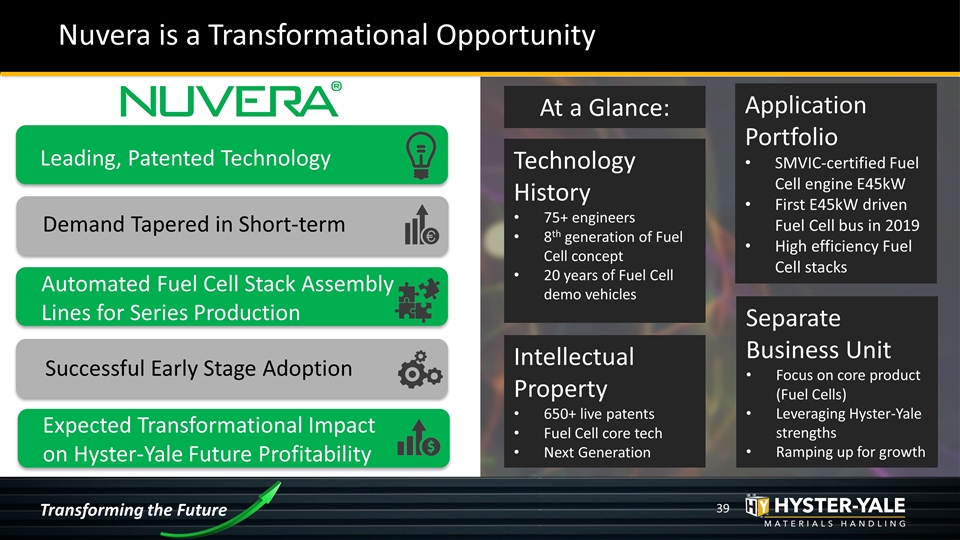

Mass Customization Electrification Automation Globalization Digitization Q2 2020 INVESTOR PRESENTATION Exhibit 99

Safe Harbor Statement & Disclosure Transforming the Future This presentation includes forward-looking comments subject to important risks and uncertainties. It may also contain financial measures that are not in conformance with accounting principles generally accepted in the United States of America (GAAP). Refer to Hyster-Yale’s reports filed on Forms 8-K (current), 10-Q (quarterly), and 10-K (annual) for information on factors that could cause actual results to differ materially from information in this presentation and for information reconciling financial measures to GAAP. Past performance may not be representative of future results. Forward-looking Information noted in the following slides was effective as of the Company’s most recent earnings release and conference call (August 5, 2020). Nothing in this presentation should be construed as reaffirming or disaffirming the outlook provided as of that date. This presentation is not an offer to sell or a solicitation of offers to buy any of Hyster-Yale’s securities.

Our Businesses Our Attachments Business Our Fuel Cell Business Transforming the Future Our Core Lift Truck Business

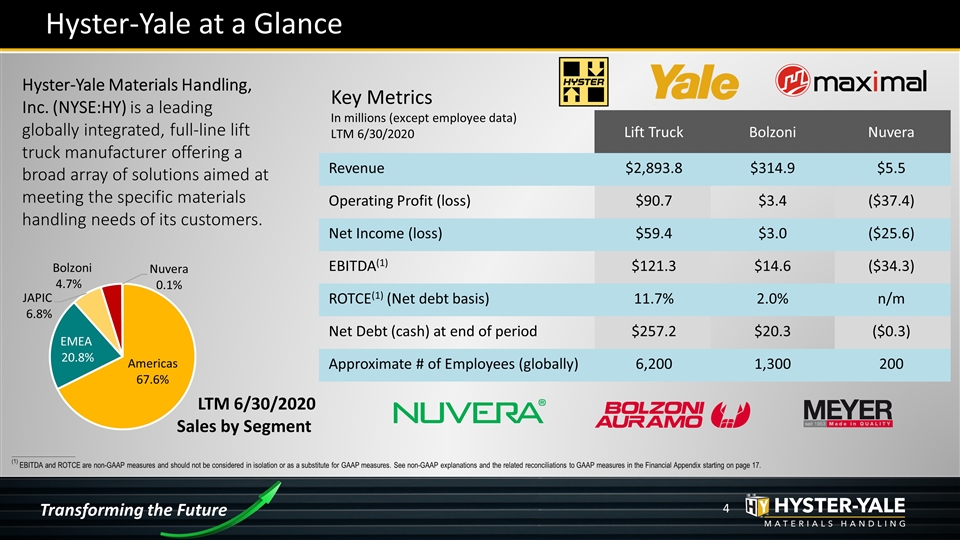

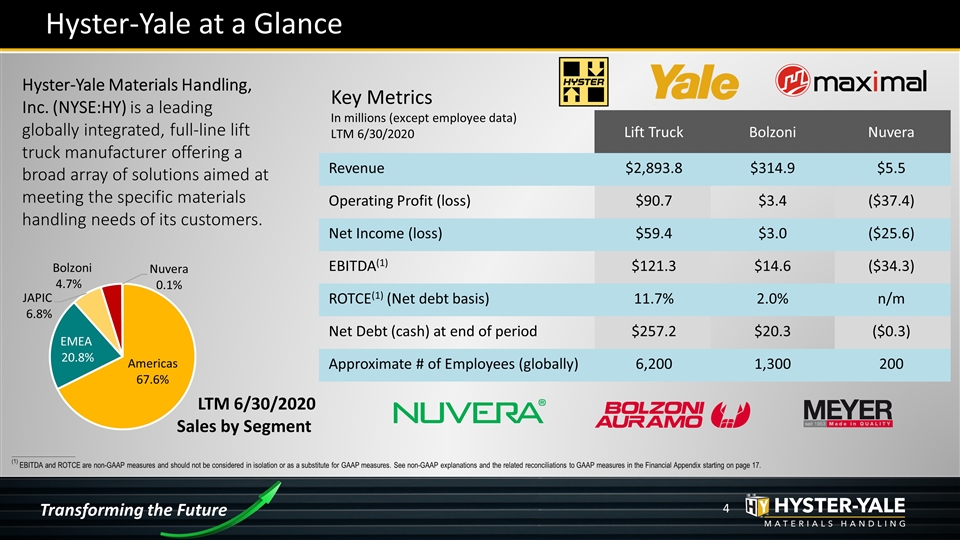

Hyster-Yale Materials Handling, Inc. (NYSE:HY) is a leading globally integrated, full-line lift truck manufacturer offering a broad array of solutions aimed at meeting the specific materials handling needs of its customers. Hyster-Yale at a Glance Lift Truck Bolzoni Nuvera Revenue $2,893.8 $314.9 $5.5 Operating Profit (loss) $90.7 $3.4 ($37.4) Net Income (loss) $59.4 $3.0 ($25.6) EBITDA(1) $121.3 $14.6 ($34.3) ROTCE(1) (Net debt basis) 11.7% 2.0% n/m Net Debt (cash) at end of period $257.2 $20.3 ($0.3) Approximate # of Employees (globally) 6,200 1,300 200 Transforming the Future Key Metrics In millions (except employee data) LTM 6/30/2020 LTM 6/30/2020 Sales by Segment _____________________ (1) EBITDA and ROTCE are non-GAAP measures and should not be considered in isolation or as a substitute for GAAP measures. See non-GAAP explanations and the related reconciliations to GAAP measures in the Financial Appendix starting on page 17. Bolzoni 4.7%

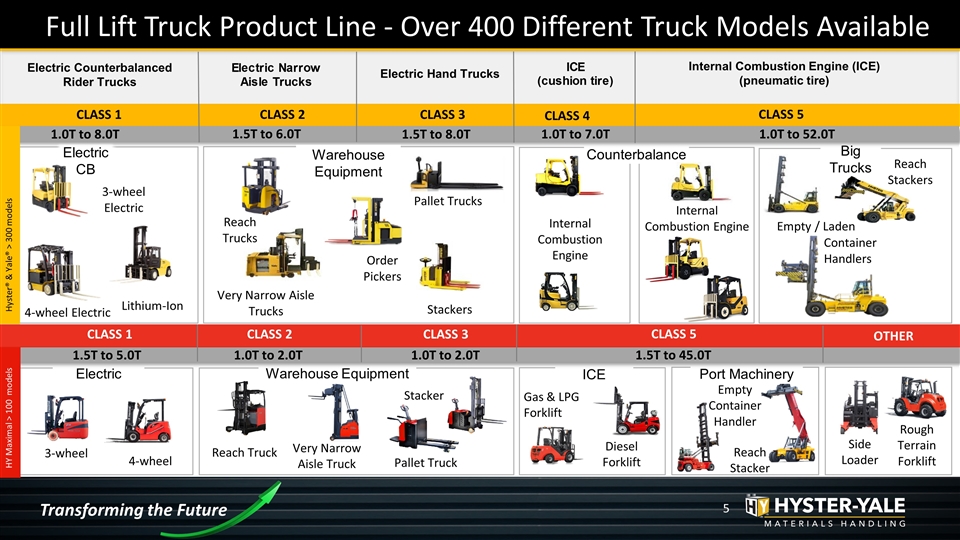

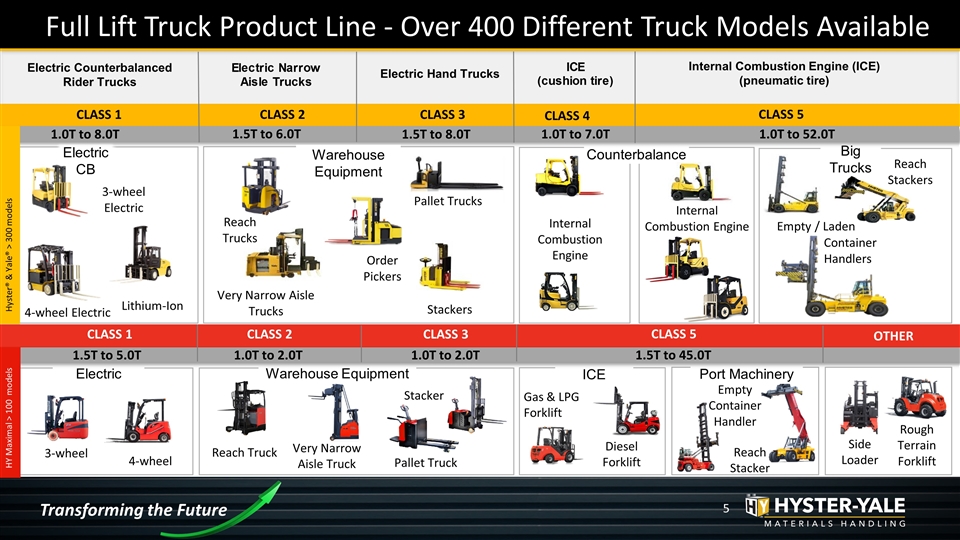

Internal Combustion Engine Reach Trucks Counterbalance 4-wheel Diesel Forklift Port Machinery ICE Warehouse Equipment Electric Internal Combustion Engine Lithium-Ion Reach Stackers Big Trucks Very Narrow Aisle Trucks Full Lift Truck Product Line - Over 400 Different Truck Models Available Electric Hand Trucks 3-wheel Electric 4-wheel Electric Pallet Trucks Stackers Order Pickers Empty / Laden CLASS 1 CLASS 2 CLASS 3 CLASS 4 CLASS 5 1.0T to 8.0T 1.5T to 6.0T 1.5T to 8.0T 1.0T to 7.0T 1.0T to 52.0T Electric CB Container Handlers 1.5T to 5.0T 1.0T to 2.0T 1.0T to 2.0T 1.5T to 45.0T CLASS 1 CLASS 2 CLASS 3 CLASS 5 Empty Container Handler Reach Stacker Rough Terrain Forklift Very Narrow Aisle Truck 3-wheel Side Loader Reach Truck Hyster® & Yale® > 300 models HY Maximal > 100 models Stacker Pallet Truck Gas & LPG Forklift OTHER Warehouse Equipment Transforming the Future Electric Counterbalanced Rider Trucks Internal Combustion Engine (ICE) (pneumatic tire) Electric Narrow Aisle TrucksICE(cushion tire)

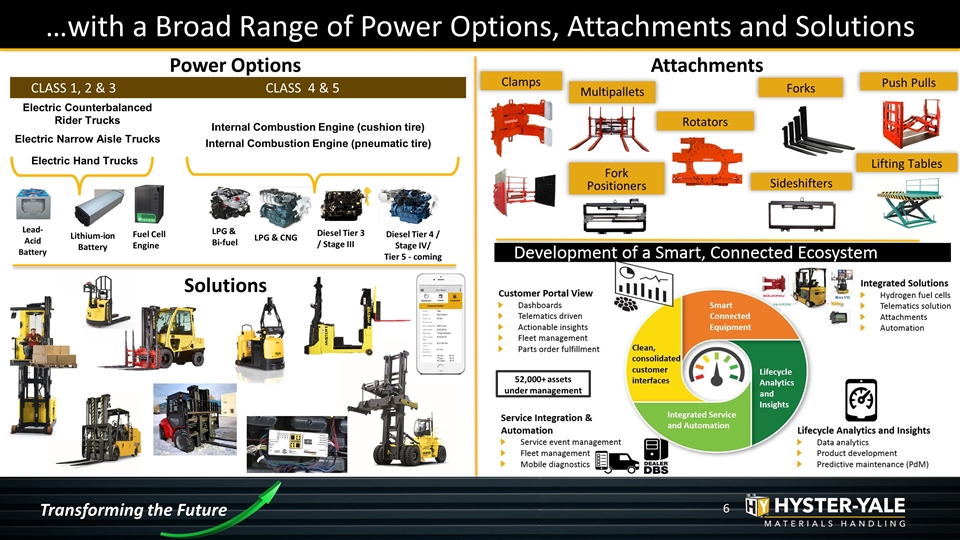

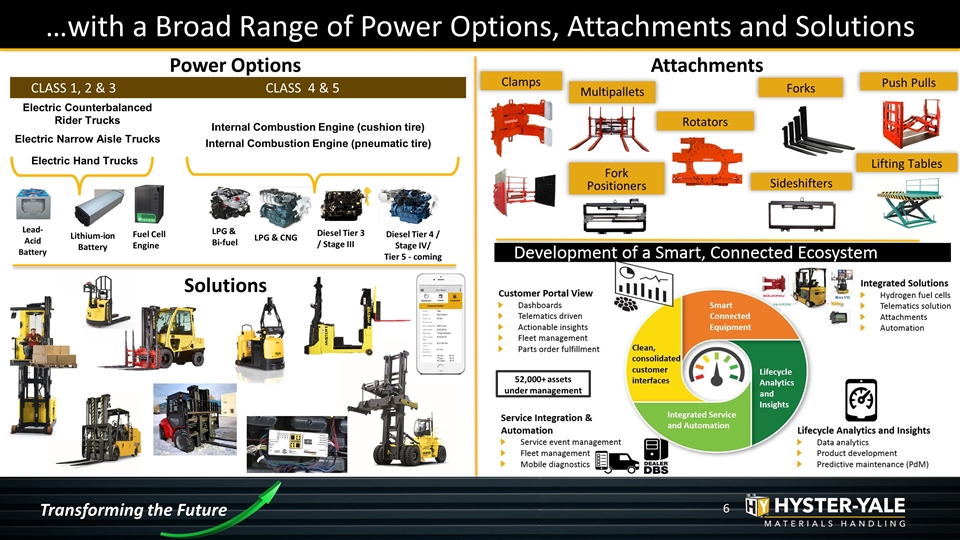

…with a Broad Range of Power Options, Attachments and Solutions Push Pulls Lifting Tables Electric Counterbalanced Rider Trucks Electric Narrow Aisle Trucks Electric Hand Trucks Internal Combustion Engine (cushion tire) Internal Combustion Engine (pneumatic tire) CLASS 1, 2 & 3 Fuel Cell Engine LPG & Bi-fuel Diesel Tier 3 / Stage III LPG & CNG Diesel Tier 4 / Stage IV/ Tier 5 - coming Lithium-ion Battery CLASS 4 & 5 Clamps Multipallets Rotators Sideshifters Fork Positioners Forks 52,000+ assets under management Power Options Attachments Lead-Acid Battery Solutions Transforming the Future

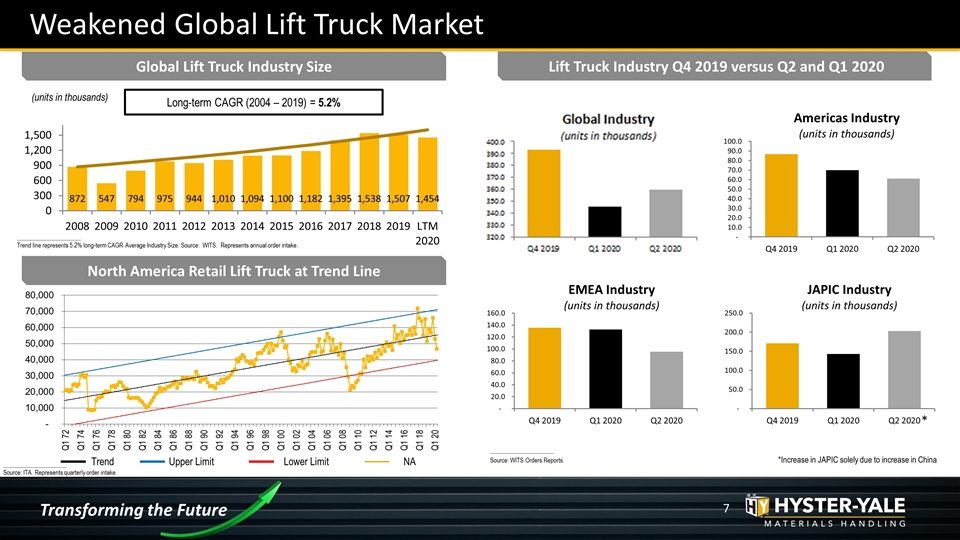

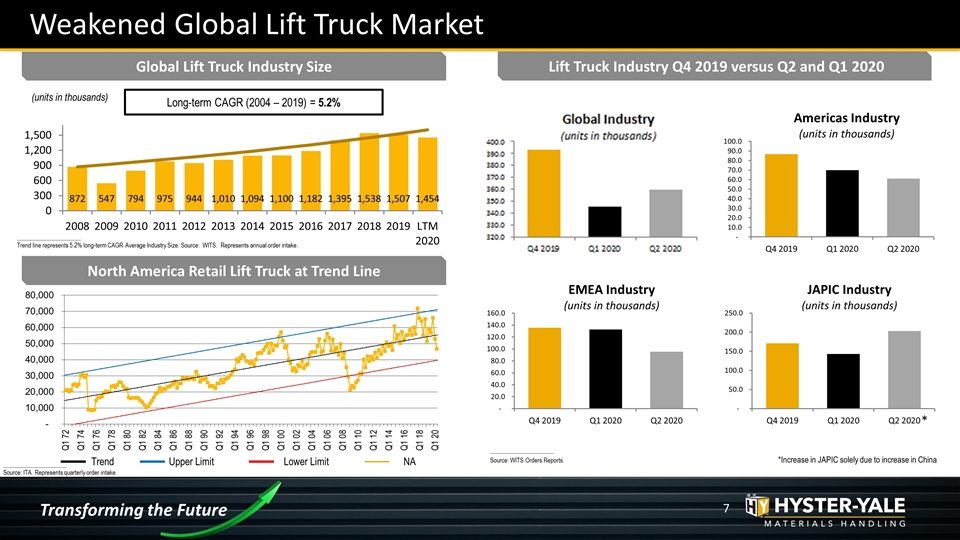

Long-term CAGR (2004 – 2019) = 5.2% _____________________ Source: ITA. Represents quarterly order intake. (units in thousands) Global Lift Truck Industry Size _____________________ Trend line represents 5.2% long-term CAGR Average Industry Size. Source: WITS. Represents annual order intake. North America Retail Lift Truck at Trend Line _____________________ Source: WITS Orders Reports.*Increase in JAPIC solely due to increase in China Lift Truck Industry Q4 2019 versus Q2 and Q1 2020 Trend Upper Limit Lower Limit NA Transforming the Future Weakened Global Lift Truck Market *

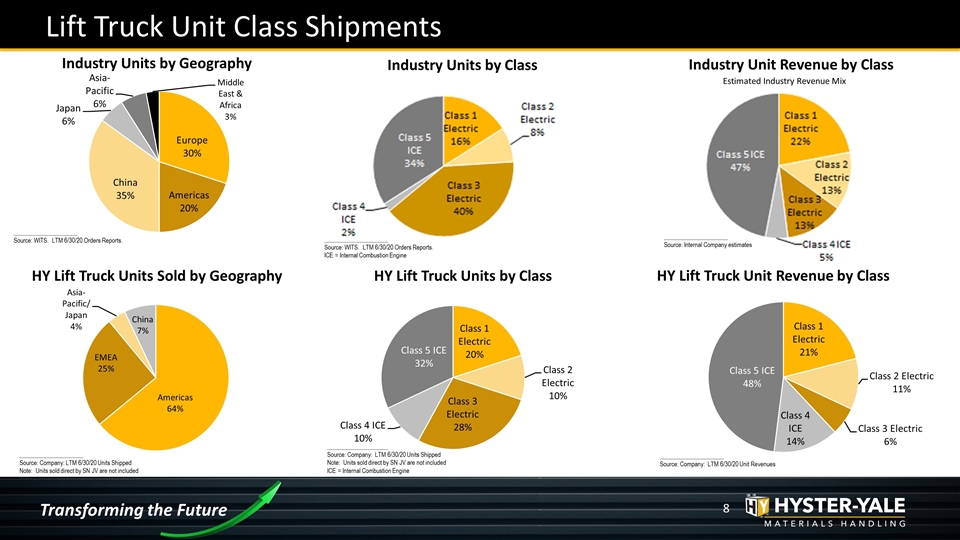

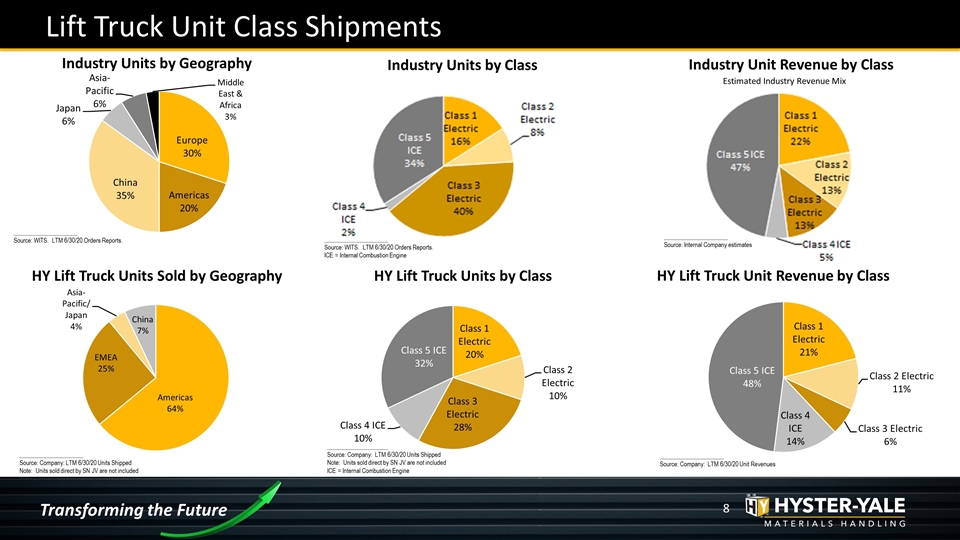

Lift Truck Unit Class Shipments _____________________ Source: Company: LTM 6/30/20 Unit Revenues Industry Units by Geography _____________________ Source: Company: LTM 6/30/20 Units Shipped Note: Units sold direct by SN JV are not included _____________________ Source: WITS. LTM 6/30/20 Orders Reports. _____________________ Source: WITS. LTM 6/30/20 Orders Reports. ICE = Internal Combustion Engine ____________________ Source: Company: LTM 6/30/20 Units Shipped Note: Units sold direct by SN JV are not included ICE = Internal Combustion Engine Industry Units by Class _____________________ Source: Internal Company estimates HY Lift Truck Unit Revenue by Class HY Lift Truck Units by Class HY Lift Truck Units Sold by Geography Industry Unit Revenue by Class Estimated Industry Revenue Mix Transforming the Future

Q2 2020 results were adversely affected by the COVID-19 pandemic: Declines in economic activity significantly reduced demand in the global lift truck markets and for HY’s products Shipments, bookings and backlog decreased compared with Q1 2020 and Q4 2019 – at lowest point in April 2020 with sequential improvements over the remaining months of Q2 at a declining rate Production significantly reduced or suspended in EMEA, and to a lesser extent in the Americas, during first half of Q2 due to COVID-19-related shutdowns Supply chain production and delivery disruptions resulted in some material and component shortages early in Q2 2020 As economies have reopened, market activity has increased and bookings have improved, though at significantly lower levels than prior year periods Severity and duration of the pandemic and consequential economic impact remains uncertain Recent booking activity is encouraging, but pandemic-related uncertainty continues to limit ability to forecast bookings over the remainder of 2020 and 2021 and, as a result, expected shipment levels for Q4 2020 and FY 2021 COVID-19 Impact on Hyster-Yale Transforming the Future

Operational Actions: Procedures implemented to limit employees’ exposure to COVID-19: production reduced/suspended as required by government mandates, adjusted shift schedules, enhanced cleaning and sanitation practices, and instituted remote working where possible. Carefully managing shipments, backlog and lead times to match market conditions while also maintaining adequate production levels and minimal open production slots Focused on adapting production levels quickly to market changes and working closely with suppliers to help ensure appropriate component supply levels Cost Containment Actions: Targeted to achieve $50m-$75m in cost savings in 2020 vs. 2019 spending Suspension of 2020 incentive compensation plans, 401K contributions and profit sharing plan Spending and travel restrictions, including aggressive reductions in discretionary spending, as well as hiring freezes and minimization or elimination of contract & temporary workers Reductions in base salaries, Board of Directors’ fees and work-scheduled furloughs at manufacturing plants Cash Flow Actions: Focused on reducing working capital and reducing or deferring capital expenditures HY continues to maintain a long-term focus, but given actions, the pace and timing of the Company’s strategic programs have been reprioritized and, in some cases, delayed due to COVID-19 Actions Taken to Moderate Near-Term Impact of COVID-19 Transforming the Future

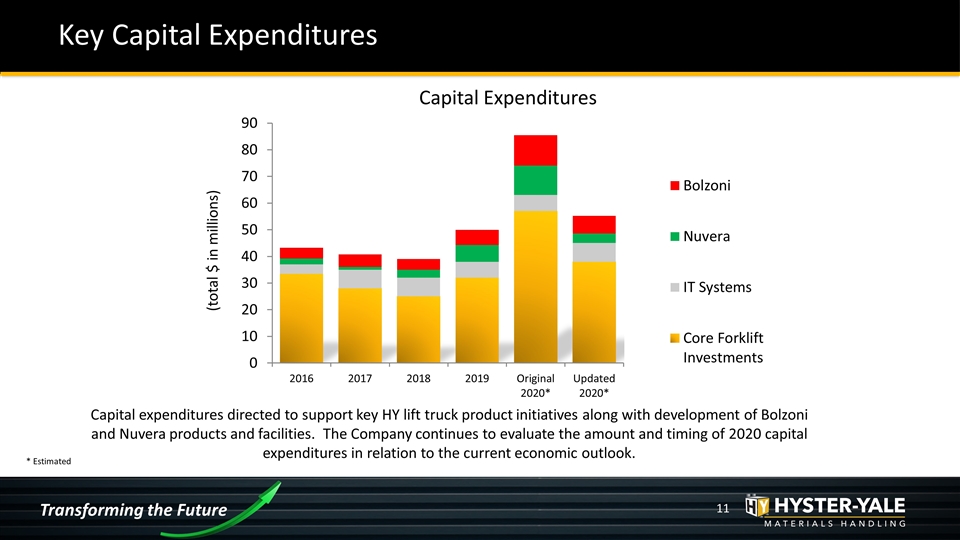

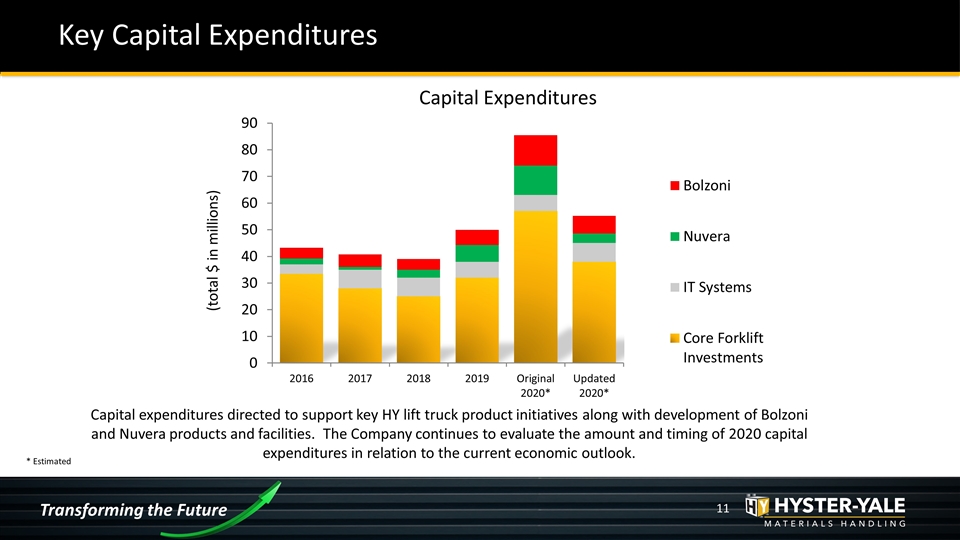

Key Capital Expenditures Capital expenditures directed to support key HY lift truck product initiatives along with development of Bolzoni and Nuvera products and facilities. The Company continues to evaluate the amount and timing of 2020 capital expenditures in relation to the current economic outlook. (total $ in millions) * Estimated Capital Expenditures Transforming the Future

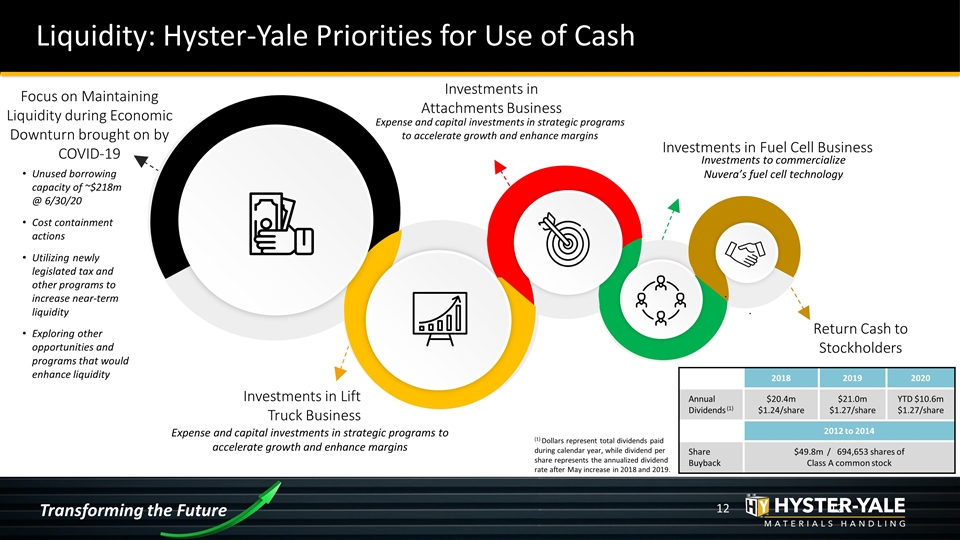

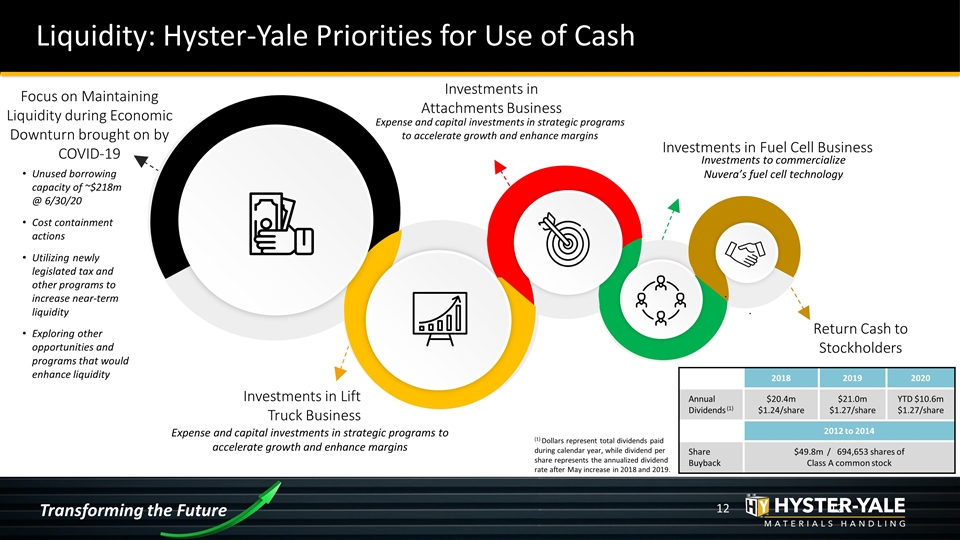

Focus on Maintaining Liquidity during Economic Downturn brought on by COVID-19 Investments in Fuel Cell Business Investments in Lift Truck Business Liquidity: Hyster-Yale Priorities for Use of Cash Expense and capital investments in strategic programs to accelerate growth and enhance margins Investments to commercialize Nuvera’s fuel cell technology Transforming the Future Expense and capital investments in strategic programs to accelerate growth and enhance margins Investments in Attachments Business Return Cash to Stockholders 2018 2019 2020 Annual Dividends (1) $20.4m $1.24/share $21.0m $1.27/share YTD $10.6m $1.27/share 2012 to 2014 Share Buyback $49.8m / 694,653 shares of Class A common stock (1) Dollars represent total dividends paid during calendar year, while dividend per share represents the annualized dividend rate after May increase in 2018 and 2019. Unused borrowing capacity of ~$218m @ 6/30/20 Cost containment actions Utilizing newly legislated tax and other programs to increase near-term liquidity Exploring other opportunities and programs that would enhance liquidity

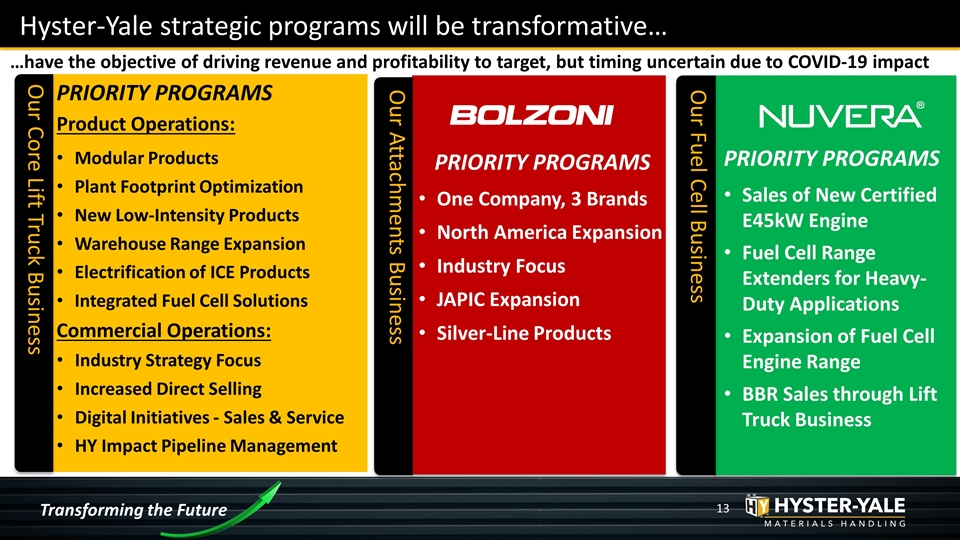

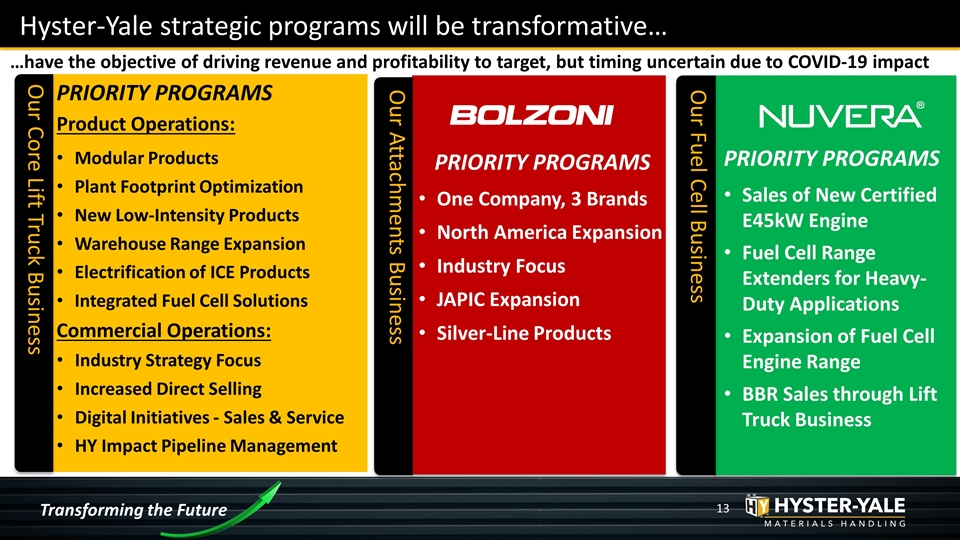

Path to Execution of Strategic Initiatives In total, Hyster-Yale projects maturing over the next 1 to 4 years are transformative and have the objective of driving revenue and profitability to target New Utility Products New Standard Products New Premium Products HY Maximal Integration BBR Range Expansion BBR Greenville Manufacture Enhanced India Production Integrated Telematics Warehouse Range Expansion Big Truck Electrification Expanded Automation Offering Bolzoni Premium and Standard Products Range Expansion Increased Direct Selling Global Accounts Expansion China Plants Consolidation Brazil Export Expansion Industry Strategy Focus HY – Impact Selling HY – Flow Dealer Stocking Program Dealer Excellence Initiatives Maximal Domestic China & Export Growth Comprehensive Lithium-Ion Offering Digital Initiatives – Sales & Service Bolzoni North America Expansion Nuvera to Breakeven Nuvera OEM & Partner Initiatives Automation of Key Production Processes Fuel Cell Range Extenders to Heavy Duty Applications Bolzoni Industry Focus Bolzoni Asia Customer Expansion Any update?? PRIORITY PROGRAMS Product Operations: Modular Products Plant Footprint Optimization New Low-Intensity Products Warehouse Range Expansion Electrification of ICE Products Integrated Fuel Cell Solutions Commercial Operations: Industry Strategy Focus Increased Direct Selling Digital Initiatives - Sales & Service HY Impact Pipeline Management PRIORITY PROGRAMS Sales of New Certified E45kW Engine Fuel Cell Range Extenders for Heavy-Duty Applications Expansion of Fuel Cell Engine Range BBR Sales through Lift Truck Business Our Core Lift Truck Business PRIORITY PROGRAMS One Company, 3 Brands North America Expansion Industry Focus JAPIC Expansion Silver-Line Products Our Attachments Business Our Fuel Cell Business Hyster-Yale strategic programs will be transformative… …have the objective of driving revenue and profitability to target, but timing uncertain due to COVID-19 impact Transforming the Future

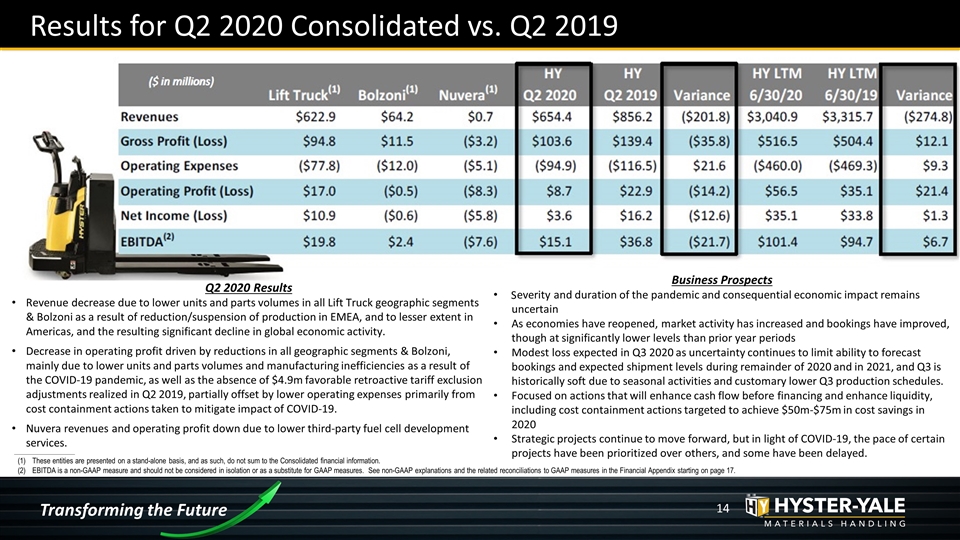

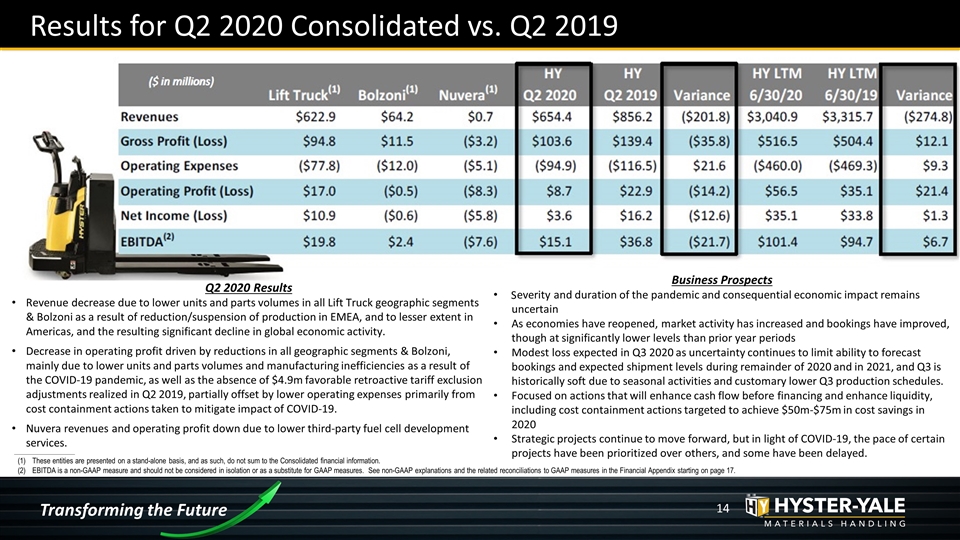

($ in millions) Results for Q2 2020 Consolidated vs. Q2 2019 Q2 2020 Results Revenue decrease due to lower units and parts volumes in all Lift Truck geographic segments & Bolzoni as a result of reduction/suspension of production in EMEA, and to lesser extent in Americas, and the resulting significant decline in global economic activity. Decrease in operating profit driven by reductions in all geographic segments & Bolzoni, mainly due to lower units and parts volumes and manufacturing inefficiencies as a result of the COVID-19 pandemic, as well as the absence of $4.9m favorable retroactive tariff exclusion adjustments realized in Q2 2019, partially offset by lower operating expenses primarily from cost containment actions taken to mitigate impact of COVID-19. Nuvera revenues and operating profit down due to lower third-party fuel cell development services. Business Prospects everity and duration of the pandemic and consequential economic impact remains uncertain As economies have reopened, market activity has increased and bookings have improved, though at significantly lower levels than prior year periods Modest loss expected in Q3 2020 as uncertainty continues to limit ability to forecast bookings and expected shipment levels during remainder of 2020 and in 2021, and Q3 is historically soft due to seasonal activities and customary lower Q3 production schedules. Focused on actions that will enhance cash flow before financing and enhance liquidity, including cost containment actions targeted to achieve $50m-$75m in cost savings in 2020 Strategic projects continue to move forward, but in light of COVID-19, the pace of certain projects have been prioritized over others, and some have been delayed. ____________________ These entities are presented on a stand-alone basis, and as such, do not sum to the Consolidated financial information. EBITDA is a non-GAAP measure and should not be considered in isolation or as a substitute for GAAP measures. See non-GAAP explanations and the related reconciliations to GAAP measures in the Financial Appendix starting on page 17. Transforming the Future S

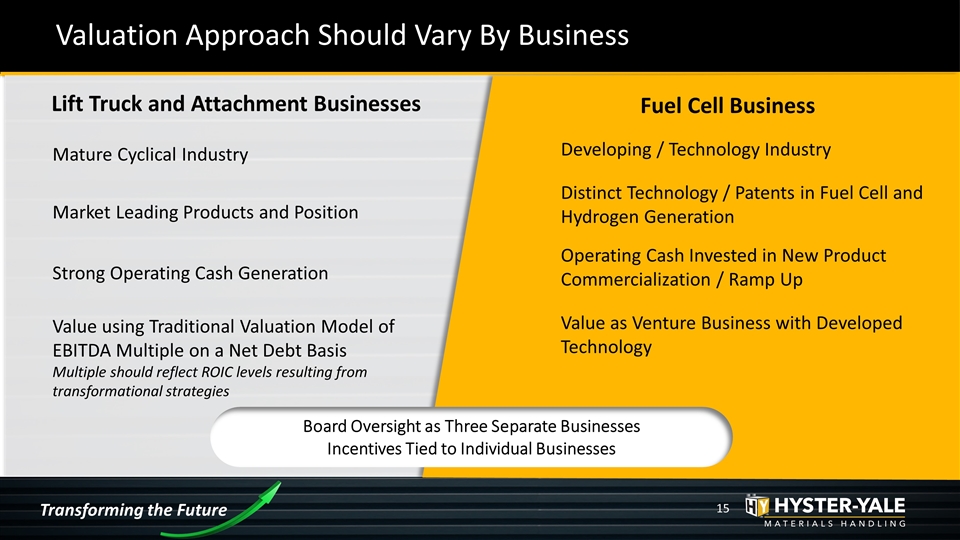

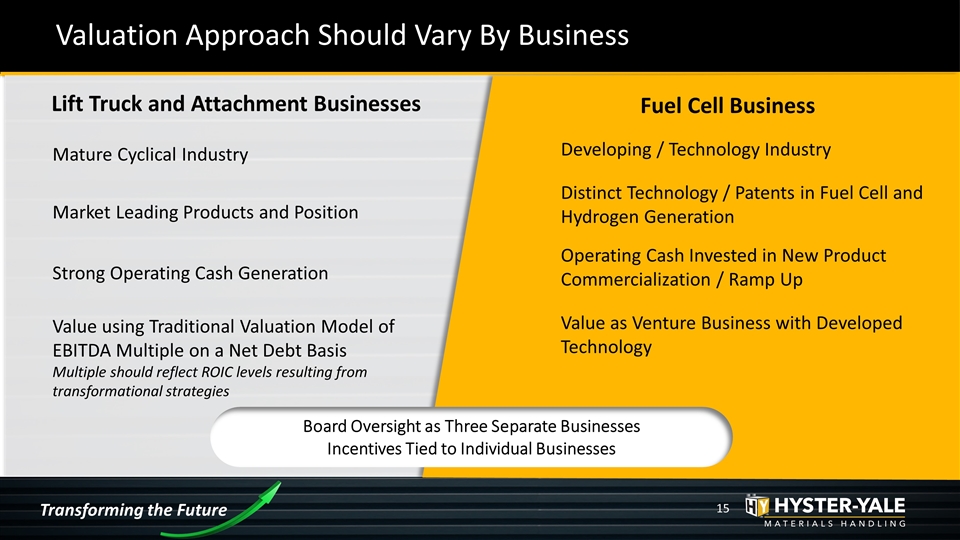

Valuation Approach Should Vary By Business Lift Truck and Attachment Businesses Fuel Cell Business Board Oversight as Three Separate Businesses Incentives Tied to Individual Businesses Strong Operating Cash Generation Market Leading Products and Position Mature Cyclical Industry Value using Traditional Valuation Model of EBITDA Multiple on a Net Debt Basis Multiple should reflect ROIC levels resulting from transformational strategies Developing / Technology Industry Distinct Technology / Patents in Fuel Cell and Hydrogen Generation Operating Cash Invested in New Product Commercialization / Ramp Up Value as Venture Business with Developed Technology Transforming the Future

ENTER SESSION TITLE HERE… Presenter Name FINANCIAL APPENDIX

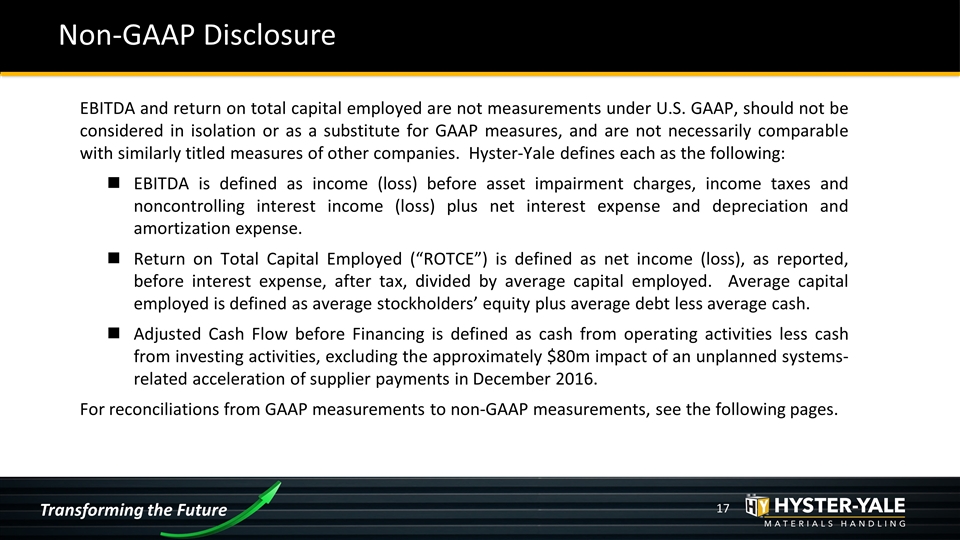

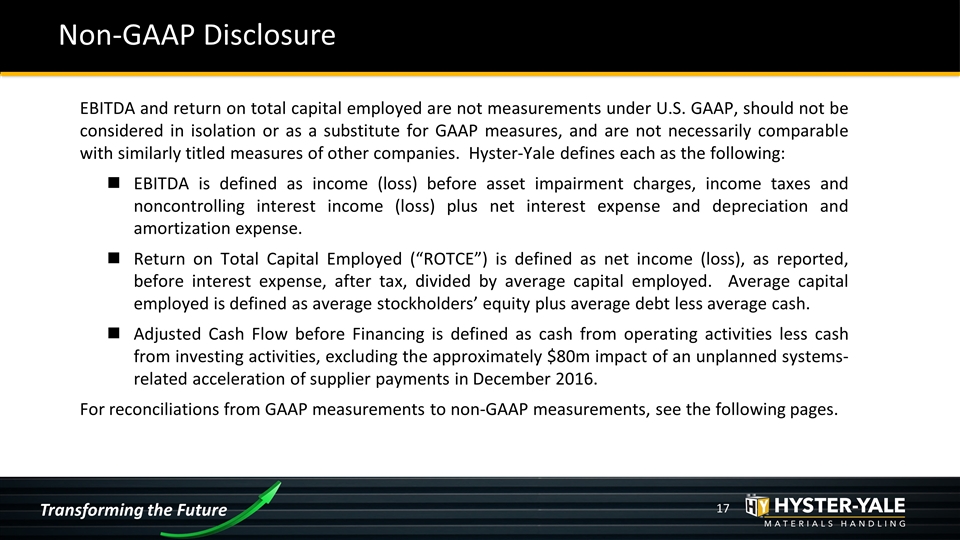

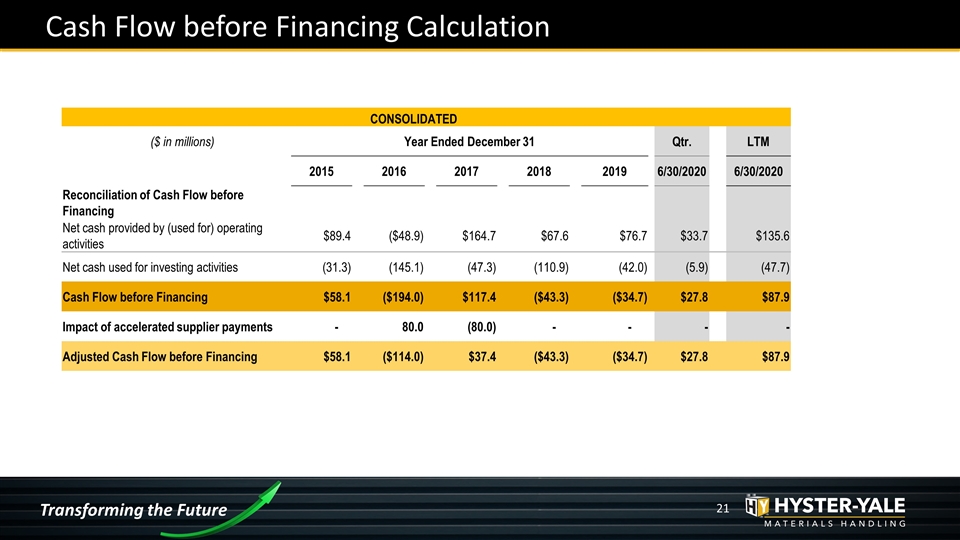

17 Non-GAAP Disclosure Transforming the Future EBITDA and return on total capital employed are not measurements under U.S. GAAP, should not be considered in isolation or as a substitute for GAAP measures, and are not necessarily comparable with similarly titled measures of other companies. Hyster-Yale defines each as the following: EBITDA is defined as income (loss) before asset impairment charges, income taxes and noncontrolling interest income (loss) plus net interest expense and depreciation and amortization expense. Return on Total Capital Employed (“ROTCE”) is defined as net income (loss), as reported, before interest expense, after tax, divided by average capital employed. Average capital employed is defined as average stockholders’ equity plus average debt less average cash. Adjusted Cash Flow before Financing is defined as cash from operating activities less cash from investing activities, excluding the approximately $80m impact of an unplanned systems-related acceleration of supplier payments in December 2016. For reconciliations from GAAP measurements to non-GAAP measurements, see the following pages.

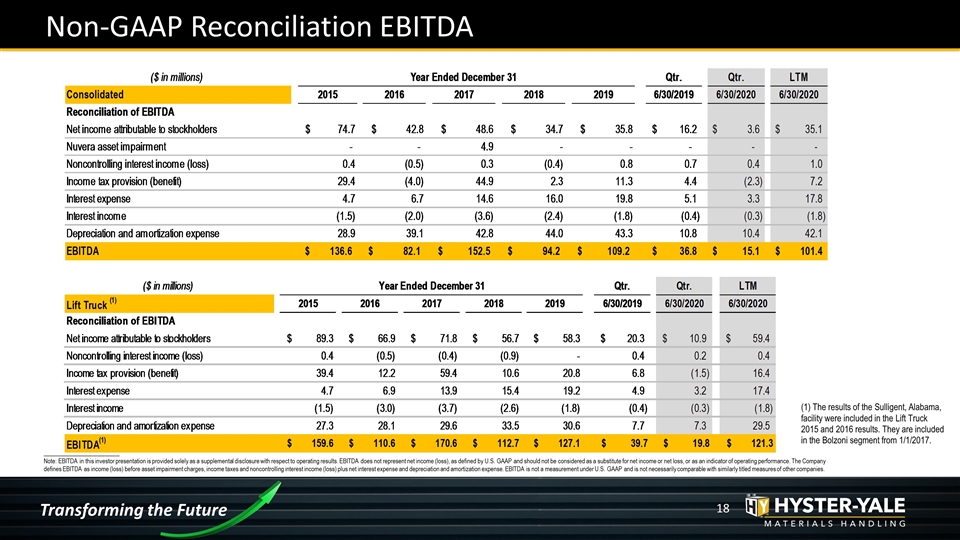

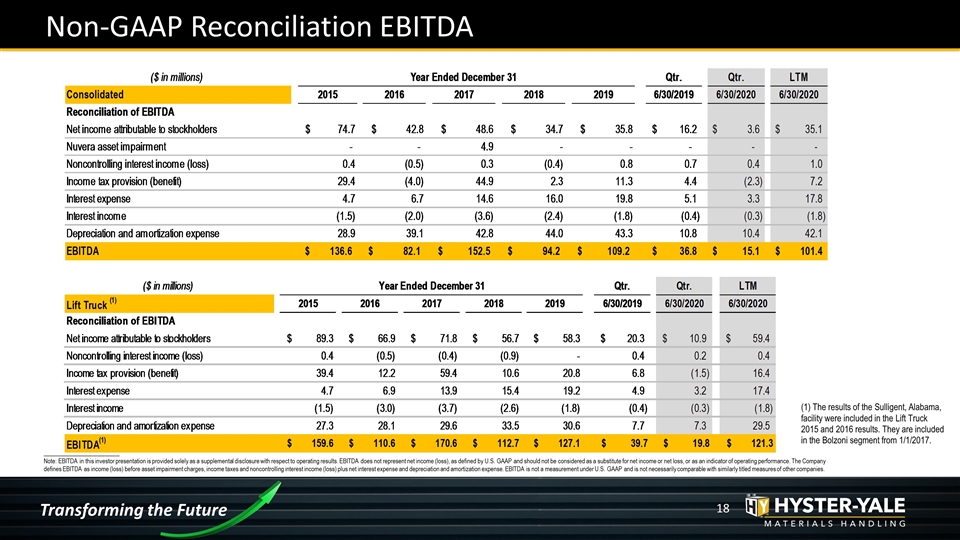

Non-GAAP Reconciliation EBITDA _____________________ Note: EBITDA in this investor presentation is provided solely as a supplemental disclosure with respect to operating results. EBITDA does not represent net income (loss), as defined by U.S. GAAP and should not be considered as a substitute for net income or net loss, or as an indicator of operating performance. The Company defines EBITDA as income (loss) before asset impairment charges, income taxes and noncontrolling interest income (loss) plus net interest expense and depreciation and amortization expense. EBITDA is not a measurement under U.S. GAAP and is not necessarily comparable with similarly titled measures of other companies. Transforming the Future (1) The results of the Sulligent, Alabama, facility were included in the Lift Truck 2015 and 2016 results. They are included in the Bolzoni segment from 1/1/2017.

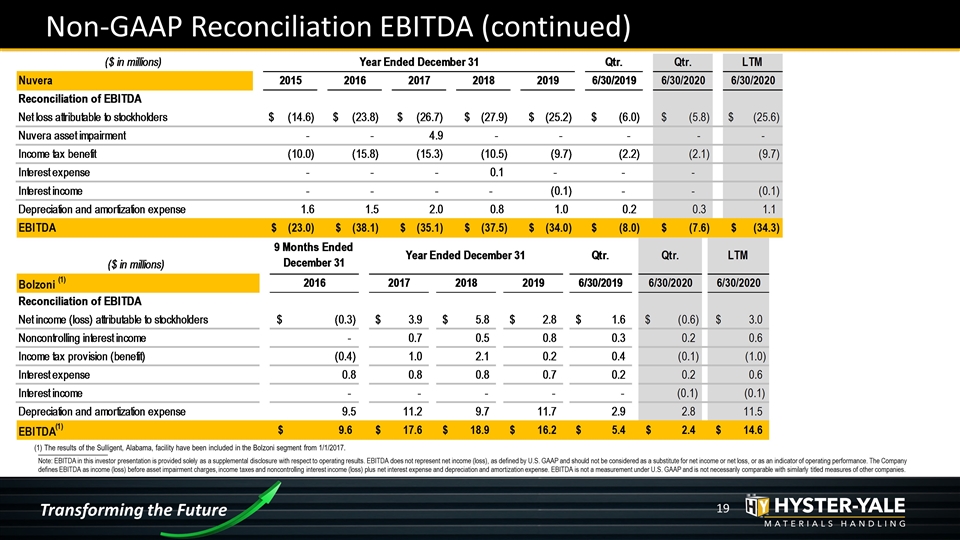

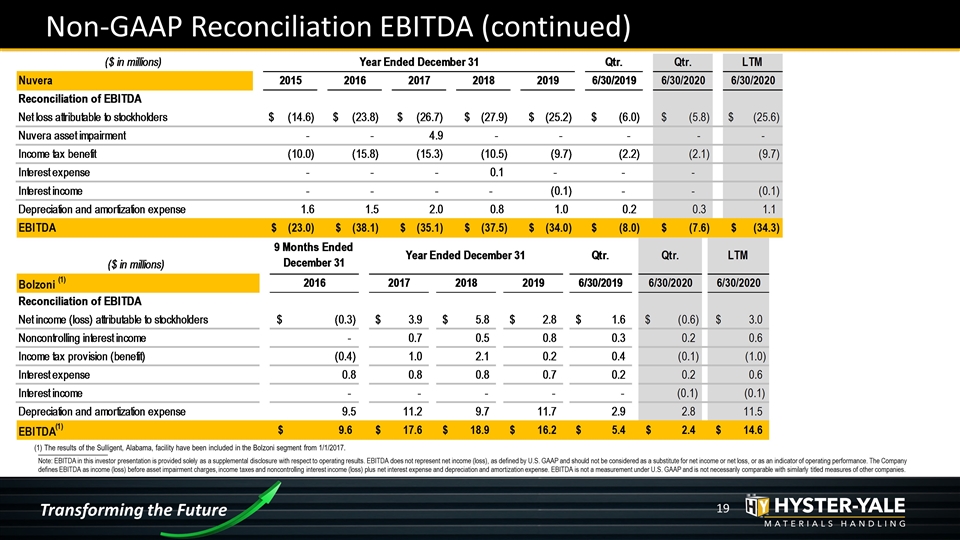

Non-GAAP Reconciliation EBITDA (continued) _____________________ Note: EBITDA in this investor presentation is provided solely as a supplemental disclosure with respect to operating results. EBITDA does not represent net income (loss), as defined by U.S. GAAP and should not be considered as a substitute for net income or net loss, or as an indicator of operating performance. The Company defines EBITDA as income (loss) before asset impairment charges, income taxes and noncontrolling interest income (loss) plus net interest expense and depreciation and amortization expense. EBITDA is not a measurement under U.S. GAAP and is not necessarily comparable with similarly titled measures of other companies. Transforming the Future (1) The results of the Sulligent, Alabama, facility have been included in the Bolzoni segment from 1/1/2017.

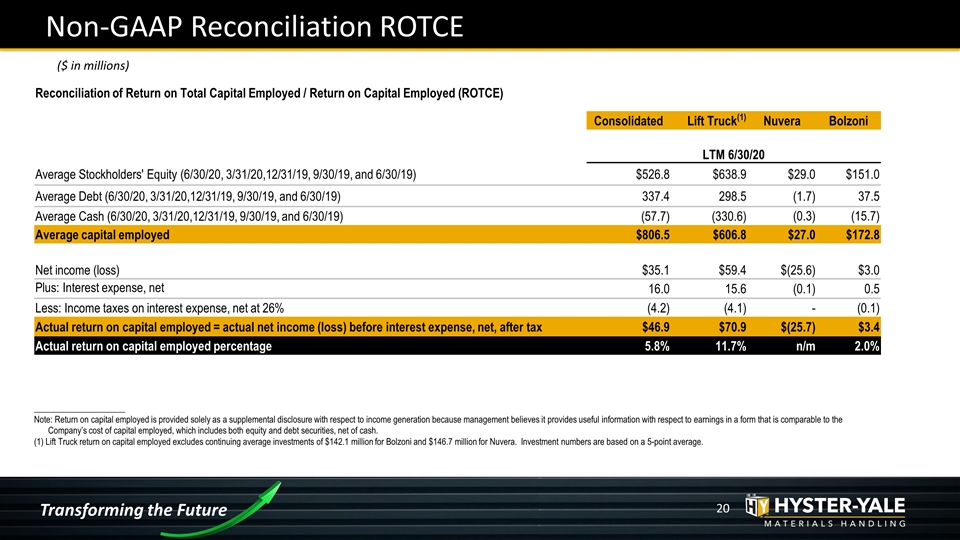

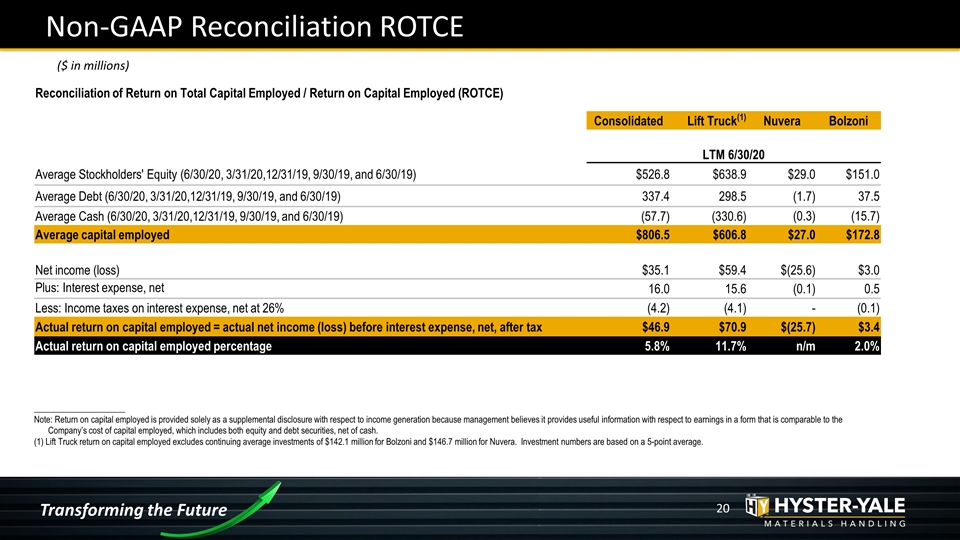

Non-GAAP Reconciliation ROTCE _____________________ Note: Return on capital employed is provided solely as a supplemental disclosure with respect to income generation because management believes it provides useful information with respect to earnings in a form that is comparable to the Company’s cost of capital employed, which includes both equity and debt securities, net of cash. (1) Lift Truck return on capital employed excludes continuing average investments of $142.1 million for Bolzoni and $146.7 million for Nuvera. Investment numbers are based on a 5-point average. Reconciliation of Return on Total Capital Employed / Return on Capital Employed (ROTCE) Consolidated Lift Truck(1) Nuvera Bolzoni LTM 6/30/20 Average Stockholders' Equity (6/30/20, 3/31/20,12/31/19, 9/30/19, and 6/30/19) $526.8 $638.9 $29.0 $151.0 Average Debt (6/30/20, 3/31/20,12/31/19, 9/30/19, and 6/30/19) 337.4 298.5 (1.7) 37.5 Average Cash (6/30/20, 3/31/20,12/31/19, 9/30/19, and 6/30/19) (57.7) (330.6) (0.3) (15.7) Average capital employed $806.5 $606.8 $27.0 $172.8 Net income (loss) $35.1 $59.4 $(25.6) $3.0 Plus: Interest expense, net 16.0 15.6 (0.1) 0.5 Less: Income taxes on interest expense, net at 26% (4.2) (4.1) - (0.1) Actual return on capital employed = actual net income (loss) before interest expense, net, after tax $46.9 $70.9 $(25.7) $3.4 Actual return on capital employed percentage 5.8% 11.7% n/m 2.0% ($ in millions) Transforming the Future

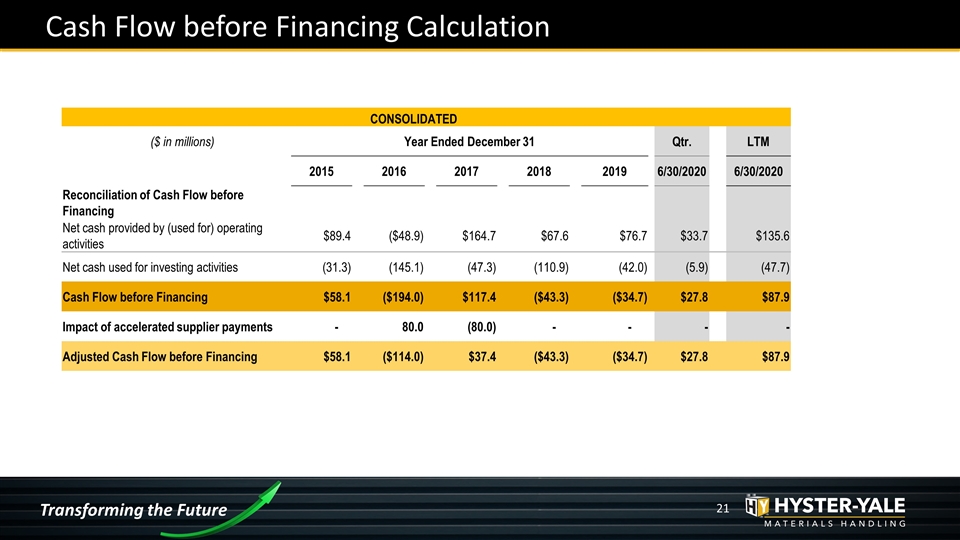

Cash Flow before Financing Calculation Transforming the Future CONSOLIDATED ($ in millions) Year Ended December 31 Qtr. LTM 2015 2016 2017 2018 2019 6/30/2020 6/30/2020 Reconciliation of Cash Flow before Financing Net cash provided by (used for) operating activities $89.4 ($48.9) $164.7 $67.6 $76.7 $33.7 $135.6 Net cash used for investing activities (31.3) (145.1) (47.3) (110.9) (42.0) (5.9) (47.7) Cash Flow before Financing $58.1 ($194.0) $117.4 ($43.3) ($34.7) $27.8 $87.9 Impact of accelerated supplier payments - 80.0 (80.0) - - - - Adjusted Cash Flow before Financing $58.1 ($114.0) $37.4 ($43.3) ($34.7) $27.8 $87.9

ENTER SESSION TITLE HERE… Presenter Name Supplemental Information

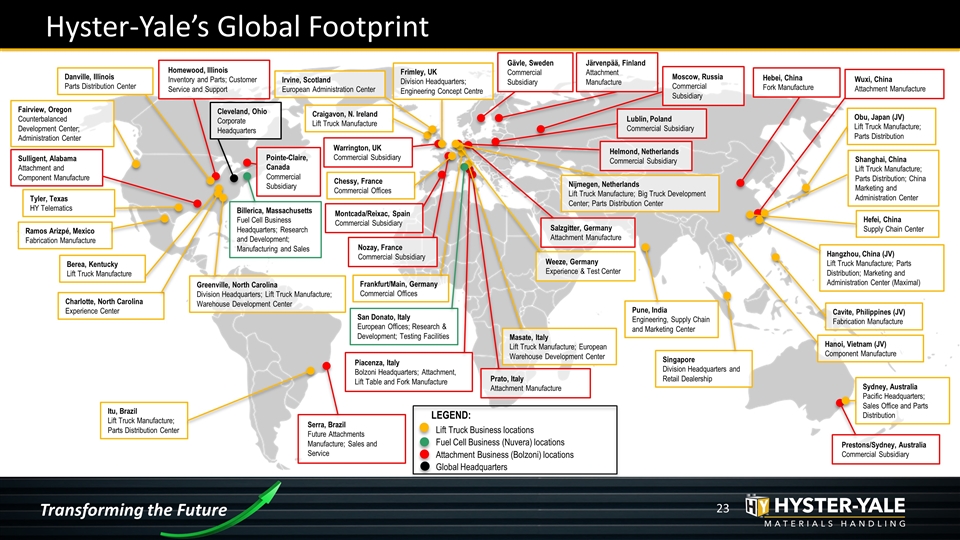

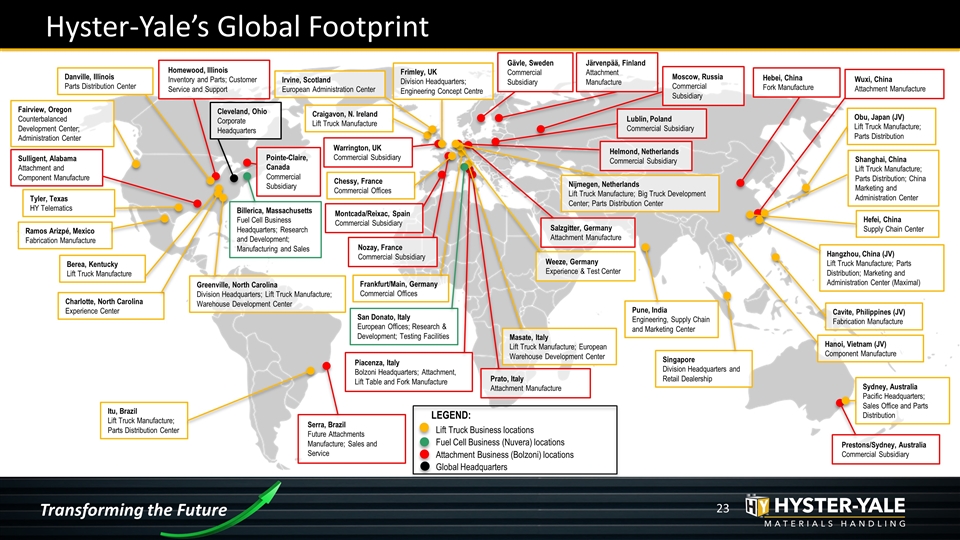

Hyster-Yale’s Global Footprint Ramos Arizpé, Mexico Fabrication Manufacture Sulligent, Alabama Attachment and Component Manufacture Berea, Kentucky Lift Truck Manufacture Greenville, North Carolina Division Headquarters; Lift Truck Manufacture; Warehouse Development Center Cleveland, Ohio Corporate Headquarters Danville, Illinois Parts Distribution Center Charlotte, North Carolina Experience Center Itu, Brazil Lift Truck Manufacture; Parts Distribution Center Craigavon, N. Ireland Lift Truck Manufacture Nijmegen, Netherlands Lift Truck Manufacture; Big Truck Development Center; Parts Distribution Center Masate, Italy Lift Truck Manufacture; European Warehouse Development Center Shanghai, China Lift Truck Manufacture; Parts Distribution; China Marketing and Administration Center Obu, Japan (JV) Lift Truck Manufacture; Parts Distribution Cavite, Philippines (JV) Fabrication Manufacture Irvine, Scotland European Administration Center Hanoi, Vietnam (JV) Component Manufacture Sydney, Australia Pacific Headquarters; Sales Office and Parts Distribution Pune, India Engineering, Supply Chain and Marketing Center Frimley, UK Division Headquarters; Engineering Concept Centre Hefei, China Supply Chain Center Fairview, Oregon Counterbalanced Development Center; Administration Center San Donato, Italy European Offices; Research & Development; Testing Facilities Billerica, Massachusetts Fuel Cell Business Headquarters; Research and Development; Manufacturing and Sales Homewood, Illinois Inventory and Parts; Customer Service and Support Piacenza, Italy Bolzoni Headquarters; Attachment, Lift Table and Fork Manufacture Järvenpää, Finland Attachment Manufacture Salzgitter, Germany Attachment Manufacture Wuxi, China Attachment Manufacture Hebei, China Fork Manufacture Pointe-Claire, Canada Commercial Subsidiary Prestons/Sydney, Australia Commercial Subsidiary Warrington, UK Commercial Subsidiary Montcada/Reixac, Spain Commercial Subsidiary Nozay, France Commercial Subsidiary Prato, Italy Attachment Manufacture Lublin, Poland Commercial Subsidiary Moscow, Russia Commercial Subsidiary Gävle, Sweden Commercial Subsidiary Helmond, Netherlands Commercial Subsidiary Lift Truck Business locations Fuel Cell Business (Nuvera) locations Attachment Business (Bolzoni) locations Global Headquarters LEGEND: Tyler, Texas HY Telematics Chessy, France Commercial Offices Frankfurt/Main, Germany Commercial Offices Weeze, Germany Experience & Test Center Hangzhou, China (JV) Lift Truck Manufacture; Parts Distribution; Marketing and Administration Center (Maximal) Singapore Division Headquarters and Retail Dealership Serra, Brazil Future Attachments Manufacture; Sales and Service Transforming the Future

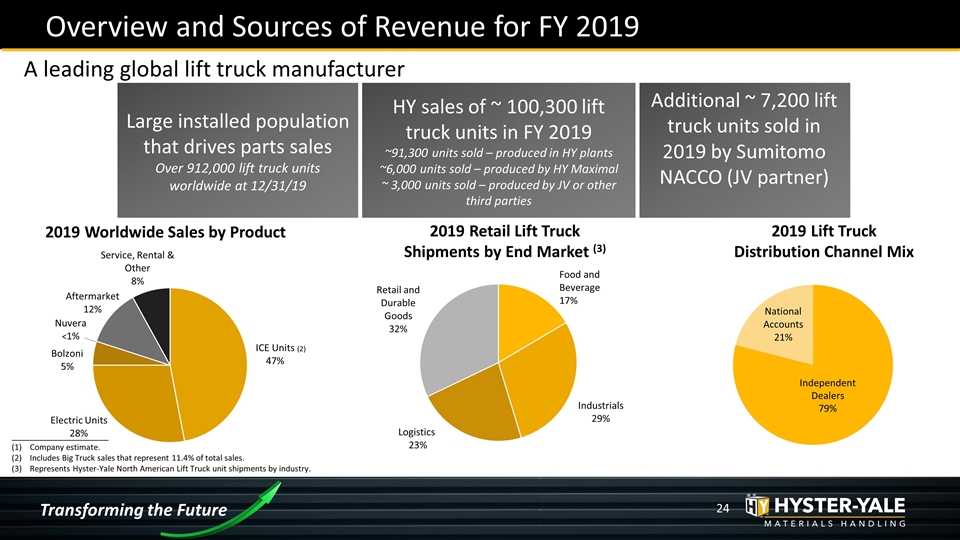

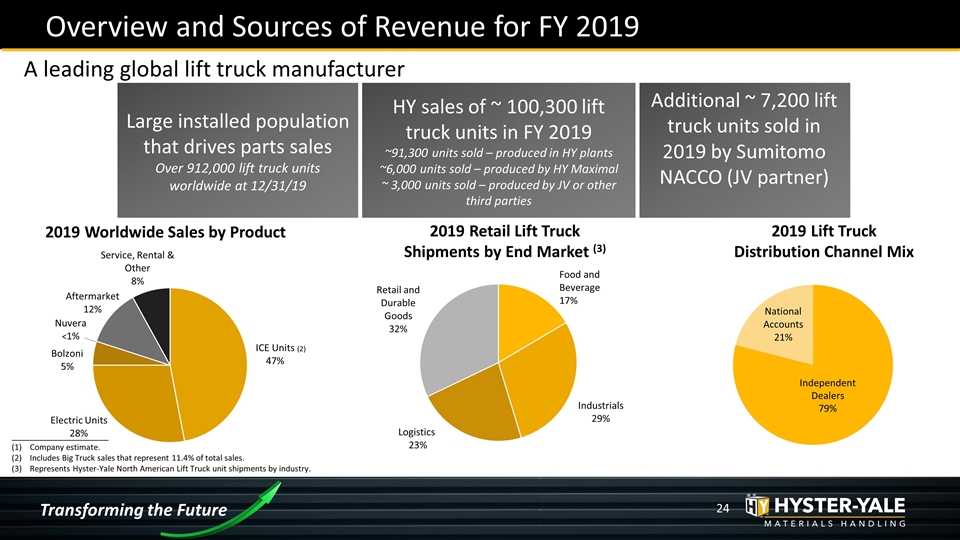

Overview and Sources of Revenue for FY 2019 2019 Worldwide Sales by Product _____________________ Company estimate. Includes Big Truck sales that represent 11.4% of total sales. Represents Hyster-Yale North American Lift Truck unit shipments by industry. A leading global lift truck manufacturer 2019 Retail Lift Truck Shipments by End Market (3) Large installed population that drives parts sales Over 912,000 lift truck units worldwide at 12/31/19 HY sales of ~ 100,300 lift truck units in FY 2019 ~91,300 units sold – produced in HY plants ~6,000 units sold – produced by HY Maximal ~ 3,000 units sold – produced by JV or other third parties Additional ~ 7,200 lift truck units sold in 2019 by Sumitomo NACCO (JV partner) (2) 2019 Lift Truck Distribution Channel Mix Transforming the Future

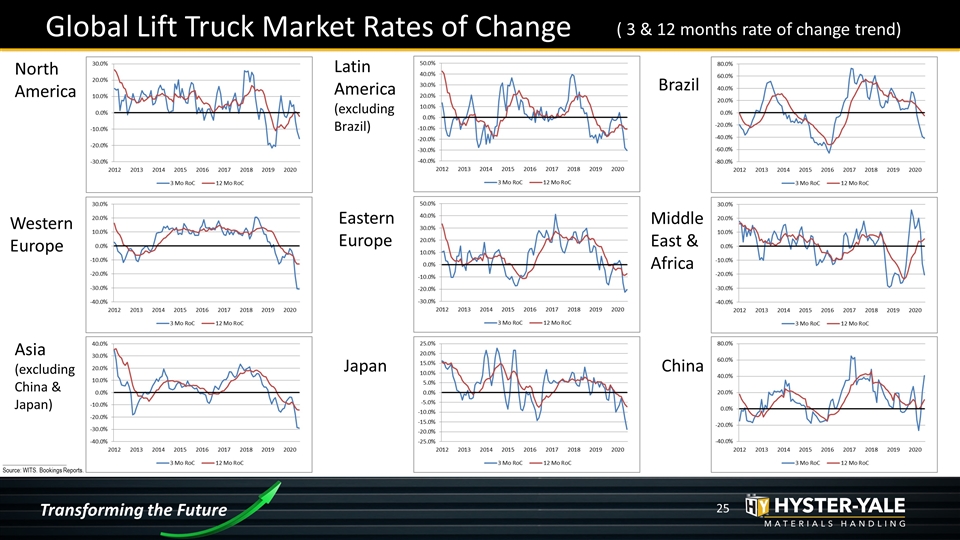

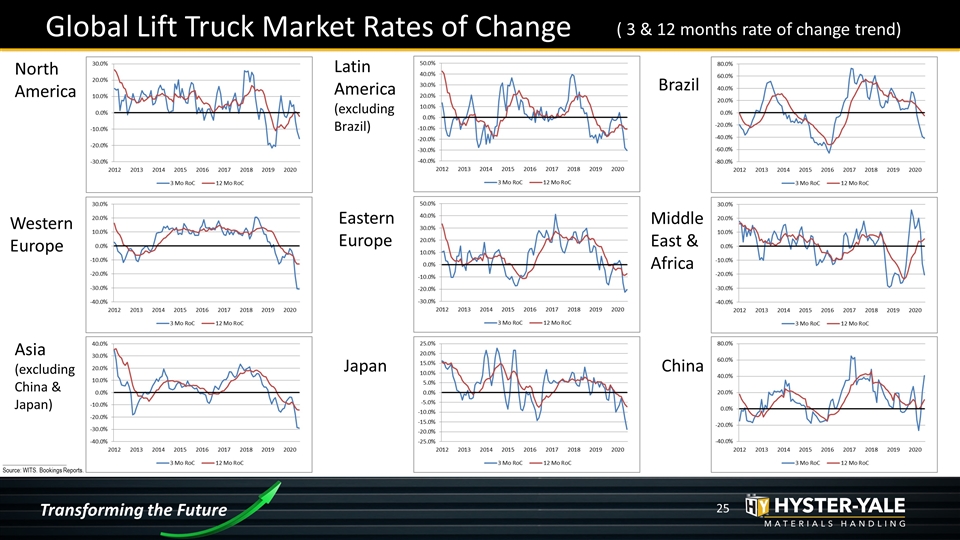

Japan Western Europe Eastern Europe Brazil North America Middle East & Africa Latin America (excluding Brazil) Asia (excluding China & Japan) China ( 3 & 12 months rate of change trend) Global Lift Truck Market Rates of Change _____________________ Source: WITS. Bookings Reports. Transforming the Future

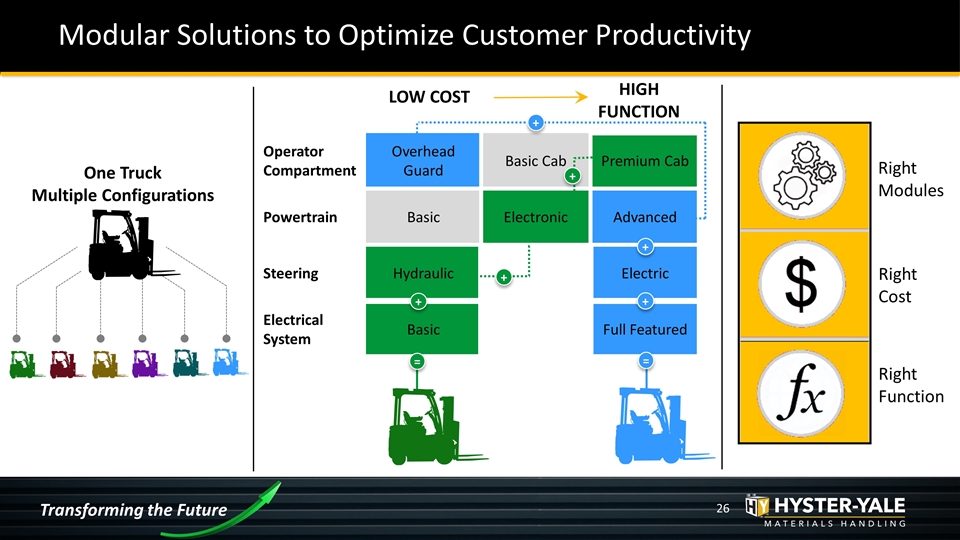

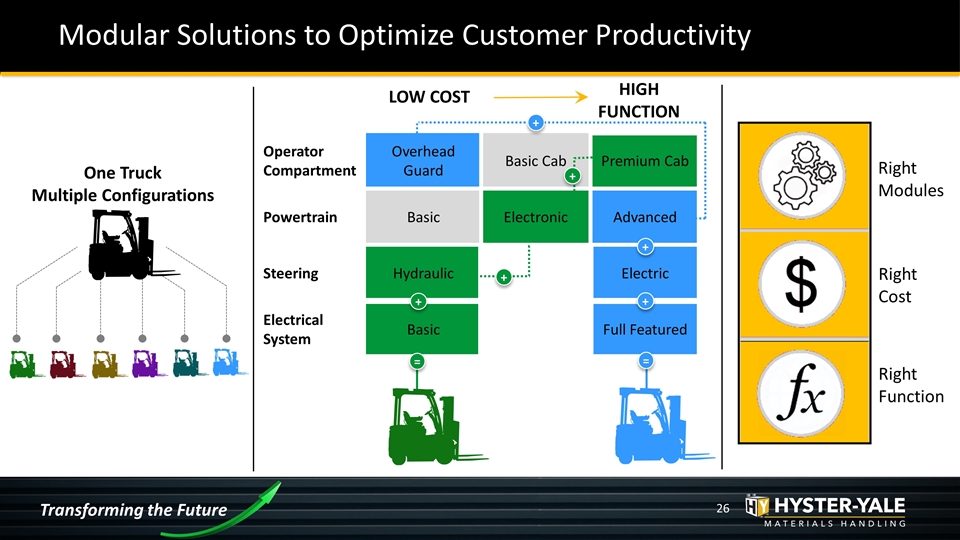

LOW COST HIGH FUNCTION Operator Compartment Overhead Guard Basic Cab Premium Cab Powertrain Basic Electronic Advanced Steering Hydraulic Electric Electrical System Basic Full Featured + + + = + + = + Right Modules Right Cost Right Function Transforming the Future One Truck Multiple Configurations Modular Solutions to Optimize Customer Productivity

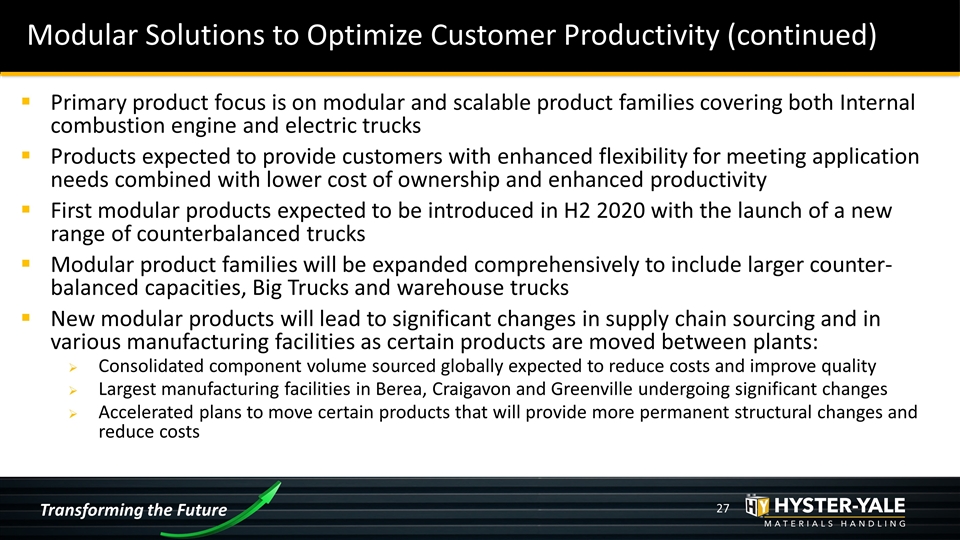

Transforming the Future Modular Solutions to Optimize Customer Productivity (continued) Primary product focus is on modular and scalable product families covering both Internal combustion engine and electric trucks Products expected to provide customers with enhanced flexibility for meeting application needs combined with lower cost of ownership and enhanced productivity First modular products expected to be introduced in H2 2020 with the launch of a new range of counterbalanced trucks Modular product families will be expanded comprehensively to include larger counter-balanced capacities, Big Trucks and warehouse trucks New modular products will lead to significant changes in supply chain sourcing and in various manufacturing facilities as certain products are moved between plants: Consolidated component volume sourced globally expected to reduce costs and improve quality Largest manufacturing facilities in Berea, Craigavon and Greenville undergoing significant changes Accelerated plans to move certain products that will provide more permanent structural changes and reduce costs

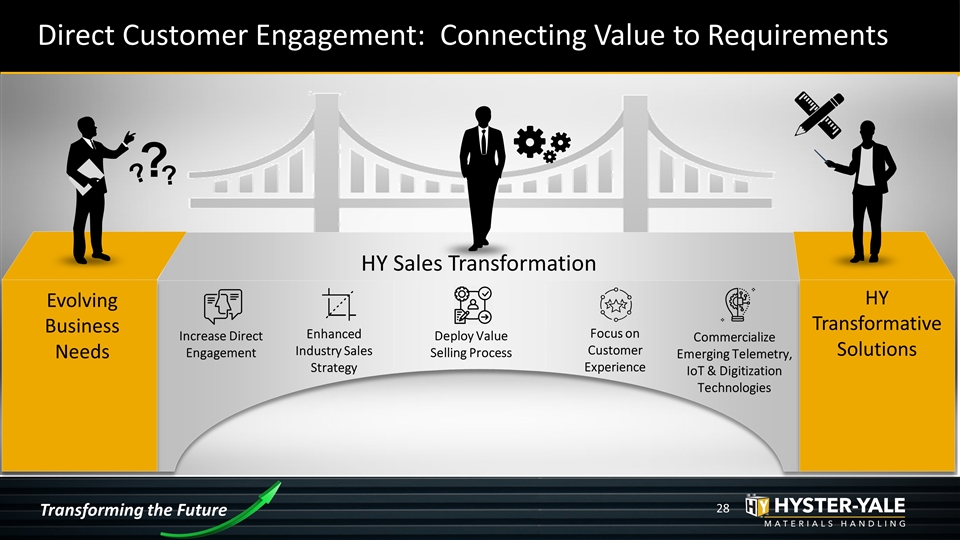

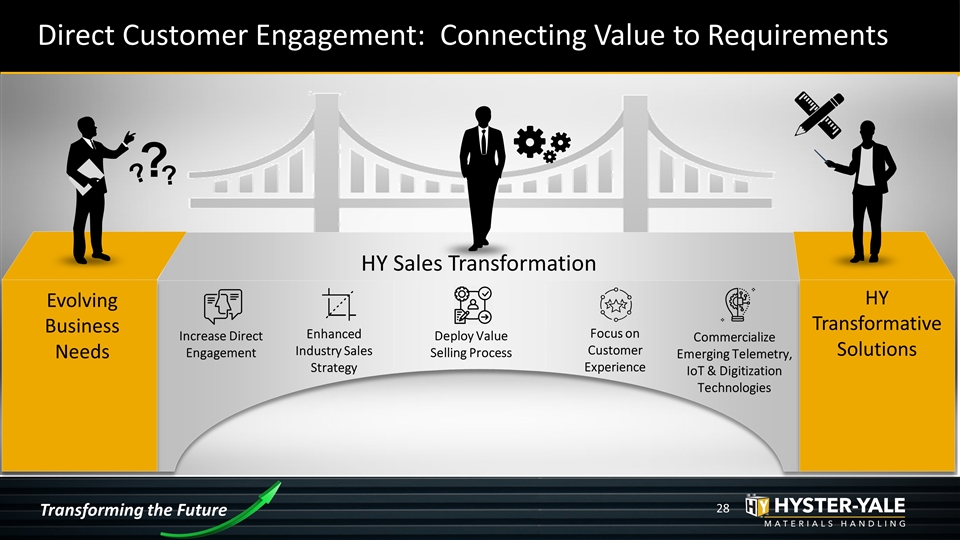

Direct Customer Engagement: Connecting Value to Requirements Evolving Business Needs HY Transformative Solutions HY Sales Transformation Enhanced Industry Sales Strategy Deploy Value Selling Process Increase Direct Engagement Focus on Customer Experience Commercialize Emerging Telemetry, IoT & Digitization Technologies Transforming the Future

Direct Customer Engagement: Connecting Value to Requirements (continued) Transforming the Future COVID-19 Implications for Direct Customer Engagement: Direct Customer Engagement = both Physically and Digitally COVID-19 has accelerated the shift toward digitizing the buying process Customers want an easy online experience to self-educate about products, including digital sales/marketing platforms, investigation tools and virtual product demonstrations COVID-19 has increased the need for inside sales to support a digitally enabled sales process, including processes to handle influx of inbound leads from enhanced digital marketing platforms; establish early stage customer contacts/relationships; and make sales appointments COVID-19 is rapidly shifting face-to-face selling to virtual/remote skill sets

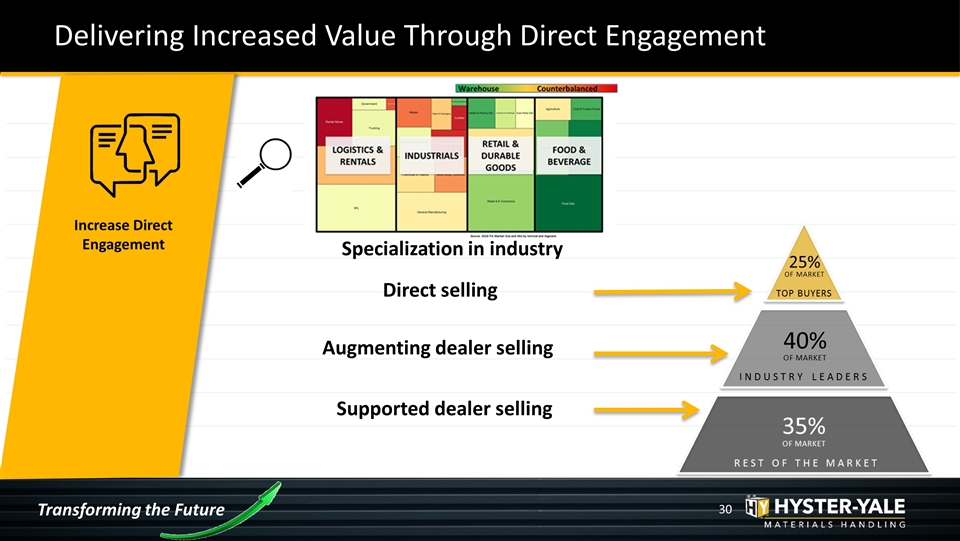

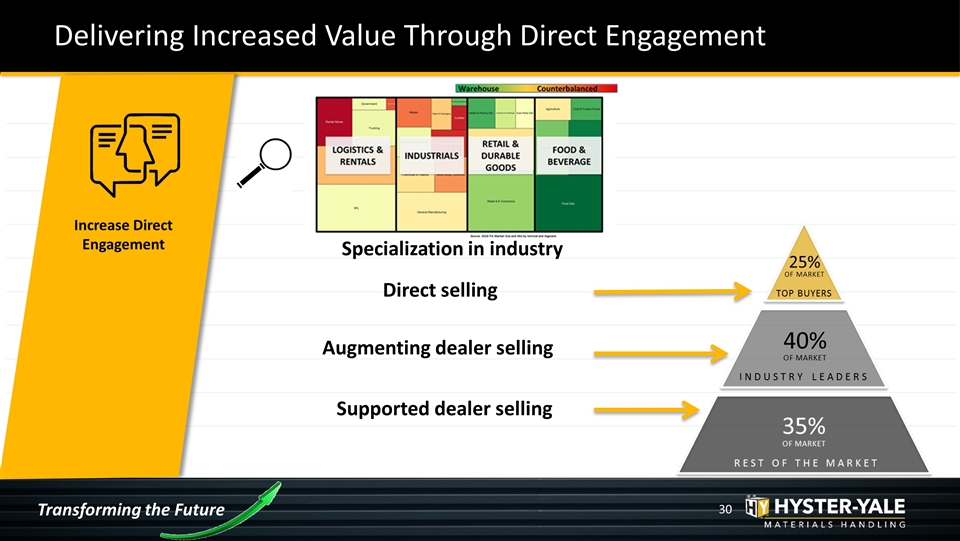

Delivering Increased Value Through Direct Engagement Specialization in industry Direct selling Augmenting dealer selling Supported dealer selling Increase Direct Engagement Transforming the Future

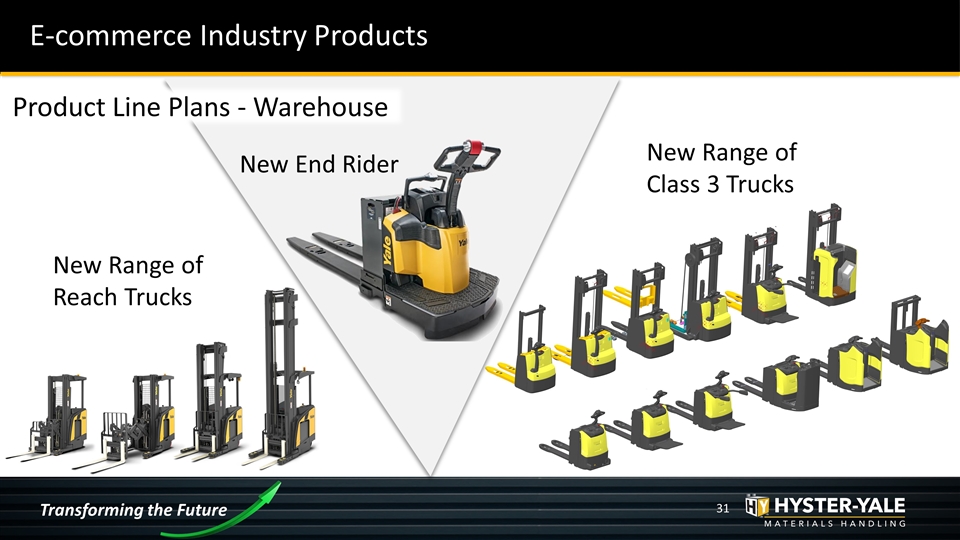

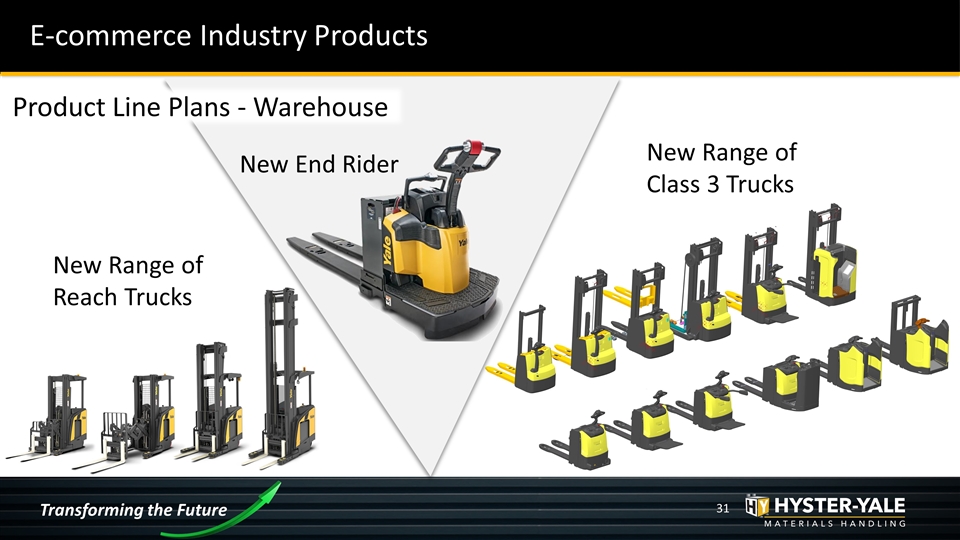

Product Line Plans - Warehouse New End Rider New Range of Class 3 Trucks New Range of Reach Trucks Transforming the Future E-commerce Industry Products

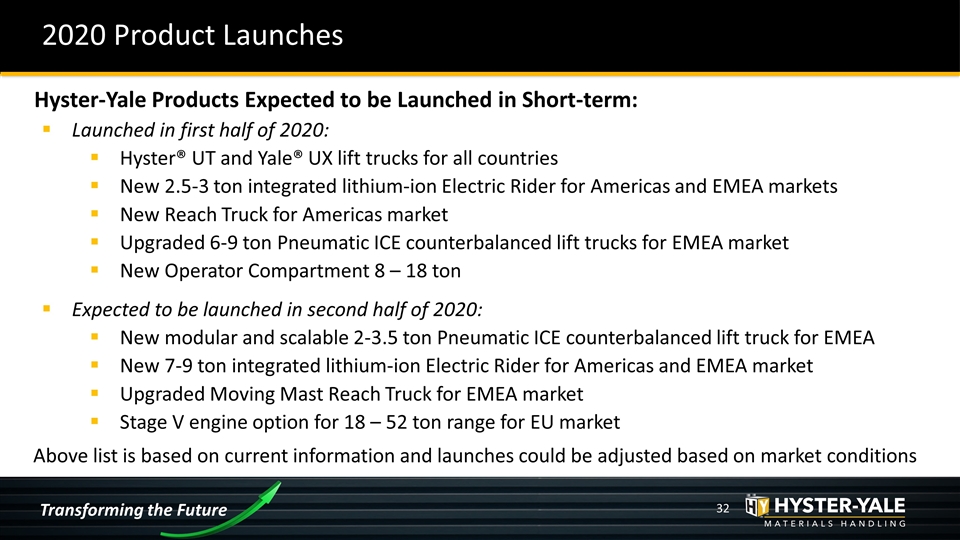

2020 Product Launches Transforming the Future Hyster-Yale Products Expected to be Launched in Short-term: Launched in first half of 2020: Hyster® UT and Yale® UX lift trucks for all countries New 2.5-3 ton integrated lithium-ion Electric Rider for Americas and EMEA markets New Reach Truck for Americas market Upgraded 6-9 ton Pneumatic ICE counterbalanced lift trucks for EMEA market New Operator Compartment 8 – 18 ton Expected to be launched in second half of 2020: New modular and scalable 2-3.5 ton Pneumatic ICE counterbalanced lift truck for EMEA New 7-9 ton integrated lithium-ion Electric Rider for Americas and EMEA market Upgraded Moving Mast Reach Truck for EMEA market Stage V engine option for 18 – 52 ton range for EU market Above list is based on current information and launches could be adjusted based on market conditions

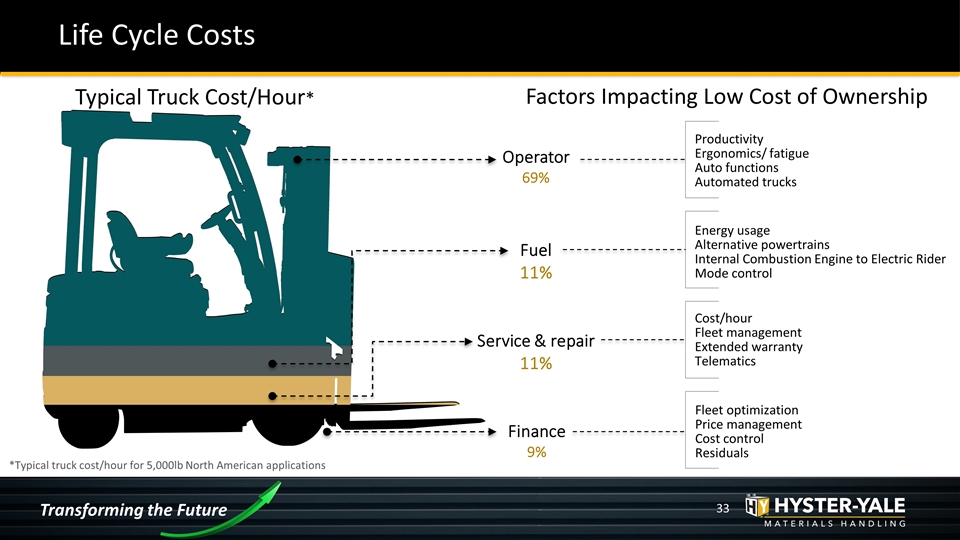

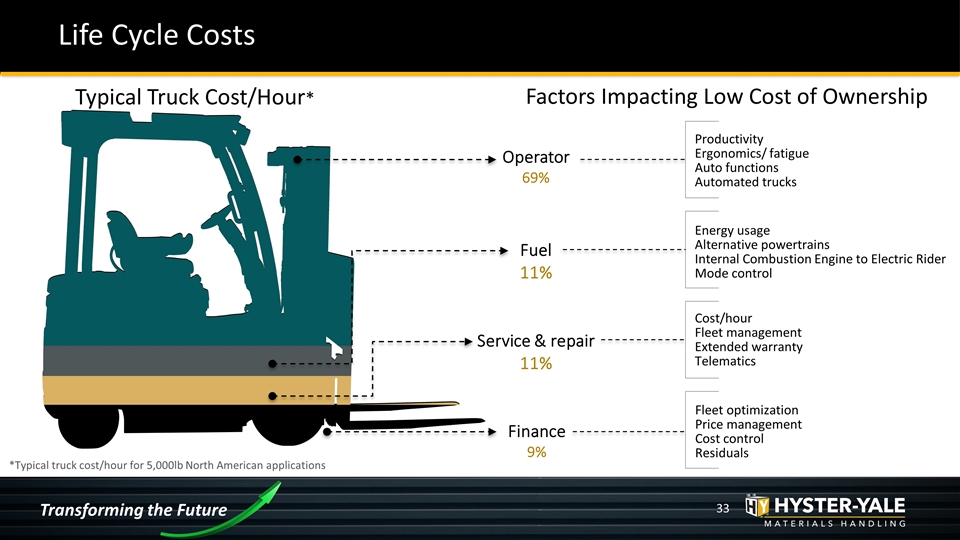

Life Cycle Costs *Typical truck cost/hour for 5,000lb North American applications Operator 69% Fuel 11% Finance 9% Service & repair 11% Typical Truck Cost/Hour* Factors Impacting Low Cost of Ownership Fleet optimization Price management Cost control Residuals Cost/hour Fleet management Extended warranty Telematics Productivity Ergonomics/ fatigue Auto functions Automated trucks Energy usage Alternative powertrains Internal Combustion Engine to Electric Rider Mode control Transforming the Future

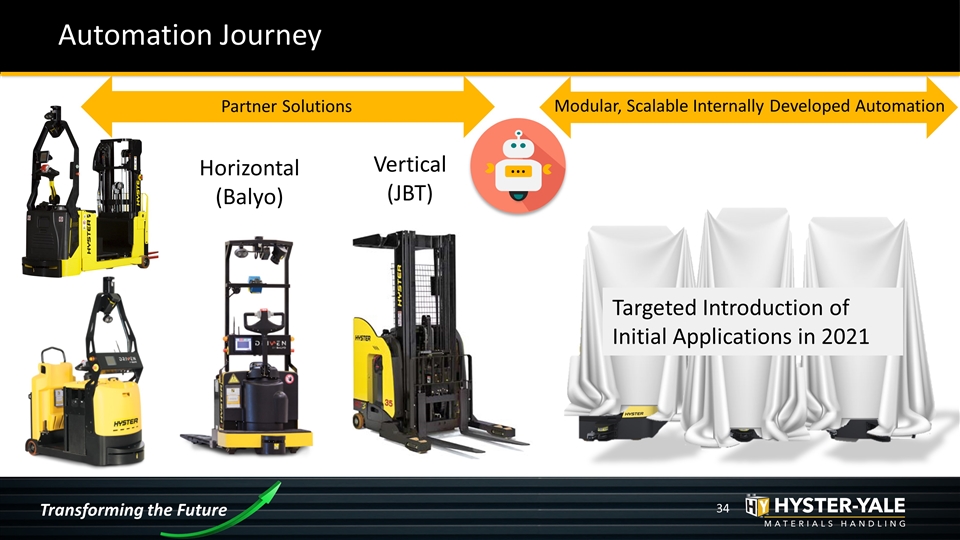

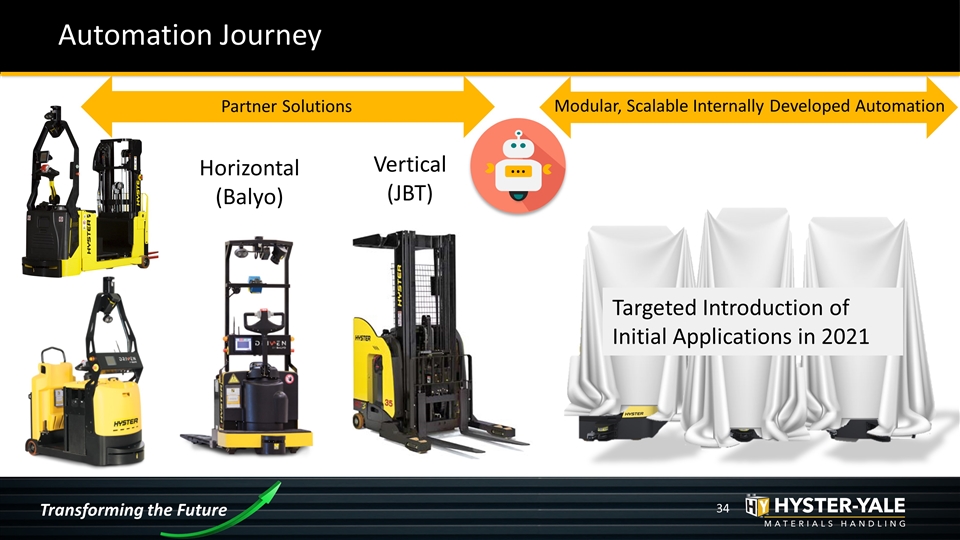

Automation Journey Horizontal (Balyo) Vertical (JBT) Partner Solutions Modular, Scalable Internally Developed Automation … Transforming the Future Targeted Introduction of Initial Applications in 2021

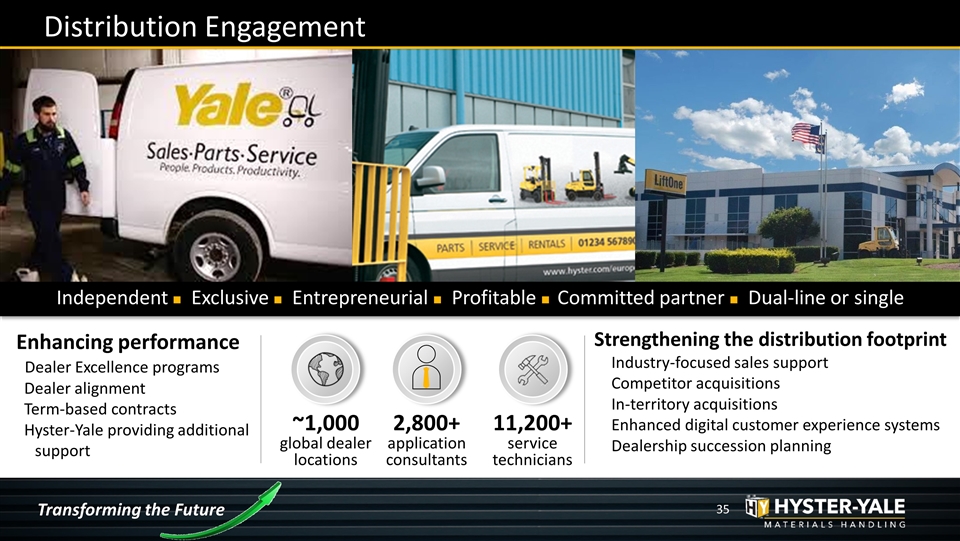

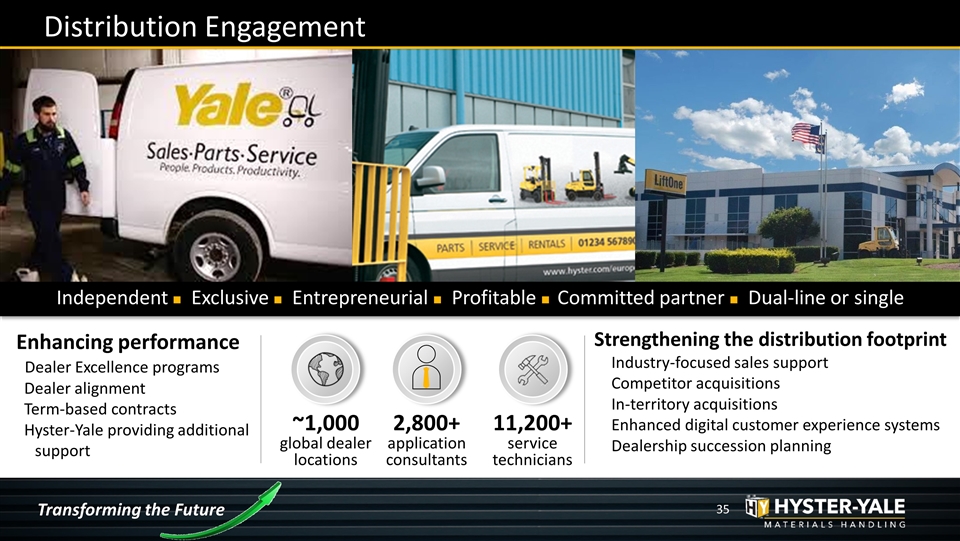

Distribution Engagement Enhancing performance Dealer Excellence programs Dealer alignment Term-based contracts Hyster-Yale providing additional support ~1,000 global dealer locations 2,800+ application consultants 11,200+ service technicians Independent n Exclusive n Entrepreneurial n Profitable n Committed partner n Dual-line or single Strengthening the distribution footprint Industry-focused sales support Competitor acquisitions In-territory acquisitions Enhanced digital customer experience systems Dealership succession planning Transforming the Future

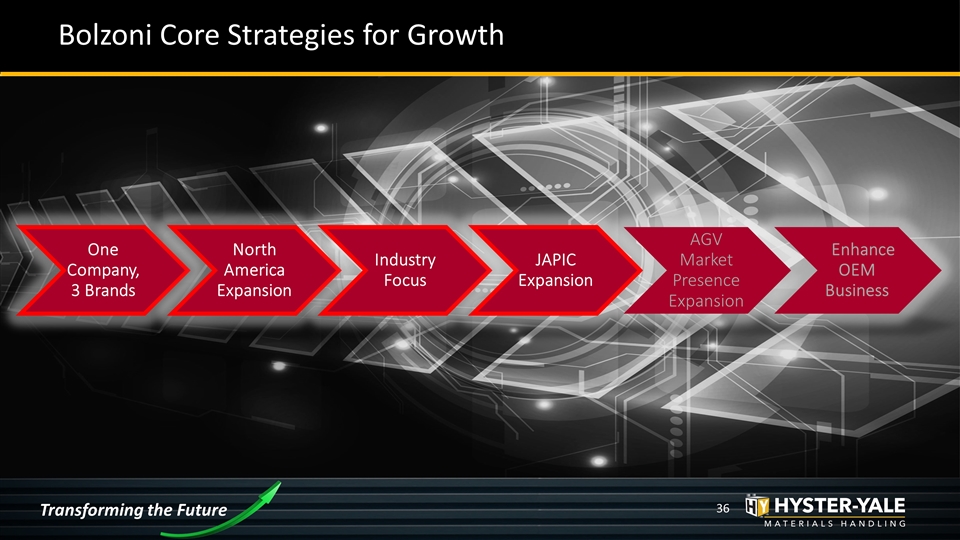

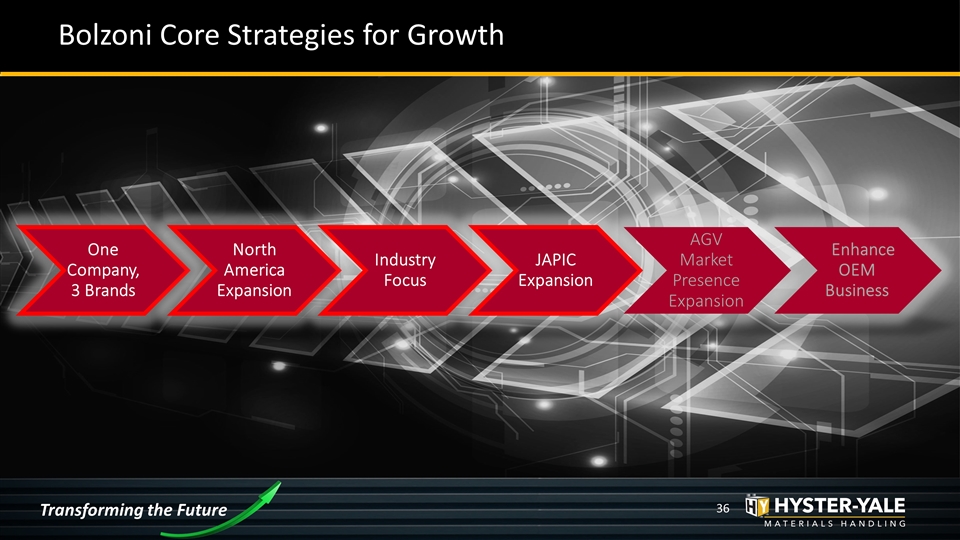

Bolzoni Core Strategies for Growth Transforming the Future One Company, 3 Brands Industry Focus AGV Market Presence Expansion North America Expansion Enhance OEM Business JAPIC Expansion

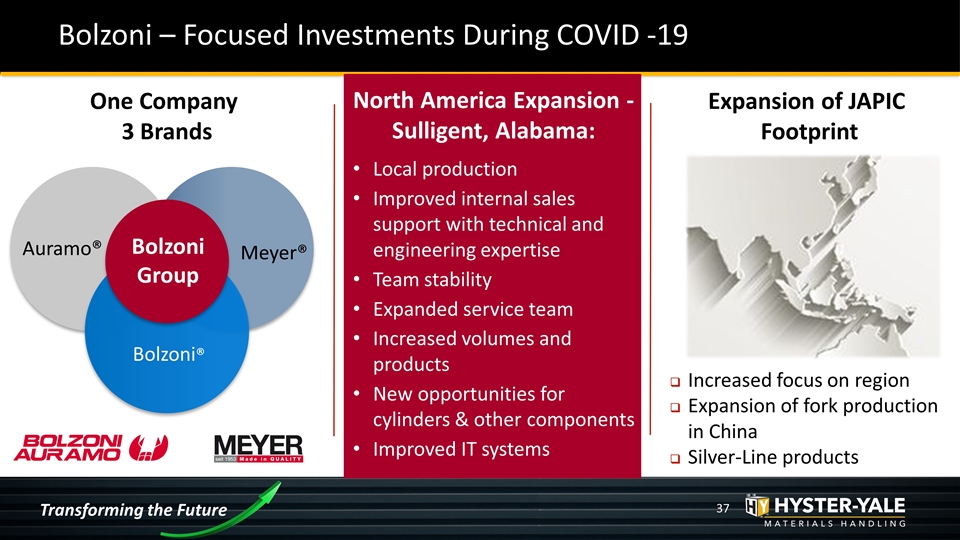

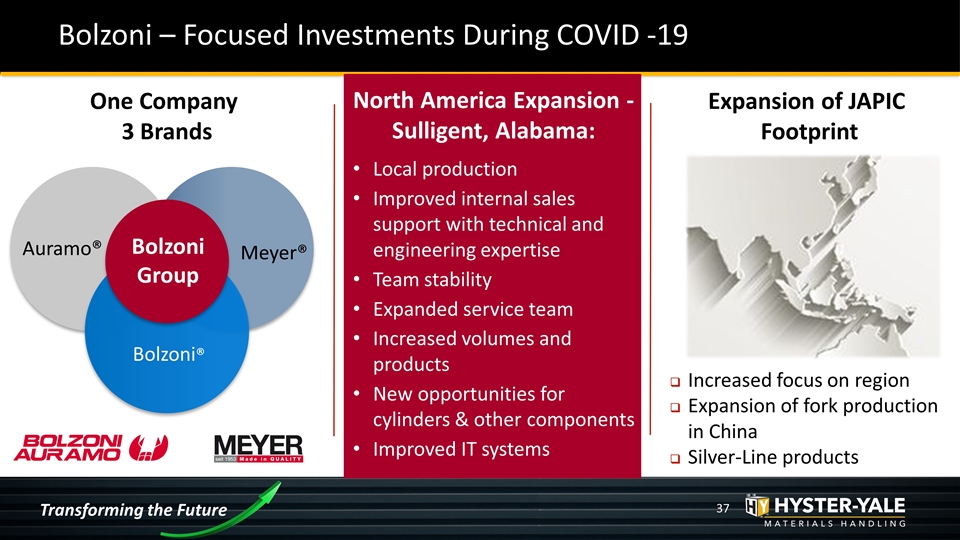

Transforming the Future Bolzoni – Focused Investments During COVID -19 Expansion of JAPIC Footprint Increased focus on region Expansion of fork production in China Silver-Line products One Company 3 Brands Bolzoni® Bolzoni Group Auramo® Meyer® Local production Improved internal sales support with technical and engineering expertise Team stability Expanded service team Increased volumes and products New opportunities for cylinders & other components Improved IT systems North America Expansion - Sulligent, Alabama:

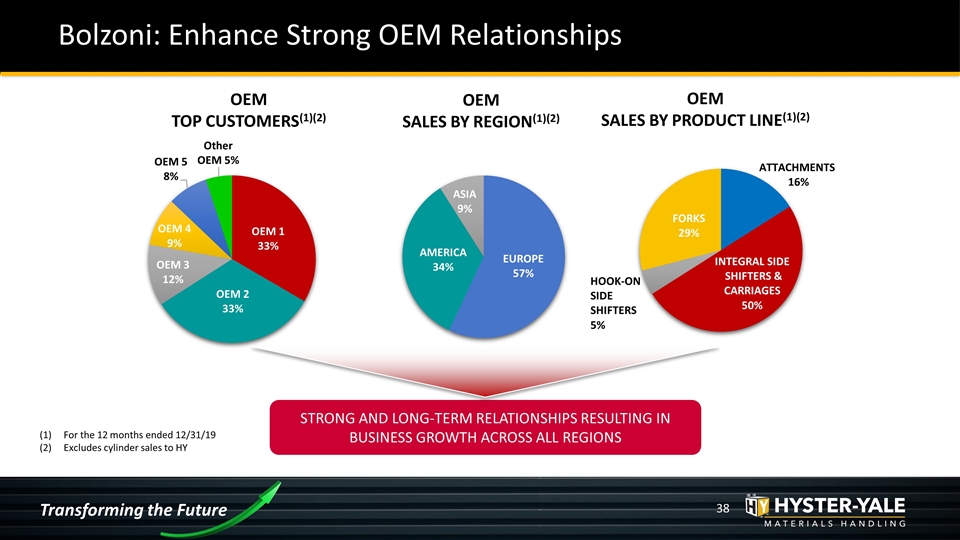

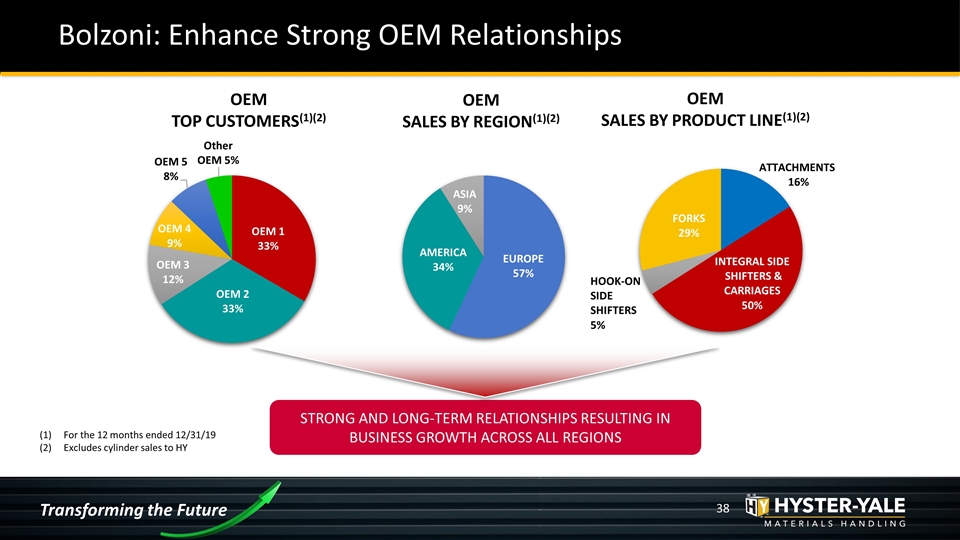

Bolzoni: Enhance Strong OEM Relationships Transforming the Future OEM TOP CUSTOMERS(1)(2) OEM SALES BY REGION(1)(2) OEM SALES BY PRODUCT LINE(1)(2) STRONG AND LONG-TERM RELATIONSHIPS RESULTING IN BUSINESS GROWTH ACROSS ALL REGIONS For the 12 months ended 12/31/19 Excludes cylinder sales to HY

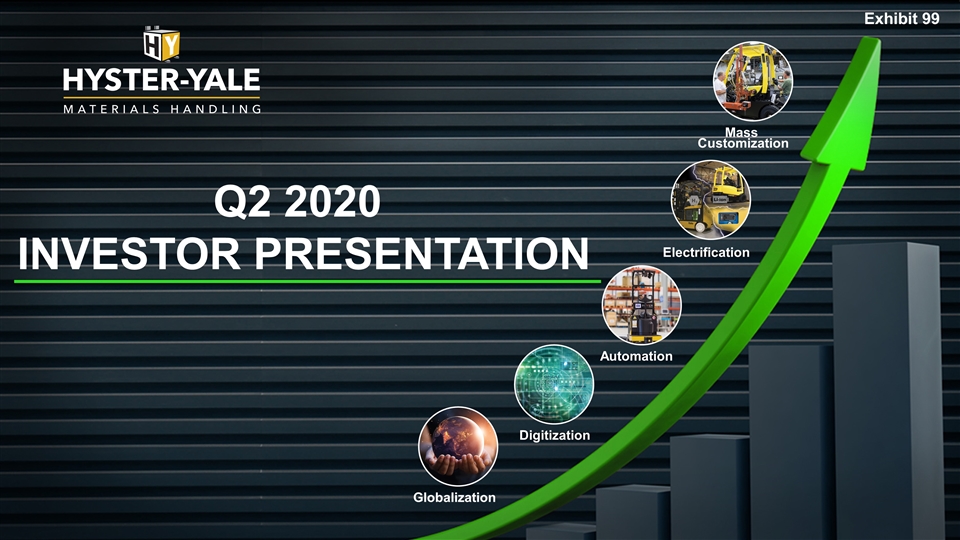

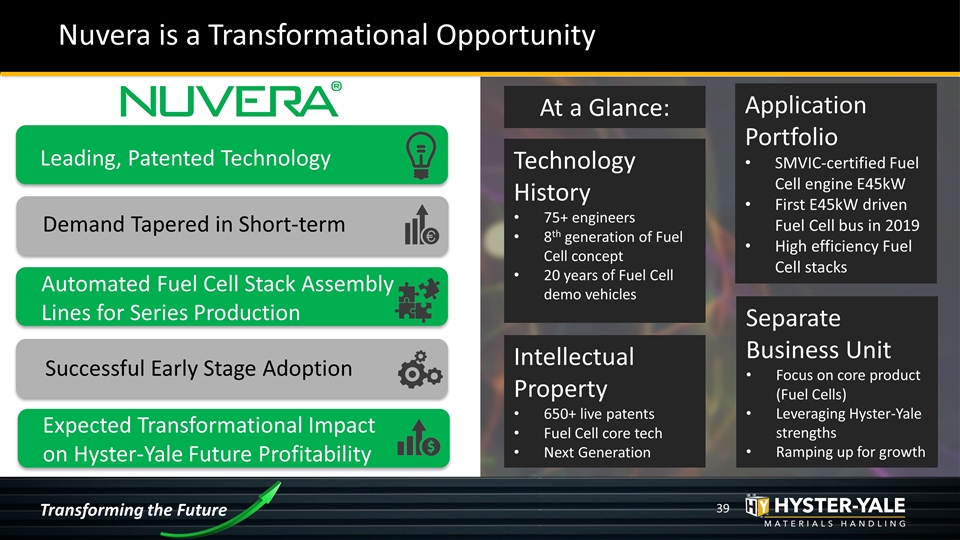

Nuvera is a Transformational Opportunity Transforming the Future Leading, Patented Technology Demand Tapered in Short-term Successful Early Stage Adoption Automated Fuel Cell Stack Assembly Lines for Series Production Expected Transformational Impact on Hyster-Yale Future Profitability Technology History 75+ engineers 8th generation of Fuel Cell concept 20 years of Fuel Cell demo vehicles Application Portfolio SMVIC-certified Fuel Cell engine E45kW First E45kW driven Fuel Cell bus in 2019 High efficiency Fuel Cell stacks Intellectual Property 650+ live patents Fuel Cell core tech Next Generation Separate Business Unit Focus on core product (Fuel Cells) Leveraging Hyster-Yale strengths Ramping up for growth At a Glance:

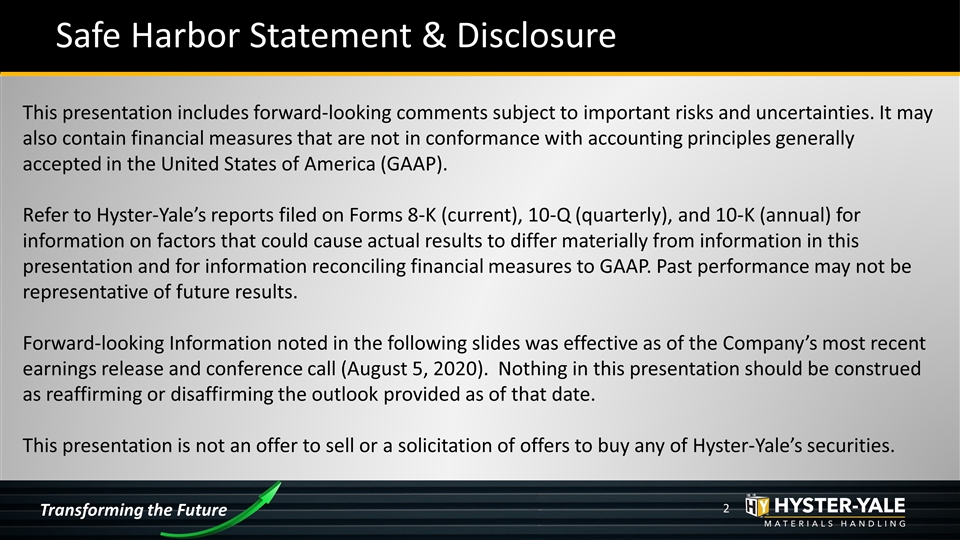

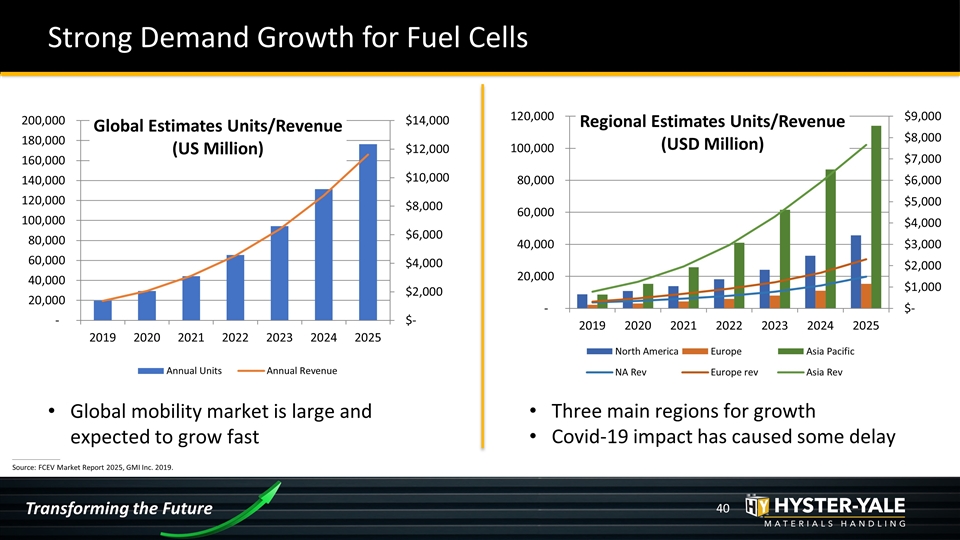

Strong Demand Growth for Fuel Cells Global mobility market is large and expected to grow fast Three main regions for growth Covid-19 impact has caused some delay Source: FCEV Market Report 2025, GMI Inc. 2019. Transforming the Future

Market Trends / Nuvera Activity Europe Market Trend: City & Country bans on ICE Realizing network of public facing H2 stations Increasing focus on Bus (12 meter) Current activity focused on systems for industrial machines North America Market Trend: Currently dominated by Materials Handling (>25k units) Fuel Cell-driven electric Port Equipment upcoming Opportunities for use in delivery vans California leading activity China Market Trend: Government subsidy driving adoption Early targets are Buses and Commercial Vehicles (Large) passenger Vehicles expected to rise quickly Nuvera E45kW FC engine certified by SMVIC and currently undergoing endurance testing in China Bus Transforming the Future Source: FuelCellsWorks.com June 17, 2020 Nuvera launched first of modular engine systems targeting bus, port equipment, machinery, utility vehicles https://fuelcellsworks.com/news/mitsui-invests-usd25-million-in-firstelement-fuel-inc-expands-collaboration-with-hydrogen-station-operator-in-california/

Long-Term Focused, not Short-Term Oriented Transforming the Future Partners Shareholders Employees Dealers Suppliers Transforming the Future Customers