June 15, 2022

VIA EDGAR CORRESPONDENCE

Michael Rosenberg

U.S. Securities and Exchange Commission

100 F Street, N.E.

Washington, DC 20549

Re: | ProShares Trust (the "Trust") (File Nos. 333-89822; 811-21114) |

Dear Mr. Rosenberg:

On April 5, 2022, the Trust filed with the Securities and Exchange Commission (the "Commission") Post-Effective Amendment No. 260 under the Securities Act of 1933, as amended (the "1933 Act"), and Amendment No. 269 under the Investment Company Act of 1940, as amended (the "1940 Act") to the Trust's registration statement (collectively, the "Amendment"). The Trust filed the Amendment to add a new exchange traded fund to the Trust – the ProShares Short Bitcoin Strategy ETF (the "Fund").

We received comments from you relating to the Amendment. For your convenience and reference, we have summarized the comments in this letter and provided the Trust's response below each comment. The Trust will file a Post-Effective Amendment to the Registration Statement pursuant to Rule 485(b) under the 1933 Act (the "B-Filing"). The B-Filing is being made for the purpose of incorporating modifications to the Fund's Prospectus and Statement of Additional Information in response to your comments on the Amendment as described in this letter and to make other minor and conforming changes.

Prospectus

General

1.Comment: Please provide the ticker symbol for the Fund.

Response: The Trust will provide the ticker symbol in the B-Filing. The ticker symbol for the Fund is expected to be BITI.

2.Comment: The Staff believes it is appropriate to add the word daily to the Fund's name in light of the Fund's objective of seeking daily results.

Response: The Trust respectfully declines to make the requested change. The Advisor does not believe Section 35(d) or Rule 35d-1 require the inclusion of the word "Daily" in the name of the Fund.

3.Comment: Under "Important Information About the Fund," please disclose prominently in bold that the Fund will not invest in or sell short bitcoin directly. This disclosure should be included in this section and under the Fund's principal investment strategies.

Response: The Trust has included the following disclosure as the last paragraph under

1

"Important Information About the Fund" and as the second paragraph under "Principal Investment Strategies."

The Fund does not invest directly in or directly short bitcoin. Instead, the Fund seeks to benefit from decreases in the price of bitcoin futures contracts for a single day.

4.Comment: Please supplementally disclose the anticipated liquidity classification under Rule 22e-4 of the bitcoin futures contracts in which the Fund intends to invest and the rationale for that classification.

Response: The front-month, cash-settled bitcoin futures contracts in which the Fund invests are expected to be classified as "highly liquid." Under current market conditions and at the level at which the Fund is expected to invest, the Fund expects that positions in significant size would be convertible to cash in three business days or less without the conversion to cash significantly changing the market value of such contracts.

5.Comment: Supplementally, please explain the Fund's plans for liquidity management generally, including during both normal and reasonably foreseeable stressed conditions.

Response: As required by the Fund's Liquidity Risk Management Program, the Fund's liquidity program administrator will evaluate the liquidity of the Fund's investments under both normal and reasonably foreseeably stressed conditions. In doing so, the Liquidity Risk Manager will take into consideration factors such as (i) short-term and long-term cash flow projections, (ii) the Fund's money market instrument holdings, (iii) the Fund's concentration in bitcoin futures contracts, (iv) the Fund's access to borrowing and use of reverse repurchase agreements, (v) the size of the Fund's holdings and anticipated creations and redemptions in relation to the market for CME bitcoin futures contracts, (vi) position limits and accountability levels applicable to CME bitcoin futures contracts, (vii) the capacity of futures commission merchants ("FCMs") to engage in such transactions, (viii) the relationship between the Fund's portfolio liquidity and the spread at which it is anticipated to trade, and (ix) the effect of the cash redemption basket on the overall liquidity of the Fund's portfolio.

6.Comment: Does the Fund anticipate any capacity constraints in the bitcoin futures market that would limit the size of the Fund's exposure to bitcoin futures? Please also explain to the Staff how the Fund will monitor market capacity as new participants enter the market. Discuss in your response any differences in capacity constraints associated with obtaining short exposure to bitcoin futures rather than long exposure to bitcoin futures. Please describe in more detail the short positions in U.S. listed equity securities the Fund intends to use and indicate supplementally whether such investment include short positions in ETFs or mutual funds advised by the Advisor.

Response: The Advisor does not expect that the current level of existing CME bitcoin futures volumes and open interest would create capacity constraints for the Fund or otherwise limit the Fund's ability (or the ability of similar products) to obtain the desired inverse exposure to bitcoin futures contracts, or that the Fund's futures transactions (and transactions by similar products) are likely to have a material impact on the price of such contracts.

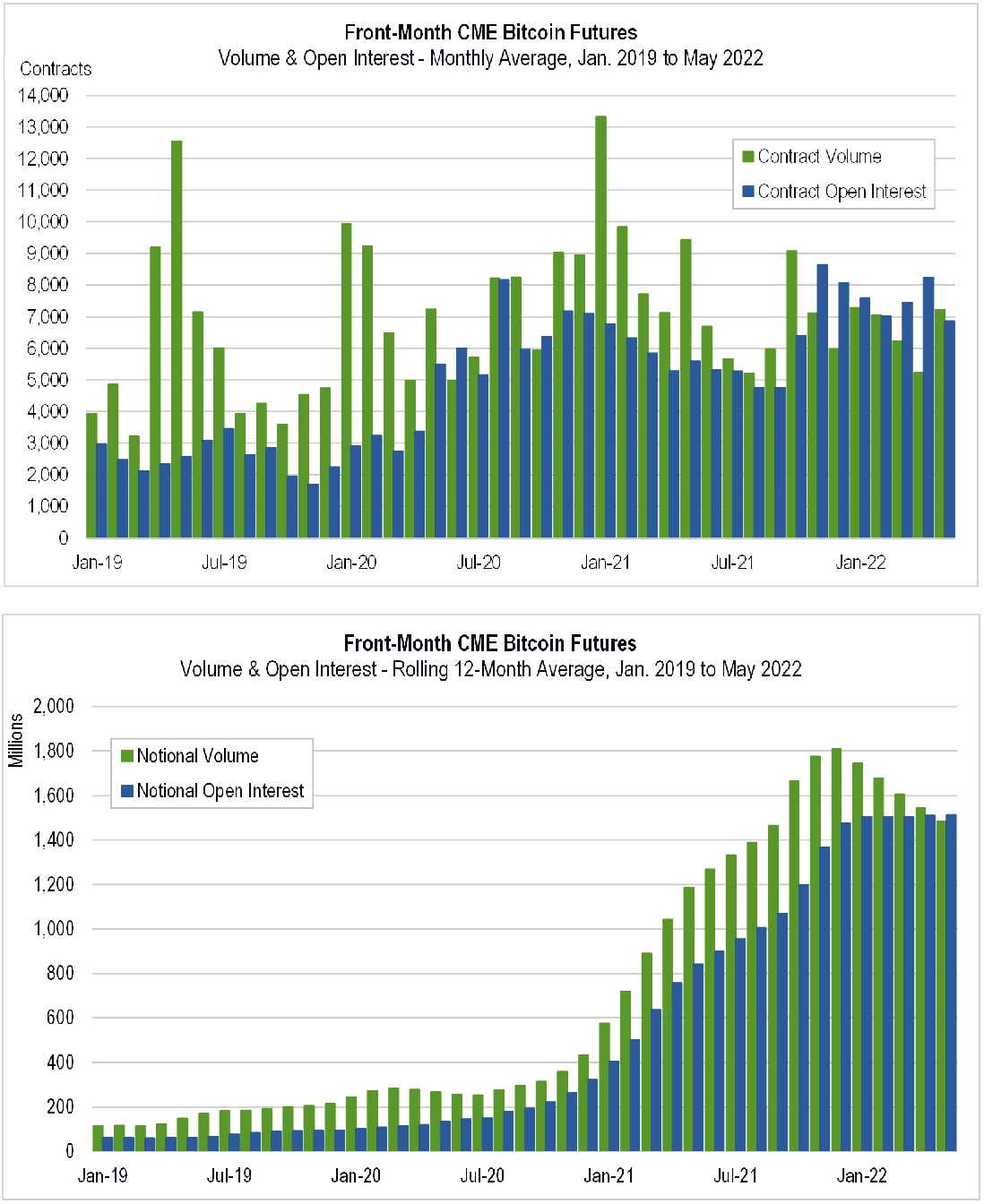

The current volume and open interest in CME bitcoin futures contracts has increased significantly since such contracts began trading. See, https://www.cmegroup.com/education/bitcoin/futures- liquidity-report.html.

The Advisor believes the current level of futures volumes and open interest indicate a market of sufficient size and liquidity and will not create capacity constraints or exposure limits for or limit the ability of the Fund (or similar products) to obtain the desired inverse exposure. For the same

2

reasons, the Advisor does not believe the Fund's futures transactions (and transactions by similar products) are likely to have a material impact on the price of such contracts. Importantly, unlike the supply of equity securities (which typically is fixed by the number of shares issued) additional futures contracts may be created whenever there is sufficient interest in such contracts.

The charts below illustrate these points. The first two charts show the growth in volume and open interest of CME futures contracts and that, in general, open interest has moved with contract volume. The first chart looks at monthly averages and the second looks at 12-month rolling periods.

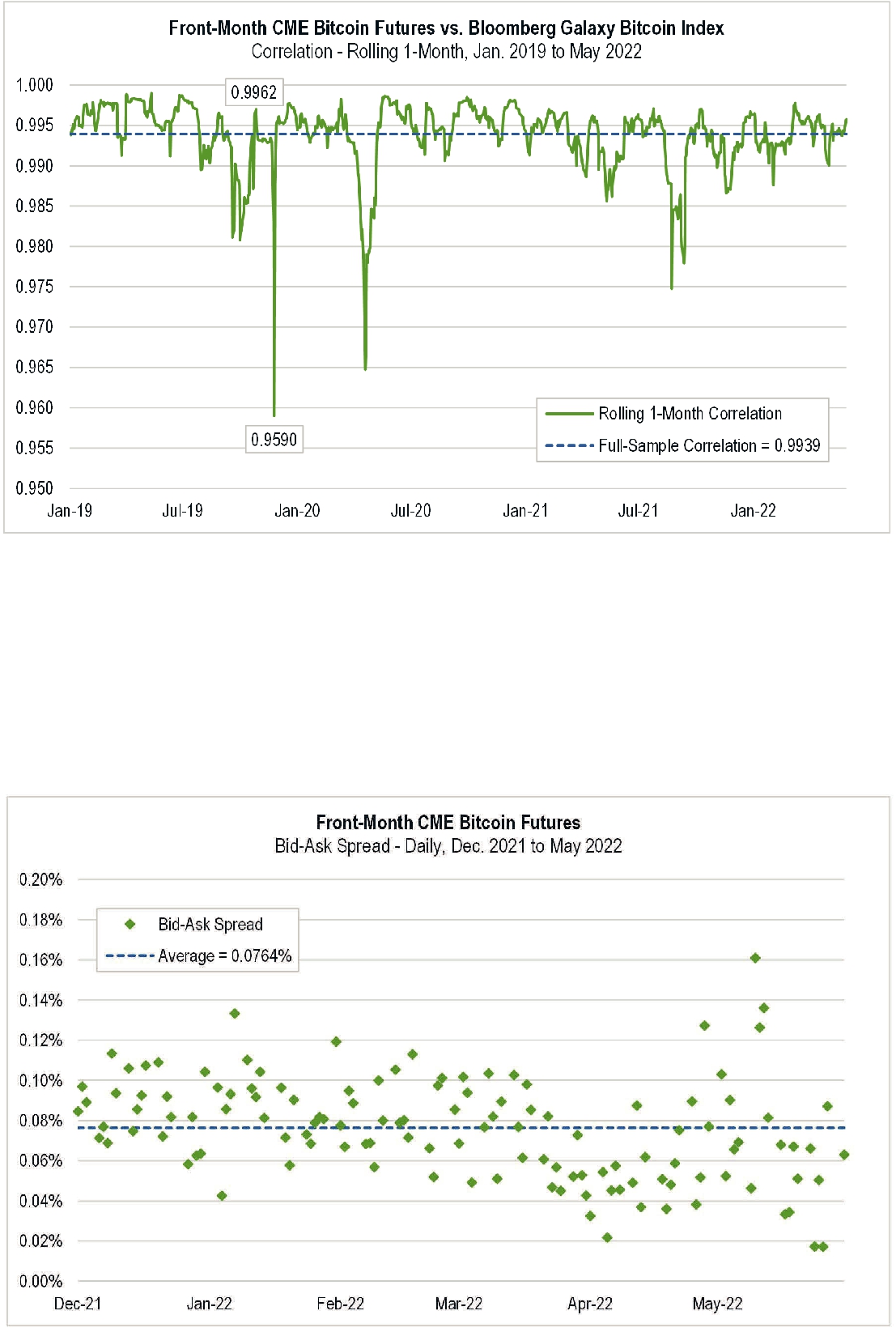

The chart that follows shows the high degree of correlation between the price of front-month CME bitcoin futures and spot bitcoin, as measured by the Bloomberg Galaxy Bitcoin Index. The significant increases in contract volume illustrated above have not resulted in significant deviations between the price of front-month CME bitcoin futures and the price of spot bitcoin, as measured

3

by the Bloomberg Galaxy Bitcoin Index, which were highly correlated during the measurement period.

1-Month Correlation Minimum = 0.9590 (Nov. 26, 2019)

1-Month Correlation, as of Oct. 25, 2019 = 0.9962

The lack of a material impact on price is further supported by an analysis of the bid-ask spreads on the front-month CME bitcoin futures contracts (this analysis uses a shorter sample due to intraday data availability). If demand had a material impact on price, we would expect to see widening bid- ask spreads as demand increases. Instead, as illustrated below, spreads clustered around the mean throughout the period.

4

As the assets of the Fund and similar products grow, the Fund and such products will need to sell additional CME bitcoin futures contracts to achieve their desired inverse exposures. As illustrated by the data provided above, the Advisor expects the market will meet this demand with a corresponding increase in open interest and trading volumes without a detrimental impact on the price of such contracts.

As with other types of futures contracts and securities tracking a benchmark or index, there is always the possibility that (i) investors seeking inverse exposure to such benchmark or index may utilize similar, or even identical, investment strategies or (ii) investors seeking to change their exposure or "roll" their futures positions will seek to do so within the same general period of time (i.e., "herd behavior"). However, given the depth and liquidity of the market, the Advisor believes these risks are limited with respect to the Fund. Nevertheless, in the "Liquidity Risk" discussion on page 6 of the Prospectus, the Trust has included risk disclosure warning investors about potentially illiquid markets and the potential impact of trading by the Fund and other market participants on the liquidity and price of the CME futures contracts traded by the Fund.

In addition, the Trust has revised the disclosure to provide the Fund with additional investment capacity through short positions in U.S. listed equity securities the Advisor believes provide returns that generally correspond, or are closely related, to the performance of bitcoin or bitcoin futures. The U.S. listed equity securities include, for example, U.S. listed companies engaged in digital asset mining or offering digital asset trading platforms. These investments do not include short positions in ETFs or mutual funds advised by the Advisor.

The Advisor will continue to monitor these and other market indications of capacity as new entrants enter the marketplace.

The Advisor does not believe obtaining short exposure to bitcoin futures contracts is subject to materially different capacity constraints than obtaining long exposure to bitcoin futures contracts.

7.Comment: Given the inability of ETFs to close to new investors, how will the Fund manage liquidity pressures should the fund become so large it will require more liquidity to meet potential redemptions than the market can provide.

Response: Currently, the Advisor does not anticipate that the liquidity of Bitcoin futures contracts will have any material negative impact on the ability of the Fund to achieve its investment objective or meet any redemptions The current Bitcoin futures position limit is 4,000 contracts with an additional accountability level of 5,000 contracts, which equates to approximately $1,424,250,000 of exposure based on current contract values.

If the Fund were to reach its position limits and position accountability levels on Bitcoin futures contracts or experience limited liquidity in the Bitcoin futures market, the Advisor intends to take such action as it believes appropriate and in the best interest of the Fund in light of the totality of the circumstances at such time. Given that it is not clear whether or when the Fund would hit such position limits or limitations on liquidity, what market conditions would exist at the time, and what regulations would be in effect, it is difficult to say with more specificity how the Fund intends to act. That said, the Fund intends to reserve the right in its registration statement in such instances, to short U.S. listed equity securities whose performance the Advisor believes may correspond, or be closely related, to the performance of bitcoin or bitcoin futures contracts, such as equity securities of companies involved in the cryptocurrency industry. Under the current principal investment strategies, the Fund may also consider investing any cash on hand due to position limits or accountability levels in money market instruments.

5

The Fund also may, after consultation with the Staff of the SEC, consider obtaining short exposure to U.S. listed futures contracts on cryptocurrencies other than Bitcoin or in other bitcoin-related instruments whose performance the Advisor believes may correspond to the performance of bitcoin or bitcoin futures contracts, such as exchange traded notes and funds, privately offered funds, or swaps on a Bitcoin reference rate. The Fund would not invest in these other instruments if doing so would be inconsistent with applicable law or regulation or the then-stated position of the Securities and Exchange Commission. The Fund notes that such investments would be subject to Board approval and shareholder notification requirements.

Additionally, the Fund may seek any potentially available exemption from position limits or accountability levels under the rules of the CME or other exchanges listing such contracts. Lastly, the Fund could consider changing its investment objective or converting from an ETF to a traditional mutual fund or closed-end fund.

8.Comment: Please describe how you would expect the Fund to perform during significant daily upturns in the price of bitcoin futures such as on October 25, 2019. Would such significant price increases impact the Fund's operation?

Response: The Advisor believes (i) the Fund would have operated as expected if it had been in operation on October 25, 2019, and (ii) the Fund would not have experienced any significant issues obtaining appropriate investment exposure, exiting its positions, honoring redemptions (if any) or calculating a net asset value ("NAV").

While there was significant volatility in bitcoin and bitcoin futures contracts on October 25, 2019, and the front-month CME bitcoin futures contracts experienced a temporary trading halt, trading continued throughout the day with significant volume and a closing price was reported. Specifically, the notional traded value based on the volume weighted average price was $334 million. Open interest in the contracts increased by 2.27% (38 contracts), as compared to the day before. This indicates that there was significant interest in both sides of the trade from both buyers and sellers. Additionally, the 1-month correlation between the price returns of front-month CME bitcoin futures contracts and spot bitcoin on October 25th (0.9962) was not meaningfully different from the full sample correlation (0.9846, December 18, 2017 to May 31, 2022), notwithstanding the volatility in the market on October 25th.

In light of this liquidity, the Advisor believes the Fund would have been able to obtain the desired futures exposure and exit its positions, if necessary.

Additionally, the CME reported a closing price for CME bitcoin futures, which would have allowed the Fund to calculate an end-of-day NAV. In light of the above, the Advisor believes the market events on this day would not have had an impact on the liquidity profile of the Fund, the ability of the Fund to obtain appropriate investment exposure or to meet redemption requests, the ability of the Fund to calculate NAV or otherwise had a material adverse impact on the operations of the Fund or secondary market trading of Fund shares.

9.Comment: Please confirm whether the Fund has lined up an FCM and who that FCM is.

Response: The Trust confirms that the Fund, through its subsidiary, has several available FCMs, the names of which will be provided under a separate cover.

10.Comment: Please describe the Fund's plan for coming into compliance with Rule 18f-4 including a preliminary overview of the key elements of the expected derivatives risk management program and anticipated use of a relative or absolute VaR test. If using a relative VaR test, please include the anticipated designated index.

6

Response: The Fund intends to comply with Rule 18f-4 at the time the Fund is launched. The Fund has adopted and is implementing a written derivatives risk management program, which includes policies and procedures reasonably designed to manage the Fund's derivatives risks as required by Rule 18f-4. The program is administered and overseen by a committee that has been designated by the Fund's Board as the derivatives risk manager. The program will identify and provide an assessment of the Fund's derivatives usage and risks as they pertain to both bitcoin futures contracts and reverse repurchase agreements. The program will provide risk guidelines that, among other things, consider and provide for (1) limits on the Fund's futures exposure; (2) monitoring and assessment of the Fund's exposure to illiquid investments (if any); (3) monitoring and assessment of the credit quality of the Fund's counterparties and FCMs; and (4) monitoring of margin requirements, position limits and position accountability levels. Additionally, the program will provide for stress testing, backtesting, internal reporting and escalation, and periodic review in compliance with Rule 18f-4.

The Fund anticipates that it will use and comply with a relative VaR test and anticipates using the Fund's index as its designated index for purposes of 18f-4 compliance.

The Fund notes that it expects its derivatives risk management program will operate in substantially the same manner as the derivatives risk management program for the ProShares Bitcoin Strategy ETF, which has been in operation since October 2021.

11.Comment: Please discuss how the Fund would value its bitcoin futures positions if the CME halted the trading of bitcoin futures due to price limits or otherwise.

Response: In the event that trading in bitcoin futures contracts was halted due to price limits or otherwise, the Advisor may determine that market quotations for the contracts are not readily available. In circumstances where market prices are not readily available the Fund, in compliance with Rule 2a-5, would fair value its bitcoin futures contracts in accordance with its pricing and valuation policy and procedures for fair value determinations. Pursuant to those policies and procedures, the Adviser will look to other pricing sources depending on the facts circumstances surrounding market conditions at that time as the Advisor deems appropriate. Such pricing sources may include for example bitcoin spot prices.

12.Comment: With respect to the Fund's Rule 17j-1 Code of Ethics, please confirm whether the Fund's Code of Ethics applies to transactions in bitcoin and bitcoin futures and whether employees are required to pre-clear such transactions.

Response: The Trust so confirms. Principal Investment Strategies

13.Comment: Under "Important Information About the Fund," please provide the name of the index and, supplementally, provide the index methodology and model constituents.

Response: The Trust will include the name of the Index in the B-Filing. Additionally, the Trust will provide to the Staff, under separate cover, the index methodology and model constituents.

14.Comment: Under the second paragraph under "Important Information About the Fund," please change the second sentence to state that "the Fund is not suitable for all investors."

Response: The Trust respectfully declines to make the requested change. The existing disclosure accurately indicates that the Fund may or may not be suitable for all investors. Suitability is a facts and circumstances determination and consequently the Trust declines to make blanket statements regarding suitability.

7

15.Comment: Please clarify under principal investment strategies and throughout the prospectus, that the investment strategy is to short bitcoin futures contracts. Specifically, explain that "investing" or "seeks to invest" in bitcoin futures means obtaining short exposure through those contracts. Also, clarify what other financial instruments will be used as described in that section

Response: The Trust has revised the disclosure as requested.

16.Comment: Under the bullet point "Bitcoin Futures Contracts," please clarify that at this time the only such contracts are traded on the CME.

Response: The Trust has revised the disclosure as requested.

17.Comment: Please amend the first sentence to clearly state that the Fund will seek to achieve its investment objective by maintaining at least 80% exposure to or invest 80% of its assets in bitcoin futures contracts that perform inversely to the index.

Response: The Trust respectfully declines to include an 80% policy for the Fund. The Fund's name does not imply that it focuses its investments in a particular type of investment or in a particular industry or group of industries. The Trust notes that an 80% policy was not applied to either ProShares Bitcoin Strategy ETF or Bitcoin Strategy ProFund.

18.Comment: On page 5 under "borrowing," the disclosure states that the Fund will use reverse repurchase agreements for investment purposes. Please confirm that the Fund will not pursue a levered or inverse levered strategy. If that is confirmed, then please explain the purpose of the borrowing.

Response: The Fund does not intend to use reverse repurchase agreements to pursue a levered or inverse strategy for the Fund. Generally, the Fund may use reverse repurchase agreements to manage exposure in light of applicable margin requirements and to facilitate compliance with the applicable diversification requirements under the tax code.

19.Comment: Please state that the Fund does not invest in or seek short exposure to the current spot or cash price of bitcoin and that investors seeking direct exposure to the inverse exposure of bitcoin should consider an investment other than the Fund.

Response: The Trust has added the following disclosure:

The Fund does not invest in, or seek short exposure to, a current "spot" or cash price of bitcoin. Investors seeking direct inverse exposure to a spot price of bitcoin should consider an investment other than the Fund.

Principal Risks

20.Comment: On page 6, under "investment strategy risk," the disclosure indicates that the Fund will invest in "financial instruments that provide inverse exposure to bitcoin futures." Please state what financial instruments are contemplated or revise the disclosure to state the Fund invests in bitcoin futures to seek its inverse exposure. Please also state that the price and performance will differ due to divergence in prices and potential costs of futures.

Response: The Trust has revised the disclosure as requested.

21.Comment: Please supplementally inform the Staff whether the risks associated with rolling futures contracts for a daily reset Fund differ from those associated with funds that do not reset daily. If so, how do they differ?

8

Response: The risks associated with rolling bitcoin futures contracts for a daily reset fund are similar in nature to the risks of rolling bitcoin futures contracts (or other futures contracts) in other types of funds. The Fund anticipates repositioning its exposure at the end of each day (subject to creation and redemption activity and changes in the value of its underlying index) in accordance with the roll methodology outlined in the index methodology it will provide under a separate cover. Other types of funds would generally be expected to roll contracts in a similar manner, depending on factors such as the level of asset flows, changes in the value of such futures contracts and their particular investment strategy.

22.Comment: On page 6, under "bitcoin futures risk," please consider whether it is still accurate to say that bitcoin futures trade at significant premiums to the spot price. Further, please consider whether this risk disclosure is appropriate in the context of a fund that seeks short exposure.

Response: The Trust has revised the disclosure in response to the Staff's comment.

23.Comment: In the second paragraph of "Bitcoin Futures Risk," the Fund suggests that it seeks inverse exposure to bitcoin futures contracts. Elsewhere, the Fund discloses that it is seeking inverse exposure to the index. Please describe the Fund's approach consistently or explain why differences are appropriate.

Response: The Trust appreciates the Staff's comment and has revised the disclosure in some instances to provide additional clarity. In general, the Advisor believes that in some instances it is appropriate to refer to the Fund's investment strategy as seeking inverse exposure to bitcoin futures contracts as this description is a more "plain English" explanation of what the Fund invests in. In other instances, particularly in the context of how the Fund manages its inverse exposure, the Advisor believes the more precise language is appropriate to convey to investors the specifics of how the Fund expects to operate.

24.Comment: In the last paragraph on "Bitcoin Futures Risk," please explain the nature of the counterparty risk. Is the Fund entering into any non-cleared derivatives?

Response: The Fund does not intend to enter into any non-cleared derivatives transactions but expects to have counterparty risk with respect to trading futures contracts and the use of reverse repurchase agreements. Consequently, the Advisor believes the current disclosure is appropriate.

25.Comment: On page 8, under "Compounding Risk," the disclosure provides that Fund performance for a period longer than a single day can be more pronounced as index volatility and holding periods increase and includes certain factors. One factor states "financing rates associated with inverse exposure." Please explain to the Staff what this factor is referring to especially as the Staff believes the Fund is primarily going to be obtaining short exposure to bitcoin futures.

Response: The financing rates associated with inverse exposure may include, among other things, the interest paid in connection with any reverse repurchase agreements entered into in connection with obtaining inverse exposure.

26.Comment: Under "Bitcoin Risk," the disclosure provides that "the realization of any of these risks could result in a decline in the acceptance of bitcoin and consequently a reduction in the value of bitcoin and bitcoin futures." Consider whether this risk is appropriate for an inverse Fund.

Response: The Trust has revised the disclosure in response to this comment.

27.Comment: On page 8, under "Borrowing Risk," please explain the purpose of the disclosure if the Fund is not levered.

Response: See the Trust's response to Comment 18.

9

28.Comment: On page 9, under "Correlation Risk," the discussion of the Fund not having inverse exposure to all of the securities in the index does not seem relevant to the Fund and potentially suggests investments the Fund cannot make. Please delete or explain to the Staff why it is appropriate to include this discussion. Further, the Staff notes that the registration statement often refers to "securities" when the Fund does not invest in securities. Please carefully review the document to ensure references to "securities" are correct.

Response: The Trust notes that the Fund may invest in certain money market securities, however, the Trust has revised the noted references from "securities" to "financial instruments" to reference its investments more generically.

29.Comment: On page 8, please explain why the discussion of the annualized historical volatility rate runs from May-to-May. Explain how this does not raise a "cherry picking" concern.

Response: The Trust has included the May-to-May reference as this time-period corresponds to the Trust's fiscal year end of May 31st.

30.Comment: On page 9, under "Correlation Risk," referring to when the markets may be open, please clarify that the Fund's reference asset trades 24 hours per day, seven days per week but that the trading times for bitcoin futures contracts may differ.

Response: The Trust has revised the disclosure as requested.

31.Comment: Under "Counterparty Risk," the disclosure should be tailored to the Fund as this Fund should not be exposed to counterparty risk for derivative transactions.

Response: The Trust respectfully declines to revise the disclosure. See Trust's response to Comment 24.

32.Comment: Under "Short Sale Exposure Risk," please explain how the Fund is negatively impacted by income, dividends, or payments by the assets underlying the Fund's short positions.

Response: The Trust has revised the disclosure in Summary section of the Prospectus to remove references to income, dividends, or payments by the assets underlying the Fund's short positions, however, the Trust will retain such disclosure in the later sections of the prospectus in light of the changes made in response to Comment 6.

33.Comment: Under "Early Close / Late Close / Trading Halt Risk," please tailor the first sentence to the risk of the Fund and the instruments it will invest in. For example, instead of trading halts on specific securities, the disclosure should be revised to reflect "trading halts on bitcoin futures."

Response: The Trust has revised the first sentence of this risk disclosure as follows:

An exchange or market may close early, close late or issue trading halts on specific securities or financial instruments bitcoin futures contracts.

Investment Objective, Principal Investment Strategies and Related Risks

34.Comment: On page 13, the bitcoin discussion provides ways in which bitcoin is typically used, but this may be different from how it was originally envisioned. Please consider if the Fund wants to revise the sentence stating that "Bitcoin may be used to pay for goods and services, stored for future use, or converted to a government-issued currency."

Response: The Advisor continues to believe this disclosure is accurate.

10

35.Comment: On page 13, please provide a more detailed discussion of the Fund's principal investment strategy.

Response: The Trust has revised the disclosure as requested.

36.Comment: On page 13, the Fund notes that it will generally hold "bitcoin-related investments." Please be more clear about what "bitcoin-related investments" are. The disclosure seems to indicate in other areas that the investments would only be in CME-related futures.

Response: The Trust has revised the disclosure to define bitcoin-related investments as bitcoin futures contracts and the U.S. listed equity securities described in Comment 6.

37.Comment: With respect to the Cayman subsidiary, please:

(a)Disclose that the Fund complies with the provisions of the 1940 Act governing investment policy on an aggregate basis with the subsidiary.

(b)Disclose that the Fund complies with the provision of the 1940 Act governing capital structure and leverage (Section 18) on an aggregate basis with the subsidiary so that the Fund treats the subsidiary's debt as its own for purposes of Section 18.

(c)Confirm that the investment adviser to the subsidiary complies with the provisions of the 1940 Act relating to investment advisory contracts as an investment adviser to the Fund under Section 2(a)(20) of the 1940 Act and that the Fund will include the investment advisory agreement between the subsidiary and its adviser as a material contract in its registration statement.

(d)Confirm that the subsidiary complies with the provision relating to affiliated transactions and custody under the 1940 Act. Additionally, please identify the custodian of the subsidiary.

(e)Confirm that the subsidiary and its Board of Directors will agree to designate an agent for service of process in the United States and the subsidiary and its Board of Directors will agree to inspection by the Staff of the SEC of the subsidiary's books and records which will be maintained in accordance with Section 31 of the 1940 Act.

(f)Confirm that any management fee of the subsidiary will be included in the Fund's management fee and similarly that any other expenses of the subsidiary will be included in the Fund's other expenses.

(g)Confirm whether the Fund intends to create or acquire primary control with any entity that engages in investment activity in securities or other assets other than the entity wholly owned by the Fund.

Response:

(a)The Trust has revised its Subsidiary Investment Risk disclosure contained in the statutory prospectus as follows:

Subsidiary Investment Risk — Changes in the laws of the United States and/or the Cayman Islands, under which the Fund and the Subsidiary are organized, respectively, could result in the inability of the Fund to operate as intended and could negatively affect the Fund and its shareholders. The Fund complies with the provisions of the 1940 Act governing investment policies, capital structure, and leverage on an aggregate basis with the Subsidiary.

(b)See the Trust's response to Comment 37(a) above.

11

(c)The Trust confirms that the Advisor to the Cayman subsidiary complies with the provision of the 1940 Act relating to investment advisory contracts as an investment adviser to the Fund under 2(a)(20) of the 1940 Act and that the Fund will include the investment advisory agreement between the subsidiary and its adviser as a material contract in its registration statement.

(d)The Trust confirms that the subsidiary will comply with the requirements of Section 17 of the 1940 Act. The Trust notes that JPMorgan Chase Bank, N.A., the Fund's custodian will serve as custodian to the subsidiary.

(e)The Trust so confirms.

(f)The Trust hereby confirms that any management fee of the subsidiary will be included in the Fund's management fee and similarly that any other expenses of the subsidiary will be included in the Fund's other expenses.

(g)The Trust confirms it does not intend to create or acquire control of any entity that engages in investment activity in securities or other assets other than the subsidiary.

38.Comment: Please inform the Staff whether the reference to position limits in the second paragraph under "Bitcoin Futures" is appropriate in as much as the Fund invests in futures. If this refers to FCM imposed position limits, please disclose.

Response: The reference to position limits in that paragraph refers to the position limits imposed by either the exchange or the Fund's FCMs, which apply to both long and short positions in bitcoin futures contracts.

39.Comment: On page 16, under the bullet point on "what it means for you," the Fund refers to management of exposure to "various markets and market segments." Please revise this disclosure to specifically reference inverse exposure to bitcoin futures.

Response: The Trust has revised the disclosure as follows:

What it means for you. The daily objective of the Fund, if used properly and in conjunction with the investor's view on the future direction and volatility of the markets, can be a useful tool for knowledgeable investors who want to manage their exposure to bitcoin futuresvarious markets and market segments.

40.Comment: On page 18, under "Environmental Risk," please confirm that the last sentence is appropriate given that this is an inverse fund.

Response: The Trust has deleted the last sentence in response to this comment.

41.Comment: On page 18, under "Risks Associated with the Use of Derivatives," the Fund references investment in "securities." Please revise this disclosure to reference "underlying assets" or "bitcoin futures."

Response: The Trust respectfully declines to revise the disclosure. See the Trust's response to Comment 28.

42.Comment: Under "Liquidity Risk," there is a discussion of limits imposed by counterparties. Please explain to the Staff how the CME's position limits will work for the Fund in combination with the limits on Bitcoin Strategy ProFund and ProShares Bitcoin Strategy ETF. Please let us know if there are any special considerations associated with offsetting position limits.

Response: Based on conversations with the CME, the Advisor understands that for purposes of the exchange's position limits and accountability levels, the Fund will be required to aggregate

12

its exposure to bitcoin futures contracts with the exposure of other funds managed by the Advisor or its affiliates. As a result, the Fund's short exposure is expected to be aggregated with the short exposure of any other fund advised by the Advisor or its affiliates, including for example Short Bitcoin Strategy ProFund, and will be offset against the long exposure of any other fund advised by the Advisor or its affiliates, including for example ProShares Bitcoin Strategy ETF and Bitcoin Strategy ProFund.

43.Comment: On Page 22, please update the "Libor Risk" discussion to be more current.

Response: The Trust will remove the Libor disclosure in the B-Filing.

44.Comment: On page 27, please disclose Juneteenth holiday in the NYSE schedule.

Response: The Trust has revised the disclosure to add this holiday.

* * * * *

We hope that these responses adequately address your comments. If you or any other SEC staff member should have any further comments or questions regarding this filing, please contact me at (240) 497-6400. Thank you for your time and attention to this filing.

Very truly yours,

/s/Kristen Freeman ProShare Advisors LLC Senior Director, Counsel

13