Exhibit 99.1

Notice of Meeting

and Management Information Circular

for

Annual Meeting of Shareholders of

Claude Resources Inc.

to be held on Thursday, May 8, 2014

Table of Contents

Page

| Notice of Annual Meeting of Shareholders | 3 |

| Letter to Shareholders | 4 |

| Solicitation of Proxies by Management | 5 |

| Appointment of Proxies | 5 |

| Revocability of Proxies | 6 |

| Exercise of Discretion with Respect to Proxies | 6 |

| Voting Securities and Principal Holders of Voting Securities | 6 |

| Business to be Transacted at the Meeting | 6 |

| Financial Statements | 6 |

| Election of Directors | 7 |

| Corporate Cease Trade Orders and Other Proceedings | 14 |

| Directors’ Attendance at Meetings | 15 |

| Appointment of Auditor | 15 |

| Shareholder Proposals | 16 |

| Corporate Governance | 16 |

| Committee Reports | 16 |

| Compensation and Other Information | 22 |

| Executive Compensation Discussion & Analysis | 27 |

| Termination Contracts | 41 |

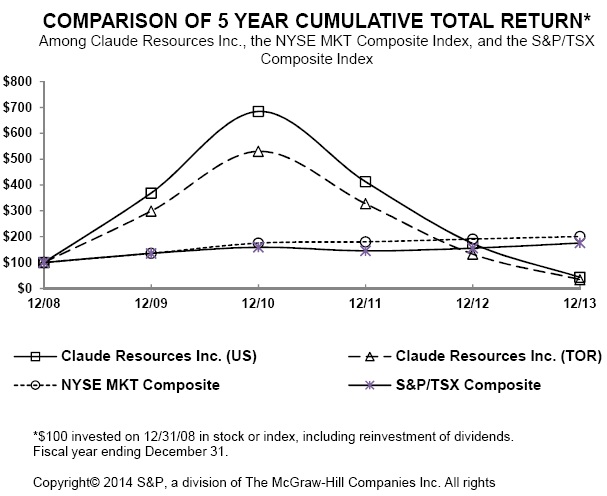

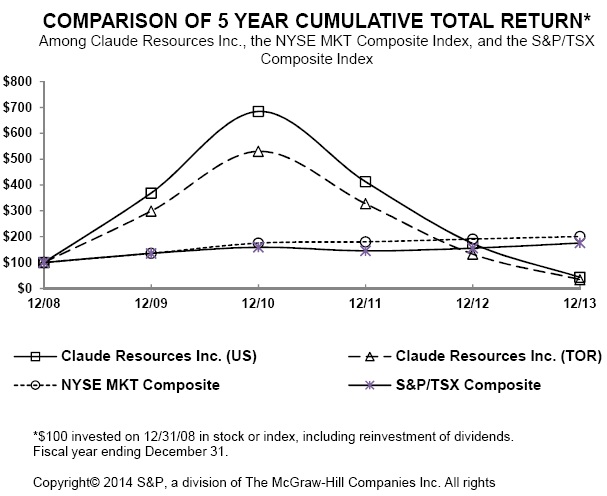

| Performance Graph | 42 |

| Equity Compensation Plan Information | 44 |

| Management Stock Option Incentive Plan | 45 |

| Employee Share Purchase Plan | 46 |

| Indebtedness of Directors and Executive Officers | 47 |

| Directors’ and Officers’ Liability Insurance | 48 |

| Communication with the Board of Directors | 48 |

| Other Matters | 48 |

| Additional Information | 48 |

| Directors’ Approval | 48 |

| Appendices | |

| Appendix A - Corporate Governance Disclosure Required Under NI 58-101 | 49 |

| Appendix B - Board of Directors Charter | 53 |

CLAUDE RESOURCES INC.

Notice of Annual Meeting of Shareholders

TAKE NOTICE that the Annual Meeting (the "Meeting") of the shareholders of CLAUDE RESOURCES INC. (the "Corporation") will be held at the Saskatoon Club, Upper Lounge, 417 - 21st Street East, Saskatoon, Saskatchewan, on Thursday the 8th day of May, 2014 at the hour of 10:00 a.m. (Saskatoon time) for the following purposes:

| 1. | To receive and consider the report of the directors and audited consolidated financial statements for the year ended December 31, 2013, and the report of the auditor thereon; |

| 2. | To elect directors for the ensuing year; |

| 3. | To appoint the auditor for the ensuing year and to authorize the directors of the Corporation to fix their remuneration; and, |

| 4. | To transact such other business as may properly come before the Meeting or any adjournment thereof. |

Particulars of the matters referred to above are set forth in the accompanying Management Information Circular.

Shareholders who are unable to attend the Meeting are requested to date, sign and return the enclosed form of proxy to Valiant Trust Company, 310, 606 - 4th Street SW, Calgary, Alberta T2P 1T1, in the enclosed self-addressed envelope or to the Chair of the Corporation at Suite 200, 224 - 4th Avenue South, Saskatoon, Saskatchewan, S7K 5M5, not less than 24 hours prior to the time of the Meeting or any adjournment thereof.

DATED at the City of Saskatoon, in the Province of Saskatchewan, this 28th day of March, 2014.

BY ORDER OF THE BOARD OF

DIRECTORS

Ted J. Nieman, Q.C.

Chair

March 28, 2014

Dear Shareholder:

It is my pleasure to invite you to attend the annual meeting of shareholders of Claude Resources Inc. (“Claude”), which will be held on Thursday, May 8, 2014 in Saskatoon at the Saskatoon Club, Upper Lounge, 417 - 21st Street East at 10:00 a.m. It is an opportunity for the directors and Management of Claude to meet with you, our shareholders. At the meeting, we will report to you on Claude’s performance in 2013 and our plans for the future.

Included in this package are Claude’s 2014 Notice of Meeting, Management Information Circular, a form of Proxy, and Mail List Request Form. These materials describe the business to be dealt with at the meeting and provide you with additional information about Claude and its directors and executive officers. Please exercise your rights as shareholders either by attending the meeting in person or by using the enclosed request for voting instructions or form of Proxy.

I thank you for your interest and confidence in Claude and I urge you to exercise your right to vote.

Sincerely,

CLAUDE RESOURCES INC.

Ted J. Nieman, Q.C.

Chair of the Board of Directors

CLAUDE RESOURCES INC.

Management Information Circular

For the Annual Meeting of Shareholders

to be held on May 8, 2014

SOLICITATION OF PROXIES BY MANAGEMENT

This Management Information Circular is furnished in connection with the solicitation of proxies by or on behalf of the management of Claude Resources Inc. (the "Corporation") for use at the Annual Meeting (the "Meeting") of the shareholders of the Corporation. The information contained herein is current as of March 28, 2014, unless otherwise indicated. The Meeting will be held at the Saskatoon Club, Upper Lounge, 417 - 21st Street East, Saskatoon, Saskatchewan, on May 8, 2014, 10:00 a.m. (Saskatoon time) for the purposes set forth in the accompanying Notice of Annual Meeting of Shareholders (the "Notice").It is expected that the solicitation of proxies will be primarily by mail. Management of the Corporation may also solicit proxies in person, by telephone, telecopier, e-mail or other electronic or telecommunication devices. The cost of solicitation by or on behalf of Management of the Corporation (“Management”) will be borne by the Corporation.

The Corporation has distributed copies of the Notice, this Management Information Circular and the form of proxy (collectively, the "Documents") to clearing agencies, securities dealers, banks and trust companies or their nominees ("Intermediaries"), for onward distribution to shareholders of the Corporation whose shares are held by or in the custody of those Intermediaries ("Non-Registered Shareholders"). The Intermediaries are required to forward the Documents to Non-Registered Shareholders.

The solicitation of proxies from Non-Registered Shareholders will be carried out by Intermediaries or by the Corporation if the names and addresses of Non-Registered Shareholders are provided by the Intermediaries. The cost of solicitation will be borne by the Corporation.

Non-Registered Shareholders who wish to file proxies should follow the directions of the Intermediary with respect to the procedure to be followed. Generally, Non-Registered Shareholders will either:

| (a) | be provided with a form of proxy executed by the Intermediary, but otherwise not completed. A Non-Registered Shareholder may complete the proxy and return it directly to the Corporation; or |

| (b) | be provided with a request for voting instructions. The Intermediary is required to send to the Corporation an executed form of proxy completed in accordance with any voting instructions received by it. |

APPOINTMENT OF PROXIES

The persons named in the enclosed form of proxy are directors and/or officers of the Corporation. A shareholder has the right to appoint a person, who need not be a shareholder, as nominee to attend and act for such shareholder and on such shareholder’s behalf at the Meeting, other than the persons designated in the enclosed form of proxy. A shareholder desiring to appoint some other person as a representative at the Meeting may do so either by inserting such person's name in the blank space provided in the form of proxy or by completing another proper form of proxy and, in either case, delivering the completed form of proxy to Valiant Trust Company, 310, 606 - 4 Street SW, Calgary, Alberta T2P 1T1, in the enclosed self-addressed envelope or to the Chair of the Corporation at Suite 200, 224 - 4th Avenue South, Saskatoon, Saskatchewan, S7K 5M5, not less than 48 hours prior to the time of the Meeting or any adjournment thereof. Proxies not delivered by the time specified may not be treated as valid for purposes of the Meeting. A shareholder may also vote using the internet at www.valianttrust.com to transmit their voting instructions.

REVOCABILITY OF PROXIES

A shareholder may revoke a proxy:

| (a) | by depositing a written notice of revocation executed by the shareholder or the shareholder’s attorney authorized in writing: |

| (i) | at the registered office of the Corporation at any time up to and including the last business day preceding the day of the Meeting, or any adjournment thereof; or |

| (ii) | with the chair of the Meeting on the day of the Meeting or any adjournment thereof; or |

| (b) | in any other manner permitted by law. |

EXERCISE OF DISCRETION WITH RESPECT TO PROXIES

The persons named in the enclosed form of proxy will vote the shares in respect of which they are appointed in accordance with the direction of the shareholders appointing them. In the absence of such direction, such shares will be voted FOR the matters referred to in the Notice.

The enclosed form of proxy confers a discretionary authority upon the persons named therein to vote the shares represented thereby as such persons consider best with respect to amendments or variations to matters identified in the Notice, and with respect to other matters which may properly come before the Meeting.

VOTING SECURITIES AND PRINCIPAL HOLDERS OF VOTING SECURITIES

On March 28, 2014, there were 188,155,978 common shares in the capital stock of the Corporation ("common shares") issued and outstanding. Each common share carries the right to one vote. No other voting securities of the Corporation are currently issued and outstanding.

The Board of Directors of the Corporation (the "Board") has fixed April 1, 2014 as the record date for determining shareholders entitled to receive notice of the Meeting. A person shown as a shareholder of record as of the close of business on April 1, 2014 shall be entitled to vote the common shares registered in such person’s name on that date, except to the extent that the person has transferred the ownership of any of such person’s shares after April 1, 2014 and the transferee of those shares produces a properly endorsed share certificate(s) or otherwise establishes that the transferee owns such shares and demands, not later than 10 days before the Meeting, that the transferee’s name be included in the list of shareholders for purposes of the Meeting, in which event the transferee shall be entitled to vote such shares at the Meeting.

To the knowledge of the directors and executive officers of the Corporation, no person beneficially owns, directly or indirectly, or exercises control or direction over shares carrying more than 10% of the voting rights attached to all shares of the Corporation.

BUSINESS TO BE TRANSACTED AT THE MEETING

This Management Information Circular contains information relating to the receipt of the Corporation’s audited consolidated financial statements, the election of directors and the appointment of the auditor of the Corporation.

FINANCIAL STATEMENTS

It is necessary at annual meetings that the shareholders of the Corporation receive and consider the consolidated financial statements for the most recently completed fiscal year of the Corporation together with the auditor’s report on such consolidated financial statements. Reference is made to the consolidated financial statements and auditor’s report with respect to the fiscal year ended December 31, 2013. Receipt and review, at the Meeting, of the auditor’s report and the Corporation's consolidated financial statements will not constitute approval or disapproval of any matters referred to therein. These audited consolidated financial statements form part of the 2013 Annual Report, copies of which are available on SEDAR at www.sedar.com and may also be obtained from the Corporate Secretary upon request and will be available at the Meeting.

ELECTION OF DIRECTORS

Management of the Corporation proposes to nominate, and the persons named in the accompanying form of proxy intend to vote in favour of the election, as directors of the Corporation, the persons named below (each, a “Nominee”). Unless otherwise indicated, all of the nominees are now directors and have been for the periods indicated. Each director elected will hold office until the next annual meeting or until his or her successor is elected or appointed, unless his or her office is vacated in accordance with the by-laws of the Corporation or theCanada Business Corporations Act.

Management does not anticipate that any of the proposed nominees will, at the time of the Meeting, be unable to stand for election as a director. However, if any proposed nominee is unable to stand for election as a director, then the persons named in the enclosed proxy have the right to vote for any other alternate nominees in their sole discretion.

The following tables set forth the details with respect to each Nominee and is based upon information furnished by the Nominee concerned. The principal occupations, businesses or employments of each of the Nominees within the past five years are disclosed in brief biographies.

The tables also show the details regarding Board and committee membership and attendance, current directorships held in other public companies, previous voting results, the current share ownership, consisting of common shares beneficially owned, directly or indirectly or controlled or directed, options and deferred share units ("DSUs") (each equivalent to a common share). The tables also provide information on the total market value of the securities held and whether the Nominee's ownership meets the minimum shareholding requirement set by the Corporation. The share ownership requirement for directors is further described on page 24.

Majority voting

The Board has adopted a policy stipulating that if any incumbent director who is not elected by at least a majority (50% + 1 vote) of the votes cast with regard to his or her election will immediately tender his or her resignation to the Chair of the Board following the meeting. The Board will promptly consider the offer of resignation and decide whether to accept or reject the resignation. The Board will act within 90 days following certification of the shareholder vote. The Board’s decision to accept or reject the resignation offer will promptly be disclosed to the public by press release. The policy does not apply in circumstances involving contested director elections.

Ted J. Nieman,Q.C. Age: 63 Saskatoon (SK),Canada Director since: January 8, 2007 Independent Areas of Expertise: Legal Corporate Matters Governance Financing Business Management | Ted J. Nieman began his career with the law firm of Estey, Robertson, Muzyka, Beaumont, Barton & Bell in Saskatoon, Saskatchewan, Canada in 1973. In 1993, Mr. Nieman joined Canpotex Limited (“Canpotex”), the offshore marketing company for the Saskatchewan potash producers, Agrium, Mosaic and Potash Corporation as General Counsel and Corporate Secretary. In 1995, he was appointed Vice President and in 2001 he was appointed Senior Vice President. He is a current member of the Canpotex Executive Management Group, and is a member of the board of directors of all Canpotex subsidiaries and affiliates. In 2012, Mr. Nieman was honored with a Queen’s Counsel (Q.C.) designation in the province of Saskatchewan. Ted became a director of the Corporation in 2007 and was appointed Chair in 2011. Public Board Membership During Last Five Years: None |

| Board / Committee Membership: | Attendance: |

Chair of the Board(1) Audit Committee Human Resources & Compensation Committee Nominating & Corporate Governance Committee (Chair) Safety, Health & Environmental Committee Reserves Committee | 13 of 13 5 of 5 3 of 3 2 of 2 4 of 4 2 of 2 | 100% |

| Voting Results of 2013 Annual & Special General Meeting: |

| Votes For: | Votes Withheld: | Total Votes Cast: |

| 31,877,034 | 93.71% | 2,139,353 | 6.29% | 34,016,387 |

| Securities Held as at December 31 (at a market value of $0.14 per Common Share for 2013): | | Options Held (as at December 31): |

| Minimum Share Ownership: Attained | | |

| Year | Common Shares (#) | DSUs (#) | Total Common Shares/DSUs (#) | Total Value of Common Shares/DSUs | | Number | Average Weighted Exercise Price | Total Exercisable | Value of Exercisable Options |

| 2013 | 35,100 | 225,508 | 260,608 | 36,485 | 190,717 | $1.45 | 190,717 | Nil |

| 2012 | 34,600 | 40,323 | 74,923 | $41,208 | 190,717 | $1.45 | 190,717 | $500 |

| | | | | | | | | | | | | | | |

(1)As Chair, Mr. Nieman is an Ex-Officio member of all the Committees of the Board and in this capacity attended 3 of 3 Human Resources & Compensation Committee meetings, 4 of 4 Safety, Health & Environmental Committee meetings and 2 of 2 Reserves Committee meetings.

Ronald J. Hicks, C.A. Age: 73 Saskatoon (SK), Canada Director since: May 9, 2006 Independent Areas of Expertise: Accounting Finance Governance Business Management | Ronald J. Hicks is a member of the Institute of Chartered Accountants of Saskatchewan (“ICAS”). He joined Deloitte & Touche LLP in 1959 and was admitted to partnership in 1977 until his retirement in August 2000. In 2004, Mr. Hicks received the Distinguished Community Service Award from ICAS. He is currently a Director Emeritus, Ducks Unlimited Canada. In 2013, Mr. Hicks was awarded the Queen Elizabeth II Diamond Jubilee medal for his contributions to conservation and his work with Ducks Unlimited Canada. In his career, he has served as director with Dickenson Mines Limited, KamKotia Mines Limited, Saskatchewan Government Insurance and Prairie Malt Limited. Mr. Hicks served as Chairman of the Saskatchewan Roughrider Football Club (Saskatoon Committee), Ducks Unlimited (Saskatoon Committee), ICAS Public Practice Review and Appraisal Committee and Admissions Committee. Ron became a director of the Corporation in 2006. Public Board Membership During Last Five Years: None |

| Board / Committee Membership: | Attendance: |

Board Audit Committee (Chair) Human Resources & Compensation Committee Nominating & Corporate Governance Committee | 13 of 13 5 of 5 3 of 3 2 of 2 | 100% |

| Voting Results of 2013 Annual and Special General Meeting: |

| Votes For: | Votes Withheld: | Total Votes Cast: |

| 32,361,913 | 95.14% | 1,654,474 | 4.86% | 34,016,387 |

| Securities Held as at December 31 (at a market value of $0.14 per Common Share for 2013): |

| Minimum Share Ownership: Attained |

| Year | Common Shares (#) | DSUs (#) | Total Common Shares/DSUs (#) | Total Value of Common Shares/DSUs |

| 2013 | 219,927 | 225,508 | 445,435 | $62,361 |

| 2012 | 139,927 | 40,323 | 180,250 | $99,138 |

| Options Held (as at December 31): | | Warrants Held (as at December 31): |

| Year | Number | Average Weighted Exercise Price | Total Exercisable | Value of Exercisable Options | | Number | Average Weighted Exercise Price | Total Exercisable | Value of Exercisable Warrants |

| 2013 | 200,717 | $1.51 | 200,717 | Nil | | - | - | - | $0 |

| 2012 | 200,717 | $1.51 | 200,717 | $500 | | 10,000 | $1.60 | 10,000 | $0 |

| | | | | | | | | | | | | | | |

J. Robert Kowalishin, P.Eng. Age: 74 Saskatoon (SK), Canada Director since: March 20, 2007 Independent Areas of Expertise: Business Management Organizational Reengineering Strategic Planning Health & Safety | J. Robert Kowalishin retired after a 42 year career with the Trane Company. He has held senior management positions in Canada and the United States, most recently District Manager of Trane's Ontario operations based in Toronto. Previous to that, he served as Franchise Holder in Saskatoon (1972-1995), and Regional Manager responsible for Canada and North Eastern United States. After retirement, he was a consultant and adviser to Trane's Leadership Development Program. Mr. Kowalishin received his Bachelor of Science (Mechanical Engineering) from the University of Saskatchewan in 1962 and is a Life Member of the American Society of Heating, Refrigeration, and Air Conditioning Engineers and a Life Member of the Association of Professional Engineers and Geoscientists of Saskatchewan. Bob became a director of the Corporation in 2007. Public Board Membership During Last Five Years: None |

| Board / Committee Membership: | Attendance: |

Board Audit Committee Safety, Health & Environmental Committee (Chair) Reserves Committee | 13 of 13 5 of 5 4 of 4 2 of 2 | 100% |

| Voting Results of 2013 Annual and Special General Meeting: |

| Votes For: | Votes Withheld: | Total Votes Cast: |

| 32,380,857 | 95.19% | 1,635,530 | 4.81% | 34,016,387 |

| Securities Held as at December 31 (at a market value of $0.14 per Common Share for 2013): | | Options Held (as at December 31): |

| Minimum Share Ownership: Attained | | |

| Year | Common Shares (#) | DSUs (#) | Total Common Shares/DSUs (#) | Total Value of Common Shares/DSUs | | Number | Average Weighted Exercise Price | Total Exercisable | Value of Exercisable Options |

| 2013 | 62,118 | 225,508 | 287,626 | $40,268 | 190,717 | $1.54 | 190,717 | Nil |

| 2012 | 62,118 | 40,323 | 102,441 | $56,343 | 190,717 | $1.54 | 190,717 | $500 |

| | | | | | | | | | | | | | | |

Ray A. McKay Age: 73 La Ronge (SK), Canada Director since: May 8, 2007 Independent Areas of Expertise: Public Policy Human Resources Economic Development Business Management | Ray A. McKay began his career in Alberta as an educator in 1968, retiring as a principal in 1979. He then became the Executive Director for Saskatchewan Education, Training and Employment, Northern Education Services Branch in La Ronge, SK and in 1996 he became the Deputy Minister for the Government of Saskatchewan, Northern Affairs. He recently retired as the Chief Executive Officer (“CEO”) for Kitsaki Management Limited Partnership. Mr. McKay received numerous awards including the Educational Development Award, Keewatin Career Development Corporation, in recognition of“Dedication to the Development of Education and Training for the people of northern Saskatchewan”;the Bill Hansen Award, Interprovincial Association on Native Employment Inc. (I.A.N.E.), in recognition of“Outstanding Contribution to the Employment of Aboriginal People”;and the Commemorative Medal for the 125th Anniversary of Canadian Confederation, Government of Canada, for significant contribution to Canada, community and fellow Canadians. Ray became a director of the Corporation in May 2007. Public Board Membership During Last Five Years: None |

| Board / Committee Membership: | Attendance: |

Board Human Resources & Compensation Committee Safety, Health & Environmental Committee Reserves Committee | 12 of 13 3 of 3 4 of 4 2 of 2 | 95.45% |

| Voting Results of 2013 Annual and Special General Meeting: |

| Votes For: | Votes Withheld: | Total Votes Cast: |

| 32,360,013 | 95.13% | 1,656,374 | 4.87% | 34,016,387 |

| Securities Held as at December 31 (at a market value of $0.14 per Common Share for 2013): | | Options Held (as at December 31): |

| Minimum Share Ownership: Attained | | |

| Year | Common Shares (#) | DSUs (#) | Total Common Shares/DSUs (#) | Total Value of Common Shares/DSUs | | Number | Average Weighted Exercise Price | Total Exercisable | Value of Exercisable Options |

| 2013 | 30,000 | 225,508 | 255,508 | $35,771 | 170,717 | $1.59 | 170,717 | Nil |

| 2012 | 30,000 | 40,323 | 70,323 | $38,678 | 170,717 | $1.59 | 170,717 | $500 |

| | | | | | | | | | | | | | | |

Rita M. Mirwald, C.M. Age: 71 Saskatoon (SK), Canada Director since: January 1, 2011 Independent Areas of Expertise: Human Resources Public Relations Strategic Planning Governance | Ms. Mirwald retired from her role as Senior Vice President, Corporate Services at Cameco Corporation which she held since 1995. In this role she was responsible for brand and image development, communications, investor relations, human resources, and government and community liaison. She also played a leading role in the execution of Cameco’s training, employment and community investment programs for First Nations and Metis people of northern Saskatchewan. In July 2010, Ms. Mirwald was appointed as a member of the Order of Canada. Ms. Mirwald has a Bachelor of Arts degree and a Diploma of Education from University of Saskatchewan, a Master of Arts from University of Oregon and has completed the executive program at Queen’s University. She is past Chair of the Saskatchewan Institute of Public Policy and the Global Strategies Committee of the World Nuclear Association. Rita became a director of the Corporation in 2011. Public Board Membership During Last Five Years: None |

| Board / Committee Membership: | Attendance: |

Board Human Resources & Compensation Committee (Chair) Nominating & Corporate Governance Committee Safety, Health & Environmental Committee | 12 of 13 3 of 3 2 of 2 4 of 4 | 95.45% |

| Voting Results of 2013 Annual and Special General Meeting: |

| Votes For: | Votes Withheld: | Total Votes Cast: |

| 32,364,390 | 95.14% | 1,651,997 | 4.86% | 34,016,387 |

| Securities Held as at December 31 (at a market value of $0.14 per Common Share for 2013): | | Options Held (as at December 31): |

| Minimum Share Ownership: Attained | | |

| Year | Common Shares (#) | DSUs (#) | Total Common Shares/DSUs (#) | Total Value of Common Shares/DSUs | | Number | Average Weighted Exercise Price | Total Exercisable | Value of Exercisable Options |

| 2013 | 26,500 | 225,508 | 252,008 | $35,281 | 90,717 | $1.55 | 90,717 | Nil |

| 2012 | 26,500 | 40,323 | 66,823 | $36,753 | 90,717 | $1.55 | 90,717 | $500 |

| | | | | | | | | | | | | | | |

Michel Sylvestre, M.Sc., P.Eng.(1) Age: 58 Port Hope (ON), Canada Director since: June 20, 2011 Not Independent, effective April 1, 2014 (Management) Areas of Expertise: Operations and Business Management Health and Safety Engineering and Technical Governance Strategic Planning | Mr. Sylvestre is currently the President and CEO for Castle Resources Inc. Castle Resources is an exploration and mine development company based in Toronto, Canada. Mr. Sylvestre holds an M.Sc. and a B.Sc. in Mining Engineering from McGill University and Queen’s University, respectively. He is also a member of the Professional Engineers of Ontario and the Canadian Institute of Mining. For most of his career, Mr. Sylvestre worked at Inco Ltd. where he most recently held senior management positions domestically and internationally. Most notably, he was the CEO of Vale Inco, New Caledonia, President Vale Inco, Manitoba Operations and Vice President of Operations PT Inco, Indonesia. Mr. Sylvestre also serves on the Boards of Castle Resources Inc., James Bay Resources and Wellgreen Platinum (formerly Prophecy Platinum Corp.) and brings over 35 years of mining experience to the Corporation. Michel became a director of the Corporation in 2011. Public Board Membership During Last Five Years: •James Bay Resources Ltd. (2011 - Present) •Castle Resources Ltd. (2010 - Present) •Wellgreen Platinum Ltd. (2012 - Present) |

| Board / Committee Membership: | Attendance: |

Board Human Resources & Compensation Committee Safety, Health & Environmental Committee Reserves Committee | 13 of 13 3 of 3 4 of 4 2 of 2 | 100% |

| Voting Results of 2013 Annual and Special General Meeting: |

| Votes For: | Votes Withheld: | Total Votes Cast: |

| 31,327,668 | 92.10% | 2,688,719 | 7.90% | 34,016,387 |

| Securities Held as at December 31 (at a market value of $0.14 per Common Share for 2013): | | Options Held (as at December 31): |

| Minimum Share Ownership: Attained | | |

| Year | Common Shares (#) | DSUs (#) | Total Common Shares/DSUs (#) | Total Value of Common Shares/DSUs | | Number | Average Weighted Exercise Price | Total Exercisable | Value of Exercisable Options |

| 2013 | 50,000 | 225,508 | 275,508 | $38,571 | 90,717 | $1.45 | 90,717 | Nil |

| 2012 | 50,000 | 40,323 | 90,323 | $49,678 | 90,717 | $1.45 | 90,717 | $500 |

| | | | | | | | | | | | | | | |

(1)Effective April 1, 2014, Mr. Sylvestre will assume the role of President and CEO of the Corporation on an interim basis. As President and CEO, Mr. Sylvestre will no longer be a member of any Board Committee but will attend meetings of all Committees by invitation, whenever possible.

Brian R. Booth, B.Sc., P.Geo. Age: 54 Vancouver (BC), Canada Director since: April 1, 2012 Independent Areas of Expertise: Mineral Exploration Business Management Strategic Planning Governance | Mr. Booth currently serves as the President and CEO of Pembrook Mining Corp., an exploration company based in Vancouver, BC, Canada. Mr. Booth holds a B.Sc in Geology from McGill University and is also a member of the Professional Geoscientists of Ontario. Mr. Booth began his career as a Geologist on the Casa Berardi gold discoveries in Quebec. He opened Inco's exploration office in Val d'Or, Quebec and is credited with the discovery of the Douay West gold deposit in 1990 and was subsequently appointed to the board of Societe D'Exploration Miniere Vior Inc. In 1994, as Inco's Manager Exploration, Eastern North America, he conducted the preliminary assessment of the Voisey's Bay Ni-Cu-Co discovery . He later relocated to Indonesia to manage Inco's exploration office in Jakarta during which time he was involved, through a joint venture with Highlands Gold, in the discovery of the Beutong copper porphyry in Sumatra. Mr. Booth served as the CEO and President of Lake Shore Gold Corp. and later as a Director. Mr. Booth who serves on the Boards of Pembrook Mining Corp., and Northern Superior Resources Inc. brings more than 30 years experience in mineral exploration throughout Canada, Europe and southeast Asia. Brian became a director of the Corporation in 2012. Public Board Membership During Last Five Years: •Northern Superior Resources Inc. (2007 - Present) •Paget Minerals Corp. (2009 - 2011) •Maxy Gold Corp. (2008 - 2010) •Lake Shore Gold Corp. (2005 - 2008) |

| Board / Committee Membership: | Attendance: |

Board Audit Committee Safety, Health & Environmental Committee Reserves Committee | 10 of 13 4 of 5 4 of 4 2 of 2 | 83.33% |

| Voting Results of 2013 Annual and Special General Meeting: |

| Votes For: | Votes Withheld: | Total Votes Cast: |

| 32,404,179 | 95.26% | 1,612,208 | 4.74% | 34,016,387 |

| Securities Held as at December 31 (at a market value of $0.14 per Common Share for 2013): | | Options Held (as at December 31): |

| Minimum Share Ownership: Attained(1) | | |

| Year | Common Shares (#) | DSUs (#) | Total Common Shares/DSUs (#) | Total Value of Common Shares/DSUs | | Number | Average Weighted Exercise Price | Total Exercisable | Value of Exercisable Options |

| 2013 | - | 227,038 | 227,038 | $31,785 | 71,239 | $1.06 | 71,239 | Nil |

| 2012 | - | 41,853 | 41,853 | $23,019 | 71,239 | $1.06 | 71,239 | $500 |

| | | | | | | | | | | | | | | |

CORPORATE CEASE TRADE ORDERS and OTHER PROCEEDINGS

No proposed director has, within the 10 years prior to the date of this Management Information Circular, been a director or executive officer of any company that (i) was the subject of a cease trade order or similar order or an order that denied the Company access to any exemption under securities legislation for more than 30 consecutive days, (ii) was subject, after the proposed director ceased to be a director or executive officer, to a cease trade order or similar order or an order that denied the Company access to any exemption under securities legislation for more than 30 consecutive days that resulted from an event that occurred while that person was active in the capacity of director or executive officer, or (iii) during the tenure of the director or executive officer or within one year of the director or executive officer ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets.

No proposed director has, within 10 years prior to the date of this Management Information Circular, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangements or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold the assets of the proposed director.

DIRECTORS’ ATTENDANCE AT MEETINGS

The following table summarizes the meetings of the Board and its Committees held for the year ended December 31, 2013.

| Summary of Board and Committee Meetings held |

| | |

| Board of Directors | 13 |

| Audit Committee | 5 |

| Human Resources & Compensation Committee | 3 |

| Nominating & Corporate Governance Committee | 2 |

| Safety, Health & Environmental (SHE) Committee | 4 |

| Reserves Committee | 2 |

| | |

The attendance of individual directors is set forth in the summaries under the heading “Election of Directors”.

The Board and its Committees may conduct “in camera” sessions at which no members of Management or non-independent directors are present. The in camera sessions of the Board are held at such times as the independent directors or the Chair of the Board determine advisable. The in camera sessions are intended not only to encourage the Board and its Committees to fully and independently fulfill their mandates, but also to facilitate the performance of their fiduciary duties on behalf of shareholders of the Corporation.

Directors Attendance at Annual Meeting

The Corporation encourages Board members to attend the Annual Meeting. At the last Annual Meeting held on May 9, 2013, all of the Board members attended.

APPOINTMENT OF AUDITOR

The Audit Committee and the Board of Directors of the Corporation recommend the reappointment of KPMGLLPChartered Accountants as auditor of the Corporation. KPMGLLPChartered Accountants were first appointed auditor in 1993. The persons named in the enclosed form of proxy intend to voteFOR the reappointment of KPMGLLP Chartered Accountants as auditors of the Corporation, to hold office until the next annual meeting of the shareholders, at a remuneration to be approved by the Audit Committee and the Board.

Auditor’s Fees

The aggregate fees for professional services rendered by KPMGLLPfor the 2013 and 2012 fiscal years are shown in the table below:

| | 2013 | 2012 |

| Audit fees(1) | $206,700 | $441,000 |

| Tax fees(2) | - | $37,000 |

| Total | $206,700 | $478,000 |

(1)Audit fees were for KPMGLLP services in respect of the audit of the December 31, 2013 consolidated financial statements.

(2)Tax fees in 2012 were for KPMGLLP services in respect of certain tax compliance and tax planning, including the St. Eugene Mining transaction.

Pre-Approval Policies & Procedures

The Audit Committee has adopted a policy that requires pre-approval by the Audit Committee of audit services and other services within permissible categories of non-audit services. The policy prohibits the Corporation from engaging the auditor for “prohibited” categories of non-audit services.

SHAREHOLDER PROPOSALS

The final date by which the Corporation must receive a proposal for any matter that a person entitled to vote at an annual meeting of the Corporation proposes to raise at the 2015 annual meeting of the Corporation is December 22, 2014.

CORPORATE GOVERNANCE

The Corporation, its Board and Management are committed to the highest standard of corporate governance. The Board, previously through its Nominating & Corporate Governance Committee, continually evaluates and enhances the Corporation’s corporate governance practices by monitoring regulatory developments in Canada and the United States affecting corporate governance and transparency of public company disclosure.

As a Canadian reporting issuer with securities listed on the TSX and registered with the U.S. Securities & Exchange Commission (“SEC”), the Corporation complies with the applicable regulatory requirements concerning corporate governance in both Canada and the United States.

In Canada, the Corporation complies with corporate governance rules of the Canadian securities regulatory authorities in all of the provinces of Canada. The Corporation discloses its corporate governance practices in accordance with National Instrument 58-101 (“NI 58-101”) in reference to the benchmarks set out in National Policy 58-201 “Corporate Governance Guidelines”.

In the United States, the Corporation is required to comply with the provisions of theSarbanes-Oxley Actof 2002 and the rules adopted by the SEC pursuant to that Act as applicable to a foreign private issuer.

To comply with the applicable corporate governance standards and achieve those best practices, the Board has adopted “Corporate Governance Principles”, “Codes of Conduct”, and Board and Committee Charters.

In accordance with NI 58-101, the Corporation annually discloses information relating to its system of corporate governance. Details of the Corporation’s corporate governance practices are described in Appendix A to this Management Information Circular. Furthermore, in accordance with the requirements of NI 58-101, the text of the Board’s Charter is attached as Appendix B.

COMMITTEE REPORTS

The Board has established five committees to assist in exercising its responsibilities: the Audit Committee, the Human Resources & Compensation Committee, the Nominating & Corporate Governance Committee, the Safety, Health & Environmental Committee, and the Reserves Committee. Each committee has provided a report below which describes the composition of the committee, its responsibilities and key activities. On December 12, 2013 the Nominating & Corporate Governance Committee re-examined the Corporation’s committee structure and determined that the Nominating & Corporate Governance Committee and Reserves Committee should be disbanded, effective January 1, 2014. The duties and responsibilities of these committees have been assumed by the Board.

Audit Committee

The Board has determined that all of the members of the Audit Committee (sometimes referred to in this section as the “Committee”) are independent directors under applicable laws, rules and regulations in Canada and the United States. The Board has determined that each member of the Audit Committee is “financially literate” within the meaning of the rules of the Canadian securities regulatory authorities in all of the provinces of Canada relating to audit committees. The Board has determined that Ronald J. Hicks, C.A. (Chair) qualifies as an “audit committee financial expert” as defined by rules of the SEC.

This Committee is responsible for assisting the Board in its oversight of the integrity of the Corporation’s financial statements, the qualifications, performance and independence of the external auditor, KPMGLLP, the adequacy and effectiveness of internal controls, and compliance with legal and regulatory requirements. The Committee has the authority to retain and set the compensation of independent counsel and other external advisors as it deems necessary at the expense of the Corporation.

The Committee is responsible for recommending the appointment and revocation of the appointment of the external auditor and for recommending the external auditor’s remuneration. The Committee is directly responsible for the oversight of the work of the external auditor, including resolution of differences between Management and the external auditor regarding financial reporting. It has sole authority to approve all audit engagement fees and terms, as well as the provision of any legally permissible non-audit services provided by the external auditor, and has established policies and procedures for the pre-approval of audit and legally permissible non-audit services. The Committee is responsible for reviewing the independence and objectivity of the external auditor, including reviewing any relationships between the external auditor and the Corporation that may affect the external auditor’s independence and objectivity. The Committee is also charged with reviewing any audit issues raised by the external auditor and Management’s response thereto. The Committee has the authority to communicate directly with the external auditors.

Management of the Corporation is responsible for the preparation, presentation and integrity of the Corporation’s financial statements and for maintaining appropriate accounting and financial reporting principles, policies, internal controls and procedures designed to ensure compliance with accounting standards and applicable laws and regulations. The external auditor is responsible for planning and carrying out, in accordance with professional standards, an audit of the Corporation’s annual financial statements. The Committee is responsible for reviewing the adequacy and effectiveness of these activities.

In addition, the Committee has established a Whistleblower Policy which contains procedures for the receipt and resolution by the Corporation of complaints concerning accounting, auditing, internal accounting controls or other matters, as well as procedures for the confidential and anonymous submission by employees or others of concerns regarding these matters.

For further information relating to the Audit Committee and the Corporation’s external auditor, please refer to the section entitled “Audit Committee” in the Corporation’s annual information form dated March 28, 2014, which has been filed with securities regulators on SEDAR at www.sedar.com.

Annually, the Committee reviews its Charter and its own effectiveness in fulfilling its mandate. The Committee is satisfied that it has appropriately fulfilled its mandate to the best of its ability for the year ended December 31, 2013.

The Committee met five times this year and its key activities are summarized below:

| • | reviewed and discussed with Management the quarterly financial statements and reviewed and discussed with Management and KPMGLLP the annual audited financial statements for the year ended December 31, 2012; |

| • | recommended for approval by the Board the quarterly unaudited financial statements, the audited financial statements for the year ended December 31, 2012, earnings releases on quarterly and annual results, the 2012 Annual Information Form, the 2012 Annual Report, the 2012 Information Circular and the Corporation’s annual report on Form 40-F for the year ended December 31, 2012 to be filed with the SEC. The Committee’s recommendations were based on the reports and discussions described in this report and subject to the limitations on the role and responsibilities of the Committee in its charter; |

| • | discussed with KPMGLLP their responsibilities in performing an audit in accordance with Canadian generally accepted auditing standards and the design of the audit. The objectives of the audit are to express opinions on the fairness of the presentation in the Corporation’s consolidated financial statements; |

| • | discussed with KPMGLLP matters arising from the audit that are required to be discussed under Canadian generally accepted auditing standards as adopted by the PCAOB; |

| • | received the written disclosures and the letter from KPMGLLPrequired by Canadian generally accepted auditing standards, and by Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees, as adopted by the PCAOB, which disclose all relationships between the Corporation and its related entities and the external auditor and its related entities that, in the external auditor’s judgment, may reasonably be thought to bear on its independence, and which confirm the independence of KPMGLLPfrom the Corporation. In connection with its assessment of the independence of the external auditor, the Committee has discussed with KPMGLLPthat firm’s independence; |

| • | as part of its oversight responsibility, the Committee requires that Management implement and maintain appropriate internal control procedures, including internal control over financial reporting. During the year, the Committee reviewed and monitored the Corporation’s compliance with the certification requirements of Section 404 of the Sarbanes-Oxley Act of 2002; |

| • | met two times with KPMGLLP without Management present to discuss and review specific issues as the Committee deemed appropriate; |

| • | reviewed the performance of KPMGLLP; |

| • | approved policies and procedures for the pre-approval of services to be performed by KPMG LLP and pre-approved all engagements with the external auditor, KPMG LLP, reviewed the scope of the annual audit examination, received summaries of observations and recommendations regarding accounting and reporting mattersarising from the year-end audit, and approved all fees of KPMG LLP; |

| • | discussed with Management and KPMG LLP significant estimates and areas of judgement regarding accounting principles and financial statement presentation and the overall quality of its financial reporting; |

| • | received regular updates from Management on changes to accounting standards; reviewed and approved changes to accounting policies and monitored the implementation of International Financial Reporting Standards; |

| • | reviewed the Corporation’s major financial risk exposures and the steps Management has taken to monitor and control such exposure; |

| • | approved, subject to Board and shareholder approval, the selection of KPMGLLPas the Corporation’s external auditors; reviewed Management’s analysis of commitments and contingencies, if any; |

| • | monitored Management’s improvement of supply chain management system; |

| • | received regular reports from the Corporation’s Disclosure Committee; |

| • | received regular updates from Management on debt covenant compliance; |

| • | reviewed correspondence between the Corporation and SEC; and |

| • | received updates from Management on the implementation of the SEC’s Extensible Business Reporting Language (“Xbrl”) initiatives. |

This report has been adopted and approved by the members of the Audit Committee.

Members: Ronald J. Hicks, C.A. (Chair), Ted J. Nieman, Q.C., J. Robert Kowalishin and Brian Booth.

Human Resources & Compensation Committee

The Human Resources & Compensation Committee (sometimes referred to in this section as the “Committee”) is responsible for advising the Board on compensation and human resources principles, as well as related policies, programs and practices designed to achieve the strategic goals and financial objectives of the Corporation. The Committee also makes recommendations to the Board on the compensation of directors and executive Management, including the CEO and those executives whose compensation is set forth in the Committee’s Report on Executive Compensation.

The amount of compensation for the CEO is based on the Committee’s assessment of the CEO’s performance against the Corporation’s annual goals and objectives. Compensation for the Senior Vice President & Chief Operating Officer and Vice Presidents is based on the recommendation from the CEO.

The Committee also reviews and approves succession plans, leadership development and executive compensation disclosure.

The Board recognizes the importance of appointing to the Committee knowledgeable and experienced individuals who have the background in executive compensation necessary to fulfill the Committee’s obligation to the Board and shareholders. All of the Committee members have experience in the area of executive compensation through their roles as senior leaders in other businesses. The Committee has an annual work plan which is reviewed and updated as necessary.

The Committee recognizes that independence from Management is fundamental to its effectiveness in managing executive compensation programs. Accordingly, the Committee was composed solely of independent directors. At each of its meetings the Committee has the opportunity to hold an “in-camera” session without Management present. The Committee chose to do so twice during the year.

The Committee has sole authority to retain and approve the fees of any independent compensation consultant to assist in determining compensation for executives of the Corporation. During the year, the Committee engaged the services of Mercer (Canada) Limited ("Mercer") an independent compensation consultant, to provide advice and counsel on executive and director compensation and other matters. The Chair of the Committee has direct access to the independent consultant. During 2013 the fees for consultant services amounted to $10,983 (2012 - $56,744).

The Committee reviews its Charter annually and assesses its effectiveness in fulfilling its mandate. The Committee is satisfied that it has appropriately fulfilled its mandate to the best of its ability for the year ended December 31, 2013.

The Committee met three times in 2013 and carried out the following key activities as part of its annual work plan:

| • | retained Mercer as an independent human resources consultant, to review the Corporation's compensation philosophy, programs and practices, where necessary; |

| • | monitored emerging market trends, developments in compensation design, practices and disclosure; |

| • | stress-tested the target award levels, weighting of performance objectives, and individual and corporate performance measures under the Short-Term and Long-Term Incentive Plans and approved changes to the target award levels for implementation in 2013; |

| • | reviewed both internal and external comparator benchmarking analysis for director’s compensation and recommended to the Board no change in directors’ compensation for 2014; |

| • | recommended to the Board certain 2014 corporate goals and objectives that are the key performance guidelines for the executive compensation program; |

| • | reviewed corporate performance against the goals and objectives approved by the Board; |

| • | assessed the annual performance of the CEO against corporate goals and objectives; |

| • | reviewed base salary changes, short-term incentive awards and long-term incentive awards for the CEO, Senior Vice President & Chief Operating Officer and Vice Presidents; |

| • | reviewed the succession plans for executive Management to ensure effective leadership development is in place; |

| • | reviewed quarterly Management reports on Enterprise Risk Management; |

| • | reviewed employment contracts for the CEO, Senior Vice President & Chief Operating Officer and Vice Presidents; |

| • | reviewed the Committee Chair position description; |

| • | reviewed the mandate of the Committee; reviewed and approved executive compensation disclosure included in this Management Information Circular; and, |

| • | submitted its recommendations regarding the above matters to the Board for approval, where required. |

This report has been adopted and approved by the members of the Human Resources & Compensation Committee.

Members: Rita M. Mirwald (Chair); Ray A. McKay, Ronald J. Hicks, C.A., Mike Sylvestre and Ted J. Nieman, Q.C. (Ex-Officio).

Nominating & Corporate Governance Committee

The Nominating & Corporate Governance Committee (sometimes referred to in this section as the “Committee”) is responsible for establishing the Corporation’s governance policies and practices, identifying individuals qualified to become members of the Board, reviewing the composition of the Board and its Committees, recommending certain Board and Committee meeting venues and monitoring compliance with the Corporation’s Code of Ethics.

The Committee establishes and recommends to the Board the qualifications and attributes that individuals should have in order to be nominated for election or re-election as a corporate director. The Committee reviews the appropriateness of both the Board’s current size and its composition as a whole.

The Committee has developed a process for assessing the performance and effectiveness of the Board and its Committees which includes annual performance reviews.

The Committee recognizes that independence from Management is fundamental to its effectiveness. Accordingly, the Committee is comprised solely of independent directors. At each of its meetings the Committee has the opportunity to hold an “in-camera” session without Management present.

Annually, the Committee reviews its Charter and its own effectiveness in fulfilling its mandate. The Committee is satisfied that it has appropriately fulfilled its mandate to the best of its ability for the year ended December 31, 2013.

The Committee met two times in 2013 and its key activities are summarized below:

| • | reviewed and recommended to the Board the appointment of the Chair of the Board, the composition of Board committees and the appointment of their respective Chairs; |

| • | reviewed the current Board and Committee size and composition; |

| • | reviewed the Corporation’s Code of Ethics Policy and Conflict of Interest Reports; |

| • | reviewed the Corporation's Corporate Governance Principles and Independence Standards; |

| • | reviewed and updated the Committee Chair and Board Chair position descriptions; |

| • | conducted the annual evaluation of effectiveness of the Board, its Chair and its Committees; |

| • | monitored the training and educational initiatives undertaken by each director; |

| • | continued to monitor applicable legislation and best practices directives relating to corporate governance in general; |

| • | reviewed the mandate of the Committee; |

| • | reorganized the Corporation's committee structure resulting in the dissolution of this Committee and the Reserves Committee and the continuance of their respective mandates by the independent directors of the Board; and |

| • | submitted its recommendations regarding the above matters to the Board for approval, where required. |

This report has been adopted and approved by the independent directors of the Board.

Members: Ted J. Nieman, Q.C., Ronald J. Hicks, C.A., J. Robert Kowalishin, Ray A. McKay, Rita M. Mirwald, Mike Sylvestre and Brian Booth.

Safety, Health & Environmental Committee

The Safety, Health & Environmental Committee (sometimes referred to in this section as the “Committee”) is responsible for the review of safety, health and environmental policies and programs, to oversee the Corporation’s safety, health and environmental performance, to monitor current and future regulatory issues and to make recommendations, where appropriate, on significant matters in respect of safety, health and environmental matters to the Board.

The Committee recognizes that independence from Management is fundamental to its effectiveness. Accordingly, the Committee was composed solely of independent directors. At each of its meetings the Committee has the opportunity to hold an “in-camera” session without Management present.

Annually, the Committee reviews its Charter and its own effectiveness in fulfilling its mandate. The Committee is satisfied that it has appropriately fulfilled its mandate to the best of its ability for the year ended December 31, 2013.

The Committee met four times in 2013 and its key activities are summarized below:

| • | reviewed Safety, Health and Environmental Policies to ensure Claude is not only compliant with all regulations but strives to be a leader in this area; |

| • | monitored progress in the development and implementation of the Safety, Health and Environmental Management System; |

| • | reviewed all safety, health and environmental contraventions and orders, if and when issued, by regulatory agencies and monitored remediation; |

| • | reviewed all incident reports and statistics; reviewed minutes of all internal OH&S committee meetings; |

| • | received quarterly Management certification that all required environmental reporting requirements had been met; |

| • | reviewed reports of regular, documented fire drills and monitored remediation of camp fire protection and alarm systems; |

| • | monitored relevant reports, publications and statistics from governmental regulatory agencies and industry peer groups; |

| • | reviewed quarterly Management reports on Enterprise Risk Management; |

| • | monitored relevant data and reports from outside consultants engaged in environmental and safety compliance issues; reviewed/monitored decommissioning plan submissions to and communications with Saskatchewan and Ontario regulatory authorities; |

| • | received quarterly Management updates on duty to consult initiatives and licensing applications; |

| • | monitored training initiatives and opportunities; |

| • | reviewed the mandate of the Committee; |

| • | reviewed the Chair position description; and |

| • | submitted its recommendations regarding the above matters to the Board for approval, where required. |

This report has been adopted and approved by the members of the Safety, Health & Environmental Committee.

Members: J. Robert Kowalishin (Chair), Ray A. McKay, Rita M. Mirwald, Mike Sylvestre, Brian Booth and Ted Nieman, Q.C. (Ex-Officio).

Reserves Committee

The Reserves Committee (sometimes referred to in this section as the “Committee”) is responsible for the annual review of the Corporation’s Mineral Reserves and Mineral Resources; the integrity of the Corporation’s reserves evaluation and reporting system; the Corporation’s compliance with legal and regulatory requirements related to reserves evaluation, preparation and disclosure; the qualifications and independence, if applicable, of the Corporation’s Qualified Persons; the adequacy of performance of the Corporation’s independent engineering consultants; and the business practices and ethical standards of the Corporation in relation to the preparation and disclosure of reserves.

The Committee recognizes that independence from Management is fundamental to its effectiveness. Accordingly, the Committee is comprised solely of independent directors. At each of its meetings the Committee has the opportunity to hold an “in-camera” session without Management present.

Annually, the Committee reviews its Charter and its own effectiveness in fulfilling its mandate. The Committee is satisfied that it has appropriately fulfilled its mandate to the best of its ability for the year ended December 31, 2013.

The Committee met twice in 2013 and its key activities are summarized below:

| • | reviewed updates to the December 31, 2012, Mineral Reserves and Mineral Resources estimate of the Seabee Properties; |

| • | reviewed the mandate of the Committee; |

| • | requested an external audit of the Mineral Reserves and Mineral Resources estimation procedures on the Seabee Gold Properties; |

| • | reviewed the Committee Chair position description; |

| • | reviewed updates to the December 31, 2012 Mineral Reserves and Mineral Resources estimate of the Seabee Properties which incorporated the findings of the Stantec Pre-feasibility study on the Santoy Gap deposit; |

| • | reorganized the Corporation’s Committee structure resulting in the dissolution of this Committee and the continuance of their respective mandates by the independent directors of the Board; and |

| • | submitted its recommendations regarding the above matters to the Board for approval, where required. |

This report has been adopted and approved by the independent directors of the Board.

Members: Ted J. Nieman, Q.C., Ronald J. Hicks, C.A., J. Robert Kowalishin, Ray A. McKay, Rita M. Mirwald, Mike Sylvestre and Brian Booth.

COMPENSATION AND OTHER INFORMATION

Board of Directors’ Compensation

Compensation Philosophy and Objectives:

The philosophy and benchmarking with respect to director compensation is the same as for executive compensation, as discussed on page 27. The director compensation program is designed to attract and retain highly qualified individuals with the capability to meet the demanding responsibilities of Board members. The Human Resources & Compensation Committee (sometimes referred to in this section as the “Committee”) believes that the combination of share ownership guidelines plus the greater emphasis on the equity component of director compensation as well as the requirement for directors to retain all DSUs until retirement effectively aligns the interests of directors with those of its shareholders. The Committee believes that the director compensation program provides for competitive and reasonable compensation levels.

The Board follows a formal performance assessment process to ensure director effectiveness and encourage director engagement.

Review and Assessment:

The Human Resources & Compensation Committee reviews director compensation once a year and recommends updates to the Board for approval when considered appropriate or necessary to recognize the workload, time commitment and responsibility of Board and committee members.

In December 2012 the Board engaged Mercer to update their independent review of director compensation using the same comparator companies referenced in the discussion of executive compensation. Based on the benchmarking study, Mercer recommended no change to the existing director compensation structure for 2013. However, given the share price performance, the Committee recommended, and the Board approved, a $25,000 reduction to the equity component of total direct compensation. In addition, for 2013, the Board approved a recommendation from the Committee that all of the directors’ equity compensation would be awarded in the form of DSUs.

Director Compensation for 2013:

| Annual Retainer: | Chair of the Board - $40,000; |

| | Chair of the Audit Committee - $32,500; |

| | Chair of the SHE Committee - $27,500; |

| | Chair of HRC Committee - $27,500; |

| | Chair of NCG Committee - $25,000; |

| | Chair of Reserves Committee - $25,000; and |

| | |

| | Director - $20,000. |

| | |

| Attendance fees: | $1,000 for each Board meeting; |

| | $1,000 for each Committee meeting, other than the Audit Committee; and |

| | $1,500 for each Audit Committee meeting. |

| | |

| Equity Compensation: | Up to $62,500 fully-vested common share stock options; and |

| | $62,500 fully-vested DSUs, or combination thereof. Both stock options and DSUs are to be granted to each director as of January 1 of each year. |

| | |

| | In 2013, the Committee recommended and the board approved a reduction of $25,000, to $100,000 in the equity component of director compensation - all of which are to be delivered in the form of DSUs. |

| | |

| Directors are reimbursed for certain travel and other expenses incurred in attending meetings and the performance of their duties. |

Deferred Share Unit Plan:

Effective January 1, 2012, the Board implemented a Deferred Share Unit Plan (“DSUP”) for the Corporation’s non-executive directors. Unless otherwise approved by the Board, each director is required to receive at least 50 percent of their equity compensation in the form of DSUs.

The purpose of the DSUP is to enhance the Corporation’s ability to attract and retain talented individuals to serve as directors and to promote a greater alignment of interests between directors and shareholders of the Corporation by linking a portion of annual director compensation to the future value of the Corporation’s common shares.

DSUs are only redeemable once a director ceases to serve as a director, at which point they are paid out in cash. The value of the DSU at the time it is granted or redeemed for cash is calculated as the volume weighted average trading price of the common shares on the TSX on the last 20 trading days prior to the grant or redemption.

DSUs credited to a director are counted as common shares when determining whether a director has met minimum share ownership guidelines.

Share Ownership Guidelines:

Directors were required to hold at least 80,000 common shares or DSUs within five years of joining the Board. The Board believes this contributes to the goal of aligning the interests of directors with those of shareholders. In 2014, the Committee recommended and the Board approved increasing director share ownership requirements as follows:

Chair: 3 times annual retainer; and,

Director: 2 times annual retainer.

Further, each director should achieve this level of ownership within four years of joining the board.

Compensation Details

The following table provides a detailed breakdown of the fees earned, before withholdings, by non-employee directors for the year ended December 31, 2013. Annual and committee retainers are paid quarterly.

| | Fee Breakdown | | Allocation of total Fees |

Name | Board Retainer | Board/ Committee Chair retainer ($) | Board attendance fees ($) | Committee attendance fees ($) | Total fees earned ($) | In cash ($) | In equity ($) |

Equity Component ($) | Cash Component ($) |

Ted J. Nieman | 100,000 | 20,000 | 25,000 | 13,000 | 18,500 | 176,500 | 76,500 | 100,000 |

Ronald J. Hicks | 100,000 | 20,000 | 12,500 | 13,000 | 12,500 | 158,000 | 58,000 | 100,000 |

| J. Robert Kowalishin | 100,000 | 20,000 | 7,500 | 13,000 | 13,500 | 154,000 | 54,000 | 100,000 |

Ray A. McKay | 100,000 | 20,000 | - | 12,000 | 9,000 | 141,000 | 41,000 | 100,000 |

| Rita M. Mirwald | 100,000 | 20,000 | 7,500 | 12,000 | 9,000 | 148,500 | 48,500 | 100,000 |

Mike Sylvestre | 100,000 | 20,000 | 5,000 | 13,000 | 9,000 | 147,000 | 47,000 | 100,000 |

Brian Booth | 100,000 | 20,000 | - | 10,000 | 12,000 | 142,000 | 42,000 | 100,000 |

Outstanding Option and Share-Based Awards

The following table shows all option and share-based awards outstanding at December 31, 2013 that were granted to non-executive directors. The value of unexercised in-the-money options at December 31, 2013, is the difference between the exercise price of the options and the fair market value of the Corporation’s common shares at year end, which was $0.14.

| | Option-Based Awards | Share-Based Awards |

Name | Number of securities underlying unexercised options (#) | Option exercise price ($) | Option expiration date | Value of unexercised in-the-money options ($) | Number of units of shares that have not vested (#) | Market or payout value of share-based awards ($) | Market or payout value of vested share based awards ($) |

Ted J. Nieman | 60,000 10,000 10,000 10,000 10,000 20,000 70,717 | 1.59 1.39 0.50 1.24 1.03 2.20 1.36 | Jan 8, 2017 Jan 1, 2018 Jan 5, 2019 Jan 1, 2020 Feb 26, 2020 Jan 1, 2021 Jan 1, 2019 | - - - - - - - | - - - - - - - | 31,571 | 31,571 |

| Totals | 190,717 | | | - | - | 31,571 | 31,571 |

Ronald J. Hicks | 10,000 60,000 10,000 10,000 10,000 10,000 20,000 70,717 | 1.75 1.72 1.39 0.50 1.24 1.03 2.20 1.36 | May 9, 2016 Jan 1, 2017 Jan 1, 2018 Jan 5, 2019 Jan 1, 2020 Feb 26, 2020 Jan 1, 2021 Jan 1, 2019 | - - - - - - - - | - - - - - - - - | 31,571 | 31,571 |

| Totals | 200,717 | | | - | - | 31,571 | 31,571 |

J.Robert Kowalishin | 60,000 10,000 10,000 10,000 10,000 20,000 70,717 | 1.86 1.39 0.50 1.24 1.03 2.20 1.36 | Mar 20, 2017 Jan 1, 2018 Jan 5, 2019 Jan 1, 2020 Feb 26, 2020 Jan 1, 2021 Jan 1, 2019 | - - - - - - - | - - - - - - - | 31,571 | 31,571 |

| Totals | 190,717 | | | - | - | 31,571 | 31,571 |

Ray A. McKay | 60,000 10,000 10,000 20,000 70,717 | 1.76 1.39 1.24 2.20 1.36 | May 8, 2017 Jan 1, 2018 Jan 1, 2020 Jan 21, 2021 Jan 1, 2019 | - - - - - | - - - - - | 31,571 | 31,571 |

| Totals | 170,717 | | | - | - | 31,571 | 31,571 |

| Rita M. Mirwald | 20,000 70,717 | 2.20 1.36 | Jan 1, 2021 Jan 1, 2019 | - - | - - | 31,571 | 31,571 |

| Totals | 90,717 | | | - | - | 31,571 | 31,571 |

Mike Sylvestre | 20,000 70,717 | 1.75 1.36 | June 20, 2021 Jan 1, 2019 | - - | - - | 31,571 | 31,571 |

| Totals | 90,717 | | | - | - | 31,571 | 31,571 |

| Brian R. Booth | 71,239 | 1.06 | April 3, 2019 | - | - | 31,785 | 31,785 |

| Totals | 71,239 | | | - | - | 31,785 | 31,785 |

The following table provides information regarding the share value vested or earned for each non-executive director during the year ended December 31, 2013.

| | Value Vested or Earned During the Year |

Name (a) | Option-based awards - Value Vested during the year ($) (b) | Share-based awards - Value Vested during the year ($) (c) | Non-equity incentive plan Compensation - Value earned during the year ($) (d) |

| Ted J. Nieman | - | 100,000 | - |

| Ronald J. Hicks | - | 100,000 | - |

| J. Robert Kowalishin | - | 100,000 | - |

| Ray A. McKay | - | 100,000 | - |

| Rita M. Mirwald | - | 100,000 | - |

| Mike Sylvestre | - | 100,000 | - |

| Brian Booth | - | 100,000 | - |

Director Compensation for 2014

In December 2013 the Board reviewed an internal benchmarking analysis of director compensation using the same comparator companies referenced in the discussion of executive compensation.

Based on this benchmarking study, the Committee believes director compensation levels were reasonable. However, given the share-price performance, the Board approved the Committee recommendation to reduce the equity component of total direct compensation by $25,000. Further, the Board approved a recommendation from the Committee that all of the directors’ equity compensation would continue to be awarded in the form of DSUs. The Committee believes the use of DSUs better links director interests with those of the Corporation’s shareholders (see “Chair Realizable Pay Analysis” below).

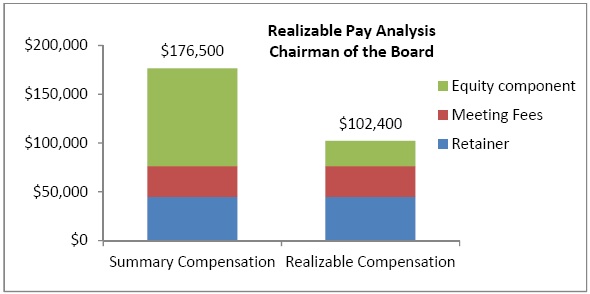

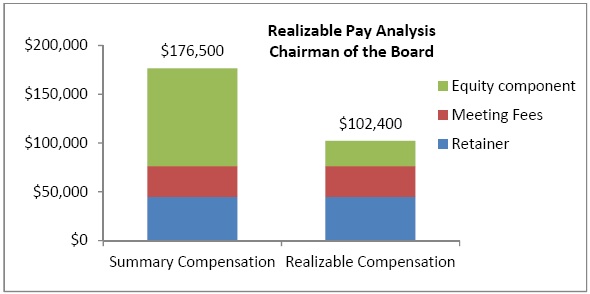

Chair Realizable Pay Analysis

As with executive compensation, the Committee focuses on total director compensation (retainer, meeting fees and the total grant date value of stock options or DSUs granted for that fiscal year) in structuring the director compensation program. In addition to reviewing total director compensation, the Committee also believes that it is important to review and assess “realizable” compensation. Realizable compensation approximates the directors’ “actual pay” and is comprised of retainer, meeting fees and the change in intrinsic value of exercisable options or DSUs. As shown in the chart below, based upon a combination of actual stock price performance, the realizable compensation of the Company’s chair for 2013 was meaningfully lower than the values reported in the Compensation detail above.

Director Equity Compensation Hedging

Pursuant to the Corporation’s policy, directors are not permitted to engage in short selling in shares or purchase financial instruments (including, for greater certainty, puts, options, calls, prepaid variable formal contracts, equity swaps, collars or units of exchange funds) that are designed to hedge or offset a change in the market value of common shares or other securities held by a director.

EXECUTIVE COMPENSATION DISCUSSION & ANALYSIS

The Corporation’s executive compensation practices and programs support our strategic growth and operational excellence goals, which are focused on increasing shareholder value. Compensation is aligned with our risk management processes to ensure there is an appropriate balance between risk and reward. The program is also designed to attract, engage and retain talented executives who have the capability to manage the Corporation’s assets in order to build and sustain shareholder value.

Our philosophy is to compensate executives with:

| • | compensation levels and opportunities that are sufficiently competitive to facilitate recruitment and retention of executives, while being fair and reasonable to shareholders; |

| • | compensation programs that reinforce the Corporation’s business strategy by rewarding the achievement of key metrics and operational performance objectives, both annual and long-term; |

| • | compensation that is responsive to the commodity-based cyclical business environment by emphasizing operational performance measures over performance measures that are more directly influenced by gold prices; |

| • | compensation programs that align executives' long-term financial interests with those of the Corporation's shareholders by emphasizing incentives in the long-term; |

| • | compensation programs that support the management of risk and ensure management's plans are focused on generating shareholder value within a risk controlled environment; and |

| • | compensation that is transparent so that both executives and shareholders understand the executive compensation program (e.g., how the program works, the goals it seeks to promote and the compensation levels and opportunities provided). |

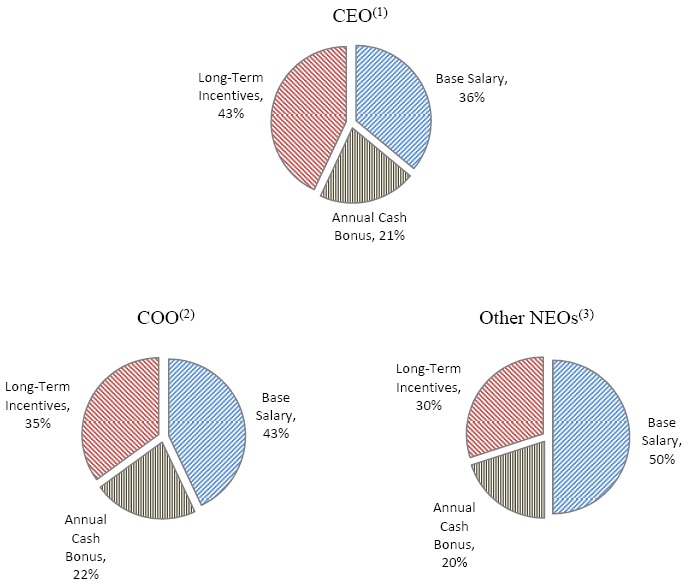

At-Risk Pay

In determining the appropriate compensation mix, consideration is given to the proportion of pay that should be at risk, based on the executive’s ability to affect the Corporation’s results, as well as the compensation mix for similar positions in the Corporation’s comparator group. Generally, the more senior the position, the greater the officer’s total compensation is “at-risk”. The Human Resources & Compensation Committee (referred to in this section as the “Committee”) generally sought to balance the Named Executive Officer (“NEO”) target compensation components at 20 to 22% short-term cash compensation and 30 to 45% long-term equity compensation in the form of stock options or Restricted Share Units (see Amendments to Long-Term Incentive Program on page 37). If the NEO’s or the Corporation’s performance is poor, the value of “at-risk” compensation will decrease and conversely, if the NEO’s or Corporation’s performance is strong, the value of “at-risk” compensation will increase.

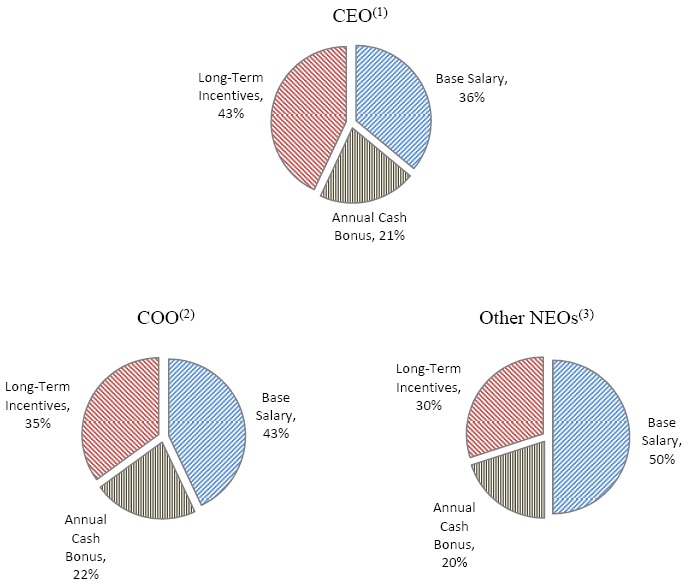

The following charts outline the Corporation’s targeted current mix of fixed and at-risk pay within the Corporation’s executive compensation plan:

| (1) | For the President and CEO, individual performance and corporate performance is weighted at 25% and 75%, respectively. |

| (2) | For the Senior Vice President & Chief Operating Officer individual performance and corporate performance is weighted at 30% and 70%, respectively. |

| (3) | For Other NEOs, individual performance and corporate performance is weighted at 35% and 65%, respectively. |

Benchmarking

The Committee believes that it is appropriate to establish compensation levels based in part on benchmarking against similar companies, both in terms of compensation practices as well as levels of compensation. In this way, the Corporation can gauge if its compensation is competitive in the marketplace for its talent, as well as ensure that the Corporation’s compensation is reasonable. When making compensation decisions the Committee may target at or near median levels of the comparator group when setting compensation levels.

Accordingly, the Committee reviews compensation levels for the NEOs against compensation levels of the comparator companies. Annually, the Committee reviews information regarding compensation programs and compensation levels among the comparator companies. The comparator group is gold mining specific, is comprised of organizations that are similar to the Corporation in terms of scope and complexity and what the Committee believes represents the market for executive talent.

The following table sets out the comparator group used for the year ended December 31, 2013:

| Kirkland Lake Gold | Premier Gold Mines Limited |

Rainy River Resources Ltd. Elgin Mining Inc. | Brigus Gold Corp. Richmont Mines Inc. |

| Wesdome Gold Mines | Rubicon Minerals Corporation |

| Veris Gold Corp. | San Gold Corporation |

| Lake Shore Gold Corp. | St. Andrews Goldfields Ltd. |

The criteria for choosing the comparator group were as follows:

| i) | companies operating in the gold sector, based in Canada, and with operations primarily in Canada; |

| ii) | companies of comparable complexity and size - as measured in terms of, revenues, market capitalization, enterprise value and total assets; and |

| iii) | companies that are either in the exploration stage only or are also in production with a comparable number of producing properties. |

The Corporation ranked, as compared to the comparator group, near the 30th percentile in relation to total assets; in the 25th to 50th percentile for revenues; and, near or below the 25th percentile for both market capitalization and enterprise value.

Managing Compensation Risks

While the mining business, by its nature, has inherent risks, the Corporation has designed and structured its corporate and compensation policies and programs to limit risk. When considering the potential risks facing the Corporation, it is important to recognize that many of the factors that influence the organization’s performance (e.g., commodity prices and foreign exchange) are outside of the direct control of Management and therefore are not subject to potential manipulation for financial gain. Given the oversight procedures and the key risk mitigation features of the Corporation’s compensation programs described below, the Committee believes that it would be difficult for anyone in Management acting alone, or acting as a group, to make “self-interest” decisions for immediate short-term gains that could have a material impact on the organization’s financial or share price performance.

Oversight Procedures

As part of its corporate governance, the Board has overseen Management’s development of the Corporation’s Enterprise Risk Management Program (“ERMP”). ERMP includes an entity-wide approach to risk identification, assessment, monitoring and management. Also, in the normal course of business, the Corporation has financial controls that provide limits in areas such as capital and operating expenditures, divestiture decisions and gold and foreign currency trading transactions. These financial controls mitigate inappropriate risk taking that could affect compensation.

Key Risk Mitigating Features

The Corporation’s compensation program has the following key features to mitigate risk: