Exhibit 99.1

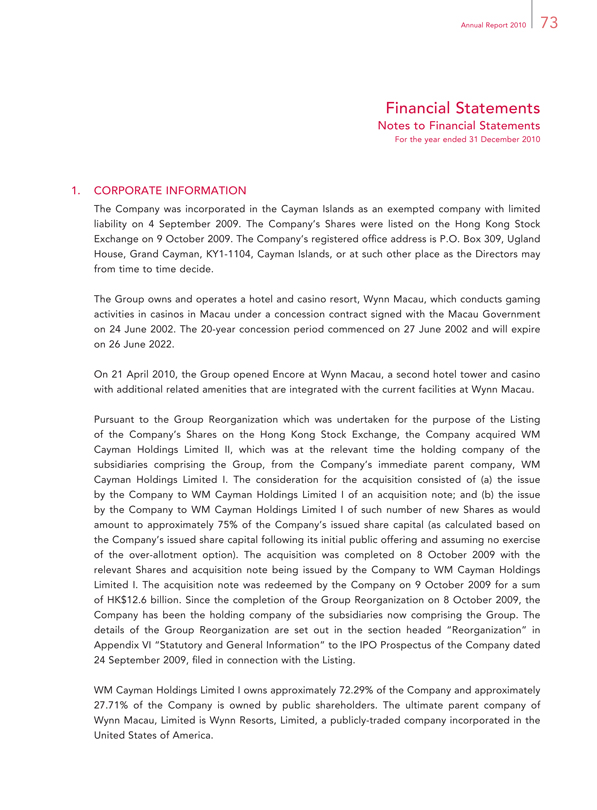

2010 Annual Report Wynn Macau, Limited

6 | | Management Discussion and Analysis |

29 | | Directors and Senior Management |

Contents

38 | | Report of the Directors |

56 | | Corporate Governance Report |

65 | | Independent Auditors’ Report |

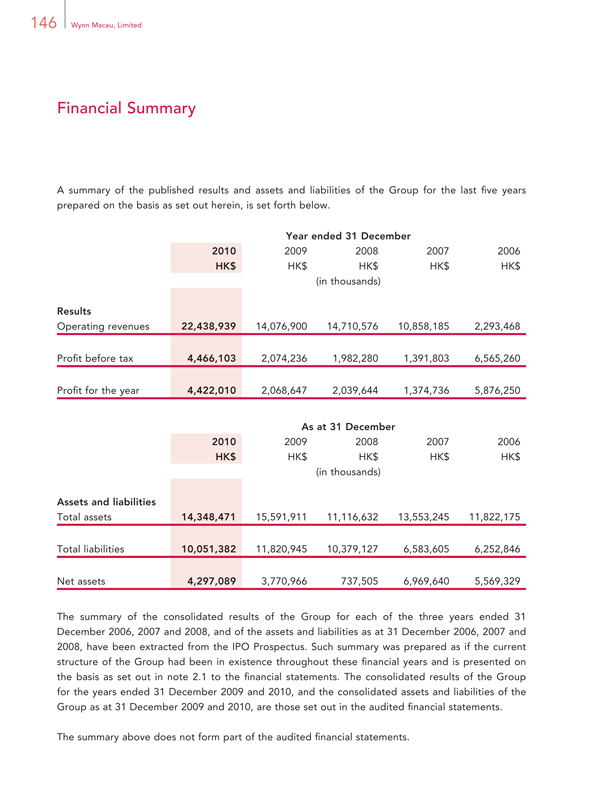

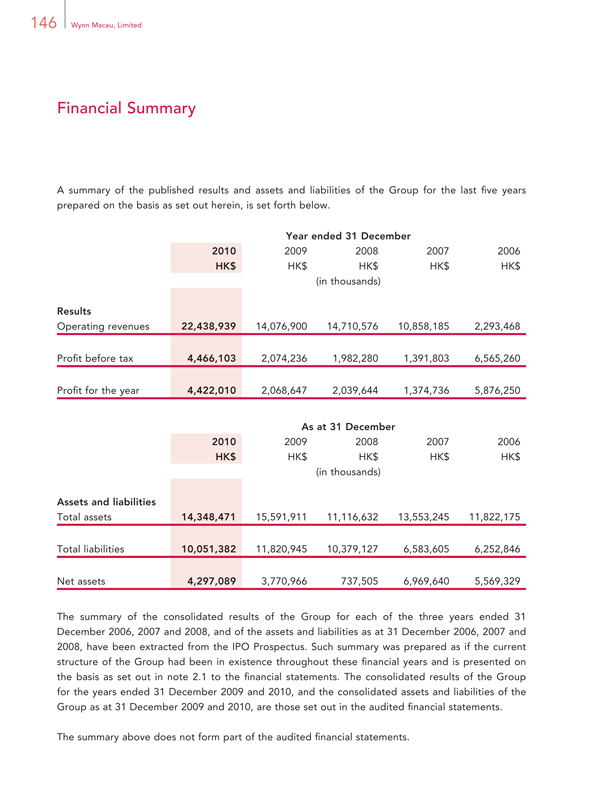

146 Financial Summary

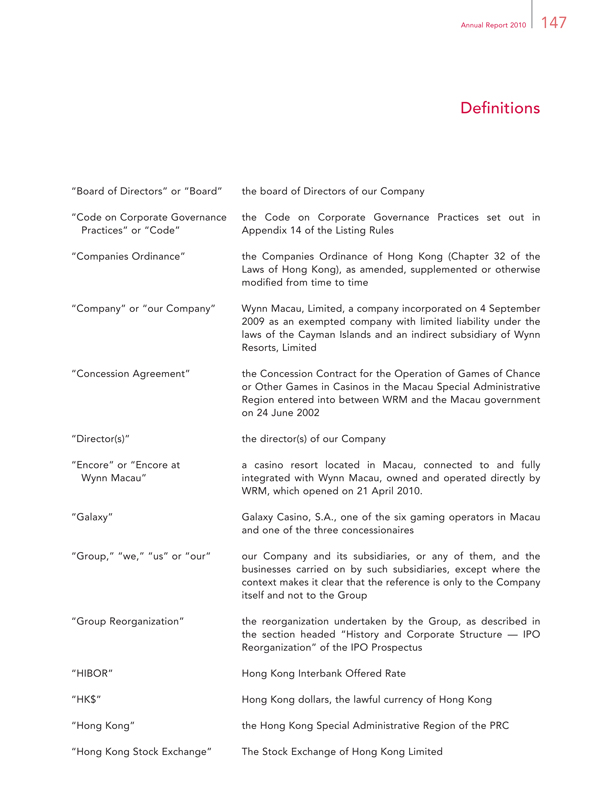

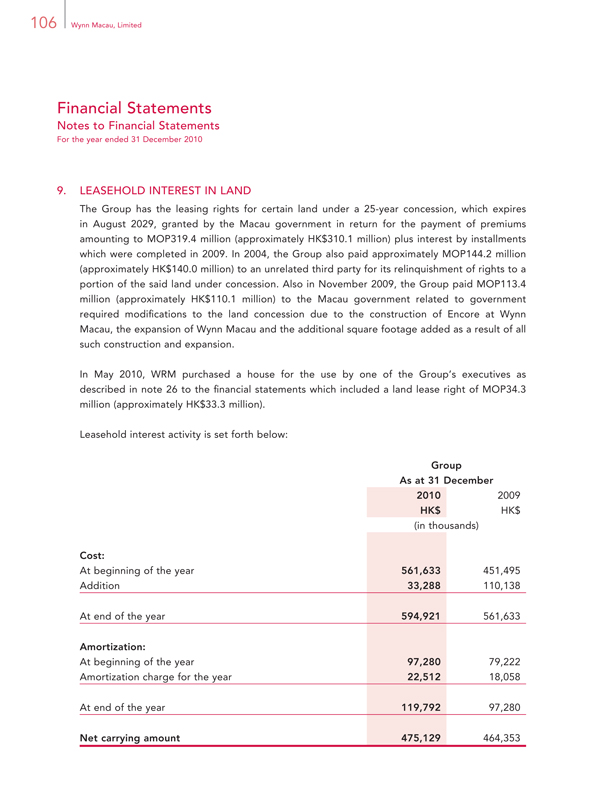

147 Definitions

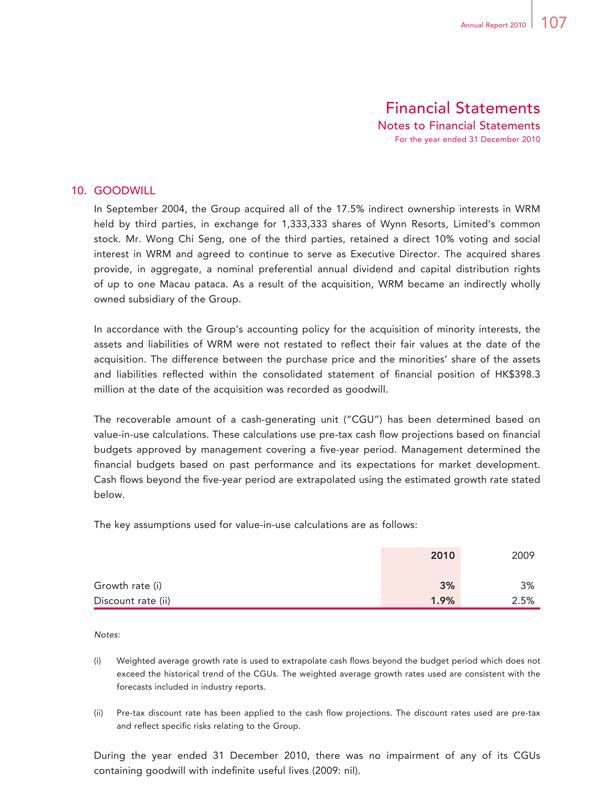

151 Glossary

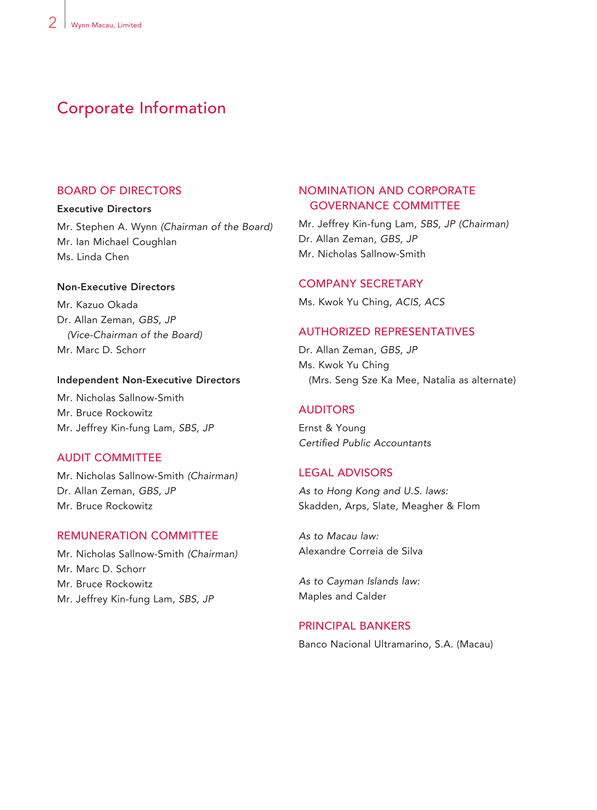

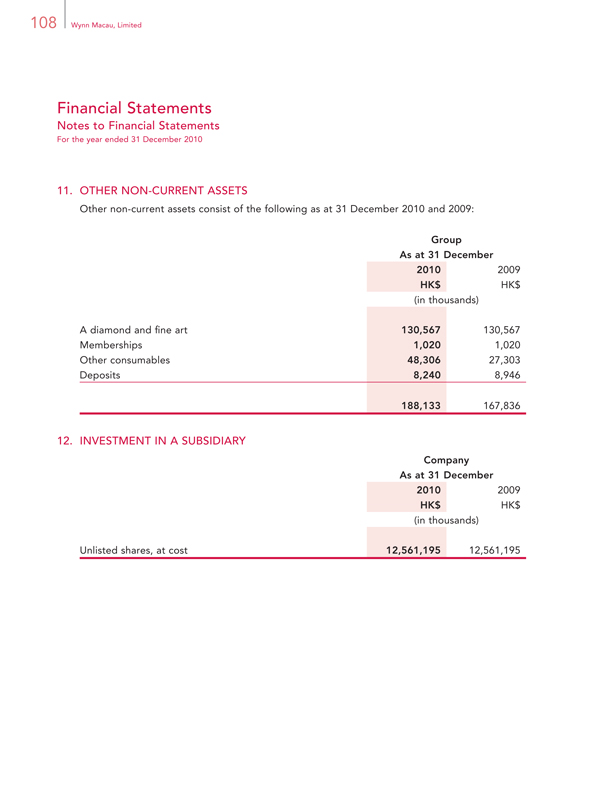

Corporate Information

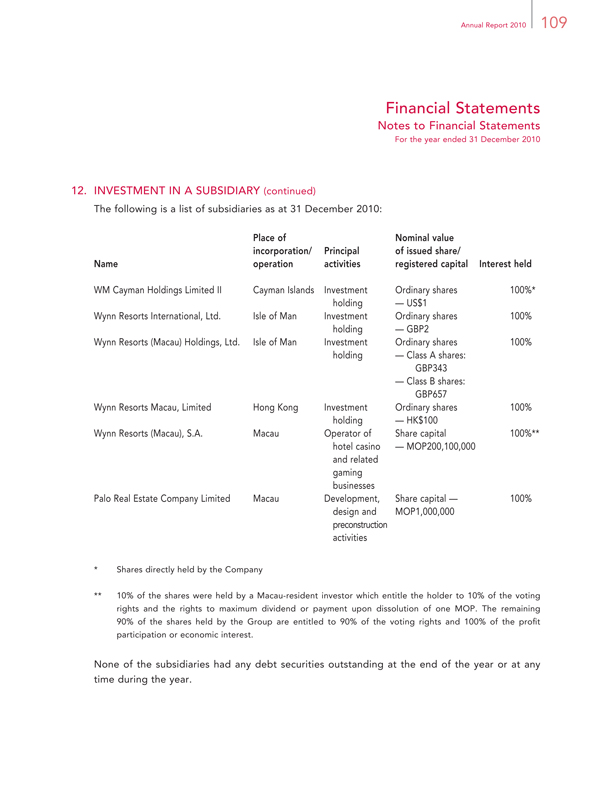

BOARD OF DIRECTORS

Executive Directors

Mr. Stephen A. Wynn (Chairman of the Board)

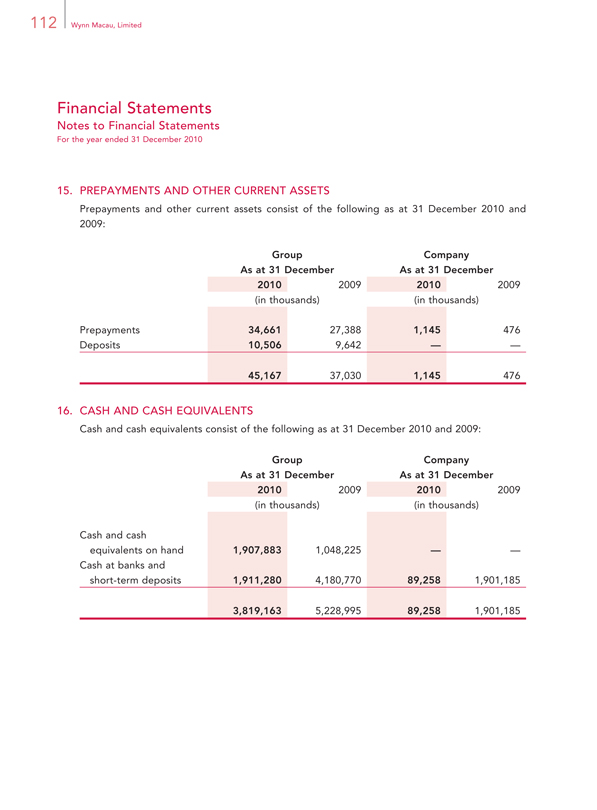

Mr. Ian Michael Coughlan Ms. Linda Chen

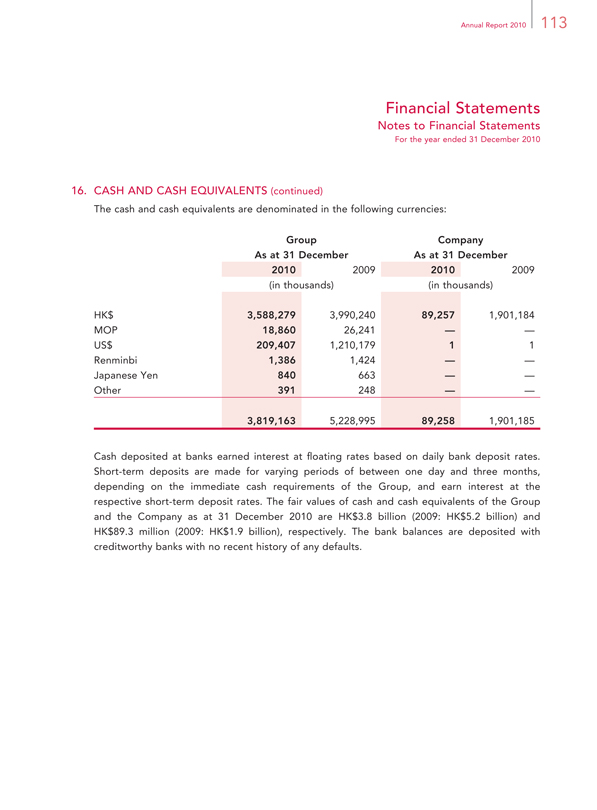

Non-Executive Directors

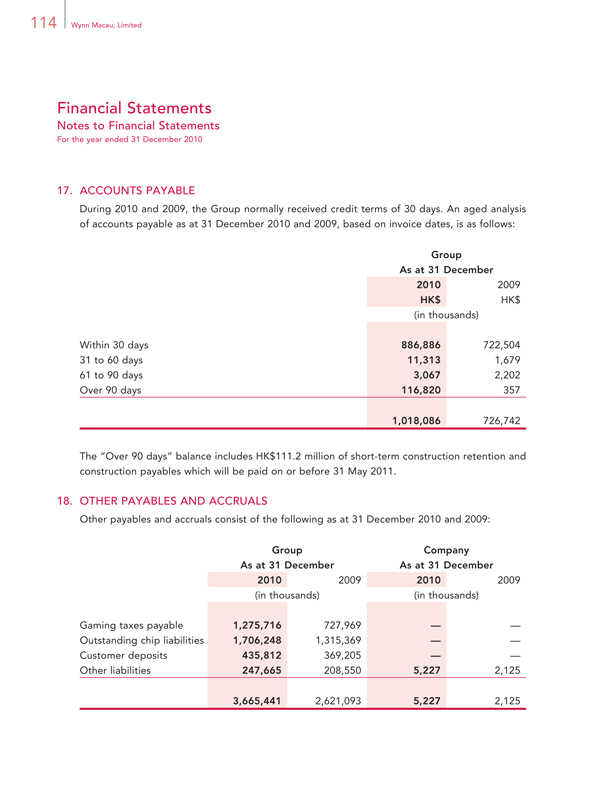

Mr. Kazuo Okada Dr. Allan Zeman, GBS, JP

(Vice-Chairman of the Board)

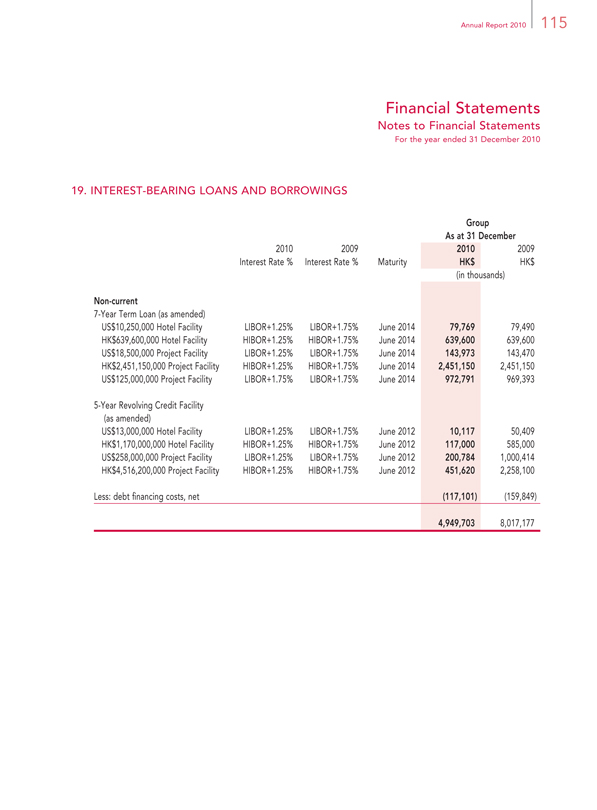

Mr. Marc D. Schorr

Independent Non-Executive Directors

Mr. Nicholas Sallnow-Smith Mr. Bruce Rockowitz Mr. Jeffrey Kin-fung Lam, SBS, JP

AUDIT COMMITTEE

Mr. Nicholas Sallnow-Smith (Chairman) Dr. Allan Zeman, GBS, JP

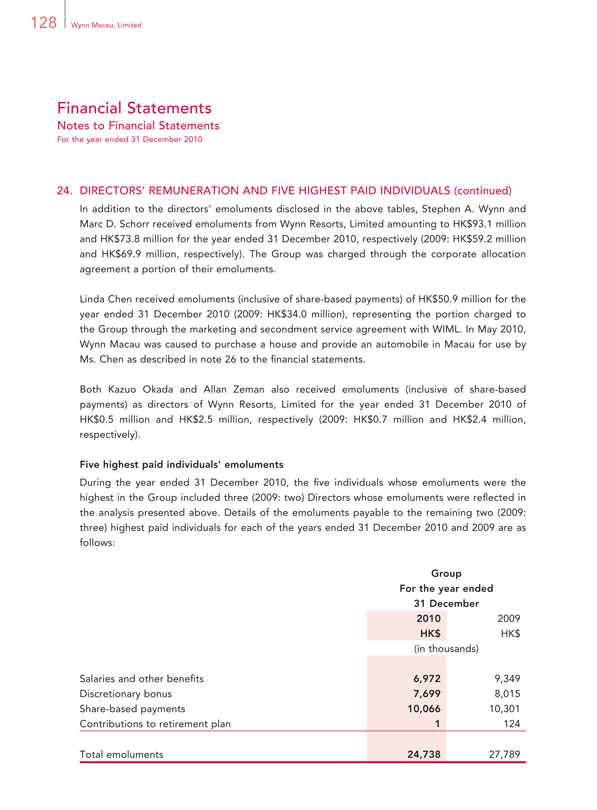

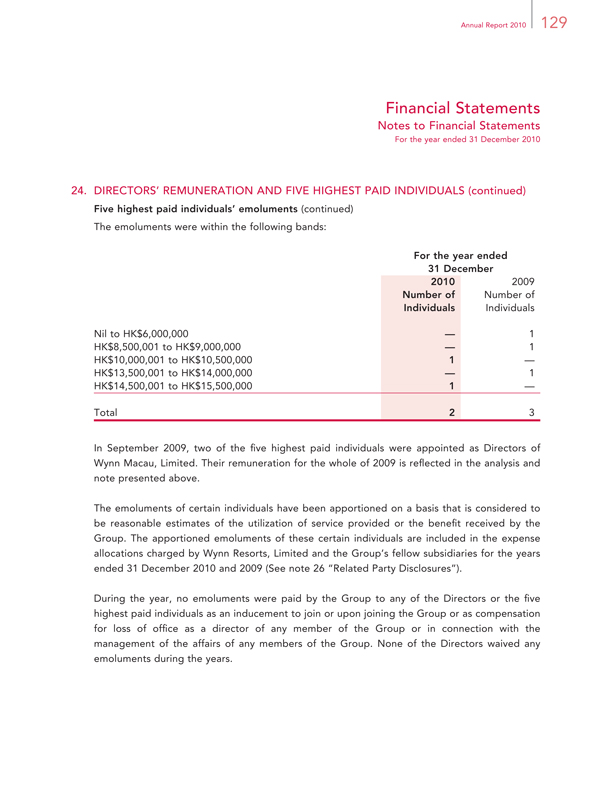

Mr. Bruce Rockowitz

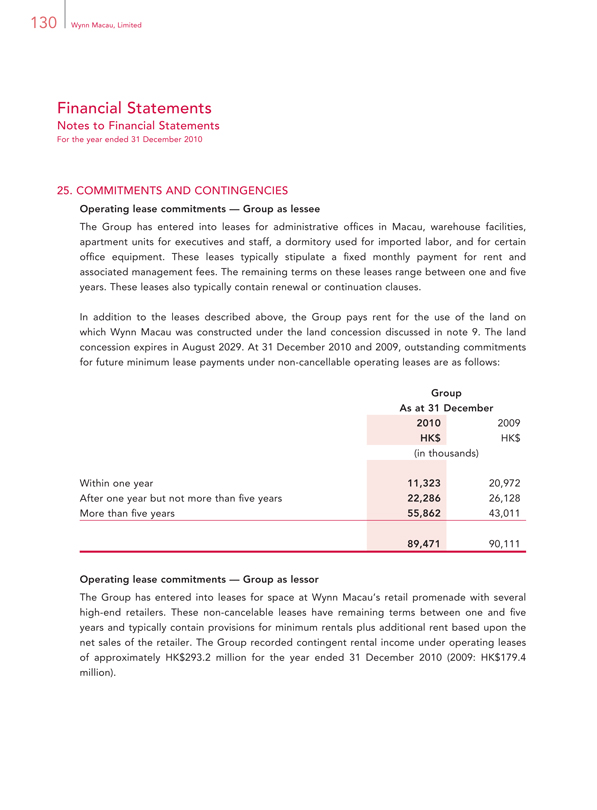

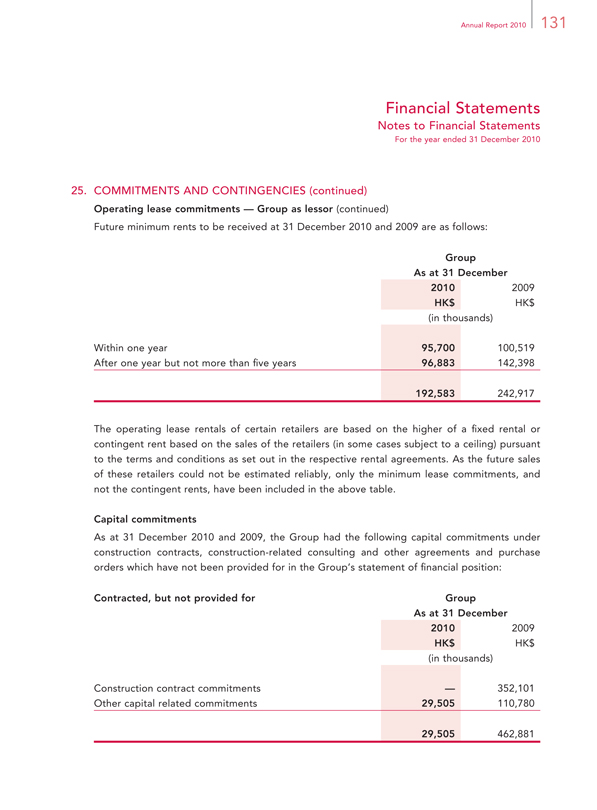

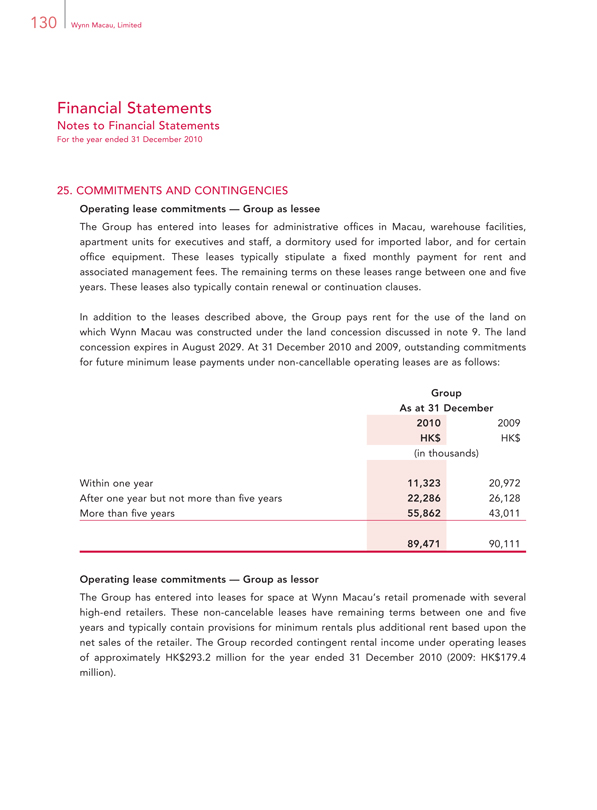

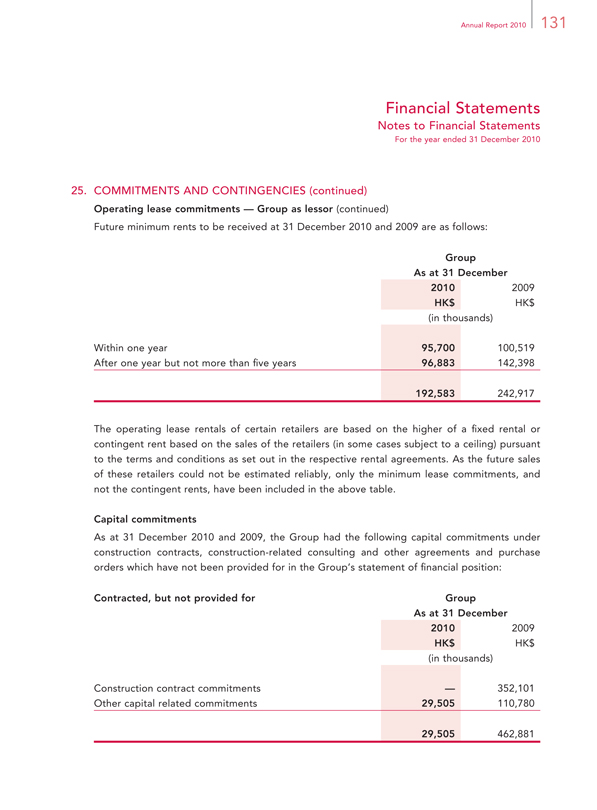

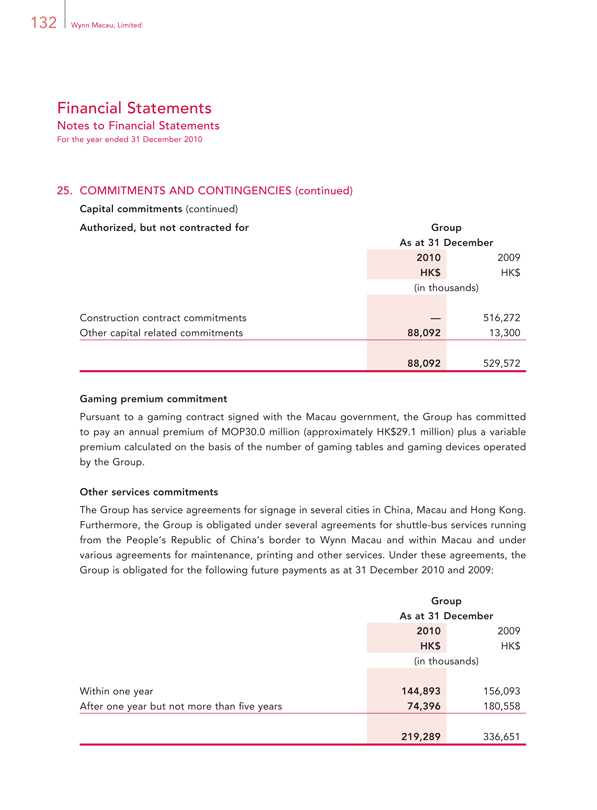

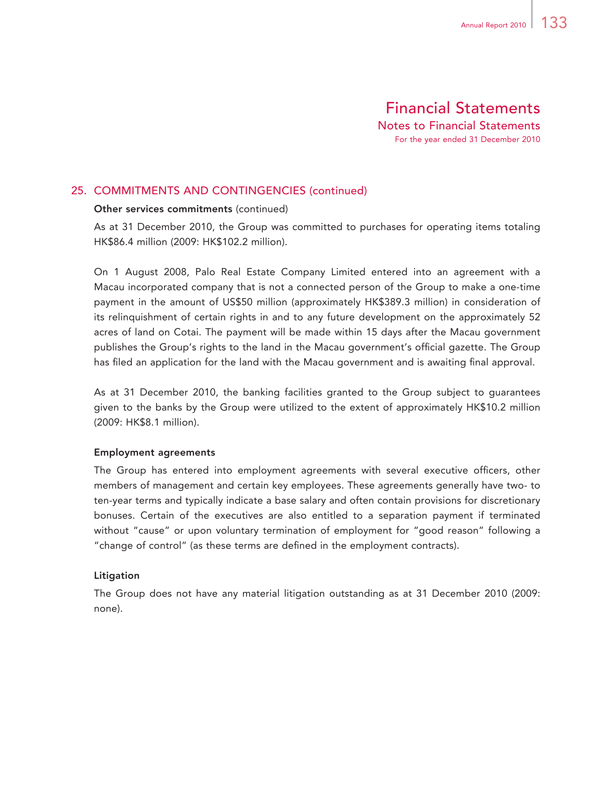

REMUNERATION COMMITTEE

Mr. Nicholas Sallnow-Smith (Chairman) Mr. Marc D. Schorr Mr. Bruce Rockowitz Mr. Jeffrey Kin-fung Lam, SBS, JP

NOMINATION AND CORPORATE GOVERNANCE COMMITTEE

Mr. Jeffrey Kin-fung Lam, SBS, JP (Chairman) Dr. Allan Zeman, GBS, JP

Mr. Nicholas Sallnow-Smith

COMPANY SECRETARY

Ms. Kwok Yu Ching, ACIS, ACS

AUTHORIZED REPRESENTATIVES

Dr. Allan Zeman, GBS, JP Ms. Kwok Yu Ching

(Mrs. Seng Sze Ka Mee, Natalia as alternate)

AUDITORS

Ernst & Young

Certified Public Accountants

LEGAL ADVISORS

As to Hong Kong and U.S. laws:

Skadden, Arps, Slate, Meagher & Flom

As to Macau law:

Alexandre Correia de Silva

As to Cayman Islands law:

Maples and Calder

PRINCIPAL BANKERS

Banco Nacional Ultramarino, S.A. (Macau)

Annual Report 2010 3

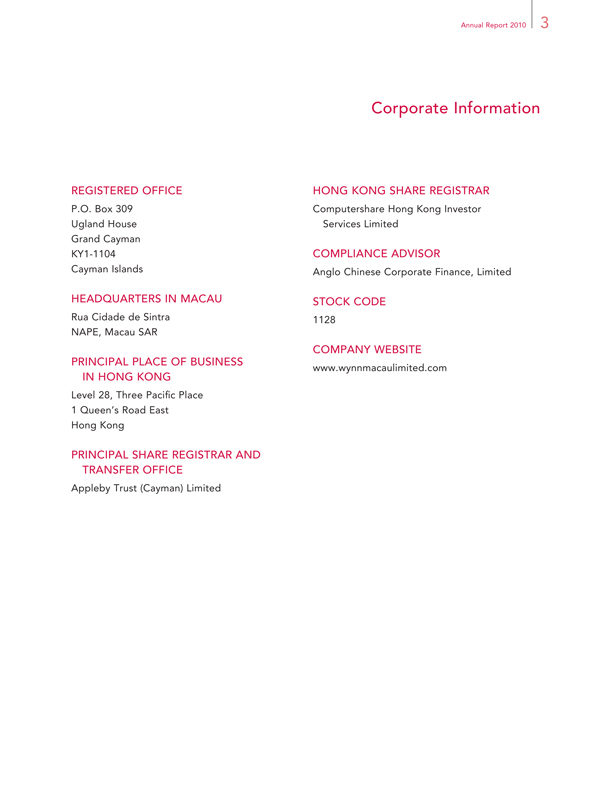

Corporate Information

REGISTERED OFFICE HONG KONG SHARE REGISTRAR

P.O. Box 309 Computershare Hong Kong Investor

Ugland House Services Limited

Grand Cayman

KY1-1104 COMPLIANCE ADVISOR

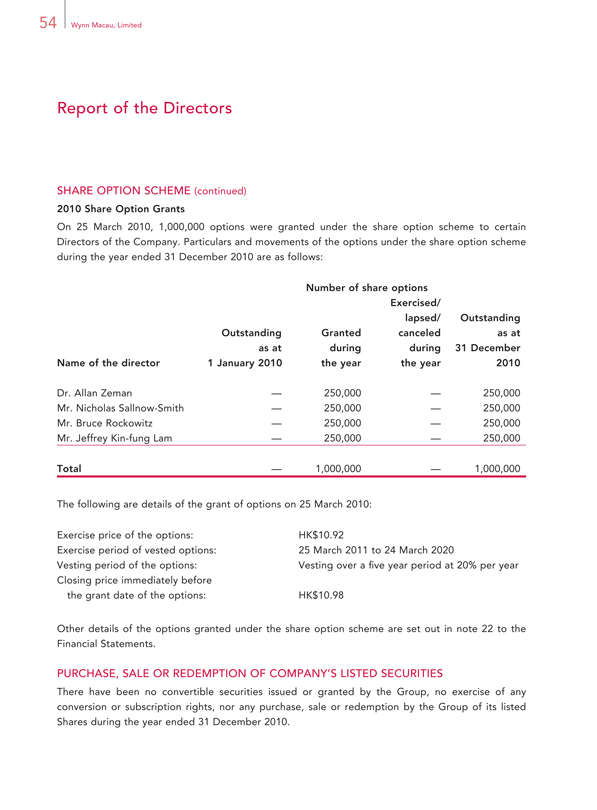

Cayman Islands Anglo Chinese Corporate Finance, Limited

HEADQUARTERS IN MACAU STOCK CODE

Rua Cidade de Sintra 1128

NAPE, Macau SAR

COMPANY WEBSITE

PRINCIPAL PLACE OF BUSINESS www.wynnmacaulimited.com

IN HONG KONG

Level 28, Three Pacific Place

Hong Kong

PRINCIPAL SHARE REGISTRAR AND

TRANSFER OFFICE

Appleby Trust (Cayman) Limited

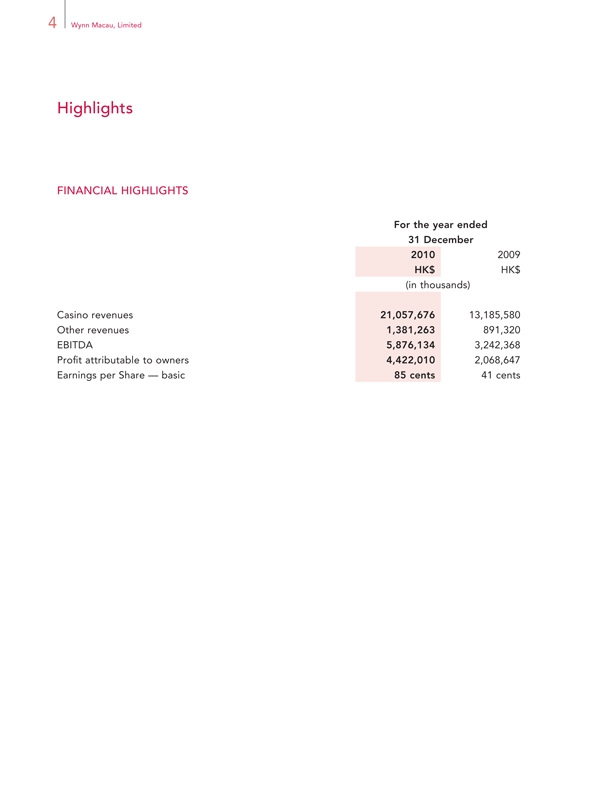

Highlights

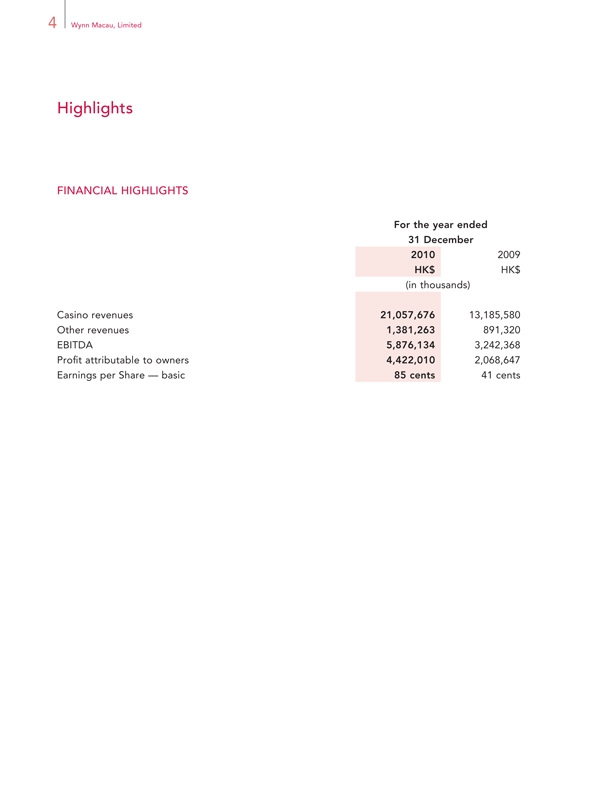

FINANCIAL HIGHLIGHTS

For the year ended

2010 2009

HK$ HK$

(in thousands)

Casino revenues 21,057,676 13,185,580

Other revenues 1,381,263 891,320

EBITDA 5,876,134 3,242,368

Profit attributable to owners 4,422,010 2,068,647

Earnings per Share — basic 85 cents 41 cents

Annual Report 2010 5

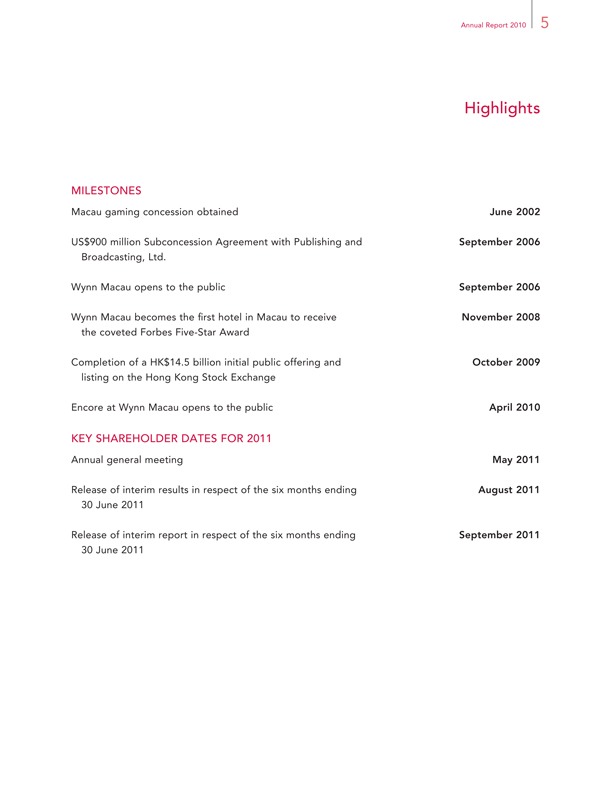

Highlights

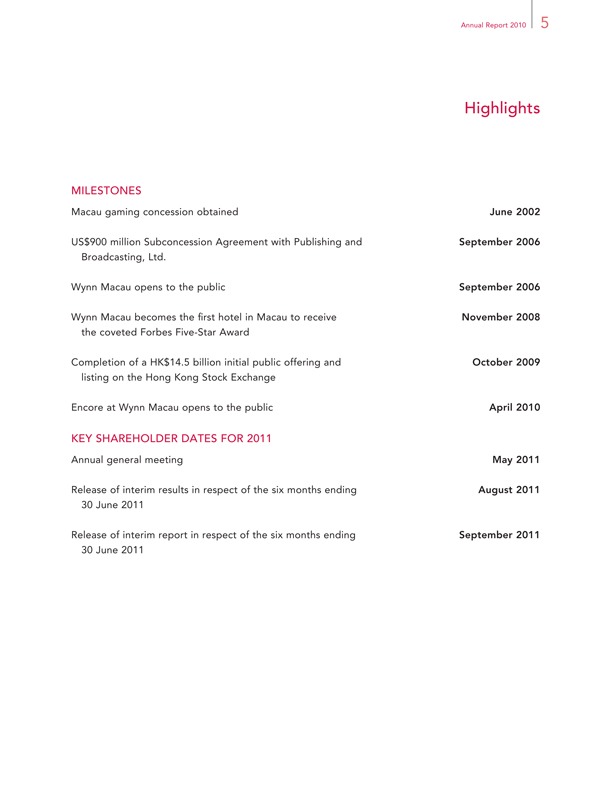

MILESTONES

Macau gaming concession obtained June 2002

US$900 million Subconcession Agreement with Publishing and September 2006

Broadcasting, Ltd.

Wynn Macau opens to the public September 2006

Wynn Macau becomes the first hotel in Macau to receive November 2008

the coveted Forbes Five-Star Award

Completion of a HK$14.5 billion initial public offering and October 2009

listing on the Hong Kong Stock Exchange

Encore at Wynn Macau opens to the public April 2010

KEY SHAREHOLDER DATES FOR 2011

Annual general meeting May 2011

Release of interim results in respect of the six months ending August 2011

Release of interim report in respect of the six months ending September 2011

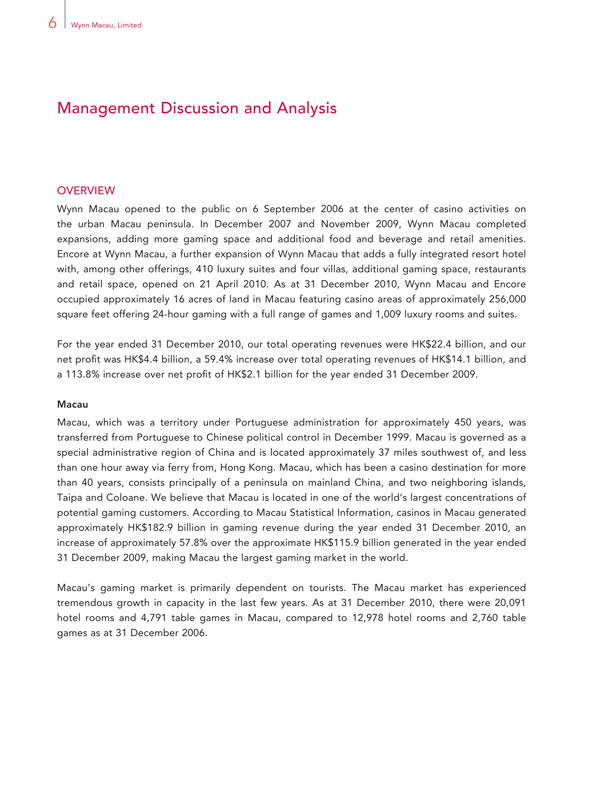

Management Discussion and Analysis

OVERVIEW

Wynn Macau opened to the public on 6 September 2006 at the center of casino activities on the urban Macau peninsula. In December 2007 and November 2009, Wynn Macau completed expansions, adding more gaming space and additional food and beverage and retail amenities. Encore at Wynn Macau, a further expansion of Wynn Macau that adds a fully integrated resort hotel with, among other offerings, 410 luxury suites and four villas, additional gaming space, restaurants and retail space, opened on 21 April 2010. As at 31 December 2010, Wynn Macau and Encore occupied approximately 16 acres of land in Macau featuring casino areas of approximately 256,000 square feet offering 24-hour gaming with a full range of games and 1,009 luxury rooms and suites.

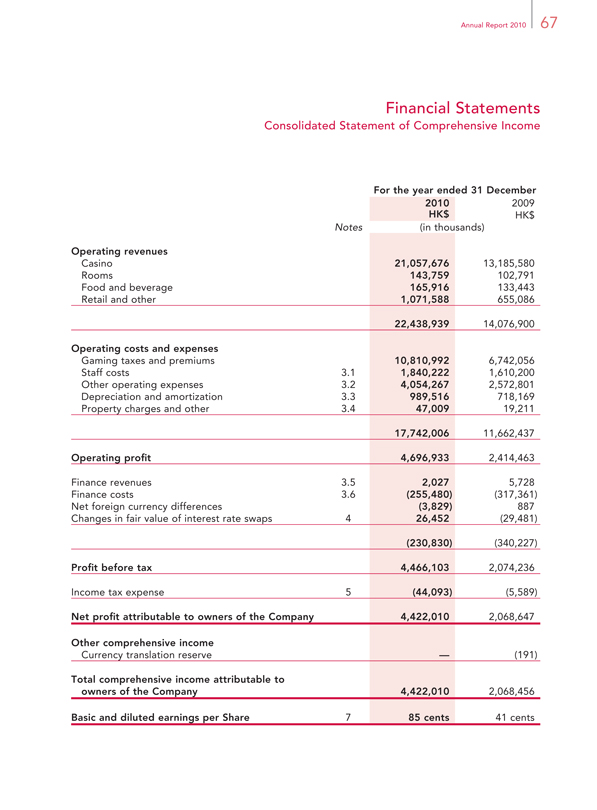

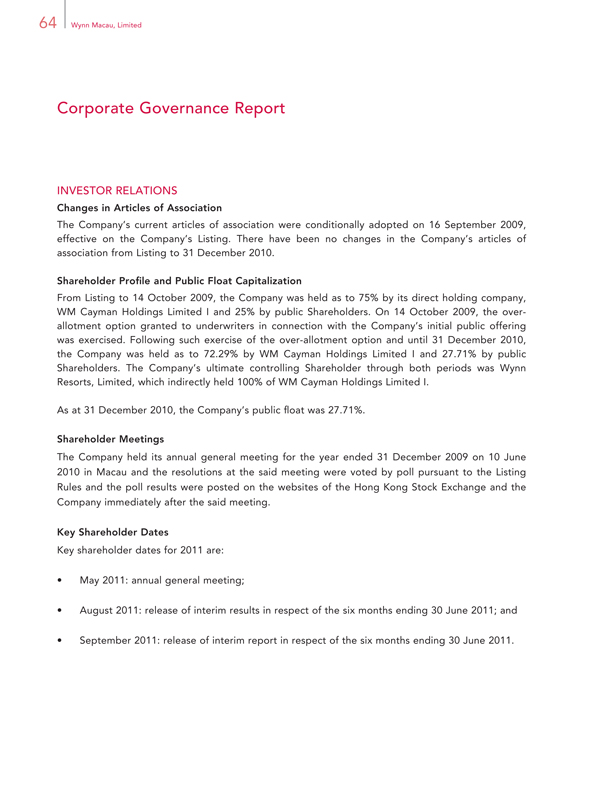

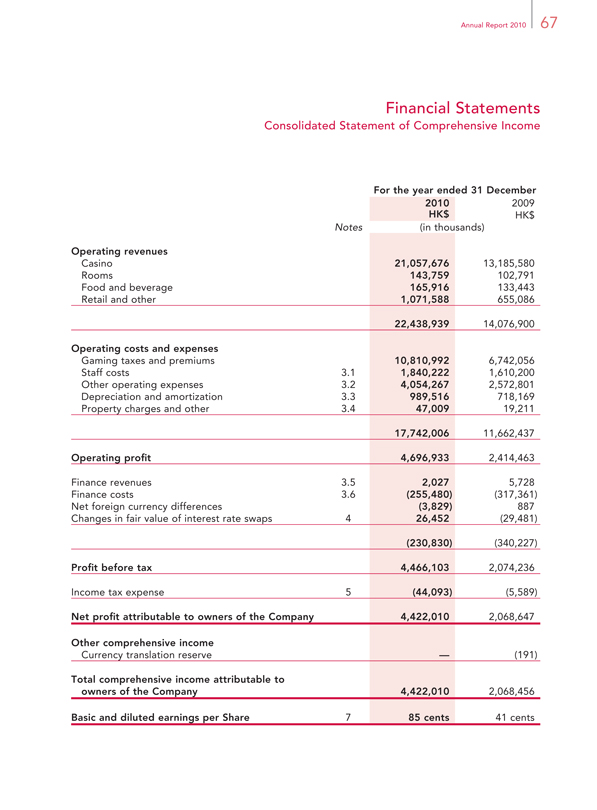

For the year ended 31 December 2010, our total operating revenues were HK$22.4 billion, and our net profit was HK$4.4 billion, a 59.4% increase over total operating revenues of HK$14.1 billion, and a 113.8% increase over net profit of HK$2.1 billion for the year ended 31 December 2009.

Macau

Macau, which was a territory under Portuguese administration for approximately 450 years, was transferred from Portuguese to Chinese political control in December 1999. Macau is governed as a special administrative region of China and is located approximately 37 miles southwest of, and less than one hour away via ferry from, Hong Kong. Macau, which has been a casino destination for more than 40 years, consists principally of a peninsula on mainland China, and two neighboring islands, Taipa and Coloane. We believe that Macau is located in one of the world’s largest concentrations of potential gaming customers. According to Macau Statistical Information, casinos in Macau generated approximately HK$182.9 billion in gaming revenue during the year ended 31 December 2010, an increase of approximately 57.8% over the approximate HK$115.9 billion generated in the year ended 31 December 2009, making Macau the largest gaming market in the world.

Macau’s gaming market is primarily dependent on tourists. The Macau market has experienced tremendous growth in capacity in the last few years. As at 31 December 2010, there were 20,091 hotel rooms and 4,791 table games in Macau, compared to 12,978 hotel rooms and 2,760 table games as at 31 December 2006.

Annual Report 2010 7

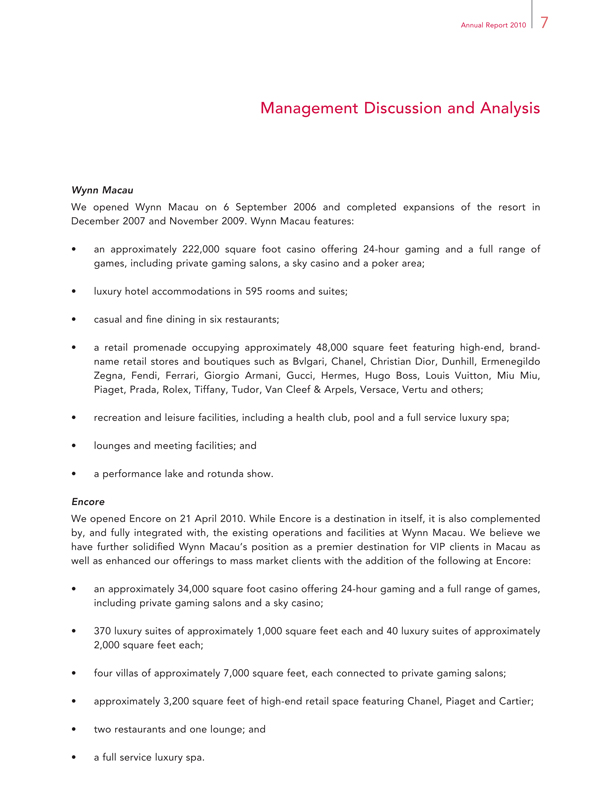

Management Discussion and Analysis

Wynn Macau

We opened Wynn Macau on 6 September 2006 and completed expansions of the resort in December 2007 and November 2009. Wynn Macau features:

an approximately 222,000 square foot casino offering 24-hour gaming and a full range of games, including private gaming salons, a sky casino and a poker area;

luxury hotel accommodations in 595 rooms and suites;

casual and fine dining in six restaurants;

a retail promenade occupying approximately 48,000 square feet featuring high-end, brand- name retail stores and boutiques such as Bvlgari, Chanel, Christian Dior, Dunhill, Ermenegildo Zegna, Fendi, Ferrari, Giorgio Armani, Gucci, Hermes, Hugo Boss, Louis Vuitton, Miu Miu, Piaget, Prada, Rolex, Tiffany, Tudor, Van Cleef & Arpels, Versace, Vertu and others;

recreation and leisure facilities, including a health club, pool and a full service luxury spa;

lounges and meeting facilities; and

a performance lake and rotunda show.

Encore

We opened Encore on 21 April 2010. While Encore is a destination in itself, it is also complemented by, and fully integrated with, the existing operations and facilities at Wynn Macau. We believe we have further solidified Wynn Macau’s position as a premier destination for VIP clients in Macau as well as enhanced our offerings to mass market clients with the addition of the following at Encore:

an approximately 34,000 square foot casino offering 24-hour gaming and a full range of games, including private gaming salons and a sky casino;

370 luxury suites of approximately 1,000 square feet each and 40 luxury suites of approximately 2,000 square feet each;

four villas of approximately 7,000 square feet, each connected to private gaming salons;

approximately 3,200 square feet of high-end retail space featuring Chanel, Piaget and Cartier;

two restaurants and one lounge; and

a full service luxury spa.

Management Discussion and Analysis

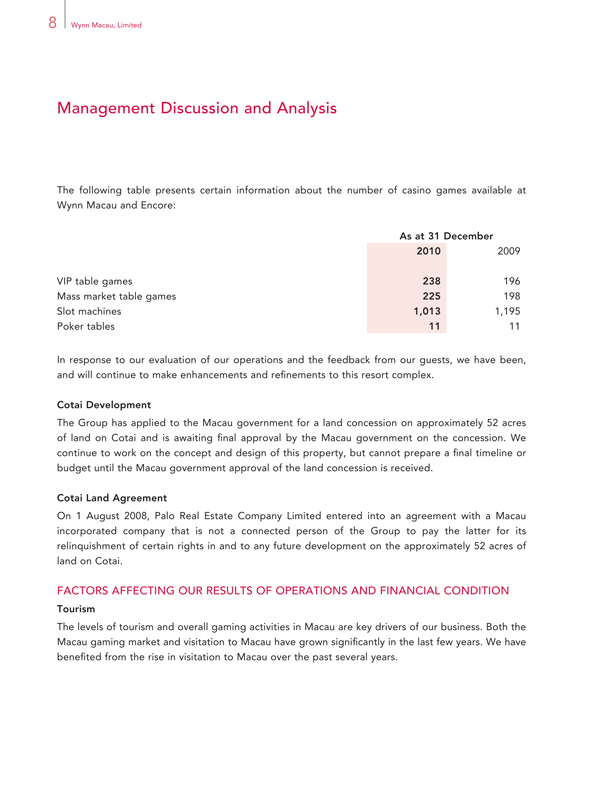

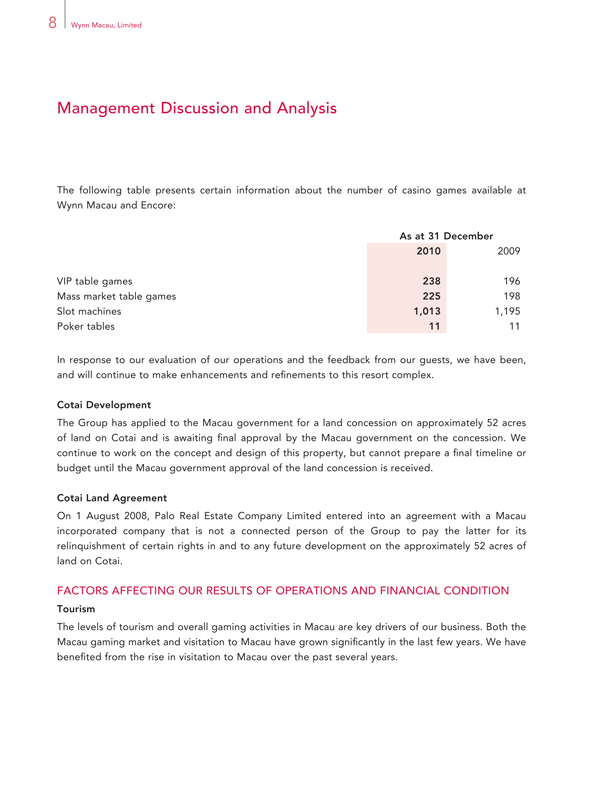

The following table presents certain information about the number of casino games available at Wynn Macau and Encore:

As at 31 December

2010 2009

VIP table games 238 196

Mass market table games 225 198

Slot machines 1,013 1,195

Poker tables 11 11

In response to our evaluation of our operations and the feedback from our guests, we have been, and will continue to make enhancements and refinements to this resort complex.

Cotai Development

The Group has applied to the Macau government for a land concession on approximately 52 acres of land on Cotai and is awaiting final approval by the Macau government on the concession. We continue to work on the concept and design of this property, but cannot prepare a final timeline or budget until the Macau government approval of the land concession is received.

Cotai Land Agreement

On 1 August 2008, Palo Real Estate Company Limited entered into an agreement with a Macau incorporated company that is not a connected person of the Group to pay the latter for its relinquishment of certain rights in and to any future development on the approximately 52 acres of land on Cotai.

FACTORS AFFECTING OUR RESULTS OF OPERATIONS AND FINANCIAL CONDITION

Tourism

The levels of tourism and overall gaming activities in Macau are key drivers of our business. Both the Macau gaming market and visitation to Macau have grown significantly in the last few years. We have benefited from the rise in visitation to Macau over the past several years.

Annual Report 2010 9

Management Discussion and Analysis

Gaming customers traveling to Macau typically come from nearby destinations in Asia including Hong Kong, mainland China, Taiwan, South Korea and Japan. According to the Macau Statistics and Census Service Monthly Bulletin of Statistics, approximately 88% of visitors to Macau in 2010 were from Hong Kong, mainland China and Taiwan. We believe that visitation and gross gaming revenue growth for the Macau market have been, and will continue to be, driven by a combination of factors, including the level of regional wealth in Asia which, should it continue to increase, is expected to lead to a large and growing middle class with rising disposable income; Macau’s proximity to major Asian population centers; infrastructure improvements that are expected to facilitate more convenient travel to and within Macau; and the increasing supply of better quality casino, hotel and entertainment offerings in Macau.

Tourism levels in Macau are affected by a number of factors, all of which are beyond our control. Key factors affecting tourism levels in Macau may include, among others:

Prevailing economic conditions in China and Asia;

Various countries’ policies on the issuance of travel visas that may be in place from time to time and could affect travel to Macau;

Competition from other destinations which offer gaming and leisure activities;

Possible changes to government restrictions on currency conversion or the ability to export currency from China or other countries; and

Possible outbreaks of infectious disease.

Economic and Operating Environment

Our operating environment remained stable in 2010. However, economic conditions can have a significant impact on our business. A number of factors, including a slowdown in the global economy, contracting credit markets, reduced consumer spending, various countries’ policies that affect travel to Macau and any outbreak of infections diseases can negatively impact the gaming industry in Macau and our business.

10 Wynn Macau, Limited

Management Discussion and Analysis

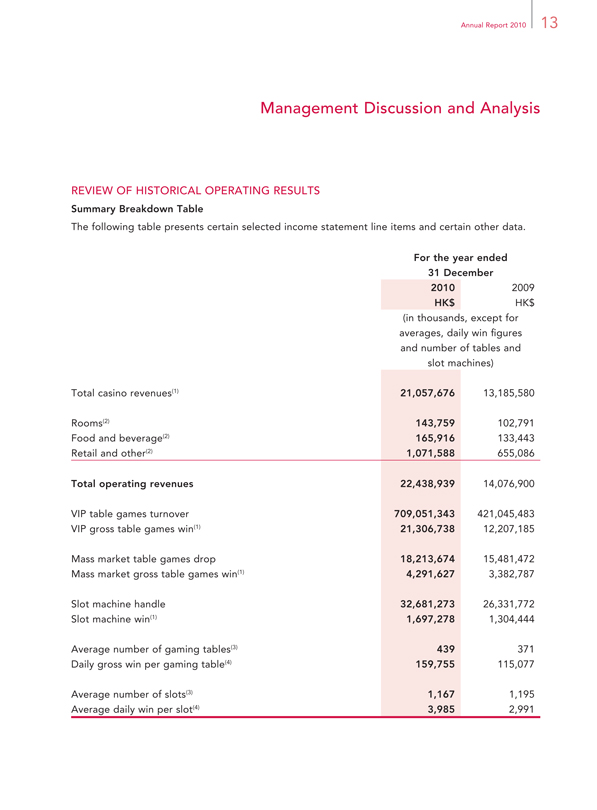

Competition

Since the liberalization of Macau’s gaming industry in 2002, there has been a significant increase in the number of gaming operators and casino properties in Macau. Currently, there are six gaming operators in Macau, including WRM. The three concessionaires are WRM, Galaxy and SJM. The three subconcessionaires are Venetian Macau, Melco Crown, and MGM Macau. As at 31 December 2010, there were approximately 33 casinos in Macau, including 20 operated by SJM. Each of the current six operators has operating casinos and several expansion plans announced or underway.

Wynn Macau also faces competition from casinos located in other areas of Asia, such as Genting Highlands Resort, a major gaming and resort destination located outside of Kuala Lumpur, Malaysia, and casinos in the Philippines. Two large-scale casinos in Singapore, which opened in February 2010 and in April 2010, have added further competition to the region. Wynn Macau also encounters competition from other major gaming centers located around the world, including Australia and Las Vegas, cruise ships in Asia that offer gaming, and other casinos throughout Asia. Further, if current efforts to legalize gaming in other Asian countries are successful, Wynn Macau will face additional regional competition.

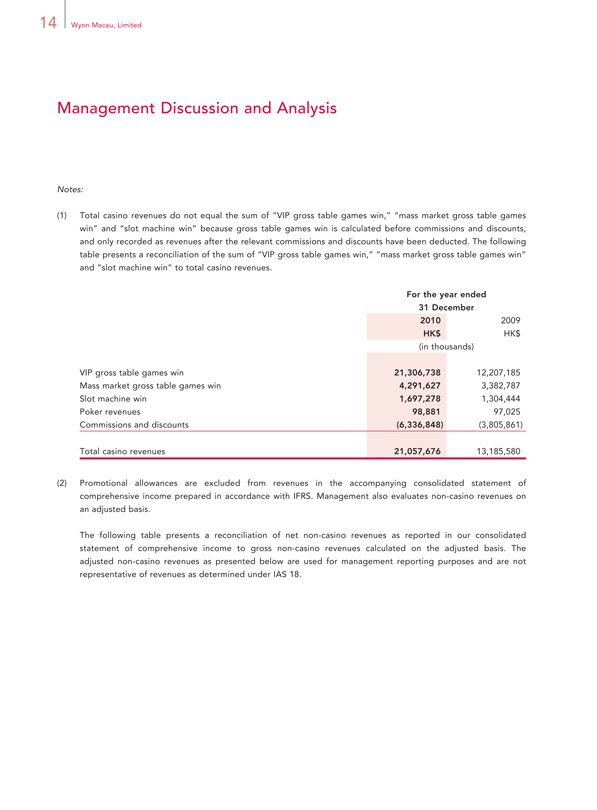

Gaming Promoters

A significant amount of our casino play is brought to us by gaming promoters. Gaming promoters have historically played a critical role in the Macau gaming market and are important to Wynn Macau’s casino business.

Gaming promoters introduce high-spending VIP players to Wynn Macau and often assist those clients with their travel and entertainment arrangements. In addition, gaming promoters often grant credit to their players. In exchange for their services, Wynn Macau pays the gaming promoters a fixed percentage of the gross gaming win generated by each gaming promoter. This percentage has remained stable since 2006. Approximately 80% of these commissions are netted against casino revenues, because such commissions approximate the amount of the commission returned to the VIP players by the gaming promoters, and approximately 20% of these commissions are included in other operating expenses, which approximate the amount of the commission ultimately retained by the gaming promoters for their compensation. The total amount of commissions netted against casino revenues were HK$5.8 billion and HK$3.4 billion for the year ended 31 December 2010 and 2009, respectively. Commissions increased 69.7% for the year ended 31 December 2010 compared to the year ended 31 December 2009 due to increased volumes of play generated by gaming promoters and the addition of three new gaming promoters. Additionally, gaming promoters each receive a monthly complimentary allowance based on a percentage of the turnover their clients generate.

Annual Report 2010 11

Management Discussion and Analysis

The allowance is available for room, food and beverage and other products and services for discretionary use with clients. We typically advance commissions to gaming promoters at the beginning of each month to facilitate their working capital requirements. These advances are provided to a gaming promoter and are offset by the commissions earned by such gaming promoter during the applicable month. The aggregate amounts of exposure to our gaming promoters, which is the difference between commissions advanced to each individual gaming promoter, and the commissions payable to each such gaming promoter, were HK$246.3 million and HK$127.7 million as at 31 December 2010 and 2009, respectively. Outstanding commissions advanced during a month to a gaming promoter are always cleared no later than the fifth day of the succeeding month and prior to the advancement of any further funds to a gaming promoter. We believe we have developed strong relationships with our gaming promoters. Our commission levels have remained stable throughout our operating history and we have not increased levels of commissions paid to gaming promoters.

In August 2009, the Macau government published, in its official gazette, certain guidelines with respect to caps on the commission rates payable to gaming promoters that became effective on 1 December 2009. Further changes or tightening of caps may occur and if the Macau government were to implement caps on commission rates payable to gaming promoters that cause WRM to pay gaming promoters effectively less than what WRM currently pays, gaming promoters may have less incentive to bring travelers to casinos in Macau, including Wynn Macau.

High-End Credit Play

We selectively extend credit to players contingent upon our marketing team’s knowledge of the players, their financial background and payment history. We follow a series of credit procedures and require from each credit recipient various signed documents that are intended to ensure among other things that, if permitted by applicable law, the debt can be legally enforced in the jurisdiction where the player resides. In the event the player does not reside in a jurisdiction where gaming debts are legally enforceable, we often can assert jurisdiction over assets the player maintains in jurisdictions where gaming debts are recognized. In addition, we typically require a check in the amount of the applicable credit line from credit players, collateralizing the credit we grant to a player.

Number and Mix of Table Games and Slot Machines

The mix of VIP table games, mass table games and slot machines in operation at Wynn Macau and Encore changes from time to time as a result of marketing and operating strategies in response to changing market demand and industry competition. The shift in the mix of Wynn Macau’s and Encore’s games will affect casino profitability.

12 Wynn Macau, Limited

Management Discussion and Analysis

ADJUSTED EBITDA

Adjusted EBITDA is earnings before finance costs, taxes, depreciation, amortization, pre-opening costs, property charges and other, share-based payments, and other non-operating income/ (expense). Adjusted EBITDA is presented exclusively as a supplemental disclosure because our Directors believe that it is widely used to measure the performance, and as a basis for valuation, of gaming companies. Our Adjusted EBITDA presented herein also differs from the Adjusted EBITDA presented by Wynn Resorts, Limited for its Macau segment in its filings with the Securities and Exchange Commission in the United States, primarily due to the inclusion of royalty fees, adjustments for IFRS differences with U.S. GAAP, corporate support and other support services in arriving at operating profit.

The following table sets forth a quantitative reconciliation of Adjusted EBITDA to its most directly comparable IFRS measurement, operating profit, for the years ended 31 December 2010 and 2009.

Note:

Pre-opening costs for the years 2010 and 2009 primarily consisted of payroll attributable to staff engaged in the start-up operations of Encore which opened on 21 April 2010.

Annual Report 2010 13

Management Discussion and Analysis

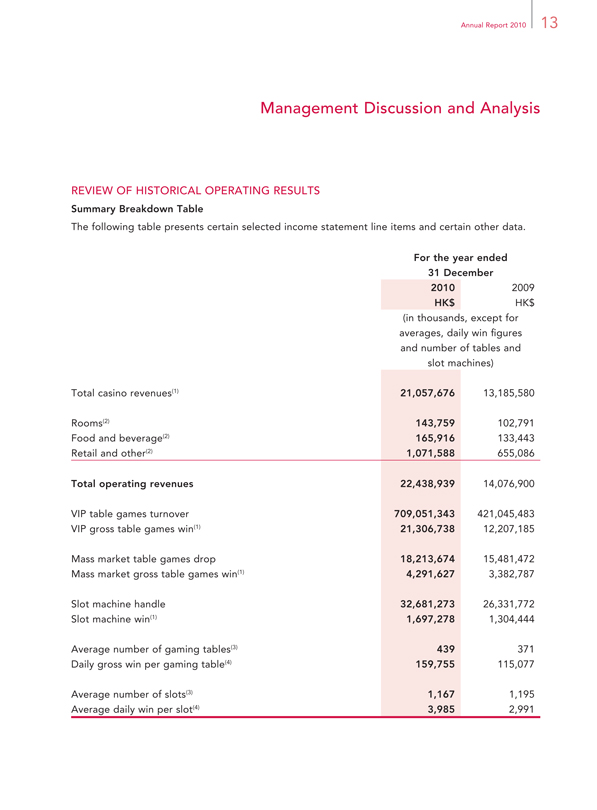

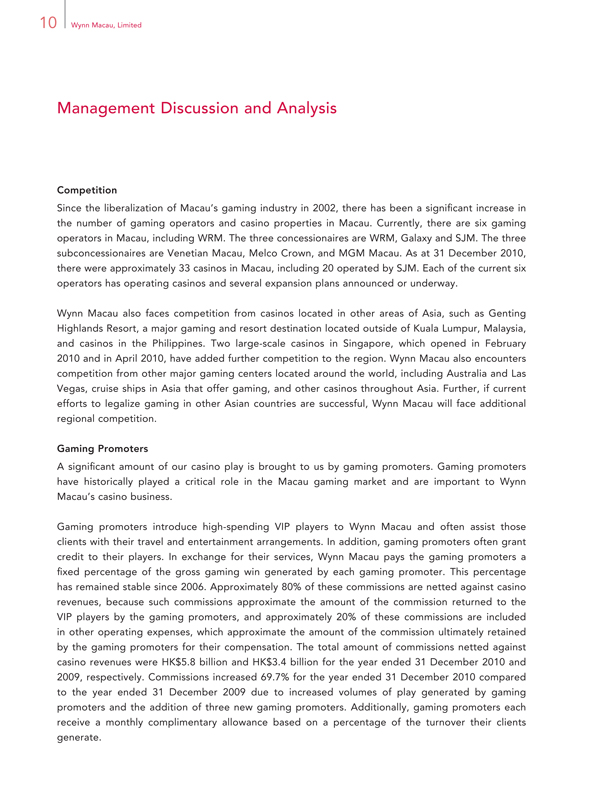

REVIEW OF HISTORICAL OPERATING RESULTS

Summary Breakdown Table

The following table presents certain selected income statement line items and certain other data.

For the year ended

2010 2009

HK$ HK$

(in thousands, except for

averages, daily win figures

and number of tables and

slot machines)

Total casino revenues(1) 21,057,676 13,185,580

Rooms(2) 143,759 102,791

Food and beverage(2) 165,916 133,443

Retail and other(2) 1,071,588 655,086

Total operating revenues 22,438,939 14,076,900

VIP table games turnover 709,051,343 421,045,483

VIP gross table games win(1) 21,306,738 12,207,185

Mass market table games drop 18,213,674 15,481,472

Mass market gross table games win(1) 4,291,627 3,382,787

Slot machine handle 32,681,273 26,331,772

Slot machine win(1) 1,697,278 1,304,444

Average number of gaming tables(3) 439 371

Daily gross win per gaming table(4) 159,755 115,077

Average number of slots(3) 1,167 1,195

Average daily win per slot(4) 3,985 2,991

14 Wynn Macau, Limited

Management Discussion and Analysis

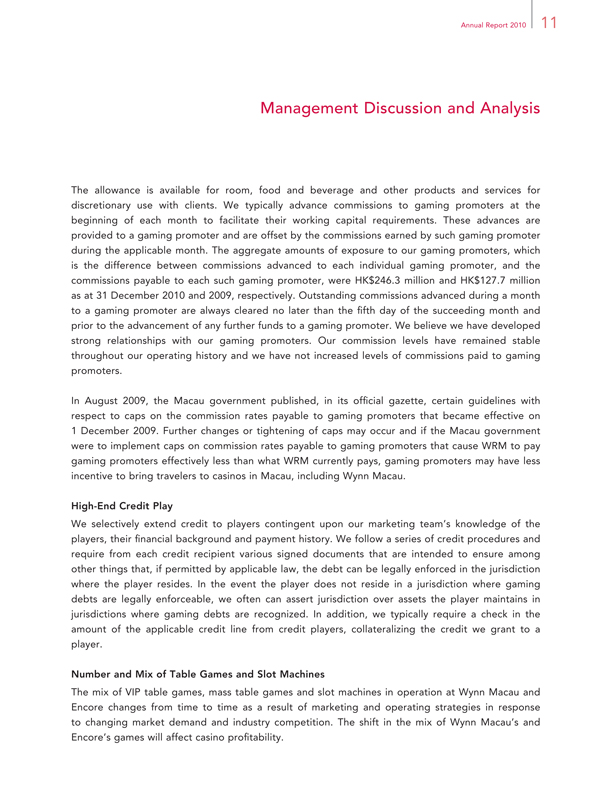

Notes:

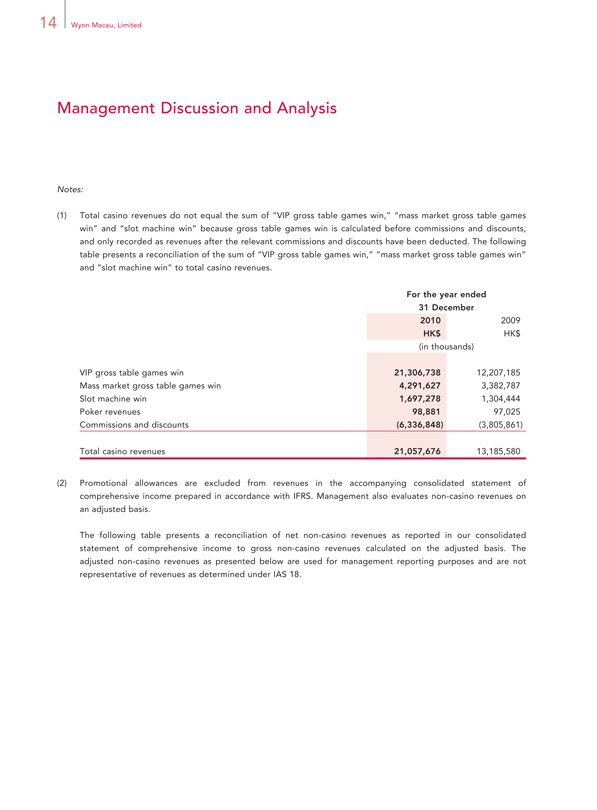

Total casino revenues do not equal the sum of “VIP gross table games win,” “mass market gross table games win” and “slot machine win” because gross table games win is calculated before commissions and discounts, and only recorded as revenues after the relevant commissions and discounts have been deducted. The following table presents a reconciliation of the sum of “VIP gross table games win,” “mass market gross table games win” and “slot machine win” to total casino revenues.

For the year ended

2010 2009

HK$ HK$

(in thousands)

VIP gross table games win 21,306,738 12,207,185

Mass market gross table games win 4,291,627 3,382,787

Slot machine win 1,697,278 1,304,444

Poker revenues 98,881 97,025

Commissions and discounts(6,336,848)(3,805,861)

Total casino revenues 21,057,676 13,185,580

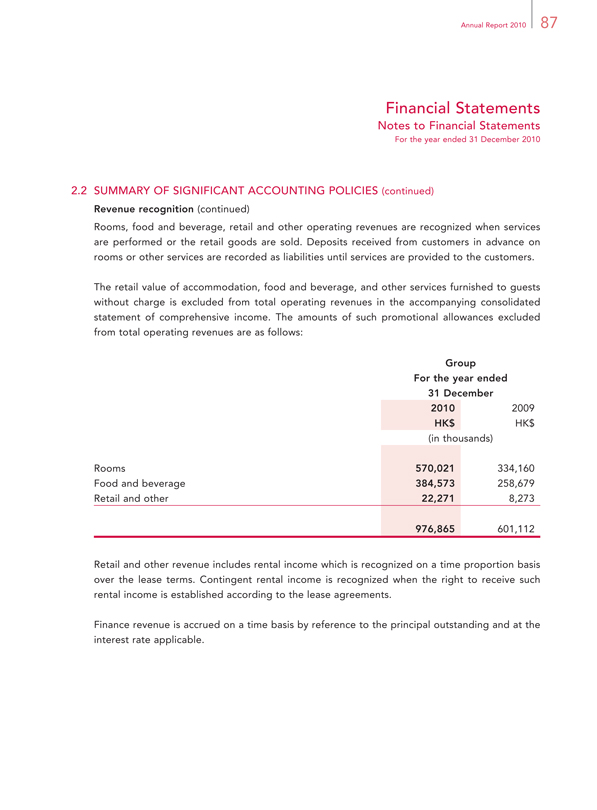

Promotional allowances are excluded from revenues in the accompanying consolidated statement of comprehensive income prepared in accordance with IFRS. Management also evaluates non-casino revenues on an adjusted basis.

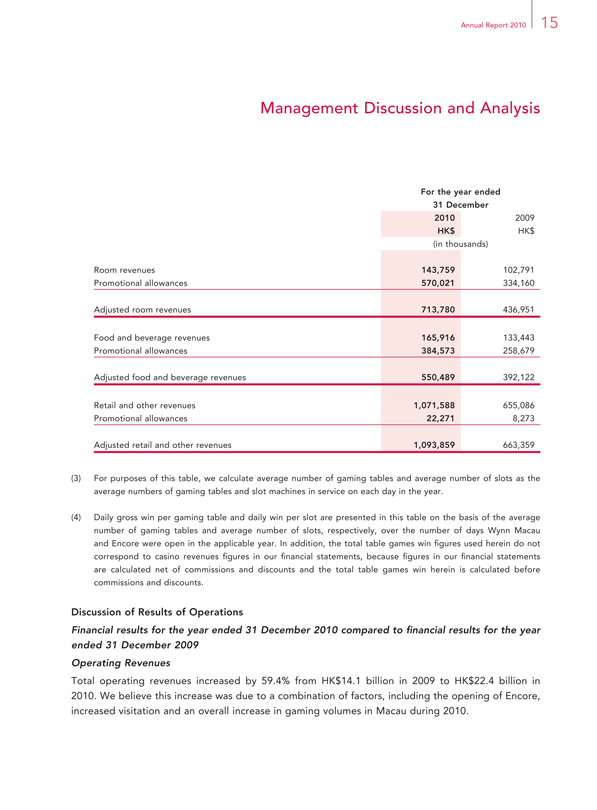

The following table presents a reconciliation of net non-casino revenues as reported in our consolidated statement of comprehensive income to gross non-casino revenues calculated on the adjusted basis. The adjusted non-casino revenues as presented below are used for management reporting purposes and are not representative of revenues as determined under IAS 18.

Annual Report 2010 15

Management Discussion and Analysis

For the year ended

2010 2009

HK$ HK$

(in thousands)

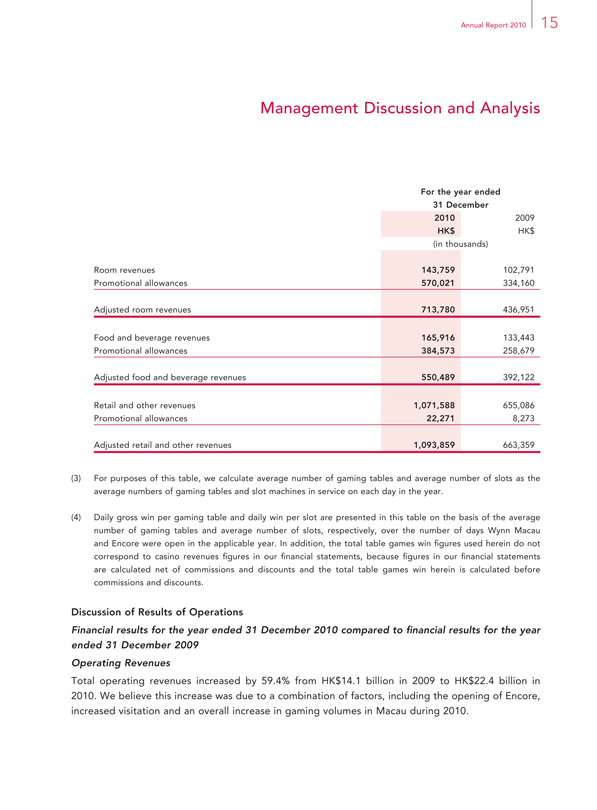

Room revenues 143,759 102,791

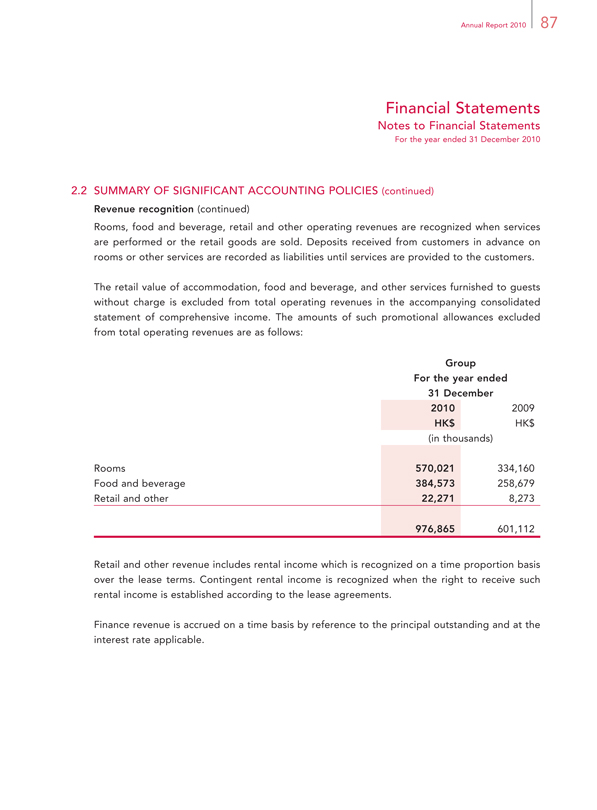

Promotional allowances 570,021 334,160

Adjusted room revenues 713,780 436,951

Food and beverage revenues 165,916 133,443

Promotional allowances 384,573 258,679

Adjusted food and beverage revenues 550,489 392,122

Retail and other revenues 1,071,588 655,086

Promotional allowances 22,271 8,273

Adjusted retail and other revenues 1,093,859 663,359

For purposes of this table, we calculate average number of gaming tables and average number of slots as the average numbers of gaming tables and slot machines in service on each day in the year.

Daily gross win per gaming table and daily win per slot are presented in this table on the basis of the average number of gaming tables and average number of slots, respectively, over the number of days Wynn Macau and Encore were open in the applicable year. In addition, the total table games win figures used herein do not correspond to casino revenues figures in our financial statements, because figures in our financial statements are calculated net of commissions and discounts and the total table games win herein is calculated before commissions and discounts.

Discussion of Results of Operations

Financial results for the year ended 31 December 2010 compared to financial results for the year ended 31 December 2009

Operating Revenues

Total operating revenues increased by 59.4% from HK$14.1 billion in 2009 to HK$22.4 billion in 2010. We believe this increase was due to a combination of factors, including the opening of Encore, increased visitation and an overall increase in gaming volumes in Macau during 2010.

16 Wynn Macau, Limited

Management Discussion and Analysis

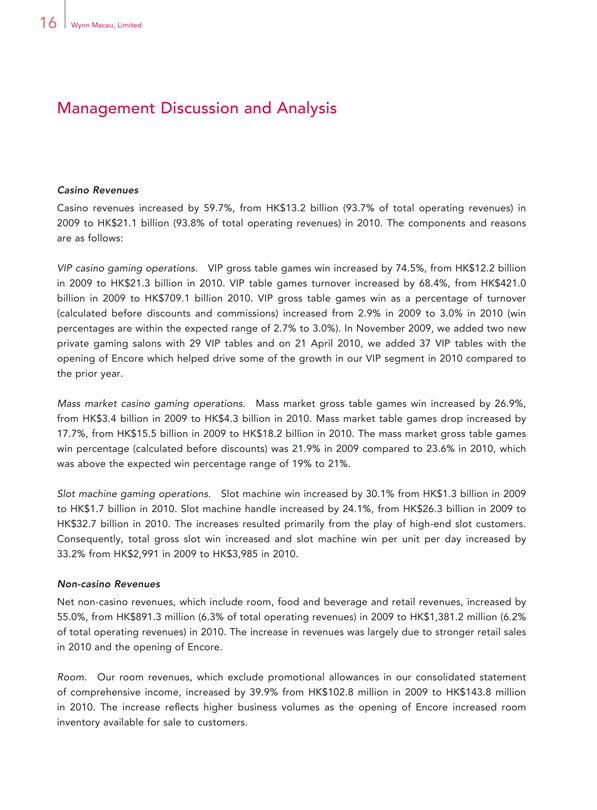

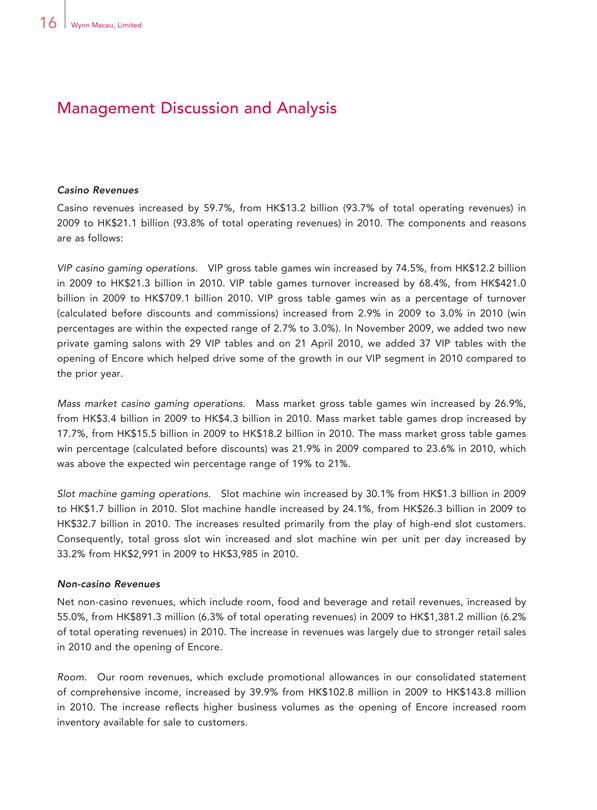

Casino Revenues

Casino revenues increased by 59.7%, from HK$13.2 billion (93.7% of total operating revenues) in 2009 to HK$21.1 billion (93.8% of total operating revenues) in 2010. The components and reasons are as follows:

VIP casino gaming operations. VIP gross table games win increased by 74.5%, from HK$12.2 billion in 2009 to HK$21.3 billion in 2010. VIP table games turnover increased by 68.4%, from HK$421.0 billion in 2009 to HK$709.1 billion 2010. VIP gross table games win as a percentage of turnover (calculated before discounts and commissions) increased from 2.9% in 2009 to 3.0% in 2010 (win percentages are within the expected range of 2.7% to 3.0%). In November 2009, we added two new private gaming salons with 29 VIP tables and on 21 April 2010, we added 37 VIP tables with the opening of Encore which helped drive some of the growth in our VIP segment in 2010 compared to the prior year.

Mass market casino gaming operations. Mass market gross table games win increased by 26.9%, from HK$3.4 billion in 2009 to HK$4.3 billion in 2010. Mass market table games drop increased by 17.7%, from HK$15.5 billion in 2009 to HK$18.2 billion in 2010. The mass market gross table games win percentage (calculated before discounts) was 21.9% in 2009 compared to 23.6% in 2010, which was above the expected win percentage range of 19% to 21%.

Slot machine gaming operations. Slot machine win increased by 30.1% from HK$1.3 billion in 2009 to HK$1.7 billion in 2010. Slot machine handle increased by 24.1%, from HK$26.3 billion in 2009 to HK$32.7 billion in 2010. The increases resulted primarily from the play of high-end slot customers. Consequently, total gross slot win increased and slot machine win per unit per day increased by 33.2% from HK$2,991 in 2009 to HK$3,985 in 2010.

Non-casino Revenues

Net non-casino revenues, which include room, food and beverage and retail revenues, increased by 55.0%, from HK$891.3 million (6.3% of total operating revenues) in 2009 to HK$1,381.2 million (6.2% of total operating revenues) in 2010. The increase in revenues was largely due to stronger retail sales in 2010 and the opening of Encore.

Room. Our room revenues, which exclude promotional allowances in our consolidated statement of comprehensive income, increased by 39.9% from HK$102.8 million in 2009 to HK$143.8 million in 2010. The increase reflects higher business volumes as the opening of Encore increased room inventory available for sale to customers.

Annual Report 2010 17

Management Discussion and Analysis

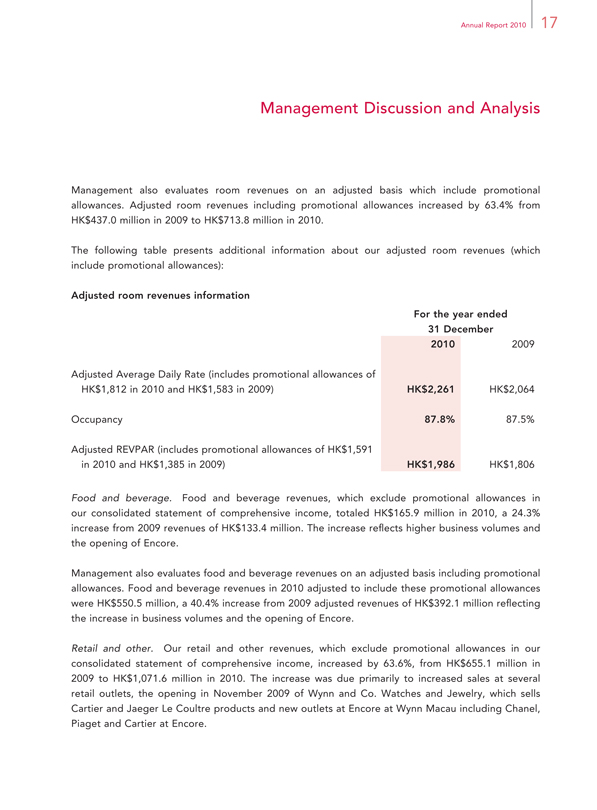

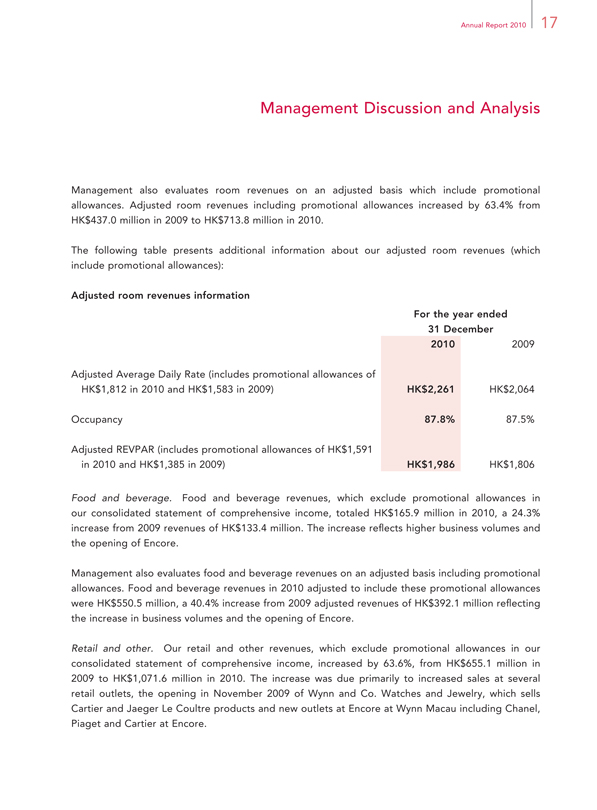

Management also evaluates room revenues on an adjusted basis which include promotional allowances. Adjusted room revenues including promotional allowances increased by 63.4% from HK$437.0 million in 2009 to HK$713.8 million in 2010.

The following table presents additional information about our adjusted room revenues (which include promotional allowances):

Food and beverage. Food and beverage revenues, which exclude promotional allowances in our consolidated statement of comprehensive income, totaled HK$165.9 million in 2010, a 24.3% increase from 2009 revenues of HK$133.4 million. The increase reflects higher business volumes and the opening of Encore.

Management also evaluates food and beverage revenues on an adjusted basis including promotional allowances. Food and beverage revenues in 2010 adjusted to include these promotional allowances were HK$550.5 million, a 40.4% increase from 2009 adjusted revenues of HK$392.1 million reflecting the increase in business volumes and the opening of Encore.

Retail and other. Our retail and other revenues, which exclude promotional allowances in our consolidated statement of comprehensive income, increased by 63.6%, from HK$655.1 million in 2009 to HK$1,071.6 million in 2010. The increase was due primarily to increased sales at several retail outlets, the opening in November 2009 of Wynn and Co. Watches and Jewelry, which sells Cartier and Jaeger Le Coultre products and new outlets at Encore at Wynn Macau including Chanel, Piaget and Cartier at Encore.

18 Wynn Macau, Limited

Management Discussion and Analysis

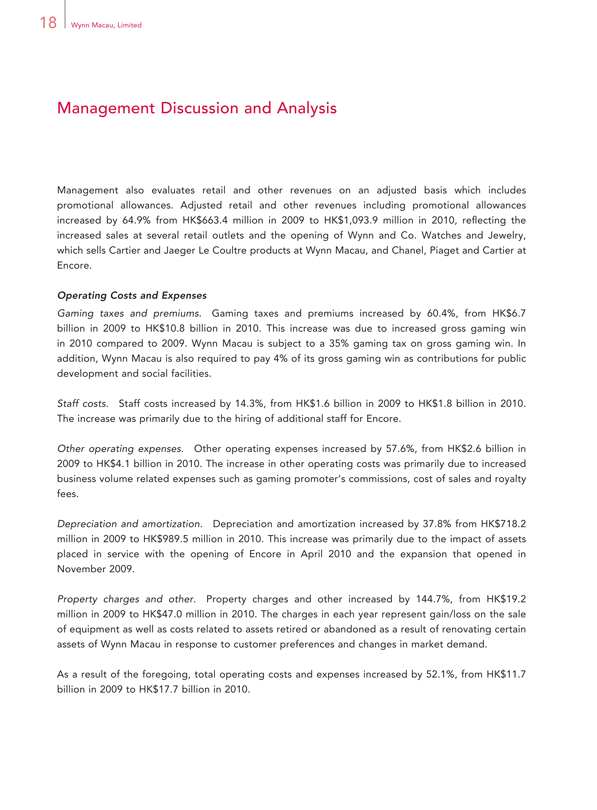

Management also evaluates retail and other revenues on an adjusted basis which includes promotional allowances. Adjusted retail and other revenues including promotional allowances increased by 64.9% from HK$663.4 million in 2009 to HK$1,093.9 million in 2010, reflecting the increased sales at several retail outlets and the opening of Wynn and Co. Watches and Jewelry, which sells Cartier and Jaeger Le Coultre products at Wynn Macau, and Chanel, Piaget and Cartier at Encore.

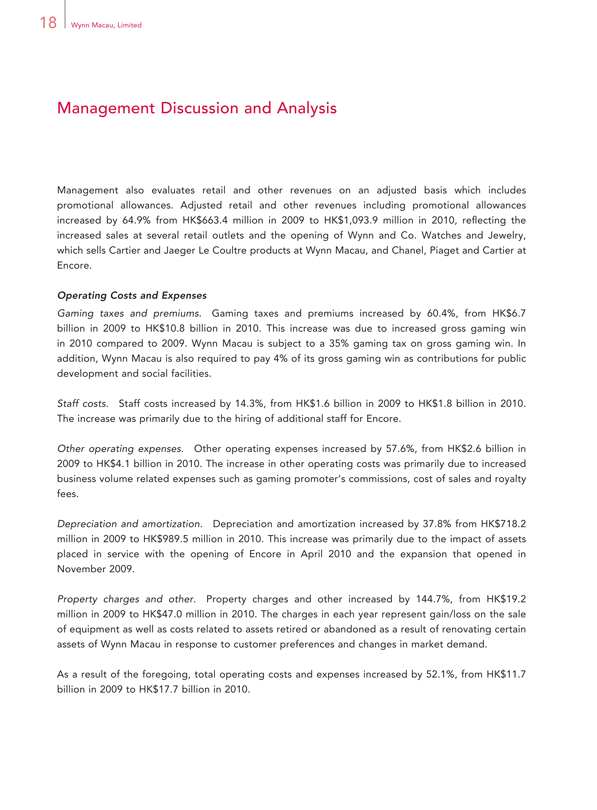

Operating Costs and Expenses

Gaming taxes and premiums. Gaming taxes and premiums increased by 60.4%, from HK$6.7 billion in 2009 to HK$10.8 billion in 2010. This increase was due to increased gross gaming win in 2010 compared to 2009. Wynn Macau is subject to a 35% gaming tax on gross gaming win. In addition, Wynn Macau is also required to pay 4% of its gross gaming win as contributions for public development and social facilities.

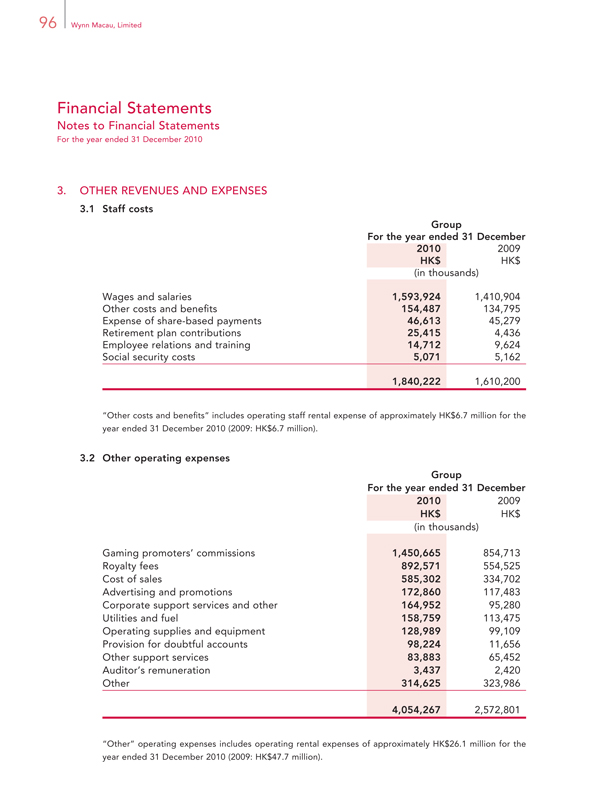

Staff costs. Staff costs increased by 14.3%, from HK$1.6 billion in 2009 to HK$1.8 billion in 2010. The increase was primarily due to the hiring of additional staff for Encore.

Other operating expenses. Other operating expenses increased by 57.6%, from HK$2.6 billion in 2009 to HK$4.1 billion in 2010. The increase in other operating costs was primarily due to increased business volume related expenses such as gaming promoter’s commissions, cost of sales and royalty fees.

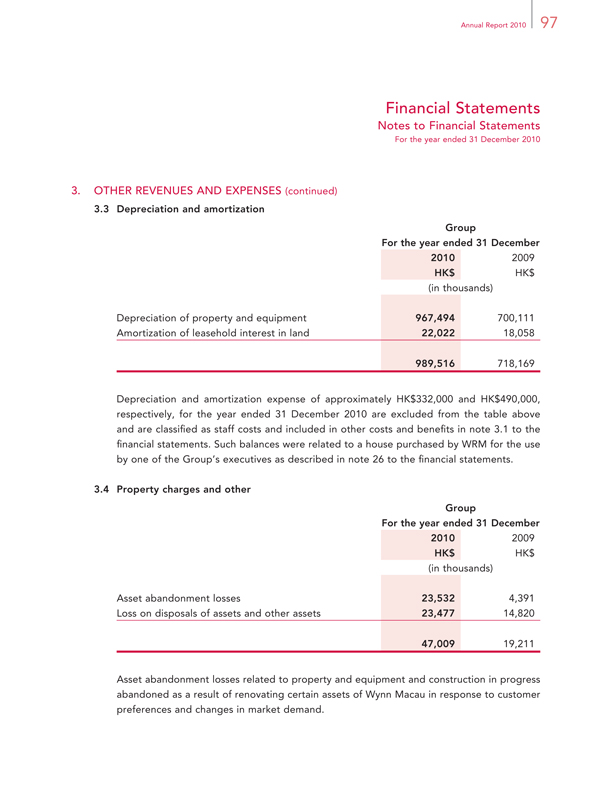

Depreciation and amortization. Depreciation and amortization increased by 37.8% from HK$718.2 million in 2009 to HK$989.5 million in 2010. This increase was primarily due to the impact of assets placed in service with the opening of Encore in April 2010 and the expansion that opened in November 2009.

Property charges and other. Property charges and other increased by 144.7%, from HK$19.2 million in 2009 to HK$47.0 million in 2010. The charges in each year represent gain/loss on the sale of equipment as well as costs related to assets retired or abandoned as a result of renovating certain assets of Wynn Macau in response to customer preferences and changes in market demand.

As a result of the foregoing, total operating costs and expenses increased by 52.1%, from HK$11.7 billion in 2009 to HK$17.7 billion in 2010.

Annual Report 2010 19

Management Discussion and Analysis

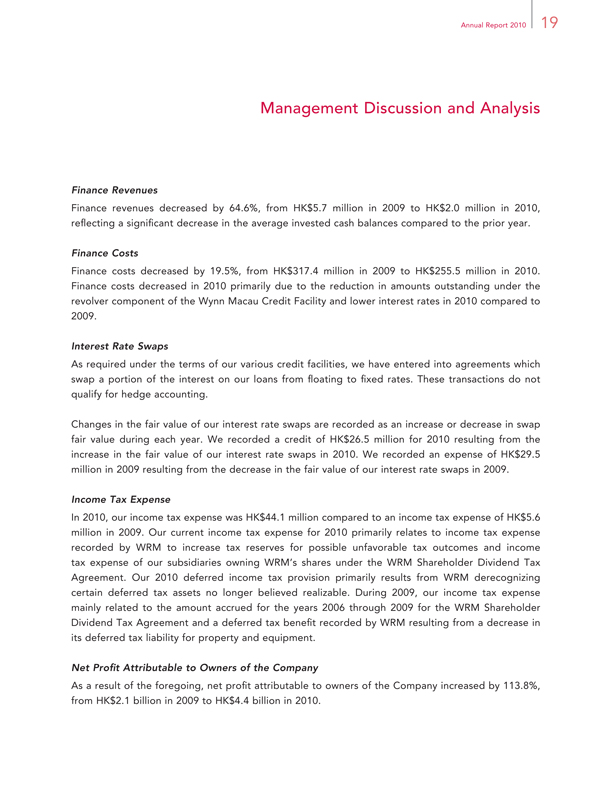

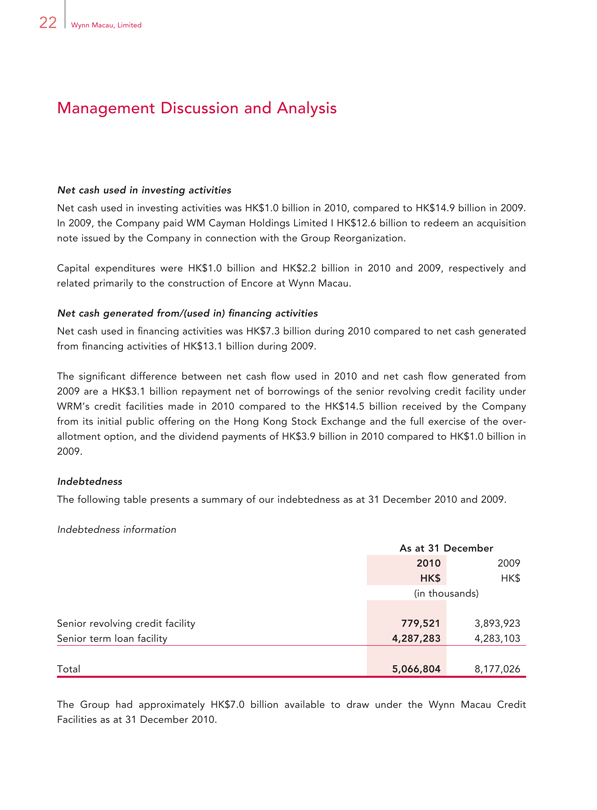

Finance Revenues

Finance revenues decreased by 64.6%, from HK$5.7 million in 2009 to HK$2.0 million in 2010, reflecting a significant decrease in the average invested cash balances compared to the prior year.

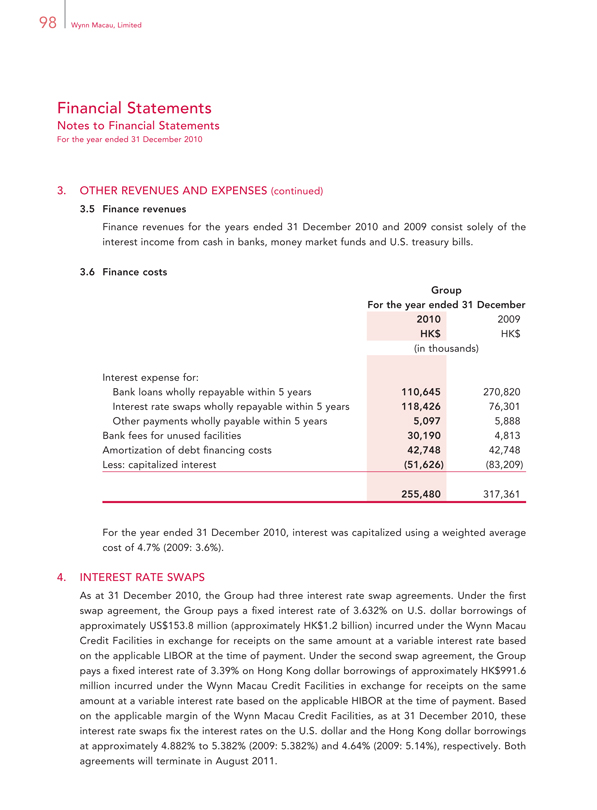

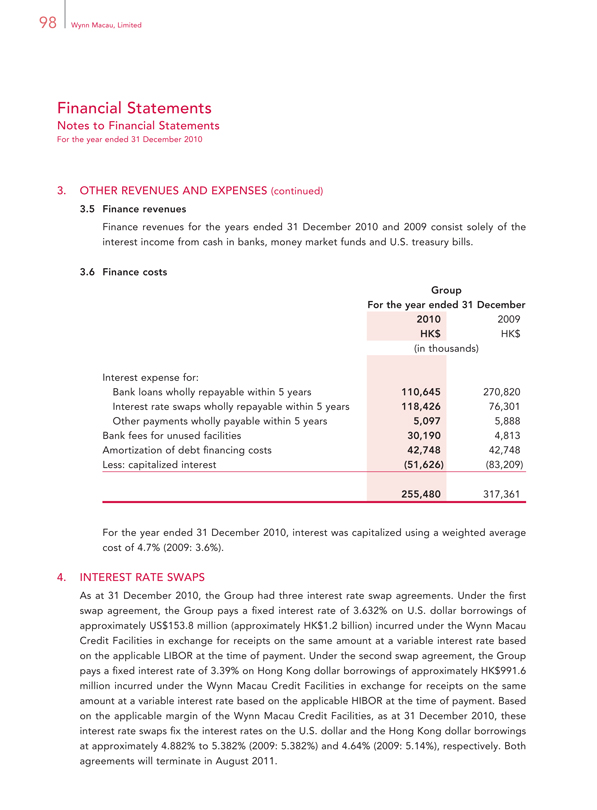

Finance Costs

Finance costs decreased by 19.5%, from HK$317.4 million in 2009 to HK$255.5 million in 2010. Finance costs decreased in 2010 primarily due to the reduction in amounts outstanding under the revolver component of the Wynn Macau Credit Facility and lower interest rates in 2010 compared to 2009.

Interest Rate Swaps

As required under the terms of our various credit facilities, we have entered into agreements which swap a portion of the interest on our loans from floating to fixed rates. These transactions do not qualify for hedge accounting.

Changes in the fair value of our interest rate swaps are recorded as an increase or decrease in swap fair value during each year. We recorded a credit of HK$26.5 million for 2010 resulting from the increase in the fair value of our interest rate swaps in 2010. We recorded an expense of HK$29.5 million in 2009 resulting from the decrease in the fair value of our interest rate swaps in 2009.

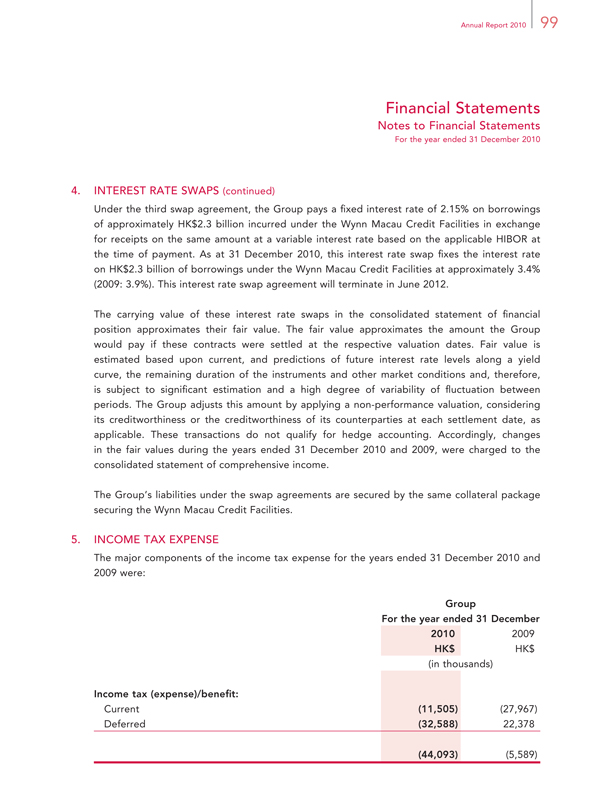

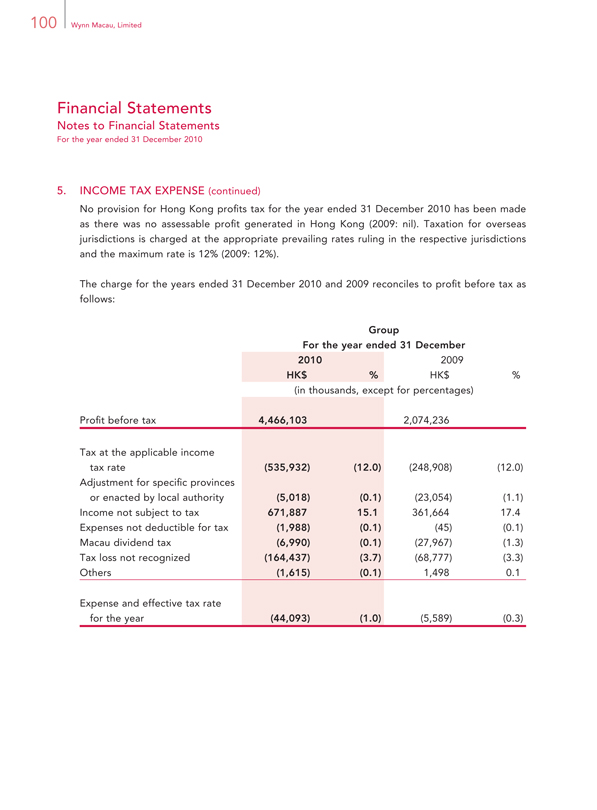

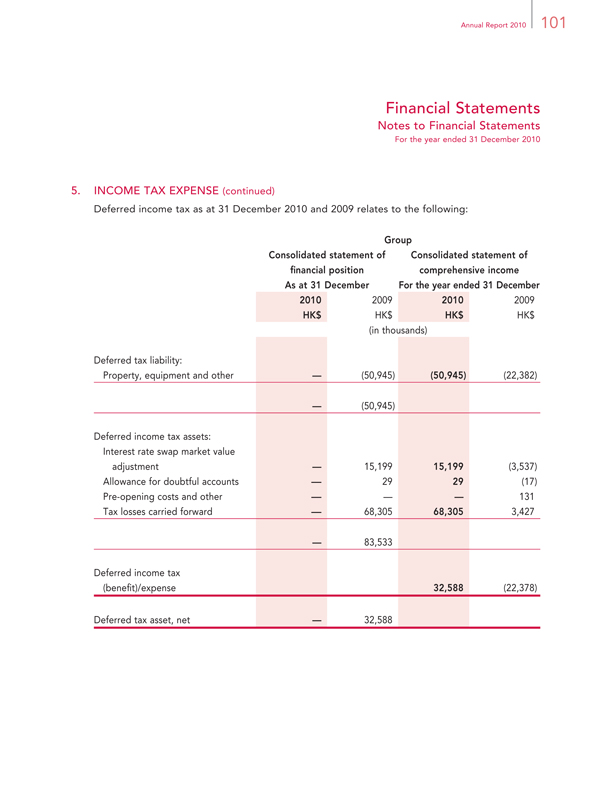

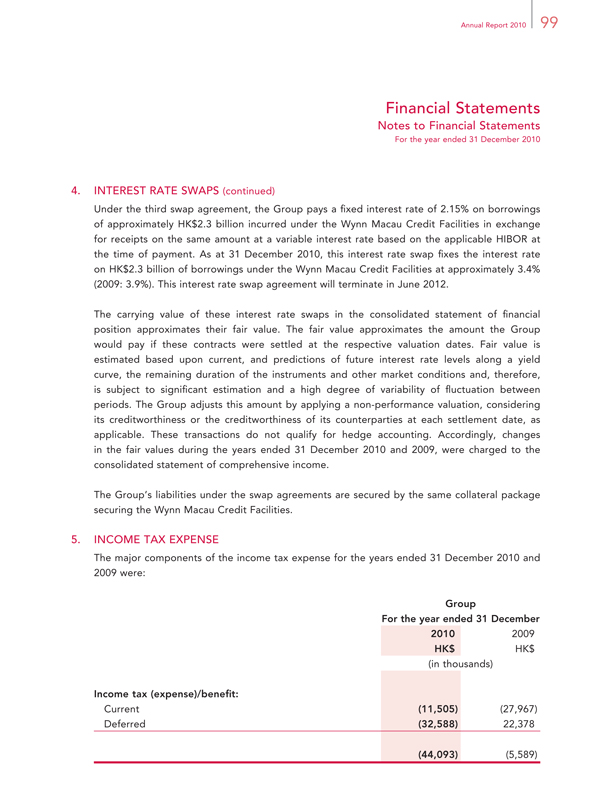

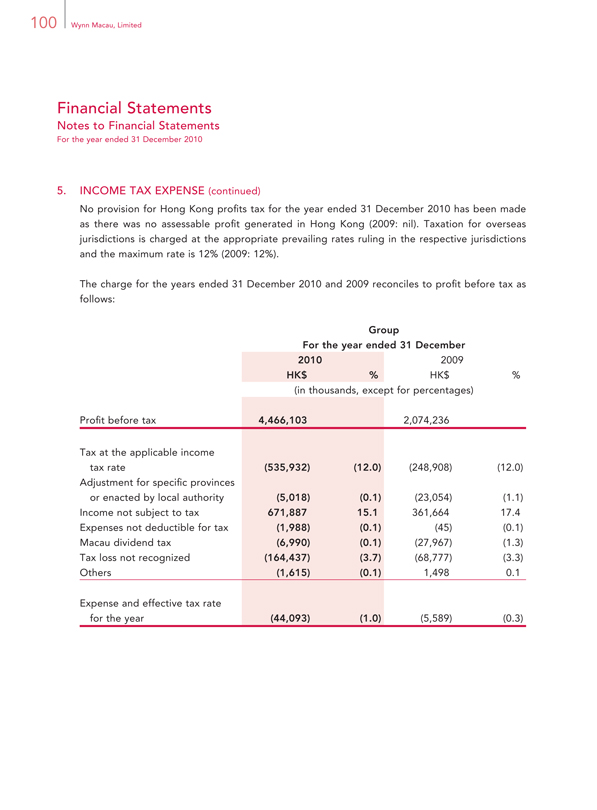

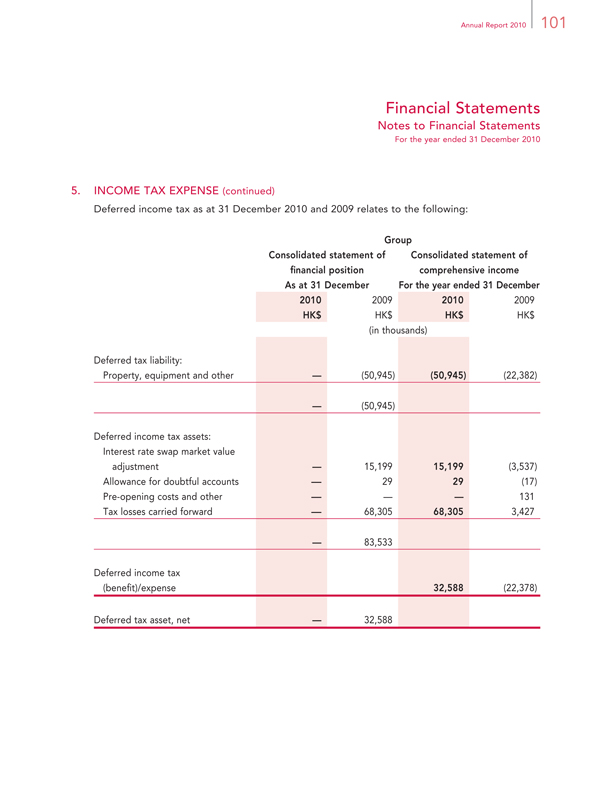

Income Tax Expense

In 2010, our income tax expense was HK$44.1 million compared to an income tax expense of HK$5.6 million in 2009. Our current income tax expense for 2010 primarily relates to income tax expense recorded by WRM to increase tax reserves for possible unfavorable tax outcomes and income tax expense of our subsidiaries owning WRM’s shares under the WRM Shareholder Dividend Tax Agreement. Our 2010 deferred income tax provision primarily results from WRM derecognizing certain deferred tax assets no longer believed realizable. During 2009, our income tax expense mainly related to the amount accrued for the years 2006 through 2009 for the WRM Shareholder Dividend Tax Agreement and a deferred tax benefit recorded by WRM resulting from a decrease in its deferred tax liability for property and equipment.

Net Profit Attributable to Owners of the Company

As a result of the foregoing, net profit attributable to owners of the Company increased by 113.8%, from HK$2.1 billion in 2009 to HK$4.4 billion in 2010.

20 Wynn Macau, Limited

Management Discussion and Analysis

LIQUIDITY AND CAPITAL RESOURCES

Capital Resources

Since Wynn Macau opened in 2006, we have generally funded our working capital and recurring expenses as well as capital expenditures from cash flow from operations and cash on hand.

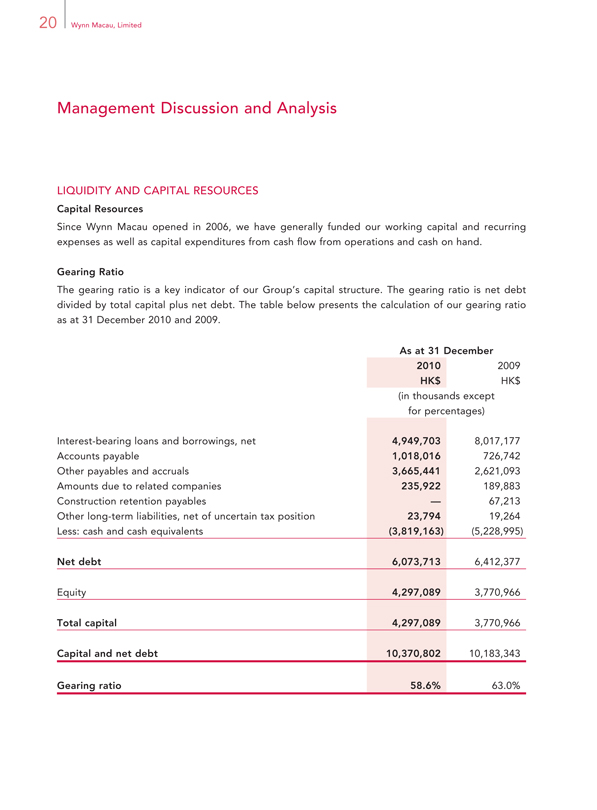

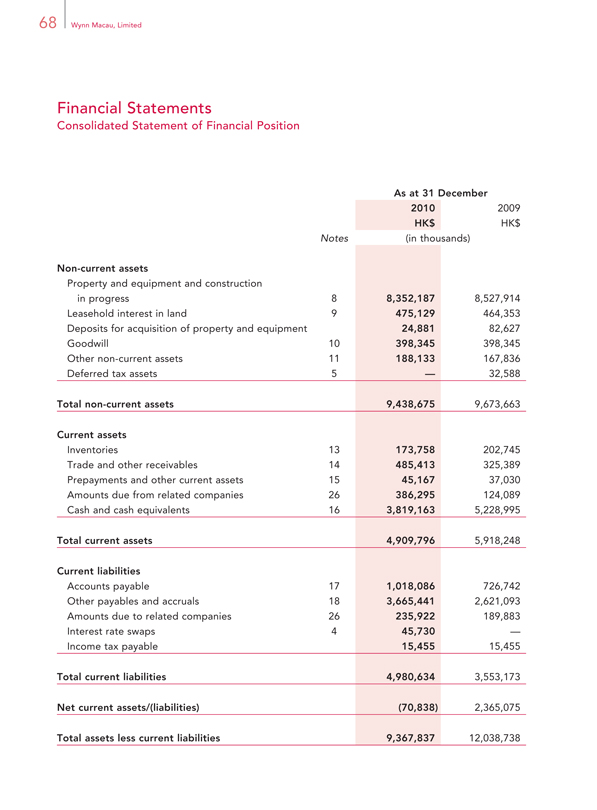

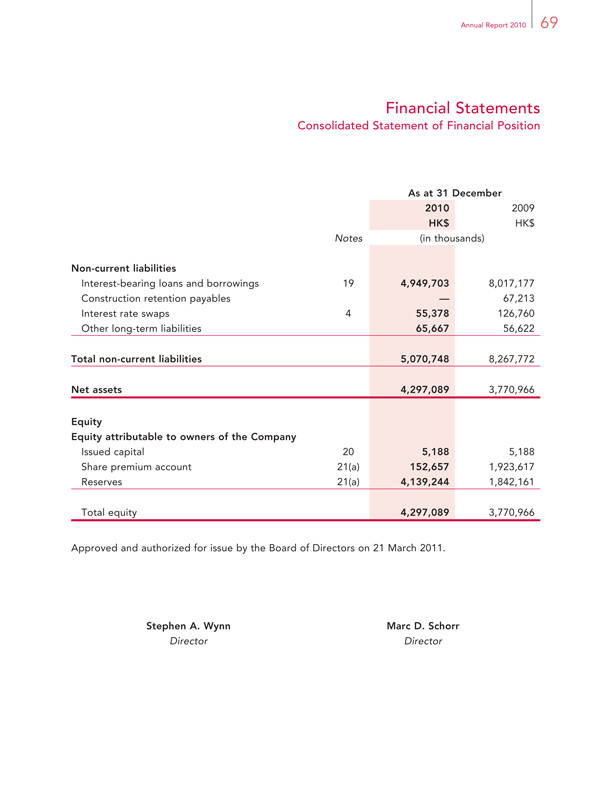

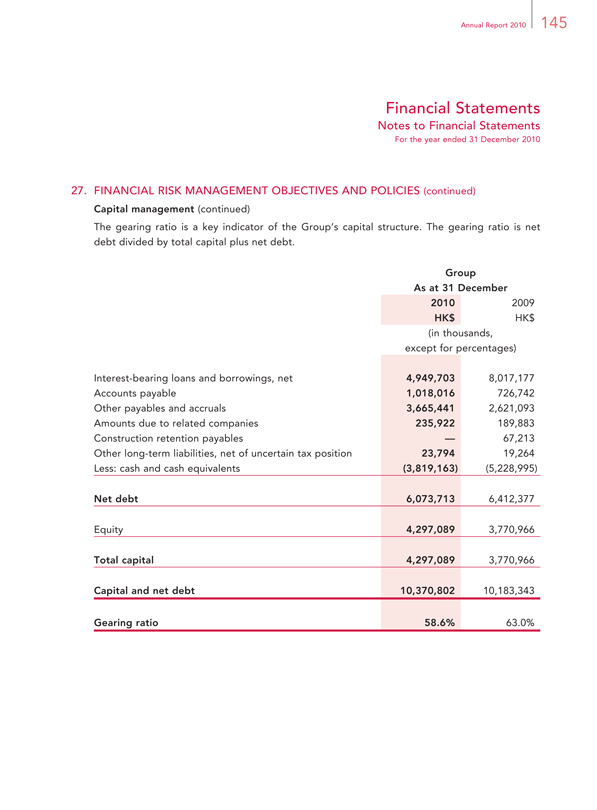

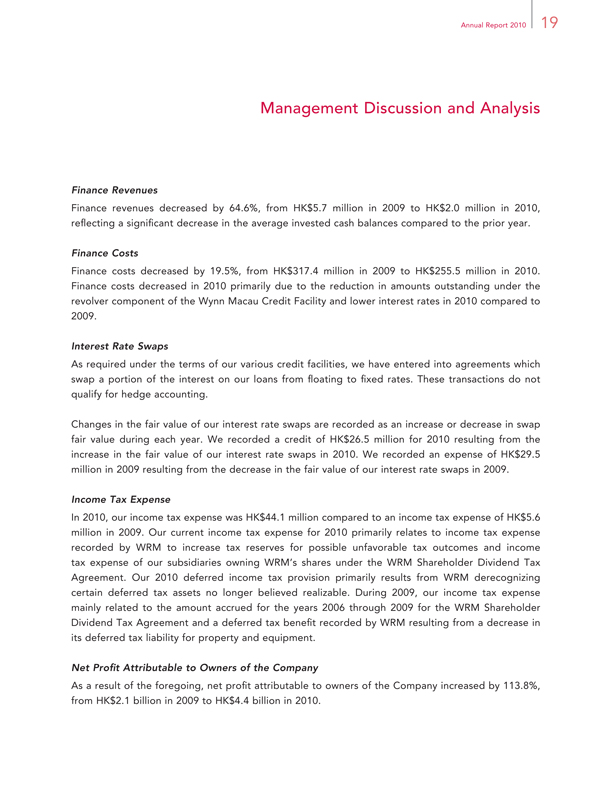

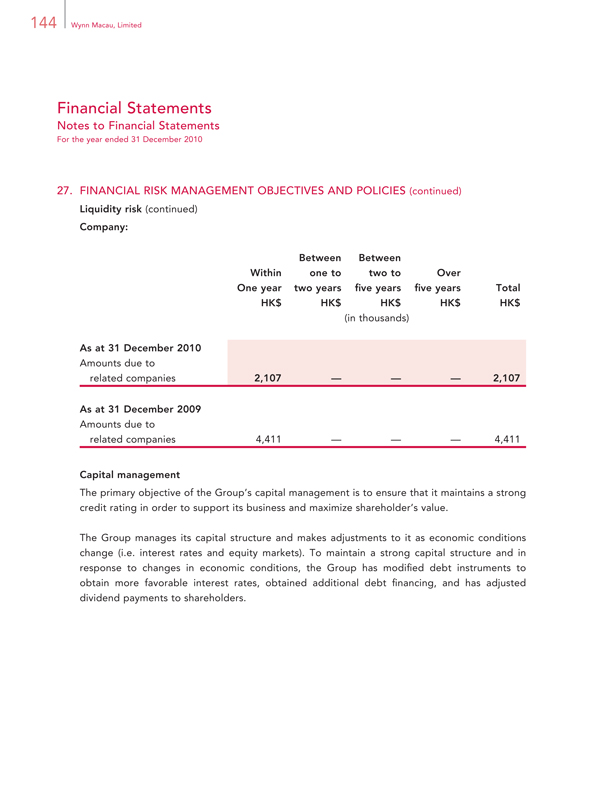

Gearing Ratio

The gearing ratio is a key indicator of our Group’s capital structure. The gearing ratio is net debt divided by total capital plus net debt. The table below presents the calculation of our gearing ratio as at 31 December 2010 and 2009.

As at 31 December

2010 2009

HK$ HK$

(in thousands except

for percentages)

Interest-bearing loans and borrowings, net 4,949,703 8,017,177

Accounts payable 1,018,016 726,742

Other payables and accruals 3,665,441 2,621,093

Amounts due to related companies 235,922 189,883

Construction retention payables — 67,213

Other long-term liabilities, net of uncertain tax position 23,794 19,264

Less: cash and cash equivalents (3,819,163) (5,228,995)

Net debt 6,073,713 6,412,377

Equity 4,297,089 3,770,966

Total capital 4,297,089 3,770,966

Capital and net debt 10,370,802 10,183,343

Gearing ratio

58.6%

63.0%

Annual Report 2010 21

Management Discussion and Analysis

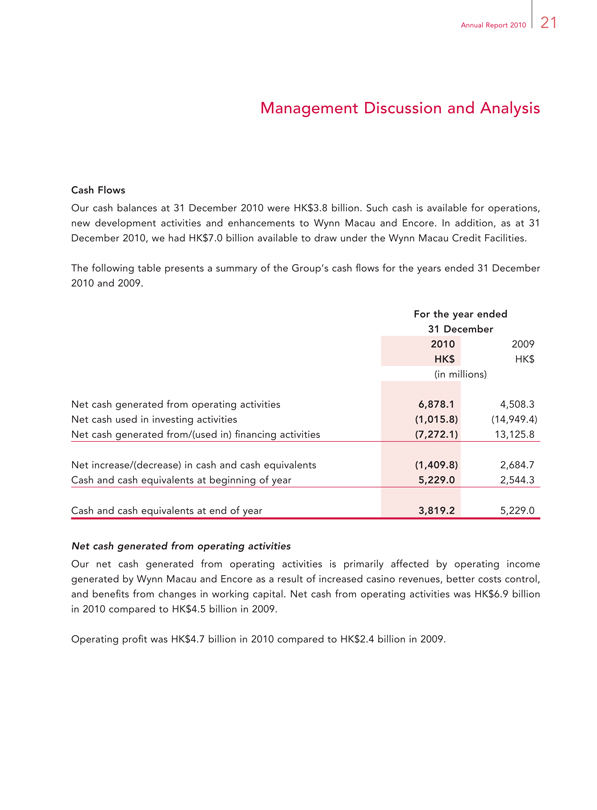

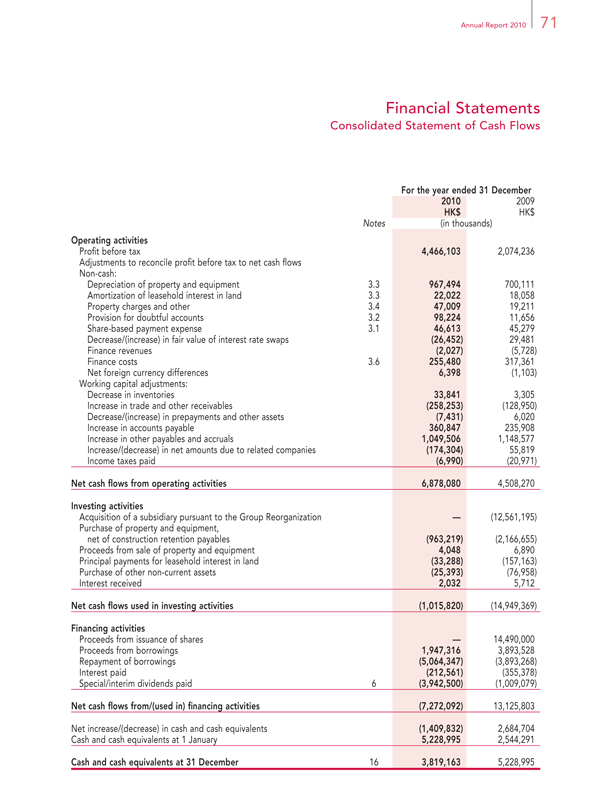

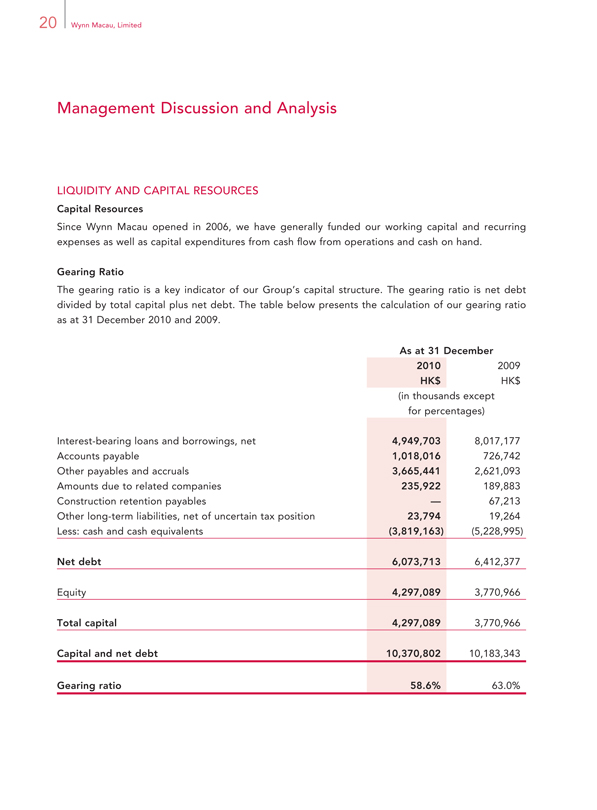

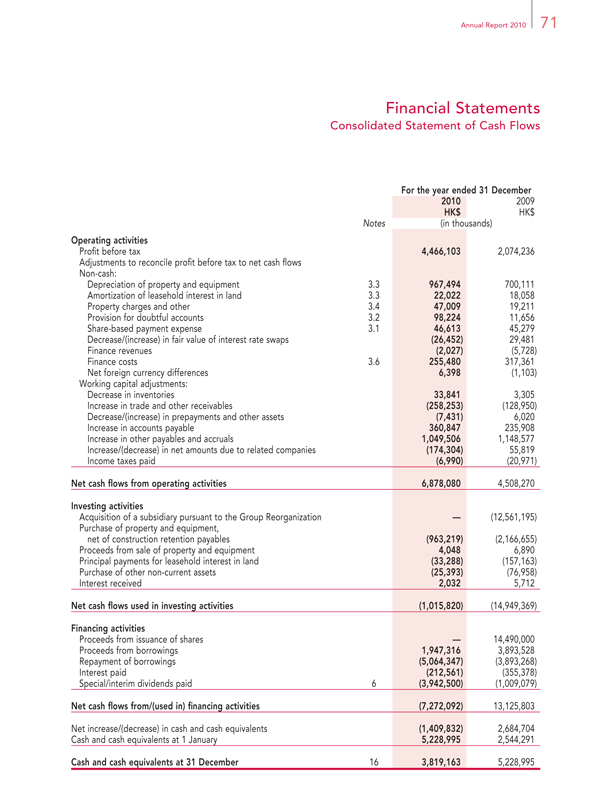

Cash Flows

Our cash balances at 31 December 2010 were HK$3.8 billion. Such cash is available for operations, new development activities and enhancements to Wynn Macau and Encore. In addition, as at 31 December 2010, we had HK$7.0 billion available to draw under the Wynn Macau Credit Facilities.

The following table presents a summary of the Group’s cash flows for the years ended 31 December 2010 and 2009.

For the year ended

2010 2009

HK$ HK$

(in millions)

Net cash generated from operating activities 6,878.1 4,508.3

Net cash used in investing activities (1,015.8) (14,949.4)

Net cash generated from/(used in) financing activities(7,272.1) 13,125.8

Net increase/(decrease) in cash and cash equivalents (1,409.8) 2,684.7

Cash and cash equivalents at beginning of year 5,229.0 2,544.3

Cash and cash equivalents at end of year 3,819.2 5,229.0

Net cash generated from operating activities

Our net cash generated from operating activities is primarily affected by operating income generated by Wynn Macau and Encore as a result of increased casino revenues, better costs control, and benefits from changes in working capital. Net cash from operating activities was HK$6.9 billion in 2010 compared to HK$4.5 billion in 2009.

Operating profit was HK$4.7 billion in 2010 compared to HK$2.4 billion in 2009.

22 Wynn Macau, Limited

Management Discussion and Analysis

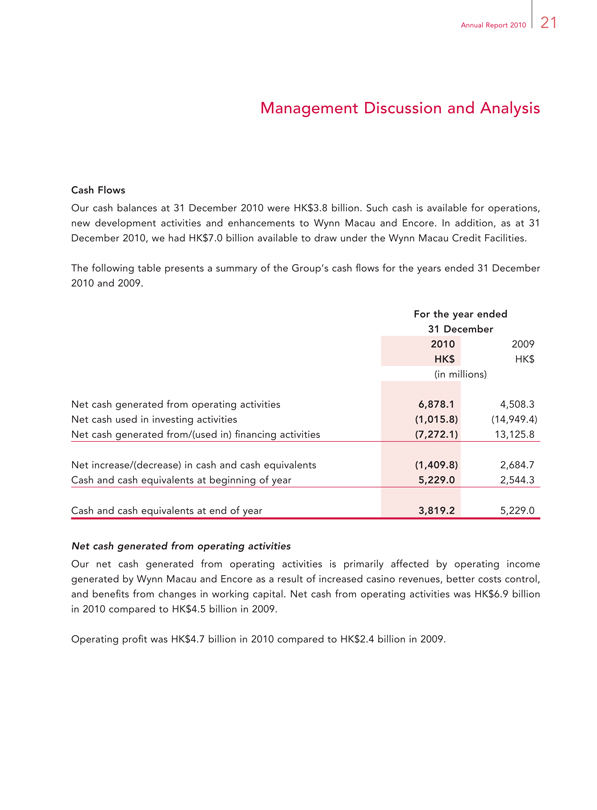

Net cash used in investing activities

Net cash used in investing activities was HK$1.0 billion in 2010, compared to HK$14.9 billion in 2009. In 2009, the Company paid WM Cayman Holdings Limited I HK$12.6 billion to redeem an acquisition note issued by the Company in connection with the Group Reorganization.

Capital expenditures were HK$1.0 billion and HK$2.2 billion in 2010 and 2009, respectively and related primarily to the construction of Encore at Wynn Macau.

Net cash generated from/(used in) financing activities

Net cash used in financing activities was HK$7.3 billion during 2010 compared to net cash generated from financing activities of HK$13.1 billion during 2009.

The significant difference between net cash flow used in 2010 and net cash flow generated from 2009 are a HK$3.1 billion repayment net of borrowings of the senior revolving credit facility under WRM’s credit facilities made in 2010 compared to the HK$14.5 billion received by the Company from its initial public offering on the Hong Kong Stock Exchange and the full exercise of the over-allotment option, and the dividend payments of HK$3.9 billion in 2010 compared to HK$1.0 billion in 2009.

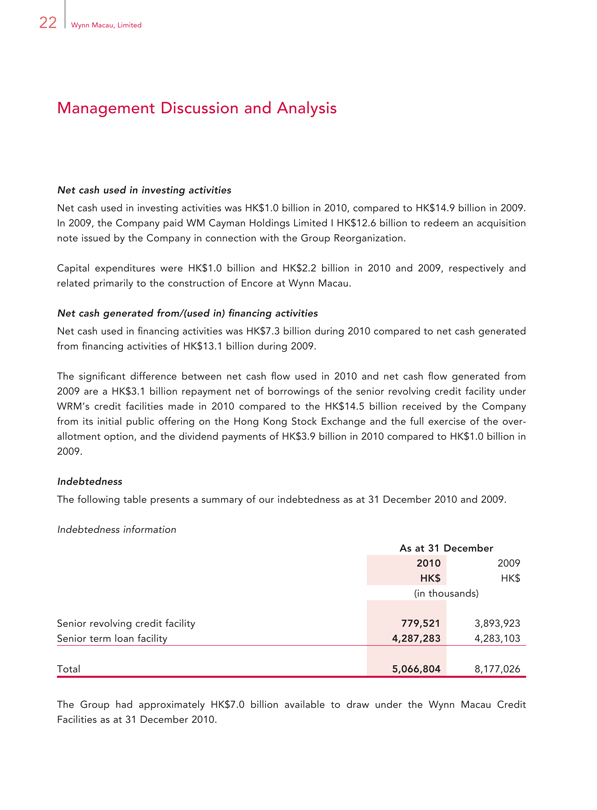

Indebtedness

The following table presents a summary of our indebtedness as at 31 December 2010 and 2009.

The Group had approximately HK$7.0 billion available to draw under the Wynn Macau Credit Facilities as at 31 December 2010.

Annual Report 2010 23

Management Discussion and Analysis

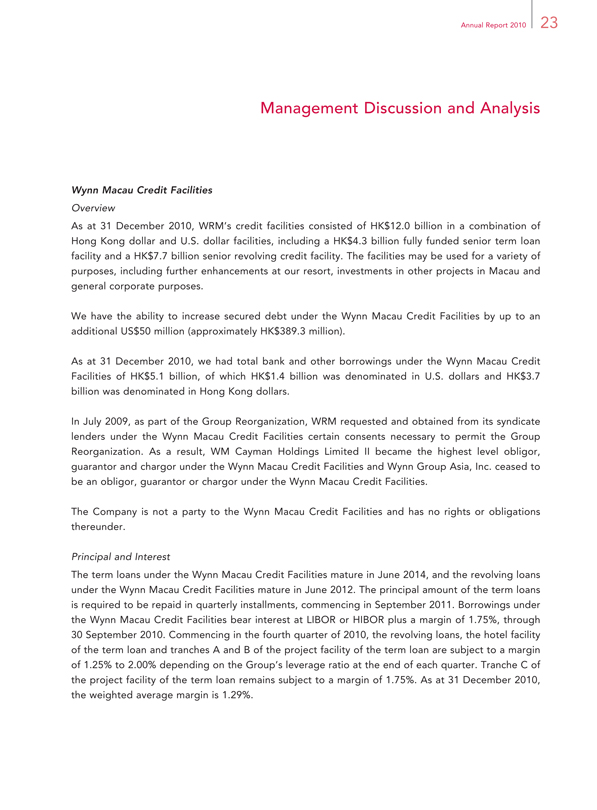

Wynn Macau Credit Facilities

Overview

As at 31 December 2010, WRM’s credit facilities consisted of HK$12.0 billion in a combination of Hong Kong dollar and U.S. dollar facilities, including a HK$4.3 billion fully funded senior term loan facility and a HK$7.7 billion senior revolving credit facility. The facilities may be used for a variety of purposes, including further enhancements at our resort, investments in other projects in Macau and general corporate purposes.

We have the ability to increase secured debt under the Wynn Macau Credit Facilities by up to an additional US$50 million (approximately HK$389.3 million).

As at 31 December 2010, we had total bank and other borrowings under the Wynn Macau Credit Facilities of HK$5.1 billion, of which HK$1.4 billion was denominated in U.S. dollars and HK$3.7 billion was denominated in Hong Kong dollars.

In July 2009, as part of the Group Reorganization, WRM requested and obtained from its syndicate lenders under the Wynn Macau Credit Facilities certain consents necessary to permit the Group Reorganization. As a result, WM Cayman Holdings Limited II became the highest level obligor, guarantor and chargor under the Wynn Macau Credit Facilities and Wynn Group Asia, Inc. ceased to be an obligor, guarantor or chargor under the Wynn Macau Credit Facilities.

The Company is not a party to the Wynn Macau Credit Facilities and has no rights or obligations thereunder.

Principal and Interest

The term loans under the Wynn Macau Credit Facilities mature in June 2014, and the revolving loans under the Wynn Macau Credit Facilities mature in June 2012. The principal amount of the term loans is required to be repaid in quarterly installments, commencing in September 2011. Borrowings under the Wynn Macau Credit Facilities bear interest at LIBOR or HIBOR plus a margin of 1.75%, through 30 September 2010. Commencing in the fourth quarter of 2010, the revolving loans, the hotel facility of the term loan and tranches A and B of the project facility of the term loan are subject to a margin of 1.25% to 2.00% depending on the Group’s leverage ratio at the end of each quarter. Tranche C of the project facility of the term loan remains subject to a margin of 1.75%. As at 31 December 2010, the weighted average margin is 1.29%.

24 Wynn Macau, Limited

Management Discussion and Analysis

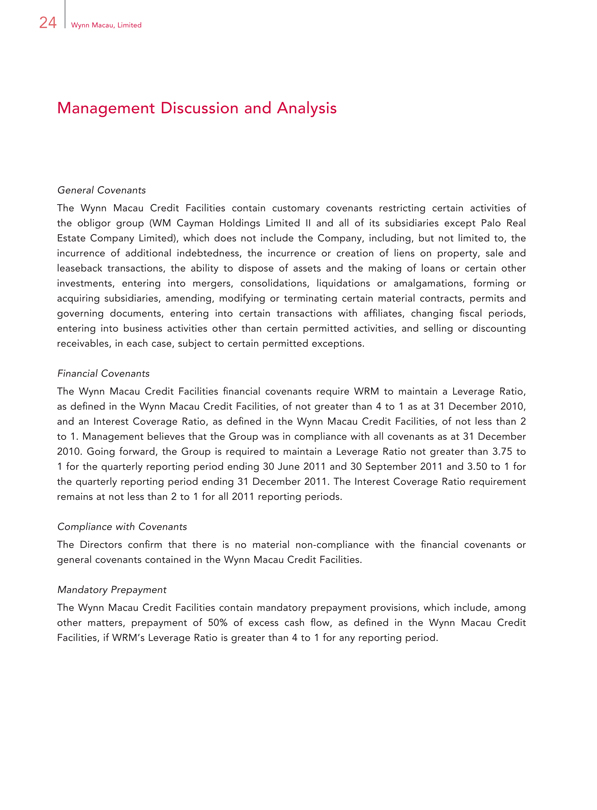

General Covenants

The Wynn Macau Credit Facilities contain customary covenants restricting certain activities of the obligor group (WM Cayman Holdings Limited II and all of its subsidiaries except Palo Real Estate Company Limited), which does not include the Company, including, but not limited to, the incurrence of additional indebtedness, the incurrence or creation of liens on property, sale and leaseback transactions, the ability to dispose of assets and the making of loans or certain other investments, entering into mergers, consolidations, liquidations or amalgamations, forming or acquiring subsidiaries, amending, modifying or terminating certain material contracts, permits and governing documents, entering into certain transactions with affiliates, changing fiscal periods, entering into business activities other than certain permitted activities, and selling or discounting receivables, in each case, subject to certain permitted exceptions.

Financial Covenants

The Wynn Macau Credit Facilities financial covenants require WRM to maintain a Leverage Ratio, as defined in the Wynn Macau Credit Facilities, of not greater than 4 to 1 as at 31 December 2010, and an Interest Coverage Ratio, as defined in the Wynn Macau Credit Facilities, of not less than 2 to 1. Management believes that the Group was in compliance with all covenants as at 31 December 2010. Going forward, the Group is required to maintain a Leverage Ratio not greater than 3.75 to 1 for the quarterly reporting period ending 30 June 2011 and 30 September 2011 and 3.50 to 1 for the quarterly reporting period ending 31 December 2011. The Interest Coverage Ratio requirement remains at not less than 2 to 1 for all 2011 reporting periods.

Compliance with Covenants

The Directors confirm that there is no material non-compliance with the financial covenants or general covenants contained in the Wynn Macau Credit Facilities.

Mandatory Prepayment

The Wynn Macau Credit Facilities contain mandatory prepayment provisions, which include, among other matters, prepayment of 50% of excess cash flow, as defined in the Wynn Macau Credit Facilities, if WRM’s Leverage Ratio is greater than 4 to 1 for any reporting period.

Annual Report 2010 25

Management Discussion and Analysis

Dividend Restrictions

WRM and certain of its affi liates are subject to restrictions on payment of dividends or distributions or other amounts to their shareholders or to other affi liates, unless certain fi nancial and non-fi nancial criteria have been satisfi ed. Provided certain conditions are met, WRM is permitted to pay dividends. The conditions to be satisfi ed for the payment of dividends include:

Compliance with applicable legal requirements;

No event of default occurring under the Wynn Macau Credit Facilities;

Compliance with the applicable financial covenants; and

Such dividends may be made once in each fiscal quarter (and in respect of the first fiscal quarter in a fiscal year, only after borrowings under the Wynn Macau Credit Facilities have been prepaid to the extent required by the application of the excess cash flow mandatory prepayment provisions).

Events of Default

The Wynn Macau Credit Facilities contain customary events of default, such as failure to pay, breach of covenants, initiation of insolvency proceedings, material adverse effect and cross default provisions. Events of default also include certain breaches of the terms of the Concession Agreement, and the taking of certain formal measures or administrative intervention by the Macau government in respect of the Concession Agreement or the concession for the land on which Wynn Macau is located.

The Wynn Macau Credit Facilities also include a change of control event of default which includes:

Mr. Stephen A. Wynn, our Chairman and Chief Executive Officer (together with Mr. Kazuo Okada of Universal Entertainment Corporation (formerly known as Aruze Corp.), our non— executive Director) and certain other related parties, including any 80% (or more) owned subsidiary, trust, estate or immediate family members of Mr. Wynn or Mr. Okada) ceasing to control at least 20% of the voting power of Wynn Resorts, Limited;

Mr. Wynn, together with his related parties but excluding Mr. Okada and Mr. Okada’s related parties, ceasing to control at least 10% of the voting power of Wynn Resorts, Limited. Elaine P. Wynn is a related party to Mr. Wynn following the execution of an amended and restated stockholders agreement between Mr. Wynn, Elaine P. Wynn and Aruze USA, Inc., a Nevada corporation, in relation to shares in the common stock of Wynn Resorts, Limited on 6 January 2010; and

Wynn Resorts, Limited ceasing to own or control at least 51% of WRM (or ceasing to have the ability to direct the management of WRM).

26 Wynn Macau, Limited

Management Discussion and Analysis

Security and Guarantees

Collateral for the Wynn Macau Credit Facilities consists of substantially all of the assets of WRM. Certain of our direct and indirect subsidiaries have executed guarantees and pledged their interests in WRM in support of the obligations under the Wynn Macau Credit Facilities. With respect to the Concession Agreement, the WRM lenders do have certain cure rights and consultation rights with the Macau government upon an enforcement by the lenders.

Second Ranking Lender

WRM is also party to a bank guarantee reimbursement agreement with Banco National Ultramarino S.A. to secure a guarantee in favor of the Macau government as required under the Concession Agreement. The amount of this guarantee is MOP300 million (approximately HK$291.3 million) and it lasts until 180 days after the end of the term of the Concession Agreement. The guarantee assures WRM’s performance under the Concession Agreement, including the payment of certain premiums, fines and indemnities for breach. The guarantee is secured by a second priority security interest in the same collateral package securing the Wynn Macau Credit Facilities.

QUANTITATIVE AND QUALITATIVE DISCLOSURE ABOUT MARKET RISK

Market risk is the risk of loss arising from adverse changes in market rates and conditions, such as inflation, interest rates, and foreign currency exchange rates.

Foreign Exchange Risks

The financial statements of foreign operations are translated into Hong Kong dollars, the Group’s presentation currency, for incorporation into the consolidated financial information. Assets and liabilities are translated at the prevailing foreign exchange rates in effect at the end of the reporting period. Income, expenditures and cash flow items are measured at the actual foreign exchange rates or average foreign exchange rates for the period. The Hong Kong dollar is linked to the U.S. dollar and the exchange rate between these two currencies has remained relatively stable over the past several years. However, the exchange linkages of the Hong Kong dollar and the Macau pataca to the U.S. dollar, are subject to potential changes due to, among other things, changes in governmental policies and international economic and political developments.

Interest Rate Risks

One of our primary exposures to market risk is interest rate risk associated with our credit facilities, which bear interest based on floating rates. We attempt to manage interest rate risk by managing the mix of long-term fixed rate borrowings and variable rate borrowings supplemented by hedging activities as considered necessary. We cannot assure you that these risk management strategies will have the desired effect, and interest rate fluctuations could have a negative impact on our results of operations.

Annual Report 2010 27

Management Discussion and Analysis

As at 31 December 2010, the Group had three interest rate swaps intended to manage a portion of the underlying interest rate risk on borrowings under the Wynn Macau Credit Facilities. Under the first swap agreement, the Group pays a fixed interest rate of 3.632% on U.S. dollar borrowings of approximately US$153.8 million (approximately HK$1.2 billion) incurred under the Wynn Macau Credit Facilities in exchange for receipts on the same amount at a variable interest rate based on the applicable LIBOR at the time of payment. Under the second swap agreement, the Group pays a fixed interest rate of 3.39% on Hong Kong dollar borrowings of approximately HK$991.6 million incurred under the Wynn Macau Credit Facilities in exchange for receipts on the same amount at a variable interest rate based on the applicable HIBOR at the time of payment. Based on the applicable margin of the Wynn Macau Credit Facilities, as at 31 December 2010, these interest rate swaps fix the interest rates on the U.S. dollar and the Hong Kong dollar borrowings at approximately 4.882% to 5.382% and 4.64%, respectively. Both agreements will terminate in August 2011.

The Group entered into the third interest rate swap agreement on 17 August 2009, with an effective date of 27 November 2009, to manage a portion of the underlying interest rate risk on borrowings under the Wynn Macau Credit Facilities. Under this swap agreement, beginning 27 November 2009, the Group pays a fi xed interest rate of 2.15% on borrowings of approximately HK$2.3 billion incurred under the Wynn Macau Credit Facilities in exchange for receipts on the same amount at a variable interest rate based on the applicable HIBOR at the time of payment. As at 31 December 2010, this interest rate swap fixes the interest rate on HK$2.3 billion of borrowings under the Wynn Macau Credit Facilities at approximately 3.4%. This interest rate swap agreement will terminate in June 2012.

The carrying values of these interest rate swaps on the consolidated statement of financial position approximates their fair values. The fair value approximates the amount the Group would pay if these contracts were settled at the respective valuation dates. Fair value is estimated based upon current, and predictions of future interest rate levels along a yield curve, the remaining duration of the instruments and other market conditions and, therefore, is subject to significant estimation and a high degree of variability of fluctuation between periods. We adjust this amount by applying a non-performance valuation, considering our creditworthiness or the creditworthiness of our counterparties at each settlement date, as applicable. These transactions do not qualify for hedge accounting. Accordingly, changes in the fair values during the years ended 31 December 2010 and 2009, were charged to the consolidated statement of comprehensive income.

Our liabilities under the swap agreements are secured by the same collateral package securing the Wynn Macau Credit Facilities.

28 Wynn Macau, Limited

Management Discussion and Analysis

OFF BALANCE SHEET ARRANGEMENTS

We have not entered into any transactions with special purpose entities nor do we engage in any transactions involving derivatives except for interest rate swaps. We do not have any retained or contingent interest in assets transferred to an unconsolidated entity.

OTHER LIQUIDITY MATTERS

We expect that Wynn Macau and Encore will fund their operations and capital expenditure requirements from operating cash flows, cash on hand and availability under the Wynn Macau Credit Facilities. However, we cannot be sure that operating cash flows will be sufficient for those purposes. We may refinance all or a portion of our indebtedness on or before maturity. We cannot be sure that we will be able to refinance any of the indebtedness on acceptable terms or at all.

New business developments (including our development of a project in Cotai) or other unforeseen events may occur, resulting in the need to raise additional funds. There can be no assurances regarding the business prospects with respect to any other opportunity. Any other development would require us to obtain additional financing.

In the ordinary course of business, in response to market demands and client preferences, and in order to increase revenues, we have made and will continue to make enhancements and refinements to Wynn Macau and Encore. We have incurred and will continue to incur capital expenditures related to these enhancements and refinements.

Taking into consideration our financial resources, including our cash and cash equivalents, internally generated funds and availability under the Wynn Macau Credit Facilities, we believe that we have sufficient liquid assets to meet our working capital and operating requirements for the following 12 months.

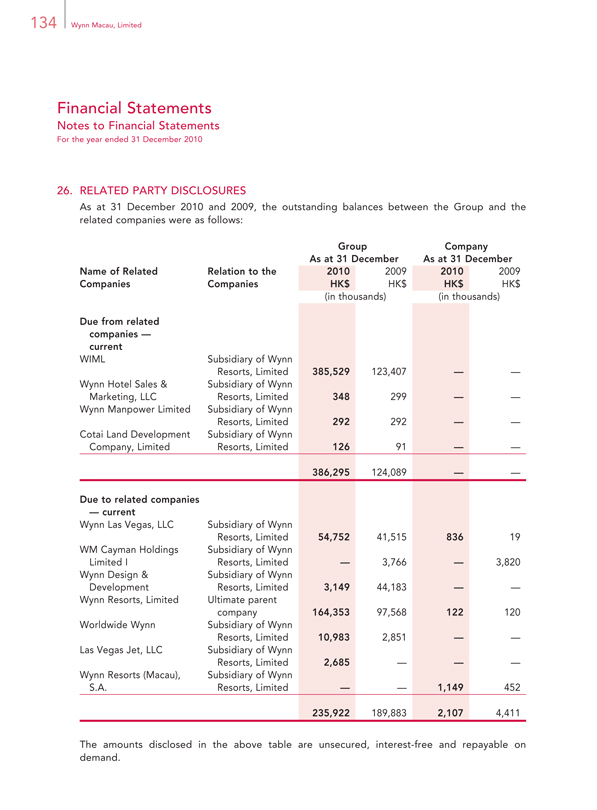

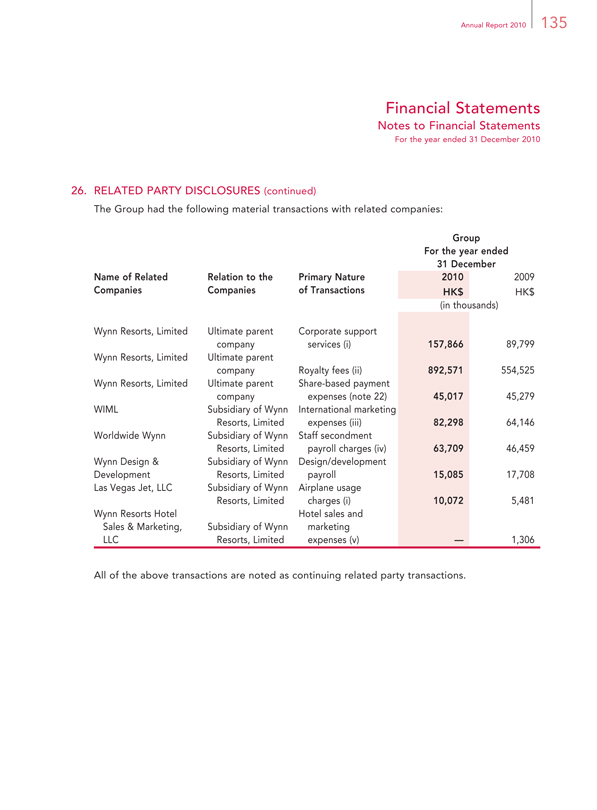

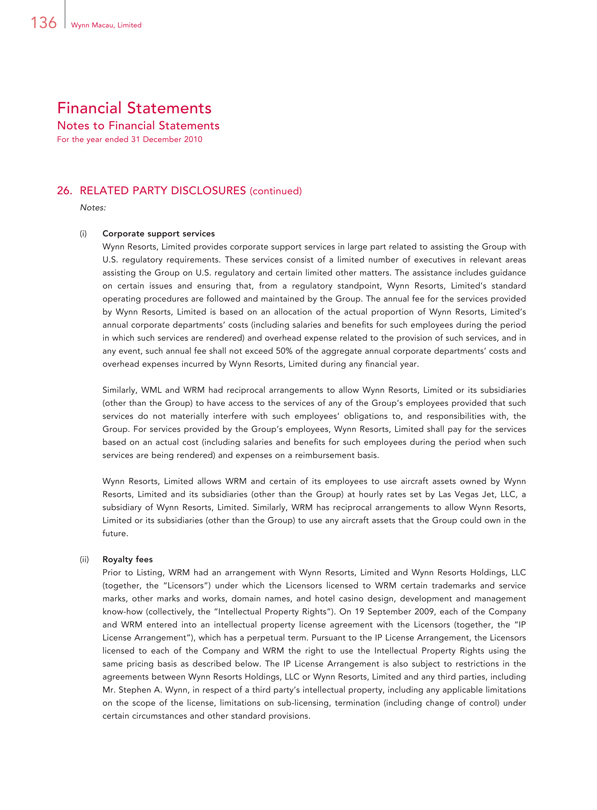

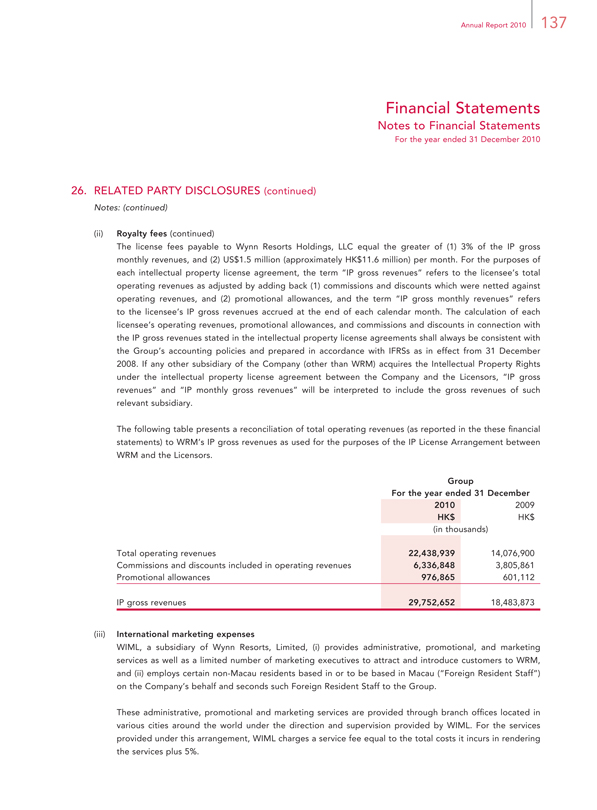

RELATED PARTY TRANSACTIONS

For details of the related party transactions, see note 26 to the Financial Statements. Our Directors confirm that all related party transactions are conducted on normal commercial terms, and that their terms are fair and reasonable.

Annual Report 2010 29

Directors and Senior Management

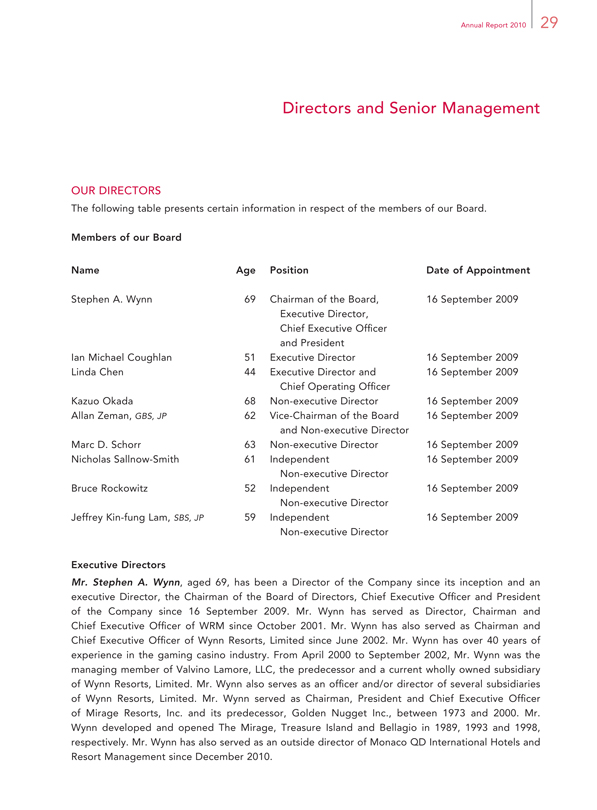

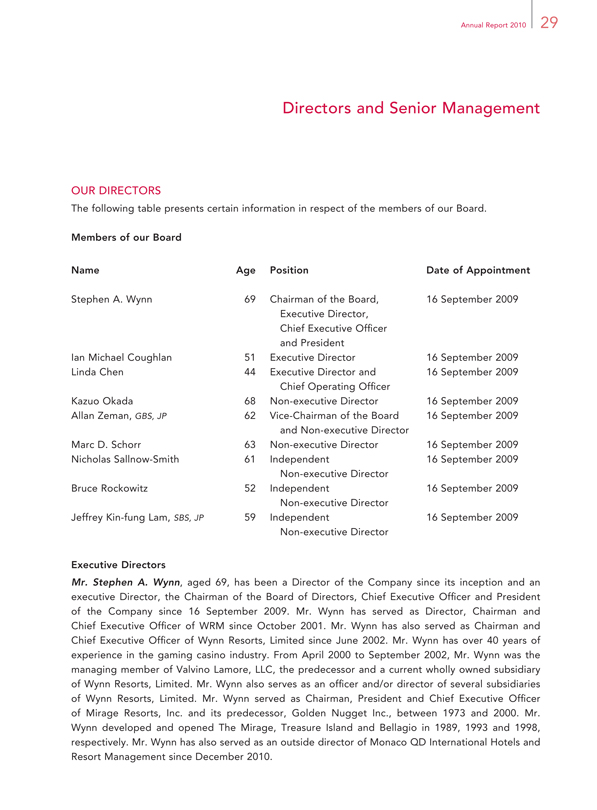

OUR DIRECTORS

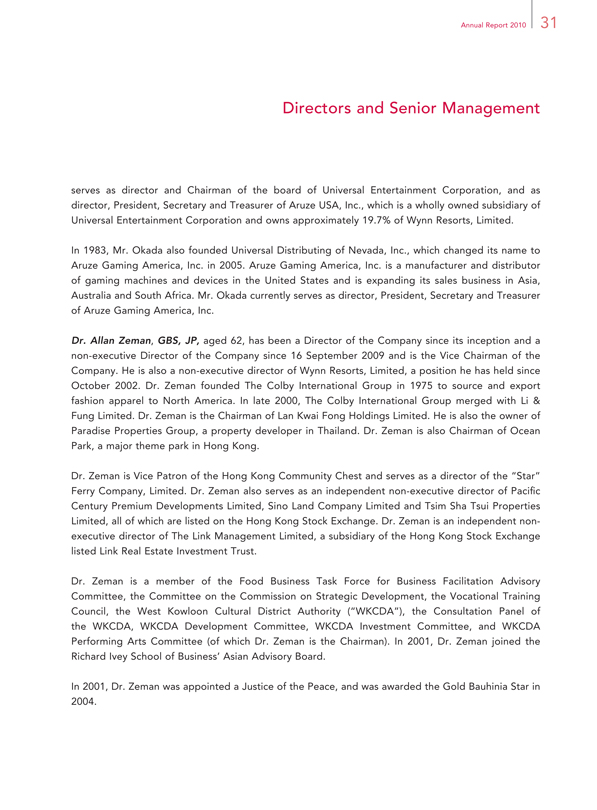

The following table presents certain information in respect of the members of our Board.

Members of our Board

Name Age Position Date of Appointment

Stephen A. Wynn 69 Chairman of the Board, 16 September 2009

Executive Director,

Chief Executive Officer

and President

Ian Michael Coughlan 51 Executive Director 16 September 2009

Linda Chen 44 Executive Director and 16 September 2009

Chief Operating Officer

Kazuo Okada 68 Non-executive Director 16 September 2009

Allan Zeman, GBS, JP 62 Vice-Chairman of the Board 16 September 2009

and Non-executive Director

Marc D. Schorr 63 Non-executive Director 16 September 2009

Nicholas Sallnow-Smith 61 Independent 16 September 2009

Non-executive Director

Bruce Rockowitz 52 Independent 16 September 2009

Non-executive Director

Jeffrey Kin-fung Lam, SBS, JP 59 Independent 16 September 2009

Non-executive Director

Executive Directors

Mr. Stephen A. Wynn, aged 69, has been a Director of the Company since its inception and an executive Director, the Chairman of the Board of Directors, Chief Executive Officer and President of the Company since 16 September 2009. Mr. Wynn has served as Director, Chairman and Chief Executive Officer of WRM since October 2001. Mr. Wynn has also served as Chairman and Chief Executive Officer of Wynn Resorts, Limited since June 2002. Mr. Wynn has over 40 years of experience in the gaming casino industry. From April 2000 to September 2002, Mr. Wynn was the managing member of Valvino Lamore, LLC, the predecessor and a current wholly owned subsidiary of Wynn Resorts, Limited. Mr. Wynn also serves as an officer and/or director of several subsidiaries of Wynn Resorts, Limited. Mr. Wynn served as Chairman, President and Chief Executive Officer of Mirage Resorts, Inc. and its predecessor, Golden Nugget Inc., between 1973 and 2000. Mr. Wynn developed and opened The Mirage, Treasure Island and Bellagio in 1989, 1993 and 1998, respectively. Mr. Wynn has also served as an outside director of Monaco QD International Hotels and Resort Management since December 2010.

30 Wynn Macau, Limited

Directors and Senior Management

Mr. Ian Michael Coughlan, aged 51, has been an executive Director of the Company since 16 September 2009. Mr. Coughlan is also the President of WRM, a position he has held since July 2007. In this role, he is responsible for the entire operation and development of Wynn Macau. Prior to this role, Mr. Coughlan was Director of Hotel Operations — Worldwide for Wynn Resorts, Limited. Mr. Coughlan has over 30 years of hospitality experience with leading hotels across Asia, Europe and the United States. Before joining Wynn Resorts, Limited, he spent ten years with The Peninsula Group, including posts as General Manager of The Peninsula Hong Kong from September 2004 to January 2007, and General Manager of The Peninsula Bangkok from September 1999 to August 2004. His previous assignments include senior management positions at The Oriental Singapore, and a number of Ritz-Carlton properties in the United States. Mr. Coughlan has a Diploma from Shannon College of Hotel Management, Ireland.

Ms. Linda Chen, aged 44, has been an executive Director and the Chief Operating Officer of the Company since 16 September 2009 and Chief Operating Officer of WRM since June 2002. Ms. Chen is responsible for the marketing and strategic development of WRM. Ms. Chen is also a director of Wynn Resorts, Limited and President of WIML. In these positions, she is responsible for the setup of international marketing operations of Wynn Resorts, Limited. Prior to joining the Group, Ms. Chen was Executive Vice President — International Marketing at MGM Mirage, a role she held from June 2000 until May 2002, and was responsible for the international marketing operations for MGM Grand, Bellagio and The Mirage. Prior to this position, Ms. Chen served as the Executive Vice President of International Marketing for Bellagio and was involved with its opening in 1998. She was also involved in the opening of the MGM Grand in 1993 and The Mirage in 1989. Ms. Chen is also a member of the Nanjing Committee of the Chinese People’s Political Consultative Conference (Macau). Ms. Chen holds a Bachelor of Science Degree in Hotel Administration from Cornell University in 1989 and completed the Stanford Graduate School of Business Executive Development Program in 1997.

Non-executive Directors

Mr. Kazuo Okada, aged 68, has been a non-executive Director of the Company since 16 September 2009. Mr. Okada is also a non-executive director of Wynn Resorts, Limited and has served as Vice Chairman of the board of Wynn Resorts, Limited since October 2002. He is also a director of Wynn Las Vegas Capital Corp.

In 1969, Mr. Okada founded Universal Lease Co. Ltd., which became Aruze Corp. in 1998, a company listed on the Japanese Association of Securities Dealers Automated Quotation Securities Exchange. In November 2009, Aruze Corp. changed its name to Universal Entertainment Corporation. Universal Entertainment Corporation is a Japanese manufacturer of pachislot and pachinko machines, amusement machines and video games for domestic sales. Mr. Okada currently

Annual Report 2010 31

Directors and Senior Management

serves as director and Chairman of the board of Universal Entertainment Corporation, and as director, President, Secretary and Treasurer of Aruze USA, Inc., which is a wholly owned subsidiary of Universal Entertainment Corporation and owns approximately 19.7% of Wynn Resorts, Limited.

In 1983, Mr. Okada also founded Universal Distributing of Nevada, Inc., which changed its name to Aruze Gaming America, Inc. in 2005. Aruze Gaming America, Inc. is a manufacturer and distributor of gaming machines and devices in the United States and is expanding its sales business in Asia, Australia and South Africa. Mr. Okada currently serves as director, President, Secretary and Treasurer of Aruze Gaming America, Inc.

Dr. Allan Zeman, GBS, JP, aged 62, has been a Director of the Company since its inception and a non-executive Director of the Company since 16 September 2009 and is the Vice Chairman of the Company. He is also a non-executive director of Wynn Resorts, Limited, a position he has held since October 2002. Dr. Zeman founded The Colby International Group in 1975 to source and export fashion apparel to North America. In late 2000, The Colby International Group merged with Li & Fung Limited. Dr. Zeman is the Chairman of Lan Kwai Fong Holdings Limited. He is also the owner of Paradise Properties Group, a property developer in Thailand. Dr. Zeman is also Chairman of Ocean Park, a major theme park in Hong Kong.

Dr. Zeman is Vice Patron of the Hong Kong Community Chest and serves as a director of the “Star” Ferry Company, Limited. Dr. Zeman also serves as an independent non-executive director of Pacific Century Premium Developments Limited, Sino Land Company Limited and Tsim Sha Tsui Properties Limited, all of which are listed on the Hong Kong Stock Exchange. Dr. Zeman is an independent non-executive director of The Link Management Limited, a subsidiary of the Hong Kong Stock Exchange listed Link Real Estate Investment Trust.

Dr. Zeman is a member of the Food Business Task Force for Business Facilitation Advisory Committee, the Committee on the Commission on Strategic Development, the Vocational Training Council, the West Kowloon Cultural District Authority (“WKCDA”), the Consultation Panel of the WKCDA, WKCDA Development Committee, WKCDA Investment Committee, and WKCDA Performing Arts Committee (of which Dr. Zeman is the Chairman). In 2001, Dr. Zeman joined the Richard Ivey School of Business’ Asian Advisory Board.

In 2001, Dr. Zeman was appointed a Justice of the Peace, and was awarded the Gold Bauhinia Star in 2004.

32 Wynn Macau, Limited

Directors and Senior Management

Mr. Marc D. Schorr, aged 63, has been a non-executive Director of the Company since 16 September 2009, and also a director of WRM. He is also the Chief Operating Officer of Wynn Resorts, Limited, a position he has held since June 2002, and a director of WRL since 29 July 2010. Mr. Schorr has over 30 years of experience in the casino gaming industry. From June 2000 through April 2001, Mr. Schorr served as Chief Operating Officer of Valvino Lamore, LLC. Prior to joining the Group, Mr. Schorr was the President of The Mirage Casino-Hotel from January 1997 until May 2000 and, prior to this position, was the President and Chief Executive Officer of Treasure Island at The Mirage from August 1992. His experience also includes establishing a casino marketing department and a branch office network throughout the United States as director of Casino Marketing for the Golden Nugget in Las Vegas in 1984 and managing the Golden Nugget in Laughlin, Nevada and its multi-million dollar expansion program in 1989 in his position as President and Chief Executive Officer.

Independent non-executive Directors

Mr. Nicholas Sallnow-Smith, aged 61, has been an independent non-executive Director of the Company since 16 September 2009. Mr. Sallnow-Smith has also served as the Chairman and an independent non-executive director of The Link Management Limited since April 2007 and is also Chairman of the Link Management Limited’s Finance and Investment, and Nominations Committees. The Link Management Limited is the manager to the Link Real Estate Investment Trust, a company listed on the Hong Kong Stock Exchange. Mr. Sallnow-Smith is also an independent non-executive director of Dah Sing Financial Holdings Limited, a company listed on the Hong Kong Stock Exchange; Dah Sing Bank, Limited, a subsidiary of Dah Sing Banking Group Limited which is a company listed on the Hong Kong Stock Exchange; the Chairman of LionRock Master Fund Limited in Singapore; and a member of the Advisory Board of Winnington Group. Prior to joining The Link Management Limited, Mr. Sallnow-Smith was Chief Executive of Hongkong Land Holdings Limited from February 2000 to March 2007. He has a wide ranging finance background in Asia and the United Kingdom for over 30 years, including his roles as Finance Director of Hongkong Land Holdings Limited from 1998 to 2000 and as Group Treasurer of Jardine Matheson Limited from 1993 to 1998.

Mr. Sallnow-Smith’s early career was spent in the British Civil Service, where he worked for Her Majesty’s Treasury in Whitehall, London from 1975 to 1985. During that time, he was seconded for two years to Manufacturers Hanover London, working in export finance and in their merchant banking division, Manufacturers Hanover Limited. He left the Civil Service in 1985, following a period working in the International Finance section of H. M. Treasury on Paris Club and other international debt policy matters, and spent two years with Lloyds Bank before moving into the corporate sector in 1987. Mr. Sallnow-Smith served as the Convenor of the Hong Kong Association of Corporate Treasurers in 1996 to 2000 and Chairman of the Matilda Child Development Centre. He is a director

Annual Report 2010 33

Directors and Senior Management

of the Hong Kong Philharmonic Society, Chairman of the Hong Kong Youth Arts Foundation, a member of the Council of the Treasury Markets Association (Hong Kong Association of Corporate Treasures Representative) and a member of the General Committee of The British Chamber of Commerce in Hong Kong. He is also the Chairman of AFS Intercultural Exchanges Ltd. in Hong Kong.

Mr. Sallnow-Smith was educated at Gonville & Caius College, Cambridge, and the University of Leicester and is a Fellow of the Association of Corporate Treasurers. He holds M.A. (Cantab) and M.A. (Soc. of Ed.) Degrees.

Mr. Bruce Rockowitz, aged 52, has been an independent non-executive Director of the Company since 16 September 2009. Mr. Rockowitz is also the President of Li & Fung (Trading) Ltd, the principal operating subsidiary of Li & Fung Limited, a company listed on the Hong Kong Stock Exchange. Mr. Rockowitz has been an executive director of Li & Fung Limited since 2001 and was the co-founder and Chief Executive Officer of Colby International Limited, a large Hong Kong buying agent, prior to the sale of Colby International Limited to Li & Fung Limited in 2000. He is a member of the Advisory Board for the Wharton School’s Jay H Baker Retailing Initiative, an industry research center for retail at the University of Pennsylvania. He is also a board member of the Education Foundation for Fashion Industries, the private fund-raising arm of the Fashion Institute of Technology, New York, United States. In December 2008, Mr. Rockowitz was ranked first by Institutional Investor for Asia’s Best CEOs in the consumer category. In the years 2010 and 2011, he was ranked as one of the world’s 30 best CEOs by Barron’s. In addition to his position at Li & Fung, Mr. Rockowitz is the non-executive Chairman of The Pure Group, a lifestyle, fitness and yoga group operating in Hong Kong, Singapore and Taiwan and soon to be opening in mainland China. As non—executive Chairman of The Pure Group, Mr. Rockowitz provides strategic vision and direction to the senior management of The Pure Group.

Mr. Jeffrey Kin-fung Lam, SBS, JP, aged 59, has been an independent non-executive Director of the Company since 16 September 2009. Mr. Lam is a member of the National Committee of the Chinese People’s Political Consultative Conference, a member of the Hong Kong Legislative Council, the Chairman of the Assessment Committee of Mega Events Funds, a member of the board of the West Kowloon Cultural District Authority and a member of the Independent Commission Against Corruption’s Advisory Committee on Corruption. Mr. Lam is also a General Committee Member of the Hong Kong General Chamber of Commerce and the Vice-Chairman of The Hong Kong Shippers’ Council. In addition, Mr. Lam is an independent non-executive director of CC Land Holdings Limited, Hsin Chong Construction Group Ltd., China Overseas Grand Oceans Group Limited and Sateri Holdings Limited, all of which are listed on the Hong Kong Stock Exchange.

34 Wynn Macau, Limited

Directors and Senior Management

In 1996, Mr. Lam was appointed Justice of the Peace and became a member of the Most Excellent Order of the British Empire. In 2004, he was awarded the Silver Bauhinia Star Award. Mr. Lam was conferred University Fellow of Tufts University in the United States and Hong Kong Polytechnic University in 1997 and in 2000, respectively.

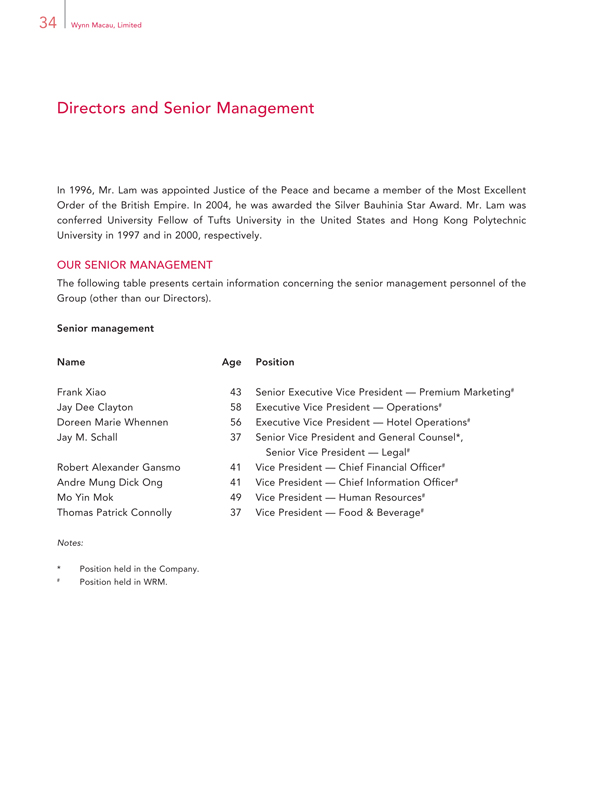

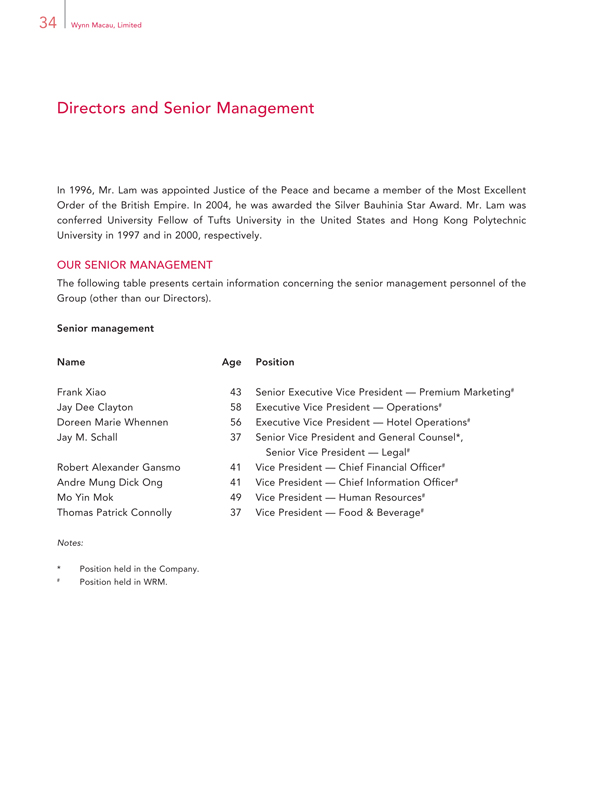

OUR SENIOR MANAGEMENT

The following table presents certain information concerning the senior management personnel of the Group (other than our Directors).

Senior management

Name Age Position

Frank Xiao 43 Senior Executive Vice President — Premium Marketing#

Jay Dee Clayton 58 Executive Vice President — Operations#

Doreen Marie Whennen 56 Executive Vice President — Hotel Operations#

Jay M. Schall 37 Senior Vice President and General Counsel*,

Senior Vice President — Legal#

Robert Alexander Gansmo 41 Vice President — Chief Financial Officer#

Andre Mung Dick Ong 41 Vice President — Chief Information Officer#

Mo Yin Mok 49 Vice President — Human Resources#

Thomas Patrick Connolly 37 Vice President — Food & Beverage#

Notes:

* | | Position held in the Company. |

# Position held in WRM.

Annual Report 2010 35

Directors and Senior Management

Mr. Frank Xiao, aged 43, is the Senior Executive Vice President — Premium Marketing of WRM, a position he has held since August 2006. Mr. Xiao is responsible for providing leadership and guidance to the marketing team and staff, developing business and promoting Wynn Macau. Prior to this position, Mr. Xiao was the Senior Executive Vice President — China Marketing for WIML and Worldwide Wynn between 2005 until 2006. Prior to joining the Group, Mr. Xiao was the Senior Vice President of Far East Marketing at MGM Grand Hotel. During his 12 years at MGM Grand Hotel, he was promoted several times from his first position as Far East Marketing Executive in 1993. Mr. Xiao holds a Bachelor of Science Degree in Hotel Administration and a Master’s Degree in Hotel Administration from the University of Nevada, Las Vegas.

Mr. Jay Dee Clayton, aged 58, is the Executive Vice President — Operations of WRM, a position he has held since May 2006. Mr. Clayton is responsible for assisting the President of the Company in providing leadership and operational direction for the development and operation of Wynn Macau, with a particular focus on gaming operations. Mr. Clayton joined the gaming industry in 1975 and has over 25 years of experience in the industry, having served at gaming companies including Del Webb, Harrah’s, Caesar’s, MGM and Mirage Resorts. Over his career, Mr. Clayton gained experience in a wide range of assignments including training and development, marketing and promotions, player development, project management and operations. Prior to joining WRM, Mr. Clayton held managerial roles at MGM Grand Detroit Casino, where he served from January 2000. Mr. Clayton served as General Manager of MGM Grand Darwin in Australia where he was the Chief Liaison between the company and Australia’s Northern Territory Racing and Gaming Authority. Mr. Clayton acquired a Master’s Degree in Hotel Administration from the University of Nevada, Las Vegas in 1993. Prior to that, Mr. Clayton obtained a Bachelor of Science Degree from Utah State University in 1975 and an Associate’s Degree in Culinary Arts from the Atlantic Community College in Mays Landing, New Jersey in 1985.

Ms. Doreen Marie Whennen, aged 56, is the Executive Vice President — Hotel Operations of WRM, a position she has held since May 2007. Ms. Whennen is responsible for overseeing the hotel operations of Wynn Macau. Ms. Whennen has over 20 years of experience in the hospitality industry. She joined Valvino Lamore, LLC in 2000 and prior to joining the Group, she held various positions at The Mirage, which she joined in 1989, including Front Office Manager, Director of Guest Services and Vice President of Hotel Operations. Ms. Whennen started her career in 1987 as an Assistant Front Desk Manager at the Tropicana Hotel, Las Vegas. In 1988, she was promoted to Front Desk Manager.

36 Wynn Macau, Limited

Directors and Senior Management

Mr. Jay M. Schall, aged 37, is the Senior Vice President and General Counsel of the Company and Senior Vice President – Legal of WRM. He has held senior legal positions with WRM since May 2006. Mr. Schall has over ten years of experience in the legal field, including seven years in Macau and Hong Kong. Prior to joining the Group, Mr. Schall practiced United States law at a major law firm in the United States and in Hong Kong. Mr. Schall is a member of the State Bar of Texas. Mr. Schall holds a Bachelor of Arts Degree from Colorado College, an MBA from Tulane University, Freeman School of Business and a Juris Doctor (magna cum laude, order of the coif) from Tulane University School of Law.

Mr. Robert Alexander Gansmo, aged 41, is the Vice President — Chief Financial Officer of WRM, a position he has held since April 2009. Prior to taking this position, Mr. Gansmo was the Director

— Finance of WRM, a position he assumed in January 2007. Mr. Gansmo is responsible for the management and administration of WRM’s finance division. Before joining WRM, Mr. Gansmo worked at Wynn Resorts, Limited, where he served as the Director of Financial Reporting from November 2002. Prior to joining the Group, Mr. Gansmo practiced as a certified public accountant with fi rms in Las Vegas, Washington and California, including KPMG Peat Marwick, Arthur Andersen, and Deloitte and Touche. Mr. Gansmo graduated in 1993 from California State University, Chico, where he obtained a Bachelor of Science Degree in Business Administration with a focus on accounting. He became a Certified Public Accountant in the State of California in 1997.

Mr. Andre Mung Dick Ong, aged 41, is the Vice President — Chief Information Officer of WRM, a position he has held since March 2007. Mr. Ong is responsible for the strategic planning, development and overall operation of information systems and technology services for WRM. Prior to taking up this role, Mr. Ong was the executive director, Chief Information Officer of WRM, a position he held from June 2003. Before joining the Group, Mr. Ong served at Shangri-La Hotels & Resorts where, from August 2001 until May 2003, he was the Director of Corporate Information Technology and was responsible for the planning and deployment of information technology for the group of 40 hotels and five regional sales offices. Prior to this role, he was Director of Technology Support as well as Systems Support Manager since 1993. Mr. Ong has more than 18 years of experience in the hospitality/gaming industry and extensive skills in technology consultation and execution, vendor management, operation management and software development. Mr. Ong was educated in Western Australia and obtained a Bachelor of Engineering Degree in Computer Systems from Curtin University of Technology in 1991.

Annual Report 2010 37

Directors and Senior Management

Ms. Mo Yin Mok, aged 49, is the Vice President — Human Resources of WRM, a position she has held since June 2008. Ms. Mok has an extensive 20-year background in hospitality and human resources, primarily in the luxury hotel sector at The Regent Four Seasons Hong Kong and The Peninsula Hong Kong. Prior to joining the Group, she led The Peninsula Group’s worldwide human resources team and, in her position, supported eight Peninsula hotels with more than 5,000 staff, and orchestrated human resources activities for the opening of The Peninsula Tokyo. Ms. Mok also served at the front lines of the hospitality industry as the Director of Rooms Division at The Peninsula Hong Kong with responsibility for front office, housekeeping, security and spa departments. Ms. Mok holds a Bachelor of Science Degree in Hospitality Management from Florida International University in the United States, where she received a Rotary International Ambassadorial Scholarship. She also obtained an MBA from the Chinese University of Hong Kong.

Mr. Thomas Patrick Connolly, aged 37, is the Vice-President — Food & Beverage of WRM, a position he has held since July 2008. Prior to taking this position, Mr. Connolly was the Director —Food and Beverage, a position he assumed in April 2007. Mr. Connolly is responsible for all aspects of WRM’s food and beverage operations. Prior to joining the Group, Mr. Connolly was Assistant Food and Beverage Manager at The Peninsula Hong Kong, a role he held from March 2006 until April 2007. His experience also includes managing The Mandarin Grill at The Mandarin Oriental Hong Kong from October 1999 until November 2000, managing JJ’s at The Grand Hyatt Hong Kong, managing the opening of a major Hyatt food and beverage operation in South Korea, and serving as General Manager of Jean Georges in Shanghai, China, which he opened with world-renowned chef Jean Georges Vongerichten in 2004.

OUR COMPANY SECRETARY

Ms. Kwok Yu Ching is the company secretary of the Company.

Ms. Kwok Yu Ching, aged 45, has been a company secretary of the Company since September 2009. She is a director of Corporate Services Division of Tricor Services Limited. Ms. Kwok, a Chartered Secretary, is an Associate of both The Hong Kong Institute of Chartered Secretaries and The Institute of Chartered Secretaries and Administrators. She has been providing professional services to companies listed on the Hong Kong Stock Exchange for over 20 years. Prior to joining Tricor Services Limited in 2002, Ms. Kwok was the Senior Manager of Company Secretarial Services at Ernst & Young and Tengis Limited in Hong Kong.

38 Wynn Macau, Limited

Report of the Directors

The Directors present their report together with the audited Financial Statements of the Company and the Group for the year ended 31 December 2010.

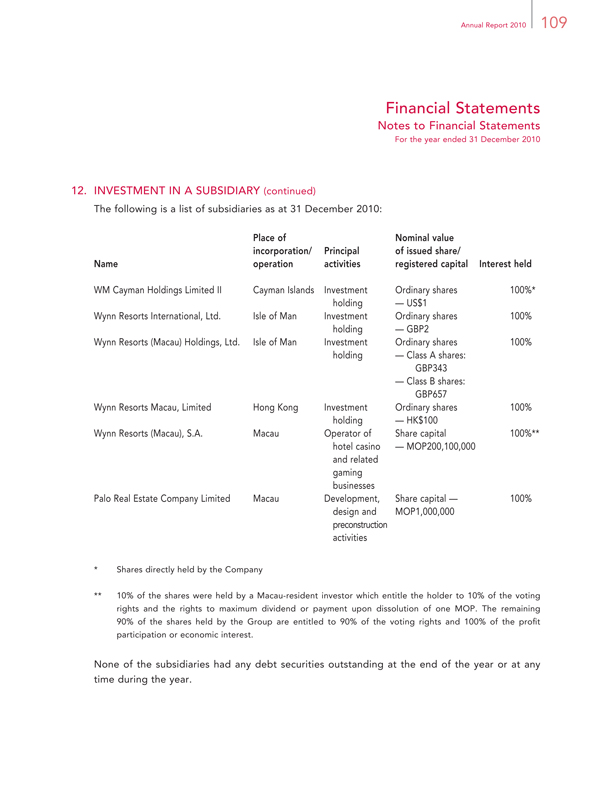

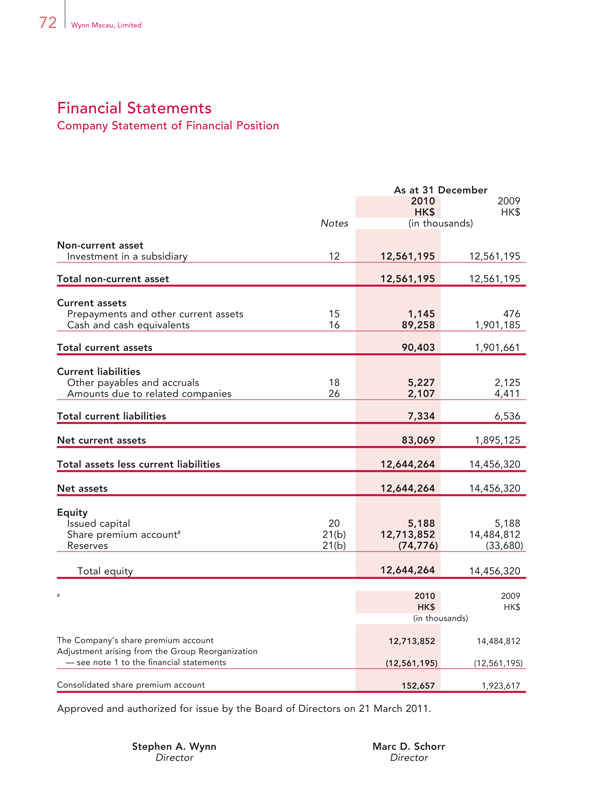

PRINCIPAL ACTIVITIES AND SUBSIDIARIES

The Company and the Group are a leading developer, owner and operator of destination casino gaming and entertainment resort facilities in Macau. The Company is a holding company and our main operating subsidiary, WRM, owns and operates the destination casino resort “Wynn Macau” in Macau. A list of the Company’s subsidiaries, together with their places of incorporation, principal activities and particulars of their issued share/registered capital, is set out in note 12 to the Financial Statements.

FINANCIAL RESULTS

The results of the Group for the year ended 31 December 2010 are set out in the consolidated statement of comprehensive income on page 67 of this Annual Report. The financial highlights for the Group for the most recent five years are set out on page 146 of this Annual Report.

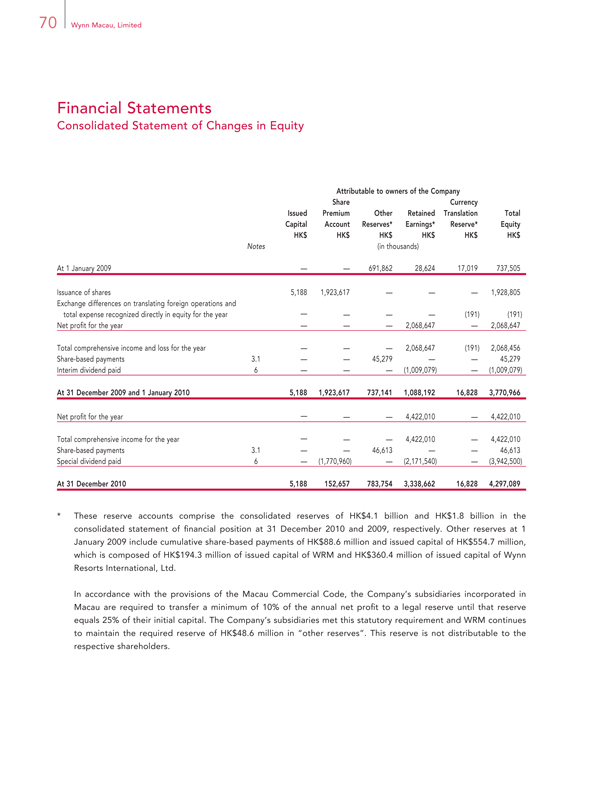

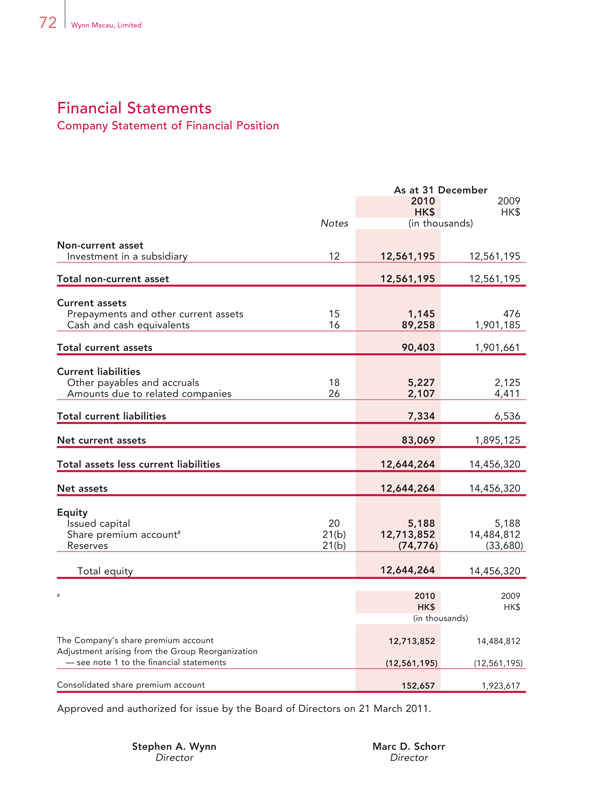

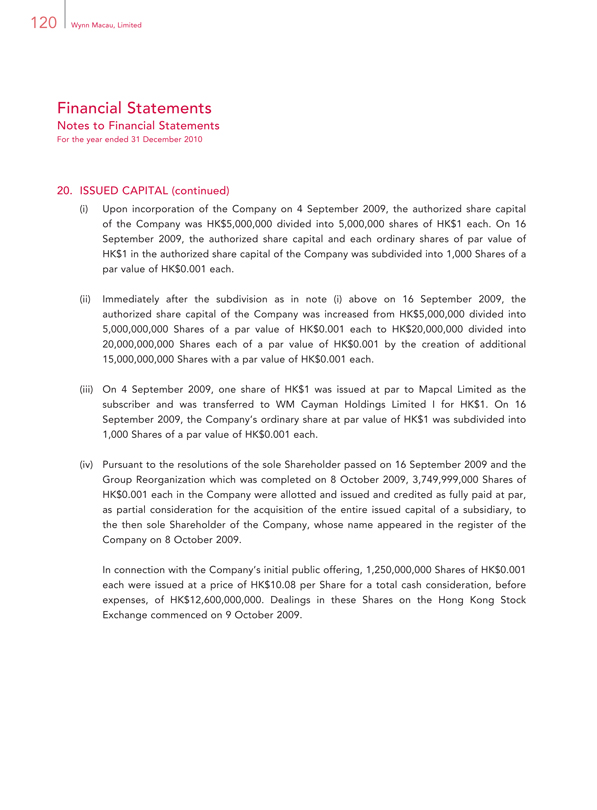

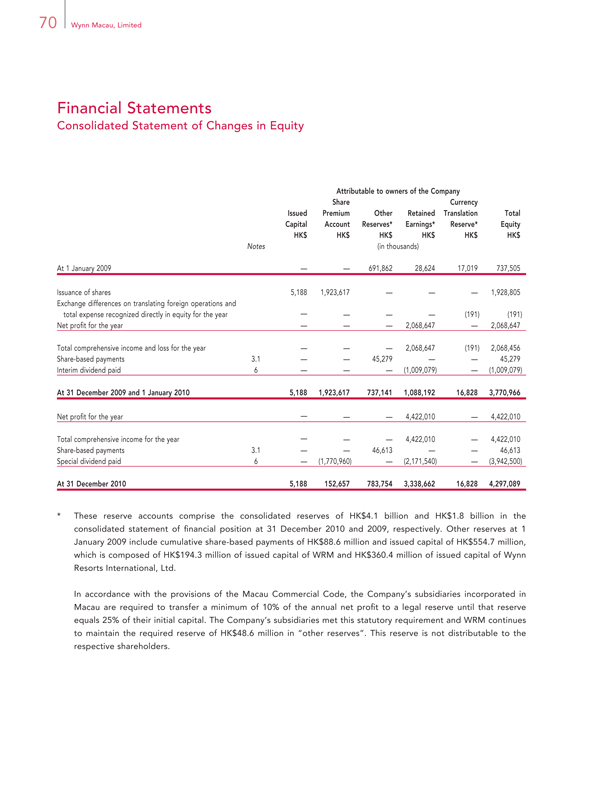

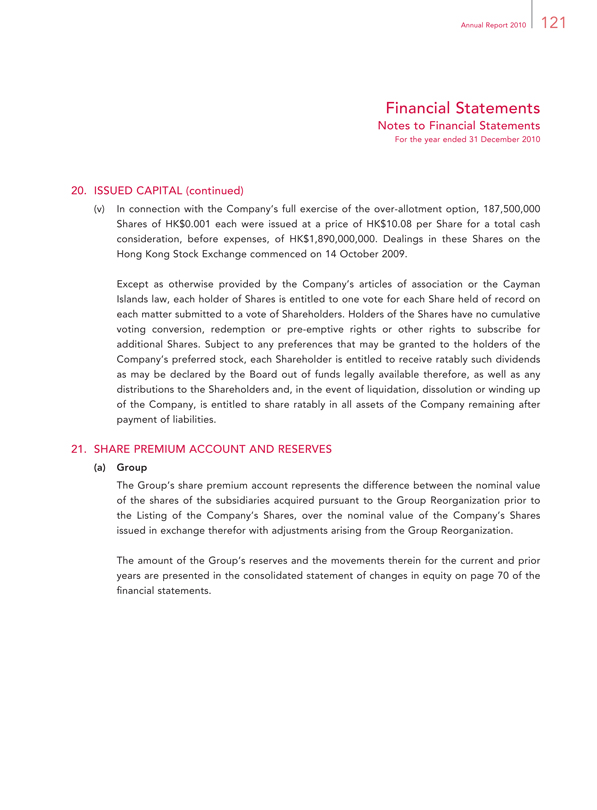

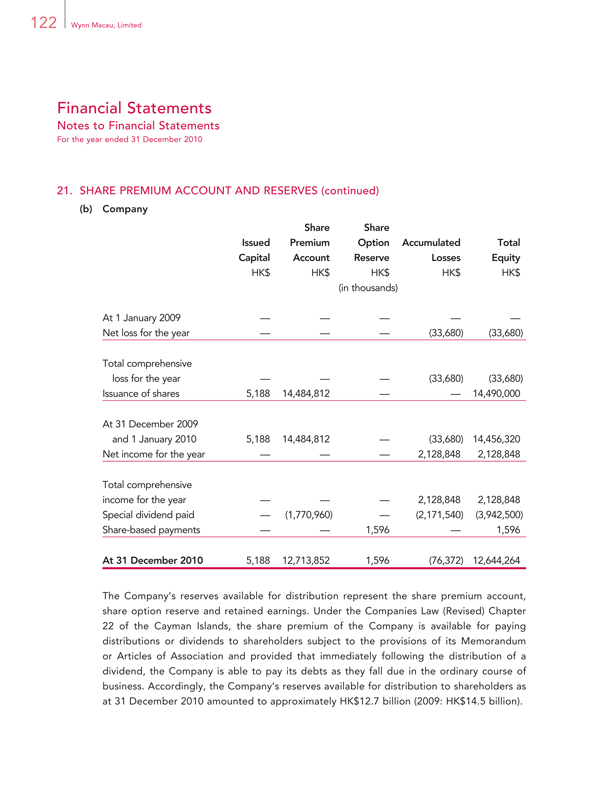

RESERVES

Details of the movements in the reserves of the Company and reserves available for distribution to Shareholders as at 31 December 2010 are set out in note 21(b) to the Financial Statements and the distributable reserves of the Company at 31 December 2010 are HK$12.7 billion. Movements in the reserves of the Group are reflected in the consolidated statement of changes in equity.

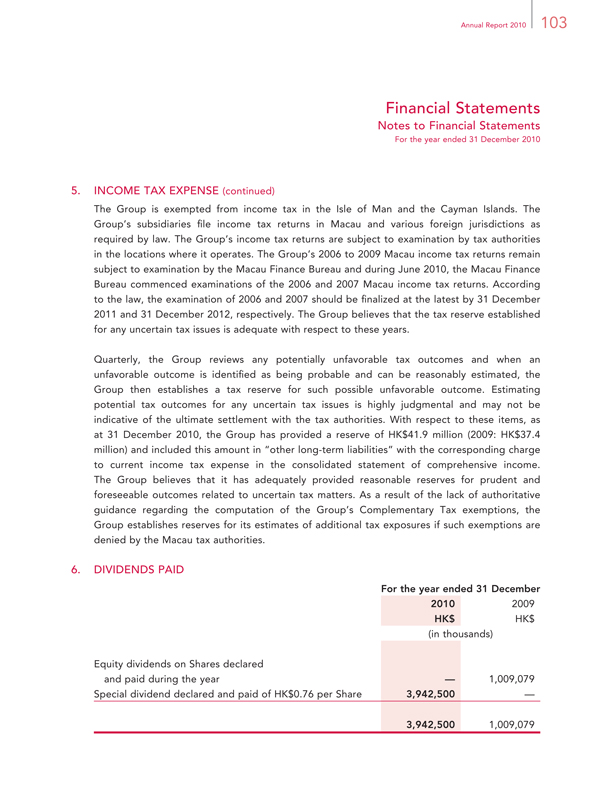

DIVIDENDS

During the year ended 31 December 2010, the Company declared and paid a special dividend of HK$0.76 per share totaling approximately HK$3.9 billion to its shareholders.

The Board has recommended that no final dividend be paid in respect of the year ended 31 December 2010.

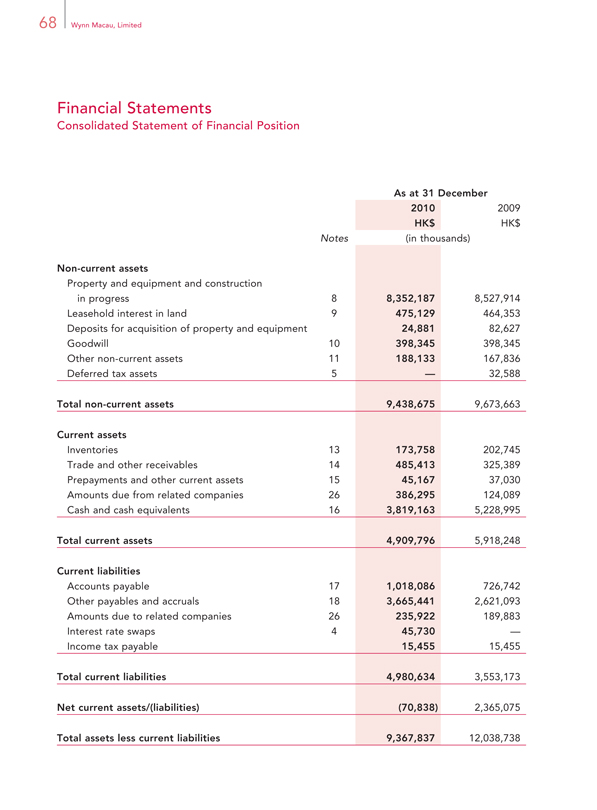

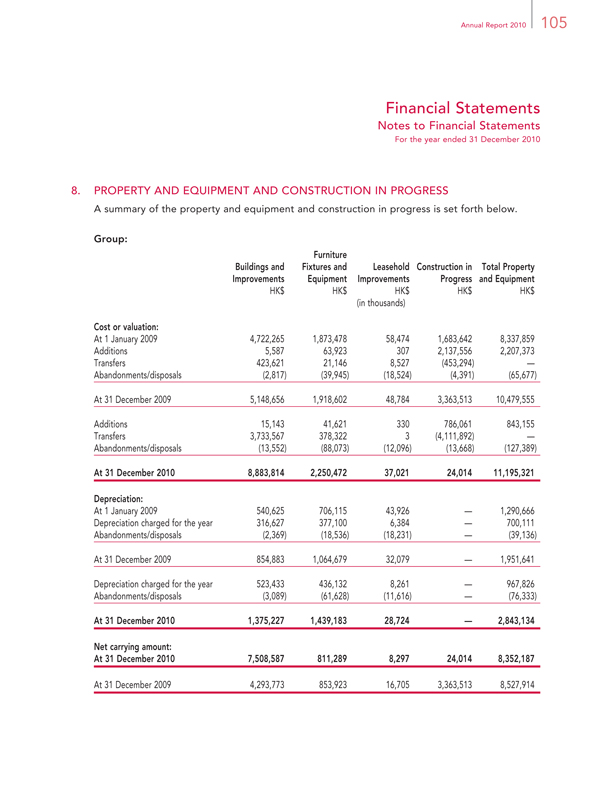

PROPERTY AND EQUIPMENT

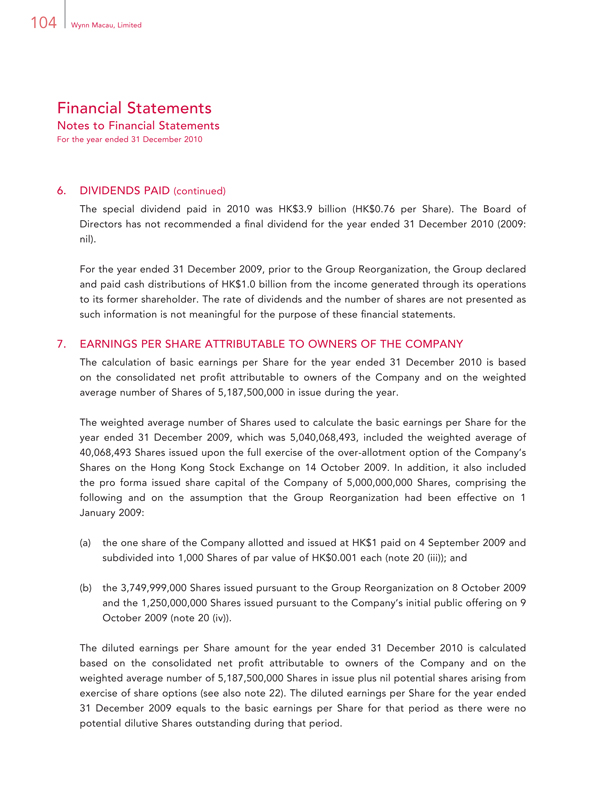

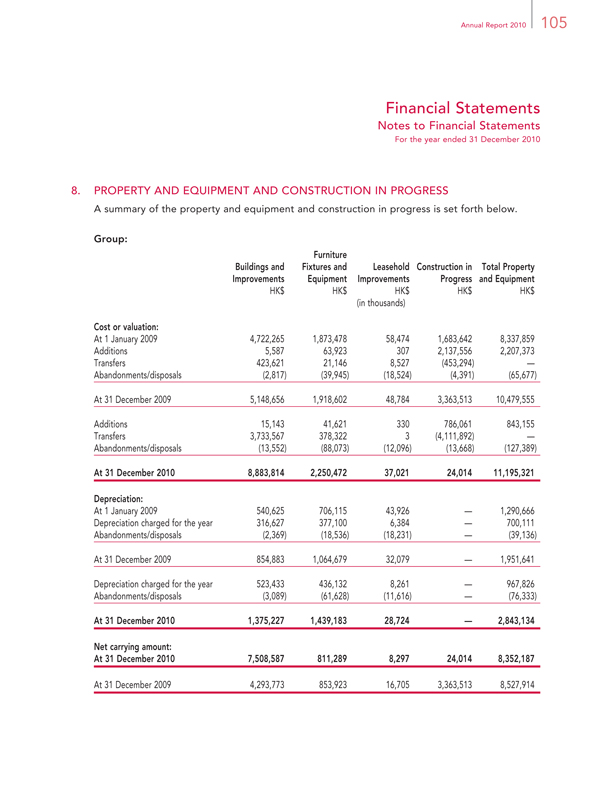

Details of movements in property and equipment during the year are set out in note 8 to the Financial Statements.

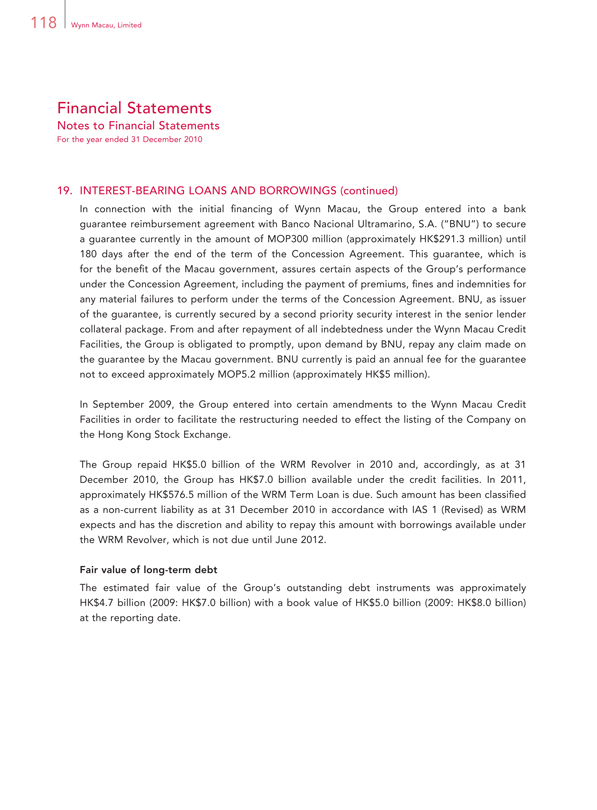

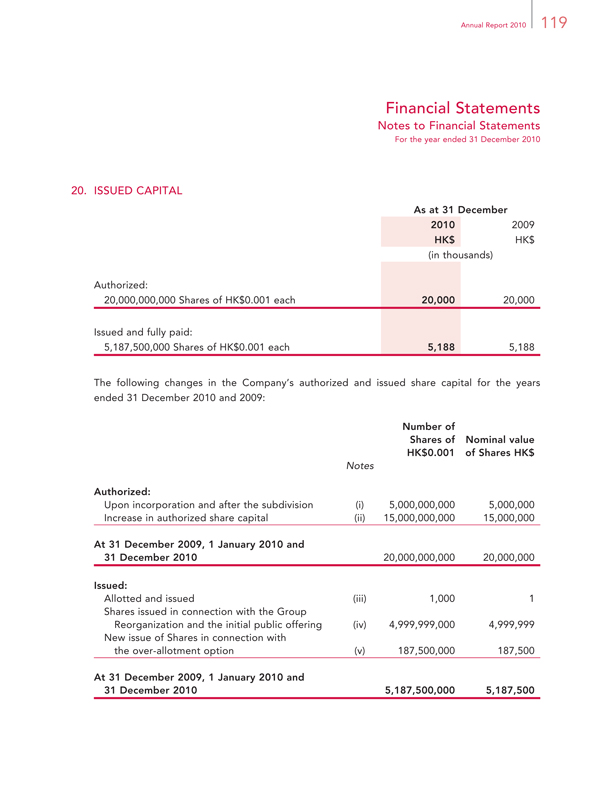

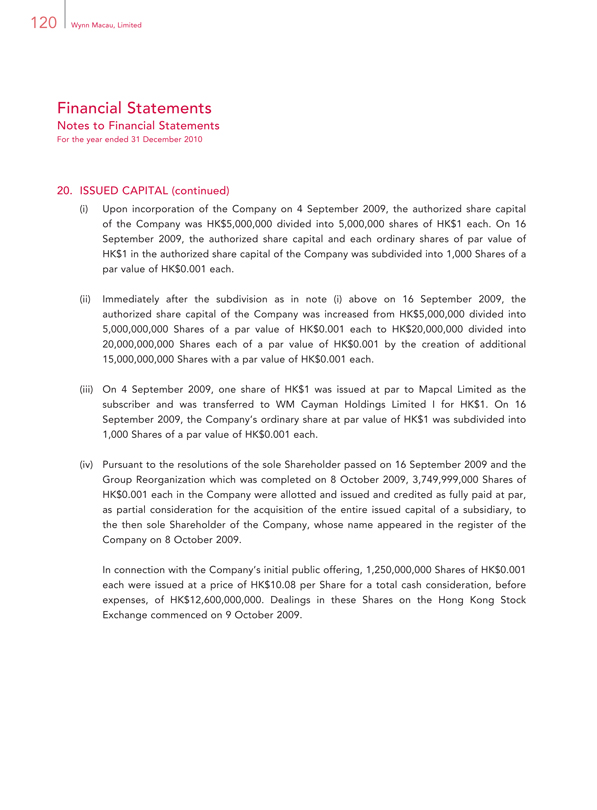

SHARE CAPITAL

Details of the movements in share capital of the Company are set out in note 20 to the Financial Statements.

CHARITABLE CONTRIBUTIONS

During the year ended 31 December 2010, the Group made charitable contributions totaling HK$6.7 million.

Annual Report 2010 39

Report of the Directors

DIRECTORS

Directors during the Year Ended 31 December 2010

The Directors during the year were:

Executive Directors:

Mr. Stephen A. Wynn (also our Chairman, President and Chief Executive Officer) Mr. Ian Michael Coughlan Ms. Linda Chen

Non-executive Directors:

Mr. Kazuo Okada

Dr. Allan Zeman (also our Vice-Chairman)

Mr. Marc D. Schorr

Independent non-executive Directors:

Mr. Nicholas Sallnow-Smith

Mr. Bruce Rockowitz

Mr. Jeffery Kin-fung Lam

Directors Retiring by Rotation

In accordance with article 17.18 of the Company’s articles of association, one third of our Board will retire from office by rotation at the forthcoming annual general meeting. The three directors who will retire by rotation are Ms. Linda Chen, one of our executive Directors, Dr. Allan Zeman, one of our non-executive Directors, and Mr. Bruce Rockowitz, one of our independent non-executive Directors. All retiring directors, being eligible, will offer themselves for re-election at the forthcoming annual general meeting.

Directors’ Service Contracts

None of the Directors proposed for re-election at the forthcoming annual general meeting has a service contract with the Company which is not determinable by the Company within one year without payment of compensation, other than statutory compensation.

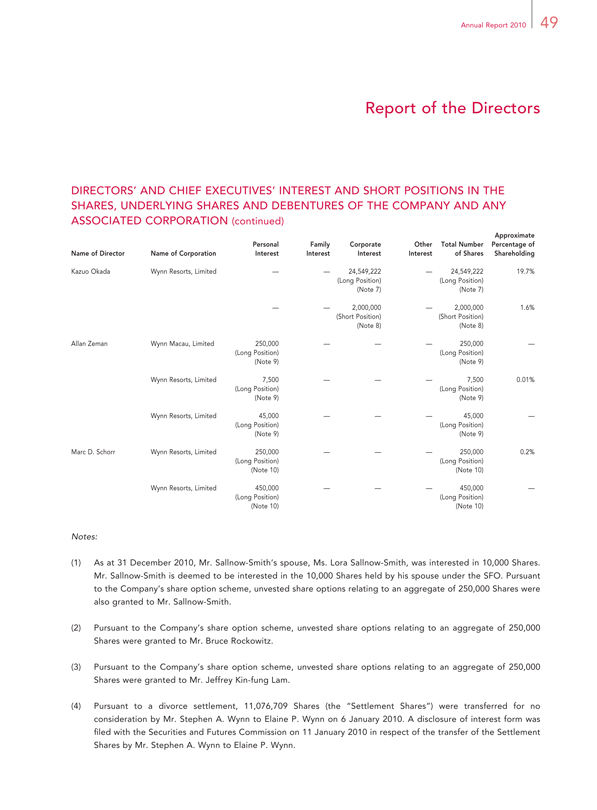

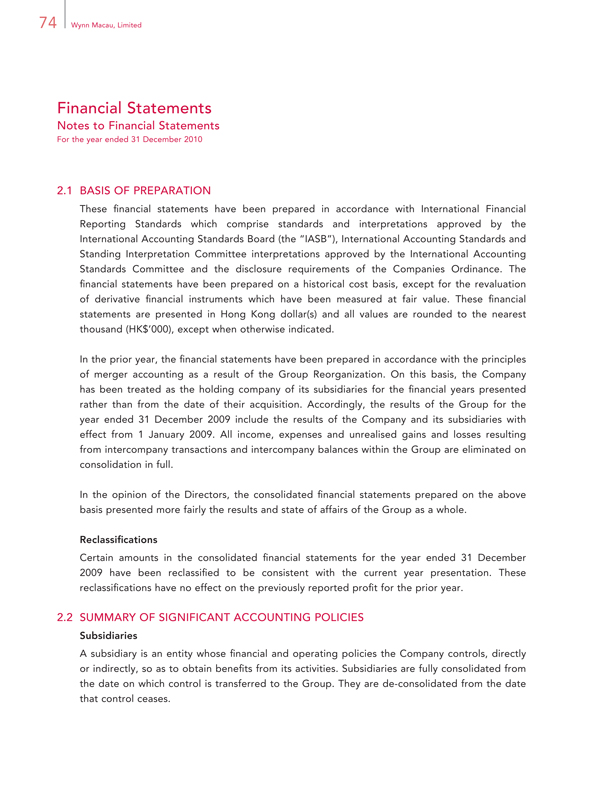

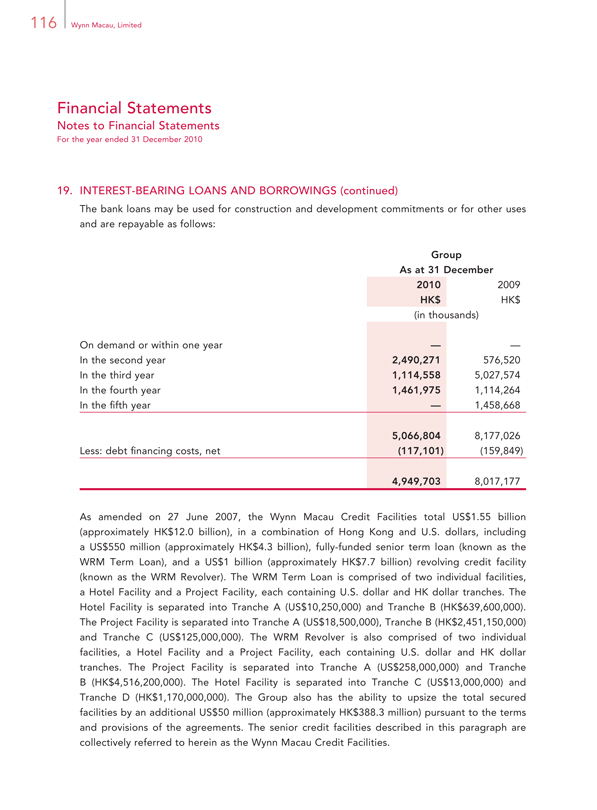

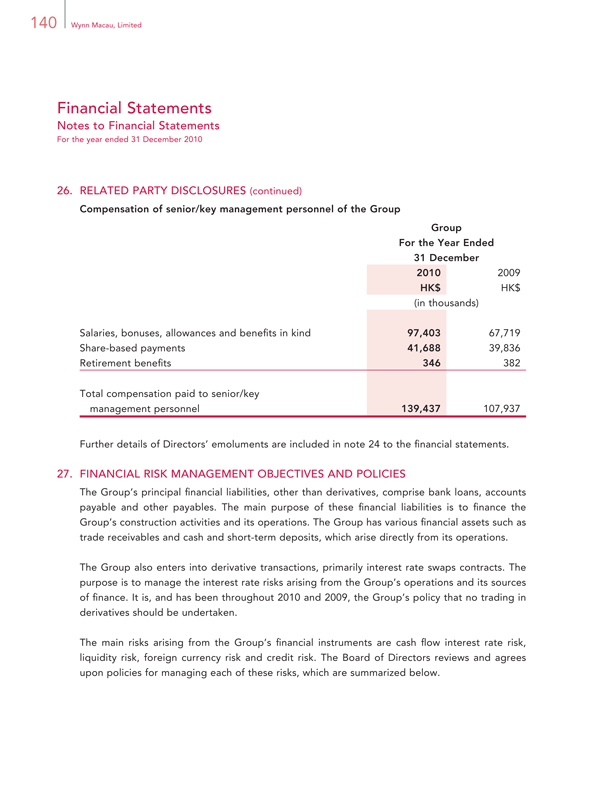

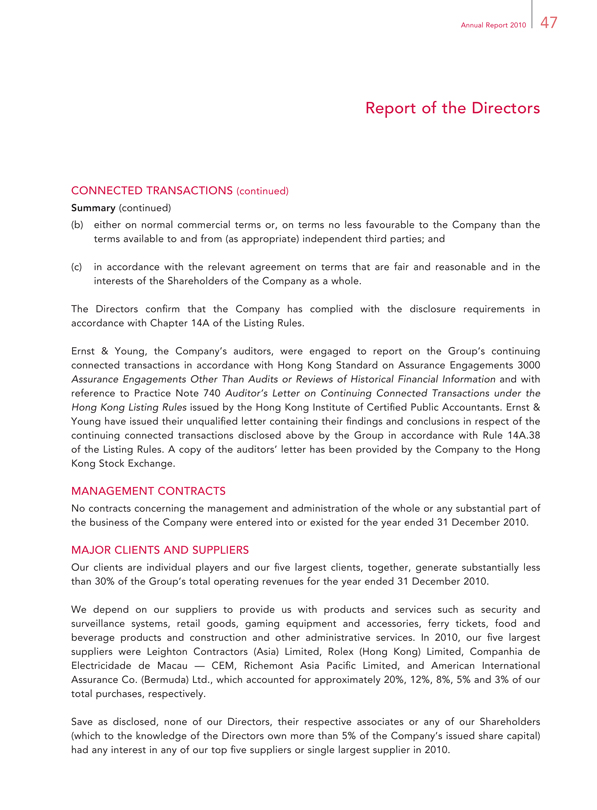

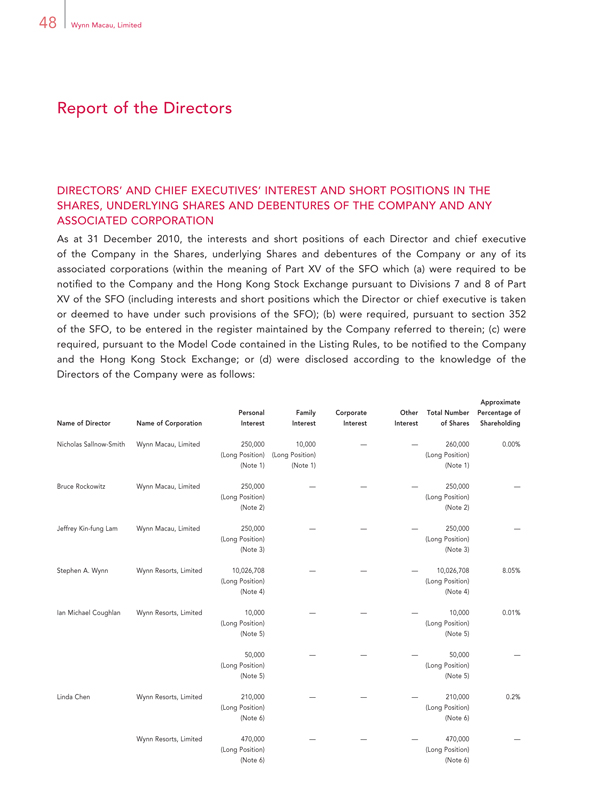

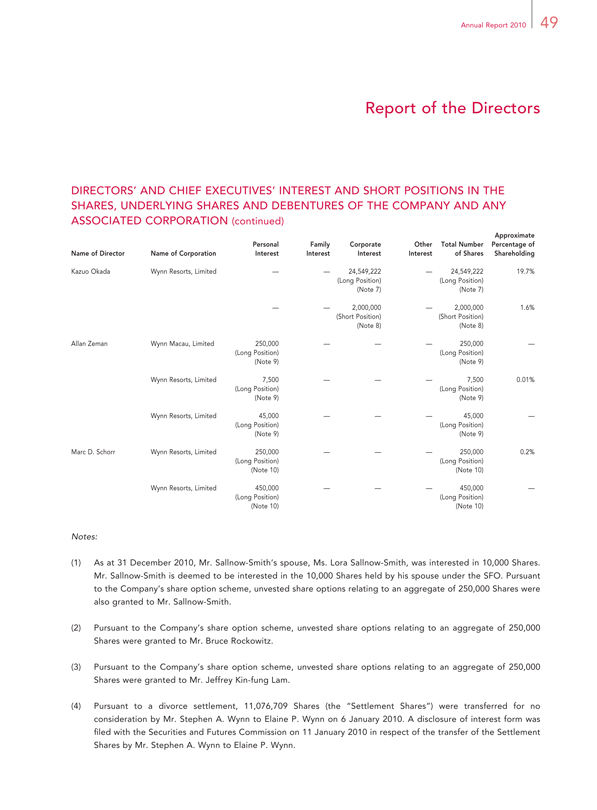

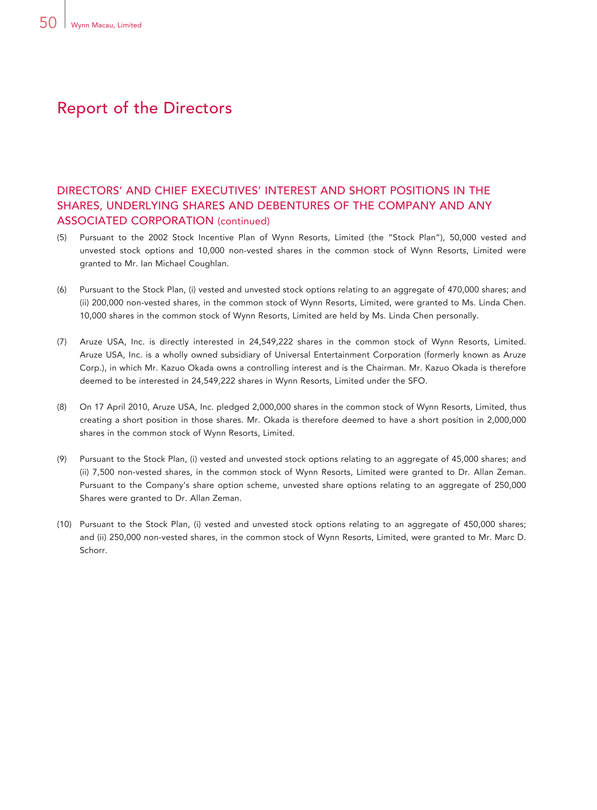

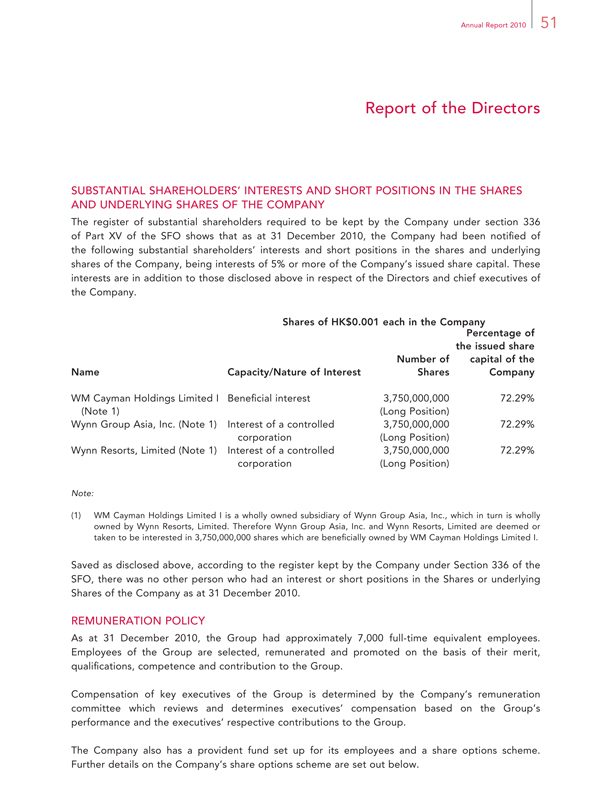

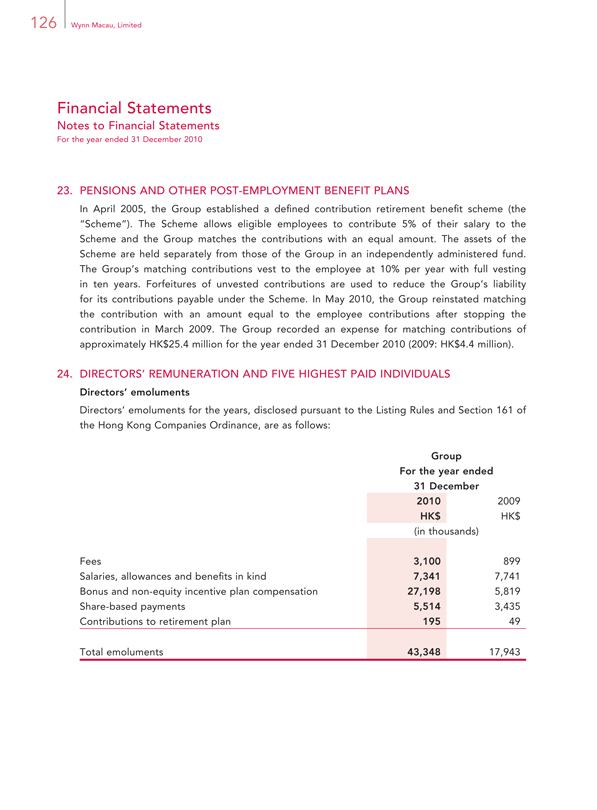

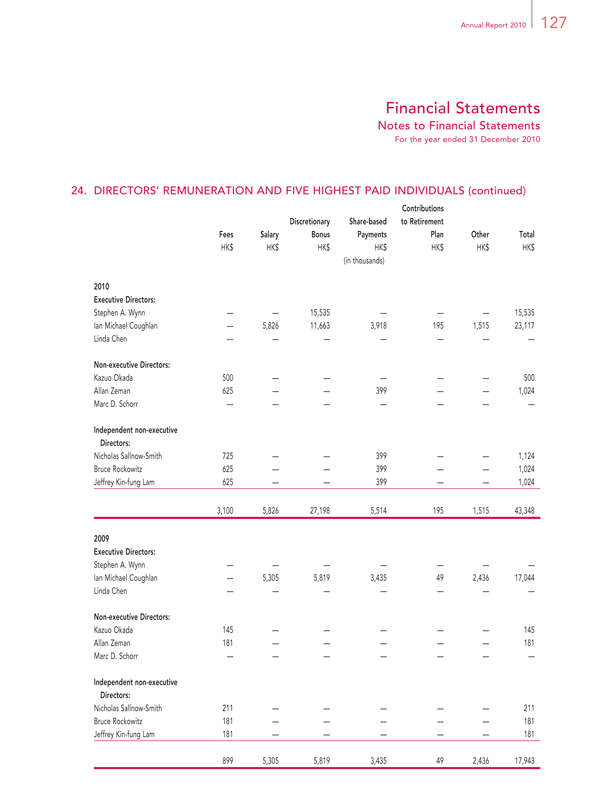

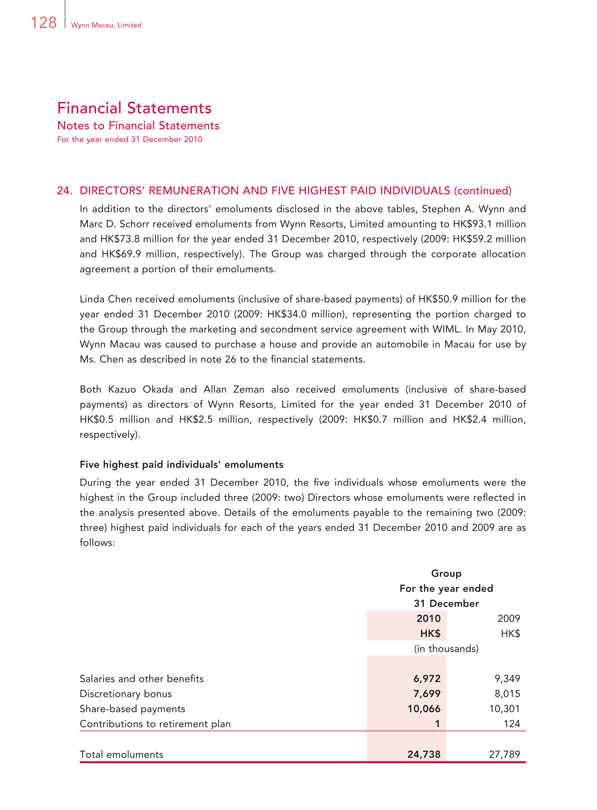

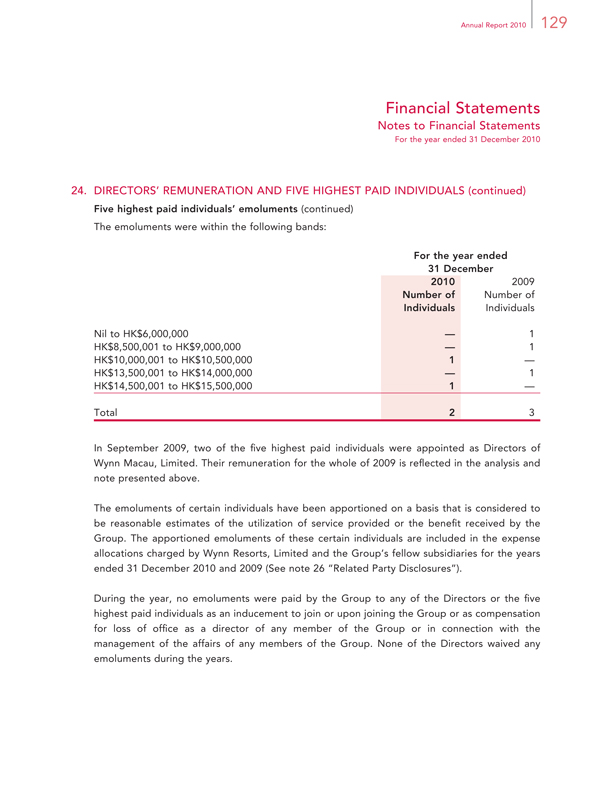

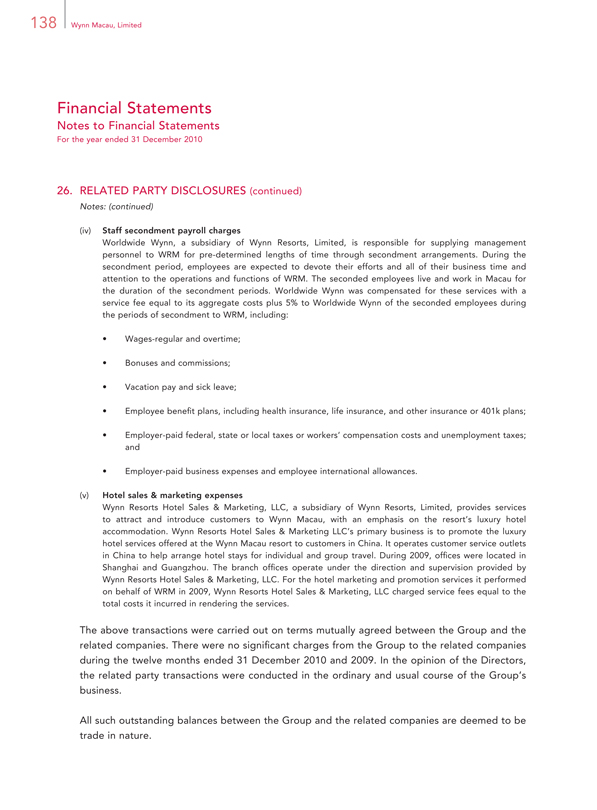

Directors’ Emoluments