UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | | | |

¨ | | Preliminary Proxy Statement | | ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | | Definitive Proxy Statement | | |

¨ | | Definitive Additional Materials | | |

¨ | | Soliciting Material Pursuant to §240.14a-12 | | |

CITADEL BROADCASTING CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which the transaction applies: |

| | (2) | | Aggregate number of securities to which the transaction applies: |

| | (3) | | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of the transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

CITADEL BROADCASTING CORPORATION

7201 West Lake Mead Boulevard, Suite 400

Las Vegas, Nevada 89128

(702) 804-5200

To the Stockholders of Citadel Broadcasting Corporation:

You are cordially invited to attend the 2006 Annual Meeting of Stockholders of Citadel Broadcasting Corporation (the “Company”) to be held on Wednesday, May 24, 2006, at 8:30 a.m., local time, at the JPMorgan Chase Conference Centers, 270 Park Avenue, 11th Floor Room C, New York, NY 10017.

The accompanying Notice of Annual Meeting and Proxy Statement describe the business to be transacted at the meeting. Also enclosed is a copy of the Company’s Annual Report on Form 10-K for the year ended December 31, 2005. Please read these documents so you will be informed about the business to come before the meeting.

The purpose of the Annual Meeting is to elect three members of the Company’s Board of Directors, to approve the material terms of the performance objectives that may apply to performance-based awards under the Citadel Broadcasting Corporation Amended and Restated 2002 Long-Term Incentive Plan, to approve modifications to certain existing long-term incentive compensation arrangements with our chief executive officer, to ratify the appointment of the Company’s independent accountants and to conduct such other business as may properly come before the meeting or any adjournment or postponement thereof. You are not being asked to act on any matters relating to our proposed merger with the ABC radio businesses of The Walt Disney Company, which we intend to describe to you in a separate document in the coming months.

Your vote is important, regardless of the number of shares you own. It is important that you mark, sign, date, and return the enclosed proxy card as soon as possible, whether or not you plan to attend the Annual Meeting. If you do later decide to attend, your proxy will be automatically revoked if you vote in person. Accordingly, you are urged to mark, sign, date, and return the proxy card now in order to ensure that your shares are represented at the meeting.

We appreciate your continued support.

|

Sincerely, |

|

|

Farid Suleman |

| Chairman and Chief Executive Officer |

Las Vegas, Nevada

April 17, 2006

CITADEL BROADCASTING CORPORATION

7201 West Lake Mead Boulevard, Suite 400

Las Vegas, Nevada 89128

(702) 804-5200

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 24, 2006

To the Stockholders of Citadel Broadcasting Corporation:

The 2006 Annual Meeting of Stockholders of Citadel Broadcasting Corporation (the “Company”) will be held on Wednesday, May 24, 2006 at 8:30 a.m., local time, at the JPMorgan Chase Conference Centers, 270 Park Avenue, 11th Floor Room C, New York, NY 10017. The purpose of the meeting is to consider and act upon:

| | 1. | the election of three Class III directors to the Company’s Board of Directors; |

| | 2. | the approval of the material terms of the performance objectives that may apply to performance-based awards under the Citadel Broadcasting Corporation Amended and Restated 2002 Long-Term Incentive Plan; |

| | 3. | the approval of the terms of the agreement to cancel certain fully vested stock options held by Mr. Suleman, our chief executive officer, and to replace them with fully vested restricted stock units with a deferred distribution date; |

| | 4. | the ratification of the appointment of Deloitte & Touche LLP to serve as independent accountants for the year ending December 31, 2006; and |

| | 5. | such other business as may properly come before the meeting or any adjournment or postponement thereof. |

Stockholders of record at the close of business on March 30, 2006 will be entitled to notice of and to vote at the Annual Meeting and at any adjournment or postponement thereof.

The Company’s Annual Report to Stockholders for the year ended December 31, 2005 is also enclosed.

|

By Order of the Board of Directors |

|

|

Patricia Stratford |

| Secretary |

Las Vegas, Nevada

April 17, 2006

WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING IN PERSON, PLEASE SIGN, DATE AND RETURN THE ENCLOSED PROXY CARD IN THE ENCLOSED POSTAGE PAID ENVELOPE AS PROMPTLY AS POSSIBLE. AS SPECIFIED IN THE ENCLOSED PROXY STATEMENT, A STOCKHOLDER MAY REVOKE A PROXY AT ANY TIME PRIOR TO ITS USE.

CITADEL BROADCASTING CORPORATION

7201 West Lake Mead Boulevard, Suite 400

Las Vegas, Nevada 89128

(702) 804-5200

PROXY STATEMENT

2006 Annual Meeting of Stockholders

SOLICITATION OF PROXIES

This Proxy Statement (first mailed to stockholders on or about April 21, 2006) is furnished in connection with the solicitation of proxies by Citadel Broadcasting Corporation (the “Company”) for use at the Company’s 2006 Annual Meeting of Stockholders, to be held on Wednesday, May 24, 2006, at 8:30 a.m., local time, at the JPMorgan Chase Conference Centers, 270 Park Avenue, 11th Floor Room C, New York, NY 10017, and at any adjournment or postponement thereof, for the purposes set forth in the accompanying Notice of Annual Meeting of Stockholders. Each valid proxy received in time will be voted at the meeting according to the choice specified, if any. A proxy may be revoked at any time before the proxy is voted, as outlined below.

The Company’s Annual Report on Form 10-K for the year ended December 31, 2005 accompanies this Proxy Statement but does not form a part of the proxy soliciting material.

If your shares of common stock of the Company are registered directly in your name on the records of Computershare Investor Services, you are considered a stockholder of record and will receive your proxy soliciting material from the Company. If your shares are held through a broker, bank or other financial institution, you are considered the beneficial owner of shares held in street name and will receive your proxy soliciting material from your broker, bank or other institution. If you hold your shares in street name, you are generally entitled to provide voting instructions to the registered holder.

The shares of common stock of the Company represented by valid proxies that we receive in time for the Annual Meeting will be voted as specified in such proxies. Valid proxies include all properly executed, written proxy cards received pursuant to this solicitation that are not later revoked. Voting your proxy will not limit your right to vote at the Annual Meeting if you later decide to attend in person. Executed but unvoted proxies will be voted:

FOR Proposal 1 — the election of the Board of Directors’ nominees for Class III directors;

FOR Proposal 2 — the approval of the material terms of the performance objectives that may apply to performance-based awards under the Citadel Broadcasting Corporation Amended and Restated 2002 Long-Term Incentive Plan;

FOR Proposal 3 — the approval of the terms of the agreement to cancel certain fully vested stock options held by Mr. Suleman, our chief executive officer, and to replace them with fully vested restricted stock units with a deferred distribution date; and

FOR Proposal 4 — the ratification of Deloitte & Touche LLP as the Company’s independent accountants.

If any other matters properly come before the Annual Meeting, the persons named on the proxies will, unless the stockholder otherwise specifies in the proxy, have the discretion to vote upon such matters in accordance with their best judgment.

On March 16, 2006, the compensation committee of the Board of Directors approved the grants of performance shares under the Citadel Broadcasting Corporation Amended and Restated 2002 Long-Term Incentive Plan (the “Long-Term Incentive Plan”) to three executive officers and approved modifications to existing long-term incentive compensation arrangements with the Company’s chief executive officer. The effectiveness of these actions is contingent on the Company’s receipt of stockholder approval of Proposals 2 and 3 in this Proxy Statement.

VOTING SECURITIES

The Company has one class of outstanding voting securities, common stock, par value $0.01 per share. As of March 30, 2006, there were 110,789,226 shares of common stock of the Company outstanding, net of shares held in treasury. Only stockholders of record of common stock of the Company at the close of business on March 30, 2006, which the Board of Directors has fixed as the record date, are entitled to vote at the Annual Meeting.

Each share of common stock of the Company is entitled to one vote. The presence in person or by proxy of holders of a majority of the voting power of the shares of common stock of the Company outstanding and entitled to vote at the meeting on the record date will constitute a quorum, permitting the stockholders to act on Proposal 1 regarding the election of directors; Proposal 2 regarding approval of the material terms of the performance objectives that may apply to performance-based awards under the Long-Term Incentive Plan; Proposal 3 regarding approval of the agreement to cancel certain fully vested stock options held by Mr. Suleman, our chief executive officer, and to replace them with fully vested restricted stock units with a deferred distribution date; Proposal 4 regarding the appointment of our independent accountants; and other business matters properly brought before the Annual Meeting.

The vote of a plurality of the shares of the common stock of the Company present in person or by proxy at the Annual Meeting is required to elect each of the Class III director nominees. Abstentions and broker non-votes in connection with the election of directors have no effect on such election since directors are elected by a plurality of the votes cast at the meeting.

For all other business matters, including the matters set forth in Proposals 2, 3 and 4 in this Proxy Statement, the affirmative vote of the holders of a majority of the voting power of the shares of common stock of the Company entitled to vote at the meeting and constituting a quorum is required to pass the proposal. Abstentions with respect to these other matters will be considered a vote against the proposal and broker non-votes will have no effect on such matters since these votes will not be considered present and entitled to vote for this purpose. Broker non-votes will, however, be considered as present for determining whether a quorum is present at the meeting. A broker non-vote occurs when the nominee of a beneficial owner with the power to vote on at least one matter does not vote on another matter because the nominee does not have the discretionary voting power and has not received instructions from the beneficial owner with respect to such matter.

VOTING BY PROXY

If a stockholder is a corporation or a partnership, a duly authorized person must sign the accompanying proxy card in the full corporate or partnership name. If the proxy card is signed pursuant to a power of attorney or by an executor, administrator, trustee or guardian, the signer’s full title must be given and a certificate or other evidence of appointment must be furnished. If shares are owned jointly, each joint owner must sign the proxy card.

Even after you have submitted your proxy, you may change your vote at any time before the proxy is exercised by filing with the Secretary of the Company either a notice of revocation or a duly executed proxy bearing a later date. In addition, the powers of the proxy holders will be suspended if you attend the meeting in person and vote, although attendance at the meeting will not by itself revoke a previously granted proxy.

Unless you give other instructions on your proxy card, the persons named as proxy holders on the proxy card will vote in accordance with the recommendations of the Board of Directors. The Board’s recommendation is set forth together with the description of each item in this Proxy Statement. In summary, the Board recommends a vote:

FOR Proposal 1 — the election of the Board of Directors’ nominees for Class III directors;

2

FOR Proposal 2 — the approval of the material terms of the performance objectives that may apply to performance-based awards under the Long-Term Incentive Plan;

FOR Proposal 3 — the approval of the terms of the agreement to cancel certain fully vested stock options held by Mr. Suleman, our chief executive officer, and to replace them with fully vested restricted stock units with a deferred distribution date; and

FOR Proposal 4 — the ratification of Deloitte & Touche LLP as the Company’s independent accountants.

Management is not aware of any matters, other than those specified above, that will be presented for action at the Annual Meeting, but if any other matters do properly come before the meeting, the proxy holders will vote as recommended by the Board of Directors, or, if no recommendation is given, in their own discretion.

As of March 30, 2006, Forstmann Little partnerships held approximately 69% of the combined voting power of the outstanding common stock of the Company. Accordingly, Forstmann Little partnerships will have sufficient voting power to elect all members of the Board of Directors and to control substantially all other actions that may come before the Annual Meeting.

3

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Principal Stockholders

The following table sets forth information regarding the beneficial ownership of the common stock of the Company. The table includes:

| | • | | each person who is known by the Company to be the beneficial owner of more than 5% of the outstanding common stock of the Company; |

| | • | | each of the Company’s current directors and each other person who served as a director in 2005; |

| | • | | each current executive officer of the Company named in the summary compensation table in this Proxy Statement and each other person who served as an executive officer in 2005; and |

| | • | | all such directors and all executive officers as a group. |

Except as otherwise indicated, the persons or entities listed below have sole voting and investment power with respect to all shares of common stock of the Company beneficially owned by them, except to the extent this power may be shared with a spouse. Unless indicated below, the address for each individual listed below is City Center West, Suite 400, 7201 West Lake Mead Boulevard, Las Vegas, Nevada 89128.

As of March 30, 2006, there were 110,789,226 shares of common stock of the Company outstanding, net of shares held in treasury.

| | | | | |

| | | Shares Beneficially Owned(1)

| |

Name

| | Number

| | Percent

| |

5% Stockholders: | | | | | |

Forstmann Little & Co. Equity Partnership-VI, L.P.(2) | | 34,484,608 | | 31.13 | % |

Forstmann Little & Co. Equity Partnership-VII, L.P.(2) | | 11,064,880 | | 9.99 | % |

Forstmann Little & Co. Subordinated Debt and Equity Management Buyout Partnership-VII, L.P.(2) | | 21,662,812 | | 19.55 | % |

Forstmann Little & Co. Subordinated Debt and Equity Management Buyout Partnership-VIII, L.P.(2) | | 9,065,403 | | 8.18 | % |

T. Rowe Price Associates, Inc.(3) | | 8,669,450 | | 7.83 | % |

T. Rowe Price Mid-Cap Growth Fund, Inc.(3) | | 6,500,000 | | 5.87 | % |

| | |

Directors: | | | | | |

Farid Suleman(2)(4)(5) | | 6,304,767 | | 5.47 | % |

Katherine Brown(6) | | 12,500 | | * | |

David W. Checketts(7)(8) | | 42,500 | | * | |

J. Anthony Forstmann(2)(9) | | 37,500 | | * | |

Theodore J. Forstmann(2) | | 76,277,703 | | 68.85 | % |

Gordon A. Holmes(2)(8) | | — | | * | |

Sandra J. Horbach(2) | | — | | * | |

Michael A. Miles(2)(7)(10) | | 42,500 | | * | |

Charles P. Rose, Jr.(9) | | 57,500 | | * | |

Herbert J. Siegel(11) | | 25,000 | | * | |

Wayne T. Smith(2)(12) | | 15,000 | | * | |

| | |

Other Named Executive Officers: | | | | | |

Judith A. Ellis(13) | | 237,842 | | * | |

Patricia Stratford(14) | | 21,250 | | * | |

Randy L. Taylor(15) | | 52,883 | | * | |

| | |

All Directors and Executive Officers as a Group (14 persons)(16) | | 83,126,945 | | 71.87 | % |

4

| (1) | A person or group of persons is deemed to have “beneficial ownership” of any shares of common stock of the Company when a person or persons has the right to acquire them (for example, upon exercise of an option) within 60 days of the date as of which the information is provided. For purposes of computing the percentage of outstanding shares of common stock of the Company held by each person or group of persons named above, any shares which a person or persons have the right to acquire within 60 days after the date of this Proxy Statement are deemed to be outstanding but are not deemed to be outstanding for the purpose of computing the percentage ownership of any other person. As a result, the percentage of outstanding shares of any person as shown in the table does not necessarily reflect the person’s actual voting power at any particular date. |

| (2) | The general partner of Forstmann Little & Co. Equity Partnership-VI, L.P., a Delaware limited partnership (“Equity-VI”), and Forstmann Little & Co. Equity Partnership-VII, L.P., a Delaware limited partnership (“Equity-VII”), is FLC XXXII Partnership, L.P., a New York limited partnership (“FLC XXXII”). The general partners of FLC XXXII are Theodore J. Forstmann, Winston W. Hutchins and T. Geoffrey McKay. The general partner of Forstmann Little & Co. Subordinated Debt and Equity Management Buyout Partnership-VII, L.P., a Delaware limited partnership (“MBO-VII”), and Forstmann Little & Co. Subordinated Debt and Equity Management Buyout Partnership-VIII, L.P., a Delaware limited partnership (“MBO-VIII”), is FLC XXXIII Partnership, L.P., a New York limited partnership (“FLC XXXIII”). The general partners of FLC XXXIII are Theodore J. Forstmann, Winston W. Hutchins and T. Geoffrey McKay. During his tenure as a director of the Company, Gordon A. Holmes was a general partner of FLC XXXII and FLC XXXIII, until his resignation therefrom as of November 1, 2005, at which time he became a limited partner of those partnerships. Accordingly, each of the individuals named above, other than Mr. Holmes and Mr. McKay for the reasons described below, may be deemed the beneficial owners of shares owned by Equity-VI, Equity-VII, MBO-VII and MBO-VIII and, for purposes of this table, beneficial ownership is included. While he was a general partner Mr. Holmes did not have (and as a limited partner he does not have), and Mr. McKay does not have any voting or investment power with respect to, or any economic interest in, the shares of common stock of the Company held by Equity-VI, Equity-VII, MBO-VII or MBO-VIII; and, accordingly, Mr. Holmes was not (and is not) and Mr. McKay is not deemed to be a beneficial owner of these shares. Messrs. Theodore J. Forstmann and J. Anthony Forstmann are brothers. Mr. Miles is a member of the Forstmann Little advisory board and is an investor in certain affiliated partnerships of Forstmann Little & Co., which give him an economic interest in certain portfolio investments, including the Company. Messrs. J. Anthony Forstmann, Michael A. Miles and Farid Suleman are special limited partners of Forstmann Little & Co. Sandra J. Horbach is a limited partner in FLC XXXII and FLC XXXIII, which gives her an economic interest in certain portfolio investments, including the Company, but no voting or investment power with respect to the shares of common stock of the Company held by Equity-VI, Equity VII, MBO-VII or MBO-VIII. Accordingly, Ms. Horbach is not deemed to be a beneficial owner of these shares except to the extent of any pecuniary interest therein. Wayne T. Smith is a limited partner in Equity VI and Equity VII, which gives him an economic interest, but no voting or investment power, in the shares of common stock of the Company held by those entities. Accordingly, Mr. Smith is not deemed to be a beneficial owner of these shares except to the extent of any pecuniary interest therein. None of the other limited partners in each of FLC XXXII, FLC XXXIII, Equity-VI, Equity-VII, MBO-VII and MBO-VIII is otherwise affiliated with the Company or Forstmann Little & Co. The address of FLC XXXII, FLC XXXIII, Equity-VI, Equity-VII, MBO-VII and MBO-VIII is c/o Forstmann Little & Co., 767 Fifth Avenue, New York, New York 10153. The address for J. Anthony Forstmann, Theodore J. Forstmann, Gordon A. Holmes, Sandra J. Horbach, Winston W. Hutchins, T. Geoffrey McKay, Michael A. Miles, and Farid Suleman is c/o Forstmann Little & Co., 767 Fifth Avenue, New York, New York 10153. In connection with the Agreement and Plan of Merger by and among The Walt Disney Company (“Disney”), ABC Chicago FM Radio, Inc., the Company and Alphabet Acquisition Corp., dated February 6, 2006 (the “ABC Radio Merger Agreement”), Equity-VI, Equity-VII, MBO-VII and MBO-VIII entered into a Support Agreement with Disney. In connection therewith, Disney filed a Schedule 13D with the SEC on February 15, 2006 in which Disney stated that neither the filing of the statement nor any of its contents shall be deemed to constitute an admission by Disney that it is the beneficial owner of any of the |

5

| | shares of common stock of the Company referred to therein for purposes of the Exchange Act of 1934, or for any other purpose, and Disney expressly disclaimed such beneficial ownership. |

| (3) | These securities are owned by various individual and institutional investors. As reported in the Schedule 13G filed with the SEC dated February 13, 2006, T. Rowe Price Associates, Inc. (“Price Associates”) serves as an investment adviser with power to direct investments and/or sole power to vote the securities. Price Associates has sole voting power over 1,389,800 shares and sole dispositive power over 8,669,450 shares, which includes 6,500,000 shares over which T. Rowe Price Mid-Cap Growth Fund, Inc. (“Price Mid-Cap”) has sole voting power. For purposes of the reporting requirements of the Securities Exchange Act of 1934, Price Associates may be deemed to be a beneficial owner of such securities; however, Price Associates expressly disclaims that it is, in fact, the beneficial owner of such securities. The address of Price Associates and Price Mid-Cap is 100 E. Pratt Street, Baltimore, Maryland 21202. |

| (4) | Includes 4,462,500 shares subject to options that are currently exercisable or exercisable within 60 days of the date as of which this information is provided. Also includes 1,250,000 shares of restricted stock which vest in three equal portions annually, commencing on September 20, 2006. On March 16, 2006, the compensation committee approved the cancellation of the fully vested options to purchase 4,150,000 shares of common stock of the Company at an exercise price of $3.50 per share granted to Mr. Suleman under the Stock Option Agreement, dated April 23, 2002, as amended on June 4, 2002, and replacement of them with 2,868,006 fully vested restricted stock units with a deferred distribution date. In addition, the compensation committee approved the cancellation of Mr. Suleman’s option to purchase 400,000 shares of common stock of the Company at an exercise price of $16.94 granted to him under the Long-Term Incentive Plan on March 26, 2004 and approved the grant of 1,131,994 shares of performance-based restricted stock that will vest over a two-year period subject to certain performance objectives. The compensation committee also approved modifications to the vesting terms of Mr. Suleman’s 1,250,000 shares of restricted stock to make them subject to the Company’s satisfaction of certain performance objectives and to extend the vesting dates to January 1, 2007, October 1, 2007 and October 1, 2008. The effectiveness of these actions is subject to stockholder approvals of Proposals 2 and 3 in this Proxy Statement. Assuming stockholder approval is received at the Annual Meeting, as of the date hereof Mr. Suleman would be deemed the beneficial owner of 5,954,767 shares of common stock of the Company, representing 5.18% of the common stock outstanding. |

| (5) | Mr. Suleman holds 20,000 shares as custodian for his children, for which he disclaims any beneficial ownership. These shares were not considered for purposes of calculating Mr. Suleman’s beneficial ownership interest. |

| (6) | Includes 12,500 shares subject to options that are currently exercisable or exercisable within 60 days of the date as of which this information is provided. |

| (7) | Includes 42,500 shares subject to options that are currently exercisable or exercisable within 60 days of the date as of which this information is provided. |

| (8) | Mr. Holmes and Mr. Checketts resigned from the Board of Directors effective November 1, 2005 and March 27, 2006, respectively. |

| (9) | Includes 37,500 shares subject to options that are currently exercisable or exercisable within 60 days of the date as of which this information is provided. |

| (10) | Pursuant to a contractual arrangement with FLC XXXII Partnership, L.P., an affiliate of Forstmann Little & Co. Equity Partnership-VI, L.P., Mr. Miles is entitled to payment from such affiliate in respect of certain share dispositions to the extent proceeds of dispositions exceed $13.00 per share. Alternatively, Mr. Miles may purchase such shares for $13.00 per share. These shares were not considered for purposes of calculating Mr. Miles’ beneficial ownership interests. |

| (11) | Includes 25,000 shares subject to options that are currently exercisable or exercisable within 60 days of the date as of which this information is provided. |

| (12) | Mr. Smith became a director on April 10, 2006. |

| (13) | Includes 168,750 shares subject to options that are currently exercisable or exercisable within 60 days of the date as of which this information is provided. On March 16, 2006, the compensation committee approved the grant of 100,000 shares of performance-based restricted stock that will vest over a two-year period subject to certain performance objectives. The effectiveness of this grant is subject to stockholder approval of Proposal 2 in this Proxy Statement. Assuming stockholder approval is received at the Annual Meeting, as |

6

| | of the date hereof Ms. Ellis would be deemed the beneficial owner of 337,842 shares of common stock of the Company, representing less than 1% of the common stock outstanding. |

| (14) | Includes 16,250 shares subject to options that are currently exercisable or exercisable within 60 days of the date as of which this information is provided. On March 16, 2006, the compensation committee approved the grant of 50,000 shares of performance-based restricted stock that will vest over a two-year period subject to certain performance objectives. The effectiveness of this grant is subject to stockholder approval of Proposal 2 in this Proxy Statement. Assuming stockholder approval is received at the Annual Meeting, as of the date hereof Ms. Stratford would be deemed the beneficial owner of 66,250 shares of common stock of the Company, representing less than 1% of the common stock outstanding. |

| (15) | Mr. Taylor resigned and terminated his employment with the Company effective October 1, 2005. |

| (16) | Includes 4,845,000 shares subject to options that are currently exercisable or exercisable within 60 days of the date as of which this information is provided. |

Stockholder’s Agreements

In June 2001, 15 employees (together with two entities controlled by an employee) were awarded the right to purchase, and actually purchased, shares of common stock of the Company. Mr. Taylor, one of the Company’s named executive officers in fiscal year 2005 who resigned at the end of the third quarter, was among these 15 employees and purchased 88,785 shares of common stock of the Company for approximately $6.76 per share. In accordance with the terms of Mr. Taylor’s stockholder’s agreement, upon his departure from the Company in 2005, the Company purchased from him 17,757 shares of common stock of the Company. In addition, at the time of his appointment as Chief Executive Officer, Mr. Suleman purchased 1,143,000 shares of class B common stock of the Company at a purchase price of $3.50 per share, which shares were converted into 592,074 shares of common stock of the Company in connection with the Company’s initial public offering. In May 2003, Judith A. Ellis, the Company’s Chief Operating Officer, was awarded the right to purchase, and actually purchased, a total of 48,899 shares of common stock of the Company for approximately $10.23 per share. The price paid for these shares was based upon the estimated fair value of the shares on the date of purchase. These members of our management entered into stockholder’s agreements relating to these shares of common stock of the Company, which, among other things, restrict the transfer of the shares of common stock. The stockholder’s agreements are substantially identical and are summarized below. As of March 30, 2006, the Company has an aggregate amount of 1,262,759 shares of common stock of the Company subject to stockholder’s agreements.

The stockholder’s agreements provide that the stockholder may participate proportionately in any sale by the Forstmann Little partnerships of their shares of common stock of the Company to a third party. In addition, the stockholder may, and may be required to (if determined by the Board of Directors), participate proportionately in a public offering of shares of common stock of the Company by the Forstmann Little partnerships, by selling the same percentage of his or her shares that the Forstmann Little partnerships are selling of their shares. If the Forstmann Little partnerships sell their common stock of the Company to a third party, the Forstmann Little partnerships may require the stockholder to sell a proportionate amount of his or her shares and, if stockholder approval of the transaction is required, to vote his or her shares in favor of the sale. The provisions described in this paragraph are expected to be terminated prior to the closing of the transactions pursuant to which the Company will combine with the ABC Radio Stations and ABC Radio Network businesses, in accordance with the terms of the ABC Radio Merger Agreement.

If a stockholder’s employment is terminated, the Company has the option to purchase any unvested shares of common stock of the Company held by the stockholder that are subject to the terms of a stockholder’s agreement. The purchase price for these shares is the stockholder’s cost. If a stockholder engages in prohibited or competitive activities, or criminal acts, or grossly or willfully neglects his or her duties, we have the option to purchase any shares of common stock of the Company held by the stockholder that are subject to the terms of a stockholder’s agreement. The purchase price for these shares is the lesser of the stockholder’s cost or the book value per share.

7

If a stockholder’s employment is terminated without cause, a stockholder may require the Company to purchase all, but not less than all, of the shares of common stock of the Company held by the stockholder that are subject to the terms of a stockholder’s agreement. The purchase price for these shares is the stockholder’s cost, except that in the case of the repurchase of vested shares from a stockholder terminated by reason of death, permanent disability or adjudicated incompetency, the purchase price is fair value.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) requires the Company’s executive officers and directors and persons who own more than 10% of the common stock of the Company to file reports of ownership and changes in ownership of common stock of the Company with the Securities and Exchange Commission (the “SEC”) and the New York Stock Exchange (the “NYSE”). Based solely on a review of copies of such reports and written representations from the reporting persons, the Company believes that during the year ended December 31, 2005, its executive officers, directors and greater than 10% stockholders filed on a timely basis all reports due under Section 16(a) of the Exchange Act, with two exceptions: Ms. Judith A. Ellis, the Company’s Chief Operating Officer, and Ms. Patricia Stratford, the Company’s Acting Chief Financial Officer, each made one late filing, in each case due to an unintentional administrative oversight. Ms. Ellis’s filing was to reflect the grant of options to her in February 2005 and Ms. Stratford’s filing was in connection with her becoming a named executive officer of the Company.

CORPORATE GOVERNANCE

Companies listed on the NYSE must comply with certain standards regarding corporate governance, as codified in Section 303A of the Listed Company Manual of the NYSE, with some exceptions. A company of which more than 50% of the voting power is held by an individual, a group or another company need not comply with the requirements of Sections 303A.01 Independent Directors, 303A.04 Nominating/Corporate Governance Committee or 303A.05 Compensation Committee. Since four of the Company’s stockholders, Forstmann Little & Co. Equity Partnership-VI, L.P., Forstmann Little & Co. Equity Partnership-VII, L.P., Forstmann Little & Co. Subordinated Debt and Equity Management Buyout Partnership-VII, L.P. and Forstmann Little & Co. Subordinated Debt and Equity Management Buyout Partnership-VIII, L.P., which are affiliates of each other, control 69% of the combined voting power of the common stock of the Company, the Company has elected to avail itself of the above exemptions from these three requirements. Accordingly, the Company’s Board of Directors has standing compensation and audit committees, but not a nominating/corporate governance committee. The Board has affirmatively determined that Charles P. Rose, Jr., Wayne T. Smith, at least two of the members of the compensation committee, Sandra J. Horbach and Herbert J. Siegel, and both members of the audit committee, Katherine Brown and Michael A. Miles, qualify as “independent” under the NYSE’s and SEC’s corporate governance rules, and that our Chairman and Chief Executive Officer, Farid Suleman, does not qualify as “independent” under either set of rules.

The Company has undertaken a review of its corporate governance policies and taken the following measures to comply with the rules and regulations of the SEC and NYSE regarding corporate governance practices:

| | • | | Adopted governance guidelines for the Board of Directors. |

| | • | | Adopted procedures for our non-management directors to meet in executive sessions. |

| | • | | Adopted a Code of Business Conduct and Ethics that is applicable to all of our directors, officers and employees. |

| | • | | Adopted a Code of Ethics that is applicable to our principal executive officer and senior financial and accounting officers. |

8

| | • | | Adopted a policy on reporting of improper financial practices to address accounting or auditing concerns. |

| | • | | Adopted an Audit Committee Charter, incorporating the applicable requirements of Sarbanes-Oxley, the New York Stock Exchange and the related regulations. |

| | • | | Adopted a Compensation Committee Charter, incorporating the applicable requirements of Sarbanes-Oxley, the New York Stock Exchange and the related regulations. |

| | • | | Adopted a procedure for handling complaints regarding accounting matters. |

| | • | | Adopted a Securities Trading Policy to ensure that persons subject to the reporting requirements of Section 16 of the Exchange Act will be able to comply with all applicable filing requirements in a timely manner. |

The Company’s Corporate Governance Guidelines, Code of Business Conduct and Ethics and Code of Ethics for Principal Executive and Senior Financial and Accounting Officers, as well as the Audit Committee Charter and Compensation Committee Charter are available on the Company’s website at www.citadelbroadcasting.com.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

In June 2001, the Company was capitalized by four partnerships affiliated with Forstmann Little & Co. and members of the Company’s management to acquire Citadel Communications Corporation, which was then a publicly owned company. The Company financed the acquisition by issuing its common stock to the Forstmann Little partnerships and members of management, by incurring indebtedness under a new credit facility and by issuing an aggregate of $500 million of subordinated debentures to two of the Forstmann Little partnerships. These partnerships immediately distributed the subordinated debentures to their respective limited partners. The subordinated debentures were general senior subordinated obligations, were not subject to mandatory redemption and were to mature in three equal annual installments beginning June 26, 2012, with the final payment due on June 26, 2014. The debentures bore interest at a fixed rate of 6%, payable semi-annually in June and December each year. On February 18, 2004, the Company prepaid all of the outstanding subordinated debentures with the net proceeds from the offering by the Company of 9,630,000 shares of common stock and the issuance of $330.0 million of convertible subordinated notes.

Each of the four Forstmann Little partnerships has a contractual right, for so long as it holds any shares of common stock of the Company, to designate a nominee for election to the Company’s Board of Directors, and the Company is obligated to solicit proxies in favor of each of these four nominees and to use reasonable efforts to cause each of these four nominees to be elected. The contractual rights to designate a nominee for election to the Company’s Board of Directors described in this paragraph are expected to be terminated prior to the closing of the transactions pursuant to which the Company will combine with the ABC Radio Stations and the ABC Radio Network businesses, in accordance with the terms of the ABC Radio Merger Agreement.

The Company has also granted to the Forstmann Little partnerships six demand rights to cause the Company to file a registration statement under the Securities Act covering resales of all shares of common stock of the Company held by the Forstmann Little partnerships, and to cause the registration statement to become effective. The registration rights agreement also grants “piggyback” registration rights permitting the Forstmann Little partnerships to include their registrable securities in a registration of securities by the Company. Under the agreement, the Company will pay the expenses of these registrations.

The Company reimburses Forstmann Little & Co. and its affiliates for expenses paid on the Company’s behalf and receives reimbursements from Forstmann Little & Co. for expenses paid on its behalf, including travel and related expenses, and office and other miscellaneous expenses. For the year ended December 31, 2005, the

9

Company reimbursed Forstmann Little & Co. and its affiliates a net amount of approximately $2.2 million. Forstmann Little & Co. also provides use of office space to certain of the Company’s executive officers and employees at no cost.

FL Aviation Corp., an affiliate of Forstmann Little & Co., operates and maintains the Company’s corporate aircraft at cost. In connection therewith, the Company reimburses all costs incurred by FL Aviation Corp. in operating the aircraft.

The Company’s Chairman and Chief Executive Officer, Farid Suleman, is a special limited partner of Forstmann Little & Co. Mr. Suleman was paid approximately $0.6 million in 2005 for providing advice and consulting services to Forstmann Little & Co. as a special limited partner. Mr. Suleman has the right to invest in Forstmann Little & Co. portfolio investments from time to time. Mr. Suleman has informed us that he has not invested in the Forstmann Little partnerships’ investments.

Certain of our other directors also have or have had relationships with Forstmann Little & Co. Theodore J. Forstmann is the senior partner of Forstmann Little & Co. J. Anthony Forstmann is his brother and a special limited partner of Forstmann Little & Co. Michael A. Miles also is a special limited partner of Forstmann Little & Co. and serves on the Forstmann Little advisory board. Sandra J. Horbach and Gordon A. Holmes each were general partners of the Forstmann Little partnerships that are general partners of the funds that own shares of common stock of the Company until they resigned from those positions in 2004 and as of November 1, 2005, respectively, and became limited partners of those partnerships. Wayne T. Smith is a limited partner of two of the funds that own shares of common stock of the Company. As a result of their relationships with Forstmann Little & Co., Messrs. T. Forstmann, Anthony Forstmann, Miles and Smith and Ms. Horbach have an economic interest in certain of the Forstmann Little & Co. partnerships and their portfolio investments, including the Company, but of those directors, only Mr. T. Forstmann has any voting or investment power over the shares of common stock of the Company. Herbert J. Siegel serves as a director of IMG Worldwide Holdings Inc., a majority of the stock of which is controlled by certain affiliated partnerships of Forstmann Little & Co. David W. Checketts, a director of the Company until his resignation effective March 27, 2006, also serves as a director of IMG Worldwide Holdings Inc. In addition, on January 31, 2005, Mr. T. Forstmann made a loan in the principal amount of $3,500,000 to Sports Capital Partners, LLC, an entity controlled by Mr. Checketts. The loan was repaid in its entirety, with interest, prior to the end of the third quarter in fiscal year 2005.

On February 18, 2004, the Company completed a public offering of 29,630,000 shares of its common stock at $19.00 per share, including 9,630,000 primary shares sold by the Company and 20,000,000 shares sold by certain of the Company’s stockholders. The 20,000,000 shares included 19,856,626 and 18,338 shares of common stock of the Company sold by Forstmann Little & Co. and its affiliates and Randy Taylor, a former executive officer of the Company, respectively.

Randy L. Taylor, a former executive officer of the Company, was indebted to the Company since June 2001 under a promissory note which bore an annual interest rate of 5.02%. This note was delivered to the Company by Mr. Taylor in partial payment for his purchase of common stock of the Company. The promissory note was secured by the 88,785 shares of common stock of the Company to which it relates. On February 18, 2004, Mr. Taylor repaid $304,466 of his note using proceeds of the sale of 18,338 shares of common stock of the Company, and in July 2004, Mr. Taylor repaid an additional $75,000. In connection with his departure from the Company in 2005, Mr. Taylor repaid in full all outstanding amounts owed under the promissory note.

MEETINGS AND COMMITTEES OF THE BOARD OF DIRECTORS

During the year ended December 31, 2005, the Board of Directors met six times. During 2005, each director attended at least 75% of the total number of meetings of the Board of Directors, except for Messrs. Anthony Forstmann and Rose, who each attended four out of the six meetings.

10

As discussed above under the heading, “Corporate Governance”, the Company has elected to avail itself of the exemptions from the NYSE corporate governance rules under Section 303A available to listed companies of which more than 50% of the voting power is held by an individual, a group or another company. Accordingly, during the year ended December 31, 2005, the Board had two standing committees, the audit committee and the compensation committee, and did not have any other standing committees.

Although the Board does not have a formal nominating/governance committee, Theodore Forstmann, Sandra J. Horbach and Farid Suleman have from time to time acted as an ad hoc committee for the purpose of identifying and recruiting qualified Board members consistent with the principles and director qualifications set forth in the Company’s Corporate Governance Guidelines. In addition, as discussed at page 39 of this Proxy Statement, stockholders may propose nominees for consideration by the Board by timely submitting names and supporting information to the Chairman of the Board or to the Company’s Secretary.

The Board has not designated a presiding director of executive sessions held on a regular basis by non-management directors. Instead, a presiding director is selected at the time of such sessions by the other non-management directors present.

Any interested party that wishes to communicate directly with the non-management directors may do so by writing to the following address:

Citadel Broadcasting Corporation

Attn: Non-Management Directors

7201 W. Lake Mead Blvd., Suite 400

Las Vegas, Nevada 89128

or by sending an email to the following address:

nonmanagementdirectors@citcomm.com

Communications will be distributed as appropriate to the Board depending upon the facts and circumstances outlined in the communication.

The Company does not have a policy regarding Board members’ attendance at the annual meeting of stockholders.

The Audit Committee

The audit committee provides assistance to the Company’s Board of Directors in fulfilling its legal and fiduciary obligations in matters involving the Company’s accounting, auditing, financial reporting, internal control and legal compliance function. The audit committee also oversees the audit efforts of the Company’s independent accountants and takes those actions it deems necessary to satisfy itself that the accountants are independent of management.

The audit committee is primarily responsible for oversight of the integrity of the financial reporting process and financial statements of the Company. In general, the audit committee is responsible for the financial statements and disclosure matters, oversight of the Company’s relationship with the independent accountants, oversight of the Company’s internal audit function and oversight of compliance responsibilities. As part of these responsibilities, the audit committee, among other things:

| | • | | appoints, retains and replaces the independent accountants for the Company; |

| | • | | reviews the compensation of and services performed by the independent accountants, including non-audit services (if any); |

| | • | | reviews and discusses the preparation of quarterly and annual financial reports with the Company’s management and its independent accountants; |

11

| | • | | discusses with its independent accountants the matters required by SAS 61,Codification of Standards on Auditing Standards and evaluating the independence of the accountants in accordance with Independence Standards Board Standard No. 1,Independence Discussions with Audit Committees; |

| | • | | reviews and discusses major issues regarding the Company’s accounting principles with management and financial statement presentations and major issues as to the adequacy of the Company’s internal controls; |

| | • | | reviews and discusses the initial adoption of, and all significant changes to, critical accounting policies and practices used by the Company with the independent accountants; |

| | • | | evaluates the qualifications, performance and independence of the auditors; |

| | • | | reviews the significant reports to management prepared by the internal auditing department and any management responses; and |

| | • | | reviews reports and disclosures of insider and affiliated party transactions. |

The members of the audit committee in 2005 were Michael A. Miles, David W. Checketts and Katherine Brown. Effective March 27, 2006, Mr. Checketts resigned from our Board of Directors. The Board of Directors has appointed Wayne T. Smith to replace Mr. Checketts on the Board and, effective May 1, 2006, to serve as a member of the audit committee.

The Board of Directors has considered the independence of each of the members of the audit committee and Mr. Smith and determined that each of them qualifies as independent under rules of the NYSE and the SEC. The Board of Directors made this determination after considering the following relationships and assessing the potential effect of these relationships on the independence of the named director:

| | • | | Mr. Miles is a member of the Forstmann Little advisory board and an investor in certain affiliated partnerships of Forstmann Little & Co., which give him an economic interest in certain portfolio investments, including the Company. |

| | • | | Mr. Miles is a special limited partner of Forstmann Little & Co. |

| | • | | Mr. Smith is a limited partner in two of the partnerships of Forstmann Little & Co., which gives him an economic interest in certain portfolio investments, including the Company. |

| | • | | Mr. Smith is a director of 24 Hour Fitness Worldwide, Inc., a majority of the stock of which is controlled by certain affiliated partnerships of Forstmann Little & Co. |

| | • | | Mr. Smith is the Chairman of the Board, President and CEO of Community Health Systems, Inc. (“CHS”), a majority of the stock of which was controlled by certain affiliated partnerships of Forstmann Little & Co. until their sale of their interest in CHS in 2004. |

The Board of Directors has determined that the relationships discussed above do not affect the independence of Mr. Miles because he has not made any commitment to the affiliated partnerships of Forstmann Little & Co. and none of the rights of an advisory board member or a special limited partner of Forstmann Little & Co. are contingent in any way on or affected by his continued service as a director or member of our audit committee nor do his duties as an advisory board member and special limited partner of Forstmann Little & Co. conflict with his duties as a member of the audit committee. The Board of Directors is not aware of any other relationships involving the audit committee and the Company that required an assessment of materiality by the Board.

The Board of Directors has determined that the relationships discussed above do not affect the independence of Mr. Smith because none of the rights of a limited partner of the affiliated partnerships of Forstmann Little & Co. or his duties as the Chairman, President and CEO of CHS or as a director of 24 Hour Fitness Worldwide, Inc. are contingent in any way on or affected by his continued service as a director or member of our audit committee nor conflict with his duties as a director or member of the audit committee. The Board of Directors is not aware of any other relationships involving the audit committee and the Company that required an assessment of materiality by the Board.

12

The Board, in its business judgment, has determined that each of the audit committee members and Mr. Smith is financially literate. In addition, the Board of Directors has determined that Mr. Miles is an “audit committee financial expert” as defined under the applicable rules of the SEC.

During 2005, the audit committee held seven meetings, including four meetings to review quarterly results with the independent auditors. Each director who was a member of the audit committee during 2005 attended all of the meetings of the committee. The Board of Directors has adopted a written audit committee charter. The charter is attached hereto asAppendix A and is also available on the Company’s website at www.citadelbroadcasting.com or upon the request of the stockholder by writing to the Company’s Secretary at 7201 West Lake Mead Boulevard, Suite 400, Las Vegas, NV 89128.

Report of the Audit Committee

The audit committee reviewed and discussed with both management and its independent accountants all financial statements prior to their filing with the SEC. In connection with the December 31, 2005 financial statements, the audit committee (1) reviewed and discussed the audited financial statements with management, including any significant transactions or issues; and (2) discussed with the independent auditors the matters required by Statement on Auditing Standards No. 61, as amended. The audit committee also discussed with Deloitte & Touche LLP (“D&T”) their independence, including a consideration of the compatibility of non-audit services with such independence, and received from D&T written disclosures and the letter from D&T required by Independent Standards Board Standard No. 1,Independence Discussions with Audit Committees. Based upon these reviews and discussions, the audit committee has recommended that the Board of Directors include the audited financial statements in the Company’s Annual Report filed with the Securities and Exchange Commission on Form 10-K for the fiscal year ended December 31, 2005.

This report is respectfully submitted by the Audit Committee of the Board of Directors.

Katherine Brown

Michael A. Miles

The Compensation Committee

The Board of Directors established a compensation committee on February 24, 2005. Three members of the Board serve on the compensation committee: Sandra J. Horbach, chairperson, Theodore J. Forstmann and Herbert J. Siegel. Although the Company continues to avail itself of the exemptions from the NYSE corporate governance rules under Section 303A available to listed companies of which more than 50% of the voting power is held by an individual, a group or another company, the Board has considered the independence of each of the members of the compensation committee and determined that Ms. Horbach and Mr. Siegel qualify as independent directors under the rules of the NYSE.

The compensation committee is responsible for discharging the Board’s duties and responsibilities relating to compensation of the Company’s directors and executive officers and overseeing the Company’s various employee welfare and benefits plans. These duties include discussing, reviewing and determining the compensation of our chief executive officer and other senior executives, reviewing and recommending compensation plans for the Company, modifying existing compensation plans, making awards under such plans and performing such other functions as are designated in the compensation committee charter or commonly performed by compensation committees.

The compensation committee met two times during the fiscal year ending December 31, 2005, and each director who is a member of the compensation committee attended all the meetings. The compensation committee has a written charter that is available to the public on the Company’s website at www.citadelbroadcasting.com or upon request of the stockholder by writing to the Company’s Secretary at 7201 West Lake Mead Boulevard, Suite 400, Las Vegas, NV 89128.

13

Report of the Compensation Committee

Fiscal 2005 Executive Compensation

It is the policy of the Board and compensation committee to provide attractive compensation packages to the Company’s executive officers to attract and retain individuals with the appropriate experience and skills, to motivate them to devote their full energies to our success, to reward them for their services and to align their interests with the interests of our stockholders. Considering all of the foregoing, our executive compensation packages currently consist primarily of base salaries, annual cash bonuses, stock options, restricted shares of our common stock and other stock-based incentive compensation.

Section 162(m) of the Internal Revenue Code generally provides that a publicly held corporation will be able to deduct, for federal income tax purposes, compensation paid to its named executive officers in excess of $1,000,000 per year only if the compensation is paid pursuant to qualified performance-based compensation plans approved by our stockholders. Compensation as defined under Section 162(m) includes, among other things, base salary, incentive compensation and income attributable to stock option and restricted stock transactions. The compensation committee’s primary objective in designing and administering our compensation policies is to support and encourage the achievement of our long-term strategic goals and to enhance stockholder value. When consistent with this compensation philosophy, the compensation committee also intends to structure its compensation programs such that compensation paid thereunder will be tax deductible by us to the maximum extent possible. The compensation committee intends to consider, on a case-by-case basis, how Section 162(m) will affect our compensation plans and contractual and discretionary compensation but reserves the right to pay compensation that is not deductible under Section 162(m).

Determinations as to appropriate base salaries of our executive officers are largely subjective and do not depend upon the application of a particular formula or the use of designated benchmarks. In general, the level of base salary is intended to provide appropriate base pay to our executive officers, taking into account the competitive employment market for comparable positions, each individual’s historical contribution to our success, each individual’s unique value and, when appropriate, the recommendations of Mr. Suleman. In establishing base salaries for our executive officers in 2005, we considered numerous factors, including a subjective assessment of each individual’s performance, the nature of the individual’s responsibilities, the individual’s contributions and importance to us, the individual’s historical compensation and the nature and extent of the individual’s other forms of compensation. We anticipate that future determinations of base salary made by the compensation committee will be based on similar factors. More information is available in the Summary Compensation Table provided on page 17.

Cash bonuses are generally based on the achievement of specific financial and operating objectives such as targeted results for EBITDA and free cash flow. Each executive officer is assigned a target bonus, which is generally expressed as a percentage of base salary. Target bonuses vary in relation to each individual’s responsibilities. Cash bonuses are paid based on the achievement of individual objectives considered along with our performance as a whole. In certain cases, bonuses have been guaranteed based on the compensation package negotiated at the time of employment. All of our executive officers are participants in the bonus program. More information is available in the Summary Compensation Table provided on page 17.

We also utilize long-term incentive awards as a means of linking our directors’, executives’ and other employees’ interests with our stockholders’ interests, supporting business plans and long-term Company goals, tying executive compensation to Company performance and attracting and retaining talented leadership. We generally use stock options, restricted shares of our common stock, restricted stock units and other stock-based incentive compensation to provide such long-term incentive compensation. The compensation committee determines the number of incentive awards granted to our executive officers and other employees on an

14

individual, discretionary basis based, as appropriate, on the recommendation of Mr. Suleman, discussions with outside advisors and the deliberations of the compensation committee.

In the past, these awards primarily have been comprised of stock options and time-vesting restricted stock. The Long-Term Incentive Plan, however, also permits other types of awards, including stock appreciation rights, performance awards and phantom shares. On March 16, 2006, we approved the grants of performance shares to three executive officers and approved modifications to existing time-vesting restricted stock held by the Company’s chief executive officer, subject to receipt of stockholder approval to Proposal 2 in this Proxy Statement. If the stockholders approve the material terms of the performance objectives that may apply to performance-based awards under the Long-Term Incentive Plan contained in Proposal 2 in this Proxy Statement, then in addition to the grants made on March 16, 2006, we may increasingly utilize performance awards in our approach to long-term incentive compensation.

Compensation of the Chief Executive Officer

All compensation awarded in 2005 to our CEO, Farid Suleman, was made pursuant to the terms of compensation arrangements negotiated on the Board’s behalf by Theodore Forstmann and Sandra Horbach at the time Mr. Suleman joined us in 2002 and subsequently renegotiated and approved by us on October 25, 2005. In 2005, this payment included a base salary of $1,074,375 and a year-end bonus of $681,000. Effective as of September 20, 2005, Mr. Suleman became eligible to receive an annual salary in the amount of $1,250,000, subject to annual review and adjustment by the compensation committee, and the value of the annual bonus that Mr. Suleman is eligible to receive is between $1 million and $2 million, the actual value of which is to be set by the compensation committee and to be payable either in cash or in the form of warrants to purchase common stock of the Company at the option of the compensation committee, in both cases in accordance with past practices. In addition, in 2005 we granted to Mr. Suleman options to purchase 450,000 shares of common stock of the Company and 1,250,000 shares of time-vesting restricted stock. The 450,000 stock options vest in four annual installments, beginning on May 24, 2006, and have an exercise price of $13.50 per share. The 1,250,000 shares of time-vesting restricted stock vest in three annual portions, beginning on September 20, 2006. Other than as described in the Summary Compensation Table on page 17 in this Proxy Statement, Mr. Suleman received no other compensation from us in 2005, and, accordingly, neither the Board nor the compensation committee took any other action with respect to Mr. Suleman’s compensation during the year.

As described in more detail under Proposals 2 and 3 in this Proxy Statement, on March 16, 2006, subject to stockholder approval of the material terms of the performance objectives that may apply to performance-based awards under the Long-Term Incentive Plan at the Annual Meeting, we approved the modification of the vesting terms of the 1,250,000 shares of restricted stock granted to Mr. Suleman effective September 20, 2005, to subject them to additional criteria based on the Company’s attainment of certain revenue-related performance objectives and to extend the applicable vesting dates to January 1, 2007, October 1, 2007 and October 1, 2008. We also granted to Mr. Suleman, subject to receipt of the same stockholder approval, 1,131,994 performance-vesting restricted shares, which are also subject to the Company’s attainment of certain revenue-related performance objectives and Mr. Suleman’s continued employment, and vest in two equal installments beginning on March 16, 2007. Also on March 16, 2006, and subject to stockholder approval, we approved the cancellation of the fully vested options to purchase 4,150,000 shares of common stock of the Company at an exercise price of $3.50 per share granted to Mr. Suleman under the Stock Option Agreement, dated April 23, 2002, as amended on June 4, 2002, and the replacement of them with 2,868,006 fully vested restricted stock units with a deferred distribution date. Finally, subject to receipt of the stockholder approvals described above, we also approved the cancellation of Mr. Suleman’s option to purchase 400,000 shares of common stock of the Company at an exercise price of $16.94 granted to him under the Long-Term Incentive Plan on March 26, 2004.

This report is respectfully submitted by the compensation committee.

Sandra J. Horbach,Chairperson

Theodore J. Forstmann

Herbert J. Siegel

15

Director Compensation

Our directors who are members of management (currently only Mr. Suleman) do not receive additional compensation for their service on the Board of Directors. The compensation that has been paid to Mr. Suleman in connection with his service as the Company’s chief executive officer is described below in the executive compensation section of this Proxy Statement.

We compensate each of our directors who is not an employee of the Company or any of its subsidiaries, a general partner or employee of Forstmann Little & Co. or a relative of any such person for his or her service on the Board of Directors through a combination of cash payments and stock option grants. For meetings occurring in the year ended 2005, Katherine Brown, David W. Checketts, Sandra J. Horbach, Michael A. Miles, Herbert J. Siegel and Charles P. Rose each earned quarterly payments in the amount of $5,000 for their service on the Board and, if applicable, $2,500 for their service on a committee of the Board. Ms. Brown and Messrs. Checketts and Miles served on the audit committee in 2005, and Ms. Horbach and Mr. Siegel served on the compensation committee.

On October 25, 2002, the Company granted options to purchase 50,000 shares of common stock of the Company to David W. Checketts, J. Anthony Forstmann and Michael A. Miles. On February 28, 2003, the Company granted Charles P. Rose, Jr. options to purchase 50,000 shares of common stock of the Company. The exercise price of the options granted to Messrs. Checketts, Forstmann, Miles and Rose is $16.00, which was based on the estimated fair market value of the underlying common stock of the Company on the date of grant. The options have a term of ten years and vest in four equal annual installments beginning on the first anniversary of the grant date, so long as the holder is a director of the Company on the applicable vesting date. On July 28, 2003, the Company granted options to purchase 50,000 shares of common stock of the Company to Herbert J. Siegel. The exercise price of Mr. Siegel’s options was the initial public offering price of $19.00 per share. On March 2, 2004, the Company granted options to purchase 10,000 shares of common stock of the Company to each of Messrs. Checketts and Miles at an exercise price of $18.79, which is equal to the fair market value on the date of grant. On September 29, 2004, the Company granted options to purchase 50,000 shares of common stock of the Company to Katherine Brown. The exercise price of Ms. Brown’s options is $12.71, which is equal to the fair market value on the date of grant.

16

Executive Compensation

The following table sets forth information with respect to compensation for the last three completed fiscal years (or, if shorter, the actual period of employment) paid for services to the Company’s Chief Executive Officer and the Company’s three other most highly paid executive officers during the fiscal year ended December 31, 2005.

Summary Compensation Table

| | | | | | | | | | | | | | |

| | | Annual Compensation

| | Long-Term

Compensation

| | | |

Name and Position

| | Year

| | Base

Salary ($)

| | Bonus ($)

| | Securities

Underlying

Options (#)

| | | Restricted

Stock

Grant ($)

| | | All Other

Compensation

($)(1)

|

Farid Suleman Chairman and Chief Executive Officer | | 2005

2004

2003 | | 1,074,375

943,750

1,000,000 | | 681,000

750,000

— | | 450,000

400,000

— |

(3)

| | 1,250,000

—

— | (2)

| | 3,213

3,213

4,138 |

| | | | | | |

Judith A. Ellis Chief Operating Officer | | 2005

2004

2003 | | 494,583

391,667

320,833 | | 158,333

208,333

229,167 | | 125,000

125,000

100,000 |

| | —

—

— |

| | 3,333

15,333

11,172 |

| | | | | | |

Patricia Stratford Acting Chief Financial Officer(4) | | 2005 | | 144,333 | | 100,000 | | 15,000 | | | — | | | 859 |

| | | | | | |

Randy L. Taylor Vice President-Finance and Secretary(5) | | 2005

2004

2003 | | 192,600

249,985

225,000 | | —

75,000

25,000 | | —

30,000

— |

| | —

—

— |

| | 3,421

10,335

11,260 |

| (1) | Included in 2005 are payments for matching contributions to the Citadel Broadcasting Company 401(k) Retirement Savings Plan, premiums for term life insurance and car allowances, as summarized by the table below. |

| | | | | | |

| | | Plan

Contributions ($)

| | Insurance

Premiums ($)

| | Auto

Allowance ($)

|

Farid Suleman | | 3,075 | | 138 | | — |

Judith A. Ellis | | 3,075 | | 258 | | — |

Patricia Stratford | | 799 | | 60 | | — |

Randy L. Taylor | | 3,075 | | 46 | | 300 |

| (2) | The Company granted to Mr. Suleman 1,250,000 shares of restricted stock under the Long-Term Incentive Plan effective September 20, 2005, which vest in three equal annual portions beginning on September 20, 2006, subject to Mr. Suleman’s continuous employment through the applicable vesting date. As described in Proposal 2 in this Proxy Statement, subject to the Company’s receipt of the stockholder approval sought in Proposal 2, on March 16, 2006, the compensation committee approved modifications to the vesting terms of these shares of restricted stock to make them subject to the Company’s satisfaction of certain revenue-related performance objectives and to extend the vesting dates to January 1, 2007, October 1, 2007 and October 1, 2008. |

| (3) | As described in Proposals 2 and 3 in this Proxy Statement, on March 16, 2006, subject to the Company’s receipt of the stockholder approvals sought in Proposals 2 and 3, the compensation committee of the Board of Directors approved the cancellation of the options to purchase 400,000 shares of common stock of the Company at an exercise price of $16.94 per share granted to Mr. Suleman under the Long-Term Incentive Plan effective March 26, 2004. |

| (4) | Ms. Stratford became an executive officer of the Company effective September 14, 2005. |

| (5) | Mr. Taylor ceased to be an employee and executive officer of the Company effective October 1, 2005. |

17

Grants of Stock Options and Other Awards under the Long-Term Incentive Plan in Last Fiscal Year

The following table shows all options to acquire shares of common stock of the Company granted to the executive officers and former executive officer named in the Summary Compensation Table above for the fiscal year ended December 31, 2005.

| | | | | | | | | | | | | | | | | | |

| | | Option Grants in Last Fiscal Year

|

| | | Individual Grants

| | | | | | | | | |

| | | Date of

Grant

| | Number of

Securities

Underlying

Options

Granted

| | Percent of Total

Options Granted

to Citadel

Employees in

Fiscal Year(1)

| | | Exercise or

Base Price

($/Share)(2)

| | Expiration

Date

| | Potential Realizable Value

at Assumed Annual Rates

of Stock Price Appreciation

for Option Term(3)

|

Name

| | | | | | | 5%($)

| | 10%($)

|

Farid Suleman(4) | | 2/24/2005 | | 450,000 | | 24.8 | % | | $ | 13.64 | | 2/24/2015 | | $ | 3,860,155 | | $ | 9,782,391 |

Judith A. Ellis(4) | | 2/24/2005 | | 125,000 | | 6.9 | % | | | 13.64 | | 2/24/2015 | | | 1,072,265 | | | 2,717,331 |

Patricia Stratford(4) | | 2/24/2005 | | 15,000 | | 0.8 | % | | | 13.64 | | 2/24/2015 | | | 128,672 | | | 326,080 |

Randy L. Taylor(5) | | — | | — | | — | | | | — | | — | | | — | | | — |

| (1) | The table shows the percentage of total options granted to employees during the fiscal year ended December 31, 2005. |

| (2) | The exercise price is the equivalent of the market value of shares of common stock of the Company at the time of grant. |

| (3) | These amounts are based on assumed annual appreciation rates of 5% and 10%, as prescribed by the SEC rules, and are not intended to forecast possible future appreciation, if any, of the Company’s stock price. The amounts have been calculated using the market value per share of common stock of the Company on the date of grant. |

| (4) | These options become exercisable at a rate of 25% per year, with the first 25% exercisable on February 24, 2006, and an additional 25% becoming exercisable on each of February 24, 2007, 2008 and 2009. |

| (5) | Mr. Taylor ceased to be an employee and executive officer of the Company effective October 1, 2005. |

The only other award under a long-term incentive plan that the Company made to an executive officer or former executive officer named in the Summary Compensation Table in this Proxy Statement during the fiscal year ended December 31, 2005 was the grant to Mr. Suleman under the Long-Term Incentive Plan, effective September 20, 2005, of 1,250,000 shares of restricted stock. The restrictions on the restricted stock lapse, and the shares vest, in three annual portions, beginning on September 20, 2006. As described in more detail under Proposal 2 in this Proxy Statement, on March 16, 2006, subject to stockholder approval of the material terms of the performance objectives that may apply to performance-based awards under the Long-Term Incentive Plan at the Annual Meeting, the compensation committee approved the modification of the vesting terms of the 1,250,000 shares of restricted stock to subject them to additional criteria based on the Company’s attainment of certain revenue-related performance objectives and to extend the applicable vesting dates to January 1, 2007, October 1, 2007 and October 1, 2008.

18

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

The following table shows the aggregate options exercised by the executive officers named in the Summary Compensation Table above for the fiscal year ended December 31, 2005, as well as the value of the options held by such persons on December 31, 2005.

| | | | | | | | | | | | | | |

Name

| | Shares Acquired

on Exercise (#)

| | Value

Realized ($)

| | Number of Securities

Underlying Unexercised

Options at Fiscal

Year-End (#)

| | Value of Unexercised In-the

Money Options at Fiscal

Year-End ($)(1)

|

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

Farid Suleman(2) | | — | | — | | 4,250,000 | | 750,000 | | $ | 41,251,000 | | $ | — |

Judith A. Ellis | | — | | — | | 81,250 | | 268,750 | | | — | | | — |

Patricia Stratford | | — | | — | | 7,500 | | 27,500 | | | — | | | — |

Randy L. Taylor(3) | | — | | — | | — | | — | | | — | | | — |

| (1) | The amounts have been calculated using the closing price of common stock of the Company on the NYSE on December 31, 2005, which was $13.44 per share. |

| (2) | On March 16, 2006, the compensation committee approved the cancellation of the fully vested options to purchase 4,150,000 shares of common stock of the Company at an exercise price of $3.50 per share granted to Mr. Suleman under the Stock Option Agreement, dated April 23, 2002, as amended on June 4, 2002, and replacement of them with 2,868,006 fully vested restricted stock units with a deferred distribution date. The compensation committee also approved the cancellation of Mr. Suleman’s option to purchase 400,000 shares of common stock of the Company at an exercise price of $16.94 granted to him under the Long-Term Incentive Plan on March 26, 2004. The effectiveness of these actions is subject to the Company’s receipt of the stockholder approval sought in Proposals 2 and 3 in this Proxy Statement. |

| (3) | Mr. Taylor ceased to be an employee and executive officer of the Company effective October 1, 2005. |

Securities Authorized for Issuance under Equity Compensation Plans

The following table sets forth, as of December 31, 2005: (1) the number of shares of common stock of the Company that are issuable upon the exercise of stock options outstanding under our equity compensation plans; (2) the weighted average exercise prices of such securities; (3) the number of shares of restricted common stock that have been awarded under the Long-Term Incentive Plan; and (4) the number of securities available for grant under Long-Term Incentive Plan.

| | | | | | | | | | | | |

Plan Category

| | Number of Shares

to be Issued Upon

Exercise of

Outstanding

Option, Warrants

and Rights (a)

| | | Weighted Average

Exercise Price of

Outstanding

Options,

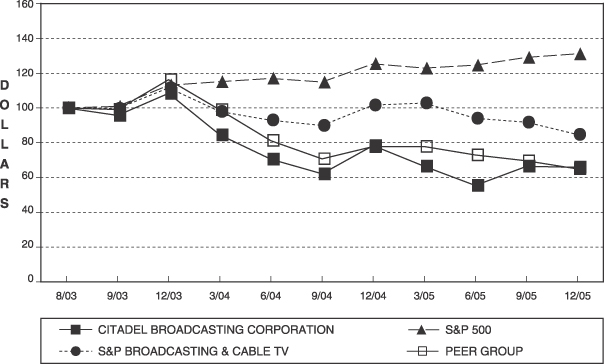

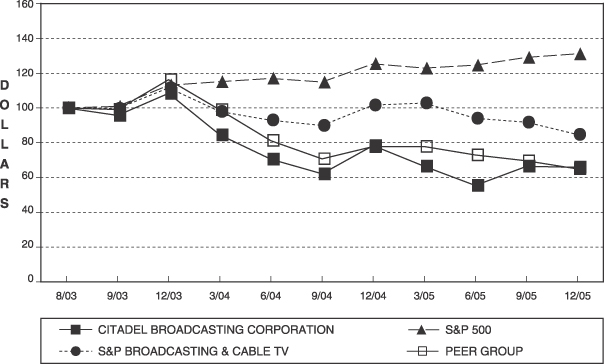

Warrants and