Exhibit 99.1

2011 Interim Report

5 | | Management Discussion and Analysis |

30 Directors and Senior Management

Contents

39 Other Information

49 Report on Review of

Interim Financial Information

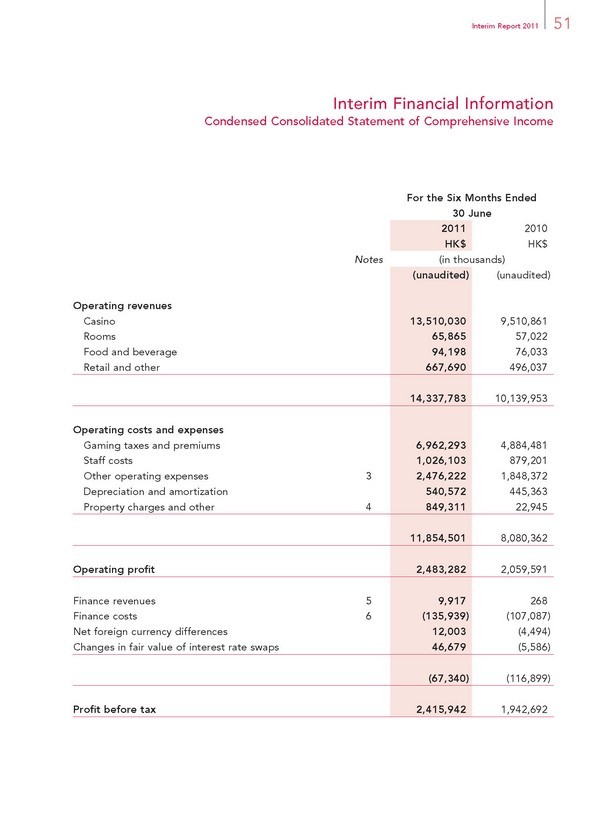

51 Interim Financial Information

77 Defi nitions

82 Glossary

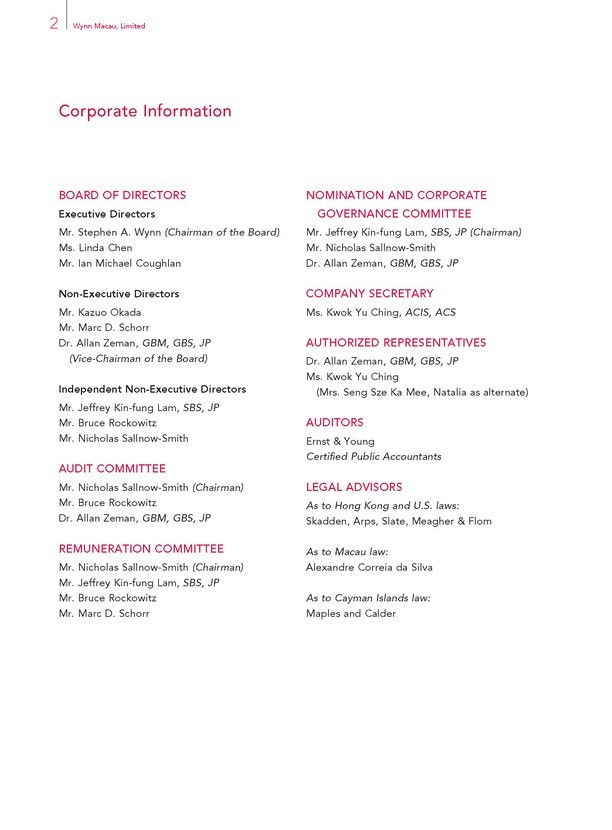

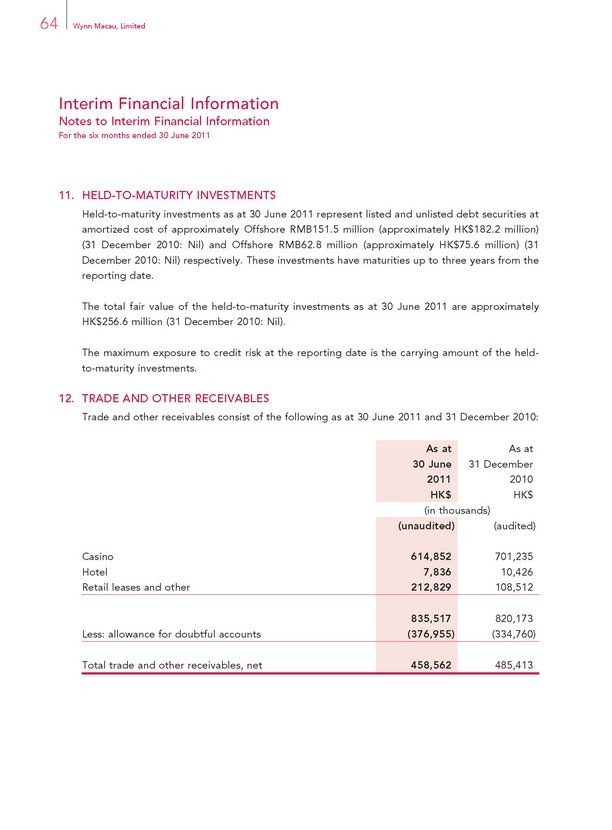

2 Wynn Macau, Limited

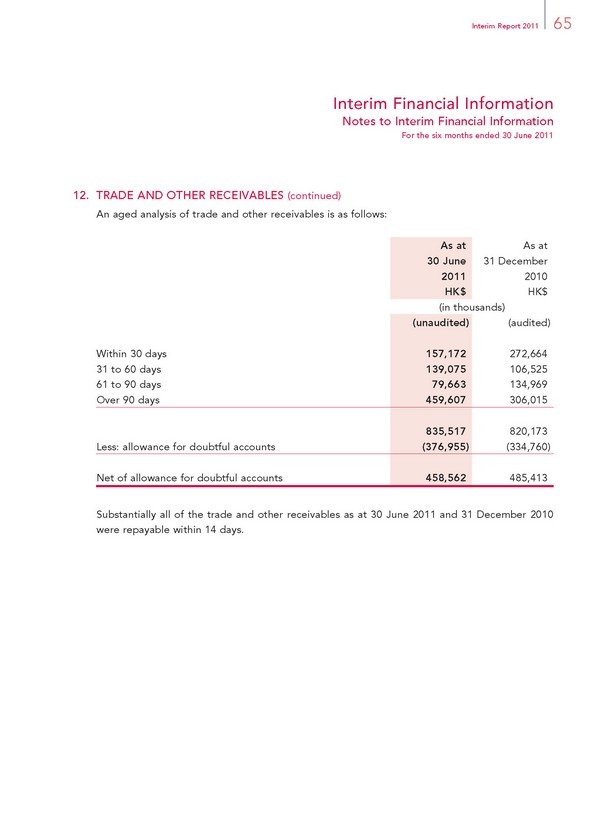

Corporate Information

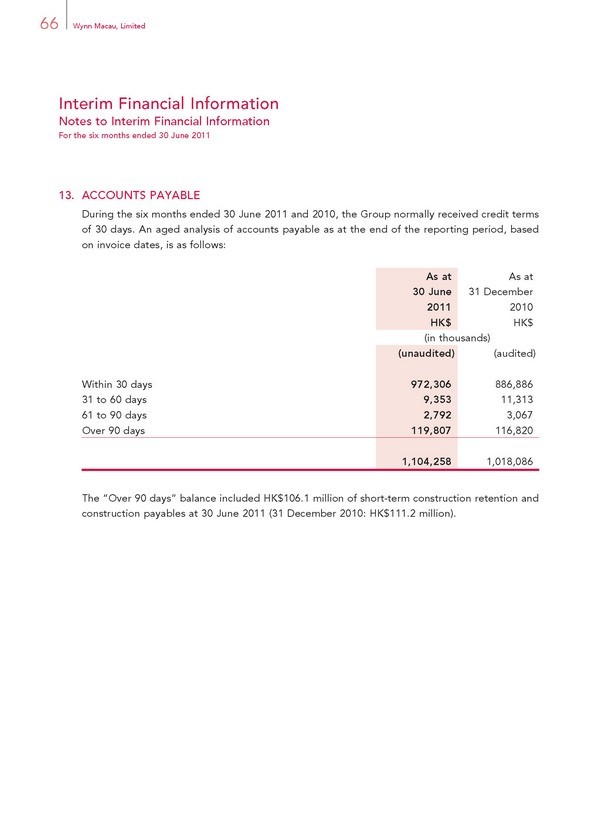

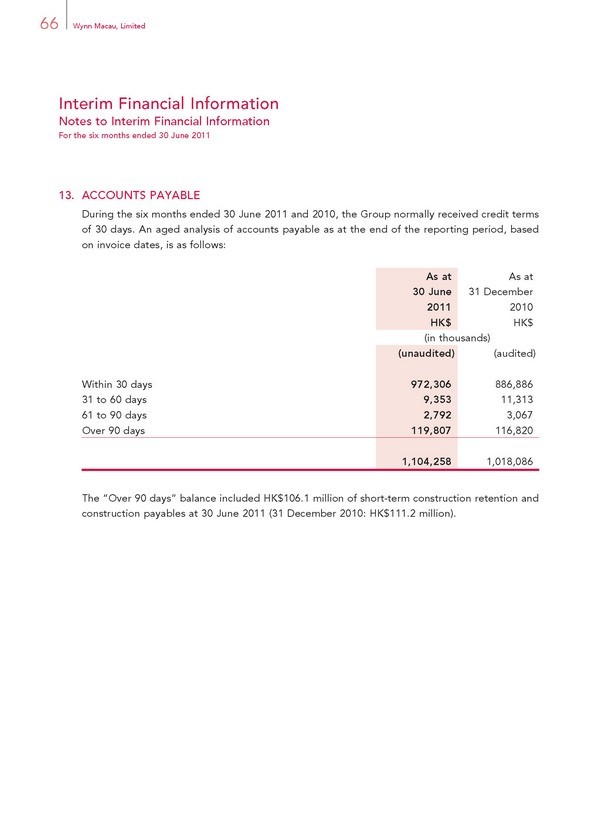

BOARD OF DIRECTORS NOMINATION AND CORPORATE

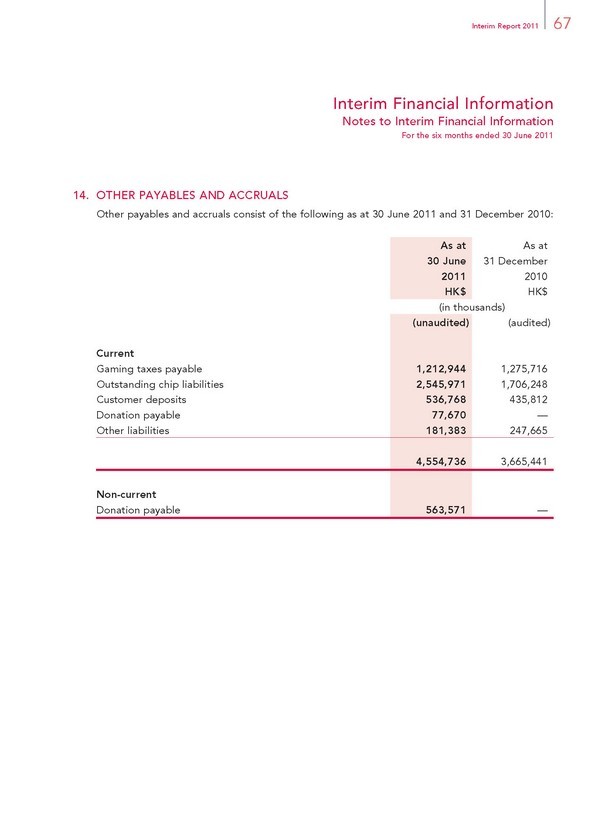

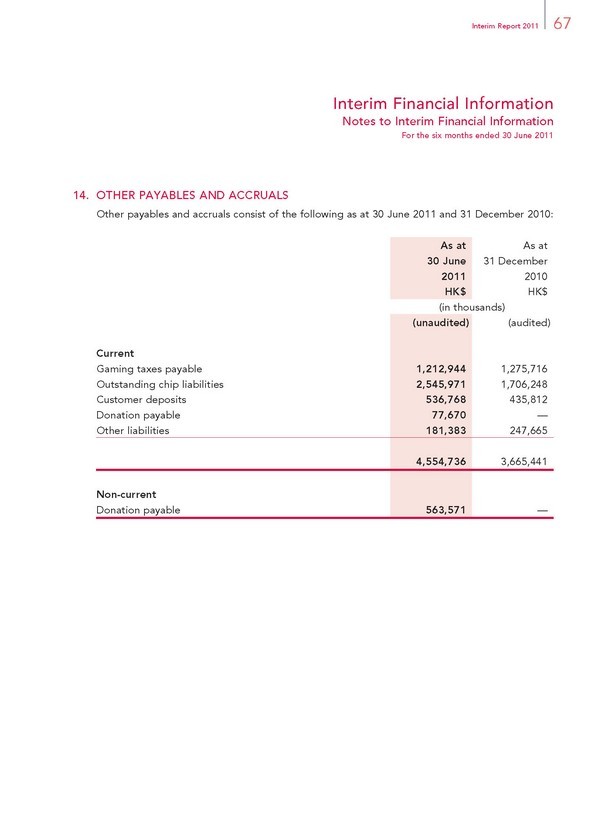

Executive Directors GOVERNANCE COMMITTEE

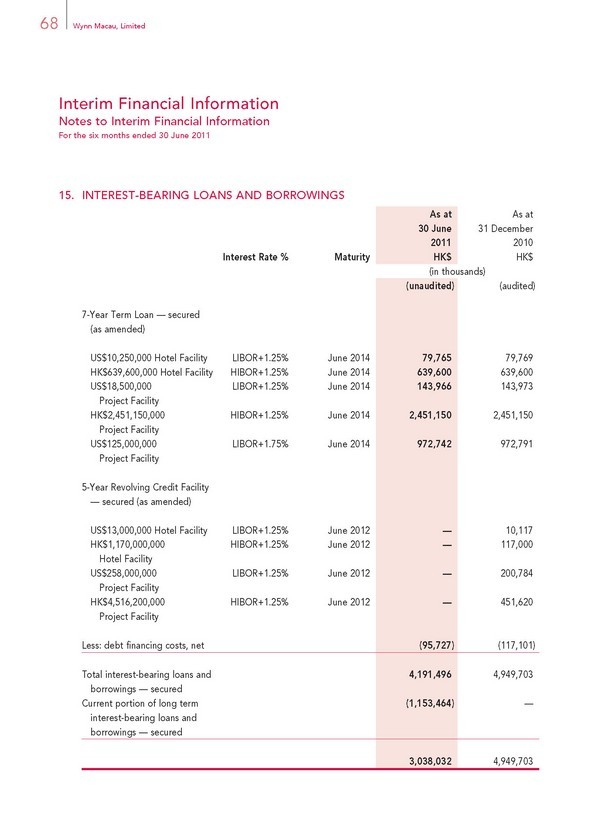

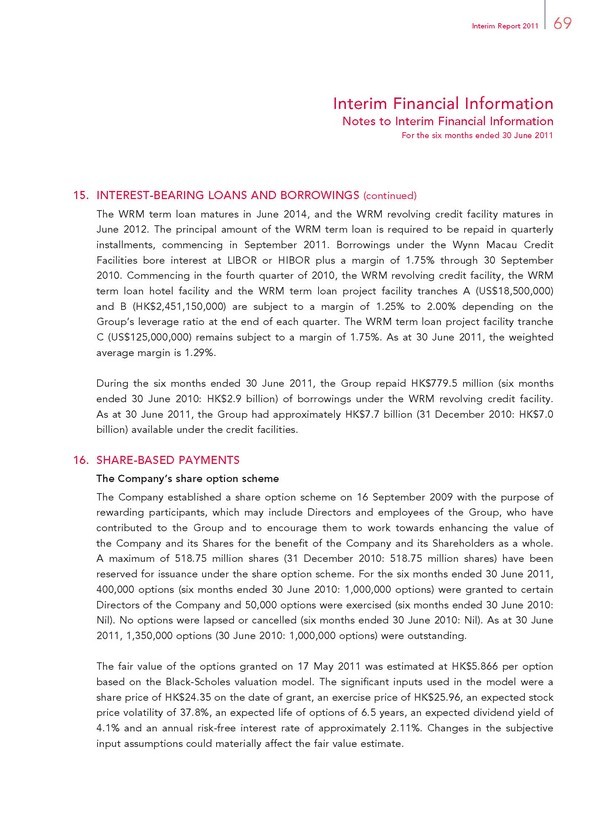

Mr. Stephen A. Wynn (Chairman of the Board) Mr. Jeffrey Kin-fung Lam, SBS, JP (Chairman)

Ms. Linda Chen Mr. Nicholas Sallnow-Smith

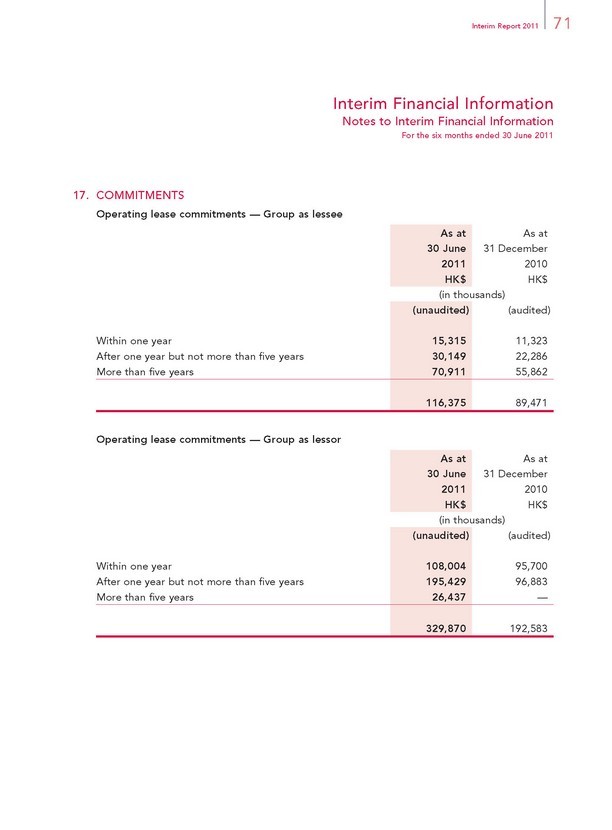

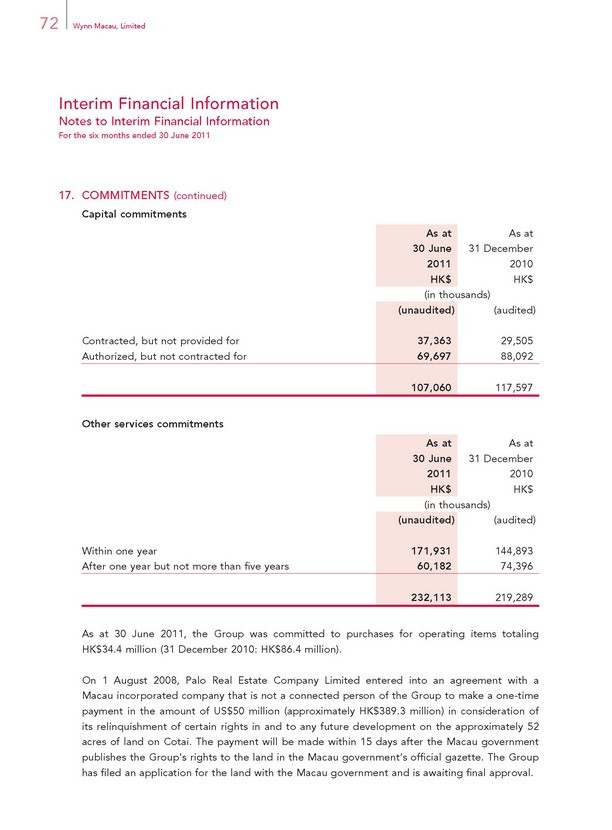

Mr. Ian Michael Coughlan Dr. Allan Zeman, GBM, GBS, JP

Non-Executive Directors COMPANY SECRETARY

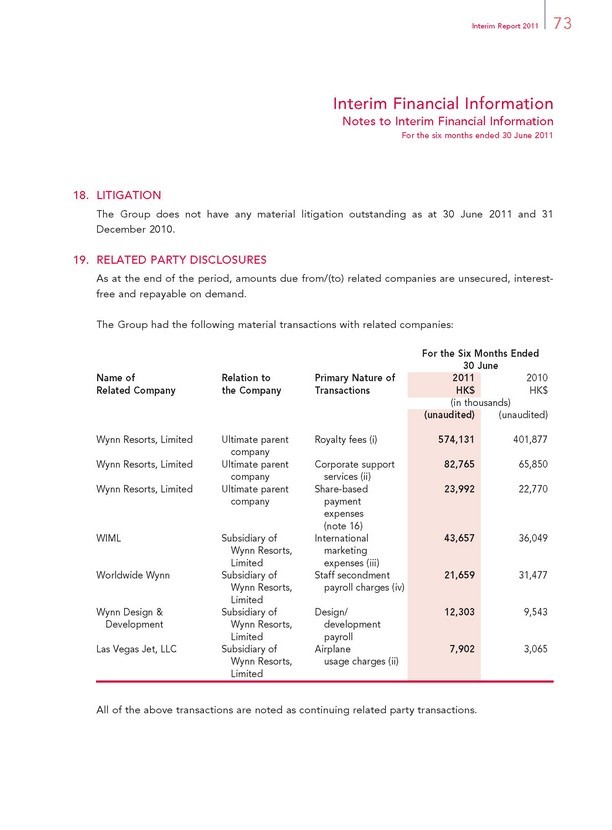

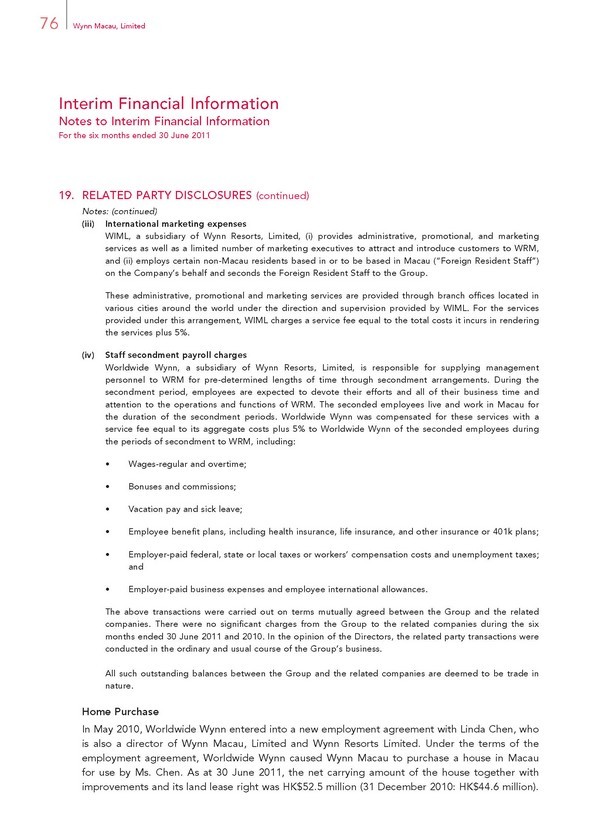

Mr. Kazuo Okada Ms. Kwok Yu Ching, ACIS, ACS

Mr. Marc D. Schorr

Dr. Allan Zeman, GBM, GBS, JP AUTHORIZED REPRESENTATIVES

(Vice-Chairman of the Board) Dr. Allan Zeman, GBM, GBS, JP

Ms. Kwok Yu Ching

Independent Non-Executive Directors (Mrs. Seng Sze Ka Mee, Natalia as alternate)

Mr. Jeffrey Kin-fung Lam, SBS, JP

Mr. Bruce Rockowitz AUDITORS

Mr. Nicholas Sallnow-Smith Ernst & Young

AUDIT COMMITTEE Certifi ed Public Accountants

Mr. Nicholas Sallnow-Smith (Chairman) LEGAL ADVISORS

Mr. Bruce Rockowitz As to Hong Kong and U.S. laws:

Dr. Allan Zeman, GBM, GBS, JP Skadden, Arps, Slate, Meagher & Flom

REMUNERATION COMMITTEE As to Macau law:

Mr. Nicholas Sallnow-Smith (Chairman) Alexandre Correia da Silva

Mr. Jeffrey Kin-fung Lam, SBS, JP

Mr. Bruce Rockowitz As to Cayman Islands law:

Mr. Marc D. Schorr Maples and Calder

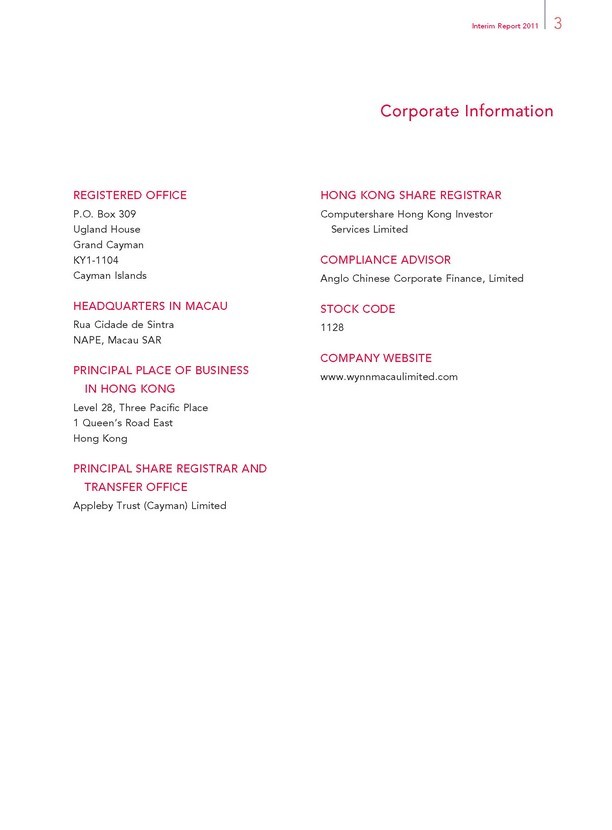

REGISTERED OFFICE

P.O. Box 309

Ugland House

Grand Cayman

KY1-1104

Cayman Islands

HEADQUARTERS IN MACAU

Rua Cidade de Sintra

NAPE, Macau SAR

PRINCIPAL PLACE OF BUSINESS IN HONG KONG

Level 28, Three Pacifi c Place

Hong Kong

PRINCIPAL SHARE REGISTRAR AND

TRANSFER OFFICE

Appleby Trust (Cayman) Limited

Interim Report 2011 3

Corporate Information

HONG KONG SHARE REGISTRAR

Computershare Hong Kong Investor

Services Limited

COMPLIANCE ADVISOR

Anglo Chinese Corporate Finance, Limited

STOCK CODE

1128

COMPANY WEBSITE

www.wynnmacaulimited.com

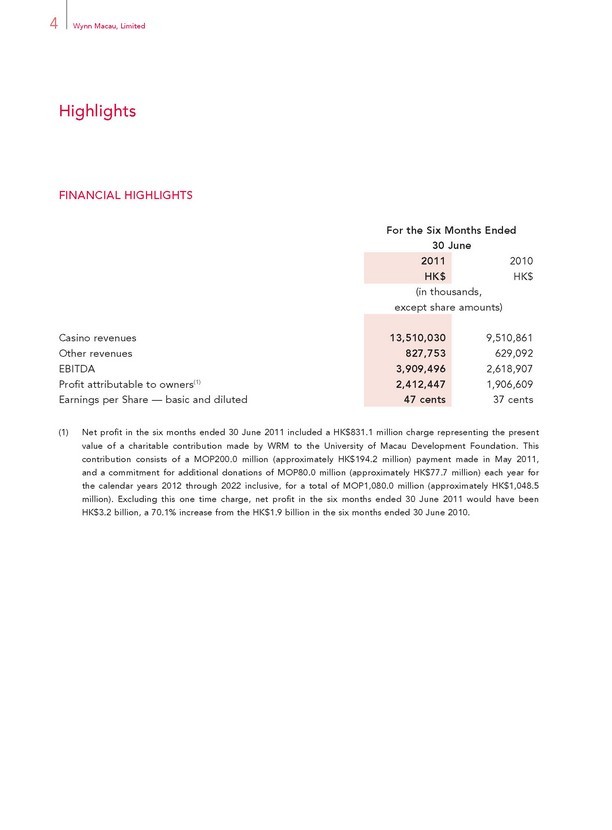

Highlights

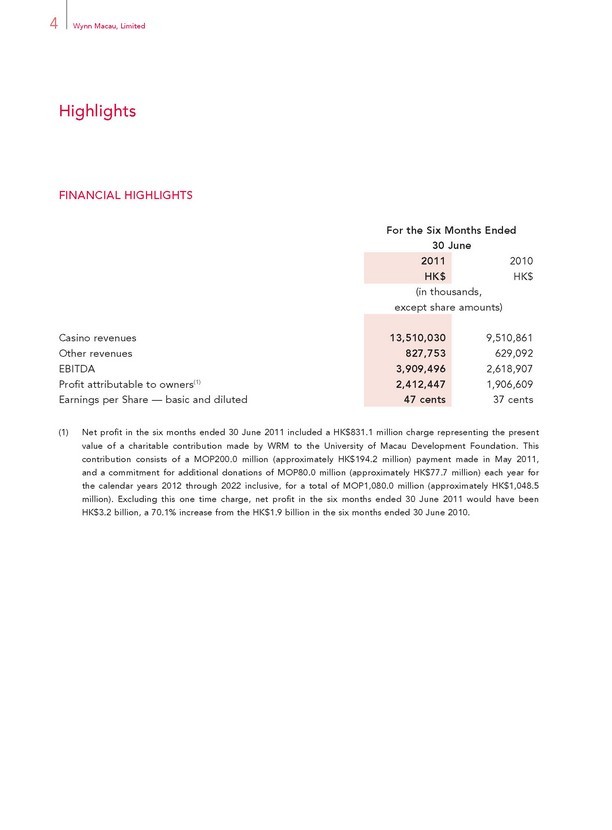

FINANCIAL HIGHLIGHTS

For the Six Months Ended

30 June

2011 2010

HK$ HK$

(in thousands,

except share amounts)

Casino revenues 13,510,030 9,510,861

Other revenues 827,753 629,092

EBITDA 3,909,496 2,618,907

Profi t attributable to owners(1) 2,412,447 1,906,609

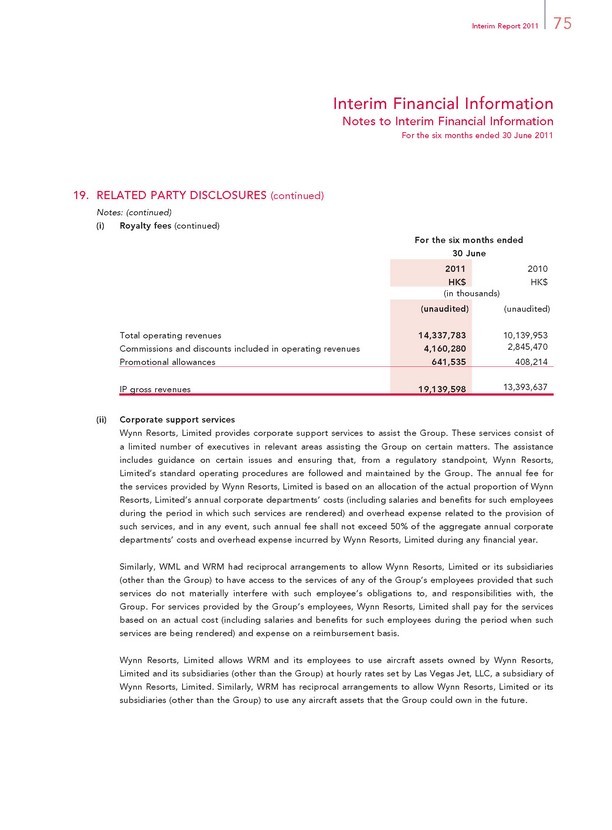

Earnings per Share — basic and diluted 47 cents 37 cents

Net profi t in the six months ended 30 June 2011 included a HK$831.1 million charge representing the present value of a charitable contribution made by WRM to the University of Macau Development Foundation. This contribution consists of a MOP200.0 million (approximately HK$194.2 million) payment made in May 2011, and a commitment for additional donations of MOP80.0 million (approximately HK$77.7 million) each year for the calendar years 2012 through 2022 inclusive, for a total of MOP1,080.0 million (approximately HK$1,048.5 million). Excluding this one time charge, net profi t in the six months ended 30 June 2011 would have been HK$3.2 billion, a 70.1% increase from the HK$1.9 billion in the six months ended 30 June 2010.

Interim Report 2011 5

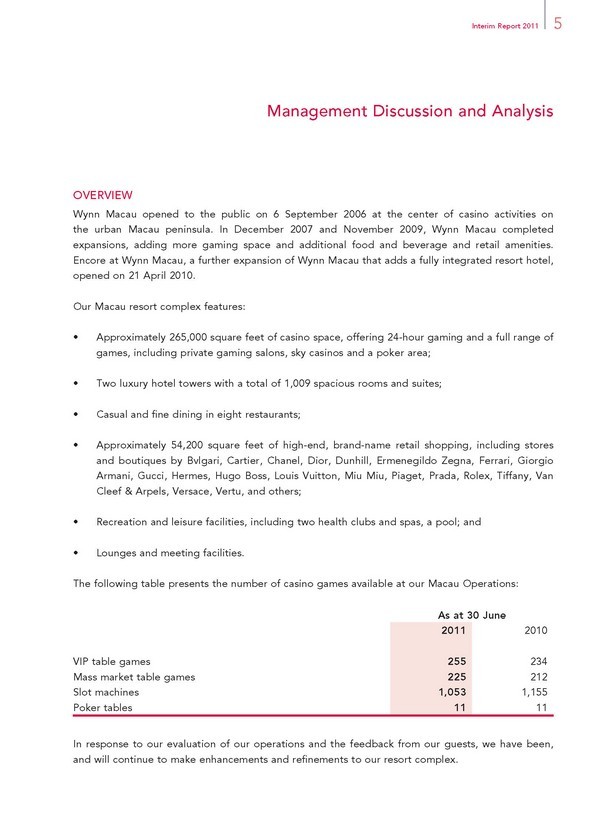

Management Discussion and Analysis

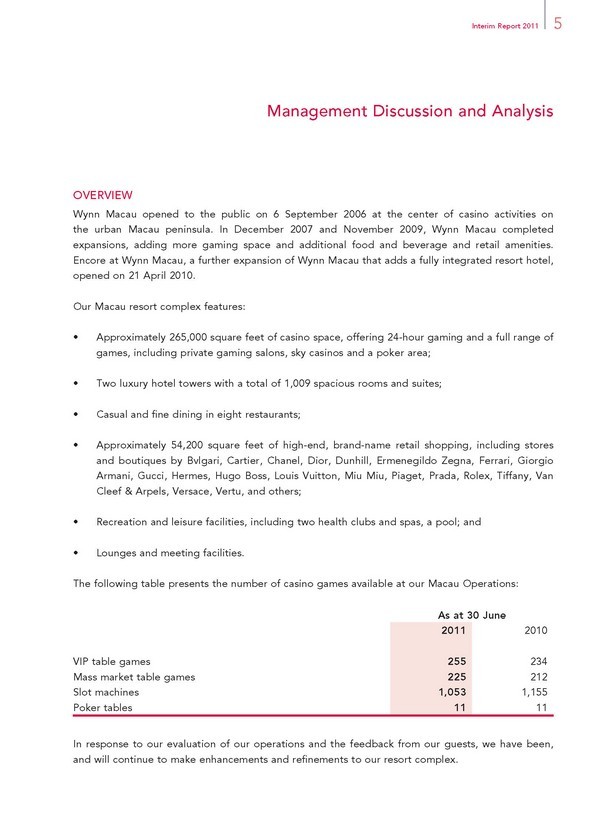

OVERVIEW

Wynn Macau opened to the public on 6 September 2006 at the center of casino activities on the urban Macau peninsula. In December 2007 and November 2009, Wynn Macau completed expansions, adding more gaming space and additional food and beverage and retail amenities. Encore at Wynn Macau, a further expansion of Wynn Macau that adds a fully integrated resort hotel, opened on 21 April 2010.

Our Macau resort complex features:

Approximately 265,000 square feet of casino space, offering 24-hour gaming and a full range of games, including private gaming salons, sky casinos and a poker area;

Two luxury hotel towers with a total of 1,009 spacious rooms and suites;

Casual and fi ne dining in eight restaurants;

Approximately 54,200 square feet of high-end, brand-name retail shopping, including stores and boutiques by Bvlgari, Cartier, Chanel, Dior, Dunhill, Ermenegildo Zegna, Ferrari, Giorgio Armani, Gucci, Hermes, Hugo Boss, Louis Vuitton, Miu Miu, Piaget, Prada, Rolex, Tiffany, Van Cleef & Arpels, Versace, Vertu, and others;

Recreation and leisure facilities, including two health clubs and spas, a pool; and

Lounges and meeting facilities.

The following table presents the number of casino games available at our Macau Operations:

As at 30 June

2011 2010

VIP table games 255 234

Mass market table games 225 212

Slot machines 1,053 1,155

Poker tables 11 11

In response to our evaluation of our operations and the feedback from our guests, we have been, and will continue to make enhancements and refi nements to our resort complex.

Management Discussion and Analysis

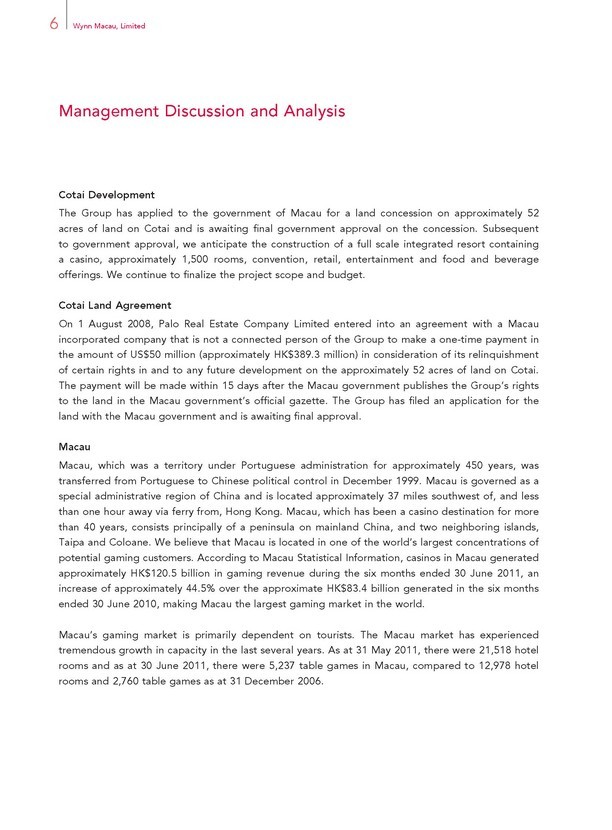

Cotai Development

The Group has applied to the government of Macau for a land concession on approximately 52 acres of land on Cotai and is awaiting fi nal government approval on the concession. Subsequent to government approval, we anticipate the construction of a full scale integrated resort containing a casino, approximately 1,500 rooms, convention, retail, entertainment and food and beverage offerings. We continue to fi nalize the project scope and budget.

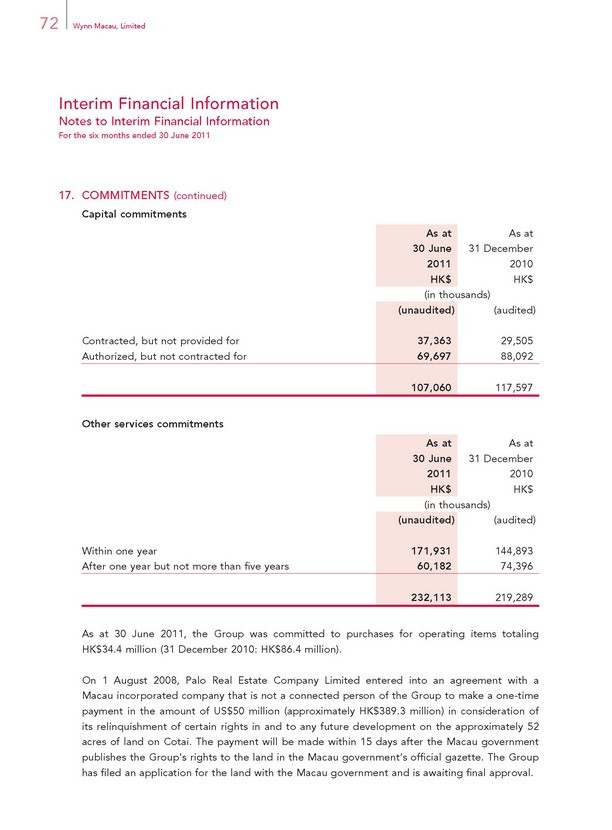

Cotai Land Agreement

On 1 August 2008, Palo Real Estate Company Limited entered into an agreement with a Macau incorporated company that is not a connected person of the Group to make a one-time payment in the amount of US$50 million (approximately HK$389.3 million) in consideration of its relinquishment of certain rights in and to any future development on the approximately 52 acres of land on Cotai. The payment will be made within 15 days after the Macau government publishes the Group’s rights to the land in the Macau government’s offi cial gazette. The Group has fi led an application for the land with the Macau government and is awaiting fi nal approval.

Macau

Macau, which was a territory under Portuguese administration for approximately 450 years, was transferred from Portuguese to Chinese political control in December 1999. Macau is governed as a special administrative region of China and is located approximately 37 miles southwest of, and less than one hour away via ferry from, Hong Kong. Macau, which has been a casino destination for more than 40 years, consists principally of a peninsula on mainland China, and two neighboring islands, Taipa and Coloane. We believe that Macau is located in one of the world’s largest concentrations of potential gaming customers. According to Macau Statistical Information, casinos in Macau generated approximately HK$120.5 billion in gaming revenue during the six months ended 30 June 2011, an increase of approximately 44.5% over the approximate HK$83.4 billion generated in the six months ended 30 June 2010, making Macau the largest gaming market in the world.

Macau’s gaming market is primarily dependent on tourists. The Macau market has experienced tremendous growth in capacity in the last several years. As at 31 May 2011, there were 21,518 hotel rooms and as at 30 June 2011, there were 5,237 table games in Macau, compared to 12,978 hotel rooms and 2,760 table games as at 31 December 2006.

Interim Report 2011 7

Management Discussion and Analysis

FACTORS AFFECTING OUR RESULTS OF OPERATIONS AND FINANCIAL CONDITION

Tourism

The levels of tourism and overall gaming activities in Macau are key drivers of our business. Both the Macau gaming market and visitation to Macau have grown signifi cantly in the last few years. We have benefi ted from the rise in visitation to Macau over the past several years.

Gaming customers traveling to Macau typically come from nearby destinations in Asia including mainland China, Hong Kong, Taiwan, South Korea and Singapore. According to the Macau Statistics and Census Service Monthly Bulletin of Statistics, approximately 89.1% of visitors to Macau in the six months ended 30 June 2011 were from mainland China, Hong Kong, and Taiwan.

Tourism levels in Macau are affected by a number of factors, all of which are beyond our control. Key factors affecting tourism levels in Macau may include, among others:

— Prevailing economic conditions in mainland China and Asia;

— Various countries’ policies on the issuance of travel visas that may be in place from time to time and could affect travel to Macau;

— Competition from other destinations which offer gaming and leisure activities;

— Possible changes to government restrictions on currency conversion or the ability to export currency from mainland China or other countries;

— Occurrence of natural disasters and disruption of travel; and

— Possible outbreaks of infectious disease.

Economic and Operating Environment

Our operating environment has remained stable during the six months ended 30 June 2011. However, economic conditions can have a signifi cant impact on our business. A number of factors, including a slowdown in the global economy, contracting credit markets, reduced consumer spending, various countries’ policies that affect travel to Macau and any outbreak of infectious diseases can negatively impact the gaming industry in Macau and our business.

Management Discussion and Analysis

Competition

Since the liberalization of Macau’s gaming industry in 2002, there has been a signifi cant increase in the number of gaming operators and casino properties in Macau. Currently, there are six gaming operators in Macau including WRM. The three concessionaires are WRM, SJM, and Galaxy which opened Galaxy Macau, a major resort in the Cotai area, on 15 May 2011. The three subconcessionaires are Melco Crown, MGM Macau, and Venetian Macau. As at 30 June 2011, there were approximately 34 casinos in Macau, including 20 operated by SJM. Each of the current six operators has operating casinos and expansion plans announced or underway.

Wynn Macau also faces competition from casinos primarily located in other areas of Asia, such as Resorts World Sentosa and Marina Bay Sands which opened in February and April 2010, respectively, in Singapore, Genting Highlands Resort located outside of Kuala Lumpur, Malaysia and casinos in the Philippines. Wynn Macau also encounters competition from other major gaming centers located around the world, including Australia and Las Vegas, cruise ships in Asia that offer gaming, and other casinos throughout Asia. Further, if current efforts to legalize gaming in other Asian countries are successful, Wynn Macau will face additional regional competition.

Gaming Promoters

A signifi cant amount of our casino play is brought to us by gaming promoters. Gaming promoters have historically played a critical role in the Macau gaming market and are important to our casino business.

Gaming promoters introduce premium VIP players to Wynn Macau and often assist those clients with their travel and entertainment arrangements. In addition, gaming promoters often grant credit to their players. In exchange for their services, Wynn Macau generally pays the gaming promoters a percentage of the gross gaming win generated by each gaming promoter. Approximately 80% of these commissions are netted against casino revenues, because such commissions approximate the amount of the commission returned to the VIP players by the gaming promoters, and approximately 20% of these commissions are included in other operating expenses, which approximate the amount of the commission ultimately retained by the gaming promoters for their compensation. The total amount of commissions paid to these promoters and netted against casino revenues were HK$3.8 billion and HK$2.6 billion for the six months ended 30 June 2011 and 2010, respectively. Commissions increased 47.4% for the six months ended 30 June 2011 compared to the six months ended 30 June 2010, due to increased volumes of play generated by gaming promoters and the addition of two new gaming promoters. Additionally, gaming promoters each receive a monthly complimentary allowance based on a percentage of the turnover their clients generate.

Interim Report 2011 9

Management Discussion and Analysis

The allowance is available for room, food and beverage and other products and services for discretionary use with clients. We typically advance commissions to gaming promoters at the beginning of each month to facilitate their working capital requirements. These advances are provided to a gaming promoter and are offset by the commissions earned by such gaming promoter during the applicable month. The aggregate amounts of exposure to our gaming promoters, which is the difference between commissions advanced to each individual gaming promoter, and the commissions payable to each such gaming promoter, were HK$361.4 million and HK$61.2 million as at 30 June 2011 and 2010, respectively. These outstanding commissions were cleared no later than the fi fth day of the succeeding month and prior to the advancement of any further funds to a gaming promoter. We believe we have developed strong relationships with our gaming promoters. Our commission percentages have remained stable throughout our operating history.

Premium Credit Play

We selectively extend credit to players contingent upon our marketing team’s knowledge of the players, their fi nancial background and payment history. We follow a series of credit procedures and require from each credit recipient various signed documents that are intended to ensure among other things that, if permitted by applicable law, the debt can be legally enforced in the jurisdiction where the player resides. In the event the player does not reside in a jurisdiction where gaming debts are legally enforceable, we often can assert jurisdiction over assets the player maintains in jurisdictions where gaming debts are recognized. In addition, we typically require a check in the amount of the applicable credit line from credit players, collateralizing the credit we grant to a player.

Number and Mix of Table Games and Slot Machines

The mix of VIP table games, mass table games and slot machines in operation at our resort changes from time to time as a result of marketing and operating strategies in response to changing market demand and industry competition. The shift in the mix of our games will affect casino profi tability.

10 Wynn Macau, Limited

Management Discussion and Analysis

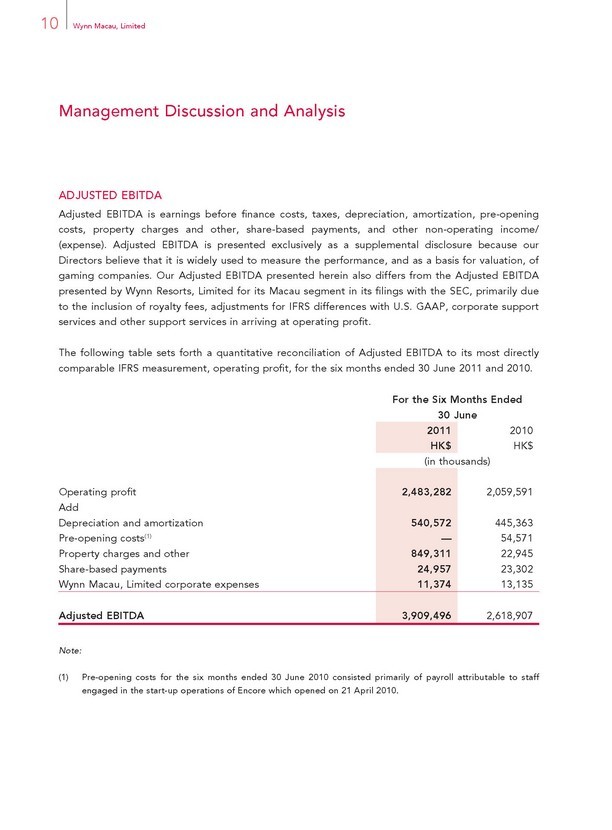

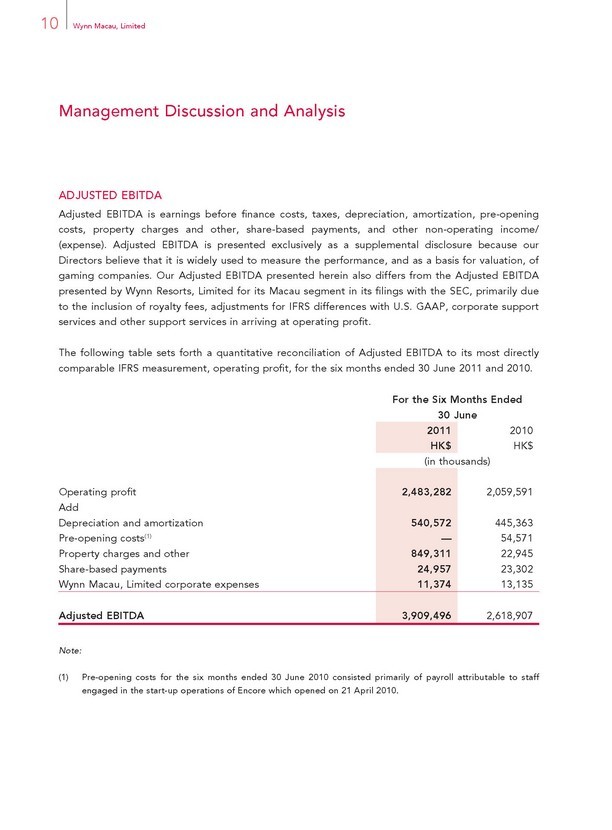

ADJUSTED EBITDA

Adjusted EBITDA is earnings before fi nance costs, taxes, depreciation, amortization, pre-opening costs, property charges and other, share-based payments, and other non-operating income/ (expense). Adjusted EBITDA is presented exclusively as a supplemental disclosure because our Directors believe that it is widely used to measure the performance, and as a basis for valuation, of gaming companies. Our Adjusted EBITDA presented herein also differs from the Adjusted EBITDA presented by Wynn Resorts, Limited for its Macau segment in its fi lings with the SEC, primarily due to the inclusion of royalty fees, adjustments for IFRS differences with U.S. GAAP, corporate support services and other support services in arriving at operating profi t.

The following table sets forth a quantitative reconciliation of Adjusted EBITDA to its most directly comparable IFRS measurement, operating profi t, for the six months ended 30 June 2011 and 2010.

For the Six Months Ended

30 June

2011 2010

HK$ HK$

(in thousands)

Operating profi t 2,483,282 2,059,591

Add

Depreciation and amortization 540,572 445,363

Pre-opening costs(1) — 54,571

Property charges and other 849,311 22,945

Share-based payments 24,957 23,302

Wynn Macau, Limited corporate expenses 11,374 13,135

Adjusted EBITDA 3,909,496 2,618,907

Note:

Pre-opening costs for the six months ended 30 June 2010 consisted primarily of payroll attributable to staff engaged in the start-up operations of Encore which opened on 21 April 2010.

Interim Report 2011 11

Management Discussion and Analysis

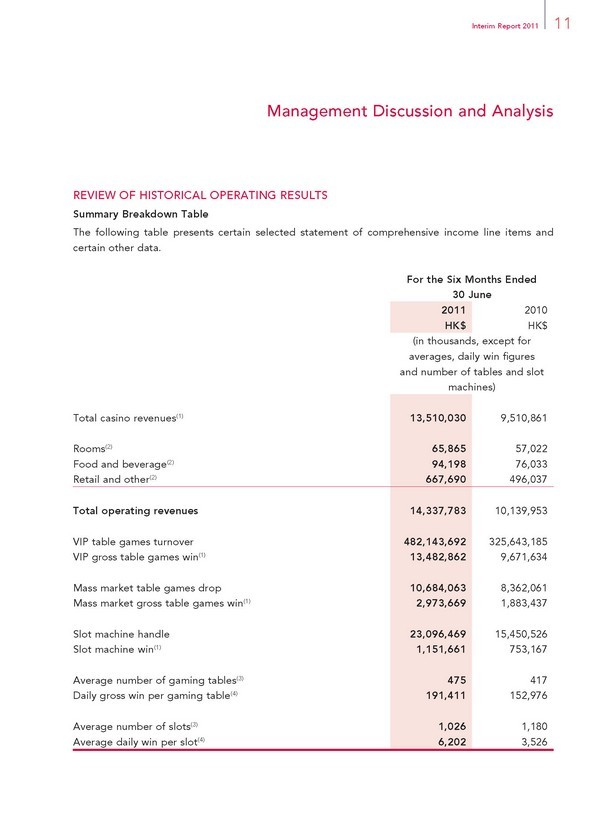

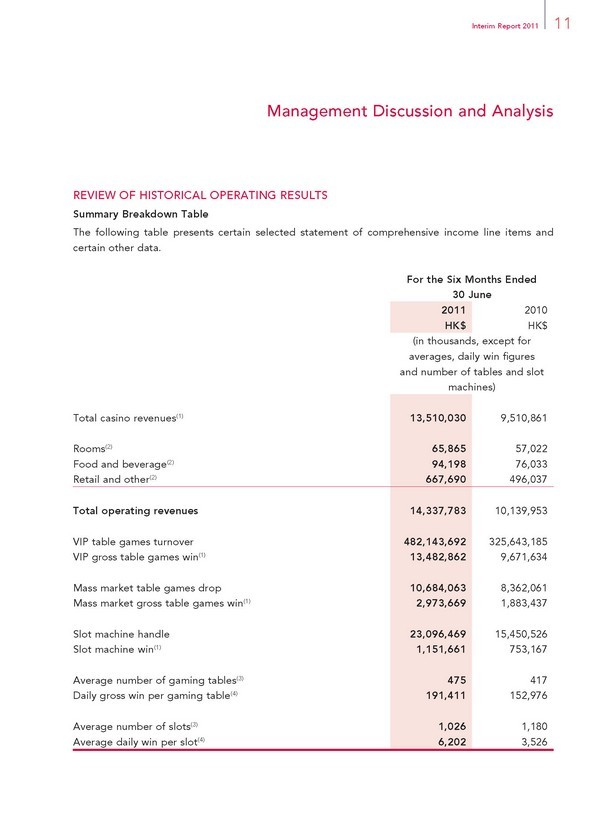

REVIEW OF HISTORICAL OPERATING RESULTS

Summary Breakdown Table

The following table presents certain selected statement of comprehensive income line items and certain other data.

For the Six Months Ended

30 June

2011 2010

HK$ HK$

(in thousands, except for

averages, daily win fi gures

and number of tables and slot

machines)

Total casino revenues(1) 13,510,030 9,510,861

Rooms(2) 65,865 57,022

Food and beverage(2) 94,198 76,033

Retail and other(2) 667,690 496,037

Total operating revenues 14,337,783 10,139,953

VIP table games turnover 482,143,692 325,643,185

VIP gross table games win(1) 13,482,862 9,671,634

Mass market table games drop 10,684,063 8,362,061

Mass market gross table games win(1) 2,973,669 1,883,437

Slot machine handle 23,096,469 15,450,526

Slot machine win(1) 1,151,661 753,167

Average number of gaming tables(3) 475 417

Daily gross win per gaming table(4) 191,411 152,976

Average number of slots(3) 1,026 1,180

Average daily win per slot(4) 6,202 3,526

12 Wynn Macau, Limited

Management Discussion and Analysis

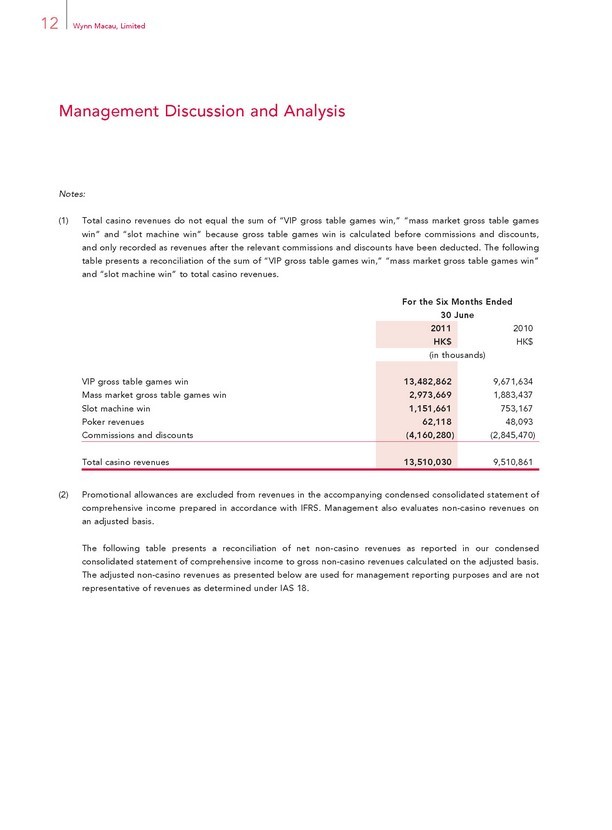

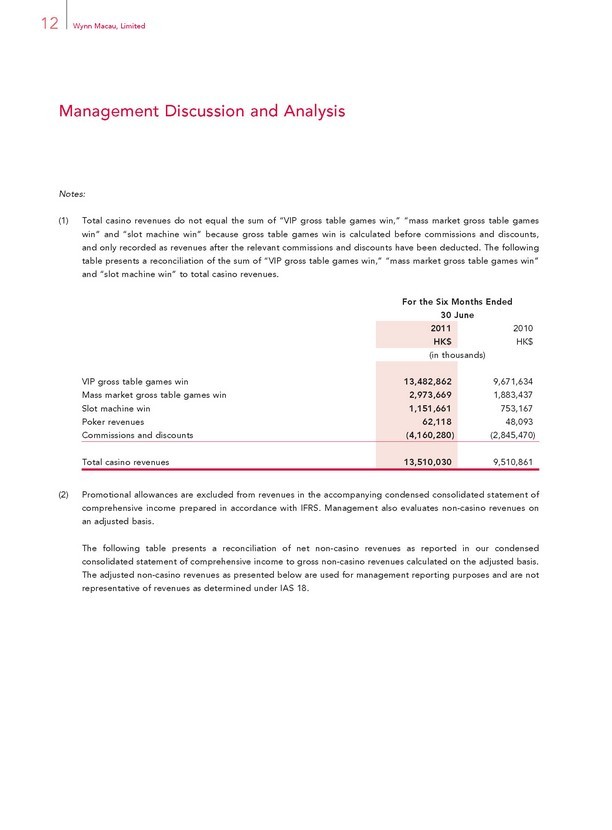

Notes:

Total casino revenues do not equal the sum of “VIP gross table games win,” “mass market gross table games win” and “slot machine win” because gross table games win is calculated before commissions and discounts, and only recorded as revenues after the relevant commissions and discounts have been deducted. The following table presents a reconciliation of the sum of “VIP gross table games win,” “mass market gross table games win” and “slot machine win” to total casino revenues.

For the Six Months Ended

30 June

2011 2010

HK$ HK$

(in thousands)

VIP gross table games win 13,482,862 9,671,634

Mass market gross table games win 2,973,669 1,883,437

Slot machine win 1,151,661 753,167

Poker revenues 62,118 48,093

Commissions and discounts (4,160,280) (2,845,470)

Total casino revenues 13,510,030 9,510,861

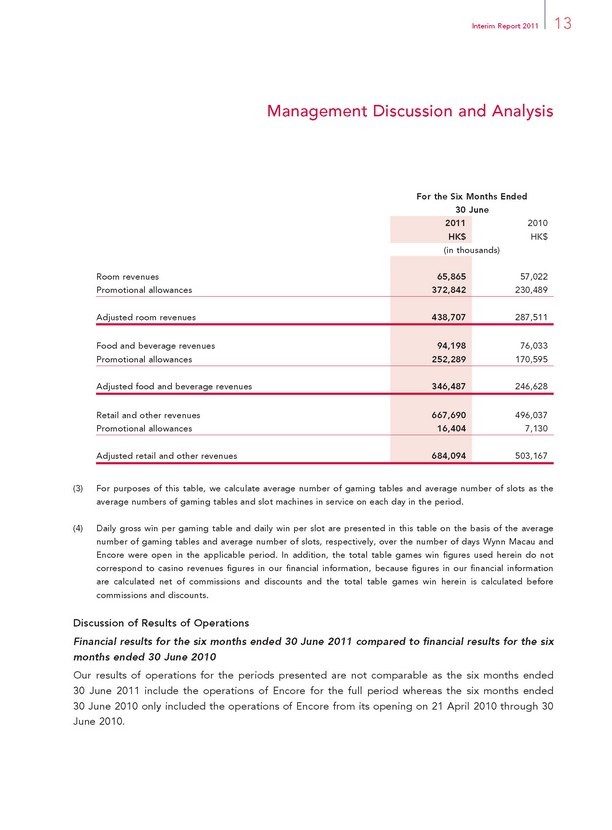

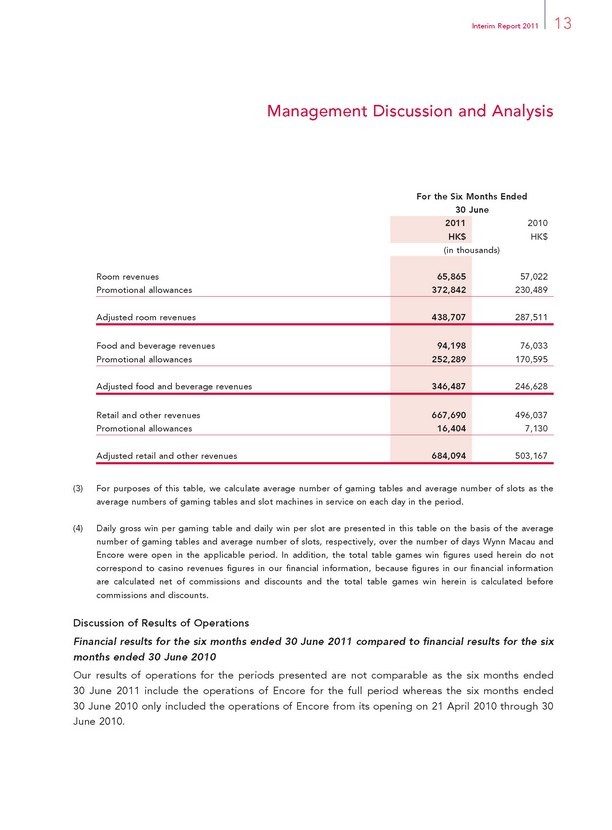

Promotional allowances are excluded from revenues in the accompanying condensed consolidated statement of comprehensive income prepared in accordance with IFRS. Management also evaluates non-casino revenues on an adjusted basis.

The following table presents a reconciliation of net non-casino revenues as reported in our condensed consolidated statement of comprehensive income to gross non-casino revenues calculated on the adjusted basis. The adjusted non-casino revenues as presented below are used for management reporting purposes and are not representative of revenues as determined under IAS 18.

Interim Report 2011 13

Management Discussion and Analysis

For the Six Months Ended

30 June

2011 2010

HK$ HK$

(in thousands)

Room revenues 65,865 57,022

Promotional allowances 372,842 230,489

Adjusted room revenues 438,707 287,511

Food and beverage revenues 94,198 76,033

Promotional allowances 252,289 170,595

Adjusted food and beverage revenues 346,487 246,628

Retail and other revenues 667,690 496,037

Promotional allowances 16,404 7,130

Adjusted retail and other revenues 684,094 503,167

For purposes of this table, we calculate average number of gaming tables and average number of slots as the average numbers of gaming tables and slot machines in service on each day in the period.

Daily gross win per gaming table and daily win per slot are presented in this table on the basis of the average number of gaming tables and average number of slots, respectively, over the number of days Wynn Macau and Encore were open in the applicable period. In addition, the total table games win fi gures used herein do not correspond to casino revenues fi gures in our fi nancial information, because fi gures in our fi nancial information are calculated net of commissions and discounts and the total table games win herein is calculated before commissions and discounts.

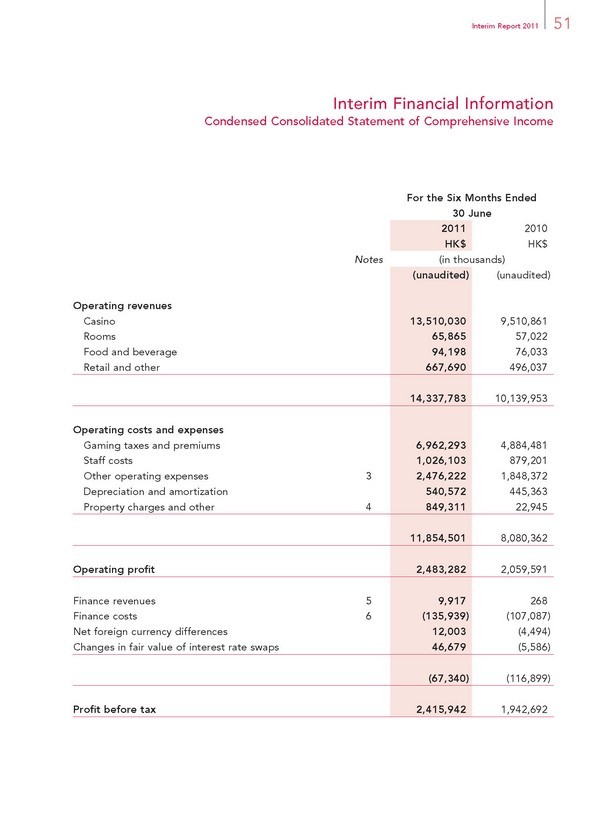

Discussion of Results of Operations

Financial results for the six months ended 30 June 2011 compared to fi nancial results for the six months ended 30 June 2010

Our results of operations for the periods presented are not comparable as the six months ended 30 June 2011 include the operations of Encore for the full period whereas the six months ended 30 June 2010 only included the operations of Encore from its opening on 21 April 2010 through 30 June 2010.

14 Wynn Macau, Limited

Management Discussion and Analysis

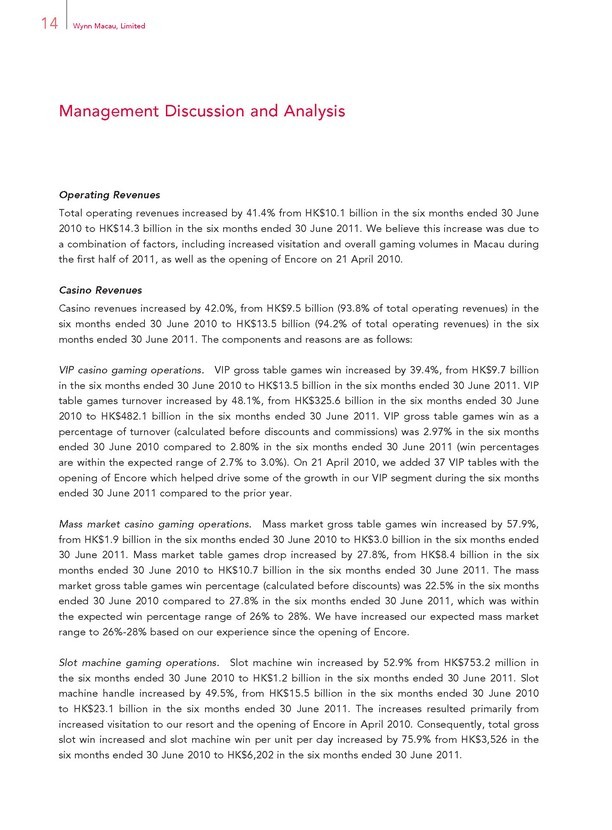

Operating Revenues

Total operating revenues increased by 41.4% from HK$10.1 billion in the six months ended 30 June 2010 to HK$14.3 billion in the six months ended 30 June 2011. We believe this increase was due to a combination of factors, including increased visitation and overall gaming volumes in Macau during the fi rst half of 2011, as well as the opening of Encore on 21 April 2010.

Casino Revenues

Casino revenues increased by 42.0%, from HK$9.5 billion (93.8% of total operating revenues) in the six months ended 30 June 2010 to HK$13.5 billion (94.2% of total operating revenues) in the six months ended 30 June 2011. The components and reasons are as follows:

VIP casino gaming operations. VIP gross table games win increased by 39.4%, from HK$9.7 billion in the six months ended 30 June 2010 to HK$13.5 billion in the six months ended 30 June 2011. VIP table games turnover increased by 48.1%, from HK$325.6 billion in the six months ended 30 June 2010 to HK$482.1 billion in the six months ended 30 June 2011. VIP gross table games win as a percentage of turnover (calculated before discounts and commissions) was 2.97% in the six months ended 30 June 2010 compared to 2.80% in the six months ended 30 June 2011 (win percentages are within the expected range of 2.7% to 3.0%). On 21 April 2010, we added 37 VIP tables with the opening of Encore which helped drive some of the growth in our VIP segment during the six months ended 30 June 2011 compared to the prior year.

Mass market casino gaming operations. Mass market gross table games win increased by 57.9%, from HK$1.9 billion in the six months ended 30 June 2010 to HK$3.0 billion in the six months ended 30 June 2011. Mass market table games drop increased by 27.8%, from HK$8.4 billion in the six months ended 30 June 2010 to HK$10.7 billion in the six months ended 30 June 2011. The mass market gross table games win percentage (calculated before discounts) was 22.5% in the six months ended 30 June 2010 compared to 27.8% in the six months ended 30 June 2011, which was within the expected win percentage range of 26% to 28%. We have increased our expected mass market range to 26%-28% based on our experience since the opening of Encore.

Slot machine gaming operations. Slot machine win increased by 52.9% from HK$753.2 million in the six months ended 30 June 2010 to HK$1.2 billion in the six months ended 30 June 2011. Slot machine handle increased by 49.5%, from HK$15.5 billion in the six months ended 30 June 2010 to HK$23.1 billion in the six months ended 30 June 2011. The increases resulted primarily from increased visitation to our resort and the opening of Encore in April 2010. Consequently, total gross slot win increased and slot machine win per unit per day increased by 75.9% from HK$3,526 in the six months ended 30 June 2010 to HK$6,202 in the six months ended 30 June 2011.

Interim Report 2011 15

Management Discussion and Analysis

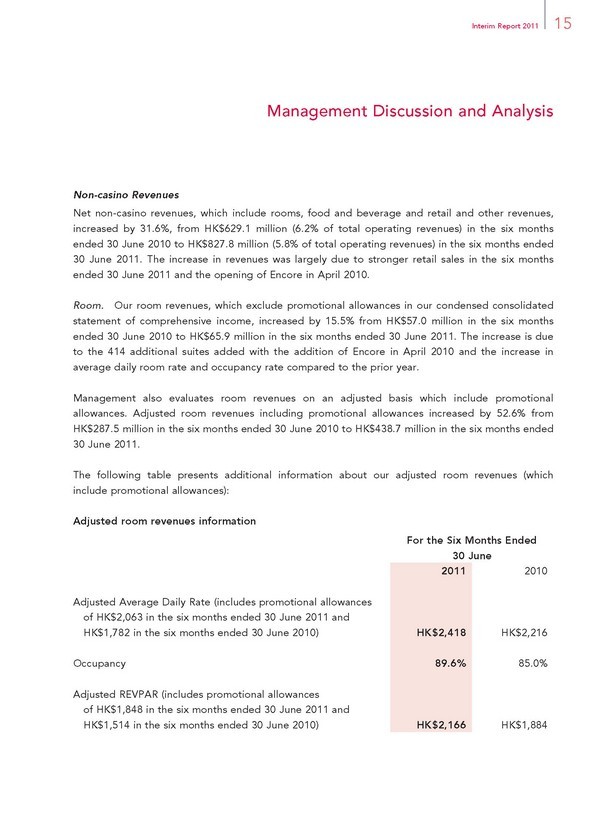

Non-casino Revenues

Net non-casino revenues, which include rooms, food and beverage and retail and other revenues, increased by 31.6%, from HK$629.1 million (6.2% of total operating revenues) in the six months ended 30 June 2010 to HK$827.8 million (5.8% of total operating revenues) in the six months ended 30 June 2011. The increase in revenues was largely due to stronger retail sales in the six months ended 30 June 2011 and the opening of Encore in April 2010.

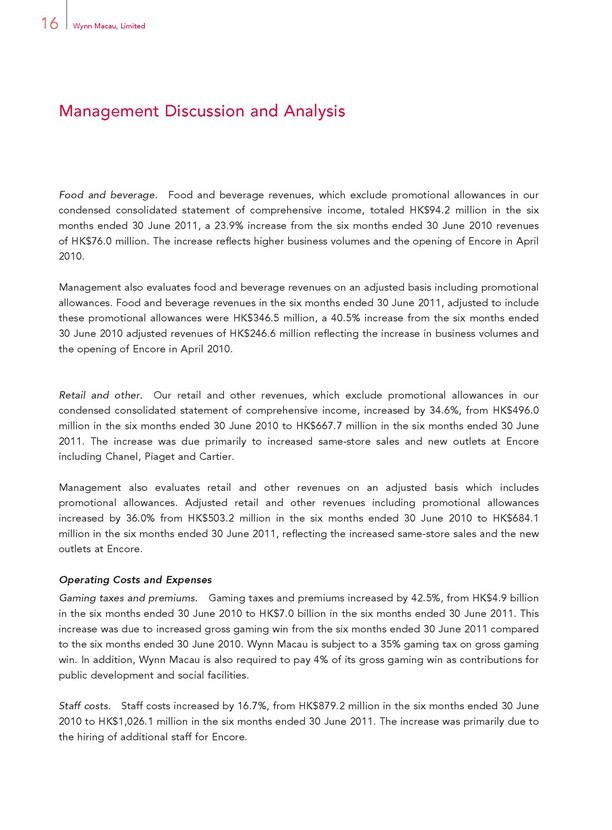

Room. Our room revenues, which exclude promotional allowances in our condensed consolidated statement of comprehensive income, increased by 15.5% from HK$57.0 million in the six months ended 30 June 2010 to HK$65.9 million in the six months ended 30 June 2011. The increase is due to the 414 additional suites added with the addition of Encore in April 2010 and the increase in average daily room rate and occupancy rate compared to the prior year.

Management also evaluates room revenues on an adjusted basis which include promotional allowances. Adjusted room revenues including promotional allowances increased by 52.6% from HK$287.5 million in the six months ended 30 June 2010 to HK$438.7 million in the six months ended 30 June 2011.

The following table presents additional information about our adjusted room revenues (which include promotional allowances):

Adjusted room revenues information

For the Six Months Ended

30 June

2011 2010

Adjusted Average Daily Rate (includes promotional allowances

of HK$2,063 in the six months ended 30 June 2011 and

HK$1,782 in the six months ended 30 June 2010) HK$2,418 HK$2,216

Occupancy 89.6% 85.0%

Adjusted REVPAR (includes promotional allowances

of HK$1,848 in the six months ended 30 June 2011 and

HK$1,514 in the six months ended 30 June 2010) HK$2,166 HK$1,884

16 Wynn Macau, Limited

Management Discussion and Analysis

Food and beverage. Food and beverage revenues, which exclude promotional allowances in our condensed consolidated statement of comprehensive income, totaled HK$94.2 million in the six months ended 30 June 2011, a 23.9% increase from the six months ended 30 June 2010 revenues of HK$76.0 million. The increase refl ects higher business volumes and the opening of Encore in April 2010.

Management also evaluates food and beverage revenues on an adjusted basis including promotional allowances. Food and beverage revenues in the six months ended 30 June 2011, adjusted to include these promotional allowances were HK$346.5 million, a 40.5% increase from the six months ended 30 June 2010 adjusted revenues of HK$246.6 million refl ecting the increase in business volumes and the opening of Encore in April 2010.

Retail and other. Our retail and other revenues, which exclude promotional allowances in our condensed consolidated statement of comprehensive income, increased by 34.6%, from HK$496.0 million in the six months ended 30 June 2010 to HK$667.7 million in the six months ended 30 June 2011. The increase was due primarily to increased same-store sales and new outlets at Encore including Chanel, Piaget and Cartier.

Management also evaluates retail and other revenues on an adjusted basis which includes promotional allowances. Adjusted retail and other revenues including promotional allowances increased by 36.0% from HK$503.2 million in the six months ended 30 June 2010 to HK$684.1 million in the six months ended 30 June 2011, refl ecting the increased same-store sales and the new outlets at Encore.

Operating Costs and Expenses

Gaming taxes and premiums. Gaming taxes and premiums increased by 42.5%, from HK$4.9 billion in the six months ended 30 June 2010 to HK$7.0 billion in the six months ended 30 June 2011. This increase was due to increased gross gaming win from the six months ended 30 June 2011 compared to the six months ended 30 June 2010. Wynn Macau is subject to a 35% gaming tax on gross gaming win. In addition, Wynn Macau is also required to pay 4% of its gross gaming win as contributions for public development and social facilities.

Staff costs. Staff costs increased by 16.7%, from HK$879.2 million in the six months ended 30 June 2010 to HK$1,026.1 million in the six months ended 30 June 2011. The increase was primarily due to the hiring of additional staff for Encore.

Interim Report 2011 17

Management Discussion and Analysis

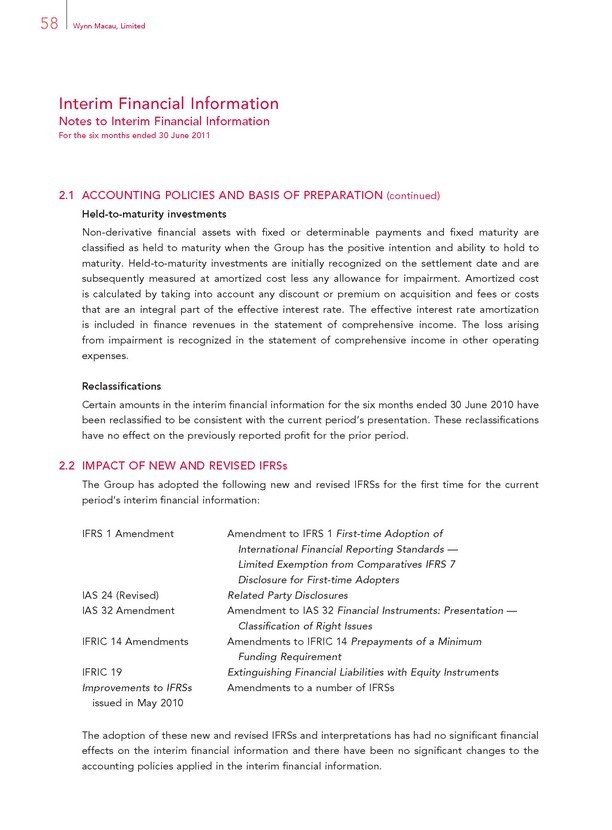

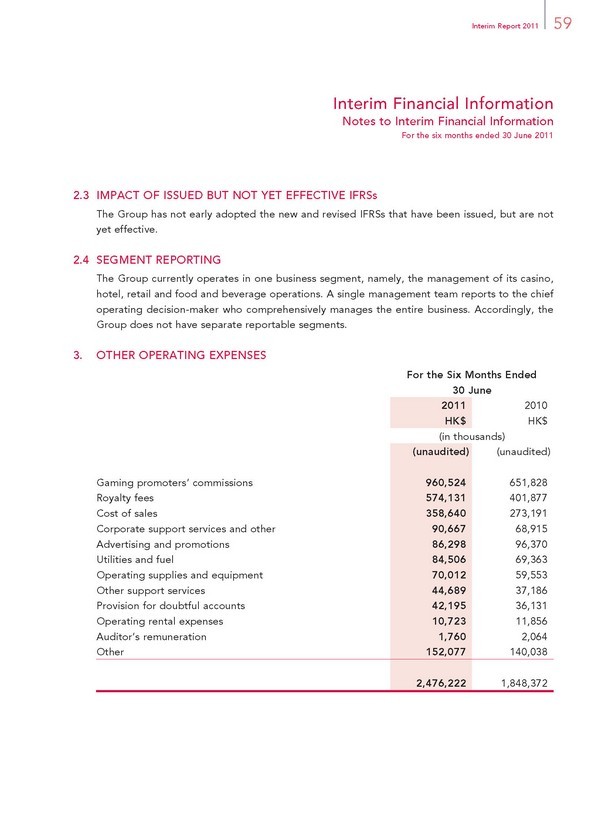

Other operating expenses. Other operating expenses increased by 34.0%, from HK$1.8 billion in the six months ended 30 June 2010 to HK$2.5 billion in the six months ended 30 June 2011. The increase in other operating costs was primarily due to the opening of Encore.

Depreciation and amortization. Depreciation and amortization increased by 21.4% from HK$445.4 million in the six months ended 30 June 2010 to HK$540.6 million in the six months ended 30 June 2011. This increase was primarily due to the impact of assets placed in service with the opening of Encore in April 2010.

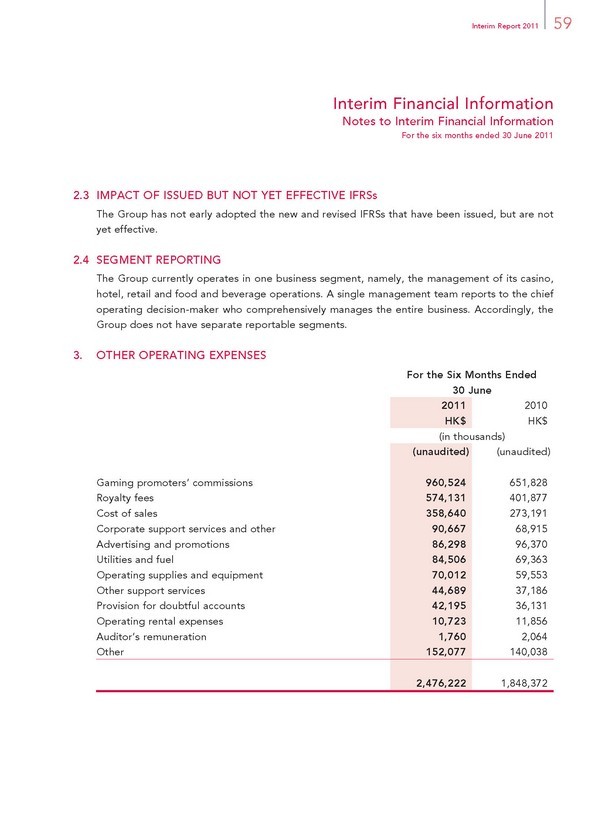

Property charges and other. Property charges and other increased from HK$22.9 million in the six months ended 30 June 2010 to HK$849.3 million in the six months ended 30 June 2011. Included in property charges and other for the six months ended 30 June 2011 is a charge of HK$831.1 million refl ecting the present value of a charitable contribution made by WRM to the University of Macau Development Foundation. This contribution consists of a MOP200.0 million (approximately HK$194.2 million) payment made in May 2011, and a commitment for additional donations of MOP80.0 million (approximately HK$77.7 million) each year for the calendar years 2012 through 2022 inclusive, for a total of MOP1,080.0 million (approximately HK$1,048.5 million). The amount refl ected in our accompanying condensed consolidated statement of comprehensive income has been discounted using our current estimated borrowing rate over the time period of the remaining committed payments. Other charges in each period represent gain/loss on the sale of equipment as well as costs related to assets retired or abandoned as a result of renovating certain assets of Wynn Macau in response to customer preferences and changes in market demand.

As a result of the foregoing, total operating costs and expenses increased by 46.7%, from HK$8.1 billion in the six months ended 30 June 2010 to HK$11.9 billion in the six months ended 30 June 2011.

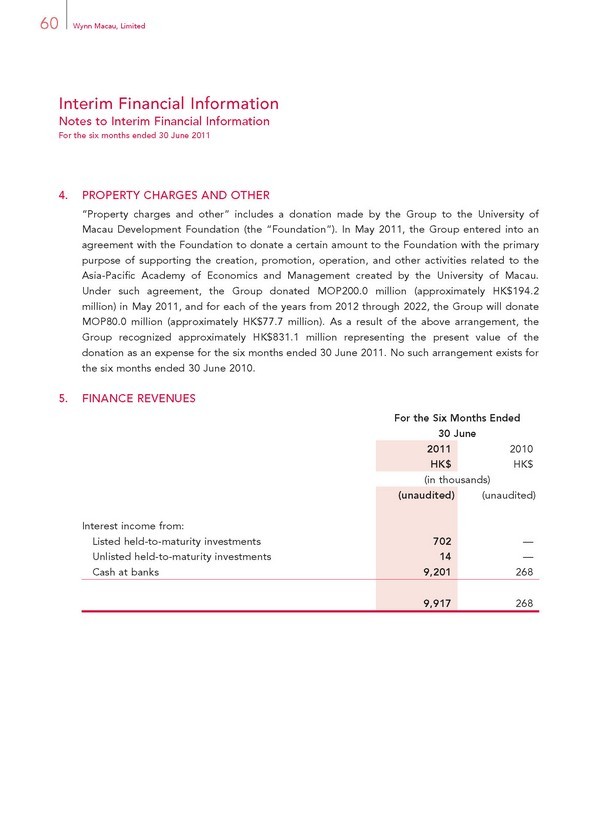

Finance Revenues

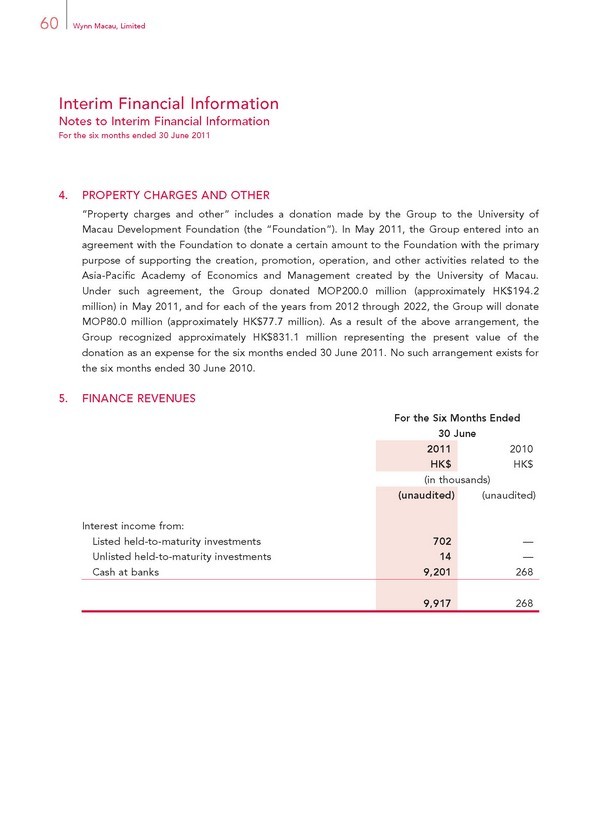

Finance revenues increased from HK$0.3 million in the six months ended 30 June 2010 to HK$9.9 million in the six months ended 30 June 2011. During 2011 and 2010, our short-term investment strategy has been to preserve capital while retaining suffi cient liquidity. While we have recently invested in certain corporate debt securities which contributed to the increase in interest income, the majority of our short-term investments are primarily in time deposits with a maturity of three months or less.

18 Wynn Macau, Limited

Management Discussion and Analysis

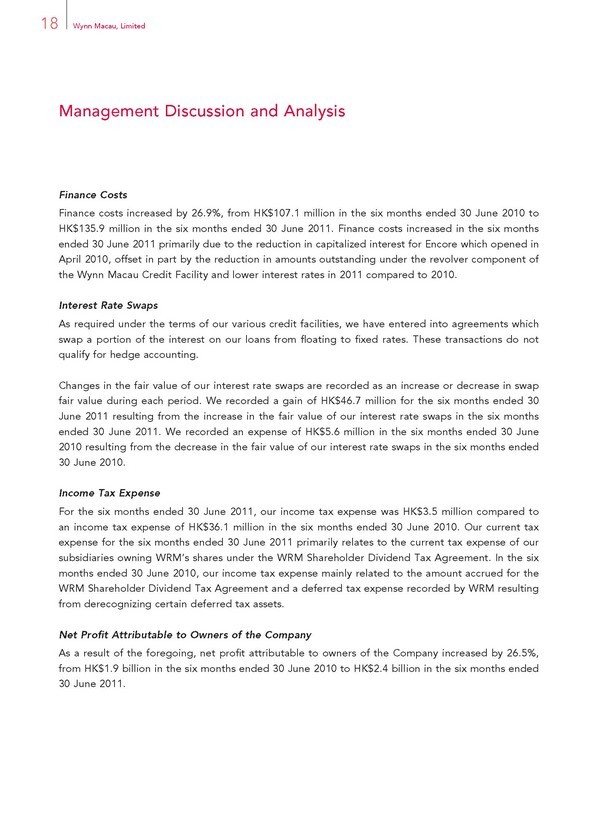

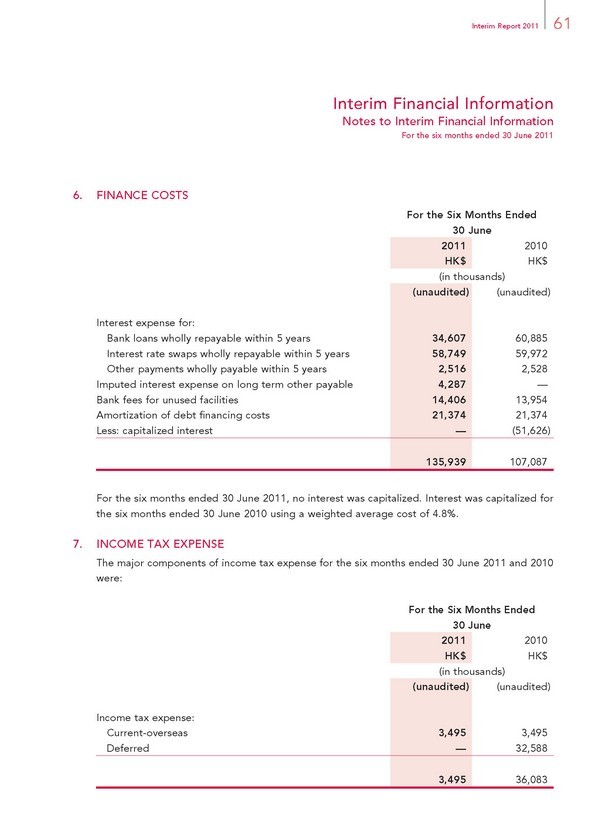

Finance Costs

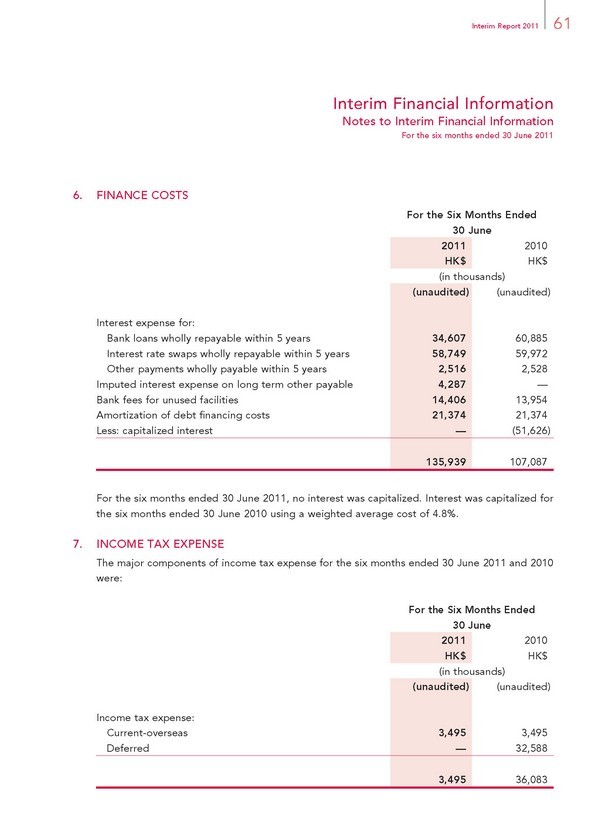

Finance costs increased by 26.9%, from HK$107.1 million in the six months ended 30 June 2010 to HK$135.9 million in the six months ended 30 June 2011. Finance costs increased in the six months ended 30 June 2011 primarily due to the reduction in capitalized interest for Encore which opened in April 2010, offset in part by the reduction in amounts outstanding under the revolver component of the Wynn Macau Credit Facility and lower interest rates in 2011 compared to 2010.

Interest Rate Swaps

As required under the terms of our various credit facilities, we have entered into agreements which swap a portion of the interest on our loans from fl oating to fi xed rates. These transactions do not qualify for hedge accounting.

Changes in the fair value of our interest rate swaps are recorded as an increase or decrease in swap fair value during each period. We recorded a gain of HK$46.7 million for the six months ended 30 June 2011 resulting from the increase in the fair value of our interest rate swaps in the six months ended 30 June 2011. We recorded an expense of HK$5.6 million in the six months ended 30 June 2010 resulting from the decrease in the fair value of our interest rate swaps in the six months ended 30 June 2010.

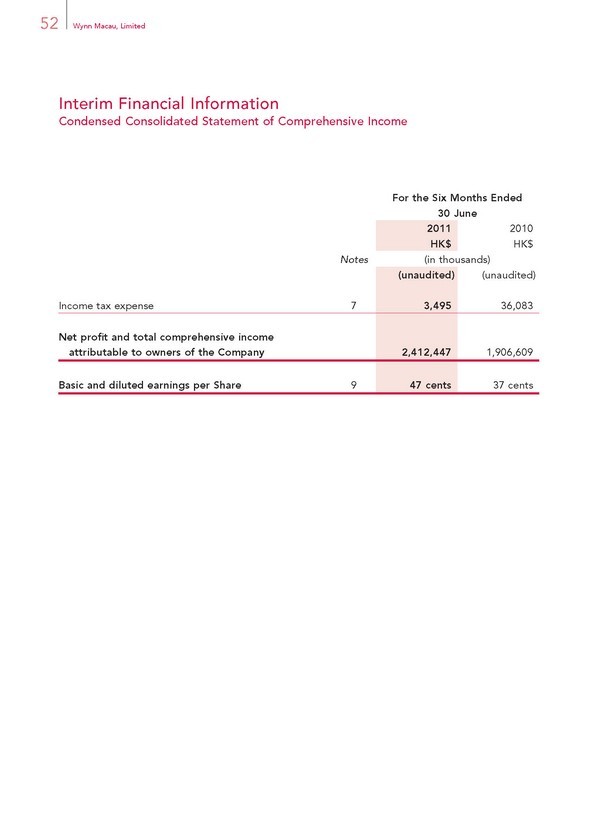

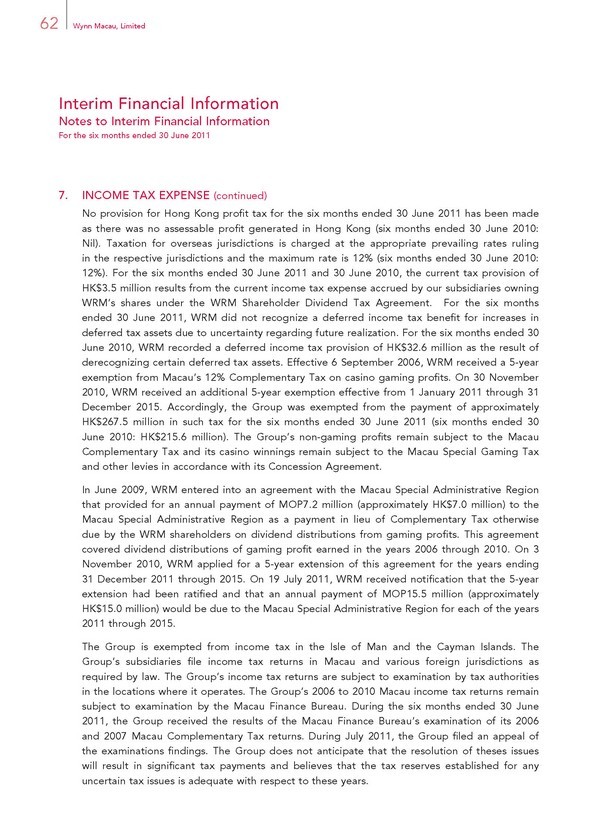

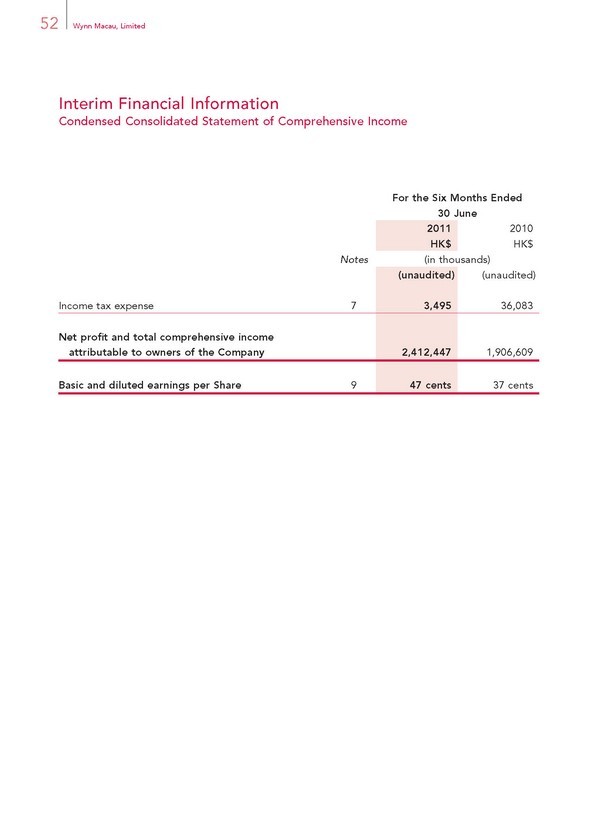

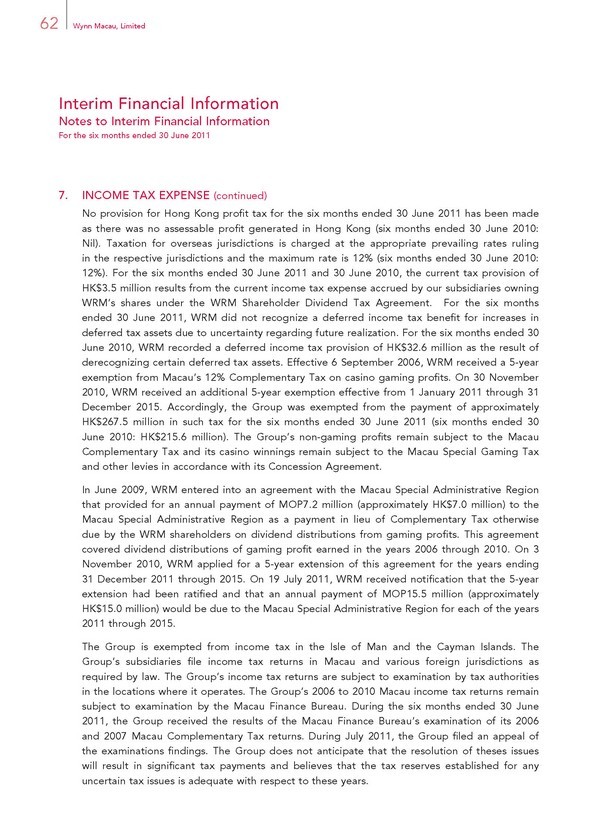

Income Tax Expense

For the six months ended 30 June 2011, our income tax expense was HK$3.5 million compared to an income tax expense of HK$36.1 million in the six months ended 30 June 2010. Our current tax expense for the six months ended 30 June 2011 primarily relates to the current tax expense of our subsidiaries owning WRM’s shares under the WRM Shareholder Dividend Tax Agreement. In the six months ended 30 June 2010, our income tax expense mainly related to the amount accrued for the WRM Shareholder Dividend Tax Agreement and a deferred tax expense recorded by WRM resulting from derecognizing certain deferred tax assets.

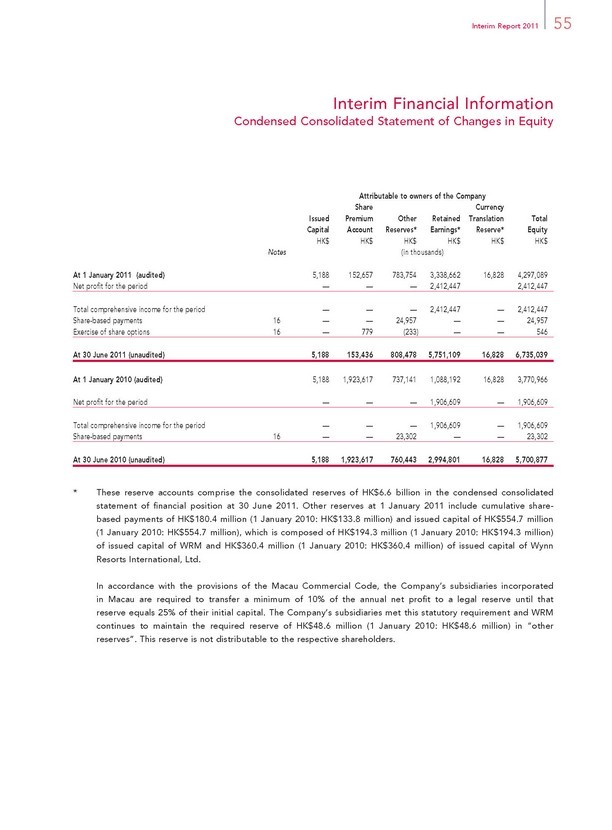

Net Profi t Attributable to Owners of the Company

As a result of the foregoing, net profi t attributable to owners of the Company increased by 26.5%, from HK$1.9 billion in the six months ended 30 June 2010 to HK$2.4 billion in the six months ended 30 June 2011.

Interim Report 2011 19

Management Discussion and Analysis

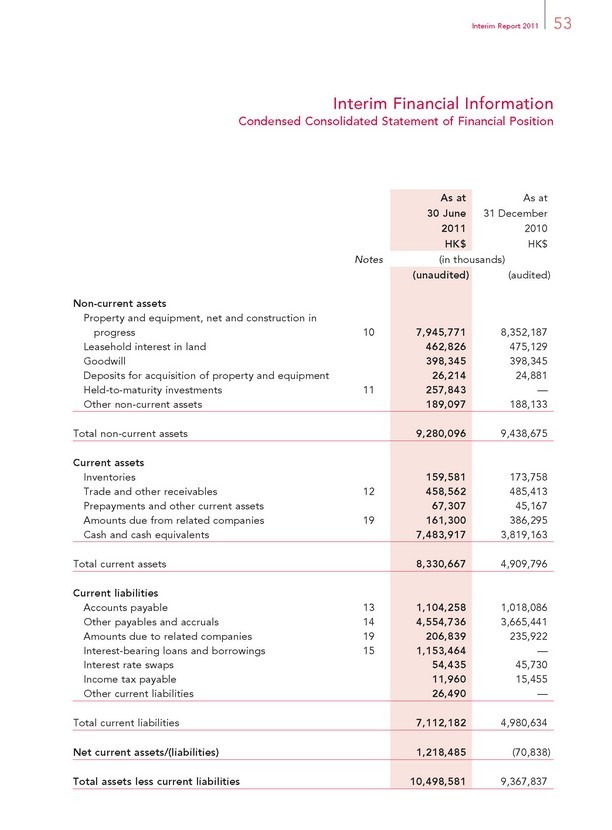

LIQUIDITY AND CAPITAL RESOURCES

Capital Resources

Since Wynn Macau opened in 2006, we have generally funded our working capital and recurring expenses as well as capital expenditures from cash fl ow from operations and cash on hand.

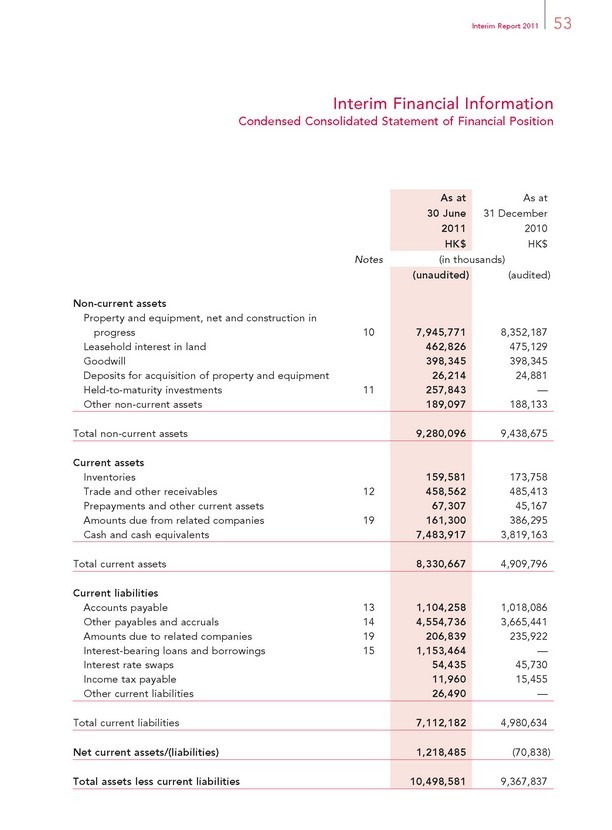

Our cash balances as at 30 June 2011 were HK$7.5 billion. Such cash is available for operations, new development activities, enhancements to Wynn Macau and Encore and general corporate purposes.

In addition, as at 30 June 2011, we had HK$7.7 billion available to draw under the Wynn Macau Credit Facilities.

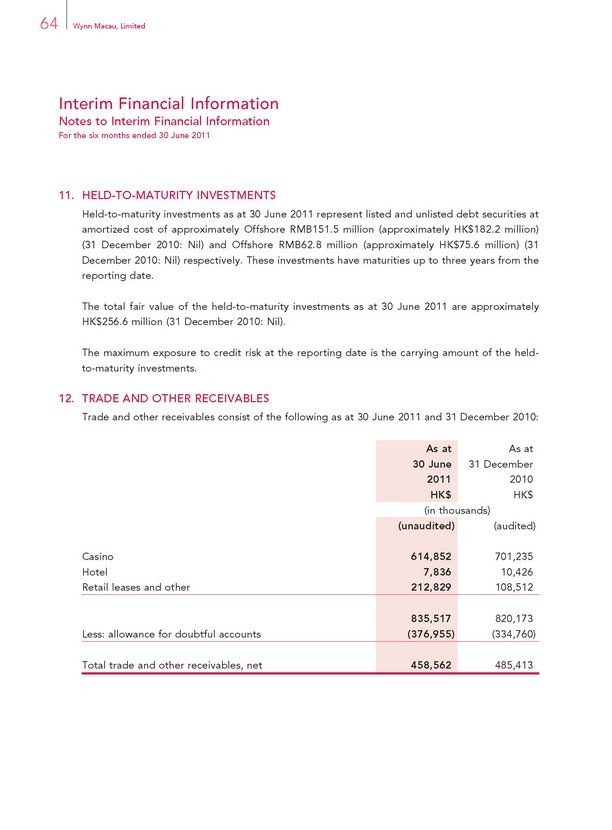

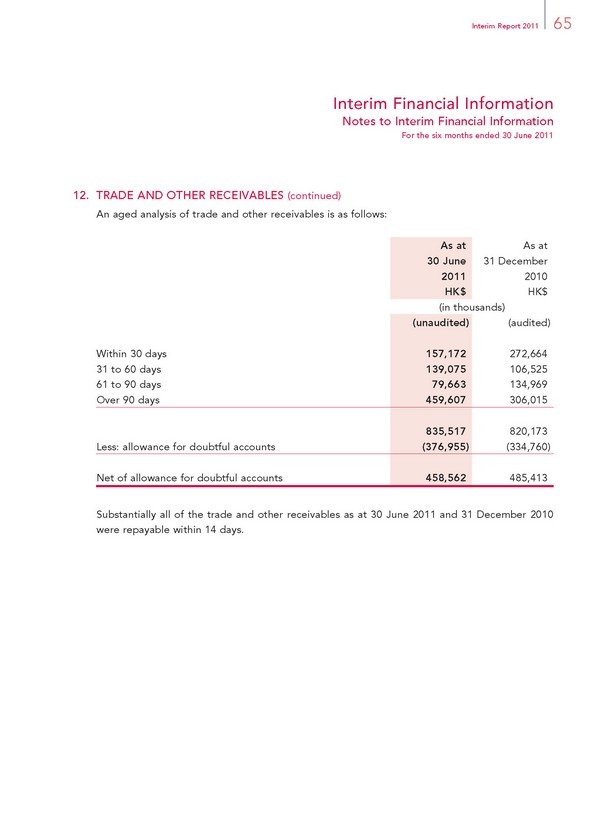

Investments

As at 30 June 2011, the Group had net investments in Offshore RMB denominated debt securities with maturities of up to three years that amounted to Offshore RMB214.3 million (approximately HK$257.8 million) compared to nil as at 31 December 2010.

20 Wynn Macau, Limited

Management Discussion and Analysis

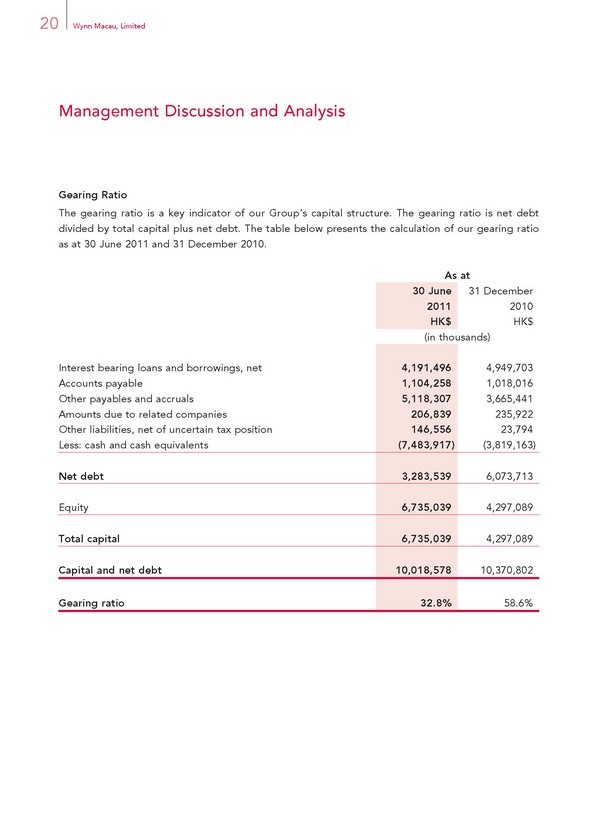

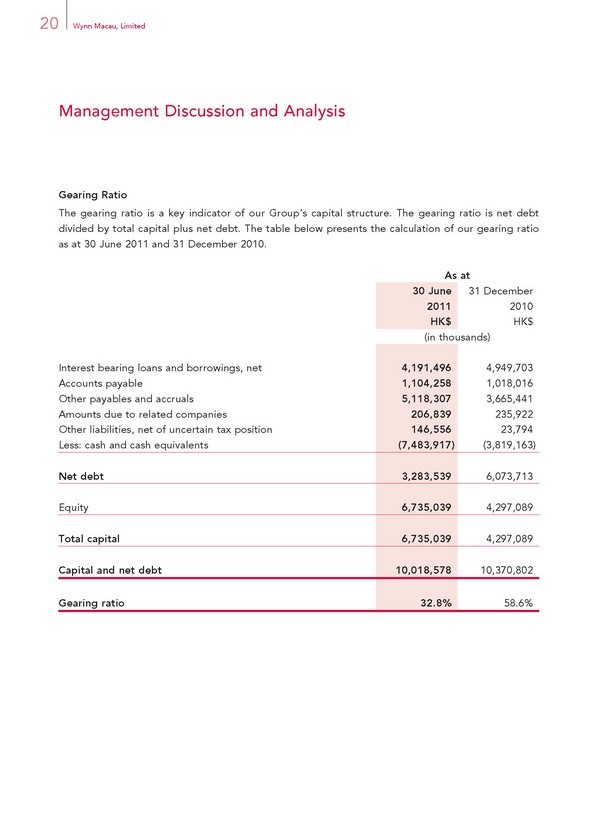

Gearing Ratio

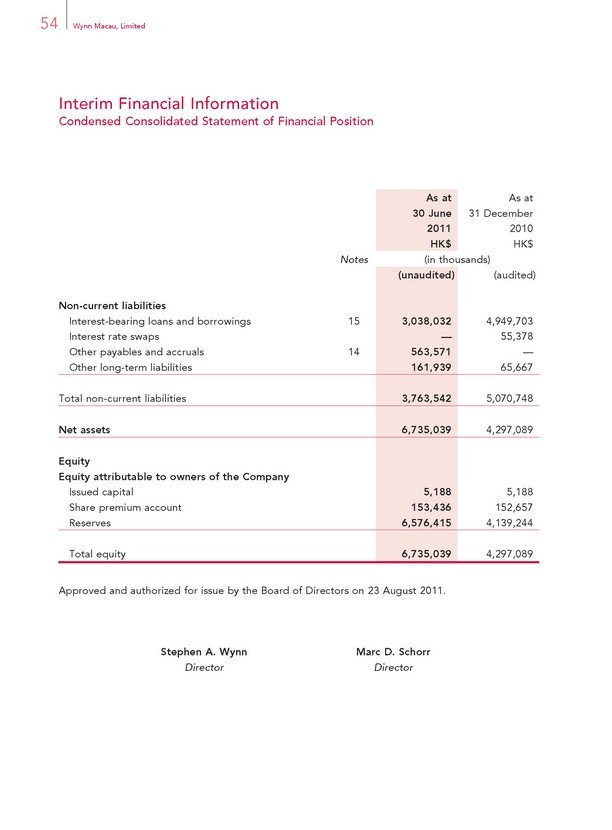

The gearing ratio is a key indicator of our Group’s capital structure. The gearing ratio is net debt divided by total capital plus net debt. The table below presents the calculation of our gearing ratio as at 30 June 2011 and 31 December 2010.

As at

30 June 31 December

2011 2010

HK$ HK$

(in thousands)

Interest bearing loans and borrowings, net 4,191,496 4,949,703

Accounts payable 1,104,258 1,018,016

Other payables and accruals 5,118,307 3,665,441

Amounts due to related companies 206,839 235,922

Other liabilities, net of uncertain tax position 146,556 23,794

Less: cash and cash equivalents (7,483,917) (3,819,163)

Net debt 3,283,539 6,073,713

Equity 6,735,039 4,297,089

Total capital 6,735,039 4,297,089

Capital and net debt 10,018,578 10,370,802

Gearing ratio 32.8% 58.6%

Interim Report 2011 21

Management Discussion and Analysis

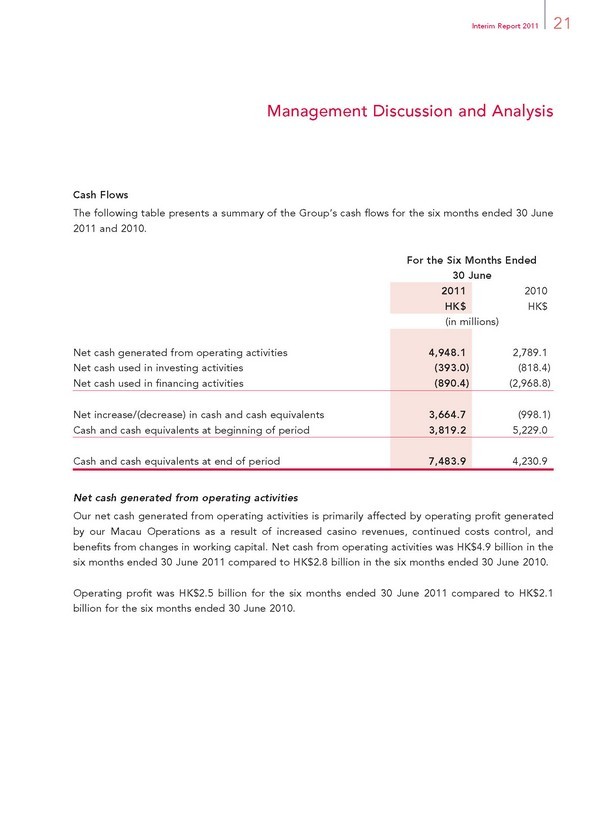

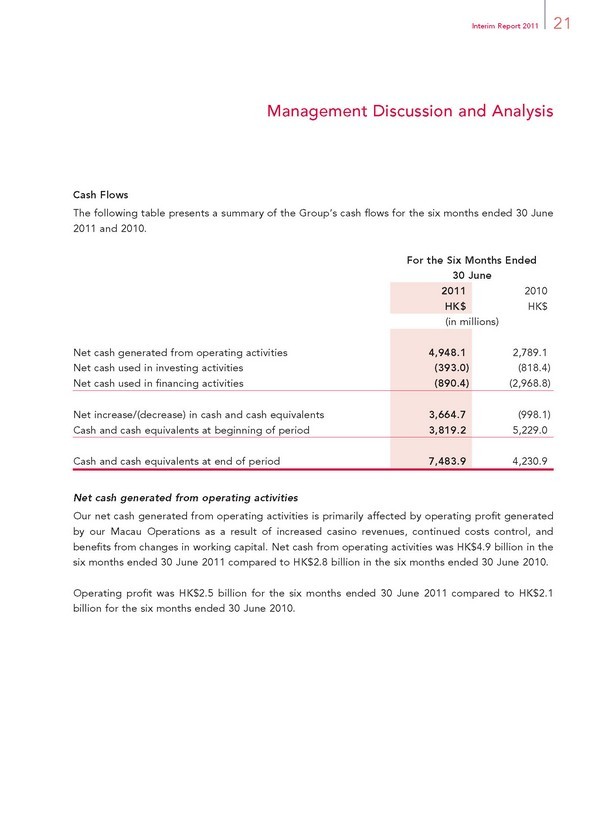

Cash Flows

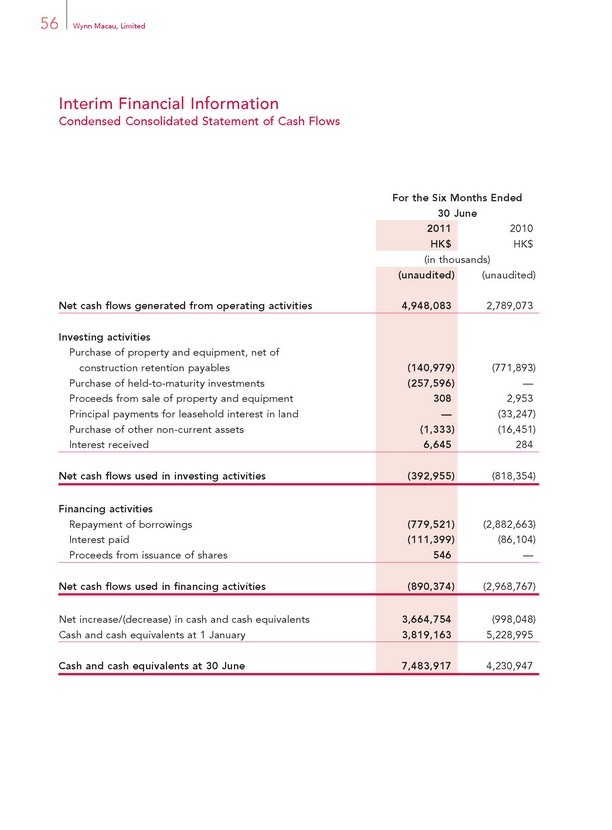

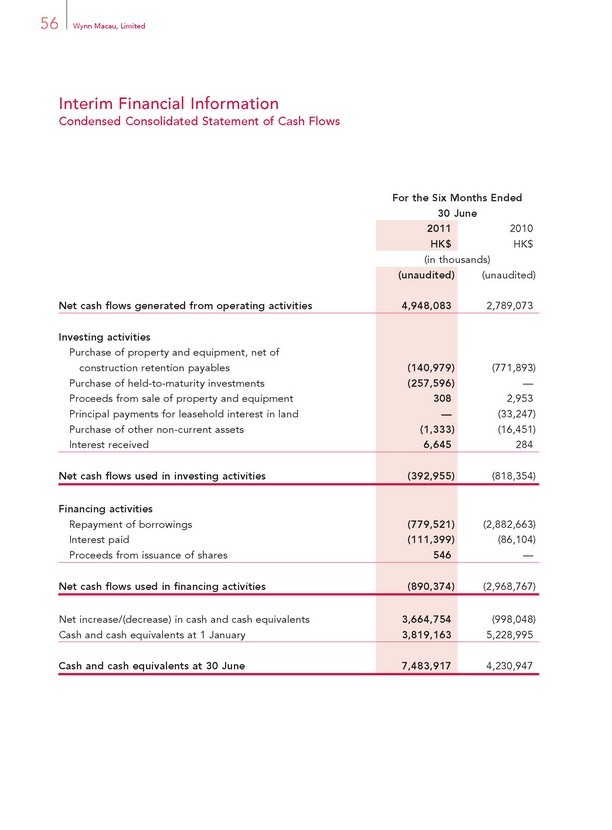

The following table presents a summary of the Group’s cash fl ows for the six months ended 30 June 2011 and 2010.

For the Six Months Ended

30 June

2011 2010

HK$ HK$

(in millions)

Net cash generated from operating activities 4,948.1 2,789.1

Net cash used in investing activities (393.0) (818.4)

Net cash used in fi nancing activities (890.4) (2,968.8)

Net increase/(decrease) in cash and cash equivalents 3,664.7 (998.1)

Cash and cash equivalents at beginning of period 3,819.2 5,229.0

Cash and cash equivalents at end of period 7,483.9 4,230.9

Net cash generated from operating activities

Our net cash generated from operating activities is primarily affected by operating profi t generated by our Macau Operations as a result of increased casino revenues, continued costs control, and benefi ts from changes in working capital. Net cash from operating activities was HK$4.9 billion in the six months ended 30 June 2011 compared to HK$2.8 billion in the six months ended 30 June 2010.

Operating profi t was HK$2.5 billion for the six months ended 30 June 2011 compared to HK$2.1 billion for the six months ended 30 June 2010.

22 Wynn Macau, Limited

Management Discussion and Analysis

Net cash used in investing activities

Net cash used in investing activities was HK$393.0 million in the six months ended 30 June 2011, compared to net cash used in investing activities of HK$818.4 million in the six months ended 30 June 2010.

Capital expenditures were HK$141.0 million for the six months ended 30 June 2011, and related primarily to renovation projects to enhance and refi ne the Macau Operations. Capital expenditures for the six months ended 30 June 2010 were HK$771.9 million and related primarily to the construction of Encore.

Net cash used in fi nancing activities

Net cash used in fi nancing activities was HK$890.4 million during the six months ended 30 June 2011 compared to HK$3.0 billion during the six months ended 30 June 2010.

The difference between net cash fl ow used in 2011 compared to 2010 is primarily due to a HK$2.9 billion repayment of the senior revolving credit facility under Wynn Macau Credit Facilities made in 2010 compared to a HK$779.5 million repayment of the facilities made in 2011.

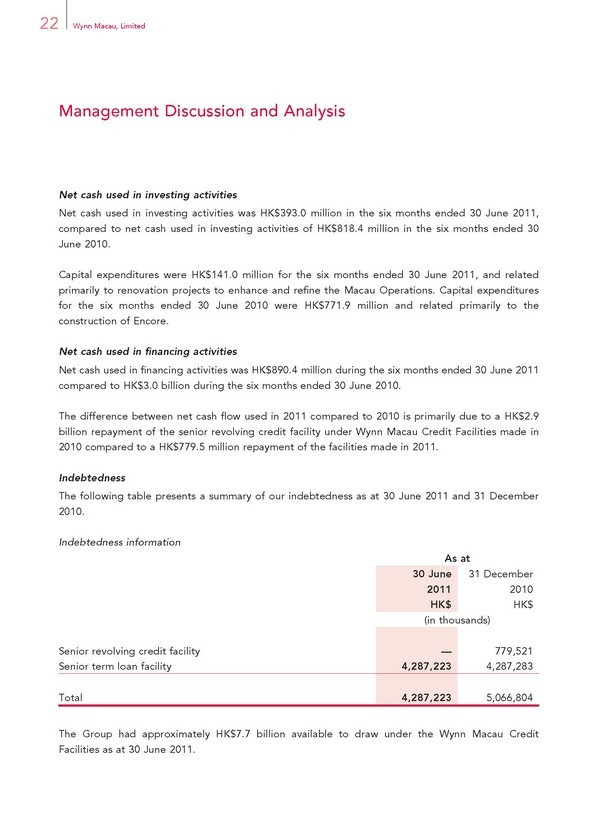

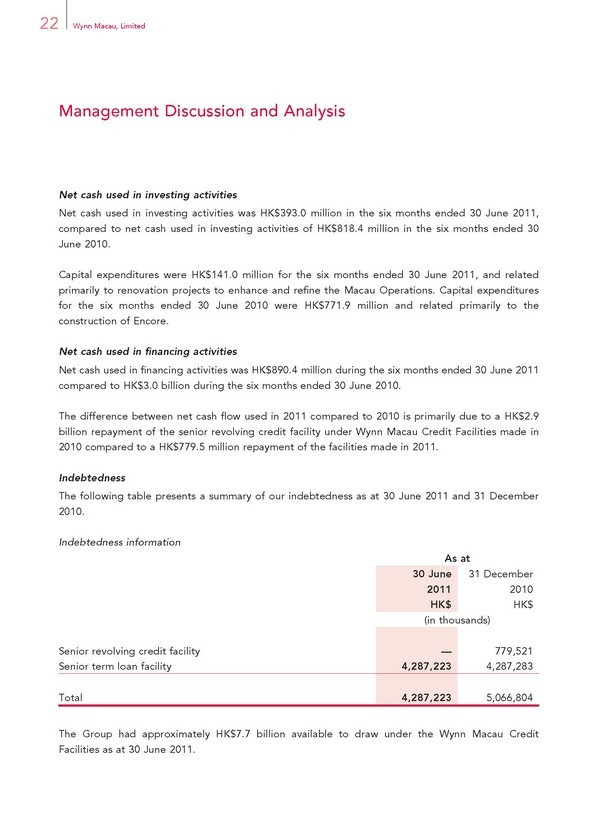

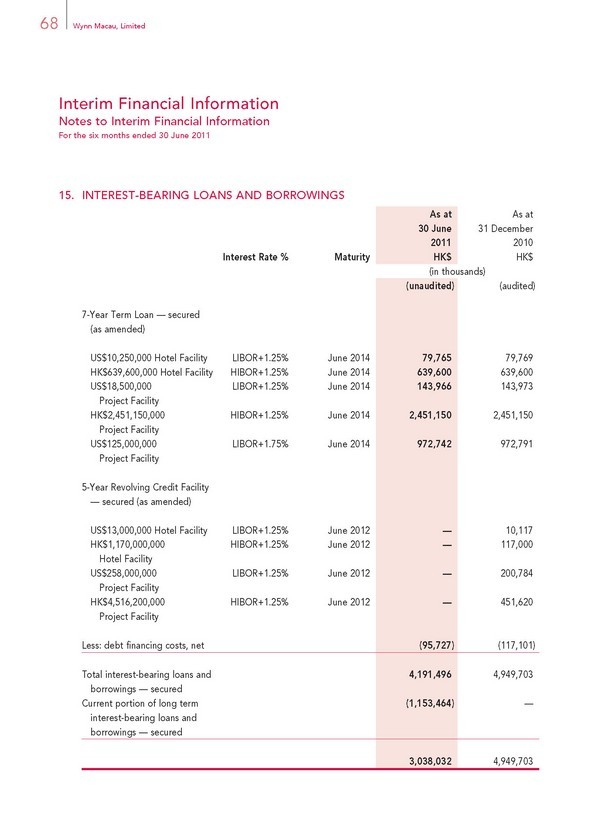

Indebtedness

The following table presents a summary of our indebtedness as at 30 June 2011 and 31 December 2010.

Indebtedness information

As at

30 June 31 December

2011 2010

HK$ HK$

(in thousands)

Senior revolving credit facility — 779,521

Senior term loan facility 4,287,223 4,287,283

Total 4,287,223 5,066,804

The Group had approximately HK$7.7 billion available to draw under the Wynn Macau Credit Facilities as at 30 June 2011.

Interim Report 2011 23

Management Discussion and Analysis

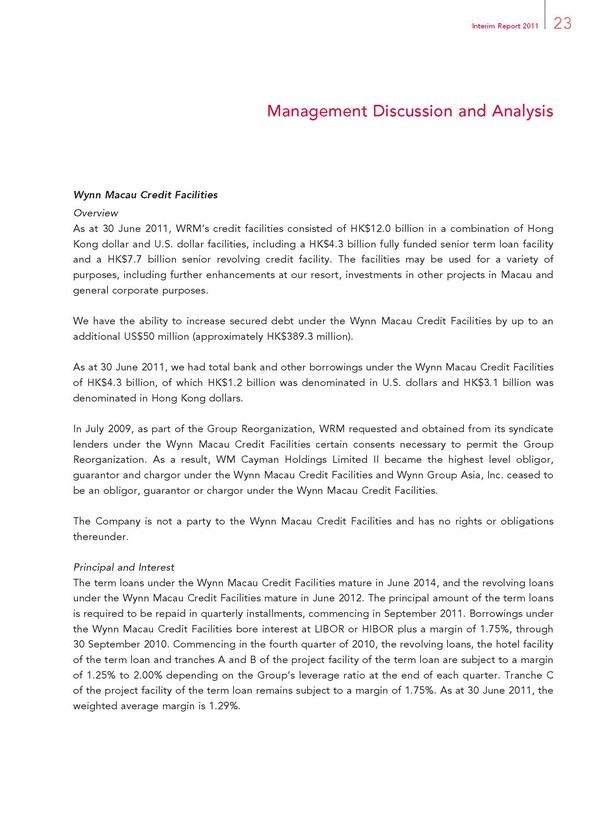

Wynn Macau Credit Facilities

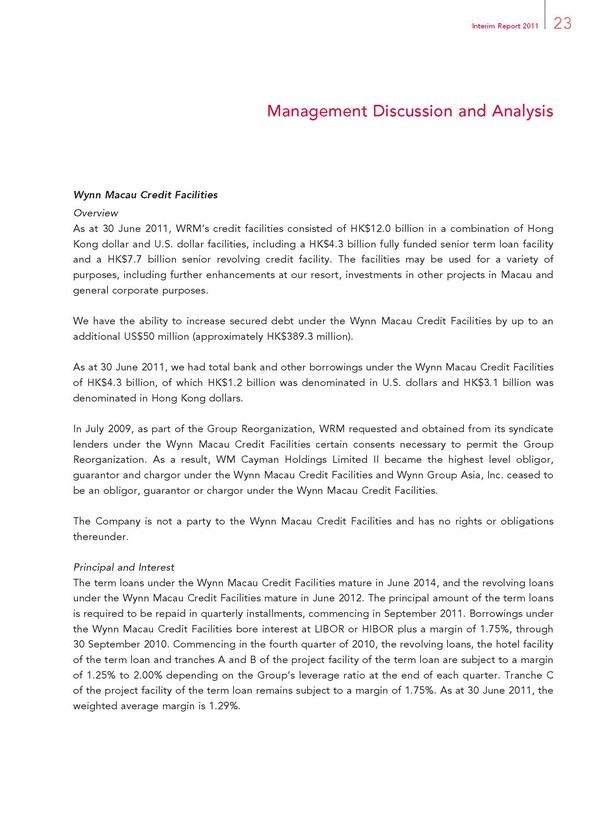

Overview

As at 30 June 2011, WRM’s credit facilities consisted of HK$12.0 billion in a combination of Hong Kong dollar and U.S. dollar facilities, including a HK$4.3 billion fully funded senior term loan facility and a HK$7.7 billion senior revolving credit facility. The facilities may be used for a variety of purposes, including further enhancements at our resort, investments in other projects in Macau and general corporate purposes.

We have the ability to increase secured debt under the Wynn Macau Credit Facilities by up to an additional US$50 million (approximately HK$389.3 million).

As at 30 June 2011, we had total bank and other borrowings under the Wynn Macau Credit Facilities of HK$4.3 billion, of which HK$1.2 billion was denominated in U.S. dollars and HK$3.1 billion was denominated in Hong Kong dollars.

In July 2009, as part of the Group Reorganization, WRM requested and obtained from its syndicate lenders under the Wynn Macau Credit Facilities certain consents necessary to permit the Group Reorganization. As a result, WM Cayman Holdings Limited II became the highest level obligor, guarantor and chargor under the Wynn Macau Credit Facilities and Wynn Group Asia, Inc. ceased to be an obligor, guarantor or chargor under the Wynn Macau Credit Facilities.

The Company is not a party to the Wynn Macau Credit Facilities and has no rights or obligations thereunder.

Principal and Interest

The term loans under the Wynn Macau Credit Facilities mature in June 2014, and the revolving loans under the Wynn Macau Credit Facilities mature in June 2012. The principal amount of the term loans is required to be repaid in quarterly installments, commencing in September 2011. Borrowings under the Wynn Macau Credit Facilities bore interest at LIBOR or HIBOR plus a margin of 1.75%, through 30 September 2010. Commencing in the fourth quarter of 2010, the revolving loans, the hotel facility of the term loan and tranches A and B of the project facility of the term loan are subject to a margin of 1.25% to 2.00% depending on the Group’s leverage ratio at the end of each quarter. Tranche C of the project facility of the term loan remains subject to a margin of 1.75%. As at 30 June 2011, the weighted average margin is 1.29%.

24 Wynn Macau, Limited

Management Discussion and Analysis

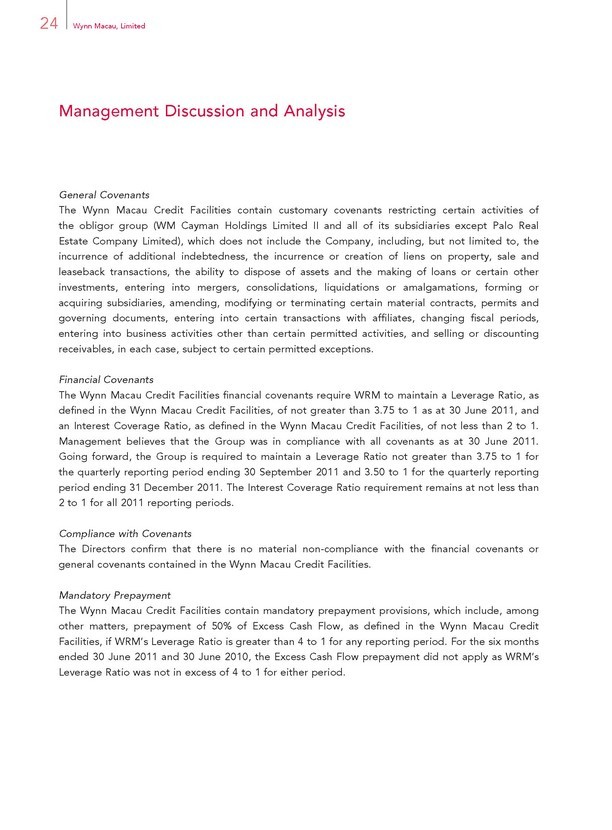

General Covenants

The Wynn Macau Credit Facilities contain customary covenants restricting certain activities of the obligor group (WM Cayman Holdings Limited II and all of its subsidiaries except Palo Real Estate Company Limited), which does not include the Company, including, but not limited to, the incurrence of additional indebtedness, the incurrence or creation of liens on property, sale and leaseback transactions, the ability to dispose of assets and the making of loans or certain other investments, entering into mergers, consolidations, liquidations or amalgamations, forming or acquiring subsidiaries, amending, modifying or terminating certain material contracts, permits and governing documents, entering into certain transactions with affi liates, changing fi scal periods, entering into business activities other than certain permitted activities, and selling or discounting receivables, in each case, subject to certain permitted exceptions.

Financial Covenants

The Wynn Macau Credit Facilities fi nancial covenants require WRM to maintain a Leverage Ratio, as defi ned in the Wynn Macau Credit Facilities, of not greater than 3.75 to 1 as at 30 June 2011, and an Interest Coverage Ratio, as defi ned in the Wynn Macau Credit Facilities, of not less than 2 to 1. Management believes that the Group was in compliance with all covenants as at 30 June 2011. Going forward, the Group is required to maintain a Leverage Ratio not greater than 3.75 to 1 for the quarterly reporting period ending 30 September 2011 and 3.50 to 1 for the quarterly reporting period ending 31 December 2011. The Interest Coverage Ratio requirement remains at not less than 2 to 1 for all 2011 reporting periods.

Compliance with Covenants

The Directors confi rm that there is no material non-compliance with the fi nancial covenants or general covenants contained in the Wynn Macau Credit Facilities.

Mandatory Prepayment

The Wynn Macau Credit Facilities contain mandatory prepayment provisions, which include, among other matters, prepayment of 50% of Excess Cash Flow, as defi ned in the Wynn Macau Credit Facilities, if WRM’s Leverage Ratio is greater than 4 to 1 for any reporting period. For the six months ended 30 June 2011 and 30 June 2010, the Excess Cash Flow prepayment did not apply as WRM’s Leverage Ratio was not in excess of 4 to 1 for either period.

Interim Report 2011 25

Management Discussion and Analysis

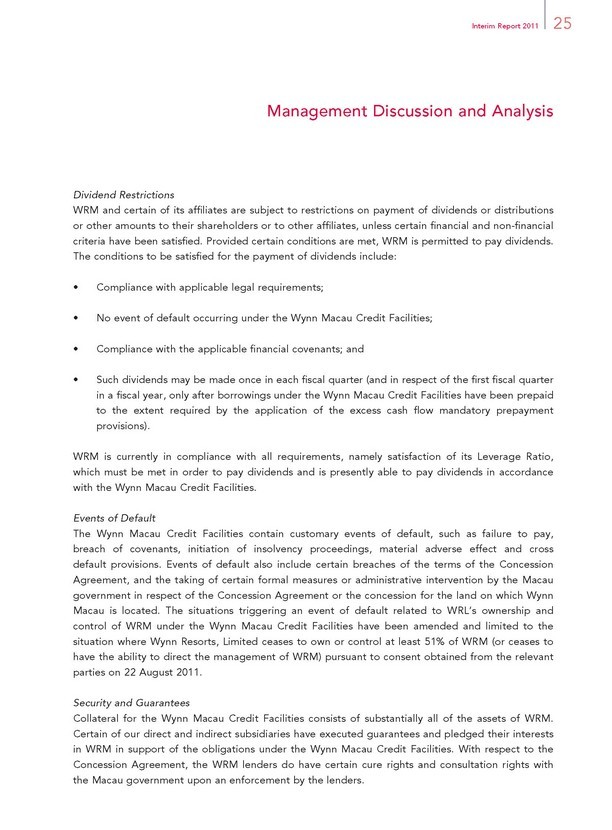

Dividend Restrictions

WRM and certain of its affi liates are subject to restrictions on payment of dividends or distributions or other amounts to their shareholders or to other affi liates, unless certain fi nancial and non-fi nancial criteria have been satisfi ed. Provided certain conditions are met, WRM is permitted to pay dividends. The conditions to be satisfi ed for the payment of dividends include:

Compliance with applicable legal requirements;

No event of default occurring under the Wynn Macau Credit Facilities;

Compliance with the applicable fi nancial covenants; and

Such dividends may be made once in each fi scal quarter (and in respect of the fi rst fi scal quarter in a fi scal year, only after borrowings under the Wynn Macau Credit Facilities have been prepaid to the extent required by the application of the excess cash fl ow mandatory prepayment provisions).

WRM is currently in compliance with all requirements, namely satisfaction of its Leverage Ratio, which must be met in order to pay dividends and is presently able to pay dividends in accordance with the Wynn Macau Credit Facilities.

Events of Default

The Wynn Macau Credit Facilities contain customary events of default, such as failure to pay, breach of covenants, initiation of insolvency proceedings, material adverse effect and cross default provisions. Events of default also include certain breaches of the terms of the Concession Agreement, and the taking of certain formal measures or administrative intervention by the Macau government in respect of the Concession Agreement or the concession for the land on which Wynn Macau is located. The situations triggering an event of default related to WRL’s ownership and control of WRM under the Wynn Macau Credit Facilities have been amended and limited to the situation where Wynn Resorts, Limited ceases to own or control at least 51% of WRM (or ceases to have the ability to direct the management of WRM) pursuant to consent obtained from the relevant parties on 22 August 2011.

Security and Guarantees

Collateral for the Wynn Macau Credit Facilities consists of substantially all of the assets of WRM. Certain of our direct and indirect subsidiaries have executed guarantees and pledged their interests in WRM in support of the obligations under the Wynn Macau Credit Facilities. With respect to the Concession Agreement, the WRM lenders do have certain cure rights and consultation rights with the Macau government upon an enforcement by the lenders.

26 Wynn Macau, Limited

Management Discussion and Analysis

Second Ranking Lender

WRM is also party to a bank guarantee reimbursement agreement with Banco National Ultramarino S.A. to secure a guarantee in favor of the Macau government as required under the Concession Agreement. The amount of this guarantee is MOP300 million (approximately HK$291.3 million) and it lasts until 180 days after the end of the term of the Concession Agreement. The guarantee assures WRM’s performance under the Concession Agreement, including the payment of certain premiums, fi nes and indemnities for breach. The guarantee is secured by a second priority security interest in the same collateral package securing the Wynn Macau Credit Facilities.

QUANTITATIVE AND QUALITATIVE DISCLOSURE ABOUT MARKET RISK

Market risk is the risk of loss arising from adverse changes in market rates and conditions, such as infl ation, interest rates, and foreign currency exchange rates.

Foreign Exchange Risks

The fi nancial statements of foreign operations are translated into Hong Kong dollars, the Group’s functional and presentation currency, for incorporation into the condensed consolidated fi nancial information. The majority of our assets and liabilities are denominated in U.S. dollars, Hong Kong dollars, Macau patacas and Offshore RMB, and there are no signifi cant assets and liabilities denominated in other currencies. Assets and liabilities are translated at the prevailing foreign exchange rates in effect at the end of the reporting period. Income, expenditures and cash fl ow items are measured at the actual foreign exchange rates or average foreign exchange rates for the period. The Hong Kong dollar is linked to the U.S. dollar and the exchange rate between these two currencies has remained relatively stable over the past several years. The Macau pataca is pegged to the Hong Kong dollar, and in many cases the two currencies are used interchangeably in Macau. However, the exchange linkages of the Hong Kong dollar and the Macau pataca, and the Hong Kong dollar to the U.S. dollar, are subject to potential changes due to, among other things, changes in governmental policies and international economic and political developments. In particular, our Group is exposed to foreign exchange risk arising primarily with respect to the Offshore RMB, which does not have pegged exchange linkages to the U.S. dollar, Hong Kong dollar or Macau pataca.

Interim Report 2011 27

Management Discussion and Analysis

Interest Rate Risks

One of our primary exposures to market risk is interest rate risk associated with our credit facilities, which bear interest based on fl oating rates. We attempt to manage interest rate risk by managing the mix of long-term fi xed rate borrowings and variable rate borrowings supplemented by hedging activities as considered necessary. We cannot assure you that these risk management strategies will have the desired effect, and interest rate fl uctuations could have a negative impact on our results of operations.

As at 30 June 2011, the Group had three interest rate swaps intended to manage a portion of the underlying interest rate risk on borrowings under the Wynn Macau Credit Facilities. Under the fi rst swap agreement, the Group pays a fi xed interest rate of 3.63% on U.S. dollar borrowings of approximately US$153.8 million (approximately HK$1.2 billion) incurred under the Wynn Macau Credit Facilities in exchange for receipts on the same amount at a variable interest rate based on the applicable LIBOR at the time of payment. Under the second swap agreement, the Group pays a fi xed interest rate of 3.39% on Hong Kong dollar borrowings of approximately HK$991.6 million incurred under the Wynn Macau Credit Facilities in exchange for receipts on the same amount at a variable interest rate based on the applicable HIBOR at the time of payment. Based on the applicable margin of the Wynn Macau Credit Facilities, as at 30 June 2011, these interest rate swaps fi x the interest rates on the U.S. dollar and the Hong Kong dollar borrowings at approximately 4.88% to 5.38% and 4.64%, respectively. Both agreements terminate at the end of August 2011.

Under the third swap agreement, the Group pays a fi xed interest rate of 2.15% on borrowings of approximately HK$2.3 billion incurred under the Wynn Macau Credit Facilities in exchange for receipts on the same amount at a variable interest rate based on the applicable HIBOR at the time of payment. As at 30 June 2011, this interest rate swap fi xes the interest rate on HK$2.3 billion of borrowings under the Wynn Macau Credit Facilities at approximately 3.40%. This interest rate swap agreement will terminate in June 2012.

28 Wynn Macau, Limited

Management Discussion and Analysis

The carrying values of these interest rate swaps on the condensed consolidated statement of fi nancial position approximates their fair values. The fair value approximates the amount the Group would pay if these contracts were settled at the respective valuation dates. Fair value is estimated based upon current, and predictions of future interest rate levels along a yield curve, the remaining duration of the instruments and other market conditions and, therefore, is subject to signifi cant estimation and a high degree of variability of fl uctuation between periods. We adjust this amount by applying a non-performance valuation, considering our creditworthiness or the creditworthiness of our counterparties at each settlement date, as applicable. These transactions do not qualify for hedge accounting. Accordingly, changes in the fair values during the six months ended 30 June 2011 and 2010, were charged to the condensed consolidated statement of comprehensive income.

Our liabilities under the swap agreements are secured by the same collateral package securing the Wynn Macau Credit Facilities.

OFF BALANCE SHEET ARRANGEMENTS

We have not entered into any transactions with special purpose entities nor do we engage in any transactions involving derivatives except for interest rate swaps. We do not have any retained or contingent interest in assets transferred to an unconsolidated entity.

OTHER LIQUIDITY MATTERS

We expect to fund our operations and capital expenditure requirements from operating cash fl ows, cash on hand and availability under the Wynn Macau Credit Facilities. However, we cannot be sure that operating cash fl ows will be suffi cient for those purposes. We may refi nance all or a portion of our indebtedness on or before maturity. We cannot be sure that we will be able to refi nance any of the indebtedness on acceptable terms or at all.

New business developments (including our development of a project in Cotai) or other unforeseen events may occur, resulting in the need to raise additional funds. There can be no assurances regarding the business prospects with respect to any other opportunity. Any other development would require us to obtain additional fi nancing.

Interim Report 2011 29

Management Discussion and Analysis

In the ordinary course of business, in response to market demands and client preferences, and in order to increase revenues, we have made and will continue to make enhancements and refi nements to our resort. We have incurred and will continue to incur capital expenditures related to these enhancements and refi nements.

Taking into consideration our fi nancial resources, including our cash and cash equivalents, internally generated funds and availability under the Wynn Macau Credit Facilities, we believe that we have suffi cient liquid assets to meet our working capital and operating requirements for the following 12 months.

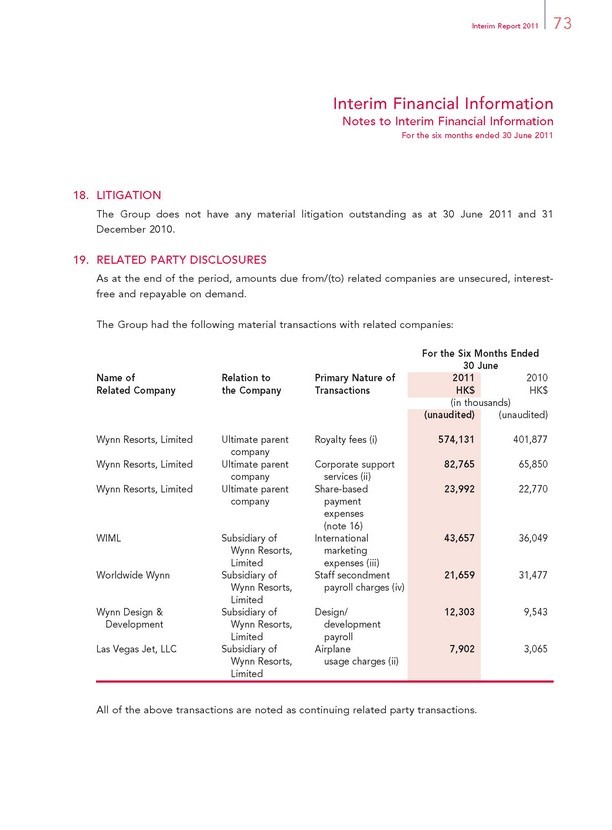

RELATED PARTY TRANSACTIONS

For details of the related party transactions, see note 19 to the Interim Financial Information. Our Directors confi rm that all related party transactions are conducted on normal commercial terms, and that their terms are fair and reasonable.

30 Wynn Macau, Limited

Directors and Senior Management

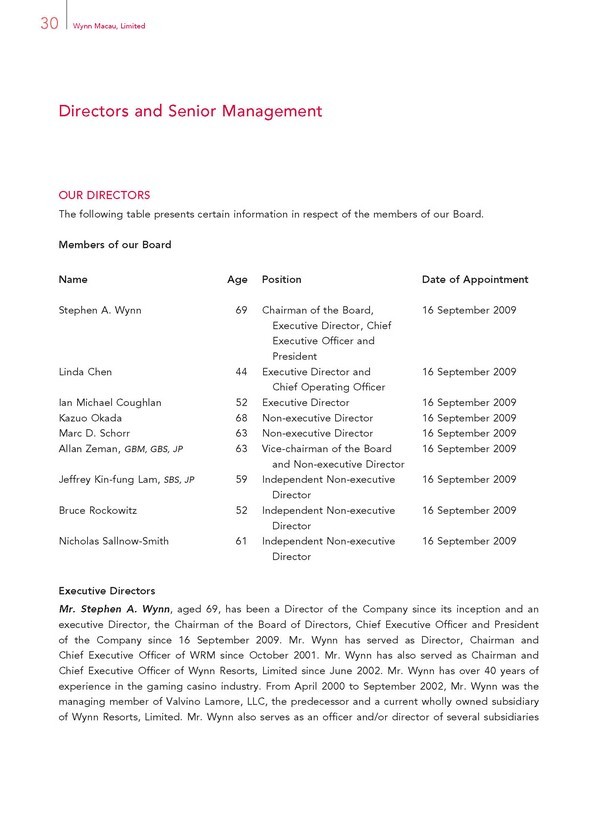

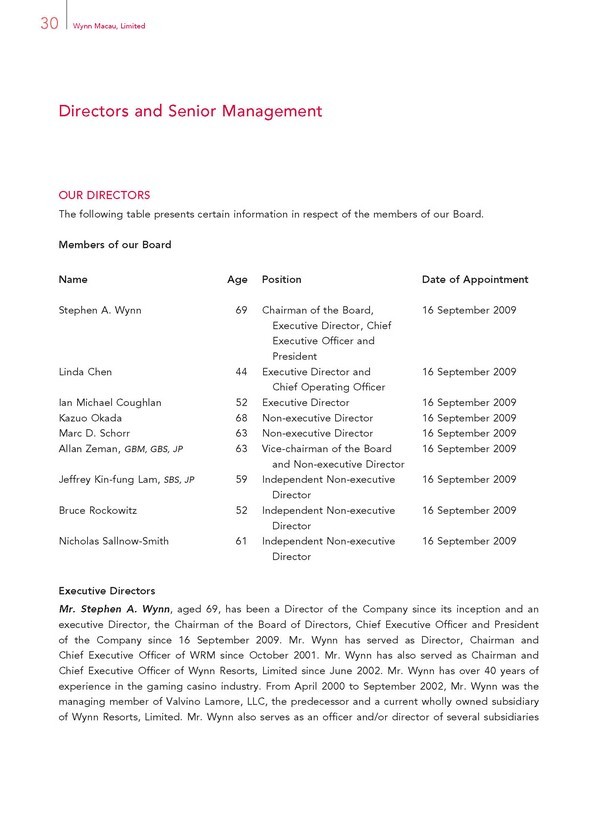

OUR DIRECTORS

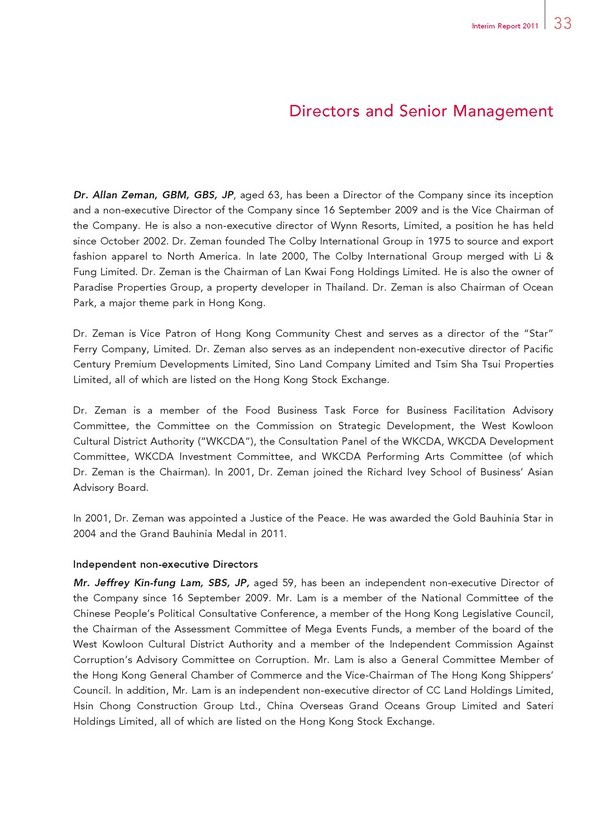

The following table presents certain information in respect of the members of our Board.

Members of our Board

Name Age Position Date of Appointment

Stephen A. Wynn 69 Chairman of the Board, 16 September 2009

Executive Director, Chief

Executive Offi cer and

President

Linda Chen 44 Executive Director and 16 September 2009

Chief Operating Offi cer

Ian Michael Coughlan 52 Executive Director 16 September 2009

Kazuo Okada 68 Non-executive Director 16 September 2009

Marc D. Schorr 63 Non-executive Director 16 September 2009

Allan Zeman, GBM, GBS, JP 63 Vice-chairman of the Board 16 September 2009

and Non-executive Director

Jeffrey Kin-fung Lam, SBS, JP 59 Independent Non-executive 16 September 2009

Director

Bruce Rockowitz 52 Independent Non-executive 16 September 2009

Director

Nicholas Sallnow-Smith 61 Independent Non-executive 16 September 2009

Director

Executive Directors

Mr. Stephen A. Wynn, aged 69, has been a Director of the Company since its inception and an executive Director, the Chairman of the Board of Directors, Chief Executive Offi cer and President of the Company since 16 September 2009. Mr. Wynn has served as Director, Chairman and Chief Executive Offi cer of WRM since October 2001. Mr. Wynn has also served as Chairman and Chief Executive Offi cer of Wynn Resorts, Limited since June 2002. Mr. Wynn has over 40 years of experience in the gaming casino industry. From April 2000 to September 2002, Mr. Wynn was the managing member of Valvino Lamore, LLC, the predecessor and a current wholly owned subsidiary of Wynn Resorts, Limited. Mr. Wynn also serves as an offi cer and/or director of several subsidiaries

Interim Report 2011 31

Directors and Senior Management

of Wynn Resorts, Limited. Mr. Wynn served as Chairman, President and Chief Executive Offi cer of Mirage Resorts, Inc. and its predecessor, Golden Nugget Inc., between 1973 and 2000. Mr. Wynn developed and opened The Mirage, Treasure Island and Bellagio in 1989, 1993 and 1998, respectively. Mr. Wynn has also served as an outside director of Monaco QD International Hotels and Resort Management since December 2010. In 2011, Barron’s ranked Mr. Wynn as one of the world’s 30 best CEOs.

Ms. Linda Chen, aged 44, has been an executive Director and the Chief Operating Offi cer of the Company since 16 September 2009 and Chief Operating Offi cer of WRM since June 2002. Ms. Chen is responsible for the marketing and strategic development of WRM. Ms. Chen is also a director of Wynn Resorts, Limited and President of WIML. In these positions, she is responsible for the set-up of international marketing operations of Wynn Resorts, Limited. Prior to joining the Group, Ms. Chen was Executive Vice President — International Marketing at MGM Mirage, a role she held from June 2000 until May 2002, and was responsible for the international marketing operations for MGM Grand, Bellagio and The Mirage. Prior to this position, Ms. Chen served as the Executive Vice President of International Marketing for Bellagio and was involved with its opening in 1998. She was also involved in the opening of the MGM Grand in 1993 and The Mirage in 1989. Ms. Chen is also a member of the Nanjing Committee of the Chinese People’s Political Consultative Conference (Macau). Ms. Chen holds a Bachelor of Science Degree in Hotel Administration from Cornell University in 1989 and completed the Stanford Graduate School of Business Executive Development Program in 1997.

Mr. Ian Michael Coughlan, aged 52, has been an executive Director of the Company since 16 September 2009. Mr. Coughlan is also the President of WRM, a position he has held since July 2007. In this role, he is responsible for the entire operation and development of Wynn Macau. Prior to this role, Mr. Coughlan was Director of Hotel Operations — Worldwide for Wynn Resorts, Limited. Mr. Coughlan has over 30 years of hospitality experience with leading hotels across Asia, Europe and the United States. Before joining Wynn Resorts, Limited, he spent ten years with The Peninsula Group, including posts as General Manager of The Peninsula Hong Kong from September 2004 to January 2007, and General Manager of The Peninsula Bangkok from September 1999 to August 2004. His previous assignments include senior management positions at The Oriental Singapore, and a number of Ritz-Carlton properties in the United States. Mr. Coughlan has a Diploma from Shannon College of Hotel Management, Ireland.

32 Wynn Macau, Limited

Directors and Senior Management

Non-executive Directors

Mr. Kazuo Okada, aged 68, has been a non-executive Director of the Company since 16 September 2009. Mr. Okada is also a non-executive director of Wynn Resorts, Limited and has served as Vice Chairman of the board of Wynn Resorts, Limited since October 2002. He is also a director of Wynn Las Vegas Capital Corp.

In 1969, Mr. Okada founded Universal Lease Co. Ltd., which became Aruze Corp. in 1998, a company listed on the Japanese Association of Securities Dealers Automated Quotation Securities

Exchange. In November 2009, Aruze Corp. changed its name to Universal Entertainment Corporation. Universal Entertainment Corporation is a Japanese manufacturer of pachislot and pachinko machines, amusement machines and video games for domestic sales. Mr. Okada currently serves as director and Chairman of the board of Universal Entertainment Corporation, and as director, President, Secretary and Treasurer of Aruze USA, Inc., which is a wholly owned subsidiary of Universal Entertainment Corporation and owns approximately 19.7% of Wynn Resorts, Limited.

In 1983, Mr. Okada also founded Universal Distributing of Nevada, Inc., which changed its name to Aruze Gaming America, Inc. in 2005. Aruze Gaming America, Inc. is a manufacturer and distributor of gaming machines and devices in the United States and is expanding its sales business in Asia, Australia and South Africa. Mr. Okada currently serves as director, President, Secretary and Treasurer of Aruze Gaming America, Inc.

Mr. Marc D. Schorr, aged 63, has been a non-executive Director of the Company since 16 September 2009, and also a director of WRM. He is also the Chief Operating Offi cer of Wynn Resorts, Limited, a position he has held since June 2002, and a director of WRL since 29 July 2010. Mr. Schorr has over 30 years of experience in the casino gaming industry. From June 2000 through April 2001, Mr. Schorr served as Chief Operating Offi cer of Valvino Lamore, LLC. Prior to joining the Group, Mr. Schorr was the President of The Mirage Casino-Hotel from January 1997 until May 2000 and, prior to this position, was the President and Chief Executive Offi cer of Treasure Island at The Mirage from August 1992. His experience also includes establishing a casino marketing department and a branch offi ce network throughout the United States as director of Casino Marketing for the Golden Nugget in Las Vegas in 1984 and managing the Golden Nugget in Laughlin, Nevada and its multi-million dollar expansion program in 1989 in his position as President and Chief Executive Offi cer.

Interim Report 2011 33

Directors and Senior Management

Dr. Allan Zeman, GBM, GBS, JP, aged 63, has been a Director of the Company since its inception and a non-executive Director of the Company since 16 September 2009 and is the Vice Chairman of the Company. He is also a non-executive director of Wynn Resorts, Limited, a position he has held since October 2002. Dr. Zeman founded The Colby International Group in 1975 to source and export fashion apparel to North America. In late 2000, The Colby International Group merged with Li & Fung Limited. Dr. Zeman is the Chairman of Lan Kwai Fong Holdings Limited. He is also the owner of Paradise Properties Group, a property developer in Thailand. Dr. Zeman is also Chairman of Ocean Park, a major theme park in Hong Kong.

Dr. Zeman is Vice Patron of Hong Kong Community Chest and serves as a director of the “Star” Ferry Company, Limited. Dr. Zeman also serves as an independent non-executive director of Pacifi c Century Premium Developments Limited, Sino Land Company Limited and Tsim Sha Tsui Properties Limited, all of which are listed on the Hong Kong Stock Exchange.

Dr. Zeman is a member of the Food Business Task Force for Business Facilitation Advisory Committee, the Committee on the Commission on Strategic Development, the West Kowloon Cultural District Authority (“WKCDA”), the Consultation Panel of the WKCDA, WKCDA Development Committee, WKCDA Investment Committee, and WKCDA Performing Arts Committee (of which Dr. Zeman is the Chairman). In 2001, Dr. Zeman joined the Richard Ivey School of Business’ Asian Advisory Board.

In 2001, Dr. Zeman was appointed a Justice of the Peace. He was awarded the Gold Bauhinia Star in 2004 and the Grand Bauhinia Medal in 2011.

Independent non-executive Directors

Mr. Jeffrey Kin-fung Lam, SBS, JP, aged 59, has been an independent non-executive Director of the Company since 16 September 2009. Mr. Lam is a member of the National Committee of the Chinese People’s Political Consultative Conference, a member of the Hong Kong Legislative Council, the Chairman of the Assessment Committee of Mega Events Funds, a member of the board of the West Kowloon Cultural District Authority and a member of the Independent Commission Against Corruption’s Advisory Committee on Corruption. Mr. Lam is also a General Committee Member of the Hong Kong General Chamber of Commerce and the Vice-Chairman of The Hong Kong Shippers’ Council. In addition, Mr. Lam is an independent non-executive director of CC Land Holdings Limited,

Hsin Chong Construction Group Ltd., China Overseas Grand Oceans Group Limited and Sateri Holdings Limited, all of which are listed on the Hong Kong Stock Exchange.

34 Wynn Macau, Limited

Directors and Senior Management

In 1996, Mr. Lam was appointed Justice of the Peace and became a member of the Most Excellent Order of the British Empire. In 2004, he was awarded the Silver Bauhinia Star Award. Mr. Lam was conferred University Fellow of Tufts University in the United States and Hong Kong Polytechnic University in 1997 and in 2000, respectively.

Mr. Bruce Rockowitz, aged 52, has been an independent non-executive Director of the Company since 16 September 2009. Mr. Rockowitz is also the Group President and Chief Executive Offi cer of Li & Fung Limited, a company listed on the Hong Kong Stock Exchange. Mr. Rockowitz has been an executive director of Li & Fung Limited since 2001 and was the co-founder and Chief Executive Offi cer of Colby International Limited, a large Hong Kong buying agent, prior to the sale of Colby International Limited to Li & Fung Limited in 2000. He is a member of the Advisory Board for the Wharton School’s Jay H Baker Retailing Initiative, an industry research center for retail at the University of Pennsylvania. He is also a board member of the Education Foundation for Fashion Industries, the private fund-raising arm of the Fashion Institute of Technology, New York, United States. In December 2008, Mr. Rockowitz was ranked fi rst by Institutional Investor for Asia’s Best CEOs in the consumer category. In the years 2010 and 2011, he was also ranked as one of the world’s 30 best CEOs by Barron’s. In addition to his position at Li & Fung, Mr. Rockowitz is the non-executive Chairman of The Pure Group, a lifestyle, fi tness and yoga group operating in Hong Kong, Singapore and Taiwan and soon to be opening in mainland China. As non-executive Chairman of The Pure Group, Mr. Rockowitz provides strategic vision and direction to the senior management of The Pure Group.

Mr. Nicholas Sallnow-Smith, aged 61, has been an independent non-executive Director of the Company since 16 September 2009. Mr. Sallnow-Smith has also served as the Chairman and an independent non-executive director of The Link Management Limited since April 2007 and is also Chairman of the Link Management Limited’s Finance and Investment, and Nominations Committees. The Link Management Limited is the manager to the Link Real Estate Investment Trust, a company listed on the Hong Kong Stock Exchange. Mr. Sallnow-Smith is also a non-executive director of Unitech Corporate Parks Plc., a company listed on the London Stock Exchange in the Alternative Investment Market (“AIM”); an independent non-executive director of Dah Sing Financial Holdings Limited, a company listed on the Hong Kong Stock Exchange; Dah Sing Bank, Limited, a subsidiary of Dah Sing Banking Group Limited which is a company listed on the Hong Kong Stock Exchange; the Chairman of LionRock Master Fund Limited in Singapore; and a member of the Advisory Board of Winnington Group. Prior to joining The Link Management Limited, Mr. Sallnow-Smith was Chief Executive of Hongkong Land Holdings Limited from February 2000 to March 2007. He has a wide ranging fi nance background in Asia and the United Kingdom for over 30 years, including his roles as Finance Director of Hongkong Land Holdings Limited from 1998 to 2000 and as Group Treasurer of Jardine Matheson Limited from 1993 to 1998.

Interim Report 2011 35

Directors and Senior Management

Mr. Sallnow-Smith’s early career was spent in the British Civil Service, where he worked for Her Majesty’s Treasury in Whitehall, London from 1975 to 1985. During that time, he was seconded for two years to Manufacturers Hanover London, working in export fi nance and in their merchant banking division, Manufacturers Hanover Limited. He left the Civil Service in 1985, following a period working in the International Finance section of H. M. Treasury on Paris Club and other international debt policy matters, and spent two years with Lloyds Bank before moving into the corporate sector in 1987. Mr. Sallnow-Smith served as the Convenor of the Hong Kong Association of Corporate Treasurers in 1996 to 2000 and Chairman of the Matilda Child Development Centre. He is a director of the Hong Kong Philharmonic Society, Chairman of the Hong Kong Youth Arts Foundation, a member of the Council of the Treasury Markets Association (Hong Kong Association of Corporate Treasures Representative) and a member of the General Committee of The British Chamber of Commerce in Hong Kong. He is also the Chairman of AFS Intercultural Exchanges Ltd. in Hong Kong.

Mr. Sallnow-Smith was educated at Gonville & Caius College, Cambridge, and the University of Leicester and is a Fellow of the Association of Corporate Treasurers. He holds M.A. (Cantab) and M.A. (Soc. of Ed.) Degrees.

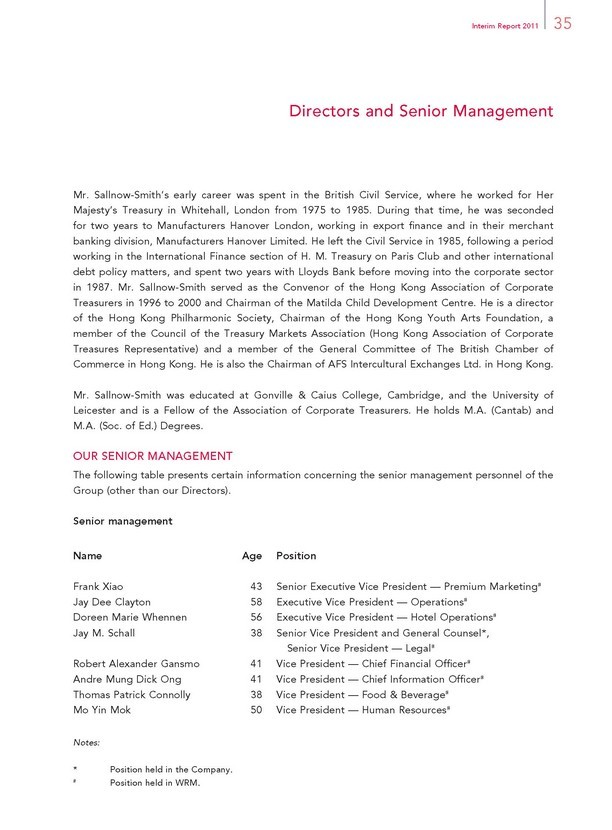

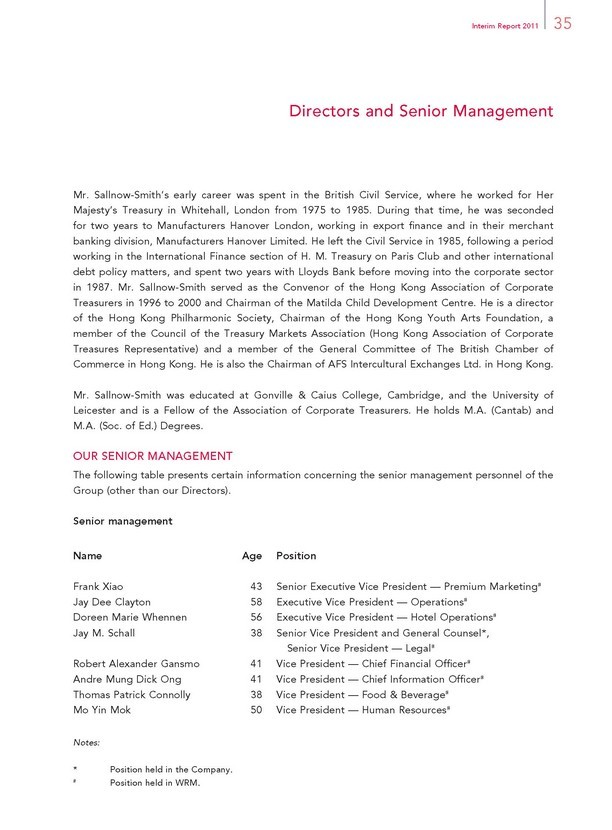

OUR SENIOR MANAGEMENT

The following table presents certain information concerning the senior management personnel of the Group (other than our Directors).

Senior management

Name Age Position

Frank Xiao 43 Senior Executive Vice President — Premium Marketing#

Jay Dee Clayton 58 Executive Vice President — Operations#

Doreen Marie Whennen 56 Executive Vice President — Hotel Operations#

Jay M. Schall 38 Senior Vice President and General Counsel*,

Senior Vice President — Legal#

Robert Alexander Gansmo 41 Vice President — Chief Financial Offi cer#

Andre Mung Dick Ong 41 Vice President — Chief Information Offi cer#

Thomas Patrick Connolly 38 Vice President — Food & Beverage#

Mo Yin Mok 50 Vice President — Human Resources#

Notes:

* | | Position held in the Company. |

# Position held in WRM.

36 Wynn Macau, Limited

Directors and Senior Management

Mr. Frank Xiao, aged 43, is the Senior Executive Vice President — Premium Marketing of WRM, a position he has held since August 2006. Mr. Xiao is responsible for providing leadership and guidance to the marketing team and staff, developing business and promoting Wynn Macau. Prior to this position, Mr. Xiao was the Senior Executive Vice President — China Marketing for WIML and Worldwide Wynn between 2005 until 2006. Prior to joining the Group, Mr. Xiao was the Senior Vice President of Far East Marketing at MGM Grand Hotel. During his 12 years at the MGM Grand Hotel, he was promoted several times from his fi rst position as Far East Marketing Executive in 1993. Mr. Xiao holds a Bachelor of Science Degree in Hotel Administration and a Master’s Degree in Hotel Administration from the University of Nevada, Las Vegas.

Mr. Jay Dee Clayton, aged 58, is the Executive Vice President — Operations of WRM, a position he has held since May 2006. Mr. Clayton is responsible for assisting the President of the Company in providing leadership and operational direction for the development and operation of Wynn Macau, with a particular focus on gaming operations. Mr. Clayton joined the gaming industry in 1975 and has over 30 years of experience in the industry, having served at gaming companies including Del Webb, Harrah’s, Caesar’s, MGM and Mirage Resorts. Over his career, Mr. Clayton gained experience in a wide range of assignments including training and development, marketing and promotions, player development, project management and operations. Prior to joining WRM, Mr. Clayton held managerial roles at MGM Grand Detroit Casino, where he served from January 2000. Mr. Clayton served as General Manager of MGM Grand Darwin in Australia where he was the Chief Liaison between the company and Australia’s Northern Territory Racing and Gaming Authority. Mr. Clayton acquired a Master’s Degree in Hotel Administration from the University of Nevada, Las Vegas in 1993. Prior to that, Mr. Clayton obtained a Bachelor of Science Degree from Utah State University in 1975 and an Associate’s Degree in Culinary Arts from the Atlantic Community College in Mays Landing, New Jersey in 1985.

Ms. Doreen Marie Whennen, aged 56, is the Executive Vice President — Hotel Operations of WRM, a position she has held since May 2007. Ms. Whennen is responsible for overseeing the hotel operations of Wynn Macau. Ms. Whennen has over 20 years of experience in the hospitality industry. She joined Valvino Lamore, LLC in 2000 and prior to joining the Group, she held various positions at The Mirage, which she joined in 1989, including Front Offi ce Manager, Director of Guest Services and Vice President of Hotel Operations.

Interim Report 2011 37

Directors and Senior Management

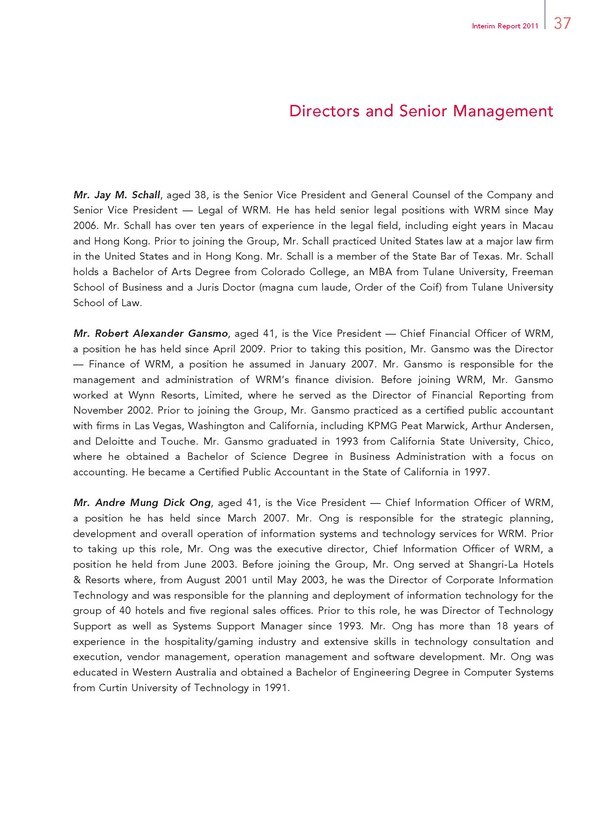

Mr. Jay M. Schall, aged 38, is the Senior Vice President and General Counsel of the Company and Senior Vice President — Legal of WRM. He has held senior legal positions with WRM since May 2006. Mr. Schall has over ten years of experience in the legal fi eld, including eight years in Macau and Hong Kong. Prior to joining the Group, Mr. Schall practiced United States law at a major law fi rm in the United States and in Hong Kong. Mr. Schall is a member of the State Bar of Texas. Mr. Schall holds a Bachelor of Arts Degree from Colorado College, an MBA from Tulane University, Freeman School of Business and a Juris Doctor (magna cum laude, Order of the Coif) from Tulane University School of Law.

Mr. Robert Alexander Gansmo, aged 41, is the Vice President — Chief Financial Offi cer of WRM, a position he has held since April 2009. Prior to taking this position, Mr. Gansmo was the Director

— Finance of WRM, a position he assumed in January 2007. Mr. Gansmo is responsible for the management and administration of WRM’s fi nance division. Before joining WRM, Mr. Gansmo worked at Wynn Resorts, Limited, where he served as the Director of Financial Reporting from November 2002. Prior to joining the Group, Mr. Gansmo practiced as a certifi ed public accountant with fi rms in Las Vegas, Washington and California, including KPMG Peat Marwick, Arthur Andersen, and Deloitte and Touche. Mr. Gansmo graduated in 1993 from California State University, Chico, where he obtained a Bachelor of Science Degree in Business Administration with a focus on accounting. He became a Certifi ed Public Accountant in the State of California in 1997.

Mr. Andre Mung Dick Ong, aged 41, is the Vice President — Chief Information Offi cer of WRM, a position he has held since March 2007. Mr. Ong is responsible for the strategic planning, development and overall operation of information systems and technology services for WRM. Prior to taking up this role, Mr. Ong was the executive director, Chief Information Offi cer of WRM, a position he held from June 2003. Before joining the Group, Mr. Ong served at Shangri-La Hotels & Resorts where, from August 2001 until May 2003, he was the Director of Corporate Information Technology and was responsible for the planning and deployment of information technology for the group of 40 hotels and fi ve regional sales offi ces. Prior to this role, he was Director of Technology Support as well as Systems Support Manager since 1993. Mr. Ong has more than 18 years of experience in the hospitality/gaming industry and extensive skills in technology consultation and execution, vendor management, operation management and software development. Mr. Ong was educated in Western Australia and obtained a Bachelor of Engineering Degree in Computer Systems from Curtin University of Technology in 1991.

38 Wynn Macau, Limited

Directors and Senior Management

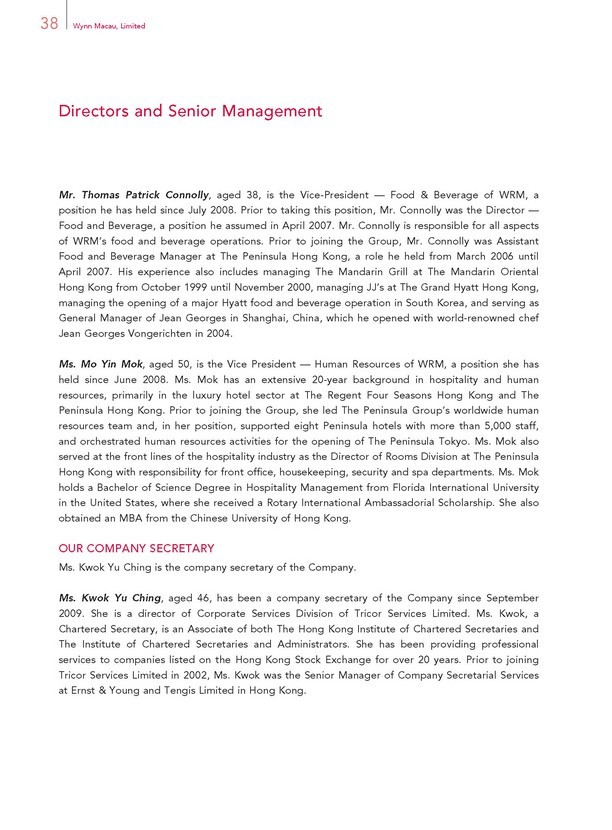

Mr. Thomas Patrick Connolly, aged 38, is the Vice-President — Food & Beverage of WRM, a position he has held since July 2008. Prior to taking this position, Mr. Connolly was the Director — Food and Beverage, a position he assumed in April 2007. Mr. Connolly is responsible for all aspects of WRM’s food and beverage operations. Prior to joining the Group, Mr. Connolly was Assistant Food and Beverage Manager at The Peninsula Hong Kong, a role he held from March 2006 until April 2007. His experience also includes managing The Mandarin Grill at The Mandarin Oriental Hong Kong from October 1999 until November 2000, managing JJ’s at The Grand Hyatt Hong Kong, managing the opening of a major Hyatt food and beverage operation in South Korea, and serving as General Manager of Jean Georges in Shanghai, China, which he opened with world-renowned chef Jean Georges Vongerichten in 2004.

Ms. Mo Yin Mok, aged 50, is the Vice President — Human Resources of WRM, a position she has held since June 2008. Ms. Mok has an extensive 20-year background in hospitality and human resources, primarily in the luxury hotel sector at The Regent Four Seasons Hong Kong and The Peninsula Hong Kong. Prior to joining the Group, she led The Peninsula Group’s worldwide human resources team and, in her position, supported eight Peninsula hotels with more than 5,000 staff, and orchestrated human resources activities for the opening of The Peninsula Tokyo. Ms. Mok also served at the front lines of the hospitality industry as the Director of Rooms Division at The Peninsula Hong Kong with responsibility for front offi ce, housekeeping, security and spa departments. Ms. Mok holds a Bachelor of Science Degree in Hospitality Management from Florida International University in the United States, where she received a Rotary International Ambassadorial Scholarship. She also obtained an MBA from the Chinese University of Hong Kong.

OUR COMPANY SECRETARY

Ms. Kwok Yu Ching is the company secretary of the Company.

Ms. Kwok Yu Ching, aged 46, has been a company secretary of the Company since September 2009. She is a director of Corporate Services Division of Tricor Services Limited. Ms. Kwok, a Chartered Secretary, is an Associate of both The Hong Kong Institute of Chartered Secretaries and The Institute of Chartered Secretaries and Administrators. She has been providing professional services to companies listed on the Hong Kong Stock Exchange for over 20 years. Prior to joining Tricor Services Limited in 2002, Ms. Kwok was the Senior Manager of Company Secretarial Services at Ernst & Young and Tengis Limited in Hong Kong.

Interim Report 2011 39

Other Information

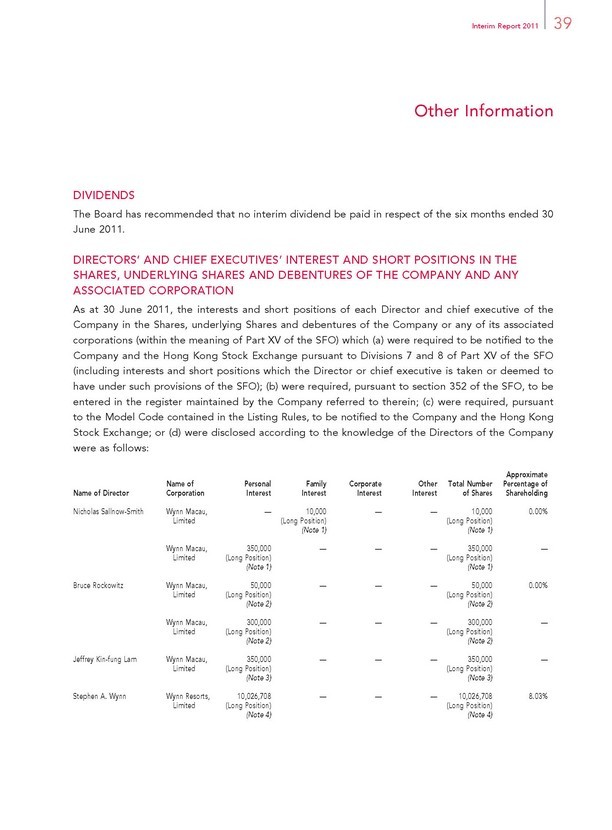

DIVIDENDS

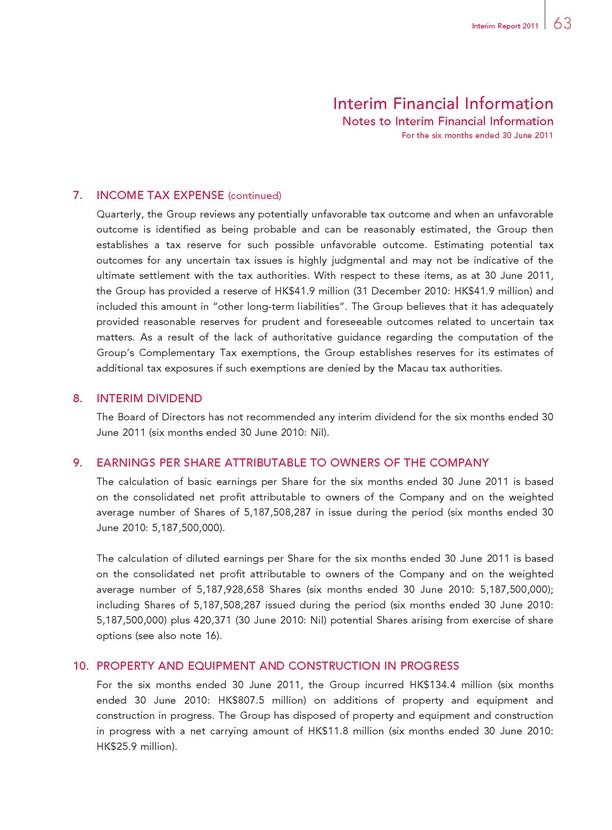

The Board has recommended that no interim dividend be paid in respect of the six months ended 30 June 2011.

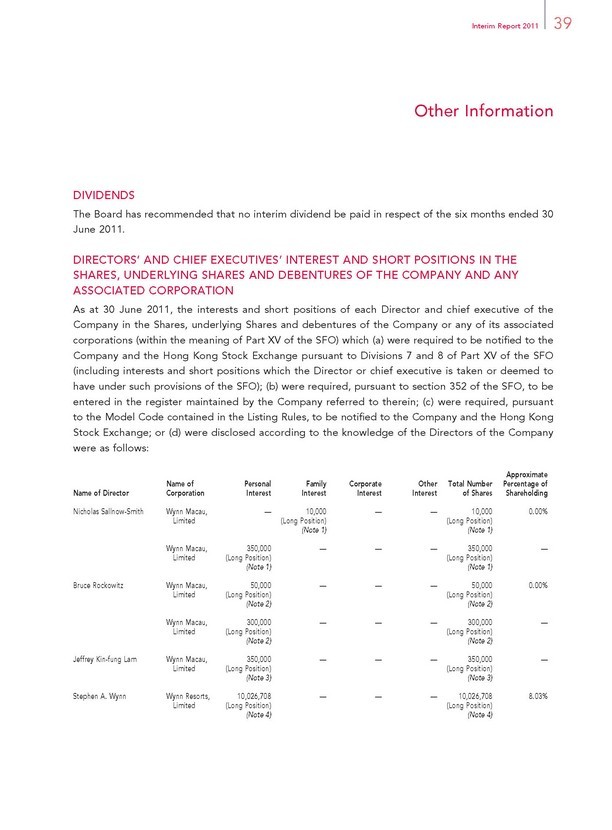

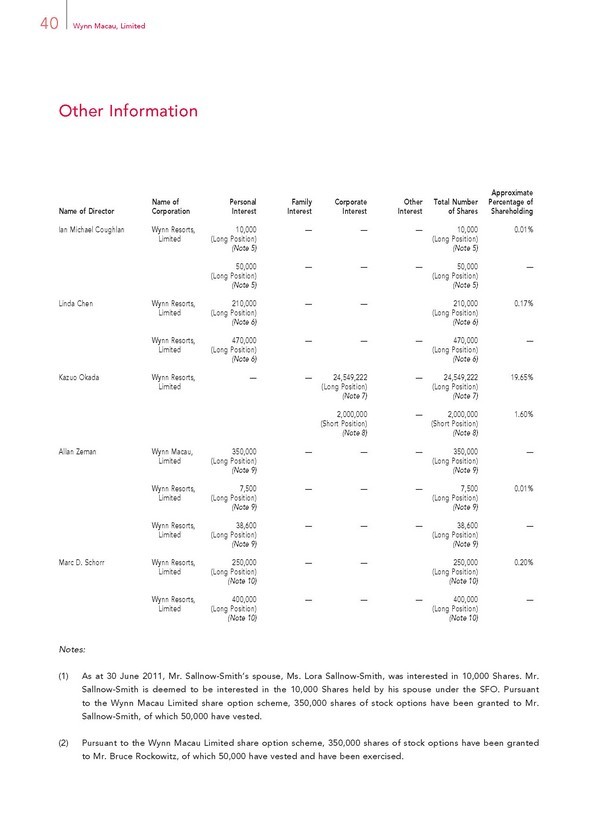

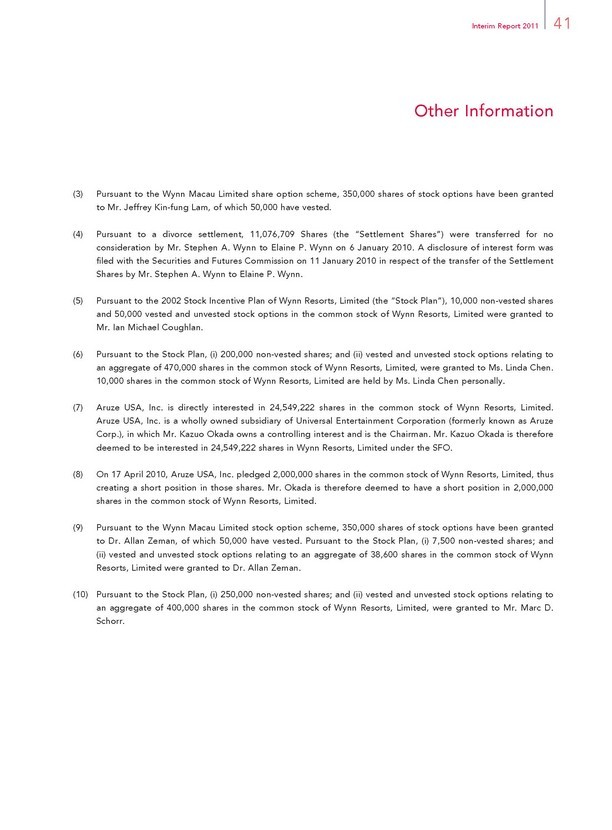

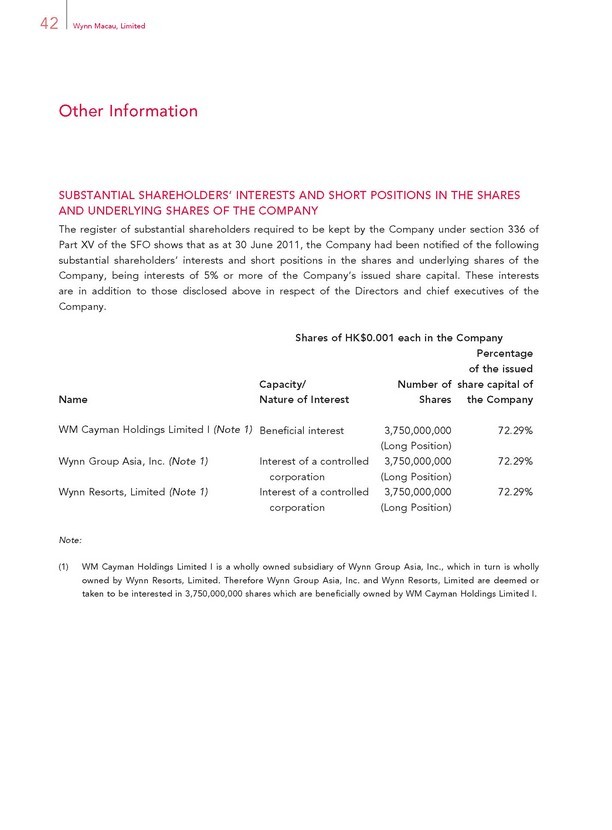

DIRECTORS’ AND CHIEF EXECUTIVES’ INTEREST AND SHORT POSITIONS IN THE SHARES, UNDERLYING SHARES AND DEBENTURES OF THE COMPANY AND ANY ASSOCIATED CORPORATION

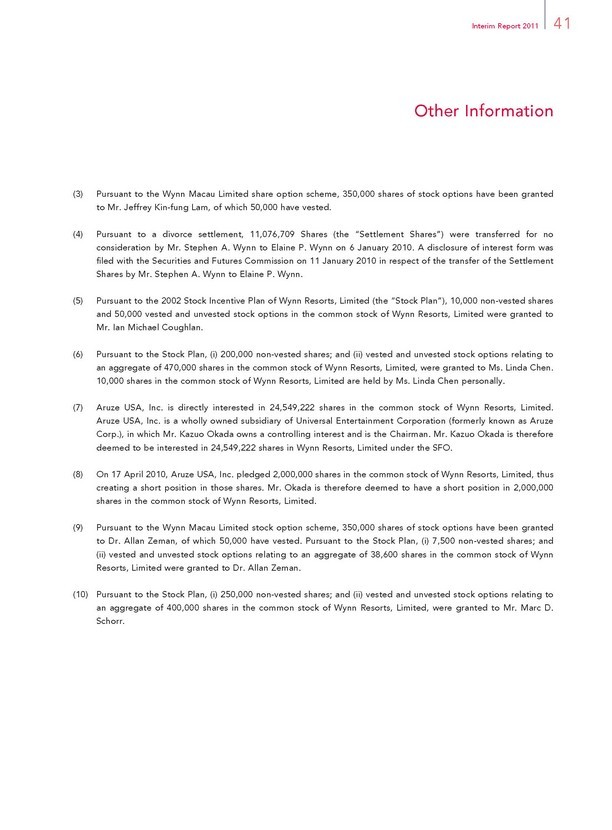

As at 30 June 2011, the interests and short positions of each Director and chief executive of the Company in the Shares, underlying Shares and debentures of the Company or any of its associated corporations (within the meaning of Part XV of the SFO) which (a) were required to be notifi ed to the Company and the Hong Kong Stock Exchange pursuant to Divisions 7 and 8 of Part XV of the SFO (including interests and short positions which the Director or chief executive is taken or deemed to have under such provisions of the SFO); (b) were required, pursuant to section 352 of the SFO, to be entered in the register maintained by the Company referred to therein; (c) were required, pursuant to the Model Code contained in the Listing Rules, to be notifi ed to the Company and the Hong Kong Stock Exchange; or (d) were disclosed according to the knowledge of the Directors of the Company were as follows:

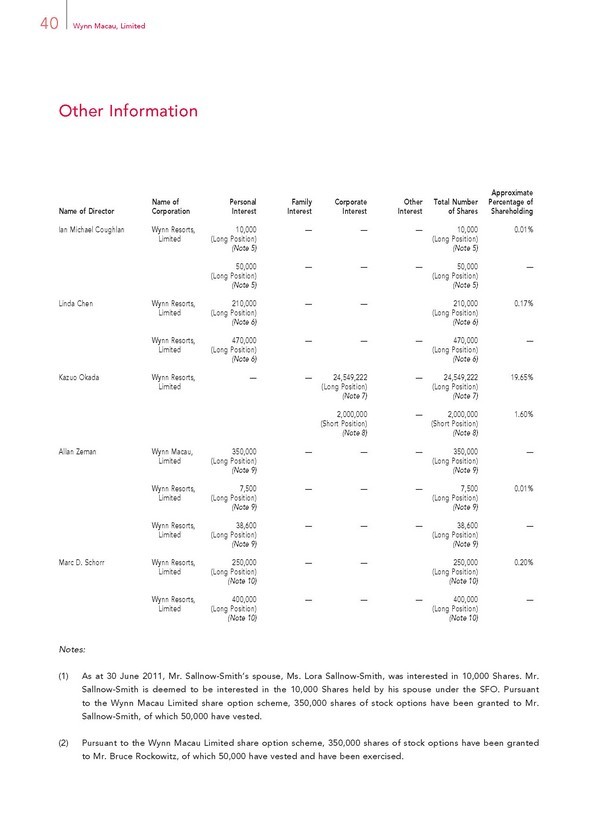

Approximate

Name of Personal Family Corporate Other Total Number Percentage of

Name of Director Corporation Interest Interest Interest Interest of Shares Shareholding

Nicholas Sallnow-Smith Wynn Macau, — 10,000 — — 10,000 0.00%

Limited (Long Position) (Long Position)

(Note 1) (Note 1)

Wynn Macau, 350,000 — — — 350,000 —

Limited (Long Position) (Long Position)

(Note 1) (Note 1)

Bruce Rockowitz Wynn Macau, 50,000 — — — 50,000 0.00%

Limited (Long Position) (Long Position)

(Note 2) (Note 2)

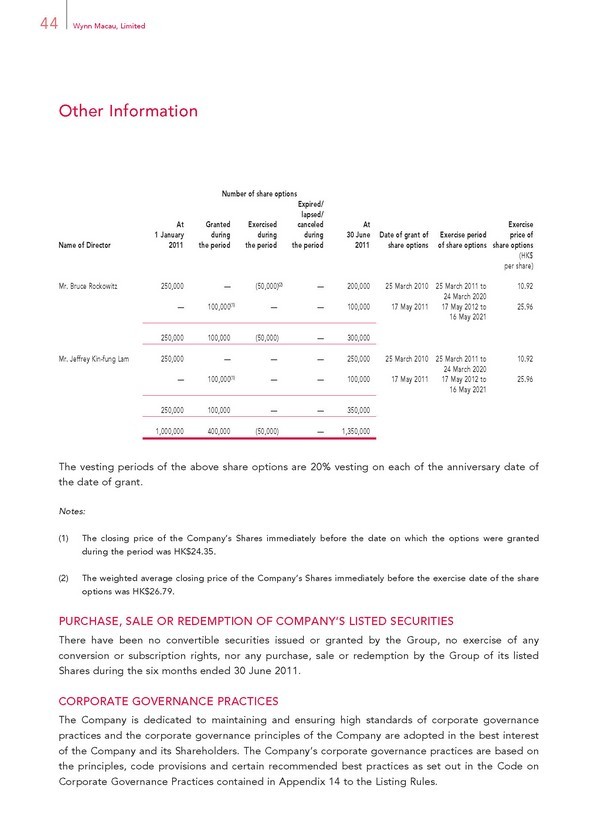

Wynn Macau, 300,000 — — — 300,000 —