1 Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. (incorporated in the Cayman Islands with limited liability) (Stock Code: 1128) INTERIM RESULTS ANNOUNCEMENT FOR THE SIX MONTHS ENDED 30 JUNE 2014, DECLARATION OF INTERIM DIVIDEND AND CLOSURE OF REGISTER OF MEMBERS The Board of Directors of Wynn Macau, Limited (the “Company”) is pleased to announce the unaudited consolidated results of the Company and its subsidiaries (collectively, the “Group”) for the six months ended 30 June 2014 as follows: FINANCIAL HIGHLIGHTS Group For the six months ended 30 June 2014 2013 HK$ HK$ (in thousands, except per share amounts or otherwise stated) Casino revenues 15,358,669 13,995,004 Other revenues 879,691 924,731 EBITDA 4,623,914 4,143,028 Profit attributable to owners 3,649,615 3,695,214 Earnings per Share — basic and diluted 70 cents 71 cents INTERIM DIVIDEND AND CLOSURE OF REGISTER OF MEMBERS On 21 August 2014, the Board declared an interim dividend of HK$0.70 per Share for the six months ended 30 June 2014, payable to Shareholders whose names appear on the register of members of the Company on 12 September 2014. It is expected that the interim dividend will be paid on 23 September 2014. The register of members of the Company will be closed for the purpose of determining the identity of members who are entitled to the interim dividend from 10 September 2014 to 12 September 2014, both days inclusive, during which period no transfer of Shares will be effected. In order to qualify for the interim dividend, all duly completed transfer forms accompanied by the relevant share certificates must be lodged with the share registrar of the Company, Computershare Hong Kong Investor Services Limited at Shops 1712–1716, 17th Floor, Hopewell Centre, 183 Queen’s Road East, Wanchai, Hong Kong no later than 4:30 p.m. on 8 September 2014. * For identification purpose only

2 CONDENSED CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME For the Six Months Ended 30 June 2014 2013 HK$ HK$ (in thousands) Notes (unaudited) (unaudited) Operating revenues Casino 15,358,669 13,995,004 Rooms 65,647 73,529 Food and beverage 101,973 93,182 Retail and other 712,071 758,020 16,238,360 14,919,735 Operating costs and expenses Gaming taxes and premiums 7,766,149 7,208,748 Staff costs 1,491,653 1,157,957 Other operating expenses 3 2,498,669 2,458,974 Depreciation and amortization 485,939 451,936 Property charges and other 80,954 (6,381) 12,323,364 11,271,234 Operating profit 3,914,996 3,648,501 Finance revenues 73,895 61,649 Finance costs 4 (295,694) (159,192) Net foreign currency differences (1,542) 22,528 Changes in fair value of interest rate swaps (29,559) 129,252 (252,900) 54,237 Profit before tax 3,662,096 3,702,738 Income tax expense 5 12,481 7,524 Net profit attributable to owners of the Company 3,649,615 3,695,214 Other comprehensive income Other comprehensive income to be reclassified to profit or loss in subsequent periods: Available-for-sale investments: Changes in fair value 254 802 Reclassification adjustment for loss (gain) on de-recognition of available-for-sale investments included in the profit or loss 169 (9) Other comprehensive income for the period 423 793 Total comprehensive income attributable to owners of the Company 3,650,038 3,696,007 Basic and diluted earnings per Share 6 70 cents 71 cents

3 CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION Group As at 30 June 2014 As at 31 December 2013 HK$ HK$ (in thousands) Notes (unaudited) (audited) Non-current assets Property and equipment and construction in progress 13,885,257 11,159,229 Leasehold interests in land 2,023,051 2,071,136 Goodwill 398,345 398,345 Deposits for acquisition of property and equipment 69,969 6,807 Interest rate swaps 50,372 79,929 Other non-current assets 161,119 156,768 Total non-current assets 16,588,113 13,872,214 Current assets Available-for-sale investments — 38,022 Inventories 185,813 197,053 Trade and other receivables 8 643,859 556,359 Prepayments and other current assets 100,371 64,084 Amounts due from related companies 12 387,425 500,438 Restricted cash and cash equivalents — 1,550,340 Cash and cash equivalents 16,147,269 14,130,433 Total current assets 17,464,737 17,036,729 Current liabilities Accounts payable 9 1,463,000 1,810,427 Land premium payables 233,199 227,511 Other payables and accruals 10 5,796,506 6,585,496 Amounts due to related companies 12 213,147 287,638 Income tax payables 5 7,524 15,049 Other current liabilities 22,092 22,864 Total current liabilities 7,735,468 8,948,985 Net current assets 9,729,269 8,087,744 Total assets less current liabilities 26,317,382 21,959,958

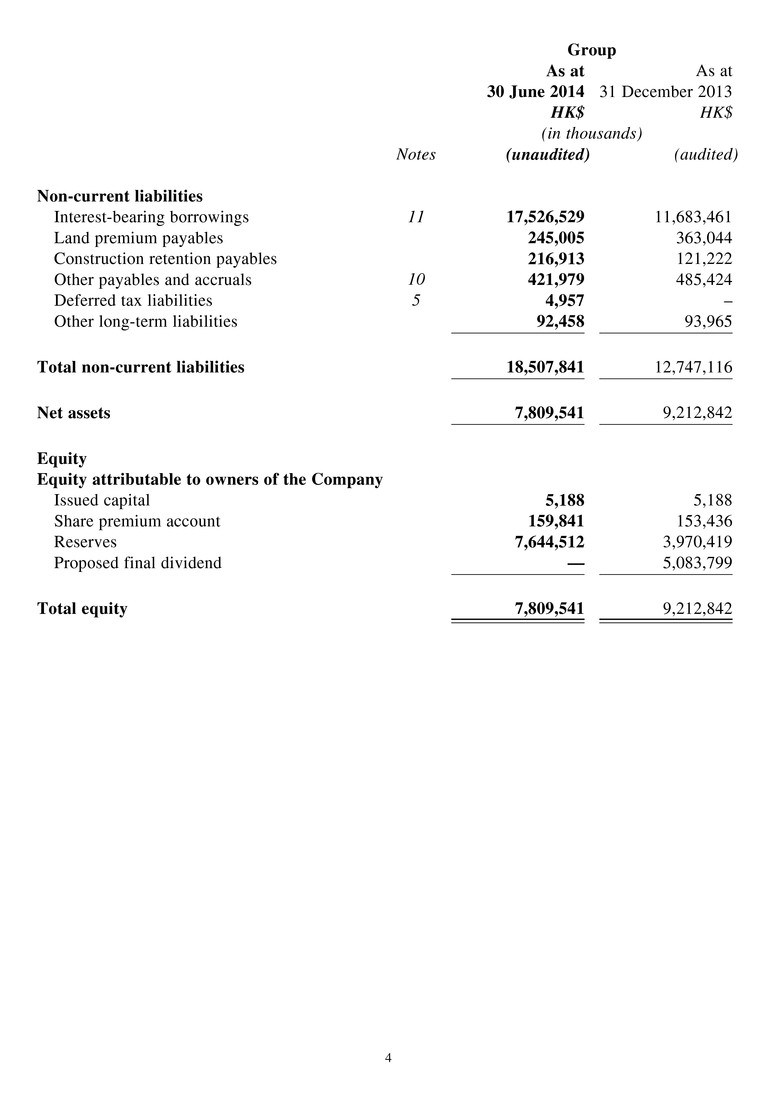

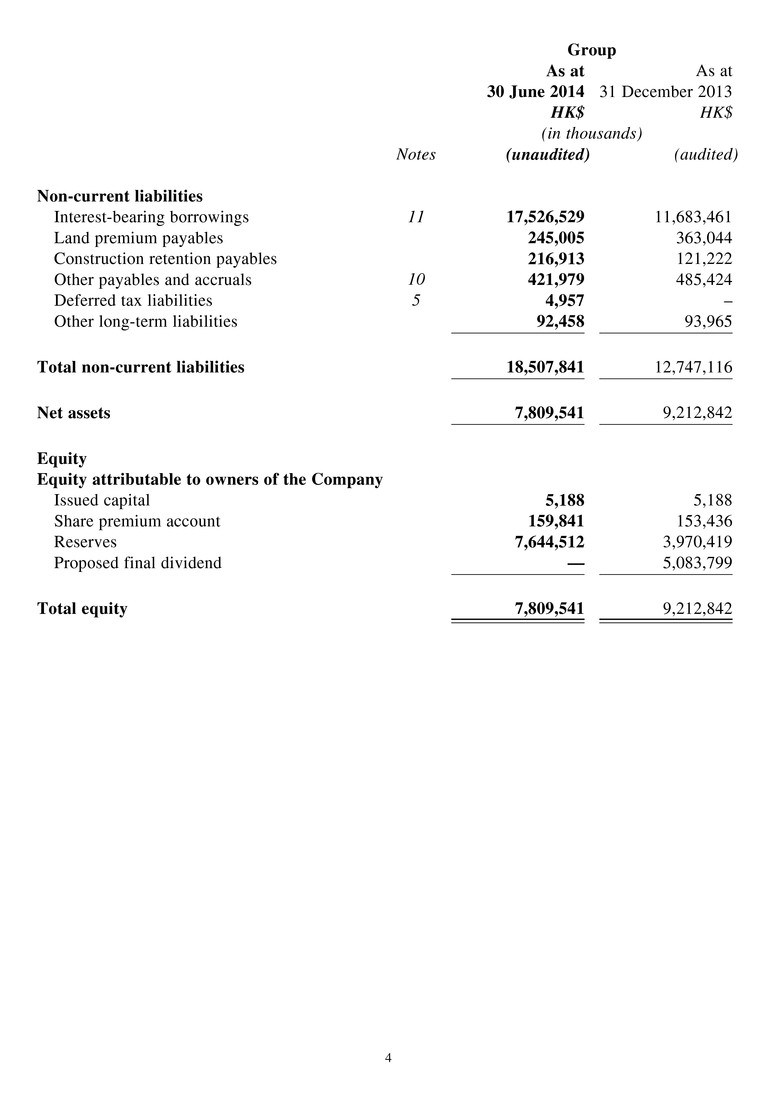

4 Group As at 30 June 2014 As at 31 December 2013 HK$ HK$ (in thousands) Notes (unaudited) (audited) Non-current liabilities Interest-bearing borrowings 11 17,526,529 11,683,461 Land premium payables 245,005 363,044 Construction retention payables 216,913 121,222 Other payables and accruals 10 421,979 485,424 Deferred tax liabilities 5 4,957 – Other long-term liabilities 92,458 93,965 Total non-current liabilities 18,507,841 12,747,116 Net assets 7,809,541 9,212,842 Equity Equity attributable to owners of the Company Issued capital 5,188 5,188 Share premium account 159,841 153,436 Reserves 7,644,512 3,970,419 Proposed final dividend — 5,083,799 Total equity 7,809,541 9,212,842

5 NOTES TO INTERIM FINANCIAL INFORMATION 1. BASIS OF PREPARATION AND PRESENTATION This interim financial information has been prepared in accordance with the applicable disclosure requirements of Appendix 16 to the Rules Governing the Listing of Securities on the Hong Kong Stock Exchange and International Accounting Standard (“IAS”) 34 Interim Financial Reporting issued by the International Accounting Standards Board. The interim financial information does not include all the information and disclosures required in the annual financial statements, and should be read in conjunction with the Group’s annual financial statements for the year ended 31 December 2013. Application of new and revised IFRSs The Group has adopted the following new and revised IFRSs for the first time for the current period’s interim financial information: IFRS 10, IFRS 12 and IAS 27 Amendments Amendments to IFRS 10, IFRS 12 and IAS 27 — Investment Entities IAS 32 Amendments Amendments to IAS 32 Financial Instruments: Presentation — Offsetting Financial Assets and Financial Liabilities IAS 36 Amendments Amendments to IAS 36 Impairment of Assets — Recoverable Amount Disclosures for Non-Financial Assets IAS 39 Amendments Amendments to IAS 39 Financial Instruments: Recognition and Measurement — Novation of Derivatives and Continuation of Hedge Accounting IFRIC 21 Levies The adoption of these new and revised IFRSs and interpretations has had no significant financial effects on the interim financial information and there have been no significant changes to the accounting policies applied in the interim financial information. The Group has not early adopted the new and revised IFRSs that have been issued, but are not yet effective. 2. SEGMENT REPORTING The Group currently operates in one business segment, namely, the management of its casino and hotel resort in Macau. A single management team reports to the chief operating decision- maker who comprehensively manages the entire business. Accordingly, the Group does not have separate reportable segments.

6 3. OTHER OPERATING EXPENSES Group For the Six Months Ended 30 June 2014 2013 HK$ HK$ (in thousands) (unaudited) (unaudited) Gaming promoters’ commissions 993,699 1,002,367 Royalty fees 638,904 596,444 Cost of sales 240,409 270,334 Advertising and promotions 153,924 115,741 Corporate support services and other 101,641 78,460 Utilities and fuel 95,736 91,908 Repairs and maintenance expense 79,426 56,731 Operating supplies and equipment 78,695 71,890 Operating rental expenses 26,281 15,095 Other support services 17,707 27,398 Auditor’s remuneration 1,904 2,065 (Reversal of provision) provision for doubtful accounts, net (61,495) 12,077 Other 131,838 118,464 2,498,669 2,458,974

7 4. FINANCE COSTS Group For the Six Months Ended 30 June 2014 2013 HK$ HK$ (in thousands) (unaudited) (unaudited) Interest expense for: Bank loans wholly repayable within 5 years 71,549 — Bank loans not wholly repayable within 5 years — 60,465 Senior notes not wholly repayable within 5 years 207,804 — Interest rate swaps wholly repayable within 5 years 15,126 14,399 Land lease premium wholly payable within 5 years 13,828 19,286 Other payments wholly payable within 5 years 2,424 2,528 Imputed interest expense on other payable 14,225 15,446 Bank fees for unused facilities 36,804 39,162 Amortization of debt financing costs 40,874 35,382 Less: capitalized interest (106,940) (27,476) 295,694 159,192 5. INCOME TAX EXPENSE Group For the Six Months Ended 30 June 2014 2013 HK$ HK$ (in thousands) (unaudited) (unaudited) Income tax expense: Current — overseas 7,524 7,524 Deferred — overseas 4,957 — 12,481 7,524 No provision for Hong Kong profit tax for the six months ended 30 June 2014 has been made as there was no assessable profit generated in Hong Kong (six months ended 30 June 2013: Nil). Taxation for overseas jurisdictions is charged at the appropriate prevailing rates ruling in the respective jurisdictions and the maximum rate is 12% (six months ended 30 June 2013: 12%). For the six months ended 30 June 2014, the tax provision of HK$7.5 million results from

8 the current income tax expense accrued by our subsidiaries owning WRM’s shares under the WRM Shareholder Dividend Tax Agreement (six months ended 30 June 2013: HK$7.5 million) and a deferred tax expense of HK$5.0 million resulting from an increase in its deferred tax liability (six months ended 30 June 2013: Nil). Effective 6 September 2006, WRM received a 5-year exemption from Macau’s 12% Complementary Tax on casino gaming profits (the “Tax Holiday”). On 30 November 2010, WRM received an additional 5-year exemption effective from 1 January 2011 through 31 December 2015. Accordingly, the Group was exempted from the payment of approximately HK$436.4 million in such tax for the six months ended 30 June 2014 (six months ended 30 June 2013: HK$399.1 million). The Group’s non-gaming profits remain subject to the Macau Complementary Tax and its casino winnings remain subject to the Macau Special Gaming Tax and other levies in accordance with its Concession Agreement. In June 2009, WRM entered the WRM Shareholder Dividend Tax Agreement, effective retroactively to 2006, with the Macau Special Administrative Region that provided for annual payments of MOP7.2 million (approximately HK$7.0 million) to the Macau Special Administrative Region in lieu of Complementary Tax on dividend distributions to its shareholders from gaming profits. The term of this agreement was five years, which coincided with the Tax Holiday which began in 2006. In November 2010, WRM applied for a 5-year extension of this agreement. In August 2011, the 5-year extension was granted with an annual payment of MOP15.5 million (approximately HK$15.0 million) due to the Macau Special Administrative Region for each of the years 2011 through 2015. The Group is exempted from income tax in the Isle of Man and the Cayman Islands. The Group’s subsidiaries file income tax returns in Macau and various foreign jurisdictions as required by law. The Group’s income tax returns are subject to examinations by tax authorities in the locations where it operates. The Group’s 2009 to 2013 Macau Complementary Tax returns remain subject to examination by the Financial Services Bureau of the Government of the Macau Special Administrative Region (The “Financial Services Bureau”). In March 2013, the Financial Services Bureau commenced an examination of the 2009, 2010 and 2011 Macau Complementary Tax returns for WRM. Since the examination is in its initial stage, the Group is unable to determine if it will conclude within the next 12 months. The Group believes that its liability for uncertain tax positions is adequate with respect to these years. In January 2013, the Financial Services Bureau examined the 2009 and 2010 Macau Complementary Tax returns of Palo. The examination resulted in no change to the tax returns. Quarterly, the Group undertakes reviews for any potentially unfavorable tax outcome and when an unfavorable outcome is identified as being probable and can be reasonably estimated, the Group then establishes a tax reserve for such possible unfavorable outcome. Estimating potential tax outcomes for any uncertain tax issues is highly judgmental and may not be indicative of the ultimate settlement with the tax authorities. As of 30 June 2014 and 31 December 2013, the Group has unrecognized tax losses of HK$2.1 billion (31 December 2013: HK$1.8 billion) and the Group believes that these unrecognized tax losses are adequate to offset adjustments that might be proposed by the Macau tax authorities. The Group believes that it has adequately provided reasonable reserves for prudent and foreseeable outcomes related to uncertain tax matters.

9 6. EARNINGS PER SHARE ATTRIBUTABLE TO OWNERS OF THE COMPANY The calculation of basic earnings per Share for the six months ended 30 June 2014 is based on the consolidated net profit attributable to owners of the Company and on the weighted average number of Shares of 5,187,704,033 in issue during the period (six months ended 30 June 2013: 5,187,550,000). The calculation of diluted earnings per Share for the six months ended 30 June 2014 is based on the consolidated net profit attributable to owners of the Company and on the weighted average number of 5,188,732,699 Shares (six months ended 30 June 2013: 5,188,002,997); including 5,187,704,033 Shares in issue during the period (six months ended 30 June 2013: 5,187,550,000) plus 1,028,666 (30 June 2013: 452,997) dilutive potential Shares arising from the exercise of share options. 7. DIVIDENDS PAID AND PROPOSED Group For the Six Months Ended 30 June 2014 2013 HK$ HK$ (in thousands) (unaudited) (unaudited) Dividends declared and paid: Final dividend for 2013: HK$0.98 per Share (2012: HK$1.24 per Share) 5,084,179 6,432,562 Dividends declared (not recognized as a liability as at 30 June): Interim dividend for 2014: HK$0.70 per Share (2013: HK$0.50 per Share) 3,636,814 2,593,775 The 2013 final dividend was approved by the Shareholders on 16 May 2014 and paid during the six months ended 30 June 2014. On 21 August 2014, the Board declared the 2014 interim dividend based on 5,195,449,000 Shares as at 21 August 2014.

10 8. TRADE AND OTHER RECEIVABLES Group As at 30 June 2014 As at 31 December 2013 HK$ HK$ (in thousands) (unaudited) (audited) Casino 555,197 486,954 Hotel 4,916 665 Retail leases and other 189,033 232,642 749,146 720,261 Less: allowance for doubtful accounts (105,287) (163,902) Total trade and other receivables, net 643,859 556,359 An aged analysis of trade and other receivables is as follows: Group As at 30 June 2014 As at 31 December 2013 HK$ HK$ (in thousands) (unaudited) (audited) Within 30 days 205,906 170,675 31 to 60 days 237,266 165,814 61 to 90 days 72,836 123,141 Over 90 days 233,138 260,631 749,146 720,261 Less: allowance for doubtful accounts (105,287) (163,902) Net of allowance for doubtful accounts 643,859 556,359 Substantially all of the trade and other receivables as at 30 June 2014 and 31 December 2013 were repayable within 14 days.

11 9. ACCOUNTS PAYABLE During the six months ended 30 June 2014 and 2013 the Group normally received credit terms of 30 days. An aged analysis of accounts payable as at the end of the reporting period, based on invoice dates, is as follows: Group As at 30 June 2014 As at 31 December 2013 HK$ HK$ (in thousands) (unaudited) (audited) Within 30 days 1,369,256 1,698,108 31 to 60 days 22,837 53,973 61 to 90 days 10,316 5,722 Over 90 days 60,591 52,624 1,463,000 1,810,427 10. OTHER PAYABLES AND ACCRUALS Other payables and accruals consist of the following as at 30 June 2014 and 31 December 2013: Group As at 30 June 2014 As at 31 December 2013 HK$ HK$ (in thousands) (unaudited) (audited) Current: Gaming taxes payable 1,012,479 1,471,397 Outstanding chip liabilities 3,064,503 3,442,012 Customer deposits 1,079,548 1,230,927 Donation payable 77,670 77,670 Other liabilities 562,306 363,490 5,796,506 6,585,496 Non-current: Donation payable 421,979 485,424 Total 6,218,485 7,070,920

12 11. INTEREST-BEARING BORROWINGS As at 30 June 2014 As at 31 December 2013 HK$ HK$ (in thousands) Notes (unaudited) (audited) Bank loans, secured (a) 7,388,531 7,389,170 Senior notes, unsecured (b) 10,506,868 4,652,505 17,895,399 12,041,675 Less: debt financing costs, net (368,870) (358,214) Portion classified as non-current 17,526,529 11,683,461 (a) Bank loans, secured The Wynn Macau Credit Facilities total HK$19.5 billion equivalent, consisting of a HK$7.4 billion equivalent fully funded senior term loan facility and a HK$12.1 billion equivalent senior revolving credit facility. As at 30 June 2014, the Group had approximately HK$12.1 billion in funding available under the revolving credit facility of the Wynn Macau Credit Facilities. (b) Senior notes, unsecured On 20 March 2014, the Company issued 5.25% fixed rate, unsecured senior notes due 2021 for an aggregate principal amount of US$750 million (approximately HK$5.9 billion), which were consolidated to form a single series with the then existing US$600 million (approximately HK$4.7 billion) 5.25% fixed rate, unsecured senior notes due 2021. The WML 2021 Additional Notes have the same terms and conditions as those of the WML 2021 Notes save for the issue date and purchase price, and are also listed on the Hong Kong Stock Exchange. The Company received net proceeds of US$749 million (approximately HK$5.8 billion) from the offering of the WML 2021 Additional Notes after including the premiums and deducting the commissions and expenses of the offering and excluding the receipt of accrued interest. The Company will use the net proceeds for working capital and general corporate purposes.

13 12. RELATED PARTY DISCLOSURES As at the end of the period, amounts due from/(to) related companies are unsecured, interest- free and repayable on demand. The Group had the following material transactions with related companies: Group For the Six Months Ended 30 June Name of Related Company Relation to the Company Primary Nature of Transactions 2014 2013 HK$ HK$ (in thousands) (unaudited) (unaudited) Wynn Resorts, Limited Ultimate parent company Royalty fees (i) 638,904 596,444 Wynn Resorts, Limited Ultimate parent company Corporate support services (ii) 96,890 73,608 Wynn Resorts, Limited Ultimate parent company Share-based payment expenses 24,182 14,942 WIML Subsidiary of Wynn Resorts, Limited International marketing expenses (iii) 14,289 24,732 Worldwide Wynn Subsidiary of Wynn Resorts, Limited Staff secondment payroll charges (iv) 60,278 44,000 Wynn Design & Development Subsidiary of Wynn Resorts, Limited Design/development Payroll (v) 79,858 40,130 Las Vegas Jet, LLC Subsidiary of Wynn Resorts, Limited Airplane usage charges (ii) 4,809 5,693 Except for the share-based payment expenses incurred with Wynn Resorts, Limited, all of the above transactions are noted as continuing connected transactions. Notes: (i) Royalty fees The license fee payable to Wynn Resorts, Limited equals the greater of (1) 3% of the gross monthly revenues of the Intellectual Property, as defined and (2) US$1.5 million (approximately HK$11.6 million) per month. (ii) Corporate support services The annual fee for the services provided by Wynn Resorts, Limited is based on an allocation of the actual proportion of Wynn Resorts, Limited’s annual corporate departments’ costs (including salaries and benefits for such employees during the period in which such services are rendered) and overhead expense related to the provision of such services, and in any event, such annual fee shall not exceed 50% of the aggregate annual corporate departments’ costs and overhead expense incurred by Wynn Resorts, Limited during any financial year. Wynn Resorts, Limited allows WRM and its employees to use aircraft assets owned by Wynn Resorts, Limited and its subsidiaries (other than the Group) at hourly rates set by Las Vegas Jet, LLC, a subsidiary of Wynn Resorts, Limited. (iii) International marketing expenses These administrative, promotional and marketing services are provided through branch offices located in various cities around the world under the direction and supervision provided by WIML. For the services provided under this arrangement, WIML charges a service fee equal to the total costs it incurs in rendering the services plus 5%.

14 (iv) Staff secondment payroll charges Worldwide Wynn, a subsidiary of Wynn Resorts, Limited, is responsible for supplying management personnel to WRM for pre-determined lengths of time through secondment arrangements. Worldwide Wynn was compensated for these services with a service fee equal to its aggregate costs plus 5% to Worldwide Wynn of the seconded employees during the periods of secondment to WRM. (v) Design/development payroll Wynn Design & Development provides design and development services to the Group in connection with the Group’s project in Cotai. A service fee is charged at cost incurred by Wynn Design & Development to the Group for the services provided. The above transactions were carried out on terms mutually agreed between the Group and the related companies. There were no significant charges from the Group to the related companies during the six months ended 30 June 2014 and 2013. In the opinion of the Directors, the related party transactions were conducted in the ordinary and usual course of the Group’s business. All such outstanding balances between the Group and the related companies are deemed to be trade in nature. Home Purchase In May 2010, Worldwide Wynn entered into a new employment agreement with Ms. Linda Chen, who is also a director of Wynn Macau, Limited. Under the terms of the employment agreement, Worldwide Wynn caused WRM to purchase a house in Macau for use by Ms. Chen. As at 30 June 2014, the net carrying amount of the house together with improvements and its land lease right was HK$61.7 million (31 December 2013: HK$63.9 million). 14. EVENT AFTER THE REPORTING PERIOD On 30 June 2014, the Company approved and adopted the employee ownership scheme with the purpose of aligning the employees’ interests with those of the Group, and encouraging and retaining them to make contributions to the long-term growth and profits of the Group. The resolutions to, among other things, approve and adopt the employee ownership scheme and grant a mandate to the Directors of the Company to allot, issue, procure the transfer of and otherwise deal with up to 50,000,000 Shares in connection with the employee ownership scheme during the Relevant Period (as defined in the Company’s circular dated 9 April 2014) were passed at the Company’s annual general meeting in May 2014. As at 30 June 2014, no awards were granted to those individuals selected to participate in the employee ownership scheme. The Company issued a total of 7,511,000 Shares on 16 July 2014 for the initial grant of share awards to 7,511 eligible participants under the employee ownership scheme. Subject to the conditions of the grant of award, the awards are anticipated to vest in two equal tranches on 3 April 2017 and 2 April 2018, respectively.

15 MANAGEMENT DISCUSSION AND ANALYSIS OVERVIEW Wynn Macau opened to the public on 6 September 2006 at the center of casino activities on the urban Macau peninsula. In December 2007 and November 2009, Wynn Macau completed expansions, adding more gaming space and additional food and beverage and retail amenities. Encore at Wynn Macau, a further expansion of Wynn Macau that added a fully integrated resort hotel, opened in April 2010. Our Macau resort complex features: • Approximately 280,000 square feet of casino space, offering 24-hour gaming and a full range of games, including private gaming salons, sky casinos and a poker pit; • Two luxury hotel towers with a total of 1,008 spacious guest rooms and suites; • Casual and fine dining in eight restaurants; • Approximately 57,000 square feet of high-end, brand-name retail shopping, including stores and boutiques such as Bvlgari, Cartier, Chanel, Dior, Dunhill, Ermenegildo Zegna, Ferrari, Giorgio Armani, Graff, Gucci, Hermes, Hugo Boss, Jaeger LeCoultre, Louis Vuitton, Miu Miu, Piaget, Prada, Roger Dubuis, Rolex, Tiffany, Vacheron Constantin, Van Cleef & Arpels, Versace, Vertu, and others; • Recreation and leisure facilities, including two health clubs and spas, a salon, and a pool; and • Lounges and meeting facilities. The following table presents the number of casino games available at our Macau Operations: As at 30 June 2014 2013 VIP table games 256 285 Mass market table games 200 205 Slot machines 613 884 Poker tables 9 10 In response to on-going evaluation of our operations and the feedback from our guests, we have been making, and will continue to make enhancements and refinements to our resort complex. In March 2014, we began renovation of approximately 27,000 square feet of casino space for new VIP gaming rooms which has resulted in a reduction in the number of table games and slot machines. We expect to complete this renovation before Chinese New Year of 2015.

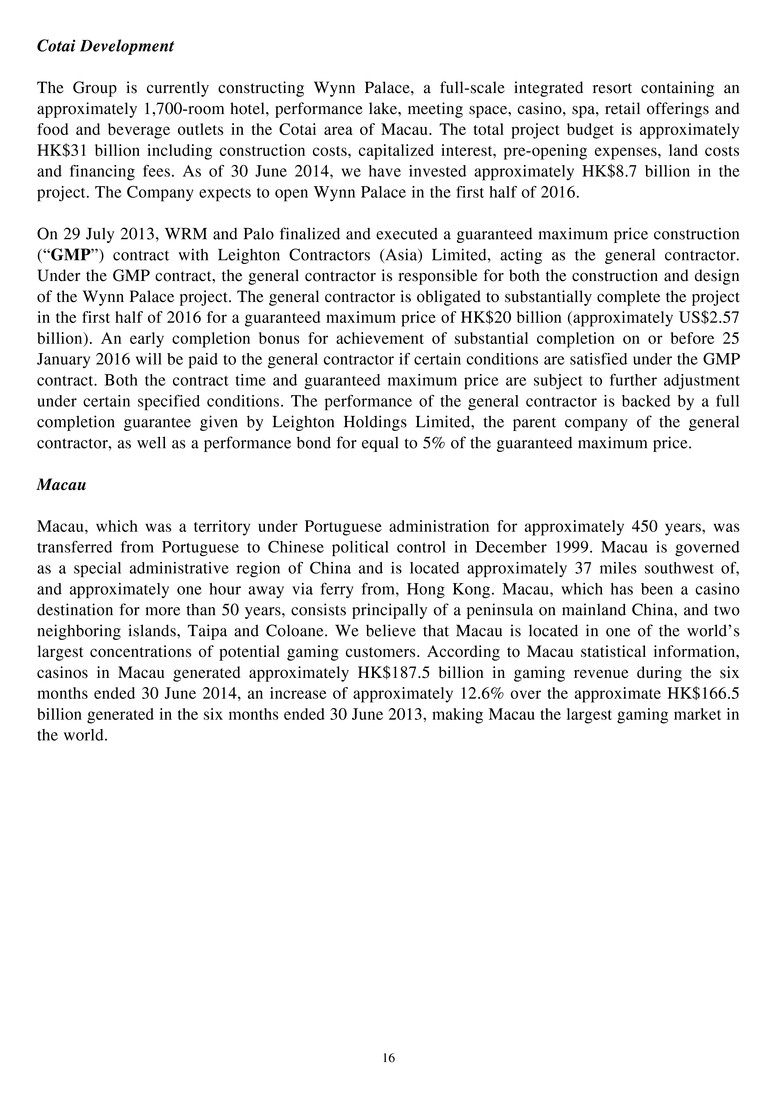

16 Cotai Development The Group is currently constructing Wynn Palace, a full-scale integrated resort containing an approximately 1,700-room hotel, performance lake, meeting space, casino, spa, retail offerings and food and beverage outlets in the Cotai area of Macau. The total project budget is approximately HK$31 billion including construction costs, capitalized interest, pre-opening expenses, land costs and financing fees. As of 30 June 2014, we have invested approximately HK$8.7 billion in the project. The Company expects to open Wynn Palace in the first half of 2016. On 29 July 2013, WRM and Palo finalized and executed a guaranteed maximum price construction (“GMP”) contract with Leighton Contractors (Asia) Limited, acting as the general contractor. Under the GMP contract, the general contractor is responsible for both the construction and design of the Wynn Palace project. The general contractor is obligated to substantially complete the project in the first half of 2016 for a guaranteed maximum price of HK$20 billion (approximately US$2.57 billion). An early completion bonus for achievement of substantial completion on or before 25 January 2016 will be paid to the general contractor if certain conditions are satisfied under the GMP contract. Both the contract time and guaranteed maximum price are subject to further adjustment under certain specified conditions. The performance of the general contractor is backed by a full completion guarantee given by Leighton Holdings Limited, the parent company of the general contractor, as well as a performance bond for equal to 5% of the guaranteed maximum price. Macau Macau, which was a territory under Portuguese administration for approximately 450 years, was transferred from Portuguese to Chinese political control in December 1999. Macau is governed as a special administrative region of China and is located approximately 37 miles southwest of, and approximately one hour away via ferry from, Hong Kong. Macau, which has been a casino destination for more than 50 years, consists principally of a peninsula on mainland China, and two neighboring islands, Taipa and Coloane. We believe that Macau is located in one of the world’s largest concentrations of potential gaming customers. According to Macau statistical information, casinos in Macau generated approximately HK$187.5 billion in gaming revenue during the six months ended 30 June 2014, an increase of approximately 12.6% over the approximate HK$166.5 billion generated in the six months ended 30 June 2013, making Macau the largest gaming market in the world.

17 FACTORS AFFECTING OUR RESULTS OF OPERATIONS AND FINANCIAL CONDITION Tourism The levels of tourism and overall gaming activities in Macau are key drivers of our business. Both the Macau gaming market and visitation to Macau have grown significantly in the last few years; however, tourist arrivals to Macau remained stable during the six months ended 30 June 2014 compared to the six months ended 30 June 2013. We have benefited from the rise in visitation to Macau over the past several years. Macau’s gaming market is primarily dependent on tourists. Tourist arrivals for the six months ended 30 June 2014 were 15.3 million compared to 14.1 million for the same period last year. The Macau market has experienced tremendous growth in capacity since the opening of Wynn Macau. As at 31 May 2014, there were 28,000 hotel rooms and as at 30 June 2014, there were 5,710 table games and 12,895 slots in Macau, compared to 12,978 hotel rooms and 2,762 table games and 6,546 slots as at 31 December 2006. Gaming customers traveling to Macau typically come from nearby destinations in Asia including mainland China, Hong Kong, Taiwan, South Korea and Japan. According to the Macau Statistics and Census Service Monthly Bulletin of Statistics, approximately 90.6% of visitors to Macau for the six months ended 30 June 2014 were from mainland China, Hong Kong, and Taiwan. Tourism levels in Macau are affected by a number of factors, all of which are beyond our control. Key factors affecting tourism levels in Macau may include, among others: • Prevailing economic conditions in mainland China and Asia; • Various countries’ policies on currency restrictions and the issuance of travel visas that may be in place from time to time; • Competition from other destinations which offer gaming and leisure activities; • Occurrence of natural disasters and disruption of travel; and • Possible outbreaks of infectious disease. Economic and Operating Environment Our operating environment has remained stable during the six months ended 30 June 2014. However, economic conditions can have a significant impact on our business. A number of factors, including a slowdown in the global economy, contracting credit markets, reduced consumer spending, various countries’ policies that affect travel to Macau, any outbreak of infectious diseases and stricter smoking regulations can negatively impact the gaming industry in Macau and our business.

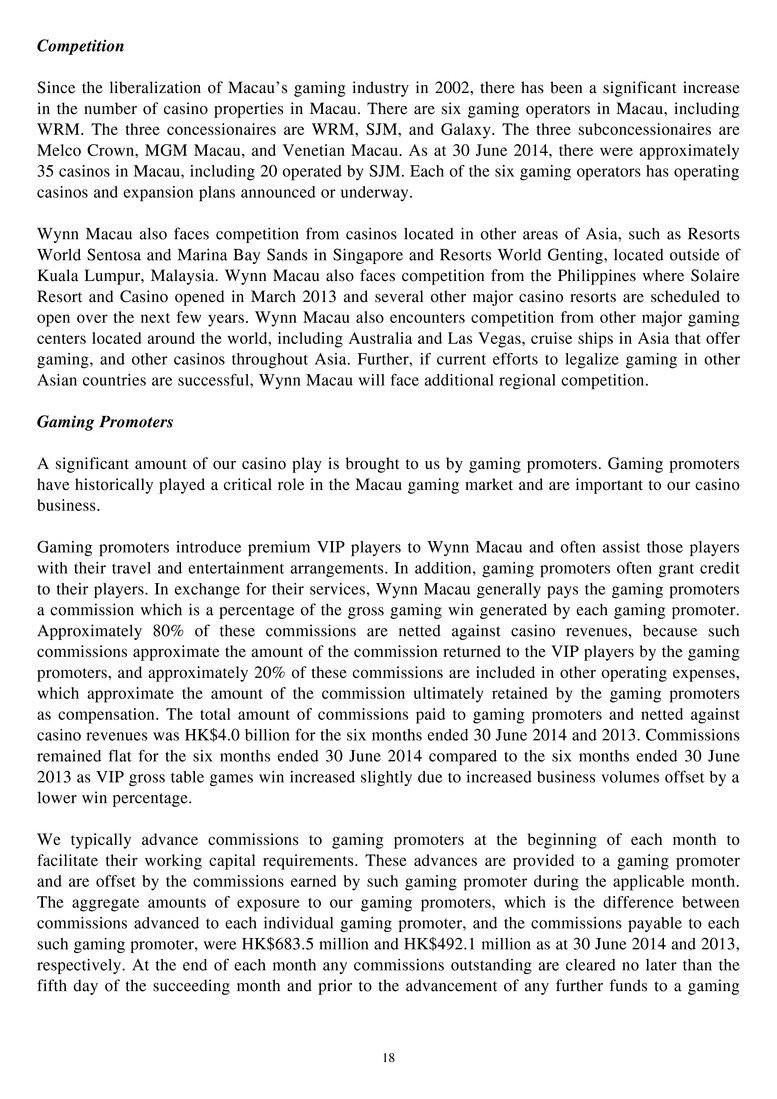

18 Competition Since the liberalization of Macau’s gaming industry in 2002, there has been a significant increase in the number of casino properties in Macau. There are six gaming operators in Macau, including WRM. The three concessionaires are WRM, SJM, and Galaxy. The three subconcessionaires are Melco Crown, MGM Macau, and Venetian Macau. As at 30 June 2014, there were approximately 35 casinos in Macau, including 20 operated by SJM. Each of the six gaming operators has operating casinos and expansion plans announced or underway. Wynn Macau also faces competition from casinos located in other areas of Asia, such as Resorts World Sentosa and Marina Bay Sands in Singapore and Resorts World Genting, located outside of Kuala Lumpur, Malaysia. Wynn Macau also faces competition from the Philippines where Solaire Resort and Casino opened in March 2013 and several other major casino resorts are scheduled to open over the next few years. Wynn Macau also encounters competition from other major gaming centers located around the world, including Australia and Las Vegas, cruise ships in Asia that offer gaming, and other casinos throughout Asia. Further, if current efforts to legalize gaming in other Asian countries are successful, Wynn Macau will face additional regional competition. Gaming Promoters A significant amount of our casino play is brought to us by gaming promoters. Gaming promoters have historically played a critical role in the Macau gaming market and are important to our casino business. Gaming promoters introduce premium VIP players to Wynn Macau and often assist those players with their travel and entertainment arrangements. In addition, gaming promoters often grant credit to their players. In exchange for their services, Wynn Macau generally pays the gaming promoters a commission which is a percentage of the gross gaming win generated by each gaming promoter. Approximately 80% of these commissions are netted against casino revenues, because such commissions approximate the amount of the commission returned to the VIP players by the gaming promoters, and approximately 20% of these commissions are included in other operating expenses, which approximate the amount of the commission ultimately retained by the gaming promoters as compensation. The total amount of commissions paid to gaming promoters and netted against casino revenues was HK$4.0 billion for the six months ended 30 June 2014 and 2013. Commissions remained flat for the six months ended 30 June 2014 compared to the six months ended 30 June 2013 as VIP gross table games win increased slightly due to increased business volumes offset by a lower win percentage. We typically advance commissions to gaming promoters at the beginning of each month to facilitate their working capital requirements. These advances are provided to a gaming promoter and are offset by the commissions earned by such gaming promoter during the applicable month. The aggregate amounts of exposure to our gaming promoters, which is the difference between commissions advanced to each individual gaming promoter, and the commissions payable to each such gaming promoter, were HK$683.5 million and HK$492.1 million as at 30 June 2014 and 2013, respectively. At the end of each month any commissions outstanding are cleared no later than the fifth day of the succeeding month and prior to the advancement of any further funds to a gaming

19 promoter. We believe we have developed strong relationships with our gaming promoters. Our commission percentages have remained stable throughout our operating history. In addition to commissions, gaming promoters each receive a monthly complimentary allowance based on a percentage of the turnover their clients generate. The allowance is available for room, food and beverage and other products and services for discretionary use with the gaming promoter’s clients. Premium Credit Play We selectively extend credit to our VIP players contingent upon our marketing team’s knowledge of the players, their financial background and payment history. We follow a series of credit procedures and require various signed documents from each credit recipient that are intended to ensure, among other things that, if permitted by applicable law, the debt can be legally enforced in the jurisdiction where the player resides. In the event the player does not reside in a jurisdiction where gaming debts are legally enforceable, we can attempt to assert jurisdiction over assets the player maintains in jurisdictions where gaming debts are recognized. In addition, we typically require a check in the amount of the applicable credit line from credit players, collateralizing the credit we grant. Number and Mix of Table Games and Slot Machines The mix of VIP table games, mass table games and slot machines in operation at our resort changes from time to time as a result of marketing and operating strategies in response to changing market demand and industry competition. The shift in the mix of our games will affect casino profitability.

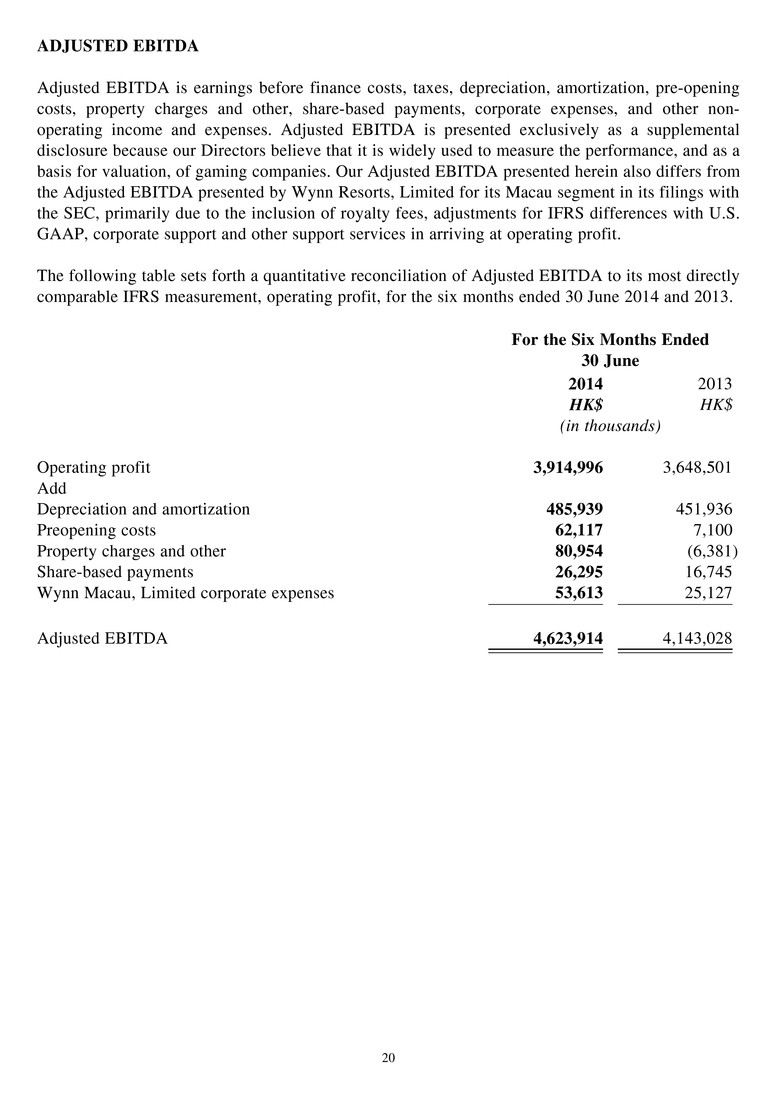

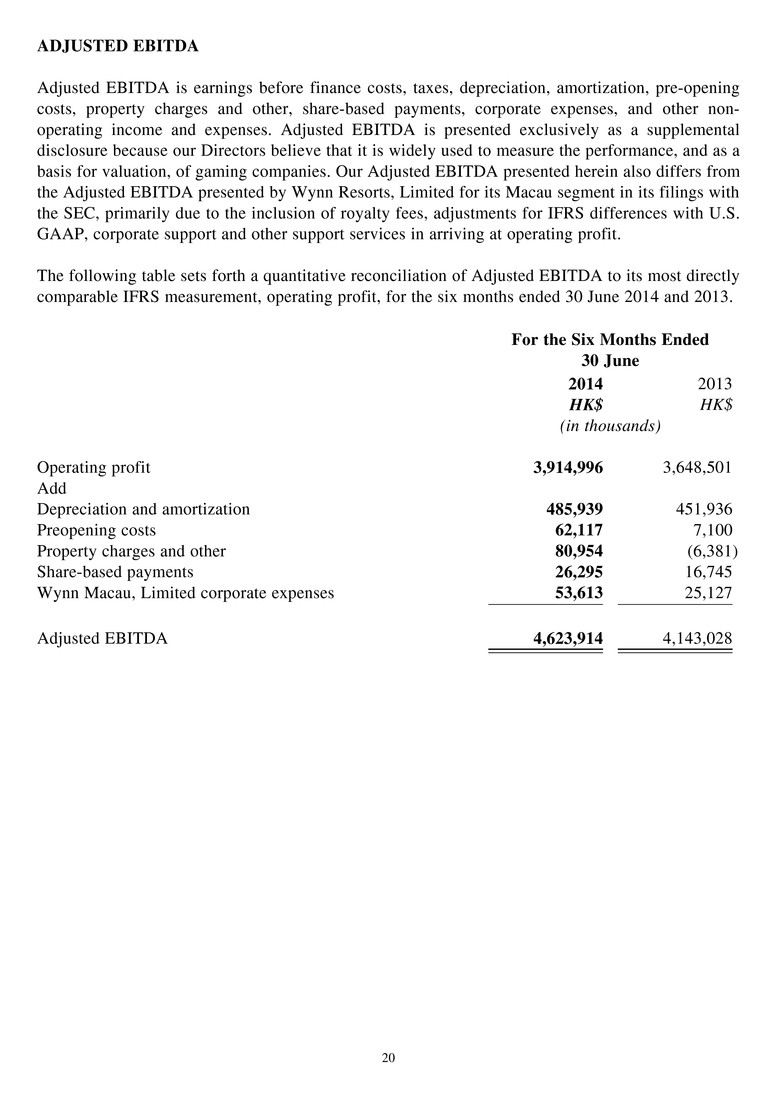

20 ADJUSTED EBITDA Adjusted EBITDA is earnings before finance costs, taxes, depreciation, amortization, pre-opening costs, property charges and other, share-based payments, corporate expenses, and other non- operating income and expenses. Adjusted EBITDA is presented exclusively as a supplemental disclosure because our Directors believe that it is widely used to measure the performance, and as a basis for valuation, of gaming companies. Our Adjusted EBITDA presented herein also differs from the Adjusted EBITDA presented by Wynn Resorts, Limited for its Macau segment in its filings with the SEC, primarily due to the inclusion of royalty fees, adjustments for IFRS differences with U.S. GAAP, corporate support and other support services in arriving at operating profit. The following table sets forth a quantitative reconciliation of Adjusted EBITDA to its most directly comparable IFRS measurement, operating profit, for the six months ended 30 June 2014 and 2013. For the Six Months Ended 30 June 2014 2013 HK$ HK$ (in thousands) Operating profit 3,914,996 3,648,501 Add Depreciation and amortization 485,939 451,936 Preopening costs 62,117 7,100 Property charges and other 80,954 (6,381) Share-based payments 26,295 16,745 Wynn Macau, Limited corporate expenses 53,613 25,127 Adjusted EBITDA 4,623,914 4,143,028

21 REVIEW OF HISTORICAL OPERATING RESULTS Summary Breakdown Table The following table presents certain selected statement of profit or loss and other comprehensive income line items and certain other data. For the Six Months Ended 30 June 2014 2013 HK$ HK$ (in thousands, except for averages, daily win figures and number of tables and slot machines) Total casino revenues(1) 15,358,669 13,995,004 Rooms(2) 65,647 73,529 Food and beverage(2) 101,973 93,182 Retail and other(2) 712,071 758,020 Total operating revenues 16,238,360 14,919,735 VIP table games turnover 483,737,001 452,212,945 VIP gross table games win(1) 13,764,628 13,728,620 Mass market table games drop(3) 10,663,674 10,174,605 Mass market gross table games win(1), (3) 4,745,327 3,570,317 Slot machine handle 22,157,034 17,747,645 Slot machine win(1) 1,050,412 924,815 Average number of gaming tables(4) 473 492 Daily gross win per gaming table(5) 216,094 194,438 Average number of slots(4) 732 856 Average daily win per slot(5) 7,928 5,968

22 Notes: (1) Total casino revenues do not equal the sum of “VIP gross table games win,” “mass market gross table games win” and “slot machine win” because casino revenues are reported net of the relevant commissions. The following table presents a reconciliation of the sum of “VIP gross table games win,” “mass market gross table games win” and “slot machine win” to total casino revenues. For the Six Months Ended 30 June 2014 2013 HK$ HK$ (in thousands) VIP gross table games win 13,764,628 13,728,620 Mass market gross table games win 4,745,327 3,570,317 Slot machine win 1,050,412 924,815 Poker revenues 82,731 66,346 Commissions (4,284,429) (4,295,094) Total casino revenues 15,358,669 13,995,004 (2) Promotional allowances are excluded from revenues in the accompanying condensed consolidated statement of profit or loss and other comprehensive income prepared in accordance with IFRS. Management also evaluates non-casino revenues on an adjusted basis. The following table presents a reconciliation of net non-casino revenues as reported in our condensed consolidated statement of profit or loss and other comprehensive income to gross non-casino revenues calculated on the adjusted basis. The adjusted non-casino revenues as presented below are used for management reporting purposes and are not representative of revenues as determined under IAS 18. For the Six Months Ended 30 June 2014 2013 HK$ HK$ (in thousands) Room revenues 65,647 73,529 Promotional allowances 452,851 374,351 Adjusted room revenues 518,498 447,880 Food and beverage revenues 101,973 93,182 Promotional allowances 301,442 273,695 Adjusted food and beverage revenues 403,415 366,877 Retail and other revenues 712,071 758,020 Promotional allowances 22,775 19,210 Adjusted retail and other revenues 734,846 777,230 (3) Mass market customers purchase gaming chips at either the gaming tables or the casino cage. Chips purchased at the casino cage are excluded from table games drop and will increase the expected win percentage. With the increased purchases at the casino cage, we believe the relevant indicator of volumes in the mass market should be table games win.

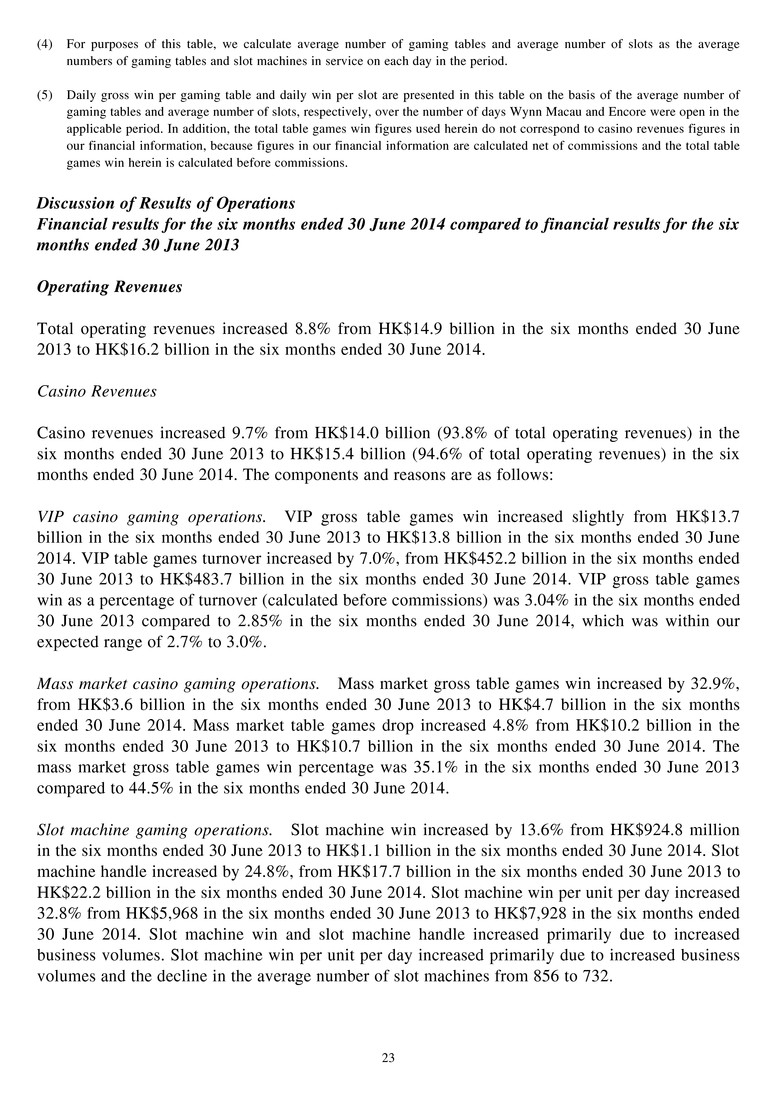

23 (4) For purposes of this table, we calculate average number of gaming tables and average number of slots as the average numbers of gaming tables and slot machines in service on each day in the period. (5) Daily gross win per gaming table and daily win per slot are presented in this table on the basis of the average number of gaming tables and average number of slots, respectively, over the number of days Wynn Macau and Encore were open in the applicable period. In addition, the total table games win figures used herein do not correspond to casino revenues figures in our financial information, because figures in our financial information are calculated net of commissions and the total table games win herein is calculated before commissions. Discussion of Results of Operations Financial results for the six months ended 30 June 2014 compared to financial results for the six months ended 30 June 2013 Operating Revenues Total operating revenues increased 8.8% from HK$14.9 billion in the six months ended 30 June 2013 to HK$16.2 billion in the six months ended 30 June 2014. Casino Revenues Casino revenues increased 9.7% from HK$14.0 billion (93.8% of total operating revenues) in the six months ended 30 June 2013 to HK$15.4 billion (94.6% of total operating revenues) in the six months ended 30 June 2014. The components and reasons are as follows: VIP casino gaming operations. VIP gross table games win increased slightly from HK$13.7 billion in the six months ended 30 June 2013 to HK$13.8 billion in the six months ended 30 June 2014. VIP table games turnover increased by 7.0%, from HK$452.2 billion in the six months ended 30 June 2013 to HK$483.7 billion in the six months ended 30 June 2014. VIP gross table games win as a percentage of turnover (calculated before commissions) was 3.04% in the six months ended 30 June 2013 compared to 2.85% in the six months ended 30 June 2014, which was within our expected range of 2.7% to 3.0%. Mass market casino gaming operations. Mass market gross table games win increased by 32.9%, from HK$3.6 billion in the six months ended 30 June 2013 to HK$4.7 billion in the six months ended 30 June 2014. Mass market table games drop increased 4.8% from HK$10.2 billion in the six months ended 30 June 2013 to HK$10.7 billion in the six months ended 30 June 2014. The mass market gross table games win percentage was 35.1% in the six months ended 30 June 2013 compared to 44.5% in the six months ended 30 June 2014. Slot machine gaming operations. Slot machine win increased by 13.6% from HK$924.8 million in the six months ended 30 June 2013 to HK$1.1 billion in the six months ended 30 June 2014. Slot machine handle increased by 24.8%, from HK$17.7 billion in the six months ended 30 June 2013 to HK$22.2 billion in the six months ended 30 June 2014. Slot machine win per unit per day increased 32.8% from HK$5,968 in the six months ended 30 June 2013 to HK$7,928 in the six months ended 30 June 2014. Slot machine win and slot machine handle increased primarily due to increased business volumes. Slot machine win per unit per day increased primarily due to increased business volumes and the decline in the average number of slot machines from 856 to 732.

24 Non-casino Revenues Net non-casino revenues, which include rooms, food and beverage and retail and other revenues, decreased by 4.9% from HK$924.7 million (6.2% of total operating revenues) in the six months ended 30 June 2013 to HK$879.7 million (5.4% of total operating revenues) in the six months ended 30 June 2014. The decrease in revenues was largely due to lower retail sales in the six months ended 30 June 2014. Room. Our room revenues, which exclude promotional allowances in our condensed consolidated statement of profit or loss and other comprehensive income, decreased by 10.7% from HK$73.5 million in the six months ended 30 June 2013 to HK$65.6 million in the six months ended 30 June 2014. The decrease reflects increased promotional allowances due to increased VIP business, which resulted in fewer rooms being made available to paying customers. Management also evaluates room revenues on an adjusted basis which include promotional allowances. Adjusted room revenues including promotional allowances increased by 15.8% from HK$447.9 million in the six months ended 30 June 2013 to HK$518.5 million in the six months ended 30 June 2014. The following table presents additional information about our adjusted room revenues (which include promotional allowances): Adjusted room revenues information For the Six Months Ended 30 June 2014 2013 Adjusted Average Daily Rate (includes promotional allowances of HK$2,284 in the six months ended 30 June 2014 and HK$2,048 in the six months ended 30 June 2013) HK$2,605 HK$2,440 Occupancy 98.3% 94.7% Adjusted REVPAR (includes promotional allowances of HK$2,245 in the six months ended 30 June 2014 and HK$1,939 in the six months ended 30 June 2013) HK$2,559 HK$2,310 Food and beverage. Food and beverage revenues, which exclude promotional allowances in our condensed consolidated statement of profit or loss and other comprehensive income increased by 9.4% from HK$93.1 million to HK$102.0 million in the six months ended 30 June 2014.

25 Management also evaluates food and beverage revenues on an adjusted basis including promotional allowances. Food and beverage revenues adjusted to include these promotional allowances increased by 10.0% from HK$366.9 million in the six months ended 30 June 2013 to HK$403.4 million in the six months ended 30 June 2014. The increase was due primarily to increased business volumes. Retail and other. Our retail and other revenues, which exclude promotional allowances in our condensed consolidated statement of profit or loss and other comprehensive income, decreased by 6.1%, from HK$758.0 million in the six months ended 30 June 2013 to HK$712.1 million in the six months ended 30 June 2014. The decrease was due primarily to lower retail sales. Management also evaluates retail and other revenues on an adjusted basis which includes promotional allowances. Adjusted retail and other revenues including promotional allowances decreased by 5.5% from HK$777.2 million in the six months ended 30 June 2013 to HK$734.8 million in the six months ended 30 June 2014, reflecting lower retail sales. Operating Costs and Expenses Gaming taxes and premiums. Gaming taxes and premiums increased by 7.7% from HK$7.2 billion in the six months ended 30 June 2013 to HK$7.8 billion in the six months ended 30 June 2014. This increase from the six months ended 30 June 2013 compared to the six months ended 30 June 2014 was due primarily to increased gross gaming win. WRM is subject to a 35% gaming tax on gross gaming win. In addition, WRM is required to pay 4% of its gross gaming win as contributions for public development and social facilities. Staff costs. Staff costs increased by 28.8%, from HK$1.2 billion in the six months ended 30 June 2013 to HK$1.5 billion in the six months ended 30 June 2014. This increase in staff costs was primarily due to general salary increases and the new 2014 bonus plan for non-management employees. Other operating expenses. Other operating expenses remained flat at HK$2.5 billion for the six months ended 30 June 2013 compared to the six months ended 30 June 2014. During the six months ended 30 June 2013 and 2014, the Group recorded adjustments to the provision for doubtful accounts based on the results of historical collection patterns and current collection trends. For the six months ended 30 June 2013 compared to 30 June 2014, the adjustment made to the provision for doubtful accounts and a reduction in cost of sales was offset by increases in royalty fees, corporate support services and advertising and promotion expenses. Depreciation and amortization. Depreciation and amortization in the six months ended 30 June 2013 increased 7.5% from HK$451.9 million to HK$485.9 million in the six months ended 30 June 2014.

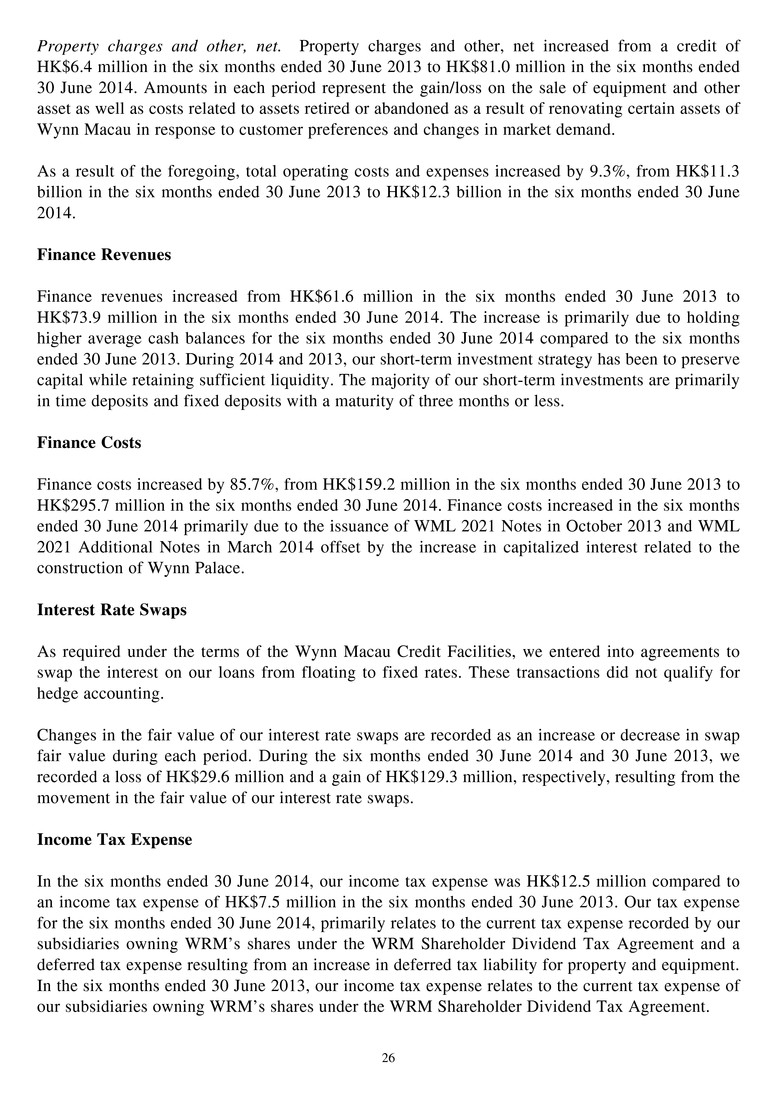

26 Property charges and other, net. Property charges and other, net increased from a credit of HK$6.4 million in the six months ended 30 June 2013 to HK$81.0 million in the six months ended 30 June 2014. Amounts in each period represent the gain/loss on the sale of equipment and other asset as well as costs related to assets retired or abandoned as a result of renovating certain assets of Wynn Macau in response to customer preferences and changes in market demand. As a result of the foregoing, total operating costs and expenses increased by 9.3%, from HK$11.3 billion in the six months ended 30 June 2013 to HK$12.3 billion in the six months ended 30 June 2014. Finance Revenues Finance revenues increased from HK$61.6 million in the six months ended 30 June 2013 to HK$73.9 million in the six months ended 30 June 2014. The increase is primarily due to holding higher average cash balances for the six months ended 30 June 2014 compared to the six months ended 30 June 2013. During 2014 and 2013, our short-term investment strategy has been to preserve capital while retaining sufficient liquidity. The majority of our short-term investments are primarily in time deposits and fixed deposits with a maturity of three months or less. Finance Costs Finance costs increased by 85.7%, from HK$159.2 million in the six months ended 30 June 2013 to HK$295.7 million in the six months ended 30 June 2014. Finance costs increased in the six months ended 30 June 2014 primarily due to the issuance of WML 2021 Notes in October 2013 and WML 2021 Additional Notes in March 2014 offset by the increase in capitalized interest related to the construction of Wynn Palace. Interest Rate Swaps As required under the terms of the Wynn Macau Credit Facilities, we entered into agreements to swap the interest on our loans from floating to fixed rates. These transactions did not qualify for hedge accounting. Changes in the fair value of our interest rate swaps are recorded as an increase or decrease in swap fair value during each period. During the six months ended 30 June 2014 and 30 June 2013, we recorded a loss of HK$29.6 million and a gain of HK$129.3 million, respectively, resulting from the movement in the fair value of our interest rate swaps. Income Tax Expense In the six months ended 30 June 2014, our income tax expense was HK$12.5 million compared to an income tax expense of HK$7.5 million in the six months ended 30 June 2013. Our tax expense for the six months ended 30 June 2014, primarily relates to the current tax expense recorded by our subsidiaries owning WRM’s shares under the WRM Shareholder Dividend Tax Agreement and a deferred tax expense resulting from an increase in deferred tax liability for property and equipment. In the six months ended 30 June 2013, our income tax expense relates to the current tax expense of our subsidiaries owning WRM’s shares under the WRM Shareholder Dividend Tax Agreement.

27 Net Profit Attributable to Owners of the Company As a result of the foregoing, net profit attributable to owners of the Company decreased slightly from HK$3.7 billion for the six months ended 30 June 2013 to HK$3.6 billion for the six months ended 30 June 2014. LIQUIDITY AND CAPITAL RESOURCES Capital Resources Since Wynn Macau opened in 2006, we have generally funded our working capital and recurring expenses as well as capital expenditures from cash flow from operations and cash on hand. Our cash balances as at 30 June 2014 were HK$16.1 billion. Such cash is available for operations, new development activities, enhancements to Wynn Macau and Encore and general corporate purposes. On 20 March 2014, the Company issued 5.25% fixed rate, unsecured senior notes due 2021 for an aggregate principal amount of US$750 million (approximately HK$5.9 billion), which were consolidated to form a single series with the then existing US$600 million (approximately HK$4.7 billion) 5.25% fixed rate, unsecured senior notes due 2021. The Company received net proceeds of US$749 million (approximately HK$5.8 billion) from the offering of the WML 2021 Additional Notes after including the premiums and deducting the commissions and expenses of the offering and excluding the receipt of accrued interest. The Company will use the net proceeds for working capital requirements and general corporate purposes. The WML 2021 Additional Notes have the same terms and conditions as those of the WML 2021 Notes, save for the issue date and purchase price, and also mature in October 2021.

28 Gearing Ratio The gearing ratio is a key indicator of our Group’s capital structure. The gearing ratio is net debt divided by total capital plus net debt. The table below presents the calculation of our gearing ratio as at 30 June 2014 and 31 December 2013. As at 30 June 2014 31 December 2013 HK$ HK$ (in thousands except for percentages) Interest-bearing borrowings 17,526,529 11,683,461 Accounts payable 1,463,000 1,810,427 Land premium payables 478,204 590,555 Other payables and accruals 6,218,485 7,070,920 Construction retention payables 216,913 121,222 Amounts due to related companies 213,147 287,638 Other liabilities 114,550 116,829 Less: cash and cash equivalents (16,147,269) (14,130,433) restricted cash and cash equivalents — (1,550,340) Net debt 10,083,559 6,000,279 Equity 7,809,541 9,212,842 Total capital 7,809,541 9,212,842 Capital and net debt 17,893,100 15,213,121 Gearing ratio 56.4% 39.4%

29 Cash Flows The following table presents a summary of the Group’s cash flows for the six months ended 30 June 2014 and 2013. For the Six Months Ended 30 June 2014 2013 HK$ HK$ (in millions) Net cash generated from operating activities 2,897.4 5,833.7 Net cash used in investing activities (1,314.5) (122.9) Net cash generated from (used in) financing activities 447.7 (6,654.9) Net increase (decrease) in cash and cash equivalents 2,030.6 (944.1) Cash and cash equivalents at beginning of period 14,130.4 10,475.4 Effect of foreign exchange rate changes, net (13.7) 19.7 Cash and cash equivalents at end of period 16,147.3 9,551.0 Net cash generated from operating activities Our net cash generated from operating activities is primarily affected by operating profit generated by our Macau Operations and changes in our working capital. Net cash from operating activities was HK$2.9 billion for the six months ended 30 June 2014 compared to HK$5.8 billion for the six months ended 30 June 2013. Operating profit was HK$3.9 billion for the six months ended 30 June 2014 compared to HK$3.6 billion for the six months ended 30 June 2013. The decline in net cash from operating activities was primarily due to a decrease in other payables and accruals and accounts payable offset by the increase in operating profit. Net cash used in investing activities Net cash used in investing activities was HK$1.3 billion for the six months ended 30 June 2014, compared to net cash used in investing activities of HK$122.9 million for the six months ended 30 June 2013. Major expenditures in the six months ended 30 June 2014 included capital expenditures of HK$3.0 billion for both Wynn Palace construction costs and renovations to enhance and refine the Macau Operations offset by a HK$1.6 billion reduction in restricted cash. Major expenditures in the six months ended 30 June 2013 included capital expenditures of HK$1.3 billion related to both land improvement costs for Wynn Palace and renovation projects to enhance and refine the Macau Operations offset by HK$768.7 million reduction in restricted cash, HK$206.4 million in bond redemption proceeds and HK$155.6 million in proceeds from the sale of assets.

30 Net cash generated from (used in) financing activities Net cash from financing activities was HK$447.7 million during the six months ended 30 June 2014 compared to HK$6.7 billion net cash used in financing activities during the six months ended 30 June 2013. The net cash from financing activities was primarily due to the Company’s receipt of HK$5.9 billion proceeds from the WML 2021 Additional Notes offset by the Company’s payment of a HK$5.1 billion dividend payment made in June 2014. During the six months ended 30 June 2013, the net cash used in financing activities was primarily due to the Company’s payment of a HK$6.4 billion dividend. Indebtedness The following table presents a summary of our indebtedness as at 30 June 2014 and 31 December 2013. Indebtedness information As at 30 June 2014 31 December 2013 HK$ HK$ (in thousands) Bank loans 7,388,531 7,389,170 Senior notes 10,506,868 4,652,505 Less: debt financing costs, net (368,870) (358,214) Total interest-bearing borrowings 17,526,529 11,683,461 The Group had approximately HK$12.1 billion available to draw under the Wynn Macau Credit Facilities as at 30 June 2014. Wynn Macau Credit Facilities Overview As at 30 June 2014, the Wynn Macau Credit Facilities consisted of approximately HK$19.5 billion in a combination of Hong Kong dollar and U.S. dollar facilities, including an approximately HK$7.4 billion fully funded senior term loan facility and an approximately HK$12.1 billion senior revolving credit facility. The facilities may be used for a variety of purposes, including investment in our Wynn Palace project, further enhancements at our resort and general corporate purposes.

31 The HK$7.4 billion equivalent term loan facility matures in July 2018 with the principal amount of the term loan to be repaid in two installments in July 2017 and July 2018. The final maturity for the revolving credit facility is July 2017, by which date any outstanding revolving loans must be repaid. The senior secured facilities bear interest at a rate of LIBOR or HIBOR plus a margin of between 1.75% and 2.50% depending on WRM’s leverage ratio. Security and Guarantees Borrowings under the Wynn Macau Credit Facilities are guaranteed by Palo and by certain subsidiaries of the Company that own equity interest in WRM, and are secured by substantially all of the assets of WRM, the equity interests in WRM and substantially all of the assets of Palo. With respect to the Concession Agreement and WRM’s land concession agreement, the WRM lenders have certain cure rights and consultation rights with the Macau government in the event of an enforcement action by the lenders. Second Ranking Lender WRM is also party to a bank guarantee reimbursement agreement with Banco National Ultramarino S.A. to secure a guarantee in favor of the Macau government as required under the Concession Agreement. The amount of this guarantee is MOP300 million (approximately HK$291.3 million) and it lasts until 180 days after the end of the term of the Concession Agreement. The guarantee assures WRM’s performance under the Concession Agreement, including the payment of certain premiums, fines and indemnities for breach. The guarantee is secured by a second priority security interest in the same collateral package securing the Wynn Macau Credit Facilities. Other Terms The Wynn Macau Credit Facilities contain representations, warranties, covenants and events of default customary for casino development financings in Macau. The Directors confirm that there is no non-compliance with the financial covenants or general covenants contained in the Wynn Macau Credit Facilities. The Company is not a party to the credit facilities agreement and related agreements and has no rights or obligations thereunder.

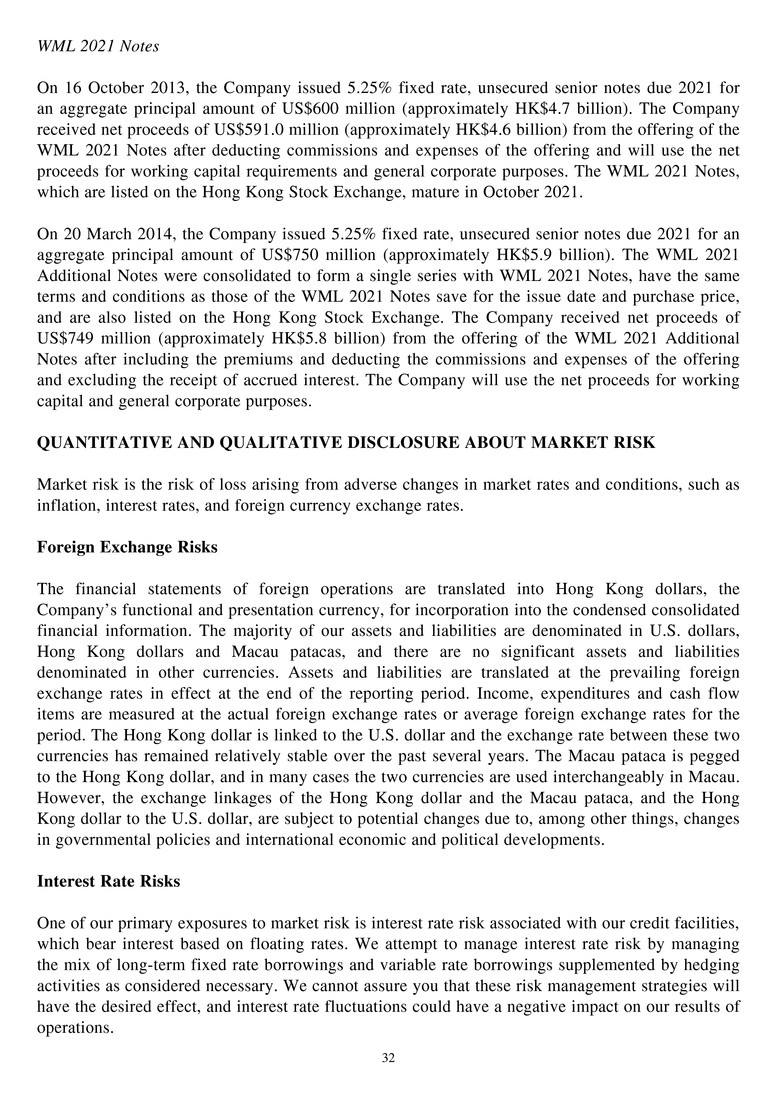

32 WML 2021 Notes On 16 October 2013, the Company issued 5.25% fixed rate, unsecured senior notes due 2021 for an aggregate principal amount of US$600 million (approximately HK$4.7 billion). The Company received net proceeds of US$591.0 million (approximately HK$4.6 billion) from the offering of the WML 2021 Notes after deducting commissions and expenses of the offering and will use the net proceeds for working capital requirements and general corporate purposes. The WML 2021 Notes, which are listed on the Hong Kong Stock Exchange, mature in October 2021. On 20 March 2014, the Company issued 5.25% fixed rate, unsecured senior notes due 2021 for an aggregate principal amount of US$750 million (approximately HK$5.9 billion). The WML 2021 Additional Notes were consolidated to form a single series with WML 2021 Notes, have the same terms and conditions as those of the WML 2021 Notes save for the issue date and purchase price, and are also listed on the Hong Kong Stock Exchange. The Company received net proceeds of US$749 million (approximately HK$5.8 billion) from the offering of the WML 2021 Additional Notes after including the premiums and deducting the commissions and expenses of the offering and excluding the receipt of accrued interest. The Company will use the net proceeds for working capital and general corporate purposes. QUANTITATIVE AND QUALITATIVE DISCLOSURE ABOUT MARKET RISK Market risk is the risk of loss arising from adverse changes in market rates and conditions, such as inflation, interest rates, and foreign currency exchange rates. Foreign Exchange Risks The financial statements of foreign operations are translated into Hong Kong dollars, the Company’s functional and presentation currency, for incorporation into the condensed consolidated financial information. The majority of our assets and liabilities are denominated in U.S. dollars, Hong Kong dollars and Macau patacas, and there are no significant assets and liabilities denominated in other currencies. Assets and liabilities are translated at the prevailing foreign exchange rates in effect at the end of the reporting period. Income, expenditures and cash flow items are measured at the actual foreign exchange rates or average foreign exchange rates for the period. The Hong Kong dollar is linked to the U.S. dollar and the exchange rate between these two currencies has remained relatively stable over the past several years. The Macau pataca is pegged to the Hong Kong dollar, and in many cases the two currencies are used interchangeably in Macau. However, the exchange linkages of the Hong Kong dollar and the Macau pataca, and the Hong Kong dollar to the U.S. dollar, are subject to potential changes due to, among other things, changes in governmental policies and international economic and political developments. Interest Rate Risks One of our primary exposures to market risk is interest rate risk associated with our credit facilities, which bear interest based on floating rates. We attempt to manage interest rate risk by managing the mix of long-term fixed rate borrowings and variable rate borrowings supplemented by hedging activities as considered necessary. We cannot assure you that these risk management strategies will have the desired effect, and interest rate fluctuations could have a negative impact on our results of operations.

33 As at 30 June 2014, the Group had three interest rate swap agreements intended to manage the underlying interest rate risk on borrowings under the Wynn Macau Credit Facilities. Under two swap agreements, the Group pays a fixed interest rate of 0.73% on borrowings of approximately HK$3.95 billion incurred under the Wynn Macau Credit Facilities in exchange for receipts on the same amount at a variable interest rate based on the applicable HIBOR at the time of payment. These interest rate swaps fix the all-in interest rate on approximately HK$3.95 billion of borrowings under the Wynn Macau Credit Facilities at approximately 2.48% and expire in July 2017. Under the third swap agreement, the Group pays a fixed rate of 0.6763% on borrowings of US$243.8 million (approximately HK$1.8 billion) incurred under the Wynn Macau Credit Facilities in exchange for receipts on the same amount at a variable interest rate based on the applicable LIBOR at the time of payment. This interest rate swap fixes the all-in interest rate on the US$243.8 million (approximately HK$1.8 billion) of borrowings under the Wynn Macau Credit Facilities at approximately 2.43% and expires in July 2017. The carrying values of these interest rate swaps on the condensed consolidated statement of financial position approximates their fair values. The fair value approximates the amount the Group would pay if these contracts were settled at the respective valuation dates. Fair value is estimated based upon current, and predictions of future interest rate levels along a yield curve, the remaining duration of the instruments and other market conditions and, therefore, is subject to significant estimation and a high degree of variability of fluctuation between periods. We adjusted this amount by applying a non-performance valuation, considering our creditworthiness or the creditworthiness of our counterparties at each settlement date, as applicable. These transactions did not qualify for hedge accounting. Accordingly, changes in the fair values during the six months ended 30 June 2014 and 2013, were charged to the condensed consolidated statement of profit or loss and other comprehensive income. To the extent there are liabilities of Wynn Macau under the swap agreement, such liabilities are secured by the same collateral package securing the Wynn Macau Credit Facilities. OFF BALANCE SHEET ARRANGEMENTS We have not entered into any transactions with special purpose entities nor do we engage in any transactions involving derivatives except for interest rate swaps. We do not have any retained or contingent interest in assets transferred to an unconsolidated entity. OTHER LIQUIDITY MATTERS We expect to fund our operations and capital expenditure requirements from operating cash flows, cash on hand and availability under the Wynn Macau Credit Facilities. However, we cannot be sure that operating cash flows will be sufficient for those purposes. We may refinance all or a portion of our indebtedness on or before maturity. We cannot be sure that we will be able to refinance any of the indebtedness on acceptable terms or at all. New business developments (including the development of our Wynn Palace project) or other unforeseen events may occur, resulting in the need to raise additional funds. There can be no assurances regarding the business prospects with respect to any other opportunity. Any other development would require us to obtain additional financing.

34 In the ordinary course of business, in response to market demands and client preferences, and in order to increase revenues, we have made and will continue to make enhancements and refinements to our resort. We have incurred and will continue to incur capital expenditures related to these enhancements and refinements. Taking into consideration our financial resources, including our cash and cash equivalents, internally generated funds and availability under the Wynn Macau Credit Facilities, we believe that we have sufficient liquid assets to meet our working capital and operating requirements for the following 12 months. RELATED PARTY TRANSACTIONS For details of the related party transactions, see note 12 to the Interim Financial Information. Our Directors confirm that all related party transactions are conducted on normal commercial terms, and that their terms are fair and reasonable. PURCHASE, SALE OR REDEMPTION OF THE COMPANY’S LISTED SECURITIES Neither the Company, nor any of its subsidiaries purchased, sold or redeemed any of the Company’s shares during the six months ended 30 June 2014. CORPORATE GOVERNANCE REPORT The Company is dedicated to maintaining and ensuring high standards of corporate governance practices and the corporate governance principles of the Company are adopted in the best interest of the Company and its Shareholders. The Company’s corporate governance practices are based on the principles, code provisions and certain recommended best practices as set out in the Code. The Company has complied with the code provisions in the Code for the six months ended 30 June 2014 except for the following deviation from provision A.2.1 of the Code. Stephen A. Wynn as our Chairman and Chief Executive Officer Under code provision A.2.1 of the Code, the roles of chairman and chief executive officer should be separate and should not be performed by the same individual. The Company does not at present separate the roles of the chairman and chief executive officer. Mr. Wynn, the founder of the Company and Wynn Macau, serves as the Chairman and Chief Executive Officer of the Company. The Board has determined that the combination of these roles held singularly by Mr. Wynn is in the best interest of the Company and all Shareholders. The Board believes that the issue of whether to combine or separate the offices of Chairman of the Board and Chief Executive Officer is part of the succession planning process and that it is in the best interests of the Company for the Board to make a determination whether to combine or separate the roles based upon the circumstances. The Board has given careful consideration to separating the roles of Chairman and Chief Executive Officer and has determined that the Company and its Shareholders are best served by the current structure. Mr. Wynn’s combined role promotes unified leadership and direction for the Board and executive management and allows for a single, clear focus for the Company’s operational and strategic efforts.

35 The combined role of Mr. Wynn as both Chairman and Chief Executive Officer is balanced by the Company’s governance structure, policies and controls. All major decisions are made in consultation with members of the Board and the relevant Board committees. The Company has three Board committees, namely the Audit Committee, Remuneration Committee, and Nomination and Corporate Governance Committee. Each Board committee comprises non- executive Directors only and is chaired by an independent non-executive Director. In addition, there are four independent non-executive Directors on the Board offering independent perspectives. This structure encourages independent and effective oversight of the Company’s operations and prudent management of risk. For the reasons stated above and as a result of the structure, policies and procedures outlined above, and in light of the historical success of Mr. Wynn’s leadership, the Board has concluded that the current Board leadership structure is in the best interests of the Company and its Shareholders. MODEL CODE FOR SECURITIES TRANSACTIONS BY DIRECTORS The Company adopted the Model Code on 16 September 2009 as its code of conduct for securities transactions by Directors. On 23 March 2010, the Company adopted its own code of conduct for securities transactions, which was subsequently updated in November 2013. The terms of such code are no less exacting than those set out in the Model Code. Having made specific enquiry of the Directors, all Directors have confirmed that they have complied with the required standard of dealings and code of conduct regarding securities dealings by directors as set out in the Model Code and the Company’s own code of conduct for the six months ended 30 June 2014. AUDIT COMMITTEE An Audit Committee has been established by the Company to review and supervise the financial reporting process and internal control procedures of the Group. The Audit Committee comprises three independent non-executive Directors of the Company. The Audit Committee members have reviewed the Group’s results for the six months ended 30 June 2014. INTERIM REPORT The Company’s unaudited interim financial information for the reporting period has been reviewed by the Company’s Audit Committee members which comprises three independent non-executive Directors: Mr. Nicholas Sallnow-Smith, Dr. Allan Zeman and Mr. Bruce Rockowtiz and by the Company’s auditors in accordance with Hong Kong Standards on Review Engagements 2410, “Review of Interim Financial Information Performed by the Independent Auditor of the Entity” issued by the Hong Kong Institute of Certified Public Accountants. The report on review of the interim financial information by the auditors will be included in the interim report to be sent to the shareholders.

36 COOPERATION WITH THE CCAC The Company was contacted by the Commission Against Corruption of Macau (the “CCAC”) requesting certain information related to the Company’s land in the Cotai area of Macau (the “Cotai Land”). The Company is cooperating with the CCAC’s request. The Company has previously disclosed information regarding the Cotai Land in the Company’s prospectus dated 24 September 2009 and the Company’s 2011 and 2012 interim and annual reports and certain other public announcements. DEFINITIONS USED IN THIS ANNOUNCEMENT “Board of Directors” or “Board” the Board of Directors of our Company “Code”, “Corporate Governance Code” or “Corporate Governance Code and Corporate Governance Report” the Corporate Governance Code and Corporate Governance Report set out in Appendix 14 of the Listing Rules “Company” or “our Company” Wynn Macau, Limited, a company incorporated on 4 September 2009 as an exempted company with limited liability under the laws of the Cayman Islands and an indirect subsidiary of Wynn Resorts, Limited “Concession Agreement” the Concession Contract for the Operation of Games of Chance or Other Games in Casinos in the Macau Special Administrative Region entered into between WRM and the Macau government on 24 June 2002 “Cotai Land Concession Agreement” the land concession contract entered into between WRM, Palo and the Macau government for approximately 51 acres of land in the Cotai area of Macau, and for which formal approval from the Macau government was published in the official gazette of Macau on 2 May 2012 “Director(s)” the director(s) of our Company “Encore” or “Encore at Wynn Macau” a casino resort located in Macau, connected to and fully integrated with Wynn Macau, owned and operated directly by WRM, which opened on 21 April 2010 “Galaxy” Galaxy Casino, S.A., one of the six gaming operators in Macau and one of the three concessionaires “Group”, “we”, “us” or “our” our Company and its subsidiaries, or any of them, and the businesses carried on by such subsidiaries, except where the context makes it clear that the reference is only to the Company itself and not to the Group

37 “HIBOR” Hong Kong Interbank Offered Rate “HK$” Hong Kong dollars, the lawful currency of Hong Kong “Hong Kong” the Hong Kong Special Administrative Region of the PRC “Hong Kong Stock Exchange” The Stock Exchange of Hong Kong Limited “IFRS” International Financial Reporting Standards “Las Vegas Jet, LLC” Las Vegas Jet, LLC, a company formed under the laws of the State of Nevada, United States and a wholly owned subsidiary of Wynn Resorts, Limited “LIBOR” London Interbank Offered Rate “Listing” the initial listing of the Shares on the Main Board of the Hong Kong Stock Exchange on 9 October 2009 “Listing Rules” the Rules Governing the Listing of Securities on the Stock Exchange of Hong Kong Limited (as amended from time to time) “Macau” or “Macau Special Administrative Region” the Macau Special Administrative Region of the PRC “Macau Operations” the fully integrated Wynn Macau and Encore at Wynn Macau resort “Melco Crown” Melco Crown Gaming (Macau) Limited, one of the six gaming operators in Macau and one of the three sub-concessionaires “MGM Macau” MGM Grand Paradise Limited, one of the six gaming operators in Macau and one of the three sub-concessionaires “Model Code” the Model Code for Securities Transactions by Directors of Listed Issuers set out in Appendix 10 of the Listing Rules “MOP” or “pataca” Macau pataca, the lawful currency of Macau “Palo Real Estate Company Limited” or “Palo” Palo Real Estate Company Limited, a limited liability company incorporated under the laws of Macau and an indirect wholly owned subsidiary of the Company, subject to a 10% social and voting interest and MOP1.00 economic interest held by Mr. Wong Chi Seng (a Macau resident) in WRM

38 “PRC”, “China” or “mainland China” the People’s Republic of China and, except where the context requires and only for the purpose of this announcement references in this announcement to the PRC or China do not include Taiwan, Hong Kong or Macau; the term “Chinese” has a similar meaning “Securities and Exchange Commission” or “SEC” the U.S. Securities and Exchange Commission “SFO” the Securities and Futures Ordinance (Chapter 571 of the Laws of Hong Kong) “Share(s)” ordinary share(s) with a nominal value of HK$0.001 each in the share capital of our Company “Shareholder(s)” holder(s) of Share(s) of the Company from time to time “SJM” Sociedade de Jogos de Macau S.A., one of the six gaming operators in Macau and one of the three concessionaires “US$” United States dollars, the lawful currency of the United States “Venetian Macau” Venetian Macau S.A., one of the six gaming operators in Macau and one of the three sub-concessionaires “WIML” Wynn International Marketing, Ltd., a company incorporated under the laws of Isle of Man and a wholly owned subsidiary of Wynn Resorts, Limited “WML 2021 Notes” the US$600 million (approximately HK$4.7 billion) 5.25% senior notes due 2021 issued by the Company in October 2013 “WML 2021 Additional Notes” the additional US$750 million (approximately HK$5.9 billion) 5.25% senior notes due 2021 that were issued by the Company on 20 March 2014 and were consolidated to form a single series with the WML 2021 Notes “Worldwide Wynn” Worldwide Wynn, LLC, a company formed under the laws of the State of Nevada, United States and a wholly owned subsidiary of Wynn Resorts, Limited

39 “WRM” Wynn Resorts (Macau) S.A., a company incorporated under the laws of Macau and a wholly-owned subsidiary of the Company “WRM Shareholder Dividend Tax Agreement” the agreements, entered into during June 2009 and July 2011, each for a term of five years between WRM and the Macau Special Administrative Region, effective retroactively to 2006, that provide for an annual payment to the Macau Special Administrative Region of MOP7.2 million in years 2006 through 2010 and MOP15.5 million in years 2011 through 2015 in lieu of Complementary Tax otherwise due by WRM shareholders on dividend distributions to them from gaming profits earned in those years “Wynn Design & Development” Wynn Design & Development, LLC, a company formed under the laws of the State of Nevada, United States and a wholly owned subsidiary of Wynn Resorts, Limited “Wynn Macau” a casino hotel resort located in Macau, owned and operated directly by WRM, which opened on 6 September 2006, and where appropriate, the term also includes Encore at Wynn Macau “Wynn Macau Credit Facilities” together, the HK$7.4 billion (equivalent) fully-funded senior term loan facilities and the HK$12.1 billion (equivalent) senior revolving credit facilities extended to WRM as subsequently amended from time to time and, refinanced on 31 July 2012 and upsized on 30 July 2013 “Wynn Palace” a full-scale integrated resort which we are constructing on approximately 51 acres of land in the Cotai area of Macau in accordance with the terms of the Cotai Land Concession Agreement “Wynn Resorts, Limited”, “Wynn Resorts” or “WRL” Wynn Resorts, Limited, a company formed under the laws of the State of Nevada, United States, our controlling shareholder (as defined in the Listing Rules)