U. S. Securities and Exchange Commission

Washington, D.C. 20549

Form 10-K

ANNUAL REPORT UNDER SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2007

Commission File Number 000-49848

MIDCAROLINA FINANCIAL CORPORATION

(Name of Issuer in Its Charter)

| | |

| North Carolina | | 55-6144577 |

(State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

| | |

3101 South Church Street Burlington, North Carolina | | 27215 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(336) 538-1600

(Issuer’s Telephone Number, Including Area Code)

Securities Registered Under Section 12(b) of the Act: None

| | | | | | |

| | Securities Registered Under Section 12(g) of the Act: | | common stock, no par value | | |

| | | | Title of Class | | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company, (as defined in Rule 12b-2 of the Exchange Act).

| | | | |

| Large Accelerated filer ¨ | | Accelerated filer ¨ | | |

| | |

| Non-accelerated filer ¨ | | Smaller reporting filer x | | |

Indicate by check mark whether the registrant is a shell company (as defined in rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the Registrant’s voting and non-voting equity, held by non affiliates, computed by reference to the average bid and asked price of such common equity, as of the last business day of the Registrant’s most recently completed second fiscal quarter was $55.5 million.

State the number of shares outstanding of each of the issuer’s classes of common equity, as of the latest practicable date.4,919,251 shares of common stock, no par value, as of March 15, 2008.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement for the 2008 Annual Meeting of Shareholders of MidCarolina Financial Corporation, to be held on May 27, 2008 (the “Proxy Statement”), are incorporated by reference into Part III.

Statement Regarding Forward Looking Statements

This Annual Report on Form 10-K contains certain forward-looking statements with respect to the financial condition, results of operations and business of MidCarolina Financial Corporation (“Company”) and its banking subsidiary, MidCarolina Bank (“Bank”). These forward-looking statements involve risks and uncertainties and are based on the beliefs and assumptions of management of the Company and the Bank and on the information available to management at the time that these disclosures were prepared. These statements can be identified by the use of words like “expect,” “anticipate,” “estimate” and “believe,” variations of these words and other similar expressions. Readers should not place undue reliance on forward-looking statements as a number of important factors could cause results to differ materially from those in the forward-looking statements. Factors that could cause actual results to differ materially include, but are not limited to, (1) competition in the Bank’s markets, (2) changes in the interest rate environment, (3) general national, regional or local economic conditions may be less favorable than expected, resulting in, among other things, a deterioration in credit quality and the possible impairment of collectibility of loans, (4) legislative or regulatory changes including changes in accounting standards, (5) significant changes in the federal and state legal and regulatory environment and tax laws, (6) the impact of changes in monetary and fiscal policies, laws, rules, and regulations and (7) other risks and factors identified in the Company’s other filings with the Securities and Exchange Commission. The Company undertakes no obligation to update any forward-looking statements.

2

PART I

| ITEM 1. | DESCRIPTION OF BUSINESS |

General

MidCarolina Financial Corporation (the “Company”) was formed in 2002 to serve as a holding company for MidCarolina Bank (the “Bank”). The Company is registered with the Board of Governors of the Federal Reserve System (the “Federal Reserve”) under the Bank Holding Company Act of 1956, as amended (the “BHCA”), and the bank holding company laws of North Carolina. The Company’s office is located at 3101 South Church Street, Burlington, North Carolina 27216. The Company’s principal source of income is earnings on investments, including any dividends that are declared and paid by the Bank on its capital stock.

The Bank is incorporated under the laws of North Carolina and began operations on August 14, 1997 as a North Carolina chartered commercial bank. The Bank is engaged in general commercial banking primarily in Alamance and Guilford Counties, North Carolina, and operates under the banking laws of North Carolina and the rules and regulations of the Federal Deposit Insurance Corporation (the “FDIC”).

As a North Carolina bank, the Bank is subject to examination and regulation by the FDIC and the Commissioner of Banks, North Carolina Department of Commerce (the “Commissioner”). The Bank is further subject to certain regulations of the Federal Reserve governing reserve requirements to be maintained against deposits and other matters. The business and regulation of the Bank are also subject to legislative changes from time to time. See “SUPERVISION AND REGULATION.”

The Bank’s primary market area is Alamance County and Guilford County, North Carolina. The Bank’s main office is located in Burlington, North Carolina. The Bank also has one full-service branch in Burlington, NC, one full-service branch in Graham, North Carolina, two full-service branches in Greensboro, North Carolina and one full-service branch in Mebane, North Carolina. The Bank has limited service offices in the Alamance Regional Medical Center and the Village of Brookwood Retirement Center, both of which are located in Burlington. The Bank’s loans and deposits are primarily generated from the areas where its offices are located.

The Bank’s primary sources of revenue are interest and fee income from its lending activities. These lending activities consist principally of originating commercial operating and working capital loans, residential mortgage loans, home equity lines of credit, other consumer loans and loans secured by commercial real estate. The Bank’s current lending strategy is to establish market share throughout Alamance and Guilford Counties, with an emphasis in Burlington, Graham, Greensboro amd Mebane. At December 31, 2007, the largest amount the Bank had outstanding to any one borrower and its affiliates was approximately $5.3 million.

Interest and dividend income from investment activities generally provide the second largest source of income to the Bank after interest on loans. During 2007, the Bank chose to manage its overall liquidity position by marginally increasing the average balance of its securities portfolio and deploying more of its funds into lower risk mortgage-backed securities with short durations, U.S. Agency securities and State and Local Government issued federally tax-exempt securities. The interest and dividends earned from the investment portfolio therefore increased during 2007.

Deposits are the primary source of the Bank’s funds for lending and other investment purposes. The Bank attracts both short-term and long-term deposits from the general public by offering a variety of accounts and rates. The Bank offers statement savings accounts, negotiable order of withdrawal accounts, money market demand accounts, non-interest-bearing accounts and fixed interest rate certificates with varying maturities. The Bank also utilizes alternative sources of funds such as brokered certificates of deposit and borrowings from the Federal Home Loan Bank (the “FHLB”) of Atlanta, Georgia.

The Bank’s savings deposits are obtained primarily from its primary market area. The Bank uses traditional marketing methods to attract new customers and savings deposits including print media advertising and direct mailings. Deposit flows are greatly influenced by economic conditions, the general level of interest rates, competition and other factors.

3

The Bank is the sole banking subsidiary of the Company. Two trusts (MidCarolina I and MidCarolina Trust II) were formed as subsidiaries of the Company to facilitate the infusion of Trust Preferred Securities as a form of non-dilutive equity into the Company. The trusts are not consolidated in these financial statements. The majority of the Company’s operations are located at the Bank level. Throughout this Annual Report on Form 10-K, results of operations will be discussed by referring to the Bank’s operations, unless a specific reference is made to the Company and its operating results apart from the Bank.

The Bank has continued to experience steady growth since its formation in 1997. The Bank’s assets totaled $466.5 million, $420.9 million and $370.4 million as of December 31, 2007, 2006 and 2005, respectively. The Company had net income available to shareholders for the year ended December 31, 2007 of $4.5 million, or $0.92 per diluted share. When adjusted for an after-tax one time adjustment of $579,000 related to the reversal of accrued benefits originally designated for the benefit of a former executive officer, diluted earnings per common share for 2007 were $0.80, compared with $3.5 million, or $0.73 per diluted share for the year ended December 31, 2006. The per share amounts have been adjusted to reflect the 5-for-4 stock split effective January 19, 2007.

At December 31, 2007, the Company had total assets of $467.2 million, net loans of $367.2 million, deposits of $373.9 million, investment securities available-for-sale of $70.8 million and shareholders’ equity of $33.2 million.

Subsidiaries

Other than the Bank, the Company has two trust subsidiaries: MidCarolina I and MidCarolina Trust II. The Bank’s only subsidiary, MidCarolina Investments, Inc, was dormant during 2007. MidCarolina Investments engaged in general securities brokerage and offered insurance and other financial services through a contract arrangement with a third-party provider. The Bank continues to offer these services through a third-party provider.

Employees

At December 31, 2007, the Bank had 77 full-time equivalent employees.

Competition and Market Area

The Bank faces strong competition both in attracting deposits and making real estate and other loans. Its most direct competition for deposits comes from commercial banks, savings institutions and credit unions located in its primary market area, including large financial institutions that have greater financial and marketing resources available to them. At December 31, 2007, there were 16 depository institutions with 50 offices in Alamance County. The Bank had a deposit market share of 13.9% in Alamance County. The Bank also faces additional significant competition for investors’ funds from short-term money market securities and other corporate and government securities. The ability of the Bank to attract and retain savings deposits depends on its ability to generally provide a rate of return, liquidity and risk comparable to that offered by competing investment opportunities.

The Bank’s competition for real estate loans is from savings institutions, credit unions, commercial banks, and mortgage banking companies. It competes for loans primarily through the interest rates and loan fees it charges and the efficiency and quality of services it provides borrowers. Competition is increasing as a result of the reduction of restrictions on the interstate operations of financial institutions.

The Bank’s primary market area is Alamance County. The population of Alamance County is 139,786 and the median household income is $40,365. Alamance County has a diverse economy with no concentration in any one specific industry. Major businesses and industries in the area include LabCorp, a laboratory that provides specialized testing services for the medical industry, Alamance Health Services, Elon University, Honda Power Equipment Manufacturing and GKN Automotive, a manufacturer of automobile drive shafts.

Supervision and Regulation

Bank holding companies and state chartered commercial banks are extensively regulated under both federal and state law. The following is a brief summary of certain statutes and rules and regulations that affect or will affect the Company and the Bank. This summary is qualified in its entirety by reference to the particular statute and regulatory provisions referred to below and is not intended to be an exhaustive description of the statutes or regulations applicable to the business of the Company and the Bank. Supervision, regulation and examination of the Company and the Bank by the regulatory agencies are intended primarily for the protection of depositors rather than shareholders of the Company.

4

General.There are a number of obligations and restrictions imposed on bank holding companies and their depository institution subsidiaries by law and regulatory policy that are designed to minimize potential loss to the depositors of such depository institutions and the FDIC insurance fund in the event the depository institution becomes in danger of default or in default. For example, to avoid receivership of an insured depository institution subsidiary, a bank holding company is required to guarantee the compliance of any insured depository institution subsidiary that may become “undercapitalized” with the terms of any capital restoration plan filed by such subsidiary with its appropriate federal banking agency up to the lesser of (i) an amount equal to 5% of the bank’s total assets at the time the bank became undercapitalized or (ii) the amount which is necessary (or would have been necessary) to bring the bank into compliance with all acceptable capital standards as of the time the bank fails to comply with such capital restoration plan. The Company, as a registered bank holding company, is subject to the regulation of the Federal Reserve. Under a policy of the Federal Reserve with respect to bank holding company operations, a bank holding company is required to serve as a source of financial strength to its subsidiary depository institutions and to commit resources to support such institutions in circumstances where it might not do so absent such policy. The Federal Reserve under the BHCA also has the authority to require a bank holding company to terminate any activity or to relinquish control of a non-bank subsidiary (other than a non-bank subsidiary of a bank) upon the Federal Reserve’s determination that such activity or control constitutes a serious risk to the financial soundness and stability of any bank subsidiary of the bank holding company.

In addition, insured depository institutions under common control are required to reimburse the FDIC for any loss suffered by its deposit insurance fund as a result of the default of a commonly controlled insured depository institution or for any assistance provided by the FDIC to a commonly controlled insured depository institution in danger of default. The FDIC may decline to enforce the cross-guarantee provisions if it determines that a waiver is in the best interest of the deposit insurance fund. The FDIC’s claim for damages is superior to claims of stockholders of the insured depository institution or its holding company but is subordinate to claims of depositors, secured creditors and holders of subordinated debt (other than affiliates) of the commonly controlled insured depository institutions.

As a result of the Company’s ownership of the Bank, the Company is also registered under the bank holding company laws of North Carolina. Accordingly, the Company is also subject to regulation and supervision by the Commissioner.

Capital Adequacy Guidelines for Bank Holding Companies.The Federal Reserve has adopted capital adequacy guidelines for bank holding companies and banks that are members of the Federal Reserve System and have consolidated assets of $150 million or more. Bank holding companies subject to the Federal Reserve’s capital adequacy guidelines are required to comply with the Federal Reserve’s risk-based capital guidelines. Under these regulations, the minimum ratio of total capital to risk-weighted assets is 8%. At least half of the total capital is required to be “Tier I capital,” principally consisting of common stockholders’ equity, non-cumulative perpetual preferred stock, and a limited amount of cumulative perpetual preferred stock, less certain goodwill items. The remainder (“Tier II capital”) may consist of a limited amount of subordinated debt, certain hybrid capital instruments and other debt securities, perpetual preferred stock and a limited amount of the allowance for loan losses. In addition to the risk-based capital guidelines, the Federal Reserve has adopted a minimum Tier I capital (leverage) ratio, under which a bank holding company must maintain a minimum level of Tier I capital to average total consolidated assets of at least 3% in the case of a bank holding company which has the highest regulatory examination rating and is not contemplating significant growth or expansion. All other bank holding companies are expected to maintain a Tier I capital (leverage) ratio of at least 1% to 2% above the stated minimum.

Capital Requirements for the Bank.The Bank, as a North Carolina commercial bank, is required to maintain a surplus account equal to 50% or more of its paid-in capital stock. As a North Carolina chartered, FDIC-insured commercial bank that is not a member of the Federal Reserve, the Bank is also subject to capital requirements imposed by the FDIC. Under the FDIC’s regulations, state nonmember banks that (a) receive the highest rating during the examination process and (b) are not anticipating or experiencing any significant growth, are required to maintain a minimum leverage ratio of 3% of total consolidated assets; all other banks are required to maintain a minimum ratio of 1% or 2% above the stated minimum, with a minimum leverage ratio of not less than 4%. The Bank exceeded all applicable capital requirements as of December 31, 2007.

Dividend and Repurchase Limitations.The Company must obtain Federal Reserve approval prior to repurchasing common stock in excess of 10% of its net worth during any twelve-month period unless the Company (i) both before and after the redemption satisfies capital requirements for a “well capitalized” bank holding company; (ii) received a one or two rating in its last examination; and (iii) is not the subject of any unresolved supervisory issues.

5

Although the payment of dividends and the repurchase of stock by the Company are subject to certain requirements and limitations of North Carolina corporate law, except as set forth in this section, neither the Commissioner nor the FDIC have promulgated any regulations specifically limiting the right of the Company to pay dividends and repurchase shares. However, the ability of the Company to pay dividends or repurchase shares is largely dependent upon the Company’s receipt of dividends from the Bank.

North Carolina commercial banks, such as the Bank, are subject to legal limitations on the amounts of dividends they are permitted to pay. The Bank may pay dividends from undivided profits, which are determined by deducting and charging certain items against actual profits, including any contributions to surplus required by North Carolina law. Also, an insured depository institution, such as the Bank, is prohibited from making capital distributions, including the payment of dividends, if, after making such distribution, the institution would become “undercapitalized” (as such term is defined in the applicable law and regulations).

Deposit Insurance. The deposits of the Bank are currently insured to a maximum of $100,000 per depositor, subject to aggregation rules. The FDIC establishes rates for the payment of premiums by federally insured banks and thrifts for deposit insurance. Since 1993, insured depository institutions like the Bank have paid for deposit insurance under a risk-based premium system. Insurance of deposits may be terminated by the FDIC upon a finding that the institution has engaged in unsafe and unsound practices, is in an unsafe or unsound condition to continue operations, or has violated any applicable law, regulation, rule, order, or condition imposed by the FDIC. Due to its severe consequences, the FDIC historically uses insurance termination as an enforcement action of last resort and the termination process itself involves substantial notice, a formal adjudicative hearing and federal appellate review. In instances where insurance deposit is terminated, the financial institution is required to notify its depositors and insured funds on the date of termination that they will continue to be insured for at least six months and up to two years, at the discretion of the FDIC. After the date of termination, no new deposits accepted by the financial institution will be federally insured.

Federal Deposit Insurance Reform. On February 8, 2006, President Bush signed the Federal Deposit Insurance Reform Act of 2005 (FDIRA). The FDIC was required to adopt rules implementing the various provisions of FDIRA by November 5, 2006. Among other things, FDIRA changes the federal deposit insurance system by:

| | • | | raising the coverage level for retirement accounts to $250,000; |

| | • | | indexing deposit insurance coverage levels for inflation beginning in 2012; |

| | • | | prohibiting undercapitalized financial institutions from accepting employee benefit plan deposits; |

| | • | | merging the Bank Insurance Fund and Savings Association Insurance Fund into a new Deposit Insurance Fund (the DIF); and |

| | • | | providing credits to financial institutions that capitalized the FDIC prior to 1996 to offset future assessment premiums. |

FDIRA also authorizes the FDIC to revise the current risk-based assessment system, subject to notice and comment and caps the amount of the DIF at 1.50% of domestic deposits. The FDIC must issue cash dividends, awarded on a historical basis, for the amount of the DIF over the 1.50% ratio. Additionally, if the DIF exceeds 1.35% of domestic deposits at year-end, the FDIC must issue cash dividends, awarded on a historical basis, for half of the amount of the excess.

Deposit Insurance Assessments. The Bank is subject to insurance assessments imposed by the FDIC. Under current law, the insurance assessment to be paid by members of the Deposit Insurance Fund, such as the Bank, is specified in a schedule required to be issued by the FDIC. Prior to January 1, 2007, FDIC assessments for deposit insurance ranged from 0 to 27 basis points per $100 of insured deposits, depending on the institution’s capital position and other supervisory factors. Effective January 1, 2007, the assessments range from 5 to 43 basis points per $100 of insured deposits. The assessment rate schedule can change from time to time, at the discretion of the FDIC, subject to certain limits. Under the current system, premiums are charged quarterly.

Federal Home Loan Bank System.The Federal Home Loan Bank System provides a central credit facility for member institutions. In December 2004, the FHLB of Atlanta implemented a new capital plan. As a member of the FHLB of Atlanta and under the new capital plan, the Bank is required to own capital stock in the FHLB of Atlanta in an amount equal to at least 0.20% (or 20 basis points) of the Bank’s total assets at the end of each calendar year, plus 4.5% of its outstanding advances (borrowings) from the FHLB under the new activity-based stock ownership requirement. On December 31, 2007, the Bank was in compliance with this requirement.

6

Community Reinvestment.Under the Community Reinvestment Act (“CRA”), as implemented by regulations of the FDIC, an insured institution has a continuing and affirmative obligation consistent with its safe and sound operation to help meet the credit needs of its entire community, including low and moderate income neighborhoods. The CRA does not establish specific lending requirements or programs for financial institutions, nor does it limit an institution’s discretion to develop, consistent with the CRA, the types of products and services that it believes are best suited to its particular community. The CRA requires the federal banking regulators, in connection with their examinations of insured institutions, to assess the institutions’ records of meeting the credit needs of their communities, using the ratings of “outstanding,” “satisfactory,” “needs to improve,” or “substantial noncompliance,” and to take those records into account in its evaluation of certain applications by those institutions. All institutions are required to make public disclosure of their CRA performance ratings. The Bank received a “satisfactory” rating in its last CRA examination that was conducted during August 2007.

Prompt Corrective Action.The FDIC has broad powers to take corrective action to resolve the problems of insured depository institutions. The extent of these powers will depend upon whether the institution in question is “well capitalized,” “adequately capitalized,” “undercapitalized,” “significantly undercapitalized” or “critically undercapitalized.” Under the regulations, an institution is considered “well capitalized” if it has (i) a total risk-based capital ratio of 10% or greater, (ii) a Tier I risk-based capital ratio of 6% or greater, (iii) a leverage ratio of 5% or greater and (iv) is not subject to any order or written directive to meet and maintain a specific capital level for any capital measure. An “adequately capitalized” institution is defined as one that has (i) a total risk-based capital ratio of 8% or greater, (ii) a Tier I risk-based capital ratio of 4% or greater and (iii) a leverage ratio of 4% or greater (or 3% or greater in the case of an institution with the highest examination rating). An institution is considered (A) “undercapitalized” if it has (i) a total risk-based capital ratio of less than 8%, (ii) a Tier I risk-based capital ratio of less than 4% or (iii) a leverage ratio of less than 4% (or 3% in the case of an institution with the highest examination rating); (B) “significantly undercapitalized” if the institution has (i) a total risk-based capital ratio of less than 6%, or (ii) a Tier I risk-based capital ratio of less than 3% or (iii) a leverage ratio of less than 3%; and (C) “critically undercapitalized” if the institution has a ratio of tangible equity to total assets equal to or less than 2%. At December 31, 2007, the Bank had the requisite capital levels to qualify as “well capitalized”.

Changes in Control.The BHCA prohibits the Company from acquiring direct or indirect control of more than 5% of the outstanding voting stock or substantially all of the assets of any bank or savings bank or merging or consolidating with another bank holding company or savings bank holding company without prior approval of the Federal Reserve. Similarly, Federal Reserve approval (or, in certain cases, non-disapproval) must be obtained prior to any person acquiring control of the Company. Control is conclusively presumed to exist if, among other things, a person acquires more than 25% of any class of voting stock of the Company or controls in any manner the election of a majority of the directors of the Company. Control is presumed to exist if a person acquires more than 10% of any class of voting stock and the stock is registered under Section 12 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or the acquirer will be the largest shareholder after the acquisition.

Federal Securities Law.The Company has registered its common stock with the Securities and Exchange Commission (the “SEC”) pursuant to Section 12(g) of the Exchange Act. As a result of such registration, the proxy and tender offer rules, insider trading reporting requirements, annual and periodic reporting and other requirements of the Exchange Act are applicable to the Company.

Transactions with Affiliates.Under current federal law, depository institutions are subject to the restrictions contained in Section 22(h) of the Federal Reserve Act with respect to loans to directors, executive officers and principal shareholders. Under Section 22(h), loans to directors, executive officers and shareholders who own more than 10% of a depository institution (18% in the case of institutions located in an area with less than 30,000 in population) and certain affiliated entities of any of the foregoing, may not exceed, together with all other outstanding loans to such person and affiliated entities, the institution’s loans-to-one-borrower limit (as discussed below). Section 22(h) also prohibits loans above amounts prescribed by the appropriate federal banking agency to directors, executive officers and shareholders who own more than 10% of an institution and their respective affiliates, unless such loans are approved in advance by a majority of the board of directors of the institution. Any “interested” director may not participate in the voting. The FDIC has prescribed the loan amount (which includes all other outstanding loans to such person), as to which such prior board of director approval is required, as being the greater of $25,000 or 5% of capital and surplus (up to $500,000). Further, pursuant to Section 22(h), the Federal Reserve requires that loans to directors, executive officers, and principal shareholders be made on terms substantially the same as offered in comparable transactions with non-executive employees of the Bank. The FDIC has imposed additional limits on the amount a bank can loan to an executive officer.

7

Loans to One Borrower.The Bank is subject to the Commissioner’s loans to one borrower limits, which are substantially the same as those applicable to national banks. Under these limits, no loans and extensions of credit to any borrower outstanding at one time and not fully secured by readily marketable collateral shall exceed 15% of the unimpaired capital and unimpaired surplus of the Bank. Loans and extensions of credit to such a borrower fully secured by readily marketable collateral may comprise an additional 10% of unimpaired capital and unimpaired surplus.

Gramm-Leach-Bliley Act. The federal Gramm-Leach-Bliley Act enacted in 1999 (the “GLB Act”) dramatically changed various federal laws governing the banking, securities and insurance industries. The GLB Act has expanded opportunities for banks and bank holding companies to provide services and engage in other revenue-generating activities that previously were prohibited to them. In doing so it increased competition in the financial services industry, presenting greater opportunities to our larger competitors who were more able to expand their services and products than smaller oriented financial institutions, such as the Bank.

USA Patriot Act of 2001. The USA Patriot Act of 2001 was enacted in response to the terrorist attacks that occurred in New York, Pennsylvania and Washington, D.C. on September 11, 2001. The Act is intended to strengthen the ability of U.S. law enforcement and the intelligence community to work cohesively to combat terrorism on a variety of fronts. The impact of the Act on financial institutions of all kinds is significant and wide ranging. The Act contains sweeping anti-money laundering and financial transparency laws and imposes various regulations, including standards for verifying customer identification at account opening and rules to promote cooperation among financial institutions, regulators, and law enforcement entities in identifying parties that may be involved in terrorism or money laundering.

Sarbanes-Oxley Act of 2002.The Sarbanes-Oxley Act of 2002 was signed into law and included significant changes addressing accounting, corporate governance and disclosure issues. The impact of the Sarbanes-Oxley Act is wide-ranging as it applies to all public companies and imposes significant new requirements for public company governance and disclosure requirements.

In general, the Sarbanes-Oxley Act mandated corporate governance and financial reporting requirements intended to enhance the accuracy and transparency of public companies’ reported financial results. It established new responsibilities for corporate chief executive officers, chief financial officers and audit committees in the financial reporting process and created a new regulatory body to oversee auditors of public companies. It backed these requirements with new SEC enforcement tools, increased criminal penalties for federal mail, wire and securities fraud and created new criminal penalties for document and record destruction in connection with federal investigations. It also increased the opportunity for more private litigation by lengthening the statute of limitations for securities fraud claims and providing new federal corporate whistleblower protection.

The economic and operational effects of this Act on public companies, including the Bank, has been and is expected to continue to be significant in terms of the time, resources and costs associated with complying with the law.

Other. The federal banking agencies, including the FDIC, have developed joint regulations requiring annual examinations of all insured depository institutions by the appropriate federal banking agency, with some exceptions for small, well-capitalized institutions and state chartered institutions examined by state regulators and establish operational and managerial, asset quality, earnings and stock valuation standards for insured depository institutions as well as compensation standards when such compensation would endanger the insured depository institution or would constitute an unsafe practice.

In addition, the Bank is subject to various other state and federal laws and regulations, including state usury laws, laws relating to fiduciaries, consumer credit and equal credit, fair credit reporting laws and laws relating to branch banking. The Bank, as an insured North Carolina commercial bank, is prohibited from engaging as a principal in activities that are not permitted for national banks, unless (i) the FDIC determines that the activity would pose no significant risk to the Deposit Insurance Fund and (ii) the Bank is, and continues to be, in compliance with all applicable capital standards.

Under Chapter 53 of the North Carolina General Statutes, if the capital stock of a North Carolina commercial bank is impaired by losses or otherwise, the Commissioner is authorized to require payment of the deficiency by assessment upon the bank’s shareholders, pro rata, and to the extent necessary, if any such assessment is not paid by any shareholder, upon 30 days notice, to sell as much as is necessary of the stock of such shareholder to make good the deficiency.

8

Available Information.The Company makes its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports available free of charge on its internet website www.midcarolinabank.com, as soon as reasonably practicable after the reports are electronically filed with the SEC. Any materials that the Company files with the SEC may be read and/or copied at the SEC’s Public Reference Room at 100 F Street, NE, Washington DC 20549. Information on the operation of the Public Reference room may be obtained by calling the SEC at 1-800-SEC-0330. These filings are also accessible on the SEC’s website at www.sec.gov.

The Company is subject to certain risks. In addition to the factors discussed below, please see the discussion under “Item 7A. Quantitative and Qualitative Disclosure about Market Risk” beginning on page 46. These factors, along with the other information in this Annual Report on Form 10-K, should be considered in evaluating forward-looking statements, and undue reliance should not be placed on such statements.

We may have higher credit losses than the reserve we have set aside

Our credit losses could exceed the allowance for credit losses we have set aside. Our average loan size continues to increase. Reliance on historic credit loss experience may not be indicative of future credit losses. Approximately 71.7% of our loan portfolio is composed of construction, commercial mortgage and commercial loans. Repayment of such loans is generally considered more vulnerable to market risk than residential mortgage loans. Industry experience shows that a portion of loans will become delinquent and a portion of the loans will require partial or entire charge-off. Regardless of the underwriting criteria we utilize, losses may be experienced as a result of various factors beyond our control, including, among other things, changes in market conditions affecting the value of our loan collateral and problems affecting the credit repayment capacity of our borrowers.

A significant amount of the Bank’s business is concentrated in lending which is secured by property located in Alamance and Guilford Counties and surrounding areas

In addition to the financial strength and cash flow characteristics of the borrower in each case, the Bank often secures its loans with real estate collateral. The real estate collateral in each case provides an alternate source of repayment in the event of default by the borrower and may deteriorate in value during the time the credit is extended. If the Bank is required to liquidate the collateral securing a loan during a period of reduced real estate values to satisfy the debt, the Bank’s earnings and capital could be adversely affected.

Additionally, with most of the Bank’s loans concentrated in Alamance and Guilford Counties and surrounding areas, a decline in local economic conditions could adversely affect the values of the Bank’s real estate collateral. Consequently, a decline in local economic conditions may have a greater effect on the Bank’s earnings and capital than on the earnings and capital of larger financial institutions whose real estate loan portfolios are geographically diverse.

Changes in technology may impact the Bank’s business

The Bank uses various technologies in its business and the banking industry is undergoing rapid technological changes. The effective use of technology increases efficiency and enables financial institutions to reduce costs. The Bank’s future success will depend in part on its ability to address the needs of its customers by using technology to provide products and services that will satisfy customer demands for convenience as well as create additional efficiencies in the Bank’s operations. The Bank’s competitors may have substantially greater resources to invest in technological improvements.

The small amount of trading volume in our common stock can cause price volatility

The trading history of our common stock has been characterized by relatively low trading volume. The value of a shareholder’s investment may be subject to sudden decreases due to the volatility of the price of our common stock, which is traded over-the-counter, with quotations available on the National Daily Quotation Services “Bulletin Board”. The market price of our common stock may be volatile and subject to fluctuations in response to numerous factors, including, but not limited to, the factors discussed in other risk factors and the following:

| | • | | actual or anticipated fluctuation in our operating results; |

9

| | • | | changes in interest rates; |

| | • | | changes in the legal or regulatory environment in which we operate; |

| | • | | press releases, announcements or publicity relating to us or our competitors or relating to trends in our industry; |

| | • | | changes in expectations as to our future financial performance, including financial estimates or recommendations by securities analysts and investors; |

| | • | | future sales of our common stock; |

| | • | | changes in economic conditions in our market, general conditions in the U.S. economy, financial markets or the banking industry; and |

| | • | | other developments affecting us or our competitors. |

These factors may adversely affect the trading price of our common stock, regardless of our actual operating performance, and could prevent a shareholder from selling common stock at or above the current market price.

Our growth strategy may not be successful.

As a strategy, we have sought to increase the size of our franchise by aggressively pursuing business development opportunities, and we have grown rapidly during the last decade. We can provide no assurance that we will continue to be successful in increasing the volume of our loans and deposits at acceptable risk levels and upon acceptable terms, expanding our asset base while managing the costs and implementation risks associated with this growth strategy. There can be no assurance that any further expansion will be profitable or that we will continue to be able to sustain our historical rate of growth, either through internal growth or through other successful expansions of our banking markets, or that we will be able to maintain capital sufficient to support our continued growth.

Interest rate volatility could significantly harm our business.

The Company’s results of operations are affected by the monetary and fiscal policies of the federal government and the regulatory policies of governmental authorities. The principal component of the Company’s earnings is the net interest income of the Bank. Net interest income is the difference between income from interest-earning assets, such as loans, and the expense of interest-bearing liabilities, such as deposits. We may not be able to effectively manage changes in what we charge as interest on our earning assets and the expense we must pay on interest-bearing liabilities, which may significantly reduce our earnings. The Federal Reserve has made significant changes in interest rates. Since rates charged on loans often tend to react to market conditions faster than do rates paid on deposit accounts, these rate changes may have a negative impact on our earnings until we can make appropriate adjustments in our deposit rates. In addition, there are costs associated with our risk management techniques, and these costs could be material. Fluctuations in interest rates are not predictable or controllable and, therefore, there can be no assurances of our ability to continue to maintain a consistent positive spread between the interest earned on our earning assets and the interest paid on our interest-bearing liabilities.

If we lose key employees with significant business contacts in our market area, our business may suffer.

Our success is largely dependent on the personal contacts of our officers and employees in our market areas. If we lose key employees temporarily or permanently, our business could be hurt. We could be particularly hurt if our key employees go to work for competitors. Our future success depends on the continued contributions of our existing senior management personnel, many of whom have significant local experience and contacts in our market areas.

Government regulations may prevent or impair our ability to pay dividends, engage in additional acquisitions, or operate in other ways.

Current and future legislation and the policies established by federal and state regulatory authorities will affect our operations. We are subject to supervision and periodic examination by the Reserve Bank and the Commission. Our subsidiary bank, as a state chartered commercial bank, also receives regulatory scrutiny from the FDIC and the Commission. Banking regulations, designed primarily for the protection of depositors, may limit our growth and the return to you as an investor in our Company, by restricting our activities, such as:

| | • | | the payment of dividends to shareholders; |

10

| | • | | possible transactions with or acquisitions by/of other institutions; |

| | • | | loans and interest rates; |

| | • | | the level of our allowance for loan losses; |

| | • | | imposing higher capital requirements; |

| | • | | interest rates paid on deposits; |

| | • | | the possible expansion of branch offices; and |

| | • | | the ability to provide other services. |

We cannot predict what changes, if any, will be made to existing federal and state legislation and regulations or the effect that such changes may have on our business. The cost of compliance with regulatory requirements may adversely affect our ability to operate profitably.

We may be subject to examinations by taxing authorities which could adversely affect our results of operations.

In the normal course of business, we may be subject to examinations from federal and state taxing authorities regarding the amount of taxes due in connection with investments we have made and the businesses in which we are engaged. Recently, federal and state taxing authorities have become increasingly aggressive in challenging tax positions taken by financial institutions. The challenges made by taxing authorities may result in adjustments to the timing or amount of taxable income or deductions or the allocation of income among tax jurisdictions. If any such challenges are made and are not resolved in our favor, they could have an adverse effect on our financial condition and results of operations.

We face strong competition in our market areas, which may limit our asset growth and profitability.

The banking business in our market areas is very competitive, and the level of competition facing us may increase further, which may limit our asset growth and/or profitability. We experience competition in both lending and attracting deposits from other banks and nonbank financial institutions located within our market area, some of which are significantly larger institutions. Nonbank competitors for deposits and deposit-type accounts include savings associations, credit unions, securities firms, money market funds, life insurance companies and the mutual funds industry. For loans, we encounter competition from other banks, savings associations, finance companies, mortgage bankers and brokers, insurance companies, small loan and credit card companies, credit unions, pension trusts and securities firms.

The Company’s common stock is not FDIC insured.

The common stock of the Company is not a savings or deposit account or other obligation of any bank and is not insured by the Federal Deposit Insurance Corporation or any other governmental agency and is subject to investment risk, including loss of principal.

| ITEM 2. | DESCRIPTION OF PROPERTY |

The Bank owns its main office, which is located at 3101 South Church Street in Burlington, as well as its full-service branch offices located at 5509-A West Friendly Avenue, Suite 102, Greensboro, North Carolina and 842 South Main Street, Graham, North Carolina. The Bank leases its full-service offices located at Cum-Park Plaza, 2214 North Church Street, Burlington; 701 Green Valley Road, Greensboro; and 1107 South Fifth Street, Mebane, North Carolina. The Bank occupies space in the Alamance Regional Medical Center in Burlington from which it operates a limited-service office as well as a limited-service office located in the Village of Brookwood Retirement Center located in Burlington.

The total net book value of the Bank’s furniture, fixtures, leasehold improvements, land, buildings and equipment at December 31, 2007 was approximately $6.8 million. All properties are considered by the Bank’s management to be in good condition and adequately covered by insurance. Additional information about this property is set forth in Note (F) to the Consolidated Financial Statements contained in Item 8 of this Annual Report on Form 10-K, which note is incorporated herein by reference.

11

In the opinion of management, neither the Company nor the Bank is involved in any material pending legal proceedings other than routine litigation that is incidental to its business.

| ITEM 4. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS |

No matter was submitted to a vote of the stockholders of the Company during the fourth quarter of the fiscal year ended December 31, 2007.

PART II

| ITEM 5. | MARKET FOR COMMON EQUITY AND RELATED SHAREHOLDER MATTERS AND SMALL BUSINESS ISSUER PURCHASES OF EQUITY SECURITIES |

There currently is a limited trading market for the Company’s common stock, and there can be no assurance that a more active market will develop. The Company’s common stock is traded over-the-counter with quotations available on the National Daily Quotation Services “Bulletin Board” under the symbol “MCFI.” There were 1,599 stockholders of record as of February 5, 2008, not including the persons or entities whose stock is held in nominee or “street” name and by various banks and brokerage firms.

The table below presents the over-the-counter market quotations for the Company’s common stock for the year- ended December 31, 2007 and 2006. The quotations, which have been adjusted to reflect declared stock splits in the form of stock dividends in 2007 and 2006, reflect inter-dealer prices, without retail mark-up, mark-down or commission, and may not represent actual transactions.

| | | | | | |

| | | High | | Low |

2007 | | | | | | |

First quarter | | $ | 19.60 | | $ | 12.75 |

Second quarter | | $ | 15.00 | | $ | 13.70 |

Third quarter | | $ | 14.95 | | $ | 12.50 |

Fourth quarter | | $ | 13.75 | | $ | 9.00 |

| | |

2006 | | | | | | |

First quarter | | $ | 18.18 | | $ | 10.51 |

Second quarter | | $ | 16.00 | | $ | 13.09 |

Third quarter | | $ | 15.12 | | $ | 13.20 |

Fourth quarter | | $ | 16.00 | | $ | 13.60 |

12

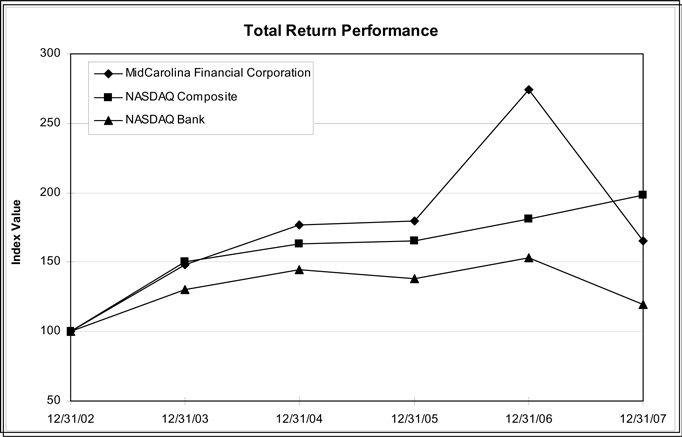

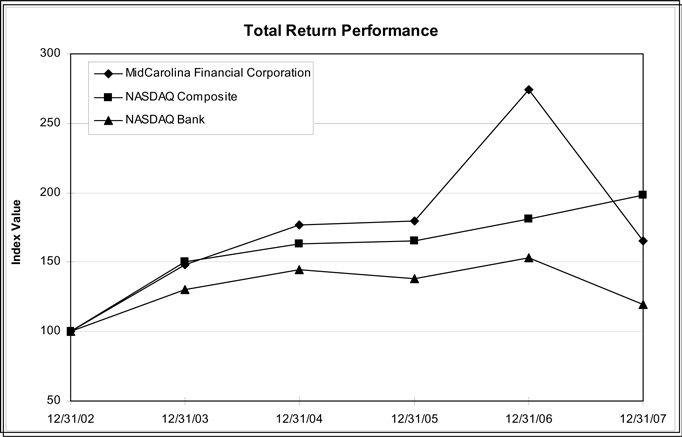

The following graph and index compare (i) the yearly change in the cumulative total stockholders return on the Company’s common stock with (ii) the cumulative return of the Nasdaq Composite, and (iii) the Nasdaq Bank index. The graph and index assume that the value of an investment in the Company’s common stock was $100.00 on December 31, 2002, and that all dividends were reinvested. The performance shown in the graph and index represents past performance and should not be considered an indication of future performance.

MidCarolina Financial Corporation

| | | | | | | | | | | | |

| | | Period Ending |

Index | | 12/31/02 | | 12/31/03 | | 12/31/04 | | 12/31/05 | | 12/31/06 | | 12/31/07 |

MidCarolina Financial Corporation | | 100.00 | | 147.96 | | 176.84 | | 180.00 | | 274.42 | | 165.00 |

NASDAQ Composite | | 100.00 | | 150.01 | | 162.89 | | 165.13 | | 180.85 | | 198.60 |

NASDAQ Bank | | 100.00 | | 129.93 | | 144.21 | | 137.97 | | 153.15 | | 119.35 |

Recent Sale of Unregistered Securities

The following table provides information with respect to all securities sold by the Company during the three years ended December 31, 2007 that were not registered under the Securities Act of 1933, as amended. All of the sales concern exercises of options to purchase shares of the Company’s common stock by participants in the Company’s employee or director stock option plans and did not involve underwriters. The sales are exempt from registration under Section 4(2) of the Securities Act of 1933, as amended, by virtue of being transactions not involving any public offering.

| | | | | | | | |

Year of Sale | | Number of

shares sold | | Average

exercise price

per share | | Aggregate

price |

2005 | | 7,734 | | $ | 2.75 | | $ | 21,269 |

2006 | | 219,607 | | $ | 4.99 | | $ | 1,095,839 |

2007 | | 65,301 | | $ | 2.94 | | $ | 191,985 |

13

Recent Repurchase of Company’s Securities

The Company did not repurchase any of its securities in the last quarter of the fiscal year ending December 31, 2007.

Securities Authorized for Issuance Under Equity Compensation Plans

In 1998, the Bank’s board of directors and shareholders approved a non-qualified stock option plan for certain Bank directors, and an incentive stock option plan for certain officers and key employees (together the “1998 Plans”). In 2004, the Company’s Board of Directors and shareholders approved the MidCarolina Financial Corporation Omnibus Equity Compensation Plan (the “2004 Omnibus Plan”). For more information on these plans, see Note L in the Notes to Consolidated Financial Statements of this Annual Report on Form 10-K.

The following table presents, as of December 31, 2007, the numbers of shares of common stock to be issued upon the exercise of outstanding options, warrants and rights, the weighted-average price of the outstanding options, warrants and rights, and the number of securities remaining that may be issued under the 1998 Plans and 2004 Omnibus Plan.

EQUITY COMPENSATION PLAN INFORMATION

| | | | | | | | |

Plan category | | (a) Number of shares

to be issued upon

exercise of

outstanding options,

warrants and rights(2) | | | (b) Weighted-average

exercise price of

outstanding options,

warrants and rights (2) | | (c) Number of securities remaining

available for future issuance under

equity compensation plans (excluding

shares reflected in column (a)) (2) |

Equity compensation plans approved by our stockholders | | 536,519 | (1)(2) | | $ | 5.53 | | 202,309 |

Equity compensation plans not approved by our stockholders | | — | | | $ | — | | — |

Total | | 536,519 | | | $ | 5.53 | | 202,309 |

(1) | Of the 536,519 stock options issued under the 1998 Plans and the 2004 Omnibus Plan, a total of 522,519 of those stock options have vested or are exercisable within 60 days. |

(2) | All per share data has been restated to reflect the effects of a stock split effected in the form of a 10% stock dividend in 2002, a stock split effected in the form of a 20% stock dividend in 2003 and 2004, a stock split effected in the form of a 25% stock dividend in 2005, a stock split effected in the form of a 10% stock dividend in 2006 and a 25% stock split in the form of a stock dividend in January 2007. |

14

See “ITEM 1. DESCRIPTION OF BUSINESS — Supervision and Regulation” above, and “NOTE P – Shareholders Equity – Notes to Consolidated Financial Statements” below for regulatory restrictions which limit the ability of the Bank to pay dividends. Except for cash dividends paid by the Bank to MidCarolina Financial Corporation, the Company has not paid any cash dividends to common stockholders from the time either began operations through December 31, 2007. Management believes that the most effective use of its capital is to retain it for the purpose of supporting continued growth in earning assets. The Company paid cash dividends in the amount of $417 thousand to non-cumulative perpetual preferred stockholders during 2007. Cash dividends in the amount of $417 thousand were paid to non-cumulative perpetual preferred stockholders during 2006.

15

| ITEM 6. | SELECTED FINANCIAL DATA |

The following table sets forth certain summary consolidated financial data, performance ratios and other data at, or for the periods indicated. As this information is only a summary, you should read it in conjunction with the historical financial statements (and related notes) of the Company and “Item 7. —Management’s Discussion and Analysis of Financial Condition and Results of Operations”.

MidCarolina Financial Corporation

Table 1

Selected Consolidated Financial Information and Other Data

($ in thousands, except per share and nonfinancial data)

| | | | | | | | | | | | | | | |

| | | At or for the Year Ended December 31, |

| | | 2007 | | 2006 | | 2005 | | 2004 | | 2003 |

Operating Data: | | | | | | | | | | | | | | | |

Total interest income | | $ | 31,053 | | $ | 27,061 | | $ | 19,208 | | $ | 12,174 | | $ | 9,652 |

Total interest expense | | | 17,721 | | | 14,241 | | | 8,327 | | | 4,383 | | | 3,298 |

| | | | | | | | | | | | | | | |

Net interest income | | | 13,332 | | | 12,820 | | | 10,881 | | | 7,791 | | | 6,354 |

Provision for loan losses | | | 425 | | | 394 | | | 1,373 | | | 1,030 | | | 586 |

| | | | | | | | | | | | | | | |

Net interest income after provision | | | 12,907 | | | 12,426 | | | 9,508 | | | 6,761 | | | 5,768 |

Noninterest income | | | 3,108 | | | 2,304 | | | 2,683 | | | 4,141 | | | 3,575 |

Noninterest expense | | | 8,786 | | | 9,077 | | | 8,546 | | | 8,010 | | | 6,845 |

| | | | | | | | | | | | | | | |

Income before income taxes | | | 7,229 | | | 5,653 | | | 3,645 | | | 2,892 | | | 2,498 |

Provision for income taxes | | | 2,342 | | | 1,757 | | | 1,277 | | | 950 | | | 835 |

| | | | | | | | | | | | | | | |

Net income | | | 4,887 | | | 3,896 | | | 2,368 | | | 1,942 | | | 1,663 |

Dividends on preferred stock | | | 417 | | | 417 | | | 104 | | | — | | | — |

| | | | | | | | | | | | | | | |

Net income available to common shareholders | | $ | 4,470 | | $ | 3,479 | | $ | 2,264 | | $ | 1,942 | | $ | 1,663 |

| | | | | | | | | | | | | | | |

Per Share Data (1): | | | | | | | | | | | | | | | |

Earnings per common share—basic | | $ | 0.98 | | $ | 0.80 | | $ | 0.53 | | $ | 0.45 | | $ | 0.39 |

Earnings per common share—diluted | | | 0.92 | | | 0.73 | | | 0.48 | | | 0.42 | | | 0.36 |

Market price | | | | | | | | | | | | | | | |

High | | | 19.60 | | | 18.18 | | | 12.37 | | | 10.67 | | | 9.68 |

Low | | | 9.00 | | | 10.51 | | | 8.44 | | | 7.52 | | | 5.43 |

Close | | | 9.50 | | | 15.80 | | | 10.36 | | | 8.49 | | | 8.51 |

Book value—common shares | | | 6.13 | | | 5.20 | | | 4.25 | | | 3.83 | | | 3.40 |

| | | | | |

Weighted average common shares outstanding | | | | | | | | | | | | | | | |

Basic | | | 4,548,565 | | | 4,348,128 | | | 4,299,522 | | | 4,289,401 | | | 4,233,899 |

Diluted | | | 4,864,893 | | | 4,775,853 | | | 4,669,601 | | | 4,621,764 | | | 4,556,784 |

| | | | | |

Selected Year-End Balance Sheet Data: | | | | | | | | | | | | | | | |

Total assets | | $ | 467,186 | | $ | 420,850 | | $ | 370,440 | | $ | 284,888 | | $ | 212,561 |

Loans, held to maturity | | | 371,714 | | | 313,572 | | | 279,962 | | | 217,683 | | | 178,913 |

Allowance for loan losses | | | 4,462 | | | 4,222 | | | 4,090 | | | 2,865 | | | 2,522 |

Deposits | | | 373,897 | | | 339,275 | | | 300,262 | | | 216,791 | | | 151,982 |

Short-term borrowings | | | 19,000 | | | 25,000 | | | 10,000 | | | 15,500 | | | 18,500 |

Long-term debt | | | 38,764 | | | 26,764 | | | 34,764 | | | 34,764 | | | 26,500 |

Shareholders’ equity | | | 33,150 | | | 28,259 | | | 23,093 | | | 16,424 | | | 14,411 |

| | | | | |

Selected Average Balances: | | | | | | | | | | | | | | | |

Total assets | | $ | 447,442 | | $ | 397,514 | | $ | 329,395 | | $ | 253,352 | | $ | 192,822 |

Loans, net | | | 344,620 | | | 301,405 | | | 252,914 | | | 204,121 | | | 160,041 |

Total interest-earning assets | | | 427,142 | | | 379,168 | | | 309,935 | | | 241,992 | | | 177,780 |

Deposits | | | 370,128 | | | 329,724 | | | 264,730 | | | 187,090 | | | 150,962 |

Total interest-bearing liabilities | | | 380,288 | | | 338,283 | | | 280,412 | | | 215,080 | | | 158,961 |

Shareholders’ equity | | | 29,901 | | | 24,550 | | | 19,743 | | | 15,484 | | | 13,665 |

Shareholders’ equity less average preferred equity | | | 25,082 | | | 19,731 | | | 17,910 | | | 15,484 | | | 13,665 |

16

MidCarolina Financial Corporation

Table 1

Selected Consolidated Financial Information and Other Data

($ in thousands, except per share and nonfinancial data)

| | | | | | | | | | | | | | | |

| | | At or for the Year Ended December 31, | |

| | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

Selected Performance Ratios: | | | | | | | | | | | | | | | |

Return on average assets | | 1.09 | % | | 0.98 | % | | 0.72 | % | | 0.77 | % | | 0.86 | % |

Return on average equity excluding preferred equity | | 17.82 | % | | 17.63 | % | | 12.64 | % | | 12.54 | % | | 12.17 | % |

Net interest spread | | 2.61 | % | | 2.93 | % | | 3.23 | % | | 2.99 | % | | 3.35 | % |

Net interest margin | | 3.12 | % | | 3.38 | % | | 3.51 | % | | 3.22 | % | | 3.57 | % |

Noninterest income to total net revenue | | 18.91 | % | | 15.23 | % | | 19.78 | % | | 34.70 | % | | 36.01 | % |

Noninterest income to average assets | | 0.69 | % | | 0.58 | % | | 0.81 | % | | 1.63 | % | | 1.85 | % |

Noninterest expense to average assets | | 1.96 | % | | 2.28 | % | | 2.59 | % | | 3.16 | % | | 3.55 | % |

| | | | | |

Asset Quality Ratios: | | | | | | | | | | | | | | | |

Nonperforming loans to period-end loans | | 0.19 | % | | 0.25 | % | | 0.08 | % | | 0.11 | % | | 0.32 | % |

Allowance for loan losses to period-end loans | | 1.20 | % | | 1.35 | % | | 1.46 | % | | 1.32 | % | | 1.41 | % |

Allowance for loan losses to nonperforming loans | | 637.43 | % | | 531.74 | % | | 1725.74 | % | | 1127.95 | % | | 428.18 | % |

Nonperforming assets to total assets | | 0.21 | % | | 0.74 | % | | 0.83 | % | | 0.80 | % | | 0.29 | % |

Net loan charge-offs to average loans | | 0.05 | % | | 0.09 | % | | 0.06 | % | | 0.34 | % | | 0.09 | % |

| | | | | |

Capital Ratios: | | | | | | | | | | | | | | | |

Total risk-based capital | | 11.48 | % | | 11.28 | % | | 11.34 | % | | 11.13 | % | | 13.11 | % |

Tier 1 risk-based capital | | 10.37 | % | | 10.12 | % | | 9.90 | % | | 8.78 | % | | 9.95 | % |

Leverage ratio | | 8.95 | % | | 8.73 | % | | 8.64 | % | | 7.83 | % | | 9.53 | % |

Equity to assets ratio | | 7.10 | % | | 6.71 | % | | 6.23 | % | | 5.77 | % | | 6.78 | % |

| | | | | |

Other Data: | | | | | | | | | | | | | | | |

Number of banking offices | | 8 | | | 8 | | | 6 | | | 6 | | | 5 | |

Number of full time equivalent employees | | 77 | | | 71 | | | 69 | | | 77 | | | 63 | |

| (1) | All per share data has been restated to reflect the effects of a stock split effected in the form of a 10% stock dividend in 2002, a stock split effected in the form of a 20% stock dividend in 2003 and 2004, a stock split effected in the form of a 25% stock dividend in 2005, a stock split effected in the form of a 10% stock dividend in 2006 and a 25% stock split in the form of a stock dividend effected in January 2007. |

17

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

The discussion and analysis that follows is intended to assist readers in the understanding and evaluation of the financial condition and results of operations of the Company. It should be read in conjunction with the audited consolidated financial statements and accompanying notes included in this Annual Report on Form 10-K and the supplemental financial data appearing throughout this discussion and analysis. Because the Company’s primary asset is the Bank, the discussion that follows focuses on the Bank’s business and operations.

EXECUTIVE OVERVIEW

Significant accomplishments

In the opinion of its management, the Company’s most significant accomplishments during 2007, which are discussed in more detail in this Item 7, were as follows:

| | • | | Total loans classified as held for investment increased 18.5% |

| | • | | Commercial and industrial loans outstanding at year end increased 20.3% |

| | • | | Average non-interest bearing deposits increased 7.2% |

| | • | | Total deposits at year end increased 10.2% |

| | • | | Non interest income increased 34.9% |

| | • | | Net income available to common shareholders increased 28.5% |

| | • | | Improved operating efficiencies |

Challenges.

The Bank has achieved significant growth without the advent of acquisitions or mergers since first opening its doors in 1997. The financial industry in general is faced with many uncertainties and challenges. As management plans its strategic goals and objectives, future expectations of economic activity, and how these uncertainties could impact the Company’s performance, must be taken into consideration. The challenges that we believe are most likely to have an impact on the operations of the Company in the foreseeable future are presented below:

| | • | | Sustaining profitable growth |

| | • | | Managing margins in an uncertain economic environment |

| | • | | Competition from bank and non-bank entities, including fierce price competition |

| | • | | Uncertainty of commercial real estate regulatory environment |

| | • | | Obtaining adequate funding of asset growth |

| | • | | Meeting capital adequacy requirements |

SELECTED CONSOLIDATED FINANCIAL INFORMATION AND OTHER DATA

Selected Consolidated Financial Information and Other Data are presented in Table 1 of Item 6. The information in this table is derived in part from the audited consolidated financial statements and notes thereto of the Company. The information in this table does not purport to be complete and should be read in conjunction with the Company’s consolidated financial statements that are included in this Annual Report on Form 10-K.

FINANCIAL CONDITION

DECEMBER 31, 2007 AND 2006

The Company reported total assets increasing by $46.3 million, or 11.0%, to $467.2 million at year-end 2007. This growth was principally reflected in increased loans. Loans, excluding those held for sale, increased by $58.1 million, or 18.5%, from $313.6 million at the beginning of the year to $371.7 million at year end. Investment securities decreased by $3.0 million, or 4.1%, from $73.8 million to $70.8 million. The increase in loans was composed principally of increases of $15.8 million in commercial mortgage loans, $20.2 million in residential mortgage loans (including income producing properties) and $7.9 million in commercial and industrial loans, all of which are segments of lending the Company targets and intends to continue targeting in the future. Liquid assets, consisting of cash and demand balances due from banks, interest-earning deposits in other banks and investment securities, were 16.1% of total assets, at December 31, 2007, a decrease from the 20.4% of total assets at December 31, 2006. The Bank, as a member of the FHLB of Atlanta, has an investment of $3.0 million in FHLB stock. The Bank’s investment in life insurance used to offset the cost of employee benefit plans, increased by $290 thousand during 2006 to $7.6 million. The increase was due to an increase in the cash surrender value of the policies.

18

Deposits increased $34.6 million during 2007. Non-interest-bearing demand accounts decreased $4.1 million, or 11.8%, money market and NOW accounts increased $3.5 million, or 4.9%, and time deposits increased $35.7 million or 15.7%, over the amount of such deposits at December 31, 2006. The Bank also used wholesale brokered certificates of deposit and advances from the FHLB of Atlanta, Georgia as funding sources during 2007 to serve as a secondary source of funding asset growth. Borrowings from the FHLB increased from $43.0 million at the end of 2006 to $49.0 million at December 31, 2007. Wholesale brokered certificates of deposit comprised approximately 33.7% of total certificate of deposit balances. Typically brokered certificates of deposit have similar terms to retail certificates of deposit issued in the Bank’s local markets, with rates marginally lower than local market certificates of deposit rates.

Total shareholders’ equity increased by $4.9 million, or 17.3%, during 2007. All capital ratios continue to place the Company and the Bank in excess of the minimum required to be a well-capitalized institution by regulatory measures. The proceeds from the exercising of stock options of $279 thousand during 2007 increased shareholders’ equity by that amount. The Company issued $4.8 million in Non-Cumulative Perpetual Preferred Stock on August 15, 2005 and $8.5 million in Trust Preferred Securities during prior years, so as to remain “well capitalized” under regulatory capital guidelines without diluting existing shareholders’ ownership. The Trust Preferred Securities and Preferred Stock should provide sufficient capital to retain a “well-capitalized” designation as defined by regulatory capital guidelines for the foreseeable future. The Trust Preferred Securities qualify as Tier 1 regulatory capital and are reported in Federal Reserve regulatory reports as a qualifying security in a consolidated subsidiary. The junior subordinated debentures issued to guarantee the Trust Preferred Securities do not qualify as Tier 1 regulatory capital. On July 2, 2003, the Federal Reserve issued a letter, SR 03-13, stating that notwithstanding any potential implications FIN 46 may have on reporting trust preferred securities on financial statements, trust preferred securities will continue to be included in Tier 1 capital until notice is given to the contrary. There can be no assurance that the Federal Reserve will continue to allow institutions to include trust-preferred securities in Tier I capital for regulatory capital purposes. In the event of a disallowance, there would be a reduction in the Company’s consolidated capital ratios. However, the Company believes that the Bank would remain “well capitalized” under FDIC guidelines.

At December 31, 2007, the Bank was considered to be “well capitalized” under the FDIC guidelines.

NET INTEREST INCOME

Similar to most financial institutions, the primary component of earnings for the Bank is net interest income. Net interest income is the difference between interest income, principally from the loan and investment securities portfolios, and interest expense, principally on deposits and borrowings. Changes in net interest income result from changes in volume, spread and margin. For this purpose, “volume” refers to the average dollar level of interest-earning assets and interest-bearing liabilities, “spread” refers to the difference between the average yield on interest-earning assets and the average cost of interest-bearing liabilities and “margin” refers to net interest income divided by average interest-earning assets and is influenced by the level and relative mix of interest-earning assets and interest-bearing liabilities, as well as levels of non-interest-bearing liabilities. During the years ended December 31, 2007, 2006 and 2005, average interest-earning assets were $427.1 million, $379.2 million and $310.0 million, respectively. During these same years, the Bank’s net yields on average interest-earning assets were 3.12%, 3.38% and 3.51%, respectively. The decrease in net yields from 2006 to 2007 is a reflection of the flatness of the yield curve during much of the year and an overall increase in cost of funding earning assets due to extreme competitive pressures in our markets. The Bank’s balance sheet is moderately positioned for stable interest rates. When interest rates change, the Bank’s earnings and net yields may compact.

Table 2, following this discussion, “Average Balances and Net Interest Income”, presents an analysis of the Bank’s net interest income for 2007, 2006 and 2005.

Table 3, following this discussion, “Volume and Rate Variance Analysis”, shows the amounts of changes in net interest income due to changes in volume and rates and illustrates that the change in the average volume of loans and the increase in average deposit rates were the predominant factors in the higher amount of net interest income realized by the Bank in 2007, when compared to 2006.

19

RESULTS OF OPERATIONS

YEARS ENDED DECEMBER 31, 2007 AND 2006

Overview.The Company reported net income available to common shareholders of $4.5 million, or $0.92 per diluted common share, for the year ended December 31, 2007, compared with net income available to shareholders of $3.5 million, or $0.73 per diluted common share, for 2006, an improvement of $1.0 million or $0.19 per diluted share. When adjusted for an after-tax one time adjustment of $579 thousand related to the reversal of accrued benefits originally designated for the benefit of a former executive officer, net income available to common shareholders is $3.9 million, or $0.80 per diluted share, an increase of $412 thousand or 11.8%. Net interest income increased $512 thousand, or 4.0%, in 2007, and the provision for loan losses increased $31 thousand, or 7.9%, while non-interest income increased by $804 thousand or 34.9%. Non-interest expense decreased by $291 thousand or 3.2% in 2007, when adjusted for a $905 thousand pre-tax reversal of accrued benefits originally designated for a former executive officer, non-interest expense totaled $9.7 million in 2007 compared to $9.1 million in 2006, or an increase of 6.8%.

Net Interest Income.Net interest income increased to $13.3 million for the year ended December 31, 2007, a $512 thousand or 4.0% increase from the $12.8 million earned in 2006. Total interest income benefited from strong growth in the level of average earning assets and higher asset yields caused by the increase in interest rates during the year. The rates earned on a significant portion of the Bank’s loans adjust immediately when indexes like the prime rate change. Conversely, a large portion of interest-bearing liabilities, including certificates of deposit and Bank borrowings, have rates fixed until maturity. As a result, interest rate reductions will generally result in an immediate drop in the Bank’s interest income on loans, with a more delayed impact on interest expense because reductions in interest costs will only occur upon renewals of certificates of deposit or borrowings. Interest rate increases will generally result in an immediate increase in the Bank’s interest income on loans, with a more delayed impact on interest expense because increases in interest costs will only occur upon renewals of certificates of deposit or borrowings. Average total interest-earning assets increased $48.0 million, or 12.7%, during 2007 compared to 2006, while the average yield increased by 13 basis points from 7.14% to 7.27%. As interest rates increased during 2007, the average rate on loans increased year over year. The average rate on investment securities increased in 2007 compared to 2006, reflecting management’s decision to purchase higher yielding securities during 2007 as interest rates began to rise. Average total interest-bearing liabilities increased by $42.0 million, or 12.4%, consistent with the increase in interest-earning assets. The average cost of interest-bearing liabilities increased by 45 basis points from 4.21% to 4.66%. With the yield on earning assets increasing less significantly than the cost of interest bearing liabilities, the Bank’s net interest margin decreased by 26 basis points. For the year ended December 31, 2007, the net interest margin was 3.12%, while for the year ended December 31, 2006, the net interest margin was 3.38%. Table 3 reflects the volume and rate variances from 2007 vs. 2006.

Provision for Loan Losses.The Bank recorded $425 thousand as the provision for loan losses in 2007, an increase of $31 thousand from the $394 thousand provision made in 2006. Provisions for loan losses are charged to income to bring the allowance for loan losses to a level deemed appropriate by management. In evaluating the allowance for loan losses, management considers factors that include growth, composition and industry diversification of the portfolio, historical loan loss experience, current delinquency levels, adverse situations that may affect a borrower’s ability to repay, estimated value of any underlying collateral, prevailing economic conditions and other relevant factors. For 2007 the provision for loan losses was made in response to a weakening economy and real estate market in the 4th quarter as well as growth in loans, as total loans outstanding, net of loans held for sale, increased by $58.1 million in 2007 and by $33.6 million in 2006. At December 31, 2007, the allowance for loan losses was $4.5 million, an increase of $240 thousand, or 5.7%, from the $4.2 million at the end of 2006. The allowance represented 1.20% and 1.35%, respectively, of loans outstanding at the end of 2007 and 2006, net of loans held for sale. At December 31, 2007, the Bank had $700 thousand in non-accrual loans. In 2006, the Bank had $794 thousand in non-accrual loans. It is management’s opinion that reserve levels are adequate.

Non-Interest Income.Non-interest income increased to $3.1 million for the year ended December 31, 2007 compared to $2.3 million for the year ended December 31, 2006, an increase of $804 thousand or 34.9%. A one time gain on the sale of other real estate in the amount of $481 thousand accounted for 15.5% of total non-interest income. Excluding the gain on the sale of other real estate, non-interest income increased $323 thousand or 14.0% for 2007. Mortgage operations income decreased to $600 thousand in 2007, from $632 thousand in 2006, reflecting a softening in the overall mortgage origination market. Service charges on deposit accounts in 2007 were $1.1 million, an increase of $114 thousand, or 12.1%, compared to $944 thousand in 2006 reflecting the positive results of a focused marketing effort to increase demand deposit accounts. Table 4, following this discussion, is a comparative analysis of the components of non-interest income for 2007, 2006 and 2005.

20