Q4 2018 Investor Presentation Exhibit 99 Solutions that DRIVE Productivity

Safe Harbor Statement & Disclosure This presentation includes forward-looking comments subject to important risks and uncertainties. It may also contain financial measures that are not in conformance with accounting principles generally accepted in the United States of America (GAAP). Refer to Hyster-Yale’s reports filed on Forms 8-K (current), 10-Q (quarterly), and 10-K (annual) for information on factors that could cause actual results to differ materially from information in this presentation and for information reconciling financial measures to GAAP. Past performance may not be representative of future results. Guidance noted in the following slides was effective as of the Company’s most recent earnings release and conference call (February 27, 2019). Nothing in this presentation should be construed as reaffirming or disaffirming such guidance. This presentation is not an offer to sell or a solicitation of offers to buy any of Hyster-Yale’s securities.

Key Perspectives Global markets expected to be strong for next few years Investments to expand HY’s product and solutions portfolio and geographic breadth and depth Core lift truck programs aim to trigger organic growth through intensified industry and customer focus Nuvera remains a venture business with developed technology; breakeven plan in place Lift Truck business objective of 7% operating profit margin in the medium term through execution of key projects, with an added focus on progressive revenue growth and achieving ROTCE above 20% Pricing raised to offset tariffs but cost/price differential lag through first half 2019 Stable Market Foundation with Strong Growth Drivers: Automation, Alternative Energy & the Rise of E-commerce Supply chain challenges have delayed shipments but are being addressed

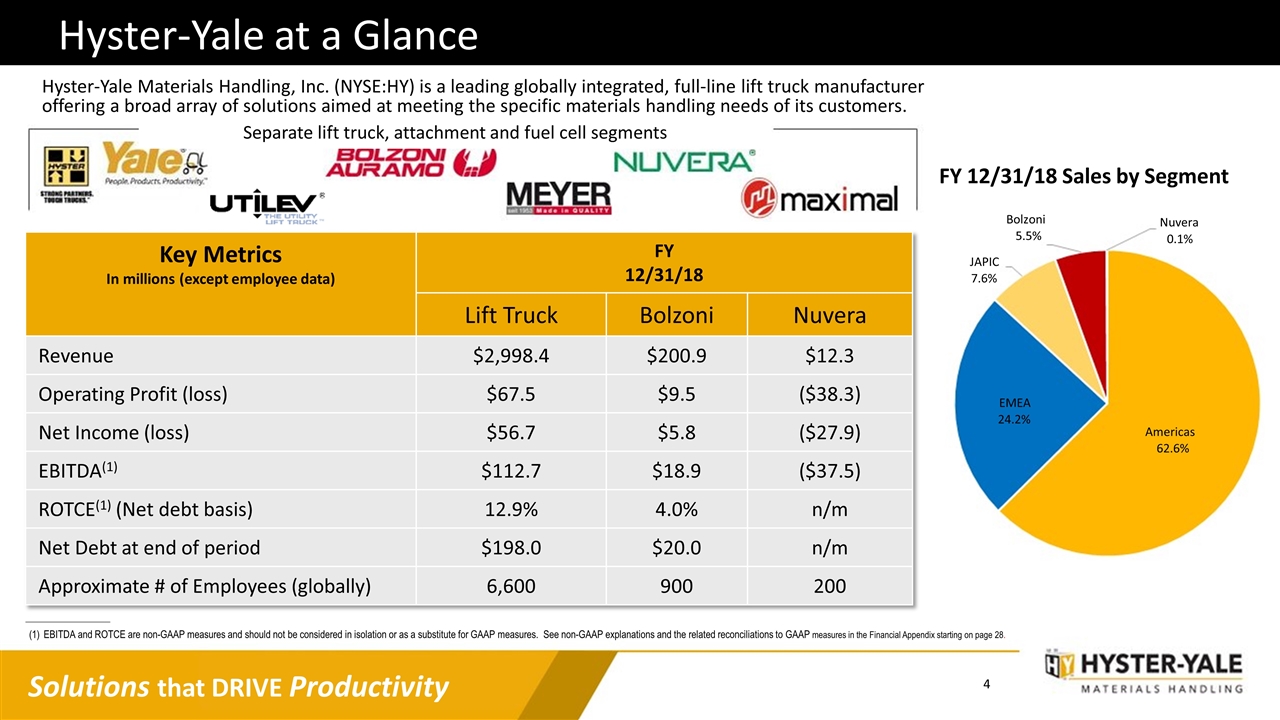

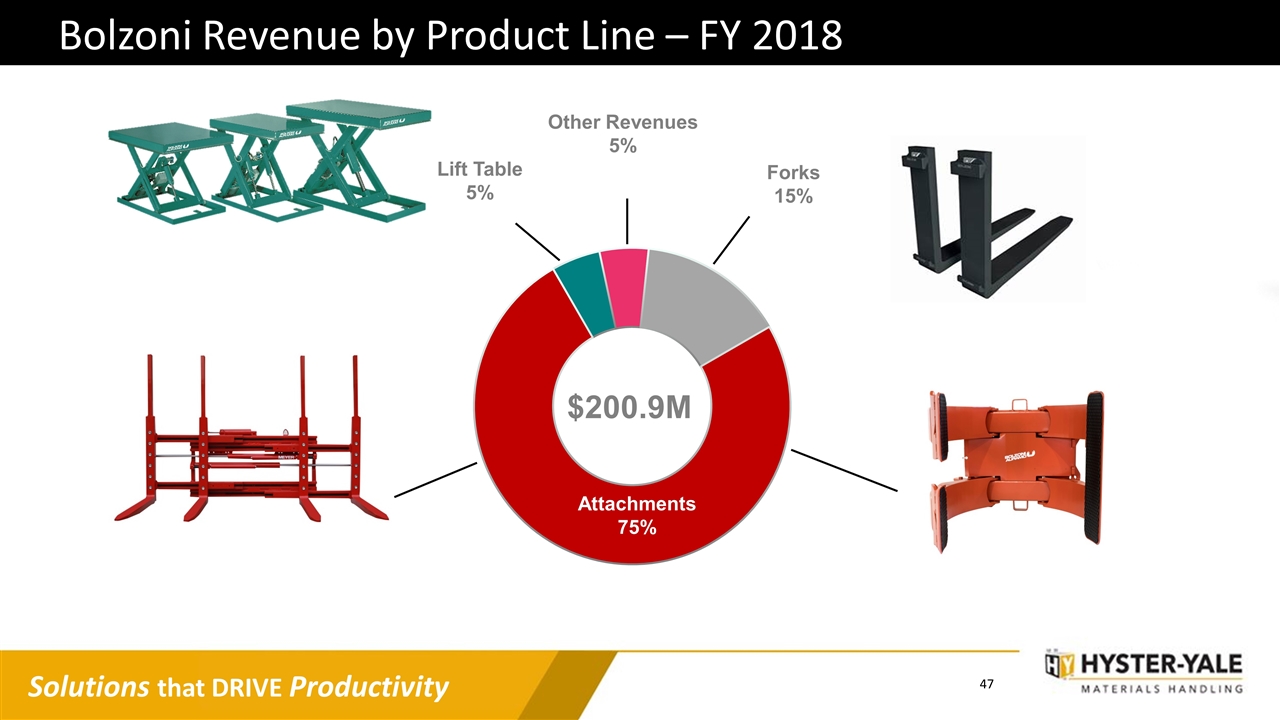

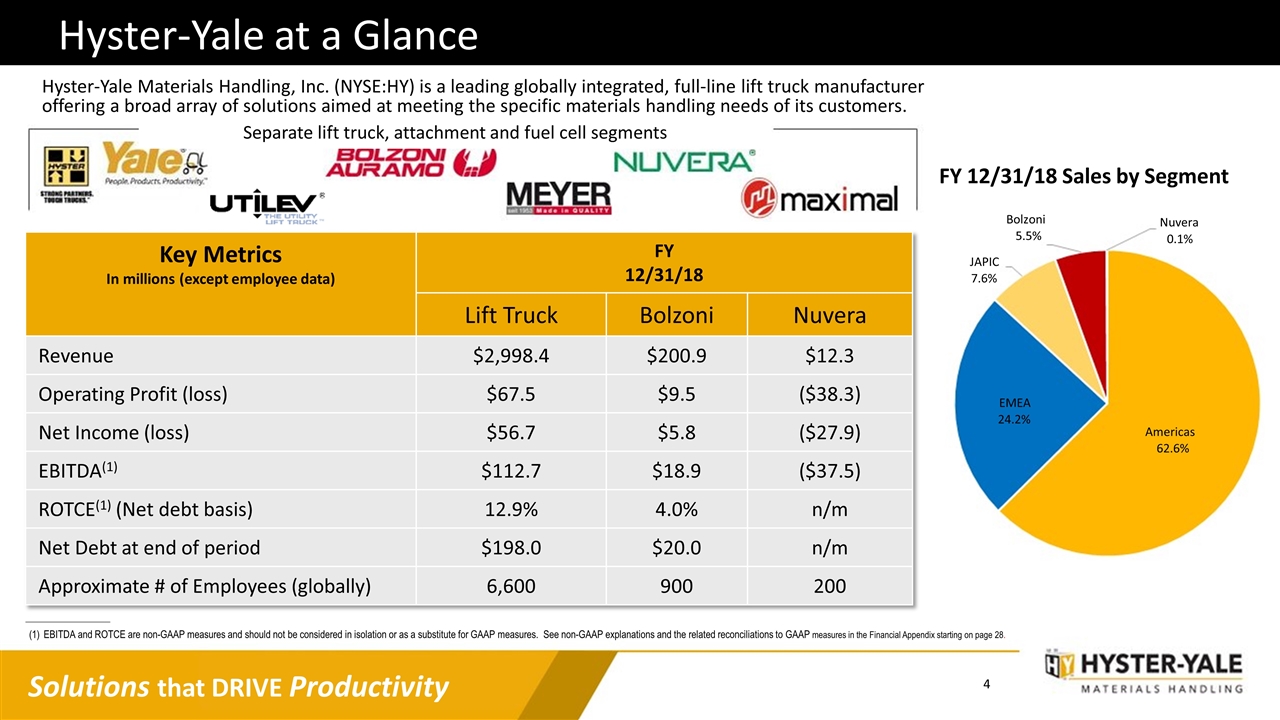

Hyster-Yale at a Glance Hyster-Yale Materials Handling, Inc. (NYSE:HY) is a leading globally integrated, full-line lift truck manufacturer offering a broad array of solutions aimed at meeting the specific materials handling needs of its customers. _____________________ EBITDA and ROTCE are non-GAAP measures and should not be considered in isolation or as a substitute for GAAP measures. See non-GAAP explanations and the related reconciliations to GAAP measures in the Financial Appendix starting on page 28. Key Metrics In millions (except employee data) FY 12/31/18 Lift Truck Bolzoni Nuvera Revenue $2,998.4 $200.9 $12.3 Operating Profit (loss) $67.5 $9.5 ($38.3) Net Income (loss) $56.7 $5.8 ($27.9) EBITDA(1) $112.7 $18.9 ($37.5) ROTCE(1) (Net debt basis) 12.9% 4.0% n/m Net Debt at end of period $198.0 $20.0 n/m Approximate # of Employees (globally) 6,600 900 200 FY 12/31/18 Sales by Segment Separate lift truck, attachment and fuel cell segments Americas 62.6% EMEA 24.2% JAPIC 7.6% Bolzoni 5.5% Nuvera 0.1%

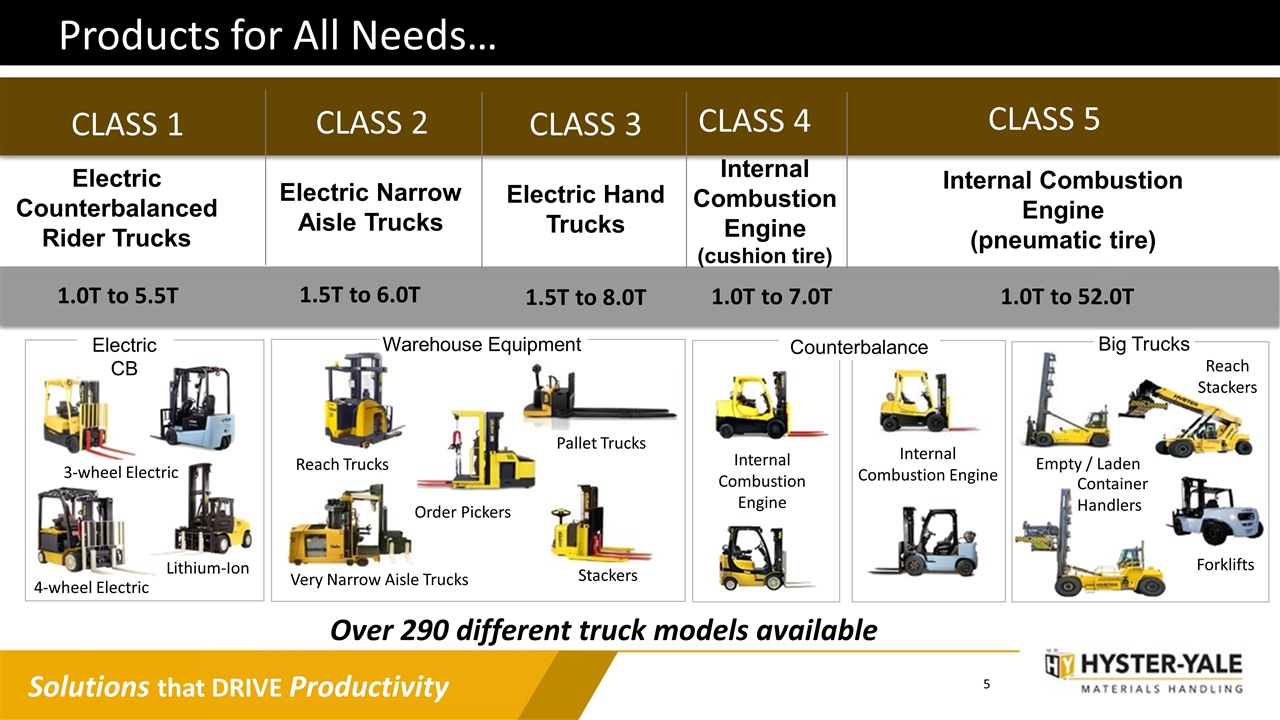

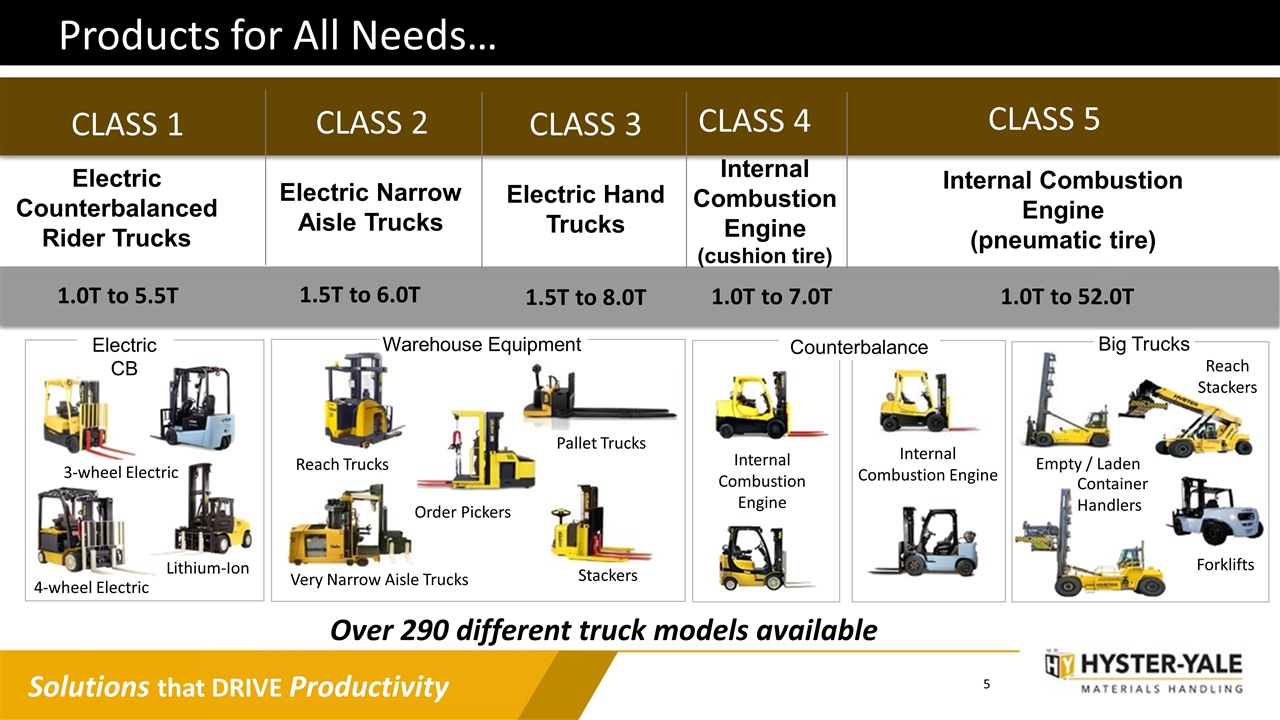

Forklifts Internal Combustion Engine Lithium-Ion Reach Stackers Very Narrow Aisle Trucks Products for All Needs… Electric Counterbalanced Rider Trucks Electric Narrow Aisle Trucks Electric Hand Trucks Internal Combustion Engine (cushion tire) Internal Combustion Engine (pneumatic tire) 3-wheel Electric 4-wheel Electric Pallet Trucks Stackers Order Pickers Reach Trucks Empty / Laden CLASS 1 CLASS 2 CLASS 3 CLASS 4 CLASS 5 Over 290 different truck models available Container Handlers Internal Combustion Engine 1.0T to 5.5T 1.5T to 6.0T 1.5T to 8.0T 1.0T to 7.0T 1.0T to 52.0T Electric CB Warehouse Equipment Counterbalance Big Trucks

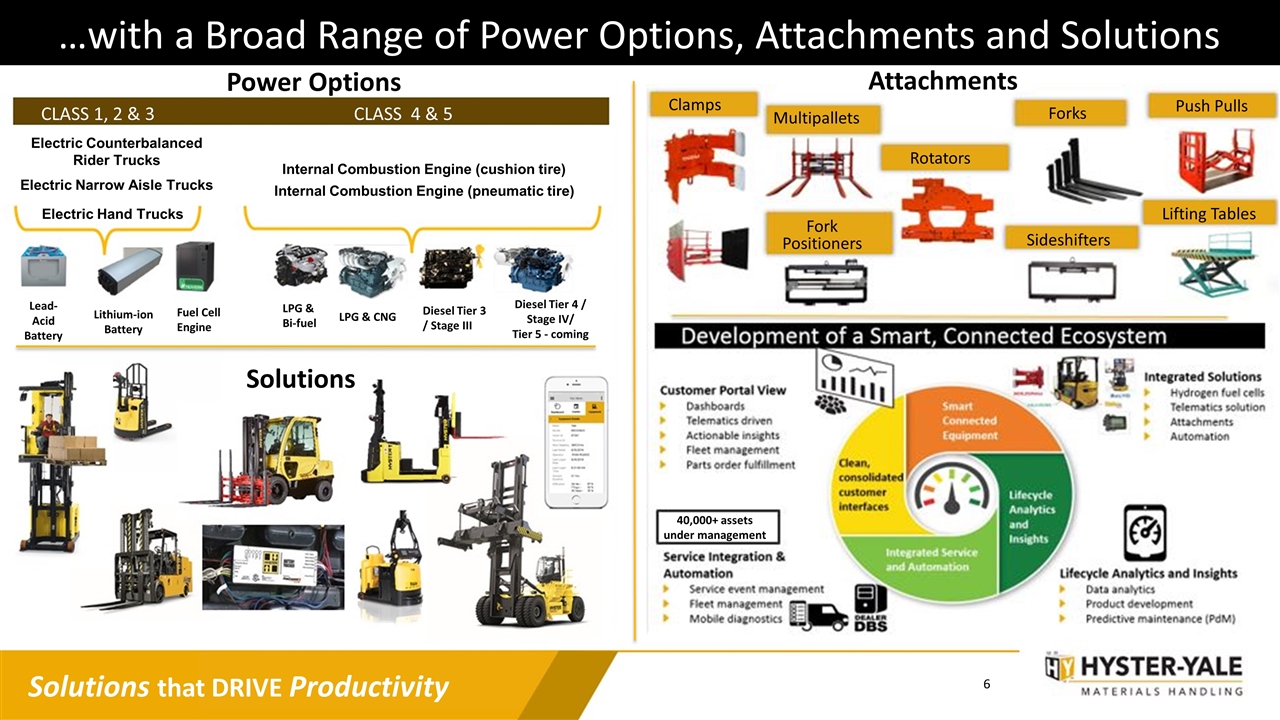

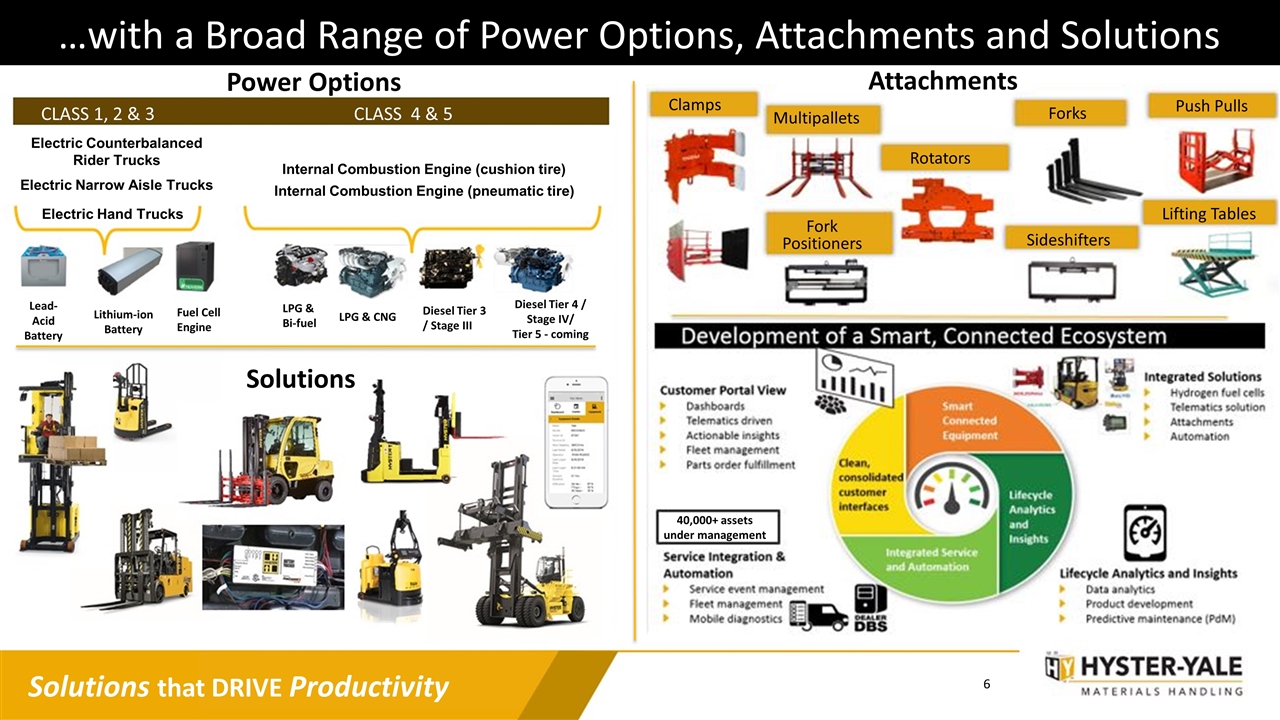

…with a Broad Range of Power Options, Attachments and Solutions Push Pulls Lifting Tables Electric Counterbalanced Rider Trucks Electric Narrow Aisle Trucks Electric Hand Trucks Internal Combustion Engine (cushion tire) Internal Combustion Engine (pneumatic tire) Fuel Cell Engine LPG & Bi-fuel Diesel Tier 3 / Stage III LPG & CNG Diesel Tier 4 / Stage IV/ Tier 5 - coming Lithium-ion Battery Clamps Multipallets Rotators Sideshifters Fork Positioners Forks Power Options Attachments Solutions Lead-Acid Battery CLASS 1, 2 & 3 CLASS 4 & 5 40,000+ assets under management Solutions that DRIVE Productivity

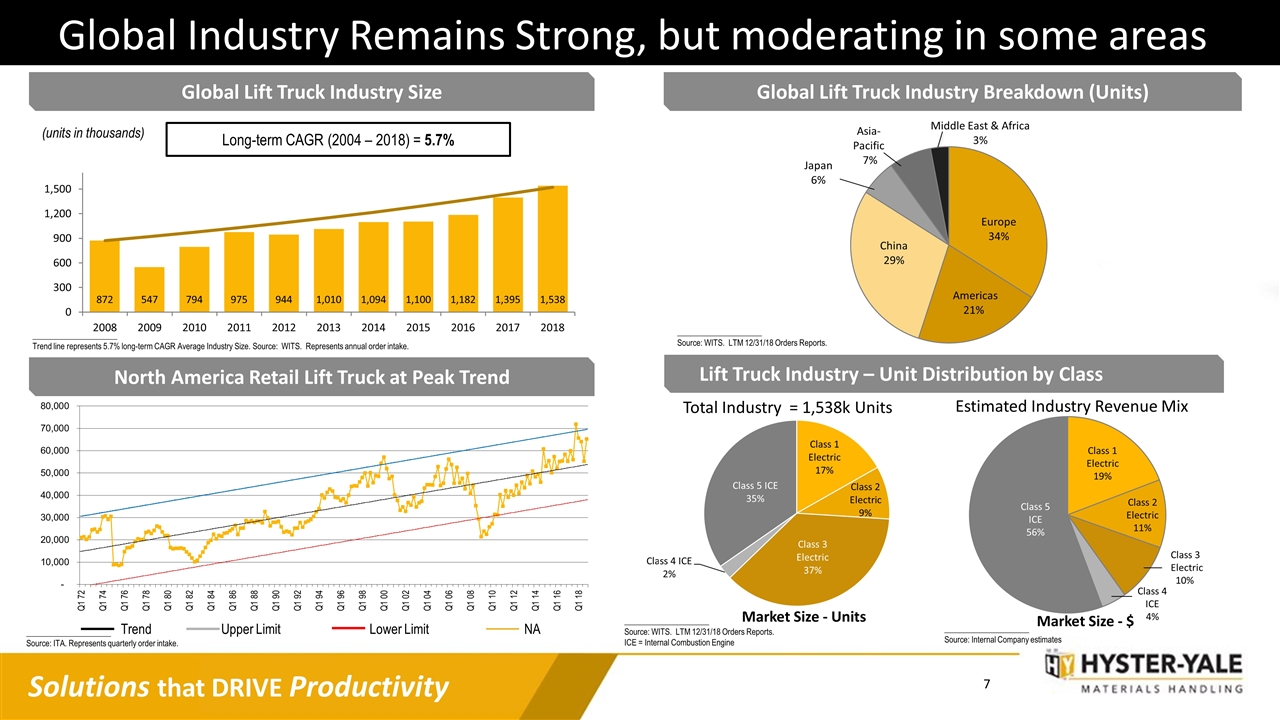

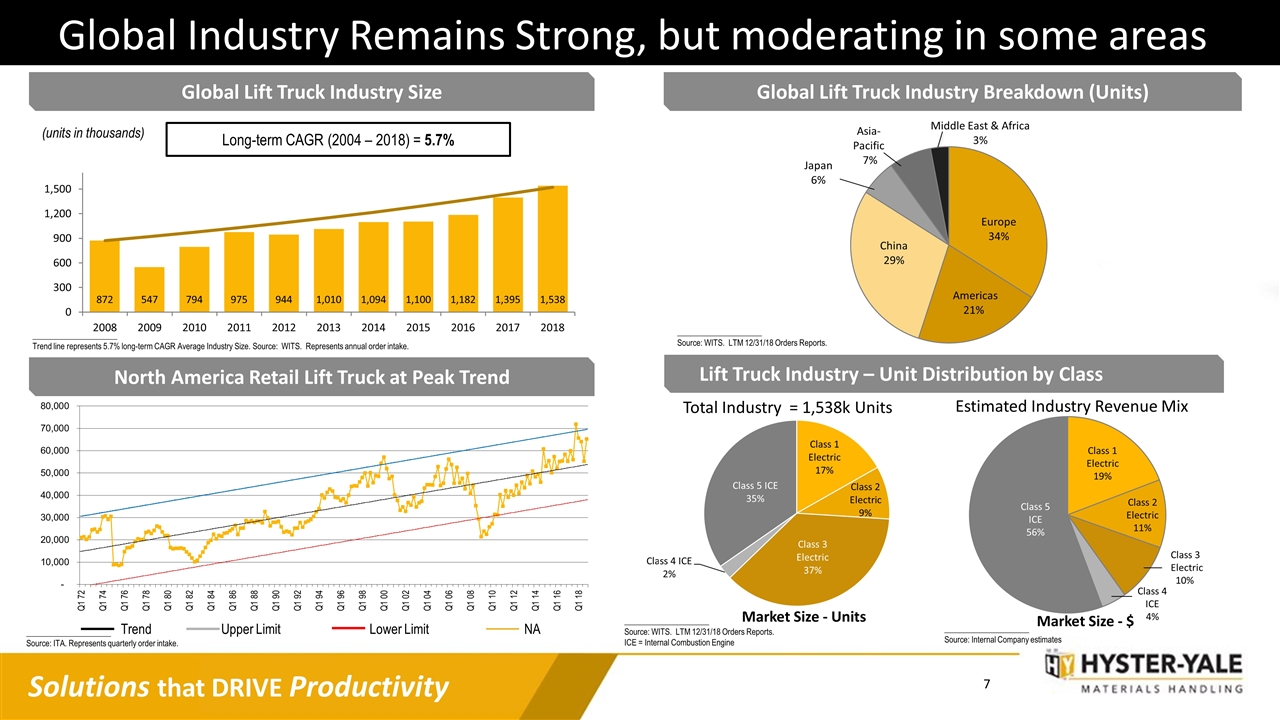

Global Industry Remains Strong, but moderating in some areas Long-term CAGR (2004 – 2018) = 5.7% _____________________ Source: ITA. Represents quarterly order intake. (units in thousands) Global Lift Truck Industry Size _____________________ Trend line represents 5.7% long-term CAGR Average Industry Size. Source: WITS. Represents annual order intake. North America Retail Lift Truck at Peak Trend _____________________ Source: WITS. LTM 12/31/15 Orders Reports. Lift Truck Industry – Unit Distribution by Class _____________________ Source: WITS. LTM 12/31/18 Orders Reports. ICE = Internal Combustion Engine Total Industry = 1,538k Units Class 4 ICE 4% Market Size - $ _____________________ Source: Internal Company estimates Market Size - Units Class 5 ICE 56% Class 1 Electric 19% Class 2 Electric 11% Class 3 Electric 10% Estimated Industry Revenue Mix _____________________ Source: WITS. LTM 12/31/18 Orders Reports. Global Lift Truck Industry Breakdown (Units) Trend Upper Limit Lower Limit NA

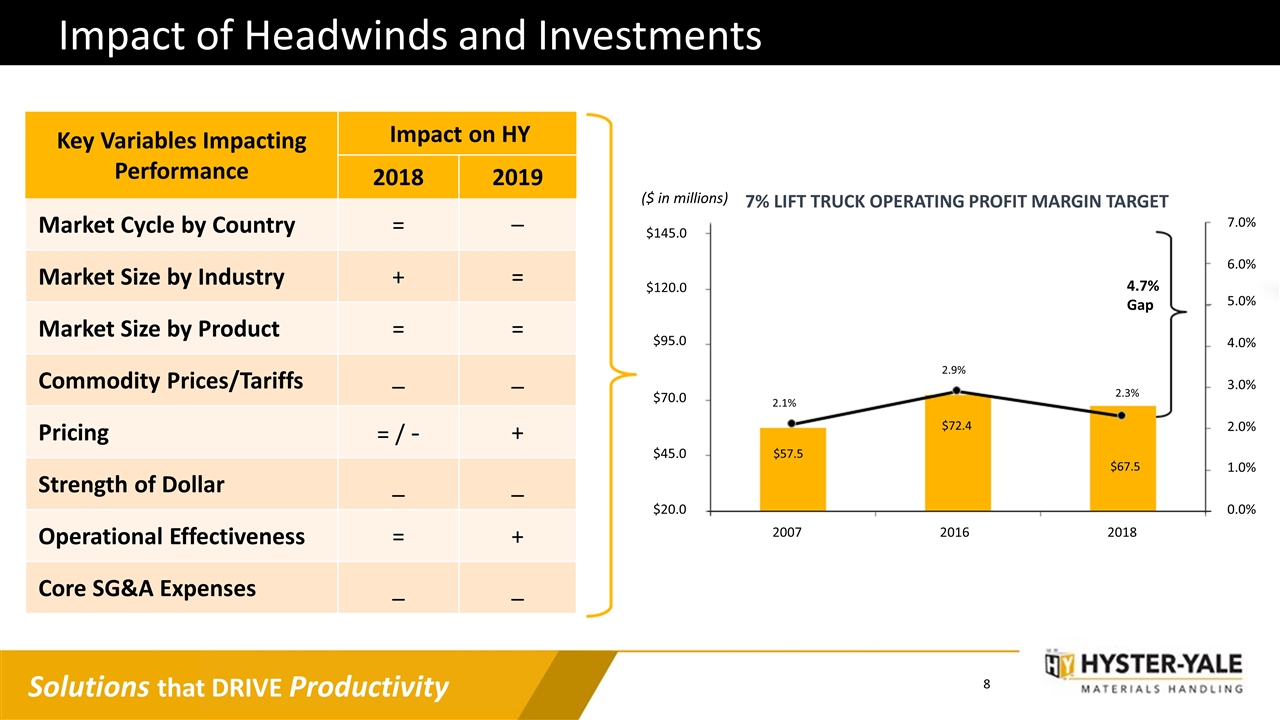

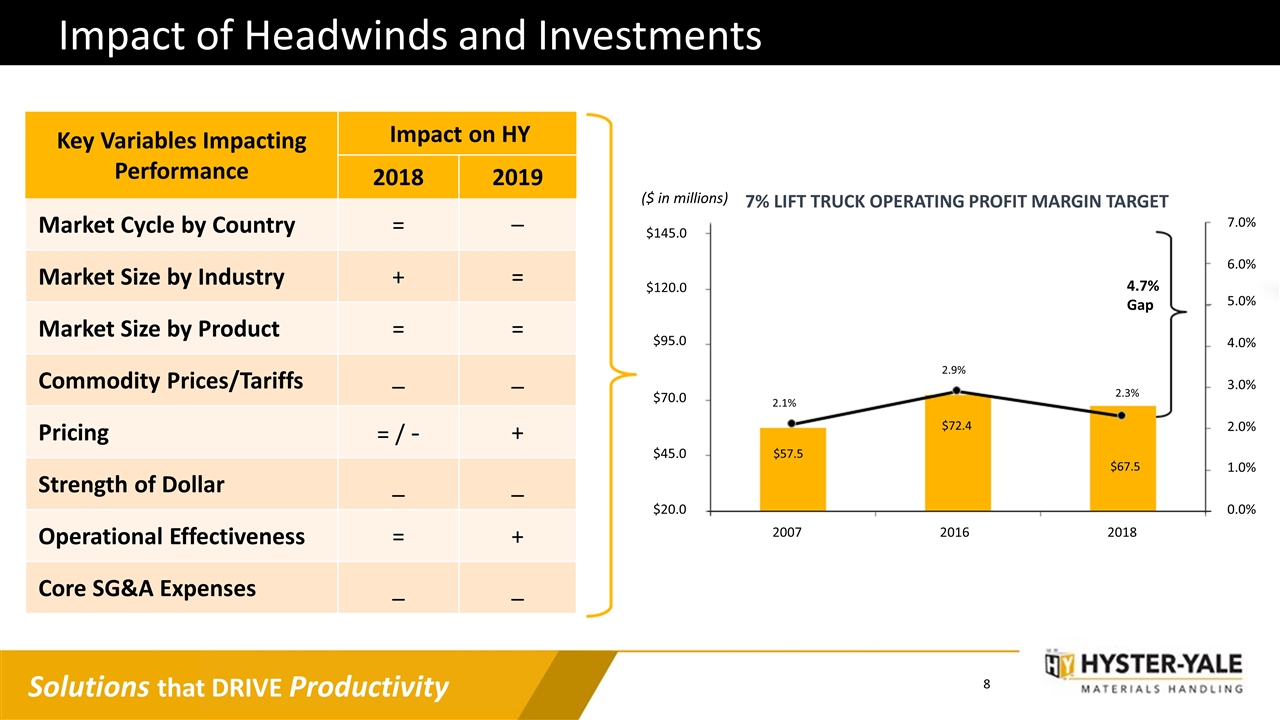

Impact of Headwinds and Investments Key Variables Impacting Performance Impact on HY 2018 2019 Market Cycle by Country = _ Market Size by Industry + = Market Size by Product = = Commodity Prices/Tariffs _ _ Pricing = / - + Strength of Dollar _ _ Operational Effectiveness = + Core SG&A Expenses _ _ ($ in millions) 7% LIFT TRUCK OPERATING PROFIT MARGIN TARGET 4.7% Gap $57.5 $72.4 $67.5 2.1% 2.9% 2.3% 2007 2016 2018 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% $20.0 $45.0 $70.0 $95.0 $120.0 $145.0

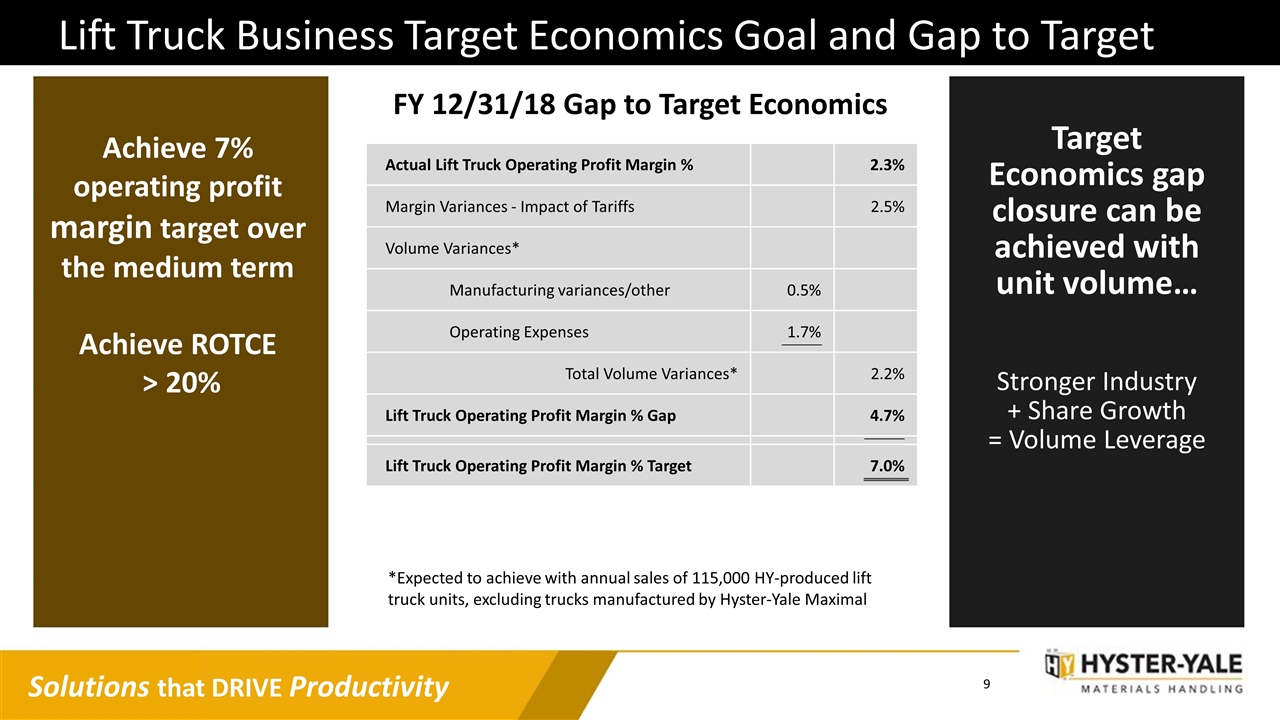

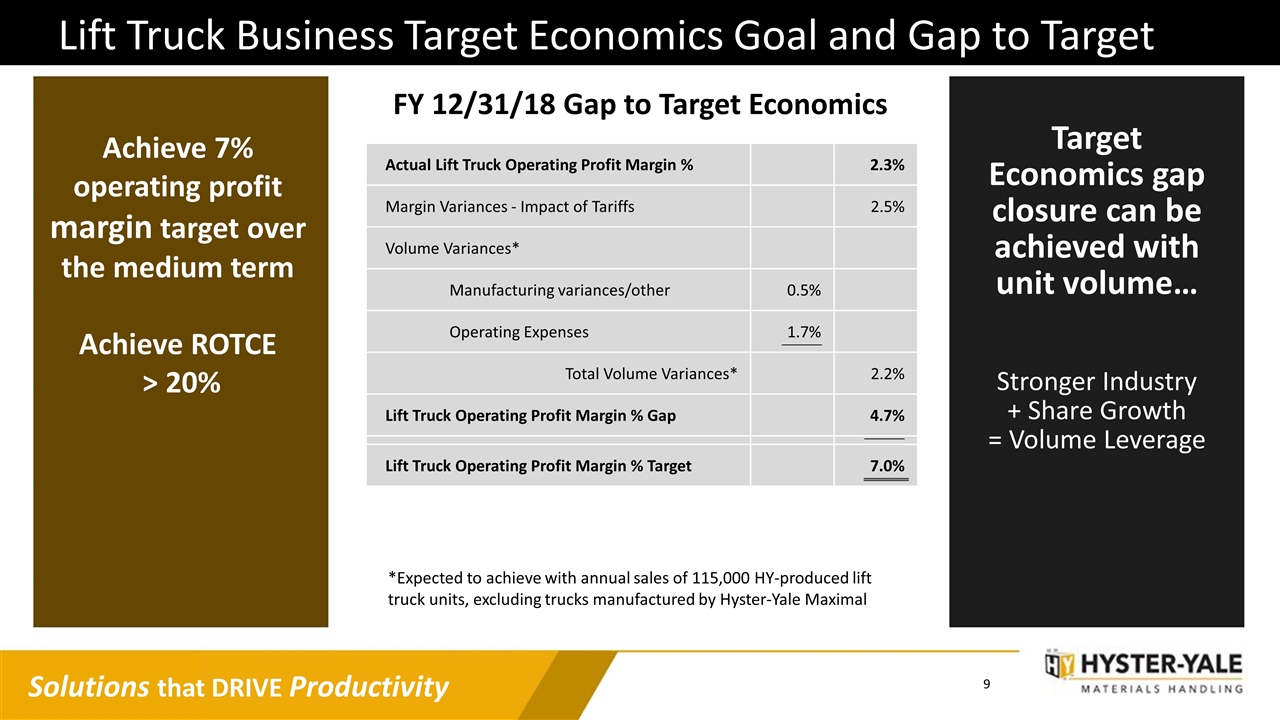

Lift Truck Business Target Economics Goal and Gap to Target Achieve 7% operating profit margin target over the medium term Achieve ROTCE > 20% Target Economics gap closure can be achieved with unit volume… Stronger Industry + Share Growth = Volume Leverage FY 12/31/18 Gap to Target Economics Actual Lift Truck Operating Profit Margin % 2.3% Margin Variances - Impact of Tariffs 2.5% Volume Variances* Manufacturing variances/other 0.5% Operating Expenses 1.7% Total Volume Variances* 2.2% Lift Truck Operating Profit Margin % Gap 4.7% Lift Truck Operating Profit Margin % Target 7.0% *Expected to achieve with annual sales of 115,000 HY-produced lift truck units, excluding trucks manufactured by Hyster-Yale Maximal

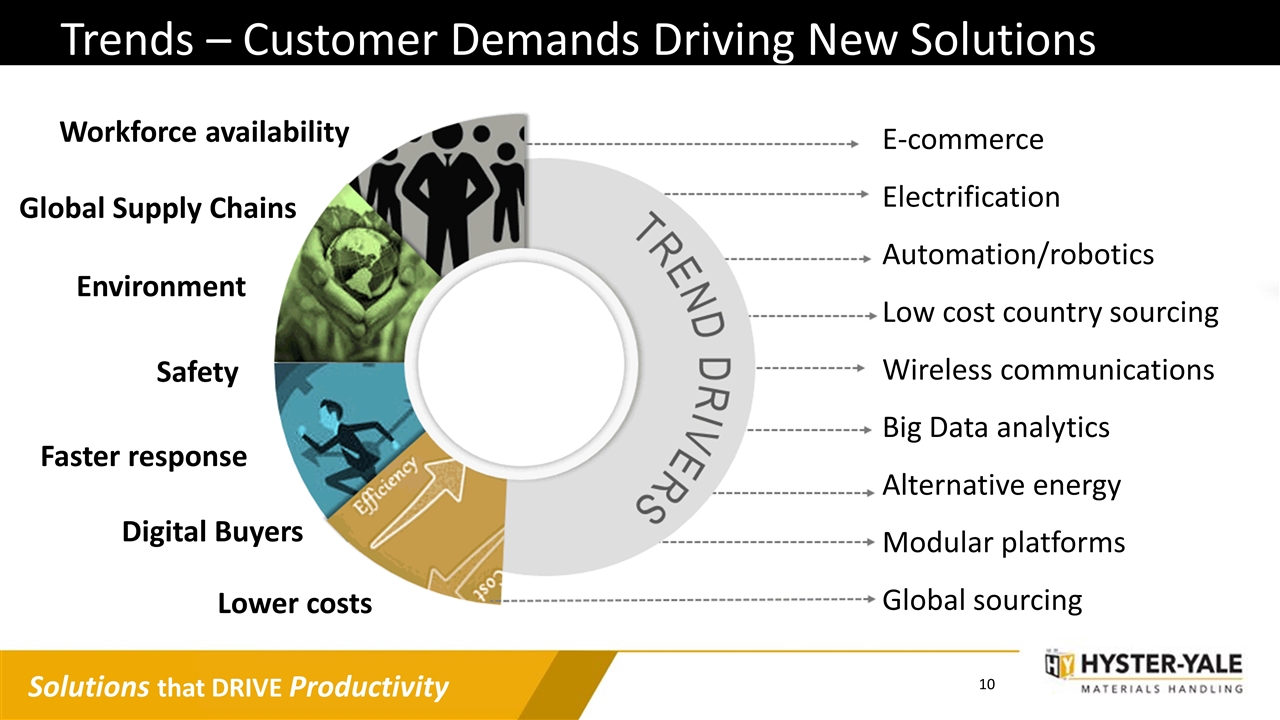

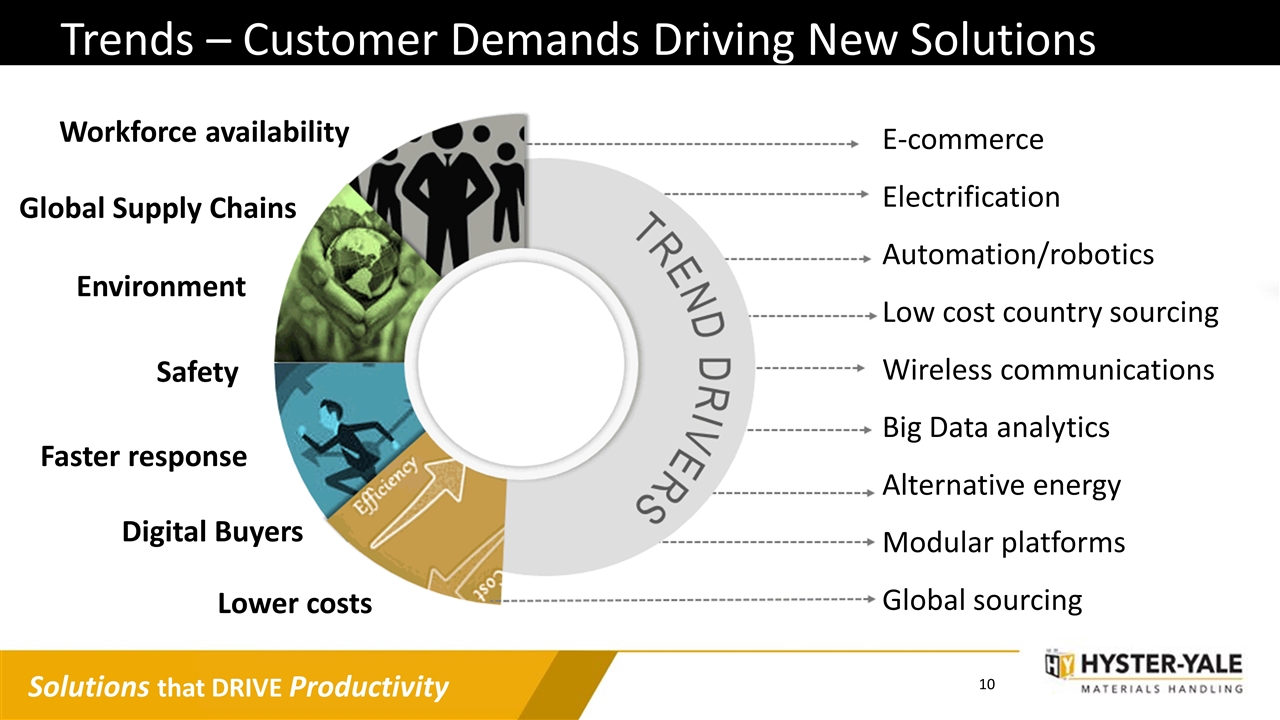

Global Supply Chains Trends – Customer Demands Driving New Solutions Workforce availability Faster response Lower costs Environment E-commerce Electrification Automation/robotics Low cost country sourcing Wireless communications Big Data analytics Alternative energy Modular platforms Global sourcing Digital Buyers Safety

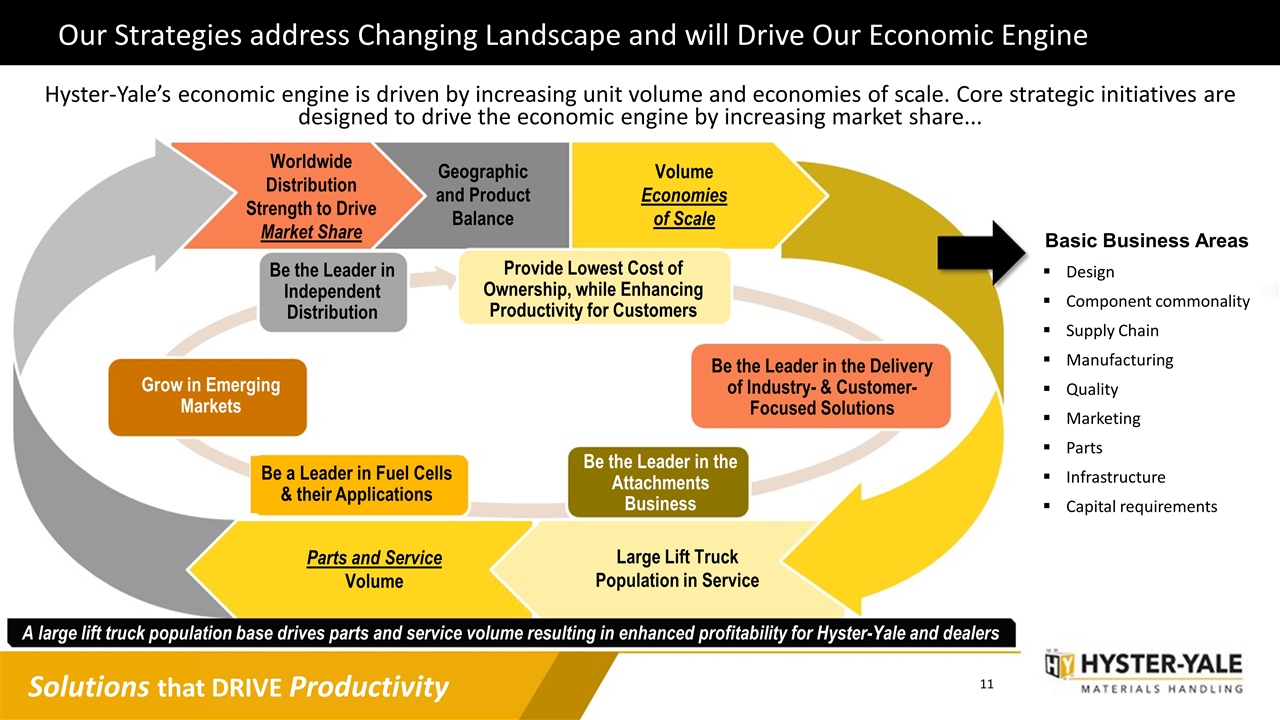

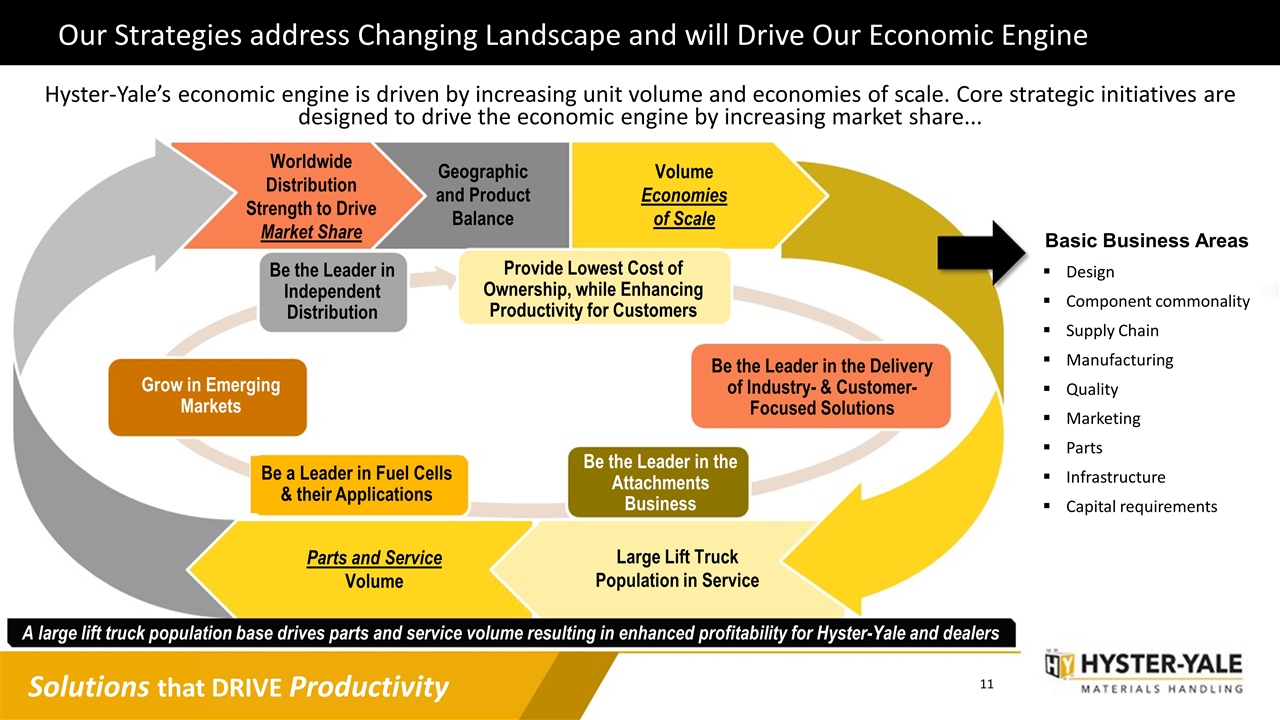

Our Strategies address Changing Landscape and will Drive Our Economic Engine Basic Business Areas Design Component commonality Supply Chain Manufacturing Quality Marketing Parts Infrastructure Capital requirements Hyster-Yale’s economic engine is driven by increasing unit volume and economies of scale. Core strategic initiatives are designed to drive the economic engine by increasing market share... A large lift truck population base drives parts and service volume resulting in enhanced profitability for Hyster-Yale and dealers Be the Leader in the Attachments Business Be a Leader in Fuel Cells & their Applications Grow in Emerging Markets Be the Leader in Independent Distribution Provide Lowest Cost of Ownership, while Enhancing Productivity for Customers Be the Leader in the Delivery of Industry- & Customer-Focused Solutions Solutions that DRIVE Productivity Large Lift Truck Population in Service Parts and Service Volume Worldwide Distribution Strength to Drive Market Share Geographic and Product Balance Volume Economies of Scale

#1: Provide the Lowest Cost of Ownership, while Enhancing Productivity for Customers New RS45 Reachstacker Segmentation – Right Product at Right Price Leads to Lower Cost of Ownership Constant power and refuel as quick as 3 minutes No batteries or battery charging rooms Environmentally clean Fuel Cell-Powered Battery Box Replacements Partner Collaboration Telemetry Solutions Internally Developed Automation (IDA) HY Automation with Dual-Mode Operation Lithium-Ion Solutions Modular designs Increased component commonality Ability to tailor to meet specific customer needs at lowest cost Substantial expense and expenditures upfront with expected significant supply chain and manufacturing cost savings and efficiencies beginning in 2020 Next Generation Products Under Development New End Rider

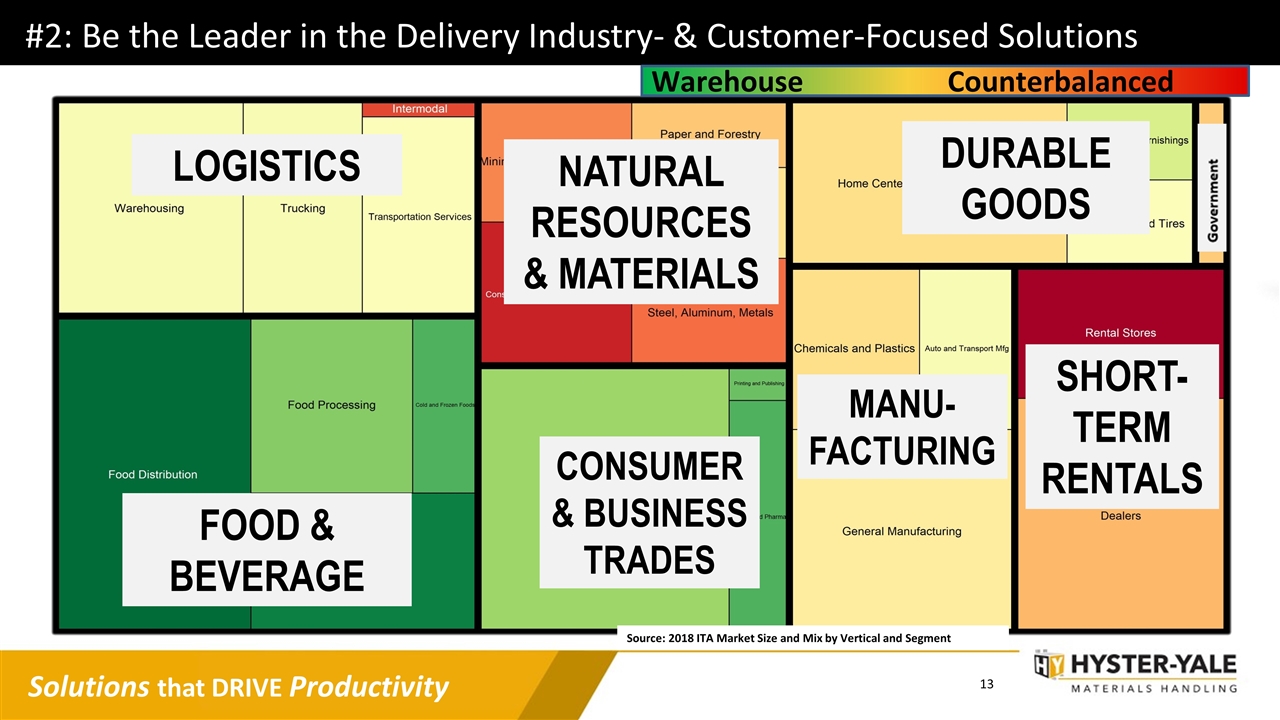

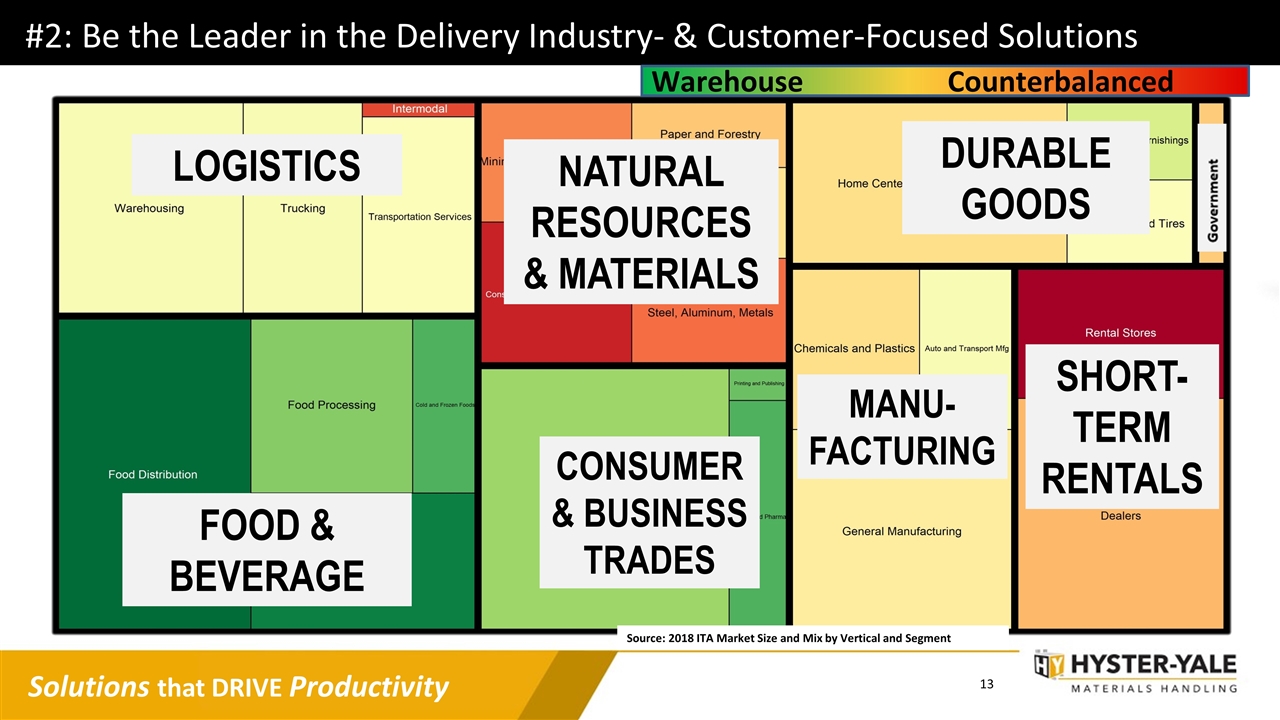

#2: Be the Leader in the Delivery Industry- & Customer-Focused Solutions LOGISTICS FOOD & BEVERAGE MANU- FACTURING NATURAL RESOURCES & MATERIALS DURABLE GOODS SHORT-TERM RENTALS CONSUMER & BUSINESS TRADES Warehouse Counterbalanced Source: 2018 ITA Market Size and Mix by Vertical and Segment

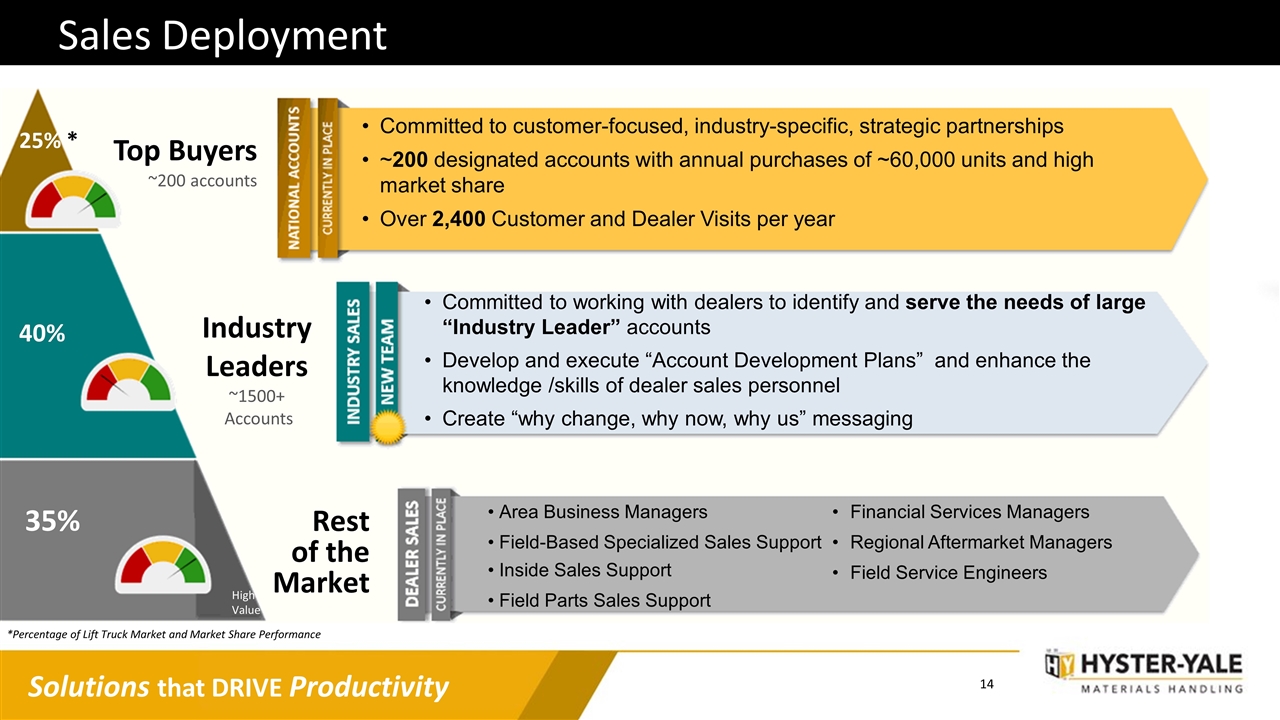

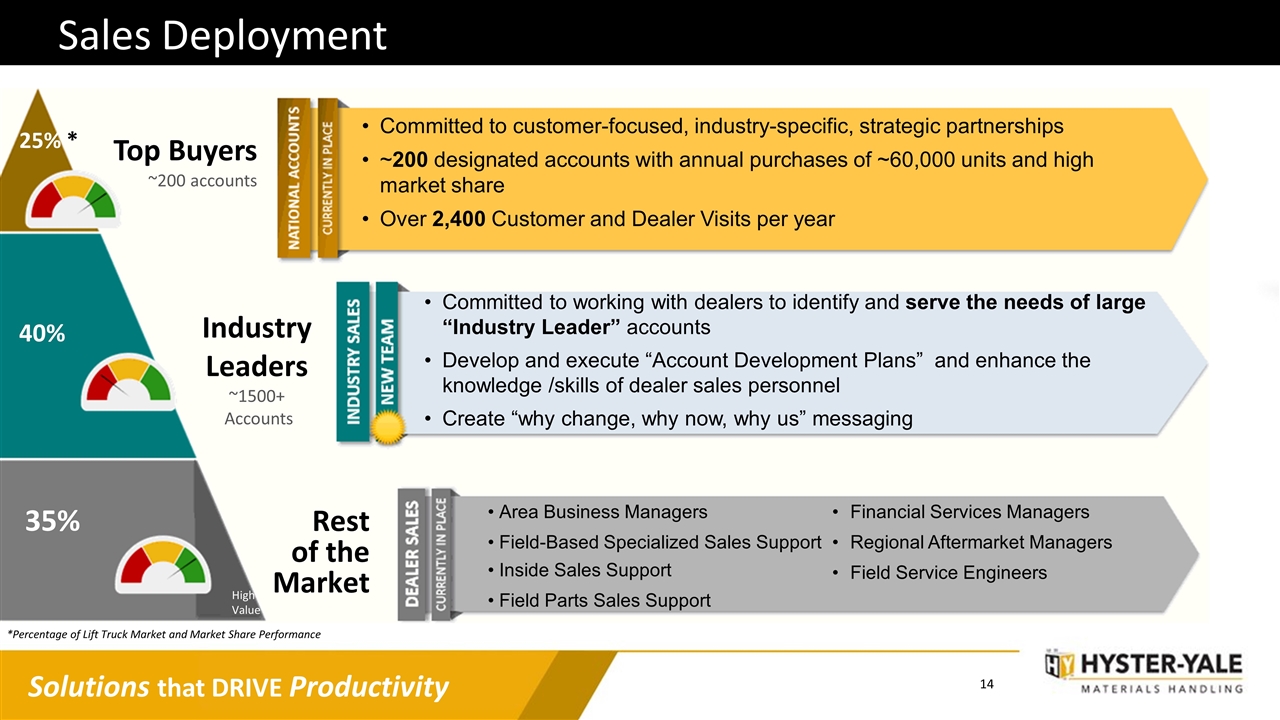

Sales Deployment Top Buyers ~200 accounts Industry Leaders ~1500+ Accounts Rest of the Market 35% 40% Committed to customer-focused, industry-specific, strategic partnerships ~200 designated accounts with annual purchases of ~60,000 units and high market share Over 2,400 Customer and Dealer Visits per year Committed to working with dealers to identify and serve the needs of large “Industry Leader” accounts Develop and execute “Account Development Plans” and enhance the knowledge /skills of dealer sales personnel Create “why change, why now, why us” messaging Area Business Managers Field-Based Specialized Sales Support Inside Sales Support Field Parts Sales Support Financial Services Managers Regional Aftermarket Managers Field Service Engineers High Value 25% * *Percentage of Lift Truck Market and Market Share Performance

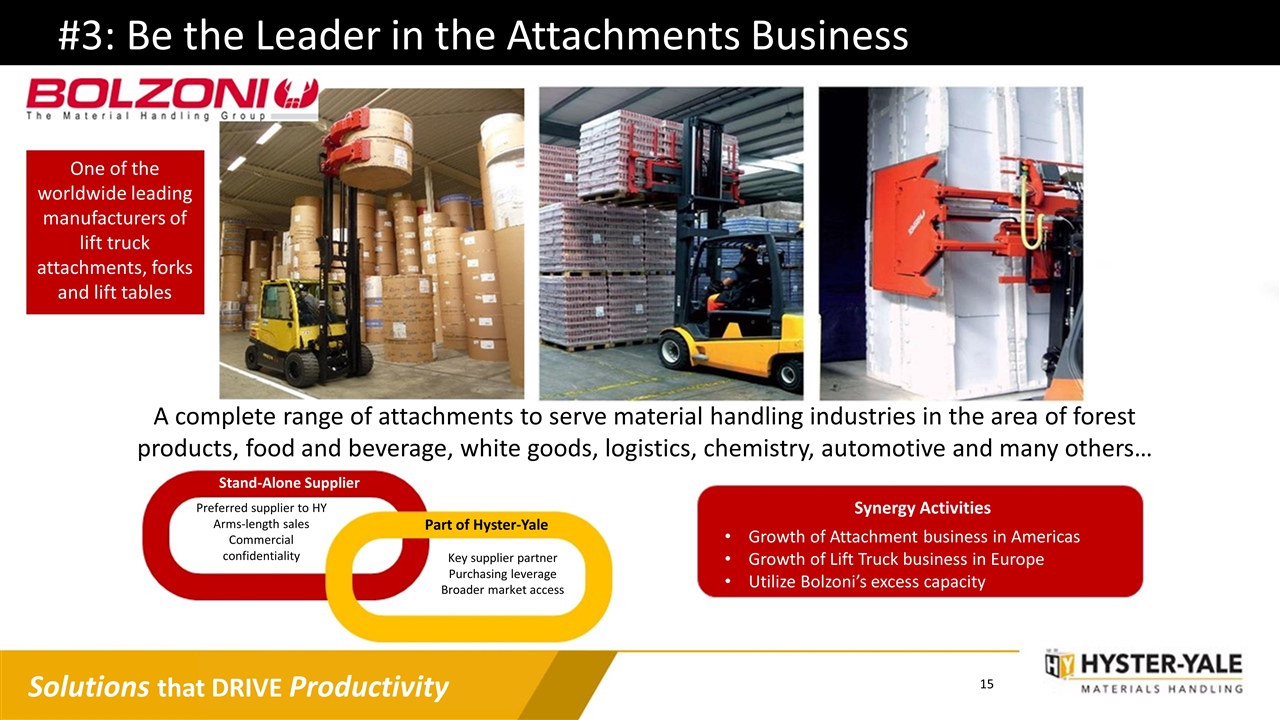

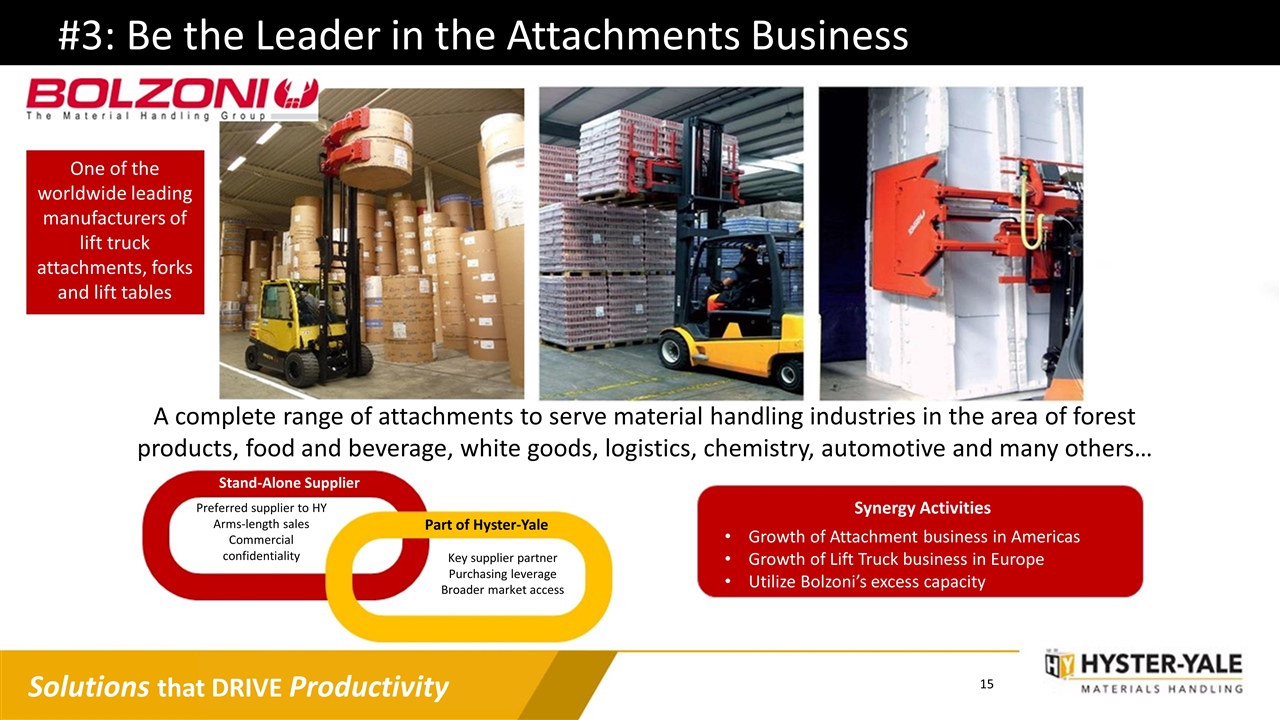

#3: Be the Leader in the Attachments Business A complete range of attachments to serve material handling industries in the area of forest products, food and beverage, white goods, logistics, chemistry, automotive and many others… One of the worldwide leading manufacturers of lift truck attachments, forks and lift tables Synergy Activities Growth of Attachment business in Americas Growth of Lift Truck business in Europe Utilize Bolzoni’s excess capacity Part of Hyster-Yale Stand-Alone Supplier Preferred supplier to HY Arms-length sales Commercial confidentiality Key supplier partner Purchasing leverage Broader market access

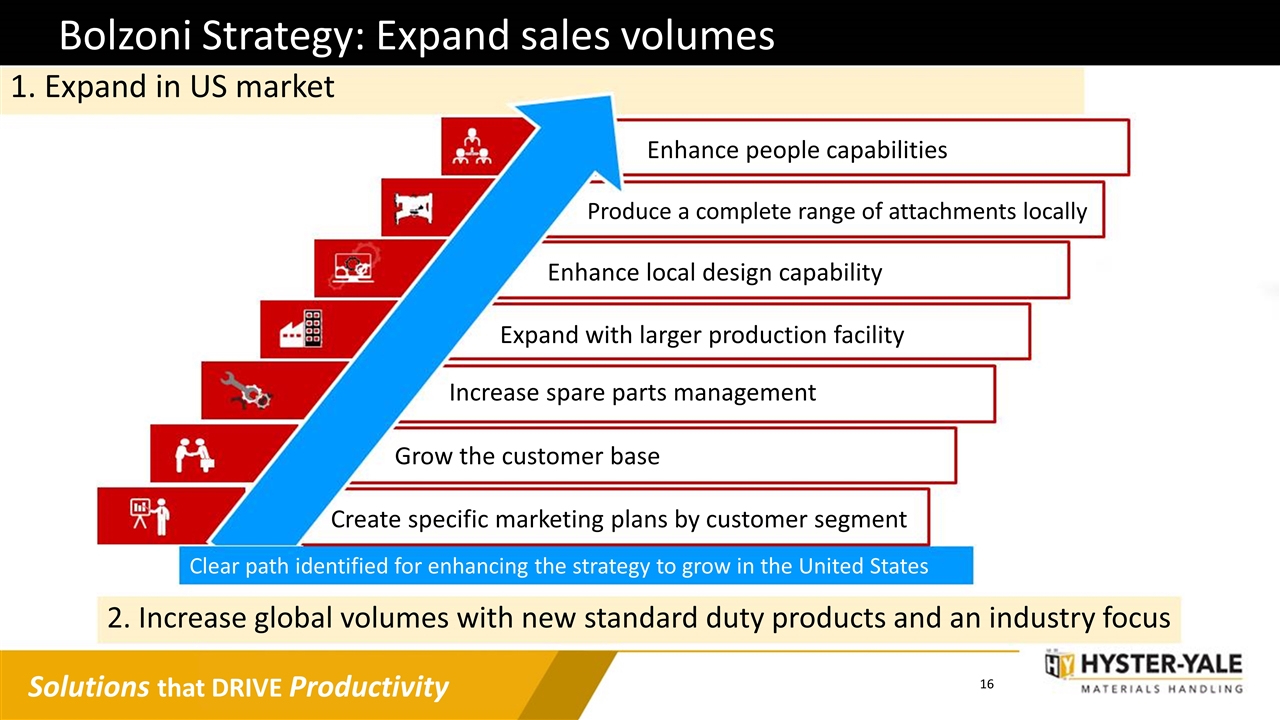

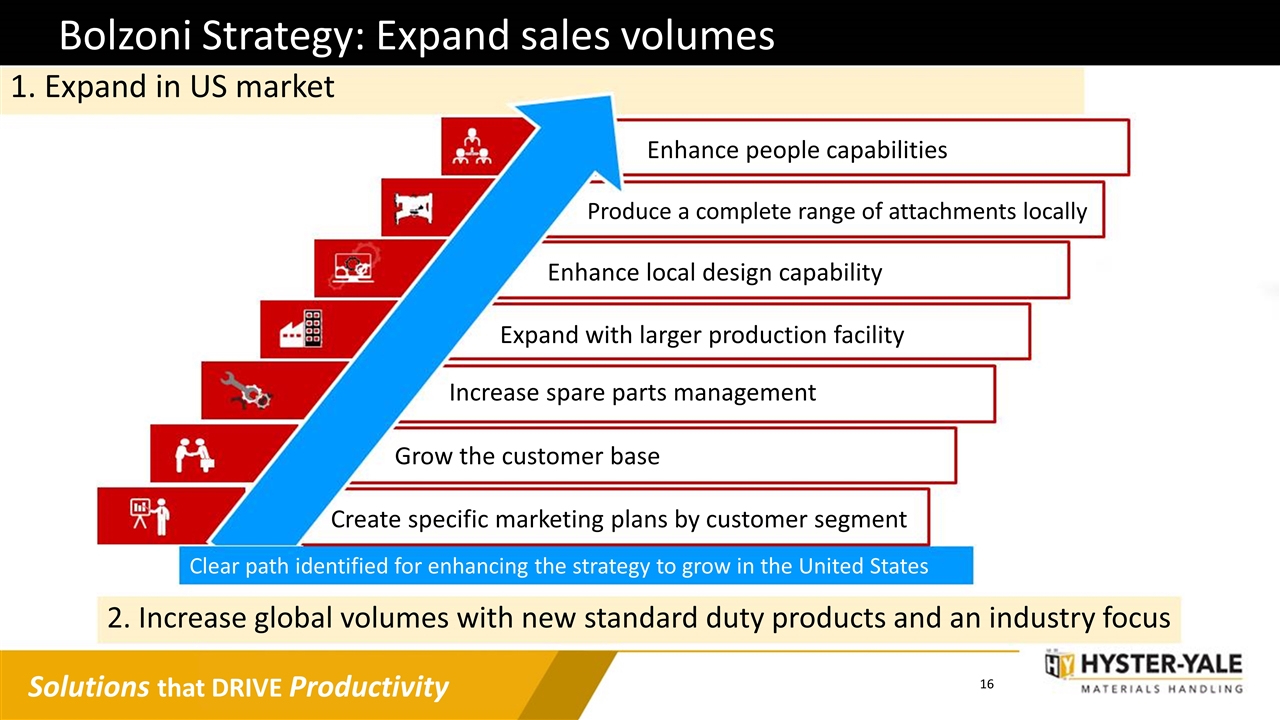

Bolzoni Strategy: Expand sales volumes 1. Expand in US market Clear path identified for enhancing the strategy to grow in the United States 2. Increase global volumes with new standard duty products and an industry focus Enhance people capabilities Produce a complete range of attachments locally Enhance local design capability Expand with larger production facility Increase spare parts management Grow the customer base Create specific marketing plans by customer segment

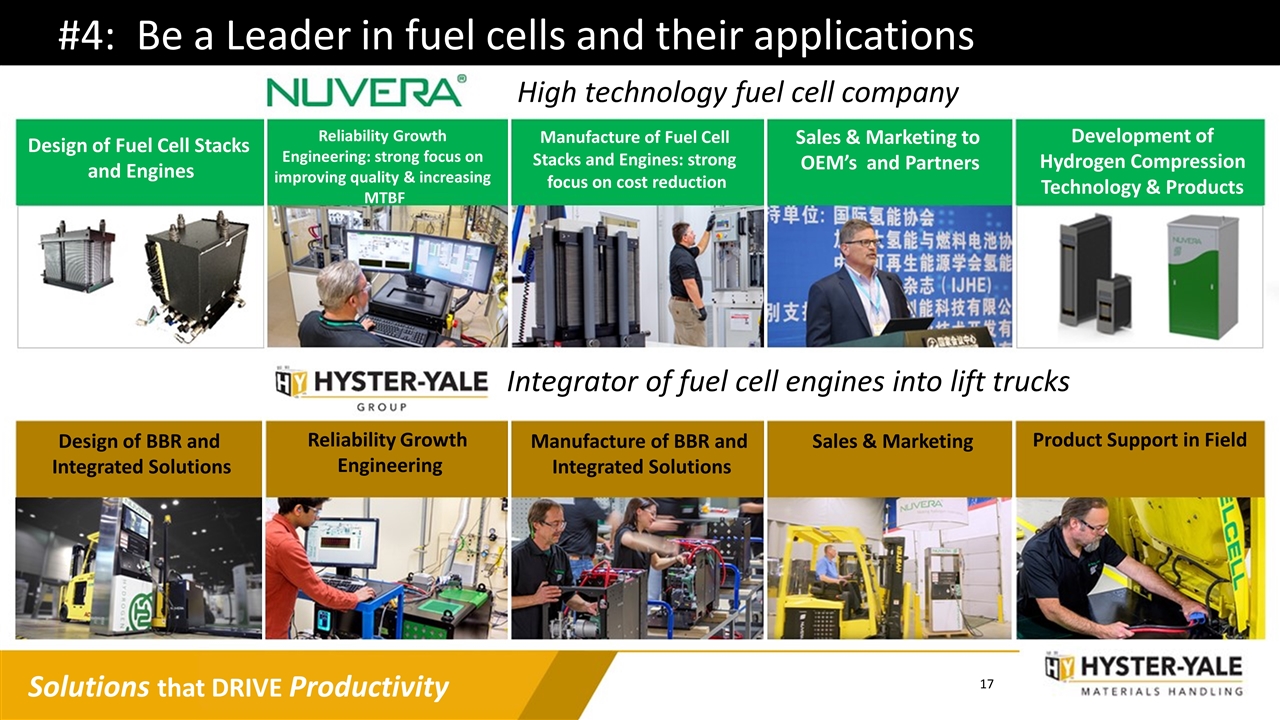

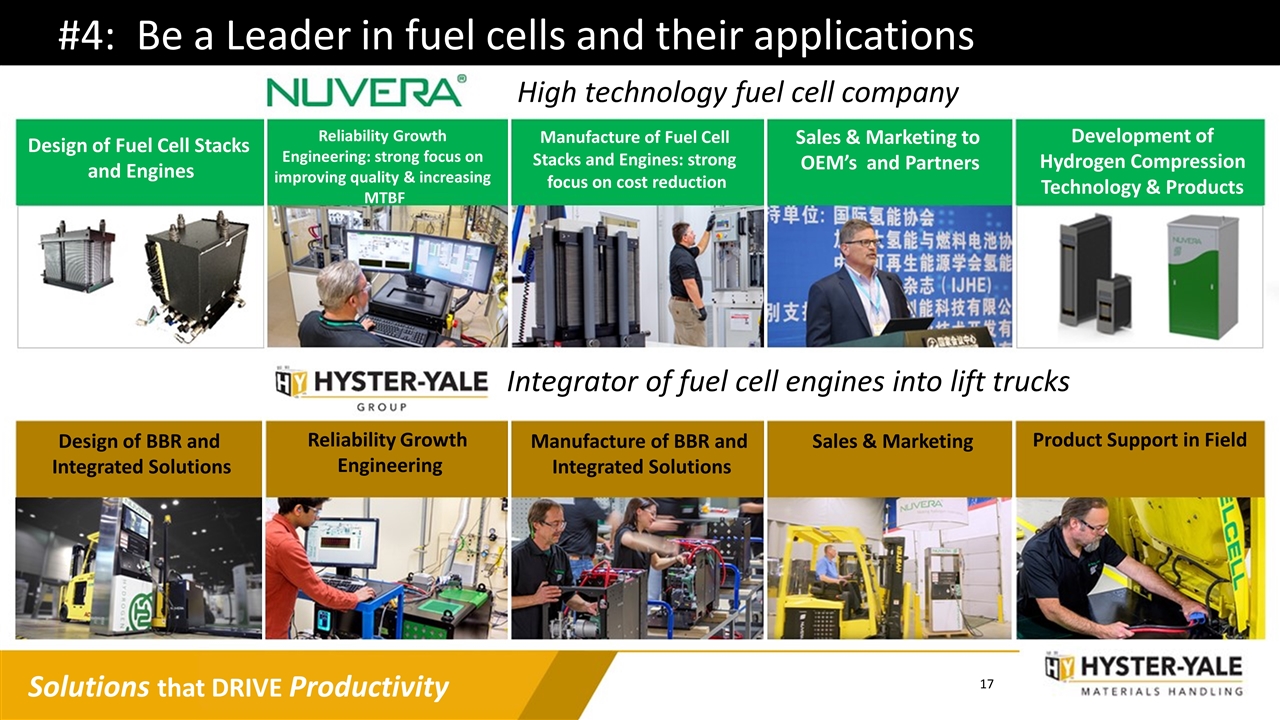

#4: Be a Leader in fuel cells and their applications High technology fuel cell company Integrator of fuel cell engines into lift trucks Design of Fuel Cell Stacks and Engines Reliability Growth Engineering: strong focus on improving quality & increasing MTBF Manufacture of Fuel Cell Stacks and Engines: strong focus on cost reduction Sales & Marketing to OEM’s and Partners Development of Hydrogen Compression Technology & Products Design of BBR and Integrated Solutions Reliability Growth Engineering Manufacture of BBR and Integrated Solutions Sales & Marketing Product Support in Field

Non-Lift Truck Growth Opportunities Heavy duty applications Port equipment n Delivery vehicles n Buses China market entry Market research n Two agreements signed n Other opportunities in evaluation n Low cost sourcing

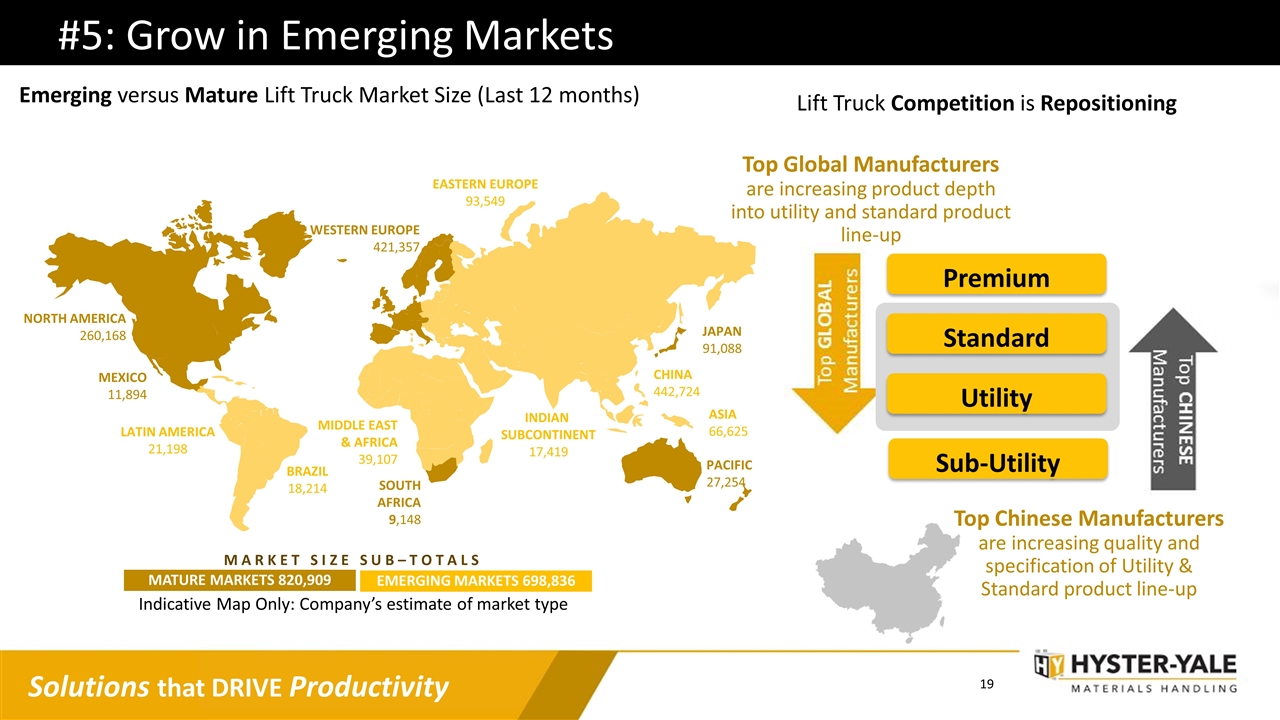

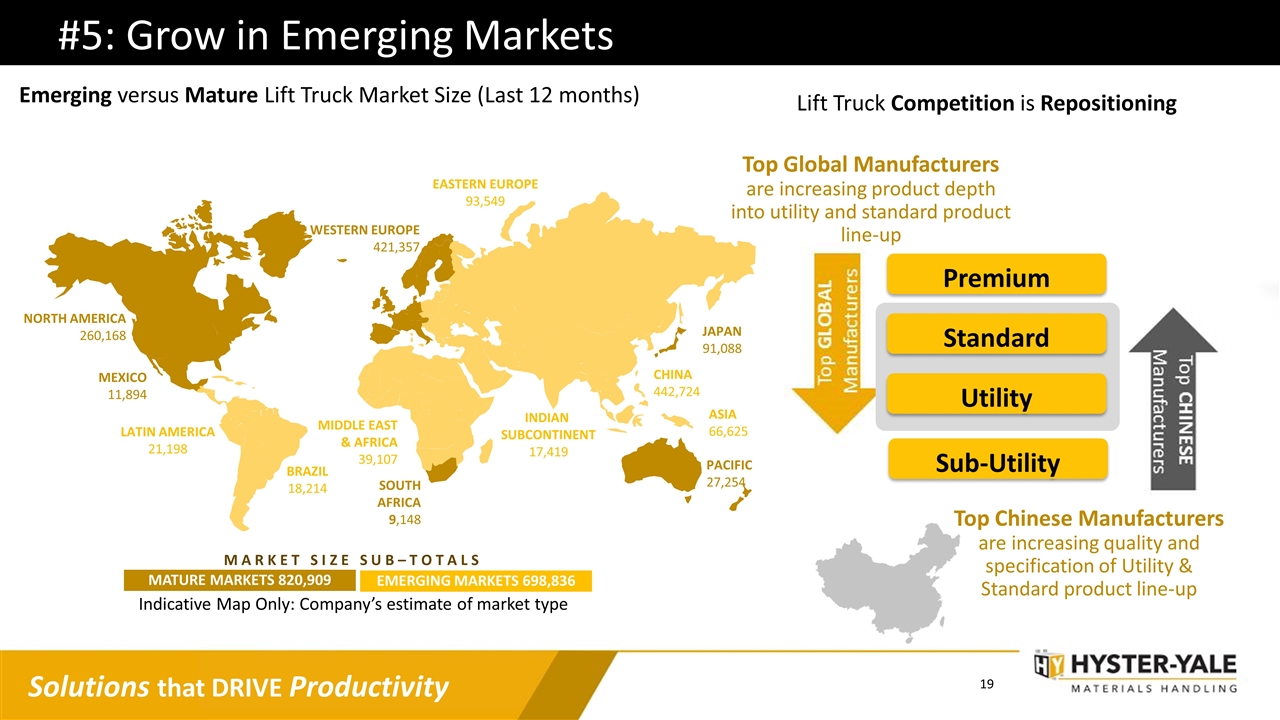

#5: Grow in Emerging Markets MATURE MARKETS 820,909 EMERGING MARKETS 698,836 M A R K E T S I Z E S U B – T O T A L S Indicative Map Only: Company’s estimate of market type Emerging versus Mature Lift Truck Market Size (Last 12 months) Top Global Manufacturers are increasing product depth into utility and standard product line-up Lift Truck Competition is Repositioning Premium Sub-Utility Standard Utility Top Chinese Manufacturers are increasing quality and specification of Utility & Standard product line-up NORTH AMERICA 260,168 WESTERN EUROPE 421,357 PACIFIC 27,254 JAPAN 91,088 MIDDLE EAST & AFRICA 39,107 INDIAN SUBCONTINENT 17,419 ASIA 66,625 CHINA 442,724 EASTERN EUROPE 93,549 LATIN AMERICA 21,198 BRAZIL 18,214 MEXICO 11,894 SOUTH AFRICA 9,148

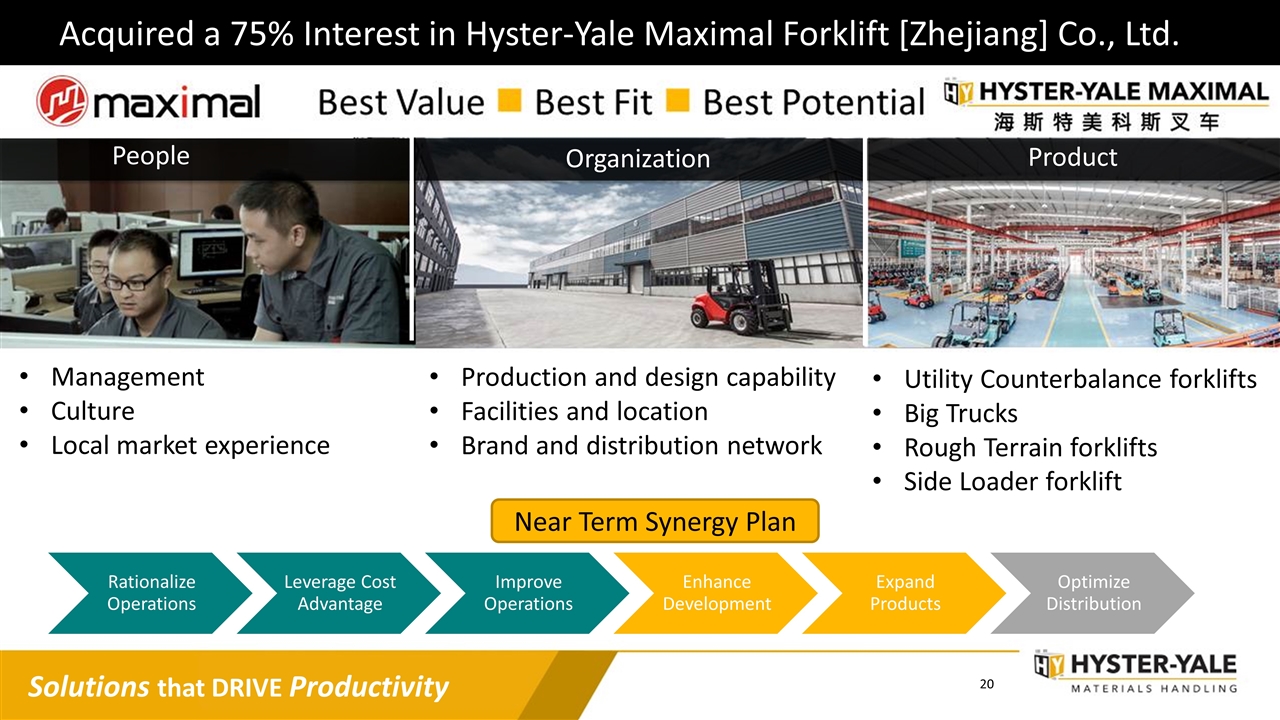

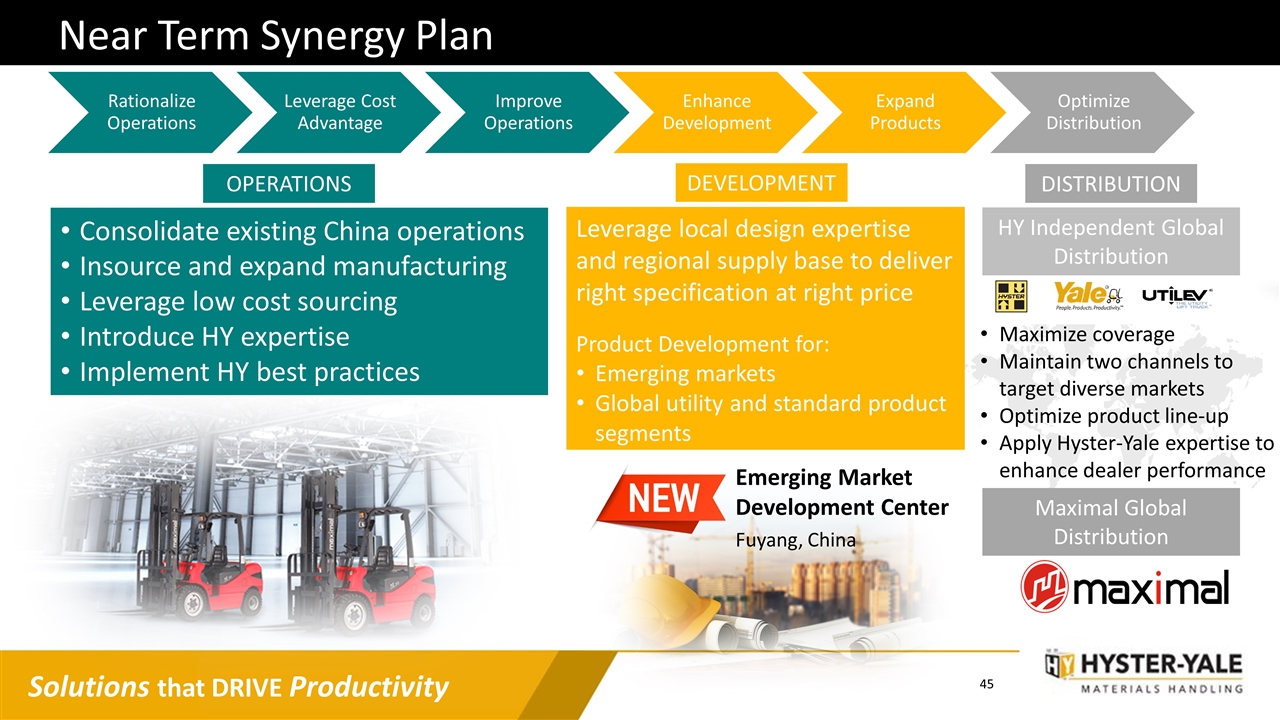

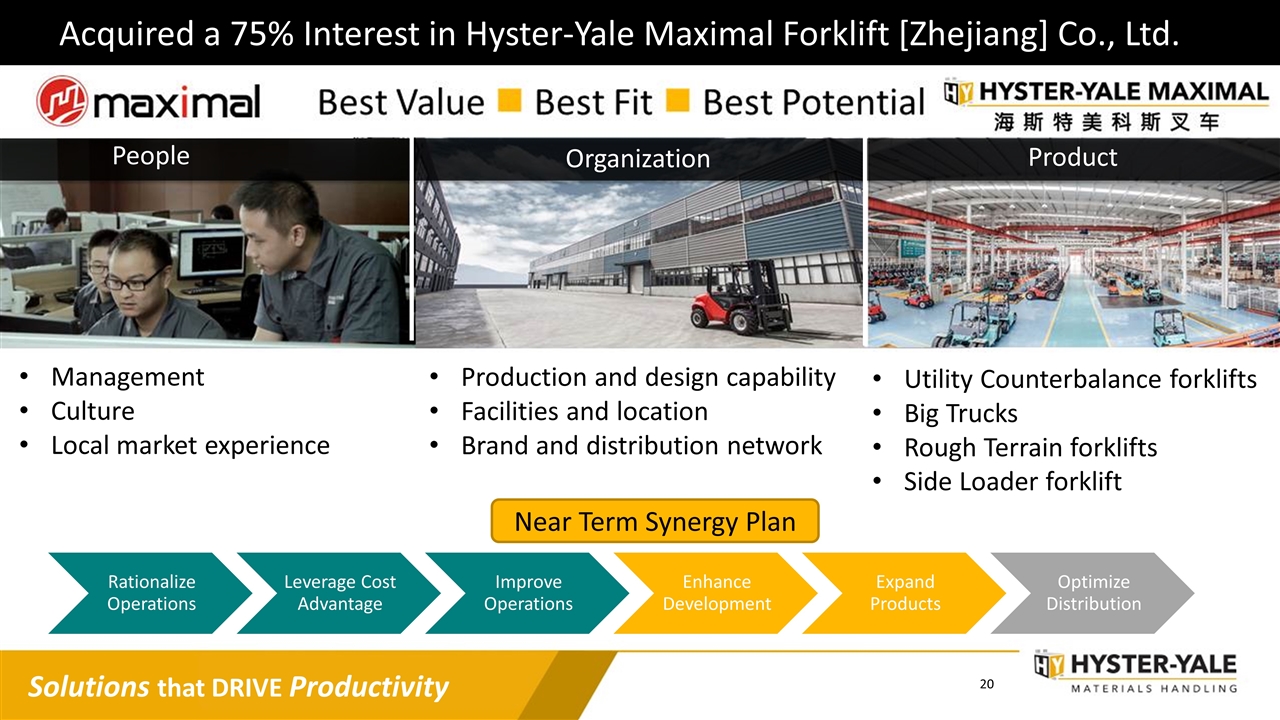

Acquired a 75% Interest in Hyster-Yale Maximal Forklift [Zhejiang] Co., Ltd. Management Culture Local market experience Production and design capability Facilities and location Brand and distribution network Utility Counterbalance forklifts Big Trucks Rough Terrain forklifts Side Loader forklift Organization Product People Near Term Synergy Plan Rationalize Operations Improve Operations Enhance Development Optimize Distribution Leverage Cost Advantage Expand Products

#6: Be the Leader in Independent Distribution Enhancing performance Dealer Excellence programs Dealer incentives Term-based contracts 1,000+ global dealer locations 2,000+ application consultants 10,000+ service technicians Independent n Exclusive n Entrepreneurial n Profitable n Committed partner n Dual-line or single Strengthening the distribution footprint Sales and Service territories Competitor conversions In-territory acquisitions Enhanced digital customer experience systems

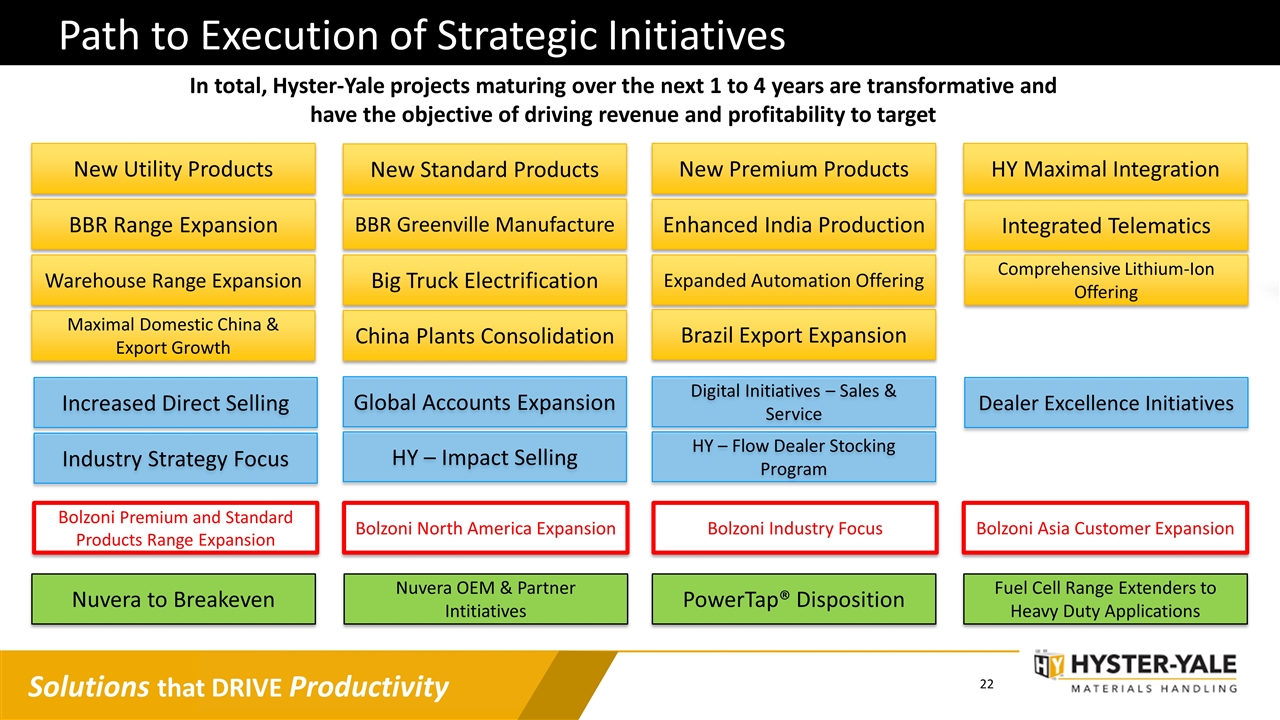

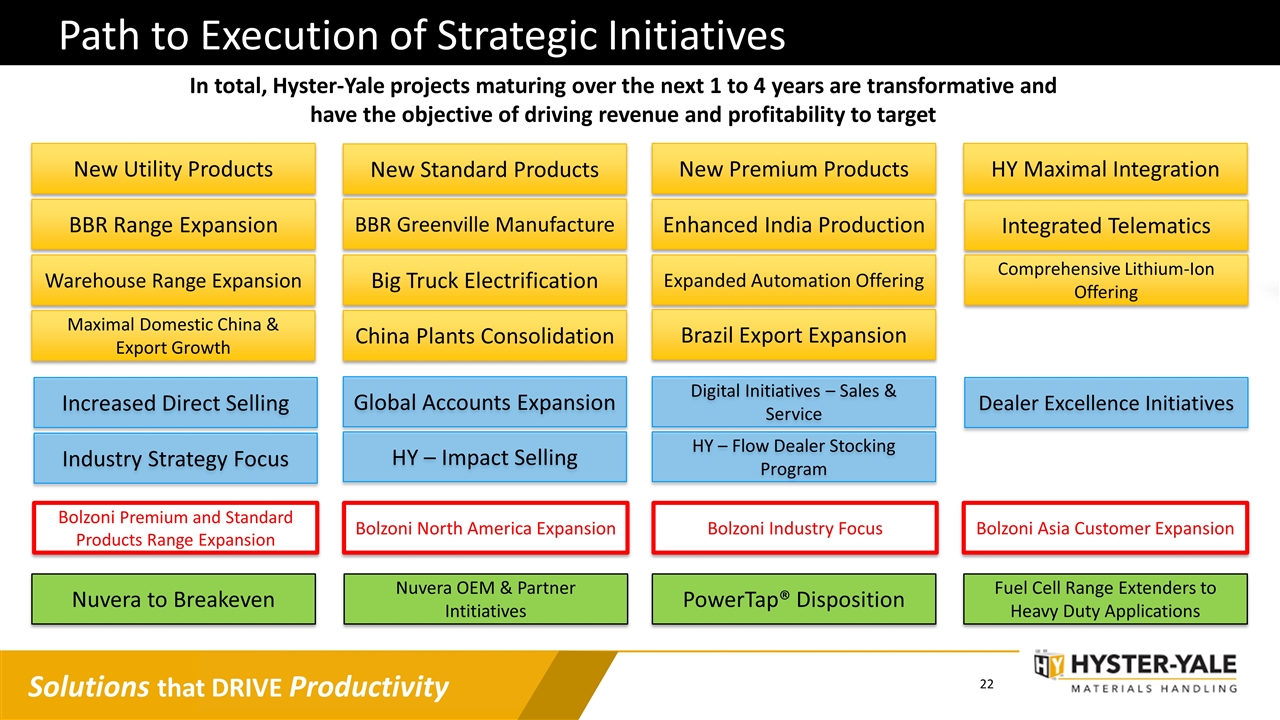

Path to Execution of Strategic Initiatives In total, Hyster-Yale projects maturing over the next 1 to 4 years are transformative and have the objective of driving revenue and profitability to target New Utility Products New Standard Products New Premium Products HY Maximal Integration BBR Range Expansion BBR Greenville Manufacture Enhanced India Production Integrated Telematics Warehouse Range Expansion Big Truck Electrification Expanded Automation Offering Bolzoni Premium and Standard Products Range Expansion Increased Direct Selling Global Accounts Expansion China Plants Consolidation Brazil Export Expansion Industry Strategy Focus HY – Impact Selling HY – Flow Dealer Stocking Program Dealer Excellence Initiatives Maximal Domestic China & Export Growth Comprehensive Lithium-Ion Offering Digital Initiatives – Sales & Service Bolzoni North America Expansion Nuvera to Breakeven Nuvera OEM & Partner Intitiatives PowerTap® Disposition Fuel Cell Range Extenders to Heavy Duty Applications Bolzoni Industry Focus Bolzoni Asia Customer Expansion

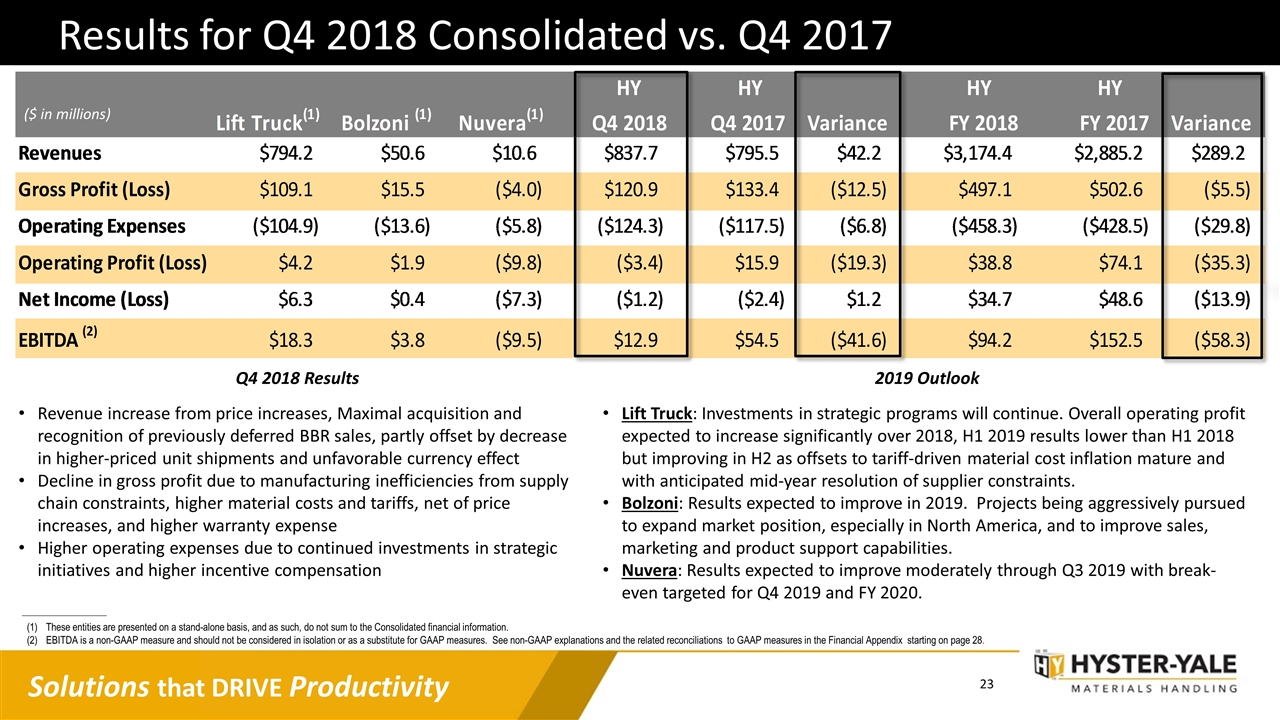

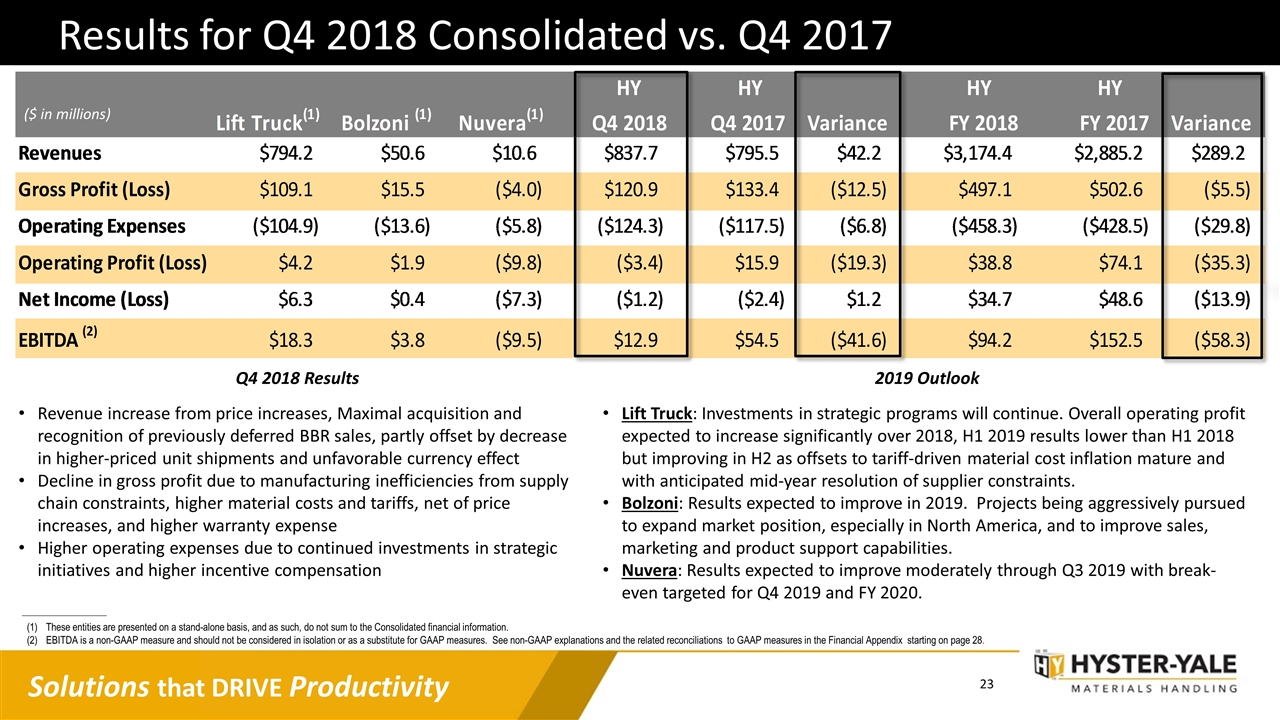

($ in millions) Results for Q4 2018 Consolidated vs. Q4 2017 23 _____________________ These entities are presented on a stand-alone basis, and as such, do not sum to the Consolidated financial information. EBITDA is a non-GAAP measure and should not be considered in isolation or as a substitute for GAAP measures. See non-GAAP explanations and the related reconciliations to GAAP measures in the Financial Appendix starting on page 28. Q4 2018 Results Revenue increase from price increases, Maximal acquisition and recognition of previously deferred BBR sales, partly offset by decrease in higher-priced unit shipments and unfavorable currency effect Decline in gross profit due to manufacturing inefficiencies from supply chain constraints, higher material costs and tariffs, net of price increases, and higher warranty expense Higher operating expenses due to continued investments in strategic initiatives and higher incentive compensation 2019 Outlook Lift Truck: Investments in strategic programs will continue. Overall operating profit expected to increase significantly over 2018, H1 2019 results lower than H1 2018 but improving in H2 as offsets to tariff-driven material cost inflation mature and with anticipated mid-year resolution of supplier constraints. Bolzoni: Results expected to improve in 2019. Projects being aggressively pursued to expand market position, especially in North America, and to improve sales, marketing and product support capabilities. Nuvera: Results expected to improve moderately through Q3 2019 with break-even targeted for Q4 2019 and FY 2020.

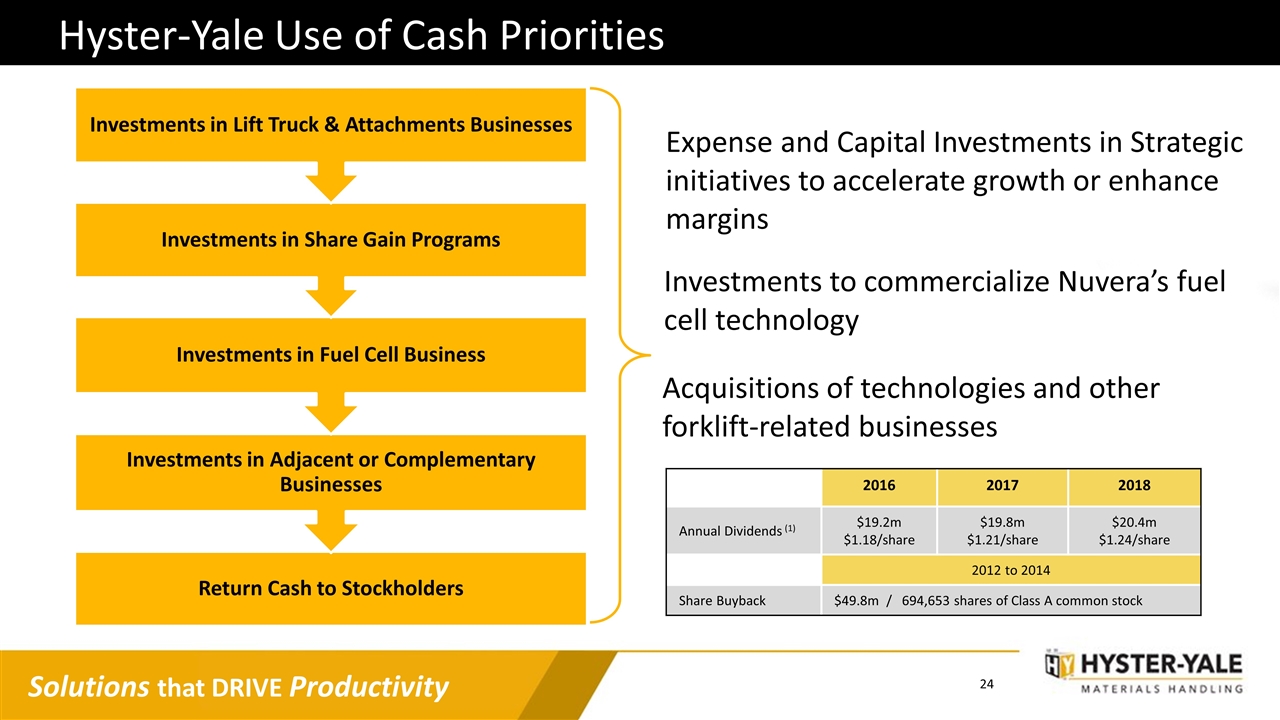

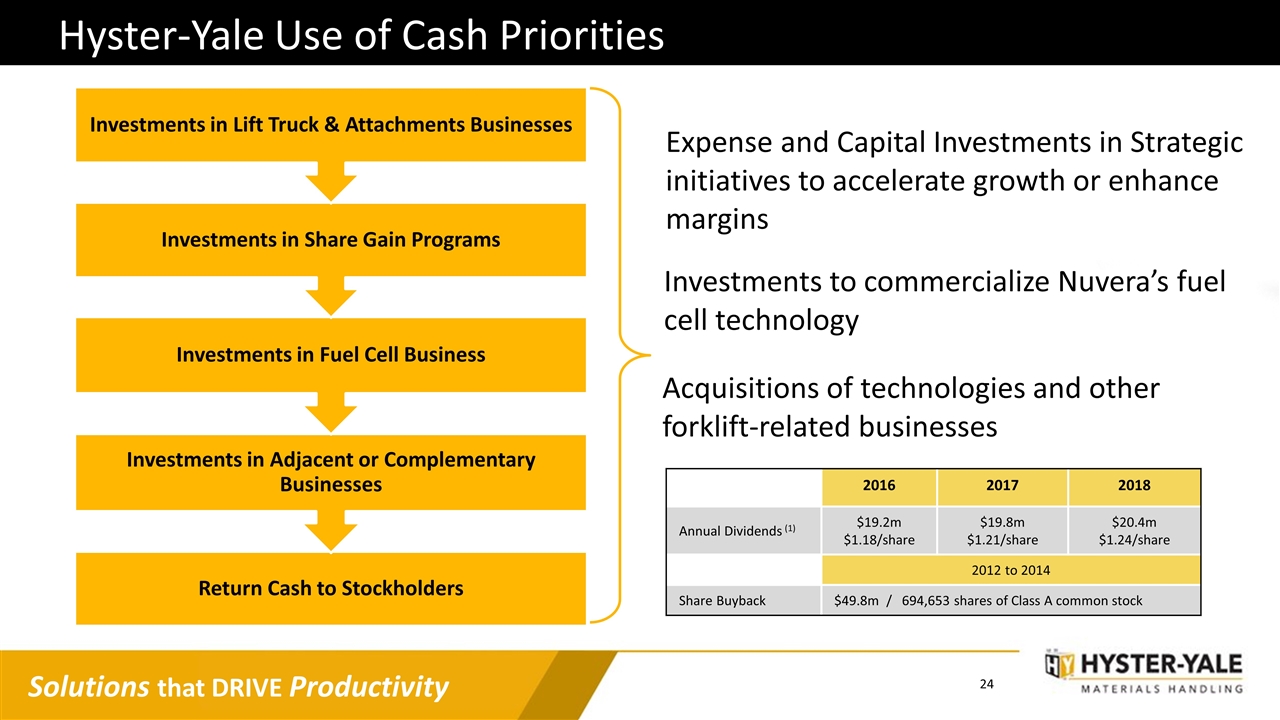

Hyster-Yale Use of Cash Priorities Expense and Capital Investments in Strategic initiatives to accelerate growth or enhance margins Acquisitions of technologies and other forklift-related businesses Investments to commercialize Nuvera’s fuel cell technology 2016 2017 2018 Annual Dividends (1) $19.2m $1.18/share $19.8m $1.21/share $20.4m $1.24/share 2012 to 2014 Share Buyback $49.8m / 694,653 shares of Class A common stock Investments in Lift Truck & Attachments Businesses Investments in Fuel Cell Business Return Cash to Stockholders Investments in Adjacent or Complementary Businesses Investments in Share Gain Programs

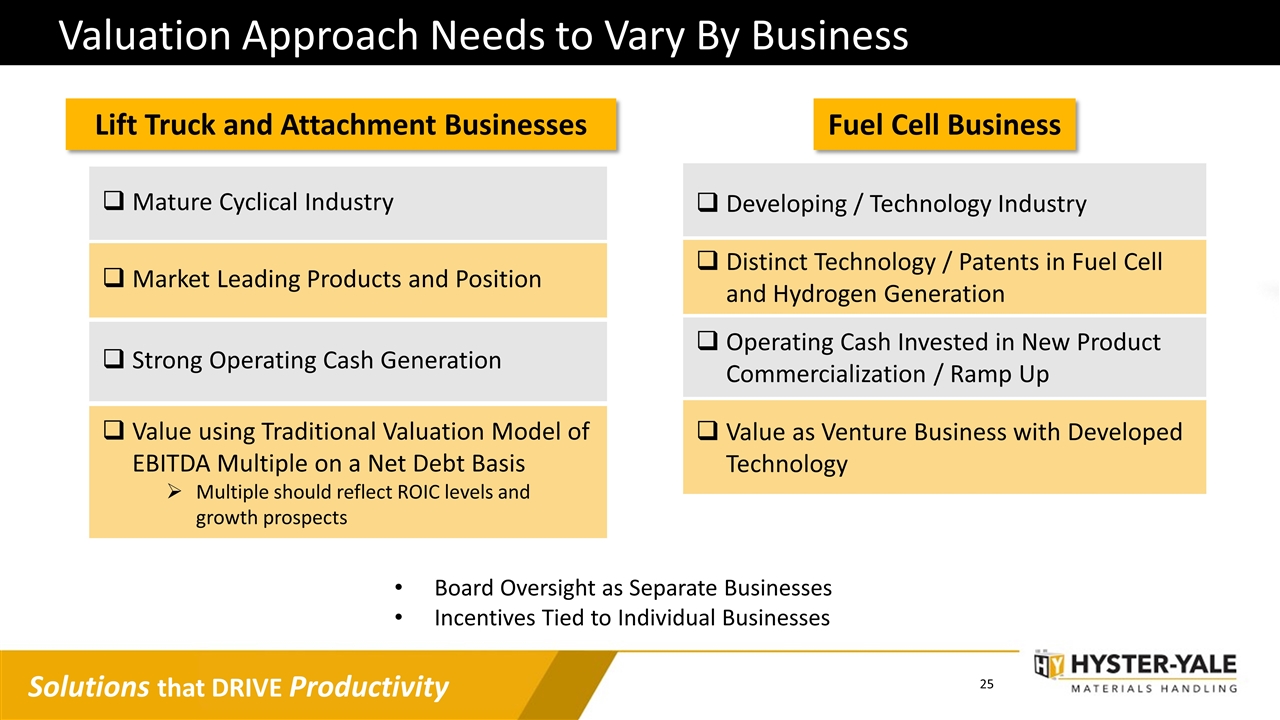

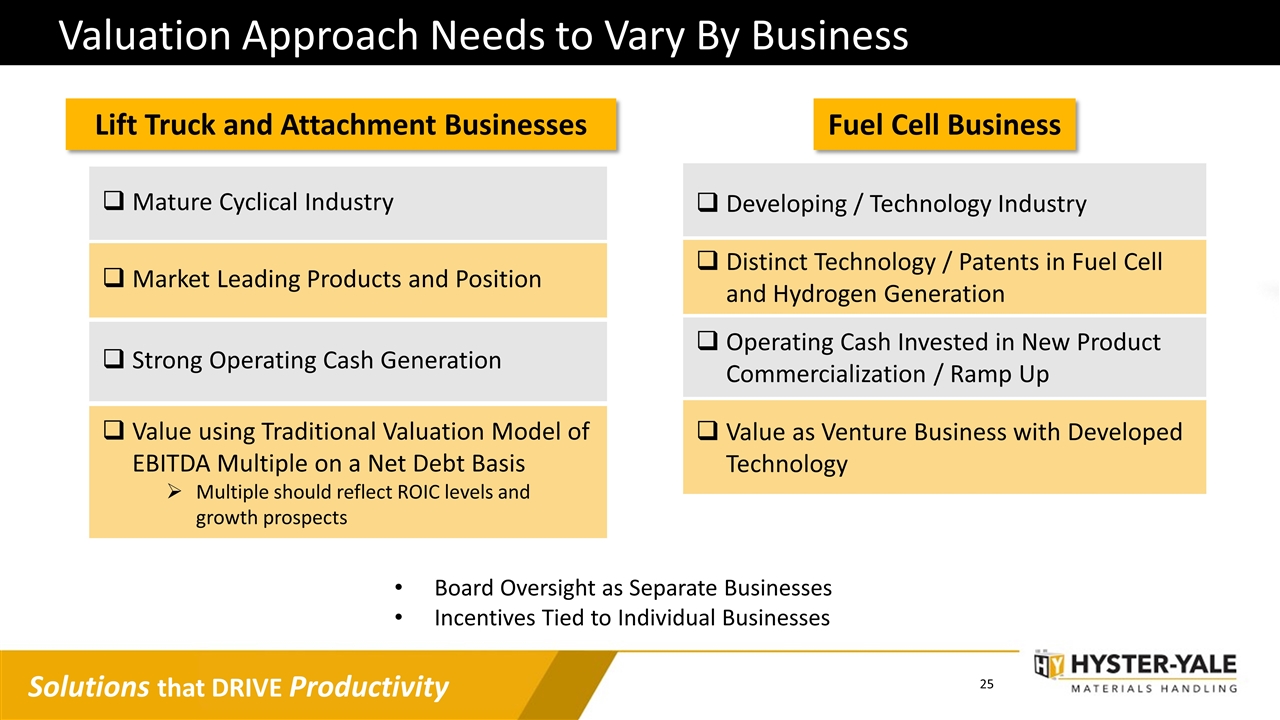

Valuation Approach Needs to Vary By Business Lift Truck and Attachment Businesses Fuel Cell Business Board Oversight as Separate Businesses Incentives Tied to Individual Businesses Strong Operating Cash Generation Market Leading Products and Position Mature Cyclical Industry Value using Traditional Valuation Model of EBITDA Multiple on a Net Debt Basis Multiple should reflect ROIC levels and growth prospects Developing / Technology Industry Distinct Technology / Patents in Fuel Cell and Hydrogen Generation Operating Cash Invested in New Product Commercialization / Ramp Up Value as Venture Business with Developed Technology

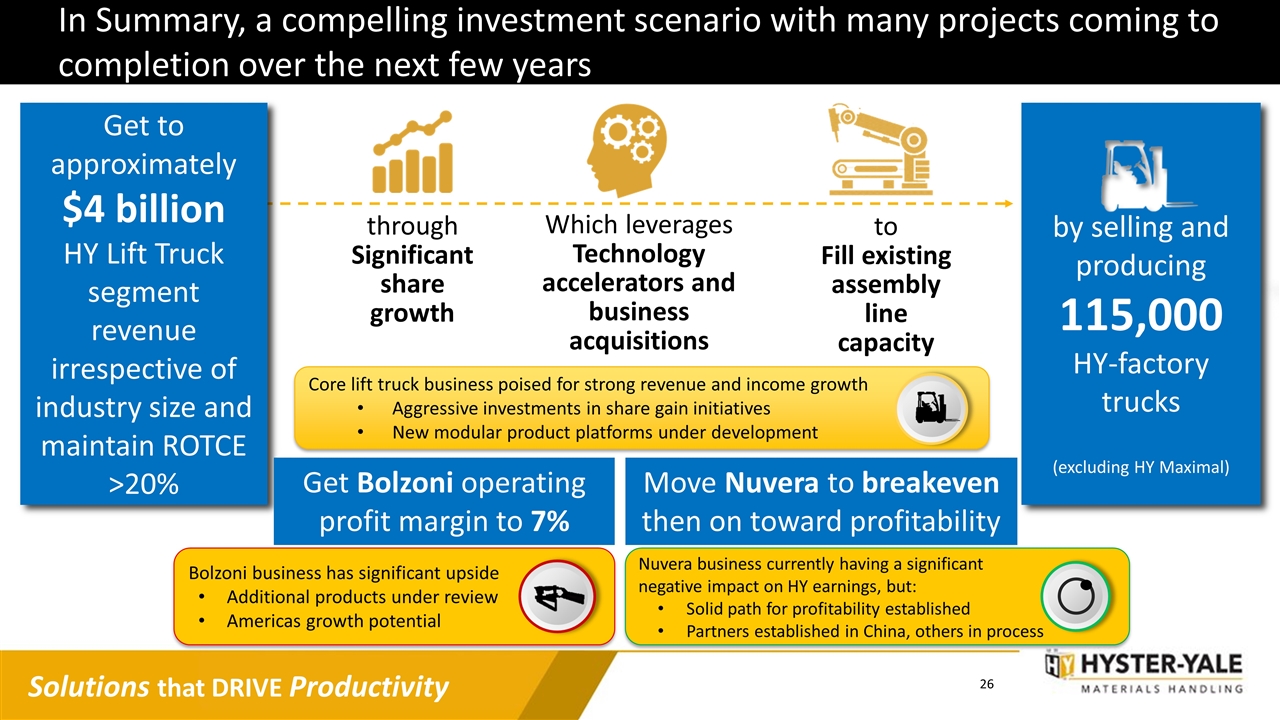

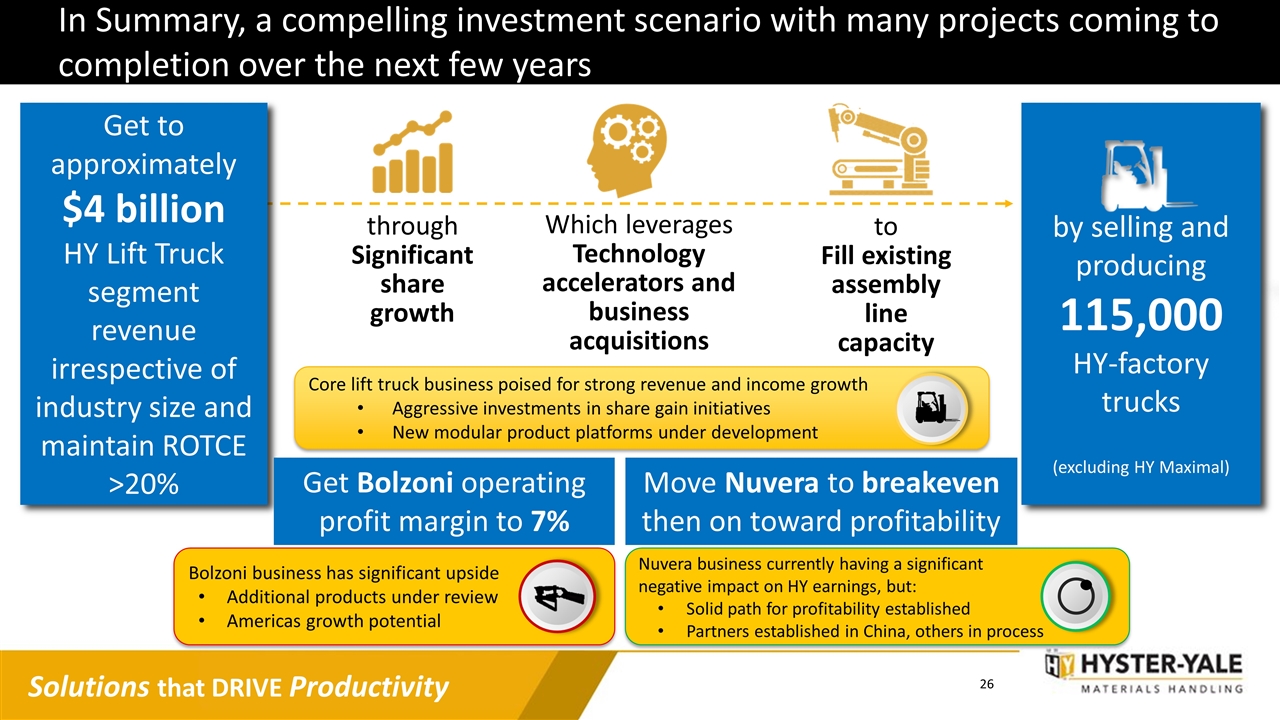

by selling and producing 115,000 HY-factory trucks (excluding HY Maximal) In Summary, a compelling investment scenario with many projects coming to completion over the next few years Get to approximately $4 billion HY Lift Truck segment revenue irrespective of industry size and maintain ROTCE >20% to Fill existing assembly line capacity through Significant share growth Which leverages Technology accelerators and business acquisitions Get Bolzoni operating profit margin to 7% Move Nuvera to breakeven then on toward profitability Core lift truck business poised for strong revenue and income growth Aggressive investments in share gain initiatives New modular product platforms under development Bolzoni business has significant upside Additional products under review Americas growth potential Nuvera business currently having a significant negative impact on HY earnings, but: Solid path for profitability established Partners established in China, others in process

Financial Appendix

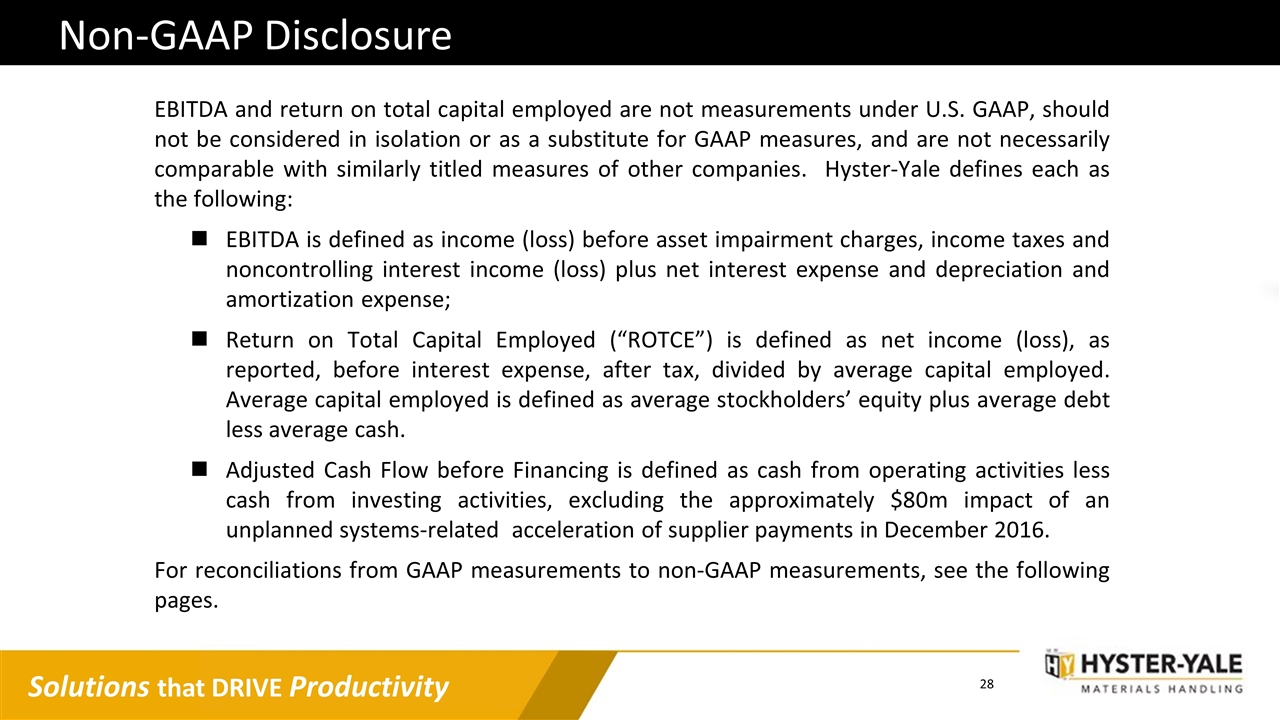

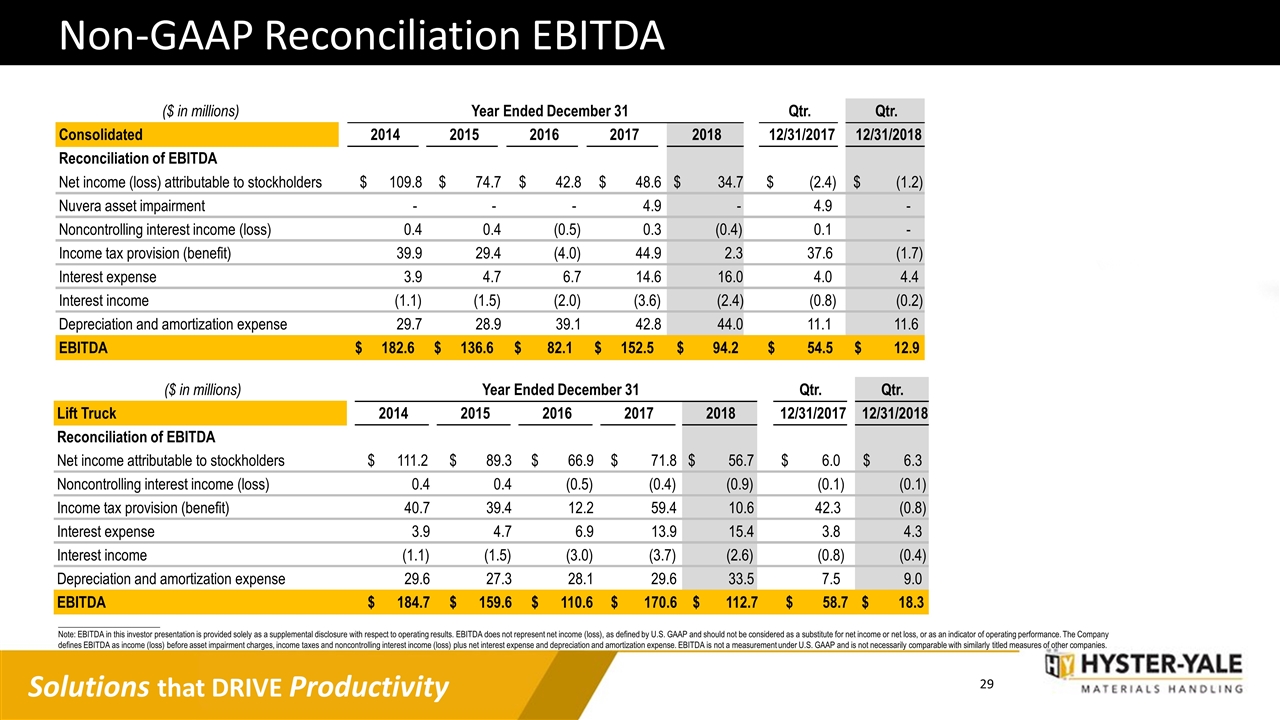

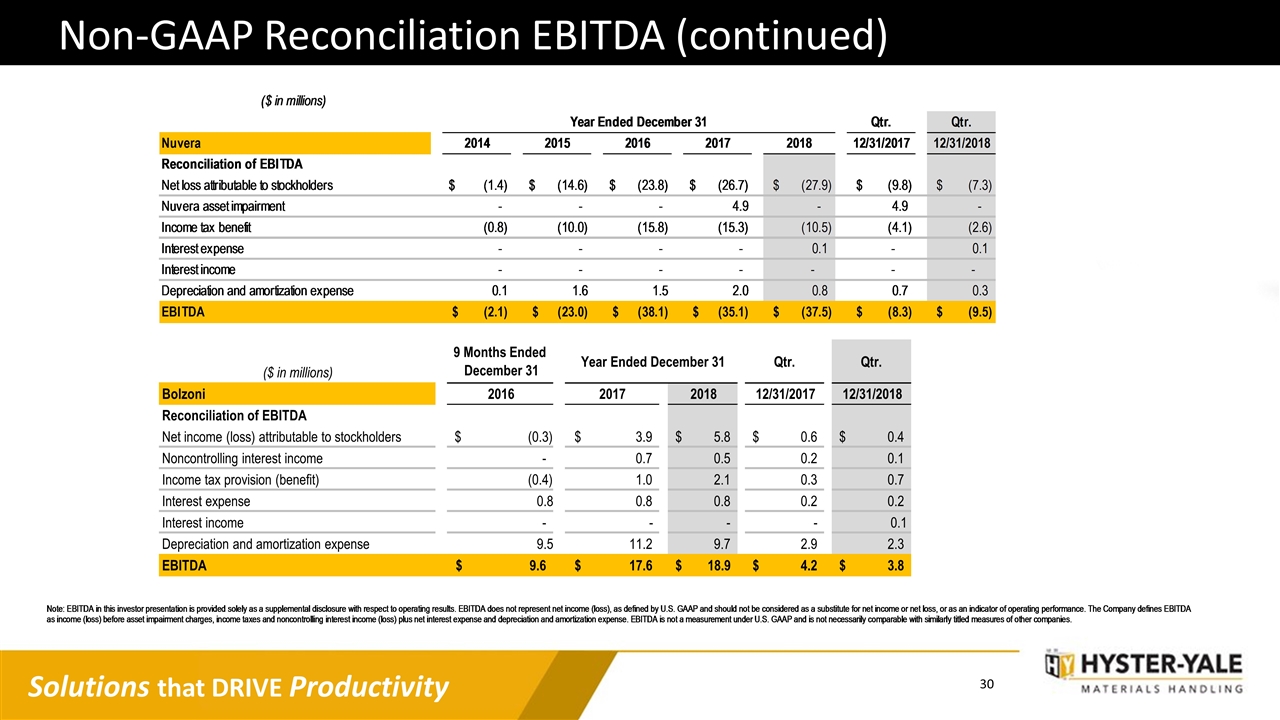

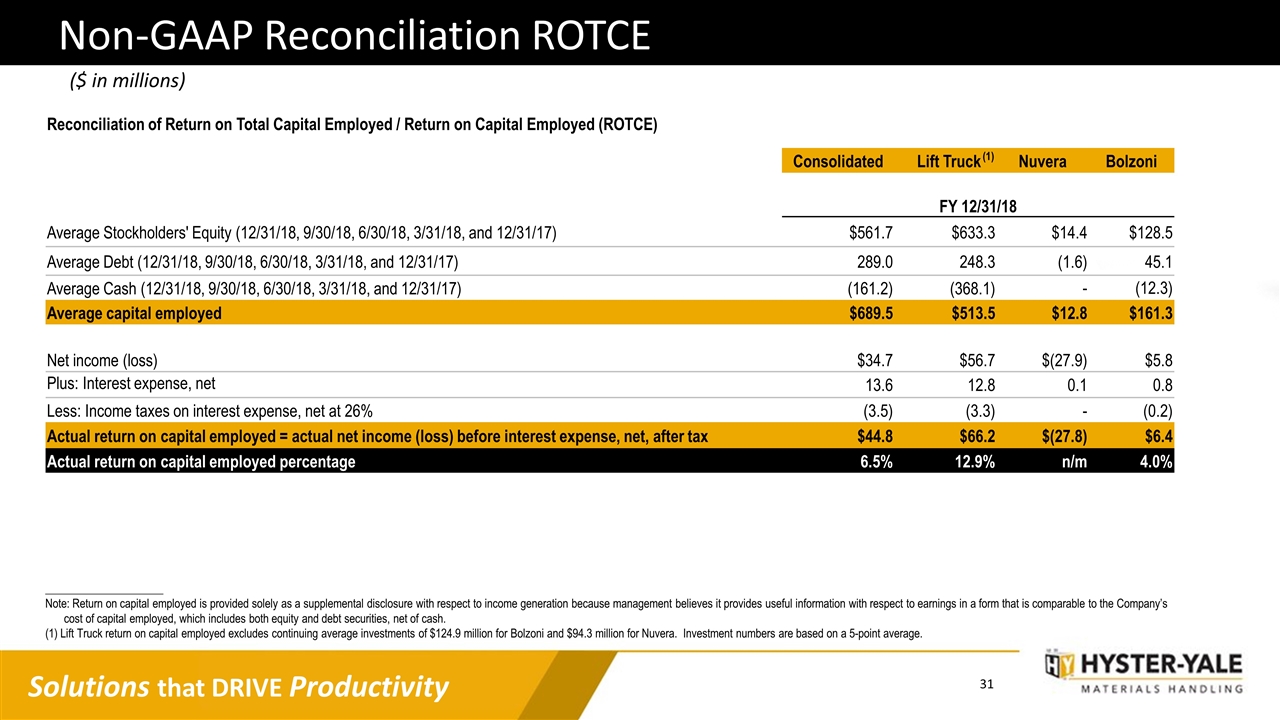

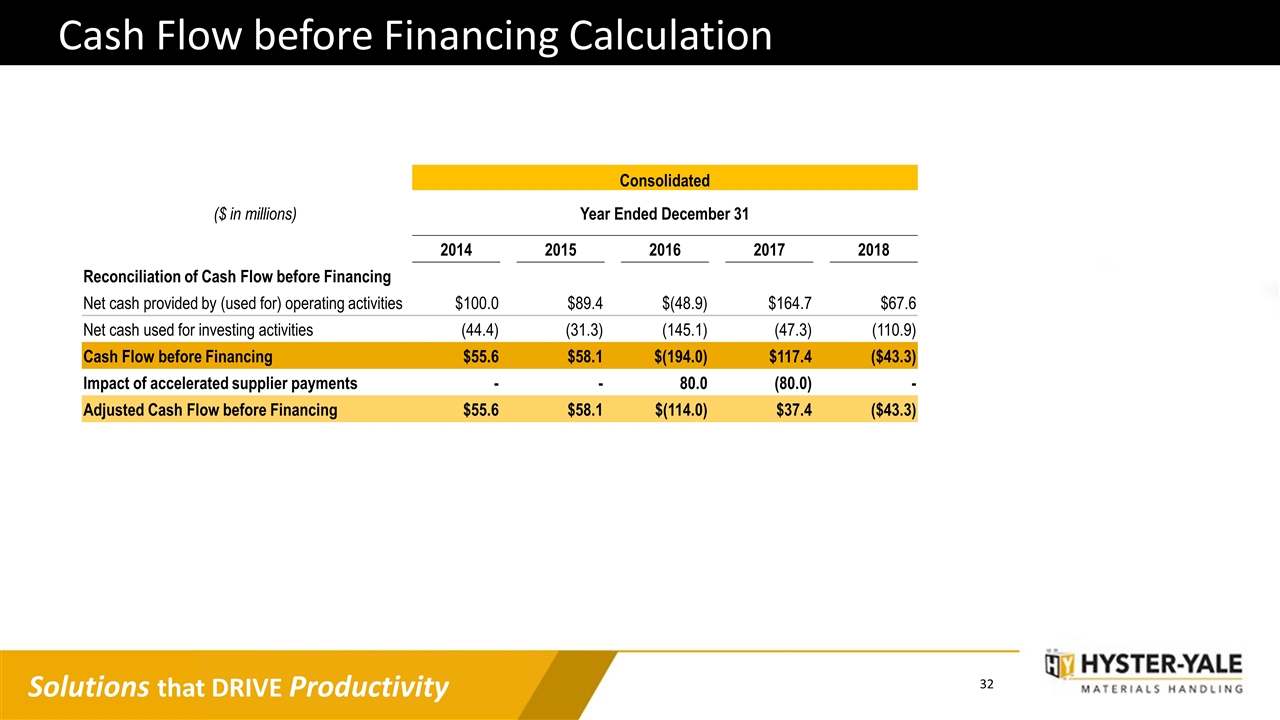

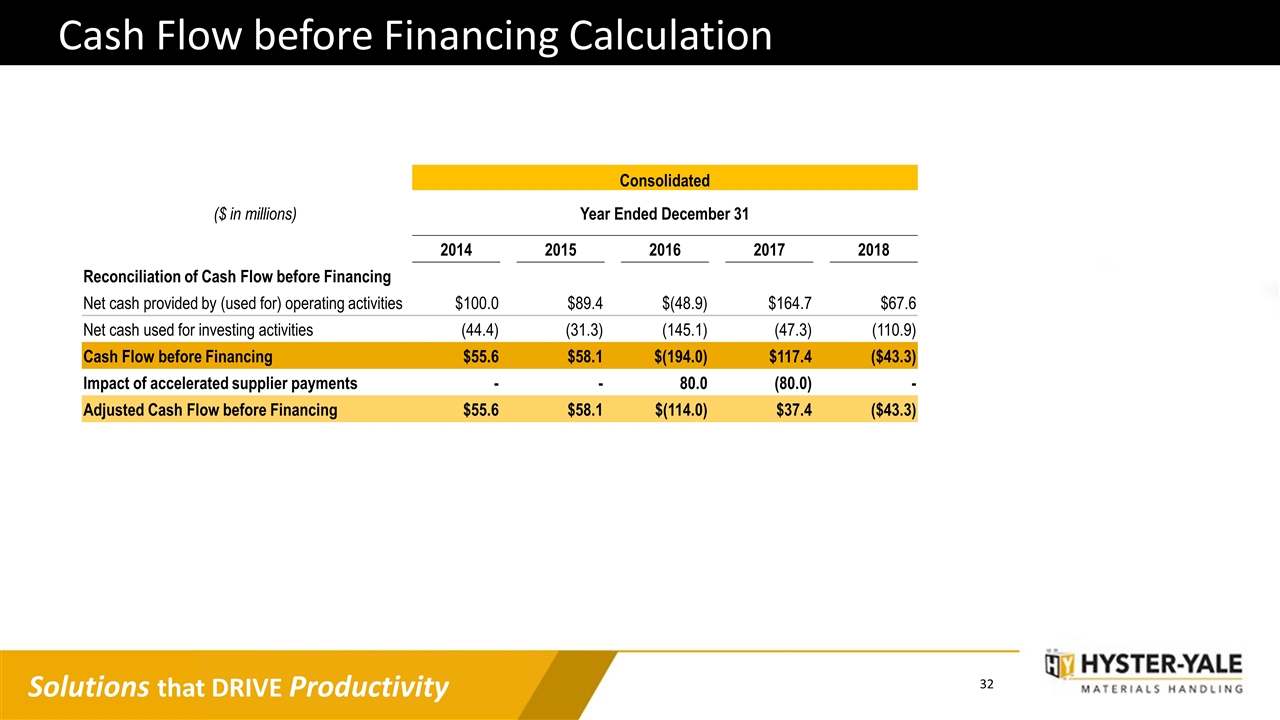

Non-GAAP Disclosure EBITDA and return on total capital employed are not measurements under U.S. GAAP, should not be considered in isolation or as a substitute for GAAP measures, and are not necessarily comparable with similarly titled measures of other companies. Hyster-Yale defines each as the following: EBITDA is defined as income (loss) before asset impairment charges, income taxes and noncontrolling interest income (loss) plus net interest expense and depreciation and amortization expense; Return on Total Capital Employed (“ROTCE”) is defined as net income (loss), as reported, before interest expense, after tax, divided by average capital employed. Average capital employed is defined as average stockholders’ equity plus average debt less average cash. Adjusted Cash Flow before Financing is defined as cash from operating activities less cash from investing activities, excluding the approximately $80m impact of an unplanned systems-related acceleration of supplier payments in December 2016. For reconciliations from GAAP measurements to non-GAAP measurements, see the following pages.

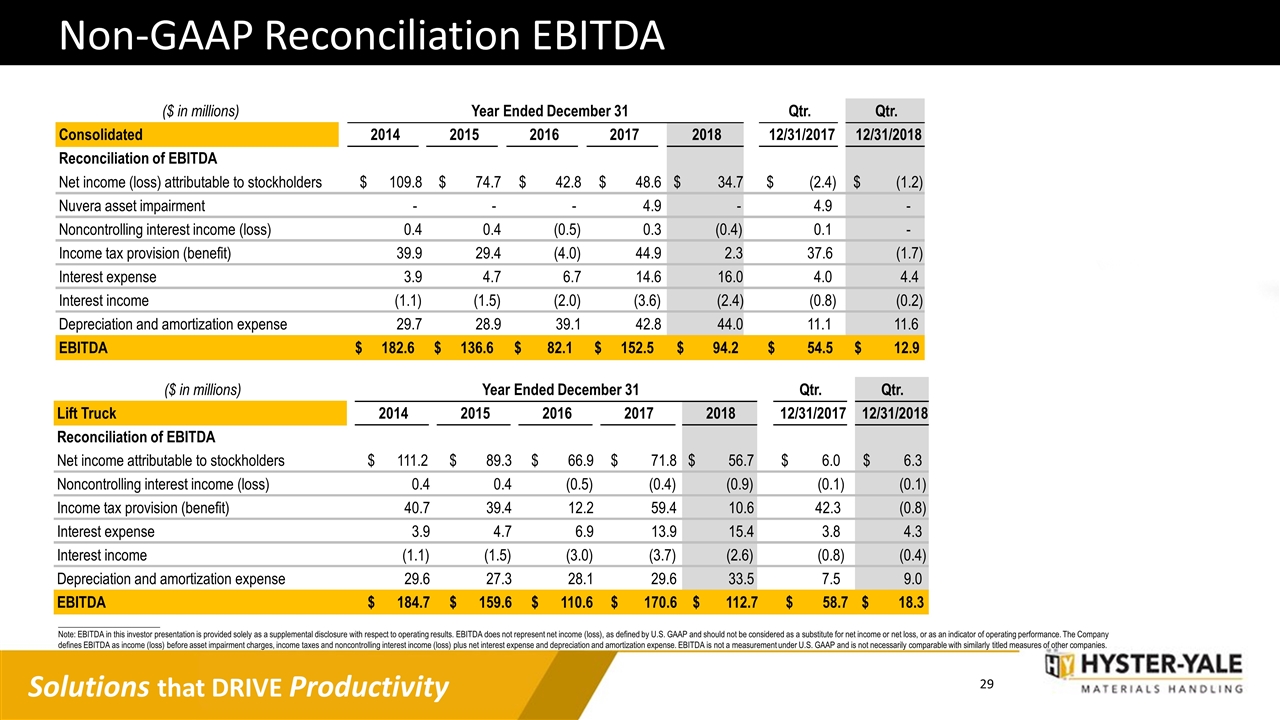

Non-GAAP Reconciliation EBITDA _____________________ Note: EBITDA in this investor presentation is provided solely as a supplemental disclosure with respect to operating results. EBITDA does not represent net income (loss), as defined by U.S. GAAP and should not be considered as a substitute for net income or net loss, or as an indicator of operating performance. The Company defines EBITDA as income (loss) before asset impairment charges, income taxes and noncontrolling interest income (loss) plus net interest expense and depreciation and amortization expense. EBITDA is not a measurement under U.S. GAAP and is not necessarily comparable with similarly titled measures of other companies. ($ in millions) Year Ended December 31 Qtr. Qtr. Consolidated 2014 2015 2016 2017 2018 12/31/2017 12/31/2018 Reconciliation of EBITDA Net income (loss) attributable to stockholders $ 109.8 $ 74.7 $ 42.8 $ 48.6 $ 34.7 (2.4) $ (1.2) $ Nuvera asset impairment - - - 4.9 - 4.9 - Noncontrolling interest income (loss) 0.4 0.4 (0.5) 0.3 (0.4) 0.1 - Income tax provision (benefit) 39.9 29.4 (4.0) 44.9 2.3 37.6 (1.7) Interest expense 3.9 4.7 6.7 14.6 16.0 4.0 4.4 Interest income (1.1) (1.5) (2.0) (3.6) (2.4) (0.8) (0.2) Depreciation and amortization expense 29.7 28.9 39.1 42.8 44.0 11.1 11.6 EBITDA 182.6 $ 136.6 $ 82.1 $ 152.5 $ 94.2 $ 54.5 $ 12.9 $ ($ in millions) Year Ended December 31 Qtr. Qtr. Lift Truck 2014 2015 2016 2017 2018 12/31/2017 12/31/2018 Reconciliation of EBITDA Net income attributable to stockholders $ 111.2 $ 89.3 $ 66.9 $ 71.8 $ 56.7 6.0 $ 6.3 $ Noncontrolling interest income (loss) 0.4 0.4 (0.5) (0.4) (0.9) (0.1) (0.1) Income tax provision (benefit) 40.7 39.4 12.2 59.4 10.6 42.3 (0.8) Interest expense 3.9 4.7 6.9 13.9 15.4 3.8 4.3 Interest income (1.1) (1.5) (3.0) (3.7) (2.6) (0.8) (0.4) Depreciation and amortization expense 29.6 27.3 28.1 29.6 33.5 7.5 9.0 EBITDA $ 184.7 $ 159.6 $ 110.6 $ 170.6 $ 112.7 $ 58.7 $ 18.3

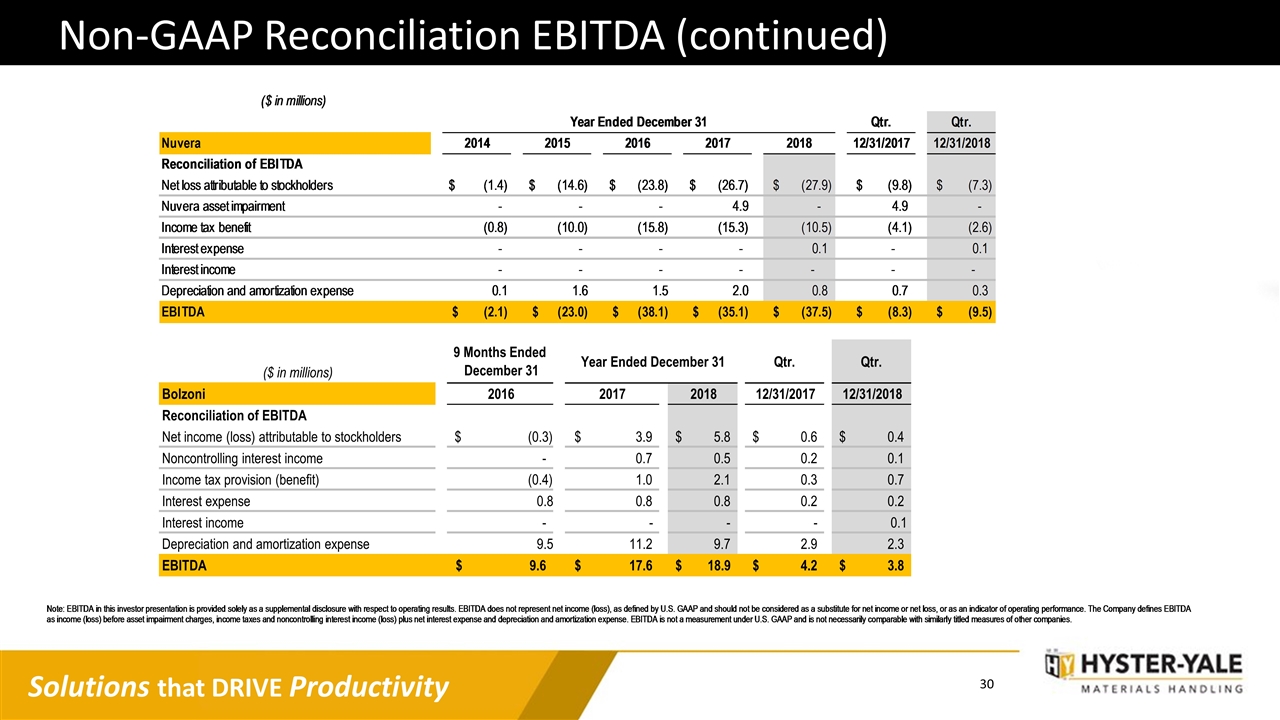

Non-GAAP Reconciliation EBITDA (continued) ($ in millions) Bolzoni 2016 2017 2018 12/31/2017 12/31/2018 Reconciliation of EBITDA Net income (loss) attributable to stockholders $ (0.3) 3.9 $ 5.8 $ 0.6 $ 0.4 $ Noncontrolling interest income - 0.7 0.5 0.2 0.1 Income tax provision (benefit) (0.4) 1.0 2.1 0.3 0.7 Interest expense 0.8 0.8 0.8 0.2 0.2 Interest income - - - - 0.1 Depreciation and amortization expense 9.5 11.2 9.7 2.9 2.3 EBITDA 9.6 $ 17.6 $ 18.9 $ 4.2 $ 3.8 $ 9 Months Ended December 31 Qtr. Qtr. Year Ended December 31

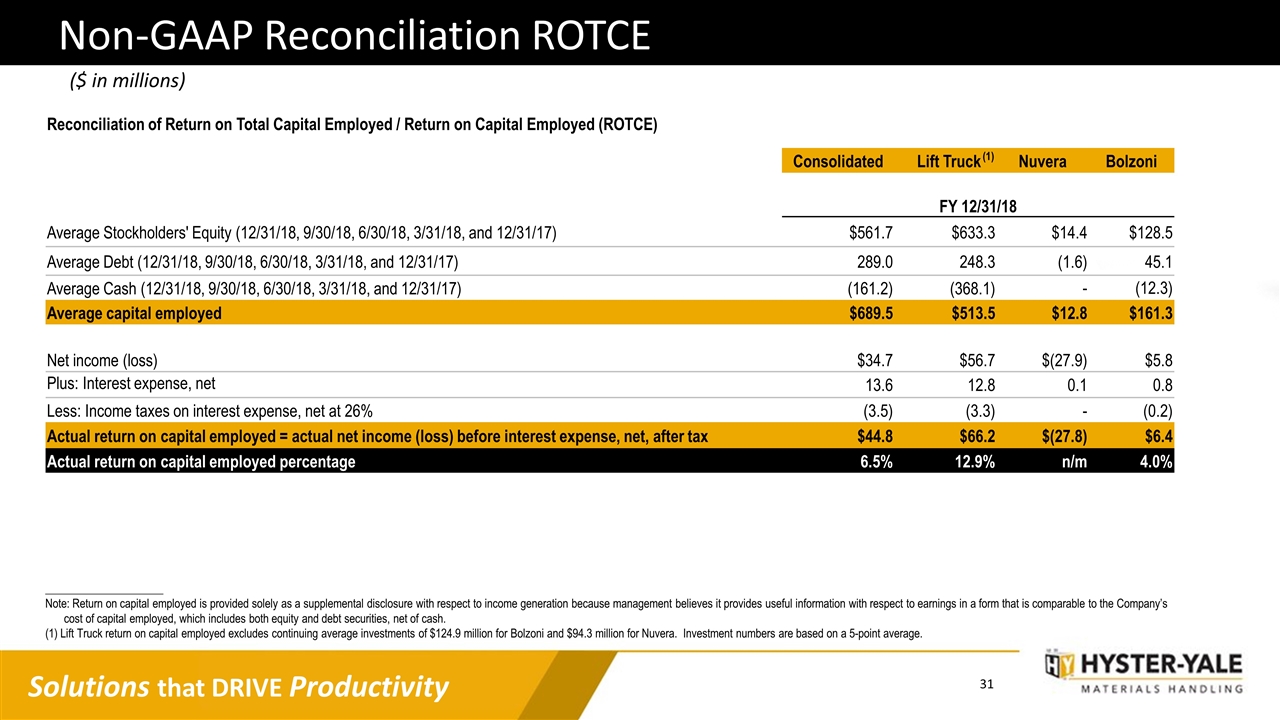

Non-GAAP Reconciliation ROTCE _____________________ Note: Return on capital employed is provided solely as a supplemental disclosure with respect to income generation because management believes it provides useful information with respect to earnings in a form that is comparable to the Company’s cost of capital employed, which includes both equity and debt securities, net of cash. (1) Lift Truck return on capital employed excludes continuing average investments of $124.9 million for Bolzoni and $94.3 million for Nuvera. Investment numbers are based on a 5-point average. Reconciliation of Return on Total Capital Employed / Return on Capital Employed (ROTCE) Consolidated Lift Truck (1) Nuvera Bolzoni FY 12/31/18 Average Stockholders' Equity (12/31/18, 9/30/18, 6/30/18, 3/31/18, and 12/31/17) $561.7 $633.3 $14.4 $128.5 Average Debt (12/31/18, 9/30/18, 6/30/18, 3/31/18, and 12/31/17) 289.0 248.3 (1.6) 45.1 Average Cash (12/31/18, 9/30/18, 6/30/18, 3/31/18, and 12/31/17) (161.2) (368.1) - (12.3) Average capital employed $689.5 $513.5 $12.8 $161.3 Net income (loss) $34.7 $56.7 $(27.9) $5.8 Plus: Interest expense, net 13.6 12.8 0.1 0.8 Less: Income taxes on interest expense, net at 26% (3.5) (3.3) - (0.2) Actual return on capital employed = actual net income (loss) before interest expense, net, after tax $44.8 $66.2 $(27.8) $6.4 Actual return on capital employed percentage 6.5% 12.9% n/m 4.0% ($ in millions)

Cash Flow before Financing Calculation Consolidated ($ in millions) Year Ended December 31 2014 2015 2016 2017 2018 Reconciliation of Cash Flow before Financing Net cash provided by (used for) operating activities $100.0 $89.4 $(48.9) $164.7 $67.6 Net cash used for investing activities (44.4) (31.3) (145.1) (47.3) (110.9) Cash Flow before Financing $55.6 $58.1 $(194.0) $117.4 ($43.3) Impact of accelerated supplier payments - - 80.0 (80.0) - Adjusted Cash Flow before Financing $55.6 $58.1 $(114.0) $37.4 ($43.3)

Supplemental Information

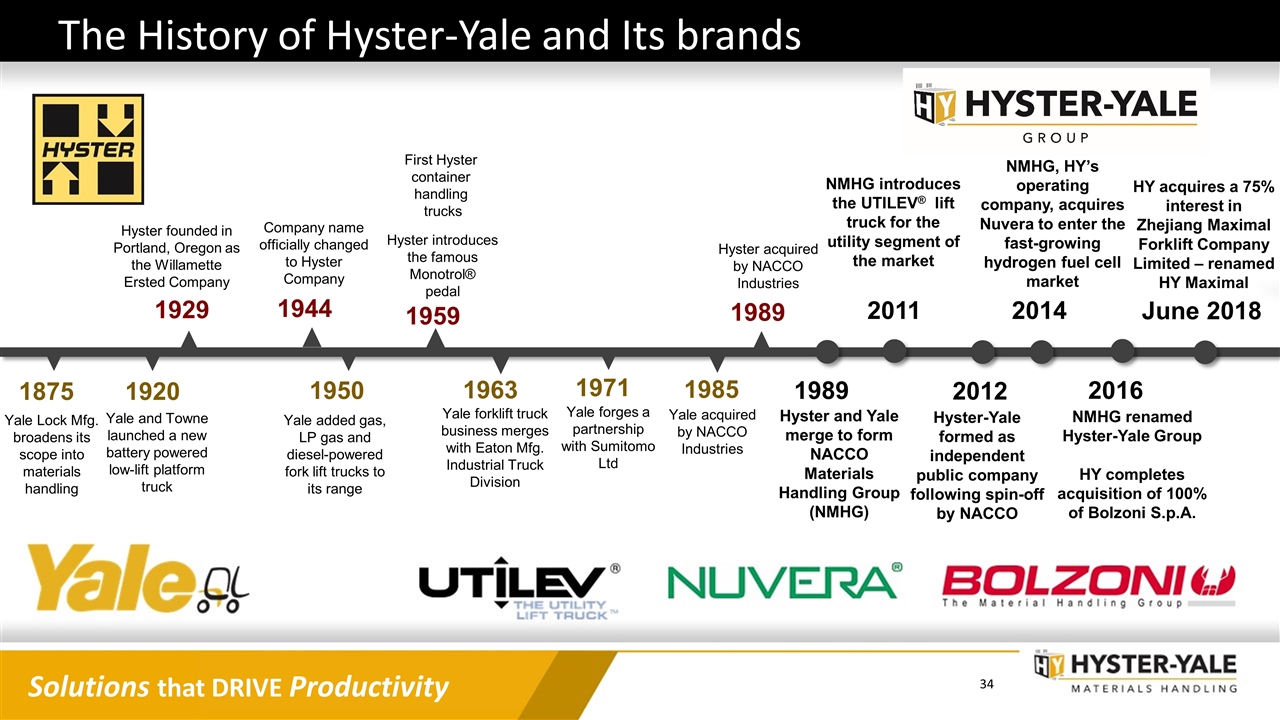

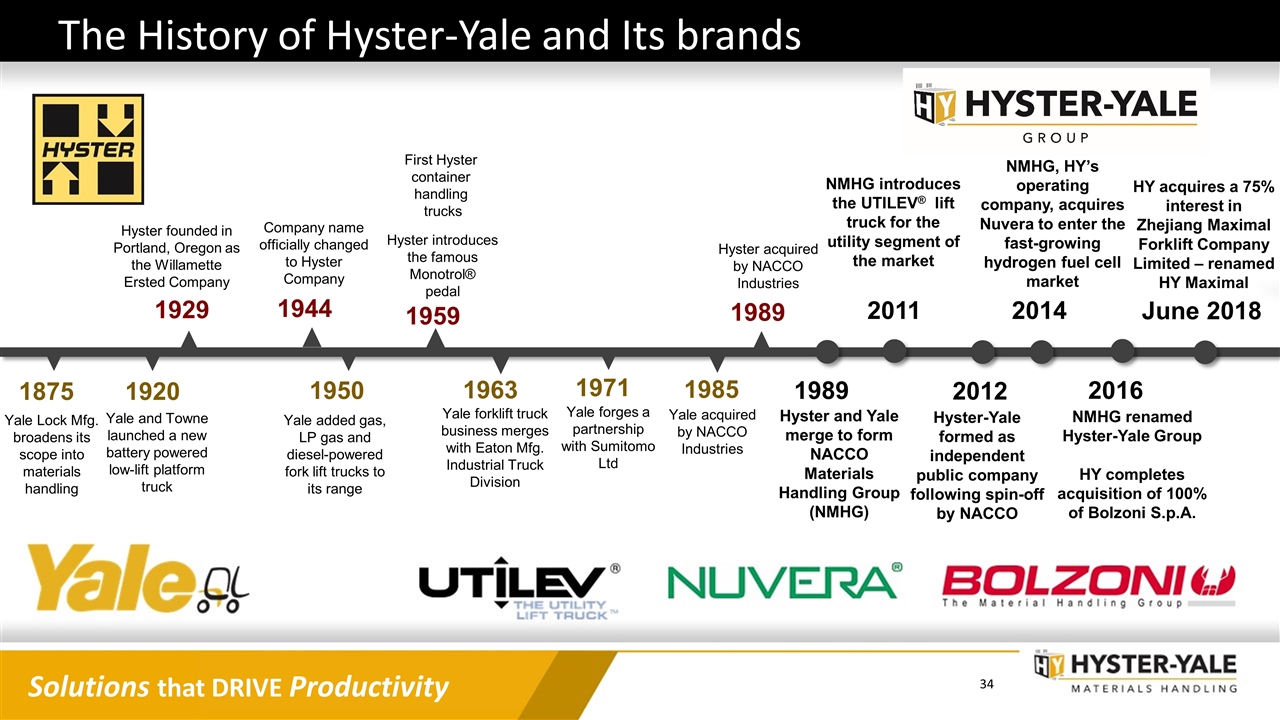

Hyster founded in Portland, Oregon as the Willamette Ersted Company 1929 1944 1959 Company name officially changed to Hyster Company First Hyster container handling trucks 1875 1920 Yale Lock Mfg. broadens its scope into materials handling Yale and Towne launched a new battery powered low-lift platform truck 1963 Yale forklift truck business merges with Eaton Mfg. Industrial Truck Division 1950 Yale added gas, LP gas and diesel-powered fork lift trucks to its range Hyster introduces the famous Monotrol® pedal 1971 Yale forges a partnership with Sumitomo Ltd 2011 NMHG introduces the UTILEV® lift truck for the utility segment of the market 2016 1985 Yale acquired by NACCO Industries 1989 Hyster acquired by NACCO Industries NMHG renamed Hyster-Yale Group HY completes acquisition of 100% of Bolzoni S.p.A. The History of Hyster-Yale and Its brands 1989 2012 Hyster-Yale formed as independent public company following spin-off by NACCO 2014 NMHG, HY’s operating company, acquires Nuvera to enter the fast-growing hydrogen fuel cell market Hyster and Yale merge to form NACCO Materials Handling Group (NMHG) June 2018 HY acquires a 75% interest in Zhejiang Maximal Forklift Company Limited – renamed HY Maximal Solutions that DRIVE Productivity

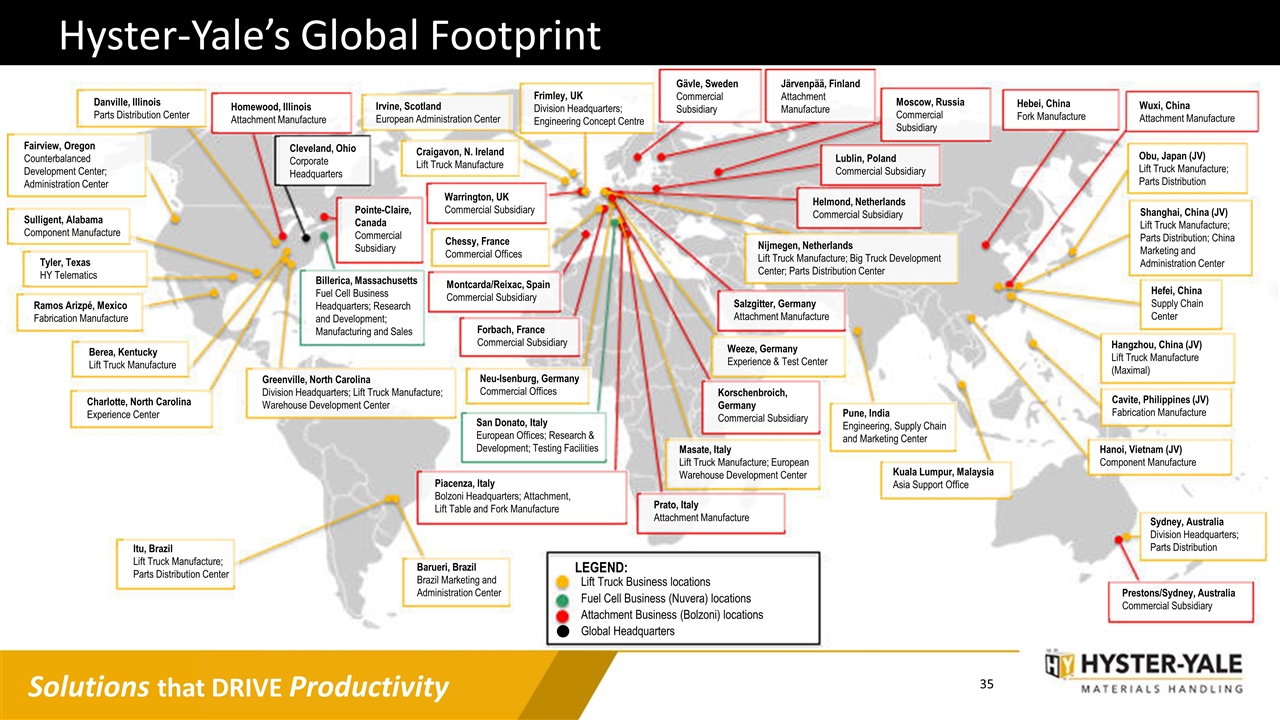

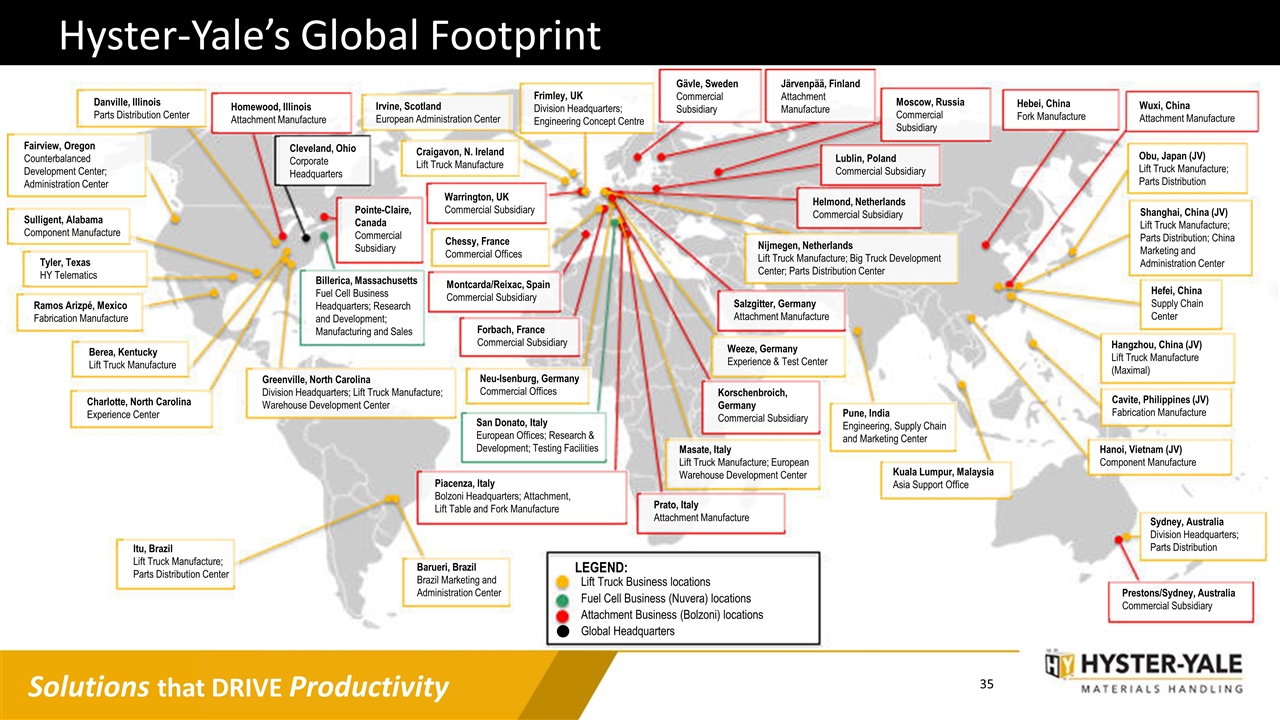

Hyster-Yale’s Global Footprint Ramos Arizpé, Mexico Fabrication Manufacture Sulligent, Alabama Component Manufacture Berea, Kentucky Lift Truck Manufacture Greenville, North Carolina Division Headquarters; Lift Truck Manufacture; Warehouse Development Center Cleveland, Ohio Corporate Headquarters Danville, Illinois Parts Distribution Center Charlotte, North Carolina Experience Center Barueri, Brazil Brazil Marketing and Administration Center Itu, Brazil Lift Truck Manufacture; Parts Distribution Center Craigavon, N. Ireland Lift Truck Manufacture Nijmegen, Netherlands Lift Truck Manufacture; Big Truck Development Center; Parts Distribution Center Masate, Italy Lift Truck Manufacture; European Warehouse Development Center Shanghai, China (JV) Lift Truck Manufacture; Parts Distribution; China Marketing and Administration Center Obu, Japan (JV) Lift Truck Manufacture; Parts Distribution Cavite, Philippines (JV) Fabrication Manufacture Irvine, Scotland European Administration Center Hanoi, Vietnam (JV) Component Manufacture Sydney, Australia Division Headquarters; Parts Distribution Pune, India Engineering, Supply Chain and Marketing Center Frimley, UK Division Headquarters; Engineering Concept Centre Kuala Lumpur, Malaysia Asia Support Office Hefei, China Supply Chain Center Fairview, Oregon Counterbalanced Development Center; Administration Center San Donato, Italy European Offices; Research & Development; Testing Facilities Billerica, Massachusetts Fuel Cell Business Headquarters; Research and Development; Manufacturing and Sales Homewood, Illinois Attachment Manufacture Piacenza, Italy Bolzoni Headquarters; Attachment, Lift Table and Fork Manufacture Järvenpää, Finland Attachment Manufacture Salzgitter, Germany Attachment Manufacture Wuxi, China Attachment Manufacture Hebei, China Fork Manufacture Pointe-Claire, Canada Commercial Subsidiary Prestons/Sydney, Australia Commercial Subsidiary Warrington, UK Commercial Subsidiary Montcarda/Reixac, Spain Commercial Subsidiary Forbach, France Commercial Subsidiary Prato, Italy Attachment Manufacture Lublin, Poland Commercial Subsidiary Moscow, Russia Commercial Subsidiary Korschenbroich, Germany Commercial Subsidiary Gävle, Sweden Commercial Subsidiary Helmond, Netherlands Commercial Subsidiary Lift Truck Business locations Fuel Cell Business (Nuvera) locations Attachment Business (Bolzoni) locations Global Headquarters LEGEND: Tyler, Texas HY Telematics Chessy, France Commercial Offices Neu-Isenburg, Germany Commercial Offices Weeze, Germany Experience & Test Center Hangzhou, China (JV) Lift Truck Manufacture (Maximal) l

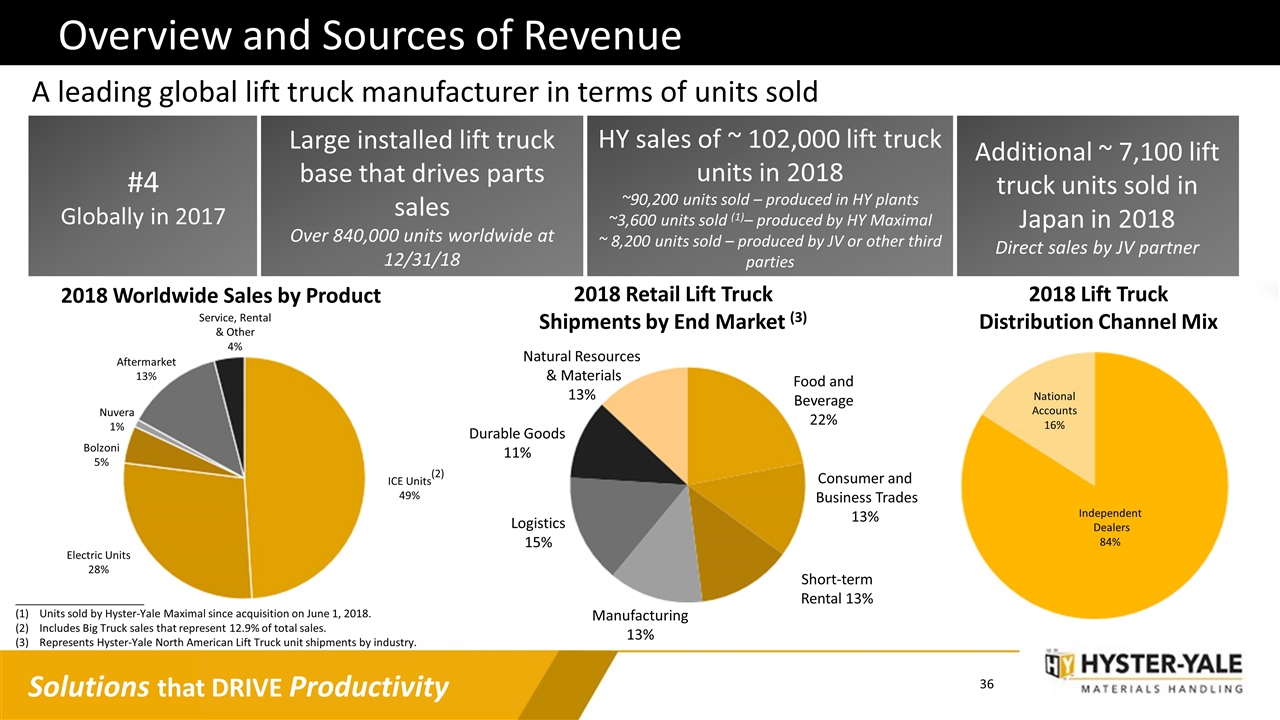

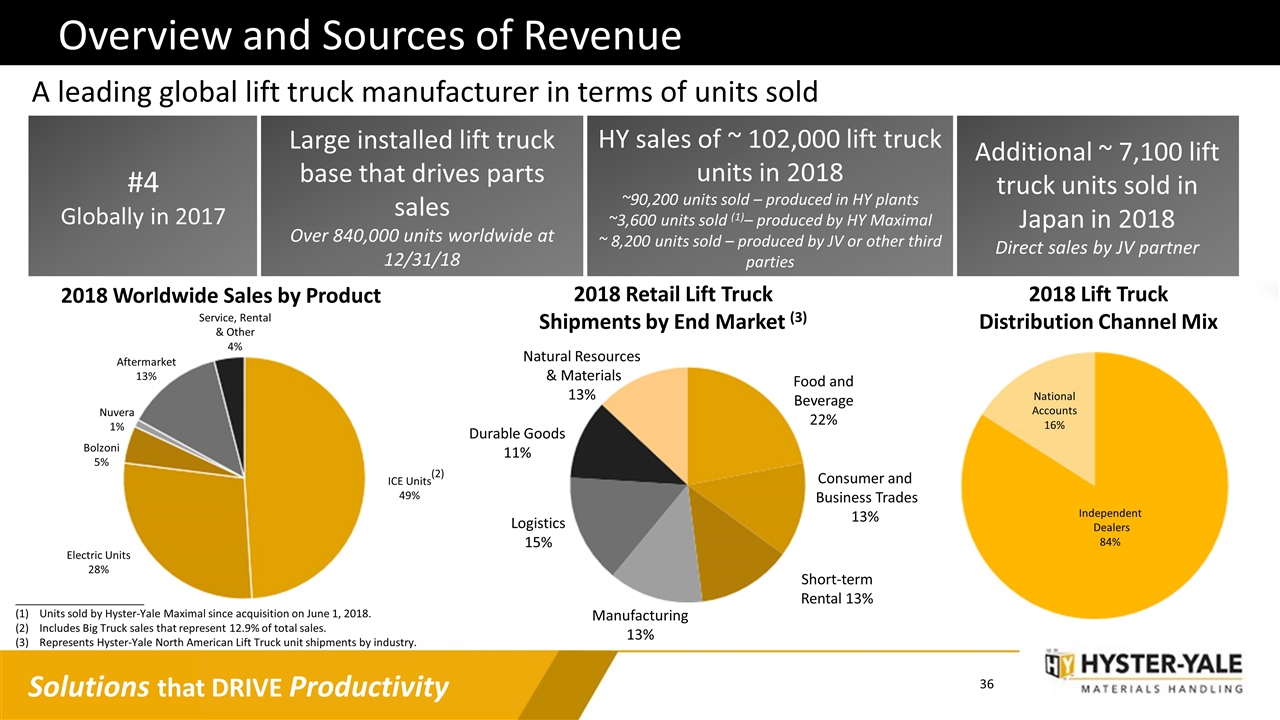

Overview and Sources of Revenue A leading global lift truck manufacturer in terms of units sold #4 Globally in 2017 Large installed lift truck base that drives parts sales Over 840,000 units worldwide at 12/31/18 HY sales of ~ 102,000 lift truck units in 2018 ~90,200 units sold – produced in HY plants ~3,600 units sold (1)– produced by HY Maximal ~ 8,200 units sold – produced by JV or other third parties Additional ~ 7,100 lift truck units sold in Japan in 2018 Direct sales by JV partner Consumer and Business Trades 13% Manufacturing 13% Durable Goods 11% Natural Resources & Materials 13% 2018 Worldwide Sales by Product 2018 Retail Lift Truck Shipments by End Market (3) 2018 Lift Truck Distribution Channel Mix Independent Dealers 84% (2) _____________________ Units sold by Hyster-Yale Maximal since acquisition on June 1, 2018. Includes Big Truck sales that represent 12.9% of total sales. Represents Hyster-Yale North American Lift Truck unit shipments by industry.

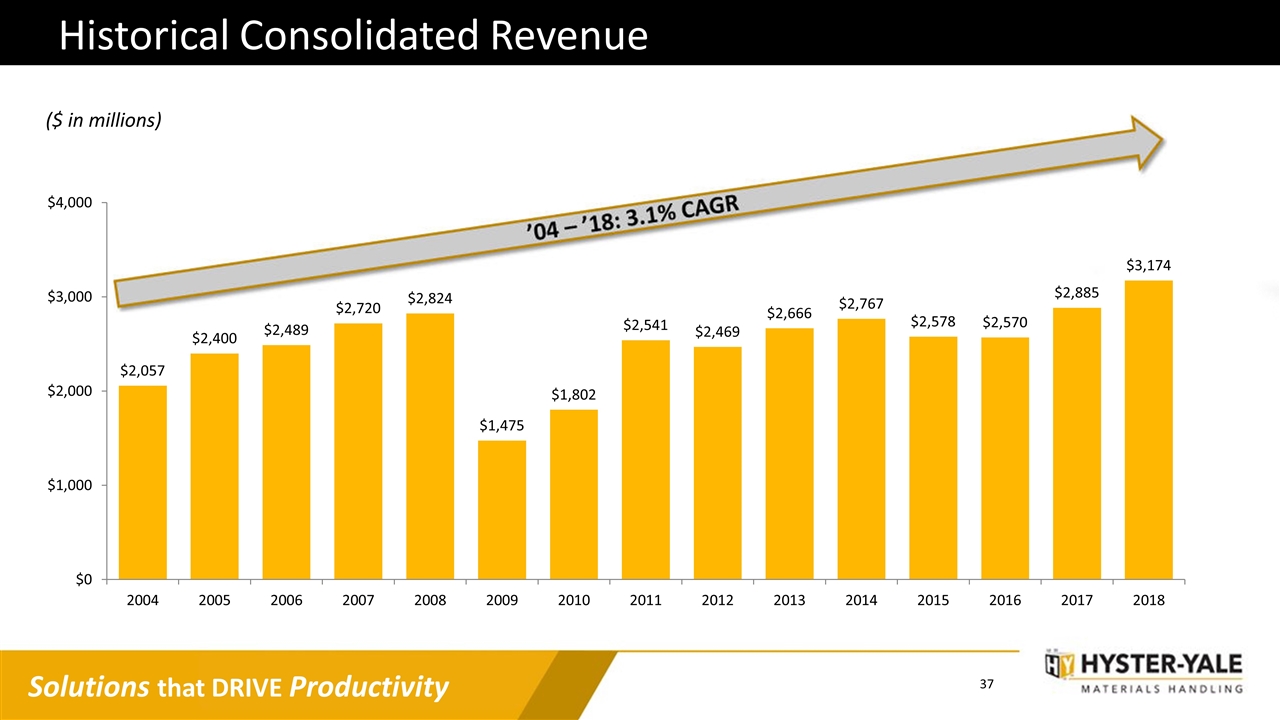

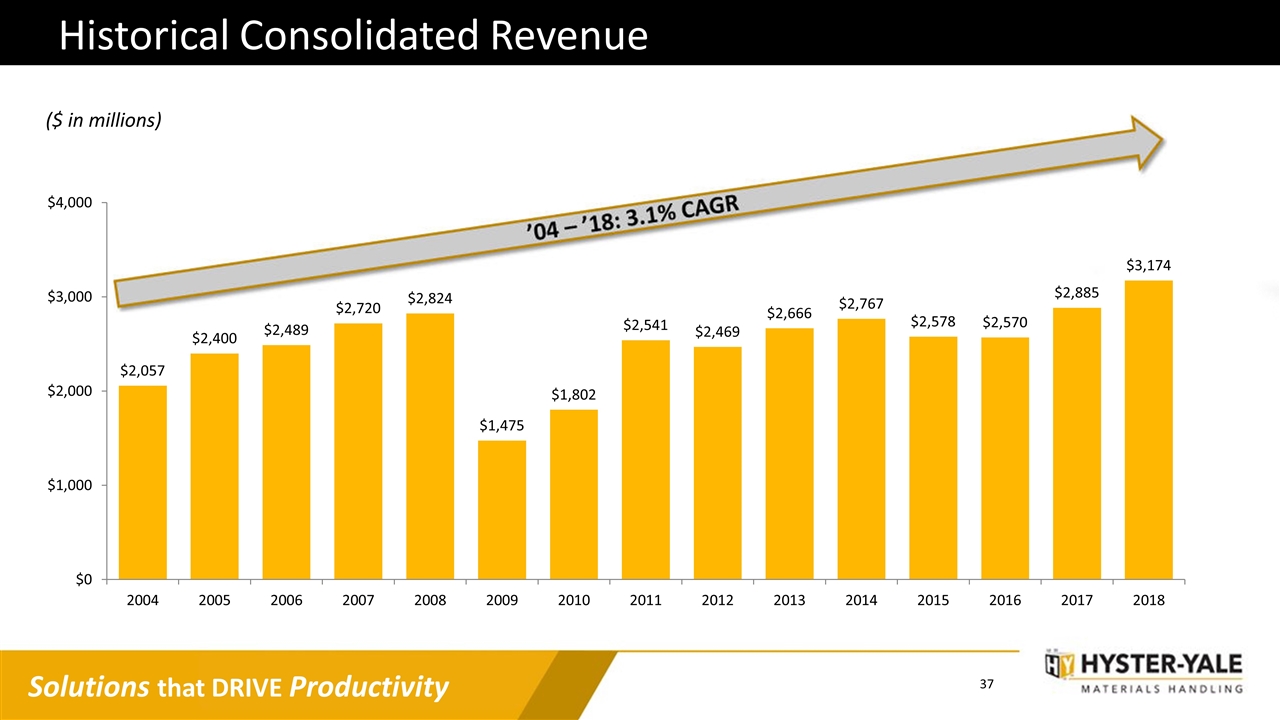

Historical Consolidated Revenue ($ in millions)

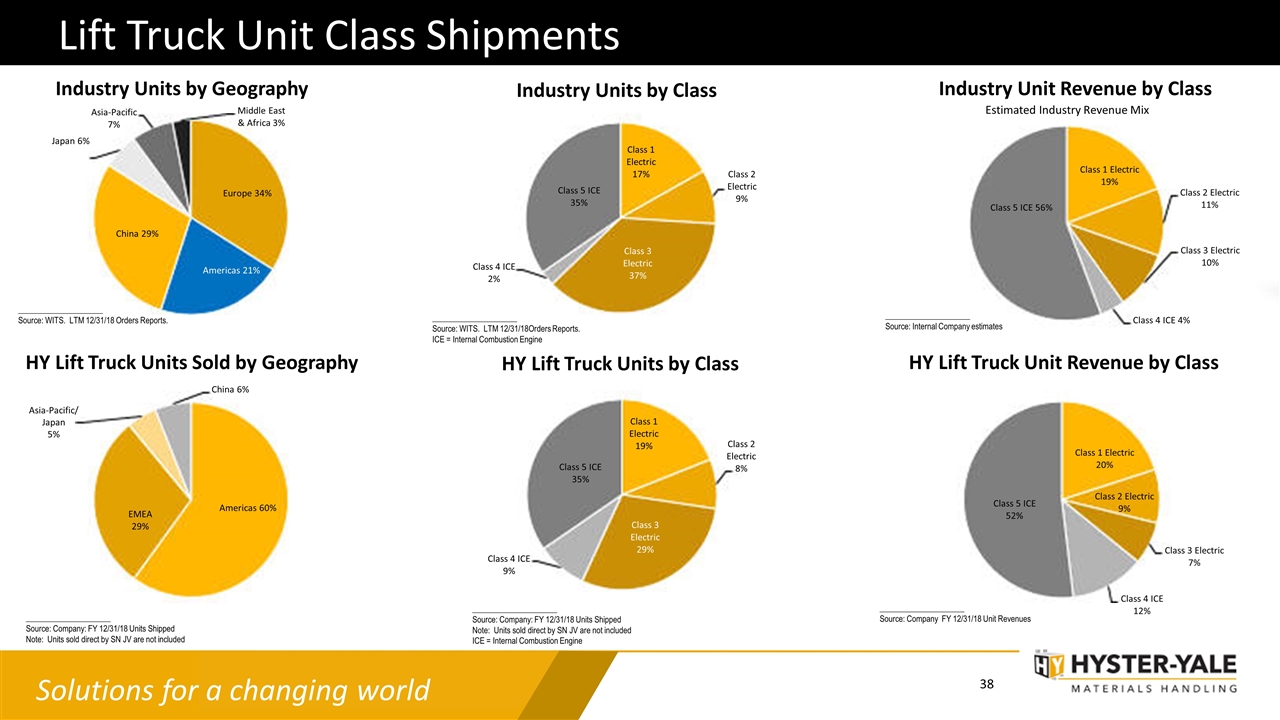

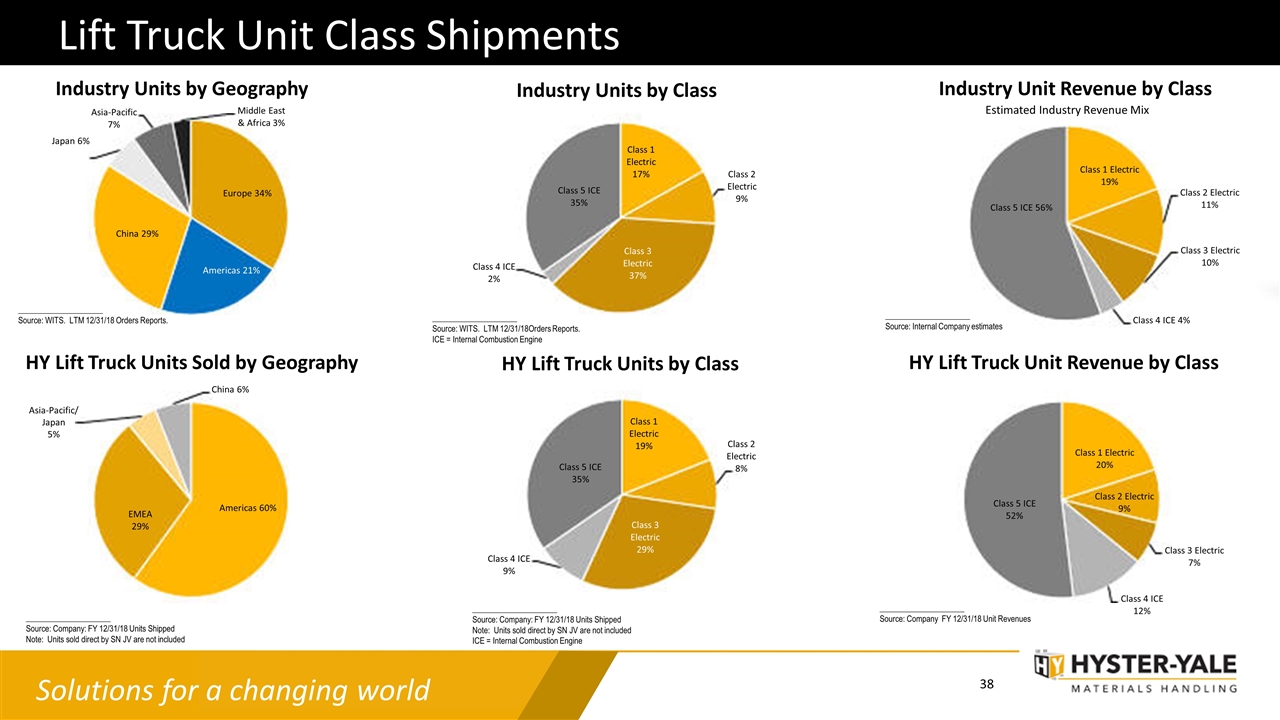

Industry Units by Geography Lift Truck Unit Class Shipments _____________________ Source: Company: FY 12/31/18 Units Shipped Note: Units sold direct by SN JV are not included HY Lift Truck Units Sold by Geography _____________________ Source: WITS. LTM 12/31/18 Orders Reports. _____________________ Source: WITS. LTM 12/31/18Orders Reports. ICE = Internal Combustion Engine _____________________ Source: Company: FY 12/31/18 Units Shipped Note: Units sold direct by SN JV are not included ICE = Internal Combustion Engine Industry Units by Class HY Lift Truck Units by Class _____________________ Source: Internal Company estimates Estimated Industry Revenue Mix Industry Unit Revenue by Class HY Lift Truck Unit Revenue by Class _____________________ Source: Company FY 12/31/18 Unit Revenues Asia-Pacific/ Japan 5%

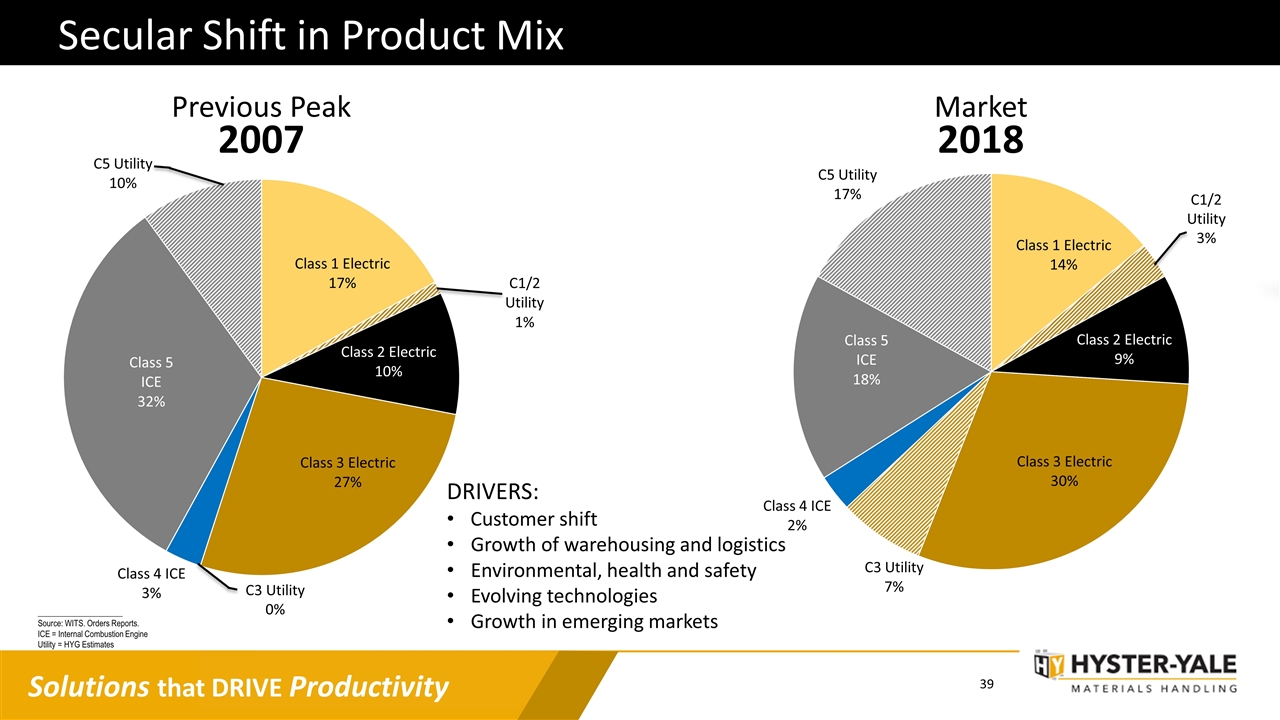

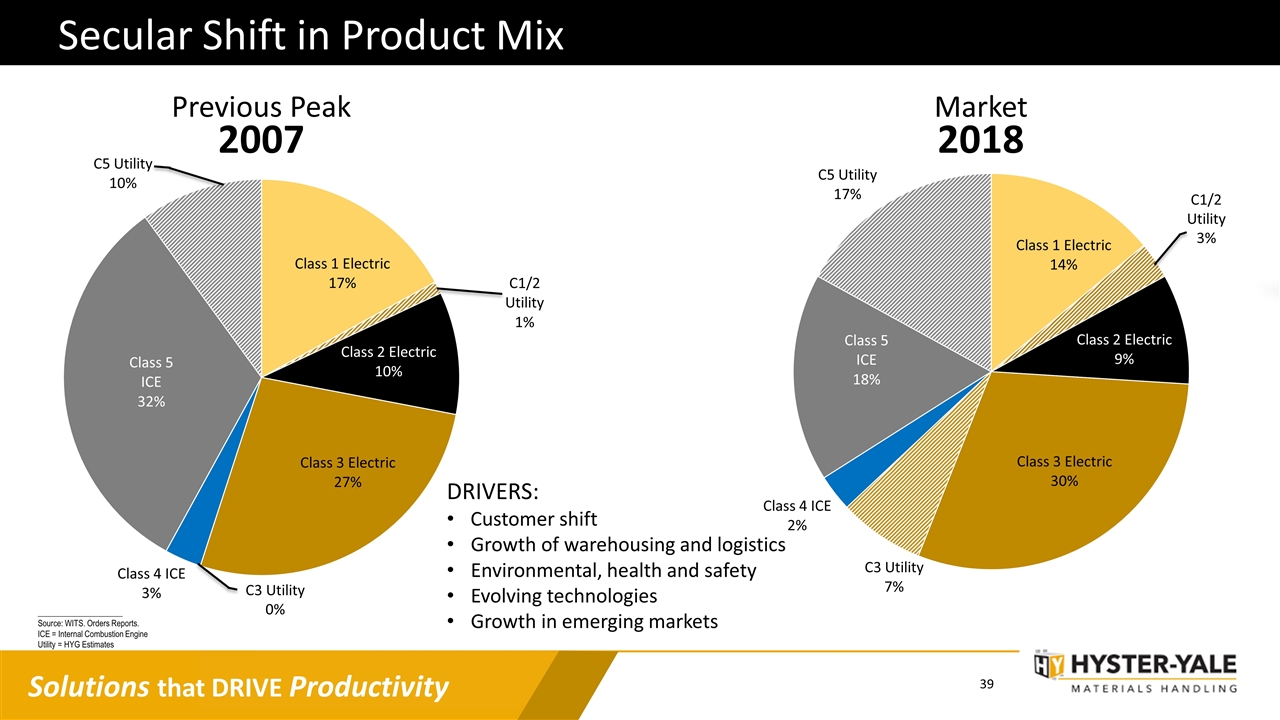

Secular Shift in Product Mix Market 2018 _____________________ Source: WITS. Orders Reports. ICE = Internal Combustion Engine Utility = HYG Estimates DRIVERS: Customer shift Growth of warehousing and logistics Environmental, health and safety Evolving technologies Growth in emerging markets Previous Peak 2007 C1/2 Utility 3% Solutions that DRIVE Productivity

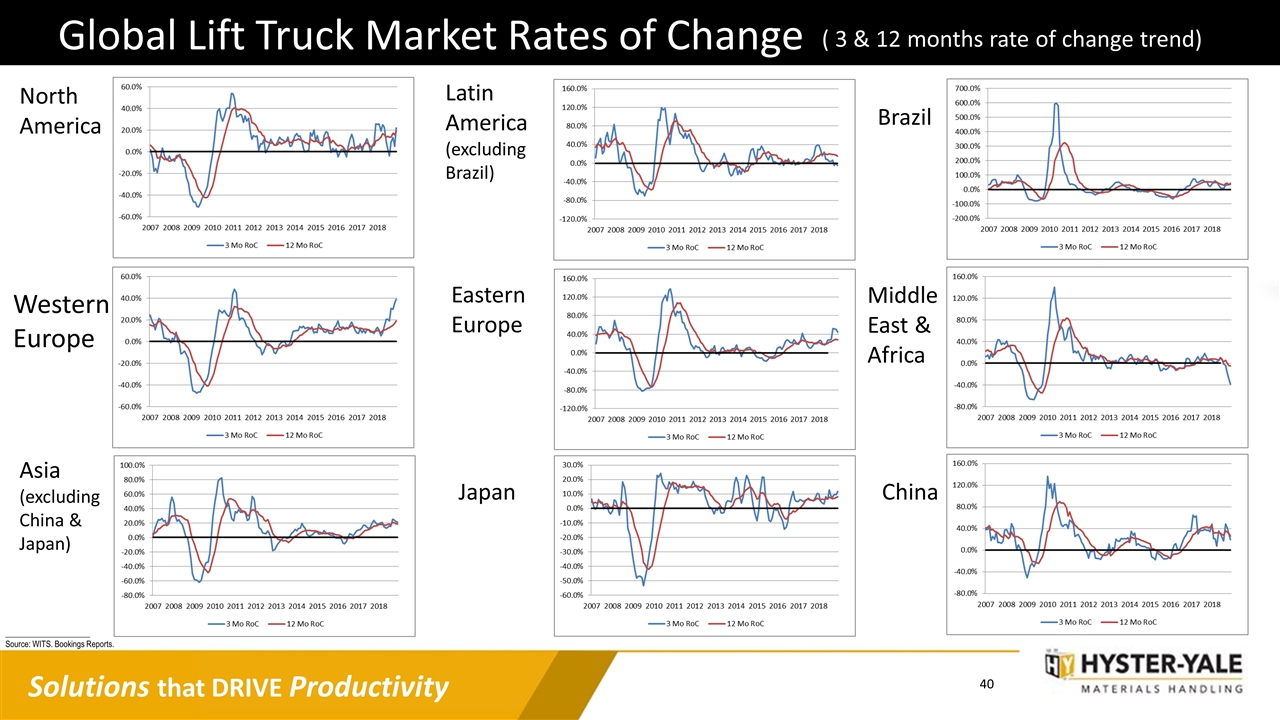

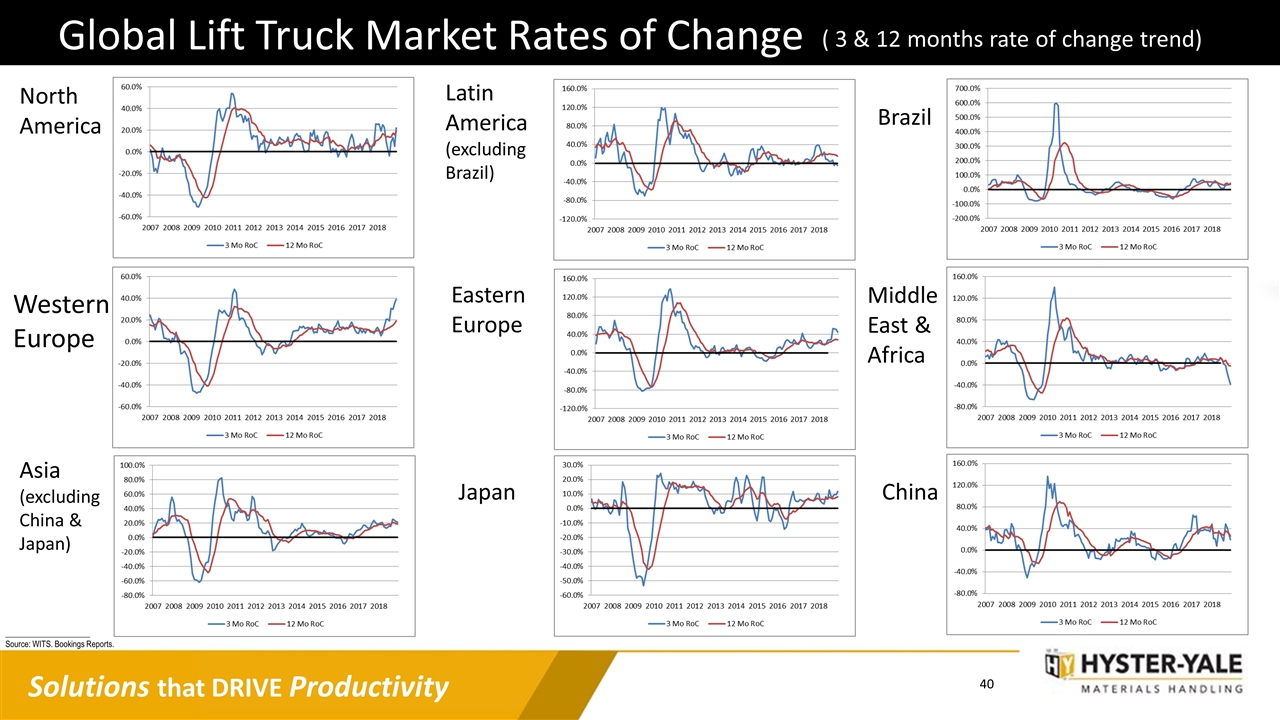

Japan Western Europe Eastern Europe Brazil North America Middle East & Africa Latin America (excluding Brazil) Asia (excluding China & Japan) China ( 3 & 12 months rate of change trend) Global Lift Truck Market Rates of Change _____________________ Source: WITS. Bookings Reports.

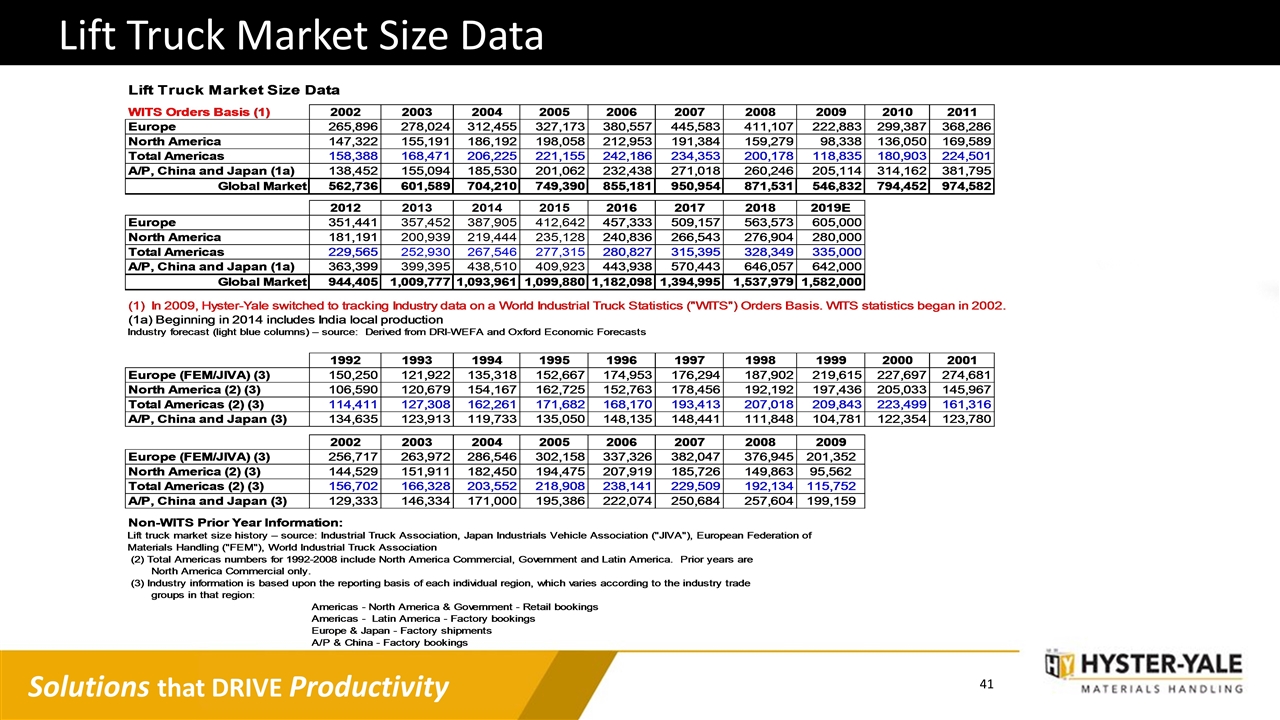

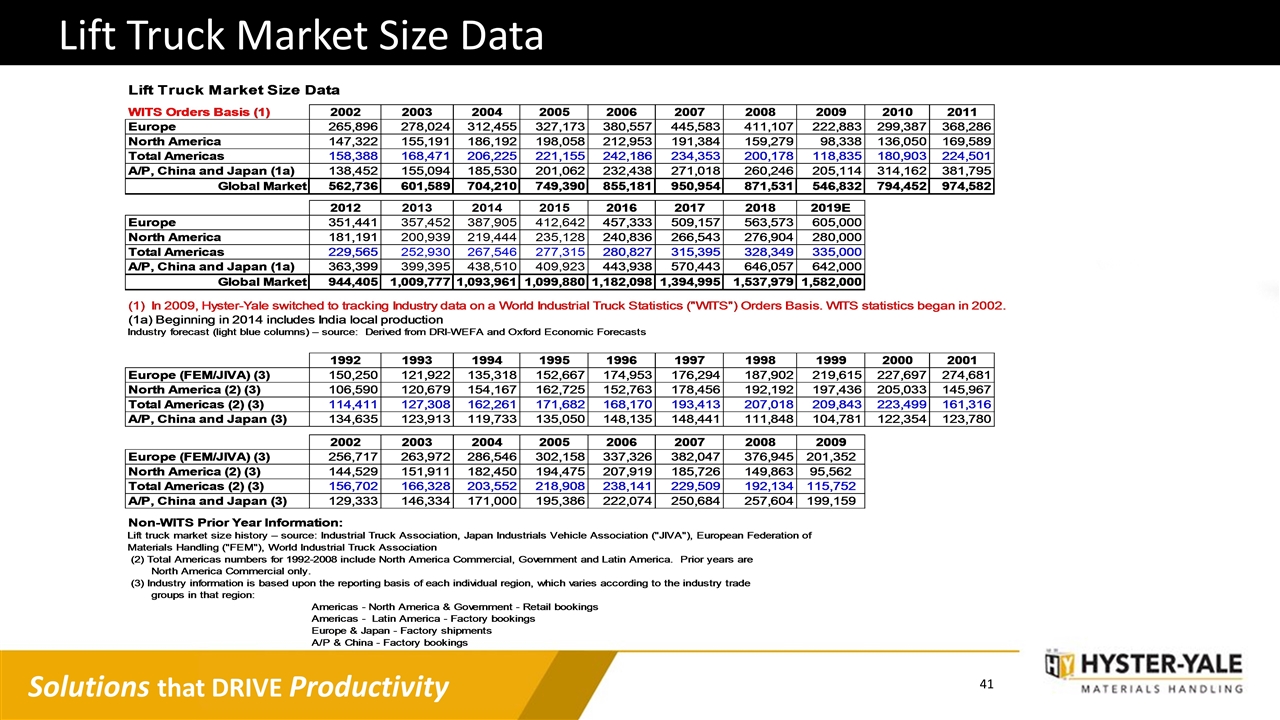

Lift Truck Market Size Data

Our Long-Term Philosophy Long-term growth Long-term shareholders Shareholder protection Senior management incentivized as long-term shareholders Increase shareholder value Return on Capital Employed and Market Share Increase focus

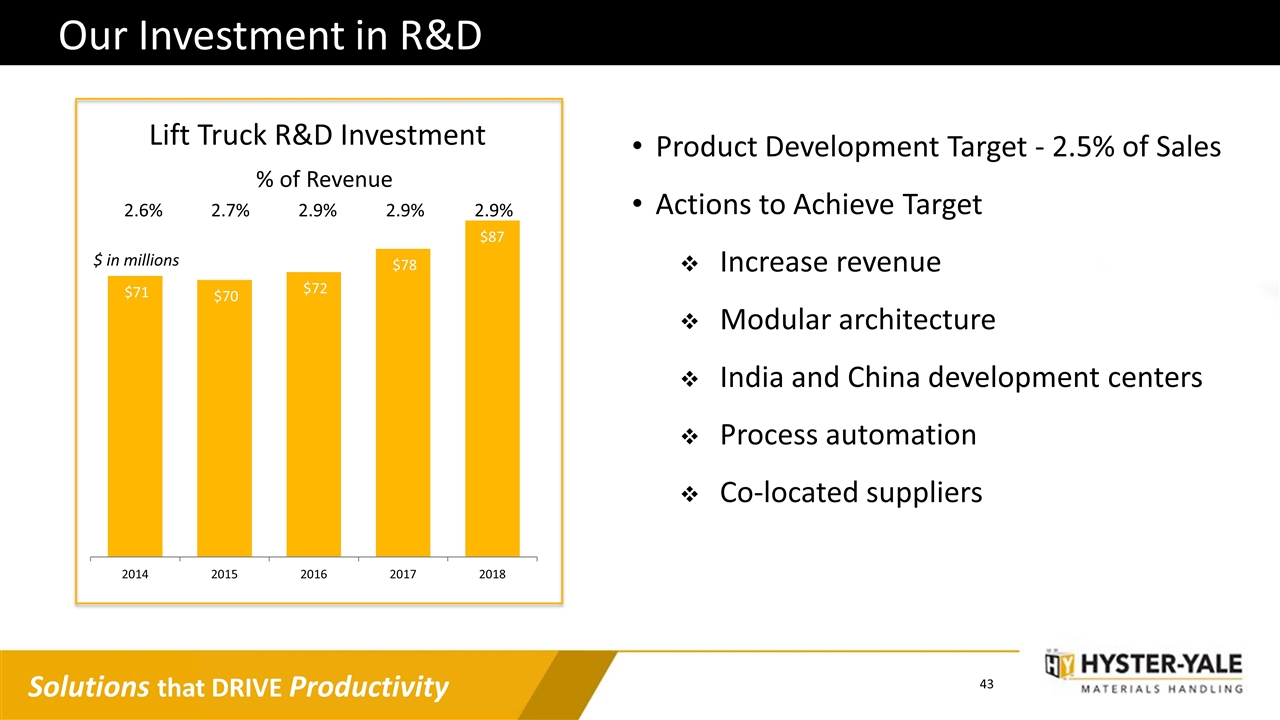

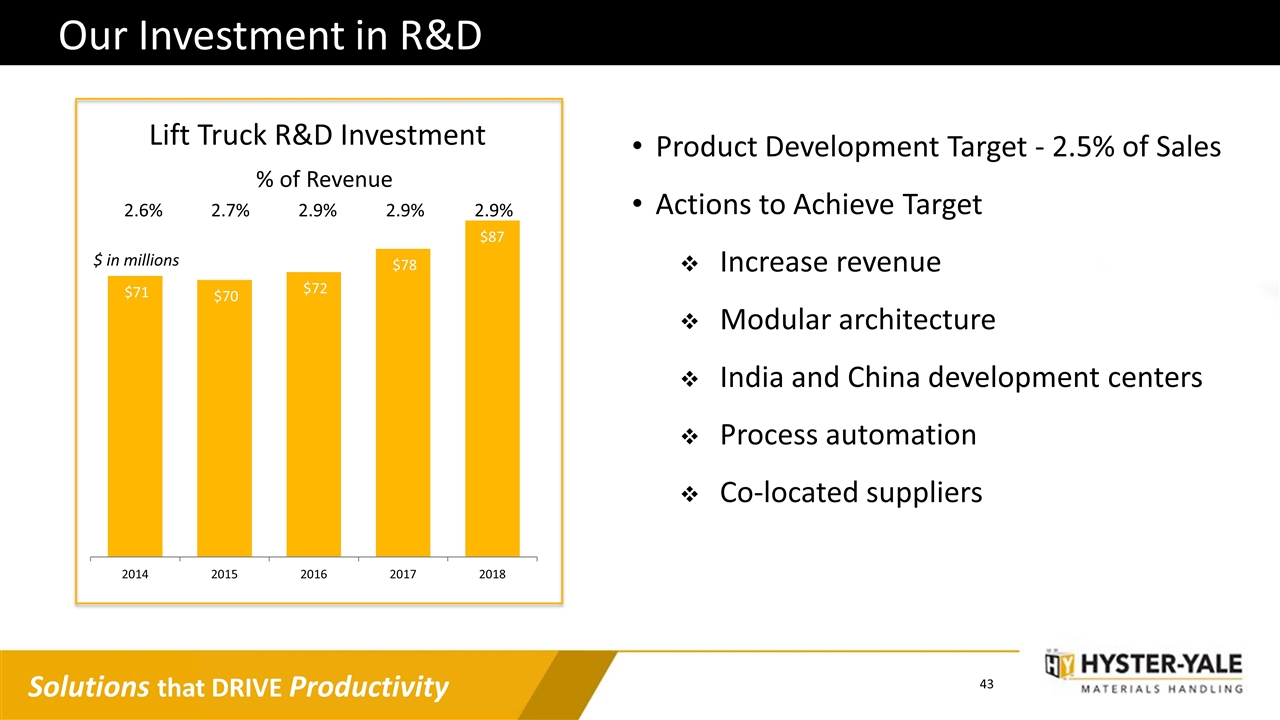

Our Investment in R&D Lift Truck R&D Investment 2.6% 2.7% 2.9% 2.9% 2.9% % of Revenue $ in millions Product Development Target - 2.5% of Sales Actions to Achieve Target Increase revenue Modular architecture India and China development centers Process automation Co-located suppliers

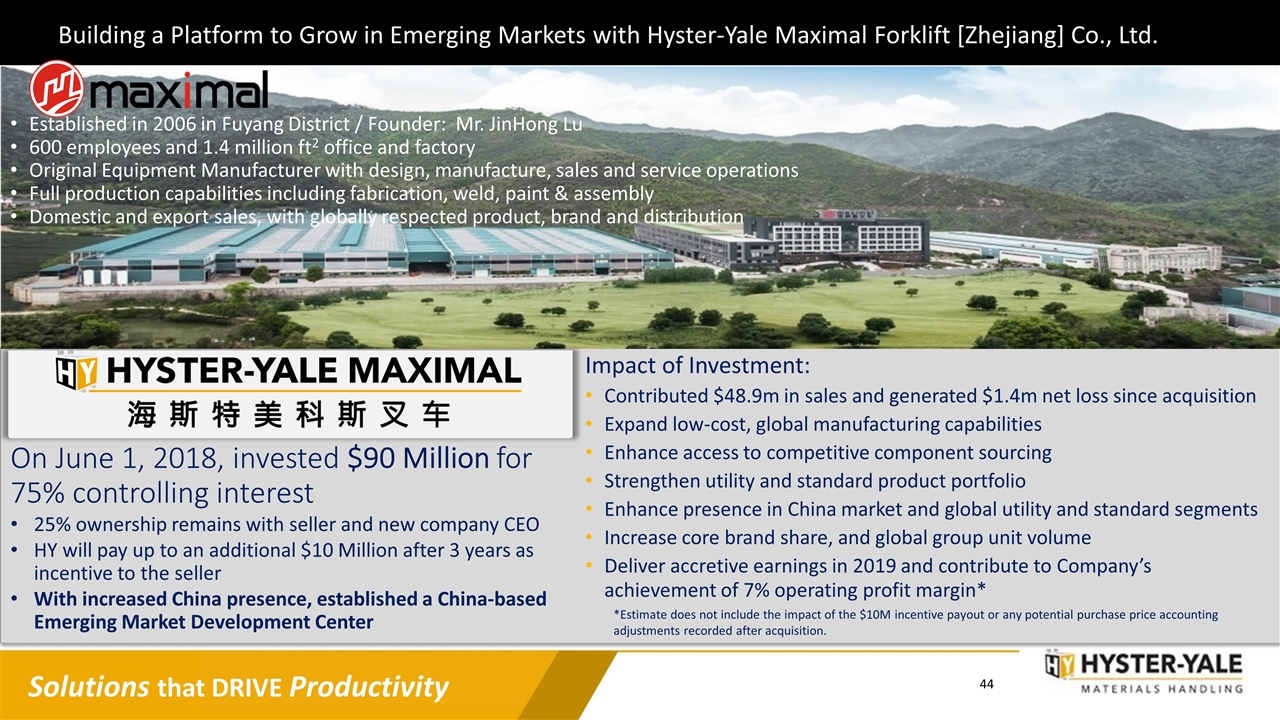

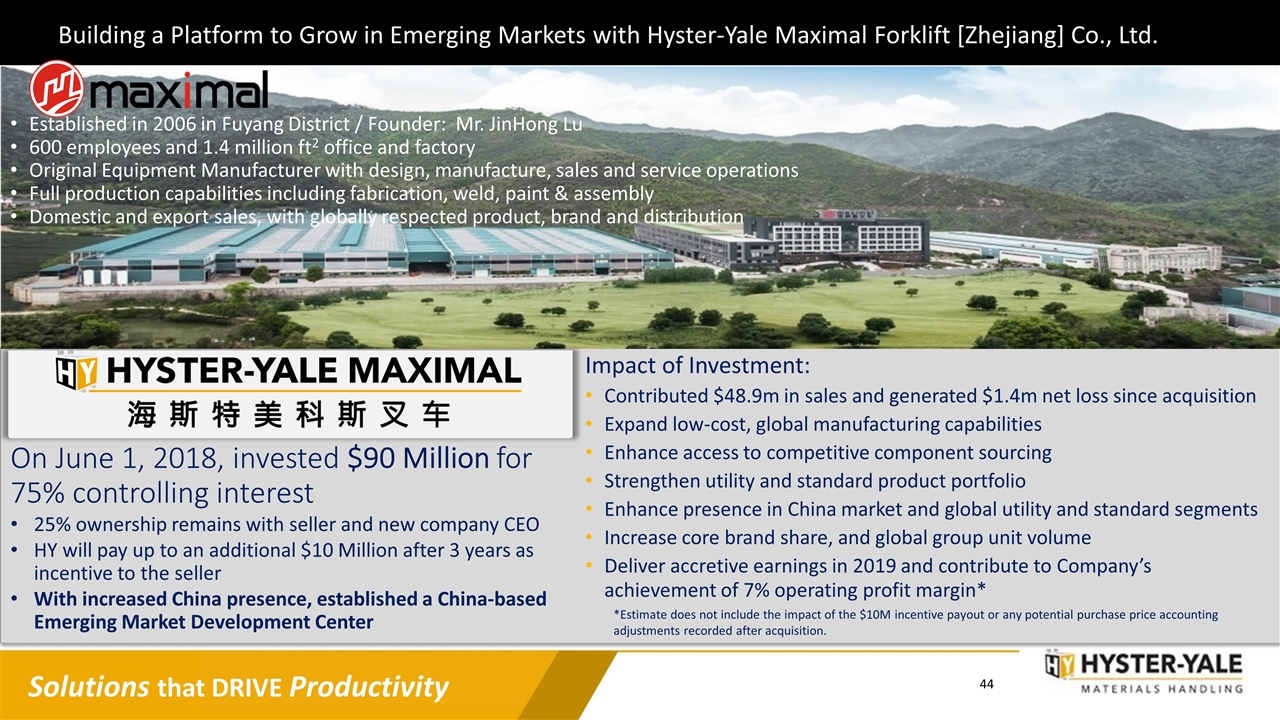

Building a Platform to Grow in Emerging Markets with Hyster-Yale Maximal Forklift [Zhejiang] Co., Ltd. Established in 2006 in Fuyang District / Founder: Mr. JinHong Lu 600 employees and 1.4 million ft2 office and factory Original Equipment Manufacturer with design, manufacture, sales and service operations Full production capabilities including fabrication, weld, paint & assembly Domestic and export sales, with globally respected product, brand and distribution On June 1, 2018, invested $90 Million for 75% controlling interest 25% ownership remains with seller and new company CEO HY will pay up to an additional $10 Million after 3 years as incentive to the seller With increased China presence, established a China-based Emerging Market Development Center Impact of Investment: Contributed $48.9m in sales and generated $1.4m net loss since acquisition Expand low-cost, global manufacturing capabilities Enhance access to competitive component sourcing Strengthen utility and standard product portfolio Enhance presence in China market and global utility and standard segments Increase core brand share, and global group unit volume Deliver accretive earnings in 2019 and contribute to Company’s achievement of 7% operating profit margin* *Estimate does not include the impact of the $10M incentive payout or any potential purchase price accounting adjustments recorded after acquisition.

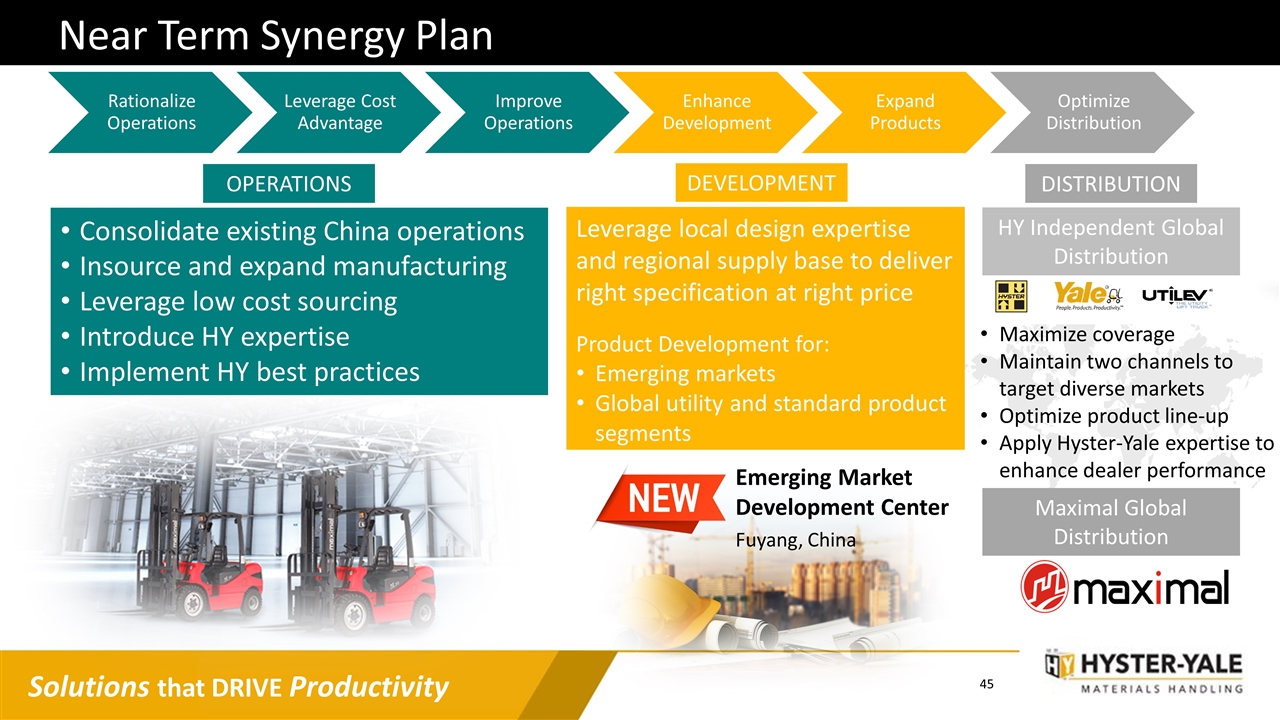

Near Term Synergy Plan Consolidate existing China operations Insource and expand manufacturing Leverage low cost sourcing Introduce HY expertise Implement HY best practices Emerging Market Development Center Fuyang, China HY Independent Global Distribution Maximize coverage Maintain two channels to target diverse markets Optimize product line-up Apply Hyster-Yale expertise to enhance dealer performance Maximal Global Distribution OPERATIONS DEVELOPMENT DISTRIBUTION Leverage local design expertise and regional supply base to deliver right specification at right price Product Development for: Emerging markets Global utility and standard product segments Rationalize Operations Improve Operations Enhance Development Optimize Distribution Leverage Cost Advantage Expand Products

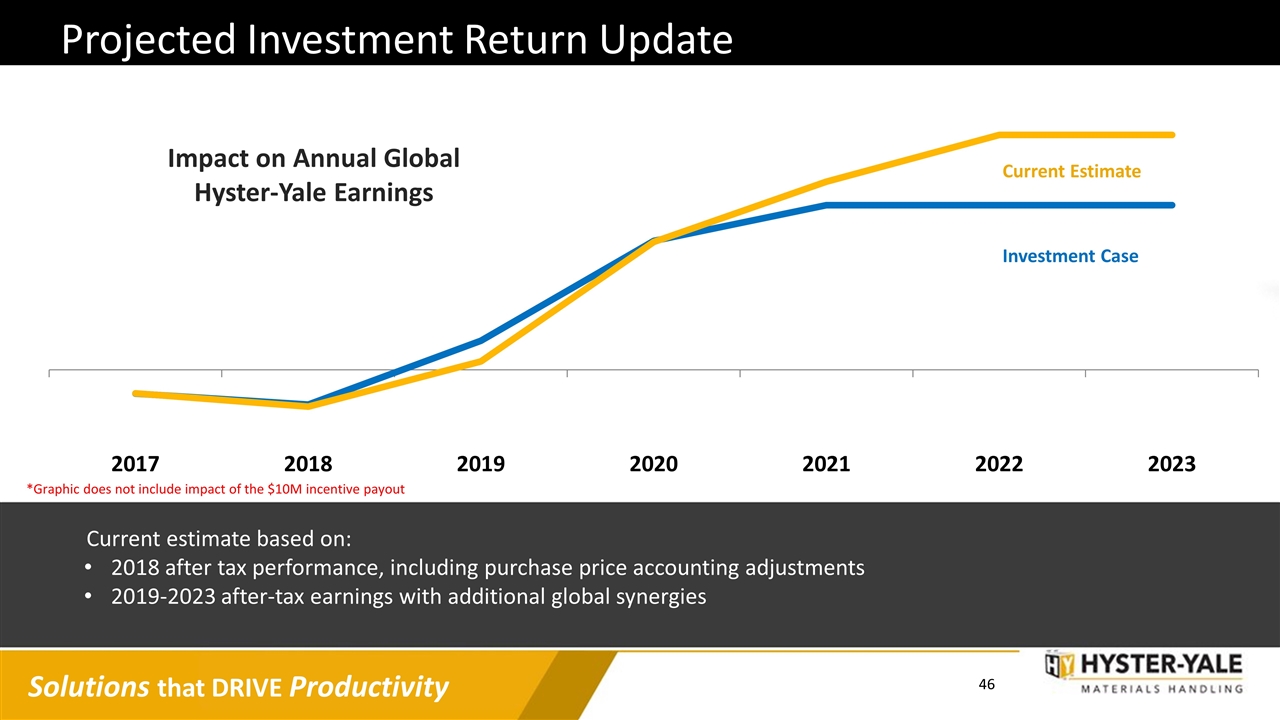

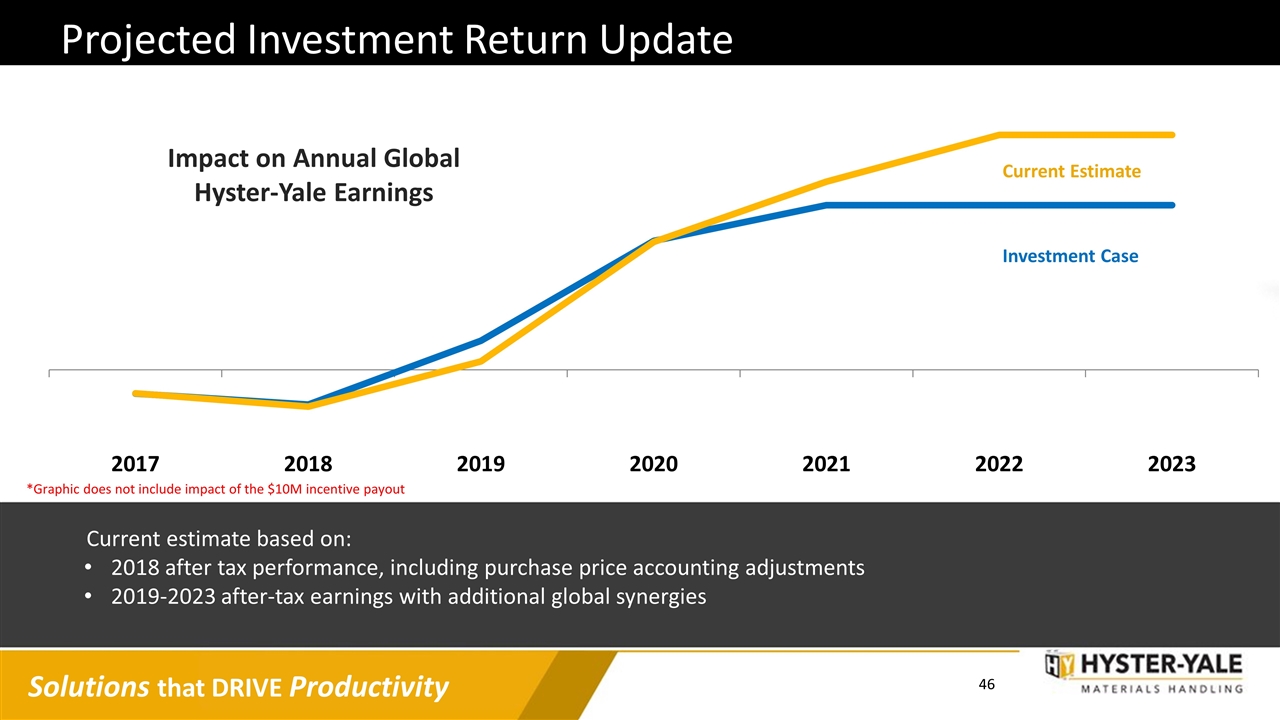

Projected Investment Return Update Current Estimate Investment Case *Graphic does not include impact of the $10M incentive payout Impact on Annual Global Hyster-Yale Earnings Current estimate based on: 2018 after tax performance, including purchase price accounting adjustments 2019-2023 after-tax earnings with additional global synergies

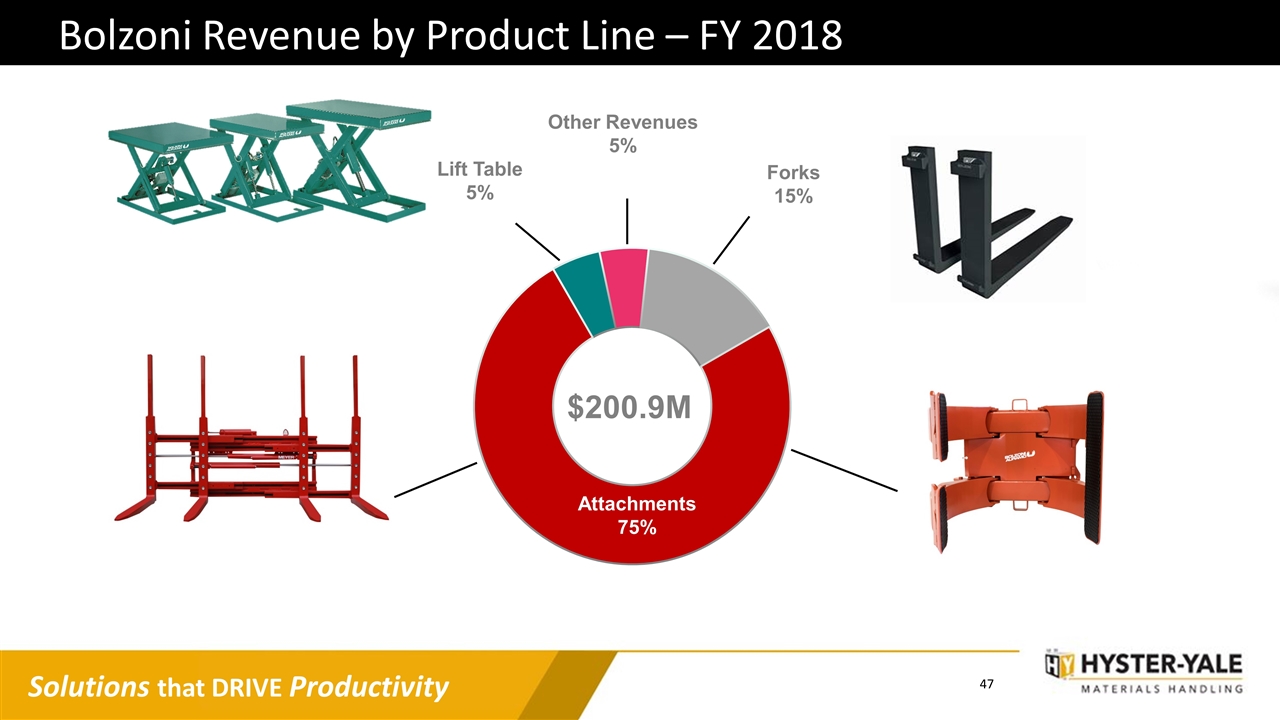

Bolzoni Revenue by Product Line – FY 2018 Other Revenues 5% Forks 15% Lift Table 5% Attachments 75% $200.9M

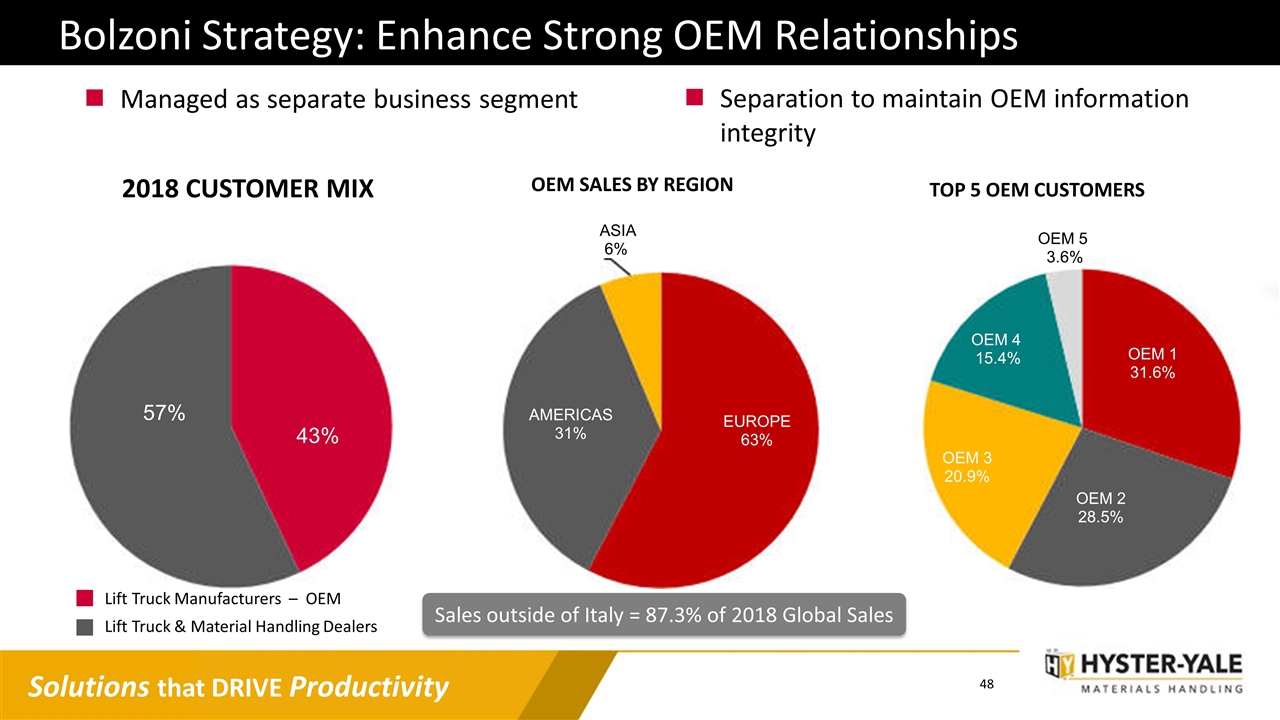

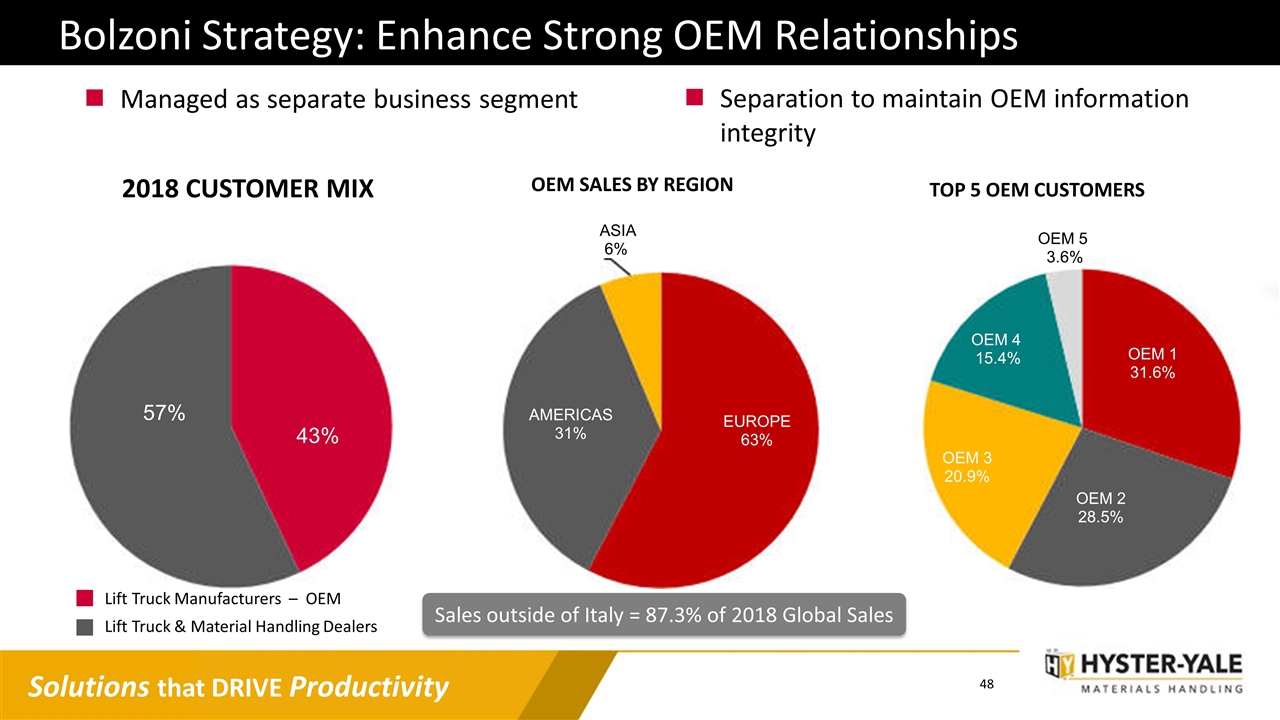

Managed as separate business segment Bolzoni Strategy: Enhance Strong OEM Relationships Lift Truck Manufacturers – OEM Lift Truck & Material Handling Dealers 2018 CUSTOMER MIX Separation to maintain OEM information integrity Sales outside of Italy = 87.3% of 2018 Global Sales

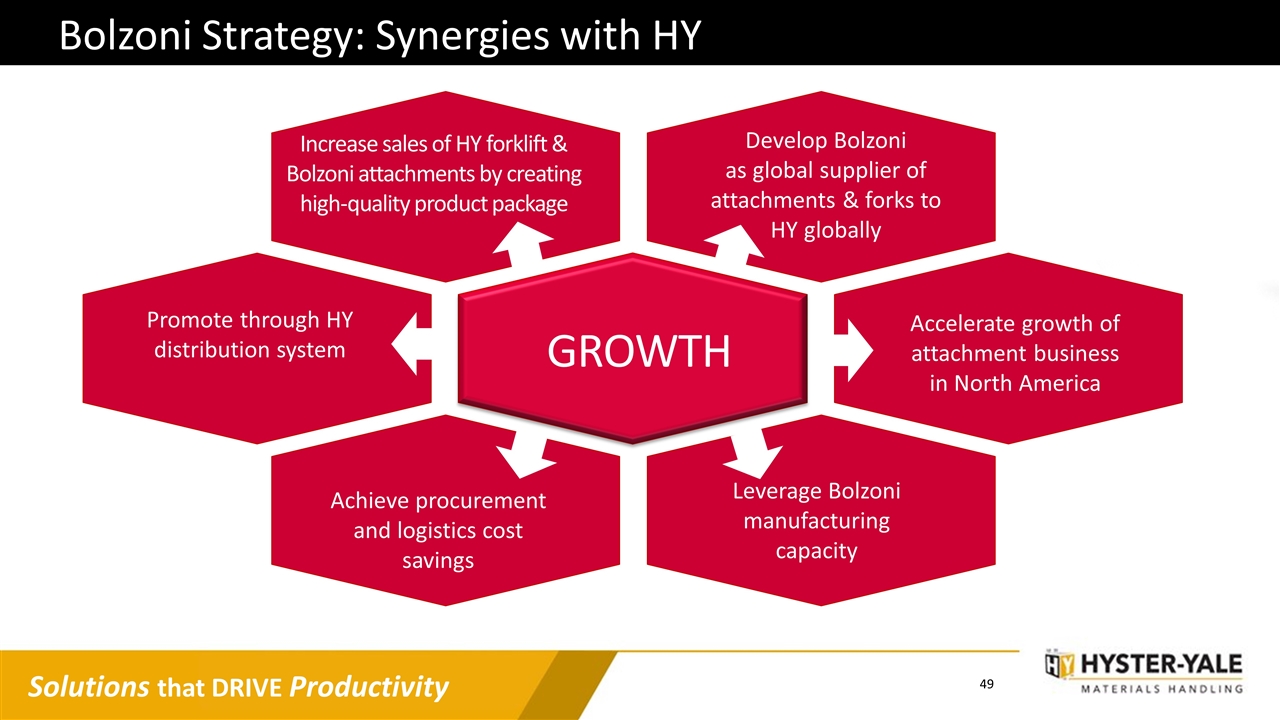

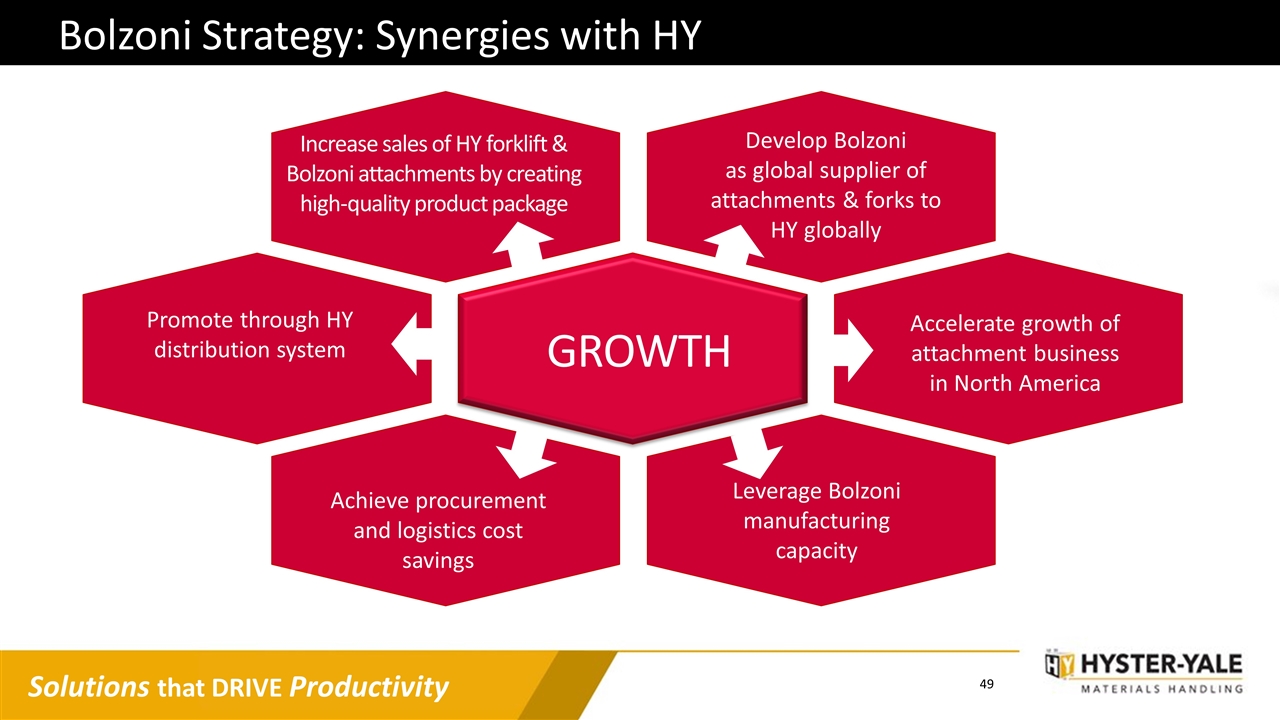

Bolzoni Strategy: Synergies with HY Develop Bolzoni as global supplier of attachments & forks to HY globally Accelerate growth of attachment business in North America Leverage Bolzoni manufacturing capacity Achieve procurement and logistics cost savings Increase sales of HY forklift & Bolzoni attachments by creating high-quality product package GROWTH Promote through HY distribution system

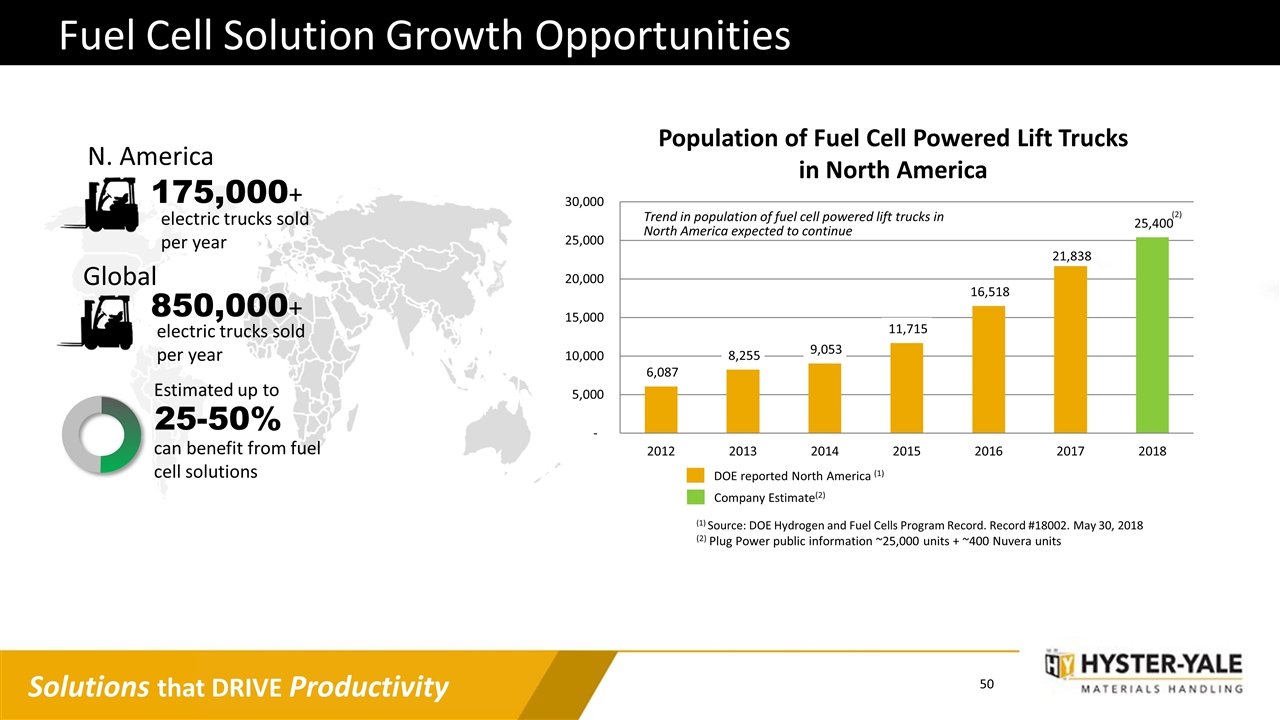

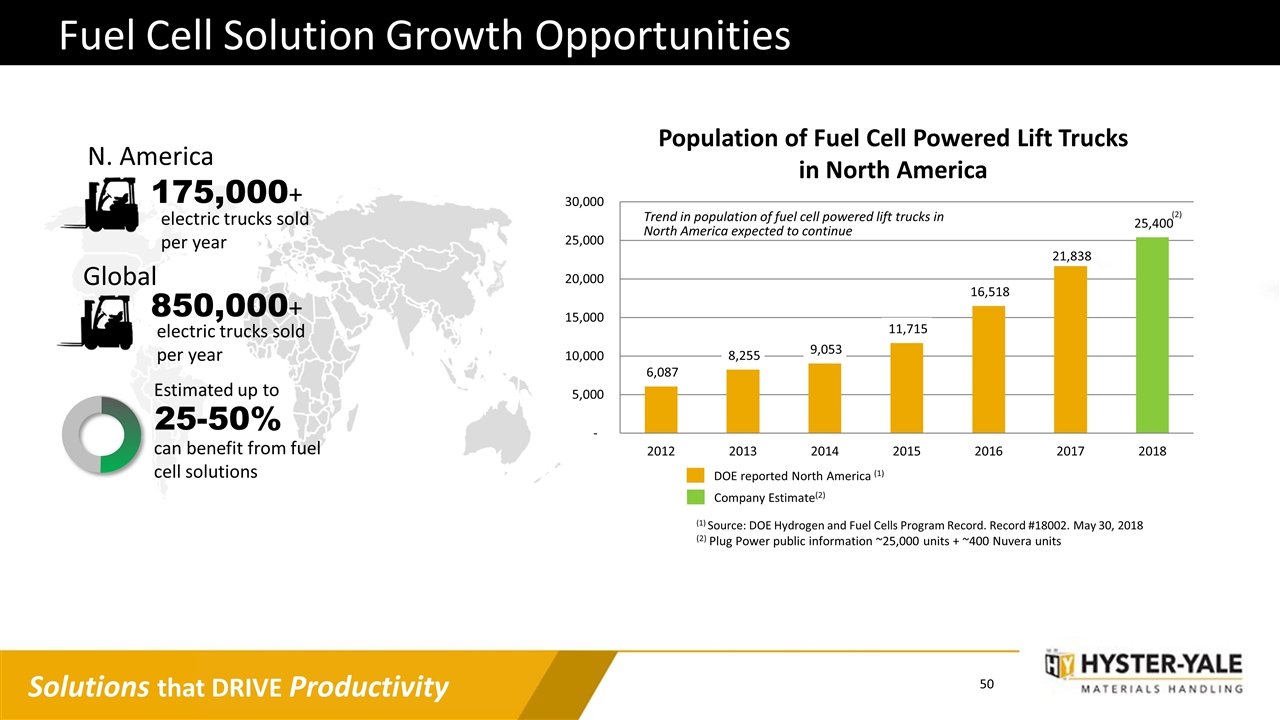

Fuel Cell Solution Growth Opportunities N. America electric trucks sold per year 175,000+ 25-50% Estimated up to can benefit from fuel cell solutions Global 850,000+ electric trucks sold per year DOE reported North America (1) Population of Fuel Cell Powered Lift Trucks in North America Trend in population of fuel cell powered lift trucks in North America expected to continue (1) Source: DOE Hydrogen and Fuel Cells Program Record. Record #18002. May 30, 2018 (2) Plug Power public information ~25,000 units + ~400 Nuvera units (2) Company Estimate(2)

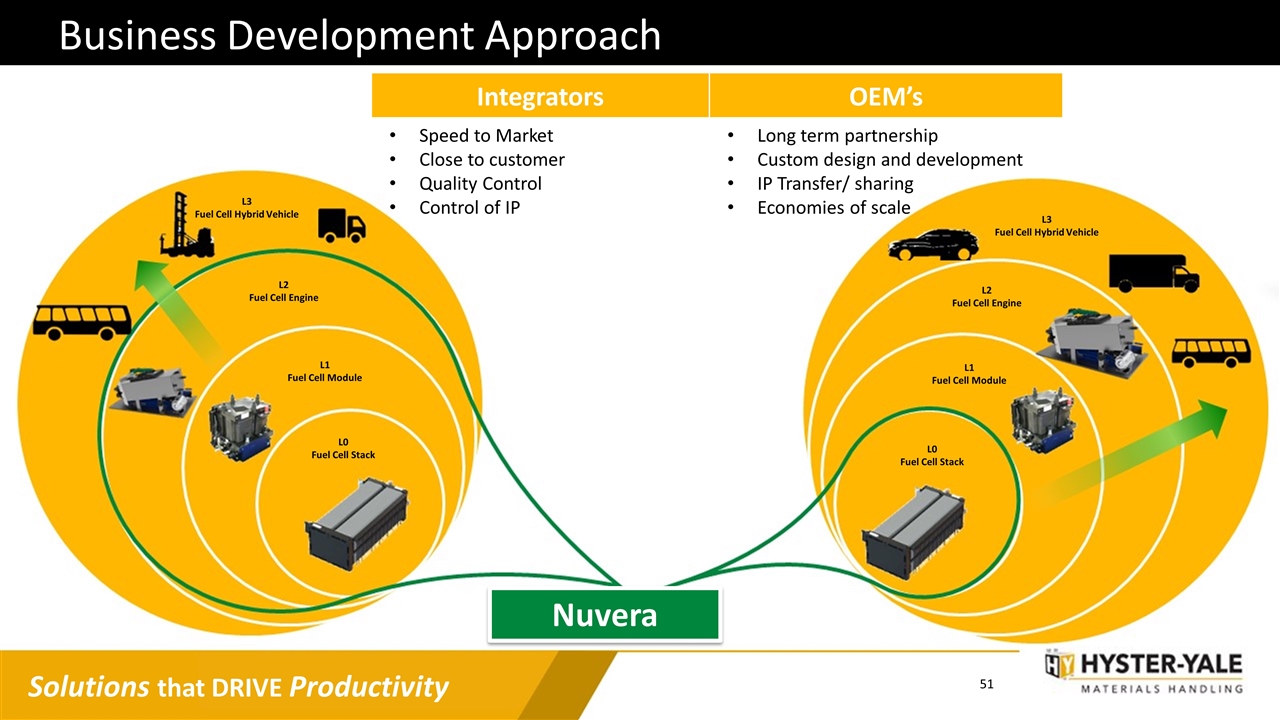

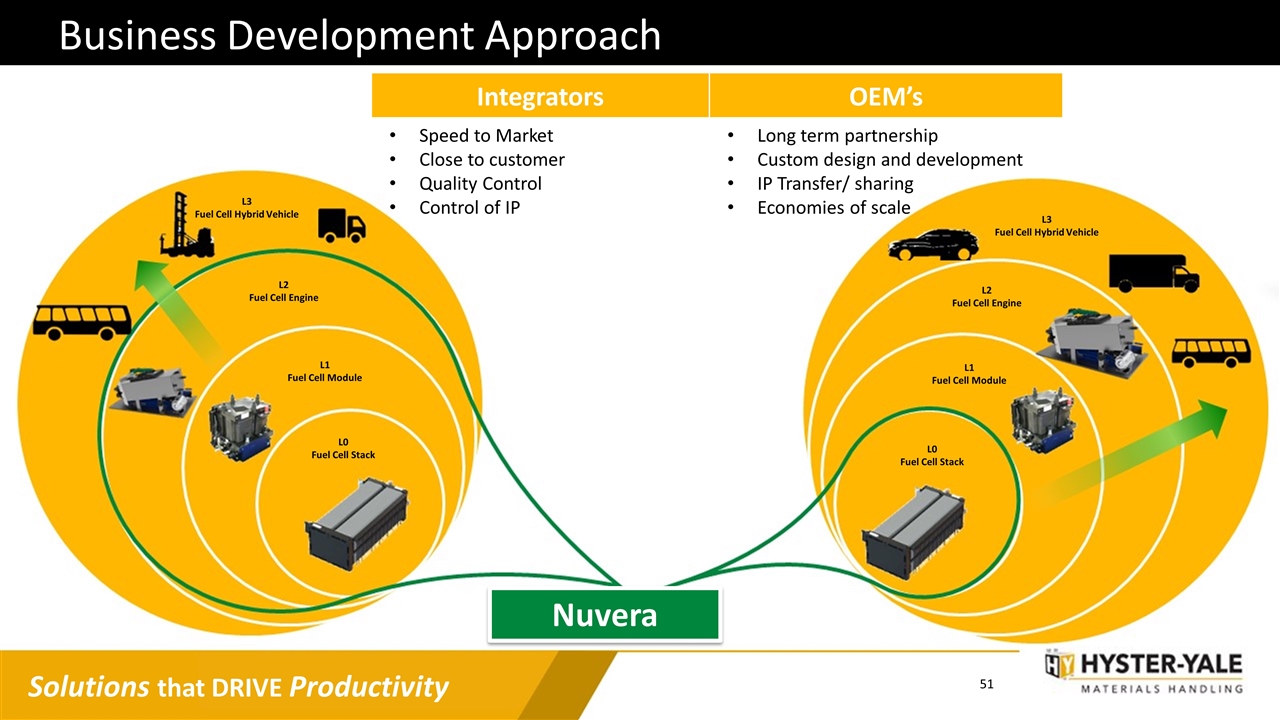

Business Development Approach Nuvera Integrators OEM’s Speed to Market Close to customer Quality Control Control of IP Long term partnership Custom design and development IP Transfer/ sharing Economies of scale L3 Fuel Cell Hybrid Vehicle L2 Fuel Cell Engine L1 Fuel Cell Module L0 Fuel Cell Stack L3 Fuel Cell Hybrid Vehicle L2 Fuel Cell Engine L1 Fuel Cell Module L0 Fuel Cell Stack

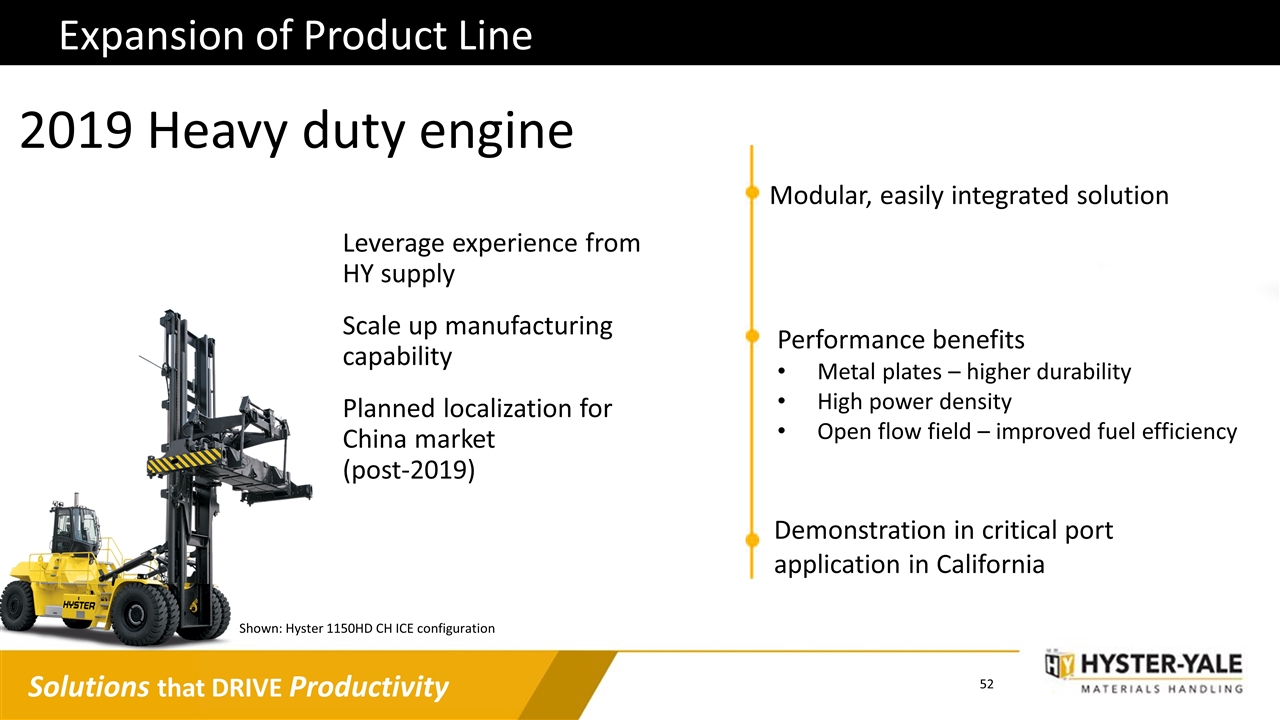

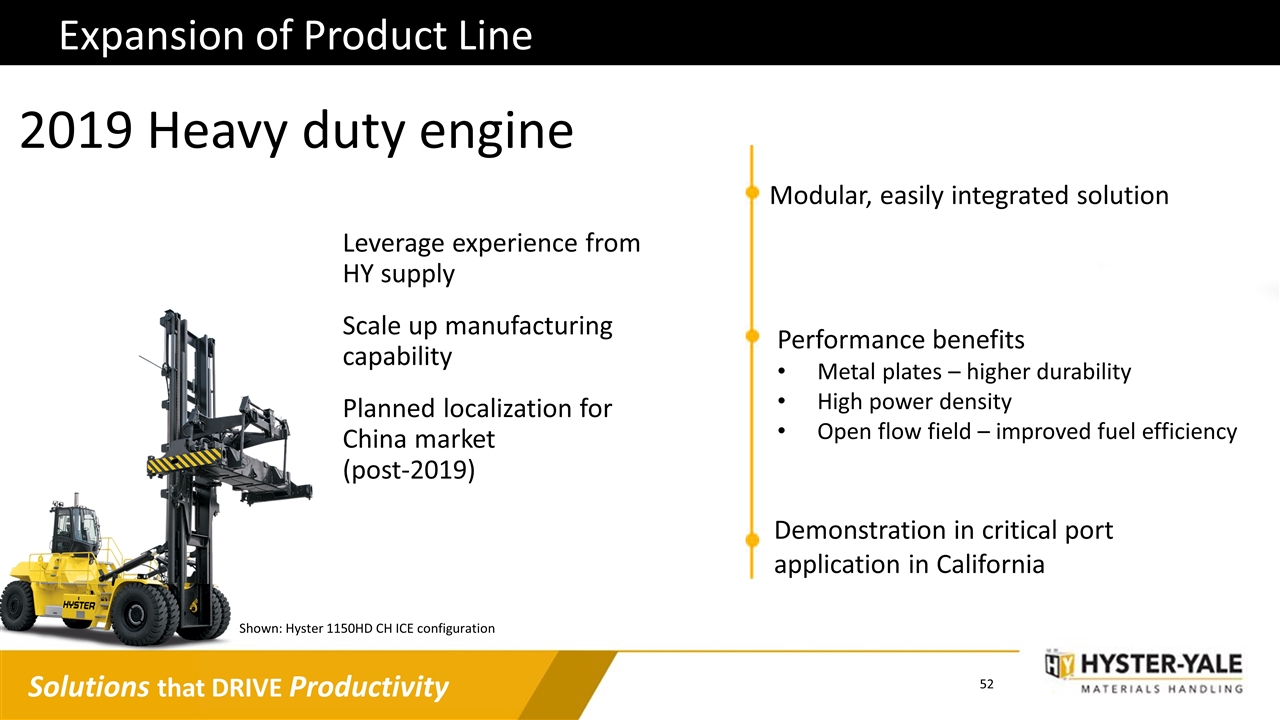

Expansion of Product Line Demonstration in critical port application in California Performance benefits Metal plates – higher durability High power density Open flow field – improved fuel efficiency Modular, easily integrated solution 2019 Heavy duty engine Leverage experience from HY supply Scale up manufacturing capability Planned localization for China market (post-2019) Shown: Hyster 1150HD CH ICE configuration

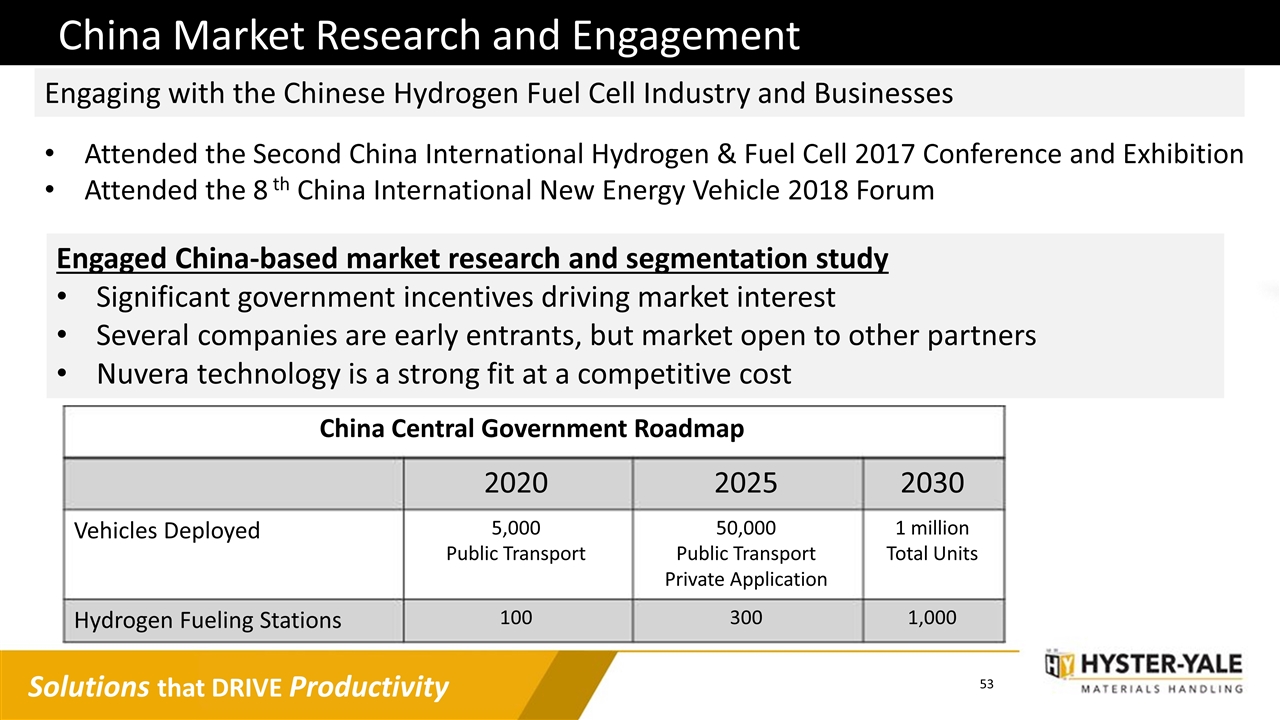

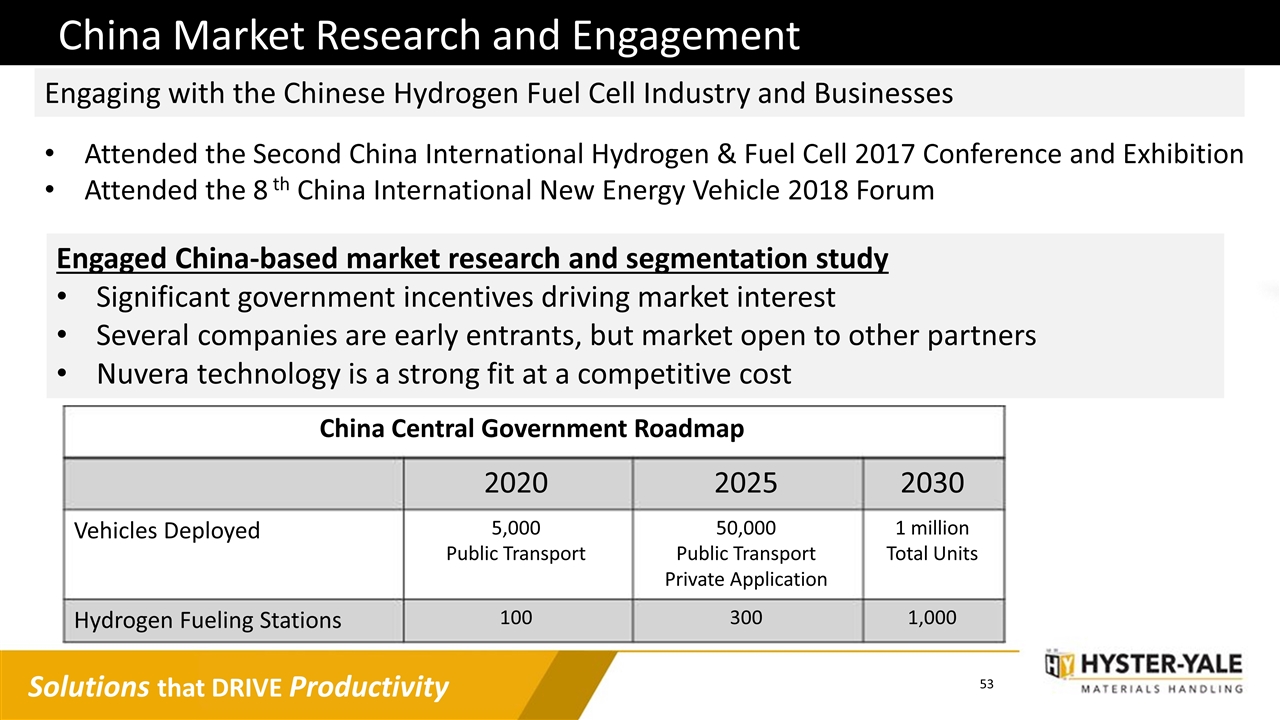

China Market Research and Engagement Engaged China-based market research and segmentation study Significant government incentives driving market interest Several companies are early entrants, but market open to other partners Nuvera technology is a strong fit at a competitive cost Engaging with the Chinese Hydrogen Fuel Cell Industry and Businesses China Central Government Roadmap 2020 2025 2030 Vehicles Deployed 5,000 Public Transport 50,000 Public Transport Private Application 1 million Total Units Hydrogen Fueling Stations 100 300 1,000 Attended the Second China International Hydrogen & Fuel Cell 2017 Conference and Exhibition Attended the 8 th China International New Energy Vehicle 2018 Forum

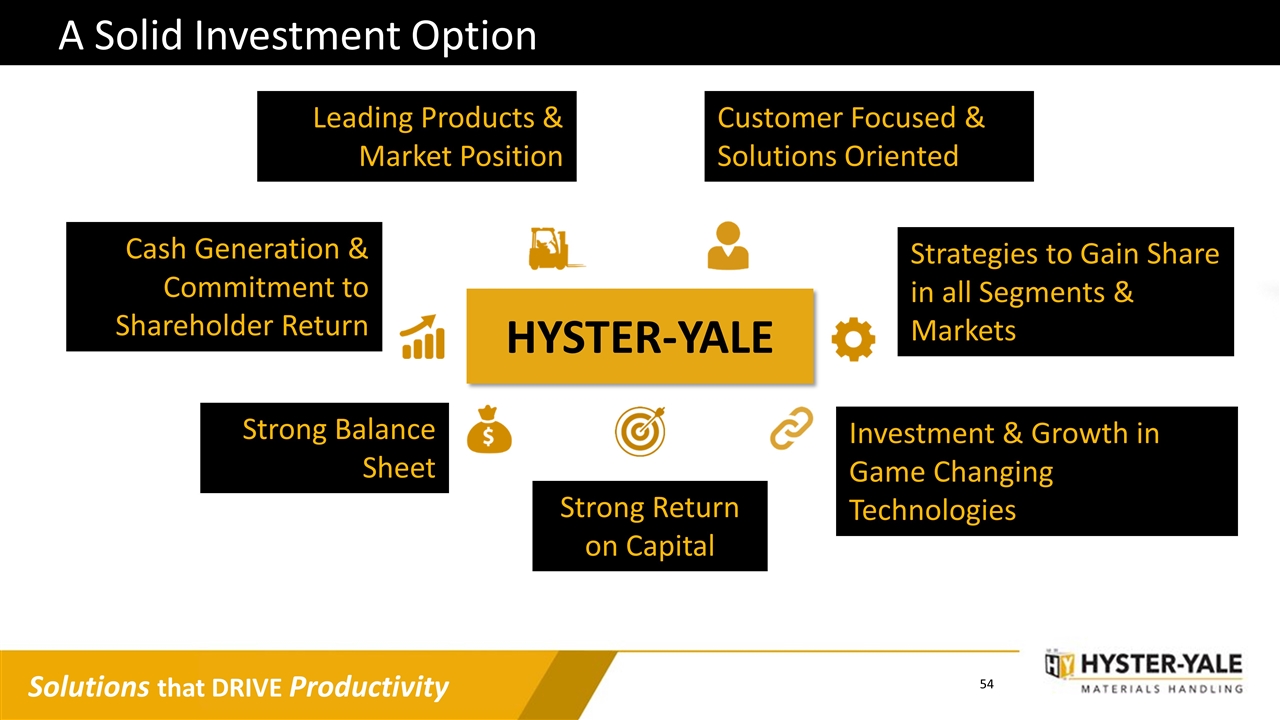

A Solid Investment Option HYSTER-YALE Strong Balance Sheet Cash Generation & Commitment to Shareholder Return Investment & Growth in Game Changing Technologies Leading Products & Market Position Strategies to Gain Share in all Segments & Markets Customer Focused & Solutions Oriented Strong Return on Capital