(ii) Amendment of Designated Preferred Stock. Any amendment, alteration or repeal of any provision of the Certificate of Designation for the Designated Preferred Stock or the Charter (including, unless no vote on such merger or consolidation is required by Section 7(d)(iii) below, any amendment, alteration or repeal by means of a merger, consolidation or otherwise~ so as to adversely affect the rights, preferences, privileges or voting powers of the Designated Preferred Stock; (iii) Share Exchanges, Reclassifications, Mergers and Consolidations. Subject to Section 7(d)(v) below, any consummation of a binding share exchange or reclassification involving the Designated Preferred Stock, or of a merger or consolidation of the Issuer with another corporation or other entity, unless in each case (x) the shares of Designated Preferred Stock remain outstanding or, in the case of any such merger or consolidation with respect to which the Issuer is not the surviving or resulting entity, are converted into or exchanged for preference securities of the surviving or resulting entity or its ultimate parent, and (y) such shares remaining outstanding or such preference securities, as the case may be, have such rights, preferences, privileges and voting powers, and limitations and· restrictions thereof that are the same as the rights, preferences, privileges and voting powers, and limitations and restrictions thereof, of Designated Preferred Stock ilIunediately prior to such consummation, taken as a whole; provided, that in all cases, the obligations of the Issuer are assumed (by operation of law or by express written assumption) by the resulting entity or its ultimate parent; (iv) Certain Asset Sales. Any sale of all, substantially all, or any material portion of, the assets df the Company, if the Designated Preferred Stock will not be redeemed in full contemporaneously with the consummation of such sale; and (v) Holding Company Transactions. Any consummation of a Holding Company Transaction, unless as a result of the Holding Company Transaction each share of Designated Preferred Stock Shall be converted into or exchanged for one share with an equal liquidation preference of preference securities of the Issuer or the Acquiror (the "Holding Company Preferred Stock"). Any such Holding Company Preferred Stock shall entitle holders thereof to dividends from the date of issuance of such Holding Company Preferred Stock on terms that are equivalent to the terms set forth herein, and shall have such other rights, preferences, privileges and voting powers, and limitations and restrictions thereof that are the same as the rights, preferences, privileges and voting powers, and limitations and restrictions thereof, of Designated Preferred Stock immediately prior to such conversion or exchange, taken as a whole; provided, however, that for all purposes of this Section 7(d), any increase in the amount of the authorized Preferred Stock, including any increase in the authorized amount of Designated Preferred Stock necessary to satisfy preemptive or similar rights granted by the Issuer to other persons prior to the Signing Date, or the creation and issuance, or an increase in the authorized or issued amount, whether pursuant to preemptive or similar rights or otherwise, of any other series of Preferred Stock, or any securities convertible into or exchangeable or exercisable for any other series of Preferred Stock, ranking equally with and/or junior to Designated Preferred Stock with respect to the payment of dividends (whether such dividends are cumulative or non-cumulative) and the distribution of assets upon liquidation, dissolution or winding up of the Issuer will not be SBLF Participant No. 240 A-iS

deemed to adversely affect the rights, preferences, privileges or voting powers, and shall not require the affirmative vote or consent of, the holders of outstanding shares of the Designated Preferred Stock. (e) Changes after Provision for Redemption. No vote or consent of the holders of Designated Preferred Stock shall be required pursuant to Section 7(d) above if, at or prior to the time when any such vote or consent would otherwise be required pursuant to such Section, all outstanding shares of the Designated Preferred Stock shall have been redeemed, or shall have been called for redemption upon proper notice and sufficient funds shall have been deposited in trust for such redemption, in each case pursuant to Section 5 above. (f) Procedures for Voting and Consents. The rules and procedures for calling and conducting any meeting of the holders of Designated Preferred Stock (including, without limitation, the fixing of a record date in connection therewith), the solicitation and use of proxies at such a meeting, the obtaining of written consents and any other aspect or matter with regard to such a meeting or such consents shall be governed by any rules of the Board of Directors or any duly authorized committee of the Board of Directors, in its discretion, may adopt from time to time, which rules and procedures shall conform to the requirements of the Charter, the Bylaws, and applicable law and the rules of any national securities exchange or other trading facility on which Designated Preferred Stock is listed or traded at the time. Section 8. Restriction on Redemptions and Repurchases. (a) Subject to Sections 8(b) and (c), so long as any share of Designated Preferred Stock remains outstanding, the Issuer may repurchase or redeem any shares of Capital Stock (as defined below), in each case only if (i) after giving effect to such dividend, repurchase or redemption, the Issuer's Tier 1 capital would be at least equal to the Tier 1 Dividend Threshold and (ii) dividends on all outstanding shares of Designated Preferred Stock for the most recently completed Dividend Period have been or are contemporaneously declared and paid (or have been declared and a sum sufficient for the payment thereof has been set aside for the benefit of the holders of shares of Designated Preferred Stock on the applicable record date). (b) If a dividend is lIlot declared and paid on the Designated Preferred Stock in respect of any Dividend Period, then from the last day of such Dividend Period until the last day of the third (3rd) Dividend Period immediately following it, neither the Issuer nor any Issuer Subsidiary shall, redeem, purchase or'acquire any shares of Conunon Stock, Junior Stock, Parity Stock or other capital stock or other equity securities of any kind of the Issuer or any Issuer Subsidiary, or any trust preferred securities issued by the Issuer or any Affiliate of the Issuer ("Capital Stock"), (other than (i) redemptions, purchases, repurchases or other acquisitions of the Designated Preferred Stock and (ii) repurchases of Junior Stock or Common Stock in connection with the administration of any employee benefit plan in the ordinary course of business (including purchases to offset any Share Dilution Amount pursuant to a publicly announced repurchase plan) and consistent with past practice; provided that any purchases to offset the Share Dilution Amount shall in no event exceed the Share Dilution Amount, (iii) the acquisition by the Issuer or any of the Issuer Subsidiaries of record ownership in Junior Stock or Parity Stock for the beneficial ownership of any other persons (other than the Issuer or any other Issuer Subsidiary), including as trustees or custodians, (iv) the exchange or conversion of Junior Stock SBLF Participant No. 240 A-16

for or into other Junior Stock or of Parity Stock or trust preferred securities for or into other Parity Stock (with the same or lesser aggregate liquidation amount) or Junior Stock, in each case set forth in this clause (iv), solely to the extent required pursuant to binding contractual agreements entered into prior to the Signing Date or any subsequent agreement for the accelerated exercise, settlement or exchange thereof for Common Stock, (v) redemptions of securities held by the Issuer or any wholly-owned Issuer Subsidiary or (vi) redemptions, purchases or other acquisitions of capital stock or other equity securities of any kind of any Issuer Subsidiary required pursuant to binding contractual agreements entered into prior to (x) if Treasury held Previously Acquired Preferred Shares immediately prior to the Original Issue Date, the original issue date of such Previously Acquired Preferred Shares, or (y) otherwise, the Signing Date). (c) If the Issuer is not Public1y-Traded, then after the tenth (lOth) anniversary of the Signing Date, so long as any share of Designated Preferred Stock remains outstanding, no Common Stock, Junior Stock or Parity Stock shall be, directly or indirectly, purchased, redeemed or otherwise acquired for consideration by the Issuer or any of its subsidiaries. Section 9. No Preemptive Rights. No share of Designated Preferred Stock shall have any rights of preemption whatsoever as to any securities of the Issuer, or any warrants, rights or options issued or granted with respect thereto, regardless of how such securities, or such warrants, rights or options, may be designated, issued or granted. Section 10. References to Line Items of Supplemental Reports. If Treasury modifies the form of Supplemental Report, pursuant to its rights under the Definitive Agreement, and any such modification includes a change to the caption or number of any line item on the Supplemental Report, then any reference herein to such line item shall thereafter be a reference to such re-captioned or re-numbered line item. Section 11. Record Holders. To the fullest extent permitted by applicable law, the Issuer and the transfer agent for Designated Preferred Stock may deem and treat the record holder of any share of Designated Preferred Stock as the true and lawful owner thereof for all purposes, and neither the Issuer nor such transfer agent shall be affected by any notice to the contrary. Section 12. Notices. All notices or communications in respect of Designated Preferred Stock shall be sufficiently given if given in writing and delivered in person or by first class mail, postage prepaid, or if given in such other manner as may be permitted in this Certificate of Designation, in the Charter or Bylaws or by applicable law. Notwithstanding the foregoing, if shares of Designated Preferred Stock are issued in book-entry form through The Depository Trust Company or any similar facility, such notices may be given to the holders of Designated Preferred Stock in any manner permitted by such facility. Section 13. Replacement Certificates. The Issuer shall replace any mutilated certificate at the holder's expense upon surrender of that certificate to the Issuer. The Issuer shall replace certificates that become destroyed, stolen or lost at the holder's expense upon delivery to the Issuer of reasonably satisfactory evidence that the certificate has been destroyed, stolen or lost, together with any indemnity that may be reasonably required by the Issuer. SBLF Participant No. 240 A-I?

Section 14. Other Rights. The shares of Designated Preferred Stock shall not have any rights, preferences, privileges or voting powers or relative, participating, optional or other special rights, or qualifications, limitations or restrictions thereof, other than as set forth herein or in the Charter or as provided by applicable law. SBlF Participant No 240 A-18

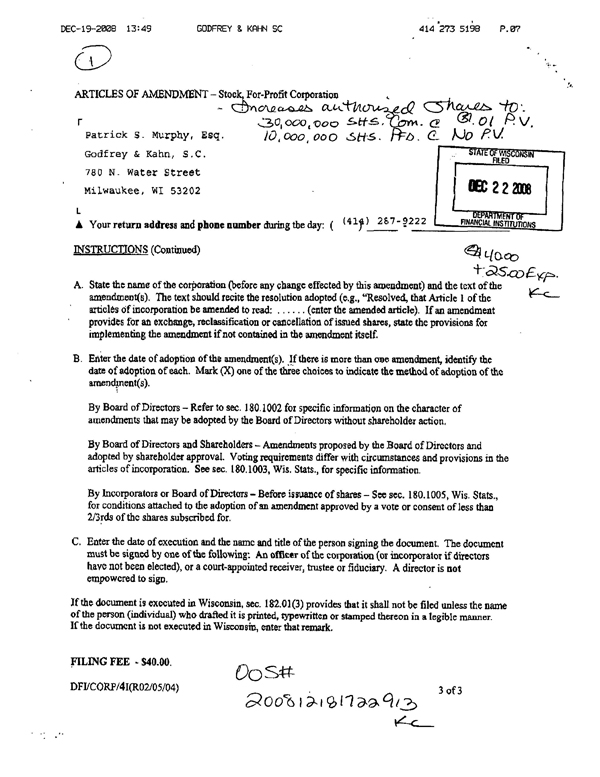

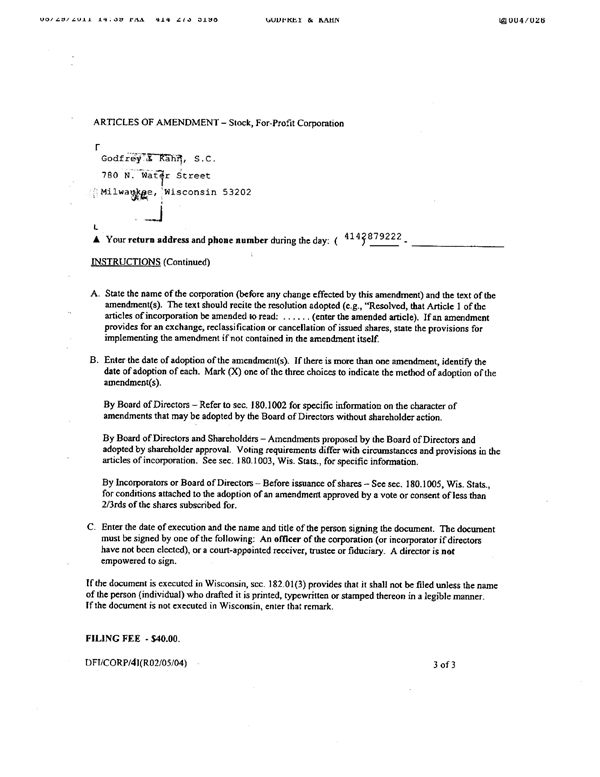

ARTICLES OF AMENDMENT - Stock, For-Profit Corporation Godfrey Kayn, S.C. 780 N. Water Street Milwaukee, Wisconsin 53202 INSTRUCTIONS (Continued) A. State the name of the corporation (before any change effected by this amendment) and the text of the amendment(s). The text should recite the resolution adopted (e.g., "Resolved, that Article I of the articles of incorporation be amended 10 read: (enter the amended article). If an amendment provides for an exchange, reclassification or cancellation of issued shares, state the provisions for implementing the amendment if not contained in the amendment itself. B. Enter the date of adoption of the amendment(s). If there is more than one amendment, identifY the date of adoption of each. Mark (X) one of the three choices to indicate the method of adoption of the amendment(s). By Board of Directors - Refer to sec. 180.1 002 for specific infoIDlation on the character of amendments that may be adopted by the Board of Directors without shareholder action. By Board of Directors and Shareholders - Amendments proposed by the Board of Directors and adopted by shareholder approval. Voting requirements differ with circumstances and provisions in the articles of incolporation. See sec. 180.1003, Wis. Slats., for specific infonnation. By Incorporators or Board of Directors - Before issuance of shares - See sec. 180.1005, Wis. Stats. for conditions attached to the adoption of an amendment approved by a vote or consent of Jess than 2/3rds of the shares subscribed for. C. Enter the date of execution and the name and ti tie of the person signing the document. The document must be signed by one of the following: An officer of the corporation (or incorporator if directors have not been elected), or a court-appointed receiver. trustee or fiduciary. A director is not empowered to sign. If the document is executed in Wisconsin, sec. 182.01(3) provides that it shall not be filed unless the name of the person (individual) who drafted it is printed, typewritten or stamped thereon in a legible manner. If the document is not executed in Wisconsin, enter that remark. FILING FEE - $40.00. DFTlCORP/4J(R02/0S/04) 30f3

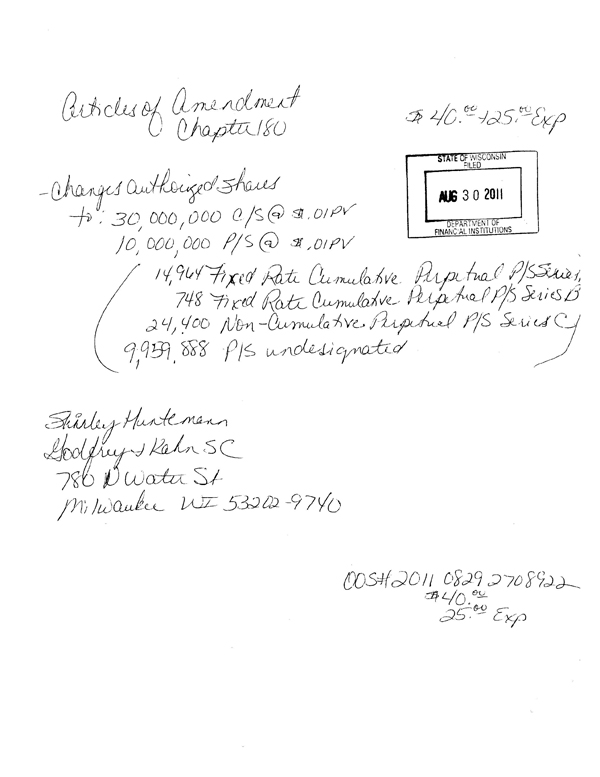

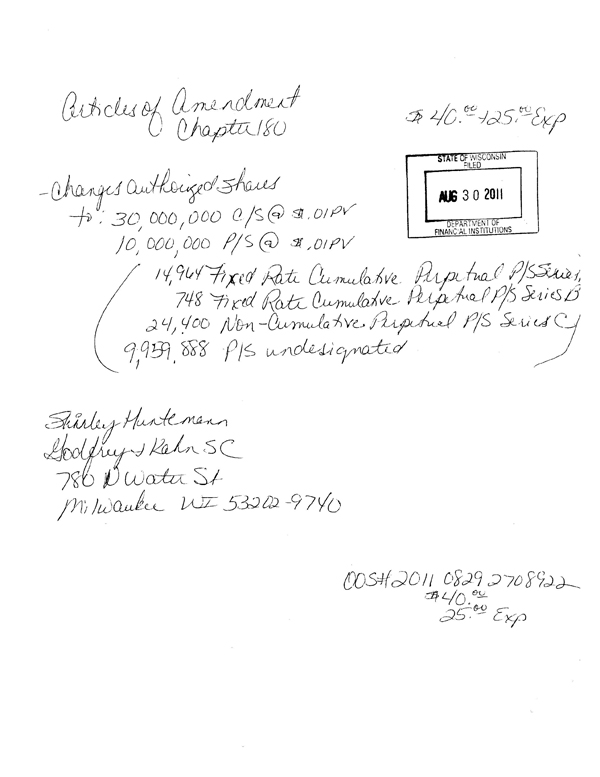

Articles of Amendment Chapt34 180 Changes Authorized Shares to: 30,000,000 c/s $0.1PV 10,000,000 p/s/ $0.1PV 14,964 Fixed Rate Cumulative Perpetual P/S. Series 748 Fixed Rate Cuulative Perpetual P/S. Series B 24,400 Non-Cumulative Perpetual P/S. Series C 9,959,888 P/S undesignated Shirley Huntemann Godfrey Kahn SC 780 N Water St Milwaukee WI 53202-9740 OOS#2011 0829 2708922 $40.00 25.00 Exp