The following summary contains basic information about the exchange notes and is not intended to be complete. We sometimes refer in this prospectus to the exchange notes denominated in U.S. dollars as the "exchange dollar notes" (or the "exchange dollar senior notes" or "exchange dollar senior subordinated notes," as applicable) and the exchange notes denominated in euros as the "exchange euro notes" (or the "exchange euro senior notes" or "exchange euro senior subordinated notes," as applicable). For a more complete understanding of each issue of exchange notes, please refer to the sections entitled "Description of senior notes" and "Description of senior subordinated notes" in this prospectus.

The summary historical financial data of the Predecessor as of December 31, 2000, 2001 and 2002 and for each of the three years in the period ended December 31, 2002 have been derived from the audited combined financial statements of our predecessor company. The summary historical financial data of the Predecessor for the six months ended June 28, 2002 and for the two months ended February 28, 2003 have been derived from the unaudited combined financial statements of our predecessor company which, in each case, have been prepared on a basis consistent with the Predecessor's audited annual combined financial statements. The summary historical financial data of the Successor as of June 27, 2003 and for the four months ended June 27, 2003 have been derived from our unaudited combined and consolidated interim financial statements and have been prepared on a different basis from the Predecessor's annual combined financial statements under the purchase method of accounting as a result of the consummation of the Acquisition on February 28, 2003. In the opinion of management, such unaudited financial data reflects all adjustments, consisting only of normal and recurring adjustments, necessary for a fair presentation of the results for those periods. The results of operations for the interim periods are not necessarily indicative of the results to be expected for the full year or any future period. The combined financial statements of the Predecessor as of December 31, 2001 and 2002 and for each of the three years in the period ended December 31, 2002 and for the six month period ended June 28, 2002 and for the two month period ended February 28, 2003, and the consolidated financial statements of the Successor as of June 27, 2003 and for the four months ended June 27, 2003 are included elsewhere in this prospectus. The following financial information for the periods prior to the Transactions may not reflect what our results of operations, financial position and cash flows would have been had we operated as a separate, stand-alone entity during the periods presented, or what our results of operations, financial position and cash flows will be in the future.

The summary pro forma financial data for the year ended December 31, 2002 and the six months ended June 28, 2002 and June 27, 2003 have been prepared to give pro forma effect to the Transactions as if they had occurred on January 1 of each period. The summary pro forma financial data is for informational purposes only and should not be considered indicative of actual results that would have been achieved had the Transactions actually been consummated on the dates indicated and do not purport to indicate results of operations as of any future date or for any future period. The following data should be read in conjunction with "The Acquisition," "Unaudited pro forma combined and consolidated financial information," "Management's discussion and analysis of financial condition and results of operations" and the combined financial statements of our predecessor company and our consolidated financial statements included elsewhere in this prospectus.

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  | Predecessor |  | Successor |

| |  | As of December 31, |  | As of

June 27,

2003 |

| (Dollars in millions) |  | 2000 |  | 2001 |  | 2002 |  |

| |  | |  | |  | |  | (unaudited) |

| Balance sheet data: |  | | | |  | | | |  | | | |  | | | |

| Cash and cash equivalents |  | $ | 151 | |  | $ | 118 | |  | $ | 188 | |  | $ | 617 | |

| Marketable securities |  | | 43 | |  | | 32 | |  | | 26 | |  | | 25 | |

| Total cash and cash equivalents and marketable securities(5) |  | | 194 | |  | | 150 | |  | | 214 | |  | | 642 | |

| Accounts receivable and interest in securitized receivables(6) |  | | 1,429 | |  | | 1,015 | |  | | 1,348 | |  | | 1,906 | |

| Inventories |  | | 676 | |  | | 552 | |  | | 608 | |  | | 623 | |

| Total assets |  | | 11,293 | |  | | 10,287 | |  | | 10,948 | |  | | 9,744 | |

| Total liabilities |  | | 9,457 | |  | | 8,712 | |  | | 8,476 | |  | | 8,477 | |

| Total debt (including current portion of long-term debt)(7) |  | | 5,053 | |  | | 4,597 | |  | | 3,925 | |  | | 3,454 | |

| Off balance sheet borrowings under receivables facility(8) |  | | — | |  | | 327 | |  | | — | |  | | — | |

| Total indebtedness (including receivables facility) |  | | 5,053 | |  | | 4,924 | |  | | 3,925 | |  | | 3,454 | |

| Total stockholders' investment |  | | 1,716 | |  | | 1,504 | |  | | 2,391 | |  | | 1,215 | |

|

|  |

| (1) | Includes miscellaneous income and expense items from operations. See note 9 to the combined financial statements and note 8 to the unaudited combined and consolidated interim financial statements for further detail. |

|  |

| (2) | EBITDA, a measure used by management to measure performance, is reconciled to net earnings (losses) in the following table. Our management believes EBITDA is useful to the investors because it is frequently used by securities analysts, investors and other interested parties in the evaluation of companies in our industry. EBITDA is not a recognized term under GAAP and does not purport to be an alternative to net earnings (losses) as an indicator of operating performance or to cash flows from operating activities as a measure of liquidity. Because not all companies use identical calculations, this presentation of EBITDA may not be comparable to other similarly titled measures of other companies. Additionally, EBITDA is not intended to be a measure of free cash flow for management's discretionary use, as it does not consider certain cash requirements such as interest payments, tax payments and debt service requirements. The amounts shown for EBITDA as presented herein differ from the amounts calculated under the definition of EBITDA used in our debt instruments. The definition of EBITDA used in our debt instruments is further adjusted for certain cash and non-cash charges and is used to determine compliance with financial covenants and our ability to engage in certain activities such as incurring additional debt and making certain payments. |

|  |

| Following is a reconciliation of net earnings (losses) to EBITDA (unaudited): |

|

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  | Predecessor |  | Pro forma |

| |  |

Year ended December 31, |  | Year ended

December 31,

2002 |  | Six months

ended

June 28,

2002 |  | Six months

ended

June 27,

2003 |

| (Dollars in millions) |  | 2000 |  | 2001 |  | 2002 |  |

| Net earnings (losses) |  | $ | 97 | |  | $ | (25 | ) |  | $ | 164 | |  | $ | 228 | |  | $ | 165 | |  | $ | 140 | |

| Depreciation and amortization |  | | 577 | |  | | 548 | |  | | 509 | |  | | 466 | |  | | 223 | |  | | 233 | |

| Interest expense |  | | 387 | |  | | 373 | |  | | 316 | |  | | 280 | |  | | 140 | |  | | 142 | |

| Interest income |  | | (13 | ) |  | | (10 | ) |  | | (7 | ) |  | | (6 | ) |  | | (2 | ) |  | | (4 | ) |

| Loss on sale of receivables |  | | — | |  | | 1 | |  | | 7 | |  | | 10 | |  | | 5 | |  | | 9 | |

| Gain on retirement of debt |  | | — | |  | | — | |  | | (4 | ) |  | | — | |  | | — | |  | | — | |

| Income tax expense (benefit) |  | | 102 | |  | | (30 | ) |  | | 138 | |  | | 170 | |  | | 83 | |  | | 87 | |

| Discontinued operations (net of taxes) |  | | 3 | |  | | 11 | |  | | — | |  | | — | |  | | — | |  | | — | |

| EBITDA |  | $ | 1,147 | |  | $ | 846 | |  | $ | 1,123 | |  | $ | 1,148 | |  | $ | 614 | |  | $ | 607 | |

|

22

|  |

| (3) | Our net earnings (losses) were negatively impacted by the effects of unusual items (pre-tax) as presented in the following table: |

|

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  | Predecessor |  | Successor |

| |  |

Year ended December 31, |  | Six months

ended

June 28,

2002 |  | Two months

ended

February 28,

2003 |  | Four months

ended

June 27,

2003 |

| (Dollars in millions) |  | 2000 |  | 2001 |  | 2002 |  |

| |  | |  | |  | |  | (unaudited) |  | (unaudited) |  | (unaudited) |

| Restructuring charges:(a) |  | | | |  | | | |  | | | |  | | | |  | | | |  | | | |

| Severance and other (cash) |  | $ | (77 | ) |  | $ | (189 | ) |  | $ | (27 | ) |  | $ | (7 | ) |  | $ | (3 | ) |  | $ | (3 | ) |

| Asset impairments (non-cash) |  | | (8 | ) |  | | (24 | ) |  | | (32 | ) |  | | (2 | ) |  | | — | |  | | — | |

| Total restructuring charges |  | | (85 | ) |  | | (213 | ) |  | | (59 | ) |  | | (9 | ) |  | | (3 | ) |  | | (3 | ) |

| Asset impairment charges other than restructuring |  | | (67 | ) |  | | (50 | ) |  | | (17 | ) |  | | (4 | ) |  | | — | |  | | — | |

| Pending and threatened litigation and claims, including certain warranty claims in 2000 |  | | (65 | ) |  | | (36 | ) |  | | (2 | ) |  | | — | |  | | — | |  | | — | |

| Net gain from the sale of assets |  | | 21 | |  | | 18 | |  | | 12 | |  | | 5 | |  | | — | |  | | — | |

| Unrealized losses on foreign currency hedges and expenses related to the acquisition of Lucas Varity |  | | (9 | ) |  | | — | |  | | — | |  | | — | |  | | — | |  | | — | |

| Northrop Grumman/TRW Merger-related transaction costs |  | | — | |  | | — | |  | | (23 | ) |  | | — | |  | | (6 | ) |  | | — | |

| Other charges |  | | (17 | ) |  | | — | |  | | — | |  | | — | |  | | — | |  | | — | |

| |  | | (222 | ) |  | | (281 | ) |  | | (89 | ) |  | | (8 | ) |  | | (9 | ) |  | | (3 | ) |

| Less unusual items in amortization of goodwill and intangible assets. |  | | — | |  | | 1 | |  | | 1 | |  | | — | |  | | — | |  | | — | |

| |  | $ | (222 | ) |  | $ | (280 | ) |  | $ | (88 | ) |  | $ | (8 | ) |  | $ | (9 | ) |  | $ | (3 | ) |

|

| (a) | Significant restructuring actions were taken over the last several years as described more fully in the "Management's discussion and analysis of financial condition and results of operations" section of this prospectus. While we continuously evaluate whether additional restructuring opportunities exist to increase our operating efficiencies, we do not have any current plans that would result in additional restructuring charges of the magnitude that we incurred in 2000 and 2001. |

|  |

| (4) | For purposes of calculating the ratio of earnings to fixed charges, earnings represents earnings from continuing operations before income taxes, less income from equity method investments and capitalized interest, plus minority interest expense, income distributions from equity method investments, amortization of capitalized interest and fixed charges. Fixed charges include interest expense (including amortization of debt issuance costs), capitalized interest, and the portion of operating rental expense which management believes is representative of the interest component of rent expense. |

|  |

| For the year ended December 31, 2001, the Predecessor's earnings were insufficient to cover fixed charges by $52 million due principally to restructuring and asset impairment charges taken in the fourth quarter of 2001, and for the four months ended June 27, 2003, our earnings were insufficient to cover fixed charges by $48 million due to charges related to the Acquisition and application of purchase accounting, most notably the write off of purchased in-process research and development. |

|  |

| (5) | Marketable securities are included in Other Assets on our balance sheets as of the periods presented. |

|  |

| (6) | Receivables include trade receivables and residual interests in receivables sold pursuant to the receivables facilities of the Predecessor and the Successor. |

|  |

| (7) | Total debt excludes any off balance sheet borrowings under receivables facilities. |

|  |

| (8) | The Predecessor's receivables facility was an off balance sheet arrangement. Our receivables facility can be treated as a general financing agreement or as an off balance sheet arrangement depending on the level of loans to the borrower as further described in "Management's discussion and analysis of financial condition and results of operations—Off-balance sheet arrangements" and "Description of other indebtedness—Receivables facility." |

23

Risk factors

You should carefully consider the risks described below, together with the other information in this prospectus, before deciding to tender your outstanding notes in the exchange offers. If any of the events described in the risk factors below actually occur, our business, financial condition, operating results and prospects could be materially adversely affected, which in turn could adversely affect our ability to repay the exchange notes. In such case, you may lose all or part of your original investment.

Risks related to our business

Our available cash and access to additional capital may be limited by our substantial

leverage.

As a result of the Transactions, we are highly leveraged. As of June 27, 2003, we had total consolidated indebtedness of approximately $3.5 billion with an additional $449 million of borrowings available under our revolving credit facility, after giving effect to $51 million in outstanding letters of credit. At June 27, 2003, we had no advances outstanding under the receivables facility. The following chart shows our level of indebtedness and certain other information as of June 27, 2003 as a result of the Transactions.

|  |  |  |  |  |  |

| (Dollars in millions) |  | As of June 27, 2003 |

| |  | | | |

| Short-term debt |  | $ | 125 | |

| Long-term debt: |  |

| Term loan A facility* |  | | 410 | |

| Term loan B facilities* |  | | 1,103 | |

| Revolving credit facility |  | | — | |

| Outstanding senior notes |  | | 1,153 | |

| Outstanding senior subordinated notes |  | | 443 | |

| 7.25% Series A Revenue Bonds due 2004 |  | | 6 | |

| 10.875% Lucas Industries plc debentures due 2020 |  | | 175 | |

| Capitalized leases |  | | 18 | |

| Other borrowings |  | | 21 | |

| Receivables facility |  | | — | |

| Total long-term debt |  | | 3,329 | |

| Total debt |  | $ | 3,454 | |

|

| * | On July 22, 2003, we refinanced $200 million of borrowings under the term loan A facility and all of the borrowings under the term loan B facilities with the proceeds of new term loan C facilities, together with approximately $46 million of cash. See "Management's discussion and analysis of financial condition and results of operations—Liquidity and capital resources" and "Description of other indebtedness—Senior credit facilities." |

Our high degree of leverage could have important consequences for you, including the following:

| • | It may limit our ability to obtain additional financing for working capital, capital expenditures, product development, debt service requirements, acquisitions and general corporate or other purposes; |

| • | A substantial portion of our cash flows from operations must be dedicated to the payment of principal and interest on our indebtedness and is not available for other purposes, including our operations, capital expenditures and future business opportunities; |

24

| • | For the year ended December 31, 2001 (Predecessor) and the four months ended June 27, 2003 (Successor), earnings were insufficient to cover fixed charges by $52 million and $48 million, respectively. Such insufficiencies could occur in future periods and may adversely impact our ability to cover all or a portion of our debt service requirements; |

| • | The debt service requirements of our other indebtedness could make it more difficult for us to make payments on the notes; |

| • | Certain of our borrowings, including borrowings under our senior credit facilities, are at variable rates of interest, exposing us to the risk of increased interest rates; |

| • | It may limit our ability to adjust to changing market conditions and place us at a competitive disadvantage compared to our competitors that have less debt; and |

| • | We may be more vulnerable than a less leveraged company to a downturn in general economic conditions or in our business, or we may be unable to carry out capital spending that is important to our growth. |

Our debt agreements contain restrictions that limit our flexibility in operating our business.

The senior credit agreement and the indentures under which the exchange notes will be issued contain a number of significant covenants that, among other things, restrict our ability to:

| • | incur additional indebtedness or issue redeemable preferred stock; |

| • | pay dividends and repurchase our capital stock; |

| • | enter into agreements that restrict dividends from subsidiaries; |

| • | enter into transactions with our affiliates; |

| • | engage in mergers or consolidations. |

In addition, under the senior credit agreement, we are required to satisfy specified financial ratios and tests. Our ability to comply with those provisions may be affected by events beyond our control, and we may not be able to meet those ratios and tests. The breach of any of these covenants could result in a default under the senior credit agreement and the lenders could elect to declare all amounts borrowed under the senior credit agreement, together with accrued interest, to be due and payable and could proceed against the collateral securing that indebtedness. Borrowings under the senior credit facilities are effectively senior in right of payment to both the exchange senior notes and the exchange senior subordinated notes. Substantially all of our domestic tangible and intangible assets (other than receivables sold to our receivables subsidiaries in connection with our receivables facility) and the assets and a portion of the stock of certain of our foreign subsidiaries are pledged as collateral pursuant to the terms of the senior credit agreement. If any of our indebtedness were to be accelerated, our assets may not be sufficient to repay in full that indebtedness and the exchange notes.

Our variable rate indebtedness subjects us to interest rate risk, which could cause our debt service obligations to increase significantly.

Certain of our borrowings, primarily borrowings under our senior credit facilities, are at variable rates of interest and expose us to interest rate risk. If interest rates increase, our debt service obligations on the variable rate indebtedness would increase even though the amount borrowed remained the same, and our net income and cash available for servicing our indebtedness, including the exchange notes, would decrease.

25

Our business would be materially and adversely affected if we lost any of our largest customers.

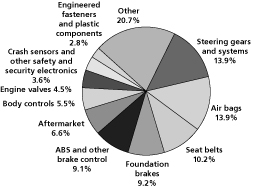

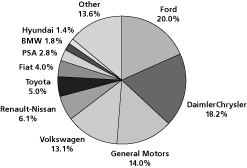

For the year ended December 31, 2002, approximately 20% of our sales were to Ford Motor Company and its subsidiaries, approximately 18% of our sales were to DaimlerChrysler AG and its subsidiaries, approximately 14% of our sales were to General Motors Corporation and its subsidiaries and approximately 13% of our sales were to Volkswagen AG and its subsidiaries. Although business with any given customer is typically split among numerous contracts, the loss of, or significant reduction in purchases by, one or more of those major customers could materially and adversely affect our business, results of operations and financial condition.

Our historical and pro forma financial information for the periods prior to the Transactions may not be representative of our results as a separate company.

Our historical and pro forma financial information included in this prospectus may not reflect what our results of operations, financial position and cash flows would have been had we been a separate, stand-alone entity during the periods presented, or what our results of operations, financial position and cash flows will be in the future. This is because:

| • | we have made certain adjustments and allocations since TRW did not account for us as, and we were not operated as, a single, stand-alone business for the periods presented; and |

| • | the information does not reflect certain changes that occurred in our operations as a result of our separation from TRW. |

Accordingly, our historical results of operations for the periods prior to the Transactions may not be indicative of our future operating or financial performance. For additional information, see "Summary historical and pro forma financial data," "Unaudited pro forma combined and consolidated statements of operations," "Selected historical combined and consolidated financial data" and "Management's discussion and analysis of financial condition and results of operations."

We may experience difficulties operating as a stand-alone company.

Prior to the Acquisition, the Predecessor historically operated as part of TRW, and we may experience difficulties operating as a stand-alone company. While TRW is contractually obligated to provide us with certain transitional services, we cannot assure you that these services will be sustained at the same level as when the Predecessor was a part of TRW or that we will obtain the same benefits. Also, we cannot assure you that, after the expiration of these various arrangements, we will be able to replace the transitional services in a timely manner or on terms and conditions, including cost, as favorable as those we will receive from TRW. These arrangements were negotiated in the overall context of the Acquisition.

Blackstone controls us and may have conflicts of interest with us or you in the future.

As a result of the Transactions, Blackstone beneficially owns approximately 78.5% of the outstanding shares of common stock of TRW Automotive Holdings, our indirect parent. As a result, Blackstone has control over our decisions to enter into any corporate transaction and has the ability to prevent any transaction that requires the approval of stockholders regardless of whether or not other stockholders or noteholders believe that any such transactions are in their own best interests. For example, Blackstone could cause us to make acquisitions that increase the amount of indebtedness that is secured or senior to the senior subordinated notes or sell revenue-generating assets, impairing our ability to make payments under the notes. Additionally, Blackstone is in the business of making investments in companies and may from time to time acquire and hold interests in businesses that compete directly or indirectly with us. Blackstone may also pursue acquisition opportunities that may be complementary to our business, and as a result, those acquisition opportunities may not be available to us. So long as Blackstone continues to own a significant amount of the outstanding shares of common stock of TRW Automotive Holdings, it will continue to be able to strongly influence or effectively control our decisions.

26

We may be unable to continue to compete successfully in the highly competitive automotive parts industry.

The automotive parts industry is highly competitive. Our competitors include independent suppliers of parts, as well as suppliers formed by spin-offs from our existing VM customers, who are becoming more aggressive in attempting to sell parts to other VMs. Depending on the particular product, the number of our competitors varies significantly. We may not be able to continue to compete favorably and increased competition in our markets may have a material adverse effect on our business.

The cyclicality of automotive production and sales could adversely affect our business.

Almost all of our business is directly related to automotive sales and automotive vehicle production by our VM customers. Automotive production and sales are highly cyclical and depend on general economic conditions and other factors, including consumer spending and preferences. In addition, automotive production and sales can be affected by labor relations issues, regulatory requirements, trade agreements and other factors. The volume of automotive production in North America, Europe and the rest of the world has fluctuated, sometimes significantly, from year to year, and such fluctuations give rise to fluctuations in the demand for our products. Any significant economic decline that results in a reduction in automotive production and sales by our VM customers could have a material adverse effect on our results of operations.

Continued pricing pressures on automotive suppliers may adversely affect our business.

Pricing pressure from customers has been a characteristic of the automotive parts industry in recent years. Virtually all VMs have policies of seeking price reductions each year. We have taken steps to reduce costs and resist price reductions; however, price reductions have impacted our sales and profit margins. If we are not able to offset continued price reductions through improved operating efficiencies and reduced expenditures, those price reductions may have a material adverse effect on our results of operations.

If the United States dollar strengthens, our reported results of operations from our international businesses will be reduced.

In 2002, over 50% of our sales were originated outside the United States. In our combined and consolidated financial statements, we translate our local currency financial results into United States dollars based on average exchange rates prevailing during a reporting period or the exchange rate at the end of that period. During times of a strengthening United States dollar, our reported international sales and earnings may be reduced because the local currency may translate into fewer United States dollars.

We are subject to other risks associated with our non-U.S. operations.

We have significant manufacturing operations outside the United States, including joint ventures and other alliances. Risks are inherent in international operations, including:

| • | exchange controls and currency restrictions; |

| • | currency fluctuations and devaluations; |

| • | changes in local economic conditions; |

| • | changes in laws and regulations; |

| • | exposure to possible expropriation or other government actions; and |

| • | unsettled political conditions and possible terrorist attacks against American interests. |

These and other factors may have a material adverse effect on our international operations or on our business, results of operations and financial condition.

We may incur material losses and costs as a result of product liability and warranty and recall claims that may be brought against us.

We may be exposed to product liability and warranty claims in the event that our products actually or allegedly fail to perform as expected or the use of our products results, or is alleged to result, in

27

bodily injury and/or property damage. Accordingly, we could experience material warranty or product liability losses in the future and incur significant costs to defend these claims.

In addition, if any of our products are, or are alleged to be, defective, we may be required to participate in a recall of that product if the defect or the alleged defect relates to automotive safety. Automotive suppliers like us are becoming more integrally involved in the vehicle design process and are assuming more of the vehicle system design responsibility. As a result, VMs are increasingly looking to their suppliers for contribution when faced with product liability, warranty and recall claims. Depending on the terms under which we supply products, a VM may hold us responsible for some or all of the repair or replacement costs of these products under new vehicle warranties, when the product supplied did not perform as represented. Our costs associated with providing product warranties could be material. Product liability, warranty and recall costs may have a material adverse effect on our financial condition.

We may be adversely affected by environmental and safety regulations or concerns.

We are subject to the requirements of environmental and occupational safety and health laws and regulations in the United States and other countries. We cannot assure you that we have been or will be at all times in complete compliance with all of these requirements, or that we will not incur material costs or liabilities in connection with these requirements in excess of amounts we have reserved. In addition, these requirements are complex, change frequently and have tended to become more stringent over time. These requirements may change in the future in a manner that could have a material adverse effect on our business, results of operations and financial condition. We have made and will continue to make capital and other expenditures to comply with environmental requirements. In addition, certain of our subsidiaries are subject to pending litigation raising various environmental and human health and safety claims, including certain asbestos-related claims. While our costs to defend and settle these claims in the past have not been material, we cannot assure you that this will remain so in the future. For more information about our environmental compliance and potential environmental liabilities, see "Business—Environmental matters" and "Business—Legal proceedings."

Increasing costs for manufactured components and raw materials may adversely affect our profitability.

We use a broad range of manufactured components and raw materials in our products, including castings, electronic components, finished sub-components, molded plastic parts, fabricated metal, aluminum, steel, resins, leather and wood. It is generally difficult to pass increased prices for manufactured components and raw materials through to our customers in the form of price increases. Therefore, a significant increase in the price of these items could materially increase our operating costs and materially and adversely affect our profit margins.

Non-performance by our suppliers may adversely affect our operations.

Because we purchase from suppliers various types of equipment and component parts, we may be materially and adversely affected by the failure of those suppliers to perform as expected. This non-performance may consist of delivery delays or failures caused by production issues or delivery of non-conforming products. The risk of non-performance may also result from the insolvency or bankruptcy of one or more of our suppliers. Our efforts to protect against and to minimize these risks may not always be effective.

Work stoppages at our customers' facilities or at our facilities could adversely affect our operations.

Work stoppages occur relatively frequently in the automotive industry. If any of our customers experience a material work stoppage, that customer may halt or limit the purchase of our products. This could cause us to shut down production facilities relating to those products, which could have a material adverse effect on our business, results of operations and financial condition.

28

As of June 27, 2003, approximately 22% of our United States workforce and approximately 73% of our hourly workforce outside of the United States were represented by 39 unions. It is likely that a significant portion of our workforce will remain unionized for the foreseeable future. In the United States, four of our union agreements, covering approximately 600 employees and representing 8% of our hourly workforce in the U.S., expire in the next two years. We will engage in labor negotiations with respect to seventy-six of our 146 non-U.S. locations during the next two years. Most of our non-U.S. locations that are covered by labor agreements have agreements that are required to be re-negotiated every two years, with the balance being covered by three-year agreements or four-year agreements. While historically negotiations at our non-U.S. locations have rarely resulted in work stoppages, we cannot assure you that we will be able to negotiate acceptable contracts with these unions or that our failure to do so will not result in work stoppages. A work stoppage at one or more of our plants may have a material adverse effect on our business.

Our ability to operate our company effectively could be impaired if we fail to attract and retain key personnel.

Our ability to operate our business and implement our strategies effectively depends, in part, on the efforts of our executive officers and other key employees. In addition, our future success will depend on, among other factors, our ability to attract and retain other qualified personnel, particularly engineers and other employees with electronics and software expertise. The loss of the services of any of our key employees or the failure to attract or retain other qualified personnel could have a material adverse effect on our business.

We may be unable to successfully implement our business strategy.

Our ability to achieve our business and financial objectives is subject to a variety of factors, many of which are beyond our control. For example, we may not be successful in implementing our strategy if unforeseen competing and/or alternative technologies emerge that render our technologies less desirable or obsolete, customer markets for our new technologies do not develop as expected, or we experience increased pressure on our margins. In addition, our ability to increase operating efficiencies by moving to lower wage countries may lead to resource constraints at our joint ventures and strategic alliances which could have a negative impact on their ability to meet customers' demands in local markets, thereby adversely affecting our relationships with those customers globally. As a result of such business or competitive factors, we may decide to alter or discontinue aspects of our business strategy and may adopt alternative or additional strategies. Any failure to successfully implement our business strategy could adversely affect our business, results of operations and growth potential.

Risks related to the exchange notes

There may be adverse consequences if you do not exchange your outstanding notes.

If you do not exchange your outstanding notes for exchange notes in the applicable exchange offer, you will continue to be subject to restrictions on transfer of your outstanding notes as set forth in the offering memorandum distributed in connection with the private offering of the outstanding notes. In general, the outstanding notes may not be offered or sold unless they are registered or exempt from registration under the Securities Act and applicable state securities laws. Except as required by the registration rights agreements, we do not intend to register resales of the outstanding notes under the Securities Act. You should refer to "Summary—The Exchange offers" and "The Exchange offers" for information about how to tender your outstanding notes.

The tender of outstanding notes under the exchange offers will reduce the outstanding amount of each series of the outstanding notes, which may have an adverse effect upon, and increase the volatility of, the market prices of the outstanding notes due to a reduction in liquidity.

29

We may not be able to generate sufficient cash to service all of our indebtedness, including the exchange notes, and may be forced to take other actions to satisfy our obligations under our indebtedness, which may not be successful.

Our ability to make scheduled payments or to refinance our debt obligations depends on our financial and operating performance, which is subject to prevailing economic and competitive conditions and to certain financial, business and other factors beyond our control. We may not be able to maintain a level of cash flows from operating activities sufficient to permit us to pay the principal, premium, if any, and interest on our indebtedness. See "Management's discussion and analysis of financial condition and results of operations—Liquidity and capital resources."

If our cash flows and capital resources are insufficient to fund our debt service obligations, we may be forced to reduce or delay capital expenditures, sell assets, seek additional capital or seek to restructure or refinance our indebtedness, including the exchange notes. These alternative measures may not be successful and may not permit us to meet our scheduled debt service obligations. In the absence of such operating results and resources, we could face substantial liquidity problems and might be required to sell material assets or operations to attempt to meet our debt service and other obligations. The senior credit facilities and the indentures under which the exchange notes will be issued will restrict our ability to sell assets and use the proceeds from the sales. We may not be able to consummate those sales or to obtain the proceeds which we could realize from them and these proceeds may not be adequate to meet any debt service obligations then due. See "Description of other indebtedness—Senior credit facilities," "Description of senior notes" and "Description of senior subordinated notes."

We are a holding company with substantially all of our operations being conducted by our subsidiaries. Our ability to repay our debt depends upon the performance of our subsidiaries and their ability to make distributions to us.

Substantially all of our operations are conducted by our subsidiaries and, therefore, our cash flow and our ability to service our indebtedness, including our ability to pay the interest on and principal of the exchange notes when due, are dependent upon cash dividends and distributions or other transfers from our subsidiaries. Any payment of dividends, distributions, loans or advances to us by our subsidiaries could be subject to restrictions on dividends or repatriation of earnings under applicable local law and monetary transfer restrictions in the jurisdictions in which our subsidiaries operate. In addition, payments to us by our subsidiaries are contingent upon our subsidiaries' earnings.

Our subsidiaries are separate and distinct legal entities and, except for our subsidiary guarantors, they will have no obligation, contingent or otherwise, to pay amounts due under the exchange notes or to make any funds available to pay those amounts, whether by dividend, distribution, loan or other payments.

Your right to receive payments on each issue of exchange notes is junior to those lenders who have a security interest in our assets.

Our obligations under the exchange notes and our guarantors' obligations under their guarantees of the exchange notes are unsecured, but our obligations under our senior credit facilities and each guarantor's obligations under their respective guarantees of the senior credit facilities are secured by a security interest in substantially all of our domestic tangible and intangible assets (other than receivables sold to our receivables subsidiaries in connection with our receivables facility) and the assets and a portion of the stock of certain of our foreign subsidiaries. If we are declared bankrupt or insolvent, or if we default under our senior credit facilities, the lenders could declare all of the funds borrowed thereunder, together with accrued interest, immediately due and payable. If we were unable to repay such indebtedness, the lenders could foreclose on the pledged assets to the exclusion of holders of the exchange notes, even if an event of default exists under the indentures under which the exchange notes will be issued at such time. Furthermore, if the lenders foreclose and sell the pledged equity interests in any subsidiary guarantor under the exchange notes, then that guarantor

30

will be released from its guarantee of the exchange notes automatically and immediately upon such sale. In any such event, because the exchange notes will not be secured by any of our assets or the equity interests in subsidiary guarantors, it is possible that there would be no assets remaining from which your claims could be satisfied or, if any assets remained, they might be insufficient to satisfy your claims fully. Additionally, to the extent our subsidiaries sell receivables pursuant to our receivables facility, payments made in respect of those interests will not be available to make payments in respect of the exchange notes. See "Description of other indebtedness."

As of June 27, 2003, as a result of the Transactions, we had approximately $1,520 million of senior secured indebtedness (all of which is indebtedness under our senior credit facilities and which does not include availability of approximately $449 million under the revolving credit facility, after giving effect to $51 million in outstanding letters of credit), and our guarantors had approximately $7 million of senior secured indebtedness (other than their guarantees of our indebtedness under the senior credit facilities). The indentures permit the incurrence of substantial additional indebtedness by us and our restricted subsidiaries in the future, including secured indebtedness and issuance of additional notes under the indentures. Additionally, as of June 27, 2003, our non-guarantor receivables subsidiaries had no advances outstanding under our receivables facility.

Claims of noteholders will be structurally subordinate to claims of creditors of our non-U.S. subsidiaries (other than TRW Automotive Luxembourg) and our receivables subsidiaries because they will not guarantee the exchange notes.

The exchange notes will not be guaranteed by any of our less than wholly-owned domestic subsidiaries, non-U.S. subsidiaries (other than TRW Automotive Luxembourg) or our receivables subsidiaries. Accordingly, claims of holders of the exchange notes will be structurally subordinate to the claims of creditors of these non-guarantor subsidiaries, including trade creditors. Without limiting the generality of the foregoing, claims of holders of the exchange notes will also be structurally subordinate to claims of the lenders under our senior credit facilities to the extent of the guarantees by non-U.S. subsidiaries of the senior credit facilities. All obligations of our non-guarantor subsidiaries will have to be satisfied before any of the assets of such subsidiaries would be available for distribution, upon a liquidation or otherwise, to us or a guarantor of the exchange notes.

As of June 27, 2003, as a result of the Transactions, our non-guarantor subsidiaries had total indebtedness of approximately $232 million (excluding intercompany liabilities and guarantees of our non-U.S. indebtedness under our senior credit facilities), representing approximately 7% of our total indebtedness. Our non-guarantor subsidiaries accounted for approximately $6.4 billion, or 60%, of our sales (excluding intercompany sales of approximately $426 million) and approximately $370 million in net earnings (of our total net earnings of $164 million) for the year ended December 31, 2002 and approximately $1.2 billion, or 64%, of our sales (excluding intercompany sales of approximately $61 million) and approximately $38 million in net earnings (of our total net earnings of $31 million) for the two months ended February 28, 2003 and approximately $2.5 billion , or 65%, of our sales (excluding intercompany sales of approximately $124 million) and approximately $5 million in net earnings (of our total net loss of $51 million) for the four months ended June 27, 2003. In addition, our non-guarantor subsidiaries accounted for approximately $5.6 billion, or 57%, of our assets and approximately $2.7 billion, or 32%, of our liabilities (excluding net intercompany payables of approximately $2.5 billion) as of June 27, 2003.

We also have joint ventures and subsidiaries in which we own less than 100% of the equity so that, in addition to the structurally senior claims of creditors of those entities, the equity interests of our joint venture partners or other shareholders in any dividend or other distribution made by these entities would need to be satisfied on a proportionate basis with us. These joint ventures and less than wholly-owned subsidiaries may also be subject to restrictions on their ability to distribute cash to us in their financing or other agreements and, as a result, we may not be able to access their cash flow to service our debt obligations, including in respect of the exchange notes.

31

Your right to receive payments on the exchange senior subordinated notes will be junior to all of our and our guarantors' senior indebtedness, including our and our guarantors' obligations under the exchange senior notes and other existing and future senior debt.

The exchange senior subordinated notes will be general unsecured obligations that will be junior in right of payment to all our existing and future senior indebtedness. The exchange senior subordinated guarantees will be general unsecured obligations of the guarantors that will be junior in right of payment to all of the applicable guarantor's existing and future senior indebtedness.

We and the guarantors may not pay principal, premium, if any, interest or other amounts on account of the exchange senior subordinated notes or the exchange senior subordinated guarantees in the event of a payment default or certain other defaults in respect of certain of our senior indebtedness, including debt under the senior credit facilities and exchange senior notes, unless the senior indebtedness has been paid in full or the default has been cured or waived. In addition, in the event of certain other defaults with respect to the exchange senior indebtedness, we or the guarantors may not be permitted to pay any amount on account of the exchange senior subordinated notes or the exchange senior subordinated guarantees for a designated period of time.

Because of the subordination provisions in the exchange senior subordinated notes and the exchange senior subordinated guarantees, in the event of a bankruptcy, liquidation or dissolution of us or any guarantor, our or the guarantor's assets will not be available to pay obligations under the exchange senior subordinated notes or the applicable exchange senior subordinated guarantee until we or the guarantor has made all payments on our or its senior indebtedness, respectively. We cannot assure you that sufficient assets will remain after all these payments have been made to make any payments on the exchange senior subordinated notes or the applicable exchange senior subordinated guarantee, including payments of principal or interest when due.

As of June 27, 2003, as a result of the Transactions, we had approximately $2,848 million of senior indebtedness, and our guarantors had approximately $7 million of senior indebtedness relating to industrial revenue bonds and capital leases in addition to their guarantees of our borrowings under the senior credit facilities and the outstanding senior notes. The senior subordinated note indenture will permit the incurrence of substantial additional indebtedness, including senior debt, by us and our restricted subsidiaries in the future. Additionally, to the extent our subsidiaries sell receivables in connection with our receivables facility, payments made in respect of those interests will not be available to make payments in respect of the exchange senior subordinated notes. As of June 27, 2003, we had no advances outstanding under our receivables facility.

If we default on our obligations to pay our other indebtedness, we may not be able to make payments on the exchange notes.

Any default under the agreements governing our indebtedness, including a default under our senior credit facilities that is not waived by the required lenders, and the remedies sought by the holders of such indebtedness could make us unable to pay principal, premium, if any, and interest on the exchange notes and substantially decrease the market value of the exchange notes. If we are unable to generate sufficient cash flow and are otherwise unable to obtain funds necessary to meet required payments of principal, premium, if any, and interest on our indebtedness, or if we otherwise fail to comply with the various covenants, including financial and operating covenants, in the instruments governing our indebtedness (including our senior credit facilities), we could be in default under the terms of the agreements governing such indebtedness. In the event of such default, the holders of such indebtedness could elect to declare all the funds borrowed thereunder to be due and payable, together with accrued and unpaid interest, the lenders under our revolving credit facility could elect to terminate their commitments, cease making further loans and institute foreclosure proceedings against our assets, and we could be forced into bankruptcy or liquidation. If our operating performance declines, we may in the future need to seek to obtain waivers from the required lenders under our senior credit facilities to avoid being in default. If we breach our covenants under our senior credit facilities and seek a waiver, we may not be able to obtain a waiver from the required lenders. If this occurs, we would be in default under our senior credit facilities, the lenders could

32

exercise their rights, as described above, and we could be forced into bankruptcy or liquidation. See "Description of other indebtedness—Senior credit facilities," "Description of senior notes" and "Description of senior subordinated notes."

We may not be able to repurchase the exchange notes upon a change of control.

Upon the occurrence of specific kinds of change of control events, we will be required to offer to repurchase all outstanding exchange notes at 101% of their principal amount, plus accrued and unpaid interest, unless such notes have been previously called for redemption. We may not have sufficient financial resources to purchase all of the exchange notes that are tendered upon a change of control offer. The occurrence of a change of control could also constitute an event of default under our senior credit facilities. Our bank lenders may have the right to prohibit any such purchase or redemption, in which event we will seek to obtain waivers from the required lenders under the senior credit facilities, but may not be able to do so. See "Description of senior notes—Change of control" and "Description of senior subordinated notes—Change of control."

Despite our current leverage, we may still be able to incur substantially more debt. This could further exacerbate the risks described above.

We and our subsidiaries may be able to incur substantial additional indebtedness in the future. The terms of the indentures do not fully prohibit us or our subsidiaries from doing so. Our revolving credit facility provides commitments of up to $500 million, $449 million of which were available for future borrowings as of June 27, 2003, after giving effect to $51 million in outstanding letters of credit. Our receivables facility provides for advances of up to $600 million, based on availability of eligible receivables. As of June 27, 2003, we had no advances outstanding under our receivables facility. All of those borrowings are secured, and as a result, effectively senior to the exchange notes and the guarantees of the exchange notes by our subsidiary guarantors. If we incur any additional indebtedness that ranks equally with the exchange senior notes or exchange senior subordinated notes, the holders of that debt will be entitled to share ratably with the holders of the exchange senior notes or the holders of the exchange senior subordinated notes, respectively, in any proceeds distributed in connection with any insolvency, liquidation, reorganization, dissolution or other winding-up of us. This may have the effect of reducing the amount of proceeds paid to you. If new debt, including the issuance of additional notes under the indentures, is added to our current debt levels, the related risks that we and our subsidiaries now face could intensify.

You may face foreign exchange risks or tax consequences by investing in the exchange euro notes.

A portion of each of the exchange senior notes and the exchange senior subordinated notes will be denominated and payable in euros. If you are a U.S. investor, an investment in the exchange euro notes will entail foreign exchange-related risks due to, among other factors, possible significant changes in the value of the euro relative to the U.S. dollar because of economic, political and other factors over which we have no control. Depreciation of the euro against the U.S. dollar could cause a decrease in the effective yield of the exchange euro notes below their stated coupon rates and could result in a loss to you on a U.S. dollar basis. Investing in the exchange euro notes by U.S. investors may also have important tax consequences. See "Certain United States federal income tax consequences—Consequences to U.S. holders—Euro notes."

Federal and state fraudulent transfer laws permit a court to void the exchange notes and the guarantees, and, if that occurs, you may not receive any payments on the exchange notes.

The issuance of the exchange notes and the exchange guarantees may be subject to review under federal and state fraudulent transfer and conveyance statutes. While the relevant laws may vary from state to state, under such laws the payment of consideration will be a fraudulent conveyance if (1) we paid the consideration with the intent of hindering, delaying or defrauding creditors or (2) we or any of our guarantors, as applicable, received less than reasonably equivalent value or fair consideration in return for issuing either the exchange notes or an exchange guarantee, and, in the case of (2) only, one of the following is also true:

33

| • | we were or any of our guarantors was insolvent or rendered insolvent by reason of the incurrence of the indebtedness; or |

| • | payment of the consideration left us or any of our guarantors with an unreasonably small amount of capital to carry on the business; or |

| • | we or any of our guarantors intended to, or believed that we or it would, incur debts beyond our or its ability to pay as they mature. |

Generally, an entity would be considered insolvent if, at the time it incurred indebtedness:

| • | the sum of its debts, including contingent liabilities, was greater than the fair salable value of all its assets; or |

| • | the present fair salable value of its assets was less than the amount that would be required to pay its probable liability on its existing debts and liabilities, including contingent liabilities, as they become absolute and mature; or |

| • | it could not pay its debts as they become due. |

We believe that immediately after the issuance of the exchange notes and the exchange guarantees, we and each of the guarantors will be solvent, will have sufficient capital to carry on our respective businesses and will be able to pay our respective debts as they mature. However, we cannot be certain as to the standards a court would apply in making these determinations or that a court would reach the same conclusions with regard to these issues.

If a court were to find that the issuance of the exchange notes or an exchange guarantee was a fraudulent conveyance, the court could void the payment obligations under the exchange notes or such guarantee or further subordinate the exchange notes or such guarantee to presently existing and future indebtedness of ours or such guarantor, or require the holders of the exchange notes to repay any amounts received with respect to the exchange notes or such guarantee. In the event of a finding that a fraudulent conveyance occurred, you may not receive any repayment on the exchange notes. Further, the voidance of the exchange notes could result in an event of default with respect to our and our subsidiaries' other debt that could result in acceleration of such debt.

If the exchange guarantees were legally challenged, any exchange guarantee could also be subject to the claim that, since the exchange guarantee was incurred for our benefit, and only indirectly for the benefit of the guarantor, the obligations of the applicable guarantor were incurred for less than fair consideration. A court could thus void the obligations under the exchange guarantees, subordinate them to the applicable guarantor's other debt or take other action detrimental to the holders of the notes.

Your ability to transfer the exchange notes may be limited by the absence of an active trading market, and we cannot assure you that any active trading market will develop for the exchange notes.

The exchange notes are new issues of securities for which there is no established public market. We expect the exchange notes to be listed on the Luxembourg Stock Exchange. The initial purchasers of the outstanding notes have advised us that they intend to make a market in the exchange notes, as permitted by applicable laws and regulations; however, the initial purchasers are not obligated to make a market in the exchange notes, and they may discontinue their market-making activities at any time without notice. Therefore, we cannot assure you that an active market for the exchange notes will develop or, if developed, that it will continue. Historically, the market for noninvestment grade debt has been subject to disruptions that have caused substantial volatility in the prices of securities similar to the exchange notes. The market, if any, for the exchange notes may experience similar disruptions and any such disruptions may adversely affect the prices at which you may sell your exchange notes. In addition, the exchange notes may trade at discounts from their initial offering prices, depending upon prevailing interest rates, the market for similar notes, our financial and operating performance, whether additional notes are issued and other factors.

34

The Acquisition

The following contains summaries of the material terms of certain agreements between Northrop Grumman and affiliates of Blackstone that were entered into in contemplation of the Acquisition. The descriptions of such agreements do not purport to be complete. For more information, please review the agreements filed as exhibits to the registration statement of which this prospectus is a part.

General

On November 18, 2002, Northrop Grumman and BCP Acquisition Company L.L.C., a Delaware limited liability company and an affiliate of Blackstone, signed a master purchase agreement providing for the acquisition by us of substantially all the assets and the assumption by us of substantially all of the liabilities (other than certain indebtedness) associated with TRW's automotive business, for which we paid a purchase price of $4,443 million (excluding assumed debt of $210 million), subject to post-closing adjustments, of which $3,533 million was paid in cash at closing. These assets and liabilities owned directly by TRW have been transferred to and assumed by one or more newly-formed TRW entities (referred to as the "New Auto Entities") prior to the Acquisition. We acquired 100% of the equity interests of the New Auto Entities and certain other subsidiaries of TRW that held automotive assets and liabilities from TRW and its affiliates upon consummation of the Acquisition. On December 20, 2002, after completion of the Merger, TRW and the former TRW Automotive Inc. became signatories to the master purchase agreement.

In connection with the Acquisition, TRW Automotive Holdings received a cash equity contribution of $698 million primarily from affiliates of Blackstone in exchange for shares of its common stock. Our management group also contributed cash in exchange for shares of TRW Automotive Holdings' common stock. TRW Automotive Holdings made a cash equity contribution of $698 million and contributed newly issued shares of its common stock having an implied value of $170 million to TRW Automotive Intermediate Holdings and thereby acquired all of the equity interests in it. TRW Automotive Intermediate Holdings issued a $600 million face amount subordinated 8% pay-in-kind note due 2018 to an affiliate of Northrop Grumman to acquire the stock of certain subsidiaries, and contributed such stock together with a cash equity contribution of $698 million and the $170 million of TRW Automotive Holdings common stock to our company, TRW Automotive, and thereby acquired all of the equity interests in us. We used (1) the $698 million cash equity contribution, (2) borrowings under our new senior secured term loan A facility, (3) borrowings under our new senior secured term loan B facilities, (4) proceeds from the offering of the outstanding dollar senior notes and the outstanding euro senior notes, (5) proceeds from the offering of the outstanding dollar senior subordinated notes and the outstanding euro senior subordinated notes and (6) proceeds from sales by certain of our subsidiaries of receivables in connection with our new receivables facility, to fund the cash portion of the purchase price and to repay the $35 million promissory note issued by an affiliate of Blackstone to an affiliate of Northrop Grumman to acquire one of the Korean subsidiaries of our predecessor company, and we used the $170 million of TRW Automotive Holdings common stock to fund the stock portion of the purchase price. The purchase price also included a short-term note payable to Northrop Grumman reflecting estimated post-closing adjustments, subject to final negotiations. As described in "Use of proceeds," we assumed $210 million of indebtedness of TRW's automotive business, representing the outstanding amount of £95 million of Lucas Varity senior notes that were assumed by TRW in connection with its acquisition of Lucas Varity in 1999, plus accrued interest, and certain other indebtedness. At the closing of the Acquisition, we also drew down $12 million of borrowings under our new senior secured revolving credit facility. See "Use of proceeds," "Capitalization" and "Description of other indebtedness."

As a result of the Acquisition, currently affiliates of Blackstone hold approximately 78.5%, an affiliate of Northrop Grumman holds approximately 19.6% and our management group holds approximately 1.9% of the capital stock of TRW Automotive Holdings.

The master purchase agreement

The master purchase agreement contains customary seller representations and warranties of Northrop Grumman, TRW and the former TRW Automotive Inc. and customary buyer representations and warranties of BCP Acquisition Company L.L.C. and customary covenants and other agreements

35

between Northrop Grumman, TRW and the former TRW Automotive Inc., on one hand, and BCP Acquisition Company L.L.C. and its affiliates, on the other hand. In addition, the Acquisition was conditioned upon the satisfaction or waiver of certain conditions.

The master purchase agreement provides for indemnification for losses relating to specified events, circumstances or matters. Northrop Grumman has agreed to indemnify TRW Automotive Holdings from certain liabilities, including:

| • | any losses or damages arising from the inaccuracy or breach of any representation or warranty of Northrop Grumman, TRW or the former TRW Automotive Inc. contained in the master purchase agreement or any of the ancillary agreements described below; |

| • | 50% of any environmental liabilities associated with the operation or ownership of TRW's automotive business on or prior to the Acquisition (subject to certain exceptions), regardless of whether the liabilities arise before or after the Acquisition; |

| • | specified tax losses or liabilities, including, among others, those associated with TRW's automotive business relating to specified tax amounts due on or prior to the Acquisition; and |

| • | certain cash OPEB payments, in excess of (1) $48 million up to $57 million for 2003; (2) $50 million up to $61 million for 2004; (3) $51 million up to $66 million for 2005; (4) $54 million up to $69 million for 2006; (5) $55 million up to $73 million for 2007; and (6) $56 million up to $74 million for 2008 and, unless an accelerated terminal value payment (as described below) was previously made, a cash payment in 2008 equal to the product of (i) the amount by which the OPEB payments made by us in 2008 exceeds $56 million, up to $74 million, multiplied by (ii) 6.5. Northrop Grumman will pay us an accelerated terminal value payment if a liquidity event occurs prior to 2008 equal to the product of (i) 6.5 multiplied by (ii) the amount by which our OPEB payments during the 12 months prior to the liquidity event exceeds the projected cash cost for such period, not to exceed the maximum payment for such period. A liquidity event is defined under the master purchase agreement as the sale or other transfer of 10% or more of the shares of capital stock of TRW Automotive Holdings held by Blackstone or any sale of all or substantially all of our assets. Following an accelerated terminal value payment, Northrop Grumman will no longer be required to make OPEB indemnification payments under the master purchase agreement. |

The master purchase agreement provides that upon and following the occurrence of a registered initial public offering of TRW Automotive Holdings' equity securities, any payments otherwise payable to TRW Automotive Holdings with respect to the OPEB indemnity will instead be paid to the non-employee shareholders as of the closing of the Acquisition who remain shareholders as of the date of such payment, in proportion to their beneficial ownership of the voting securities of TRW Automotive Holdings as of such date of payment.

Northrop Grumman's indemnification obligation with respect to breaches of representations and warranties referred to above is subject to a $50 million deductible (other than losses from certain specified matters not subject to the deductible) and to a $500 million cap (other than losses from certain specified representations and warranties as to which this cap does not apply).

We are also required to indemnify Northrop Grumman, TRW and their respective affiliates from liabilities arising from certain specified matters, including the inaccuracy or breach of any representation or warranty of BCP Acquisition Company L.L.C., the liabilities designated as "Automotive Liabilities" under the master purchase agreement and specified tax losses or liabilities.

Ancillary agreements

In connection with the Acquisition, the parties have also entered into agreements governing certain relationships between and among the parties after the closing of the Acquisition. These agreements include two intellectual property license agreements, a transition services agreement, an employee matters agreement, an insurance allocation agreement, a stockholders' agreement and a transaction and monitoring fee agreement. See "Certain relationships and related transactions" for descriptions of these agreements.

36

Use of proceeds

There will be no proceeds to us from the exchange of outstanding notes for exchange notes pursuant to the exchange offers.

The proceeds received by us from the offering of outstanding notes, together with the borrowings under our new senior credit facilities and the advances under our receivables facility, the cash equity contribution made primarily by affiliates of Blackstone, the equity issued to an affiliate of Northrop Grumman, the short term note payable to Northrop Grumman and the borrowings under the note issued to an affiliate of Northrop Grumman by our direct parent, TRW Automotive Intermediate Holdings, which have been recorded by us as paid-in-capital at an amount based on the estimated fair value of $348 million, were used upon consummation of the Transactions to pay $4,443 million (excluding assumed debt of $210 million), subject to post-closing adjustments, for the purchase of TRW's automotive business and to pay approximately $193 million in transaction fees and expenses incurred in connection with the Transactions.

The following table sets forth the sources and uses of the funds for the Transactions consummated on February 28, 2003. Information presented in the following table has been calculated using exchange rates at February 28, 2003, as described below.

|

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| (Dollars in millions) |  |

| Sources |  | |  | Uses |  | |

| Revolving credit facility(1) |  | $ | — | |  | Purchase price (excluding |  | | | |

| Short-term note payable(2) |  | | 105 | |  | assumed debt)(10) |  | $ | 4,443 | |

| Term loan A facility(3) |  | | 410 | |  | Assumed debt(8) |  | | 210 | |

| Term loan B facilities(3)(4) |  | | 1,100 | |  | Transaction fees and expenses |  | | 193 | |

| Receivables facility(5) |  | | 150 | |  | Cash(11) |  | | 174 | |

| Outstanding dollar senior notes |  | | 925 | |  | |  | | | |

| Outstanding euro senior notes(6) |  | | 217 | |  | |  | | | |

| Outstanding dollar senior subordinated notes |  | | 300 | |  | |  | | | |

| Outstanding euro senior subordinated notes(7) |  | | 135 | |  | |  | | | |

| Assumed debt(8) |  | | 210 | |  | |  | | | |

| Equity(9) |  | | 1,468 | |  | |  | | | |

| Total sources |  | $ | 5,020 | |  | Total uses |  | $ | 5,020 | |

| |  | | | |  | |  | | | |

|

| (1) | The revolving credit facility provides for borrowings of up to $500 million. At the closing of the Acquisition, we drew down $12 million from the revolving credit facility, which we repaid on March 4, 2003 with general corporate funds. At the closing of the Acquisition, JPMorgan Chase Bank (the "escrow agent"), acting for the benefit of management and employees of TRW Automotive, subscribed for and purchased $12 million of shares of common stock of TRW Automotive Holdings with the proceeds of a promissory note issued to TRW Automotive. On March 25, 2003, TRW Automotive Holdings repurchased a portion of such shares from the escrow agent (and affiliates of Blackstone purchased the balance of such shares from the escrow agent) and the note was repaid. On March 25, 2003, management and employees of TRW Automotive subscribed for and purchased the number of shares of common stock of TRW Automotive Holdings repurchased by TRW Automotive Holdings from the escrow agent. |

| (2) | Short-term note payable to Northrop Grumman reflecting certain estimated post-closing adjustments, subject to final negotiations. |

| (3) | On July 22, 2003, we refinanced $200 million of the borrowings under the term loan A facility and all of the borrowings under the term loan B facilities with the proceeds of new term loan C facilities, together with approximately $46 million of cash, in order to reduce our interest expense. See "Management's discussion and analysis of financial condition and results of operations—Liquidity and capital resources" and "Description of other indebtedness—Senior credit facilities." |

| (4) | Approximate U.S. dollar equivalent of the dollar and euro borrowings under the term loan B facilities, based on an exchange rate at February 28, 2003 of $1.0821= €1.00. |

37

| (5) | The receivables facility provides for advances of up to $600 million, based on availability of eligible receivables. Because advances under the receivables facility depend on the availability of eligible receivables, the amount available for advances under such facility fluctuates over time. See "Description of other indebtedness—Receivables facility." |

| (6) | Approximate U.S. dollar equivalent of the outstanding euro senior notes, based on an exchange rate at February 28, 2003 of $1.0821= €1.00. |

| (7) | Approximate U.S. dollar equivalent of the outstanding euro senior subordinated notes, based on an exchange rate at February 28, 2003 of $1.0821= €1.00. |

| (8) | Reflects the outstanding amount of £95 million Lucas Varity senior notes that were assumed by TRW in connection with the acquisition of Lucas Varity in 1999, plus accrued interest, based on an exchange rate at February 28, 2003 of $1.5782 = £1.00 and certain other indebtedness, which have been assumed by us as part of the Acquisition. |

| (9) | Equity consists of (a) a cash equity contribution of $698 million primarily from affiliates of Blackstone to our indirect parent, TRW Automotive Holdings, which has been contributed to TRW Automotive Intermediate Holdings and, in turn, to us, (b) $170 million of newly issued shares of TRW Automotive Holdings common stock, which has been contributed to TRW Automotive Intermediate Holdings and, in turn, to us and (c) the full face amount of the $600 million subordinated note issued by TRW Automotive Intermediate Holdings to an affiliate of Northrop Grumman to acquire the stock of certain subsidiaries. This stock has been contributed to us and recorded by us as paid-in-capital at an amount based on the estimated $348 million fair value of the note calculated by applying a 12% discount rate over the expected 15 year life of the note. See "Certain relationships and related transactions—Northrop Grumman subordinated note". |

| (10) | Purchase price (excluding assumed debt) consisted of (a) $3,533 million of cash paid at closing, (b) the short-term note payable to Northrop Grumman reflecting certain estimated post-closing adjustments, subject to final negotiations, (c) $170 million of newly issued shares of TRW Automotive Holdings common stock, (d) the full face amount of the $600 million subordinated note to be issued by TRW Automotive Intermediate Holdings to an affiliate of Northrop Grumman and (e) the $35 million promissory note issued by an affiliate of Blackstone to an affiliate of Northrop Grumman to acquire one of the Korean subsidiaries of our predecessor company in the Acquisition. This promissory note was repaid in full shortly after the closing of the Acquisition. |

| (11) | Reflects cash proceeds available to us for general working capital requirements subsequent to the completion of the Transactions. |

38

Capitalization

The following table sets forth our capitalization as of June 27, 2003. You should read the information in this table in conjunction with "The Acquisition," "Unaudited pro forma combined and consolidated statements of operations," "Management's discussion and analysis of financial condition and results of operations" and our consolidated financial statements and the combined financial statements of our predecessor company included elsewhere in this prospectus.

|

|  |  |  |  |  |  |

| (Dollars in millions) |  | As of June 27, 2003 |

| |  | (Unaudited) |

| Short term debt(1) |  | $ | 125 | |

| Long-term debt: |  | | | |

| Term loan A facility(2) |  | | 410 | |

| Term loan B facilities(3) |  | | 1,103 | |

| Revolving credit facility(4) |  | | — | |

| Outstanding senior notes(5) |  | | 1,153 | |

| Outstanding senior subordinated notes(6) |  | | 443 | |

| 7.25% Series A Revenue Bonds due 2004(7) |  | | 6 | |

| 10.875% Lucas Industries plc debentures due 2020(7) |  | | 175 | |

| Capitalized leases(7) |  | | 18 | |

| Other borrowings(7) |  | | 21 | |

| Receivables facility(8) |  | | — | |

| Total long-term debt |  | | 3,329 | |

| Total debt |  | | 3,454 | |

| Paid-in-capital(9) |  | | 1,216 | |

| Accumulated deficit |  | | (51 | ) |

| Accumulated other comprehensive earnings |  | | 50 | |

| Total stockholder's investment |  | | 1,215 | |

| Total capitalization |  | $ | 4,669 | |

| |

|

| (1) | Includes, among other things, the short-term note payable to Northrop Grumman reflecting certain estimated post-closing adjustments, subject to final negotiations. |

| (2) | As a result of the refinancing of a portion of the term loan A facility on July 22, 2003, we currently have $210 million of borrowings outstanding under the term loan A facility. See "Management's discussion and analysis of financial condition and results of operations—Liquidity and capital resources" and "Description of other indebtedness—Senior credit facilities." |

| (3) | Approximate U.S. dollar equivalent of the dollar and euro borrowings under the term loan B facilities, based on an exchange rate at June 27, 2003 of $1.1421 = €1.00. On July 22, 2003, the term loan B facilities and a portion of the term loan A facility were refinanced with the proceeds of new term loan C facilities, together with approximately $46 million of cash. As of August 29, 2003, we had $1,253 million of borrowings outstanding under the term loan C facilities which amount represents the approximate U.S. dollar equivalent of the dollar and euro borrowings based on the then exchange rate of $1.0869 = €1.00. See "Management's discussion and analysis of financial condition and results of operations—Liquidity and capital resources" and "Description of other indebtedness—Senior credit facilities." |

| (4) | The revolving credit facility provides for borrowings of up to $500 million. As of June 27, 2003, we had $449 million of borrowings available under our revolving credit facility, after giving effect to $51 million in outstanding letters of credit. |

| (5) | Approximate U.S. dollar equivalent of the outstanding dollar and euro senior notes, based on an exchange rate at June 27, 2003 of $1.1421 = €1.00. |

| (6) | Approximate U.S. dollar equivalent of the outstanding dollar and euro senior subordinated notes, based on an exchange rate at June 27, 2003 of $1.1421 = €1.00. |

| (7) | Reflects the outstanding amount of £95 million Lucas Varity senior notes due 2020 that were assumed by TRW in connection with the acquisition of Lucas Varity in 1999 based on an exchange rate at June 27, 2003 of $1.6609 = £1.00 and certain other indebtedness, which have been assumed by us as part of the Acquisition. |

39