Exhibit 99.2

Investor Presentation September 9, 2015 Creating the Premier Wisconsin Community Bank

Forward - Looking Statement Disclosure Creating the Premier Wisconsin Community Bank This report contains forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, whic h Congress passed in an effort to encourage companies to provide information about their anticipated future financial performance. This act protects a company from unwarra nted litigation if actual results are different from management expectations. This report reflects the current views and estimates of future economic circumstances, industry condit ions, company performance, and financial results of the management of Nicolet and Baylake . These forward - looking statements are subject to a number of factors and uncertainties which could cause Nicolet’s, Baylake’s or the combined company’s actual results and experience to differ from the anticipated results and expectations expressed in such fo rwa rd - looking statements, and such differences may be material. Forward - looking statements speak only as of the date they are made and neither Nicolet nor Baylake assumes any duty to update forward - looking statements. There are a number of factors that could cause our actual results to differ materially from those projected in such forward - looking statemen ts. In addition to factors previously disclosed in Nicolet’s and Baylake’s reports filed with the SEC and those identified elsewhere in this report, these forward - looking statements include, but are not limited to, statements about ( i ) the expected benefits of the transaction between Nicolet and Baylake and between Nicolet National Bank and Baylake Bank, including future financial and operating results, cost savings, enhanced revenues and the expected market position of the combined comp any that may be realized from the transaction, and (ii) Nicolet’s and Baylake’s plans, objectives, expectations and intentions and other statements contained in this report that are not historical facts. Ot her statements identified by words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “targets,” “projects” or words of sim ila r meaning generally are intended to identify forward - looking statements. These statements are based upon the current beliefs and expectations of Nicolet’s and Baylake’s management and are inherently subject to significant business, economic and competitive risks and uncertainties, many of which are beyond their respective control. In addition, these forward - looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. Actual results may differ from those indicated or implied in the forward - looking statements and such differences may be material. The following risks, among others, could cause actual results to differ materially from the anticipated results or other expe cta tions expressed in the forward - looking statements: (1) the businesses of Nicolet and Baylake may not integrate successfully or the integration may be more difficult, time - consuming or costly than expected; (2) the expect ed growth opportunities and cost savings from the transaction may not be fully realized or may take longer to realize than expected; (3 ) r evenues following the transaction may be lower than expected as a result of losses of customers or other reasons, including issues arising in connection with integration of the two banks; (4) deposit attrition, operating costs, customer loss and business disruption following the transaction, including difficulties in maintaining relationships with employees, m ay be greater than expected; (5) governmental approvals of the transaction may not be obtained on the proposed terms or expected timeframe; (6) the terms of the proposed transaction ma y n eed to be modified to satisfy such approvals or conditions; (7) Nicolet’s shareholders or Baylake’s shareholders may fail to approve the transaction; (8) reputational risks and the reaction of the companies’ customers to the transaction; (9) diversion of management time on merger related issues; (10) changes in asset quality and credit risk; (11) t he cost and availability of capital; (12) customer acceptance of the combined company’s products and services; (13) customer borrowing, repayment, investment and deposit practices; (14) t he introduction, withdrawal, success and timing of business initiatives; (15) the impact, extent, and timing of technological changes; (16) severe catastrophic events in our ge ogr aphic area; (17) a weakening of the economies in which the combined company will conduct operations may adversely affect its operating results; (18) the U.S. legal and regulatory f ram ework, including those associated with the Dodd Frank Wall Street Reform and Consumer Protection Act, could adversely affect the operating results of the combined company; ( 19) the interest rate environment may compress margins and adversely affect net interest income; and (20) competition from other financial services companies in the compani es’ markets could adversely affect operations. Additional factors that could cause Nicolet’s results to differ materially from those described in the forward - look ing statements can be found in Nicolet’s reports (such as Annual Reports on Form 10 - K, Quarterly Reports on Form 10 - Q and Current Reports on Form 8 - K) filed with the SEC and available at the SEC’s website ( www.sec.gov ). Additional factors that could cause Baylake’s results to differ materially from those described in the forward - looking statements can be found in Baylake’s reports (such as Annual Reports on Form 10 - K, Quarterly Reports on Form 10 - Q and Current Reports on Form 8 - K) filed with the SEC and available at the SEC’s website ( www.sec.gov ). All subsequent written and oral forward - looking statements concerning Nicolet, Baylake or the proposed merger or other matters and attributable to Nicolet, Baylake or any person acting on either of their behalf are expressly qualified in their entirety by the cautionary statements above. Nicolet and Baylake do not undertake any obligation to update any forward - looking statement, whether written or oral, to reflect circumstances or events that occur after the date the forward - looking statements are made.

Important Information for Investors Creating the Premier Wisconsin Community Bank This communication relates to the proposed merger transaction involving Nicolet and Baylake . In connection with the proposed merger, Nicolet and Baylake will file a joint proxy statement/prospectus on Form S - 4 and other relevant documents concerning the merger with the Securities and Exchange Commission (the “SEC”). BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, INVESTORS ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS AND ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED MERGER OR INCORPORATED BY REFERENCE IN THE JOINT PROXY STATEMENT/PROSPECTUS BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT NICOLET, BAYLAKE AND THE PROPOSED MERGER. When available, the joint proxy statement/prospectus will be delive red to shareholders of Nicolet and shareholders of Baylake . Investors may obtain copies of the joint proxy statement/prospectus and other relevant documents (as they become available) free of charge at the SEC’s website ( www.sec.gov ). Copies of the documents filed with the SEC by Nicolet will be available free of charge on Nicolet’s website at www.nicoletbank.com . Copies of the documents filed with the SEC by Baylake will be available free of charge on Baylake’s website at www.baylake.com Nicolet, Baylake and certain of their directors, executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies from the shareholders of Nicolet and the shareholders of Baylake in connection with the proposed merger. Information about the directors and executive officers of Nicolet and Baylake will be included in the joint proxy statement/prospectus for the proposed transaction filed with the SEC. Information about the directors and executive officers of Nicolet is also included in its annual report on Form 10 - K for the year ended December 31, 2014, which was filed with the SEC on March 9, 2015. Information about the directors and executive officers of Baylake is also included in the proxy statement for its 2015 annual meeting of shareholders, which was filed with the SEC on April 24 , 2015. Additional information regarding the interests of such participants and other persons who may be deemed participants in t he transaction will be included in the joint proxy statement/prospectus and the other relevant documents filed with the SEC when they become avai lab le.

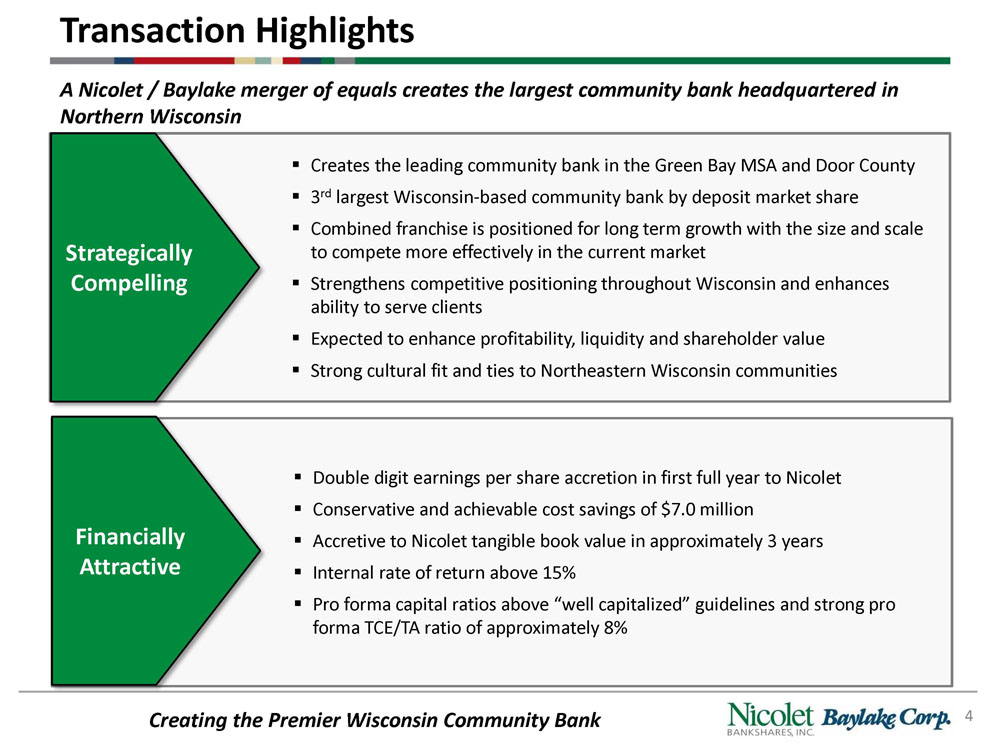

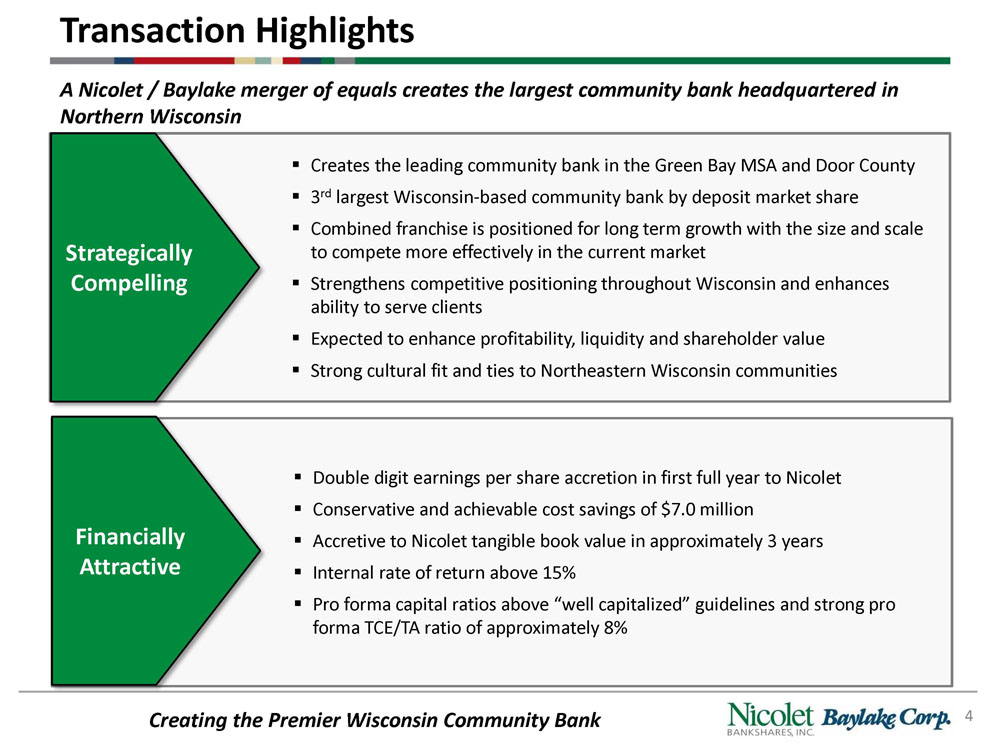

Transaction Highlights ▪ Creates the leading community bank in the Green Bay MSA and Door County ▪ 3 rd largest Wisconsin - based community bank by deposit market share ▪ Combined franchise is positioned for long term growth with the size and scale to compete more effectively in the current market ▪ Strengthens competitive positioning throughout Wisconsin and enhances ability to serve clients ▪ Expected to enhance profitability, liquidity and shareholder value ▪ Strong cultural fit and ties to Northeastern Wisconsin communities 4 Creating the Premier Wisconsin Community Bank ▪ Double digit earnings per share accretion in first full year to Nicolet ▪ Conservative and achievable cost savings of $7.0 million ▪ Accretive to Nicolet tangible book value in approximately 3 years ▪ Internal rate of return above 15% ▪ Pro forma capital ratios above “well capitalized” guidelines and strong pro forma TCE /TA ratio of approximately 8% Strategically Compelling Financially Attractive A Nicolet / Baylake merger of equals creates the largest community bank headquartered in Northern Wisconsin

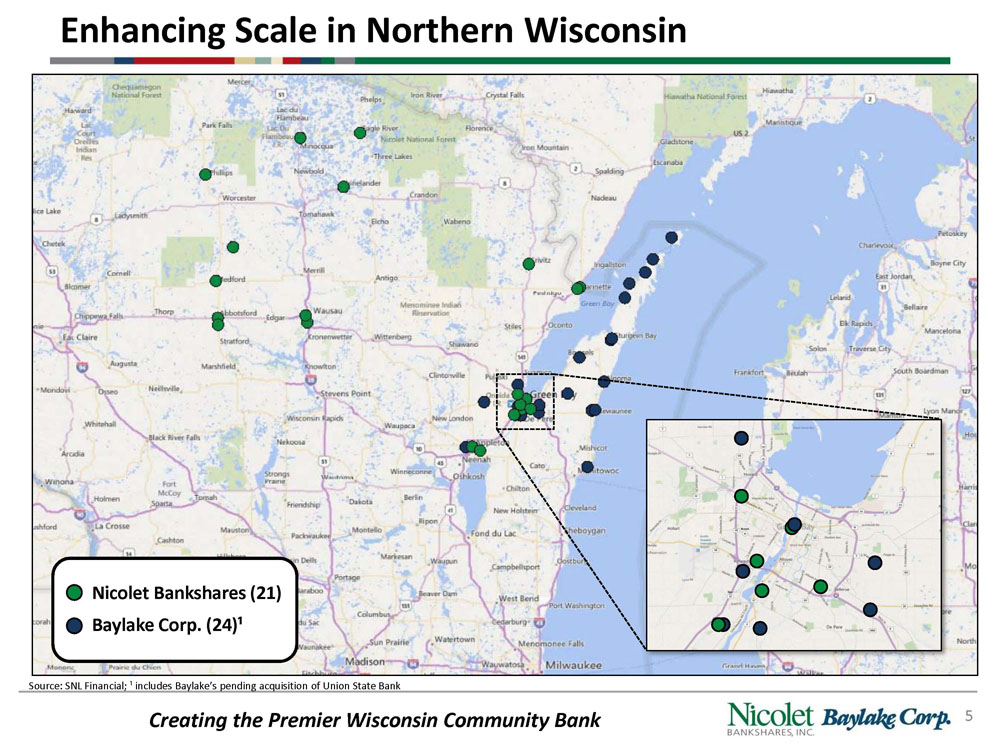

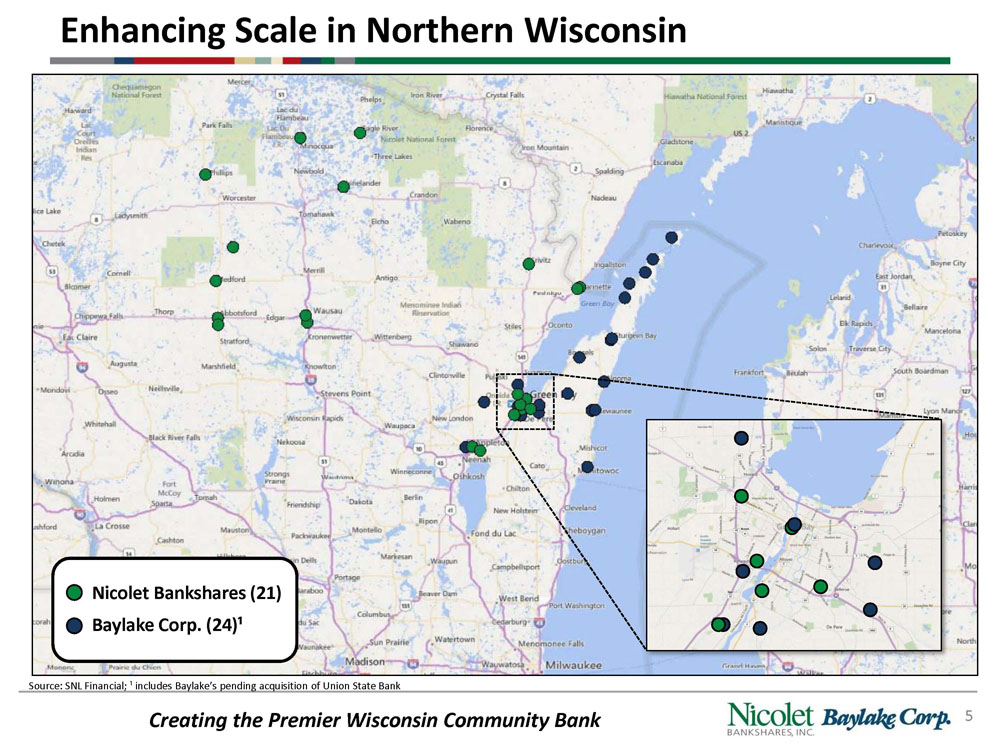

Enhancing Scale in Northern Wisconsin 5 Creating the Premier Wisconsin Community Bank Nicolet Bankshares (21) Baylake Corp. (24)¹ Source: SNL Financial; ¹ includes Baylake’s pending acquisition of Union State Bank

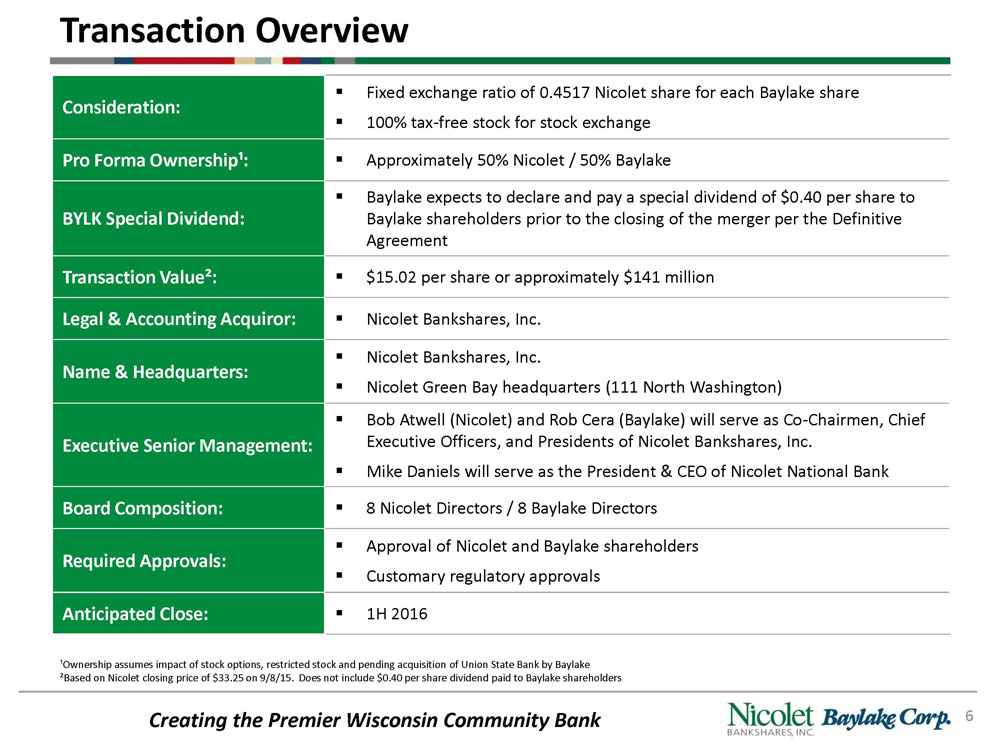

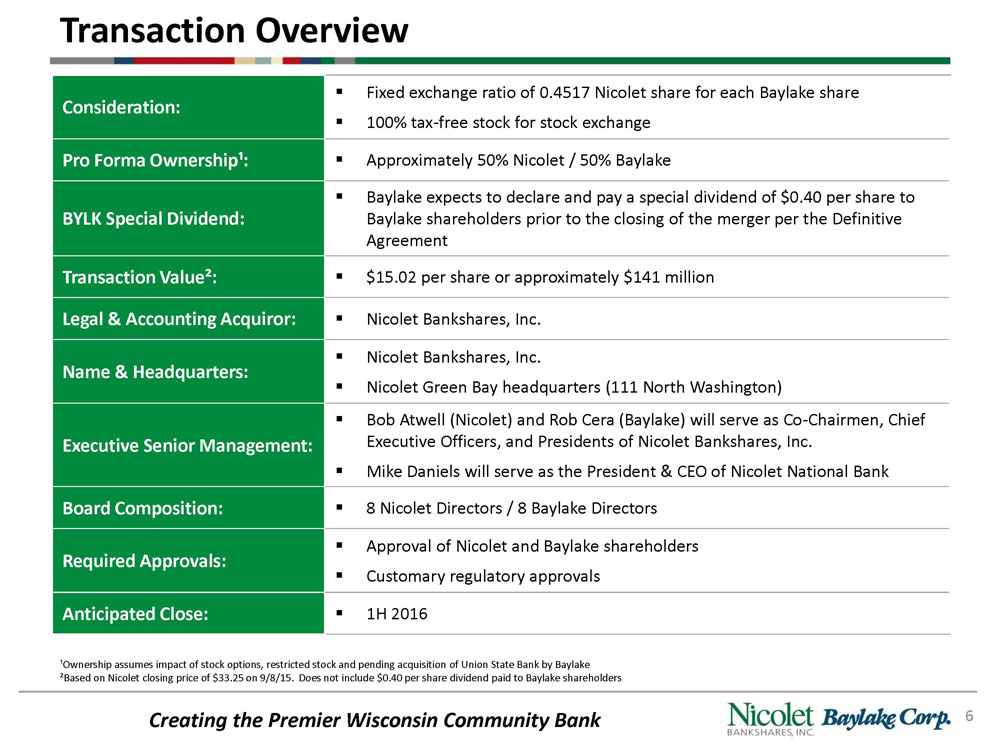

Transaction Overview 6 Creating the Premier Wisconsin Community Bank ¹Ownership assumes impact of stock options, restricted stock and pending acquisition of Union State Bank by Baylake ²Based on Nicolet closing price of $[ ] on 9/8/15. Does not include $0.40 per share dividend paid to Baylake shareholders To update transaction value Consideration: ▪ Fixed exchange ratio of 0. 4517 Nicolet share for each Baylake share ▪ 100% tax - free stock for stock exchange Pro Forma Ownership¹: ▪ Approximately 50% Nicolet / 50% Baylake BYLK Special Dividend: ▪ Baylake expects to declare and pay a special dividend of $0.40 per share to Baylake shareholders prior to the closing of the merger per the Definitive Agreement Transaction Value²: ▪ $[ ] per share or $[ ]million Legal & Accounting Acquiror : ▪ Nicolet Bankshares , Inc. Name & Headquarters: ▪ Nicolet Bankshares , Inc. ▪ Nicolet Green Bay headquarters (111 North Washington) Executive Senior Management: ▪ Bob Atwell (Nicolet) and Rob Cera (Baylake) will serve as Co - Chairmen, Chief Executive Officers, and Presidents of Nicolet Bankshares , Inc. ▪ Mike Daniels will serve as the President & CEO of Nicolet National Bank Board Composition: ▪ 8 Nicolet Directors / 8 Baylake Directors Required Approvals: ▪ Approval of Nicolet and Baylake shareholders ▪ Customary regulatory approvals Anticipated Close: ▪ 1H 2016

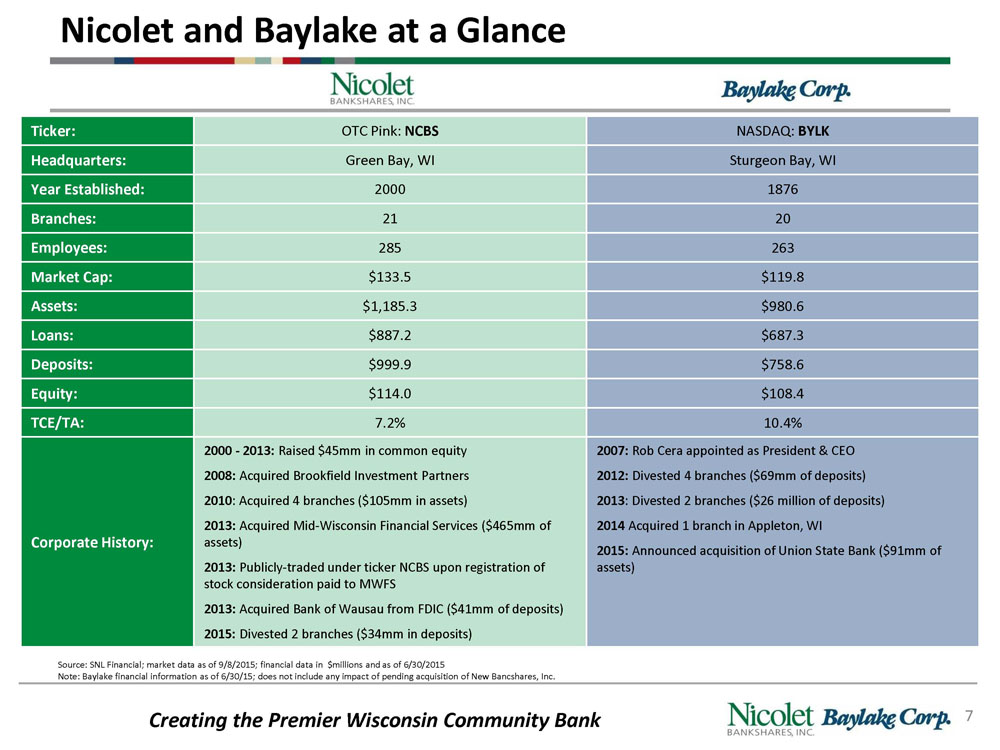

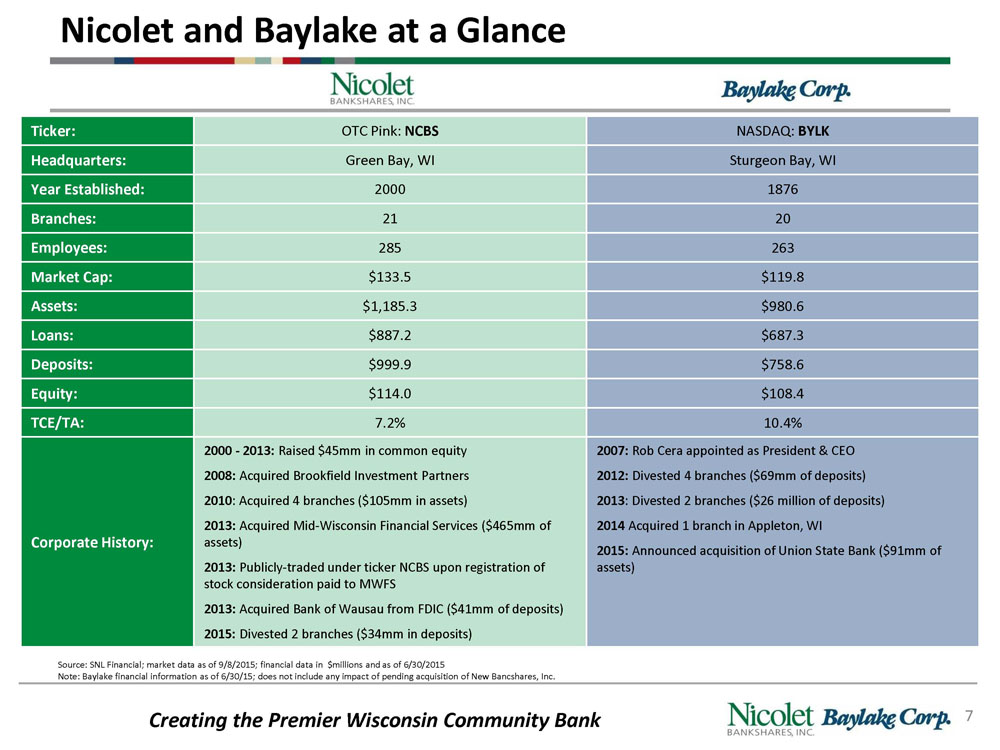

Nicolet and Baylake at a Glance 7 Creating the Premier Wisconsin Community Bank Source: SNL Financial; market data as of 9/8/2015; financial data in $millions and as of 6/30/2015 Note: Baylake financial information as of 6/30/15; does not include any impact of pending acquisition of New Bancshares, Inc. To update market caps Ticker : OTC Pink: NCBS NASDAQ: BYLK Headquarters: Green Bay, WI Sturgeon Bay, WI Year Established: 2000 1876 Branches: 21 20 Employees: 285 263 Market Cap: $133.5 $119.8 Assets: $1,185.3 $980.6 Loans: $887.2 $687.3 Deposits: $999.9 $758.6 Equity: $114.0 $108.4 TCE/TA: 7.2% 10.4% Corporate History: 2000 - 2013 : Raised $45 mm in common equity 2008: Acquired Brookfield Investment Partners 2010 : Acquired 4 branches ($105mm in assets) 2013: Acquired Mid - Wisconsin Financial Services ($465mm of assets) 2013: Publicly - traded under ticker NCBS upon registration of stock consideration paid to MWFS 2013: Acquired Bank of Wausau from FDIC ($41mm of deposits) 2015: Divested 2 branches ($34mm in deposits) 2007: Rob Cera appointed as President & CEO 2012: Divested 4 branches ($69mm of deposits) 2013 : Divested 2 branches ($26 million of deposits) 2014 Acquired 1 branch in Appleton, WI 2015: Announced acquisition of Union State Bank ($91mm of assets)

Nicolet Bankshares 8 Creating the Premier Wisconsin Community Bank Financial Highlights ($millions) ▪ Commercially focused bank since inception. Commercial & Industrial and owner occupied CRE loans comprise more than 50% of the loan portfolio ▪ Established track record of organic asset generation ▪ Diversified revenue stream that balances traditional banking spread income with meaningful revenue from wealth management and mortgage originations ▪ Proven acquirer and integrator of all types of acquisitions: ▪ Branches: Four Anchor Bank branches in 2010 ▪ Whole Bank: Mid - Wisconsin Bank in 2013 ▪ FDIC Assisted: Bank of Wausau in 2013 ▪ Strong commitment to the communities we serve. The Nicolet National Foundation, founded in 2007 and supported by contributions from employees and the Bank, has made donations to dozens of local causes and charities throughout Northeastern and Northcentral Wisconsin. ¹ Excludes TDRs Source: SNL Financial; financial data for the first 6 months ended 6/30/15

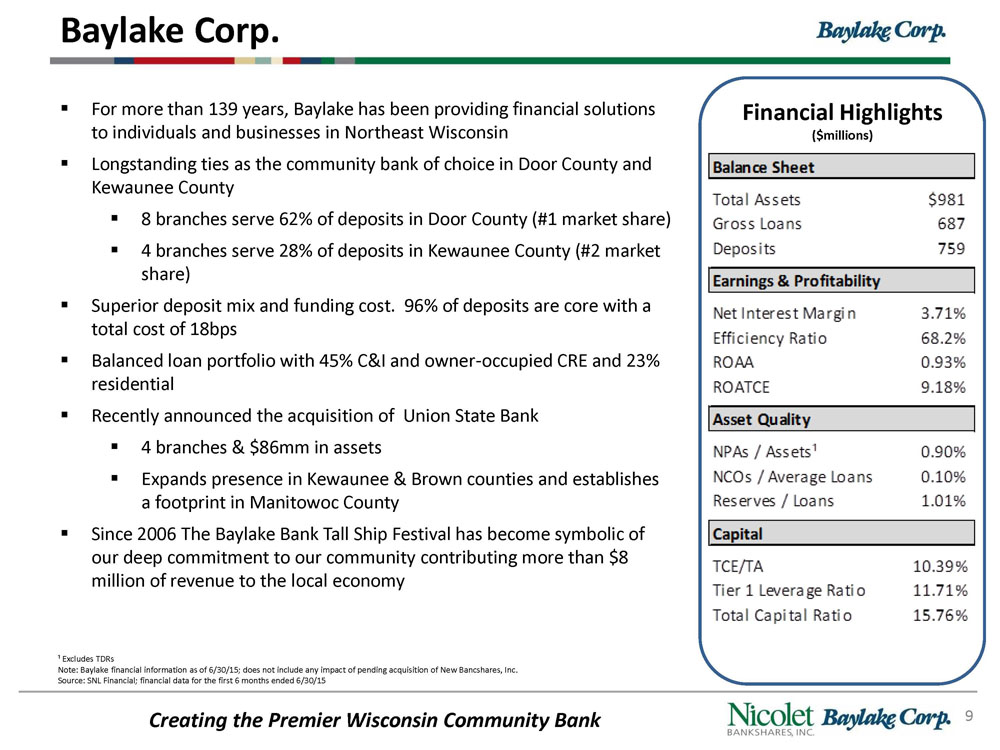

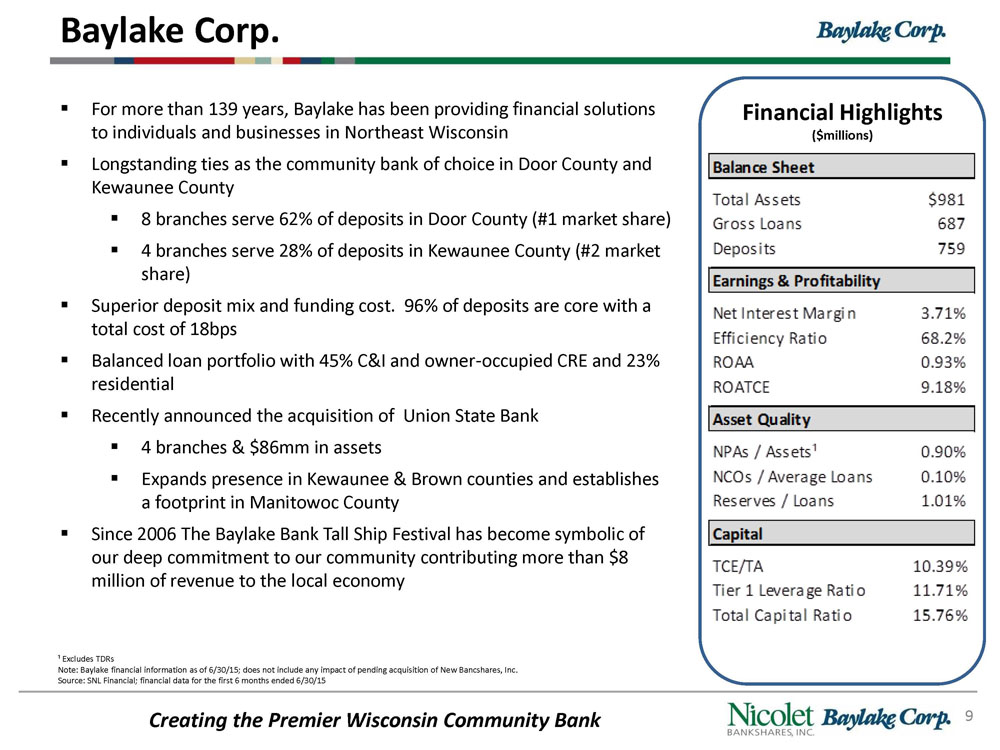

Baylake Corp. 9 Creating the Premier Wisconsin Community Bank Financial Highlights ($millions) ▪ For more than 139 years, Baylake has been providing financial solutions to individuals and businesses in Northeast Wisconsin ▪ Longstanding ties as the community bank of choice in Door County and Kewaunee County ▪ 8 branches serve 62% of deposits in Door County (#1 market share) ▪ 4 branches serve 28% of deposits in Kewaunee County (#2 market share) ▪ Superior deposit mix and funding cost. 96% of deposits are core with a total cost of 18bps ▪ Balanced loan portfolio with 45% C&I and owner - occupied CRE and 23% residential ▪ Recently announced the acquisition of Union State Bank ▪ 4 branches & $86mm in assets ▪ Expands presence in Kewaunee & Brown counties and establishes a footprint in Manitowoc County ▪ Since 2006 The Baylake Bank Tall Ship Festival has become symbolic of our deep commitment to our community contributing more than $8 million of revenue to the local economy ¹ Excludes TDRs Note: Baylake financial information as of 6/30/15; does not include any impact of pending acquisition of New Bancshares, Inc. Source: SNL Financial; financial data for the first 6 months ended 6/30/15

Building Market Share 10 Creating the Premier Wisconsin Community Bank ▪ Strong pro forma market share in Wisconsin - $1.8 billion in deposits and over 40 branches ▪ Creates the 3 rd largest community bank in Wisconsin Source: SNL Financial; deposit market share data as of 6/30/2014 and includes Baylake’s pending acquisition of Union State Bank and is adjusted for Nicolet’s August 2015 divestiture of 2 branches

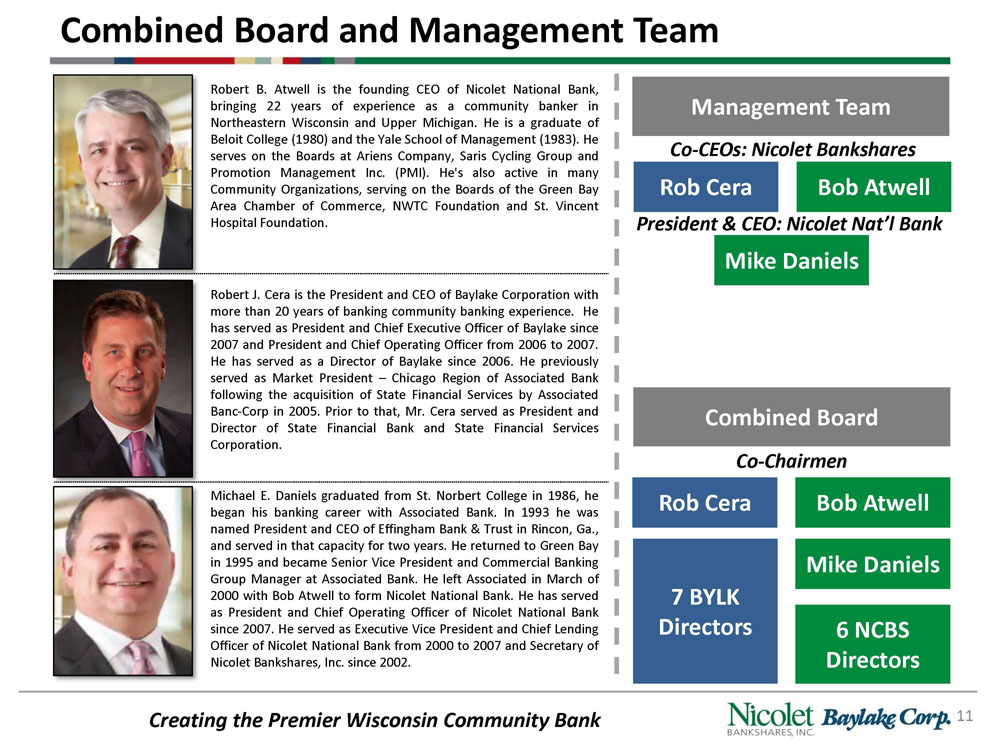

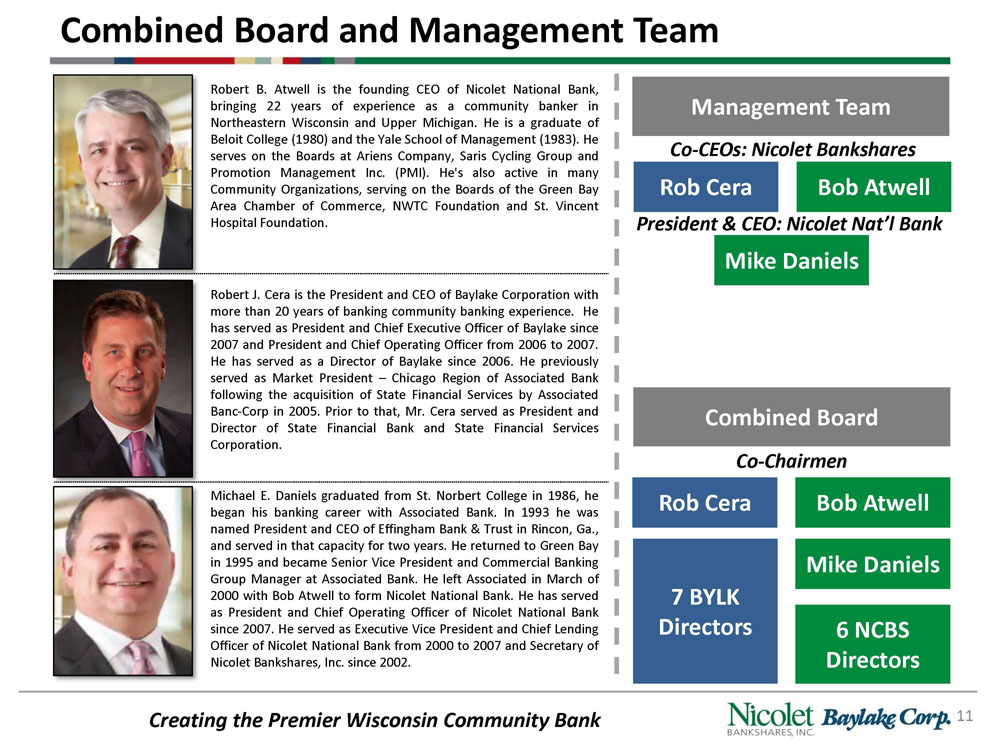

Combined Board and Management Team 11 Creating the Premier Wisconsin Community Bank Combined Board Robert B . Atwell is the founding CEO of Nicolet National Bank, bringing 22 years of experience as a community banker in Northeastern Wisconsin and Upper Michigan . He is a graduate of Beloit College ( 1980 ) and the Yale School of Management ( 1983 ) . He serves on the Boards at Ariens Company, Saris Cycling Group and Promotion Management Inc . (PMI) . He's also active in many Community Organizations, serving on the Boards of the Green Bay Area Chamber of Commerce, NWTC Foundation and St . Vincent Hospital Foundation . Robert J . Cera is the President and CEO of Baylake Corporation with more than 20 years of banking community banking experience . He has served as President and Chief Executive Officer of Baylake since 2007 and President and Chief Operating Officer from 2006 to 2007 . He has served as a Director of Baylake since 2006 . He previously served as Market President – Chicago Region of Associated Bank following the acquisition of State Financial Services by Associated Banc - Corp in 2005 . Prior to that, Mr . Cera served as President and Director of State Financial Bank and State Financial Services Corporation . Michael E . Daniels graduated from St . Norbert College in 1986 , he began his banking career with Associated Bank . In 1993 he was named President and CEO of Effingham Bank & Trust in Rincon, Ga . , and served in that capacity for two years . He returned to Green Bay in 1995 and became Senior Vice President and Commercial Banking Group Manager at Associated Bank . He left Associated in March of 2000 with Bob Atwell to form Nicolet National Bank . He has served as President and Chief Operating Officer of Nicolet National Bank since 2007 . He served as Executive Vice President and Chief Lending Officer of Nicolet National Bank from 2000 to 2007 and Secretary of Nicolet Bankshares , Inc . since 2002 . Rob Cera Bob Atwell Mike Daniels 7 BYLK Directors 6 NCBS Directors Management Team Co - Chairmen Co - CEOs: Nicolet Bankshares Rob Cera Bob Atwell Mike Daniels President & CEO: Nicolet Nat’l Bank

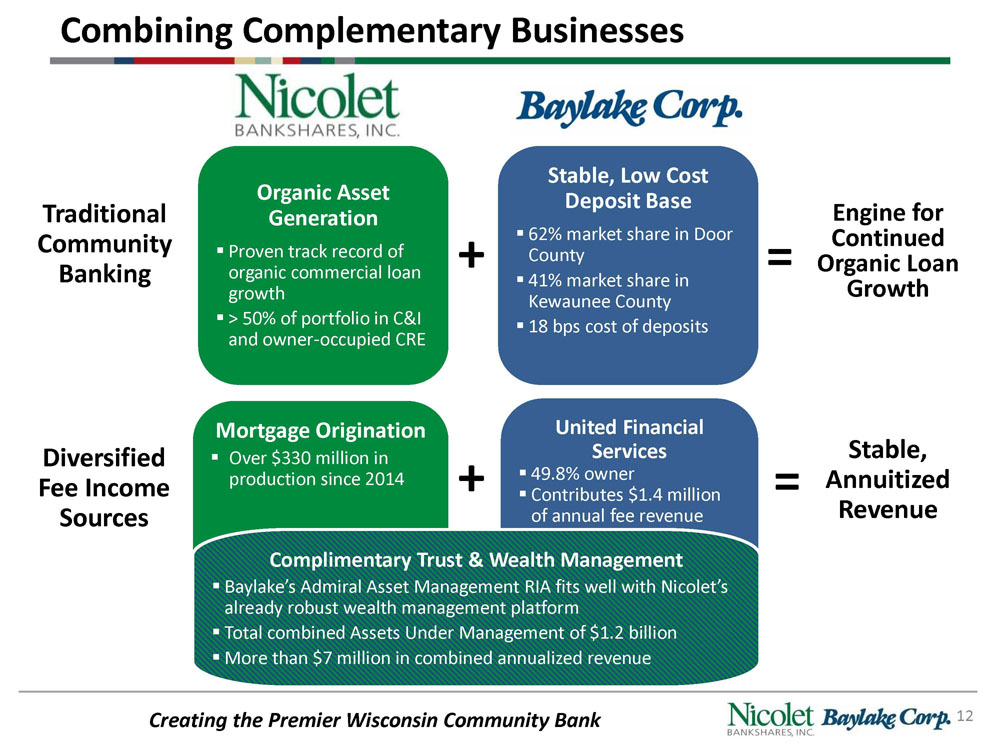

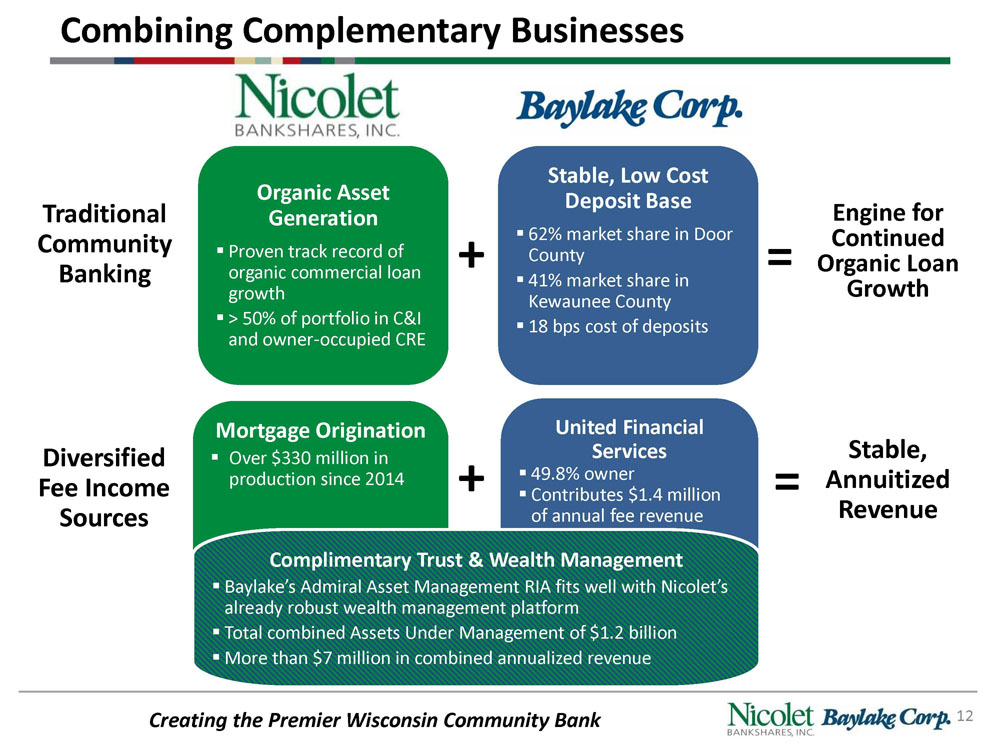

Combining Complementary Businesses 12 Creating the Premier Wisconsin Community Bank Stable, Low Cost Deposit Base ▪ 62% market share in Door County ▪ 41% market share in Kewaunee County ▪ 18 bps cost of deposits Mortgage Origination ▪ Over $330 million in production since 2014 Traditional Community Banking Diversified Fee Income Sources Organic Asset Generation ▪ Proven track record of organic commercial loan growth ▪ > 50% of portfolio in C&I and owner - occupied CRE + + = Engine for Continued Organic Loan Growth = Stable, Annuitized Revenue United Financial Services ▪ 49.8% owner ▪ Contributes $1.4 million of annual fee revenue Complimentary Trust & Wealth Management ▪ Baylake’s Admiral Asset Management RIA fits well with Nicolet’s already robust wealth management platform ▪ Total combined Assets Under Management of $1.2 b illion ▪ More than $7 million in combined annualized revenue

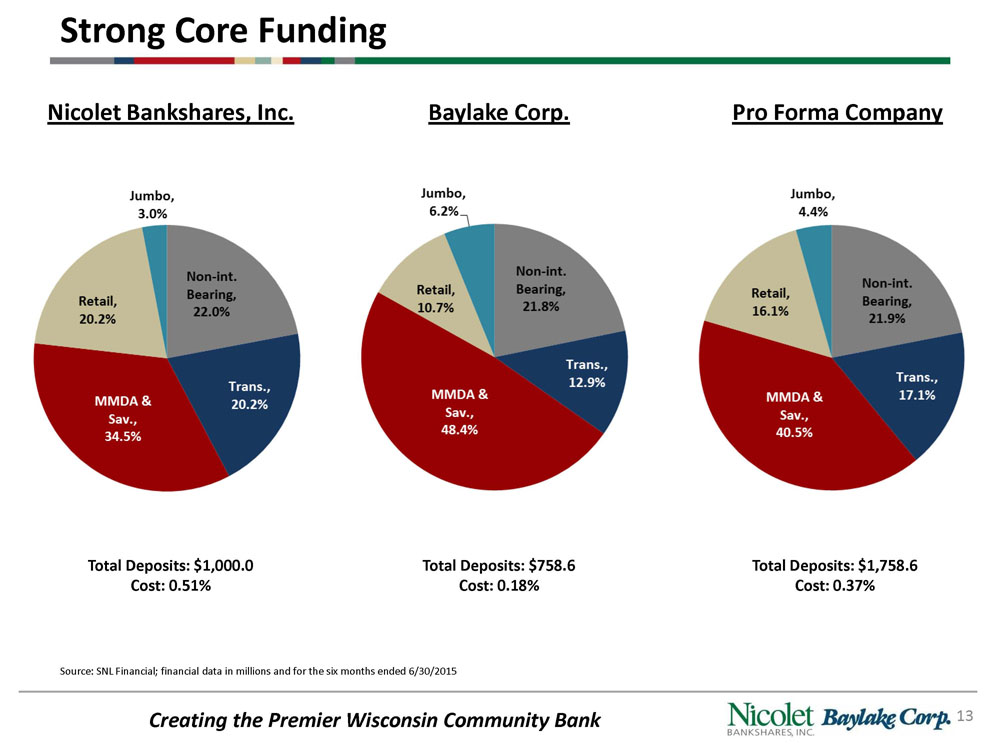

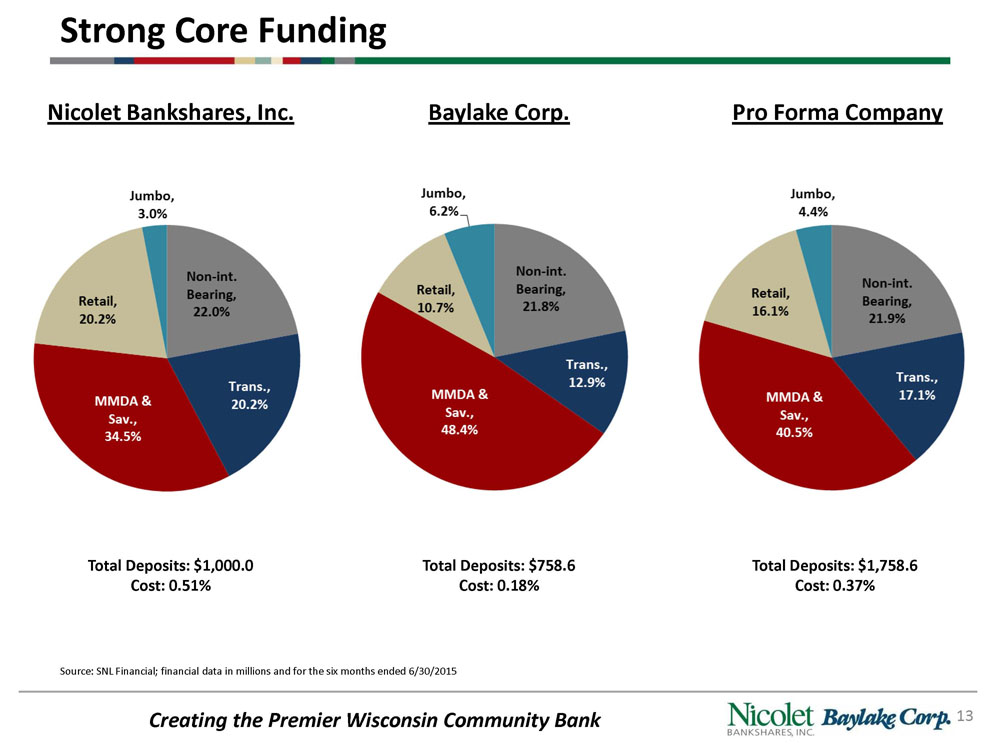

Strong Core Funding 13 Creating the Premier Wisconsin Community Bank Total Deposits: $1,000.0 Cost: 0.51% Total Deposits: $758.6 Cost: 0.18% Nicolet Bankshares , Inc. Baylake Corp. Pro Forma Company Total Deposits: $1,758.6 Cost: 0.37% Source: SNL Financial; financial data in millions and for the six months ended 6/30/2015

Diversified Loan Portfolio 14 Creating the Premier Wisconsin Community Bank Total Loans: $887.1 Yield: 5.14% Total Loans: $687.3 Yield: 4.35% Nicolet Bankshares , Inc. Baylake Corp. Pro Forma Company Total Loans: $1,574.5 Yield: 4.80% Source: SNL Financial; financial data in millions and for the six months ended 6/30/2015

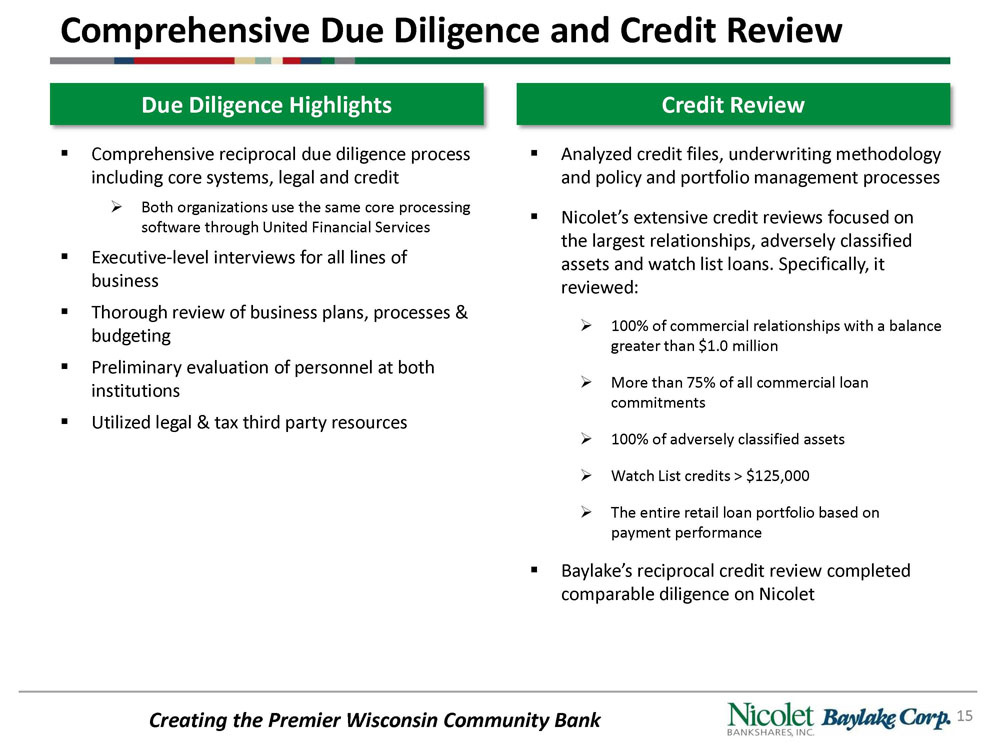

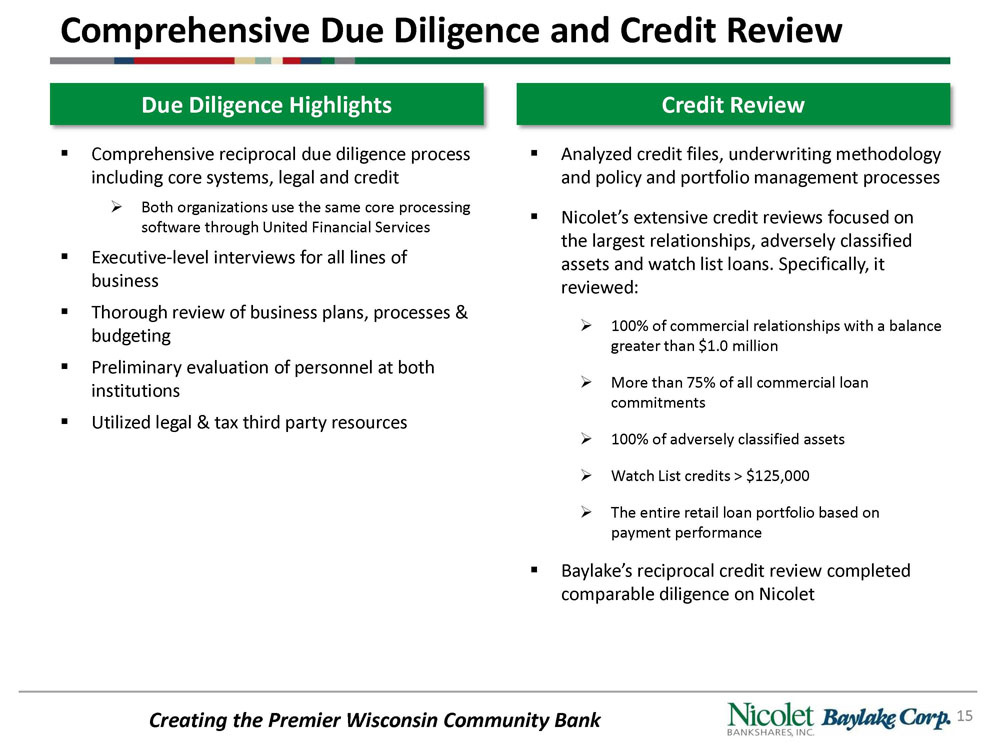

Comprehensive Due Diligence and Credit Review 15 Creating the Premier Wisconsin Community Bank Due Diligence Highlights Credit Review ▪ Comprehensive reciprocal due diligence process including core systems , legal and credit » Both organizations use the same core processing software through United Financial Services ▪ Executive - level interviews for all lines of business ▪ Thorough review of business plans, processes & budgeting ▪ Preliminary e valuation of personnel at both institutions ▪ Utilized legal & tax third party resources ▪ Analyzed credit files, underwriting methodology and policy and portfolio management processes ▪ Nicolet’s extensive credit reviews focused on the largest relationships, adversely classified assets and watch list loans. Specifically, it reviewed: » 1 00% of commercial relationships with a balance greater than $1.0 million » More than 75% of all commercial loan commitments » 100% of adversely classified assets » Watch List credits > $125,000 » The entire retail loan portfolio based on payment performance ▪ Baylake’s reciprocal credit review completed comparable diligence on Nicolet

Compelling Pro Forma Valuation 16 Creating the Premier Wisconsin Community Bank Price / Tangible Book Value Price / LTM EPS 1.18x 1.55x 1.56x 1.61x BYLK NCBS MW Peers Median National Peers Median Nationwide peers include banks with assets between $2.0bn - $ 3.0bn , ROAA > .75% and NPAs/Total Assets < 1.50 % Midwest peers include Midwest banks and thrifts with assets between $2.0bn - $3.5bn, ROAA > .75% and NPAs/Total Assets < 2.25% Source: SNL Financial; market data as of 9/8/2015 To update pricing data 13.1x 13.0x 13.5x 14.3x NCBS BYLK MW Peers Median National Peers Median

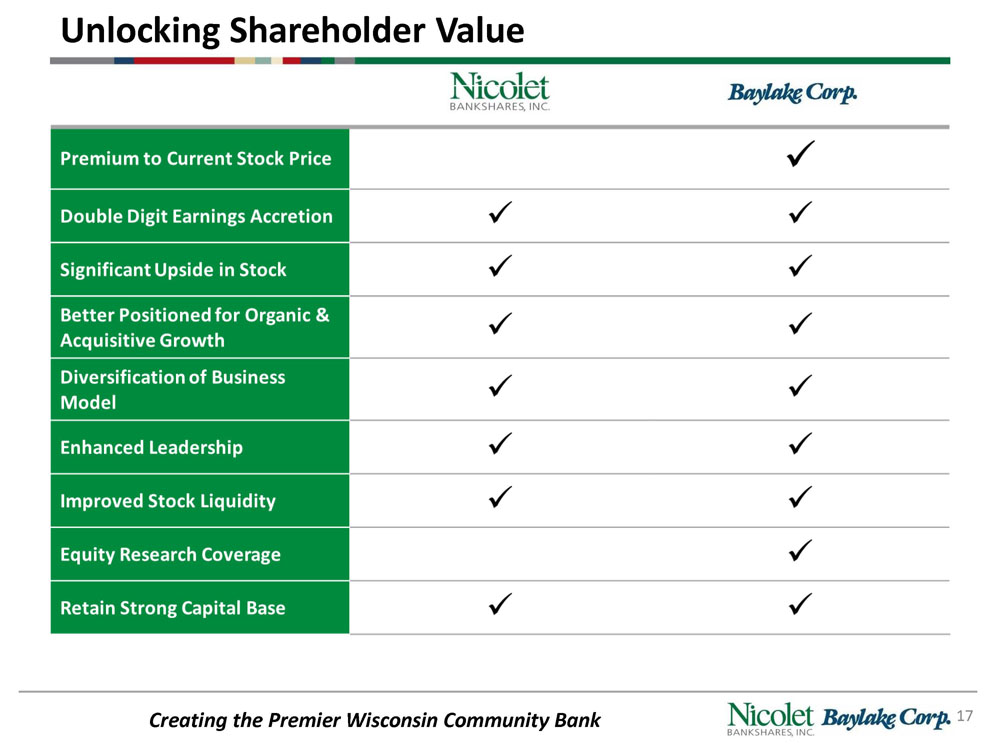

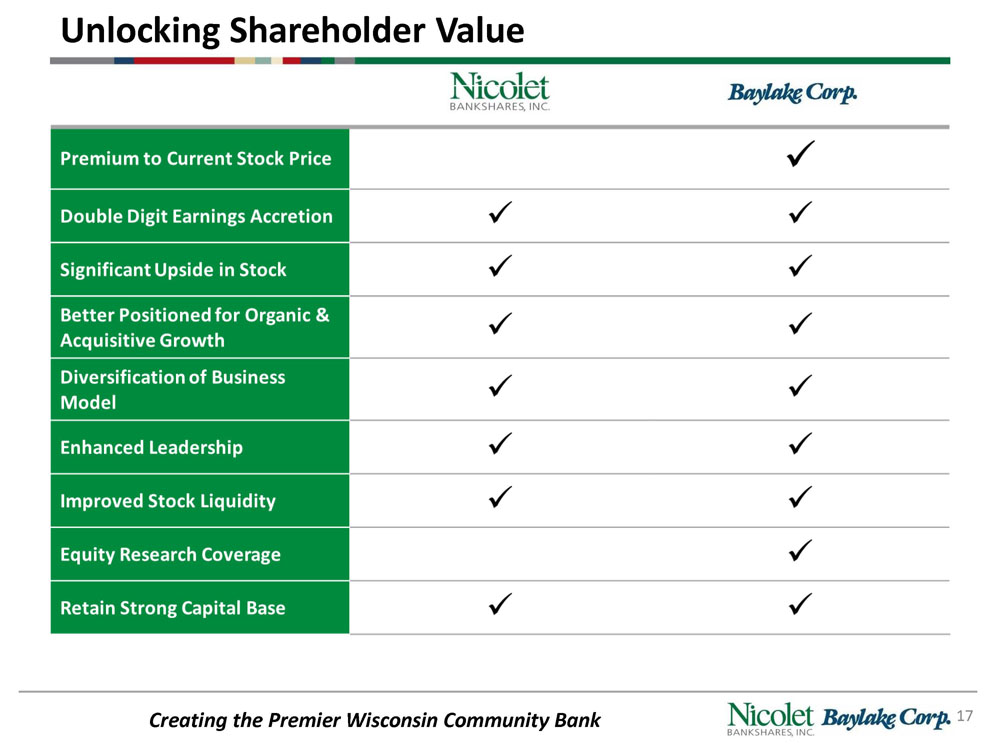

Unlocking Shareholder Value 17 Creating the Premier Wisconsin Community Bank

Summary 18 Creating the Premier Wisconsin Community Bank ▪ Creates Wisconsin’s premier community bank ▪ Combined franchise is positioned for long term growth with the size and scale to compete more effectively in the current market ▪ Attractive financial returns for all shareholders ▪ Meaningfully accretive to EPS and maintains strong capital position ▪ Attractive commercially focused loan portfolio, coupled with stable and low cost core funding ▪ Diversified noninterest income base through UFS, mortgage, and complimentary wealth management divisions ▪ Creates an institution with the financial capacity and experience to be a leading consolidator of community banks