UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

MIDCAROLINA FINANCIAL CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

MIDCAROLINA FINANCIAL CORPORATION

P. O. Box 968

3101 South Church Street

Burlington, North Carolina 27215

(336) 538-1600

NOTICE OF 2006 ANNUAL MEETING OF STOCKHOLDERS

To Be Held on May 23, 2006

NOTICE IS HEREBY GIVEN that the 2006 Annual Meeting of the Stockholders (the “Annual Meeting”) of MidCarolina Financial Corporation (the “Company”) will be held on May 23, 2006 at 10:00 a.m., local time, at the Ramada Inn of Burlington, 2703 Ramada Road, Burlington, North Carolina 27215.

The Annual Meeting is for the purpose of considering and voting upon the following matters:

1. To elect three persons who will serve as directors of the Company until the 2009 Annual Meeting of Stockholders or until their successors are duly elected and qualified.

2. To ratify the appointment of Dixon Hughes PLLC by the Company’s Audit Committee as the independent auditor for the Company for the fiscal year ending December 31, 2006.

3. To transact any other business that properly comes before the Annual Meeting or any adjournments. The Board of Directors is not aware of any other business to be considered at the Annual Meeting.

The Board of Directors has established March 16, 2006 as the record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting and at any adjournments. In the event there are not sufficient shares present in person or by proxy to constitute a quorum at the time of the Annual Meeting, the Annual Meeting may be adjourned in order to permit further solicitation of proxies by the Company.

|

| By Order of the Board of Directors |

|

/s/ Randolph J. Cary, Jr. |

Randolph J. Cary, Jr. |

President and Chief Executive Officer |

Burlington, North Carolina

April 17, 2006

You may vote your shares at the Annual Meeting by mail or in person at the Annual Meeting. You are urged, regardless of the number of shares you hold, to register your proxy promptly by following the instructions on the enclosed proxy card. A return envelope, which requires no postage if mailed in the United States, is enclosed for your convenience if you choose to vote by mail.

MIDCAROLINA FINANCIAL CORPORATION

PROXY STATEMENT

2006 ANNUAL MEETING OF STOCKHOLDERS

May 23, 2006

SOLICITATION, VOTING AND REVOCABILITY OF PROXIES

General

This Proxy Statement is being furnished to stockholders of MidCarolina Financial Corporation (the “Company”) in connection with the solicitation by the Board of Directors of the Company (the “Board of Directors”) of proxies to be used at the 2006 Annual Meeting of Stockholders (the “Annual Meeting”) to be held on May 23, 2006 at 10:00 a.m., local time, at the Ramada Inn of Burlington, 2703 Ramada Road, Burlington, North Carolina 27215, and at any adjournments. This Proxy Statement and the accompanying form of proxy were first mailed to stockholders on or about April 17, 2006.

The Company’s principal executive offices are located at 3101 South Church Street, Burlington, North Carolina 27215. The telephone number is (336) 538-1600.

Other than the matters listed on the attached Notice of the 2006 Annual Meeting of Stockholders, the Board of Directors is not aware of any matters that will be presented for consideration at the meeting. Execution of a proxy, however, confers on the designated proxy holders discretionary authority to vote the shares represented by proxy in accordance with their best judgment on any other business properly brought before the Annual Meeting or any adjournments.

Revocability of Proxy

A mailed proxy may be revoked at any time prior to its exercise by filing a written notice of revocation with the Secretary of the Company, by delivering to the Company a duly executed proxy bearing a later date, or by attending the Annual Meeting and voting in person. If you are a stockholder whose shares are not registered in your own name, you will need appropriate documentation from the holder of record of your shares to vote personally at the Annual Meeting.

Solicitation

The Company will pay the cost of soliciting proxies. In addition to the use of the mail, proxies may be solicited personally or by telephone by directors, officers, and regular employees of the Company and its wholly-owned commercial bank subsidiary, MidCarolina Bank (the “Bank”), without additional compensation. The Company has requested that brokerage houses and nominees forward these proxy materials to the beneficial owners of shares held of record by those persons and, upon request, the Company will reimburse them for their reasonable out-of-pocket expenses in doing so.

Voting Securities

Regardless of the number of shares of common stock owned, it is important that stockholders be present in person or represented by proxy at the Annual Meeting. Stockholders are requested to register their proxy by following the instructions on the enclosed proxy card. Stockholders may vote in person or by mail via the enclosed proxy. Any stockholder may vote for, against, or abstain with respect to any matter to come

2

before the Annual Meeting. If the proxy is properly completed and returned, and not revoked, it will be voted in accordance with the instructions given. If the proxy is returned with no instructions given, the proxy will be votedFOR all matters described in this Proxy Statement.If instructions are given for some but not all proposals, the instructions that are given will be followed and the proxy will be votedFOR the proposals on which no instructions are given.

The Board of Directors has fixed the close of business on March 16, 2006 as the record date (“Record Date”) for the determination of those stockholders of record entitled to notice of and to vote at the Annual Meeting and any adjournments thereof. As of the Record Date, the Company had outstanding 3,131,380 shares of common stock. Each share of common stock entitles its owner to one vote on each matter calling for a vote of stockholders at the Annual Meeting.

The presence, in person or by proxy, of the holders of at least a majority of shares of the common stock entitled to vote at the Annual Meeting is necessary to constitute a quorum at the Annual Meeting. Because many stockholders cannot attend the Annual Meeting in person, it is necessary for a large number to be represented by proxy. Accordingly, the Board of Directors has designated proxy holders to represent those stockholders who cannot be present in person and who desire to be so represented. In the event there are not sufficient votes for a quorum or to approve or ratify any proposal at the time of the Annual Meeting, the meeting may be adjourned in order to permit the further solicitation of proxies.

Vote Required for Approval

In order to be elected, a nominee to the Board of Directors needs to receive a plurality of the votes cast in the election of the applicable class of directors for which he has been nominated. As a result, those persons nominated for election that receive the largest number of votes will be elected as directors. No stockholder has the right to cumulatively vote his or her shares in the election of directors.

The proposal to ratify the appointment of the Company’s independent auditor by the Company’s Audit Committee for the year ending December 31, 2006 will be approved if the votes cast in favor of the action exceed the votes cast opposing the action.

Solicited proxies will be returned to the Board of Directors, and will be tabulated by one or more inspectors of election designated by the Board of Directors. Abstentions and broker “non-votes” will be counted for purposes of determining whether a quorum is present at the Annual Meeting. Abstentions and broker “non-votes” will not be counted in tabulating the votes cast on any proposal submitted to the stockholders. A broker “non-vote” occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power for that item and has not received instructions from the beneficial owner.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

As of the Record Date, no persons or groups, as defined in the Securities Exchange Act of 1934, as amended (the “Exchange Act”), held of record or are known to the Company to own beneficially more than 5% of the Company’s common stock.

Set forth below is certain information, as of the Record Date, regarding shares of common stock owned beneficially by each of the members of the Board of Directors, nominees to the Board, each of the members of the board of directors of the Bank, certain executive officers of the Company and the Bank, and the directors and executive officers of the Company and the Bank as a group.

3

| | | | | | |

Name and Address | | Amount and Nature of Beneficial Ownership(1) | | | Percentage of Class(2) | |

Dexter R. Barbee Sr., Director Holly Hill Lane, Suite 102 B Burlington, North Carolina 27215 | | 29,058 | (3) | | 0.92 | % |

H. Thomas Bobo, Director P.O. Box 689 Burlington, North Carolina 27215 | | 38,543 | (4) | | 1.22 | % |

Charles T. Canaday, Jr. 3127 Sutton Place Burlington, North Carolina 27215 | | 43,386 | (8) | | 1.36 | % |

Randolph J. Cary, Jr., President, Chief Executive Officer and Director P.O. Box 968 Burlington, North Carolina 27216 | | 129,681 | (5) | | 4.03 | % |

Thomas E. Chandler, Director P.O. Drawer 131 Burlington, North Carolina 27216-0131 | | 64,423 | | | 2.05 | % |

James R. Copland, III, Director P.O. Box 1208 Burlington, North Carolina 27215 | | 89,389 | (6) | | 2.82 | % |

Ralph M. Holt Jr., Director P.O. Box 819 Burlington, North Carolina 27215 | | 100,911 | (7) | | 3.18 | % |

F. D. Hornaday III, Director P.O. Box 790 Burlington, North Carolina 27216 | | 35,365 | (4) | | 1.12 | % |

Teena Marie Koury, Director P.O. Drawer 850 Burlington, North Carolina 27215 | | 29,353 | (4) | | 0.93 | % |

John H. Love, Director P.O. Box 1796 Burlington, North Carolina 27216-1796 | | 28,565 | (4) | | 0.90 | % |

R. Craig Patterson 605 Driftwood Drive Gibsonville, NC 27249 | | 58,013 | (8) | | 1.47 | % |

James B. Powell, Director 1573 York Place Burlington, North Carolina 27215 | | 93,943 | (4) | | 2.98 | % |

4

| | | | | | |

Name and Address | | Amount and Nature of Beneficial Ownership(1) | | | Percentage of Class(2) | |

Christopher B. Redcay 3142 Garden Road Burlington, North Carolina 27215 | | 29,739 | (8) | | 0.94 | % |

John K. Roberts, Director P.O. Drawer 256 Gibsonville, North Carolina 27249 | | 50,083 | (4) | | 1.59 | % |

James H. Smith, Jr., Director P.O. Box 2290 Burlington, North Carolina 27216 | | 36,268 | (4) | | 1.15 | % |

Robert A. Ward, Director 2801 Moorgate Court Burlington, North Carolina 27215 | | 44,201 | (4) | | 1.40 | % |

| Directors and Executive Officers as a Group (16 Persons) | | 900,921 | (9) | | 25.5 | % |

| (1) | Unless otherwise noted, all shares are owned directly or indirectly by the named individuals, by their spouses and minor children, or other entities controlled by the named individuals. |

| (2) | Based upon a total of 3,131,380 shares of stock outstanding at the Record Date. Assumes the exercise of only those stock options included with respect to the designated recipient. |

| (3) | Includes 2970 shares underlying options that have vested or are exercisable within 60 days under the MidCarolina Financial Corporation Director Stock Option Plan. |

| (4) | Includes 14,503 shares underlying options that have vested or are exercisable within 60 days under the MidCarolina Financial Corporation Director Stock Option Plan. |

| (5) | Includes 83,279 shares underlying options that have vested or are exercisable within 60 days under the MidCarolina Financial Corporation Employee Stock Option Plan. |

| (6) | Includes 36,763 shares underlying options that have vested or are exercisable within 60 days under the MidCarolina Financial Corporation Director Stock Option Plan. |

| (7) | Includes 36,760 shares underlying options that have vested or are exercisable within 60 days under the MidCarolina Financial Corporation Director Stock Option Plan. |

| (8) | Includes 40,760 shares underlying options that have vested or are exercisable within 60 days under the MidCarolina Employee Stock Option Plan for Mr. Canaday; 46,800 for Mr. Patterson and 26,000 for Mr. Redcay. |

| (9) | Includes 612,411 shares underlying options that have vested or are exercisable within 60 days under the MidCarolina Financial Corporation Director and Employee Stock Option Plans. |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires the Company’s executive officers and directors, and persons who own more than 10% of the Company’s common stock, to file reports of ownership and changes in ownership with the Securities and Exchange Commission (the “SEC”). Executive officers, directors and greater than 10% beneficial owners are required by SEC regulations to furnish the Company with copies of all Section 16(a) forms they file.

5

Based solely on a review of the copies of the forms furnished to the Company and written representations from the Company’s executive officers and directors, the Company believes that during the fiscal year ended December 31, 2005 all of its executive officers and directors complied with all applicable Section 16(a) filing requirements.

PROPOSAL 1

ELECTION OF DIRECTORS

General

The Bylaws of the Company provide that the number of directors of the Company will not be less than five (5) or more than thirty (30), with the exact number within this range to be fixed from time to time by the Board of Directors. The Board of Directors has currently fixed the size of the Board at thirteen (13) members.

The Company’s Articles of Incorporation and Bylaws provide that, so long as the total number of directors is nine or more, the directors are to be divided into three classes, as nearly equal as possible in number. Each director in a class will be elected for a term of three years or until his or her earlier death, resignation, retirement, removal or disqualification or until his or her successor is elected and qualifies. As a result, there is one class of directors to be elected at the Annual Meeting.

The Board of Directors, upon recommendation of the Corporate Governance and Nominating Committee, has nominated Dexter R. Barbee Sr., Thomas E. Chandler, and James H. Smith, Jr. for election as directors to serve for a three-year term or until their earlier death, resignation, retirement, removal, or disqualification or until their successors are elected and qualified. Any other persons nominated must be nominated for a three-year term.

The persons named in the accompanying form of proxy intend to vote any shares of the Company’s common stock represented by valid proxies received by them to elect these three (3) nominees as directors for three-year terms, unless authority to vote is withheld or the proxies are duly revoked. Each of the nominees for election is currently a member of the Board of Directors. In the event that any of the nominees become unavailable to accept nomination or election, it is intended that the proxy holders will vote to elect in his or her stead another person recommended by the Corporate Governance and Nominating Committee and approved by the Board of Directors, or to reduce the number of directors to be elected at the Annual Meeting by the number of persons unable or unwilling to serve (subject to the requirements of the Articles of Incorporation and Bylaws). The present Board of Directors has no reason to believe that any of the nominees named herein will be unable to serve if elected to office. In order to be elected as a director, a nominee needs to receive a plurality of the votes cast.

The same persons serving as directors of the Company are directors of the Bank.

The following table sets forth as to each nominee, his or her name, age as of December 31, 2005, principal occupation during the last five (5) years, the term for which he or she has been nominated, and the year he or she was first elected as a director.

6

NOMINEES FOR TERM ENDING AS OF 2009 ANNUAL MEETING

| | | | | | | | | | |

Name (Age) | | Position(s) Held | | Principal Occupation During Last Five Years | | Existing Term Expires | | Director of

Bank Since | | Director of

Company Since |

| Dexter R. Barbee Sr. (66) | | Director | | Chairman, CPC Chemical Holdings, December 2005 to present; Chairman and Chief Executive Officer, Apollo Chemical Corp. 1968 to December 2005 | | 2006 | | 1997 | | 2002 |

| | | | | |

| Thomas E. Chandler (70) | | Director | | Chairman and Chief Executive Officer, Chandler Concrete Co, Inc. 1974 to present | | 2006 | | 1997 | | 2002 |

| | | | | |

| James H. Smith, Jr. (50) | | Director | | President, Villane, Inc. (real estate development) 1980 to present; President, Southwick Golf Course 1988 to present; Chairman of Trust Company of the South (investment management) 1992 to present; Partner, GEM & Co. (textile imports) 1986 to present | | 2006 | | 1997 | | 2002 |

THE BOARD OF DIRECTORS RECOMMENDS A VOTEFOR ALL OF THE NOMINEES FOR ELECTION AS DIRECTORS.

The following table sets forth for each director continuing in office, his or her name, age as of December 31, 2005, principal occupation during the last five (5) years, the term for which he or she is serving and the year he or she was first elected as a director.

DIRECTORS CONTINUING IN OFFICE

| | | | | | | | | | |

Name (Age) | | Position(s) Held | | Principal Occupation During Last Five Years | | Existing Term Expires | | Director of

Bank Since | | Director of

Company Since |

| Randolph J. Cary, Jr. (58) | | Director,

President, and

Chief Executive

Officer | | President and Chief Executive Officer of the Company since May 2002; President and Chief Executive Officer of the Bank since August 1997 | | 2007 | | 1997 | | 2002 |

| | | | | |

| James R. Copland, III (65) | | Director | | Chairman of Copland Fabrics/Copland Industries, Inc. (textile manufacturer) 1962 to present | | 2007 | | 1997 | | 2002 |

| | | | | |

| Ralph M. Holt Jr. (74)(1) | | Director | | Chairman, Holt Hosiery Mills, Inc. (hosiery manufacturer) 1958 to present | | 2007 | | 1997 | | 2002 |

| | | | | |

| John K. Roberts (57) | | Director | | Chief Executive Officer, Eagle Affiliates, Inc. (management, development and consulting) 1998 to present | | 2007 | | 1997 | | 2002 |

| | | | | |

| Robert A. Ward (65) | | Director | | Executive Vice President, Chief Financial Officer, Unifi, Inc. (retired August 2005) | | 2007 | | 1997 | | 2002 |

7

| | | | | | | | | | |

Name (Age) | | Position(s) Held | | Principal Occupation During Last Five Years | | Existing Term Expires | | Director of

Bank Since | | Director of

Company Since |

| H. Thomas Bobo (61) | | Director | | Chairman, Fairystone Fabrics, Inc. (textile manufacturer) 2000 to present; President and Chief Executive Officer, Fairystone Fabrics, Inc. 1982 to 2000 | | 2008 | | 1997 | | 2002 |

| | | | | |

| F.D. Hornaday III (56)(2) | | Director | | Chief Executive Officer, Knitwear Fabrics, Inc. | | 2008 | | 1997 | | 2002 |

| | | | | |

| Teena Marie Koury (48) | | Director | | Owner, Carolina Hosiery Mills, Inc. | | 2008 | | 1997 | | 2002 |

| | | | | |

| John H. Love (46) | | Director | | President, W.E. Love & Associates, Inc. (insurance brokerage) 1982 to present | | 2008 | | 1997 | | 2002 |

| | | | | |

| James B. Powell (67) | | Director | | President, Tripath 1997 – 2000; Manager, Allemanni, LLC (personal investments) 1997 to present | | 2008 | | 1997 | | 2002 |

| (1) | Also served on Board of Directors of Caraustar Industries, Inc., an Exchange Act reporting company, until May 18, 2005. |

| (2) | Also serves on Board of Directors of Trust Company of the South. |

Meetings of the Board and Committees of the Board

The Board of Directors routinely meets every other month and held ten (10) meetings during the fiscal year ended December 31, 2005. All of the current directors of the Company attended at least 75% of the aggregate number of meetings of the Board of Directors and committees of the Board on which they served during the fiscal year ended December 31, 2005.

The Company’s Board of Directors has appointed two standing committees to which certain responsibilities have been delegated—the Audit Committee and the Corporate Governance and Nominating Committee. The full Board of Directors of the Company also serves as the Executive Committee.

Director Attendance at Annual Meetings

Although it is customary for all Board members to attend, the Company in 2005 had no formal policy in place with regard to Board members’ attendance at its annual meeting of stockholders. All of the Board members except Tom Bobo, who was on medical leave, attended the Company’s 2005 annual meeting of stockholders, which was held on May 24, 2005.

Process for Communicating with Board Members

The Company does not have a formal procedure for stockholder communication with our Board of Directors. In general, our directors and executive officers are easily accessible by telephone, postal mail or electronic mail. Any matter intended for the Board, or for any individual member or members of the Board, can be directed to Randolph J. Cary, Jr., our Chief Executive Officer, or Christopher B. Redcay,

8

our Chief Financial Officer at the Company’s address at MidCarolina Financial Corporation, Post Office Box 968, Burlington, North Carolina 27215, with a request to forward the same to the intended recipient. Alternatively, stockholders may direct correspondence to the Board, or any of its members, in care of the Company at the Company’s address above. Any such communication received will be forwarded to the intended recipient unopened.

Report of Compensation Committee

Because all of the executive officers of the Company are also executive officers of the Bank and receive their compensation through the Bank, the Bank’s Compensation Committee also serves as the compensation committee for the Company and consists of Mr. Holt, Mr. Chandler, Mr. Smith and Mr. Ward. The Board of Directors has determined that these directors are “independent” as defined in Rule 4200(a)(15) of the NASD’s listing standards. This Committee determines the compensation of the Chief Executive Officer (“CEO”) of the Company. The salary of the CEO is based upon his contributions to the Company’s overall profitability, maintenance of regulatory compliance standards, professional leadership and management effectiveness in meeting the needs of day-to-day operations. The Compensation Committee also compares the compensation of the CEO with compensation paid to CEO’s of comparable financial institutions in North Carolina. Any cash or equity incentive plans for the CEO, as well as other senior executives, are linked to the achievement of financial goals set in advance by the Compensation Committee. The Compensation Committee, upon the recommendation of Mr. Cary, the CEO, approves the compensation paid to the other officers of the Bank and the Company. The Compensation Committee met two (2) times during the fiscal year ended December 31, 2005.

Report of Corporate Governance and Nominating Committee

The Corporate Governance and Nominating Committee consists of Mr. Powell, Chairman, Mr. Barbee, Mr. Chandler, Mr. Roberts and Mr. Ward. All members of the Corporate Governance and Nominating Committee are independent as defined in Rule 4200(a)(15) of the NASD’s listing standards. The Corporate Governance and Nominating Committee establishes, reviews and interprets corporate governance policies and guidelines, evaluates qualifications and candidates for positions on the Board, nominates new and replacement members for the Board and recommends Board committee composition. In addition, the Corporate Governance and Nominating Committee facilitates an annual evaluation of the Board by its members and reviews individual director performance as well as the performance of Board committees. The Corporate Governance and Nominating Committee met once during the fiscal year ended December 31, 2005.

In identifying and reviewing candidates for the Board, the Corporate Governance and Nominating Committee seeks individuals whose background, knowledge and experience will assist the Board in furthering the interests of the Company and its stockholders. Some of the factors considered in this evaluation include experience in the areas of banking and finance, accounting and the related businesses of the Company and the Bank, as well as, outstanding achievement in his or her personal career, an understanding of the business environment generally, a willingness to devote adequate time to service on the Board of Directors, and integrity. The Corporate Governance and Nominating Committee reviews the qualifications of, and approves and recommends to the Board, those individuals to be nominated for positions on the Board and submitted to stockholders for election at each Annual Meeting. In addition, the Corporate Governance and Nominating Committee will consider nominees for the Board by stockholders that are proposed in accordance with the advance notice procedures in our bylaws, which are described in the section of this Proxy Statement titled “Date for Receipt of Stockholder Proposals.” The Committee will consider and evaluate a director candidate recommended by a stockholder in the same manner as a Committee-recommended nominee.

9

The Company did not engage a third-party consulting firm to identify director nominees in 2005. The Board of Directors has adopted a Corporate Governance and Nominating Committee Charter. The charter is not available at the Bank’s website but is provided as Appendix A to this Proxy Statement.

Report of Audit Committee

The Audit Committee of the Board of Directors consists of Mr. Roberts, Chairman, Mr. Holt, Mr. Hornaday, Mr. Love and Mr. Smith. The Board of Directors has determined that these directors are “independent” as defined in Rule 4200(a)(15) of the NASD’s listing standards and the Sarbanes-Oxley Act of 2002 (“Sarbanes-Oxley”) and the SEC’s rules and regulations. The Audit Committee meets on an as-needed basis and, among other responsibilities, (i) appoints, compensates and retains the Company’s independent auditor; (ii) oversees the independent auditing of the Company; (iii) arranges for periodic reports from the independent auditors and from management of the Company and the internal auditor of the Company; (iv) reviews corporate policies regarding compliance with laws and regulations, conflicts of interest and employee misconduct and reviews situations related thereto; (v) develops and implements the Company’s policies regarding internal and external auditing and appoints, meets with and oversees the performance of the employees responsible for those activities; (vi) establishes and reviews annually procedures for the receipt, retention, and treatment of complaints regarding accounting, internal auditing controls and auditing matters; (vii) pre-approves all audit and non-audit related services provided by the independent auditor; and (viii) performs other duties as may be assigned to it by the Board of Directors.

The Board of Directors has determined that John K. Roberts, Chairman of the Audit Committee, is an “audit committee financial expert” and “independent” as defined under applicable rules and regulations. The Board’s affirmative determination was based upon, among other things, his educational and professional credentials and financial background.

The Company has adopted a written charter for the Audit Committee that is reviewed annually, and amended as needed, by the Audit Committee. The Audit Committee Charter is attached to this Proxy Statement as Appendix B. The Audit Committee met three (3) times during the fiscal year ended December 31, 2005.

The Audit Committee reviewed and discussed with the independent auditors all matters required by generally accepted auditing standards, including those described in Statement on Auditing Standards No. 61, as amended, and reviewed and discussed the audited financial statements of the Company, both with and without management present. In addition, the Audit Committee obtained from the independent auditors a formal written statement describing all relationships between the auditors and the Company that might bear on the auditors’ independence consistent with Independence Standards Board Standard No. 1, “Independent Discussions with Audit Committees,” and discussed with the auditors any relationships that may impact their objectivity and independence and satisfied itself as to the auditors’ independence. Based upon the Audit Committee’s review and discussions with management and the independent auditors referenced above, the Audit Committee recommended to the Board of Directors that the Company’s audited financial statements be included in its Annual Report on Form 10-KSB for the fiscal year ended December 31, 2005 for filing with the SEC. The Audit Committee also reappointed the independent auditors and the Board of Directors concurred in such appointment.

John K. Roberts, Chairman

Ralph M. Holt, Jr.

F.D. Hornaday, III

John H. Love

James H. Smith, Jr.

10

Board of Directors of the Bank

At present, the Bank has a thirteen (13) member board of directors, which is currently comprised of all of the same persons who are currently directors of the Company.

The Bank’s Board of Directors has appointed the following standing committees to which certain responsibilities are delegated: the Loan Committee, the Community Reinvestment Act Committee, the Strategic Planning Committee, the Asset and Liability Committee, the Audit Committee and the Compensation Committee.

Director Compensation

Directors’ Fees. The members of the Company’s Board of Directors receive no fees or other compensation for their service to the Company. However, for the year ending December 31, 2005, for their service on the Bank’s board of directors, the directors, excluding the Chairman and Vice Chairman of the Board, received $400 for each board meeting and meeting attended, and $300 for each other committee meeting attended, except for the chairpersons of the Loan Committee and Audit Committee, who receive $500 per month. The Chairman of the Board, James R. Copland, III, and the Vice Chairman of the Board, Ralph M. Holt, Jr., received a fixed monthly amount of $1,600 and $1,500, respectively, in lieu of board and committee fees. For fiscal year ended December 31, 2005, directors’ fees totaled $98,300 in the aggregate. Mr. Cary does not receive any fees for service on the Board of Directors.

Stock Option Plan.See “Executive Compensation - Stock Option Plans” for a discussion of the directors’ benefits under the Director Stock Option Plan.

Executive Officers

The following table sets forth certain information with respect to the executive officers of the Company and the Bank.

| | | | |

Name | | Age on December 31, 2005 | | Positions and Occupations During Last Five Years |

| Randolph J. Cary, Jr. | | 58 | | President, Chief Executive Officer and Director of the Company since May 2002; President, Chief Executive Officer, and Director of the Bank since August 1997 |

| | |

| Charles T. Canaday, Jr. | | 44 | | Chief Operating Officer and Executive Vice President of the Company and the Bank since December 5, 2004; Vice President and Senior Commercial Lender of the Company and the Bank from 2000-2004; Senior Market Officer, Centura Bank, 1998-2000. |

| | |

| Christopher B. Redcay | | 53 | | Chief Financial Officer of the Company since July 15, 2003; Senior Vice President and Chief Financial Officer of the Bank since December 5, 2004; Self Employed, 2001-2003; Senior Vice President, Chief Financial Officer and Treasurer, First Community Financial Corp and Community Savings Bank, 1998 – 2001 |

| | |

| R. Craig Patterson | | 44 | | Senior Vice President of the Company since December 5, 2004; Senior Credit Officer and Vice President of the Bank since August 1997 |

11

Executive Compensation

Summary Compensation Table.The following table shows, for the fiscal years indicated, the cash and certain other compensation paid to or accrued for that year, to the Company’s and Bank’s CEO. The other executive officers are Charles T. Canaday, Jr., the Chief Operating Officer, Christopher B. Redcay, the Chief Financial Officer, and Craig Patterson, the Senior Vice President and Senior Credit Officer, all of whose total annual salary exceeded $100,000 in 2005.

| | | | | | | | | | | | | | | | | | |

| | | | | Annual Compensation | | Long-Term Compensation | |

| | | Year | | Salary

($)(1),(2) | | Bonus

($) | | Other Annual

Compensation

($) | | Awards | | | Payouts Long-

term

Incentive Payouts

($) | | All Other Compensation

($) | |

Name and Principal Position | | | | | | Restricted

Stock Award($) | | Securities Underlying Options

(#)(3) | | | |

Randolph J. Cary, Jr. President and Chief Executive Officer | | 2005 | | 190,000 | | 95,000 | | — | | — | | 20,000 | | | — | | 14,050 | (4) |

| | 2004 | | 175,000 | | 85,000 | | — | | — | | — | | | — | | 10,325 | (5) |

| | 2003 | | 155,000 | | 70,000 | | — | | — | | — | | | — | | 8,715 | (6) |

Charles T. Canaday, Jr. Chief Operating Officer and Senior Vice President | | 2005 | | 139,354 | | 50,000 | | — | | — | | 17,000 | | | — | | 7,401 | (4) |

| | 2004 | | 118,250 | | 45,000 | | — | | — | | — | | | — | | 5,102 | (5) |

| | 2003 | | 109,380 | | 38,000 | | — | | — | | — | | | — | | 7,670 | (6) |

Christopher B. Redcay Chief Financial Officer | | 2004 | | 125,000 | | 45,000 | | — | | — | | 17,000 | | | — | | 7,922 | (4) |

| | 2004 | | 110,500 | | 40,000 | | — | | — | | — | | | — | | 5,622 | (5) |

| | 2003 | | 38,642 | | 18,000 | | — | | — | | 9,000 | (7) | | — | | 1,794 | (6) |

R. Craig Patterson Senior Vice President | | 2005 | | 109,667 | | 45,000 | | — | | — | | 17,000 | | | — | | 5,656 | (4) |

| | 2004 | | 102,000 | | 40,000 | | — | | — | | — | | | — | | 4,995 | (5) |

| | 2003 | | 95,000 | | 28,000 | | — | | — | | — | | | — | | 7,658 | (6) |

| (1) | Perquisites and personal benefits awarded to Mr. Cary, Mr. Patterson, Mr. Redcay, and Mr. Canady did not exceed the lesser of $50,000 or 10% of the total annual salary and bonus. |

| (2) | Includes salary received and amounts deferred during each year at the election of the executor officer pursuant to the Bank’s Section 401(k) Retirement Plan. |

| (3) | A total of 20,000, 17,000, 17,000, and 17,000 options were granted to Messrs. Cary, Canaday, Redcay, and Patterson, respectively, on December 23, 2005 as employees of the Bank pursuant to the Omnibus Plan. The options entitle the executives to purchase, at any time after vesting and before December 23, 2015, shares of Company stock in exchange for an exercise price of $14.15 per share. All of these options are fully vested. |

| (4) | For 2005, “All Other Compensation” consisted of: (i) $6,769, $6,487, $5,649, and $5,385, the amounts of the Bank’s matching contributions under its 401(k) plan for Mr. Cary, Mr. Canaday, Mr. Redcay, and Mr. Patterson, respectively, and (ii) $7,281, $914, $2,273, and $271, the amounts of income imputed to Mr. Cary, Mr. Canaday, Mr. Redcay, and Mr. Patterson, respectively, under the BOLI policies (a portion of the whole life insurance premiums paid for the executives in lieu of term life insurance premium payments for the equivalent death benefit coverage). |

12

| (5) | For 2004, “All Other Compensation” consisted of: (i) $8,021, $4,736, $5,118, and $4,736, the amounts of the Bank’s matching contributions under its 401(k) plan for Mr. Cary, Mr. Canaday, Mr. Redcay, and Mr. Patterson, respectively, and (ii) $2,304, $366, $504, and $259, the amounts of income imputed to Mr. Cary, Mr. Canaday, Mr. Redcay, and Mr. Patterson, respectively, under the BOLI policies (a portion of the whole life insurance premiums paid for the executives in lieu of term life insurance premium payments for the equivalent death benefit coverage). |

| (6) | For 2003, “All Other Compensation” consisted of: (i) $7,121, $7,368, $1,794, and $7,368, the amounts of the Bank’s matching contributions under its 401(k) plan for Mr. Cary, Mr. Canaday, Mr. Redcay, and Mr. Patterson, respectively, and (ii) $1,594, $302, $0, and $290, the amounts of income imputed to Mr. Cary, Mr. Canaday, Mr. Redcay, and Mr. Patterson, respectively, under the BOLI policies (a portion of the whole life insurance premiums paid for the executives in lieu of term life insurance premium payments for the equivalent death benefit coverage). |

| (7) | A total of 9,000 options were granted to Mr. Redcay on July 15, 2003 as an employee of the Bank under the Employee Plan. The options entitle the executive to purchase, at any time after vesting and before July 15, 2013, shares of the Company stock in exchange for an exercise price of $10.69 per share. All of these options are fully vested, and the number of options and exercise price have been adjusted to account for stock splits subsequent to the grant of options. |

Employment Agreement.On May 30, 1997, the Bank entered into an employment agreement with Randolph J. Cary, Jr. in order to establish his duties and compensation and to provide for his continued employment with the Bank. The agreement provided for an initial term of employment of four years. Commencing on the first anniversary date and continuing on each anniversary date thereafter, following a performance evaluation of the employee, the agreement will automatically be extended for an additional year unless the Board of Directors directs otherwise. The agreement provides that base salary will be reviewed by the Board of Directors not less often than annually. Mr. Cary’s base salary for 2005 was $190,000. In addition, the employment agreement provides for discretionary bonuses and participation in all other profit-sharing or retirement plans maintained by the Bank for employees of the Bank, as well as fringe benefits normally associated with the Bank employee’s office, including the use of a company car and the payment of country club dues. The employment agreement provides that Mr. Cary may be terminated by the Bank for cause, as defined in the agreement, and that the agreement may otherwise be terminated by the Bank (subject to vested rights) or by Mr. Cary. In the event of a change in control of the Company or the Bank, the term of Mr. Cary’s agreement will be automatically extended for four years from the date of the change of control, and Mr. Cary may terminate the agreement during the first two years after the change in control and receive a severance payment in an amount equal to 2.95 times his average annual compensation paid by the Bank during the prior five years. Mr. Cary receives no additional compensation for serving as the Company’s Chief Executive Officer and President.

Severance Agreements.On March 11, 2005, the Company entered into severance agreements with Christopher B. Redcay and Charles T. Canaday. On March 7, 2006, the Company entered into a severance agreement with R. Craig Patterson. The agreements help ensure the current and future continuity of Company and Bank management, and help ensure that officers are not practically disabled from discharging their duties if a proposed or actual transaction involving a change in control arises. The initial term of each severance agreement is three years, renewing each year for an additional one-year term unless the board of directors gives advance written notice that the contract will not automatically renew. Each agreement terminates when the officer in question attains age 65. The agreements provide that the officer is entitled to severance compensation if, within one year after a change in control, his employment terminates involuntarily but without cause or voluntarily but with good reason. Good reason for voluntary termination will exist if specified adverse changes in the officers’ employment circumstances occur, such as a reduction in pay or benefits, a reduction in responsibilities, or relocation of MidCarolina Financial Corporation’s executive offices by a distance of more than 15 miles. As defined in the severance agreements, the term “change in control” means: (1) a merger of MidCarolina Financial Corporation with

13

another corporation, with the result that less than a majority of the total voting power of the resulting corporation immediately afterwards is held by persons who were MidCarolina Financial Corporation stockholders immediately before the merger or consolidation; (2) acquisition by a person or group of 25% or more of MidCarolina Financial Corporation’s common stock, (3) a change in composition of a majority of the board of directors occurring over a two-year period, or (4) a sale by MidCarolina Financial Corporation of substantially all of its assets.

Mr. Canaday’s severance compensation would be payable in a single lump sum after employment termination, and would equal three times the sum of (1) his annual salary when the change in control occurs or when employment termination occurs, whichever amount is greater, plus (2) the average bonus earned in the three years preceding the change in control. The severance compensation of Mr. Redcay and Mr. Patterson is calculated in the same way, but is twice the sum of their salary and average bonus. If a change in control occurs and the total benefits or payments to which Mr. Canaday or Mr. Redcay is entitled as a result are subject to excise taxes under sections 280G and 4999 of the Internal Revenue Code, the severance agreements provide also that these officers shall be entitled to an excise tax gross-up benefit. The Company has promised in the agreements to continue Mr. Canaday, Mr. Redcay, and Mr. Patterson’s life, health, and disability insurance coverage for up to 12 months after termination of employment. Officers’ unvested employee benefits would also become fully vested. Lastly, the Company has promised in the agreements to pay the officers’ legal fees associated with the interpretation, enforcement, or defense of their rights under the agreements, up to a maximum of $250,000 for Mr. Canaday or Mr. Redcay, and up to a maximum of $50,000 for Mr. Patterson.

Stock Option Plans. The Company has three stock option plans, the Director Stock Option Plan (the “Director Plan”) for directors of the Company, the Employee Stock Option Plan (the “Employee Plan”) for employees of the Company and the Omnibus Stock Ownership Plan and Long Term Incentive Plan (‘the “Omnibus Plan”), which is also for employees of the Company. The Employee Plan and the Director Plan are referred to collectively as the “Plans.”

The Plans are designed to attract and retain qualified personnel in key positions, to provide directors and employees with a proprietary interest in the Company as an incentive to contribute to the success of the Company, and to reward directors and employees for outstanding performance. The Employee Plan provides for the grant of incentive stock options intended to comply with the requirements of Section 422 of the Code, while the Director Plan provides for the grant of nonqualified or compensatory stock options. No cash consideration was paid by employees or directors for the award of the options under either Plan. The period for exercising the option is no more than ten years from the date of grant. The options granted under the Employee Plan vest at a rate of twenty (20%) percent per year. The options granted under the Director Plan vest immediately.

The options granted under the Plans become 100% vested upon death or disability or upon a change in control of the Company. In the event of a stock split, reverse stock split or stock dividend, the number of shares of stock under the Plans, the number of shares to which any option relates and the exercise price per share under any option shall be adjusted to reflect such increase or decrease in the total number of shares of the common stock outstanding.

Mr. Cary, Mr. Patterson, Mr. Redcay and Mr. Canaday were not granted any options under the Plans during the fiscal year ended December 31, 2005. Mr. Cary exercised 5,625 options under the Plan on November 2, 2005. On December 22, 2005, the Compensation Committee accelerated vesting of options to purchase 19,338 shares of Company stock, including all options held by Mr. Cary under the Plans, so that all such options are currently vested. This decision was motivated by the implementation of new accounting rules involving options, which would have resulted in greater tax liabilities for the Company if the options had not been accelerated.

14

Omnibus Stock Ownership and Long Term Incentive Plan. The stockholders approved the Omnibus Plan in 2003. The purposes of the Omnibus Plan are to encourage and motivate key employees to contribute to the successful performance of the Company, the Bank and its subsidiaries and the growth of the market value of the common stock; to achieve a unity of purpose among the key employees and the Company’s stockholders by providing ownership opportunities and a unity of interest in the achievement of the Company’s primary long term performance objectives; and to retain key employees by rewarding them with potentially tax-advantageous future compensation.

The employees of the Company and its subsidiaries, who are designated as eligible participants by the Board of Directors, may receive awards of Rights (as defined below) under the Omnibus Plan. The value of the benefits to be received by participants under the Omnibus Plan are not determinable. On December 28, 2005, the bid and ask quotations for the common stock on the Over the Counter Bulletin Board were $14.25 and $15.00, respectively.

The number of shares of common stock available under the Omnibus Plan for grants of Rights is 300,000 as adjusted for the six for five stock split effective January 14, 2005, the five for four stock split effective November 15, 2005, the grant of shares underlying options on December 23, 2005, and further subject to appropriate adjustment for any further stock splits, stock combinations, reclassifications and similar changes. Under the Omnibus Plan, the Compensation Committee may grant or award eligible participants stock options, restricted stock, Long Term Incentive Compensation Units (each such unit is equivalent to one share of common stock, and multiple units may be redeemed for shares of common stock or the cash equivalent of such stock shares, or a combination of the two, in the discretion of the Compensation Committee), stock appreciation rights (“SARs”) (which are rights to a monetary amount equal to the appreciation in price of a specified number of shares of common stock over a specified amount of time) and/or Book Value Shares (which are shares that may be redeemed by a participant for an amount equal to the difference between (i) the book value per share on the date granted and (ii) the book value per share on the date redeemed). Collectively, these grants and awards are referred to as the “Rights”. All Rights must be granted or awarded within ten (10) years of the date of the Company Board’s adoption of the Omnibus Plan on February 24, 2004.

If any shares of common stock allocated to Rights granted under the Omnibus Plan are subsequently cancelled or forfeited, those Rights will be available for further allocation upon such cancellation or forfeiture.

The Company Board may at any time alter, suspend, terminate or discontinue the Omnibus Plan, subject to any applicable regulatory requirements and any required stockholder approval or any stockholder approval which the Company Board may deem advisable for any reason, such as for the purpose of obtaining or retaining any statutory or regulatory benefits under tax, securities or other laws or satisfying applicable stock exchange or quotation system listing requirements. The Company Board may not, without the consent of a participant, make any alteration which would deprive the participant of his rights with respect to any previously granted Rights. Termination of the Omnibus Plan would not affect any previously granted Rights. The Company Board currently anticipates awarding only grants of options under the Omnibus Plan. Neither the Company Board nor the Committee has made any determination regarding the amount or timing of any grants. On December 23, 2005, options to acquire 150,000 shares of the Company’s common stock were granted to employees under the Omnibus Plan. The options have an exercise price of $14.15 per share, and were made immediately exercisable. The decision to accelerate the vesting schedule was motivated by the implementation of new accounting rules involving options, which would have resulted in greater tax liabilities for the Company if the options had not been accelerated.

15

Aggregated Option/SAR Exercises in Last Fiscal Year

and Fiscal Year-End Option/SAR Values

| | | | | | | | | | | | | | |

| | | | | | | Number of Securities Underlying Unexercised Options/SARs at Fiscal Year End(1) | | Value of Unexercised in-the-Money Options/SARs at Fiscal Year End(2) |

Name | | Shares

Acquired on Exercise | | Value Realized | | Exercisable | | Unexercisable | | Exercisable | | Unexercisable |

Randolph J. Cary, Jr. | | 5,625 | | $ | 86,000 | | 83,219 | | 0 | | 20,000 | | $ | 0 |

Charles T. Canaday, Jr. | | 0 | | $ | 0 | | 49,760 | | 0 | | 17,000 | | $ | 0 |

R. Craig Patterson | | 0 | | $ | 0 | | 46,700 | | 0 | | 17,000 | | $ | 0 |

Christopher C. Redcay | | 0 | | $ | 0 | | 26,000 | | 0 | | 17,000 | | $ | 0 |

| (1) | Includes options to purchase 47,520 and 23,760 shares of common stock, with an exercise price of $4.73, granted to Mr. Cary and Mr. Patterson, respectively, pursuant to the Employee Stock Option Plan on January 8, 1998. All of these options are vested. Also includes options to purchase 7,603 shares of common stock with an exercise price of $6.31 granted to Mr. Cary, pursuant to the Employee Stock Option Plan on October 17, 2000. All of these options are vested. Also includes 19,008 shares of common stock with an exercise price of $6.31 granted to Mr. Canaday pursuant to the Employee Stock Option Plan on October 17, 2000. No options were awarded to Mr. Patterson in 2000. Includes options to purchase 7,200 shares of common stock with an exercise price of $13.37 granted to Mr. Redcay pursuant to the Employee Stock Option Plan on July 15, 2003. All of these options are vested. All of these options become fully vested upon death or disability or upon a change in control of the Company. All of these options have vested. All option numbers and exercise prices reflect stock splits that have occurred since the date of grant. |

| (2) | The price paid for the common stock in the last trade known to management to have occurred prior to December 31, 2005 was $14.25, which trade occurred on December 28, 2005. The value of unexercised options is calculated by deducting the aggregate exercise price of each individual’s options from the aggregate market value as of December 31, 2005. |

401(k) Profit Sharing Plan.The Bank has established a contributory savings plan for its employees, which meets the requirements of Section 401(k) of the Code. All employees who have completed three months of service and who are at least eighteen years of age may elect to contribute up to 15% of their compensation to the plan each year, subject to certain maximums imposed by federal law. Each year, the Bank determines the percentage of each participant’s contribution that it will match with an employer contribution. For purposes of the 401(k) profit sharing plan, compensation means a participant’s compensation received from the employer as reported on Form W-2.

Participants are fully vested in amounts that they contribute to the plan. Participants are fully vested in amounts contributed to the plan on their behalf by the Bank as employer matching contributions or as discretionary contributions after five years of service according to the following schedule: one year, 20%; two years, 40%; three years, 60%; four years, 80%; five or more years, 100%.

Benefits under the plan are payable in the event of the participant’s retirement, death, disability or termination of employment. Normal retirement age under the plan is 65 years of age.

16

EQUITY COMPENSATION PLAN INFORMATION

| | | | | | | | |

Plan category | | (a) Number of shares to be issued upon

exercise of outstanding options(2) | | | (b) Weighted-average exercise price of outstanding options(2) | | (c) Number of shares remaining available for future issuance under equity compensation

plans (excluding shares

reflected in column (a)) (2) |

Equity compensation plans approved by our stockholders | | 612,411 | (1)(2) | | $ | 6.86 | | 153,504 |

Equity compensation plans not approved by our stockholders | | 0 | | | $ | 0 | | 0 |

Total | | 612,411 | | | $ | 6.86 | | 153,504 |

| (1) | Of the 612,411 stock options issued under the Plans and the Omnibus Plan, a total of 612,411 of those stock options have vested or are exercisable within 60 days. |

| (2) | The number of shares has been adjusted for the six for five stock split effective January 14, 2005 and the November 15, 2005 5 for 4 stock split. |

Certain Indebtedness and Transactions of Management

The Bank makes loans to its executive officers and directors in the ordinary course of its business. These loans are currently made on substantially the same terms, including interest rates, collateral and repayment terms, as those then prevailing for comparable transactions with nonaffiliated persons, and do not involve more than the normal risk of collectibility or present any other unfavorable features. Applicable regulations prohibit the Bank from making loans to its executive officers and directors at terms more favorable than could be obtained by persons not affiliated with the Bank. The Bank’s policy concerning loans to executive officers and directors currently complies with these regulations.

PROPOSAL 2

RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITOR

The Audit Committee of the Board of Directors retained Dixon Hughes PLLC (“Dixon Hughes”), the Company’s independent auditor for the year ended December 31, 2005, as the Company’s independent auditor for the year ended December 31, 2006. The Board of Directors has approved this appointment and is submitting it to the Company’s stockholders for ratification.

The Board of Directors expects representatives of Dixon Hughes to attend the Annual Meeting. The representatives of Dixon Hughes will be afforded an opportunity to make a statement, if they so desire and to respond to appropriate questions from stockholders.

THE BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS VOTEFOR RATIFICATION OF THE AUDIT COMMITTEE’S APPOINTMENT OF DIXON HUGHES AS INDEPENDENT AUDITOR FOR THE COMPANY FOR THE FISCAL YEAR ENDING DECEMBER 31, 2006.

Audit Fees Paid to Independent Auditor

The following table represents fees for professional services rendered by Dixon Hughes for the audit of the Bank’s annual consolidated financial statements for the years ended December 31, 2005 and 2004 and fees billed for audit-related services, tax services and all other services rendered by Dixon Hughes for each of those fiscal years.

17

| | | | | | |

| | | Year ended

December 31, |

| | | 2005 | | 2004 |

Audit Fees1 | | $ | 64,129 | | $ | 51,608 |

Audit-Related Fees2 | | $ | 10,730 | | $ | 5,001 |

Tax Fees3 | | $ | 8,075 | | $ | 7,617 |

All Other Fees4 | | $ | 0 | | $ | 0 |

Total Fees | | $ | 82,934 | | $ | 64,226 |

| | | | | | |

| 1 | These are fees paid for professional services rendered for the audit of the Company’s annual consolidated financial statements and for the reviews of the consolidated financial statements included in the Bank’s quarterly reports on Form 10-QSB, and for services normally provided in connection with statutory or regulatory filings or engagements. |

| 2 | These are fees paid for assurance and related services that were reasonably related to the performance of the audit or review of our consolidated financial statements and that are not reported under “Audit Fees” above, including fees related to collateral verification procedures required by the Federal Home Loan Bank of Atlanta, issuance of trust preferred securities and related interest rate swap and matters related to stock options, the supplemental executive retirement plan and bank-owed insurance. |

| 3 | These are fees paid for professional services rendered for tax compliance, tax planning and tax advice. |

| 4 | These fees were principally related to non-audit related accounting consultations. |

Pre-Approval of Audit and Permissible Non-Audit Services

All audited-related services, tax services and other services rendered in 2005 and 2004 were pre-approved by the Audit Committee, which concluded that the provision of those services by Dixon Hughes was compatible with the maintenance of that firm’s independence in the conduct of its auditing functions. The Audit Committee’s charter provides for pre-approval of all audit and non-audit services to be provided by the Company’s independent auditor. The charter authorizes the Audit Committee to delegate to one or more of its members pre-approval authority with respect to permitted services, provided that any approvals using this procedure are presented to the Audit Committee at its next scheduled meeting.

DATE FOR RECEIPT OF STOCKHOLDER PROPOSALS

It is presently anticipated that the 2007 Annual Meeting of Stockholders will be held in May, 2007. In order for stockholder proposals to be included in the proxy materials for that meeting, such proposals must be received by the Secretary of the Company at the Company’s main office (3101 South Church Street) not later than December 18, 2006, and meet all other applicable requirements for inclusion in the proxy statement.

In the alternative, a stockholder may commence his own proxy solicitation subject to the SEC’s rules on proxy solicitation and may present a proposal from the floor at the 2007 Annual Meeting of Stockholders. In order to do so, the stockholder must notify the Secretary of the Company, in writing, of his or her

18

proposal at the Company’s main office no later than March 3, 2007. If the Secretary of the Company is not notified of the stockholder’s proposal by March 3, 2007, the Board of Directors may vote on the proposal pursuant to the discretionary authority granted by the proxies solicited by the Board of Directors for the 2006 Annual Meeting.

The Company’s Bylaws provide that, in order to be eligible for consideration at a meeting of stockholders, all nominations of directors, other than those made by the Board of Directors, must be made in writing and must be delivered to the Secretary of the Company not less than 50 days nor more than 90 days prior to the meeting at which the nominations will be made. However, if less than 60 days notice of the meeting is given to stockholders, the nominations must be delivered to the Secretary of the Company not later than the close of business on the tenth day following the day on which the notice of meeting was mailed.

OTHER MATTERS

Because no matters were presented to management prior to March 6, 2006, it is intended that the proxyholders named in the enclosed form of proxy will vote the shares represented thereby on any matters properly coming before the meeting, pursuant to the discretionary authority granted therein. As of the date of this mailing, management knows of no other matters to be presented for consideration at the Annual Meeting or any adjournments thereof.

MISCELLANEOUS

The Company’s Annual Report to Stockholders, including the Form 10-KSB which will be filed by the Company with the SEC, for the year ended December 31, 2005, that includes financial statements audited and reported upon by the Company’s independent auditor, is being mailed along with this Proxy Statement; however, except as specifically stated herein, it is not intended that the Annual Report be deemed a part of this Proxy Statement or a solicitation of proxies.

|

| By Order of the Board of Directors |

|

/s/ Randolph J. Cary, Jr. |

| Randolph J. Cary, Jr. |

| President and Chief Executive Officer |

Burlington, North Carolina

April 17, 2006

19

Appendix A

NOMINATING AND CORPORATE GOVERNANCE COMMITTEE CHARTER

Purpose

The Nominating and Corporate Governance Committee is appointed by the Board (1) to assist the Board by identifying individuals qualified to become Board members, and by recommending to the Board the director nominees for the next annual meeting of stockholders; (2) to develop and recommend to the Board a set of corporate governance issues and policy guidelines applicable to the Company; (3) to lead the Board in its annual review of the Board’s performance; and (4) to recommend to the Board director nominees for each Board committee.

Committee Membership

The Governance Committee should consist of the Chairman of the following Committees: Loan, Audit, Asset Liability, Strategic Planning and two at large members appointed by the Board of Directors. The size of the Committees of the Board of Directors shall be at the discretion of the Boards (other than the Governance Committee) so as to be effective and efficient.

The members of the Nominating and Corporate Governance Committee shall be appointed by the Board on the recommendation of the Nominating and Corporate Governance Committee. Nominating and Corporate Governance Committee members may be removed and replaced by the Board.

Committee Powers, Authority, Duties and Responsibilities

| 1. | The Nominating and Corporate Governance Committee shall have the authority to obtain advice and assistance from internal or outside legal, accounting or other advisors. |

| 2. | The Nominating and Corporate Governance Committee shall establish criteria for the selection of new directors, evaluate the qualifications of potential candidates for director, including any nominees submitted by stockholders under and in accordance with the provisions of the Company’s Bylaws, and recommend to the Board the nominees for election at the next annual meeting or any special meeting of stockholders and any person to be considered to fill a Board vacancy or a newly created directorship resulting from any increase in the authorize number of directors. |

| 3. | The Nominating and Corporate Governance Committee shall oversee the orientation and training of newly elected directors, and continuing education of all members. |

| 4. | The Nominating and Corporate Governance Committee shall annually recommend to the Board director nominees for each Board committee, taking into account the listing standards of the New York Stock Exchange and applicable laws, rules and regulations, including, with respect to the Compensation Committee, whether Compensation Committee members meet |

20

| | the definitions of (a) a “non-employee director” within the meaning of Rule 16b-3 promulgated under the Securities Exchange Act of 1934, as amended, and (b) and “outside director” within the meaning of Section 162(m) of the Internal Revenue Code of 1986, as amended. |

| 5. | The Nominating and Corporate Governance Committee shall be responsible for ensuring that executive sessions of the Board are held regularly. |

| 6. | The Nominating and Corporate Governance Committee may form and delegate authority to subcommittees if determined to be necessary or advisable. |

| 7. | The Nominating and Corporate Governance Committee shall make reports to the Board at its next regularly scheduled meeting following the meeting of the Nominating and Corporate Governance Committee accompanied by any recommendation to the Board. |

| 8. | The Nominating and Corporate Governance Committee shall review and reassess the adequacy of this Charter annually and recommend any proposed changes to the Board for approval. |

| 9. | The Nominating and Corporate Governance Committee shall annually review its own performance. |

| 10. | The Nominating and Corporate Governance Committee shall have such other authority and responsibilities as may be assigned to it from time to time by the Board. |

Adopted by the Board of Directors on January 28, 2003

21

Appendix B

MIDCAROLINA FINANCIAL CORPORATION

AUDIT COMMITTEE CHARTER

Adopted October 16, 2003

Purpose

The principal purpose of the Audit Committee is to assist the Board of Directors of MidCarolina Financial Corporation (together with its subsidiaries, the “Company”) in fulfilling its responsibility to oversee: (i) the integrity of the Company’s financial statements; (ii) the Company’s financial reporting process; (iii) the Company’s systems of internal accounting and financial controls; (iv) the performance of the Company’s internal audit function and independent auditors; (v) the independent auditors’ qualifications and independence; and (vi) the Company’s compliance with its policies about ethical conduct and legal and regulatory requirements. In so doing, it is the responsibility of the Committee to maintain free and open communication between the Committee and each of the independent auditors, the internal auditors, and management of the Company.

In discharging its oversight role, the Committee is granted the authority to investigate any matter brought to its attention with full access to all books, records, facilities and personnel of the Company and the authority to engage independent counsel and other advisers, as it determines necessary to carry out its duties. The Company shall provide appropriate funding, as determined by the Committee, for compensation to the independent auditors and to any advisers, including independent counsel, that the Committee chooses to engage.

Committee Membership; Qualifications and Entitlements

The Audit Committee shall be comprised of no fewer than three independent members of the Board of Directors.

The Audit Committee’s members will meet the requirements of the applicable listing standards of the stock exchange or inter-dealer market on which the Company’s common stock is listed or qualified for quotation (“Listing Standards”). Accordingly, all members of the Committee shall be directors who:

| • | Have no relationship with the Company’s management or with the Company that may interfere with the exercise of their independent judgment; |

| • | Do not receive any consulting, advisory or other compensatory fee from the Company, other than in the members’ capacities as members of the Board of Directors or any of its committees; |

22

| • | Are not “affiliated persons” (as defined by applicable law or regulation) of the Company, other than as members of the Board of Directors; and |

| • | Are financially literate as required by applicable law and Listing Standards. |

In the event that regulations of the Securities and Exchange Commission (“SEC”) impose more stringent requirements or are otherwise in conflict with the Listing Standards, such regulations shall be controlling under this Charter.

In addition, at least one member of the Audit Committee will have accounting or related financial management expertise and be an “audit committee financial expert” (as that term is defined by the SEC or applicable Listing Standards) as determined by the Board of Directors.

Meetings

The Audit Committee shall meet three times per year, or more frequently as circumstances dictate. The Audit Committee may delegate authority to any subcommittees created by it and composed of one or more of its members or individuals when appropriate. Any such subcommittee or individual acting under authority delegated by the Audit Committee shall report any actions taken to the Committee at its next scheduled meeting. The Audit Committee shall report regularly to the Board of Directors.

Duties and Responsibilities

The primary responsibility of the Audit Committee is to oversee the Company’s financial reporting process on behalf of the Board and report the results of its activities to the Board of Directors. While the Audit Committee has the responsibilities and powers set forth in this Charter, it is not the duty of the Audit Committee to plan or conduct audits or to determine that the Company’s financial statements are complete and accurate and are in accordance with generally accepted accounting principles (“GAAP”) and applicable rules and regulations. Management is responsible for the preparation, presentation, and integrity of the Company’s financial statements and for the appropriateness of the accounting principles and reporting policies that are used by the Company. The independent auditors are responsible for auditing the Company’s financial statements and for reviewing the Company’s unaudited interim financial statements. In performing its role, the Audit Committee shall have the following specified duties and responsibilities:

| • | The Audit Committee shall be responsible for the appointment, compensation, retention, termination and oversight of any registered public accounting firm employed by the Company for the purpose of preparing or issuing an audit report or related work. The Audit Committee shall resolve any disagreements between the Company’s management and the auditor regarding financial reporting matters. The Company’s auditor shall report directly to the Audit Committee. |

| • | The Audit Committee shall pre-approve any permitted non-audit services to be provided by the Company’s auditor. |

23

| • | The Audit Committee or its designated representative shall review and discuss with the Company’s management and independent auditor the annual and quarterly financial statements of the Company prior to the filing of such statements in the Company’s annual and quarterly reports with the Securities and Exchange Commission. |

| • | The Audit Committee shall receive and review summary reports from the Company’s internal auditor as to examination activities for the applicable reporting period and otherwise, as well as other significant findings, trends and conclusions. |

| • | The Audit Committee shall establish procedures for the receipt, retention, and treatment of complaints received by the Company regarding accounting, internal accounting controls or auditing matters. |

| • | The Audit Committee shall establish procedures for the anonymous submission by Company employees of concerns, questions or complaints regarding questionable accounting practices or auditing matters. |

| • | The Audit Committee shall review and approve any report required to be included in the Company’s annual proxy statement. |

| • | The Audit Committee shall comply with all applicable laws, rules, regulations and Listing Standards. |

Authority and Funding

The Audit Committee shall have the authority to perform those duties and obligations set forth in this Charter. The Audit Committee shall also have access to, and the authority to engage, independent legal counsel and other advisors as the Audit Committee deems necessary to carry out its duties in its sole discretion, and all such fees, expenses and costs related thereto shall be paid by the Company.

The Company shall provide appropriate funding, as determined by the Audit Committee, for payment of compensation to the Company’s auditor for audit and pre-approved non audit services.

24

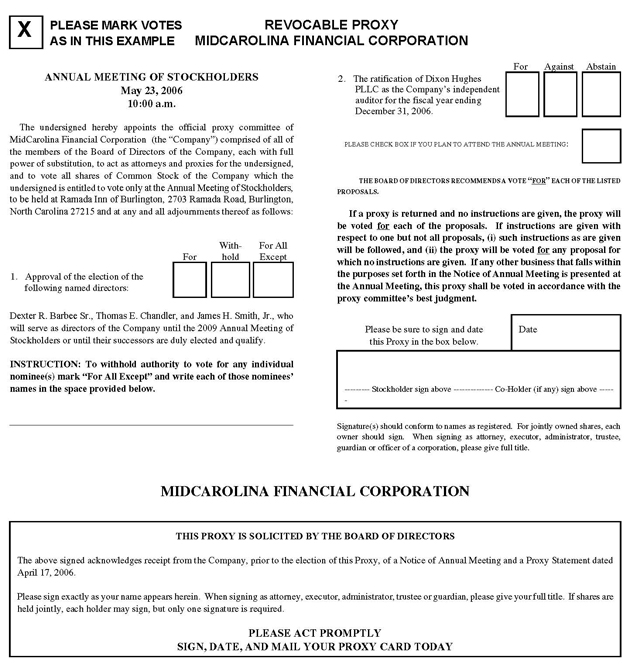

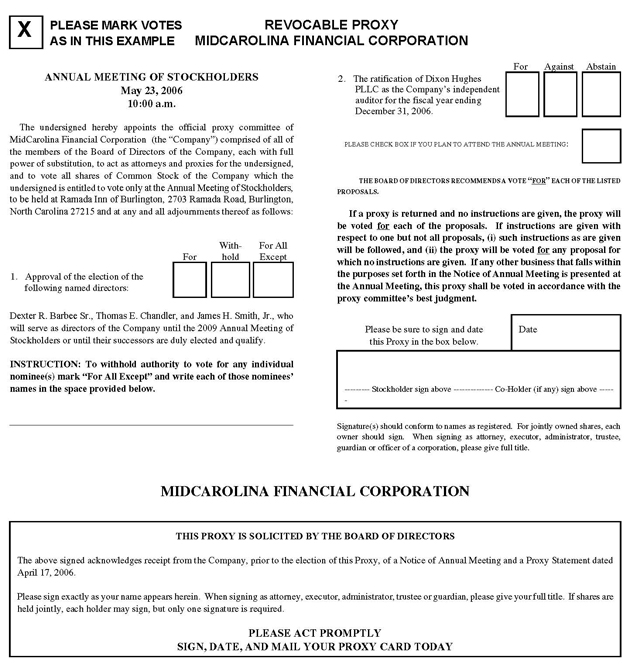

PLEASE MARK VOTES

AS IN THIS EXAMPLE

REVOCABLE PROXY

MIDCAROLINA FINANCIAL CORPORATION

ANNUAL MEETING OF STOCKHOLDERS

May 23, 2006

10:00 a.m.

The undersigned hereby appoints the official proxy committee of MidCarolina Financial Corporation (the “Company”) comprised of all of the members of the Board of Directors of the Company, each with full power of substitution, to act as attorneys and proxies for the undersigned, and to vote all shares of Common Stock of the Company which the undersigned is entitled to vote only at the Annual Meeting of Stockholders, to be held at Ramada Inn of Burlington, 2703 Ramada Road, Burlington, North Carolina 27215 and at any and all adjournments thereof as follows:

For

Withhold

For All Except

1. Approval of the election of the following named directors:

Dexter R. Barbee Sr., Thomas E. Chandler, and James H. Smith, Jr., who will serve as directors of the Company until the 2009 Annual Meeting of Stockholders or until their successors are duly elected and qualify.

INSTRUCTION: To withhold authority to vote for any individual nominee(s) mark “For All Except” and write each of those nominees’ names in the space provided below.

For

Against

Abstain

2. The ratification of Dixon Hughes PLLC as the Company’s independent auditor for the fiscal year ending December 31, 2006.

PLEASE CHECK BOX IF YOU PLAN TO ATTEND THE ANNUAL MEETING:

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” EACH OF THE LISTED PROPOSALS.

If a proxy is returned and no instructions are given, the proxy will be voted for each of the proposals. If instructions are given with respect to one but not all proposals, (i) such instructions as are given will be followed, and (ii) the proxy will be voted for any proposal for which no instructions are given. If any other business that falls within the purposes set forth in the Notice of Annual Meeting is presented at the Annual Meeting, this proxy shall be voted in accordance with the proxy committee’s best judgment.

Please be sure to sign and date this Proxy in the box below.

Date

Stockholder sign above

Co-Holder (if any) sign above

Signature(s) should conform to names as registered. For jointly owned shares, each owner should sign. When signing as attorney, executor, administrator, trustee, guardian or officer of a corporation, please give full title.

MIDCAROLINA FINANCIAL CORPORATION

THIS PROXY IS SOLICITED BY THE BOARD OF DIRECTORS

The above signed acknowledges receipt from the Company, prior to the election of this Proxy, of a Notice of Annual Meeting and a Proxy Statement dated April 17, 2006.

Please sign exactly as your name appears herein. When signing as attorney, executor, administrator, trustee or guardian, please give your full title. If shares are held jointly, each holder may sign, but only one signature is required.

PLEASE ACT PROMPTLY

SIGN, DATE, AND MAIL YOUR PROXY CARD TODAY