October 12, 2023

VIA EDGAR CORRESPONDENCE

Michael Rosenberg

U.S. Securities and Exchange Commission

100 F Street, N.E.

Washington, DC 20549

Re: | ProShares Trust (the "Trust") (File Nos. 811-21114 and 333-89822) |

Dear Mr. Rosenberg:

On August 1, 2023, the Trust filed with the Securities and Exchange Commission (the "Commission") Post-Effective Amendment No. 272 under the Securities Act of 1933, as amended (the "1933 Act") and Amendment No. 281 under the Investment Company Act of 1940, as amended (the "1940 Act") to the Trust's registration statement (the "Registration Statement"). These amendments (the "Amendments") were filed for the purpose of adding a new exchange-traded fund ("ETF") to the Trust – the ProShares Short Ether Strategy ETF (the "Fund").

We received additional comments from you (the "Staff") relating to the Amendments on September 7, 2023. For your convenience and reference, we have summarized the comments in this letter and provided the Trust's response below each such comment. The Trust will file post-effective amendments to the Registration Statement pursuant to Rule 485(b) under the 1933 Act (the "B-Filing"). The B-Filing is being made for the purpose of incorporating modifications to the Fund's prospectus and statement of additional information in response to your comments on the Amendments as described in this letter and to make other minor and conforming changes.

NOTE: As discussed with the Staff, our responses to Comments 9 – 20 relating to the ProShares Short Ether Strategy ETF are provided below while all other comments were responded to separately on September 25, 2023.

ProShares Short Ether Strategy ETF

9.Comment: Under "Investment Objective", please disclose in bold that the Fund does not seek to achieve its stated investment objective over a period of time greater than a single day.

Response: The Trust respectfully declines to include the requested disclosure in this section but notes that the disclosure is included in the summary prospectus in the first paragraph of the section entitled "Important Information About the Fund" and will be bolded in the B-Filing. The summary prospectus for ProShares Short Ether Strategy ETF states:

1

The Fund does not seek to achieve the inverse (-1x) of the daily performance of the Index (the "Daily Target") for any period other than a day.

10.Comment: Under "Important Information About the Fund", state that the Fund does not invest directly in ether, nor does it directly short ether. Instead, the Fund seeks to benefit from decreases in the price of ether futures contracts for a single day.

Response: The Trust respectfully declines to include the requested disclosure in the "Important Information About the Fund" section but will include similar disclosure in the preceding section entitled "Investment Objective".

ProShares Short Ether Strategy ETF (the "Fund") seeks daily investment results, before fees and expenses, that correspond to the inverse (-1x) of the daily performance of the S&P CME Ether Futures Index (the "Index"). The Fund does not directly short ether. Instead the Fund seeks to benefit from decreases in the price of ether. [italicized language in bold]

11.Comment: Under "Investment Objective," please disclose how a single day is measured.

Response: The Trust respectfully declines to include the requested disclosure in the "Investment Objective" section as the disclosure will be included in the summary prospectus under the section entitled "Principal Investment Strategies" as follows:

ProShare Advisors uses a mathematical approach to investing in which it determines the type, quantity and mix of investment positions that it believes, in combination, the Fund should hold to produce daily returns consistent with the Daily Target. For these purposes a day is measured from the time of one net asset value ("NAV") calculation to the next. The Fund seeks to remain fully invested at all times in financial instruments that, in combination, provide inverse exposure consistent with the investment objective, without regard to market conditions, trends or direction.

In addition, the Trust notes that the requested disclosure is included in the section entitled "Investment Objectives, Principal Investment Strategies and Related Risks – Investment Objectives":

"The Fund does not seek to achieve its stated investment objective over a period of time greater than a single day. A "single day" is measured from the time the Fund calculates its net asset value ("NAV") to the time of the Fund's next NAV calculation."

Important Information About the Fund

12.Comment: Please disclose that the returns over a period longer than a single day may not only be higher or lower than the daily target but may also differ in direction from the daily target.

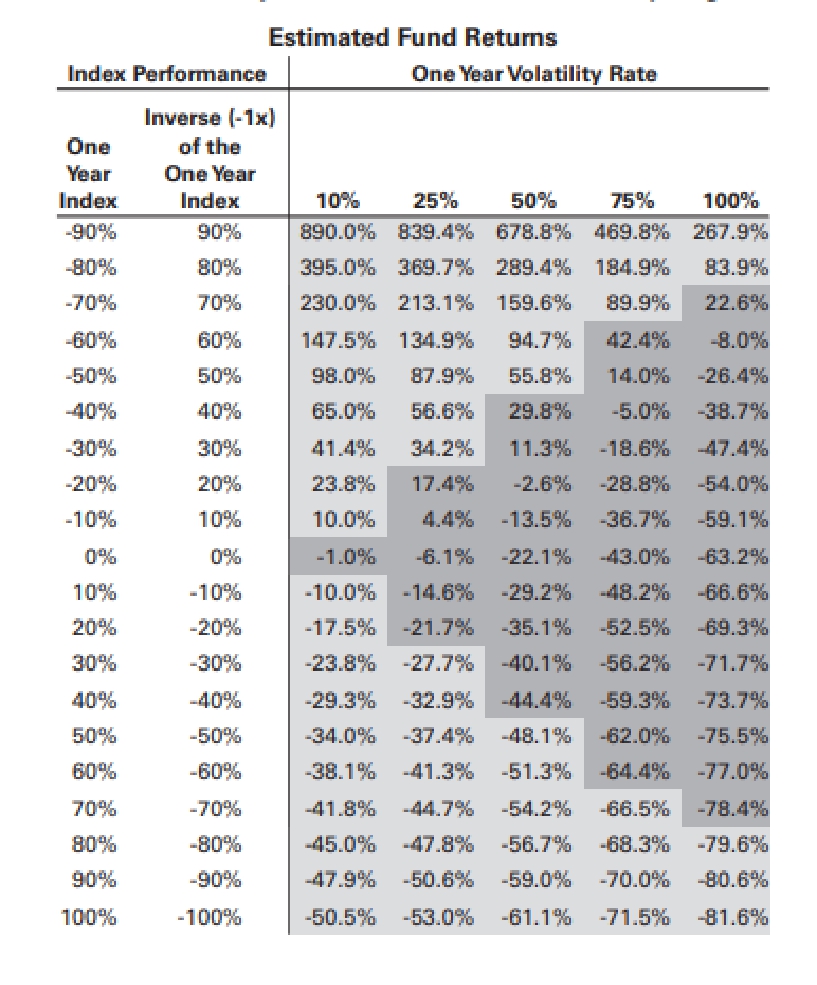

Response: The Trust respectfully declines to include the requested disclosure in the "Important Information about the Fund" section, as the disclosure is included in the summary prospectus under the section entitled "Principal Risks – Holding Period Risk." The summary prospectus for the Fund provides a chart illustrating that returns over a hypothetical longer period may differ in direction

2

from the Daily Target.

The chart provides investors with a clear and understandable illustration of when they might expect longer-term returns that differ in direction from the Daily Target. For example, if over the course of one year index returns are 20 % while volatility is 50%, the chart indicates the Fund return may be expected to be approximately -35.1%.

In addition, the paragraph that follows the chart further explains important information illustrated by the chart. The summary prospectus for the Fund (which will be revised in the B-Filing) states:

As the table illustrates, your return will tend to be worse than the Daily Target when there are smaller Index gains or losses and higher Index volatility. During periods of higher Index volatility, the Index volatility may affect the Fund's return as much as or more than the return of the Index. Your return will tend to be better than the Daily Target when there are larger Index gains or losses and lower Index volatility. You may lose money when the Index return is flat (i.e., close to zero) and you may lose money when the Index falls.

The Trust believes this risk disclosure as revised explains the risk to investors using clear, concise and understandable language as requested by the Staff in the ADI 2019-08 – Improving Principal Risks Disclosure (the "ADI 2019-08") and as required by Rule 421 under the Securities Act of 1933 ("Rule 421"). Specifically, the Trust believes that the statement that "you may lose money when the

3

Index rises" is a more clear and direct explanation of the risk than "returns...may differ in direction from the daily target."

To further highlight this issue, similar disclosure included in the section entitled "Investment Objectives, Principal Investment Strategies and Related Risks – Investment Objectives" will be revised to enhance investor understanding of this issue. The prospectus will be revised in the B- Filing as marked below to state:

For periods longer than a day, you will lose money if the Index's performance is flat. and iIt is possible that you will lose money even if the value of the Index falls during that period. During periods of higher Index volatility, the Index volatility may affect your return as much or more than the return of the Index. Returns may move in the opposite direction of the Index during periods of higher Index volatility, low Index returns, or both. In addition, during periods of higher Index volatility, the Index volatility may affect your return as much or more than the return of the Index.

13.Comment: Please state that for periods longer than a single day, the Fund will lose money if the index performance is flat, and it is possible the Fund will lose money even if the level of the index falls.

Response: The Trust respectfully declines to include the requested disclosure in this section, but notes that the disclosure is included in the summary prospectus under the section entitled "Principal Risks – Holding Period Risk," states:

You may lose money when the Index return is flat (i.e., close to zero) and you may lose money when the Index falls.

14.Comment: Please disclose that longer holding periods, higher index volatility, and greater inverse exposure each exacerbate the impact of compounding on an investor's returns. Also disclose that during periods of higher index volatility, the volatility of the index may affect the fund's return as much as or more than the return of the index.

Response: The Trust believes the second paragraph in the new "Important Information About the Fund" section discloses the impact of longer holding periods and higher index volatility on investor's returns. The disclosure provides (with updates being made in the B-Filing):

If you hold fund shares for any period other than a day, it is important for you to understand that over your holding period:

•Your return may be higher or lower than the Daily Target, and this difference may be significant.

•Factors that contribute to returns that are worse than the Daily Target include smaller Index gains or losses and higher Index volatility, as well as longer holding periods when these factors apply.

•Factors that contribute to returns that are better than the Daily Target include larger Index gains or losses and lower Index volatility, as well as longer holding periods when these factors apply.

4

•The more extreme these factors are, and the more they occur together, the more your return will tend to deviate from the Daily Target."

In addition, the section entitled "Principal Risks – Holding Period Risk" further discloses the impact of these factors and includes an example and a chart to clearly illustrate how holding periods and index volatility impact Fund returns. To further enhance this risk disclosure, the Trust will revise the "Principal Risks – Holding Period Risk" to explain when index volatility may impact an investor's returns as much or more than the return of the index.

The Trust respectfully declines to include disclosure that "greater inverse exposure"may exacerbate the impact of compounding on an investor's returns." The Trust believes this formulation is overly technical and repetitive of existing disclosure. The Trust notes that as the Fund provides inverse exposure the disclosure explains the impact of that exposure and provides an example in the section entitled "Principal Risks – Short or Inverse Investing Risk." The summary prospectus for the Fund (which will be revised in the B-Filing) states:

Short or Inverse Investing Risk — You will lose money when the Index rises – a result that is the opposite from a traditional index fund. Obtaining inverse or "short" exposure may be considered an aggressive investment technique. The costs of obtaining this short exposure will lower your returns. If the level of the Index approaches a 100% increase at any point in the day, you could lose your entire investment. As a result, an investment in the Fund may not be suitable for all investors.

The Trust believes these summary risk disclosures, as revised, explain the risks to investors using clear, concise and understandable language as requested by the Staff in the ADI 2019-08 and as required by Rule 421.

Finally, the Trust notes that similar disclosure also appears in the section entitled "Investment Objectives, Principal Investment Strategies and Related Risks – Investment Objectives" as noted below (with revisions to be made as part of the B-Filing):

If you hold Fund shares for any period other than a day, it is important for you to understand the risks and long-term performance of a daily objective fund. You should know that over your holding period:

•Your return may be higher or lower than the Daily Target, and this difference may be significant.

•Factors that contribute to returns that are worse than the Daily Target include smaller Index gains or losses and higher Index volatility, as well as longer holding periods when these factors apply.

•Factors that contribute to returns that are better than the Daily Target include larger Index gains or losses and lower Index volatility, as well as longer holding periods when these factors apply.

•The more extreme these factors are, and the more they occur together, the more your return will tend to deviate from the Daily Target.

For periods longer than a day, you will lose money if the Index's performance is flat. and iIt is possible that you will lose money even if the value of the Index falls

5

during that period. During periods of higher index volatility, the Index volatility may affect your return as much or more than the return of the Index. Returns may move in the opposite direction of the Index during periods of higher Index volatility, low Index returns, or both. In addition, during periods of higher Index volatility, the Index volatility may affect your return as much or more than the return of the Index.

15.Comment: Please disclose in bold that the fund presents different risks than other types of funds and that the Fund may not be suitable for all investors and should be used only by knowledgeable investors who understand the consequences of seeking daily inverse investment results of the index including the impact of compounding on fund performance. Please disclose that investors in the fund should actively manage and monitor their investments as frequently as daily and investors in the Fund could potentially lose the full value of their investment within a single day.

Response: The Trust respectfully declines to include this disclosure in the "Important Information about the Fund" section. With respect to disclosure that the Fund presents different risks than other types of funds and that investors may lose the full value of their investments within a single day, the Trust notes that the summary section for the Fund includes substantially similar disclosure in the section entitled "Principal Risks – Short or Inverse Investing Risk" as excerpted above in response to Comment 14.

In addition, the section entitled "Investment Objectives, Principal Investment Strategies and Related Risks – Investment Objectives" provides similar disclosure:

Investment in the Fund involves risks that are different from and additional to the risks of investments in other types of funds. An investor in a Fund could potentially lose the full value of their investment within a single day.

With respect to disclosure that the Fund "should be used only by knowledgeable investors who understand the consequences of seeking daily inverse investment results including the impact of compounding on fund performance", the Trust believes this formulation is overly technical. The Trust believes that more concise and direct language (e.g., "it is important for you to understand") when paired with an explanation of the impact of long-term investing better conveys to investors the risks of investing in the Fund and the importance of understanding the consequences of long-term investing. To further enhance the summary disclosure, the Trust will revise the section entitled "Principal Risks – Holding Period Risk" as marked below:

The table illustrates the impact of Index volatility and Index return on Fund returns for a hypothetical one-year period. However, these effects will impact your return for any holding period other than a day. The longer you hold shares of the Fund, the more magnified these effects will be. As a result, you should consider monitoring your investments in the Fund in light of your individual investment goals and risk tolerances.

If you hold Fund shares for any period other than a day, it is important for you to understand the risks and long-term performance of a daily objective fund. For more information, including additional graphs and charts demonstrating the effects of the Index volatility and Index return on the long-term performance of the Fund, see "Understanding the Risks and Long-Term

6

Performance of a Daily Objective Fund" in the Fund's Prospectus.

With respect to disclosure that "investors in the fund should actively manage and monitor their investments as frequently as daily" the Trust respectfully declines to include this disclosure in the section entitled "Important Information about the Fund." The Trust will revise the "Principal Risks

– Holding Period Risk" to incorporate this concept as noted in the excerpt above.

The Trust believes the statement "the fund may not be suitable for all investors" is overly technical in nature, is true of every investment company, and may not be readily understood by investors. Whether an investment is "suitable" is a determination a broker-dealer is required to make in connection with recommending a security to a retail customer pursuant to FINRA Rule 2111. This legal requirement may not be readily understood by investors.

Moreover, the suitability requirement applies only to broker-dealers making recommendations to a retail customer. The Trust is not making a recommendation to investors, but rather offering a public security, nor is it required or able to make suitability determinations. There is no requirement under Form N-1A that registrants disclose that their funds "may not be suitable for all investors" and the Trust notes that such disclosure is applicable to every investment company but is not found in the registration statements for the vast majority of other registered investment companies. As a result, the Trust is concerned that the inclusion of such a broad statement may potentially be misconstrued as a limit on investor choice or as being a feature unique to the Trust.

Given the existing disclosures describing the risks of an investment in the Fund, that disclosure regarding suitability is unlikely to be useful to investors, and the potential confusion it may cause, the Trust would prefer not to include such a statement. Nevertheless, the Trust will revise the "Principal Risks –Short or Inverse Investing Risk" for Fund as noted above in response to Comment

14.The Trust believes including the statement in these risk sections will provide appropriate context for the statement and minimize the chance of investor confusion.

Principal Investment Strategies

16.Comment: On page 5 of the investment strategy, please add back disclosure similar to that previously included in the ProShares Short Bitcoin Strategy ETF. Please add that daily rebalancing and the compounding of each days return over time means that the return of the Fund for a period longer than a single day will be the result of each days returns compounded over the period. This will very likely differ in amount and possibly even direction from the inverse of the return of the index for the same period. The Fund will lose money if the index performance is flat over time. The fund can lose money regardless of the performance of the index as a result of daily rebalancing, the indexes volatility compounding of each days return, and other factors.

Response: The Trust respectfully declines to include the requested disclosure in its "Principal Investment Strategy" section, as the disclosure appears in other sections of the prospectus (see for example, the disclosure excerpted in response to Comments 14 and 15.

17.Comment: In the paragraph beginning with "In order to obtain inverse or 'short' exposure to the Index, the Fund" (p. 5), please state that the cash settled futures are traded on commodity exchange registered with the CFTC.

Response: The Trust will revise the disclosure as marked below in the B-Filing:

Ether Futures Contracts – Standardized, cash-settled ether futures contracts traded

7

on commodity exchanges registered with the Commodity Futures Trading Commission ("CFTC")".

18.Comment: Under "Ether Futures Contracts" (p. 5) and elsewhere in the prospectus, the disclosure states that the Fund invests in ether futures contracts. Given the Fund is an inverse fund, consider describing the Fund's strategy as "selling" a futures contract rather than "investing" in a futures contract.

Response: The Trust respectfully declines to make the request change in the description of Ether Futures Contracts. The Trust notes that the following explanation of how the Fund obtains short exposure appears in the investment strategy in the paragraph preceding this description as marked below:

In order to obtain inverse or "short" exposure to the Index, the Fund intends to enter into cash-settled ether futures contracts as the "seller." In simplest terms, in a cash-settled futures market the seller pays the counterparty if the price of a futures contract goes up and receives cash from the counterparty if the price of the futures contract goes down.

19.Comment: Under "Short or Inverse Investing Risk" (p. 6), please bold the last sentence of the paragraph.

Response: The Trust respectfully declines to make the request change. The Trust believes the existing disclosure appropriately highlights the risk.

Principal Risks

20.Comment: Please include "Tax Risk" and "Valuation Risk" or explain to the Staff why they are not considered by the Fund to be principal risks. Additionally, please add "Aggressive Investment Risk" to the disclosure.

Response: The Trust does not consider "Tax Risk" and "Valuation Risk" to be principal risks and, as such, has moved them to the statutory portion of the prospectus. The Trust respectfully declines to add "Aggressive Investment Risk." The Trust believes the existing risk disclosure accurately describes risks associated with investment in the Fund. Additionally, the descriptor "aggressive" is a subjective determination and consequently the Trust declines to make such a statement.

* * * * *

We hope that these responses adequately address your comments. If you or any other Commission staff member should have any further comments or questions regarding this filing, please contact me at (240) 497-6400. Thank you for your time and attention to this filing.

Very truly yours,

/s/ Kristen Freeman

ProShare Advisors LLC

Senior Director, Counsel

8