm $3,000, plus out-of-pocket costs and expenses.

ELECTION OF DIRECTORS

Information Concerning the Directors and Nominees

Our Board of Directors currently consists of nine members, three of whom are Class A Directors, five of whom are Class B Directors and one of whom is the Management Director. The Class A Directors are divided into three classes having staggered three-year terms, one of whom serves in Class I and whose term expires at this year's Annual Meeting, one of whom serves in Class II and whose term will expire at the Annual Meeting to be held in 2005, and one of whom serves in Class III and whose term will expire at the Annual Meeting to be held in 2006. Upon the expiration of the term of a Class A Director, the person nominated to serve as the director in such class is elected for a

2

three-year term at the Annual Meeting in the year in which such term expires. The Class B Directors and the Management Director are elected by the holders of Class B common stock for a one-year term at each Annual Meeting.

Background information with respect to our Board of Directors and nominees for election as director appears below. See "Security Ownership" for information regarding each such person's holdings of our equity securities.

Name

| | Age

| | Position

|

|---|

| Jeffrey G. Katz* | | 48 | | Chairman of the Board of Directors, President and Chief Executive Officer |

| Denise K. Fletcher* | | 55 | | Class A Director—Class I |

| Marc L. Andreessen | | 32 | | Class A Director—Class II |

| Scott D. Miller | | 51 | | Class A Director—Class III |

| Daniel P. Garton* | | 46 | | Series B-AA Director |

| Jeffery A. Smisek* | | 49 | | Series B-CO Director |

| Vincent F. Caminiti* | | 60 | | Series B-DL Director |

| J. Timothy Griffin* | | 52 | | Series B-NW Director |

| Douglas A. Hacker* | | 48 | | Series B-UA Director |

- *

- Nominee for election as director at 2004 Annual Meeting

PROPOSAL 1—Election of Class A Director

(To Be Voted On By All Holders of Common Stock)

Holders of our Class A common stock and Class B common stock will vote together as a single class to elect one Class A Director. The nominee for Class A Director receiving the highest number of votes will be elected to serve until the 2007 Annual Meeting. Our Class A Nominating Committee has nominated Denise K. Fletcher for election as a Class A Director, to serve in Class I for a three-year term expiring at the Annual Meeting to be held in 2007. In the event that Ms. Fletcher is unavailable to serve, proxies received pursuant to this solicitation will be voted for the election of a substitute nominee that the Class A Nominating Committee may propose. Ms. Fletcher has consented to be named in this Proxy Statement and agreed to serve if elected, and our Board of Directors has no reason to believe that Ms. Fletcher will be unable to serve. Certain background information about Ms. Fletcher is set forth below:

Denise K. Fletcher has served as a director of Orbitz since March 2004. Ms. Fletcher served as Chief Financial Officer—Executive Vice President of MasterCard Incorporated, an international payment solutions company, from September 2000 to May 2003. Ms. Fletcher also served as Chief Financial Officer, Senior Vice President of Bowne Inc., a global document management and information services provider, from September 1996 to August 2000. Ms. Fletcher is a director and member of the audit committee and the nominating and corporate governance committee of Unisys Corporation, a company traded on the New York Stock Exchange.

All outstanding shares of our Class B common stock are beneficially owned by American Airlines, Continental Airlines, Delta Air Lines, Northwest Airlines and United Air Lines, or their affiliates, which we refer to as the "Founding Airlines." See "Important Information Regarding the Board of Directors and Committees—Controlled Company Exemption." The Founding Airlines have advised us that they intend to vote "FOR" Denise K. Fletcher, which would result in the election of Ms. Fletcher as a Class A Director.

THE BOARD OF DIRECTORS RECOMMENDS THAT THE SHAREHOLDERS VOTE "FOR" THE ELECTION OF DENISE K. FLETCHER AS A CLASS A DIRECTOR.

3

PROPOSAL 2—Election of Class B Directors

(To Be Voted On By Holders of Class B Common Stock Only)

The following information concerns the five nominees for election as Class B Directors. Only the holders of our Class B common stock, voting separately as a series, are entitled to vote to elect each Class B Director associated with that series. Holders of our Class A common stock do not have a vote, and we are not soliciting proxies from the holders of our Class A common stock, with respect to the election of the five Class B Directors who will be elected at the meeting. All of our Class B Directors are officers of the Founding Airlines, with which we have numerous business relationships. See "Certain Relationships and Related Party Transactions."

Election of Class B Director by Holder of Series B-AA Common Stock

The holder of our Series B-AA common stock, voting separately as a series, has the exclusive right to elect one Class B Director. The holder of our Series B-AA common stock has nominated Daniel P. Garton for election as a Class B Director, to serve for a one-year term expiring at the Annual Meeting to be held in 2005. Mr. Garton has consented to be named in this Proxy Statement and agreed to serve if elected, and the Board of Directors has no reason to believe that Mr. Garton will be unable to serve. Certain background information about Mr. Garton is set forth below:

Daniel P. Garton has served as a director of Orbitz since October 2002. Mr. Garton has served as Executive Vice President—Marketing of AMR Corporation and American Airlines since September 2002. Mr. Garton was Executive Vice President—Customer Services of American Airlines from January 2000 to September 2002, Senior Vice President—Customer Services from September 1998 to January 2000 and President of American Eagle Airlines from July 1995 to September 1998. Mr. Garton has served as a trustee of Liberty Property Trust, a Maryland real estate investment trust, since December 2001.

All outstanding shares of our Series B-AA common stock are beneficially owned by American Airlines. American Airlines has advised us that it intends to vote for Mr. Garton, which would result in the election of Mr. Garton as a Class B Director.

Election of Class B Director by Holder of Series B-CO Common Stock

The holder of our Series B-CO common stock, voting separately as a series, has the exclusive right to elect one Class B Director. The holder of our Series B-CO common stock has nominated Jeffery A. Smisek for election as a Class B Director, to serve for a one-year term expiring at the Annual Meeting to be held in 2005. Mr. Smisek has consented to be named in this Proxy Statement and agreed to serve if elected, and our Board of Directors has no reason to believe that Mr. Smisek will be unable to serve. Certain background information about Mr. Smisek is set forth below:

Jeffery A. Smisek has served as a director of Orbitz since January 2003. Mr. Smisek has served as Executive Vice President of Continental Airlines since March 2003. From May 2001 to March 2003, Mr. Smisek served as Executive Vice President—Corporate and Secretary and from November 1996 to May 2001, Mr. Smisek served as Executive Vice President, General Counsel and Secretary of Continental Airlines. Mr. Smisek is also a director of Varco International, Inc.

All outstanding shares of our Series B-CO common stock are beneficially owned by Continental Airlines. Continental Airlines has advised us that it intends to vote for Mr. Smisek, which would result in the election of Mr. Smisek as a Class B Director.

Election of Class B Director by Holder of Series B-DL Common Stock

The holder of our Series B-DL common stock, voting separately as a series, has the exclusive right to elect one Class B Director. The holder of our Series B-DL common stock has nominated Vincent F.

4

Caminiti for election as a Class B Director, to serve for a one-year term expiring at the Annual Meeting to be held in 2005. Mr. Caminiti has consented to be named in this Proxy Statement and agreed to serve if elected, and our Board of Directors has no reason to believe that Mr. Caminiti will be unable to serve. Certain background information about Mr. Caminiti is set forth below:

Vincent F. Caminiti has served as a director of Orbitz since May 2000. Mr. Caminiti has served as Senior Vice President—Profitability Initiatives of Delta Air Lines since January 2003. Mr. Caminiti was Senior Vice President—e-Business of Delta Air Lines from September 2000 to January 2003, Senior Vice President—Sales & Distribution from November 1998 to September 2000 and Senior Vice President—Sales and International from November 1996 to November 1998.

All outstanding shares of our Series B-DL common stock are beneficially owned by Omicron Reservations Management, an affiliate of Delta Air Lines. Omicron Reservations Management has advised us that it intends to vote for Mr. Caminiti, which would result in the election of Mr. Caminiti as a Class B Director.

Election of Class B Director by Holder of Series B-NW Common Stock

The holder of our Series B-NW common stock, voting separately as a series, has the exclusive right to elect one Class B Director. The holder of our Series B-NW common stock has nominated J. Timothy Griffin for election as a Class B Director, to serve for a one-year term expiring at the Annual Meeting to be held in 2005. Mr. Griffin has consented to be named in this Proxy Statement and agreed to serve if elected, and our Board of Directors has no reason to believe that Mr. Griffin will be unable to serve. Certain background information about Mr. Griffin is set forth below:

J. Timothy Griffin has served as a director of Orbitz since September 2000. Mr. Griffin has served as Executive Vice President, Marketing and Distribution of Northwest Airlines since January 1999 and was Senior Vice President, Market Planning and Systems from June 1993 to January 1999. Mr. Griffin is also a director of Pinnacle Airlines Corp.

All outstanding shares of our Series B-NW common stock are beneficially owned by Northwest Airlines. Northwest Airlines has advised us that it intends to vote for Mr. Griffin, which would result in the election of Mr. Griffin as a Class B Director.

Election of Class B Director by Holder of Series B-UA Common Stock

The holder of our Series B-UA common stock, voting separately as a series, has the exclusive right to elect one Class B Director. The holder of our Series B-UA common stock has nominated Douglas A. Hacker for election as a Class B Director, to serve for a one-year term expiring at the Annual Meeting to be held in 2005. Mr. Hacker has consented to be named in this Proxy Statement and agreed to serve if elected, and our Board of Directors has no reason to believe that Mr. Hacker will be unable to serve. Certain background information about Mr. Hacker is set forth below:

Douglas A. Hacker has served as a director of Orbitz since May 2000. Mr. Hacker has served as Executive Vice President—Strategy of UAL Corporation and United Air Lines since December 2002. From September 2001 until December 2002, Mr. Hacker served as Executive Vice President of United Air Lines and President of UAL Loyalty Services, Inc. From July 1999 to September 2001, Mr. Hacker served as Executive Vice President and Chief Financial Officer of UAL Corporation and as Executive Vice President—Finance and Planning and Chief Financial Officer of United Air Lines. From February 1996 to September 2001, Mr. Hacker served as Senior Vice President and Chief Financial Officer. On December 9, 2002, UAL Corporation and certain of its domestic subsidiaries, including United Air Lines and UAL Loyalty Services, Inc., filed for protection under Chapter 11 of the U.S. Bankruptcy Code. Mr. Hacker is also a director of 39 registered investment funds advised by Columbia Management Group.

5

All outstanding shares of our Series B-UA common stock are beneficially owned by United Air Lines. United Air Lines has advised us that it intends to vote for Mr. Hacker, which would result in the election of Mr. Hacker as a Class B Director.

PROPOSAL 3—Election of Management Director

(To Be Voted On By Holders of Class B Common Stock Only)

The following information concerns the nominee for election as the Management Director. Only the holders of our Class B common stock are entitled to vote to elect the Management Director. Holders of our Class A common stock do not have a vote, and we are not soliciting proxies from the holders of our Class A common stock, with respect to the election of the Management Director.

The Orbitz, Inc. Amended and Restated Certificate of Incorporation provides that holders of our Class B common stock will vote together as a single class to elect one director, who we refer to as the "Management Director". Pursuant to our Amended and Restated Bylaws, the nominee for Management Director shall be our chief executive officer. Pursuant to our Amended and Restated Stockholders Agreement, the Founding Airlines or their affiliates have agreed to vote all shares of our Class B common stock owned by them to elect our chief executive officer as the Management Director position. See "Certain Relationships and Related Party Transactions—Stockholders Agreement". Our chief executive officer, Jeffrey G. Katz, has been nominated for election as the Management Director, to serve for a one-year term expiring at the Annual Meeting to be held in 2005. Mr. Katz has consented to be named in this Proxy Statement and agreed to serve if elected, and our Board of Directors has no reason to believe that Mr. Katz will be unable to serve. Certain background information about Mr. Katz is set forth below.

Jeffrey G. Katz has served as our Chairman, President and Chief Executive Officer since July 2000. Prior to joining Orbitz, Mr. Katz was President and Chief Executive Officer of Swissair Group's Swissair, an international airline, from April 1997 until July 2000. Previously, Mr. Katz spent 17 years at American Airlines, an international airline, in a variety of executive roles including President of the Global Distribution System Division of Sabre. Mr. Katz received a B.S. in Mechanical Engineering from the University of California—Davis in 1976, an M.S. in Mechanical Engineering from Stanford University in 1978 and an M.S. from the Massachusetts Institute of Technology in 1980.

All outstanding shares of our Class B common stock are beneficially owned by the Founding Airlines or their affiliates. The Founding Airlines or their affiliates have agreed to vote for Mr. Katz, which would result in the election of Mr. Katz as the Management Director.

CLASS A DIRECTORS NOT STANDING FOR ELECTION

Marc L. Andreessen has served as a director of Orbitz since January 2004. Since September 1999, Mr. Andreessen has served as the Chairman of the Board of Opsware Inc., a Nasdaq company and leading provider of data center automation. Mr. Andreessen co-founded Opsware Inc. in September 1999. In 1994, Mr. Andreessen co-founded Netscape, the first Web browser company, and served as its Chief Technology Officer and Executive Vice President of Products. After America Online acquired Netscape in 1999, Mr. Andreessen became the Chief Technology Officer of America Online, responsible for guiding its overall technological direction. While attending the University of Illinois, Mr. Andreessen created the first Internet browser with a team of students and staff at the University's National Center for Supercomputing Applications (NCSA). Mr. Andreessen also serves as a director of Blue Coat Systems, a Nasdaq company that is a provider of secure proxy appliances that control user communications and content over the Internet.

6

Scott D. Miller has served as a director of Orbitz since December 2003. Since October 2003, Mr. Miller has been a private investor. Mr. Miller served as Non-Executive Vice Chairman of Hyatt Hotels Corporation from May 2003 through September 2003; President from December 1999 to April 2003; and Executive Vice President from August 1997 to December 1999. Mr. Miller is also a director of Schindler Holding Ltd. and of AXA Financial, Inc., a subsidiary of AXA Group.

IMPORTANT INFORMATION REGARDING THE BOARD OF DIRECTORS AND COMMITTEES

The Board of Directors held 14 meetings and acted by written consent six times during 2003. All directors attended at least 75% of the meetings of the Board of Directors and the committees of which they were members during 2003. We encourage the directors to attend the Annual Meetings of Shareholders. The 2004 Annual Meeting is our first Annual Meeting as a publicly-held company.

Controlled Company Exemption

Our Founding Airlines, or their affiliates, have filed a Schedule 13G with the Securities and Exchange Commission to report their Orbitz holdings as a group that controls more than 50% of our voting power. Please see "Security Ownership" below. As a result, we qualify as a "controlled company" as defined in Rule 4350(c)(5) of the Nasdaq Marketplace Rules. Therefore, we are exempt from the requirements of Rule 4350(c) of the Nasdaq Marketplace Rules with respect to our Board of Directors being comprised of a majority of "independent directors" and the related rules covering the independence of directors serving on the Compensation Committee and the Class A Nominating Committee of the Board of Directors. The controlled company exemption does not modify the independence requirements for the Audit Committee.

Of the nine directors currently serving on the Board of Directors, the Board of Directors has determined that Ms. Fletcher and Messrs. Andreessen and Miller are "independent directors" as defined in the Nasdaq Marketplace Rules and also meet the additional independence standards for Audit Committee members. During 2004, the Company intends to have two or more regularly scheduled executive session meetings attended solely by these independent directors.

Committees

The Board of Directors has an Audit Committee, a Compensation Committee and a Class A Nominating Committee. Our Amended and Restated Bylaws mandate that at least one Class A Director is entitled to serve on the Audit Committee, the Compensation Committee and the Class A Nominating Committee, except where a different composition is required under the Sarbanes-Oxley Act or the Nasdaq Marketplace Rules. In addition, our Amended and Restated Bylaws provide that the directors elected by each series of Class B common stock, other than the chief executive officer, are entitled to serve on each committee of the Board of Directors, except where a different composition is required under the Sarbanes-Oxley Act or the Nasdaq Marketplace Rules.

Audit Committee. The Audit Committee of the Board of Directors recommends the appointment of our independent auditors, reviews our internal accounting procedures and financial statements and consults with and reviews the services provided by our independent auditors, including the results and scope of the audit. The Audit Committee, which has been established in accordance with Securities and Exchange Commission rules, is currently comprised of Ms. Fletcher and Messrs. Andreessen and Miller. Ms. Fletcher was appointed as a member of the Audit Committee effective March 29, 2004, replacing Mr. Garton. The Board of Directors has determined that Ms. Fletcher is the "audit committee financial expert" as defined in the rules of the Securities and Exchange Commission. As discussed above, the Board of Directors has determined that all of the current members of the Audit Committee (including the audit committee financial expert) are "independent" for purposes of the

7

Nasdaq Marketplace Rules. The Audit Committee met four times during 2003. A copy of the current charter of the Audit Committee is attached to this Proxy Statement as Appendix A.

Compensation Committee. The Compensation Committee of the Board of Directors reviews and recommends to the Board the compensation and benefits of all of our executive officers, administers our stock plans and establishes and reviews general policies relating to compensation and benefits of our employees. The Compensation Committee is comprised of Messrs. Caminiti, Garton, Griffin, Hacker, Miller and Smisek. The Compensation Committee met seven times during 2003.

Class A Nominating Committee. The Nasdaq Marketplace Rules do not require us, as a controlled company, to have a standing nominating committee composed of independent directors. Nominations of our Class A Directors are made by our Class A Nominating Committee. The Class A Nominating Committee does not consider nominations for our Class B Directors because candidates for these director positions are identified, nominated and elected by our Founding Airlines. The Class A Nominating Committee also does not consider nominations for Management Director because our Amended and Restated Bylaws require this to be our chief executive officer. The Class A Nominating Committee will identify and select nominees for Class A Director positions to be recommended by our Board of Directors for election as Class A Directors. The Class A Nominating Committee does not have a charter, but utilizes the criteria described below under "Class A Director Nomination Process." The Class A Nominating Committee consists of Messrs. Andreessen, Caminiti, Garton, Griffin, Hacker and Smisek. The Class A Nominating Committee acted by written consent once during 2003.

Class A Director Nomination Process

When seeking candidates for Class A Director positions, the Class A Nominating Committee may solicit suggestions from incumbent directors, management or others. In connection with the implementation of independence requirements under the Nasdaq Marketplace Rules, the Company engaged Heidrick & Struggles, a search firm, to help identify and facilitate the screening and interview process of potential nominees for Class A Director positions. The Class A Nominating Committee will consider nominees for Class A Director positions recommended by our shareholders in accordance with the procedures described under "Shareholder Proposals and Director Nominations for 2005 Annual Meeting." Shareholder nominees that comply with these procedures will be given the same consideration as nominees for directors from other sources.

Our Amended and Restated Bylaws provide that nominees for Class A Director positions may not be an employee, officer or director of a Founding Airline or its affiliates so long as such airline owns any shares of Class B common stock. The Class A Nominating Committee may consider the following additional criteria, among others it deems appropriate, in recommending candidates for election to the Board of Directors:

- •

- personal and professional integrity, ethics and values;

- •

- experience in corporate management, such as service as an officer of a publicly held company, and a general understanding of marketing, finance and other elements relevant to the success of a publicly-traded company in today's business environment;

- •

- experience in the travel industry;

- •

- experience as a board member of another publicly held company; and

- •

- practical and mature business judgment, including ability to make independent analytical inquiries.

Qualified candidates for membership on the Board of Directors will be considered without regard to race, color, religion, gender, ancestry, national origin or disability. After conducting an initial evaluation of a candidate, the Class A Nominating Committee will interview that candidate if it

8

believes the candidate might be suitable to be a Class A Director. The committee may also ask the candidate to meet with management. If the committee believes a candidate would be a valuable addition to the Board of Directors, it will select that candidate for a Class A Director position to be recommended by the Board of Directors for election as a Class A Director.

Stockholder Communications with the Board of Directors

You may contact the Board or any of the individual directors by writing to them c/o Richard Buchband, Vice President, Senior Corporate Counsel and Secretary, Orbitz, Inc., 200 S. Wacker Drive, Suite 1900, Chicago, Illinois 60606. Inquiries sent by mail will be reviewed, sorted and summarized by Mr. Buchband or his designee before they are forwarded to the Board or individual directors.

Compensation Committee Interlocks and Insider Participation

Our Compensation Committee consists of Mr. Smisek, as Chair, and Messrs. Caminiti, Garton, Griffin, Hacker and Miller. Messrs. Smisek, Caminiti, Garton, Griffin and Hacker are officers of the Founding Airlines. See "Certain Relationships and Related Party Transactions." None of the members of the Compensation Committee has at any time been one of our officers or employees. None of our executive officers currently serves, or in the past year has served, as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving on our Board of Directors or Compensation Committee.

Director Compensation

The Management Director receives no additional compensation from us for his service as a director. Each other director receives an annual retainer of $20,000, with an additional stipend of $1,500 for each Board of Directors or committee meeting attended. In addition to the foregoing, the Chairman of our Audit Committee receives an annual retainer of $50,000, and other members of the Audit Committee an annual retainer of $10,000, for their service on the Audit Committee. We also reimburse our directors for their reasonable expenses incurred in attending meetings of our Board of Directors.

Certain of our non-employee directors receive option grants automatically under our 2002 Stock Plan. See "Compensation of Executive Officers—Stock Plans—Amended and Restated Orbitz, Inc. 2002 Stock Plan." At the time the registration statement for our initial public offering became effective, each of Messrs. Garton, Griffin, Hacker and Miller received an option to purchase 4,410 shares of Class A common stock. Messrs. Caminiti and Smisek, in lieu of receiving such option grants personally, directed us to pay the fair market value of such option grants to their respective employers. The options granted in connection with our initial public offering have a per share exercise price equal to $26.00 per share, which was the per share price in our initial public offering. Mr. Andreessen, upon his initial election to our Board of Directors, automatically received an option grant for 4,769 shares. The options granted to Mr. Andreessen have a per share exercise price equal to $24.05 per share, which was the fair market value of our Class A common stock on the date of the option grant. Ms. Fletcher, upon her initial election to our Board of Directors, automatically received an option grant for 5,212 shares. The options granted to Ms. Fletcher have a per share exercise price equal to $23.25 per share, which was the fair market value of our Class A common stock on the date of the option grant. In addition, at each Annual Meeting of Shareholders, each of our non-employee directors that has not waived the right to receive option grants automatically will receive an option for that number of shares, rounded up to the next whole share, which results in the option having a Black-Scholes valuation of $70,000. The options granted automatically to our non-employee directors will have a per share exercise price equal to the then-fair market value of our Class A common stock. All of the automatically granted options (including the options granted in connection with or since the date of our initial public offering) will become vested in 50% installments on the date of their grant and on the first anniversary

9

of the date of their grant, assuming continued service as a director. Options granted to our non-employee directors are exercisable until the earlier of 10 years from the date of grant or 12 months after a director terminates membership on our Board of Directors.

EXECUTIVE OFFICERS

Our executive officers are set forth in the table below:

Name

| | Age

| | Position

|

|---|

| Jeffrey G. Katz | | 48 | | Chairman of the Board of Directors, President and Chief Executive Officer |

| John J. Park | | 42 | | Chief Financial Officer |

| Christopher T. Hjelm | | 42 | | Chief Technology Officer |

| John R. Samuel | | 40 | | Executive Vice President, Consumer Travel |

Information with respect to Mr. Katz is set forth in "Election of Management Director" above.

John J. Park has served as our Chief Financial Officer since October 2000. Prior to joining Orbitz, Mr. Park served as Vice President, Services Finance from January 2000 to September 2000 and Vice President, Credit Finance from October 1998 to January 2000 for Sears Roebuck and Company, a retail and financial services firm. Previously, Mr. Park served as Assistant Treasurer, Capital Markets and Corporate Finance from August 1997 to October 1998 and Food Sector Controller from June 1996 to July 1997 for Diageo PLC, a global premium food and beverage company. Mr. Park joined Diageo in 1992 and served in various financial management roles before that with Pepsico Inc., a food and beverage company, and General Motors, an automotive corporation. Mr. Park received a B.A. in Economics and Political Science from Oberlin College in 1983 and an M.B.A. from the University of Michigan in 1985.

Christopher T. Hjelm has served as our Chief Technology Officer since July 2003. Prior to joining Orbitz, Mr. Hjelm served as Senior Vice President, Technology of eBay Inc., a worldwide online marketplace for the sale of goods and services by individuals and businesses, from March 2002 to June 2003, and as Executive Vice President, Broadband Network Services of Excite@Home, an Internet service provider, from June 2001 to February 2002. Mr. Hjelm served as Chairman, President and Chief Executive Officer of Zoho Corp., an online marketplace for the hospitality industry, from January 2000 to June 2001. Mr. Hjelm also spent 14 years at FedEx Corporation, a global provider of transportation, e-commerce and supply chain management services, in a variety of roles, including Chief Information Officer of the Information Technology Division. Mr. Hjelm received a B.S. in Computer Information Systems from Colorado State University in 1983.

John R. Samuel has served as our Executive Vice President, Consumer Travel since August 2003. Prior to joining Orbitz, Mr. Samuel spent 16 years at American Airlines, an international airline, in a variety of roles, including Vice President, Customer Technology, and Vice President, Interactive Marketing, where he led the team which launched AA.com. Mr. Samuel received a B.B.A. from Abilene Christian University in 1985 and an M.B.A. from the University of Chicago in 1987.

10

OTHER KEY EMPLOYEES

Information about our other key employees is set forth in the table below:

Name

| | Age

| | Position

|

|---|

| Gary R. Doernhoefer | | 46 | | Vice President, General Counsel |

| Eliah M. Kahn | | 42 | | Vice President, Customer Experience |

| Mary A. Oleksiuk | | 42 | | Vice President, Human Resources |

| Michael D. Sands | | 37 | | Chief Marketing Officer |

| Rick F. Weber | | 44 | | Vice President, Business Travel Services |

Gary R. Doernhoefer has served as our Vice President and General Counsel since September 2000. Prior to joining Orbitz, Mr. Doernhoefer served as American Airlines' Senior Counsel for Government Affairs from July 1998 through August 2000. During his nine-year tenure at American Airlines, he also served in Attorney and Senior Attorney positions from January 1992 until June 1998, representing American Airlines on a number of complex antitrust cases. Previously, Mr. Doernhoefer served as a general law practice litigator for Mayer, Brown and Platt, and Davis, Graham and Stubbs. Mr. Doernhoefer received a B.A. in Political Science and Russian from Grinnell College in 1979 and a J.D. from the University of Chicago in 1984.

Eliah M. Kahn has served as our Vice President, Customer Experience since January 2002. Prior to joining Orbitz, Mr. Kahn served as a partner for the CRM practice of Accenture, a management and technology services organization, from June 1998 until January 2002. Previously, Mr. Kahn was Chief Operating Officer for Market USA Inc. from March 1997 until June 1998 and held senior customer service management positions at Prudential Insurance, an insurance company, Marsh & McLennan Companies, a global professional services firm, Cigna Insurance, a financial services firm, and General Electric, a diversified industrial corporation. Mr. Kahn received a B.S. in Business Administration from Indiana University in 1983 and an M.B.A. from the University of Louisville in 1987.

Mary A. Oleksiuk has served as our Vice President, Human Resources since March 2004. Prior to joining Orbitz, Ms. Oleksiuk served as Senior Vice President, Human Resources, Communication & Learning for Solucient, a healthcare information provider, from January 2002 until March 2004. Previously, Ms. Oleksiuk spent 17 years at AlliedSignal, a diversified technology and manufacturing company, and its successor by merger, Honeywell, in a variety of human resources and technical positions, most recently as Human Resources Director, Technology and Engineering, from January 1998 until January 2002. Ms Oleksiuk received a M.S. in Biology (Genetics) from the University of Illinois in 1985 and a B.S in Computer Science and in Biology from Wayne State University in 1983.

Michael D. Sands has served as our Chief Marketing Officer since December 2001. Mr. Sands joined Orbitz in September 2000 as Vice President, Marketing. Prior to joining Orbitz, Mr. Sands served as Vice President, Customer Acquisition Marketing at Giant Step, an e-solutions subsidiary of the Bcom3 Group, from May 2000 until September 2000. Previously, Mr. Sands was Director of Advertising and Sales Promotion for the Oldsmobile Division at General Motors Corporation, an automotive manufacturer, from January 1999 until April 2000 and was Director of Advertising from January 1997 until January 1999, where he managed a $250 million advertising and promotions budget. Mr. Sands also held marketing and advertising positions at Ameritech, a telecommunications firm, and Leo Burnett Co., an advertising agency, where he led the United Air Lines national advertising account. Mr. Sands received a B.S. in Communications from Northwestern University in 1989 and an M.M. from the Kellogg School at Northwestern University in 1995.

Rick F. Weber has served as our Vice President, Business Travel Services since April 2002. Prior to joining Orbitz, Mr. Weber was a private consultant for a global travel distribution company from December 2001 until February 2002. Previously, Mr. Weber was Vice President, Electronic Commerce and Marketing IT for Swissair and Swissair Group, an international airline, from May 1998 through

11

November 2001. Prior to that, Mr. Weber was Managing Director of Corporate Products for American Airlines, an international airline, from September 1996 until April 1998 and served in a variety of sales and international management positions over a ten-year career at American Airlines. Earlier in his career, he was Director of Marketing for DER Tours, a major German tour operator. He received a B.S. in Business Administration from the University of Virginia in 1980.

COMPENSATION OF EXECUTIVE OFFICERS

Summary Compensation Table

The total compensation paid to our Chief Executive Officer and our other executive officers for services rendered to the Company in 2003, 2002 and 2001 is summarized as follows:

| |

| |

| |

| |

| | Long-Term Compensation

| |

|

|---|

| |

| | Annual Compensation

| |

| | Shares

Underlying

Options

Granted

| |

| |

|

|---|

Name and Principal Position

| |

| | Restricted

Stock

Awards

| | Long-Term

Incentive

Payouts

| |

|

|---|

| | Year

| | Salary

| | Bonus

| | Other(5)

| | All Other

|

|---|

Jeffrey G. Katz

Chairman of the Board, President

and Chief Executive Officer | | 2003

2002

2001 | | $

$

$ | 500,000

500,000

500,000 | | $

$

$ | 640,000

500,000

500,000 | (1)

| $

$

$ | 129,789

22,229

19,301 | (6)

(7)

(7) | 66,667

—

83,333 | | —

—

1,216,666 | | $

$

$ | —

—

— | | $

$

$ | —

—

— |

John J. Park

Chief Financial officer |

|

2003

2002

2001 |

|

$

$

$ |

337,147

300,000

300,000 |

|

$

$

$ |

193,875

150,000

150,000 |

(2)

|

$

$

$ |

—

—

— |

|

16,667

—

14,368 |

|

50,000

—

241,666 |

|

$

$

$ |

—

—

— |

|

$

$

$ |

—

—

— |

Christopher T. Hjelm

Chief Technology Officer |

|

2003

2002

2001 |

|

$

$

$ |

175,000

—

— |

|

$

$

$ |

50,000

—

— |

(3)

|

$

$

$ |

—

—

— |

|

33,333

—

— |

|

166,666

—

— |

|

$

$

$ |

—

—

— |

|

$

$

$ |

—

—

— |

John R. Samuel,

Executive Vice President, Consumer Travel |

|

2003

2002

2001 |

|

$

$

$ |

112,500

—

— |

|

$

$

$ |

25,000

—

— |

(4)

|

$

$

$ |

41,523

—

— |

(8)

|

33,333

—

— |

|

100,000

—

— |

|

$

$

$ |

—

—

— |

|

$

$

$ |

—

—

— |

- (1)

- Includes $565,000 bonus earned in 2002 but paid in 2003 and $75,000 bonus earned and paid in 2003.

- (2)

- Includes $169,500 bonus earned in 2002 but paid in 2003 and $24,375 bonus earned and paid in 2003.

- (3)

- Represents signing bonus paid in 2003.

- (4)

- Represents signing bonus paid in 2003.

- (5)

- Unless otherwise shown, the aggregate amount of perquisites and other personal benefits securities or property received by the named executive officers was less than either $50,000 or 10.0% of the total annual salary and bonus reported for such named executive officer, whichever is less.

- (6)

- Includes $32,160 for rent reimbursement, $59,436 for legal, accounting and investment professional advice and $38,223 reimbursed for the payment of taxes on perquisites and other personal benefits.

- (7)

- Represents amounts reimbursed for the payment of taxes on perquisites and other personal benefits.

- (8)

- Includes $29,294 in relocation expense reimbursement and $12,228 reimbursed for the payment of taxes on perquisites and other personal benefits

12

Option Grants in 2003

The following table sets forth certain information with respect to options granted in 2003 to our Chief Executive Officer and our other executive officers.

| | Individual Grants

| |

| |

|

|---|

| | Potential Realizable

Value At Assumed

Rates of Stock Price

Appreciation for Option

|

|---|

| | Number of

Shares

Underlying

Options

Granted

| | % of Total

Options

Granted

To Employees

In 2003

| |

| |

|

|---|

Name

| | Exercise

Price

| | Expiration

Date

|

|---|

| | 5%

| | 10%

|

|---|

| Jeffrey G. Katz | | — | | — | | | — | | — | | $ | — | | | — |

| John J. Park | | 50,000 | | 6.10 | % | $ | 13.02 | | 4/3/2013 | | $ | 433,844 | | $ | 1,076,432 |

| Christopher T. Hjelm | | 166,666 | | 20.33 | % | $ | 13.02 | | 7/9/2013 | | $ | 2,846,984 | | $ | 5,818,704 |

| John R. Samuel | | 100,000 | | 12.20 | % | $ | 13.98 | | 8/29/2013 | | $ | 1,753,911 | | $ | 3,620,892 |

Option Exercises in 2003 and Year-End Values

The following table sets forth certain information with respect to options exercised by our Chief Executive Officer and our other executive officers in 2003, as well as unexercised options held by them as of December 31, 2003.

| |

| |

| | Number of Shares

Underlying Unexercised

Options at

Fiscal Year End

| |

| |

|

|---|

| |

| |

| | Value of Unexercised,

In-the-Money Options

at Fiscal Year End(1)

|

|---|

| | Number of

Shares

Acquired on

Exercise

| |

|

|---|

Name

| | Value

Realized

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Jeffrey G. Katz | | — | | — | | 1,253,123 | | 380,209 | | $ | 20,513,624 | | $ | 6,224,021 |

| John J. Park | | — | | — | | 332,811 | | 125,521 | | $ | 5,448,116 | | $ | 1,751,779 |

| Christopher T. Hjelm | | — | | — | | — | | 166,666 | | $ | — | | $ | 1,718,326 |

| John R. Samuel | | — | | — | | — | | 100,000 | | $ | — | | $ | 935,000 |

- (1)

- Calculated using closing stock price on December 31, 2003 of $23.33.

Equity Compensation Plan Information

The following table sets forth certain information as of December 31, 2003 with respect to the shares of Class A common stock issuable under our equity compensation plans.

Plan Category

| | Number of securities to be

issued upon exercise

of outstanding options,

warrants and rights

| | Weighted-average

exercise price of

outstanding options,

warrants and rights

| | Number of securities

remaining for future

issuance under equity

compensation plans

(excluding securities

reflected in column (a))

|

|---|

| | (a)

| | (b)

| | (c)

|

|---|

| Equity compensation plans approved by security holders | | 5,938,055 | | $ | 8.14 | | 2,624,410 |

Equity compensation plans not approved by security holders |

|

— |

|

|

— |

|

— |

Total |

|

5,938,055 |

|

$ |

8.14 |

|

2,624,410 |

Executive Employment Agreements

We entered into an employment agreement with Mr. Katz dated as of July 6, 2000 that was amended and restated as of July 6, 2003. The agreement, which has a term of four years, provides for

13

Mr. Katz to receive a base salary of $500,000, subject to increase at the discretion of the Board, and to be eligible to receive a target annual performance bonus up to 200% of base salary upon attainment of performance goals determined by the Board. The agreement provides for a restricted stock grant of 66,667 shares on July 6, 2003. One-fourth of the shares of restricted stock will vest each year on each anniversary of the grant date. The agreement provided that if our market valuation (as defined in the agreement) was at least $1.25 billion at the time of the initial public offering, the vesting of one-fourth of the restricted stock would accelerate in the event the offering was completed before the first anniversary of the stock grant, and the vesting of the remaining installments of the restricted stock would also accelerate under specified conditions. In addition, under these circumstances, Mr. Katz would be eligible to receive a bonus stock grant of 33,333 shares if our stock price exceeded $52.00, two times the price of our Class A common stock in the initial public offering. Since the market valuation of our stock was less than $1.25 billion at the time of our initial public offering, Mr. Katz did not qualify for the accelerated vesting or stock grants described in the foregoing sentences. If Mr. Katz is discharged from Orbitz for reasons other than for cause, death or disability, or if he resigns because of a constructive termination, then, if Mr. Katz signs a release of claims against Orbitz, we will pay Mr. Katz severance equal to two times the sum of Mr. Katz's base salary plus the target bonus, which ranges from 100% to 200% of his base compensation. This severance amount will be paid over 24 months. In the event Mr. Katz is entitled to severance benefits, he will vest in and be entitled to exercise all options previously granted and outstanding as to the same number of shares as would have become vested and exercisable had he remained with Orbitz for an additional six months, and the grant of 66,667 restricted shares made to Mr. Katz on July 6, 2003 will fully vest. Mr. Katz will also be entitled to continue health care benefits until the end of his severance period, or, if earlier, the date he is no longer eligible to continue his health coverage as required by law. If, upon a change of control as defined in the agreement, Mr. Katz is not offered the position of Chairman and Chief Executive Officer of the combined corporation resulting from such change of control, then his stock grant and all of his options will vest and be exercisable as of the date of such change of control. Under the agreement, during his employment and for 12 months thereafter or for the duration of his severance period, as the case may be, Mr. Katz has agreed not to compete with us, solicit or hire any of our, our resellers' or our distributors' employees or solicit any business from any of our customers, users, resellers or distributors on behalf of any of our competitors. If Mr. Katz violates his agreement not to compete, his severance payments and all other related payments from Orbitz will cease.

At Mr. Katz's option, if on any of the following triggering dates: (i) the first four anniversaries of July 6, 2003, (ii) 30 days after the completion of our initial public offering or (iii) Mr. Katz's resignation or termination by us for any reason, the average closing price of our stock for the immediately preceding 20-day period is less than $30.00 per share, Mr. Katz may require us to make a one-time cash payment to him in an amount equal to $30.00 minus such average closing price, multiplied by 83,333. This may result in a payment of up to $2,500,000, depending on the 20-day average closing price of our stock preceding the relevant triggering date. Mr. Katz declined to exercise this right with respect to the triggering date that occurred 30 days after the completion of our initial public offering.

On October 2, 2000, July 1, 2003 and August 18, 2003, we entered into employment agreements with John J. Park, Christopher T. Hjelm and John R. Samuel, respectively, as our Chief Financial Officer, Chief Technology Officer and Executive Vice President, Consumer Travel. Under their agreements, Mr. Park and Mr. Hjelm each receive an annual salary of $350,000, subject to modification, and Mr. Samuel receives an annual salary of $300,000, subject to modification. In all other respects, the agreements are substantially similar. The agreements provide an opportunity for an annual performance-based target bonus of 50% of annual salary. The agreements may be terminated by us or the affected executive at any time, with or without cause. If any of Mr. Park, Mr. Hjelm or Mr. Samuel is terminated by us without cause or resigns as a result of constructive termination, as defined in the agreements, and if he signs a release of claims against Orbitz, we will continue to pay his

14

base salary and honor obligations under certain benefit plans as provided in the agreements for a period of six months. We will also pay a prorated amount of the targeted maximum annual bonus and credit him with six months of additional service for purposes of vesting in unvested options and restrictions on restricted shares held by him as of the date of termination or resignation. If any of Mr. Park, Mr. Hjelm or Mr. Samuel is terminated in connection with a change in control as defined in the agreements, if he signs a release of claims against Orbitz, we will continue to pay his base salary for a period of 12 months, pay him an amount equal to the targeted maximum annual bonus, and an amount equal to the pro-rated targeted maximum annual bonus less any portion already paid to him, honor obligations under certain benefits plans as provided in the agreement, and accelerate the vesting of and release of restrictions on 100% of his options and restricted shares. Under the agreements, during their employment and for 12 months thereafter, Mr. Park, Mr. Hjelm and Mr. Samuel have each agreed not to compete with us, solicit or hire any of our, our affiliates' or our independent contractors' employees or interfere with our relationships with our suppliers, customers or clients.

Stock Plans

Orbitz, Inc. 2000 Stock Plan

Our Board of Directors adopted the 2000 Stock Plan, or the 2000 Plan, and our shareholders approved the 2000 Plan on June 1, 2000. The 2000 Plan was amended as of June 19, 2001. The 2000 Plan allows us to issue awards of stock options, restricted stock, stock appreciation rights and stock purchase rights. Our employees, directors and consultants are eligible to receive awards under the 2000 Plan. As of March 15, 2004, a total of 3,751,874 shares were either granted as restricted stock or stock purchase rights or were subject to options under the 2000 Plan. On April 10, 2002, the 2000 Plan was frozen and no further awards will be made under that plan. The 2000 Plan is administered by the Compensation Committee of our Board of Directors. Restricted stock is generally subject to a repurchase option in favor of Orbitz, exercisable upon the voluntary or involuntary termination of the employee, director or consultant's service with us for any reason, including death or disability.

Options and rights granted under the 2000 Plan are generally not transferable by the participant, and each option, stock appreciation right or stock purchase right is exercisable, during the lifetime of the participant, only by such participant. Options granted under the 2000 Plan must generally be exercised within three months of the optionee's termination of employment, or within 12 months after such optionee's termination by death or disability, but in no event later than the expiration of the option term.

In the event of certain corporate transactions, such as a merger or sale of substantially all of our assets, the 2000 Plan provides that each outstanding option or stock purchase right will be assumed or an equivalent option or right will be substituted for it by the successor corporation or its parent or subsidiary. If the successor corporation does not assume or substitute for the options or rights, the administrator shall provide for the participant to have the right to exercise the option or right, including shares that would not otherwise be vested or exercisable. If the administrator makes an option or right exercisable in full in the event of a merger or sale of assets, the administrator shall notify the participant in writing or electronically that the option shall be fully exercisable for a period of 15 days from such notice, and the option will terminate upon the expiration of such period.

Amended and Restated Orbitz, Inc. 2002 Stock Plan

The Amended and Restated 2002 Stock Plan, or the 2002 Plan, was adopted by our Board of Directors and approved by our shareholders on April 10, 2002. The 2002 Plan was subsequently amended and restated by our Board of Directors on May 15, 2002 and further amended on November 25, 2003. The 2002 Plan provides for the grant of stock options, stock purchase rights, stock appreciation rights and restricted stock awards to our employees, directors and consultants. A total of

15

5,328,839 shares of common stock have been reserved for issuance under the 2002 Plan, plus any shares of restricted stock forfeited or expired unexercised options under the 2000 Plan. As of March 15, 2004, a total of 3,408,381 shares have been granted as restricted stock or stock purchase rights or were subject to options under the 2002 Plan.

The Compensation Committee as the administrator of the 2002 Plan has the power to determine the terms and conditions of the options and rights granted, including the exercise price, the number of shares to be covered by each award, the exercisability thereof and any restrictions regarding the award. Restricted stock is generally subject to a repurchase option in favor of Orbitz, exercisable upon the voluntary or involuntary termination of the employee, director or consultant's service with us for any reason, including death or disability.

Options and rights granted under the 2002 Plan are generally not transferable by the participant, and each option, stock appreciation right or stock purchase right is exercisable, during the lifetime of the participant, only by such participant. Options granted under the 2002 Plan must generally be exercised within three months of the optionee's termination, or within 12 months after such optionee's termination by death or disability, but in no event later than the expiration of the option term.

Members of our Board of Directors who are not employees are entitled to receive certain option grants automatically under the 2002 Plan. See "Important Information Regarding the Board of Directors and Committees—Director Compensation" for additional information on these option grants.

In the event of certain corporate transactions, such as a merger or sale of substantially all of our assets, the 2002 Plan provides that each outstanding option or stock purchase right will be assumed or an equivalent option or right will be substituted for it by the successor corporation or its parent or subsidiary. If the successor corporation does not assume or substitute for the options or rights, the administrator shall provide for the participant to have the right to exercise the option or right, including shares that would not otherwise be vested or exercisable. If the administrator makes an option or right exercisable in full in the event of a merger or sale of assets, the administrator shall notify the participant in writing or electronically that the options shall be fully exercisable for a period of 15 days from such notice, and the options will terminate upon the expiration of such period.

Executive Bonus Plan

Effective January 1, 2002, we adopted an Executive Bonus Plan. Our Board of Directors has delegated administration of the Bonus Plan to the Compensation Committee in accordance with our Amended and Restated Bylaws. Only our senior executive officers are eligible to participate in the Bonus Plan, as selected by its administrator.

Bonuses are determined and paid based upon objectively determinable formulas established by the administrator and relating to one or more of the following corporate business performance criteria: net income, revenues, market share, new customers, earnings per share, return on equity, return on invested capital or assets, customer satisfaction, business percentage mix, gross margins, individual management by objective goals, cash flow, or earnings before any one or more of interest, taxes, depreciation or amortization. The administrator of the Bonus Plan may also, pursuant to its discretion, set additional conditions and terms for payment of bonuses, including the achievement of other financial, strategic or individual goals, which may be objective or subjective, as it deems appropriate. Bonus formulas may be set for performance periods of one, two or three fiscal years.

The administrator may, in its discretion, reduce the amount of bonus otherwise payable to a participant under the bonus formula. However, the administrator has no discretion to increase the amount of a participant's bonus above the formula amount. In no event will a bonus payable to any participant under the Bonus Plan with respect to any performance period exceed $2,000,000.

Bonuses may be paid in cash or the equivalent value of our common stock at the time the bonus is awarded. If paid in our common stock, the administrator may impose additional vesting or other similar restrictions on such stock; however, any such vesting restrictions may not exceed a period of four years.

16

COMPENSATION COMMITTEE REPORT

The Compensation Committee of our Board of Directors consists of Mr. Smisek, as Chair, and Messrs. Caminiti, Garton, Griffin, Hacker and Miller.

The Committee has overall responsibility for our executive compensation policies and practices. The Committee's functions include determining the compensation of our Chief Executive Officer, overseeing all other executive officers' compensation, including salary and payments under annual bonus plans, and granting awards to the Chief Executive Officer, other executive officers and employees under our equity incentive plans.

The Committee also administers our 2000 Stock Plan and our Amended and Restated 2002 Stock Plan.

Compensation Philosophy and Policies. The Committee believes that long-term corporate success, defined as sustained profitable growth and the creation of stockholder value, is best achieved in an environment in which employees have the opportunity to be innovative and are rewarded appropriately for their innovation and other contributions. In order to provide a direct link between corporate performance and compensation that will attract and retain top-caliber employees, the Committee's compensation philosophy is to provide total compensation opportunities that are competitive with peer companies. We also believe it is important for employees' compensation to be aligned with company-wide financial and operational performance. Our policies rely on two principles. First, a portion of executive officers' cash compensation should be at risk and vary depending upon meeting stated financial and operational objectives. Second, a significant portion of executive officers' total compensation should be in the form of stock, stock options or other equity incentives.

When establishing salaries, bonus levels, and stock, stock option or other equity awards for executive officers, the Committee considers the individual's role, leadership responsibilities and performance during the past year, and the amount of compensation paid to executive officers in similar positions at companies that we consider to be peer companies within our industry or similar industries. The Committee utilizes an outside compensation consultant to review competitive compensation, and the Committee considers this data in determining executive officer compensation.

The Committee sets compensation targets designed to provide executive officers with compensation that exceeds the average amounts paid to executives of peer companies in years in which we achieve superior results, and with compensation below the average of amounts paid to executives of peer companies in years in which we fail to achieve superior results. In the case of setting compensation targets for executive officers other than the Chief Executive Officer, and in the case of determining initial employment offers, the Committee takes into account the recommendations of the Chief Executive Officer.

Base Salaries. Messrs. Katz, Park, Hjelm and Samuel receive base salaries pursuant to their employment agreements. The Committee reviews base salaries of other key members of the company, in consultation with the Chief Executive Officer. When reviewing base salaries, the Committee considers individual and corporate performance, levels of responsibility and competitive pay practices.

Cash Bonus Incentives. Messrs. Katz, Park, Hjelm and Samuel are eligible to receive cash bonuses under the terms of their employment agreements. Mr. Katz is eligible for an annual cash incentive bonus upon the attainment of specified performance goals set by the Committee in consultation with Mr. Katz with an annual target bonus payout of 100% and a maximum bonus payout of 200% of his base salary. Messrs. Park, Hjelm and Samuel are also eligible for annual cash incentive bonuses based on annual target bonus amounts of 50% of their respective base salaries. These bonuses are likewise payable upon attainment of performance targets that we have determined. In 2003, we paid a portion of the annual incentive bonus after the first half of the fiscal year, with the majority of the bonus being

17

paid to the executive following completion of the fiscal year and review of the company's full year performance against the specified performance targets.

Equity Incentive Awards. A fundamental tenet of our compensation policy is that equity participation creates a vital long-term alignment between executive officers and other stockholders. The number of shares of common stock subject to option grants or restricted stock awards to executive officers is based on our business plans, the executive's level of corporate responsibility, individual performance, historical award data and competitive practices of companies that compete with us for executives. In making these grants, the Committee exercises its discretion and does not explicitly assign relative weight to these factors.

During 2003, our executive officers received options to purchase a total of 316,666 shares of common stock and restricted grants of 149,998 shares of common stock. Of these totals, 66,666 shares of restricted stock and options with respect to 266,666 shares of common stock were granted in connection with the terms of the initial employment of certain of our executive officers.

Chief Executive Officer Compensation. The Committee most recently reviewed Mr. Katz's compensation package in connection with the renegotiation of his employment terms in July 2003 as a result of the slated expiration of his employment agreement. The Amended and Restated Employment Agreement, dated as of July 6, 2003, established the terms and conditions of his employment with Orbitz, including a minimum base salary, a target annual performance bonus, the vesting and terms of issuance of certain equity compensation bonuses and payments or benefits to which he would be entitled upon termination of his employment. The Compensation Committee typically reviews the compensation of the Chief Executive Officer annually pursuant to the same policies the Committee uses to evaluate the compensation of the other executive officers. The Committee determined that, as amended, Mr. Katz's Employment Agreement was consistent with the Committee's philosophy as described above.

Tax Policy. Section 162(m) of the Internal Revenue Code limits deductions for certain executive compensation in excess of $1 million. Certain types of compensation are deductible only if performance goals are pre-established and objective, and if the material terms of the performance goals and the compensation arrangement are approved by stockholders. We have endeavored to structure our compensation plans to achieve maximum deductibility under Section 162(m) with minimal limitations to flexibility and corporate objectives.

While the Committee will consider deductibility under Section 162(m) with respect to future compensation arrangements with executive officers, deductibility will not be the sole factor used in ascertaining appropriate levels or modes of compensation. Since corporate objectives may not always be consistent with the requirements for full deductibility, certain compensation paid by Orbitz may not be deductible under Section 162(m), including restricted stock awards that vest over time.

Conclusion. The Committee believes that long-term stockholder value is enhanced by rewarding corporate and individual performance achievements, and that equity compensation is an important component of creating long-term stockholder value. Through the plans and policies described above, the Committee believes that a significant portion of our executive compensation is based on corporate and individual performance.

COMPENSATION COMMITTEE

18

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

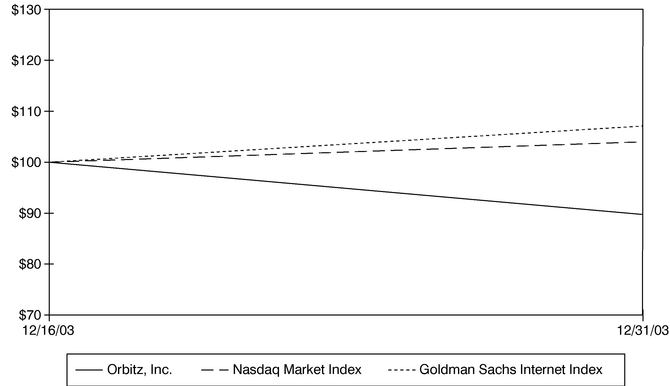

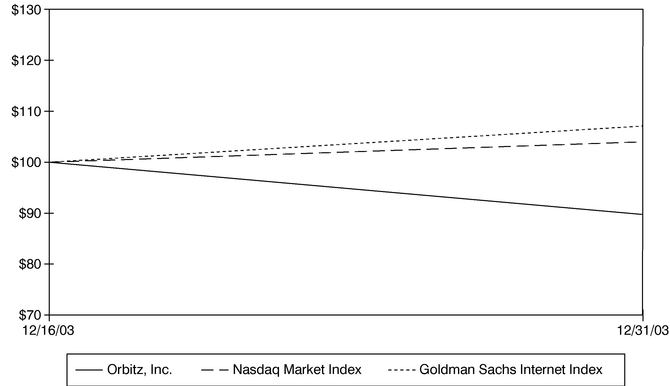

Initial Public Offering and Related Restructuring Transactions

In December 2003, we completed an initial public offering of our Class A common stock. In connection with and to facilitate the initial public offering, we engaged in a series of restructuring transactions with the Founding Airlines or their affiliates. These transactions were consummated shortly prior to the initial public offering. Specifically, pursuant to an exchange agreement among Orbitz, Inc. and the Founding Airlines or their affiliates, the Founding Airlines or their affiliates contributed all their membership interests in Orbitz, LLC to Orbitz, Inc. in exchange for an aggregate of 8,180,000 shares of Class A common stock, an aggregate of 27,262,980 shares of Class B common stock and an aggregate of 434,782 shares of Series A non-voting convertible preferred stock. We refer to this transaction as the "IPO Exchange." In the initial public offering, the Founding Airlines or their affiliates sold all of the Class A common stock obtained by them in the IPO Exchange.