UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-21098 |

|

LMP Real Estate Income Fund Inc. |

(Exact name of registrant as specified in charter) |

|

55 Water Street, New York, NY | | 10041 |

(Address of principal executive offices) | | (Zip code) |

|

Robert I. Frenkel, Esq. Legg Mason & Co., LLC 100 First Stamford Place Stamford, CT 06902 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (888)777-0102 | |

|

Date of fiscal year end: | December 31 | |

|

Date of reporting period: | December 31, 2010 | |

| | | | | | | | |

ITEM 1. REPORT TO STOCKHOLDERS.

The Annual Report to Stockholders is filed herewith.

December 31, 2010 |

|

Annual Report

LMP Real Estate Income Fund Inc.

(RIT)

| |

| INVESTMENT PRODUCTS: NOT FDIC INSURED · NO BANK GUARANTEE · MAY LOSE VALUE |

| |

II | | LMP Real Estate Income Fund Inc. | | |

Fund objectives

The Fund’s primary investment objective is high current income and the Fund’s secondary investment objective is capital appreciation.

What’s inside

Letter from the chairman | | II |

| | |

Investment commentary | | III |

| | |

Fund overview | | 1 |

| | |

Fund at a glance | | 5 |

| | |

Schedule of investments | | 6 |

| | |

Statement of assets and liabilities | | 10 |

| | |

Statement of operations | | 11 |

| | |

Statements of changes in net assets | | 12 |

| | |

Statement of cash flows | | 13 |

| | |

Financial highlights | | 14 |

| | |

Notes to financial statements | | 15 |

| | |

Report of independent registered public accounting firm | | 26 |

| | |

Board approval of management and subadvisory agreements | | 27 |

| | |

Additional information | | 33 |

| | |

Annual chief executive officer and chief financial officer certifications | | 39 |

| | |

Dividend reinvestment plan | | 40 |

| | |

Important tax information | | 42 |

Letter from the chairman |

|

Dear Shareholder,

We are pleased to provide the annual report of LMP Real Estate Income Fund Inc. for the twelve-month reporting period ended December 31, 2010. Please read on for a detailed look at prevailing economic and market conditions during the Fund’s reporting period and to learn how those conditions have affected Fund performance.

As always, we remain committed to providing you with excellent service and a full spectrum of investment choices. We also remain committed to supplementing the support you receive from your financial advisor. One way we accomplish this is through our website, www.leggmason.com/cef. Here you can gain immediate access to market and investment information, including:

· Fund prices and performance,

· Market insights and commentaries from our portfolio managers, and

· A host of educational resources.

We look forward to helping you meet your financial goals.

Sincerely,

R. Jay Gerken, CFA

Chairman, President and Chief Executive Officer

February 9, 2011

| | LMP Real Estate Income Fund Inc. | | III |

Investment commentary

Economic review

Despite continued headwinds from high unemployment and issues in the housing market, the U.S. economy continued to expand over the twelve months ended December 31, 2010. Toward the end of the reporting period, fears regarding moderating economic growth were replaced with optimism for a strengthening economy in 2011. With investor sentiment improving, U.S. equities moved sharply higher in the fourth quarter, while rising interest rates negatively impacted some sectors of the fixed-income market. All told, during 2010, investors who took on additional risk in their portfolios were generally rewarded.

In September 2010, the National Bureau of Economic Research (“NBER”), the organization charged with determining when recessions start and end, announced that the recession that began in December 2007 had concluded in June 2009. However, the NBER said, “In determining that a trough occurred in June 2009, the committee did not conclude that economic conditions since that month have been favorable or that the economy has returned to operating at normal capacity.” The NBER’s point is well-taken given continued areas of weakness in the U.S. economy.

Although the U.S. Department of Commerce continued to report positive U.S. gross domestic product (“GDP”)i growth, the expansion has moderated since peaking at 5.0% in the fourth quarter of 2009. A slower drawdown in business inventories and renewed consumer spending were contributing factors spurring the economy’s solid growth at the end of 2009. However, the economy grew at a more modest pace in 2010. According to the Commerce Department, GDP growth was 3.7%, 1.7% and 2.6% during the first, second and third quarters of 2010, respectively. The initial estimate for fourth quarter GDP was a 3.2% expansion.

Turning to the job market, while the unemployment rate moved lower in December 2010, it remained elevated throughout the reporting period. While 384,000 new jobs were created during the fourth quarter and the unemployment rate fell from 9.8% in November to 9.4% in December 2010, there continued to be some disturbing trends in the labor market. The unemployment rate has now exceeded 9.0% for twenty consecutive months, the longest period since the government began tracking this data in 1949. In addition, the U.S. Department of Labor reported in December that a total of 14.5 million Americans looking for work have yet to find a job, and 44% of these individuals have been out of work for more than six months.

There was mixed news in the housing market during the period. According to the National Association of Realtors (“NAR”), existing-home sales increased 7.0% and 8.0% in March and April, respectively, after sales had fallen for the period from December 2009 through February 2010. The rebound was largely attributed to people rushing to take advantage of the government’s $8,000 tax credit for first-time home buyers that expired at the end of April. However, with the end of the tax credit, existing-home sales then declined from May through July. Sales then generally rose from August through the end of the year. In total, existing-home sales volume in 2010 was 4.9 million, the lowest

IV | | LMP Real Estate Income Fund Inc. | | |

Investment commentary (cont’d)

amount since 1997. Looking at home prices, the NAR reported that the median existing-home price for all housing types rose a tepid 0.3% in 2010. The inventory of unsold homes was an 8.1 month supply in December at the current sales level, versus a 9.5 month supply in November.

The manufacturing sector was one area of the economy that remained relatively strong during 2010. Based on the Institute for Supply Management’s PMIii, the manufacturing sector has grown seventeen consecutive months since it began expanding in August 2009. After reaching a six-year peak of 60.4 in April 2010 (a reading below 50 indicates a contraction, whereas a reading above 50 indicates an expansion), PMI data indicated somewhat more modest growth through the remainder of the year. However, in December, the manufacturing sector expanded at its fastest pace in seven months, with a reading of 57.0 versus 56.6 in November.

Financial market overview

The financial markets experienced several periods of volatility during the reporting period that tested the resolve of novice and experienced investors alike. During most of the first four months of the reporting period, the financial markets were largely characterized by healthy investor risk appetite and solid results by stocks and lower-quality bonds. The market then experienced sharp sell-offs in late April and in May, and again beginning in mid-November. During those periods, investors tended to favor the relative safety of U.S. Treasury securities. However, these setbacks proved to be only temporary and, in each case, risk aversion was replaced with solid demand for riskier assets.

Due to signs that certain areas of the economy were moderating in the second half of the reporting period, the Federal Reserve Board (“Fed”)iii took further actions to spur the economy. At its August 10th meeting, the Fed announced an ongoing program that calls for using the proceeds from expiring agency debt and agency mortgage-backed securities to purchase longer-dated Treasury securities.

In addition, the Fed remained cautious throughout the reporting period given pockets of weakness in the economy. At its meeting in September 2010, the Fed said, “The Committee will continue to monitor the economic outlook and financial developments and is prepared to provide additional accommodation if needed to support the economic recovery. . . .” This led to speculation that the Fed may again move to purchase large amounts of agency and Treasury securities in an attempt to avoid a double-dip recession and ward off deflation.

The Fed then took additional action in early November. Citing that “the pace of recovery in output and employment continues to be slow,” the Fed announced another round of quantitative easing to help stimulate the economy, entailing the purchase of $600 billion of long-term U.S. Treasury securities by the end of the second quarter of 2011. This, coupled with the Fed’s previously announced program to use the proceeds of expiring securities to purchase Treasuries, means it could buy a total of $850 billion to $900 billion of Treasury securities by the end of June 2011. At its final meeting of the year in December, the Fed said it “will regularly review the pace of its securities purchases and the overall size of the asset-purchase

| | LMP Real Estate Income Fund Inc. | | V |

program in light of incoming information and will adjust the program as needed to best foster maximum employment and price stability.”

Equity market review

U.S. stock prices, as measured by the S&P 500 Indexiv (the “Index”), moved higher during the twelve months ended December 31, 2010. The reporting period got off to a solid start, with the Index moving higher during three of the first four months covered by this report. The market’s ascent was the result of a number of factors, including optimism regarding the economy, better-than-expected corporate profits and increased investor risk appetite. However, robust investor appetite was replaced with heightened risk aversion in May and June. This was due to the escalating sovereign debt crisis in Europe, uncertainties regarding new financial reforms in the U.S. and some worse-than-expected economic data.

After reaching a nineteen-month high on April 23, 2010, the market, as measured by the Index, fell into “correction territory” in May and declined more than 10%. Despite continued disappointing economic data, strong second quarter corporate profits helped the market to rally in July. The market then declined again in August, given some disappointing economic data. With the Fed indicating the possibility of another round of quantitative easing, stock prices then moved sharply higher in September and October. After posting solid results in early November, the market weakened later in the month as financial troubles in Ireland resulted in a re-emergence of the European sovereign debt crisis. However, investor sentiment was buoyed in December by a two-year extension of the Bush-era tax cuts and the Index gained 6.68% during the month. This represented its strongest month of December&nb sp;since 1991. All told, the Index returned 15.06% over the twelve months ended December 31, 2010.

Looking at the U.S. stock market more closely, small- and mid-cap stocks generated the best returns during the twelve months ended December 31, 2010, with the small-cap Russell 2000 Indexv and the Russell Midcap Indexvi gaining 26.85% and 25.48%, respectively. In contrast, the large-cap Russell 1000 Indexvii rose 16.10%. From an investment style perspective, growth and value stocks, as measured by the Russell 3000 Growthviii and Russell 3000 Valueix Indices, returned 17.64% and 16.23%, respectively.

As always, thank you for your confidence in our stewardship of your assets.

Sincerely,

R. Jay Gerken, CFA

Chairman, President and

Chief Executive Officer

January 28, 2011

All investments are subject to risk including the possible loss of principal. Past performance is no guarantee of future results. All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

VI | | LMP Real Estate Income Fund Inc. | | |

Investment commentary (cont’d)

i Gross domestic product (“GDP”) is the market value of all final goods and services produced within a country in a given period of time.

ii The Institute for Supply Management’s PMI is based on a survey of purchasing executives who buy the raw materials for manufacturing at more than 350 companies. It offers an early reading on the health of the manufacturing sector.

iii The Federal Reserve Board (“Fed”) is responsible for the formulation of policies designed to promote economic growth, full employment, stable prices and a sustainable pattern of international trade and payments.

iv The S&P 500 Index is an unmanaged index of 500 stocks and is generally representative of the performance of larger companies in the U.S.

v The Russell 2000 Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represents approximately 8% of the total market capitalization of the Russell 3000 Index. The Russell 3000 Index measures the performance of the 3,000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the U.S. equity market.

vi The Russell Midcap Index measures the performance of the 800 smallest companies in the Russell 1000 Index, which represents approximately 25% of the total market capitalization of the Russell 1000 Index.

vii The Russell 1000 Index measures the performance of the 1,000 largest companies in the Russell 3000 Index, which represents approximately 92% of the total market capitalization of the Russell 3000 Index.

viii The Russell 3000 Growth Index measures the performance of those Russell 3000 Index companies with higher price-to-book ratios and higher forecasted growth values. (A price-to-book ratio is the price of a stock compared to the difference between a company’s assets and liabilities.)

ix The Russell 3000 Value Index measures the performance of those Russell 3000 Index companies with lower price-to-book ratios and lower forecasted growth values.

| | LMP Real Estate Income Fund Inc. 2010 Annual Report | | 1 |

Fund overview

Q. What is the Fund’s investment strategy?

A. The Fund’s primary investment objective is high current income with capital appreciation as a secondary investment objective. At AEW Capital Management, L.P., the Fund’s subadviser, we employ a value-oriented investment strategy designed to identify securities that are priced below what we believe is their intrinsic value. We believe that the performance of real estate securities is ultimately dependent upon the performance of the underlying real estate assets and company management, as well as the overall influence of capital markets. Consequently, when selecting securities for the Fund, we draw upon the combined expertise of our real estate, research and securities professionals.

Under normal market conditions, the Fund invests at least 90% of its total assets in income-producing common shares, preferred shares, convertible preferred shares (preferred shares that, upon the passage of time or the happening of certain events, automatically convert into common shares) and debt securities issued by real estate companies, including real estate investment trusts (“REITs”)i. It is the Fund’s intention to invest approximately 60% to 80% of its total assets in common shares issued by real estate companies and 20% to 40% of its total assets in preferred shares, including convertible preferred shares, issued by real estate companies. The actual percentage of common, preferred and convertible preferred shares and debt securities in the Fund’s portfolio may vary over time based on our assessment of market conditions.

Q. What were the overall market conditions during the Fund’s reporting period?

A. The U.S. stock market performed solidly in 2010 with the major equity indices posting double-digit gains as performance was bolstered by a number of factors including improving investor sentiment regarding the prospects for a global economic recovery, increasing confidence that a double-dip recession would be avoided, improving corporate earnings results, and assurances from the Federal Reserve Board (“Fed”)ii that it would keep short-term interest rates low for the near term. Against this backdrop, the S&P 500 Indexiii rose 15.06% while the Dow Jones Industrial Average (“DJIA”)iv was up 14.06%. The U.S. REIT sector also continued to push higher as the year began, benefiting from the continued signs of an improving economic landscape, as well as positive cash flows into the sector. REITs were also aided early in the period by the fact that a number of REITs were able to successfully recapitalize, which eased fears that some companies would be forced into bankruptcy. As the year progressed, REITs continued their impressive performance run as continuing signs of stabilizing commercial real estate market fundamentals, a low interest rate environment and demand for higher-yield securities, including REITs, coalesced with the broader equity market gains to drive prices higher. The U.S. REIT market, as measured by the MSCI U.S. REIT Indexv, finished the year up 28.48%.

Q. How did we respond to these changing market conditions?

A. Our bottom-up value-oriented investment approach remained the same during 2010. We continued to focus on security selection within each property sector, with the goal of constructing a diversified portfolio of income-producing real estate securities that we believe will provide the best risk-adjusted returns for the Fund.

2 | | LMP Real Estate Income Fund Inc. 2010 Annual Report | | |

Fund overview (cont’d)

The Fund continued to maintain its exposure to interest rate swaps during the reporting period. These positions were used to manage the Fund’s exposure to interest rate fluctuations. Overall, these derivative positions detracted from performance during the period.

Performance review

For the twelve months ended December 31, 2010, LMP Real Estate Income Fund Inc. returned 33.49% based on its net asset value (“NAV”)vi and 35.86% based on its New York Stock Exchange (“NYSE”) market price per share. The Fund’s unmanaged benchmark, the MSCI U.S. REIT Index, returned 28.48% for the same period. The Lipper Real Estate Closed-End Funds Category Averagevii returned 26.33% over the same time frame. Please note that Lipper performance returns are based on each fund’s NAV.

During the twelve-month period, the Fund made distributions to shareholders totaling $0.72 per share, which included a return of capital of $0.43 per share. The performance table shows the Fund’s twelve-month total return based on its NAV and market price as of December 31, 2010. Past performance is no guarantee of future results.

Performance Snapshot as of December 31, 2010

Price Per Share | | 12-Month

Total Return* | |

$11.07 (NAV) | | 33.49% | |

$10.10 (Market Price) | | 35.86% | |

All figures represent past performance and are not a guarantee of future results.

* Total returns are based on changes in NAV or market price, respectively. Total returns assume the reinvestment of all distributions in additional shares in accordance with the Fund’s Dividend Reinvestment Plan.

Q. What were the leading contributors to performance?

A. On an individual stock basis, top contributors to the Fund’s performance during the year included Getty Realty Corp. which owns and leases gas stations, convenience stores and petroleum distribution terminals, and Industrial REIT First Potomac Realty Trust. Getty had been precluded from issuing equity due to an open issue with the Securities and Exchange Commission (“SEC”) related to its request for financial information on its largest tenant. In early 2010, the issue was resolved which allowed the company to be able to raise equity to help fund external growth and provided the catalyst for the company’s strong performance. First Potomac’s performance benefited from strong leasing activity during the year as well as accretive acquisitions which were well received by investors. From a sector perspect ive, the Fund’s overweight to the outperforming Retail — Free Standing sector and underweights to the underperforming Office and Diversified sectors contributed positively to performance. In light of the continued strong performance of common stock during the year, the performance of the Fund’s preferred stock portfolio generally underperformed its common share segment.

Q. What were the leading detractors from performance?

A. Among the top individual detractors from the Fund’s results during 2010 were Office REIT Mack-Cali Realty Corp. and Industrial REIT Liberty Property Trust. Shares of Mack-Cali, which owns suburban office properties throughout the Northeast and Mid-Atlantic regions, underperformed during the year due in large part to investor concern over the challenging

| | LMP Real Estate Income Fund Inc. 2010 Annual Report | | 3 |

leasing environment in the company’s markets and to the company’s mid-year announcement of lower-than-expected funds from operations (“FFO”) guidance for 2010. There were no material company-specific developments that negatively impacted Liberty’s performance. The company is considered more defensive from having a balance sheet in good shape and a stable business model. These characteristics have been less favored by investors in recent quarters. We continue to believe both companies represent solid relative values within their sectors and maintain both positions. On a sector basis, the Fund’s underweight to the outperforming Apartments sector and overweight to the underperforming Industrial sector also detracted from performance.

Q. Were there any significant changes to the Fund during the reporting period?

A. There were no significant changes made to the Fund’s portfolio during the twelve months ended December 31, 2010. We made marginal changes to the Fund’s holdings based on our ongoing assessment of the relative value of each company in the Fund’s investment universe consistent with the Fund’s investment objective of high current income. At the end of December 2010, the Fund’s REIT common stock exposure was approximately 62% of its total investments, with 37% in preferred shares. This compares to approximately 59% and 41%, respectively, as of year end 2009.

Looking for additional information?

The Fund is traded under the symbol “RIT” and its closing market price is available in most newspapers under the NYSE listings. The daily NAV is available on-line under the symbol “XRITX” on most financial websites. Barron’s and the Wall Street Journal’s Monday edition both carry closed-end fund tables that provide additional information. In addition, the Fund issues a quarterly press release that can be found on most major financial websites as well as www.leggmason.com/cef.

In a continuing effort to provide information concerning the Fund, shareholders may call 1-888-777-0102 (toll free), Monday through Friday from 8:00 a.m. to 5:30 p.m. Eastern Time, for the Fund’s current NAV, market price and other information.

Thank you for your investment in LMP Real Estate Income Fund Inc. As always, we appreciate that you have chosen us to manage your assets and we remain focused on achieving the Fund’s investment goals.

Sincerely,

Portfolio Management

AEW Capital Management, L.P.

January 18, 2011

RISKS: Funds that invest in securities related to the real estate industry are subject to the risks of real estate markets, including fluctuating property values, changes in interest rates and other mortgage-related risks. In addition, investment in funds that concentrate their investments in one sector or industry may involve greater risk than more broadly diversified funds. Leverage may result in greater volatility of NAV and the market price of common shares and increases a shareholder’s risk of loss. The Fund may make significant investments in derivative instruments. Derivative instruments can be illiquid, may disproportionately increase losses, and have a potentially large impact on Fund performance.

4 | | LMP Real Estate Income Fund Inc. 2010 Annual Report | | |

Fund overview (cont’d)

Portfolio holdings and breakdowns are as of December 31, 2010 and are subject to change and may not be representative of the portfolio managers’ current or future investments. The Fund’s top ten holdings (as a percentage of total investments) as of this date were: First Potomac Realty Trust (4.0%), Macerich Co. (3.9%), Urstadt Biddle Properties Inc., Cumulative, Series C, 8.500% (3.9%), Camden Property Trust (3.7%), HCP Inc. (3.7%), Entertainment Properties Trust (3.5%), National Retail Properties Inc. (3.4%), OMEGA Healthcare Investors Inc. (3.3%), Kimco Realty Corp., Series G, 7.750% (3.2%) and Getty Realty Corp. (3.2%). Please refer to pages 6 through 9 for a list and percentage breakdown of the Fund’s holdings.

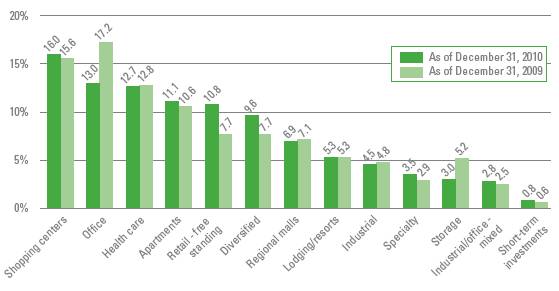

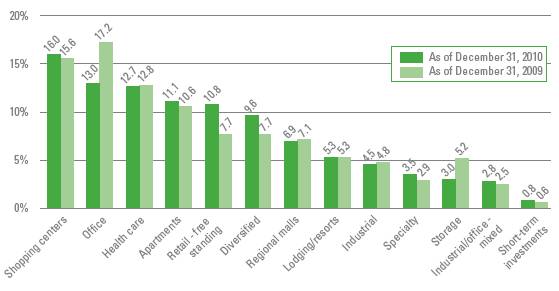

The mention of sector breakdowns is for informational purposes only and should not be construed as a recommendation to purchase or sell any securities. The information provided regarding such sectors is not a sufficient basis upon which to make an investment decision. Investors seeking financial advice regarding the appropriateness of investing in any securities or investment strategies discussed should consult their financial professional. The Fund’s top five sector holdings (as a percentage of total investments) as of December 31, 2010 were: Shopping Centers (16.0%), Office (13.0%), Health Care (12.7%), Apartments (11.1%) and Retail — Free Standing (10.8%). The Fund’s portfolio composition is subject to change at any time.

All investments are subject to risk including the possible loss of principal. Past performance is no guarantee of future results. All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. Views expressed may differ from those of the firm as a whole.

i Real estate investment trusts (“REITs”) invest in real estate or loans secured by real estate and issue shares in such investments, which can be illiquid.

ii The Federal Reserve Board (“Fed”) is responsible for the formulation of policies designed to promote economic growth, full employment, stable prices and a sustainable pattern of international trade and payments.

iii The S&P 500 Index is an unmanaged index of 500 stocks and is generally representative of the performance of larger companies in the U.S.

iv The Dow Jones Industrial Average (“DJIA”) is a widely followed measurement of the stock market. The average is comprised of thirty stocks that represent leading companies in major industries. These stocks, widely held by both individual and institutional investors, are considered to be all blue-chip companies.

v The MSCI U.S. REIT Index is a free float-adjusted market capitalization weighted index that is comprised of equity REITs that are included in the MSCI U.S. Investable Market 2500 Index, with the exception of specialty equity REITs that do not generate a majority of their revenue and income from real estate rental and leasing operations. The Index represents approximately 85% of the U.S. REIT universe.

vi Net asset value (“NAV”) is calculated by subtracting total liabilities and outstanding preferred stock (if any) from the closing value of all securities held by the Fund (plus all other assets) and dividing the result (total net assets) by the total number of the common shares outstanding. The NAV fluctuates with changes in the market prices of securities in which the Fund has invested. However, the price at which an investor may buy or sell shares of the Fund is the Fund’s market price as determined by supply of and demand for the Fund’s shares.

vii Lipper, Inc., a wholly-owned subsidiary of Reuters, provides independent insight on global collective investments. Returns are based on the twelve-month period ended December 31, 2010, including the reinvestment of all distributions, including returns of capital, if any, calculated among the 14 funds in the Fund’s Lipper category.

| | LMP Real Estate Income Fund Inc. 2010 Annual Report | | 5 |

Fund at a glance† (unaudited)

Investment breakdown (%) as a percent of total investments

† The bar graph above represents the composition of the Fund’s investments as of December 31, 2010 and December 31, 2009 and does not include derivatives, such as interest rate swaps. The Fund is actively managed. As a result, the composition of the Fund’s investments is subject to change at any time.

6 | | LMP Real Estate Income Fund Inc. 2010 Annual Report | | |

Schedule of investments

December 31, 2010

LMP Real Estate Income Fund Inc.

Security | | Shares | | Value | |

Common Stocks — 62.2% | | | | | |

Apartments — 8.2% | | | | | |

American Campus Communities Inc. | | 165,000 | | $ 5,240,400 | (a) |

Camden Property Trust | | 117,300 | | 6,331,854 | (a) |

Equity Residential | | 45,000 | | 2,337,750 | (a) |

Total Apartments | | | | 13,910,004 | |

Diversified — 2.1% | | | | | |

Dundee Real Estate Investment Trust | | 120,000 | | 3,644,775 | |

Health Care — 10.4% | | | | | |

HCP Inc. | | 170,000 | | 6,254,300 | (a) |

Nationwide Health Properties Inc. | | 105,000 | | 3,819,900 | (a) |

OMEGA Healthcare Investors Inc. | | 250,000 | | 5,610,000 | (a) |

Senior Housing Properties Trust | | 90,000 | | 1,974,600 | (a) |

Total Health Care | | | | 17,658,800 | |

Industrial — 4.5% | | | | | |

DCT Industrial Trust Inc. | | 135,300 | | 718,443 | (a) |

First Potomac Realty Trust | | 410,000 | | 6,896,200 | (a) |

Total Industrial | | | | 7,614,643 | |

Industrial/Office - Mixed — 2.8% | | | | | |

Liberty Property Trust | | 150,000 | | 4,788,000 | (a) |

Lodging/Resorts — 0.9% | | | | | |

Hospitality Properties Trust | | 70,000 | | 1,612,800 | (a) |

Office — 9.8% | | | | | |

BioMed Realty Trust Inc. | | 130,000 | | 2,424,500 | (a) |

CommonWealth REIT | | 100,000 | | 2,551,000 | (a) |

Highwoods Properties Inc. | | 60,400 | | 1,923,740 | (a) |

Kilroy Realty Corp. | | 150,000 | | 5,470,500 | (a) |

Mack-Cali Realty Corp. | | 130,000 | | 4,297,800 | (a) |

Total Office | | | | 16,667,540 | |

Regional Malls — 4.7% | | | | | |

CBL & Associates Properties Inc. | | 60,000 | | 1,417,200 | |

Macerich Co. | | 140,000 | | 6,631,800 | (a) |

Total Regional Malls | | | | 8,049,000 | |

Retail - Free Standing — 8.5% | | | | | |

Getty Realty Corp. | | 175,000 | | 5,474,000 | (a) |

National Retail Properties Inc. | | 220,000 | | 5,830,000 | (a) |

Realty Income Corp. | | 95,000 | | 3,249,000 | (a) |

Total Retail - Free Standing | | | | 14,553,000 | |

See Notes to Financial Statements.

| | LMP Real Estate Income Fund Inc. 2010 Annual Report | | 7 |

LMP Real Estate Income Fund Inc.

Security | | | | | | Shares | | Value | |

Shopping Centers — 6.8% | | | | | | | | | |

Kite Realty Group Trust | | | | | | 364,800 | | $ 1,973,568 | (a) |

Primaris Retail Real Estate Investment Trust | | | | | | 239,500 | | 4,706,658 | |

Ramco-Gershenson Properties Trust | | | | | | 125,700 | | 1,564,965 | (a) |

Regency Centers Corp. | | | | | | 80,000 | | 3,379,200 | (a) |

Total Shopping Centers | | | | | | | | 11,624,391 | |

Specialty — 3.5% | | | | | | | | | |

Entertainment Properties Trust | | | | | | 130,800 | | 6,049,500 | (a) |

Total Common Stocks (Cost — $80,276,628) | | | | | | | | 106,172,453 | |

| | | | | | | | | |

| | Rate | | | | | | | |

Preferred Stocks — 37.0% | | | | | | | | | |

Apartments — 2.9% | | | | | | | | | |

Apartment Investment & Management Co., Cumulative, Series Y | | 7.875 | % | | | 70,000 | | 1,768,200 | |

Apartment Investment & Management Co., Cumulative, Series U | | 7.750 | % | | | 64,900 | | 1,628,990 | |

BRE Properties Inc., Series C | | 6.750 | % | | | 60,000 | | 1,464,600 | (a) |

Total Apartments | | | | | | | | 4,861,790 | |

Diversified — 7.5% | | | | | | | | | |

Duke Realty Corp., Series M | | 6.950 | % | | | 169,800 | | 4,054,824 | (a) |

LBA Realty Fund LP, Cumulative Redeemable | | 8.750 | % | | | 90,000 | | 3,487,500 | (b) |

PS Business Parks Inc., Series M | | 7.200 | % | | | 75,000 | | 1,859,250 | (a) |

PS Business Parks Inc., Cumulative Redeemable, Series O | | 7.375 | % | | | 45,000 | | 1,134,900 | (a) |

Vornado Realty Trust, Cumulative Redeemable, Series G | | 6.625 | % | | | 100,000 | | 2,320,000 | (a) |

Total Diversified | | | | | | | | 12,856,474 | |

Health Care — 2.3% | | | | | | | | | |

HCP Inc., Series F | | 7.100 | % | | | 100,000 | | 2,460,000 | |

OMEGA Healthcare Investors Inc., Cumulative Redeemable, Series D | | 8.375 | % | | | 55,000 | | 1,432,200 | |

Total Health Care | | | | | | | | 3,892,200 | |

Lodging/Resorts — 4.4% | | | | | | | | | |

Hospitality Properties Trust, Cumulative Redeemable, Series B | | 8.875 | % | | | 64,800 | | 1,676,376 | (a) |

LaSalle Hotel Properties, Cumulative Redeemable, Series G | | 7.250 | % | | | 52,900 | | 1,259,681 | |

Strategic Hotels Capital Inc., Series B | | 8.250 | % | | | 94,300 | | 2,218,078 | * |

Sunstone Hotel Investors Inc., Cumulative Redeemable, Series A | | 8.000 | % | | | 100,100 | | 2,424,302 | |

Total Lodging/Resorts | | | | | | | | 7,578,437 | |

See Notes to Financial Statements.

8 | | LMP Real Estate Income Fund Inc. 2010 Annual Report | | |

Schedule of investments (cont’d)

December 31, 2010

LMP Real Estate Income Fund Inc.

Security | | Rate | | | | Shares | | Value | |

Office — 3.2% | | | | | | | | | |

BioMed Realty Trust Inc., Series A | | 7.375 | % | | | 130,000 | | $ 3,251,300 | |

Brandywine Realty Trust, Series D | | 7.375 | % | | | 46,400 | | 1,153,968 | |

Corporate Office Properties Trust, Cumulative Redeemable, Series J | | 7.625 | % | | | 40,000 | | 1,016,400 | (a) |

Total Office | | | | | | | | 5,421,668 | |

Regional Malls — 2.2% | | | | | | | | | |

Glimcher Realty Trust, Cumulative Redeemable, Series F | | 8.750 | % | | | 85,000 | | 2,142,000 | |

Taubman Centers Inc., Cumulative Redeemable, Series H | | 7.625 | % | | | 66,000 | | 1,683,000 | |

Total Regional Malls | | | | | | | | 3,825,000 | |

Retail - Free Standing — 2.3% | | | | | | | | | |

National Retail Properties Inc., Cumulative Redeemable, Series C | | 7.375 | % | | | 85,000 | | 2,123,512 | (a) |

Realty Income Corp., Cumulative Redeemable, Series E | | 6.750 | % | | | 70,000 | | 1,716,400 | (a) |

Total Retail - Free Standing | | | | | | | | 3,839,912 | |

Shopping Centers — 9.2% | | | | | | | | | |

Cedar Shopping Centers Inc., Cumulative Redeemable, Series A | | 8.875 | % | | | 50,000 | | 1,256,500 | |

Developers Diversified Realty Corp., Cumulative Redeemable, Class G | | 8.000 | % | | | 13,300 | | 331,303 | |

Kimco Realty Corp., Series G | | 7.750 | % | | | 209,100 | | 5,520,240 | |

Kite Realty Group Trust | | 8.250 | % | | | 80,000 | | 2,002,000 | * |

Urstadt Biddle Properties Inc., Cumulative, Series C | | 8.500 | % | | | 63,800 | | 6,619,569 | |

Total Shopping Centers | | | | | | | | 15,729,612 | |

Storage — 3.0% | | | | | | | | | |

Public Storage Inc., Cumulative Redeemable, Series L | | 6.750 | % | | | 200,000 | | 5,054,000 | |

Total Preferred Stocks (Cost — $63,171,971) | | | | | | | | 63,059,093 | |

Total Investments before Short-Term Investments (Cost — $143,448,599) | | | | | | | | 169,231,546 | |

See Notes to Financial Statements.

| | LMP Real Estate Income Fund Inc. 2010 Annual Report | | 9 |

LMP Real Estate Income Fund Inc.

Security | | Rate | | Maturity

Date | | | Face

Amount | | Value | |

Short-Term Investments — 0.8% | | | | | | | | | |

Repurchase Agreements — 0.8% | | | | | | | | | |

Interest in $150,000,000 joint tri-party repurchase agreement dated 12/31/10 with Deutsche Bank Securities Inc.; Proceeds at maturity — $1,321,024; (Fully collateralized by various U.S. government agency obligations, 4.125% to 4.750% due 2/24/11 to 11/19/12; Market value — $1,347,429) (Cost — $1,321,000) | | 0.220 | % | 1/3/11 | | $1,321,000 | | $ 1,321,000 | |

Total Investments — 100.0% (Cost — $144,769,599#) | | | | | | | | $170,552,546 | |

* Non-income producing security.

(a) All or a portion of these securities are held as collateral pursuant to a loan agreement.

(b) Security is exempt from registration under Rule 144A of the Securities Act of 1933. This security may be resold in transactions that are exempt from registration, normally to qualified institutional buyers. This security has been deemed liquid pursuant to guidelines approved by the Board of Directors, unless otherwise noted.

# Aggregate cost for federal income tax purposes is $145,148,885.

Abbreviation used in this schedule:

REIT — Real Estate Investment Trust

See Notes to Financial Statements.

10 | | LMP Real Estate Income Fund Inc. 2010 Annual Report | | |

Statement of assets and liabilities

December 31, 2010

Assets: | | | |

Investments, at value (Cost — $144,769,599) | | $170,552,546 | |

Cash | | 105 | |

Cash deposits with brokers for swap contracts | | 983,345 | |

Dividends and interest receivable | | 946,454 | |

Swaps, at value | | 16,446 | |

Prepaid expenses | | 1,733 | |

Total Assets | | 172,500,629 | |

| | | |

Liabilities: | | | |

Loan payable (Note 5) | | 45,000,000 | |

Swaps, at value | | 619,270 | |

Investment management fee payable | | 127,745 | |

Payable for securities purchased | | 70,356 | |

Payable for open swap contracts | | 28,795 | |

Directors’ fees payable | | 6,209 | |

Interest payable (Note 5) | | 2,382 | |

Accrued expenses | | 129,571 | |

Total Liabilities | | 45,984,328 | |

Total Net Assets | | $126,516,301 | |

| | | |

Net Assets: | | | |

Par value ($0.001 par value; 11,431,201 shares issued and outstanding; 100,000,000 shares authorized) | | $ 11,431 | |

Paid-in capital in excess of par value | | 135,061,512 | |

Undistributed net investment income | | 632,905 | |

Accumulated net realized loss on investments, swap contracts and foreign currency transactions | | (34,369,375) | |

Net unrealized appreciation on investments, swap contracts and foreign currencies | | 25,179,828 | |

Total Net Assets | | $126,516,301 | |

| | | |

Shares Outstanding | | 11,431,201 | |

| | | |

Net Asset Value | | $11.07 | |

See Notes to Financial Statements.

| | LMP Real Estate Income Fund Inc. 2010 Annual Report | | 11 |

Statement of operations

For the Year Ended December 31, 2010

Investment Income: | | | |

Dividends | | $ 6,501,746 | |

Interest | | 1,415 | |

Less: Foreign taxes withheld | | (61,049) | |

Total Investment Income | | 6,442,112 | |

Expenses: | | | |

Investment management fee (Note 2) | | 1,375,581 | |

Interest expense (Note 5) | | 590,147 | |

Transfer agent fees | | 113,172 | |

Commitment fees (Note 5) | | 64,975 | |

Legal fees | | 63,435 | |

Audit and tax | | 56,000 | |

Shareholder reports | | 37,985 | |

Directors’ fees | | 26,396 | |

Stock exchange listing fees | | 21,753 | |

Custody fees | | 10,866 | |

Insurance | | 3,455 | |

Miscellaneous expenses | | 6,916 | |

Total Expenses | | 2,370,681 | |

Net Investment Income | | 4,071,431 | |

Realized and Unrealized Gain (Loss) on Investments, Swap Contracts and Foreign Currency Transactions (Notes 1, 3 and 4): | | | |

Net Realized Gain (Loss) From: | | | |

Investment transactions | | (736,379) | |

REIT distributions | | 695,230 | |

Swap contracts | | (641,954) | |

Foreign currency transactions | | (2,928) | |

Net Realized Loss | | (686,031) | |

Change in Net Unrealized Appreciation (Depreciation) From: | | | |

Investments | | 28,990,674 | |

Swap contracts | | (314,182) | |

Foreign currencies | | (226) | |

Change in Net Unrealized Appreciation (Depreciation) | | 28,676,266 | |

Net Gain on Investments, Swap Contracts and Foreign Currency Transactions | | 27,990,235 | |

Increase in Net Assets from Operations | | $32,061,666 | |

See Notes to Financial Statements.

12 | | LMP Real Estate Income Fund Inc. 2010 Annual Report | | |

Statements of changes in net assets

For the Years Ended December 31, | | 2010 | | 2009 | |

| | | | | |

Operations: | | | | | |

Net investment income | | $ 4,071,431 | | $ 5,131,764 | |

Net realized loss | | (686,031) | | (23,289,796) | |

Change in net unrealized appreciation (depreciation) | | 28,676,266 | | 57,568,950 | |

Increase in Net Assets From Operations | | 32,061,666 | | 39,410,918 | |

| | | | | |

Distributions to Shareholders From (Note 1): | | | | | |

Net investment income | | (3,312,084) | | (5,005,137) | |

Return of capital | | (4,918,381) | | (5,686,906) | |

Decrease in Net Assets From Distributions to Shareholders | | (8,230,465) | | (10,692,043) | |

| | | | | |

Fund Share Transactions: | | | | | |

Proceeds from shares issued on reinvestment of distributions (0 and 85,193 shares issued, respectively) | | — | | 628,877 | |

Increase in Net Assets From Fund Share Transactions | | — | | 628,877 | |

Increase in Net Assets | | 23,831,201 | | 29,347,752 | |

| | | | | |

Net Assets: | | | | | |

Beginning of year | | 102,685,100 | | 73,337,348 | |

End of year* | | $126,516,301 | | $102,685,100 | |

* Includes undistributed net investment income of: | | $632,905 | | $518,440 | |

See Notes to Financial Statements.

| | LMP Real Estate Income Fund Inc. 2010 Annual Report | | 13 |

Statement of cash flows

For the Year Ended December 31, 2010

Cash Flows Provided (Used) by Operating Activities: | | | |

Dividends and interest received | | $ 9,721,826 | |

Operating expenses paid | | (1,759,302) | |

Interest paid | | (691,939) | |

Net purchases of short-term investments | | (511,000) | |

Realized loss on swap contracts | | (641,954) | |

Realized loss on foreign currency transactions | | (2,928) | |

Net change in unrealized depreciation on foreign currencies | | (226) | |

Purchases of long-term investments | | (26,976,104) | |

Proceeds from disposition of long-term investments | | 18,246,763 | |

Change in interest payable on swap contracts | | 5,262 | |

Cash deposits with brokers for swap contracts | | (160,000) | |

Net Cash Used By Operating Activities | | (2,769,602) | |

| | | |

Cash Flows Provided (Used) by Financing Activities: | | | |

Cash distributions paid on Common Stock | | (8,230,465) | |

Proceeds from loan | | 11,000,000 | |

Net Cash Provided By Financing Activities | | 2,769,535 | |

Net Decrease in Cash | | (67) | |

Cash, Beginning of year | | 172 | |

Cash, End of year | | $ 105 | |

| | | |

Reconciliation of Increase in Net Assets From Operations to Net Cash Flows Provided (Used) by Operating Activities: | | | |

Increase in Net Assets From Operations | | $ 32,061,666 | |

Increase in investments, at value | | (34,940,072) | |

Decrease in swaps, at value | | 314,182 | |

Increase in payable for securities purchased | | 70,356 | |

Increase in dividends and interest receivable | | (40,436) | |

Increase in swap contracts interest payable | | 5,262 | |

Decrease in deposits with brokers for swap contracts | | (160,000) | |

Increase in prepaid expenses | | (3) | |

Decrease in interest payable | | (101,792) | |

Increase in accrued expenses | | 21,235 | |

Total Adjustments | | (34,831,268) | |

Net Cash Flows Used by Operating Activities | | $ (2,769,602) | |

See Notes to Financial Statements.

14 | | LMP Real Estate Income Fund Inc. 2010 Annual Report | | |

Financial highlights

For a share of capital stock outstanding throughout each year ended December 31, unless otherwise noted:

| | 2010 | | 2009 | | 2008 | | 2007 | | 2006 | |

| | | | | | | | | | | |

Net asset value, beginning of year1 | | $8.98 | | $6.46 | | $16.04 | | $24.53 | | $20.58 | |

Income (loss) from operations: | | | | | | | | | | | |

Net investment income | | 0.36 | | 0.45 | | 0.90 | | 1.13 | | 0.99 | |

Net realized and unrealized gain (loss) | | 2.45 | | 3.01 | | (8.10) | | (7.04) | | 5.92 | |

Distributions paid to taxable auction rate preferred stockholders | | — | | — | | (0.21) | | (0.46) | | (0.42) | |

Total income (loss) from operations | | 2.81 | | 3.46 | | (7.41) | | (6.37) | | 6.49 | |

Less distributions paid to common stock shareholders from: | | | | | | | | | | | |

Net investment income | | (0.29) | | (0.44) | | (0.71) | | (0.97) | | (0.92) | |

Net realized gains | | — | | — | | (0.48) | | (1.15) | | (1.62) | |

Return of capital | | (0.43) | | (0.50) | | (0.98) | | — | | — | |

Total distributions | | (0.72) | | (0.94) | | (2.17) | | (2.12) | | (2.54) | |

| | | | | | | | | | | |

Net asset value, end of year | | $11.07 | | $8.98 | | $6.46 | | $16.04 | | $24.53 | |

| | | | | | | | | | | |

Market price, end of year | | $10.10 | | $8.05 | | $4.79 | | $14.52 | | $21.64 | |

Total return, based on NAV2,3 | | 33.49 | % | 63.57 | % | (49.80) | % | (27.44) | % | 34.39 | % |

Total return, based on Market Price3 | | 35.86 | % | 97.75 | % | (58.88) | % | (25.54) | % | 31.04 | % |

| | | | | | | | | | | |

Net assets, end of year (millions) | | $127 | | $103 | | $73 | | $180 | | $272 | |

| | | | | | | | | | | |

Ratios to average net assets4: | | | | | | | | | | | |

Gross expenses | | 2.08 | % | 2.48 | % | 2.27 | % | 1.55 | % | 1.57 | %5 |

Gross expenses, excluding interest expense | | 1.56 | 6 | 1.99 | 6 | 1.89 | 6 | 1.55 | | 1.57 | 5 |

Net expenses7 | | 2.08 | | 2.42 | 8,9 | 2.01 | 8,9 | 1.17 | 8,9 | 1.09 | 5,8,9 |

Net expenses, excluding interest expense | | 1.56 | 6 | 1.92 | 6,8,9 | 1.63 | 6,8,9 | 1.17 | 8,9 | 1.09 | 5,8,9 |

Net investment income | | 3.57 | | 6.76 | | 6.83 | | 5.18 | | 4.31 | |

| | | | | | | | | | | |

Portfolio turnover rate | | 12 | % | 19 | % | 14 | % | 13 | % | 18 | % |

| | | | | | | | | | | |

Taxable Auction Rate Preferred Stock10: | | | | | | | | | | | |

Total Amount Outstanding (000s) | | — | | — | | — | | $95,000 | | $95,000 | |

Asset Coverage | | — | | — | | — | | 72,306 | | 96,459 | |

Involuntary Liquidating Preference Per Share11 | | — | | — | | — | | 25,000 | | 25,000 | |

| | | | | | | | | | | |

Supplemental data: | | | | | | | | | | | |

Loans Outstanding, End of Year (000s) | | $45,000 | | $34,000 | | $27,600 | | — | | — | |

Asset Coverage for Loan Outstanding | | 381 | % | 402 | % | 366 | % | — | | — | |

Weighted Average Loan (000s) | | $38,690 | | $27,499 | | $46,502 | 12 | — | | — | |

Weighted Average Interest Rate on Loans | | 1.53 | % | 1.38 | % | 3.43 | % | — | | — | |

1 | | Per share amounts have been calculated using the average shares method. |

2 | | Performance figures may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. |

3 | | The total return calculation assumes that distributions are reinvested in accordance with the Fund’s dividend reinvestment plan. Past performance is no guarantee of future results. |

4 | | Calculated on the basis of average net assets of common stock shareholders. Ratios do not reflect the effect of dividend payments to preferred stockholders. |

5 | | Included in the expense ratios are certain non-recurring restructuring (and reorganization, if applicable) fees that were incurred by the Fund during the period. Without these fees, the gross and net expense ratios would have been 1.49% and 1.05%, respectively. |

6 | | Ratio includes commitment fees incurred on the line of credit. |

7 | | The impact of compensating balance arrangements, if any, was less than 0.01%. |

8 | | Reflects fee waivers and/or expense reimbursements. |

9 | | LMPFA has contractually agreed to waive a portion of its management fee in the amount of 0.32% of the Fund’s average daily managed assets from inception through July 31, 2007, 0.20% of the Fund’s average daily Managed Assets for the 12-month period ended July 31, 2008, and 0.10% of the Fund’s average daily Managed Assets for the 12-month period ended July 31, 2009. The waiver was eliminated August 1, 2009. |

10 | | On September 30, 2002 and July 18, 2005, the Fund issued 2,600 and 1,200 shares, respectively, of Taxable Auction Rate Cumulative Preferred Stock at $25,000 per share. On August 26, 2008, the Fund fully redeemed the 3,800 shares of Taxable Auction Rate Cumulative Preferred Stock. |

11 | | Excludes accrued interest or accumulated undeclared distributions. |

12 | | For the period August 26 through December 31, 2008. |

See Notes to Financial Statements.

| | LMP Real Estate Income Fund Inc. 2010 Annual Report | | 15 |

Notes to financial statements

1. Organization and significant accounting policies

LMP Real Estate Income Fund Inc. (the “Fund”) was incorporated in Maryland and is registered as a non-diversified, closed-end management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund’s primary investment objective is high current income and the Fund’s secondary objective is capital appreciation.

The following are significant accounting policies consistently followed by the Fund and are in conformity with U.S. generally accepted accounting principles (“GAAP”). Estimates and assumptions are required to be made regarding assets, liabilities and changes in net assets resulting from operations when financial statements are prepared. Changes in the economic environment, financial markets and any other parameters used in determining these estimates could cause actual results to differ. Subsequent events have been evaluated through the date the financial statements were issued.

(a) Investment valuation. Equity securities for which market quotations are available are valued at the last reported sales price or official closing price on the primary market or exchange on which they trade. Debt securities are valued at the mean between the last quoted bid and asked prices provided by an independent pricing service, which are based on transactions in debt obligations, quotations from bond dealers, market transactions in comparable securities and various other relationships between securities. When reliable prices are not readily available, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded, but before the Fund calculates its net asset value, the Fund values these securities as determined in accordance w ith procedures approved by the Fund’s Board of Directors. Short-term obligations with maturities of 60 days or less are valued at amortized cost, which approximates fair value.

The Fund has adopted Financial Accounting Standards Board Codification Topic 820 (“ASC Topic 820”). ASC Topic 820 establishes a single definition of fair value, creates a three-tier hierarchy as a framework for measuring fair value based on inputs used to value the Fund’s investments, and requires additional disclosure about fair value. The hierarchy of inputs is summarized below.

· | | Level 1 — quoted prices in active markets for identical investments |

| | |

· | | Level 2 — other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.) |

| | |

· | | Level 3 — significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

16 | | LMP Real Estate Income Fund Inc. 2010 Annual Report | | |

Notes to financial statements (cont’d)

The Fund uses valuation techniques to measure fair value that are consistent with the market approach and/or income approach, depending on the type of security and the particular circumstance. The market approach uses prices and other relevant information generated by market transactions involving identical or comparable securities. The income approach uses valuation techniques to discount estimated future cash flows to present value.

The following is a summary of the inputs used in valuing the Fund’s assets and liabilities carried at fair value:

ASSETS

Description | | Quoted Prices

(Level 1) | | Other Significant

Observable Inputs

(Level 2) | | Significant

Unobservable

Inputs

(Level 3) | | Total | |

Long-term investments†: | | | | | | | | | |

Common stocks | | $106,172,453 | | — | | — | | $106,172,453 | |

Preferred stocks: | | | | | | | | | |

Diversified | | 9,368,974 | | $3,487,500 | | — | | 12,856,474 | |

Lodging/resorts | | 1,676,376 | | 5,902,061 | | — | | 7,578,437 | |

Regional malls | | 2,142,000 | | 1,683,000 | | — | | 3,825,000 | |

Retail-free standing | | 1,716,400 | | 2,123,512 | | — | | 3,839,912 | |

Other preferred stocks | | 34,959,270 | | — | | — | | 34,959,270 | |

Total long-term investments | | $156,035,473 | | $13,196,073 | | — | | $169,231,546 | |

Short-term investments† | | — | | 1,321,000 | | — | | 1,321,000 | |

Total investments | | $156,035,473 | | $14,517,073 | | — | | $170,552,546 | |

Other financial instruments: | | | | | | | | | |

Interest rate swaps | | — | | 16,446 | | — | | 16,446 | |

Total | | $156,035,473 | | $14,533,519 | | — | | $170,568,992 | |

LIABILITIES

Description | | Quoted Prices

(Level 1) | | Other Significant

Observable Inputs

(Level 2) | | Significant

Unobservable

Inputs

(Level 3) | | Total | |

Other financial instruments: | | | | | | | | | |

Interest rate swaps | | — | | $619,270 | | — | | $619,270 | |

† See Schedule of Investments for additional detailed categorizations.

(b) Repurchase agreements. The Fund may enter into repurchase agreements with institutions that its investment adviser has determined are creditworthy. Each repurchase agreement is recorded at cost. Under the terms of a typical repurchase agreement, the Fund acquires a debt security subject to an obligation of the seller to repurchase, and of the Fund to resell, the security at an agreed-upon price and time, thereby determining the yield during the Fund’s holding period. When entering into repurchase agreements, it is the Fund’s policy that its custodian or a third party custodian, acting on the Fund’s behalf, take possession of the underlying collateral securities, the market value of which, at all times, at least equals the principal amount of the repurchase transaction, including accrued interest. To the extent that a ny

| | LMP Real Estate Income Fund Inc. 2010 Annual Report | | 17 |

repurchase transaction maturity exceeds one business day, the value of the collateral is marked-to-market and measured against the value of the agreement in an effort to ensure the adequacy of the collateral. If the counterparty defaults, the Fund generally has the right to use the collateral to satisfy the terms of the repurchase transaction. However, if the market value of the collateral declines during the period in which the Fund seeks to assert its rights or if bankruptcy proceedings are commenced with respect to the seller of the security, realization of the collateral by the Fund may be delayed or limited.

(c) Swap agreements. The Fund invests in swaps for the purpose of managing its exposure to interest rate, credit or market risk, or for other purposes. The use of swaps involves risks that are different from those associated with ordinary portfolio transactions.

Swap contracts are marked-to-market daily and changes in value are recorded as unrealized appreciation (depreciation). Gains or losses are realized upon termination of the swap agreement. Collateral, in the form of restricted cash or securities, may be required to be held in segregated accounts with the Fund’s custodian in compliance with the terms of the swap contracts. Securities posted as collateral for swap contracts are identified in the Schedule of Investments and restricted cash, if any, is identified on the Statement of Assets and Liabilities. Risks may exceed amounts recorded in the Statement of Assets and Liabilities. These risks include changes in the returns of the underlying instruments, failure of the counterparties to perform under the contracts’ terms, and the possible lack of liquidity with respect to the swap agreements.

Payments received or made at the beginning of the measurement period are reflected as a premium or deposit, respectively, on the Statement of Assets and Liabilities. These upfront payments are amortized over the life of the swap and are recognized as realized gain or loss in the Statement of Operations. Net periodic payments received or paid by the Fund as well as liquidation payments received or made at the termination of the swap are recognized as realized gains or losses in the Statement of Operations.

Interest rate swaps

The Fund may enter into interest rate swap contracts. Interest rate swaps are agreements between two parties to exchange cash flows based on a notional principal amount. The Fund may elect to pay a fixed rate and receive a floating rate, or, receive a fixed rate and pay a floating rate on a notional principal amount. Interest rate swaps are marked-to-market daily based upon quotations from market makers and the change, if any, is recorded as an unrealized gain or loss in the Statement of Operations. When a swap contract is terminated early, the Fund records a realized gain or loss equal to the difference between the original cost and the settlement amount of the closing transaction.

18 | | LMP Real Estate Income Fund Inc. 2010 Annual Report | | |

Notes to financial statements (cont’d)

The risks of interest rate swaps include changes in market conditions that will affect the value of the contract or changes in the present value of the future cash flow streams and the possible inability of the counterparty to fulfill its obligations under the agreement. The Fund’s maximum risk of loss from counterparty credit risk is the discounted net value of the cash flows to be received from the counterparty over the contract’s remaining life, to the extent that that amount is positive. This risk is mitigated by the posting of collateral by the counterparty to the Fund to cover the Fund’s exposure to the counterparty.

(d) Foreign currency translation. Investment securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollar amounts based upon prevailing exchange rates on the date of valuation. Purchases and sales of investment securities and income and expense items denominated in foreign currencies are translated into U.S. dollar amounts based upon prevailing exchange rates on the respective dates of such transactions.

The Fund does not isolate that portion of the results of operations resulting from fluctuations in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss on investments.

Net realized foreign exchange gains or losses arise from sales of foreign currencies, including gains and losses on forward foreign currency contracts, currency gains or losses realized between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the values of assets and liabilities, other than investments in securities, on the date of valuation, resulting from changes in exchange rates.

Foreign security and currency transactions may involve certain considerations and risks not typically associated with those of U.S. dollar denominated transactions as a result of, among other factors, the possibility of lower levels of governmental supervision and regulation of foreign securities markets and the possibility of political or economic instability.

(e) Concentration risk. The Fund invests in securities related to the real estate industry and is subject to the risks of real estate markets, including fluctuating property values, changes in interest rates and other mortgage-related risks.

(f) Security transactions and investment income. Security transactions are accounted for on a trade date basis. Interest income, adjusted for amortization of premium and accretion of discount, is recorded on the accrual basis. Dividend income is recorded on the ex-dividend date. Foreign dividend income is recorded on the ex-dividend date or as soon as practicable after

| | LMP Real Estate Income Fund Inc. 2010 Annual Report | | 19 |

the Fund determines the existence of a dividend declaration after exercising reasonable due diligence. The cost of investments sold is determined by use of the specific identification method. To the extent any issuer defaults or a credit event occurs that impacts the issuer, the Fund may halt any additional interest income accruals and consider the realizability of interest accrued up to the date of default or credit event.

(g) Distributions to shareholders. Dividends and distributions to shareholders are recorded monthly by the Fund on the ex-dividend date for the shareholders of common stock. The Fund’s policy is to pass through to its shareholders substantially all Real Estate Investment Trust (“REIT”) distributions and other income it receives, less operating expenses. The character of REIT distributions received from portfolio securities held by the Fund is generally comprised of investment income, long-term capital gains, and return of capital. The Fund reclassifies amounts within the Statement of Operations primarily based on information provided by REITs after the Fund’s fiscal year end. In those instances where such information is not available, the Fund estimates the amounts based on amounts reported by the REITs in the prior year . After all remaining REITs report the actual character of distributions paid during the year, the Fund adjusts estimates previously recorded to actual. The character of distributions paid to shareholders disclosed within the Statements of Changes in Net Assets is based on these reclassifications.

Pursuant to its Managed Distribution Policy, the Fund intends to make regular monthly distributions to shareholders at a fixed rate per common share, which rate may be adjusted from time to time by the Fund’s Board of Directors. Under Fund’s Managed Distribution Policy, if, for any monthly distribution, net investment income and net realized capital gain is less than the amount of the distribution, the difference will be distributed from the Fund’s assets (and constitute a “return of capital”). The Board of Directors may terminate the Managed Distribution Policy at any time, including when certain events would make part of the return of capital taxable to shareholders. Any such termination could have an adverse effect on the market price for Fund’s shares.

(h) Cash flow information. The Fund invests in securities and distributes dividends from net investment income, net realized gains and return of capital, if any, which are paid in cash and may be reinvested at the discretion of shareholders. These activities are reported in the Statement of Changes in Net Assets and additional information on cash receipts and cash payments are presented in the Statement of Cash Flows.

(i) Compensating balance arrangements. The Fund has an arrangement with its custodian bank whereby a portion of the custodian’s fees is paid indirectly by credits earned on the Fund’s cash on deposit with the bank.

(j) Federal and other taxes. It is the Fund’s policy to comply with the federal income and excise tax requirements of the Internal Revenue Code of 1986 (the “Code”), as amended, applicable to regulated investment companies.

20 | | LMP Real Estate Income Fund Inc. 2010 Annual Report | | |

Notes to financial statements (cont’d)

Accordingly, the Fund intends to distribute its taxable income and net realized gains, if any, to shareholders in accordance with timing requirements imposed by the Code. Therefore, no federal or state income tax provision is required in the Fund’s financial statements.

Management has analyzed the Fund’s tax positions taken on income tax returns for all open tax years and has concluded that as of December 31, 2010, no provision for income tax is required in the Fund’s financial statements. The Fund’s federal and state income and federal excise tax returns for tax years for which the applicable statutes of limitations have not expired are subject to examination by Internal Revenue Service and state departments of revenue.

Under the applicable foreign tax laws, a withholding tax may be imposed on interest, dividends and capital gains at various rates.

(k) Reclassification. GAAP requires that certain components of net assets be reclassified to reflect permanent differences between financial and tax reporting. These reclassifications have no effect on net assets or net asset values per share. During the current year, the following reclassifications have been made:

| | Undistributed Net

Investment Income | | Accumulated Net

Realized Loss | |

(a) | | $(644,882) | | $644,882 | |

(a) | Reclassifications are primarily due to foreign currency transactions treated as ordinary income for tax purposes and book/tax differences in the treatment of swap contracts. |

(l) Counterparty risk and credit-risk-related contingent features of derivative instruments. The Fund may invest in certain securities or engage in other transactions, where the Fund is exposed to counterparty credit risk in addition to broader market risks. The Fund may invest in securities of issuers, which may also be considered counterparties as trading partners in other transactions. This may increase the risk of loss in the event of default or bankruptcy by the counterparty or if the counterparty otherwise fails to meet its contractual obligations. The Fund’s investment manager attempts to mitigate counterparty risk by (i) periodically assessing the creditworthiness of its trading partners, (ii) monitoring and/or limiting the amount of its net exposure to each individual counterparty based on its assessment and (iii) requiring co llateral from the counterparty for certain transactions. Market events and changes in overall economic conditions may impact the assessment of such counterparty risk by the investment manager. In addition, declines in the values of underlying collateral received may expose the Fund to increased risk of loss.

The Fund has entered into master agreements with certain of its derivative counterparties that provide for general obligations, representations, agreements, collateral, events of default or termination and credit related contingent features. The credit related contingent features include, but are not

| | LMP Real Estate Income Fund Inc. 2010 Annual Report | | 21 |

limited to, a percentage decrease in the Fund’s net assets or NAV over a specified period of time. If these credit related contingent features were triggered, the derivatives counterparty could terminate the positions and demand payment or require additional collateral.

As of December 31, 2010, the Fund held interest rate swaps with credit related contingent features which had a liability position of $619,270. If a contingent feature in the Master Agreements would have been triggered, the Fund would have been required to pay this amount to its derivatives counterparty. As of December 31, 2010, the Fund had posted with its counterparty cash as collateral to cover the net liability of all derivatives amounting to $983,345, which could be used to reduce the required payment.

2. Investment management agreement and other transactions with affiliates

Legg Mason Partners Fund Advisor, LLC (“LMPFA”) is the Fund’s investment manager and AEW Capital Management, L.P. (“AEW”) is the Fund’s subadviser. LMPFA is a wholly-owned subsidiary of Legg Mason, Inc. (“Legg Mason”).

LMPFA provides administrative and certain oversight services to the Fund. The Fund pays LMPFA an investment management fee, calculated daily and paid monthly, at an annual rate of 0.90% of the Fund’s average daily net assets plus assets attributable to any borrowings used for leverage (“Managed Assets”).

LMPFA delegates to AEW the day-to-day portfolio management of the Fund, except for the management of cash and short-term instruments. For its services, LMPFA pays AEW a fee at an annual rate equal to 50% of the management fee paid by the Fund to LMPFA, net of waivers.

During periods in which the Fund is utilizing leverage, the fees which are payable to LMPFA as a percentage of the Fund’s net assets will be higher then if the Fund did not utilize leverage because the fees are calculated as a percentage of the Fund’s managed assets.

All officers and one Director of the Fund are employees of Legg Mason or its affiliates and do not receive compensation from the Fund.

3. Investments

During the year ended December 31, 2010, the aggregate cost of purchases and proceeds from sales of investments (excluding short-term investments) were as follows:

Purchases | $27,046,460 | | | |

Sales | 18,246,763 | | | |

22 | | LMP Real Estate Income Fund Inc. 2010 Annual Report | | |

Notes to financial statements (cont’d)

At December 31, 2010, the aggregate gross unrealized appreciation and depreciation of investments for federal income tax purposes were as follows:

Gross unrealized appreciation | | $29,101,905 | |

Gross unrealized depreciation | | (3,698,244 | ) |

Net unrealized appreciation | | $25,403,661 | |

At December 31, 2010, the Fund held the following open swap contracts:

INTEREST RATE SWAPS

Swap Counterparty | | Notional

Amount | | Termination

Date | | Payments

Made

by the

Fund‡ | | Payments

Received

by the

Fund‡ | | Upfront

Premiums

Paid/

(Received) | | Unrealized

Appreciation

(Depreciation) | |

Wells Fargo Bank, N.A. | | $ 5,000,000 | | 7/22/12 | | 4.500% | | 1-Month

LIBOR | | — | | $(313,510) | |

Wells Fargo Bank, N.A. | | 5,000,000 | | 11/25/14 | | 2.395% | | 1-Month

LIBOR | | — | | (155,364) | |

Wells Fargo Bank, N.A. | | 5,000,000 | | 12/5/15 | | 2.003% | | 1-Month

LIBOR | | — | | 8,183 | |

Wells Fargo Bank, N.A. | | 5,000,000 | | 11/25/16 | | 2.915% | | 1-Month

LIBOR | | — | | (150,396) | |

Wells Fargo Bank, N.A. | | 10,000,000 | | 12/5/17 | | 2.668% | | 1-Month

LIBOR | | — | | 8,263 | |

Total | | $30,000,000 | | | | | | | | — | | $(602,824) | |

‡ Percentage shown is an annual percentage rate.

4. Derivative instruments and hedging activities

Financial Accounting Standards Board Codification Topic 815 requires enhanced disclosure about an entity’s derivative and hedging activities.

Below is a table, grouped by derivative type that provides information about the fair value and the location of derivatives within the Statement of Assets and Liabilities at December 31, 2010.

ASSET DERIVATIVES1

| | Interest Rate

Contracts Risk | |

Swap contracts2 | | $16,446 | |

LIABILITY DERIVATIVES1

| | Interest Rate

Contracts Risk | |

Swap contracts2 | | $619,270 | |

1 | | Generally, the balance sheet location for asset derivatives is receivables/net unrealized appreciation (depreciation) and for liability derivatives is payables/net unrealized appreciation (depreciation). |

2 | | Values include premiums paid (received), if any, on swap contracts which are shown separately in the Statement of Assets and Liabilities. |

| | LMP Real Estate Income Fund Inc. 2010 Annual Report | | 23 |

The following tables provide information about the effect of derivatives and hedging activities on the Fund’s Statement of Operations for the year ended December 31, 2010. The first table provides additional detail about the amounts and sources of gains (losses) realized on derivatives during the period. The second table provides additional information about the change in unrealized appreciation (depreciation) resulting from the Fund’s derivatives and hedging activities during the period.

AMOUNT OF REALIZED GAIN (LOSS) ON DERIVATIVES RECOGNIZED

| | Interest Rate

Contracts Risk | |

Swap contracts | | $(641,954) | |

CHANGE IN UNREALIZED APPRECIATION (DEPRECIATION) ON DERIVATIVES RECOGNIZED

| | Interest Rate

Contracts Risk | |

Swap contracts | | $(314,182) | |

During the year ended December 31, 2010, the volume of derivative activity for the Fund was as follows:

| | Average

Notional Balance | |

Interest rate swaps | | $20,769,231 | |

The Fund’s contracts with derivative counterparties contain several credit related contingent features that if triggered would allow its derivatives counterparties to close out and demand payment or additional collateral to cover their exposure from the Fund. Credit related contingent features are established between the Fund and its derivatives counterparties to reduce the risk that the Fund will not fulfill its payment obligations to its counterparties. These triggering features include, but are not limited to, a percentage decrease in the Fund’s net assets and/or a percentage decrease in the Fund’s Net Asset Value or NAV. The contingent features are established within the Fund’s International Swap and Derivatives Association, Inc. master agreements which govern positions in swaps, over-the-counter options, and forward currency exchange contracts for each individual counterparty.

As of December 31, 2010, the total value of swap positions with credit related contingent features in a net liability position was $619,270. If a contingent feature would have been triggered as of December 31, 2010, the Fund would have been required to pay this amount in cash to its counterparties. The Fund posted collateral for its swap transactions in the amount of $983,345.

5. Line of credit

The Fund has a revolving credit agreement with a financial institution, which allows the Fund to borrow up to an aggregate amount of $75,000,000. The agreement has a six-month term but will renew everyday for a six-month

24 | | LMP Real Estate Income Fund Inc. 2010 Annual Report | | |

Notes to financial statements (cont’d)

term unless notice to the contrary is given to the Fund. The Fund currently pays a commitment fee at an annual rate of 0.50% on the unutilized portion of the loan. For the period January 1, 2010 through August 16, 2010, the Fund paid a commitment fee at an annual rate of 0.20% on the unutilized portion of the loan. For the period August 17, 2010 to December 15, 2010, the Fund paid a commitment fee at an annual rate of 0.15% on the unutilized portion of the loan. The interest on the loan is calculated at a variable rate based on the LIBOR plus any applicable margin. Interest expense related to the loan for the year ended December 31, 2010 was $590,147. For the year ended December 31, 2010, the Fund incurred a commitment fee in the amount of $64,975. For the year ended December 31, 2010, the Fund had an average daily loan balance outstanding of $38.7 million and the weighted ave rage interest rate was 1.53%. At December 31, 2010, the Fund had $45,000,000 of borrowings outstanding per this credit agreement.

6. Distributions subsequent to December 31, 2010

On November 15, 2010, the Board of Directors (the “Board”) of the Fund declared three distributions, each in the amount of $0.06 per share, payable on January 28, 2011, February 25, 2011 and March 25, 2011 to shareholders of record on January 21, 2011, February 18, 2011 and March 18, 2011, respectively.

On February 14, 2011, the Board declared three distributions, each in the amount of $0.06 per share, payable on April 29, 2011, May 27, 2011 and June 24, 2011 to shareholders of record on April 21, 2011, May 20, 2011 and June 17, 2011, respectively.

7. Income tax information and distributions to shareholders