Investor Presentation May 12, 2016 Exhibit 99

Safe Harbor Statement & Disclosure This presentation includes forward-looking comments subject to important risks and uncertainties. It may also contain financial measures that are not in conformance with accounting principles generally accepted in the United States of America (GAAP). Refer to Hyster-Yale’s reports filed on Forms 8-K (current), 10-Q (quarterly), and 10-K (annual) for information on factors that could cause actual results to differ materially from information in this presentation and for information reconciling financial measures to GAAP. Past performance may not be representative of future results. Guidance noted in the following slides was effective as of the company’s most recent earnings release and conference call (April 28, 2016). Nothing in this presentation should be construed as reaffirming or disaffirming such guidance. This presentation is not an offer to sell or a solicitation of offers to buy any of Hyster-Yale’s securities.

Hyster-Yale Snapshot Hyster-Yale Materials Handling, Inc. (NYSE:HY) designs, engineers, manufactures, sells and services a comprehensive line of lift trucks and aftermarket parts. Separate lift truck and fuel cell power solutions segments. Headquartered in Cleveland, Ohio Approximately 5,500 employees globally LTM 3/31/16: Revenue – $2.6 billion Net income – $70.8 million EBITDA(1) – $125.4 million ROTCE(1) of 18.7% (Net cash basis) Net cash at 3/31/16 – $138.5 million _____________________ EBITDA and ROTCE are non-GAAP measures and should not be considered in isolation or as a substitute for GAAP measures. For discussion of non-GAAP items and the related reconciliations to GAAP measures, see information in the Appendix starting on page 32.

Bolzoni Transaction – Acquisition Plan PENTA HOLDING On April 1, 2016, HY’s indirect wholly-owned subsidiary, HY Italy, acquired Penta S.p.A., a majority stakeholder (50.4%) of Bolzoni S.p.A., an Italian-listed public company and leading worldwide producer of attachments, forks and lift tables under the Bolzoni Auramo and Meyer brand names Purchase price of Penta – €53.5 million (approximately $60.9 million at April 1, 2016) On April 26, 2016, HY Italy purchased an additional 3.1 million shares, or approximately 12%, of Bolzoni’s outstanding stock for €13.4 million (approximately $15.1 million at April 26, 2016) bringing total ownership in Bolzoni to approximately 62.4% After the acquisition of Penta, HY Italy commenced the steps to launch a mandatory tender offer in Italy for all of the remaining 9.8 million outstanding shares of Bolzoni at the cash price of €4.30 per share Maximum amount to be paid pursuant to the mandatory tender offer will be €41.9 million The mandatory tender offer is expected to be funded by HY’s cash on hand and borrowings under HY’s credit facility Once acquisition is completed Bolzoni is expected to be reported as a separate segment of the business *There can be no assurance that HY Italy will be able to acquire 100% ownership of Bolzoni in the mandatory tender offer or that the anticipated benefits and effects of the acquisition of Bolzoni will be realized.

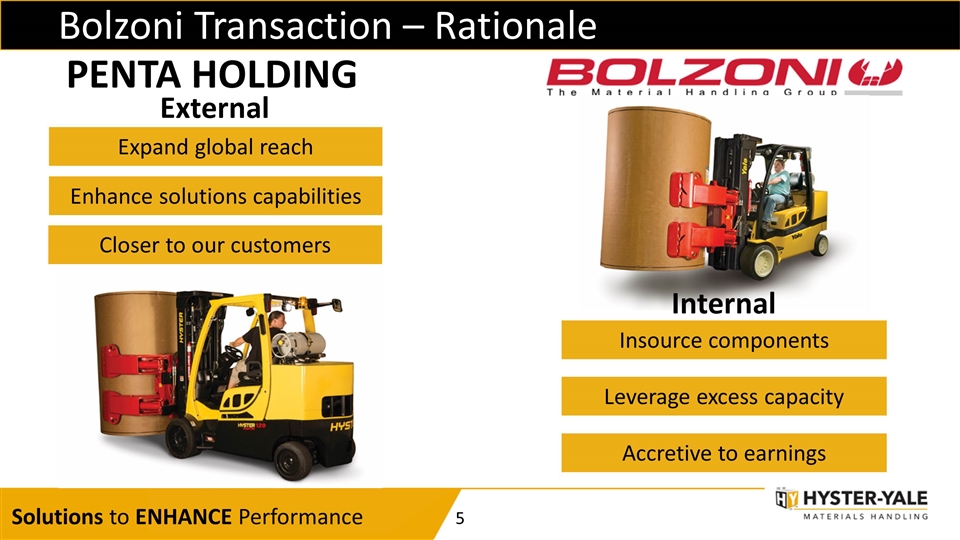

Bolzoni Transaction – Rationale PENTA HOLDING Expand global reach Enhance solutions capabilities Leverage excess capacity Insource components Closer to our customers Accretive to earnings External Internal

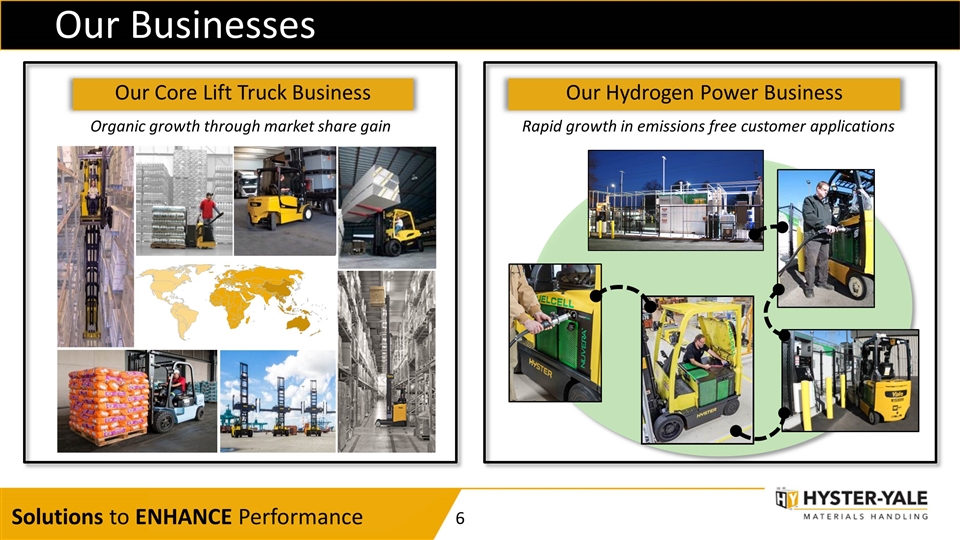

Our Businesses Our Core Lift Truck Business Organic growth through market share gain Our Hydrogen Power Business Rapid growth in emissions free customer applications

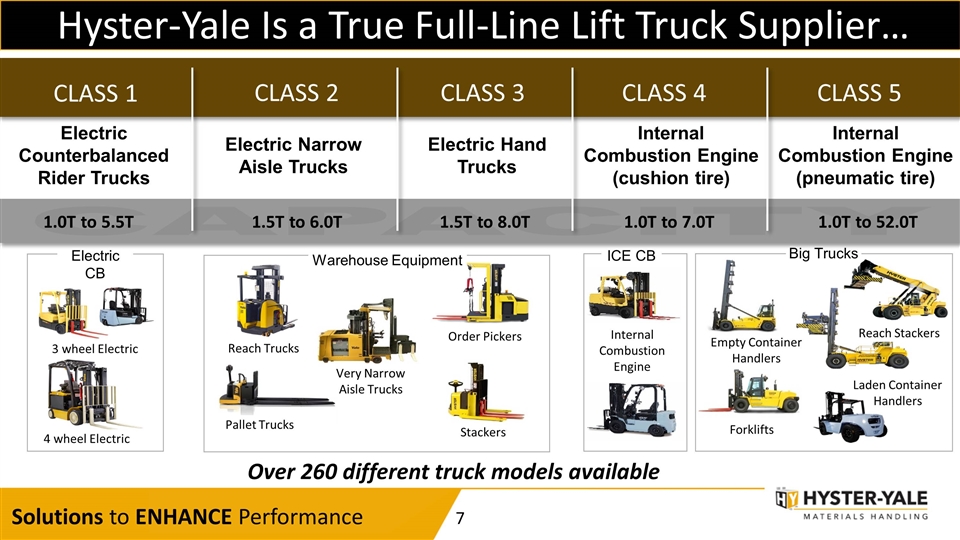

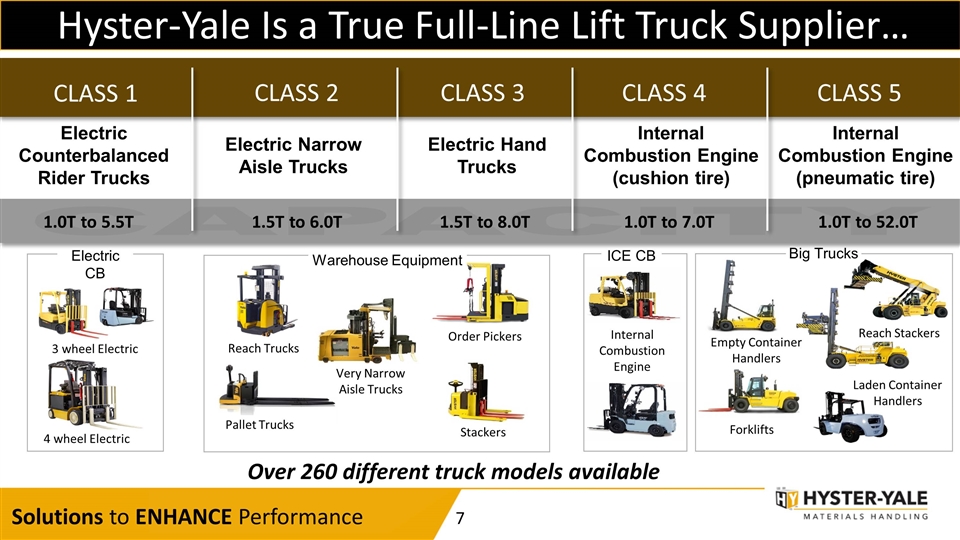

Hyster-Yale Is a True Full-Line Lift Truck Supplier… Electric Counterbalanced Rider Trucks Electric Narrow Aisle Trucks Electric Hand Trucks Internal Combustion Engine (cushion tire) Internal Combustion Engine (pneumatic tire) Electric CB 3 wheel Electric 4 wheel Electric Pallet Trucks Stackers Very Narrow Aisle Trucks Order Pickers Reach Trucks Internal Combustion Engine ICE CB Laden Container Handlers Big Trucks Empty Container Handlers Forklifts Reach Stackers CLASS 1 CLASS 2 CLASS 3 CLASS 4 CLASS 5 CAPACITY 1.0T to 5.5T 1.5T to 6.0T 1.5T to 8.0T 1.0T to 7.0T 1.0T to 52.0T Warehouse Equipment Over 260 different truck models available

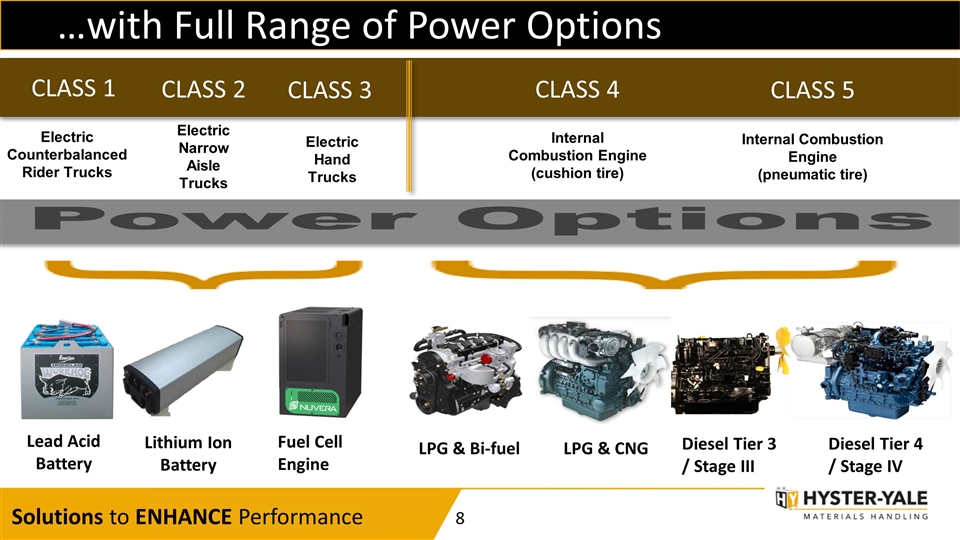

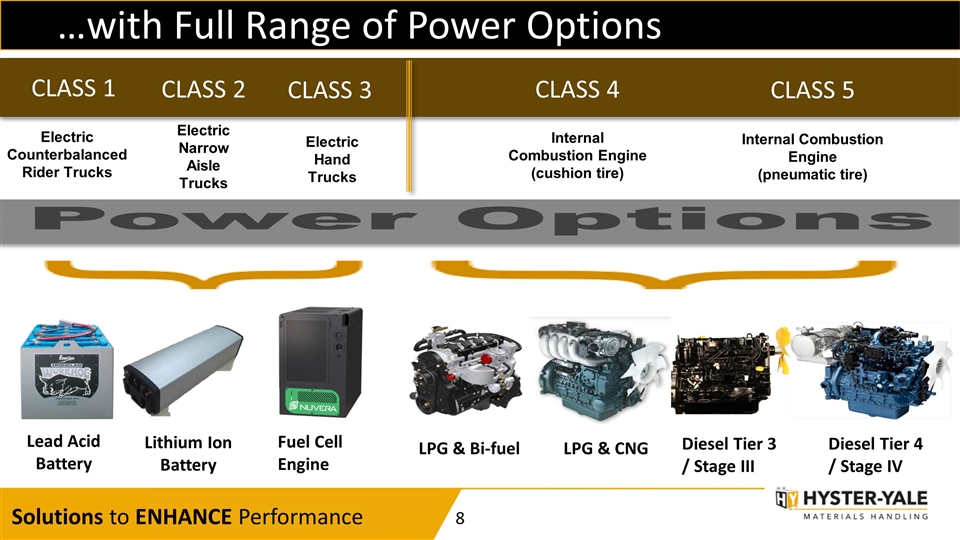

…with Full Range of Power Options Electric Counterbalanced Rider Trucks Electric Narrow Aisle Trucks Electric Hand Trucks Internal Combustion Engine (cushion tire) Internal Combustion Engine (pneumatic tire) CLASS 1 CLASS 2 CLASS 3 CLASS 4 CLASS 5 Power Options Lead Acid Battery Fuel Cell Engine LPG & Bi-fuel Diesel Tier 3 / Stage III LPG & CNG Diesel Tier 4 / Stage IV Photo Photo Photo Lithium Ion Battery

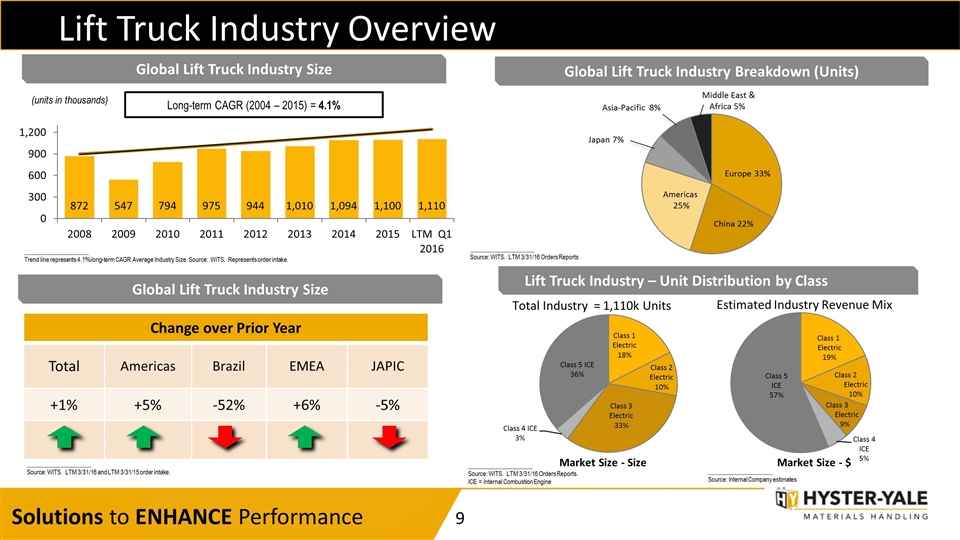

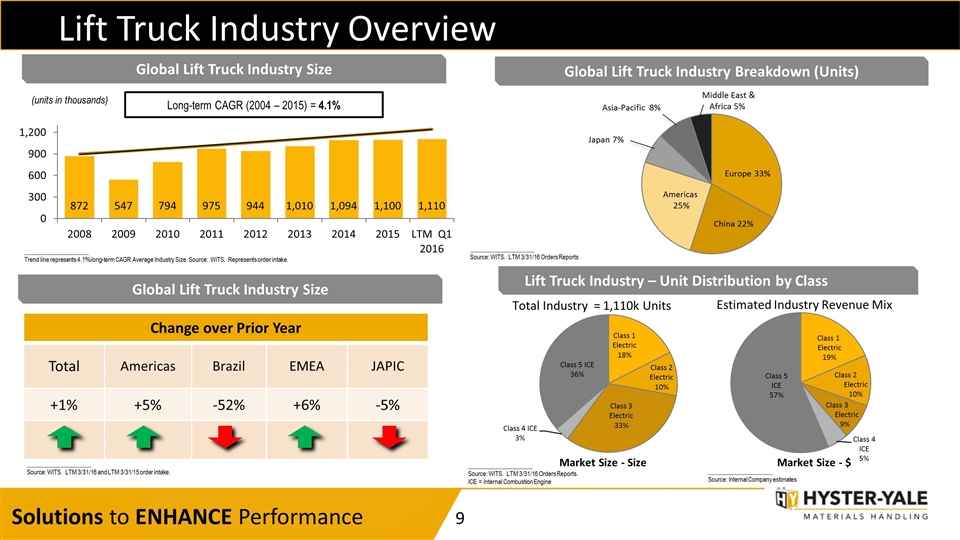

Lift Truck Industry Overview (units in thousands) Global Lift Truck Industry Size _____________________ Trend line represents 4.1% long-term CAGR Average Industry Size. Source: WITS. Represents order intake. Global Lift Truck Industry Breakdown (Units) _____________________ Source: WITS. LTM 12/31/15 Orders Reports. Long-term CAGR (2004 – 2015) = 4.1% Global Lift Truck Industry Size _____________________ Source: WITS. LTM 3/31/16 and LTM 3/31/15 order intake. Change over Prior Year Total Americas Brazil EMEA JAPIC +1% +5% -52% +6% -5% Lift Truck Industry – Unit Distribution by Class _____________________ Source: WITS. LTM 3/31/16 Orders Reports. ICE = Internal Combustion Engine Total Industry = 1,110k Units Class 4 ICE 5% Market Size - $ _____________________ Source: Internal Company estimates Market Size - Size Class 5 ICE 57% Class 1 Electric 19% Class 2 Electric 10% Class 3 Electric 9% Estimated Industry Revenue Mix _____________________ Source: WITS. LTM 3/31/16 Orders Reports

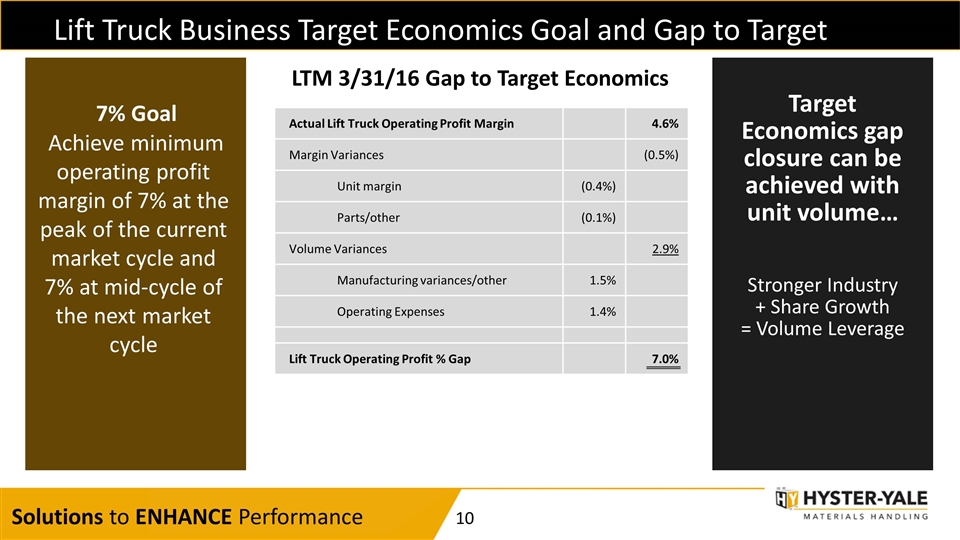

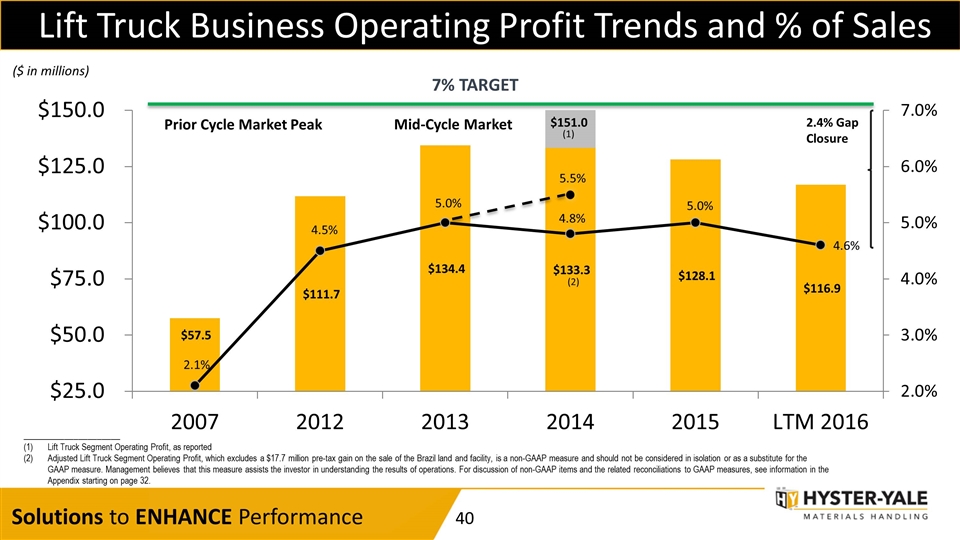

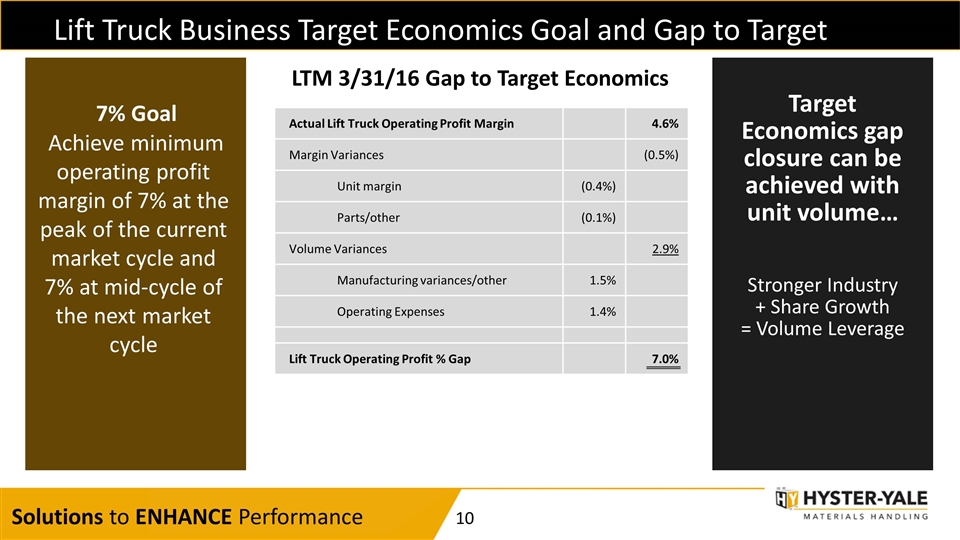

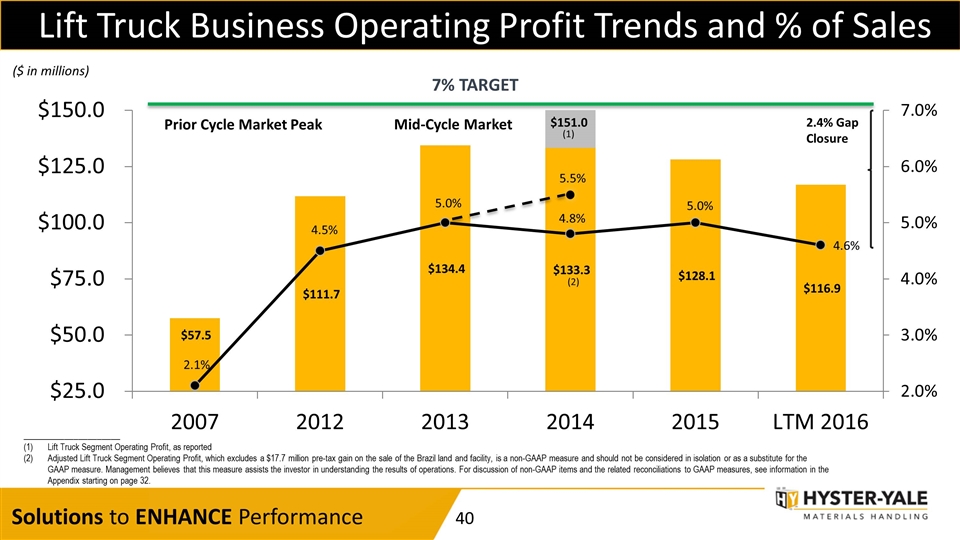

Lift Truck Business Target Economics Goal and Gap to Target 7% Goal Achieve minimum operating profit margin of 7% at the peak of the current market cycle and 7% at mid-cycle of the next market cycle Target Economics gap closure can be achieved with unit volume… Stronger Industry + Share Growth = Volume Leverage LTM 3/31/16 Gap to Target Economics Actual Lift Truck Operating Profit Margin 4.6% Margin Variances (0.5%) Unit margin (0.4%) Parts/other (0.1%) Volume Variances 2.9% Manufacturing variances/other 1.5% Operating Expenses 1.4% Lift Truck Operating Profit % Gap 7.0%

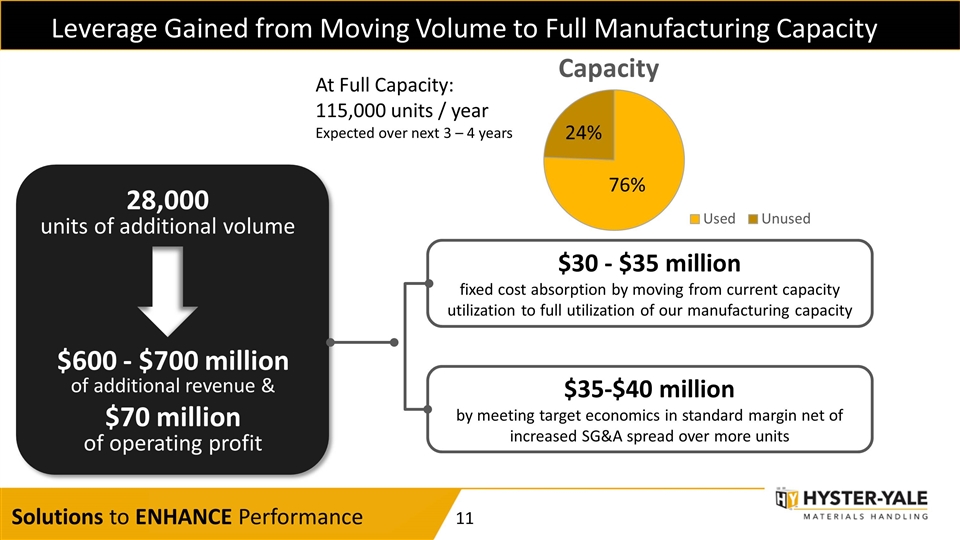

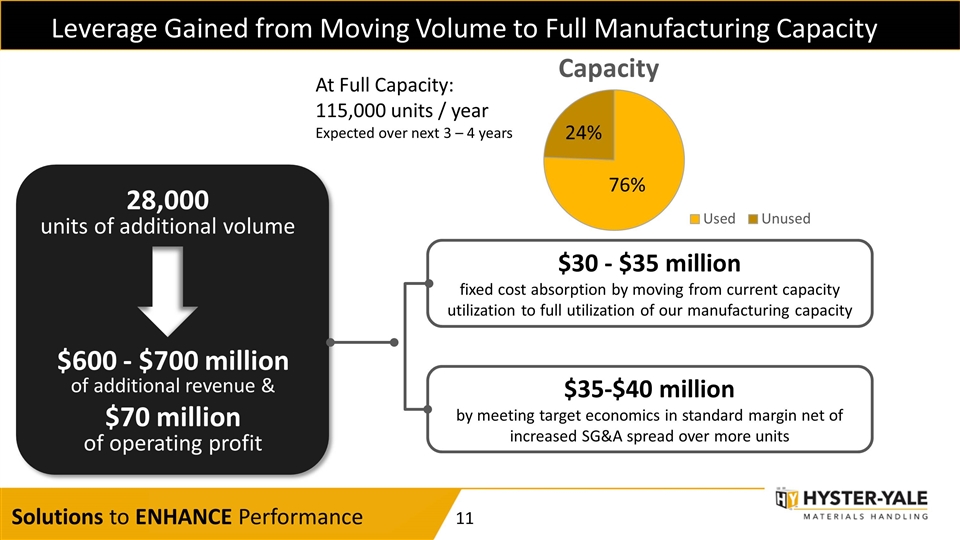

Leverage Gained from Moving Volume to Full Manufacturing Capacity 28,000 units of additional volume $600 - $700 million of additional revenue & $70 million of operating profit $30 - $35 million fixed cost absorption by moving from current capacity utilization to full utilization of our manufacturing capacity $35-$40 million by meeting target economics in standard margin net of increased SG&A spread over more units At Full Capacity: 115,000 units / year Expected over next 3 – 4 years

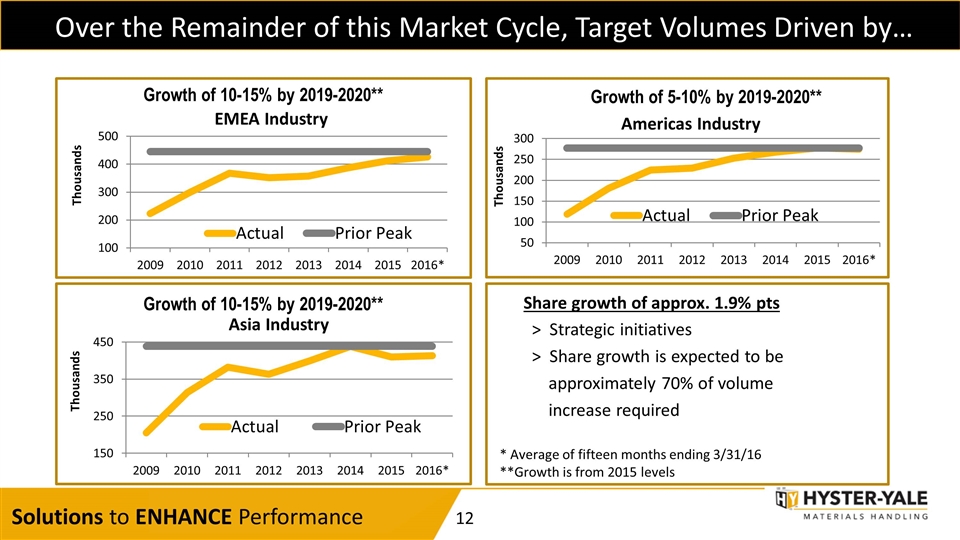

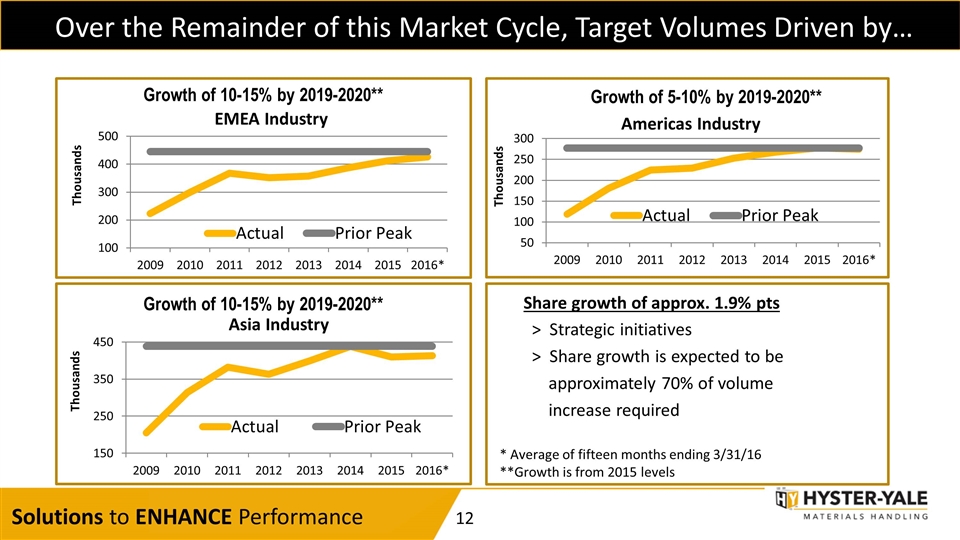

Over the Remainder of this Market Cycle, Target Volumes Driven by… Share growth of approx. 1.9% pts > Strategic initiatives > Share growth is expected to be approximately 70% of volume increase required Growth of 10-15% by 2019-2020** Growth of 5-10% by 2019-2020** Growth of 10-15% by 2019-2020** * Average of fifteen months ending 3/31/16 **Growth is from 2015 levels

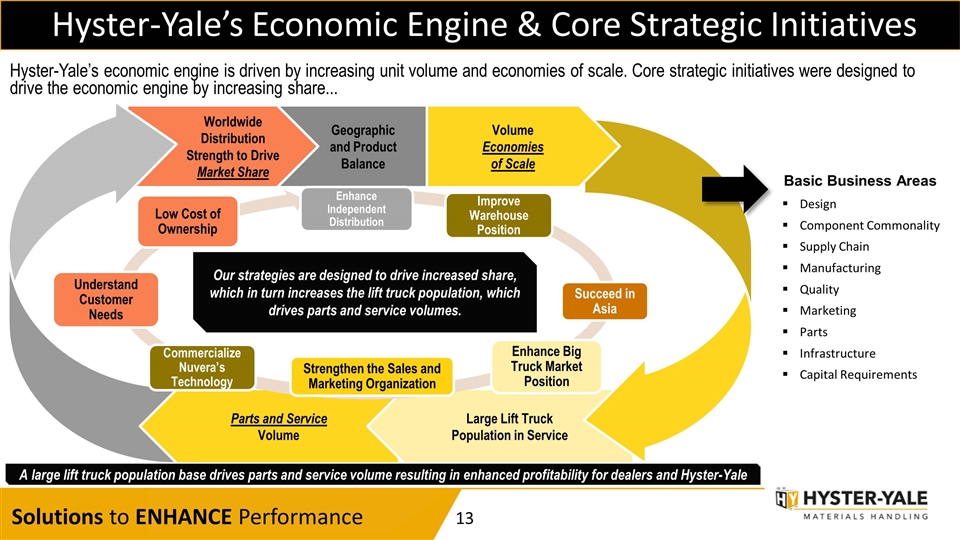

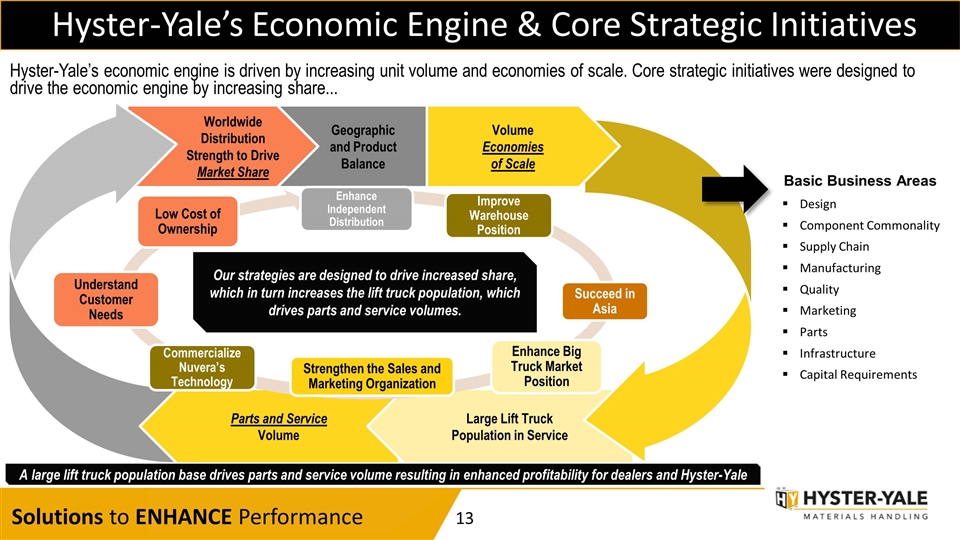

Hyster-Yale’s Economic Engine & Core Strategic Initiatives Basic Business Areas Our strategies are designed to drive increased share, which in turn increases the lift truck population, which drives parts and service volumes. Geographic and Product Balance Worldwide Distribution Strength to Drive Market Share Parts and Service Volume Large Lift Truck Population in Service Volume Economies of Scale Design Component Commonality Supply Chain Manufacturing Quality Marketing Parts Infrastructure Capital Requirements Improve Warehouse Position Enhance Independent Distribution Succeed in Asia Enhance Big Truck Market Position Strengthen the Sales and Marketing Organization Low Cost of Ownership Understand Customer Needs Hyster-Yale’s economic engine is driven by increasing unit volume and economies of scale. Core strategic initiatives were designed to drive the economic engine by increasing share... Commercialize Nuvera’s Technology A large lift truck population base drives parts and service volume resulting in enhanced profitability for dealers and Hyster-Yale

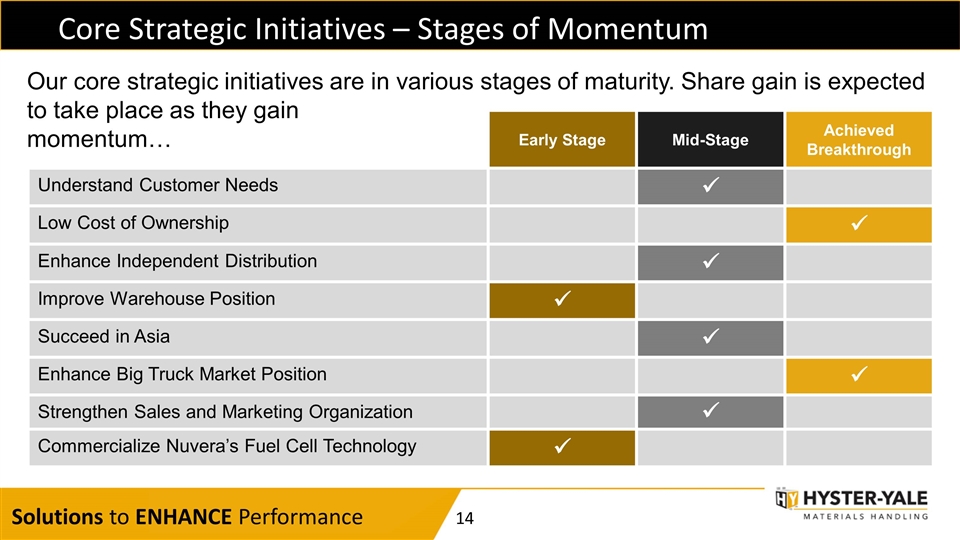

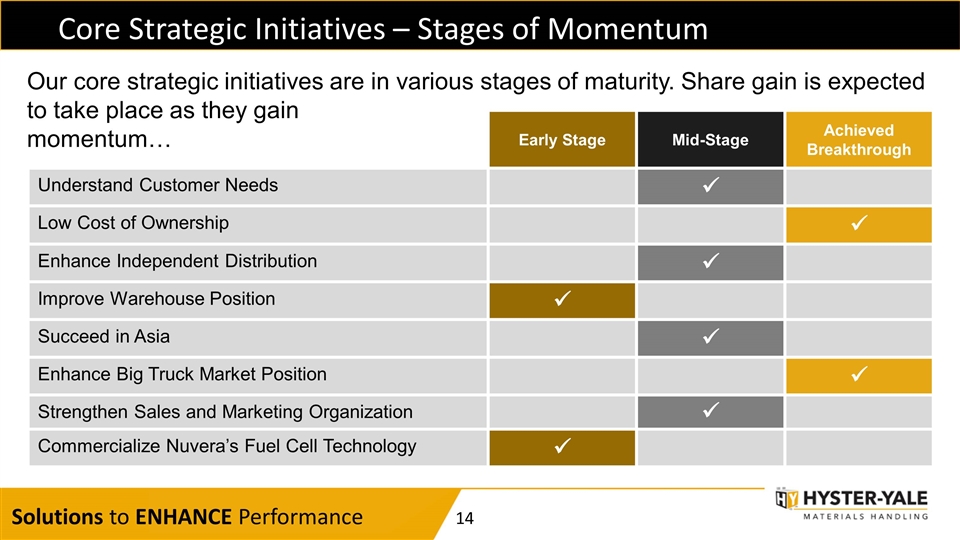

Early Stage Mid-Stage Achieved Breakthrough Understand Customer Needs ü Low Cost of Ownership ü Enhance Independent Distribution ü Improve Warehouse Position ü Succeed in Asia ü Enhance Big Truck Market Position ü Strengthen Sales and Marketing Organization ü Commercialize Nuvera’s Fuel Cell Technology ü Our core strategic initiatives are in various stages of maturity. Share gain is expected to take place as they gain momentum… Core Strategic Initiatives – Stages of Momentum

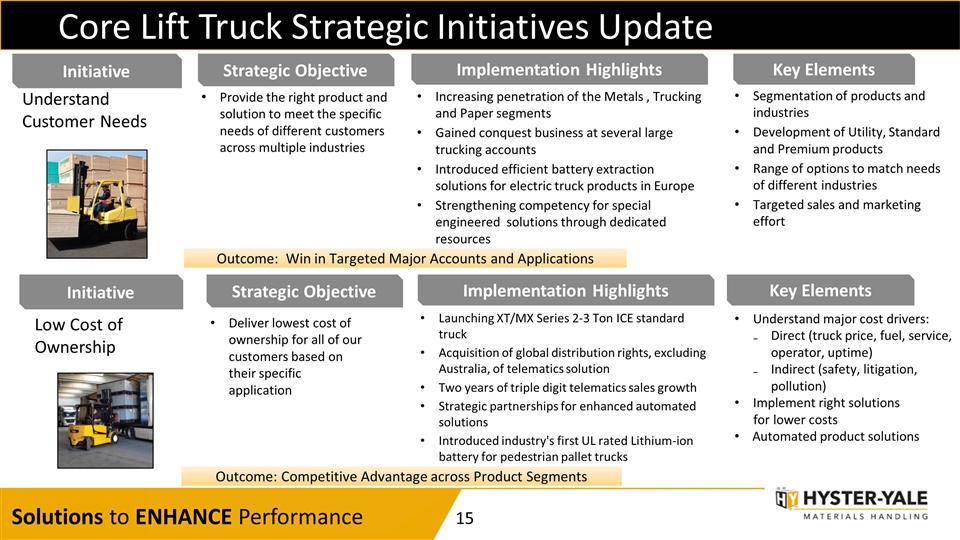

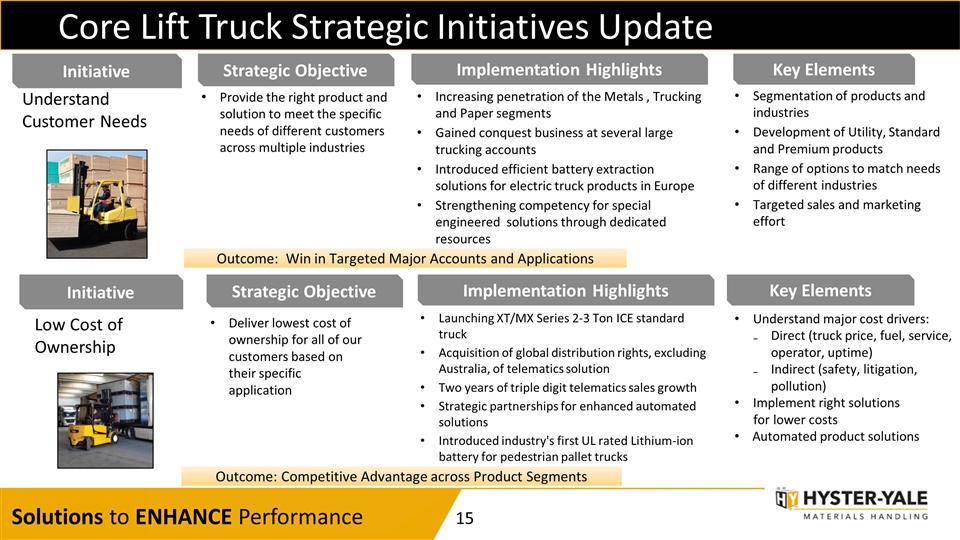

Core Lift Truck Strategic Initiatives Update Strategic Objective Implementation Highlights Provide the right product and solution to meet the specific needs of different customers across multiple industries Increasing penetration of the Metals , Trucking and Paper segments Gained conquest business at several large trucking accounts Introduced efficient battery extraction solutions for electric truck products in Europe Strengthening competency for special engineered solutions through dedicated resources Initiative Understand Customer Needs Strategic Objective Implementation Highlights Deliver lowest cost of ownership for all of our customers based on their specific application Initiative Low Cost of Ownership Launching XT/MX Series 2-3 Ton ICE standard truck Acquisition of global distribution rights, excluding Australia, of telematics solution Two years of triple digit telematics sales growth Strategic partnerships for enhanced automated solutions Introduced industry's first UL rated Lithium-ion battery for pedestrian pallet trucks Outcome: Win in Targeted Major Accounts and Applications Outcome: Competitive Advantage across Product Segments Key Elements Segmentation of products and industries Development of Utility, Standard and Premium products Range of options to match needs of different industries Targeted sales and marketing effort Key Elements Understand major cost drivers: Direct (truck price, fuel, service, operator, uptime) Indirect (safety, litigation, pollution) Implement right solutions for lower costs Automated product solutions

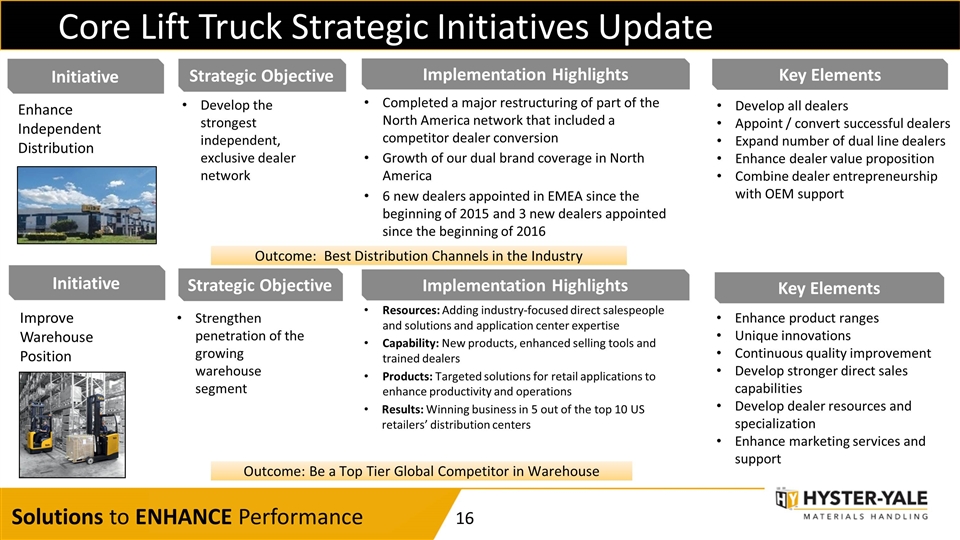

Core Lift Truck Strategic Initiatives Update Strategic Objective Implementation Highlights Develop the strongest independent, exclusive dealer network Initiative Enhance Independent Distribution Strategic Objective Implementation Highlights Strengthen penetration of the growing warehouse segment Initiative Improve Warehouse Position Completed a major restructuring of part of the North America network that included a competitor dealer conversion Growth of our dual brand coverage in North America 6 new dealers appointed in EMEA since the beginning of 2015 and 3 new dealers appointed since the beginning of 2016 Resources: Adding industry-focused direct salespeople and solutions and application center expertise Capability: New products, enhanced selling tools and trained dealers Products: Targeted solutions for retail applications to enhance productivity and operations Results: Winning business in 5 out of the top 10 US retailers’ distribution centers Outcome: Best Distribution Channels in the Industry Outcome: Be a Top Tier Global Competitor in Warehouse Key Elements Develop all dealers Appoint / convert successful dealers Expand number of dual line dealers Enhance dealer value proposition Combine dealer entrepreneurship with OEM support Key Elements Enhance product ranges Unique innovations Continuous quality improvement Develop stronger direct sales capabilities Develop dealer resources and specialization Enhance marketing services and support

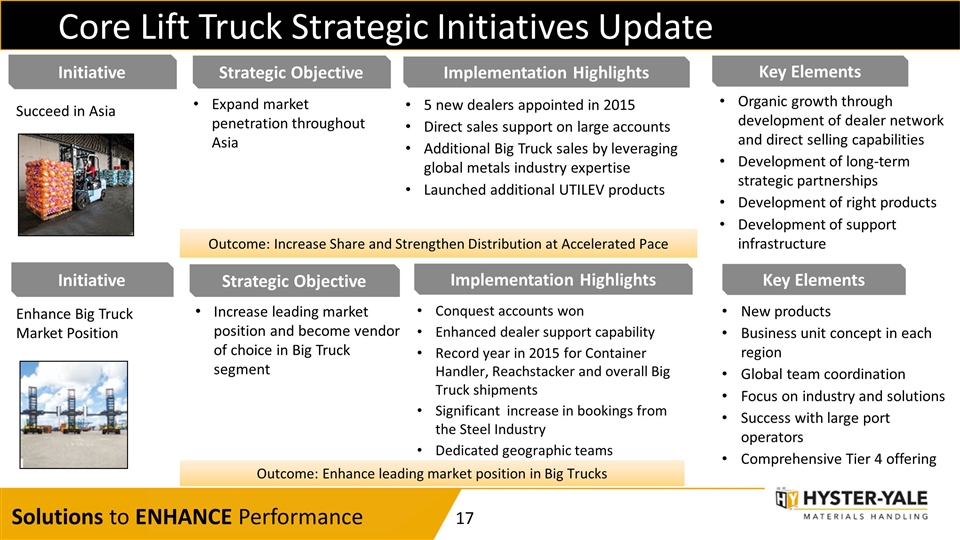

Core Lift Truck Strategic Initiatives Update Strategic Objective Implementation Highlights Initiative Succeed in Asia Strategic Objective Implementation Highlights Initiative Enhance Big Truck Market Position 5 new dealers appointed in 2015 Direct sales support on large accounts Additional Big Truck sales by leveraging global metals industry expertise Launched additional UTILEV products Conquest accounts won Enhanced dealer support capability Record year in 2015 for Container Handler, Reachstacker and overall Big Truck shipments Significant increase in bookings from the Steel Industry Dedicated geographic teams Expand market penetration throughout Asia Increase leading market position and become vendor of choice in Big Truck segment Outcome: Increase Share and Strengthen Distribution at Accelerated Pace Outcome: Enhance leading market position in Big Trucks Key Elements Organic growth through development of dealer network and direct selling capabilities Development of long-term strategic partnerships Development of right products Development of support infrastructure Key Elements New products Business unit concept in each region Global team coordination Focus on industry and solutions Success with large port operators Comprehensive Tier 4 offering

Core Lift Truck Strategic Initiatives Update Strategic Objective Implementation Highlights Initiative Strengthen Sales and Marketing Organization Recruited experienced individuals with deep knowledge of the lift truck business Added expertise in dealer management, account identification and coverage, financial merchandising and solutions development Added expertise to focus on implementing standard sales processes in our independent dealers Expanded investment in National and Major Account sales and support - winning conquest accounts Increased global collaboration to maximize efficiencies and effectiveness Strengthen and align sales and marketing organization in all geographic regions Outcome: Gain momentum leading to higher unit volumes and enhanced market share Key Elements Greater accountability for results through smaller sales management areas Leaders provided with new tools and enhanced reporting capabilities Solutions Organization integrates Engineering and Special Product Engineering (SPED) function with Sales and improves Technical Sales Support Major focus on account identification and coverage Implementing new sales approach with appropriate tools to enhance solutions selling skills

Nuvera Hydrogen Power Business Strategic Objective Key Elements Initiative Commercialize Nuvera’s Fuel Cell Technology Enables active participation in the growing hydrogen and fuel cell market Integration of Nuvera’s technology into HY’s lift truck product range Adds another power solution to robust complement of power solutions Reinforces core strategies: provides opportunity to meet customers’ needs, drives market share, enhances margins and offers low overall cost of ownership alternative Outcome: Successfully create an integrated fuel cell power solution option for customers Commercialize Nuvera’s technology through introduction of new fuel cell and improved hydrogen generation products to enhance our lift truck business value proposition and to support other share gain initiatives Expand power solution options for customers Provide strong OEM-based technology solutions Implementation Highlights Secured first total power solution agreement in Q4 2015 Shipment of PowerEdge® units, lift trucks and PowerTap® system expected in mid-2016 Exploring other complementary market opportunities, including automotive, construction equipment, aerospace, public transportation and seaports Expected to secure first orders from major customers in Q2 2016

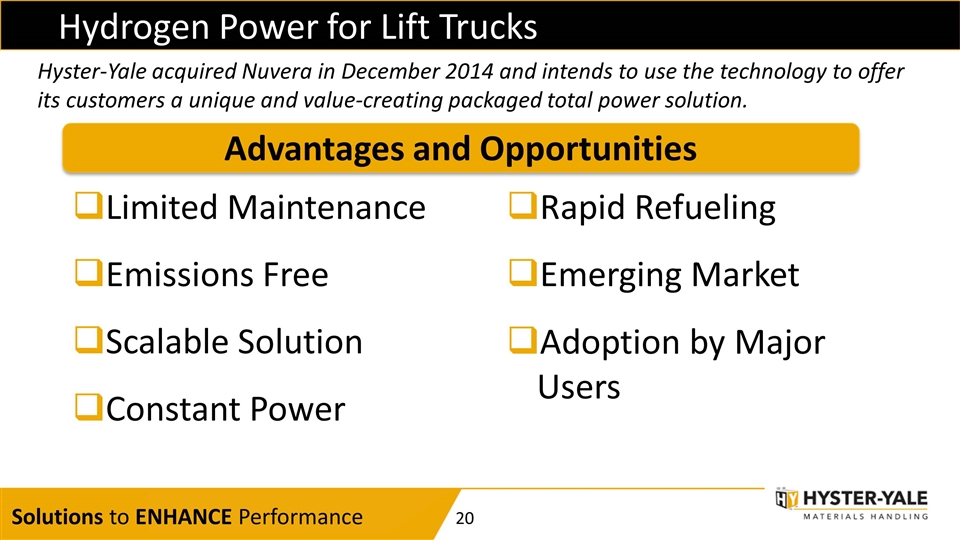

Hydrogen Power for Lift Trucks Hyster-Yale acquired Nuvera in December 2014 and intends to use the technology to offer its customers a unique and value-creating packaged total power solution. Limited Maintenance Emissions Free Growing industrial demand for high performance, zero emission solutions Constant Power Rapid Refueling Scalable Solution Fuel Cells can solve limitations: productivity, scalability, performance, costs Emerging Market Lift Truck fleets already largely electrified in developed markets Adoption by Major Users Advantages and Opportunities Limited Maintenance Emissions Free Scalable Solution Constant Power Rapid Refueling Emerging Market Adoption by Major Users

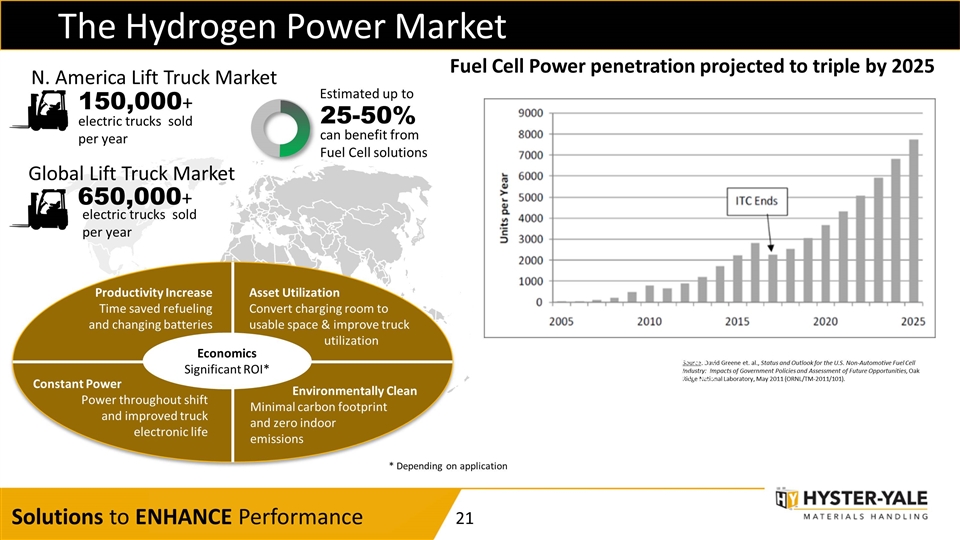

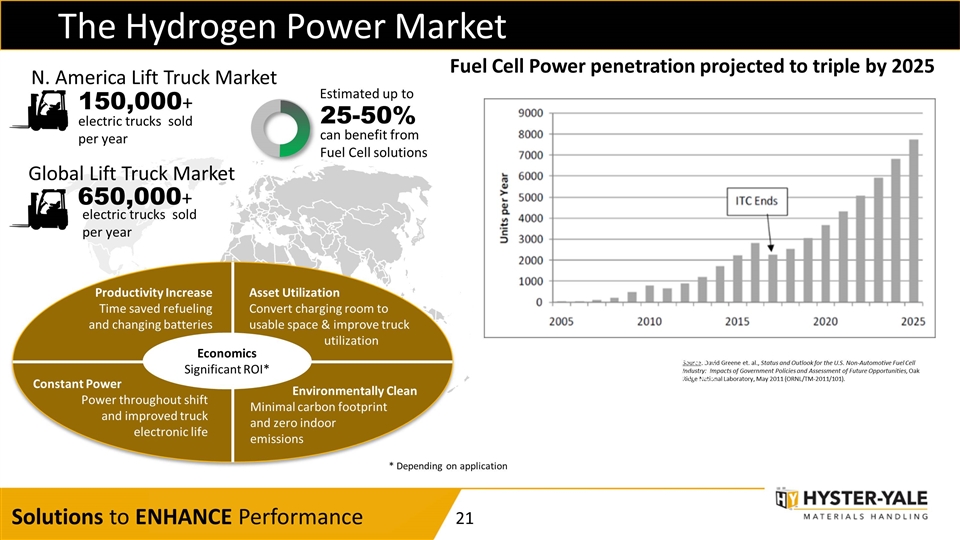

The Hydrogen Power Market 25-50% N. America Lift Truck Market electric trucks sold per year 150,000+ Estimated up to can benefit from Fuel Cell solutions Source: David Greene et. al., Status and Outlook for the U.S. Non-Automotive Fuel Cell Industry: Impacts of Government Policies and Assessment of Future Opportunities, Oak Ridge National Laboratory, May 2011 (ORNL/TM-2011/101). Fuel Cell Power penetration projected to triple by 2025 ling and changing batteries Constant Power Power throughout shift and improved truck electronic life * Depending on application Productivity Increase Time saved refueling and changing batteries Economics Significant ROI* Productivity Increase Time saved refueling and changing batteries Asset Utilization Convert charging room to usable space & improve truck utilization Constant Power Power throughout shift and improved truck electronic life Environmentally Clean Minimal carbon footprint and zero indoor emissions Global Lift Truck Market 650,000+ electric trucks sold per year

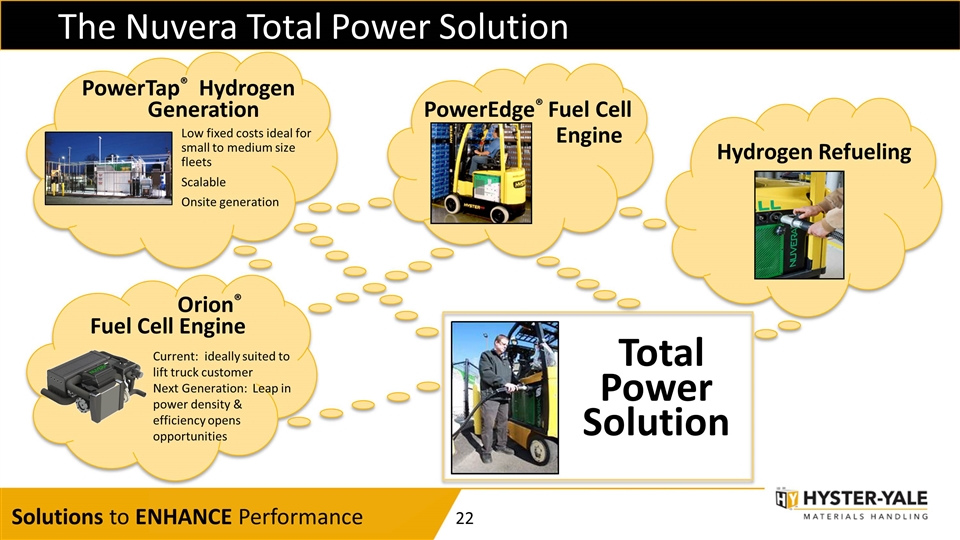

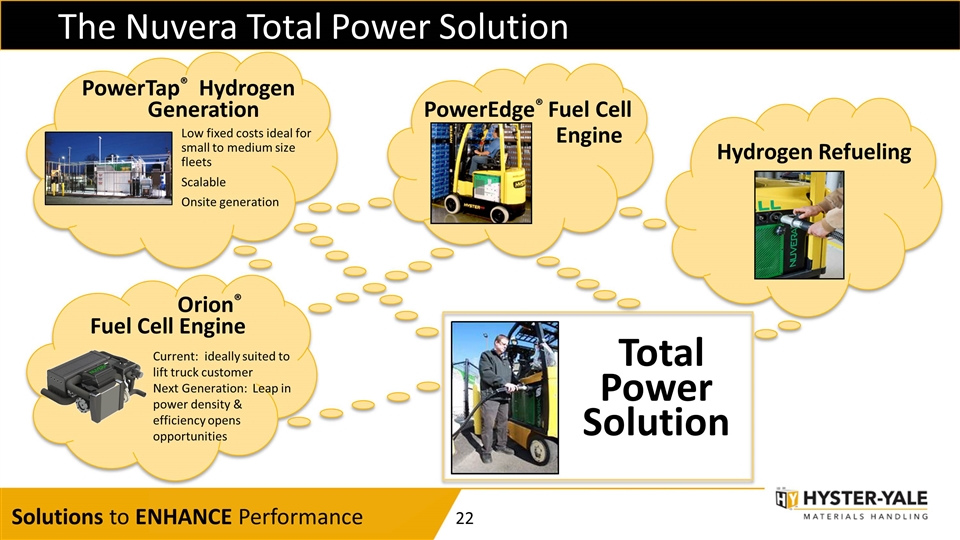

The Nuvera Total Power Solution Fuel PowerTap® Hydrogen Generation PowerEdge® Fuel Cell Orion® Fuel Cell Engine Total Power Solution Hydrogen Refueling Low fixed costs ideal for small to medium size fleets Scalable Onsite generation Current: ideally suited to lift truck customer Next Generation: Leap in power density & efficiency opens opportunities Engine

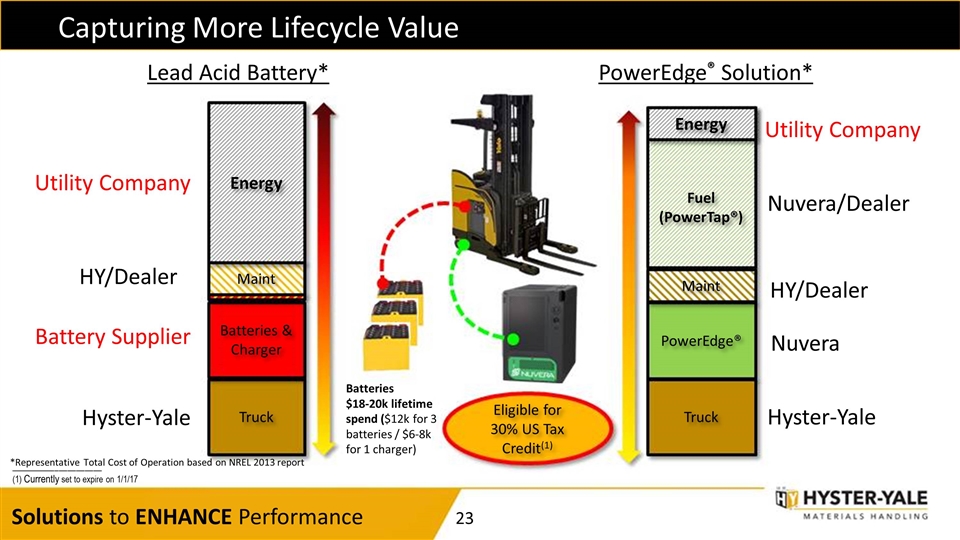

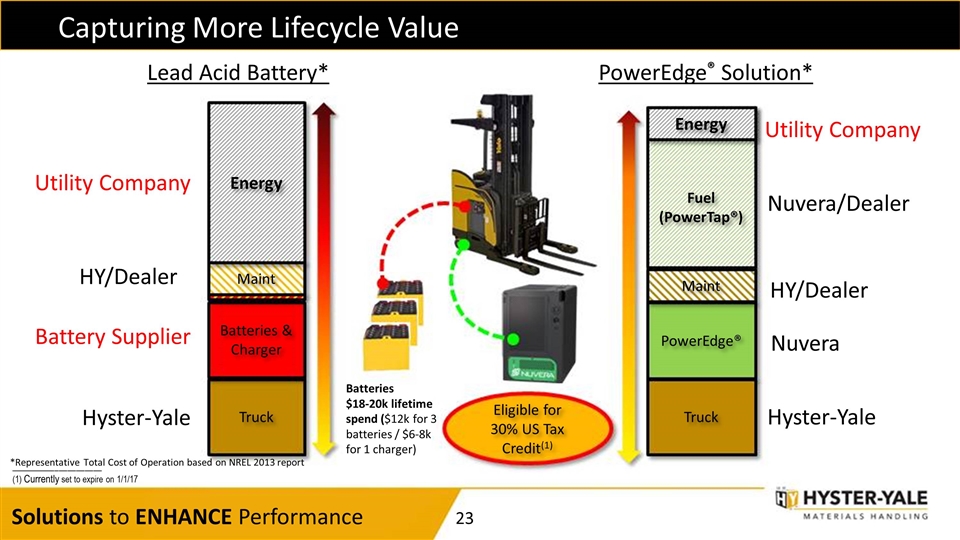

Capturing More Lifecycle Value Truck Hyster-Yale Maint HY/Dealer Energy Utility Company Fuel (PowerTap®) Energy Utility Company Nuvera/Dealer PowerEdge® Nuvera Maint HY/Dealer Truck Hyster-Yale Lead Acid Battery* PowerEdge® Solution* *Representative Total Cost of Operation based on NREL 2013 report Batteries & Charger Battery Supplier Eligible for 30% US Tax Credit(1) _____________________ (1) Currently set to expire on 1/1/17 Batteries $18-20k lifetime spend ($12k for 3 batteries / $6-8k for 1 charger)

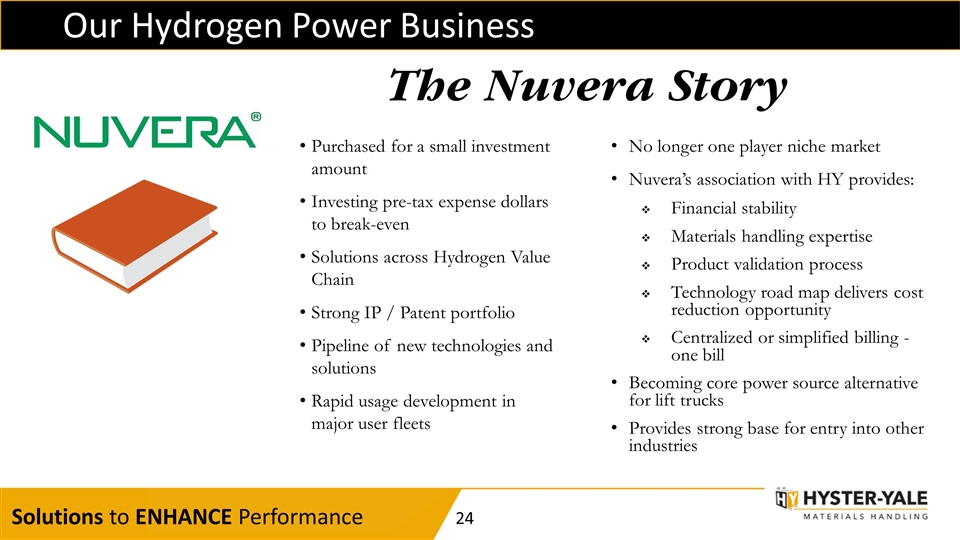

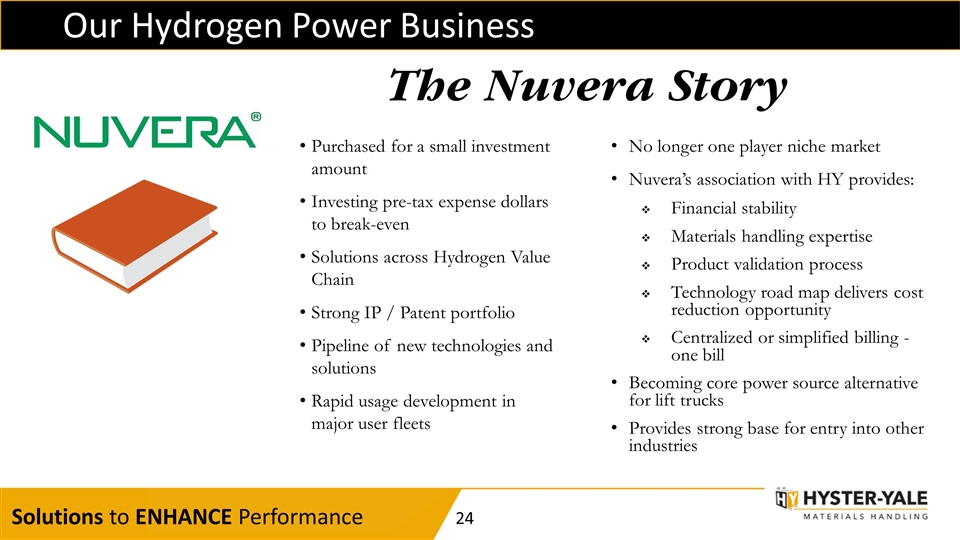

The Nuvera Story Our Hydrogen Power Business Why Hydrogen Purchased for a small investment amount Investing pre-tax expense dollars to break-even Solutions across Hydrogen Value Chain Strong IP / Patent portfolio Pipeline of new technologies and solutions Rapid usage development in major user fleets No longer one player niche market Nuvera’s association with HY provides: Financial stability Materials handling expertise Product validation process Technology road map delivers cost reduction opportunity Centralized or simplified billing - one bill Becoming core power source alternative for lift trucks Provides strong base for entry into other industries

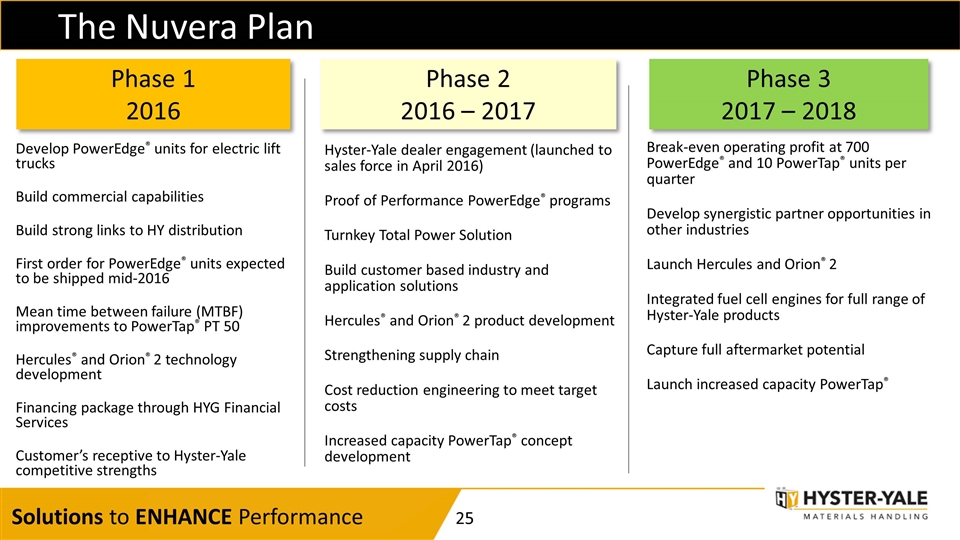

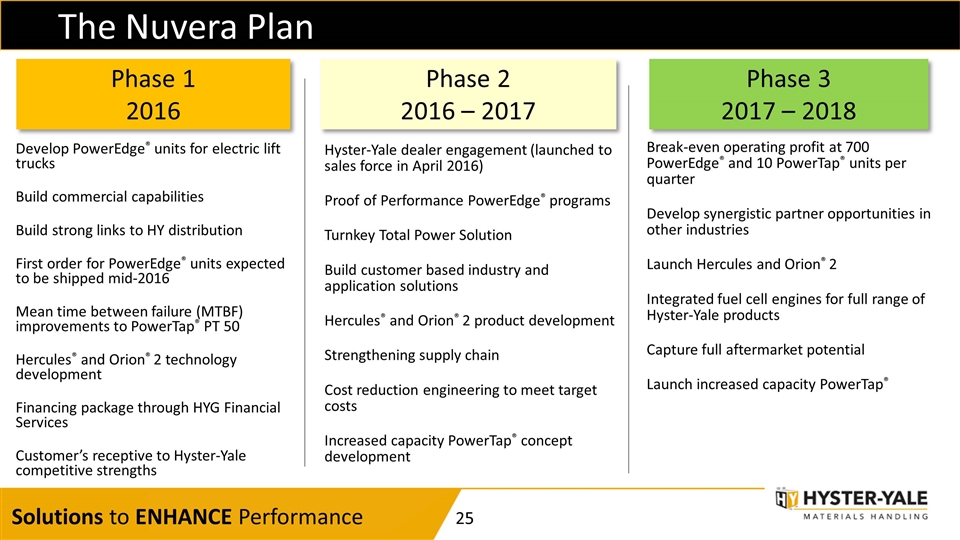

The Nuvera Plan Develop PowerEdge® units for electric lift trucks Build commercial capabilities Build strong links to HY distribution First order for PowerEdge® units expected to be shipped mid-2016 Mean time between failure (MTBF) improvements to PowerTap® PT 50 Hercules® and Orion® 2 technology development Financing package through HYG Financial Services Customer’s receptive to Hyster-Yale competitive strengths Hyster-Yale dealer engagement (launched to sales force in April 2016) Proof of Performance PowerEdge® programs Turnkey Total Power Solution Build customer based industry and application solutions Hercules® and Orion® 2 product development Strengthening supply chain Cost reduction engineering to meet target costs Increased capacity PowerTap® concept development Phase 1 2016 Phase 3 2017 – 2018 Phase 2 2016 – 2017 Break-even operating profit at 700 PowerEdge® and 10 PowerTap® units per quarter Develop synergistic partner opportunities in other industries Launch Hercules and Orion® 2 Integrated fuel cell engines for full range of Hyster-Yale products Capture full aftermarket potential Launch increased capacity PowerTap®

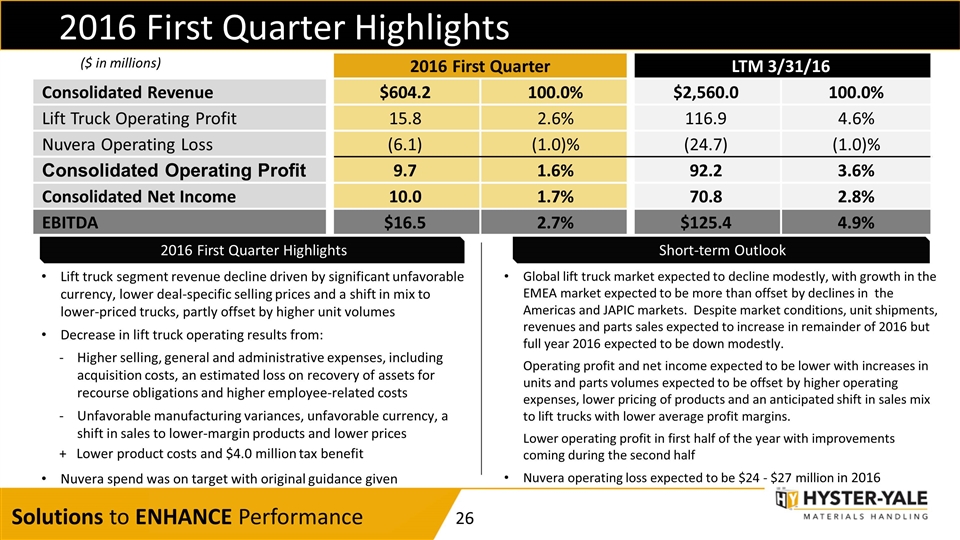

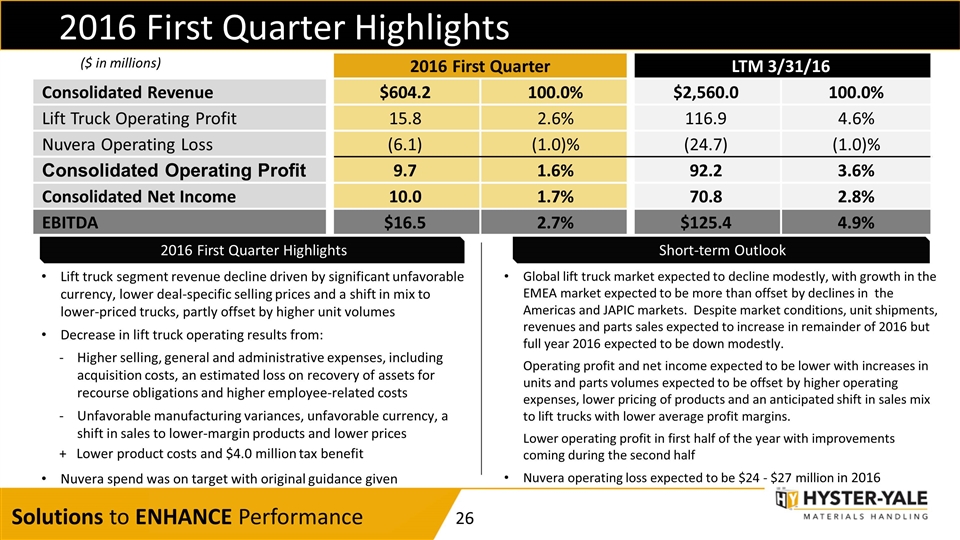

2016 First Quarter Highlights Lift truck segment revenue decline driven by significant unfavorable currency, lower deal-specific selling prices and a shift in mix to lower-priced trucks, partly offset by higher unit volumes Decrease in lift truck operating results from: Higher selling, general and administrative expenses, including acquisition costs, an estimated loss on recovery of assets for recourse obligations and higher employee-related costs Unfavorable manufacturing variances, unfavorable currency, a shift in sales to lower-margin products and lower prices + Lower product costs and $4.0 million tax benefit Nuvera spend was on target with original guidance given 2016 First Quarter Highlights Short-term Outlook 2016 First Quarter LTM 3/31/16 Consolidated Revenue $604.2 100.0% $2,560.0 100.0% Lift Truck Operating Profit 15.8 2.6% 116.9 4.6% Nuvera Operating Loss (6.1) (1.0)% (24.7) (1.0)% Consolidated Operating Profit 9.7 1.6% 92.2 3.6% Consolidated Net Income 10.0 1.7% 70.8 2.8% EBITDA $16.5 2.7% $125.4 4.9% ($ in millions) Global lift truck market expected to decline modestly, with growth in the EMEA market expected to be more than offset by declines in the Americas and JAPIC markets. Despite market conditions, unit shipments, revenues and parts sales expected to increase in remainder of 2016 but full year 2016 expected to be down modestly. Operating profit and net income expected to be lower with increases in units and parts volumes expected to be offset by higher operating expenses, lower pricing of products and an anticipated shift in sales mix to lift trucks with lower average profit margins. Lower operating profit in first half of the year with improvements coming during the second half Nuvera operating loss expected to be $24 - $27 million in 2016

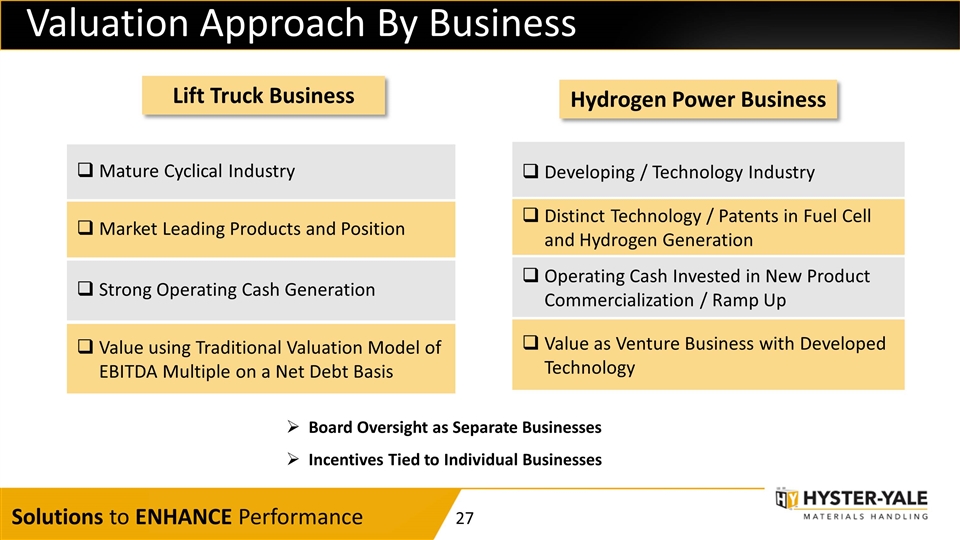

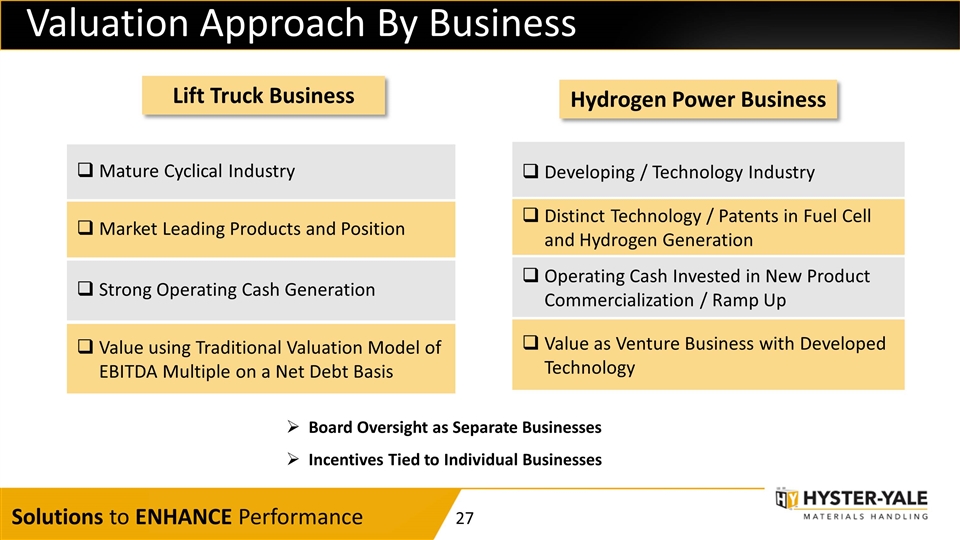

Valuation Approach By Business Lift Truck Business Hydrogen Power Business Board Oversight as Separate Businesses Incentives Tied to Individual Businesses Strong Operating Cash Generation Market Leading Products and Position Mature Cyclical Industry Value using Traditional Valuation Model of EBITDA Multiple on a Net Debt Basis Developing / Technology Industry Distinct Technology / Patents in Fuel Cell and Hydrogen Generation Operating Cash Invested in New Product Commercialization / Ramp Up Value as Venture Business with Developed Technology

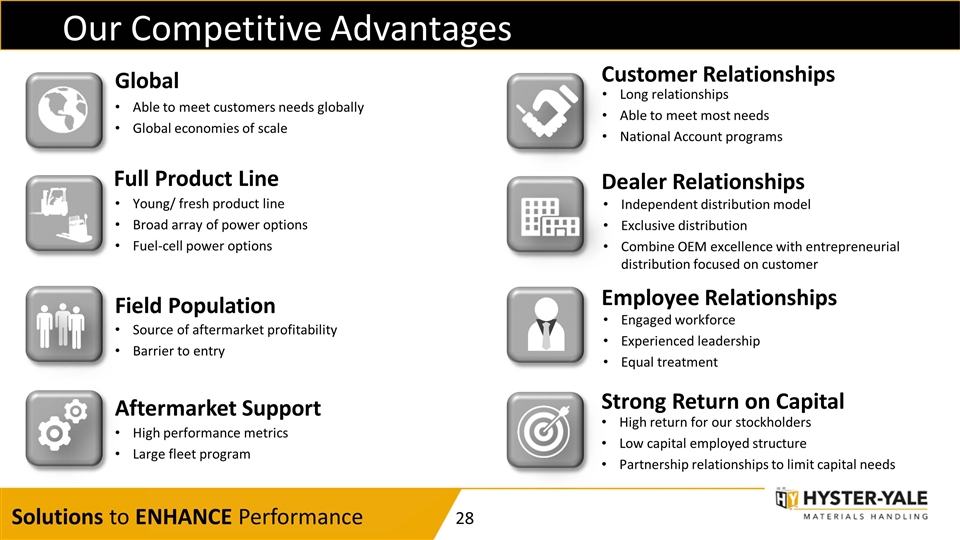

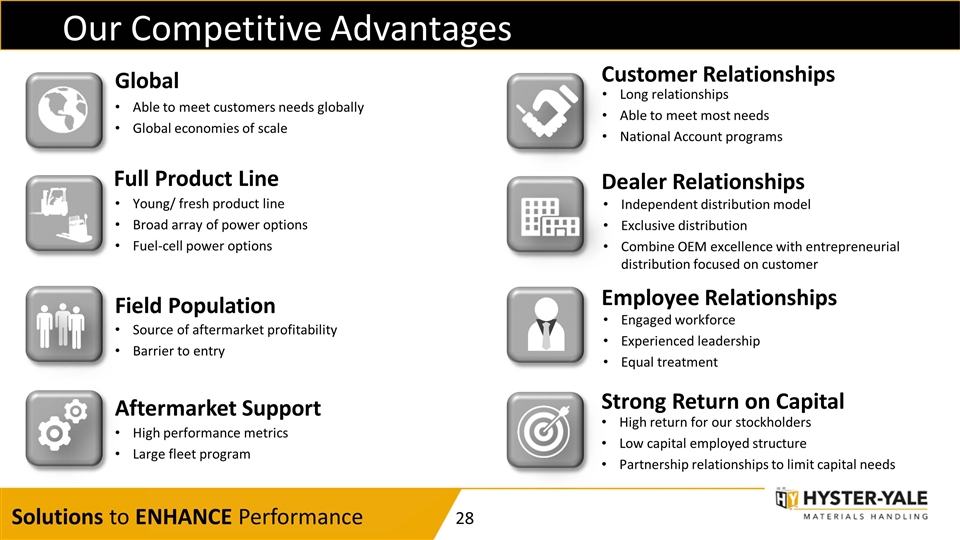

Our Competitive Advantages Able to meet customers needs globally Global economies of scale Young/ fresh product line Broad array of power options Fuel-cell power options Source of aftermarket profitability Barrier to entry Global Full Product Line Field Population Dealer Relationships Independent distribution model Exclusive distribution Combine OEM excellence with entrepreneurial distribution focused on customer Long relationships Able to meet most needs National Account programs Customer Relationships High performance metrics Large fleet program Aftermarket Support Employee Relationships Engaged workforce Experienced leadership Equal treatment High return for our stockholders Low capital employed structure Partnership relationships to limit capital needs Strong Return on Capital

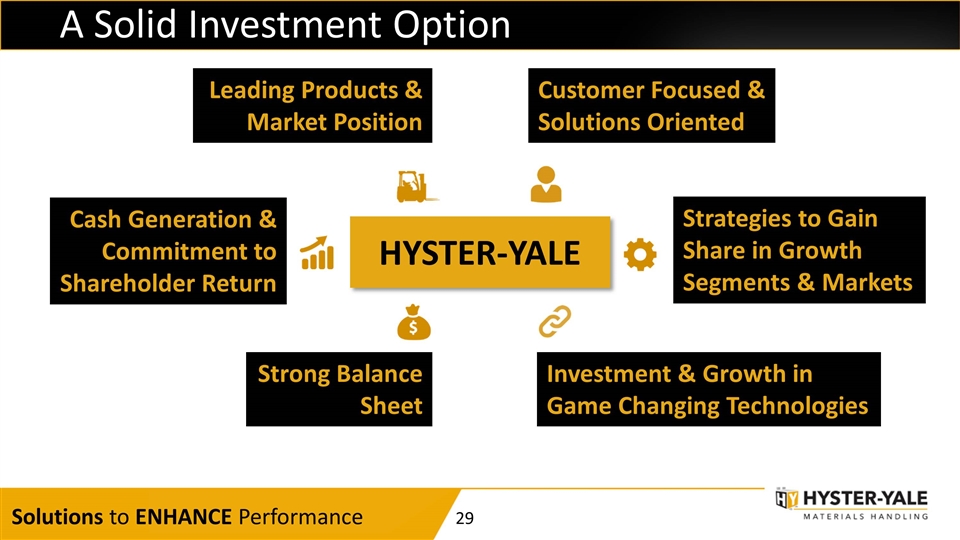

HYSTER-YALE A Solid Investment Option Strong Balance Sheet Cash Generation & Commitment to Shareholder Return Investment & Growth in Game Changing Technologies Leading Products & Market Position Strategies to Gain Share in Growth Segments & Markets Customer Focused & Solutions Oriented

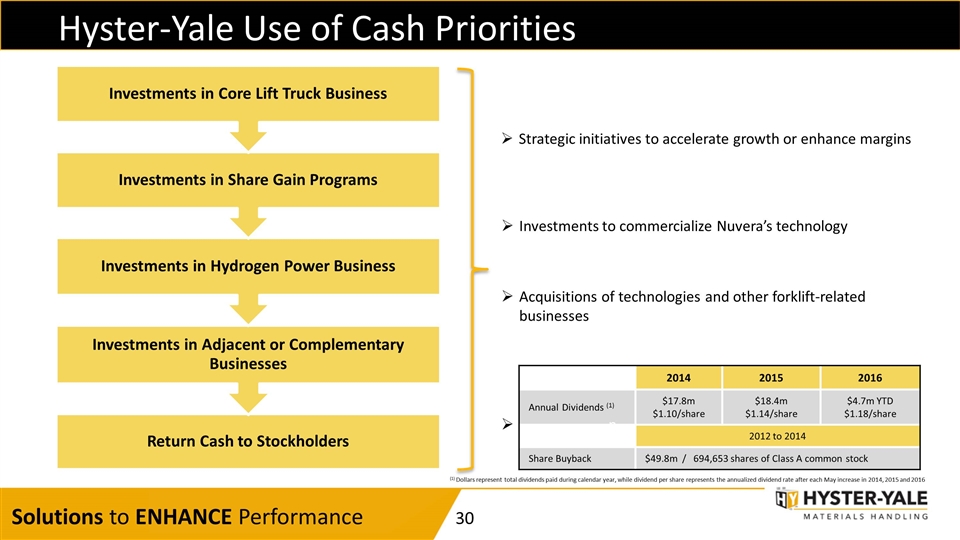

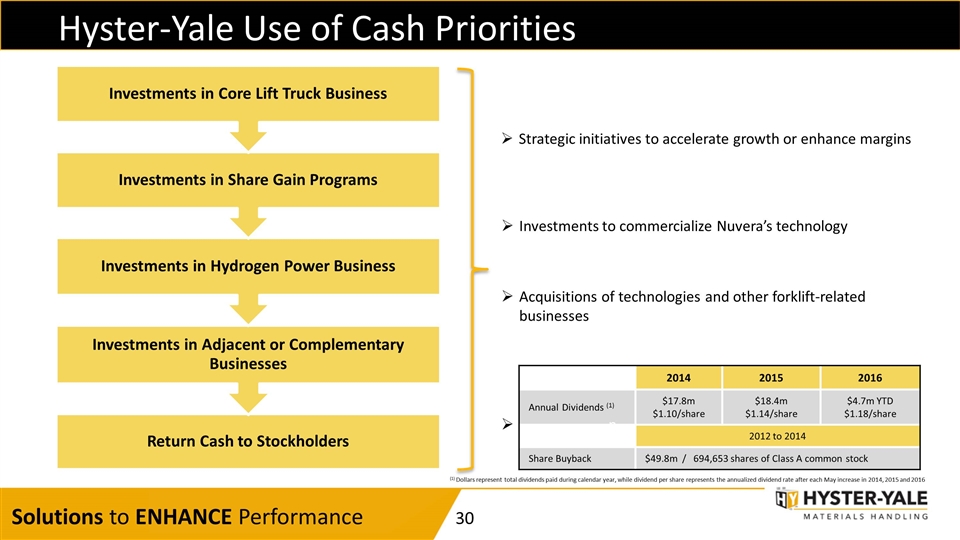

Hyster-Yale Use of Cash Priorities Strategic initiatives to accelerate growth or enhance margins Acquisitions of technologies and other forklift-related businesses 2014 2015 2016 Annual Dividends (1) $17.8m $1.10/share $18.4m $1.14/share $4.7m YTD $1.18/share 2012 to 2014 Share Buyback $49.8m / 694,653 shares of Class A common stock (1) Dollars represent total dividends paid during calendar year, while dividend per share represents the annualized dividend rate after each May increase in 2014, 2015 and 2016 n Investments to commercialize Nuvera’s technology Investments in Core Lift Truck Business Investments in Hydrogen Power Business Return Cash to Stockholders Investments in Adjacent or Complementary Businesses Investments in Share Gain Programs

Solutions to ENHANCE Performance Appendix

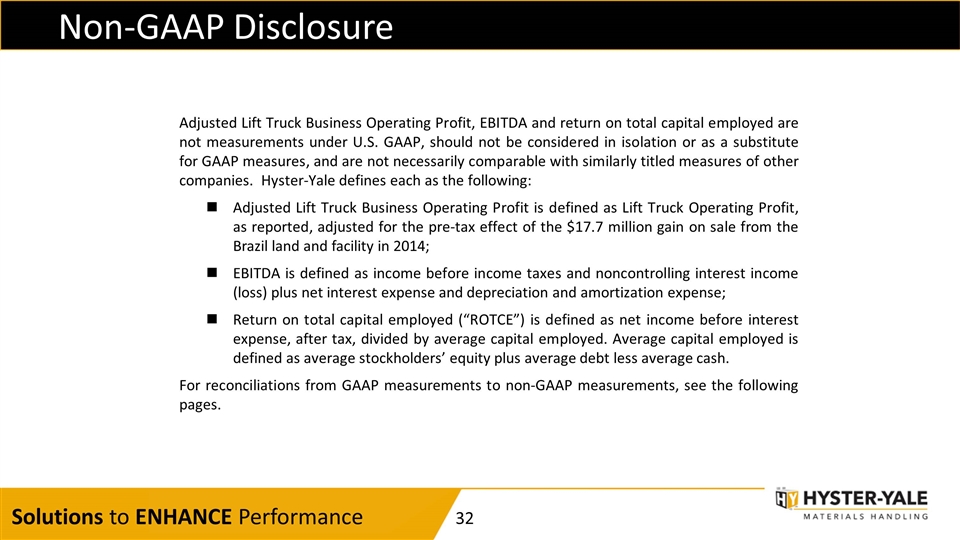

Non-GAAP Disclosure Adjusted Lift Truck Business Operating Profit, EBITDA and return on total capital employed are not measurements under U.S. GAAP, should not be considered in isolation or as a substitute for GAAP measures, and are not necessarily comparable with similarly titled measures of other companies. Hyster-Yale defines each as the following: Adjusted Lift Truck Business Operating Profit is defined as Lift Truck Operating Profit, as reported, adjusted for the pre-tax effect of the $17.7 million gain on sale from the Brazil land and facility in 2014; EBITDA is defined as income before income taxes and noncontrolling interest income (loss) plus net interest expense and depreciation and amortization expense; Return on total capital employed (“ROTCE”) is defined as net income before interest expense, after tax, divided by average capital employed. Average capital employed is defined as average stockholders’ equity plus average debt less average cash. For reconciliations from GAAP measurements to non-GAAP measurements, see the following pages.

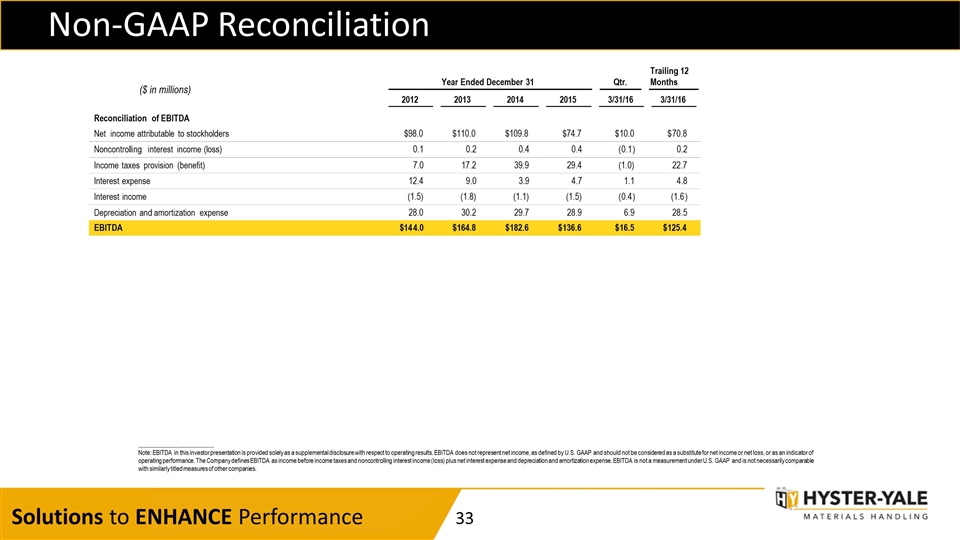

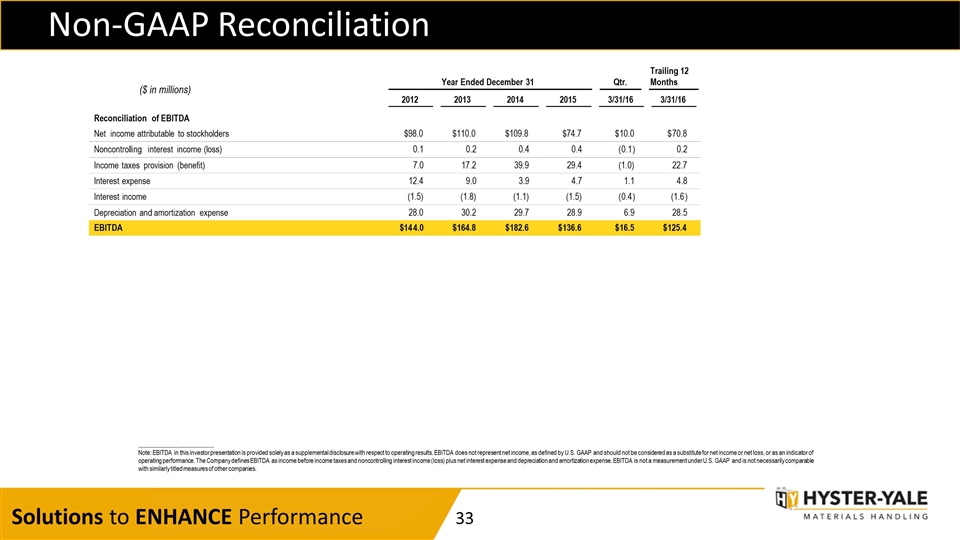

Non-GAAP Reconciliation ($ in millions) _____________________ Note: EBITDA in this investor presentation is provided solely as a supplemental disclosure with respect to operating results. EBITDA does not represent net income, as defined by U.S. GAAP and should not be considered as a substitute for net income or net loss, or as an indicator of operating performance. The Company defines EBITDA as income before income taxes and noncontrolling interest income (loss) plus net interest expense and depreciation and amortization expense. EBITDA is not a measurement under U.S. GAAP and is not necessarily comparable with similarly titled measures of other companies. Year Ended December 31 Qtr. Trailing 12 Months 2012 2013 2014 2015 3/31/16 3/31/16 Reconciliation of EBITDA Net income attributable to stockholders $98.0 $110.0 $109.8 $74.7 $ 10.0 $ 70.8 Noncontrolling i nterest income (loss) 0.1 0.2 0.4 0.4 ( 0.1 ) 0.2 Income taxes provision (benefit) 7.0 17.2 39.9 29.4 (1.0) 22.7 Interest expense 12.4 9.0 3.9 4.7 1.1 4. 8 Interest income (1.5) (1.8) (1.1) (1.5) ( 0.4 ) (1.6 ) Depreciation and amortization expense 28.0 30.2 29.7 28.9 6.9 28. 5 EBITDA $14 4.0 $ 164.8 $ 182.6 $ 136.6 $ 16.5 $ 125.4

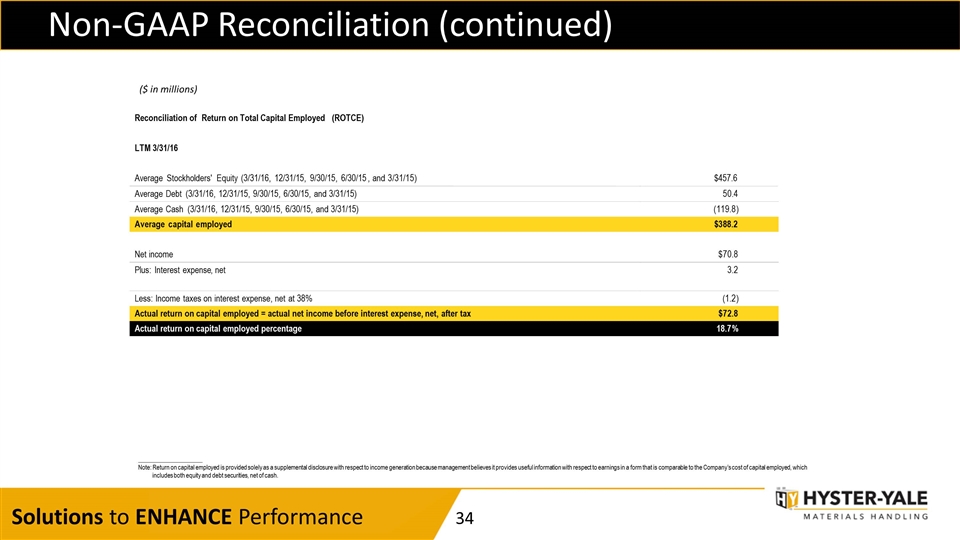

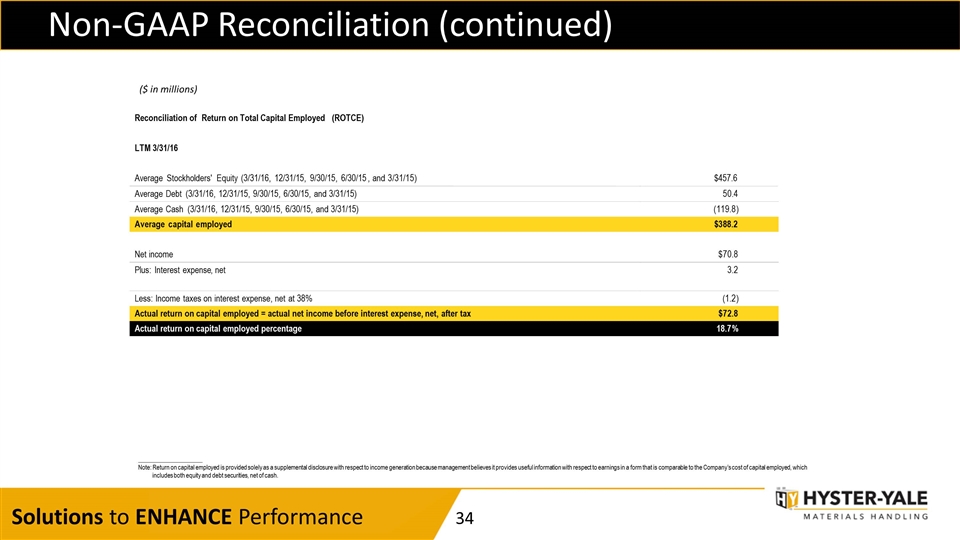

Non-GAAP Reconciliation (continued) ($ in millions) _____________________ Note: Return on capital employed is provided solely as a supplemental disclosure with respect to income generation because management believes it provides useful information with respect to earnings in a form that is comparable to the Company’s cost of capital employed, which includes both equity and debt securities, net of cash. Reconciliation of Return on Total Capital Employed (ROTCE) LTM 3/31/16 Average Stockholders' Equity ( 3/31/16, 12/31/15, 9/30/15, 6/30/15 , and 3 /3 1 /1 5 ) $ 457.6 Average Debt (3/31/16, 12/31/15, 9/30/15, 6/30/15, and 3/31/15) 5 0.4 Average Cash (3/31/16, 12/31/15, 9/30/15, 6/30/15, and 3/31/15) ( 11 9.8 ) A verage c apital e mployed $ 3 88.2 Net income $ 7 0.8 Plus: Interest expense , net 3.2 Less: Income taxes on interest expense , net at 38% ( 1.2 ) Actual return on capital employed = actual net income before interest expense, net, after tax $ 7 2.8 Actual return on capital employed percentage 18.7 %

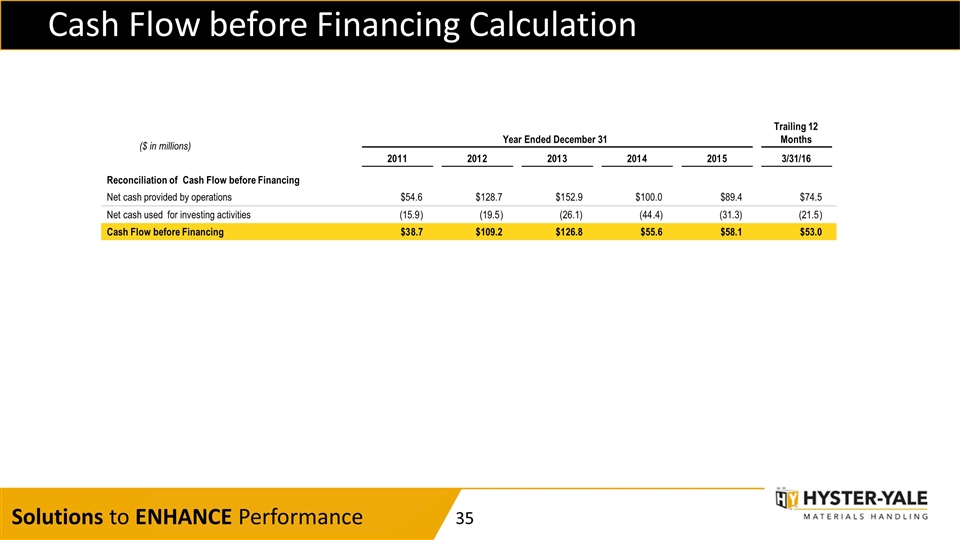

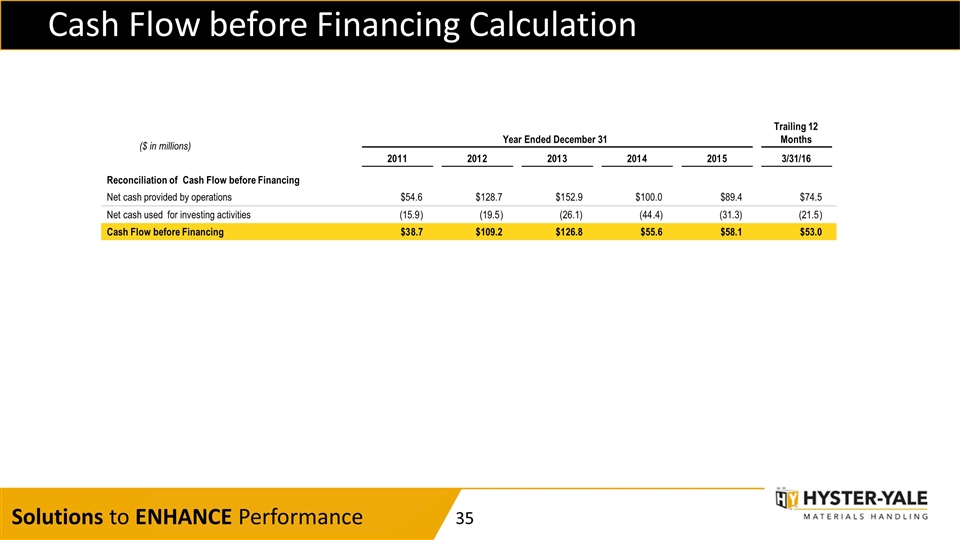

Cash Flow before Financing Calculation ($ in millions) Year Ended December 31 Trailing 12 Months 20 1 1 201 2 201 3 201 4 201 5 3/31/16 Reconciliation of Cash Flow before Financing Net cash provided by operations $54.6 $ 128.7 $1 52.9 $ 100.0 $89.4 $ 74.5 Net cash used for investing activities (15.9 ) (19.5 ) ( 26.1) ( 44 . 4) (31.3) (21.5 ) Cash Flow before Financing $3 8.7 $ 109.2 $1 26.8 $ 55.6 $58.1 $ 53.0

Supplemental Information Solutions to ENHANCE Performance

The History of Hyster-Yale and its brands Hyster founded in Portland, Oregon as the Willamette Ersted Company 1929 1944 Company name officially changed to Hyster Company 1875 Yale Lock Mfg. broadens its scope into materials handling 1963 Yale forklift truck business merges with Eaton Mfg. Industrial Truck Division 1971 Yale forges a partnership with Sumitomo Ltd 1989 Hyster and Yale merge to form NACCO Materials Handling Group (NMHG) 2012 1985 Yale acquired by NACCO Industries 1989 Hyster acquired by NACCO Industries Hyster-Yale formed as independent public company following spin-off by NACCO 2011 NMHG introduces the UTILEV lift truck for the utility segment of the market 2014 NMHG, HY’s operating company, acquires Nuvera to enter the fast-growing hydrogen fuel cell market 2016 2016 NMHG renamed Hyster-Yale Group HY acquired majority interest in Bolzoni S.p.A.

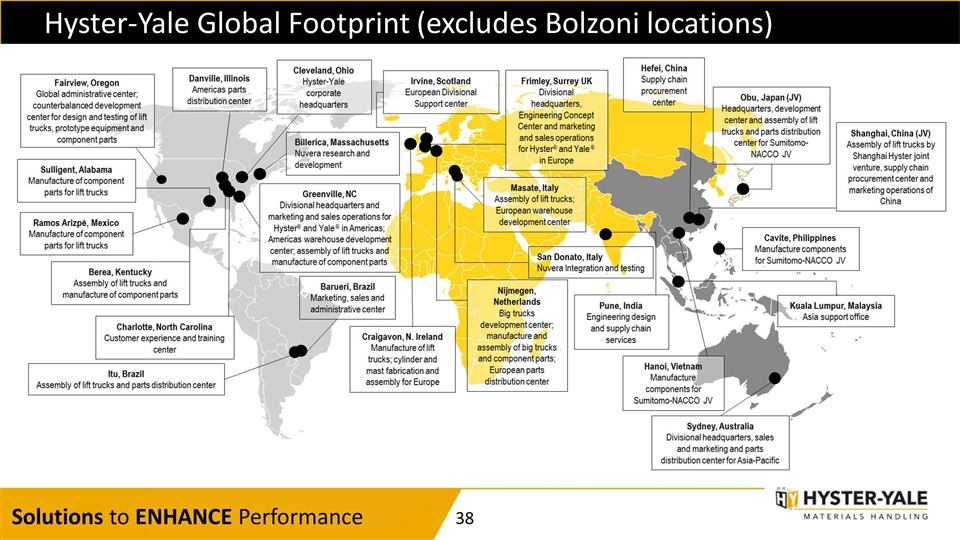

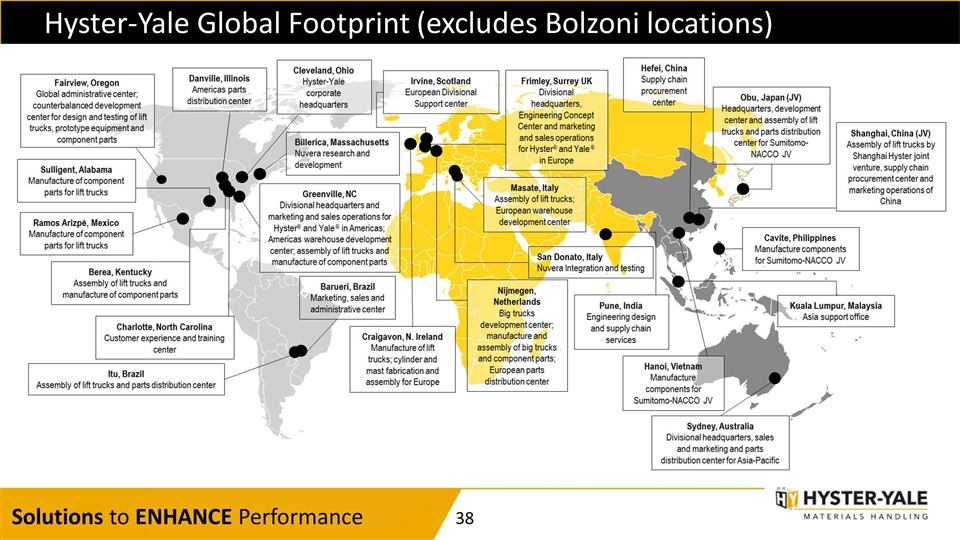

Hyster-Yale Global Footprint (excludes Bolzoni locations)

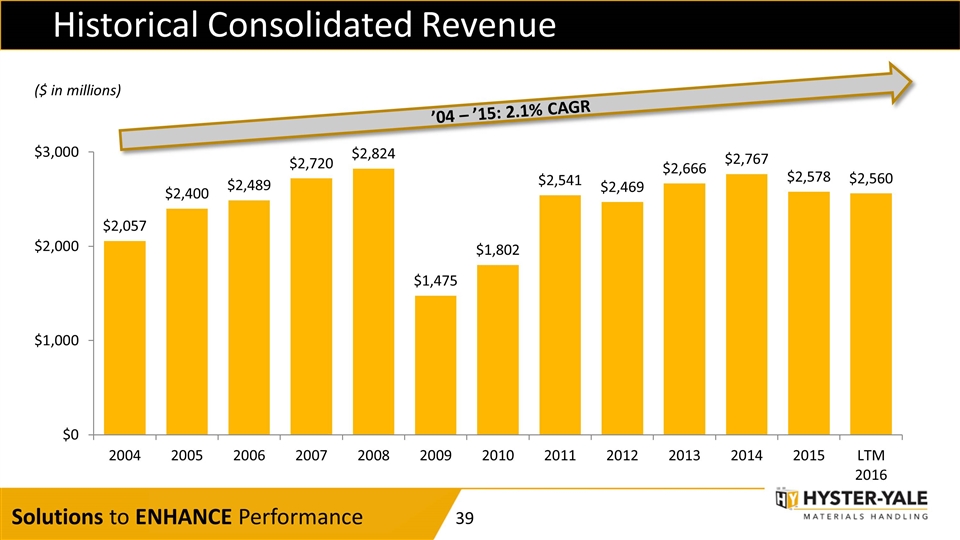

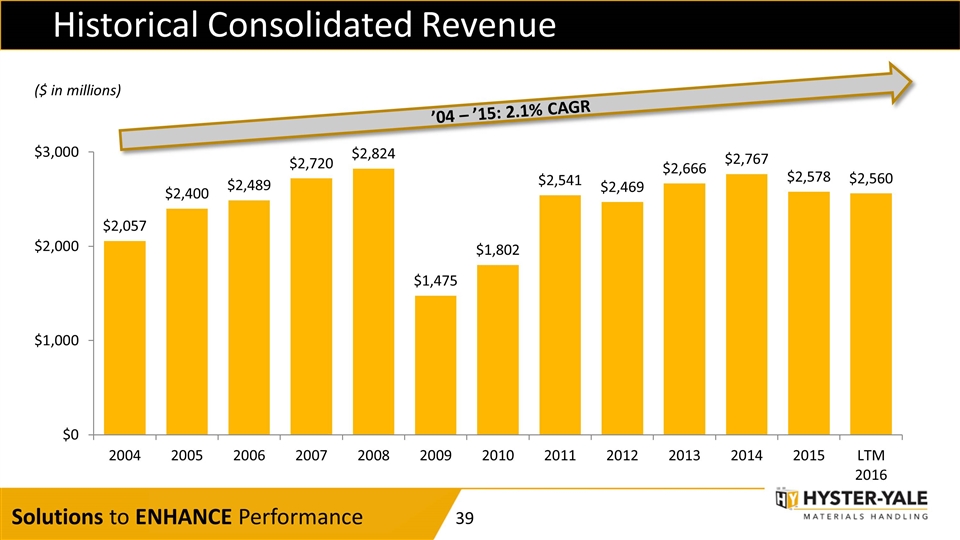

Historical Consolidated Revenue ’04 – ’15: 2.1% CAGR ($ in millions)

_____________________ Lift Truck Segment Operating Profit, as reported Adjusted Lift Truck Segment Operating Profit, which excludes a $17.7 million pre-tax gain on the sale of the Brazil land and facility, is a non-GAAP measure and should not be considered in isolation or as a substitute for the GAAP measure. Management believes that this measure assists the investor in understanding the results of operations. For discussion of non-GAAP items and the related reconciliations to GAAP measures, see information in the Appendix starting on page 32. ($ in millions) 2.4% Gap Closure Prior Cycle Market Peak Mid-Cycle Market Lift Truck Business Operating Profit Trends and % of Sales 7% TARGET

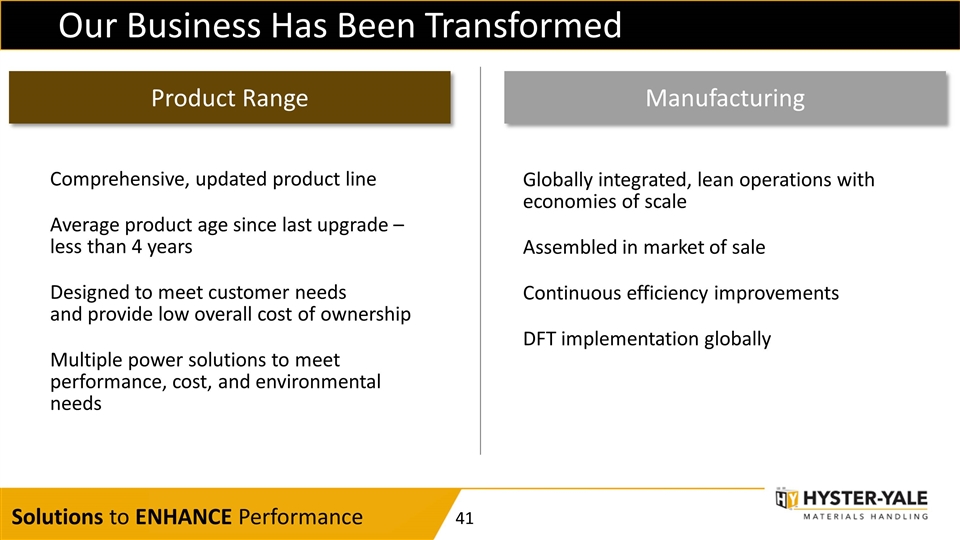

Our Business Has Been Transformed Comprehensive, updated product line Average product age since last upgrade – less than 4 years Designed to meet customer needs and provide low overall cost of ownership Multiple power solutions to meet performance, cost, and environmental needs Product Range Manufacturing Globally integrated, lean operations with economies of scale Assembled in market of sale Continuous efficiency improvements DFT implementation globally

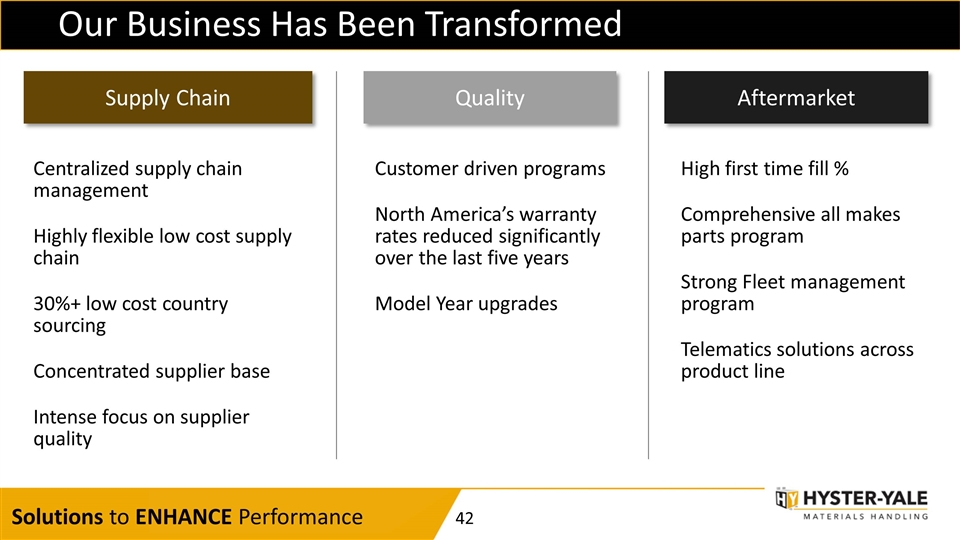

Our Business Has Been Transformed Centralized supply chain management Highly flexible low cost supply chain 30%+ low cost country sourcing Concentrated supplier base Intense focus on supplier quality Supply Chain Aftermarket Quality Customer driven programs North America’s warranty rates reduced significantly over the last five years Model Year upgrades High first time fill % Comprehensive all makes parts program Strong Fleet management program Telematics solutions across product line

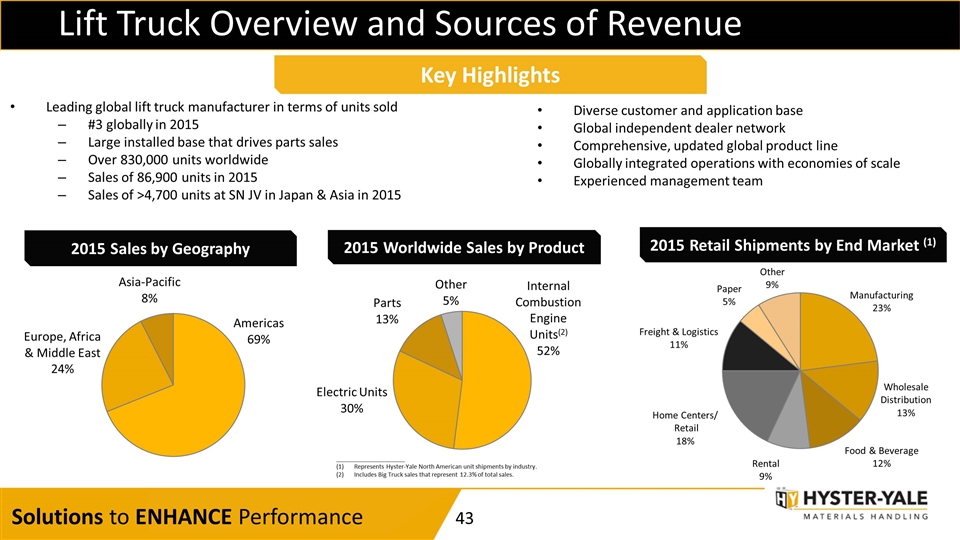

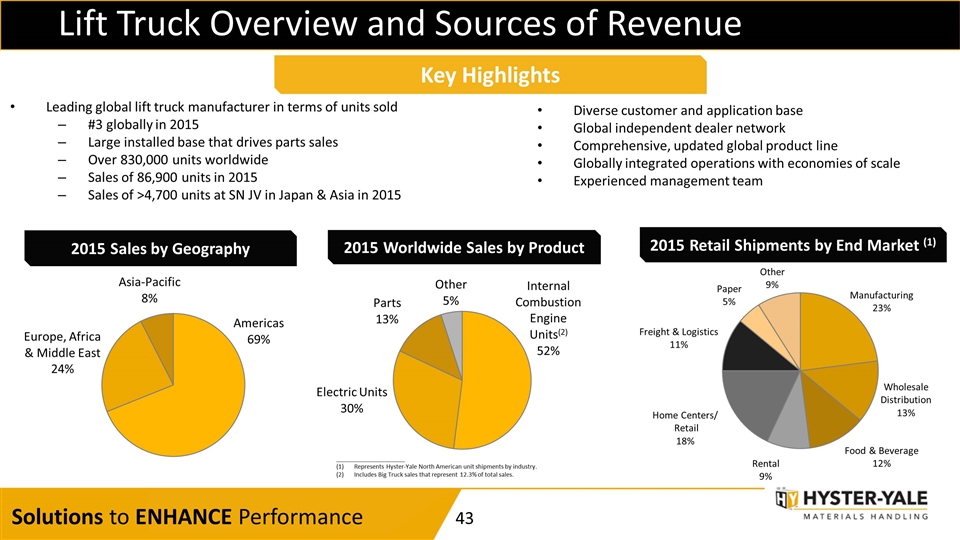

Lift Truck Overview and Sources of Revenue Leading global lift truck manufacturer in terms of units sold #3 globally in 2015 Large installed base that drives parts sales Over 830,000 units worldwide Sales of 86,900 units in 2015 Sales of >4,700 units at SN JV in Japan & Asia in 2015 2015 Worldwide Sales by Product 2015 Sales by Geography 2015 Retail Shipments by End Market (1) _____________________ Represents Hyster-Yale North American unit shipments by industry. Includes Big Truck sales that represent 12.3% of total sales. Key Highlights Diverse customer and application base Global independent dealer network Comprehensive, updated global product line Globally integrated operations with economies of scale Experienced management team

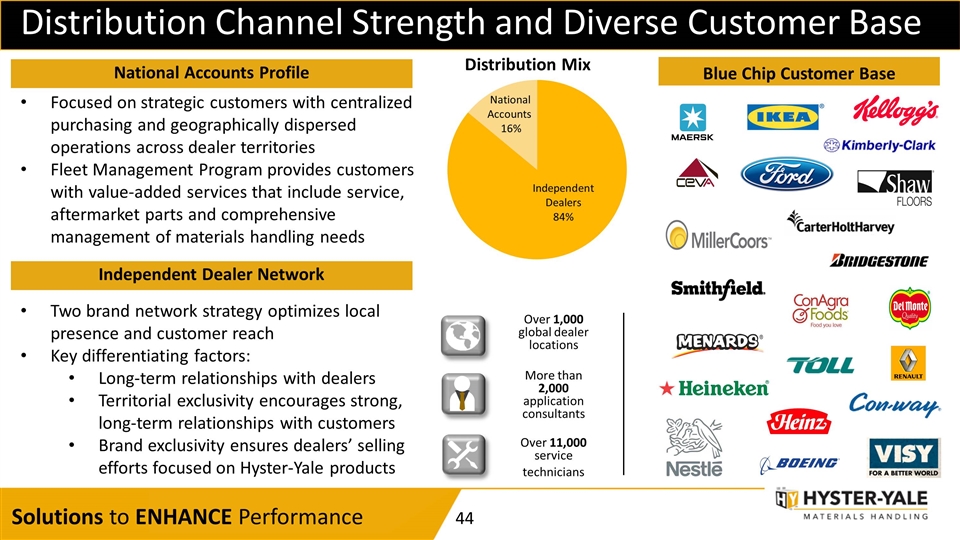

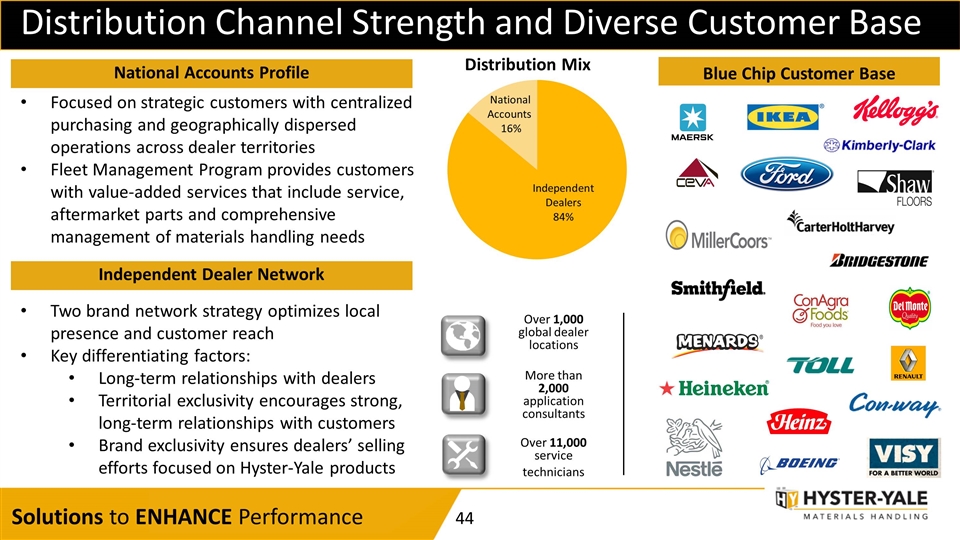

Distribution Channel Strength and Diverse Customer Base Blue Chip Customer Base Over 1,000 global dealer locations More than 2,000 application consultants Over 11,000 service technicians National Accounts Profile Independent Dealer Network Focused on strategic customers with centralized purchasing and geographically dispersed operations across dealer territories Fleet Management Program provides customers with value-added services that include service, aftermarket parts and comprehensive management of materials handling needs Two brand network strategy optimizes local presence and customer reach Key differentiating factors: Long-term relationships with dealers Territorial exclusivity encourages strong, long-term relationships with customers Brand exclusivity ensures dealers’ selling efforts focused on Hyster-Yale products National Accounts 16% Independent Dealers 84%

Positive Environment to Gain Share and Margin Performance Over Next Two Years Product gaps filled to position Hyster-Yale in most application segments and improve margins Second-tier competitors in the ICE segment more vulnerable due to their weak economies of scale position Key warehouse segment competitors are regional Key Big Truck segment competitors are niche Over the longer-term, as core strategic initiatives are executed and mature, share gains are expected to occur

Our Long-Term Philosophy Long-term growth Long-term shareholders Shareholder protection Senior management incentivized as long-term shareholders Increase shareholder value Return on Capital Employed and Market Share Increase focus