UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-21114 | |||||||

| ||||||||

ProShares Trust | ||||||||

(Exact name of registrant as specified in charter) | ||||||||

| ||||||||

7501 Wisconsin Avenue, Suite 1000 |

| 20814 | ||||||

(Address of principal executive offices) |

| (Zip code) | ||||||

| ||||||||

ProShare Advisors LLC | ||||||||

(Name and address of agent for service) | ||||||||

| ||||||||

Registrant’s telephone number, including area code: | (240) 497-6400 |

| ||||||

| ||||||||

Date of fiscal year end: | May 31 |

| ||||||

| ||||||||

Date of reporting period: | June 1, 2008 to May 31, 2009 |

| ||||||

Item 1. Reports To Stockholders.

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

Ultra ProShares

Ultra MarketCap

ULTRA  ®

®

ULTRA Dow30SM

ULTRA S&P500®

ULTRA MidCap400

ULTRA SmallCap600

ULTRA Russell2000

Ultra Style

ULTRA Russell1000 Value

ULTRA Russell1000 Growth

ULTRA Russell MidCap Value

ULTRA Russell MidCap Growth

ULTRA Russell2000 Value

ULTRA Russell2000 Growth

Ultra Sector

ULTRA Basic Materials

ULTRA Consumer Goods

ULTRA Consumer Services

ULTRA Financials

ULTRA Health Care

ULTRA Industrials

ULTRA Oil & Gas

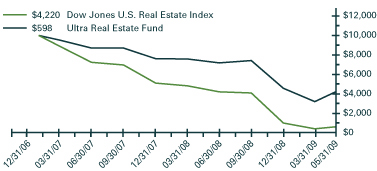

ULTRA Real Estate

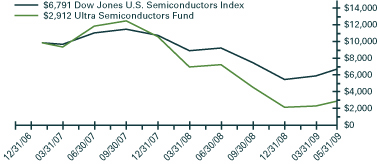

ULTRA Semiconductors

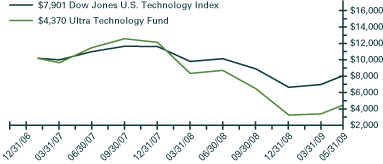

ULTRA Technology

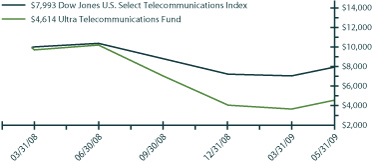

ULTRA Telecommunications

ULTRA Utilities

Short ProShares

Short MarketCap

SHORT  ®

®

SHORT Dow30SM

SHORT S&P500®

SHORT MidCap400

SHORT SmallCap600

SHORT Russell2000

ULTRASHORT  ®

®

ULTRASHORT Dow30SM

ULTRASHORT S&P500®

ULTRASHORT MidCap400

ULTRASHORT SmallCap600

ULTRASHORT Russell2000

Short Style

ULTRASHORT Russell1000 Value

ULTRASHORT Russell1000 Growth

ULTRASHORT Russell MidCap Value

ULTRASHORT Russell MidCap Growth

ULTRASHORT Russell2000 Value

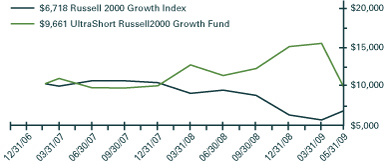

ULTRASHORT Russell2000 Growth

Short Sector

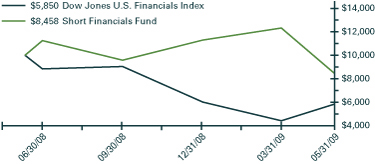

SHORT Financials

SHORT Oil & Gas

ULTRASHORT Basic Materials

ULTRASHORT Consumer Goods

ULTRASHORT Consumer Services

ULTRASHORT Financials

ULTRASHORT Health Care

ULTRASHORT Industrials

ULTRASHORT Oil & Gas

ULTRASHORT Real Estate

ULTRASHORT Semiconductors

ULTRASHORT Technology

ULTRASHORT Telecommunications

ULTRASHORT Utilities

Short International

SHORT MSCI EAFE

SHORT MSCI Emerging Markets

ULTRASHORT MSCI EAFE

ULTRASHORT MSCI Emerging Markets

ULTRASHORT MSCI Japan

ULTRASHORT FTSE/Xinhua China 25

Short Fixed-Income

ULTRASHORT 7-10 Year Treasury

ULTRASHORT 20+ Year Treasury

Annual Report

ProShares Trust

MAY 31, 2009

Table of Contents

| 1 | Shareholder Letter | ||||||

| 2 | Management Discussion of Fund Performance | ||||||

| 73 | Expense Examples | ||||||

| Schedule of Portfolio Investments | |||||||

| 79 | ULTRA QQQ® | ||||||

| 83 | ULTRA Dow30SM | ||||||

| 86 | ULTRA S&P500® | ||||||

| 90 | ULTRA MidCap400 | ||||||

| 94 | ULTRA SmallCap600 | ||||||

| 98 | ULTRA Russell2000 | ||||||

| 102 | ULTRA Russell1000 Value | ||||||

| 106 | ULTRA Russell1000 Growth | ||||||

| 110 | ULTRA Russell MidCap Value | ||||||

| 114 | ULTRA Russell MidCap Growth | ||||||

| 118 | ULTRA Russell2000 Value | ||||||

| 122 | ULTRA Russell2000 Growth | ||||||

| 126 | ULTRA Basic Materials | ||||||

| 129 | ULTRA Consumer Goods | ||||||

| 134 | ULTRA Consumer Services | ||||||

| 138 | ULTRA Financials | ||||||

| 142 | ULTRA Health Care | ||||||

| 146 | ULTRA Industrials | ||||||

| 151 | ULTRA Oil & Gas | ||||||

| 155 | ULTRA Real Estate | ||||||

| 158 | ULTRA Semiconductors | ||||||

| 161 | ULTRA Technology | ||||||

| 166 | ULTRA Telecommunications | ||||||

| 169 | ULTRA Utilities | ||||||

| 172 | SHORT QQQ® | ||||||

| 174 | SHORT Dow30SM | ||||||

| 176 | SHORT S&P500® | ||||||

| 178 | SHORT MidCap400 | ||||||

| 180 | SHORT SmallCap600 | ||||||

| 182 | SHORT Russell2000 | ||||||

| 184 | ULTRASHORT QQQ® | ||||||

| 186 | ULTRASHORT Dow30SM | ||||||

| 188 | ULTRASHORT S&P500® | ||||||

| 190 | ULTRASHORT MidCap400 | ||||||

| 192 | ULTRASHORT SmallCap600 | ||||||

| 194 | ULTRASHORT Russell2000 | ||||||

| 196 | ULTRASHORT Russell1000 Value | ||||||

| 198 | ULTRASHORT Russell1000 Growth | ||||||

| 200 | ULTRASHORT Russell MidCap Value | ||||||

| 202 | ULTRASHORT Russell MidCap Growth | ||||||

| 204 | ULTRASHORT Russell2000 Value | ||||||

| 206 | ULTRASHORT Russell2000 Growth | ||||||

| 208 | SHORT Financials | ||||||

| 210 | SHORT Oil & Gas | ||||||

| 212 | ULTRASHORT Basic Materials | ||||||

| 214 | ULTRASHORT Consumer Goods | ||||||

| 216 | ULTRASHORT Consumer Services | ||||||

| 218 | ULTRASHORT Financials | ||||||

| 220 | ULTRASHORT Health Care | ||||||

| 222 | ULTRASHORT Industrials | ||||||

| 224 | ULTRASHORT Oil & Gas | ||||||

| 226 | ULTRASHORT Real Estate | ||||||

| 228 | ULTRASHORT Semiconductors | ||||||

| 230 | ULTRASHORT Technology | ||||||

| 232 | ULTRASHORT Telecommunications | ||||||

| 234 | ULTRASHORT Utilities | ||||||

| 236 | SHORT MSCI EAFE | ||||||

| 238 | SHORT MSCI Emerging Markets | ||||||

| 240 | ULTRASHORT MSCI EAFE | ||||||

| 242 | ULTRASHORT MSCI Emerging Markets | ||||||

| 244 | ULTRASHORT MSCI Japan | ||||||

| 246 | ULTRASHORT FTSE/Xinhua China 25 | ||||||

| 248 | ULTRASHORT 7-10 Year Treasury | ||||||

| 250 | ULTRASHORT 20+ Year Treasury | ||||||

| 252 | Statements of Assets and Liabilities | ||||||

| 263 | Statements of Operations | ||||||

| 274 | Statements of Changes in Net Assets | ||||||

| 296 | Financial Highlights | ||||||

| 318 | Notes to Financial Statements | ||||||

| 346 | Report of Independent Registered Public Accounting Firm | ||||||

| 347 | Proxy Voting, Quarterly Portfolio Holdings Information & Premium and Discount Information | ||||||

| 348 | Trustees and Officers of ProShares Trust | ||||||

Dear Shareholder,

I am pleased to present the Annual Report to shareholders of ProShares ETFs for the 12 months ended May 31, 2009.

Most major market indexes came under severe pressure during the 12-month period. The S&P 500®, a measure of large-cap U.S. stocks, fell 32.6%, while the Russell 2000® index of small-cap U.S. stocks declined 31.8%. In fact, all of the major industry sector indexes that comprise the S&P 500 experienced double-digit declines. Healthcare was the best-performing sector, down 17.2%, and real estate was the worst-performing sector, declining 48.0%.

During the year, non-U.S. equities also declined, dropping 35.9%, as measured by the MSCI ACWI ex-U.S. Index. Commodity prices, as reflected in the Dow Jones-AIG Commodity Index, fell 41.6% during the period. Bonds, as measured by the Barclays Capital U.S. Aggregate Bond Index, advanced 5.36%.(1)

Notably, during the reporting period, volatility(2) for the S&P 500 spiked to 45.5% compared with 19.9% for the previous 12-month period. A volatility of 45.5% ranks the period among the top 3% of all one-year volatilities for the last 81 years of the S&P 500.(3)

In the midst of this tumultuous environment, many investors turned to ProShares' short and leveraged ETFs as a means to implement their investment strategies. From January 1, 2009, through the end of May, ProShares ranked second among all U.S. ETF families in dollars traded.(4)

With the dramatic growth in the use of our ETFs, it is hard to believe that ProShares debuted just three years ago. In the summer of 2006, we introduced our first 12 Short and Ultra ProShares. Less than a year later, ProShares surpassed $5 billion in assets and topped $20 billion just two years after its launch. Despite the extraordinary market climate during the past year, we have continued to expand our product lineup to include a broad range of investment style, sector, and international market ETFs. As we mark our third-year anniversary, ProShares is now among the largest ETF managers in the U.S. with approximately $25.5 billion in assets under management as of May 29, 2009.(5)

The recent market turmoil has also highlighted how important it is that investors understand all of the investment choices they have available to them. In light of this, we have placed increased emphasis on helping investors understand how leveraged and short ProShares perform under various market conditions and will be expanding our investor education program in the coming months.

We appreciate the trust you have placed with us by choosing ProShares and look forward to continuing to serve your investing needs.

Sincerely,

Michael Sapir

Chairman

ProShare Advisors LLC

(1) All investment performance index figures above reflect total return performance. (2) As measured by standard deviation. (3) Source: Bloomberg. Based on a comparison of all one-year rolling volatilities beginning in 1928. (4) Source: Bloomberg. Based on average daily dollar volume. (5) Source: Bloomberg and Morningstar. Based on a comparison of average daily ETF and ETN assets as of 5/29/2009.

1

ProShares Trust

Management Discussion of Fund Performance

May 31, 2009 (Unaudited)

Investment Strategies and Techniques:

Each series of ProShares Trust (each a "Fund" and collectively, the "Funds") is designed to correspond to the performance of a daily benchmark (before fees and expenses) such as the daily price performance, the inverse of the daily price performance or a multiple of the inverse of the daily price performance, of an index. ProShare Advisors LLC ("PSA") uses a quantitative approach in seeking to achieve the investment objective of each Fund. Using this approach, PSA determines the type, quantity and mix of investment positions that a Fund should hold to simulate the performance of its daily benchmark.

The Funds do not seek to provide correlation with their benchmarks over any period of time other than daily, and do not seek to take defensive positions in unfavorable markets.

Factors that materially affected the performance of each Fund during the year:

• Benchmark Performance: The performance of the index underlying each Fund's benchmark and, in turn, the factors and market conditions affecting that index are the principal factors driving fund performance3. Please see below for a discussion of market conditions that affected the performance of the Funds and their various benchmark indexes.

• The Impact of Leverage on the Funds' Performance: The performance of those Funds that seek daily investment results (before fees and expenses) of 200% or –200% of the daily performance of an index (i.e., the Ultra ProShares and UltraShort ProShares) was impacted proportionately more by the daily performance of the Funds' underlying indexes than those Funds that seek daily investment results (before fees and expenses) of –100% of the daily performance of an index (i.e., the Short ProShares). The performance of those Funds that seek daily investment results (before fees and expenses) of –100% or –200% (i.e., the Short ProShares and UltraShort ProShares) was inversely impacted by the daily performance of the Funds' underlying indexes.

• Compounding of Daily Returns and Volatility: ETFs are designed to provide a multiple of index returns (e.g. –200% or +200%) for a single day only. For longer periods, performance may be greater than or less than the one-day target times the index return. This is due to the effects of compounding, a universal mathematical concept that applies to all investments, but has a magnified effect on leveraged funds. Compounding generally increases returns in upward trending low volatility markets and generally decreases losses in downward trending low volatility markets. In volatile periods, compounding reduces returns and increases losses.

• Cost of Obtaining Leverage and Inverse Exposure: The performance of Funds with an investment objective that is a positive multiple of a benchmark index was negatively impacted by costs associated with leveraging. Inverse Funds generally benefited from financing related factors associated with the use of leveraged investment techniques. For Inverse Funds, this benefit can be offset in part or in whole by the costs associated with obtaining short exposure.

• Equity Dividends and Bond Yields: The performance of Funds with an investment objective that is a positive multiple of a benchmark index was positively impacted by capturing a multiple of the dividend or income yield associated with the benchmark index. Inverse Funds were negatively impacted by virtue of effectively having to pay out a multiple of the dividend or income yield associated with the benchmark index.

• Fees, expenses, and transaction costs: Fees and expenses are listed in the financial statements of each Fund and may generally be higher and thus have a more negative impact on performance than compared to many traditional index-based funds. Additionally, high levels of shareholder creation and redemption activity and use of leverage may lead to commensurate increases in portfolio transactions and transaction costs which negatively impact the daily NAV of each Fund. Transaction costs are not reflected in the funds expense ratio. Transaction costs are generally higher for Funds with higher turnover and for Funds that are benchmarked to indexes or securities that are comparatively less liquid than other Funds' benchmark indexes or securities.

2

Market Conditions Affecting Benchmark and Fund Performance — All Funds

General Factors Affecting Benchmark and Fund Performance:

Sixty-two (62) Funds were in existence for the entire period covered by this annual report. Two sector Funds were launched over this period, as well. Below, we review general economic and market events, as well as index performance, for the entire year ended May 31, 2009.

Economy:

The economy plummeted deeper into one of the worst recessions in U.S. history over the past twelve months. Housing prices declined almost 20%, unemployment rose throughout the year to the highest levels seen since the early 1980s, and GDP posted its worst back-to-back quarters in half a century. As a result, consumer confidence sunk to its lowest ever reading in February of this year.

Much of the distress faced by the economy during the past twelve months was a consequence of a severely faltering financial system. A volatile combination of high unemployment, tightening credit conditions, and a collapse in housing prices resulted in high rates of default and foreclosures among residential mortgages. Companies holding large portfolios of mortgage backed securities were forced to write-off billions of dollars in bad loans, and in the cases of historic Wall Street firms such as Lehman Brothers and Merrill Lynch, forced to declare bankruptcy or sell to another firm, respectively. In addition, the U.S. Treasury placed both Fannie Mae and Freddie Mac under the control of a conservatorship, a measure similar to Chapter 11 bankruptcy. Insurance giant, American International Group was also bailed out by the Federal Reserve and Treasury Department for an amount estimated to be worth roughly $150 billion. This became the largest such bailout of a publicly-traded company in U.S. history. Failure to do so, however, could have resulted in the collapse of additional major financial institutions. With more financial institutions on the verge of realizing a similar fate, massive financial bailout and economic stimulus bills were signed into law with the hope of restoring confidence in our financial system and revitalizing the economy.

A highly uncertain economic environment coupled with low inflation over the past twelve months coincided with a flight to quality among investors. As a result, Treasury prices soared and yields across the Treasury curve sunk to record low levels. The Federal Reserve cut their target rate from 2% at the beginning of the period to a floating range between 0% and 0.25% by period end. This was the lowest level the Federal Reserve had set its target rate in its history. Three-month Treasury Bills and two-year Treasury Notes followed suit, as yields dropped roughly 1.7 percentage points on both of these benchmarks, from the beginning of the period to the end, leaving them at 0.15% and 0.90% respectively. The long end of the yield curve saw rates fall as well, albeit, declines were more moderate, as the yield on ten-year Treasury Notes fell 0.6 percentage points to 3.5%, and the yield on 30-year Treasury Bonds fell 0.4 percentage points to 4.3% at year end.

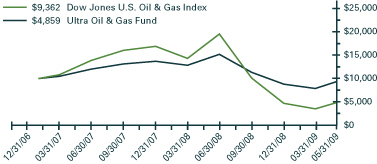

The equity market wasn't the only asset class that was affected by the global economic slowdown. After a huge surge during the prior twelve month period, commodity prices plummeted over the past year. As measured by the Dow Jones — UBS Commodity Index, broad commodity prices declined 42% for the year. Crude Oil, which soared as high as $145/barrel in July of 2008, fell precipitously to $34/barrel in December. As the period came to a close, Crude Oil prices had fallen 66% from levels seen a year earlier. Food prices came under pressure as well, as the Dow Jones — UBS Agricultural Grains Index fell 22%. Gold was the lone bright spot among commodities, often viewed as a safe haven during times of economic distress; it returned 8% on the year.

The US Dollar, which had struggled against other major currencies for much of the decade, gained some of that back versus the Euro, gaining 9.9% for the period. Overall, against a basket of six major currencies, the U.S. Dollar gained 8.9% as measured by the U.S. Dollar Index. The one exception to this trend among major currencies was the Japanese Yen, which extended its gains from the prior year, returning 10.7% against the U.S. Dollar for the period.

Index Performance:

For the period of this report, ProShare Advisors managed Funds based on five broad categories of indices — broad market, sector, style, international and fixed-income.

3

ProShares Trust

Management Discussion of Fund Performance

May 31, 2009 (Unaudited) (continued)

The U.S. equity market posted sharply negative returns as measured by various broad market indexes for the year ended May 31, 2009. These broader markets experienced negative returns that ranged from –28.9% to –33.5%, with the NASDAQ 100 experiencing the best return and the S&P MidCap 400 declining the most. All indexes would fall in a relatively narrow range, however. As measured by more narrowly based indexes, there were greater divergences between different segments and sectors of the market than among the broad market indexes.

PSA managed a total of 18 exchange traded funds which have benchmarks to broad market indexes. The performance for their benchmark indexes were as follows: the NASDAQ-100 returned –28.9%, the Dow Jones Industrial Average returned –30.4%, the Russell 2000 Index returned –31.8%, the S&P Small Cap 600 Index returned –31.9%, the S&P 500 Index returned –32.6% and the S&P MidCap 400 index returned –33.5% for the year ending May 31, 2009.

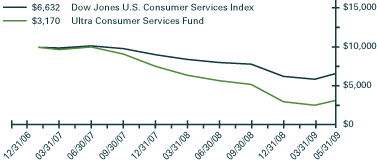

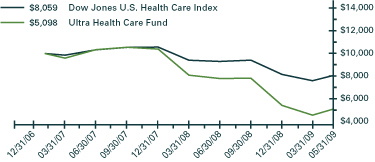

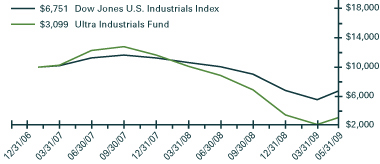

In typical down markets, a few individual sectors may buck the trend, and post respectable returns despite negative returns across the broader markets. While there was a range of returns between –17.2% to –48.0% among the sector indexes benchmarked by various ProShares, this economic downturn was too deep and far reaching for any of them to provide a safe haven during the past twelve months. PSA managed 26 sector funds, two of which were launched during the year ending May 31, 2009. For the year, these indexes had the following returns as measured by Dow Jones: Healthcare, –17.2%; Consumer Goods, –21.0%; Consumer Services, –25.9%; Technology, –27.9%; Select Telecommunications, –30.9%, Utilities, –34.1%; Semiconductors, –34.6%; Oil and Gas, –36.7%; Industrials, –40.1%; Basic Materials, –45.0%; Financials, –45.3%; and Real Estate, –48.0%.

Recent years have seen one style of investing typically gain favor over another during the course of a year. Last year, growth stocks outperformed value over all areas of the market capitalization spectrum, while value had outperformed growth for the previous seven years. This year, value stocks enjoyed a slight performance edge over growth, however, the differences were negligible, with each of the six styles tracked by ProShares down over 30% The Russell 1000 Growth Index returned –30.7%, followed by Russell 2000 Growth, –31.6%; Russell 2000 Value, –32.2%; Russell 1000 Value, –35.3%; Russell MidCap Growth, –35.7%; and Russell MidCap Value, –36.8%.

International equity markets also fell sharply. European, Asian, and Emerging Markets saw declines comparable or worse than what was seen here in the U.S. PSA managed a total of six funds benchmarked to various international indexes. For the year ending May 31, 2009, these indexes had the following returns: FTSE Xinhua China 25 Index, –25.2%; MSCI Japan Index, –36.4%; MSCI EAFE Index, –36.5%; and MSCI Emerging Markets Index, –34.7%.

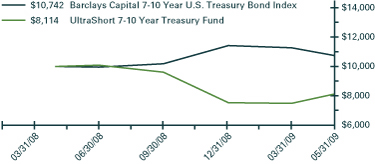

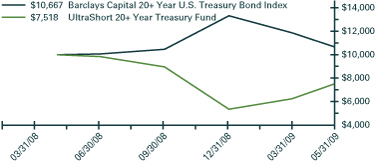

Long-term Treasury yields declined throughout the year, though considerably less than short-term yields. PSA managed two funds benchmarked to Treasury indexes. For the year ending May 31, 2009, the Barclays Capital 7-10 Year U.S. Treasury Bond Index and Barclays Capital 20+ Year U.S. Treasury Bond Index returned 8.9% and 8.5% respectively.

Index Volatility

Daily volatility for the U.S. equity markets rose to record levels over the previous 12 months. The volatility for the S&P 500 for the year ended May 31, 2009 was 45.5%, which was considerably higher than the prior year's volatility of 19.9%. Similar extreme volatility levels were reached previously only during the Great Depression period (1929 to 1932) and in the equity market crash of 1987. At a given index return level, increased volatility tends to negatively impact performance over time as described in the previous section. The most volatile Fund benchmark index was the Dow Jones Real Estate Index and the least volatile was the Barclays Capital 7-10 Year U.S. Treasury Bond Index. The volatility of each index, along with one year returns are shown below.

| Underlying Index | One Year Return | Annualized Index Volatility | |||||||||

| Dow Jones U.S. Real Estate Index | -48.0 | % | 94.6 | % | |||||||

| Dow Jones U.S. Financials Index | -45.3 | % | 85.1 | % | |||||||

| Dow Jones U.S. Basic Materials Index | -45.0 | % | 64.0 | % | |||||||

| Dow Jones U.S. Oil & Gas Index | -36.7 | % | 62.9 | % | |||||||

| FTSE/Xinhua China 25 Index | -25.2 | % | 61.0 | % | |||||||

| Russell 2000 Value Index | -32.2 | % | 57.0 | % | |||||||

| Russell 2000 Index | -31.8 | % | 53.5 | % | |||||||

| Dow Jones U.S. Semiconductors Index | -34.6 | % | 52.9 | % | |||||||

| Russell MidCap Value Index | -36.8 | % | 51.4 | % | |||||||

| Dow Jones U.S. Select Telecommunications Index | -30.9 | % | 51.3 | % | |||||||

4

| Underlying Index | One Year Return | Annualized Index Volatility | |||||||||

| S&P SmallCap 600 Index | -31.9 | % | 50.7 | % | |||||||

| Russell 2000 Growth Index | -31.6 | % | 50.4 | % | |||||||

| Russell 1000 Value Index | -35.3 | % | 50.1 | % | |||||||

| S&P MidCap 400 Index | -33.5 | % | 49.4 | % | |||||||

| Russell MidCap Growth Index | -35.7 | % | 48.7 | % | |||||||

| Dow Jones U.S. Industrials Index | -40.1 | % | 47.3 | % | |||||||

| S&P 500 Index | -32.6 | % | 45.5 | % | |||||||

| NASDAQ 100 Index | -28.9 | % | 45.2 | % | |||||||

| Dow Jones U.S. Technology Index | -27.9 | % | 45.2 | % | |||||||

| Dow Jones U.S. Consumer Services Index | -25.9 | % | 43.1 | % | |||||||

| MSCI Emerging Markets Index | -34.7 | % | 43.0 | % | |||||||

| Russell 1000 Growth Index | -30.7 | % | 42.4 | % | |||||||

| Dow Jones Industrial Average | -30.4 | % | 41.5 | % | |||||||

| Dow Jones U.S. Utilities Index | -34.1 | % | 40.2 | % | |||||||

| MSCI Japan Index | -36.4 | % | 39.9 | % | |||||||

| MSCI EAFE Index | -36.5 | % | 38.3 | % | |||||||

| Dow Jones U.S. Health Care Index | -17.2 | % | 33.9 | % | |||||||

| Dow Jones U.S. Consumer Goods Index | -21.0 | % | 32.8 | % | |||||||

| Barclays Capital 20+ Year U.S. Treasury Bond Index | 8.5 | % | 20.8 | % | |||||||

| Barclays Capital 7-10 Year U.S. Treasury Bond Index | 8.9 | % | 10.8 | % | |||||||

Costs of Leveraged and Inverse Exposure The cost (benefit) associated with obtaining leveraged (inverse) exposure varied greatly over the period. One week Libor, (the most common benchmark financing rate for the Funds) was 2.43% at the beginning of the year, dropping to a low of 0.23% in mid-January and rising again to 0.29% at the end of the period. Each Ultra Fund essentially pays one-times this rate plus a spread, while each Short and Ultra Short essentially receives two and three-time this rate respectively. Beyond basic financing rates, Inverse Funds are also negatively impacted by the costs associated with obtaining short exposure through instruments such as swaps and futures. These costs varied greatly from Index to Index with the small-cap and international indexes experiencing the highest short exposure costs. In the case of China, there were periods of t ime where the cost of obtaining short exposure completely offset what is normally a positive impact of financing rates on Inverse Funds.

PSA does not invest the assets of the Funds based on its view of the investment merit of a particular security, instrument or company. In addition, PSA does not conduct conventional stock research or analysis; forecast stock market movements, trends or market conditions; or normally take defensive positions.

5

ProShares Ultra QQQ® (Ticker: QLD)

ProShares Ultra QQQ® seeks daily investment results, before fees and expenses, that correspond to twice (200%) the daily performance of the NASDAQ-100® Index. The NASDAQ-100® Index includes 100 of the largest non-financial domestic and international issues listed on the NASDAQ Stock Market. To be eligible for inclusion companies cannot be in bankruptcy proceedings and must meet certain additional criteria including minimum trading volume and "seasoning" requirements. The Index is calculated under a modified capitalization weighted methodology.

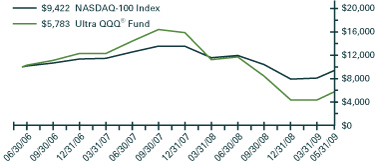

The Fund takes positions in securities and/or financial instruments that, in combination, should have similar daily return characteristics as 200% of the daily return of the index. For the year ended May 31, 2009, the Fund had a total return of –60.05%1, compared to a total return of –28.89%2 for the index. For the period, the Fund had an average daily volume of 29,665,282 and an average daily statistical correlation of over 0.99 to twice that of the daily performance of the index.3

Among the ten highest weighted index components at inception that remained in the index for the entire period, the top three performers were O'Reilly Automotive (+37.86%), Apollo Group (+23.67%), and Hansen Natural (+17.41%), while the bottom three performers in this group were Liberty International (–65.51%), Foster Wheeler (–65.18%), and Flextronics International (–63.03%).

| Value of a $10,000 Investment Since Inception at Net Asset Value* | |||

*The line graph represents historical performance of a hypothetical investment of $10,000 in the Ultra QQQ® Fund from June 19, 2006 to May 31, 2009, assuming the reinvestment of distributions.

| Average Annual Total Return as of 5/31/09 | |||||||||||

| Fund | One Year | Since Inception (6/19/06) | |||||||||

| Ultra QQQ® Fund | -60.05 | % | -16.95 | % | |||||||

| NASDAQ-100 Index | -28.89 | % | -2.00 | % | |||||||

| Expense Ratios** | |||||||||||

| Fund | Gross | Net | |||||||||

| Ultra QQQ® Fund | 1.04 | % | 0.95 | % | |||||||

**Reflects the expense ratio as reported in the Prospectus dated October 1, 2008. Contractual fee waivers are in effect through September 30, 2009.

| Allocation of Portfolio Holdings & Index Composition | |||

Market Exposure

| Investment Type | % of Net Assets | ||||||

| Equity Securities | 87 | % | |||||

| Swap Agreements | 96 | % | |||||

| Futures Contracts | 18 | % | |||||

| Total Exposure | 201 | % | |||||

"Market Exposure" includes the value of total investments (including the contract value of any derivatives) and excludes any short-term investments and cash equivalents.

Largest Equity Holdings

| Company | % of Net Assets | ||||||

| Apple, Inc. | 11.3 | % | |||||

| QUALCOMM, Inc. | 5.8 | % | |||||

| Microsoft Corp. | 4.3 | % | |||||

| Google, Inc., Class A | 4.1 | % | |||||

| Research in Motion Ltd. | 3.0 | % | |||||

Nasdaq-100 Index – Composition

| % of Index | |||||||

| Technology | 41.4 | % | |||||

| Communications | 27.0 | % | |||||

| Consumer, Non-cyclical | 19.2 | % | |||||

| Consumer, Cyclical | 7.4 | % | |||||

| Industrials | 3.2 | % | |||||

| Energy | 1.1 | % | |||||

| Basic Materials | 0.7 | % | |||||

Past performance does not guarantee future results. Return calculations assume the reinvestment of distributions and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor's shares, when redeemed may be more or less than the original cost. To obtain performance current to the most recent month please visit www.proshares.com.

1 Fund Returns are based on the Net Asset Value of the Fund. This calculation reflects the theoretical reinvestment of distributions, if any, in the fund as of the ex-date. The impact of transaction costs and the lack of ability to reinvest fractional shares are not reflected in the calculations.

2 The Index is a price return index. The total return and any graph or table reflect the theoretical reinvestment of dividends on securities in the Index. The impact of transaction costs and the deduction of expenses associated with an exchange traded fund such as investment management and accounting fees are not reflected in the Index calculation. It is not possible to invest directly in an Index.

3 1.00 equals perfect correlation. This calculation is based on the daily price return of the index and the performance of the daily price return of the Net Asset Value per share of the fund.

The above information is not covered by the Report of the Independent Registered Public Accounting Firm.

6

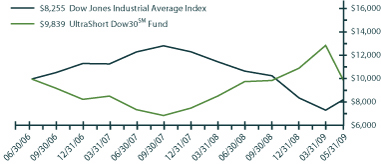

ProShares Ultra Dow30SM (Ticker: DDM)

ProShares Ultra Dow30SM seeks daily investment results, before fees and expenses, that correspond to twice (200%) the daily performance of the Dow Jones Industrial AverageSM (DJIA). The DJIA is a price-weighted index maintained by editors of The Wall Street Journal. The Index includes 30 large-cap, "blue-chip" U.S. stocks, excluding utility and transportation companies. Components are selected through a discretionary process with no predetermined criteria except that components should be established U.S. companies that are leaders in their industries, have an excellent reputation, demonstrate sustained growth, are of interest to a large number of investors and accurately represent the sectors covered by the average. The DJIA is not limited to traditionally defined industrial stocks, instead, the index serves as a measure of the entire U.S. market, covering such diverse industries as financial services, technology, retail, entertainment and consumer goods. Composition changes are rare, and generally occur only after corporate acquisitions or other dramatic shifts in a component's core business. When such an event necessitates that one component be replaced, the entire index is reviewed.

The Fund takes positions in securities and/or financial instruments that, in combination, should have similar daily return characteristics as 200% of the daily return of the index. For the year ended May 31, 2009, the Fund had a total return of –60.66%1, compared to a total return of –30.44%2 for the index. For the period, the Fund had an average daily volume of 11,116,492 and an average daily statistical correlation of over 0.99 to twice that of the daily performance of the index.3

Among the ten highest weighted index components at inception that remained in the index for the entire period, the top three performers were McDonalds Corp (–0.56%), Wal-Mart Stores (–13.86%), and Coca-Cola Co. (–14.15%), , while the bottom three performers in this group were Alcoa Inc (–77.29%), Bank of America (–66.86%), and Caterpillar Inc (–57.09%).

| Value of a $10,000 Investment Since Inception at Net Asset Value* | |||

*The line graph represents historical performance of a hypothetical investment of $10,000 in the Ultra Dow30SM Fund from June 19, 2006 to May 31, 2009, assuming the reinvestment of distributions.

| Average Annual Total Return as of 5/31/09 | |||||||||||

| Fund | One Year | Since Inception (6/19/06) | |||||||||

| Ultra Dow30SM Fund | -60.66 | % | -21.52 | % | |||||||

| Dow Jones Industrial Average Index | -30.44 | % | -5.71 | % | |||||||

| Expense Ratios** | |||||||||||

| Fund | Gross | Net | |||||||||

| Ultra Dow30SM Fund | 1.02 | % | 0.95 | % | |||||||

**Reflects the expense ratio as reported in the Prospectus dated October 1, 2008. Contractual fee waivers are in effect through September 30, 2009.

| Allocation of Portfolio Holdings & Index Composition | |||

Market Exposure

| Investment Type | % of Net Assets | ||||||

| Equity Securities | 86 | % | |||||

| Swap Agreements | 98 | % | |||||

| Futures Contracts | 17 | % | |||||

| Total Exposure | 201 | % | |||||

"Market Exposure" includes the value of total investments (including the contract value of any derivatives) and excludes any short-term investments and cash equivalents.

Largest Equity Holdings

| Company | % of Net Assets | ||||||

| International Business Machines Corp. | 8.5 | % | |||||

| Exxon Mobil Corp. | 5.6 | % | |||||

| Chevron Corp. | 5.3 | % | |||||

| McDonald's Corp. | 4.7 | % | |||||

| 3M Co. | 4.6 | % | |||||

Dow Jones Industrial Average

Index – Composition

| % of Index | |||||||

| Consumer, Non-cyclical | 21.1 | % | |||||

| Industrials | 19.1 | % | |||||

| Technology | 16.6 | % | |||||

| Energy | 12.8 | % | |||||

| Consumer, Cyclical | 12.4 | % | |||||

| Communications | 7.3 | % | |||||

| Financials | 7.2 | % | |||||

| Basic Materials | 3.5 | % | |||||

Past performance does not guarantee future results. Return calculations assume the reinvestment of distributions and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor's shares, when redeemed may be more or less than the original cost. To obtain performance current to the most recent month please visit www.proshares.com.

1 Fund Returns are based on the Net Asset Value of the Fund. This calculation reflects the theoretical reinvestment of distributions, if any, in the fund as of the ex-date. The impact of transaction costs and the lack of ability to reinvest fractional shares are not reflected in the calculations.

2 The Index is a price return index. The total return and any graph or table reflect the theoretical reinvestment of dividends on securities in the Index. The impact of transaction costs and the deduction of expenses associated with an exchange traded fund such as investment management and accounting fees are not reflected in the Index calculation. It is not possible to invest directly in an Index.

3 1.00 equals perfect correlation. This calculation is based on the daily price return of the index and the performance of the daily price return of the Net Asset Value per share of the fund.

The above information is not covered by the Report of the Independent Registered Public Accounting Firm.

7

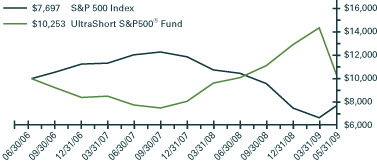

ProShares Ultra S&P500® (Ticker: SSO)

ProShares Ultra S&P500® seeks daily investment results, before fees and expenses, that correspond to twice (200%) the daily performance of the S&P 500® Index. The S&P 500® Index is a measure of large-cap U.S. stock market performance. It is a float-adjusted market capitalization weighted index of 500 U.S. operating companies and REITs selected by the S&P U.S. Index Committee through a non-mechanical process that factors criteria such as liquidity, price, market capitalization and financial viability. Reconstitution occurs both on a quarterly and ongoing basis.

The Fund takes positions in securities and/or financial instruments that, in combination, should have similar daily return characteristics as 200% of the daily return of the index. For the year ended May 31, 2009, the Fund had a total return of –64.09%1, compared to a total return of –32.57%2 for the index. For the period, the Fund had an average daily volume of 59,010,051 and an average daily statistical correlation of over 0.99 to twice that of the daily performance of the index.3

Among the ten highest weighted index components at inception that remained in the index for the entire period, the top three performers were Family Dollar Stores (+41.45%), O'Reilly Automotive (+37.86%), and First Horizon National Corp (+36.41%), while the bottom three performers in this group were American International Group (–95.31%), ProLogis (–86.29%), and Gannett Co. (–83.44%).

| Value of a $10,000 Investment Since Inception at Net Asset Value* | |||

*The line graph represents historical performance of a hypothetical investment of $10,000 in the Ultra S&P500® Fund from June 19, 2006 to May 31, 2009, assuming the reinvestment of distributions.

| Average Annual Total Return as of 5/31/09 | |||||||||||

| Fund | One Year | Since Inception (6/19/06) | |||||||||

| Ultra S&P500® Fund | -64.09 | % | -25.61 | % | |||||||

| S&P 500 Index | -32.57 | % | -7.67 | % | |||||||

| Expense Ratios** | |||||||||||

| Fund | Gross | Net | |||||||||

| Ultra S&P500® Fund | 0.98 | % | 0.95 | % | |||||||

**Reflects the expense ratio as reported in the Prospectus dated October 1, 2008. Contractual fee waivers are in effect through September 30, 2009.

| Allocation of Portfolio Holdings & Index Composition | |||

Market Exposure

| Investment Type | % of Net Assets | ||||||

| Equity Securities | 87 | % | |||||

| Swap Agreements | 100 | % | |||||

| Futures Contracts | 13 | % | |||||

| Total Exposure | 200 | % | |||||

"Market Exposure" includes the value of total investments (including the contract value of any derivatives) and excludes any short-term investments and cash equivalents.

Largest Equity Holdings

| Company | % of Net Assets | ||||||

| Exxon Mobil Corp. | 3.7 | % | |||||

| Microsoft Corp. | 1.7 | % | |||||

| Johnson & Johnson | 1.6 | % | |||||

| Procter & Gamble Co. (The) | 1.6 | % | |||||

| AT&T, Inc. | 1.6 | % | |||||

S&P 500 Index – Composition

| % of Index | |||||||

| Consumer, Non-cyclical | 24.3 | % | |||||

| Financials | 13.3 | % | |||||

| Energy | 13.2 | % | |||||

| Technology | 11.8 | % | |||||

| Communications | 11.4 | % | |||||

| Industrials | 10.4 | % | |||||

| Consumer, Cyclical | 8.5 | % | |||||

| Utilities | 3.7 | % | |||||

| Basic Materials | 3.3 | % | |||||

| Diversified | 0.1 | % | |||||

Past performance does not guarantee future results. Return calculations assume the reinvestment of distributions and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor's shares, when redeemed may be more or less than the original cost. To obtain performance current to the most recent month please visit www.proshares.com.

1 Fund Returns are based on the Net Asset Value of the Fund. This calculation reflects the theoretical reinvestment of distributions, if any, in the fund as of the ex-date. The impact of transaction costs and the lack of ability to reinvest fractional shares are not reflected in the calculations.

2 The Index is a price return index. The total return and any graph or table reflect the theoretical reinvestment of dividends on securities in the Index. The impact of transaction costs and the deduction of expenses associated with an exchange traded fund such as investment management and accounting fees are not reflected in the Index calculation. It is not possible to invest directly in an Index.

3 1.00 equals perfect correlation. This calculation is based on the daily price return of the index and the performance of the daily price return of the Net Asset Value per share of the fund.

The above information is not covered by the Report of the Independent Registered Public Accounting Firm.

8

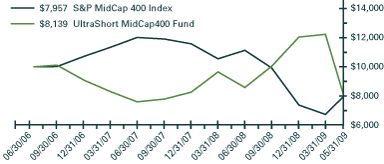

ProShares Ultra MidCap400 (Ticker: MVV)

ProShares Ultra MidCap400 seeks daily investment results, before fees and expenses, that correspond to twice (200%) the daily performance of the S&P MidCap 400TM Index. The S&P MidCap 400TM Index is a measure of mid-size company U.S. stock market performance. It is a float-adjusted market capitalization weighted index of 400 U.S. operating companies and REITs. Securities are selected for inclusion in the index by the S&P U.S. Index Committee through a non-mechanical process that factors criteria such as liquidity, price, market capitalization and financial viability. Reconstitution occurs both on a quarterly and ongoing basis.

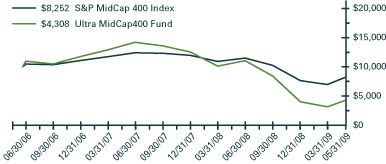

The Fund takes positions in securities and/or financial instruments that, in combination, should have similar daily return characteristics as 200% of the daily return of the index. For the year ended May 31, 2009, the Fund had a total return of –66.62%1, compared to a total return of –33.50%2 for the index. For the period, the Fund had an average daily volume of 1,015,965 and an average daily statistical correlation of over 0.99 to twice that of the daily performance of the index.3

Among the ten highest weighted index components at inception that remained in the index for the entire period, the top three performers were Palm Inc (+101.32%), 3Com Corp (+71.43%), and Airtran Holdings (+69.00%), while the bottom three performers in this group were YRC Worldwide Inc (–85.22%), Patriot Coal (–83.24%), and Terex Corp (–81.19%).

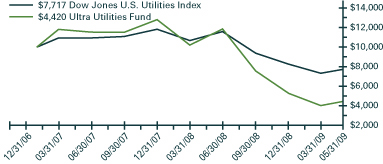

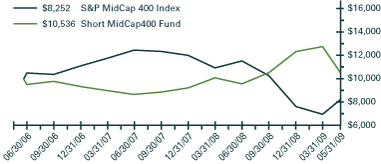

| Value of a $10,000 Investment Since Inception at Net Asset Value* | |||

*The line graph represents historical performance of a hypothetical investment of $10,000 in the Ultra MidCap400 Fund from June 19, 2006 to May 31, 2009, assuming the reinvestment of distributions.

| Average Annual Total Return as of 5/31/09 | |||||||||||

| Fund | One Year | Since Inception (6/19/06) | |||||||||

| Ultra MidCap400 Fund | -66.62 | % | -24.85 | % | |||||||

| S&P MidCap 400 Index | -33.50 | % | -6.32 | % | |||||||

| Expense Ratios** | |||||||||||

| Fund | Gross | Net | |||||||||

| Ultra MidCap400 Fund | 1.25 | % | 0.95 | % | |||||||

**Reflects the expense ratio as reported in the Prospectus dated October 1, 2008. Contractual fee waivers are in effect through September 30, 2009.

| Allocation of Portfolio Holdings & Index Composition | |||

Market Exposure

| Investment Type | % of Net Assets | ||||||

| Equity Securities | 86 | % | |||||

| Swap Agreements | 100 | % | |||||

| Futures Contracts | 14 | % | |||||

| Total Exposure | 200 | % | |||||

"Market Exposure" includes the value of total investments (including the contract value of any derivatives) and excludes any short-term investments and cash equivalents.

Largest Equity Holdings

| Company | % of Net Assets | ||||||

| Western Digital Corp. | 0.7 | % | |||||

| FMC Technologies, Inc. | 0.6 | % | |||||

| Vertex Pharmaceuticals, Inc. | 0.6 | % | |||||

| Ross Stores, Inc. | 0.6 | % | |||||

| Newfield Exploration Co. | 0.6 | % | |||||

S&P MidCap400 Index – Composition

| % of Index | |||||||

| Consumer, Non-cyclical | 21.3 | % | |||||

| Industrials | 17.6 | % | |||||

| Financials | 17.0 | % | |||||

| Consumer, Cyclical | 13.0 | % | |||||

| Technology | 7.7 | % | |||||

| Energy | 7.3 | % | |||||

| Utilities | 6.1 | % | |||||

| Basic Materials | 5.5 | % | |||||

| Communications | 4.5 | % | |||||

Past performance does not guarantee future results. Return calculations assume the reinvestment of distributions and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor's shares, when redeemed may be more or less than the original cost. To obtain performance current to the most recent month please visit www.proshares.com.

1 Fund Returns are based on the Net Asset Value of the Fund. This calculation reflects the theoretical reinvestment of distributions, if any, in the fund as of the ex-date. The impact of transaction costs and the lack of ability to reinvest fractional shares are not reflected in the calculations.

2 The Index is a price return index. The total return and any graph or table reflect the theoretical reinvestment of dividends on securities in the Index. The impact of transaction costs and the deduction of expenses associated with an exchange traded fund such as investment management and accounting fees are not reflected in the Index calculation. It is not possible to invest directly in an Index.

3 1.00 equals perfect correlation. This calculation is based on the daily price return of the index and the performance of the daily price return of the Net Asset Value per share of the fund.

The above information is not covered by the Report of the Independent Registered Public Accounting Firm.

9

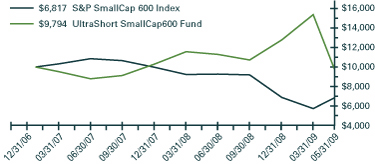

ProShares Ultra SmallCap600 (Ticker:SAA)

ProShares Ultra SmallCap600 seeks daily investment results, before fees and expenses, that correspond to twice (200%) the daily performance of the S&P SmallCap 600TM Index. The S&P SmallCap 600TM Index is a measure of small-cap company U.S. stock market performance. It is a float-adjusted market capitalization weighted index of 600 U.S. operating companies. Securities are selected for inclusion in the index by an S&P committee through a nonmechanical process that factors criteria such as liquidity, price, market capitalization, financial viability, and public float.

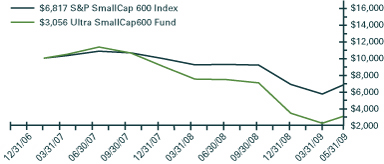

The Fund takes positions in securities and/or financial instruments that, in combination, should have similar daily return characteristics as 200% of the daily return of the index. For the year ended May 31, 2009, the Fund had a total return of –65.10%1, compared to a total return of –31.93%2 for the index. For the period, the Fund had an average daily volume of 128,506 and an average daily statistical correlation of over 0.99 to twice that of the daily performance of the index.3

Among the ten highest weighted index components at inception that remained in the index for the entire period, the top three performers were Cypress Semiconductor Corp (+93.83%), Green Mountain Coffee Roasters, Inc. (+93.40%), and World Fuel Services (+76.17%), while the bottom three performers in this group were Century Aluminum (–91.77%), Frontier Financial Corp (–89.86%), and Fairpoint Communications (–88.78%).

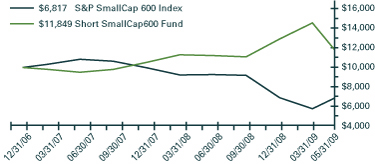

| Value of a $10,000 Investment Since Inception at Net Asset Value* | |||

*The line graph represents historical performance of a hypothetical investment of $10,000 in the Ultra SmallCap600 Fund from January 23, 2007 to May 31, 2009, assuming the reinvestment of distributions.

| Average Annual Total Return as of 5/31/09 | |||||||||||

| Fund | One Year | Since Inception (1/23/07) | |||||||||

| Ultra SmallCap600 Fund | -65.10 | % | -39.61 | % | |||||||

| S&P SmallCap 600 Index | -31.93 | % | -15.06 | % | |||||||

| Expense Ratios** | |||||||||||

| Fund | Gross | Net | |||||||||

| Ultra SmallCap600 Fund | 2.10 | % | 0.95 | % | |||||||

**Reflects the expense ratio as reported in the Prospectus dated October 1, 2008. Contractual fee waivers are in effect through September 30, 2009.

| Allocation of Portfolio Holdings & Index Composition | |||

Market Exposure

| Investment Type | % of Net Assets | ||||||

| Equity Securities | 88 | % | |||||

| Swap Agreements | 110 | % | |||||

| Futures Contracts | — | ||||||

| Total Exposure | 198 | % | |||||

"Market Exposure" includes the value of total investments (including the contract value of any derivatives) and excludes any short-term investments and cash equivalents.

Largest Equity Holdings

| Company | % of Net Assets | ||||||

| Atmos Energy Corp. | 0.6 | % | |||||

| Micros Systems, Inc. | 0.6 | % | |||||

| Senior Housing Properties Trust | 0.6 | % | |||||

| Mednax, Inc. | 0.5 | % | |||||

| Kirby Corp. | 0.5 | % | |||||

S&P SmallCap 600 Index – Composition

| % of Index | |||||||

| Industrials | 19.6 | % | |||||

| Consumer, Non-cyclical | 18.7 | % | |||||

| Financials | 17.6 | % | |||||

| Consumer, Cyclical | 16.2 | % | |||||

| Technology | 10.8 | % | |||||

| Communications | 5.4 | % | |||||

| Energy | 4.7 | % | |||||

| Utilities | 4.4 | % | |||||

| Basic Materials | �� | 2.6 | % | ||||

Past performance does not guarantee future results. Return calculations assume the reinvestment of distributions and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor's shares, when redeemed may be more or less than the original cost. To obtain performance current to the most recent month please visit www.proshares.com.

1 Fund Returns are based on the Net Asset Value of the Fund. This calculation reflects the theoretical reinvestment of distributions, if any, in the fund as of the ex-date. The impact of transaction costs and the lack of ability to reinvest fractional shares are not reflected in the calculations.

2 The Index is a price return index. The total return and any graph or table reflect the theoretical reinvestment of dividends on securities in the Index. The impact of transaction costs and the deduction of expenses associated with an exchange traded fund such as investment management and accounting fees are not reflected in the Index calculation. It is not possible to invest directly in an Index.

3 1.00 equals perfect correlation. This calculation is based on the daily price return of the index and the performance of the daily price return of the Net Asset Value per share of the fund.

The above information is not covered by the Report of the Independent Registered Public Accounting Firm.

10

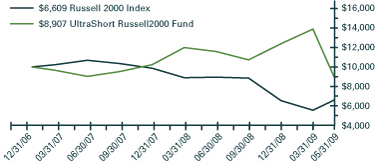

ProShares Ultra Russell2000 (Ticker: UWM)

ProShares Ultra Russell2000 seeks daily investment results, before fees and expenses, that correspond to twice (200%) the daily performance of the Russell 2000® Index. The Russell 2000® Index is a measure of small-cap U.S. stock market performance. It is a float-adjusted market capitalization weighted index containing approximately 2000 of the smallest companies in the Russell 3000® Index or approximately 8% of the total market capitalization of the Russell 3000® Index, which in turn represents approximately 98% of the investable U.S. equity market.

The Fund takes positions in securities and/or financial instruments that, in combination, should have similar daily return characteristics as 200% of the daily return of the index. For the year ended May 31, 2009, the Fund had a total return of –66.18%1, compared to a total return of –31.79%2 for the index. For the period, the Fund had an average daily volume of 5,169,827 and an average daily statistical correlation of over 0.99 to twice that of the daily performance of the index.3

Among the ten highest weighted index components at inception that remained in the index for the entire period, the top three performers were Dendreon Corp (+335.96%), Star Scientific (+157.73%), and Allscripts-Misys Healthcare Solutions (+157.31%), while the bottom three performers in this group were HSW International (–95.66%), Medis Tech Ltd (–95.64%), and Lear Corp (–95.18%).

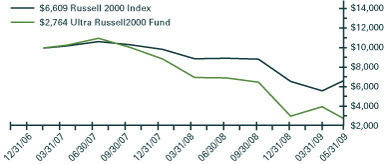

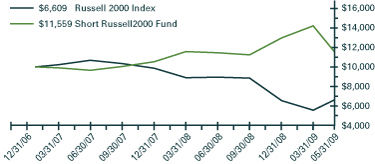

| Value of a $10,000 Investment Since Inception at Net Asset Value* | |||

*The line graph represents historical performance of a hypothetical investment of $10,000 in the Ultra Russell2000 Fund from January 23, 2007 to May 31, 2009, assuming the reinvestment of distributions.

| Average Annual Total Return as of 5/31/09 | |||||||||||

| Fund | One Year | Since Inception (1/23/07) | |||||||||

| Ultra Russell2000 Fund | -66.18 | % | -42.13 | % | |||||||

| Russell 2000 Index | -31.79 | % | -16.17 | % | |||||||

| Expense Ratios** | |||||||||||

| Fund | Gross | Net | |||||||||

| Ultra Russell2000 Fund | 1.49 | % | 0.95 | % | |||||||

**Reflects the expense ratio as reported in the Prospectus dated October 1, 2008. Contractual fee waivers are in effect through September 30, 2009.

| Allocation of Portfolio Holdings & Index Composition | |||

Market Exposure

| Investment Type | % of Net Assets | ||||||

| Equity Securities | 90 | % | |||||

| Swap Agreements | 94 | % | |||||

| Futures Contracts | 16 | % | |||||

| Total Exposure | 200 | % | |||||

"Market Exposure" includes the value of total investments (including the contract value of any derivatives) and excludes any short-term investments and cash equivalents.

Largest Equity Holdings

| Company | % of Net Assets | ||||||

| Myriad Genetics, Inc. | 0.4 | % | |||||

| Ralcorp Holdings, Inc. | 0.4 | % | |||||

| Alexion Pharmaceuticals, Inc. | 0.4 | % | |||||

| Dendreon Corp. | 0.3 | % | |||||

| Sybase, Inc. | 0.3 | % | |||||

Russell 2000 Index – Composition

| % of Index | |||||||

| Consumer, Non-cyclical | 22.2 | % | |||||

| Financials | 18.9 | % | |||||

| Industrials | 15.1 | % | |||||

| Consumer, Cyclical | 13.0 | % | |||||

| Technology | 10.9 | % | |||||

| Communications | 8.4 | % | |||||

| Energy | 4.4 | % | |||||

| Utilities | 4.0 | % | |||||

| Basic Materials | 3.1 | % | |||||

Past performance does not guarantee future results. Return calculations assume the reinvestment of distributions and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor's shares, when redeemed may be more or less than the original cost. To obtain performance current to the most recent month please visit www.proshares.com.

1 Fund Returns are based on the Net Asset Value of the Fund. This calculation reflects the theoretical reinvestment of distributions, if any, in the fund as of the ex-date. The impact of transaction costs and the lack of ability to reinvest fractional shares are not reflected in the calculations.

2 The Index is a price return index. The total return and any graph or table reflect the theoretical reinvestment of dividends on securities in the Index. The impact of transaction costs and the deduction of expenses associated with an exchange traded fund such as investment management and accounting fees are not reflected in the Index calculation. It is not possible to invest directly in an Index.

3 1.00 equals perfect correlation. This calculation is based on the daily price return of the index and the performance of the daily price return of the Net Asset Value per share of the fund.

The above information is not covered by the Report of the Independent Registered Public Accounting Firm.

11

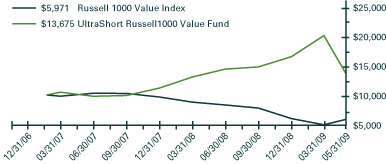

ProShares Ultra Russell1000 Value (Ticker: UVG)

ProShares Ultra Russell1000 Value seeks daily investment results, before fees and expenses, that correspond to twice (200%) the daily performance of the Russell 1000® Value Index. The Russell 1000® Value Index is designed to provide a comprehensive measure of large-cap U.S. equity "value" performance. It is an unmanaged, float-adjusted, market capitalization weighted index comprised of stocks representing approximately half the market capitalization of the Russell 1000 Index that have been identified as being on the value end of the growth value spectrum.

The Fund takes positions in securities and/or financial instruments that, in combination, should have similar daily return characteristics as 200% of the daily return of the index. For the year ended May 31, 2009, the Fund had a total return of –68.39%1, compared to a total return of –35.35%2 for the index. For the period, the Fund had an average daily volume of 43,870 and an average daily statistical correlation of over 0.99 to twice that of the daily performance of the index.3

Among the ten highest weighted index components at inception that remained in the index for the entire period, the top three performers were Family Dollar Stores (+41.45%), O'Reilly Automotive (+37.86%), and First Horizon National Corp (+36.41%), while the bottom three performers in this group were Fannie Mae (–97.30%), Freddie Mac (–96.85%), and American International Group (–95.31%).

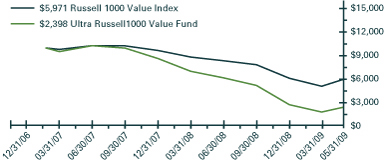

| Value of a $10,000 Investment Since Inception at Net Asset Value* | |||

*The line graph represents historical performance of a hypothetical investment of $10,000 in the Ultra Russell000 Value Fund from February 20, 2007 to May 31, 2009, assuming the reinvestment of distributions.

| Average Annual Total Return as of 5/31/09 | |||||||||||

| Fund | One Year | Since Inception (2/20/07) | |||||||||

| Ultra Russell1000 Value Fund | -68.39 | % | -46.63 | % | |||||||

| Russell 1000 Value Index | -35.35 | % | -20.31 | % | |||||||

| Expense Ratios** | |||||||||||

| Fund | Gross | Net | |||||||||

| Ultra Russell1000 Value Fund | 2.06 | % | 0.95 | % | |||||||

**Reflects the expense ratio as reported in the Prospectus dated October 1, 2008. Contractual fee waivers are in effect through September 30, 2009.

| Allocation of Portfolio Holdings & Index Composition | |||

Market Exposure

| Investment Type | % of Net Assets | ||||||

| Equity Securities | 92 | % | |||||

| Swap Agreements | 107 | % | |||||

| Futures Contracts | — | ||||||

| Total Exposure | 199 | % | |||||

"Market Exposure" includes the value of total investments (including the contract value of any derivatives) and excludes any short-term investments and cash equivalents.

Largest Equity Holdings

| Company | % of Net Assets | ||||||

| Exxon Mobil Corp. | 6.0 | % | |||||

| AT&T, Inc. | 3.1 | % | |||||

| General Electric Co. | 3.0 | % | |||||

| Chevron Corp. | 2.9 | % | |||||

| JPMorgan Chase & Co. | 2.9 | % | |||||

Russell 1000 Value Index – Composition

| % of Index | |||||||

| Financials | 23.3 | % | |||||

| Consumer, Non-cyclical | 22.1 | % | |||||

| Energy | 16.7 | % | |||||

| Communications | 10.7 | % | |||||

| Industrials | 9.1 | % | |||||

| Consumer, Cyclical | 6.4 | % | |||||

| Utilities | 6.3 | % | |||||

| Basic Materials | 3.3 | % | |||||

| Technology | 2.0 | % | |||||

| Diversified | 0.1 | % | |||||

Past performance does not guarantee future results. Return calculations assume the reinvestment of distributions and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor's shares, when redeemed may be more or less than the original cost. To obtain performance current to the most recent month please visit www.proshares.com.

1 Fund Returns are based on the Net Asset Value of the Fund. This calculation reflects the theoretical reinvestment of distributions, if any, in the fund as of the ex-date. The impact of transaction costs and the lack of ability to reinvest fractional shares are not reflected in the calculations.

2 The Index is a price return index. The total return and any graph or table reflect the theoretical reinvestment of dividends on securities in the Index. The impact of transaction costs and the deduction of expenses associated with an exchange traded fund such as investment management and accounting fees are not reflected in the Index calculation. It is not possible to invest directly in an Index.

3 1.00 equals perfect correlation. This calculation is based on the daily price return of the index and the performance of the daily price return of the Net Asset Value per share of the fund.

The above information is not covered by the Report of the Independent Registered Public Accounting Firm.

12

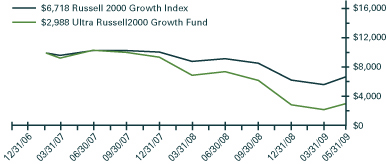

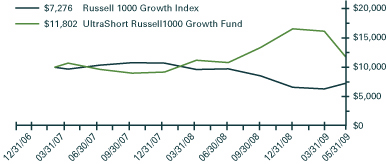

ProShares Ultra Russell1000 Growth (Ticker: UKF)

ProShares Ultra Russell1000 Growth seeks daily investment results, before fees and expenses, that correspond to twice (200%) the daily performance of the Russell 1000® Growth Index. The Russell 1000® Growth Index is designed to provide a comprehensive measure of large-cap U.S. equity "growth" performance. It is an unmanaged, float-adjusted, market capitalization weighted index comprised of stocks representing approximately half the market capitalization of the Russell 1000 Index that have been identified as being on the growth end of the growth-value spectrum.

The Fund takes positions in securities and/or financial instruments that, in combination, should have similar daily return characteristics as 200% of the daily return of the index. For the year ended May 31, 2009, the Fund had a total return of –60.90%1, compared to a total return of –30.72%2 for the index. For the period, the Fund had an average daily volume of 35,250 and an average daily statistical correlation of over 0.99 to twice that of the inverse daily performance of the index.3

Among the ten highest weighted index components at inception that remained in the index for the entire period, the top three performers were Cypress Semiconductor (+93.83%), and Family Dollar Stores (+41.45%), and O'Reilly Automotive (+37.86%), while the bottom three performers in this group were Freddie Mac (–96.85%), Century Aluminum (–91.77%), and Sirius XM Radio (–86.13%).

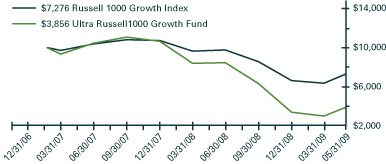

| Value of a $10,000 Investment Since Inception at Net Asset Value* | |||

*The line graph represents historical performance of a hypothetical investment of $10,000 in the Ultra Russell1000 Growth Fund from February 20, 2007 to May 31, 2009, assuming the reinvestment of distributions.

| Average Annual Total Return as of 5/31/09 | |||||||||||

| Fund | One Year | Since Inception (2/20/07) | |||||||||

| Ultra Russell1000 Growth Fund | -60.90 | % | -34.24 | % | |||||||

| Russell 1000 Growth Index | -30.72 | % | -13.07 | % | |||||||

| Expense Ratios** | |||||||||||

| Fund | Gross | Net | |||||||||

| Ultra Russell1000 Growth Fund | 1.56 | % | 0.95 | % | |||||||

**Reflects the expense ratio as reported in the Prospectus dated October 1, 2008. Contractual fee waivers are in effect through September 30, 2009.

| Allocation of Portfolio Holdings & Index Composition | |||

Market Exposure

| Investment Type | % of Net Assets | ||||||

| Equity Securities | 88 | % | |||||

| Swap Agreements | 110 | % | |||||

| Futures Contracts | — | ||||||

| Total Exposure | 198 | % | |||||

"Market Exposure" includes the value of total investments (including the contract value of any derivatives) and excludes any short-term investments and cash equivalents.

Largest Equity Holdings

| Company | % of Net Assets | ||||||

| Microsoft Corp. | 3.1 | % | |||||

| International Business Machines Corp. | 2.7 | % | |||||

| Apple, Inc. | 2.2 | % | |||||

| Cisco Systems, Inc. | 2.0 | % | |||||

| Google, Inc., Class A | 1.8 | % | |||||

Russell 1000 Growth Index – Composition

| % of Index | |||||||

| Consumer, Non-cyclical | 26.1 | % | |||||

| Technology | 21.7 | % | |||||

| Industrials | 12.2 | % | |||||

| Communications | 11.6 | % | |||||

| Consumer, Cyclical | 10.8 | % | |||||

| Energy | 8.5 | % | |||||

| Financials | 3.8 | % | |||||

| Basic Materials | 3.6 | % | |||||

| Utilities | 1.7 | % | |||||

Past performance does not guarantee future results. Return calculations assume the reinvestment of distributions and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor's shares, when redeemed may be more or less than the original cost. To obtain performance current to the most recent month please visit www.proshares.com.

1 Fund Returns are based on the Net Asset Value of the Fund. This calculation reflects the theoretical reinvestment of distributions, if any, in the fund as of the ex-date. The impact of transaction costs and the lack of ability to reinvest fractional shares are not reflected in the calculations.

2 The Index is a price return index. The total return and any graph or table reflect the theoretical reinvestment of dividends on securities in the Index. The impact of transaction costs and the deduction of expenses associated with an exchange traded fund such as investment management and accounting fees are not reflected in the Index calculation. It is not possible to invest directly in an Index.

3 1.00 equals perfect correlation. This calculation is based on the daily price return of the index and the performance of the daily price return of the Net Asset Value per share of the fund.

The above information is not covered by the Report of the Independent Registered Public Accounting Firm.

13

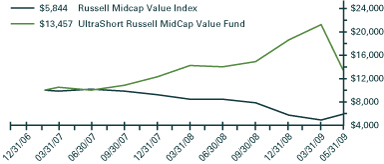

ProShares Ultra Russell MidCap Value (Ticker: UVU)

ProShares Ultra Russell MidCap Value seeks daily investment results, before fees and expenses, that correspond to twice (200%) the daily performance of the Russell Midcap® Value Index. The Russell Midcap® Value Index is designed to provide a comprehensive measure of mid-cap U.S. equity "value" performance. It is an unmanaged, float-adjusted, market capitalization weighted index comprised of stocks representing approximately half the market capitalization of the Russell Midcap Index that have been identified as being on the value end of the growth-value spectrum.

The Fund takes positions in securities and/or financial instruments that, in combination, should have similar daily return characteristics as 200% of the daily return of the index. For the year ended May 31, 2009, the Fund had a total return of –70.21%1, compared to a total return of –36.84%2 for the index. For the period, the Fund had an average daily volume of 24,872 and an average daily statistical correlation of over 0.99 to twice that of the daily performance of the index.3

Among the ten highest weighted index components at inception that remained in the index for the entire period, the top three performers were Family Dollar Stores (+41.45%), O'Reilly Automotive (+37.86%), and First Horizon National Corp (+36.41%), while the bottom three performers in this group were Century Aluminum (–91.77%), American Capital Ltd (–91.41%), and Developers Diversified Realty Corp (–86.83%).

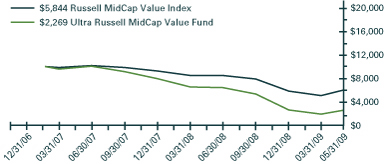

| Value of a $10,000 Investment Since Inception at Net Asset Value* | |||

*The line graph represents historical performance of a hypothetical investment of $10,000 in the Ultra Russell MidCap Value Fund from February 20, 2007 to May 31, 2009, assuming the reinvestment of distributions.

| Average Annual Total Return as of 5/31/09 | |||||||||||

| Fund | One Year | Since Inception (2/20/07) | |||||||||

| Ultra Russell MidCap Value Fund | -70.21 | % | -47.92 | % | |||||||

| Russell MidCap Value Index | -36.84 | % | -21.06 | % | |||||||

| Expense Ratios** | |||||||||||

| Fund | Gross | Net | |||||||||

| Ultra Russell MidCap Value Fund | 2.44 | % | 0.95 | % | |||||||

**Reflects the expense ratio as reported in the Prospectus dated October 1, 2008. Contractual fee waivers are in effect through September 30, 2009.

| Allocation of Portfolio Holdings & Index Composition | |||

Market Exposure

| Investment Type | % of Net Assets | ||||||

| Equity Securities | 92 | % | |||||

| Swap Agreements | 107 | % | |||||

| Futures Contracts | — | ||||||

| Total Exposure | 199 | % | |||||

"Market Exposure" includes the value of total investments (including the contract value of any derivatives) and excludes any short-term investments and cash equivalents.

Largest Equity Holdings

| Company | % of Net Assets | ||||||

| Ford Motor Co. | 1.4 | % | |||||

| PG&E Corp. | 1.0 | % | |||||

| American Electric Power Co., Inc. | 1.0 | % | |||||

| Sempra Energy | 0.9 | % | |||||

| Progressive Corp. (The) | 0.8 | % | |||||

Russell Midcap Value Index – Composition

| % of Index | |||||||

| Financials | 26.6 | % | |||||

| Consumer, Non-cyclical | 16.7 | % | |||||

| Utilities | 13.2 | % | |||||

| Consumer, Cyclical | 11.4 | % | |||||

| Industrials | 8.8 | % | |||||

| Energy | 6.3 | % | |||||

| Communications | 5.9 | % | |||||

| Technology | 5.5 | % | |||||

| Basic Materials | 5.3 | % | |||||

| Diversified | 0.3 | % | |||||

Past performance does not guarantee future results. Return calculations assume the reinvestment of distributions and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor's shares, when redeemed may be more or less than the original cost. To obtain performance current to the most recent month please visit www.proshares.com.

1 Fund Returns are based on the Net Asset Value of the Fund. This calculation reflects the theoretical reinvestment of distributions, if any, in the fund as of the ex-date. The impact of transaction costs and the lack of ability to reinvest fractional shares are not reflected in the calculations.

2 The Index is a price return index. The total return and any graph or table reflect the theoretical reinvestment of dividends on securities in the Index. The impact of transaction costs and the deduction of expenses associated with an exchange traded fund such as investment management and accounting fees are not reflected in the Index calculation. It is not possible to invest directly in an Index.

3 1.00 equals perfect correlation. This calculation is based on the daily price return of the index and the performance of the daily price return of the Net Asset Value per share of the fund.

The above information is not covered by the Report of the Independent Registered Public Accounting Firm.

14

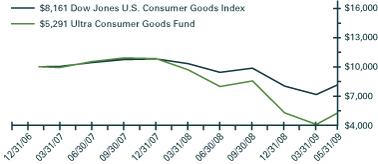

ProShares Ultra Russell MidCap Growth (Ticker:UKW)

ProShares Ultra Russell MidCap Growth seeks daily investment results, before fees and expenses, that correspond to twice (200%) the daily performance of the Russell Midcap® Growth Index. The Russell Midcap® Growth Index is designed to provide a comprehensive measure of mid-cap U.S. equity "growth" performance. It is an unmanaged, float-adjusted, market capitalization weighted index comprised of stocks representing approximately half the market capitalization of the Russell Midcap Index that have been identified as being on the growth end of the growth-value spectrum.

The Fund takes positions in securities and/or financial instruments that, in combination, should have similar daily return characteristics as 200% of the daily return of the index. For the year ended May 31, 2009, the Fund had a total return of –68.49%1, compared to a total return of –35.73%2 for the index. For the period, the Fund had an average daily volume of 30,745 and an average daily statistical correlation of over 0.99 to twice that of the daily performance of the index.3

Among the ten highest weighted index components at inception that remained in the index for the entire period, the top three performers were Cypress Semiconductor Corp (+93.83%), Family Dollar Stores (+41.45%), and O'Reilly Automotive (+37.86%), while the bottom three performers in this group were Century Aluminum (–91.77%), Sirius XM Radio (–86.13%), and Orient-Express Hotels Ltd (–84.86%).

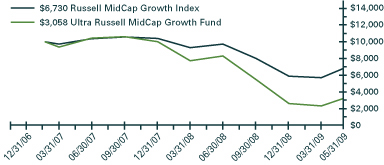

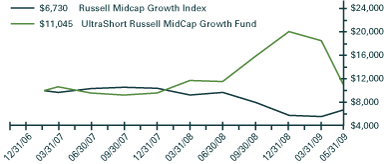

| Value of a $10,000 Investment Since Inception at Net Asset Value* | |||

*The line graph represents historical performance of a hypothetical investment of $10,000 in the Ultra Russell MidCap Growth Fund from February 20, 2007 to May 31, 2009, assuming the reinvestment of distributions.

| Average Annual Total Return as of 5/31/09 | |||||||||||

| Fund | One Year | Since Inception (2/20/07) | |||||||||

| Ultra Russell MidCap Growth Fund | -68.49 | % | -40.61 | % | |||||||

| Russell MidCap Growth Index | -35.73 | % | -16.00 | % | |||||||

| Expense Ratios** | |||||||||||

| Fund | Gross | Net | |||||||||

| Ultra Russell MidCap Growth Fund | 1.95 | % | 0.95 | % | |||||||

**Reflects the expense ratio as reported in the Prospectus dated October 1, 2008. Contractual fee waivers are in effect through September 30, 2009.

| Allocation of Portfolio Holdings & Index Composition | |||

Market Exposure

| Investment Type | % of Net Assets | ||||||

| Equity Securities | 89 | % | |||||

| Swap Agreements | 110 | % | |||||

| Futures Contracts | — | ||||||

| Total Exposure | 199 | % | |||||

"Market Exposure" includes the value of total investments (including the contract value of any derivatives) and excludes any short-term investments and cash equivalents.

Largest Equity Holdings

| Company | % of Net Assets | ||||||

| Yum! Brands, Inc. | 1.1 | % | |||||

| Southwestern Energy Co. | 1.0 | % | |||||

| Express Scripts, Inc. | 0.9 | % | |||||

| Allergan, Inc. | 0.9 | % | |||||

| St. Jude Medical, Inc. | 0.9 | % | |||||

Russell Midcap Growth Index – Composition

| % of Index | |||||||

| Consumer, Non-cyclical | 21.4 | % | |||||

| Industrials | 17.6 | % | |||||

| Consumer, Cyclical | 15.1 | % | |||||

| Technology | 14.8 | % | |||||

| Energy | 10.4 | % | |||||

| Communications | 8.9 | % | |||||

| Financials | 5.2 | % | |||||

| Basic Materials | 3.6 | % | |||||

| Utilities | 3.0 | % | |||||

Past performance does not guarantee future results. Return calculations assume the reinvestment of distributions and do not reflect taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor's shares, when redeemed may be more or less than the original cost. To obtain performance current to the most recent month please visit www.proshares.com.

1 Fund Returns are based on the Net Asset Value of the Fund. This calculation reflects the theoretical reinvestment of distributions, if any, in the fund as of the ex-date. The impact of transaction costs and the lack of ability to reinvest fractional shares are not reflected in the calculations.

2 The Index is a price return index. The total return and any graph or table reflect the theoretical reinvestment of dividends on securities in the Index. The impact of transaction costs and the deduction of expenses associated with an exchange traded fund such as investment management and accounting fees are not reflected in the Index calculation. It is not possible to invest directly in an Index.

3 1.00 equals perfect correlation. This calculation is based on the daily price return of the index and the performance of the daily price return of the Net Asset Value per share of the fund.

The above information is not covered by the Report of the Independent Registered Public Accounting Firm.

15

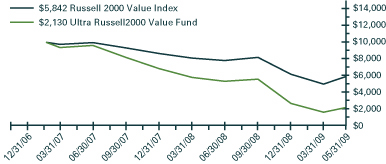

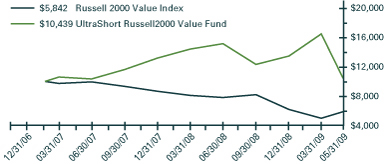

ProShares Ultra Russell2000 Value (Ticker: UVT)

ProShares Ultra Russell2000 Value seeks daily investment results, before fees and expenses, that correspond to twice (200%) the daily performance of the Russell 2000® Value Index. The Russell 2000® Value Index is designed to provide a comprehensive measure of small-cap U.S. equity "value" performance. It is an unmanaged, float-adjusted, market capitalization weighted index comprised of stocks representing approximately half the market capitalization of the Russell 2000 Index that have been identified as being on the value end of the growth-value spectrum.