As filed with the Securities and Exchange Commission on July 22, 2005

Registration No. 333-104543

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM SB-2/A

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Amendment No. 3

TEXADA VENTURES INC.

(Name of small business issuer in its charter)

| NEVADA | 2086 | 98-0431245 |

| (State or jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer |

| incorporation or organization) | Classification Code Number) | Identification No.) |

977 Keith Road

West Vancouver, BC, Canada V7T 1M6

Tel: 604-816-2555

(Address and telephone number of principal executive offices)

Stephen F.X. O’Neill, Esq.

O’NEILL LAW GROUP PLLC

435 Martin Street, Suite 1010, Blaine, WA 98230

Tel: 360-332-3300

(Name, address and telephone number of agent for service)

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement is declared effective.

If this Form is filed to register additional securities for an offering pursuant toRule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant toRule 462(c) under the Securities Act, check the following box and list the Securities Act registrations statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If delivery of the Prospectus is expected to be made pursuant toRule 434, please check the following box. ¨

CALCULATION OF REGISTRATION FEE

Title of Each Class of Securities

to be Registered | Amount to be

Registered | Proposed Maximum

Offering Price Per

Unit(1) | Proposed Maximum

Aggregate Offering

Price(2) | Amount of

Registration

Fee (2) |

Common Stock, par value

$0.001 per share, previously

issued to investors | 146,667 | $0.03 | $4,400 | $0.52 |

| | (1) | This price was arbitrarily determined by Texada Ventures Inc. |

| | (2) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(a) under the Securities Act of 1933, as amended (the “Securities Act”). |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act, or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission (the “SEC”), acting pursuant to said Section 8(a), may determine.

The information contained in this Prospectus is not complete and may be changed. The selling stockholders named in this prospectus may not sell these securities until the Registration Statement filed with the Securities and Exchange Commission is effective. This Prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, Dated July 18, 2005

PROSPECTUS

TEXADA VENTURES INC.

146,667 SHARES

COMMON STOCK

The selling stockholders named in this prospectus are offering the 146,667 shares of Texada Ventures Inc.’s (the “Company”) common stock offered through this prospectus (the “Offering”). The Company has set an offering price for these securities of $0.03 per share of its common stock offered through this prospectus.

| | Offering Price | Commissions | Proceeds to Selling Stockholders

Before Expenses and Commissions |

| Per Share | $ 0.03 | Not Applicable | $0.03 |

| Total | $4,400 | Not Applicable | $ 4,400 |

The Company is not selling any shares of its common stock in this Offering and therefore will not receive any proceeds from this Offering.

The Company’s common stock is presently not traded on any market or securities exchange. The sales price to the public is fixed at $0.03 per share until such time as the shares of the Company’s common stock are traded on the Over-The-Counter Bulletin Board (the “OTC Bulletin Board”). Although the Company intends to apply for trading of its common stock on the OTC Bulletin Board, public trading of its common stock may never materialize. The Company can provide no assurance that its shares will be traded on the OTC Bulletin Board. If the Company’s common stock becomes traded on the OTC Bulletin Board, then the sale price to the public will vary according to prevailing market prices or privately negotiated prices by the selling stockholders.

The purchase of the securities offered through this Prospectus involves a high degree of risk. You should carefully read and consider the section of this prospectus entitled “Risk Factors” on pages 8 through 10 before buying any of our common shares.

This Offering will terminate nine months after the accompanying registration statement is declared effective by the Securities and Exchange Commission. There will be no extension of the offering period. None of the proceeds from the sale of stock by the selling stockholders will be placed in escrow, trust or similar account.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The Date Of This Prospectus Is: July 18, 2005

2

TABLE OF CONTENTS

Until ninety days after the date this registration statement is declared effective, all dealers that effect transactions in these securities whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealer's obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

3

SUMMARY

As used in this prospectus, unless the context otherwise requires, “we”, “us”, “our”, “our company” or “Texada” refers to Texada Ventures Inc. All dollar amounts in this prospectus are in U.S. dollars unless otherwise stated. The following summary is not complete and does not contain all of the information that may be important to you. You should read the entire prospectus before making an investment decision to purchase our common stock.

Foreign Currency and Exchange Rates

For purposes of consistency and to express United States Dollars throughout this prospectus, Canadian Dollars have been converted into United States currency at the rate of CDN$1.00 being approximately equal to US$0.80 which is the approximate average exchange rate during recent months.

Texada Ventures Inc.

We are an exploration stage company engaged in the acquisition and exploration of mineral properties. We were formed in order to seek business opportunities in the mineral exploration area and since our incorporation have been engaged in the acquisition and exploration of mineral properties. On November 2, 2001, we acquired a 100% undivided interest in a group of mineral claims located in the Yukon Territory known as the Peek Claims (the “Peek Claims”). We acquired the Peek Claims from Glen MacDonald of Vancouver, British Columbia for consideration of $2,500.

Our plan of operations is to conduct mineral exploration activities on the Peek Claims in order to assess whether these claims possess mineral reserves. Our exploration program is designed to explore for commercially viable deposits of lead, gold, and silver. We have not, nor has any predecessor, identified any commercially exploitable reserves of these minerals on our mineral claims. We are an exploration stage company and there is no assurance that a commercially viable mineral deposit exists on our mineral claims.

Our financial information as of May 31, 2005 is summarized below:

| | As at

November 30, 2004

(Audited) | As at

May 31, 2005

(Unaudited) |

| Balance Sheet: |

| Cash | $47,783 | $36,178 |

| Total Assets | $51,233 | $39,310 |

| Liabilities | $12,579 | $10,043 |

| Total Stockholders’ Equity | $38,654 | $29,267 |

| |

| | Period from

Incorporation to

November 30, 2004

(Audited) | Six Months Ended

May 31, 2005

(Unaudited) |

| Statement of Operations: |

| Revenue | - | - |

| Net Loss for the Period | $19,057 | $13,787 |

| Net Loss Per Share | $(0.00) | $(0.01) |

4

About Us

We wereincorporated on October 17, 2001, under the laws of the State of Nevada. Our principal offices are located at 977 Keith Road, West Vancouver, British Columbia, Canada V7T 1M6. Our phone number is (604) 816-2555. Our facsimile number is (604) 921-1724.

THE OFFERING

| The Issuer: | Texada Ventures Inc. |

| | |

| Selling Stockholders: | The selling stockholders named in this prospectus are existing stockholders of Texada who purchased shares of our common stock from us in May, 2005 in a private placement transaction. The issuance of the shares by us to the selling stockholders was exempt from the registration requirements of the Securities Act of 1933 (the “Securities Act”). See “Selling Stockholders”. |

| | |

| Securities Being Offered: | Up to 146,667 shares of our common stock, par value $0.001 per share. |

| | |

| Offering Price: | The offering price of the common stock is $0.03 per share. We intend to apply to the OTC Bulletin Board to allow the trading of our common stock upon our becoming a reporting entity under the Securities Exchange Act of 1934 (the “Exchange Act”). If our common stock becomes so traded and a market for the stock develops, the actual price of stock will be determined by prevailing market prices at the time of sale or by private transactions negotiated by the selling stockholders. The offering price would thus be determined by market factors and the independent decisions of the selling stockholders. |

| | |

| Duration of Offering: | This offering will terminate nine months after the accompanying registration statement is declared effective by the Securities and Exchange Commission (the “SEC”). |

| | |

| MinimumNumber ofShares To Be Sold in This Offering: | None. |

| | |

| Shares of Common Stock Outstanding Before and After the Offering: | 12,146,667 shares of our common stock are issued and outstanding as of the date of this prospectus. All of the common stock to be sold under this prospectus will be sold by existing stockholders. |

| | |

| Use of Proceeds: | We will not receive any proceeds from the sale of the common stock by the selling stockholders. |

| | |

| Risk Factors: | See “Risk Factors” and the other information in this prospectus for a discussion of the factors you should consider before deciding to invest in shares of our common stock. |

5

Glossary of Technical Terms

The following defined technical terms are used in our registration statement:

| adit | An opening driven horizontally into the side of a mountain or hill for providing access to a mineral deposit. |

| assay | A chemical test performed on a sample of ores or minerals to determine the amount of valuable metals contained. |

| breccia | Rock consisting of angular fragments in a matrix of finer-grained cementing material. |

| batholith | A large mass of igneous rock extending to great depth with its upper portion dome-like in shape. It has crystallized below surface, but may be exposed as a result of erosion of the overlying rock. Smaller masses of igneous rocks are known as bosses or plugs. |

| conglomerate | A sedimentary rock consisting of rounded, water-worn pebbles or boulders cemented into |

| | a solid mass. |

| diamond drill(ing) | A rotary type of rock drill in which the cutting is done by abrasion rather than percussion. The cutting bit is set with diamonds and is attached to the end of long hollow rods through which water or other fluid is pumped to the cutting face as a lubricant. The drill cuts a core of rock that is recovered in long cylindrical sections, two centimetres or more in diameter. |

| dore bar | The final saleable product of a gold mine. Usually consisting of gold or silver. |

| drift | A horizontal underground opening that follows along the length of a vein or rock formation as opposed to a crosscut which crosses the rock formation. |

| dyke | A long and relatively thin body of igneous rock that, while in the molten state, intruded a |

| | fissure in older rocks. |

| fault | A break in the Earth’s crust caused by tectonic forces which have moved the rock on one side with respect to the other; faults may extend many kilometres, or be only a few centimetres in length; similarly, the movement or displacement along the fault may vary widely. |

| feldspar | A group of rock-forming minerals. |

| felsic | The term used to describe light-coloured rocks containing feldspar, fledpathoids and silica. |

| fracture | A break in the rock, the opening of which affords the opportunity for entry of mineral- bearing solutions. A “cross fracture” is a minor break extending at more-or-less right angles to the direction of the principal fractures. |

| gneiss | A coarsely crystalline metamorphic rock that looks like granite except that the light and dark minerals are segregated into thin layers or lenses. |

| granite | A course-grained (intrusive) ingenious rock consisting of quartz, feldspar and mica. |

| granitoid | Rocks which are in the family of granites. |

| greenstone | Volcanic rocks forming 'belts' within intrusive or sedimentary rocks and which are the source of most metal deposits. |

| igneous | A type of rock which has been formed by the consolidation of magma, a molten substance from the earth’s core. |

| intrusive | A body of igneous rock formed by the consolidation of magma intruded into other rocks, in contrast to lavas, which are extruded upon the surface. |

| mafic | Igneous rocks composed mostly of dark iron and magnesium rich minerals. |

| massive | Solid (without fractures) wide (thick) rock unit. |

| mesozoic | One of the eras of geologic time. It includes the Triassic, Jurassic and Cretaceous periods. |

| meta-sedimentary | Metamorphosed sedimentary rocks. |

| meta-volcanic | Metamorphosed volcanic rocks. |

6

| mill | 1) A plant in which ore is treated for the recovery of valuable metals, or the concentration of valuable minerals into a smaller volume for shipment to a smelter or refinery.

2) A piece of milling equipment consisting of a revolving drum, for the fine-grinding of ores as a preparation for treatment. |

| mineralization | The concentration of metals and their chemical compounds within a body of rock. |

| modal | The most frequent value of a set of data. |

| ore | A mixture of minerals and gangue from which at least one metal can be extracted at a profit. |

| paleozoic | Rocks that were laid down during the Paleozoic Era (between 67 and 507 million years ago). |

| plugs | A common name for a small offshoot from a larger batholith. |

| plunge | The vertical angle an orebody makes between the horizontal plane and the direction along which it extends, longitudinally to depth. |

| pluton | Body of rock exposed after solidification at great depth. |

| porphyry | Any igneous rock in which relatively large, conspicuous crystals (called phenocrysts) are set in a fine-grained groundmass. |

| quartz | A mineral whose composition is silicon dioxide. A crystalline form of silica. |

| reserve | For the purposes of this registration statement: that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. Reserves consist of:

1) Proven (Measured) Reserves.Reserves for which: (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from the results of detailed sampling; and (b) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth and mineral content of reserves are well-established.

2) Probable (Indicated) Reserves.Reserves for which quantity and grade and/or quality are computed from information similar to that used for proven (measured) reserves, but the sites for inspection, sampling and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven (measured) reserves, is high enough to assume continuity between points of observation. |

| rhyolite | A fine-grained, extrusive igneous rock which has the same chemical composition as granite. |

| schist | A foliated metamorphic rock, the grains of which have a roughly parallel arrangement generally developed by shearing. |

| sedimentary | A type of rock which has been created by the deposition of solids from a liquid. |

| shear | The deformation of rocks by lateral movement along innumerable parallel planes, generally resulting from pressure. |

| silt | Muddy deposits of fine sediment usually found on the bottoms of lakes. |

| stockpile | Broken ore heaped on surface, pending treatment or shipment. |

| structural | Pertaining to geologic structure. |

| triassic | The system of strata that was deposited between 210 and 250 million years before the present time. |

| tuff | A rock formed of compacted volcanic fragments. |

| vein | An occurrence of ore with an irregular development in length, width and depth usually from an intrusion of igneous rock. |

| volcanics | Volcanically formed rocks. |

7

RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below and the other information in this prospectus before investing in our common stock. If any of the following risks occur, our business, operating results and financial condition could be seriously harmed. The trading price of our common stock could decline due to any of these risks, and you may lose all or part of your investment.

RISKS RELATED TO OUR FINANCIAL CONDITION AND BUSINESS MODEL

If we do not obtain additional financing, our business will fail.

In order for us to perform any further exploration or extensive testing we may need to obtain additional financing. As of May 31, 2005, we had cash in the amount of $36,178. We currently do not have any operations and we have no income. Our business plan calls for significant expenses in connection with the exploration of our mineral claims. While we have sufficient funds to carry out Phase III of the recommended exploration program on the Peek Claims, we may require additional financing if further exploration programs are necessary. We will require additional financing to sustain our business operations if we are not successful in earning revenues once exploration is complete.

Because our sole executive officer does not have formal training specific to the technicalities of mineral exploration, there is a higher risk our business will fail.

Mr. Marc Branson, our sole executive officer and director, does not have formal training as geologist and lacks the technical training and experience in managing an exploration company. Additionally, Mr. Branson has never managed any company involved in starting or operating a mine. With no direct training or experience in these areas, our management may not be fully aware of many of the specific requirements related to working within this industry. Our decisions and choices may not take into account standard engineering or managerial approaches mineral exploration companies commonly use. Consequently, our operations, earnings, and ultimate financial success could suffer irreparable harm due to our lack of experience in this industry.

Because of the unique difficulties and uncertainties inherent in the mineral exploration business, we face a high risk of business failure.

Potential investors should be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration, and additional costs and expenses that may exceed current estimates.

Because we anticipate our operating expenses will increase prior to our earning revenues, we may never achieve profitability.

Prior to completion of our exploration stage, we anticipate that we will incur increased operating expenses without realizing any revenues. We therefore expect to incur significant losses into the foreseeable future. We recognize that if we are unable to generate significant revenues from the exploration of our mineral claims and the production of minerals thereon, if any, we will not be able to earn profits or continue operations. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and we may not be able to generate any operating revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely fail.

Because of the speculative nature of exploration of mineral claims, there is substantial risk that no commercially exploitable minerals will be found and this business will fail.

We have just begun the initial stages of exploration of our mineral claims, and thus have no way to evaluate the likelihood that we will be able to operate the business successfully. The search for valuable minerals as a business is extremely risky. Our mineral claims may not contain commercially exploitable deposits of gold and

8

silver. Exploration for minerals is a speculative venture necessarily involving substantial risk. The expenditures to be made by us in the exploration of the mineral claims may not result in the discovery of commercial quantities of ore. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. In such a case, we would be unable to complete our business plan.

Because of the inherent dangers involved in mineral exploration, there is a risk that we may incur liability or damages as we conduct our business.

The search for valuable minerals involves numerous hazards. As a result, we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure or against which we may elect not to insure. The payment of such liabilities may have a material adverse effect on our financial position.

Because access to our mineral claims may be restricted by inclement weather, we may be delayed in our exploration and any future mining efforts.

Access to the Peek mineral claim may be restricted through some of the year due to weather in the area. The property is in the Yukon Territory, an area which experiences sub-arctic temperatures during much of the year. During the winter months heavy snowfall and extreme low temperatures make it difficult if not impossible to undertake work programs. As a result, any attempt to test or explore the property is largely limited to the times when weather permits such activities. Generally speaking, the most efficient time for us to conduct our work programs will be during the May to October period. These limitations can result in significant delays in exploration efforts, as well as mining and production in the event that commercial amounts of minerals are found. Such delays can have a significant negative effect on our results of operations.

Because our president has only agreed to provide his services on a part-time basis, he may not be able or willing to devote a sufficient amount of time to our business operations, causing our business to fail.

Mr. Branson, our president, is also a member and officer of Moto Ergonomics Ltd., a consumer electronics company. Because we are in the early stages of our business, Mr. Branson devotes approximately five hours per week to our company’s affairs. If the demands of our business require the full business time of Mr. Branson, he is prepared to adjust his timetable to devote more time to our business. However, Mr. Branson may not be able to devote sufficient time to the management of our business, as and when needed. It is possible that the demands of Mr. Branson’s other interests will increase with the result that he would no longer be able to devote sufficient time to the management of our business. Competing demands on Mr. Branson’s time may lead to a divergence between his interests and the interests of other stockholders.

Because our president, Mr. Marc Branson, owns 49% of our outstanding common stock, investors may find that corporate decisions influenced by Mr. Branson are inconsistent with the best interests of other stockholders.

Mr. Branson is our sole director and executive officer. He owns 49% of the outstanding shares of our common stock. Accordingly, he will have a significant influence in determining the outcome of all corporate transactions or other matters, including mergers, consolidations and the sale of all or substantially all of our assets, and also the power to prevent or cause a change in control. The interests of Mr. Branson may differ from the interests of the other stockholders. Factors which could cause the interests of Mr. Branson to differ from the interest of other stockholders include his ability to devote the time required run a mineral exploration company.

Our independent auditor believes there is substantial doubt we can continue as a going concern.

Our independent auditor’s believe there is substantial doubt that we can continue as a going concern which, if true, raises substantial doubt that a purchaser of our common stock will receive a return on his or her investment. We have incurred a net loss of $101,133 for the period from October 17, 2001 (inception) to May 31, 2005, and have no sales. Our future is dependent upon our ability to obtain financing and upon future profitable operations from the development of our mineral properties. If we are not able to continue as a going concern it is likely any holder of our common stock will lose his or her investment in that stock.

9

RISKS RELATED TO LEGAL UNCERTAINTY

As we undertake exploration of our mineral claims, we will be subject to compliance with government regulation that may increase the anticipated cost of our exploration program.

There are several governmental regulations that materially restrict mineral exploration or exploitation. We will be subject to the Yukon Quartz Mining Act (the “YMQA”) as we carry out our exploration program. An annual exploration expenditure of $80 per claim is required by the YQMA to maintain the claims in good standing. Alternatively an annual payment of $80 per claim in lieu of work is sanctioned by the YQMA to maintain claims in good standing. We may be required to obtain work permits, post bonds and perform remediation work for any physical disturbance to the land in order to comply with these regulations. While our planned exploration program budgets for regulatory compliance, there is a risk that new regulations could increase our costs of doing business and prevent us from carrying our exploration program. Our annual cost of compliance with the YQMA is presently approximately $336 per year.

RISKS RELATED TO THIS OFFERING

If a market for our common stock does not develop, stockholders may be unable to sell their shares.

A market for our common stock may never develop. We currently plan to apply for quotation of our common stock on the over-the-counter bulletin board upon the effectiveness of the registration statement of which this prospectus forms a part. However, our shares may never be traded on the bulletin board or, if traded, a public market may not materialize. If our common stock is not traded on the bulletin board or if a public market for our common stock does not develop, investors may not be able to re-sell the shares of our common stock that they have purchased and may lose all of their investment.

USE OF PROCEEDS

We will not receive any proceeds from the sale of the common stock offered through this prospectus by the selling stockholders named in this prospectus.

DETERMINATION OF OFFERING PRICE

The $0.03 per share offering price of our common stock was arbitrarily chosen. However, the selection of this particular price was influenced by the last sales price from our most recent private offering of common stock which was $0.03 per share. There is no relationship whatsoever between this price and our assets, earnings, book value or any other objective criteria of value.

We intend to apply to the over-the-counter bulletin board (the “OTC BB”) for the trading of our common stock upon our becoming a reporting entity under the Securities Exchange Act of 1934 (the “Exchange Act”). We intend to file a registration statement under the Exchange Act concurrently with the effectiveness of the registration statement of which this prospectus forms a part. If our common stock becomes so traded and a market for the stock develops, the actual price of stock will be determined by prevailing market prices at the time of sale or by private transactions negotiated by the selling stockholders named in this prospectus. The offering price would thus be determined by market factors and the independent decisions of the selling stockholders named in this prospectus.

DILUTION

The common stock to be sold by the selling stockholders named in this prospectus is common stock that is currently issued and outstanding. Accordingly, there will be no dilution to our existing stockholders.

10

SELLING STOCKHOLDERS

The selling stockholders named in this prospectus are offering all of the 146,667 shares of common stock offered through this prospectus. The selling stockholders acquired the 146,667 shares of our common stock from us in an offering that was exempt from registration under Regulation S of the Securities Act of 1933, as amended (the “Securities Act”) and completed on May 21, 2005.

The following table provides as of July 18, 2005, information regarding the beneficial ownership of our common stock held by each of the selling stockholders named in this prospectus, including:

| | 1. | the number of shares owned by each prior to this offering; |

| | 2. | the total number of shares that are to be offered by each; |

| | 3. | the total number of shares that will be owned by each upon completion of the offering; |

| | 4. | the percentage owned by each upon completion of the offering; and |

| | 5. | the identity of the beneficial holder of any entity that owns the shares. |

| |

| Name Of Selling Stockholder(1) | Beneficial Ownership

Before Offering(1) | Number of

Shares Being

Offered | Beneficial Ownership

After Offering(1) |

Number of

Shares | Percent(2) | Number of

Shares | Percent(2) |

| Lauren Blaney | 5,000 | * | 5,000 | 5,000 | * |

| Ivan Dancourt | 5,000 | * | 5,000 | 5,000 | * |

| Bruce Hamilton | 5,000 | * | 5,000 | 5,000 | * |

| K. D. Healey | 5,000 | * | 5,000 | 5,000 | * |

| Charles Hill | 10,000 | * | 10,000 | 10,000 | * |

| Geoff Howes | 5,000 | * | 5,000 | 5,000 | * |

| Jomac Holdings Co. Ltd. | 5,000 | * | 5,000 | 5,000 | * |

| John Kinnimont | 5,000 | * | 5,000 | 5,000 | * |

| Mark Kouba | 5,000 | * | 5,000 | 5,000 | * |

| Craig McAllister | 10,000 | * | 10,000 | 10,000 | * |

| Brian D. Mercier | 5,000 | * | 5,000 | 5,000 | * |

| Adam R.C. Nothstein | 5,000 | * | 5,000 | 5,000 | * |

| Tom O’Connor | 5,000 | * | 5,000 | 5,000 | * |

| Hafez Panju | 5,000 | * | 5,000 | 5,000 | * |

| Ryan Phillips | 6,667 | * | 6,667 | 6,667 | * |

| Michael Rowsome | 40,000 | * | 40,000 | 40,000 | * |

| Kenley Tamoto | 5,000 | * | 5,000 | 5,000 | * |

| Lily Tamoto | 5,000 | * | 5,000 | 5,000 | * |

| Teresa Tamoto | 5,000 | * | 5,000 | 5,000 | * |

| Deborah Williams | 5,000 | * | 5,000 | 5,000 | * |

| TOTAL | 146,667 | 1.2% | 146,667 | NIL | 0% |

| | Notes | |

| | * | Represents less than 1%. |

| | (1) | The named party beneficially owns and has sole voting and investment power over all shares or rights to these shares, unless otherwise shown in the table. The numbers in this table assume that none of the selling stockholders sells shares of common stock not being offered in this prospectus or purchases additional shares of common stock, and assumes that all shares offered are sold. |

| | (2) | Applicable percentage of ownership is based on 12,146,667 common shares outstanding as of July 18, 2005, plus any securities held by such security holder exercisable for or convertible into common shares within sixty (60) days after the date of this prospectus, in accordance with Rule 13d-3(d)(1) under the Securities Exchange Act of 1934, as amended. |

11

None of the selling stockholders named in this prospectus:

| | (1) | has had a material relationship with us other than as a shareholder at any time within the past three years; or |

| |

| | (2) | has ever been one of our officers or directors. |

PLAN OF DISTRIBUTION

This prospectus is part of a registration statement that enables the selling stockholders to sell their shares on a continuous or delayed basis for a period of nine months after this registration statement is declared effective. The selling stockholders named in this prospectus may sell some or all of their common stock in one or more transactions, including block transactions:

| | - | On such public markets or exchanges as the common stock may from time to time be trading; |

| | - | In privately negotiated transactions; |

| | - | Through the writing of options on the common stock; |

| | - | In short sales; or |

| | - | In any combination of these methods of distribution. |

The sales price to the public is fixed at $0.03 per share until such time as the shares of our common stock become traded on the OTC BB or another exchange. Although we intend to apply for trading of our common stock on the OTC BB, public trading of our common stock may never materialize. If our common stock becomes traded on the OTC BB or another exchange, then the sales price to the public will vary according to the selling decisions of each selling shareholder and the market for our stock at the time of resale. In these circumstances, the sales price to the public may be:

| | - | The market price of our common stock prevailing at the time of sale; |

| | - | A price related to such prevailing market price of our common stock; or |

| | - | Such other price as the selling stockholders determine from time to time. |

The selling stockholders named in this prospectus may also sell their shares directly to market makers acting as agents in unsolicited brokerage transactions. Any broker or dealer participating in such transactions as agent may receive a commission from the selling stockholders, or, if they act as agent for the purchaser of such common stock, from such purchaser. The selling stockholders will likely pay the usual and customary brokerage fees for such services.

We can provide no assurance that all or any of the common stock offered will be sold by the selling stockholders named in this prospectus. We are bearing all costs relating to the registration of the common stock. The selling stockholders, however, will pay any commissions or other fees payable to brokers or dealers in connection with any sale of the common stock.

The selling stockholders named in this prospectus must comply with the requirements of the Securities Act and the Exchange Act in the offer and sale of the common stock. The selling stockholders and any broker-dealers who execute sales for the selling stockholders may be deemed to be an "underwriter" within the meaning of the Securities Act in connection with such sales. In particular, during such times as the selling stockholders may be deemed to be engaged in a distribution of the common stock, and therefore be considered to be an underwriter, they must comply with applicable law and may, among other things:

| 1. | Not engage in any stabilization activities in connection with our common stock; |

| |

| 2. | Furnish each broker or dealer through which common stock may be offered, such copies of this prospectus, as amended from time to time, as may be required by such broker or dealer; and |

| |

| 3. | Not bid for or purchase any of our securities or attempt to induce any person to purchase any of our securities other than as permitted under the Exchange Act. |

12

The selling stockholders named in this prospectus should be aware that the anti-manipulation provisions of Regulation M under the Exchange Act will apply to purchases and sales of shares of common stock by the selling stockholders, and that there are restrictions on market-making activities by persons engaged in the distribution of the shares offered under this prospectus. Under Regulation M, the selling stockholders or their agents may not bid for, purchase, or attempt to induce any person to bid for or purchase, shares of our common stock while such selling stockholders are distributing shares covered by this prospectus. Accordingly, the selling stockholders are not permitted to cover short sales by purchasing shares while the distribution is taking place. The Selling Stockholders are advised that if a particular offer of common stock is to be made on terms constituting a material change from the information set forth above with respect to the Plan of Distribution, then, to the extent required, a post-effective amendment to the accompanying registration statement must be filed with the SEC.

LEGAL PROCEEDINGS

We are not currently a party to any legal proceedings. Our agent for service of process is Stephen O’Neill, 435 Martin Street, Suite 1010, Blaine, Washington 98230.

DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS

The following is information regarding our sole executive officer and director and his age as of July 18, 2005:

| Name of Director | Age | Position |

| Marc Branson | 30 | President, Treasurer and Secretary |

Set forth below is a brief description of the background and business experience of our sole executive officer and director.

Mr. Marc Bransonhas been our president, secretary and treasurer and our sole member of our board of directors since our inception.

From June 2001 to January 2002, Mr. Branson was a private consultant performing management, and corporate development activities for Coastal Communications Corp., a full-service financial consulting firm, and in his capacity has had the opportunity to work closely with management and assist in the development of a wide variety of business opportunities. From September 2001 to August 2002 worked for Gale Capital Corp, a full service financial consulting firm. Mr. Branson provided various management and corporate development services to us as a private consultant. From August 2002 to present, Mr. Branson has been working for Moto Ergonomics Ltd. which is engaged in the Distribution and Marketing of Consumer Electronics to North America. Mr. Branson is currently the VP of Corporate Development, and as such is responsible in part or wholly for overseeing corporate finance, strategic planning, and product development. Mr. Branson holds a degree in Business Administration from the Open Learning University of British Columbia, which he obtained in March 2001, a Business Diploma from Capilano College and in addition has completed the Canadian Securities Course.

Mr. Branson does not have formal training as a geologist or in the technical or managerial aspects of management of a mineral exploration company. Mr. Branson's prior managerial and consulting positions have not been in the mineral exploration industry. Accordingly, we will have to rely on the technical services of others to advise us on the managerial aspects specifically associated with a mineral exploration company.

We do not have any employees who have professional training and experience in the mining industry. We rely on our independent geological consultant, Mr. Timmins, to make recommendations to us on work programs on our property, to hire appropriately skilled persons on a contract basis to complete work programs and to supervise, review, and report on such programs to us.

We presently do not pay our sole director and officer any salary or consulting fee. We anticipate that compensation may be paid to officers in the event that we determine to proceed with additional exploration programs beyond the third phase of our exploration program.

13

Term of Office

Our directors are appointed for a one-year term to hold office until the next annual general meeting of our stockholders or until removed from office in accordance with our bylaws. Our officers are appointed by our board of directors and hold office until removed by the board.

Significant Employees

We have no significant employees other than Marc Branson.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information concerning the number of shares of our common stock owned beneficially as of July 18, 2005 by: (i) each person (including any group) known to us to own more than five percent (5%) of any class of our voting securities, (ii) each of our directors, (iii) named executive officers, and (iv) officers and directors as a group. At this time, only one shareholder falls within these categories, Mr. Marc Branson, Director, President, Secretary and Treasurer. The shareholder listed possesses sole voting and investment power with respect to the shares shown.

| Title of Class | Name and Address of Beneficial Owner | Amount and Nature

of Beneficial

Ownership | Percentage

of Common

Stock(1) |

| Common Stock | Marc Branson

President, Secretary, Treasurer

and Director,

977 Keith Road,

West Vancouver, British Columbia,

Canada V7T 1M6

| 6,000,000

Direct | 49% |

| Common Stock | All Officers and Directors

as a Group (1 person) | 6,000,000 | 49% |

| Holders of More than 5% of Our Common Stock |

Common Stock

| Marc Branson

President, Secretary, Treasurer

and Director,

977 Keith Road,

West Vancouver, British Columbia,

Canada V7T 1M6 | 6,000,000

Direct | 49% |

| (1) | Applicable percentage of ownership is based on 12,146,667, shares of common stock issued and outstanding as of July 18, 2005, together with securities exercisable or convertible into shares of common stock within 60 days of July 18, 2005 for each stockholder. Beneficial ownership is determined in accordance with the rules of the SEC and generally includes voting or investment power with respect to securities. Shares of common stock subject to securities exercisable or convertible into shares of common stock that are currently exercisable or exercisable within 60 days of July 18, 2005 are deemed to be beneficially owned by the person holding such options for the purpose of computing the percentage of ownership of such person, but are not treated as outstanding for the purpose of computing the percentage ownership of any other person. |

14

DESCRIPTION OF SECURITIES

General

Our authorized capital stock consists of 100,000,000 shares of common stock, with a par value of $0.001 per share, and 100,000,000 shares of preferred stock, with a par value of $0.001 per share. As of July 18, 2005, there were 12,146,667 shares of our common stock issued and outstanding that were held by fifty seven (57) stockholders of record. We have not issued any shares of preferred stock.

Common Stock

Our common stock is entitled to one vote per share on all matters submitted to a vote of the stockholders, including the election of directors. Except as otherwise required by law or provided in any resolution adopted by our board of directors with respect to any series of preferred stock, the holders of our common stock will possess all voting power. Generally, all matters to be voted on by stockholders must be approved by a majority (or, in the case of election of directors, by a plurality) of the votes entitled to be cast by all shares of our common stock that are present in person or represented by proxy, subject to any voting rights granted to holders of any preferred stock. Holders of our common stock representing one-percent (1%) of our capital stock issued, outstanding and entitled to vote, represented in person or by proxy, are necessary to constitute a quorum at any meeting of our stockholders. A vote by the holders of a majority of our outstanding shares is required to effectuate certain fundamental corporate changes such as liquidation, merger or an amendment to our Articles of Incorporation. Our Articles of Incorporation do not provide for cumulative voting in the election of directors.

Subject to any preferential rights of any outstanding series of preferred stock created by our board of directors from time to time, the holders of shares of our common stock will be entitled to such cash dividends as may be declared from time to time by our board of directors from funds available therefor.

Subject to any preferential rights of any outstanding series of preferred stock created from time to time by our board of directors, upon liquidation, dissolution or winding up, the holders of shares of our common stock will be entitled to receive pro rata all assets available for distribution to such holders.

In the event of any merger or consolidation with or into another company in connection with which shares of our common stock are converted into or exchangeable for shares of stock, other securities or property (including cash), all holders of our common stock will be entitled to receive the same kind and amount of shares of stock and other securities and property (including cash).

Holders of our common stock have no pre-emptive rights, no conversion rights and there are no redemption provisions applicable to our common stock.

Preferred Stock

Our board of directors is authorized by our articles of incorporation to divide the authorized shares of our preferred stock into one or more series, each of which must be so designated as to distinguish the shares of each series of preferred stock from the shares of all other series and classes. Our board of directors is authorized, within any limitations prescribed by law and our articles of incorporation, to fix and determine the designations, rights, qualifications, preferences, limitations and terms of the shares of any series of preferred stock including but not limited to the following:

| | (a) | the rate of dividend, the time of payment of dividends, whether dividends are cumulative, and the date from which any dividends shall accrue; |

| |

| | (b) | whether shares may be redeemed, and, if so, the redemption price and the terms and conditions of redemption; |

| |

| | (c) | the amount payable upon shares of preferred stock in the event of voluntary or involuntary liquidation; |

| |

| | (d) | sinking fund or other provisions, if any, for the redemption or purchase of shares of preferred stock; |

15

| | (e) | the terms and conditions on which shares of preferred stock may be converted, if the shares of any series are issued with the privilege of conversion; |

| |

| | (f) | voting powers, if any, provided that if any of the preferred stock or series thereof shall have voting rights, such preferred stock or series shall vote only on a share for share basis with our common stock on any matter, including but not limited to the election of directors, for which such preferred stock or series has such rights; and |

| |

| | (g) | subject to the above, such other terms, qualifications, privileges, limitations, options, restrictions, and special or relative rights and preferences, if any, of shares or such series as our board of directors may, at the time so acting, lawfully fix and determine under the laws of the State of Nevada. |

Dividend Policy

We have never declared or paid any cash dividends on our common stock. We currently intend to retain future earnings, if any, to finance the expansion of our business. As a result, we do not anticipate paying any cash dividends in the foreseeable future.

Share Purchase Warrants

We have not issued and do not have outstanding any warrants to purchase shares of our common stock.

Options

We have not issued and do not have outstanding any options to purchase shares of our common stock.

Convertible Securities

We have not issued and do not have outstanding any securities convertible into shares of our common stock or any rights convertible or exchangeable into shares of our common stock.

Nevada Anti-Takeover laws

Nevada revised statutes sections 78.378 to 78.3793 provide state regulation over the acquisition of a controlling interest in certain Nevada corporations unless the articles of incorporation or bylaws of the corporation provide that the provisions of these sections do not apply. Our articles of incorporation and bylaws do not state that these provisions do not apply. The statute creates a number of restrictions on the ability of an acquiring person to acquire control of a Nevada company by setting down certain rules of conduct and voting restrictions in any acquisition attempt, among other things. The statute defines an "acquiring person" as any person who, individually or in association with others, acquires or offers to acquire, directly or indirectly, a controlling interest in the corporation. The term does not include any person who, in the ordinary course of business and without any intent to avoid the requirements of Nevada Revised Statutes sections 78.378 to 78.3793, acquires voting shares for the benefit of others, in respect of which he is not specifically authorized to exercise or direct the exercise of voting rights. The statute is limited to corporations that are organized in the state of Nevada and that have 200 or more stockholders, at least 100 of whom are stockholders of record and residents of the State of Nevada; and does business in the State of Nevada directly or through an affiliated corporation.

INTERESTS OF NAMED EXPERTS AND COUNSEL

No expert or counsel named in this prospectus as having prepared or certified any part of this prospectus or having given an opinion upon the validity of the securities being registered or upon other legal matters in connection with the registration or offering of the common stock was employed on a contingency basis, or had, or is to receive, in connection with the offering, a substantial interest exceeding $50,000, direct or indirect, in the registrant or any of its parents or subsidiaries. Nor was any such person connected with the registrant or any of its parents or subsidiaries as a promoter, managing or principal underwriter, voting trustee, director, officer, or employee.

16

O’Neill Law Group PLLC, our independent legal counsel, has provided an opinion on the validity of our common stock.

Telford Sadovnick, P.L.L.C, certified public accountants (“Telford”), have audited our financial statements included in this prospectus and registration statement to the extent and for the periods set forth in their audit report. Telford have presented their report with respect to our audited financial statements. The report of Telford is included in reliance upon their authority as experts in accounting and auditing.

DISCLOSURE OF COMMISSION POSITION OF

INDEMNIFICATION FOR SECURITIES ACT LIABILITIES

Our articles of incorporation provide that we will indemnify an officer, director, or former officer or director, to the full extent permitted by law. We have been advised that in the opinion of the SEC indemnification for liabilities arising under the Securities Act is against public policy as expressed in the Securities Act, and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities is asserted by one of our directors, officers, or controlling persons in connection with the securities being registered, we will, unless in the opinion of our legal counsel the matter has been settled by controlling precedent, submit the question of whether such indemnification is against public policy to a court of appropriate jurisdiction. We will then be governed by the court’s decision.

ORGANIZATION WITHIN LAST FIVE YEARS

We were incorporated on October 17, 2001 under the laws of the State of Nevada. On November 2, 2001, we acquired a 100% undivided interest in a group of mineral claims located in the Yukon Territory known as the Peek Claims.

Mr. Marc Branson, our president, secretary and treasurer and sole director, has been our sole promoter since our inception. Other than the purchase of his stock, Mr. Branson has not entered into any agreement with us in which he is to receive from us or provide to us anything of value. Mr. Branson acquired 6,000,000 shares of our common stock at a price of $0.001 per share on November 1, 2001. Mr. Branson paid a total purchase price of $6,000 for these shares.

DESCRIPTION OF BUSINESS

In General

We are an exploration stage company engaged in the acquisition and exploration of mineral properties. We have acquired a 100% undivided interest in a group of mineral claims located in the Wheaton River District in the Yukon Territory that we refer to as the Peek Claims. Although exploratory work on the claims conducted by prior owners has indicated some potential showings of mineralization, we are uncertain as to the reliability of these prior exploration results and thus we are uncertain as to whether a commercially viable mineral deposit exists on our mineral claims. Further exploration of these mineral claims is required before a final determination as to their viability can be made.

We conduct our business through verbal agreements with consultants and arms-length third parties. Our verbal agreement with our geologist includes his reviewing all of the results from the exploratory work performed upon the site and making recommendations based on those results in exchange for payments equal to the usual and customary rates received by geologists performing similar consulting services. Additionally, we have a verbal agreement with our outside auditors to perform requested accounting functions at their normal and customary rates. Our legal consultants provide legal services at their normal and customary rate.

Our plan of operations is to carry out exploration work on these claims in order to ascertain whether they possess commercially exploitable quantities of silver and gold. We will not be able to determine whether or not our mineral claims contain a commercially exploitable mineral deposit, or reserve, until appropriate exploratory work is done and an economic evaluation based on that work concludes economic viability.

17

Acquisition of the Peek Mineral Claims

We purchased a 100% interest in eight mineral claims known as the Peek Claims, located in Canada’s Yukon Territory, from Glen MacDonald of Vancouver, British Columbia by an agreement dated November 2, 2001 for consideration of $2,500. At the time of the acquisition of the Peek Claims, we were seeking a potential high-grade gold/silver project. There was at the time an extensive technical file available detailing the history of exploration on the Peek Claims property. We also considered the existence of a nearby milling plant as advantageous. Mr. Timmins, P.Eng. and Mr. Laurie Stephenson, P.Eng. were involved in assisting us in the selection process.

The Peek Claims property has been progressively explored since 1983 with work to date including road construction, bulldozer trenching, grid controlled geophysical, geochemical, and geological surveying and prospecting.

Location, Infrastructure and Access

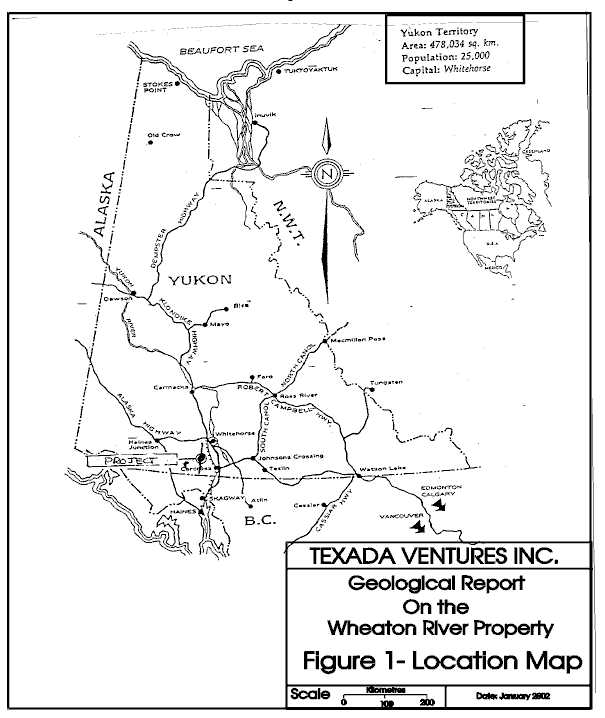

The Peek Claims cover a broad northwest trending ridge south of Pugh Peak (referred to locally as "Gold Hill"), extending from the Wheaton River to Hodnett Lakes. The property lies 40 km south of Whitehorse, the capital of the Yukon Territory, at geographical coordinates 60 16'N latitude, 135 06'W longitude, see Figure 1 below.

Whitehorse is a modern city with a population of 25,000, with most services available for conducting mineral exploration. Daily scheduled flights link the city with Vancouver, British Columbia, Edmonton, Alberta and Fairbanks, Alaska.

The Peek Claims are accessible via an all-weather gravel and paved government maintained road system which includes a tidewater port road link to Skagway, Alaska. The claims are linked by a secondary road with the Mt. Skukum gold mill approximately 12.4 miles away.

The Mount Skukum gold mill is a modern gold silver production facility that is capable of producing both dore bars and metal concentrates depending on the type of ore being processed. The mill is currently idle.

The Alaska and Klondike Highways, and the Wheaton River-Mount Skukum all-season gravel road provide access to the area. A four-wheel drive road follows Thompson Creek from the Wheaton Road to the property. Presently access to the Peek Claims is on foot, by all terrain vehicles or by helicopter because the road is closed by a slide. Further exploration of the property would require approximately $2,000 of road construction work to make the road accessible. We intend to initiate road construction work to make the road accessible prior to commencing Phase IV of our recommended exploration program. The Phase IV drilling program may only proceed if the results of Phases I, II and III of our exploration program warrant additional exploration.

Power sources for the Peek Claims property presently consist of portable generators brought onto the property.

18

Figure 1

Physiography, Climate and Vegetation

The Wheaton River district lies in the Boundary Ranges of the Coast Mountains, a rolling uplands area featuring prominent peaks and steep-walled stream and river valleys. Glacial action has modified major river valleys to deep U-shaped drainages with terrace and outwash deposits. Topographically, the area becomes progressively more severe to the southwest, culminating in 1.55 mile mountains and ice fields at the headwaters of the Wheaton and Watson Rivers.

19

A maximum elevation of 6,069 feet is reached on the Peek claims while the lowest lying feature nearby is Wheaton River at 2,900 feet. The claims cover a barren northwest-trending ridge extending from the Wheaton River to Hodnett Lakes. Outcrop is common on steep slopes descending from the rounded ridge top. The effects of local alpine glaciation are evident on the northern side of Pugh Peak, where cirques and tarns are present. The upland portion of Gold Hill is a rolling grassy plain type of environment with outcrop of less than 5%. Consequently most of the geological interpretation is based upon bulldozer trenches to expose bedrock at depths of 6.56 to16.40 feet.

Southwestern Yukon has a dry sub-arctic climate, locally modified by the Pacific Ocean. Summer temperatures average 12°C and annual precipitation totals 15.74 inches. The exploration season lasts from May until October.

Vegetation in the upland consists of dwarf grasses, moss and lichen. Timber is restricted to the main valleys at elevations below 3,936 feet.

History of Exploration

The Wheaton River/Lake Bennett district was first explored by prospectors travelling along the major lakes and rivers of southwestern Yukon in the early 1890's. More intensive exploration began in 1906 after the discovery of free gold and gold-silver tellurides on Gold Hill. Wagon roads were built along the Wheaton River, Thompson Creek and Stevens Creek to provide access to numerous adits and pits on Mount Anderson. Limited mining of high grade gold and silver bearing ore occurred on the Gold Reef vein at the northeastern end of Gold Hill and on the Becker-Cochran (Whirlwind) property on the west face of Mount Anderson.

From the mid-1920's to the late 1960's, little exploration of significance took place. By 1970's, many of the old showings were restaked as an increase in the value of base and precious metals rekindled the interest of prospectors and mining companies in the area. The Venus and Arctic mines again operated on Montana Mountain between 1969-1971. The Venus Mine was again rehabilitated during 1980-1981 and a new mill was installed at the southern end of Windy Arm, but no ore was processed.

On the area covered by the Peek Claims, recent exploration started in 1984-1985 when the Wheaton River Joint Venture performed prospecting, grid development, mapping, geochemical and geophysical surveys, bulldozer trenching and road building. Mineralized quartz veins and stockworks were discovered in several locations along a five kilometre long ridge on the claim property. The property was owned by the Wheaton River Syndicate from 1983-1986.

During 1987 and 1988 Ranger Pacific Minerals Ltd. and others conducted additional geochemical and geophysical surveys. Also, blast trenching work was undertaken to better define target zones previously identified and to further explore the property. The Peek Claims property was owned by Ranger Pacific Minerals Ltd. from 1987-1990.

During the period from 1991 to 2001, the property was owned by Glen MacDonald of Vancouver, British Columbia. From 1991-2001 exploration work on the property has included bulldozer trenching, road construction, geological mapping and prospecting. Exploration work conducted from 1984 to 1998 covered most of the Gold Hill area, including but not limited to, the area of the Peek Claims.

In 2001 we purchased a 100% interest in the Peek Claims from Glen MacDonald by way of a purchase agreement dated November 2, 2001.

Although exploratory work on the claims conducted by prior owners has indicated some potential showings of mineralization, we are uncertain as to the reliability of these prior exploration results and thus we are uncertain as to whether a commercially viable mineral deposit exists on our mineral claims. Further exploration of these mineral claims is required before a final determination as to their viability can be made.

Property Geology and Mineralization

The Wheaton River/Bennett Lake district overlies the boundary between two terranes: (i) the Whitehorse Trough consisting of Mesozoic and Paleozoic folded meta-volcanic and meta-sedimentary rocks, and (ii) crystalline rocks of the Coast Plutonic Complex and Yukon Crystalline Terrane, consisting of meta-sedimentary rocks of the

20

Late Precambrian or Paleozoic Yukon Group intruded by Mid-Cretaceous granite or granodiorite plutons. Both terranes are intruded and overlain by Early Tertiary volcanic rocks of the Skukum Group.

The Whitehorse Trough features a complex assemblage of deformed volcanic and sedimentary rocks consisting of the Triassic Lewes River Group, the Lower Jurassic Laberge Group and the Jurassic Tantalus Group. The Lewes River Group consists of andesite, basalt and pyroclastic flows, and foliated marine sedimentary rocks. A narrow but continuous unit of limestone, limestone breccia and quartzite has been traced in a northwesterly direction from the west side of Mount Stevens across Tally-Ho Mountain and Gold Hill to the Hodnett Lakes. Interbedded schists occur with the limestone and volcanic rocks of the Lewes River Group. A narrow band of Tantalus Group conglomerates and Laberge Group siltstones outcrops on Folle Mountain and Idaho Hill; however, rocks of these groups primarily outcrop north and east of the Wheaton River/Bennett Lake district.

Cretaceous granitic rocks of the Coast Plutonic Complex are the most common in the district. Typically, they consist of fresh quartz monzonite, granodiorite or quartz diorite. Pendants and masses of Yukon Group quartz-mica schist, gneisses and crystalline limestone occur in the granitic intrusives. The Yukon Group is of Early Paleozoic and Late Precambrian age.

A younger series of andesite and rhyolite flows, tuffs and agglomerates, mapped as the Tertiary Mount Skukum Group, intrude and overlie granitic rocks forming volcanic complexes at Mount Skukum and Mount Macauley. Also, Skukum Group rhyolite and granite porphyry dykes and plugs intrude Lewes River Group rocks and Cretaceous granodiorites throughout the Wheaton River area.

Mesozoic and Paleozoic sedimentary and volcanic rocks of the Whitehorse Trough Terrane are deformed and generally metamorphosed to at least lower green schist facies. These units trend north to northwest and are internally complex.

Structurally, the area features major faults, primarily along river valleys, associated with movement in the Coast Plutonic Complex and with Early Tertiary volcanism at Mount Skukum, Mount Macauley and Montana Mountain. The Skukum Group volcanic rocks are equivalent to the Sloko Group of northern British Columbia and the Mount Nansen Group of central Yukon. Late stage features of Skukum Group volcanism include dacite, rhyolite and granite porphyry dykes, emplaced in fracture and fault zones around the volcanic complexes, and quartz or quartz carbonate veining with significant precious and base metal mineralization.

Rock Formation

Triassic Lewes River Group

Limestone, limestone breccia and quartzite with some interbedded pelitic horizons occur in a continuous belt of Triassic rocks passing through Gold Hill. Grey-weathering limestone outcrops at the north and south ends of Gold Hill and on the east flank of Gold Hill above Dail Creek. It is also exposed in the bulldozer trenches excavated on the North and 4500N grids.

The limestone is a fine to medium grained, white to blue grey rock occasionally brecciated by narrow quartz and calcite veins or silicified to "quartzite". Minor amounts of siderite, barite and sulphide minerals occasionally occur in the narrow quartz-calcite veins.

At the north end of Gold Hill and on the east face overlooking Dail Creek, the limestone unit is only 16 -32 feet wide and is displaced and intruded by granitic and volcanic rocks. On the south end of Gold Hill, the limestone and limestone breccia unit widens to over 328 feet, containing interbedded schist, siltstone and argillite. At the south end of the property, crystalline limestone outcrops in a belt at least 164 feet wide and contains lenses of rusty quartz-carbonate breccia.

In numerous trenches, wide intersections of limestone, limestone breccia and quartzite are well exposed. Dark grey meta-sedimentary rocks of the Lewes River Group interbedded with andesite, basalt and limestone and quartz-sericite and graphitic schist occur with brecciated limestone. Argillite and siltstone are foliated in a northwest direction and contain quartz veins and pods developed along remnant bedding planes and foliations. Local silicification occurs in these meta-sedimentary units at contacts with Tertiary felsic dykes. Pyritic graphite schist occurs at the south end of Gold Hill with limestone near a series of rhyolite porphyry dykes.

21

On the northeast face of Gold Hill, the Triassic meta-sedimentary rocks are intruded by several Tertiary rhyolite dykes. There they are pyritized and silicified, weathering a rusty red colour. The Gold Reef quartz vein occurs in these rocks.

Triassic volcanic rocks outcrop extensively at the north end of Gold Hill and on the east face of Gold Hill above Dail Creek. Typically, they are massive green to black, slightly foliated andesite and basalt flows, breccias and tuffs and may contain narrow quartz veins in more foliated sections. Phenocrysts of quartz and feldspar occur in porphyritic andesite at the north end of Gold Hill.

Coast Plutonic Complex

Cretaceous granodiorite talus and outcrop is extensive on the east side of Gold Hill, in the steep walled valleys at the head of Thompson Creek and around Pugh Peak. Aplitic and microgranite phases are common west of Pugh Peak and on the ridge south of the Hodnett Lakes.

Typically, the intrusive rock is a homogeneous, medium grained, biotite-hornblende granodiorite or quartz diorite containing minor magnetite. Bulldozer trenching has exposed fresh granodiorite along the western side of Gold Hill where no outcrop is present.

White quartz veins bearing gold and silver mineralization occur in fractures in the granodiorite at the head of Dail Creek and on Gold Hill, Pugh Peak and the ridge south of the Hodnett Lakes.

Skukum Group

Skukum Group felsic volcanic rocks occur as rhyolite, trachyte and dacite porphyry dykes and plugs outcropping on the north face of Gold Hill, south of Pugh Peak and along the ridge top of Gold Hill. Megascopically they weather a light grey to orange colour and contain phenocrysts of quartz, feldspar and occasionally mafic minerals in a fine grained rhyolitic groundmass. Fresh surfaces are buff to brown in colour and contain minor pyrite as an accessory mineral.

On the Gold Hill ridge top, much of the float material is rhyolite and trachyte porphyry, probably derived from dykes intruding granodiorite in the middle section of Gold Hill. These dykes trend north to northwesterly and are up to 49 feet wide. Minor silicification occurs at contacts with granodiorite.

On the north face of Gold Hill, the rhyolite porphyry dykes weather buff to rusty orange and intrude silicified meta-sedimentary rocks. Spatially the dykes lie close to the Gold Reef quartz vein; this does not necessarily imply a close genetic relationship.

In several bulldozer trenches, rhyolite porphyry dykes intrude limestone and meta-sedimentary rocks. Zones of narrow quartz veins and silicification are common in the older rocks near the contacts.

Mineralization

Precious metal values to date have occurred on the Peek Claims in two types of quartz veins: (i) quartz veins up to 6.5 feet wide in granite and meta-sedimentary / metavolcanic rocks, and (ii) narrow quartz and/or quartz-calcite veins in limestones, quartzites and schists; and silver occurs disseminated in siliceous pyritic schist.

Quartz veins in the first group have a general northwest orientation and are continuous over long distances. The Gold Reef vein on the northwest end of Gold Hill is considered a typical example, and has been traced by underground workings, and surface pits for over 984 feet where the average width has been 5 feet.

Quartz and quartz-calcite veins appear less continuous and have more random orientations. They are generally spatially related to Eocene intrusive rocks.

Alteration and accessory minerals present around the vein systems include clays (kaolinite, alunite) black and green chalcedonic breccias, fluorite, barite, pyrite and hematite. Carbonatization is common in andesitic rocks near veins, and carbonatization and massive chloritization are present in the shear zones in andesitic rocks.

22

Mineralization on the Peek Claims occurs as either of the following veins and siliceous stockworks:

| 1. | Epithermal gold-silver veins associated with northeast-trending normal faults hosted with bi-modal calc- alkaline andesitic volcanics of the Skukum Group and associated with Eocene rhyolite porphyry dykes outside the volcanic complex. |

| |

| 2. | Gold-silver and telluride bearing quartz veins spatially related to the "Tally-Ho Shear Zone", sheared and chloritized mafic volcanic rocks and nearby sheared or unsheared granitic rocks and Jurassic Laberge Group arkosic sedimentary rocks. |

Geological Report

In June 2002, we hired Mr. W. Timmins, P.Eng to provide an initial Geological Report on the Peek Claims. Mr. Timmins has 39 years experience as a consulting geologist. He graduated from the Provincial Institute of Mining in Haileybury, Ontario, Canada in 1956 and attended Michigan Technological University from 1962-1965. He has been a licensed professional Engineer (Geology) in British Columbia since 1969. The purpose of this report was to evaluate the area of the claim group, and the prior exploration work conducted on the claims, and to recommend an exploration program. This review was based upon previous explorations performed on the Peek Claims including soil geochemical and electromagnetic surveys, geological mapping, bulldozer and blast trenching and underground drifting. Mr. Timmins is familiar with the Peek Claims having consulted on exploration programs conducted there during the 1980's and visited the property in 1999 and 2001.

Based upon conclusions in Mr. Timmins’ report, we believe that the Peek Claims may have the potential to host minerals based on earlier geological surveys and sampling.

The first phase of our geological exploration program was completed in the summer of 2002 at a cost of $5,000. The first phase consisted of a geological surveying and a review of prior exploration work on the Peek Claims. The second phase of our exploration program was completed in late 2003 at a cost of $10,000. The second phase consisted of more detailed geophysical surveys utilizing more sensitive geophysical techniques to enhance the data that currently exists on the claims and focused specifically upon the presently known mineralized areas.

We received a geological evaluation report on the results of Phase II of our exploration program in April, 2004. The geological report gives conclusions regarding potential mineralization of the mineral claim, discussed below, and recommends a further geological exploration program on the mineral claims. In his geological report, Mr. Timmins, recommended that a four phase exploration program, at an estimated cost of $140,000, be undertaken on the property to assess its potential to host high grade gold mineralization within quartz and sulphide veins. The four phase program consists of the following:

| Phase | Exploration Program | Status | Cost |

| Phase I | Compilation of previous exploration data, and geological analysis of the data. | Completed in August, 2002. | $5,000 |

| Phase II | Detailed field examination and study of known mineral zones including localized geophysical surveys. | Completed in December,

2003 | $10,000 |

| Phase III | Detailed field examination of potential exploration sites, including geological mapping, localized geophysical surveys and sampling using the knowledge obtained from the known exploration areas. | Expected to be commenced

in the summer exploration

season of 2005.

| $5,000 |

| Phase IV | Test diamond drilling (to 1200 Metres) of the targets delineated within the potential exploration sites. | To be commenced in 2006

subject to the results of

Phase III. | $120,000 |

23

Based upon the results of Phase I and Phase II of our geological exploration program, Mr. Timmins recommends a further Phase III program of geological mapping, geophysical surveying and sampling, to select targets for the Phase IV drilling program consisting of 1200 metres (approximately 3936 feet) of diamond drilling if the results of Phase III warrant additional exploration. A Phase IV drilling program will be dependent upon a number of factors such as the geologists’ recommendations based upon previous phases and our available funds. To date Mr. Timmins has received a total of $17,500 in connection with the completion of the first and second phases of our exploration program.

The projected costs of our exploration program include provision for mobilization and support costs. Mr. Timmins, will issue a recommendation on whether to proceed with a phase IV drilling program based on his review of the assay results and geophysical survey data compiled from our Phases I, II and III of our exploration program. The expenditures made by us in the exploration of our mineral claim may not result in the discovery of mineral deposits. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. If the results of exploration do not reveal viable commercial mineralization, we may decide to abandon our claim and acquire new claims for new exploration. The acquisition of additional claims will be dependent upon our possessing sufficient capital resources at the time in order to purchase such claims. If no funding is available, we may be forced to abandon our operations.

In the event that we proceed with Phase IV of our exploration program, we intend to implement a drilling program which will target any mineralized zones or zones of interest identified in our Phase I, Phase II and Phase III exploration results. The results of any drilling will be used to assess whether further geological exploration and drilling of identified mineralized areas is warranted. The funding required for the drilling program and our ability to complete the drilling program is expected to be dependent on the amount of funds we have available for exploration and our exploration priorities. Completion of our planned Phase IV drilling program is estimated to cost $120,000 and is expected to include the following:

| (a) | Hiring of local contractors familiar with the mining region and drill conditions to perform the drilling operations and supply the drill and all other equipment and drill technicians required to perform the drilling operations. |

| |