UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2005

Or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 333-90436

AMERICAN SEAFOODS GROUP LLC

(Exact name of registrant as specified in its charter)

| | |

| Delaware | | 22-3702647 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| |

Market Place Tower 2025 First Avenue Suite 900 Seattle, Washington 98121 | | 98121 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including the area code

(206) 374-1515

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is well-known seasoned issuer, as defined by Rule 405 of the Securities act Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes x No ¨

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, accelerated filer, or non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

| | | | |

Large Accelerated filer ¨ | | Accelerated filer ¨ | | Non-accelerated filer x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The registrant does not have a class of equity securities registered pursuant to Section 12 of the Securities Exchange Act of 1934 and there is no public market for the voting stock of the registrant.

DOCUMENTS INCORPORATED BY REFERENCE: None

TABLE OF CONTENTS

2

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This annual report includes forward-looking statements within the meaning of Section 21E of the Securities and Exchange Act of 1934. All statements other than statements of historical fact are “forward-looking statements.” Some of the statements under “Item 1—Business,” “Item 1A—Risk Factors”, “Item 7—Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and elsewhere in this annual report may include forward-looking statements that reflect our current views with respect to future events and financial performance. Statements that include the words “may,” “estimate,” “continue,” “expect,” “intend,” “plan,” “believe,” “project,” “anticipate” and similar statements of a forward-looking nature identify forward-looking statements.

Although we believe that the expectations reflected in our forward-looking statements are reasonable, all forward-looking statements address matters that involve risks and uncertainties. Accordingly, there are or will be important factors that could cause actual results to differ materially from those indicated in these statements. We believe that these factors include the following:

| | • | | our high degree of leverage and significant debt service obligations; |

| | • | | any future changes in government regulation; |

| | • | | the highly competitive nature of the seafood industry; |

| | • | | the risk of a significant decline in the market price of our products; |

| | • | | the risk of a significant decline in the population and biomass of pollock, other groundfish and catfish stocks in the fisheries in which we operate; |

| | • | | the risk that prices at which we purchase catfish remain at high levels or increase; |

| | • | | environmental conditions and regulations; |

| | • | | the risk of increased litigation against us; |

| | • | | the risk of a natural calamity affecting the U.S. Bering Sea or any of our vessels; |

| | • | | the risk of foreign currency fluctuations; and |

| | • | | other risks that impair our access to and ability to harvest pollock and other whitefish. |

We undertake no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise.

3

PART I

Item 1.Business

Unless the context otherwise requires, references to “we,” “us,” “ASG” and “our” refer to American Seafoods Group LLC and its consolidated subsidiaries.

Overview

We are one of the largest integrated seafood companies in the U.S. in terms of revenues. We harvest and process a variety of fish species aboard our sophisticated catcher-processor vessels, our freezer-longliner vessels and at our land-based processing facilities. We market our products to a diverse group of customers in North America, Asia and Europe. In the U.S., we are the largest harvester and at-sea processor of pollock and Pacific whiting and the largest processor of catfish. Pollock is the world’s highest-volume whitefish harvested for human consumption and accounts for a majority of our revenues. In the U.S., catfish is the basis for a large, commercial aquaculture industry serving major U.S. markets, and according to the Food and Agriculture Organization of the United Nations, or FAO, catfish accounted for approximately 55% of the value of all aquaculture in the U.S. in 2003. In addition, we harvest and/or process additional seafood, including cod, Pacific whiting, scallops and yellowfin sole. We maintain an international marketing network through our U.S., Japan and European offices and have developed long-term relationships with our U.S. and international customer base.

We operate in two principal operating segments, at-sea processing and land-based processing. The at-sea processing segment includes the harvesting and processing of pollock, cod, Pacific whiting and yellowfin sole on our vessels while at sea. The land-based processing segment includes the processing of pollock, cod, catfish and scallops at our facilities in Alabama and Massachusetts.

We own and operate a premier modern fleet of seven catcher-processor vessels, which average over 300 feet in length and carry crews of 90 to 125 persons. Our catcher-processors are capable of producing between 110 and 150 metric tons of frozen finished product daily. We produce a variety of products at sea, such as pollock roe (fish eggs), surimi (a fish protein paste used in products such as imitation lobster and crabmeat), fillet blocks, headed and gutted fish and fishmeal.

We own and operate three freezer-longliners, ranging in length from approximately 125 to 140 feet. These vessels carry an average of 20 crew members and operate in the U.S. Bering Sea/Aleutian Islands Pacific cod fishery, producing headed and gutted cod sold primarily in the European, Asian and North American markets. During 2005, we acquired a catcher vessel,Forum Star, that primarily operates in the cod trawl fishery.

We harvest pollock primarily in the U.S. Bering Sea pollock fishery. According to the Marine Conservation Alliance, this fishery is among the largest and most conservatively managed in the world. In 2004, the Marine Stewardship Council, or MSC, completed a comprehensive four year review of the U.S. Bering Sea pollock fishery and concluded that this fishery met the rigorous MSC criteria as a responsible and sustainably managed fishery. We benefit from the favorable regulatory system that governs pollock fishing in these waters. Under U.S. federal law, the fishery is subject to total allowable catch limitations, quota allocations among the different sectors of participants in the fishery, and rules that give exclusive harvesting rights to specifically identified vessels, with the result that any potential new competitors face significant barriers to entry. We own and operate seven of the 19 catcher-processor vessels permitted to participate in the catcher-processor sector of the fishery. Under the American Fisheries Act, this sector is allocated 40% of the annual directed pollock catch (with 3.4% being allocated to catcher-vessels that deliver to the catcher-processors) and, by the terms of the Pollock Conservation Cooperative agreement, a contractual arrangement among the seven companies that own the catcher-processors named in the statute, this percentage is further divided and allocated among the Cooperative members. Within the catcher-processor sector, our allocation for pollock under the Cooperative agreement is nearly 2.5 times larger than that of the second largest Cooperative member.

4

The U.S. Pacific cod fishery is subject to total allowable catch limitations and quota allocation among the three primary sectors of participants in the fishery: community development quota groups, the fixed gear and the trawl sectors. We participate in the trawl sector with our catcher-processors and one catcher vessel and participate in the fixed gear sector with our freezer-longliners. Of the total quota, 51% is allocated to the fixed gear sector and of that portion, 80% is allocated to the freezer-longliners. A license buyback program is in process, which is expected to reduce the number of licenses available to freezer-longliners once the program concludes. Further efforts to rationalize the cod fishery, such as implementing individual quotas, are currently in process. In 2006, the MSC certified the U.S. Bering Sea/Aleutian Islands Pacific cod fishery as a sustainable managed fishery.

We own and operate two catfish processing facilities in Alabama. We purchase catfish from local farmers and do not own any of the catfish farms. We are not controlled by or affiliated with catfish farmers or their co-operatives. We distribute fresh and frozen catfish products to both retailers and foodservice customers throughout several regions in the U.S. In addition, we conduct land-based processing operations at our facility in Massachusetts, where we manufacture products such as breaded seafood portions, fillets and scallops. We distribute these fresh and frozen seafood products to retailers and foodservice customers throughout the U.S.

Corporate History

On January 28, 2000, American Seafoods, L.P. (ASLP) purchased from Norway Seafoods six catcher-processors, one catcher-vessel, all of the outstanding stock of American Seafoods Company (now referred to as “ASC, Inc.”) and certain assets of Frionor USA (now called “American Seafoods International LLC”). ASC, Inc. was the operator of six of the seven acquired vessels and the owner-operator of one additional catcher-processor vessel. The acquisition was accounted for as a purchase, and all of the debt, assets and goodwill and other intangible assets relating to the acquisition have been “pushed down” to our balance sheet.

In August 2001, we, along with two other partners, formed Pacific Longline Company (PLC) in order to acquire three freezer-longliner vessels. In January 2004, we acquired 100% of the ownership of PLC. PLC harvests and processes primarily Pacific cod in the U.S. Bering Sea.

Effective December 16, 2002, we purchased substantially all of the assets of Southern Pride Catfish Company (now known as “Southern Pride Catfish LLC”). Southern Pride Catfish LLC and its subsidiary, Southern Pride Catfish Trucking, Inc., (collectively, Southern Pride) are engaged in the business of catfish harvesting, processing and distribution. The acquired assets included, among other things, certain real property, fixtures, equipment, accounts receivable, trade name, customer and other contracts, and cash on hand.

In August 2005, we acquired a catcher vessel and related fishing rights from Forum Star, Inc. for an aggregate purchase price of $10.8 million.

On February 27, 2006, ASLP Acquisition LLC, a new company controlled by Bernt O. Bodal, our Chairman and Chief Executive Officer, Coastal Villages Pollock LLC (CVP), one of ASLP’s existing equity holders, and other entities controlled by Bodal or CVP, purchased from Centre Partners and its affiliated funds (Centre), all of Centre’s direct and indirect ownership of partnership interests in ASLP. The aggregate purchase price for Centre’s partnership interests was $81.8 million. ASLP Acquisition LLC and CVP also purchased partnership interests from ASLP partners who had rights to “tag-along” with Centre’s sale. The aggregate purchase price paid to these partners was $34.9 million. ASLP Acquisition LLC owns 20.1% of ASLP.

5

Business Strategy

Over the past decade, we have become one of the largest integrated seafood companies in the U.S. Today, we are committed to building on our existing harvesting, processing and marketing platforms.

The primary components of our business strategy include the following:

Maximize Pollock Revenues

Our pollock harvesting and at-sea processing operations provide a majority of our revenues. Our strategy to maximize pollock revenues includes:

| | • | | Maximize access to pollock resources. Over the last five years, we have increased the share of the total allowable catch we are allowed to harvest in the U.S. Bering Sea pollock fishery by approximately 22%, largely through increasing our purchases of community development quota from Alaska Community Development Groups. Between 1999 and 2005 our purchase of community development quota increased from 5.0% to 54.0% of the total community development quota. We will continue working to maximize our share of the total allowable catch within the applicable regulatory framework. |

| | • | | Optimize product mix to maximize profitability. We will continue our efforts to maximize revenues by optimizing product mix based on global demand and pricing. Each of our vessels is staffed with production managers who coordinate continuously with our marketing department to schedule production between blocks and surimi to optimize product mix and maximize our profitability. |

Continue to Diversify Sources of Revenues

We generate most of our revenues from at-sea processing, primarily comprised of pollock-based products. In addition, we participate in a number of other fisheries, such as the cod, Pacific whiting, and yellowfin sole fisheries. We plan to continue expanding our operations in these and other fisheries, especially within the yellowfin sole fishery, where the market has improved and three of our vessels have extensive catch history. With our Southern Pride and Pacific Longline Company acquisitions, we became both the largest catfish processor in the U.S. and a participant in the freezer-longliner sector of the U.S. Bering Sea Pacific cod fishery and, therefore, have significant market positions in pollock, catfish and cod, the top three whitefish species in terms of U.S. human consumption. In addition, we have state of the art processing facilities to produce scallops, a market we entered into in 2001.

Leverage International Marketing Network

We are currently expanding our presence in worldwide seafood markets, with a particular focus on the Asian and European markets, to increase and diversify our customer base and global seafood market share. We have expanded our Japanese office in an effort to increase direct distribution to end-users and to gain an entryway into growing markets such as South Korea and China. We expect that, over time, increasing local market presence in Asia will help maintain price stability through long-term contracts, improve production planning, strengthen customer relationships and provide us with marketing and sales advantages. Additionally, we believe that a strong local market presence will provide us with an opportunity to introduce new species and product forms into the Asian market and enhance relationships with distributors in Japan. We have a sales office in Denmark to serve the growing European market for pollock block, which in the past has been supplied primarily with Russian pollock. We believe that our access to pollock resources in the U.S. Bering Sea pollock fishery provides us with a competitive advantage in implementing our strategy to increase our presence in Europe.

Pursue Strategic Acquisitions

We intend to evaluate and selectively pursue accretive opportunities that we believe are strategically important based on their potential to diversify our product and customer base, broaden our distribution network and increase our cash flow.

6

Industry and Regulatory Overview

According to the FAO, the worldwide production of seafood, excluding aquatic plants, has increased steadily at a compounded annual growth rate of approximately 2.3% from approximately 105 million metric tons in 1993 to approximately 132 million metric tons in 2003 and is projected to increase slightly from 2004 to 2010, resulting in large part from increasing world population and continued economic growth in developing countries. In 2003, the supply provided by marine and inland fisheries, or capture fisheries, accounted for approximately 90.2 million metric tons, or approximately 68% of that amount. Worldwide seafood production of capture fish has remained stable in recent years. The growth in worldwide seafood production is primarily related to increased fish farming, or aquaculture. From 1990 to 2003, the amount of seafood produced in aquaculture worldwide grew at a compounded annual growth rate of approximately 9% from approximately 13.1 million metric tons to approximately 41.7 million metric tons.

Due to its higher cost per ton of fish produced, aquaculture is used primarily to produce higher value fish species such as catfish and salmon. Aquaculture is not a cost effective alternative for lower value fish species such as pollock or Pacific whiting.

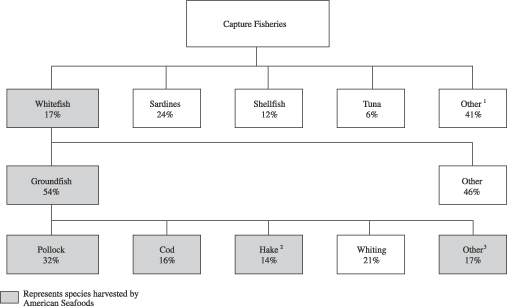

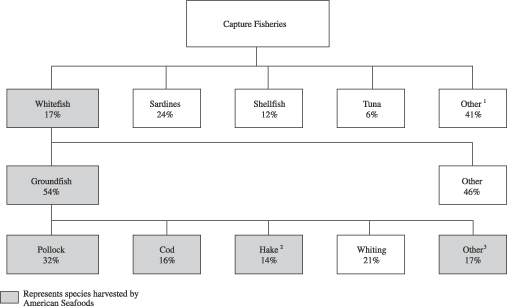

Capture Fisheries

The following chart provides a brief overview of the different categories of fish caught in the wild for human consumption and use in 2004, including the different species of groundfish which we harvest. The table indicates the percentage each species represents of the volume of each category harvested from capture fisheries.

| 1 | Represents species each accounting for less than 5% of the volume of finished products produced from capture fisheries. |

| 2 | Pacific whiting is the only species we harvest in this category. |

| 3 | Yellowfin sole is the only species we harvest in this category. |

Source: FAO Fishstat Plus Database, 2004.

In 2003, approximately 17.0 million metric tons of whitefish were produced worldwide. The whitefish category includes groundfish (such as pollock, Pacific whiting and cod), flatfish (such as sole), and the redfish, bass and conger species groups. From 1990 to 2003, the worldwide production of groundfish has fluctuated between 8.4 million and 11.6 million metric tons. We are the largest harvester and at-sea processor of groundfish

7

in the U.S. Pollock, the species representing a substantial majority of our harvest, is the most abundant whitefish and groundfish species in the world.

Aquaculture

The following chart provides a brief overview of the different categories of fish produced by aquaculture in the U.S. in 2003. In 2003, approximately 31.6% of the seafood produced worldwide was produced in aquaculture. In 2003, according to the FAO, catfish accounted for approximately 55% of the volume of all aquaculture in the U.S., the primary market in which we sell catfish. We are the largest catfish processor in the U.S.

The following table outlines the percentage each segment represents of total U.S. aquaculture production.

Groundfish

Pollock Fisheries

Pollock accounted for 31% of groundfish produced worldwide in 2003, representing 2.9 million metric tons, which is more than any other groundfish species. The two primary global pollock sources are the U.S. Bering Sea pollock fishery, the primary fishery in which we operate, and the Russian pollock fisheries in the Sea of Okhotsk and Bering Sea. The pollock biomasses in these U.S. and Russian pollock fisheries are independent of one another, with virtually no co-mingling between these stocks. Pollock stocks in the U.S. Bering Sea pollock fishery have remained relatively stable since 2001. Pollock stocks in Russia have increased in recent years, although they remain below historical levels. According to TINRO, Wespestad & Ianelli, the Russian fisheries’ pollock stocks are expected to remain at their current levels over the next several years. Approximately 53% of the pollock produced worldwide in 2003 came from the U.S. Bering Sea pollock fishery, up from 30% in 1999.

Between 2001 and 2004, U.S. pollock quotas have remained relatively stable. Russian pollock quotas have declined during that period, but have rebounded in recent years. The total Russian pollock quota in 2006

8

increased by 3% from the 2005 level, up to 1,081,050 metric tons. The quota in the Sea of Okhotsk, the primary Russian fishing area, is down compared to the 2005 level by 4%, to 489,000 metric tons.

The map below represents the U.S. Bering Sea pollock fishery and the Russian pollock fisheries in the Sea of Okhotsk and Bering Sea, our primary competing fisheries.

U.S. Pollock Fishery. According to the Marine Conservation Alliance, the U.S. Bering Sea pollock fishery is one of the healthiest and most responsibly managed fisheries in the world. In contrast to the general world trend of declining groundfish stocks, the U.S. Bering Sea pollock fishery is generally characterized by abundant fish stocks and conservative management. In 2004, the MSC completed a comprehensive four year review of the U.S. Bering Sea pollock fishery and concluded that the fishery met the MSC criteria for a responsible and sustainably managed fishery. We believe the MSC fishery certification guidelines are among the most rigorous guidelines for fishery management assessment in the world. Since the inception of the MSC review program only fifteen fisheries worldwide have received this certification.

The U.S. Bering Sea pollock fishery is highly regulated. Only 19 specifically identified catcher-processor vessels, of which we own seven, can participate in the catcher-processor sector of the fishery. Pollock matures relatively quickly, with fish aged three to seven years contributing most significantly to the commercial fisheries. Rapid growth allows a relatively high portion of the pollock biomass to be harvested each year without impacting overall population. According to the National Marine Fisheries Service, the body that conducts pollock stock assessments and recommends sustainable harvest limits in this fishery, approximately 25% of this fishery’s 2006 pollock biomass could be harvested without causing over fishing to occur. The federal government typically sets harvest limits in the 10% to 20% range, below the levels the National Marine Fisheries Service views as sustainable.

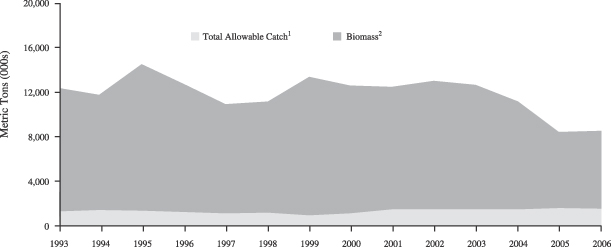

9

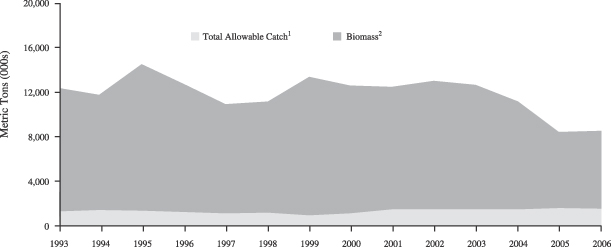

The National Marine Fisheries Service considers the current U.S. Bering Sea pollock population healthy and stable. The National Marine Fisheries Service’s population models for pollock in the U.S. Bering Sea pollock fishery show that between 1993 and 2006, the estimated biomass has averaged approximately 10.7 million metric tons. Although the estimated biomass has fallen in recent years, it remains above levels considered sustainable based on current fishing practices. The following graphic indicates the historical pollock total allowable catch and biomass in the U.S. Bering Sea pollock fishery:

U.S. Bering Sea Pollock Fishery Total Allowable Catch/Biomass

| 1 | Source for 1993 to 1998: National Marine Fisheries Service; source for 1999 to 2005: North Pacific Fishery Management Council; Amounts for 1999 and thereafter refer to the total allowable catch for the Eastern Bering Sea only. |

| 2 | Source for 1993 to 2005: Eastern Bering Sea Walleye Pollock Stock Assessment from Alaska Fisheries Science Center and National Marine Fisheries Service, November 2005. |

The pollock fishery in the U.S. Bering Sea is seasonal. The winter or “A” season takes place from January to April and the summer/fall or “B” season runs from June through October. Since 1998, the year the American Fisheries Act was passed, the National Marine Fisheries Services has permitted participants in the U.S. Bering Sea pollock fishery to harvest 40% of the annual quota during the “A” season and the remaining 60% during the “B” season. During the “A” season, spawning pollock produce large quantities of high-value roe, making this season the more profitable one.

Other Groundfish Fisheries

In addition to harvesting and processing pollock, we participate in the catcher-processor and mothership sectors of the U.S. Pacific whiting fishery and in the catcher-processor and freezer-longlinger sector for the U.S. Bering Sea Pacific cod fishery. In 2003, the U.S. Pacific whiting and cod fisheries represented approximately 13% and 19% of the worldwide production of Pacific whiting and cod, respectively. In February 2006, the MSC certified the U.S. Bering Sea and Aleutian Islands freezer-longliner fishery for Pacific cod. According to the FAO, from 1990 to 2003, the worldwide production of Pacific whiting has varied from a low of approximately 1.0 million metric tons in 1992 to a high of approximately 1.7 million metric tons in 1996. Worldwide production of cod has dropped considerably over the last two decades (mostly attributable to a decline in Atlantic cod) from approximately 2.6 million metric tons in 1981 to approximately 1.3 million metric tons in 2003. We believe this decrease in cod led to the spike in cod pricing in the early 1990s and the conversion of most fillet customers to lower-priced, relatively more abundant pollock as a primary source of groundfish. Over the past five years, the

10

total increase in the U.S. Bering Sea Pacific cod quota was approximately 3% from 188,000 metric tons in 2001 to 194,000 metric tons in 2006.

Harvesting by catcher-processors in the U.S. Pacific whiting fishery is conducted on a cooperative basis similar to the system in place for pollock fishing; the mothership sector for Pacific whiting is conducted on an “Olympic-style” or “open access” basis, meaning that any vessel licensed to operate in the fishery may harvest as much fish as possible until the fishery’s seasonal quota allocation has been reached. Harvesting in the U.S. Pacific cod fishery is Olympic-style but with limited licenses allowed to participate in the fishery.

Groundfish Consumption

Pollock and cod are the first and third, respectively, largest whitefish species in terms of human consumption. There are three primary markets for groundfish products produced for human consumption: Asia, Europe and North America. The Japanese use groundfish primarily to produce surimi (a fish protein paste used in products such as imitation lobster and crabmeat), roe and a variety of fresh-fish products. Consumers in Western Europe and the United States generally purchase groundfish in the form of fresh and frozen fillets, products produced from blocks of fillets and headed and gutted fish.

According to the National Fisheries Institute, through 2004 per capita consumption of pollock has experienced stable growth since 1987 at a compounded annual growth rate of approximately 2.2% per annum.

Groundfish Pricing

Each of the products produced from pollock has different pricing characteristics. The price of pollock roe is heavily influenced by the size and condition of roe skeins, color and freshness of the roe and the maturity of the fish caught. Catcher-processors are more likely to produce higher quality roe because they process the fish within hours of being caught, rather than several days later as is the case with inshore processors. In addition, roe prices are influenced by anticipated Russian and U.S. production and Japanese inventory carry-over, because roe is consumed almost exclusively in Japan. The U.S. Bering Sea pollock fishery commonly produces the highest quality roe.

The prices of surimi and fillets are influenced primarily by expected production in the U.S. and Russian pollock fisheries, and other factors such as carry-over inventories and changes in demand. Because surimi and fillet blocks often are composed of the same raw material, the demand for one product can influence the price of the other. Surimi and fillet blocks are also produced utilizing species of fish other than pollock, such as Pacific whiting or itoyori species. However, due to differences in flesh attributes between pollock and other species, the surimi and block produced from other species are generally not used as substitutes for pollock products yet could potentially have some influence on pollock pricing. Fillet blocks are often supplied by both the U.S. Bering Sea pollock fishery and the Russian fisheries.

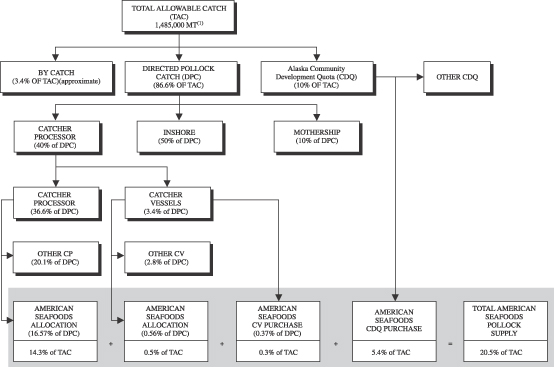

Pollock Allocation

We operate within a favorable statutory and regulatory environment. The stable nature of the U.S. Bering Sea pollock fishery is partly a function of the regulatory and cooperative structure that governs its activities. The American Fisheries Act specifically identifies the catcher-processor vessels that are eligible to participate in the fishery, prohibits the entry of additional vessels and prohibits any single entity from harvesting more than 17.5% of the annual directed pollock catch.

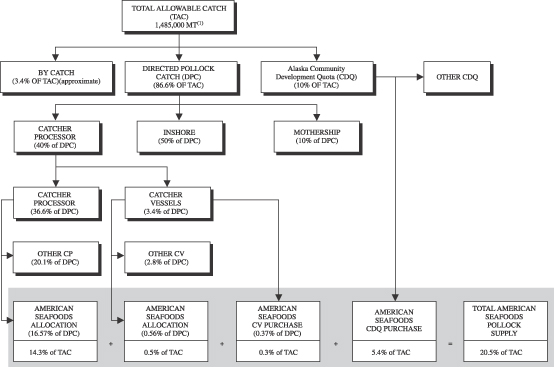

The Act allocates the total allowable catch of pollock in the U.S. Bering Sea pollock fishery among the following sectors:

| | • | | 10% of the total allowable catch is allocated to six Alaska Community Development Groups (mostly native Alaskan villages and their residents) that sell or lease their community development quota to other participants, including us; |

11

| | • | | approximately 3.4% of the total allowable catch is set aside for pollock by-catch in other fisheries; |

| | • | | the remaining 86.6% of the total allowable catch (the “directed pollock catch”) is allocated as follows: |

| | ¨ | | 50% of the directed pollock catch is allocated to catcher-vessels delivering to inshore factories; |

| | ¨ | | 40% of the directed pollock catch is allocated to catcher-processors, and catcher-vessels that deliver to catcher-processors; and |

| | ¨ | | 10% of the directed pollock catch is allocated to the catcher-vessels that deliver to at-sea processor vessels called motherships, which do not harvest. |

Catcher-processors, such as the vessels we own, harvest and process fish into products, such as roe, fillets and surimi, within hours of catching them, and operate offshore. Catcher-vessels harvest and deliver fish to catcher-processors, motherships and inshore processors for processing. Motherships are at-sea processors which rely on catcher-vessels to harvest and deliver fish to them. Inshore processors operate onshore at fixed-location processing facilities, relying on catcher-vessels to harvest and deliver fish to them.

We own and operate seven of the 19 catcher-processor vessels permitted to participate in the catcher-processor sector of the U.S. Bering Sea pollock fishery. Under the American Fisheries Act, this sector is allocated 40% of the annual directed pollock catch and, by the terms of the Pollock Conservation Cooperative agreement, a contractual arrangement among the seven companies that own the catcher-processors named in the statute, this percentage is further divided and allocated among the Cooperative members (with 3.4% being allocated to catcher-vessels). Within the catcher-processor sector, our allocation for pollock under the Cooperative agreement is nearly 2.5 times larger than that of the second largest Cooperative member.

In 2003, 2004 and 2005, we harvested an aggregate of 18.7%, 20.1% and 20.5%, respectively, of the total allowable catch in the U.S. Bering Sea pollock fishery. We are allocated 17.1% of the directed pollock catch under our Cooperative agreements, and we lease the right to harvest another 0.4% of the directed pollock catch from other vessels in our fishery, bringing us to 17.5% of the directed pollock catch (which is the maximum permitted harvesting allocation of the directed pollock catch by any single entity). Our share of the directed pollock catch represented 15.1% of the total allowable catch. We supplemented our share of the directed pollock catch in 2003, 2004 and 2005 by purchasing approximately 36.0%, 54.0% and 54.0%, respectively, of the community development quota (or 3.6%, 5.4% and 5.4%, respectively, of the total allowable catch) from Alaska Community Development Groups, two of which are equity investors in our company.

Catfish

Catfish production has grown steadily since the earliest commercial production began. According to the FAO, worldwide production of catfish was approximately 978,000 tons in 2003, up from 472,000 tons in 1990, representing an increase of approximately 107% over 14 years. Of this amount, approximately 58% came from aquaculture and approximately 42% came from capture fisheries.

A large amount of catfish produced in the U.S. comes from independently owned and operated local family farms. The catfish raised in these farms are typically sold to processors, such as ourselves. We purchase catfish from local farmers and do not own any catfish farms. We are not controlled by or affiliated with catfish farmers or their co-operatives. The catfish is processed into various ready to consume products such as fillets, nuggets and marinated and breaded products.

Prior to 1999, the total amount of catfish imports in the U.S. was insignificant, representing less than 5% of the volume of catfish sold. Beginning in 1999, there was an increase in catfish-like imports from Vietnam. In November 2002, the Department of Commerce, or DOC, made a preliminary ruling that the Vietnamese were selling catfish-like products into the U.S. at unfairly low market prices. The DOC issued its final ruling in July 2003, imposing import duties on Vietnamese catfish and other aquaculture exports, which is still in effect.

12

Worldwide catfish consumption is concentrated in the U.S., Asia, Africa and, to a lesser degree, in Central Europe. There is very little catfish consumption in Western Europe or Japan. According to the National Fisheries Institute, in the U.S., per capita catfish consumption has surpassed cod and is now the second largest selling whitefish behind pollock. According to the National Fisheries Institute, through 2004 U.S. per capita catfish consumption, like pollock consumption, has experienced stable growth since 1990 at a compounded annual growth rate of approximately 3.2% per annum since 1990. The majority of this growth has occurred in aquaculture, the sector in which we operate.

In the U.S., the catfish market has evolved over the last decade from being a regional commodity, locally produced and consumed predominantly in the southern U.S., to a large, commercial aquaculture industry serving major U.S. markets. In 2003, according to the FAO, catfish accounted for approximately 48% of the value and 55% of the volume of all aquaculture in the U.S. The U.S. catfish industry is concentrated in Alabama, the region in which we operate, as well as Mississippi, Arkansas and Louisiana. We are the largest catfish processor in the U.S., processing approximately 100 million pounds of catfish per year.

Catfish harvests are seasonal, following the warm weather-growing cycle of the fish. Farmers prefer to harvest their ponds at the end of the summer, after the period in which the fish experience their maximum weight gain and before the fish enter a period of slower growth during the winter. The harvest slows modestly during November and December due to reduced demand during the holiday season and picks up again in the beginning of the year. This leads to a seasonal abundance of fish between late summer and early winter, the time of year when catfish prices are usually at their lowest.

Products

There are three steps in preparing pollock for retail sale: harvesting, primary processing and secondary processing. At-sea catcher-processor vessels harvest fish and conduct primary processing to produce products such as fillets, surimi and roe. These products are further refined and packaged for retail sale by secondary processing companies in the United States, Asia (mainly Japan) and Europe, which produce products such as breaded seafood portions, imitation crabmeat and fish sticks.

The sale of pollock roe is our highest margin business. The fish we catch (after extraction of roe, if applicable) is either processed into surimi or fillet blocks. Each fish is first filleted and incremental flesh is removed from the carcass and sent to the surimi line. The fillets are then either inspected and frozen in block form, or minced and used to produce surimi. The manufacturing processes for surimi and fillet blocks generate different quantities of salable product from each fish.

We process fish into the following products:

At-Sea Processing Segment:

| | • | | Roe. Roe is extracted from spawning fish, which are harvested primarily during the winter and spring. Egg sacs are sorted by size and quality and frozen on the vessels. The egg sacs are then salted and dyed by processors in Asia for sale to consumers. We produce roe primarily from pollock and to a lesser extent from cod. We sell roe primarily to large Japanese and Korean importers. |

| | • | | Block. We produce different types of block products such as skinless, boneless, pin bone out, pin bone in, deepskin and minced blocks. The frozen blocks are cut into different sizes, shapes and weights by our secondary processing operations for conversion into products such as breaded and battered fish sticks and fillets. We sell block produced from pollock, Pacific whiting and cod. We sell most of our block products to foodservice customers, restaurant chains, retailers or large scale secondary processors in Asia, Europe and North America, including to our land-based processing affiliates. |

| | • | | Surimi. Surimi is a tasteless fish paste used as the primary protein in numerous Asian dishes and, to a lesser extent in Europe and the U.S. We produce surimi from pollock and Pacific whiting. We sell |

13

| | surimi as a commodity to importers and large-scale distributors, who then sell it to processors as a raw ingredient. Outside of Japan, the most recognized surimi products are imitation crab, shrimp, scallops and other similar products. Over 1,000 different products are made from surimi. |

| | • | | Fishmeal. Fishmeal is produced from fish by-products, primarily frames, guts and heads of pollock, Pacific whiting and yellowfin sole. We sell fishmeal primarily in China, Taiwan and Japan, where it is used as the main ingredient in aquaculture feeds. |

| | • | | Other. We produce headed and gutted fish from cod which is sold primarily to secondary processors in Europe, Japan and the East coast of the U.S. We produce whole round yellowfin sole which is sold primarily to secondary processors in Korea and China for conversion into individual skinless, boneless fillets. |

Our product sales value in dollars and as a percentage of total sales including intersegment sales, broken out by product type and geographic region for 2005, in our at-sea processing segment, including other revenues, are as follows:

| | | | | | |

| | | 2005 | |

| | | Amount of

Sales | | Percent of

Total Sales | |

| | | (in millions other than percentages) | |

Roe | | $ | 80.9 | | 24.6 | % |

Block | | | 106.2 | | 32.3 | |

Surimi | | | 106.0 | | 32.3 | |

Fishmeal | | | 13.3 | | 4.0 | |

Other | | | 22.2 | | 6.8 | |

| | | | | | |

Total | | $ | 328.6 | | 100.0 | % |

| | | | | | |

| | | | | | |

| | | 2005 | |

| | | Amount of

Sales | | Percent of

Total Sales | |

| | | (in millions other than percentages) | |

North America | | $ | 57.0 | | 17.3 | % |

Japan | | | 137.4 | | 41.8 | |

Europe | | | 86.3 | | 26.3 | |

Asia (other than Japan) | | | 47.9 | | 14.6 | |

| | | | | | |

Total | | $ | 328.6 | | 100.0 | % |

| | | | | | |

Land-Based Processing Segment:

| | • | | Fresh. We sell fresh catfish and scallops. Catfish is sold to foodservice customers and retailers in the U.S. Fresh scallops are sold to wholesalers and high-end restaurants in the U.S., as well as to selected importers to the European Union. |

| | • | | Individually Quick Frozen. Individually quick frozen products are skinless fillets or scallops frozen into individual portions rather than blocks. The individually quick frozen portions are of various sizes and are processed for conversion into “center of the plate” and breaded and battered products. Most of our individually quick frozen products are produced from groundfish, catfish and scallops. We sell our individually quick frozen products to foodservice customers and retailers in the U.S. |

14

Our product sales value in dollars and as a percentage of total sales, broken out by product type and geographic region for 2005, in our land-based processing segment are as follows:

| | | | | | |

| | | 2005 | |

| | | Amount of Sales | | Percent of Total Sales | |

| | | (in millions other than percentages) | |

Individually fresh frozen | | $ | 147.1 | | 71.1 | % |

Fresh | | | 59.8 | | 28.9 | |

| | | | | | |

Total | | $ | 206.9 | | 100.0 | % |

| | | | | | |

| |

| | | 2005 | |

| | | Amount of Sales | | Percent of Total Sales | |

| | | (in millions other than percentages) | |

North America | | $ | 202.2 | | 97.7 | % |

Europe | | | 2.3 | | 1.1 | |

Asia | | | 2.4 | | 1.2 | |

| | | | | | |

Total | | $ | 206.9 | | 100.0 | % |

| | | | | | |

We are continually designing and employing new factory technologies. We employ a full time technical engineer who investigates and designs processing factory improvements. We seek to increase the value of the products produced aboard our vessels and in our land-based processing facilities and to strive to reduce labor and associated costs wherever possible. One example of these efforts is a patented machine that successfully takes the fish head (which previously went entirely to fishmeal) and removes a relatively large section of meat used for higher-value surimi or minced products. We are also investigating new technology that will grade fillets automatically with the use of computers and scanners and that could potentially reduce our labor costs.

Sales, Marketing and Distribution

Overview

We have an international marketing network with offices in the United States, Japan and Denmark. We market, sell and distribute products for two distinct types of customers: the industrial market and the foodservice/retail market. The products we produce through primary processing on board our catcher-processor vessels are sold as a raw material into the industrial market and used by our customers to produce ready to consume end products. The products we produce through secondary processing at our facility in Massachusetts and at our catfish facilities in Alabama are sold in a ready to consume format to the foodservice/retail markets.

In 2005, industrial customers and foodservice/retail customers comprised approximately 60% and 40% of our revenues, respectively. Our industrial sales force consists of sales representatives and brokers targeting an international group of customers primarily in Asia, Europe and North America regions. Our foodservice and retail sales and marketing operations include a network of approximately 40 brokers throughout the U.S. This broker network sells and distributes on average in excess of one million pounds of processed, ready to consume catfish, scallops and breaded pollock or cod per week.

Our office in Denmark reflects our strategy to build a long-term presence in the European markets that will enable us to capitalize on seafood consumption growth trends in previously underserved markets such as France, Spain, Italy and Germany. In addition, we have expanded our Japanese office in an effort to increase direct distribution to end-users and to gain an entryway into growing markets such as South Korea and China.

In 2004, the MSC completed a comprehensive four year review of the U.S. Bering Sea pollock fishery and concluded that it met the rigorous MSC criteria for a responsible and sustainably managed fishery. In February

15

2006, the MSC also certified the U.S. Bering Sea and Aleutian Islands freezer-longliner fishery for Pacific cod. The MSC certification allows us to use the MSC ecolabel on our products. Products displaying the MSC ecolabel assure buyers and consumers that the seafood they purchase come from a responsible and sustainably managed fishery.

Industrial Market

Our primary processing operations focus on products used as raw materials by secondary processors serving end markets throughout the world. We harvest, manufacture and market frozen at-sea products from the Bering Sea and North Pacific. The products produced onboard our catcher-processors and freezer-longliners are specifically made for industrial processors that convert the frozen fillet blocks, headed and gutted fish and surimi products into breaded portions, individual fillets and surimi-based products like imitation crab meat. Roe is salted and dyed by processors in Asia for sale to consumers. Roe is sold to consumers as fresh or frozen whole skeins, or as bags of eggs removed from the skeins. The whole skeins are considered a high-end gourmet food product and are used for gift giving in Japan. We develop annual marketing and sales plans for our products based on anticipated demand and market pricing. We review these plans continuously and, if necessary, adjust them during the season. Because most of our vessels can easily switch between producing surimi and fillet blocks, during each season we constantly monitor and adjust the product mix to meet market demand.

Depending on the product and customer, we negotiate either seasonal or long-term contracts. We have traditionally entered into revolving arrangements in which several larger customers commit to purchase all surimi produced on a specific vessel. Prior to each fishing season, we typically enter into sales commitments for 70% to 90% of our expected production. Final pricing usually occurs during the season or shortly thereafter, based on general pricing in the market. Over the years, we have built good relationships with our core customer base.

We generally sell our pollock roe through a combination of direct sales and silent auctions to Japanese industrial customers. Prior to the commencement of the pollock “A” season, we frequently enter into agreements to sell a specified percentage of the standard grade roe production from certain vessels to particular customers. In 2005, that percentage was 50% for each of our vessels. Under these agreements, the final sales price for the roe sold to the customers is generally identical to the price at which the remainder of the vessels’ roe production is sold at auction. Depending on the quantity of production, the roe of the pollock “B” season is sold through a similar procedure, entirely by auction or through direct negotiated sales with major customers.

Through our brand names “Pride of the Sea,” “American Pride” and “Southern Pride Catfish,” we are a well recognized supplier of industrial and secondarily processed products, and we maintain a strong market position in Japan, the United States, parts of Europe and parts of Asia.

Foodservice and Retail Markets

We focus on selling, marketing and distributing seafood products produced in our four secondary processing facilities to the foodservice and retail channels utilizing our own scalable distribution system and a national broker network. We market products such as breaded portions, fresh and frozen fillets, fresh and frozen sea scallops, and single serve portions under our national brands “American Pride,” “Frionor,” and “Southern Pride Catfish,” as well as under private label brands. The majority of our sales are in the foodservice channel and about one third of our products are sold retail through either seafood specialty shops, grocery or club stores. We market sea scallops in the retail grocery and restaurant channels. The product mix is about 2/3 frozen and 1/3 fresh. Approximately 45% of our foodservice and retail products are delivered through our own fleet of trucks.

We are increasingly emphasizing direct selling, particularly to national restaurant chains in the growth segments of the foodservice industry. We focus our marketing efforts on a consultative selling approach featuring culinary and resource support that assists customers to develop their seafood businesses. We complement our marketing efforts by developing innovative high quality products that also solve specific customers’ challenges, such as scarce labor and food safety.

16

Customers

We have established long-term relationships with a number of key customers worldwide. Our customer base includes industrial importers, foodservice distributors, food retailers, restaurants and reprocessing companies.

For surimi and roe products, our customers have primarily been Japanese and South Korean importers and large scale distributors. Over the past few years, we have focused on broadening our customer base and have been building closer relationships directly with key Japanese food manufacturers. We participate in the growing European surimi market, particularly in France and Spain. The headed and gutted cod products produced aboard our freezer-longliners are primarily sold in the European, Asian and North American markets.

The United States is our primary market for pollock deepskin blocks and catfish products. For pollock deepskin product, we have established long-term customer relationships, including multi-year or multi-season supply contracts with three of the largest U.S. pollock deepskin customers. Our catfish products are sold to a diversified customer base made up of retail, foodservice and specialty seafood distributors.

The table below lists alphabetically our 15 largest customers by revenues in our at-sea processing segment in 2005:

| | | | | | |

Customer | | At-Sea Processing Product | | Market Segment | | Country |

Con Agra Foods | | Pacific Whiting, Pollock surimi | | Retail manufacturer/foodservice | | USA |

Davigel—SA | | Pollock, Pacific Whiting | | Retail manufacturer/foodservice | | Europe |

Frozen Fish International | | Pollock block, deepskin/mince | | Retail manufacturer/foodservice | | Germany |

Golden Tech International | | Pollock roe, surimi, yellowfin | | Importer | | USA |

Gortons of Gloucester | | Pollock block, deepskin/mince | | Retail manufacturer/foodservice | | USA |

Hohsui Corporation | | Roe | | Importer | | Japan |

Kibun Foods USA Inc. | | Surimi | | Importer/retail manufacturer | | Japan |

Nichimo Company Ltd. | | Surimi/roe | | Importer/retail manufacturer | | Japan, USA, Europe |

Ocean Resource Macao

Commercial Offshore | | Fishmeal | | Importer/manufacturer | | China |

Osaka Uoichiba Co Ltd. | | Surimi/roe | | Importer | | Japan |

Peter Pan Seafoods Inc. | | Roe | | Importer/retail manufacturer | | Japan, USA |

Samho America Inc. | | Roe and surimi | | Importer | | Korea |

SIF SA | | H&G Cod, Pollock block, mince, Pacific Whiting | | Retail manufacturer/foodservice | | Europe |

Tokai Denpun | | Surimi/roe, fishmeal | | Importer | | Japan |

Youngs Bluecrest SFD | | Pollock block, deepskin/mince | | Retail manufacturer | | United Kingdom |

The table below lists alphabetically our 15 largest customers by revenues in our land-based processing segment in 2005:

| | | | | | |

Customer | | Land-based Processing Product | | Market Segment | | Country |

Ben E Keith | | Frozen Catfish, Scallops | | Foodservice Distributor | | USA |

Costco Wholesale | | Frozen Scallops | | Club Store | | USA |

Darden Restaurants | | Catfish & Scallops | | Restaurant | | USA |

Dot Foods | | Frozen Catfish | | Distributor | | USA |

Ela Foods | | Scallops | | Importer | | France |

MBM Corporation | | Processed fish | | Distributor | | USA |

Performance Food Group | | Catfish & Processed Fish | | Foodservice Distributor | | USA |

Reinhart Foods | | Catfish & Processed Fish | | Foodservice Distributor | | USA |

Seacliff Seafoods | | Fresh & Frozen Catfish | | Retail Distributor | | USA |

Star Fisheries | | Fresh & Frozen Catfish | | Retail Distributor | | USA |

Sysco Corporation (all divisions) | | Fresh & Frozen Catfish, Scallops | | Foodservice Distributor | | USA |

Tampa Bay Fisheries | | Fresh Catfish | | Processor | | USA |

US Foodservice | | Frozen Catfish, Scallops | | Foodservice Distributor | | USA |

Walmart | | Catfish | | Retail Store | | USA |

Yum! Brands Inc. (LJS division) | | Processed fish | | Restaurant | | USA |

In 2005, our two largest customers accounted for approximately 5% each of our total revenues.

17

Operations

At-Sea Processing

Harvesting operations. Our catcher-processor vessel captain and fishmaster utilize highly sophisticated fish finding technology to identify the size of the fish and the location and density of the school, allowing the vessels to optimize the catch and resource value. Once the fishmaster identifies a fishing area, a mid-water trawl net, which includes cone-shaped nets, is towed behind the vessel. The fishing captain monitors the catch sensors attached along the portion of the net that holds the fish. When the optimal catch level is reached and the net is wound in, the fish are immediately dropped into tanks to await processing.

Aboard our freezer-longliners, we harvest cod using several long lines with baited hooks, which are released from the vessel and weighted on one end to allow the baited hooks to float in mid water. This method of fishing allows us to realize an optimal finish fish product that translates into higher market prices for the longline cod products.

Processing operations. Within hours, harvested fish are converted into primary processed products utilizing highly automated, continuous production processes. In the first phase of processing, fish are released from the holding tanks onto a conveyer, sorted according to size and diverted into hoppers at the head of one of the several processing lines. Headed and gutted pollock are run through an additional line which extracts roe skeins intact. These skeins are weighed, graded, packaged in groups according to grade and frozen. Fish that have been headed and gutted are either frozen as-is or filleted for conversion into either surimi or frozen fillets.

Shipping and cold storage logistics. We have established relationships with shipping agents throughout Europe and Asia to take advantage of favorable distribution and cold storage rates and service, and we have secured cold storage space in the U.S., Canada, Europe and South Korea to ensure timely delivery of quality products at the most cost efficient rate. Also, through our integrated structure, our harvesting operations utilize the cold storage facility of our secondary processing operations for East Coast shipments, further reducing storage costs.

Land-Based Processing Products

Catfish. The catfish we buy are raised in ponds by independent catfish farmers with whom we have contractual relationships. Prior to harvesting catfish, sample fish are tested. They are loaded into baskets and then placed in our aerated tank trucks for live shipment to our processing plants. Unlike a large number of our competitors that depend on farmers to deliver catfish to their plants, we operate our own in-house harvest and live-haul departments, the largest in the nation. Prior to the trucks being unloaded into our plant, sample fish are again tested. At the plant, live catfish are transferred from aerated trucks to the processing lines. The catfish are cleaned, processed, and placed on ice or frozen using an individually quick-frozen method that preserves the taste and quality of the catfish. The frozen catfish can also be breaded and battered. The processing lines and the production processes are highly automated and generally similar to those onboard our catcher-processor vessels, with the exception of some secondary processing operations.

Breaded and battered operations. Pollock is the primary whitefish used in low cost, breaded and battered fish products for the foodservice and retail frozen product markets. We convert raw fish blocks, primarily pollock blocks produced by our harvesting operations, into market ready, frozen, cut or formed, breaded and battered portions. Our products include raw breaded, pre-cooked, batter fried, glazed and dusted products.

Scallop processing operations. We operate a state-of-the-art wet-fish processing facility focused primarily on grading and processing scallops. We purchase scallops from scallop harvesters. Scallops are graded by size and quality and processed into either premium or standard products. We utilize industry leading processing equipment and food technology in the production of our scallops which generally reduce production time and manual labor.

18

Government Regulation

Fisheries Regulation

All U.S. fisheries in which we operate are regulated and subject to total allowable catch limits. Participants in U.S. federal fisheries are required to obtain a federal government permit.

We operate in the groundfish fisheries within the U.S. Exclusive Economic Zone, 3 to 200 nautical miles off the coasts of Alaska, Washington and Oregon. According to the National Marine Fisheries Service, no species in the U.S. Bering Sea is deemed to be overfished. Credit for these healthy stocks and profitable fisheries can be attributed in large part to two pieces of federal legislation.

Magnuson-Stevens Fishery Conservation and Management Act. The Magnuson-Stevens Fishery Conservation and Management Act of 1976 provides the broad framework for conserving and managing marine fisheries within the U.S. Exclusive Economic Zone. The councils that oversee the fisheries in which we participate are the North Pacific Fishery Management Council in Alaska and the Pacific Fishery Management Council in Washington and Oregon. The councils’ two primary areas of responsibility are (1) the establishment of annual maximum catch levels and (2) the development of fishery management plans that regulate who can fish, when and how they can fish and how much they can catch. The fishery management plans are then implemented and given legal force through regulations promulgated by the National Marine Fisheries Service, a division of the Department of Commerce. These regulations are then strictly enforced by both the U.S. Coast Guard and the National Marine Fisheries Service.

Each of the fisheries in which we participate is managed on a maximum sustainable yield basis. At the end of each year, the councils’ Scientific and Statistical Committees, which are composed of scientists from federal, state and academic positions, make recommendations on acceptable biological catch by species or species group. The total allowable catch is then typically set by the council at a level equal to or less than the acceptable biological catch depending upon a variety of factors. The councils also set prohibited species catch limits to limit by-catch of non-target species. These limits are set mainly to protect and preserve crab, halibut, salmon and other non-target species for other fisheries. After being reviewed by the National Marine Fisheries Service, the councils’ recommendations are implemented.

American Fisheries Act. In 1998, Congress passed a second piece of legislation, the American Fisheries Act, which introduced several major changes in the management of the U.S. Bering Sea pollock fishery. The American Fisheries Act and its implementing regulations include the following key provisions:

| | • | | Limitation on participants in the U.S. Bering Sea pollock fishery: |

| | ¨ | | Only a defined group of 20 named catcher-processors, of which 19 catcher-processors are currently eligible to operate in the fishery, and the catcher-vessels that historically delivered to them, are eligible to harvest pollock for processing by catcher-processors. As part of the implementation agreement, eight of the vessels were scrapped and one was permanently removed from the fishery, reducing the overall fleet from 29 to 20; |

| | ¨ | | Only a defined group of catcher-vessels may harvest pollock for delivery to motherships, and only three named motherships may process pollock; and |

| | ¨ | | Only inshore processors that processed more than 2,000 metric tons of pollock during each of 1996 and 1997 may receive an unlimited amount of pollock for processing; those that processed less during those years may only receive and process under 2,000 metric tons annually. Subsequently, the council imposed a processing cap limiting the amount of pollock that can be processed by any single entity to 30% of the directed pollock catch in any given year. |

| | • | | Prohibition on any entity harvesting more than 17.5% of the directed pollock catch in any given year. Allocations purchased from community development quota partners do not count against this percentage. |

19

| | • | | Prohibition on the entry of additional large fishing industry vessels into any U.S. fishery. |

| | • | | Reallocation of the pollock total allowable catch in the U.S. Bering Sea pollock fishery between the various sectors, increasing the community development quota and inshore allocations, while reducing the catcher-processor and the mothership sector allocations: |

| | ¨ | | 10% of the total allowable catch is allocated to six Alaska Community Development Groups (mostly native Alaskan villages and their residents) that sell or lease their community development quota to other participants, including us; |

| | ¨ | | approximately 3.4% of the total allowable catch is set aside for pollock by-catch in other fisheries; |

| | ¨ | | the remaining 86.6% of the total allowable catch (the “directed pollock catch”) is allocated as follows: |

| | • | | 50% of the directed pollock catch is allocated to catcher-vessels delivering to inshore factories; |

| | • | | 40% of the directed pollock catch is allocated to catcher-processors, and catcher-vessels that deliver to catcher-processors; and |

| | • | | 10% of the directed pollock catch is allocated to the catcher-vessels that deliver to at-sea processor vessels called motherships, which do not harvest. |

The American Fisheries Act requires that vessels engaged in U.S. fisheries be owned by entities that are at least 75% U.S. citizen owned and controlled. This requirement applies at each tier of ownership and must also be examined in the aggregate. In April 2006, the Maritime Administration made a favorable determination of continuing eligibility with respect to our compliance with the citizenship requirements of the American Fisheries Act.

For purposes of the American Fisheries Act, a U.S. citizen is:

(i) Any individual who is a citizen of the United States by birth, naturalization or as otherwise authorized by law; or

(ii) Any entity (A) that is organized under the laws of the United States or of a State, (B) of which not less than 75% of the interest in such entity, at each tier of ownership of such entity and in the aggregate, is owned and controlled (including beneficial ownership and control) by U.S. citizens, and (C) with respect to which no voting or other agreements confer control to non-U.S. citizens.

Special rules applicable to corporations, limited liability companies, partnerships, trusts and other entities limit the number of non-U.S. citizen directors to a minority of a quorum of the board of directors, and require that certain principal officers and managers (including the chief executive officer, the chairman of the board of directors, trustees and general partners, and persons authorized to act in the absence or disability of such persons) be U.S. citizens.

The American Fisheries Act is relatively new legislation. As a result, no reported judicial cases clearly interpret its meaning. For this reason, the full future impact of the American Fisheries Act on our ownership and debt capital structure remains uncertain.

The Pollock Conservation Cooperative. By limiting participation in the U.S. Bering Sea pollock fishery, the American Fisheries Act facilitated the formation of a cooperative agreement. In December 1998, the companies owning the 20 catcher-processors named in the American Fisheries Act formed the Pollock Conservation Cooperative. The Pollock Conservation Cooperative controls 36.6% of the directed pollock catch, with the remaining 3.4% of the sector’s 40.0% controlled by seven catcher-vessels that historically delivered to the catcher-processors. The original division of share among the companies was based primarily on historical performance and was reached by the mutual agreement of the participants. In December 1999, Alaska Trawl

20

Fisheries, one of the original Pollock Conservation Cooperative members, agreed to sell its interest to the remaining Pollock Conservation Cooperative members and its vessel, Endurance, has been permanently removed from U.S. fisheries, leaving 19 eligible catcher-processors.

Under the terms of the Pollock Conservation Cooperative membership agreement, each participating company is allocated a percentage of the directed pollock catch by private contractual arrangement. Pollock and other groundfish allocation rights under the Pollock Conservation Cooperative are freely transferable to other participants pursuant to the membership agreement, without the prior consent or approval of the other participants. Participants can then harvest and process their quota shares at their own pace with vessels named in the American Fisheries Act, within certain seasonal restrictions. The stable nature of the U.S. Bering Sea pollock fishery is partly a function of the regulatory and cooperative structure that governs its activities. In addition, the change in fishery management introduced by the American Fisheries Act allowed the catcher-processor sector to: slow the harvesting pace in order to optimize the value per ton of harvested round fish; reduce operating costs; and minimize by-catch and discards.

In 2003, 2004 and 2005, we harvested an aggregate of 18.7%, 20.1% and 20.5% respectively, of the total allowable catch. We are allocated 17.1% of the directed pollock catch under our Cooperative agreements, and we lease the right to harvest another 0.4% of the directed pollock catch from other vessels in our fishery, bringing us to 17.5% of the directed pollock catch (which is the maximum permitted harvesting allocation of the directed pollock catch by any single entity). Our share of the directed pollock catch represented 15.1% of the total allowable catch. We supplemented our share of the directed pollock catch in 2003, 2004 and 2005 by purchasing 36.0%, 54.0% and 54.0%, respectively, of the community development quota (or 3.6%, 5.4% and 5.4%, respectively, of the total allowable catch) from Alaska Community Development Groups, two of which are equity investors in our company. The Alaska Community Development Groups represent native Alaskan villages.

21

The overall allocation of the total allowable catch, as well as our allocation and quota we have purchased, is illustrated in the following chart of the 2006 total allowable catch.

| (1) | This chart reflects the pollock TAC for the Eastern Bering Sea. In addition, there is a TAC of 19,000 MT of pollock in the Aleutian Islands. This TAC is initially awarded to the Aleut Corporation but under certain conditions up to 15,300 MT may be transferred later in 2006 to the directed pollock fishery in the Bering Sea. |

The Pollock Conservation Cooperative membership agreement will continue through the remainder of the named vessels’ lives, unless the Cooperative members unanimously agree to terminate the agreement.

The following is a summary of the Pollock Conservation Cooperative’s current members and their allocations for 2006:

| | | | | |

Company | | Vessels | | % of Directed

Pollock Catch | |

American Seafoods | | 7 | | 16.572 | % |

Trident Seafoods | | 5 | | 6.824 | |

Arctic Storm/Fjord | | 2 | | 3.633 | |

Glacier Fish Ltd. | | 2 | | 3.218 | |

Alaska Ocean | | 1 | | 3.004 | |

Highland Light | | 1 | | 1.764 | |

Starbound Ltd. | | 1 | | 1.585 | |

| | | | | |

Total | | 19 | | 36.600 | % |

| | | | | |

In December 1998, the owners of the seven catcher-vessels listed in the American Fisheries Act as eligible to deliver or sell pollock to the Pollock Conservation Cooperative members formed the High Seas Catchers’

22

Cooperative. As with the Pollock Conservation Cooperative, the 3.4% of the directed pollock catch allocated to the seven catcher-vessels was divided by private contractual arrangement based primarily on historical catch performance. The members of the High Seas Catchers’ Cooperative and their respective allocations are listed below:

| | | | | |

Company | | Vessels | | % of Directed

Pollock Catch | |

Sea Storm | | 1 | | 0.8226 | % |

Neahkanie | | 1 | | 0.6679 | |

American Seafoods | | 2 | | 0.5590 | |

Tracy Anne | | 1 | | 0.4642 | |

Muir Milach | | 1 | | 0.4538 | |

Ocean Harvester | | 1 | | 0.4325 | |

| | | | | |

Total | | 7 | | 3.4000 | % |

| | | | | |

The Pollock Conservation Cooperative and the High Seas Catchers’ Cooperative have entered into an agreement that allows the High Seas Catchers’ Cooperative members to lease their allocations directly to the Pollock Conservation Cooperative members. As a result, 100% of the High Seas Catchers’ Cooperative allocation is now harvested directly by Pollock Conservation Cooperative members.

Food Safety

The manufacture, processing, packaging, storage, distribution and labeling of food products are subject to extensive foreign, federal, state and local regulation. We are regulated by the U.S. Food and Drug Administration, the U.S. Department of Agriculture, the U.S. Department of Commerce, European Union regulators and various U.S. state and local health and agricultural agencies. In addition, some of our facilities are subject to regular on-site inspections and our production and distribution facilities are subject to various federal, state and local environmental and workplace and food safety regulations. Failure to comply with all applicable laws and regulations could subject us to civil remedies, including fines, injunctions, recalls or seizures, and criminal sanctions, any of which or all of which could have a material adverse effect on our business, financial condition and results of operations. None of our products has been subject to such a recall. Additionally, we expect that the food safety regulatory environment in the U.S., Europe and Asia will become more stringent. We believe that we are in substantial compliance with all such laws and regulations. Compliance with current or future laws or regulations could require us to make material expenditures or otherwise adversely affect our business, prospects, results of operations and financial condition.

Environmental Matters

Our vessels and facilities are subject to numerous foreign, federal, state and local laws and regulations relating to the treatment, storage, handling, disposal, emission and discharge of materials into the environment, including the federal Clean Water Act, the Clean Air Act, the Resource Conservation and Recovery Act, the Emergency Planning and Community Right-To-Know Act, the Comprehensive Environmental Response, Compensation and Liability Act, and their state and local counterparts. Under some of these laws, the owner or operator of facilities may be held liable for the costs of removing or remediation of hazardous substances on or under property, regardless of whether the owner or operator knew of or was responsible for the presence of such hazardous substance and regardless of whether the release or disposal of such substances was legal at the time it occurred. We believe that we are in substantial compliance with all such laws and regulations. We also believe that none of the environmental laws and regulations that regulate our business is expected to have a material impact on our business.

Under certain environmental laws and regulations, we will be required to expend capital in the future in order to remain in compliance. We do not believe that such capital expenditures required by environmental laws currently in effect will be material.

23

The National Marine Fisheries Service imposes various operational requirements that limit our ability to discard unwanted species, or by-catch, in the North Pacific. Regulation regarding by-catch is from time to time debated in various forums, including the United Nations, and is the subject of public campaigns by environmental groups. Any significant change in the by-catch rules resulting from these debates or campaigns could materially increase the costs or decrease the flexibility of our fishing operations.

Competition

At-Sea Processing

Our main competitors in the at-sea processing segment are the other members of the Pollock Conservation Cooperative, including Trident Seafoods and Glacier Fish. We also compete with inshore processors, including Maruha and Nissui, and motherships, which rely on catcher-vessels to harvest and deliver fish. In addition, we compete with other pollock fisheries, particularly the Russian pollock fisheries in the Sea of Okhotsk and Bering Sea.

We compete in selling roe primarily on the basis of quality. The price of pollock roe is heavily influenced by the size and condition of roe skeins, color and freshness and the maturity of the fish caught. In addition, pollock roe prices are influenced by anticipated Russian and U.S. production and Japanese inventory carry-over, as pollock roe is consumed almost exclusively in Japan. Approximately one half of our roe is sold in advance and the remainder is sold at auction, where we compete to sell into the Japanese market with other participants in our fishery, as well as with Russian producers. The prices of surimi and fillets are influenced primarily by expected production in the U.S. and Russian pollock fisheries, and other factors such as carry-over inventories and changes in demand. Because surimi and fillet blocks often are composed of the same raw material, the demand for one product can influence the price of the other. Surimi and fillet blocks are also produced utilizing species of fish other than pollock, such as Pacific whiting or itoyori species. However, due to differences in flesh attributes between pollock and other species, the surimi and block produced from other species are generally not used as substitutes for pollock products, except for potentially lower grade applications in surimi, and thus have a lesser influence on pollock pricing.

Land-Based Processing

As of December 2005, there were approximately 20 U.S. catfish processing companies, including Confish, Heartland, America’s Catch and Delta Pride, our primary catfish competitors. We are the largest, processing over 16% of the U.S. farmed catfish market. In 2005, the top five and top ten U.S. catfish companies processed, in the aggregate, approximately 60% and 80% of the U.S. farmed catfish harvest, respectively.

In secondary processing, we compete both for raw materials and customers with numerous other processors. Competition for sales is based largely on price, quality, and product specifications. Our competitors range from large volume, well established secondary processors to small independent importers and brokers. Our major competitors are Ocean Cuisine, Icelandic Seafood Corporation and Trident Seafoods.

Insurance

We carry customary insurance coverage, including policies on each of our vessels which provide for the payment of an assessed amount corresponding to “fair market value” (generally approximately one-half of current replacement cost) in the event of a loss of a vessel. Additionally, all of our catcher-processor vessels have a further layer of umbrella insurance which provides coverage for 80% of the difference between such fair market value and the total replacement cost for one vessel during each one-year policy term. We also carry insurance covering product liability claims and seaman personal injury claims made under the Jones Act. We believe that we carry adequate insurance coverage for our business activities. However, such coverage may prove to be inadequate or may not continue to be available to us. If such coverage proves to be inadequate, the sinking or destruction of, or substantial damage to, any of our vessels could have a material adverse effect on our business, financial condition or results of operations.

24

Employees

As of March 1, 2006, we employed approximately 1,000 full-time personnel, including approximately 225 corporate staff employees and approximately 700 employees at our catfish and secondary processing facilities. In addition to the full-time personnel, we also employ a seasonal vessel crew, either full-time or part-time, of approximately 900. We have an annual retention rate of over 75% and we consider relations with our employees to be good. In addition to their regular compensation, all corporate staff participate in an incentive plan to reward achievement of performance targets.