Performance of a Daily Objective Fund" in the Fund's Prospectus.

With respect to disclosure that "investors in the fund should actively manage and monitor their investments as frequently as daily" the Trust respectfully declines to include this disclosure in the section entitled "Important Information about the Fund." The Trust will revise the "Principal Risks

– Holding Period Risk" to incorporate this concept as noted in the excerpt above.

The Trust believes the statement "the fund may not be suitable for all investors" is overly technical in nature, is true of every investment company, and may not be readily understood by investors. Whether an investment is "suitable" is a determination a broker-dealer is required to make in connection with recommending a security to a retail customer pursuant to FINRA Rule 2111. This legal requirement may not be readily understood by investors.

Moreover, the suitability requirement applies only to broker-dealers making recommendations to a retail customer. The Trust is not making a recommendation to investors, but rather offering a public security, nor is it required or able to make suitability determinations. There is no requirement under Form N-1A that registrants disclose that their funds "may not be suitable for all investors" and the Trust notes that such disclosure is applicable to every investment company but is not found in the registration statements for the vast majority of other registered investment companies. As a result, the Trust is concerned that the inclusion of such a broad statement may potentially be misconstrued as a limit on investor choice or as being a feature unique to the Trust.

Given the existing disclosures describing the risks of an investment in the Fund, that disclosure regarding suitability is unlikely to be useful to investors, and the potential confusion it may cause, the Trust would prefer not to include such a statement. Nevertheless, the Trust will revise the "Principal Risks –Short or Inverse Investing Risk" for Fund as noted above in response to Comment

14.The Trust believes including the statement in these risk sections will provide appropriate context for the statement and minimize the chance of investor confusion.

Principal Investment Strategies

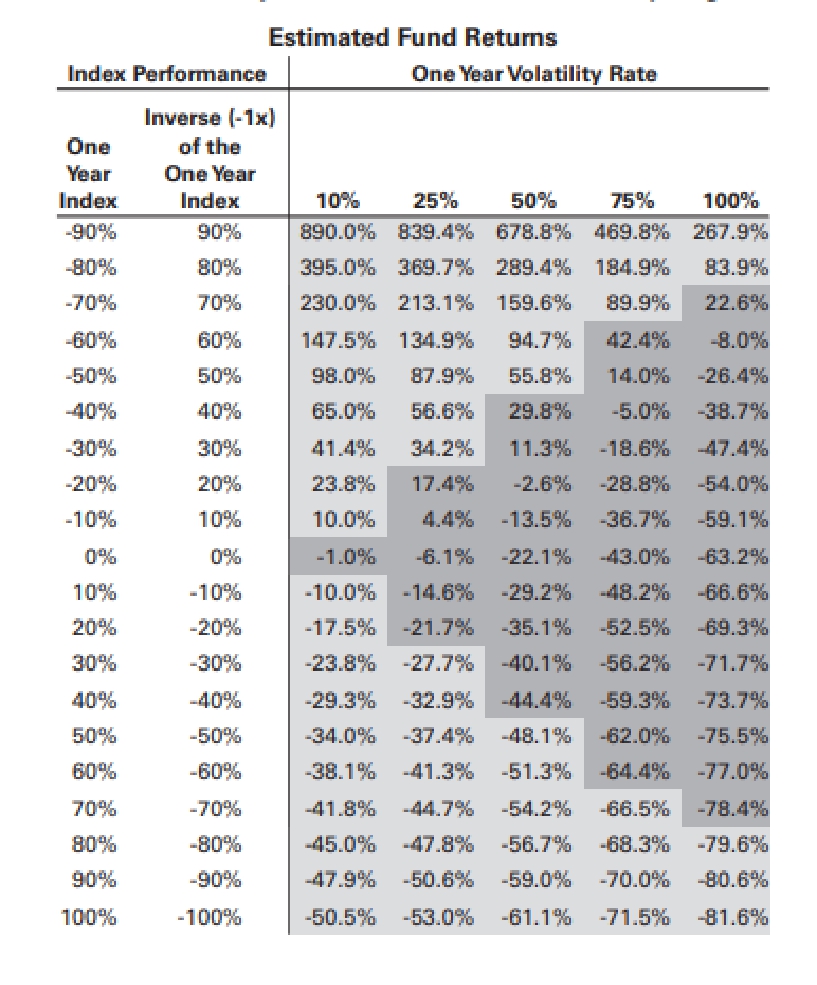

16.Comment: On page 5 of the investment strategy, please add back disclosure similar to that previously included in the ProShares Short Bitcoin Strategy ETF. Please add that daily rebalancing and the compounding of each days return over time means that the return of the Fund for a period longer than a single day will be the result of each days returns compounded over the period. This will very likely differ in amount and possibly even direction from the inverse of the return of the index for the same period. The Fund will lose money if the index performance is flat over time. The fund can lose money regardless of the performance of the index as a result of daily rebalancing, the indexes volatility compounding of each days return, and other factors.

Response: The Trust respectfully declines to include the requested disclosure in its "Principal Investment Strategy" section, as the disclosure appears in other sections of the prospectus (see for example, the disclosure excerpted in response to Comments 14 and 15.

17.Comment: In the paragraph beginning with "In order to obtain inverse or 'short' exposure to the Index, the Fund" (p. 5), please state that the cash settled futures are traded on commodity exchange registered with the CFTC.

Response: The Trust will revise the disclosure as marked below in the B-Filing:

Ether Futures Contracts – Standardized, cash-settled ether futures contracts traded