- WYNN Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Wynn Resorts, Limited (WYNN) DEF 14ADefinitive proxy

Filed: 31 Mar 14, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| x | Definitive Proxy Statement | |

| ¨ | Definitive Additional Materials | |

| ¨ | Soliciting Material Pursuant to §240.14a-12 | |

Wynn Resorts, Limited

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than The Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

Notice of Annual Meeting

Notice of Annual Meeting of Stockholders

to be held on May 16, 2014

To Our Stockholders:

The Annual Meeting of Stockholders (the “Annual Meeting”) of Wynn Resorts, Limited, a Nevada corporation (the “Company”), will be held at Wynn Macau, in the Wynn Macau Ballroom, Rua Cidade de Sintra, NAPE, Macau on May 16, 2014, at 9:00 am (local time).

Purpose of the Meeting

The Annual Meeting will be held for the following purposes:

| 1. | To elect the directors named in the Proxy Statement to serve until the 2017 Annual Meeting of Stockholders; |

| 2. | To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2014; |

| 3. | To approve, on an advisory basis, our executive compensation; |

| 4. | To approve our 2014 Omnibus Incentive Plan; |

| 5. | To ratify, on an advisory basis, the Director Qualification Bylaw Amendment, described in the Proxy Statement; |

| 6. | To consider and vote on the stockholder proposal described in the Proxy Statement, if properly presented at the Annual Meeting; and |

| 7. | To consider and transact such other business as may properly come before the Annual Meeting, or at any adjournments or postponements thereof. |

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice. Only stockholders of record at the close of business on March 24, 2014, the record date fixed by the Board of Directors are entitled to notice of, and to vote at, the Annual Meeting, and at any adjournments or postponements thereof. Only such stockholders, their proxy holders and our invited guests may attend the Annual Meeting.

Notice Regarding Availability of Proxy Materials

This Proxy Statement and our Annual Report for the fiscal year ended December 31, 2013, are available athttp://www.wynnresorts.com on the Company Information page. On or about April 2, 2014, we will begin mailing to our stockholders a notice containing instructions on how to access our Annual Meeting materials, including the Proxy Statement and our Annual Report for the fiscal year ended December 31, 2013, either electronically (together with instructions as to how to vote online) or in paper format.

Your Vote is Important

Whether or not you plan to attend the Annual Meeting, you are encouraged to read this Proxy Statement and then cast your vote as promptly as possible by following the instructions in the notice you receive. Even if you have given your proxy, you may still vote in person if you attend the Annual Meeting. If your shares are held through an intermediary such as a bank, broker or other nominee, unless you provide voting instructions to such person, your shares will not be voted on most matters being considered at the Annual Meeting and your vote is therefore especially important.

By Order of the Board of Directors

Kim Sinatra

Secretary

Las Vegas, Nevada

March 31, 2014

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 16, 2014

This Proxy Statement and our 2013 Annual Report on Form 10-K are available at http://www.wynnresorts.com under the heading “Annual Meeting & Related Materials” on the Company Information page.

| Notice of Annual Meeting | |

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 2 | ||||

| 2 | ||||

| 3 | ||||

| 3 | ||||

| 3 | ||||

| 7 | ||||

| 7 | ||||

| 7 | ||||

| 8 | ||||

| 8 | ||||

| 9 | ||||

| 9 | ||||

| 9 | ||||

| 11 | ||||

| 11 | ||||

| 12 | ||||

| 12 | ||||

| 12 | ||||

| 13 | ||||

| 14 | ||||

| 14 | ||||

| 15 | ||||

| 16 | ||||

| 16 | ||||

| 17 | ||||

| 18 | ||||

| 18 | ||||

Philosophy and Overview of our Executive Compensation Program | 23 | |||

| 24 |

| Table of Contents | |

Our 2014 Annual Meeting of Stockholders

This Proxy Statement is furnished to the stockholders of Wynn Resorts, Limited, a Nevada corporation (“Wynn Resorts,” “we” or the “Company”), in connection with the solicitation by its Board of Directors (the “Board”) of proxies for its 2014 Annual Meeting of Stockholders to be held on May 16, 2014, at Wynn Macau, in the Wynn Macau Ballroom, Rua Cidade de Sintra, NAPE, Macau, at 9:00 am (local time) (the “Annual Meeting”), and at any adjournments or postponements thereof. The Annual Meeting is being held in Macau in order to coincide with the annual meeting of Wynn Macau, Limited, our publicly traded and majority owned subsidiary. Our principal executive offices are 3131 Las Vegas Boulevard South, Las Vegas, Nevada 89109. Matters to be considered and acted upon at the Annual Meeting are set forth in the Notice of Annual Meeting of Stockholders accompanying this Proxy Statement and are more fully described herein.

The Board recommends a vote as follows:

| Proposal Number | Proposal | Board Recommendation | ||

1 | Election of director nominees named in this Proxy Statement to serve until the 2017 Annual Meeting of Stockholders | FOR each nominee | ||

2 | Ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2014 | FOR | ||

3 | Approval, on an advisory basis, of our executive compensation | FOR | ||

4 | Approval of our 2014 Omnibus Incentive Plan | FOR | ||

5 | Ratification, on an advisory basis, of the Director Qualification Bylaw Amendment, described in this Proxy Statement | FOR | ||

6 | Vote on a stockholder proposal described in this Proxy Statement, if properly presented | AGAINST | ||

Notice of Internet Availability of Proxy Materials

Under rules adopted by the U.S. Securities and Exchange Commission (the “SEC”), we are furnishing proxy materials to stockholders via the internet, instead of mailing printed copies of those materials to each stockholder. On or about April 2, 2014, we will begin mailing to stockholders a Notice of Internet Availability containing instructions on how to access our Annual Meeting materials, including this Proxy Statement and our Annual Report for the fiscal year ending December 31, 2013. The Notice of Internet Availability also explains how to vote through the internet or telephonically.

This electronic access process expedites stockholders’ receipt of our Annual Meeting materials, lowers the cost of our Annual Meeting and conserves natural resources. However, if you would prefer to receive a printed copy of our Annual Meeting materials, a paper proxy card or voting instructions cards, please follow the instructions included in the Notice of Internet Availability. If you have previously elected to receive our Annual Meeting materials electronically or by mail, you will continue to receive these materials in that format unless you elect otherwise.

A proxy delivered pursuant to this solicitation may be revoked by the person executing the proxy at any time before it is voted by (i) giving written notice to our Secretary at the address set forth below, (ii) delivering to our Secretary a later dated proxy, (iii) submitting another proxy by telephone or over the internet (your latest telephone or internet voting instructions are followed), or (iv) voting in person at the Annual Meeting. Written notice of revocation or subsequent proxy should be sent to:

Wynn Resorts, Limited

c/o Corporate Secretary

3131 Las Vegas Boulevard South

Las Vegas, Nevada 89109

Please note, however, that if your shares are held through an intermediary such as a bank, broker or other nominee, you must contact that person if you wish to revoke previously given voting instructions. In this case, attendance at the Annual Meeting, in and of itself, does not revoke a prior proxy.

| General Information | |

page 1

|

General Information

Only holders of record of shares of the Company’s common stock, par value $.01 (“Common Stock”) as of the close of business on March 24, 2014, the record date fixed by the Board (the “Record Date”), are entitled to notice of, and to vote at, the Annual Meeting and at any adjournments or postponements thereof. As of the Record Date, there were 101,257,217 shares of Common Stock outstanding. Each stockholder is entitled to one vote for each share of Common Stock held as of the Record Date on all matters presented at the Annual Meeting.

At least a majority of the outstanding shares of Common Stock must be represented at the Annual Meeting, in person or by proxy, to constitute a quorum and to transact business at the Annual Meeting. Abstentions and “withhold” votes are counted for purposes determining whether there is a quorum. A plurality of the votes cast in person or by proxy at the Annual Meeting is required for the election of the director nominees. Under Nevada law, shares as to which a stockholder withholds voting authority in the election of directors and broker non-votes, which are described below, will not be counted and therefore will not affect the election of the nominees receiving a plurality of the votes cast. In 2013, the Board implemented a Director Resignation Policy. Under this policy, if any director in an uncontested election does not receive over 50% of the votes cast, meaning that the director receives more “withhold” votes than “for” votes, such director is required to tender his or her resignation to the Chairman of the Board within five days of the election. The members of the Board (other than the affected director) then have the discretion to accept the resignation or not and the affected director must abide by the Board’s decision.

For each other item to be acted upon at the Annual Meeting, the item will be approved if the number of votes cast in favor of the item by the stockholders entitled to vote exceeds the number of votes cast in opposition to the item. Abstentions and broker non-votes will not be counted as votes cast on an item and therefore will not affect the outcome of these proposals. Shares represented by properly executed and unrevoked proxies will be voted at the Annual Meeting in accordance with the directions of stockholders indicated in their proxies. If no specification is made, shares represented by executed and unrevoked proxies will be voted in accordance with the specific recommendations of the Board set forth above. If any other matter properly comes before the Annual Meeting, the shares will be voted in the discretion of the persons voting pursuant to the respective proxies. For stockholders who hold shares through intermediaries such as brokers, banks and other nominees, such intermediaries may not be permitted to vote without instructions from the stockholder unless the matter to be voted on is considered “routine.” In this Proxy Statement, only Proposal No. 2 (ratification of Ernst & Young LLP as the Company’s independent registered public accounting firm) is considered routine. On each of the other proposals, including the election of directors, your broker, bank or other nominee may not vote your shares without receiving voting instructions from you. When a bank, broker or other nominee does not have authority to vote on a particular item without instructions from the beneficial owner and has not received instructions, a “broker non-vote” occurs.

Stockholders will be admitted to the Annual Meeting upon presentation of government-issued photo identification and, for stockholders who own shares of the Company’s Common Stock through an intermediary, such as a bank, broker or other nominee, satisfactory proof of ownership of the Company’s Common Stock as of close of business on the Record Date for the Annual Meeting. For stockholders of record, a government-issued photo identification that matches the stockholder’s name on the Company’s stock ledger must be presented to attend the meeting. For stockholders who own shares of the Company’s Common Stock through an intermediary, such as a bank, broker or other nominee, satisfactory proof of ownership consists of a government-issued photo identification and a document that includes the stockholder’s name and confirms ownership as of the Record Date, such as (a) the Notice of Internet Availability that was mailed to them, (b) a copy of a voting instruction form mailed to them or (c) a valid proxy signed by the record holder. Persons who are not stockholders will be entitled to admission only if they have a valid legal proxy from a record holder and government-issued photo identification. Each stockholder may appoint only one proxyholder to attend on his or her behalf.

| General Information | |

page 2

|

Proposal 1: Election of Directors

Under our Second Amended and Restated Articles of Incorporation (the “Articles”) and Sixth Amended and Restated Bylaws (the “Bylaws”), the number of directors on our Board is established from time to time by resolution of the Board and must not be less than one nor more than thirteen members. Our Board currently has eight directors, divided into three classes, designated as Class I, Class II and Class III. Members of each class serve for a three-year term. At each annual meeting, the terms of one class of directors expire. The term of office of the current Class III directors will expire at the 2014 Annual Meeting. The term of office of the current Class I directors will expire in 2015 and the term of office of the current Class II directors will expire in 2016. Except as provided in our Director Resignation Policy, discussed above, each director holds office until his or her successor has been duly elected and qualified, or the director’s earlier resignation, death or removal. The nominees are all current directors of the Company. The persons designated as proxies will have discretion to cast votes for other persons in the event any nominee for director is unable to serve. At present, it is not anticipated that any nominee will be unable to serve.

The Bylaws require that the number of directors in each class be such that as near as possible to one-third of the directors are elected at each annual meeting of stockholders. Accordingly, following the removal and resignation of Mr. Okada in February 2013, the Board was reclassified. Under Nevada law, the reclassification of an incumbent director may not extend that director’s current term. In accordance with these requirements, Mr. Wayson was reclassified from Class II to Class III and as a result was a nominee in 2013 and is a nominee again at this Annual Meeting.

At the recommendation of the Nominating and Corporate Governance Committee, the Board is nominating the following directors for election as Class III directors:

| • | Robert J. Miller |

| • | D. Boone Wayson |

Biographical and other information concerning these and the other directors that serve on our Board is provided below. Also included are the key skills and qualifications of our directors supporting their service, in light of the Company’s business and structure.

OUR BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE FOR THE ELECTION

OF THE NOMINEES LISTED ABOVE.

Director Biographies and Qualifications

Class III Director Nominees for Election

| Robert J. Miller. Governor Miller, 69, has served as a director of the Company since October 2002. Governor Miller serves as the Company’s independent Presiding Director, Chairman of the Nominating and Corporate Governance Committee and as a member of the Audit Committee. Governor Miller is also the Chairman of the Company’s Compliance Committee and serves as the Company’s Compliance Director. In those roles, he led the Board’s independent investigation of Aruze USA, Inc. (“Aruze”). On February 27, 2014, the Board acted to combine these roles under the Chairman of the Company’s Compliance Committee. In June 2010, Governor Miller founded Robert J. Miller Consulting, a company that provides assistance in establishing relationships with, and building partnerships between, private | |

and government entities on the local, state, national and international level. Governor Miller also currently serves as a Senior Advisor to Grayling, a multidisciplinary governmental affairs strategy and management firm. Governor Miller was a partner of the Nevada law firm of Jones Vargas from 2000 to 2005. From January 1989 until January 1999, Governor Miller served as Governor of the State of Nevada, and, from 1987 to 1989, he served as Lieutenant Governor of the State of Nevada. From 1979 to 1987, Governor Miller was the Clark County District Attorney and from 1984 to 1985, the President of the National District Attorney’s Association. Governor Miller also serves as a director of International Game Technology (IGT).

Experience, qualifications attributes and skills. Governor Miller’s extensive experience in regulatory and legal compliance matters, and in Nevada and federal government and politics, brings unique expertise and insight into law enforcement and state regulatory and public policy issues that directly impact the Company’s operations. In addition, his legal background and knowledge of Nevada gaming regulation support his service as Chairman of the Company’s Compliance Committee, which role is important in maintaining our regulatory structure and probity. In addition to serving the longest period as a Governor of the State of Nevada, Governor Miller has long standing experience in law enforcement including terms as an elected judge, police attorney and elected district attorney, during which term he served as the President of the National District Attorneys Association. | ||

| Proposal 1: Election of Directors | |

page 3

|

Proposal 1: Election of Directors

| D. Boone Wayson. Mr. Wayson, 61, has served as a director of the Company since August 2003. Mr. Wayson serves as the Chairman of the Audit Committee and as a member of the Nominating and Corporate Governance Committee. Mr. Wayson has been a principal of Wayson’s Properties, Incorporated, a real estate development and holding company, since 1970. He also serves as an officer and/or director of other real estate and business ventures. From 2000 through May 2003, Mr. Wayson served as a member of the board of directors and audit committee of MGM Resorts International (formerly MGM Mirage). | |

Experience, qualifications attributes and skills. Mr. Wayson’s experience in the real estate and gaming businesses contributes to the Board’s ability to assess and oversee these critical aspects of the Company’s business and to provide insights to the Company’s operations. Mr. Wayson has extensive operational experience in the casino finance and marketing areas beginning as casino controller and ultimately managing a resort casino property in Atlantic City, N.J. The Board is benefited by Mr. Wayson’s first-hand experience in operations and utilizes his knowledge of the business, especially in the finance, gaming and marketing areas, to identify, manage and monitor risk. | ||

Directors Continuing in Office

Class I Directors

| Elaine P. Wynn. Ms. Wynn, 71, has served as a director of the Company since October 2002. Ms. Wynn has been a strong advocate of programs and services for children at risk of dropping out of school. Since 1995, she has co-chaired the Greater Las Vegas After-School All-Stars, an organization that provides thousands of children with high quality educational, recreational and cultural after-school programs. A past member of the Executive Board of the Consortium for Policy Research in Education, Ms. Wynn has served on the State of Nevada Council to Establish Academic Standards and chaired for eight years the UNLV Foundation (the private fundraising arm of University of Nevada, Las Vegas). She is the founding chairman of Communities in Schools of Nevada and was appointed in 2009 as chair of | |

the national board of Communities in Schools, the oldest, most successful stay-in-school organization in America. In 2011, Ms. Wynn was appointed by Nevada’s governor to co-chair a Blue Ribbon Task Force for education reform that resulted in the enactment of ambitious new reform legislation. In 2013, Ms. Wynn was appointed by Governor Brian Sandoval to serve a two-year term on the Nevada State Board of Education and was subsequently elected unanimously by the board to serve as president of that body. Ms. Wynn has also been a strong supporter of the arts. She established the Elaine Wynn Studio for Arts Education at The Smith Center for the Performing Arts in Las Vegas and is a member of the Board of the Los Angeles County Museum of Art. In 2012, Ms. Wynn was re-appointed to the Kennedy Center for the Performing Arts Board of Trustees. She also serves on the Library of Congress Trust Fund Board. On October 11, 2013, Ms. Wynn was elected to the Board of Directors of Activision Blizzard, Inc.

Experience, qualifications attributes and skills. Ms. Wynn’s experience in the gaming and hospitality businesses during her tenure as a director of the Company and Mirage Resorts has been valuable to the Board and important in the continued development of the Wynn brand. In addition, her philanthropic and community efforts as well as her history of assisting the Company on such matters have been important to the Board’s strategic and brand vision.

On January 6, 2010, Elaine Wynn, Aruze USA, Inc. (“Aruze”) (a company controlled by former director Mr. Okada) and Stephen A. Wynn entered into that certain Amended and Restated Stockholders Agreement dated January 6, 2010 (the “Stockholders Agreement”) which contains covenants and provisions relating to voting agreements (including endorsement of director candidates including Ms. Wynn), pre-emptive rights, rights of first refusal, tag-along rights and certain other restrictions. On February 18, 2012, the Company redeemed all of the shares previously owned by Aruze and on February 19, 2012, the Company filed a complaint in the Eighth Judicial District Court, Clark County, Nevada against Mr. Okada, Universal Entertainment Corporation and Aruze. On June 19, 2012, Elaine Wynn asserted a cross claim against Stephen A. Wynn and Aruze in the Aruze litigation (see Item 3—“Legal Proceedings” and elsewhere in our Annual Report on Form 10-K for the year ended December 31, 2013) seeking a declaration that (1) any and all of Elaine Wynn’s duties under the Stockholders Agreement be discharged; (2) the Stockholders Agreement is subject to rescission and is rescinded; (3) the Stockholders Agreement is an unreasonable restraint on alienation in violation of public policy; and/or (4) the restrictions on sale of shares shall be construed as inapplicable to Elaine Wynn. The indentures for Wynn Las Vegas, LLC’s 7 7/8% first mortgage notes due 2020, 7 3/4% first mortgage notes due 2020 (together, the “2020 Indentures”) and the indenture for Wynn Las Vegas, LLC’s 4.25% Senior Notes due 2023 (the “2023 Indenture,” and, together with the 2020 Indentures, the “Indentures”) provide that if Stephen A. Wynn, together with certain related parties, in the aggregate beneficially owns a lesser percentage of the | ||

| Proposal 1: Election of Directors | |

page 4

|

Proposal 1: Election of Directors

outstanding common stock of the Company than are beneficially owned by any other person, a change in control will have occurred. The indentures for Wynn Las Vegas, LLC’s 5.375% first mortgage notes due 2022 (the “2022 Indenture”) provides that if any event constitutes a “change of control” under the 2020 Indentures, it will constitute a change of control under the 2022 Indenture. If Elaine Wynn prevails in her cross claim, Stephen A. Wynn would not beneficially own or control Elaine Wynn’s shares and a change in control may result under the Company’s debt documents. Under the 2020 Indentures and the 2022 Indenture, the occurrence of a change in control requires that the Company make an offer to each holder to repurchase all or any part of such holder’s notes at a purchase price equal to 101% of the aggregate principal amount thereof plus accrued and unpaid interest on the notes purchased, if any, to the date of repurchase (unless the notes have been previously called for redemption). Under the 2023 Indenture, if a change in control occurs and within 60 days after that occurrence the 4.25% senior notes are rated below investment grade by both rating agencies that rate such notes, the Company is required to make an offer to each holder to repurchase all or any part of such holder’s notes at a purchase price equal to 101% of the aggregate principal amount thereof plus accrued and unpaid interest on the notes purchased, if any, to the date of repurchase (unless the notes have been previously called for redemption). Mr. Wynn is opposing Ms. Wynn’s cross claim. | ||

| J. Edward Virtue. Mr. Virtue, 53, has served as a director of the Company since November 2012. Mr. Virtue serves as Chairman of the Compensation Committee and as a member of the Nominating and Corporate Governance Committee. Mr. Virtue is the Chief Executive Officer and Founder of MidOcean Partners, an alternative asset manager based in New York. MidOcean’s private equity and hedge funds are focused on investing in middle market companies. Prior to founding MidOcean in 2003, Mr. Virtue held senior positions at financial service firms Deutsche Bank, Bankers Trust and Drexel Burnham Lambert. | |

Experience, qualifications attributes and skills. Mr. Virtue has extensive financial experience as a fund manager and business investor, including experience in the gaming, hospitality and consumer products industries. The continuing challenges of the global economic environment require sophisticated and diverse experience in capital markets, which the Nominating and Governance Committee and the Board determined Mr. Virtue provides. | ||

| John J. Hagenbuch. Mr. Hagenbuch, 62, has served as a director of the Company since December 2012. Mr. Hagenbuch serves as a member of the Compensation Committee and as a member of the Audit Committee. Mr. Hagenbuch is Chairman of M&H Realty Partners and WestLand Capital Partners, investment firms he co-founded in 1994 and 2010, respectively. Previously, Mr. Hagenbuch was a General Partner of Hellman & Friedman, a private equity firm that he joined as its third partner in 1985. He graduated magna cum laude from Princeton University and holds an MBA from Stanford University Graduate School of Business. | |

Experience, qualifications attributes and skills. Mr. Hagenbuch brings to our Board deep corporate strategy and financial expertise gained over thirty years as a private equity investor and as a director of a number of public and private companies. Additionally, Mr. Hagenbuch provides valuable insight and perspective to our Board as the Company continues to position itself to capture new development opportunities in today’s gaming environment. | ||

Class II Directors

| Dr. Ray R. Irani. Dr. Irani, 79, has served as a director of the Company since October 2007. Dr. Irani serves as a member of the Compensation Committee and as a member of the Nominating and Corporate Governance Committee. Dr. Irani is the former Executive Chairman, Chairman and Chief Executive Officer of Occidental Petroleum Corporation, an international oil and gas exploration and production company with operations throughout the world. He is a member of The Conference Board and the Council on Foreign Relations. Dr. Irani is a Trustee of the University of Southern California. He is also a member of the Board of Governors of Town Hall Los Angeles and the Los Angeles World Affairs | |

Council, and serves on the Advisory Board of the RAND Center for Middle East Public Policy and the Atlantic Council’s International Advisory Board.

Experience, qualifications attributes and skills. After the opening of Wynn Macau in 2006, the Company sought additional representation on the Board by executives with experience in managing international operations and keen insight into issues relevant to companies with global operations, which are of great importance to the Company. Dr. Irani was elected to the Board in 2007, and the Company continues to benefit from his extensive international business experience. | ||

| Proposal 1: Election of Directors | |

page 5

|

Proposal 1: Election of Directors

|

Alvin V. Shoemaker. Mr. Shoemaker, 75, has served as a Director of the Company since December 2002. Mr. Shoemaker was the Chairman of the Board of First Boston Inc. and First Boston Corp. from April 1983 until his retirement in January 1989, at the time of its sale to Credit Suisse Bank. Mr. Shoemaker currently serves as Chairman of the Board of the Eisenhower Medical Center and is a member of the board of directors of Frontier Bank, Western Community Bank Shares, and Huntsman Corporation. | |

Experience, qualifications attributes and skills. Mr. Shoemaker has served on the Board of the Company since its formation in 2002. With his extensive knowledge of the Company’s development, strategy, financing arrangements and operations since its formation and his deep experience as a financial executive serving as the Chairman of First Boston, Mr. Shoemaker contributes to the Board’s oversight of the Company’s financial matters. Mr. Shoemaker’s experience in this respect has been especially valuable to the Company during the recent financial crisis, and enables him to provide strong leadership. | ||

| Stephen A. Wynn. Mr. Wynn, 72, has served as Chairman and Chief Executive Officer of the Company since June 2002. Mr. Wynn has been an Executive Director, the Chairman of the Board of Directors and Chief Executive Officer of Wynn Macau, Limited, a majority owned subsidiary of the Company, since September 2009 and President of Wynn Macau, Limited until January, 2014. Mr. Wynn has also served as Director, Chairman and Chief Executive Officer of Wynn Resorts (Macau) S.A. since October 2001. From April 2000 to September 2002, Mr. Wynn was the managing member of Valvino Lamore, LLC, the predecessor and a current wholly owned subsidiary of Wynn Resorts, Limited. Mr. Wynn also serves as an officer and/or director of several subsidiaries of Wynn Resorts, Limited. Mr. Wynn served as Chairman, | |

President and Chief Executive Officer of Mirage Resorts, Inc. and its predecessor, Golden Nugget Inc., between 1973 and 2000. Mr. Wynn developed, opened and operated The Mirage, Treasure Island and Bellagio in 1989, 1993 and 1998, respectively.

Experience, qualifications attributes and skills. Mr. Wynn is the founder and creative and organizational force of Wynn Resorts. Mr. Wynn’s 45 years of experience in the industry have contributed to his brand name status as the preeminent designer, developer and operator of destination casino resorts. Mr. Wynn’s involvement with our casino resorts provides a distinct advantage over other gaming enterprises. As founder, Chairman and Chief Executive Officer, he has a unique perspective into the operations and vision for the Company. | ||

Other Directors Who Served in 2013

Kazuo Okada informed the Board of his resignation on February 21, 2013, and on February 22, 2013, the Company’s stockholders voted to remove Kazuo Okada from the Board whereby approximately 99.6% of the over 86 million shares voted were in favor of the removal. See “Certain Relationships and Related Transactions”, “Share Redemption” on page 39 of this Proxy Statement and Item 3—“Legal Proceedings” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2013.

| Proposal 1: Election of Directors | |

page 6

|

Our Governance Program. Our Board and management are committed to sound and effective corporate governance. Consistent with this commitment, the Company has established a comprehensive corporate governance framework, with policies and programs designed not only to satisfy the extensive regulatory requirements applicable to our business but to build value for the Company’s stockholders and promote the vitality of the Company for its customers, employees and the other individuals and organizations that depend upon it. The key components of our corporate governance framework are set forth in the following documents:

| • | Second Amended and Restated Articles of Incorporation (“Articles”) and our Sixth Amended and Restated Bylaws (“Bylaws”); |

| • | Corporate Governance Guidelines that govern the structure and functioning of the Board and set out the Board’s position on a number of governance issues, including a requirement that all independent directors meet the heightened independence criteria applicable to audit and compensation committee members under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and the rules of the NASDAQ; |

| • | Code of Business Conduct and Ethics applicable to all directors, officers, employees and certain independent contractors; |

| • | Written charters for each of our standing Committees of the Board, which are comprised solely of independent directors: the Audit Committee, Nominating and Corporate Governance Committee and Compensation Committee; |

| • | Corporate and property level compliance committees operating under the terms of written compliance programs to promote compliance with our various regulatory requirements including, among other things, gaming regulations in each jurisdiction in which we operate, and applicable federal laws and regulations related to anti-money laundering and the Foreign Corrupt Practices Act (“FCPA”); and |

| • | Stock Ownership Guidelines. |

Other than the compliance programs, each of the above documents is available on our investor relations website athttp://www.wynnresorts.com under the heading “Corporate Governance” on the Company Information page.

Corporate Social Responsibility. In addition, we operate our business in a manner that incorporates our core values of compassion and responsibility, including participating in wide ranging community service and philanthropic efforts that assist underserved communities in the markets in which we operate. We plan to issue a corporate social responsibility and sustainability report on our website in 2014.

Key Changes to our 2013 Governance Program

The Board and its Committees routinely review evolving governance practices, including input from stockholders and review of market practices generally. The Nominating and Corporate Governance Committee oversees an annual self-assessment of the Board’s performance as well as the performance of each standing Committee of the Board. The results of the evaluations are discussed with the full Board and the respective Committees. During 2013, we engaged in our regular review of our governance practices and made the following significant changes:

| • | Increased the requirement in our Stock Ownership Guidelines for our Chief Executive Officer from five times to ten times his annual base salary; |

| • | Implemented a Director Resignation Policy for any director who does not receive over 50% of the votes cast in uncontested elections; and |

| • | Revised our Hedging/Pledging Policy to prohibit all hedging and prospective pledging of our stock by our directors and executive officers, with any exception requiring advance Board approval. |

| ||

page 7

|

Corporate Governance

The Board has given careful consideration to the leadership model that best serves the interests of our stockholders. The Board has determined that the interests of all stockholders are currently best served with a combined Chairman and Chief Executive Officer (“CEO”) position and an independent Presiding Director. The Board also believes that the issue of whether to combine or separate the offices of Chairman and CEO is part of the succession planning process and that it is in the best interests of the Company for the Board to periodically evaluate and make a determination whether to combine or separate the roles based upon current circumstances.

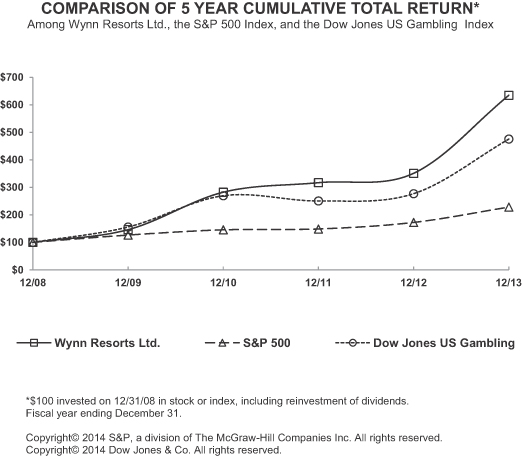

Chairman and CEO. Mr. Wynn currently serves as the Chairman and CEO of the Company. Mr. Wynn has served in these roles since the Company’s inception in 2002 and during that period, has delivered exceptional value to our stockholders. Under Mr. Wynn’s leadership our stockholders have received approximately $5.4 billion, or $48.75 per share, through the payment of dividends and seen a compounded annual total stockholder return (including reinvestment of dividends) of 32% from our initial public offering in 2002 through the end of 2013. Mr. Wynn is the founder, creator and name behind our brand. He brings extraordinary talent to our Company that is unrivaled by others in our industry. In addition, the Board believes that Mr. Wynn’s combined role as Chairman and CEO promotes unified leadership and direction for the Board and management, and provides focused leadership for the Company’s operational and strategic efforts.

Independent Presiding Director. Governor Miller currently serves as the independent Presiding Director. The independent Presiding Director is elected annually by the independent members of the Board. In accordance with the specific duties prescribed in our Corporate Governance Guidelines, the independent Presiding Director: chairs executive sessions of the independent directors which are held throughout the year; presides at all meetings of the Board at which the Chairman is not present; acts as the liaison between the Chairman and independent directors; and performs such additional functions as designated by the Board.

Other Board Governance Measures. The combined role of Chairman and CEO is further balanced by the Board’s demonstrated commitment and ability to provide independent oversight of management. Six of the eight members of our Board satisfy the most stringent requirements of independence promulgated by the Exchange Act and the NASDAQ for audit and compensation committee members, and the Audit, Compensation, and Nominating and Corporate Governance Committees are each comprised entirely of independent members of the Board. This structure encourages independent and effective oversight of the Company’s operations and prudent management of risk. In addition, the Company is subject to stringent regulatory requirements and oversight, combining our internal controls with third-party monitoring of the Company’s operations. The independent members of the Company’s Board meet separately in executive session at each regular meeting of the Board. The members of the Audit Committee also meet separately in executive session with each of the Company’s independent auditors, Vice President of Internal Audit, Chief Financial Officer, General Counsel and Compliance Officer. The independent Presiding Director is responsible for communicating to the CEO and management all concerns that arise during executive sessions. In addition, all Committee agendas and all agendas for meetings of the Board are provided in advance to all independent members of the Board. The members are encouraged to, and do, review the proposed agenda items and add additional items of concern or interest. Further, our CEO’s compensation is established and reviewed by the Compensation Committee, all of whose members are independent. The Compensation Committee engages an independent third party to evaluate the level of the compensation and benefits of employment provided to Mr. Wynn. This evaluation was last completed in 2013 by Pay Governance LLC. Please refer to the “Compensation Discussion and Analysis” beginning on page 18 for the details of this review.

The Board has determined that six of its eight members are independent under standards set forth in our Corporate Governance Guidelines and the NASDAQ listing standards. The Board has further determined that each of those six directors also meet the additional, heightened independence criteria applicable to audit and compensation committee members under the Exchange Act and NASDAQ rules. The six independent directors are Messrs. Hagenbuch, Irani, Miller, Shoemaker, Virtue and Wayson. Based upon information requested from each director concerning his background, employment and affiliations, the Board has affirmatively determined that none of the independent directors has a direct or indirect material relationship with the Company. In assessing independence, the Board considered all relevant facts and circumstances, including that none of the independent directors or their immediate family members has any economic relationship with the Company other than the receipt of his director’s compensation and compensation provided to directors’ immediate family members, as defined under NASDAQ listing standards, which was less than $120,000 in the aggregate and was not for consulting or advisory services. None of the independent directors or their immediate family members is engaged in any related party transaction with the Company.

| ||

page 8

|

Corporate Governance

Mr. Wynn and Ms. Wynn have been determined not to be independent.

Meetings of the Board of Directors and Stockholders

The Board met seven times during 2013. All of the members of our Board attended at least 75% of the meetings held by the Board and the Committees on which they served. In addition, the independent directors met in executive session, without management present, at each regular meeting of the Board.

In accordance with our Corporate Governance Guidelines, each of our directors is invited and encouraged to attend the Annual Meeting of Stockholders. All of our directors attended the 2013 Annual Meeting.

The Board has an active role in overseeing the Company’s areas of risk. The Board and its Committees regularly review information regarding the Company’s risk profile and have, in consultation with management and the Company’s independent auditors, identified specific areas of risk including: regulatory compliance, legislative and political conditions, capital availability, liquidity and general financial conditions, gaming credit extension and collection, construction, catastrophic events and succession planning. The Board (as a whole and through its Committees) has reviewed and approved management’s process for management to identify, manage and mitigate these risks. While the full Board has overall responsibility for risk oversight, the Board has assigned certain areas of risk oversight to its Committees as well as to the Company’s Compliance Committee. Throughout the year, the Board, its Committees and the Company’s Compliance Committee receive reports from management that include information regarding major risks and exposures facing the Company and the steps management has taken to monitor and control such risks and exposures. In addition, throughout the year, the Board, its Committees and the Company’s Compliance Committee dedicate a portion of their meetings to review and discuss specific risk topics in greater detail. The Audit Committee is primarily responsible for the oversight of credit, related party, construction and general financial risks. The Company’s Compliance Committee primarily oversees risks relating to regulatory, security and political compliance. For the 2013 fiscal year, management completed a review of the Company’s compensation policies and practices and presented its analysis to the Compensation Committee. The Committee concurred with management’s conclusion that such policies and practices do not present risks that are reasonably likely to have a material adverse effect on the Company.

The Board of Directors has three standing committees, each comprised solely of independent directors: the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee. The written charters for these Committees are available on our investor relations website athttp://www.wynnresorts.com under the heading “Corporate Governance” on the Company Information page.

| Name and Members | Responsibilities | Meetings in 2013 | ||

Audit Committee John J. Hagenbuch Robert J. Miller Alvin V. Shoemaker D. Boone Wayson (Chairman)

The Audit Committee, after review of each individual’s employment experience and other relevant factors, has determined that Messrs. Hagenbuch, Shoemaker and Wayson are qualified as audit committee financial experts within the meaning of SEC regulations. | • appointing, approving the compensation and retention of, and overseeing the independent auditors

• reviewing and discussing with the independent auditors and management the Company’s earnings releases and quarterly and annual reports as filed with the SEC

• reviewing the adequacy and effectiveness as well as the scope and results of the Company’s internal auditing procedures and practices

• overseeing the Company’s compliance program with respect to legal and regulatory compliance, and the Company’s policies and procedures for monitoring compliance

• meeting periodically with management to review the Company’s major risk exposures and the steps management has taken to monitor and control such exposures

• reviewing and approving the Company’s decision to enter into certain swaps and other derivative transactions | 9 meetings | ||

| Corporate Governance | |

page 9

|

Corporate Governance

| Name and Members | Responsibilities | Meetings in 2013 | ||

At each of its regular meetings, the Audit Committee meets in executive session with the Company’s independent auditors, Vice President of Internal Audit, Chief Financial Officer, General Counsel and Compliance Officer to discuss accounting principles, financial and accounting controls, the scope of the annual audit, internal controls, regulatory compliance and other matters.

The independent auditors have complete access to the Audit Committee without management present to discuss the results of their audits and their opinions on the adequacy of internal controls, quality of financial reporting and other accounting and auditing matters. | ||||

Compensation Committee John J. Hagenbuch Dr. Ray Irani Alvin V. Shoemaker J. Edward Virtue (Chairman) | • reviewing the goals and objectives of the Company’s executive compensation plans

• reviewing the Company’s executive compensation plans in light of the Company’s goals and objectives with respect to such plans and, as appropriate, recommending that the Board adopt new plans or amend the existing plans

• assessing the results of the Company’s most recent advisory vote on executive compensation

• appointing, approving the compensation and retention of, and overseeing any compensation consultants or other advisors retained by the Compensation Committee

• assessing whether the work of any compensation consultant has raised any conflict of interest

• annually evaluating the performance of the CEO of the Company, overseeing the evaluation of performance of the other officers of the Company and its operating subsidiaries, and setting compensation for the CEO, other named executive officers, and other members of our most senior management

• reviewing and approving equity awards and supervising administrative functions pursuant to the Company’s equity plans

• reviewing and approving any employment agreement or any severance or termination agreement, between the Company (or any of its subsidiaries) and any officer, as well as any other employment agreement between the Company and any individual in which annual base salary exceeds $500,000, regardless of position involved; all grants of equity compensation; bonuses for employees with annual base salaries of $250,000 or greater; all bonuses in excess of 50% of base salary (regardless of annual base salary amount) and the bonus pool for all bonuses to be paid

• reviewing and recommending to the full Board the type and amount of compensation for Board and Committee service by non-management members of the Board

• reviewing and discussing with management the Compensation Discussion and Analysis and related disclosures in the Company’s proxy statement | 7 meetings | ||

Nominating and Corporate Governance Committee Dr. Ray Irani Robert J. Miller (Chairman) J. Edward Virtue D. Boone Wayson | • identifying, screening and recommending candidates qualified to serve as directors of the Company taking into account the Company’s current and planned business and the existing membership of the Board

• assessing the independence of Board members and making appropriate recommendations to the Board

• evaluating the suitability of potential director nominees proposed by management or the stockholders

| 5 meetings | ||

| Corporate Governance | |

page 10

|

Corporate Governance

| Name and Members | Responsibilities | Meetings in 2013 | ||

• reviewing and making recommendations regarding the composition of the Board

• reviewing and making recommendations regarding the composition of the Board committees

• developing and recommending to the Board a set of corporate governance principles applicable to the Company and overseeing corporate governance matters generally

• overseeing the annual evaluation of the Board | ||||

Corporate Compliance Committee

In accordance with Nevada law, the Company has a Compliance Committee. The purpose of this committee is to assist the Company in maintaining the highest level of regulatory compliance. In his role as a director, Governor Miller currently serves as the Chairman of this committee and as the Company’s Compliance Director. On February 27, 2014, the Board acted to combine these roles under the Chairman of the Company’s Compliance Committee.

Director Nominating Procedures and Diversity

The Nominating and Corporate Governance Committee (the “Nominating Committee”) seeks to have the Board represent a diversity of backgrounds and experience and assesses potential nominees in light of the Board’s current size and composition. The Nominating Committee believes that the minimum qualifications for serving as a director of the Company are that a nominee demonstrate, by significant accomplishment in his or her field, an ability to make a meaningful contribution to the Board’s oversight of the business and affairs of the Company and have a reputation for honest and ethical conduct in both his or her professional and personal activities. The Nominating Committee may, from time to time, develop and recommend additional criteria for identifying and evaluating director candidates. In addition, the Nominating Committee examines a candidate’s other commitments, potential conflicts of interest and independence from management and the Company.

The Nominating Committee implements its policy with regard to considering diversity by annually reviewing with the Board the Board’s composition as a whole and recommending, if necessary, measures to be taken so that the Board reflects the appropriate balance of knowledge, depth, diversity of experience, and the skills and expertise required for the Board as a whole. The Nominating Committee assesses the effectiveness of this policy by periodically reviewing the Board membership criteria with the Board. This assessment enables the Board to update the skills and experience it seeks in the Board as a whole and in individual directors, as the Company’s needs evolve and change over time.

The Nominating Committee identifies potential nominees by asking current directors and executive officers to notify the Nominating Committee if they become aware of persons meeting the criteria described above who might be available to serve on the Board. The Nominating Committee will also consider director candidates recommended by stockholders on the same basis as it considers all other candidates. In considering such candidates the Nominating Committee will take into consideration the Board’s current size and composition, needs of the Board, including the skills and experience of existing directors and the qualifications of the candidate. To have a candidate considered by the Nominating Committee, a stockholder must comply with all applicable provisions of the Bylaws, must submit the recommendation in writing and must include the following information:

| • | The name of the stockholder and evidence of the stockholder’s ownership of Company stock, including the number of shares owned and the length of time of ownership; and |

| • | The name of the candidate, the candidate’s resume or a listing of his or her qualifications to be a director of the Company, and the person’s consent to be named as a director if selected by the Nominating Committee and nominated by the Board. |

The stockholder recommendation and information described above must be sent to Wynn Resorts, Limited, c/o Corporate Secretary at 3131 Las Vegas Boulevard South, Las Vegas, Nevada 89109 and must be received by the Corporate Secretary not later than the close of business on the 90thday prior to the first anniversary of the Company’s most recent Annual Meeting of Stockholders and not earlier than the close of business on the 120th day prior to such anniversary.

| Corporate Governance | |

page 11

|

Corporate Governance

If the Nominating Committee determines to pursue consideration of a person who has been identified as a potential candidate, the Nominating Committee may take any or all of the following steps: collect and review publicly available information regarding the person, contact the person and request information from the candidate, conduct one or more interviews with the candidate and contact one or more references provided by the candidate or other persons that may have greater first-hand knowledge of the candidate’s accomplishments. The Nominating Committee’s evaluation process takes into account the person’s accomplishments and qualifications, including in comparison to any other candidates that the Nominating Committee might be considering and does not vary based on whether or not a candidate is recommended by a stockholder.

The Compensation Committee is primarily responsible for monitoring risks relating to the Company’s compensation policies and practices to determine whether they create risks that may have a material adverse effect on the Company. The Compensation Committee sets all elements of compensation for our named executive officers based upon consideration of their contributions to the development and operating performance of the Company. The Committee considers the recommendations of the CEO in establishing compensation for all other named executive officers. In addition, the CEO performs annual reviews of all of our senior management and makes recommendations to the Committee. The Committee reviews the recommendations and makes final decisions regarding compensation for members of our most senior management. The Compensation Committee has the authority to retain compensation consulting firms exclusively to assist it in the evaluation of executive officer and employee compensation and benefit programs. Since 2011, the Committee has retained Pay Governance LLC, a nationally-recognized independent compensation consulting firm, to assist in performing its duties. Pay Governance does not provide services to the Company other than through the advice on director and executive compensation that it provides the Compensation Committee. In 2013, Pay Governance advised the Committee with respect to compensation trends and best practices, competitive pay levels, equity grant practices and competitive levels, peer group benchmarking and proxy disclosure. The Compensation Committee retains sole responsibility for engaging any advisor and meets with its advisor, as needed, in the Compensation Committee’s sole discretion. Upon promulgation of final rules by the SEC, the Committee will adopt clawback provisions that comply with all applicable requirements.

Stock Ownership Guidelines. The Company has rigorous Stock Ownership Guidelines which are applicable to members of the Board and each of the Company’s senior corporate officers. The Guidelines require that members of the Board achieve ownership of an amount of Common Stock of the Company for which the fair market value equals or exceeds three times such director’s annual cash retainer and for senior corporate officers three times such officer’s base salary. In 2013, after considering evolving governance practices, the Board amended the Stock Ownership Guidelines to require that the Company’s CEO achieve ownership of an amount of Common Stock of the Company for which the fair market value of Common Stock owned equals or exceeds ten times his base salary. Ownership requirements should be met for executives within three years of appointment to office and for directors within five years of election to the Board, with vested options and all restricted stock grants counted toward satisfaction of ownership guidelines. Any failure to meet guidelines will be referred to the Nominating Committee for consideration. Currently, all members of the Board and all senior corporate officers satisfy the guidelines.

Policy Regarding Prohibited Transactions. Pursuant to the Company’s Trading Policy, our directors and executive officers are prohibited from engaging in speculative transactions in Company securities, such as trading in puts and calls, or selling securities short, and from prospectively pledging Company securities as collateral for a loan, including by holding the securities in a margin account and obtaining a loan or other margin credit under such account, unless approved in advance by the Board.

Director Education. In accordance with our Corporate Governance Guidelines, all of our directors are expected to maintain the necessary level of expertise to perform their responsibilities as directors. In 2013, directors of Wynn Macau, Limited participated in the Company’s annual FCPA training program, conducted by the Company’s outside counsel (“FCPA Training”) and as of February, 2014, directors of the Company participated in our annual FCPA Training.

Compensation Committee Interlocks and Insider Participation

The members of the Compensation Committee are appointed by the Board each year. The members of the Compensation Committee that served in 2013 were Messrs. Hagenbuch, Irani, Shoemaker and Virtue. No member of the Compensation Committee is, or was formerly, one of our officers or employees. No interlocking relationship exists between the Board or Compensation Committee and the board of directors or compensation committee of any other company, nor has any interlocking relationship existed in the past.

| Corporate Governance | |

page 12

|

Corporate Governance

Stockholders who wish to communicate with the Board or any particular director, including the independent Presiding Director, or with any committee of the Board, including the chair of any Committee, may do so by writing to the following address:

Wynn Resorts, Limited

c/o Corporate Secretary

3131 Las Vegas Boulevard South

Las Vegas, Nevada 89109

All communications received will be opened by the office of our General Counsel for the purpose of assessing the nature of the communications. With the exception of advertising, promotions of a product or service, and patently offensive material, communications will be forwarded promptly to the addressee. In the case of communications addressed to more than one director, the General Counsel’s office will make sufficient copies of the contents to send to each addressee.

| Corporate Governance | |

page 13

|

Directors who are not employees of the Company currently receive fees for service on the Board and Committees as follows:

Board Service | • Monthly fee of $5,000 | |

Audit Committee Service | • Member monthly fee of $1,250 • Chairman monthly fee of $2,500 | |

Compensation Committee Service | • Member monthly fee of $1,000 • Chairman monthly fee of $2,000 | |

| Nominating and Corporate Governance Committee Service | • Member monthly fee of $1,000 • Chairman monthly fee of $2,000 |

Each non-employee director also receives a $1,500 meeting fee for each Board or Committee meeting he or she attends. Non-employee directors (other than Ms. Elaine P. Wynn) are also granted annual equity awards in the form of stock options or restricted stock determined annually at the May meeting of the Board, which for 2013, consisted of a grant of 6,300 stock options that vest 25% per year, over four years, commencing May 6, 2014. Beginning in 2014, the independent Presiding Director will also receive an annual retainer of $50,000. All directors are provided complimentary room, food and beverage privileges at our properties and are reimbursed for any other out of pocket expenses related to their attendance at meetings. Directors from time to time may receive other benefits, although the aggregate incremental cost of any such benefits and perquisites did not exceed $10,000 for any director in 2013. The Company does not provide non-equity incentive plan awards or deferred compensation or retirement plans for non-employee directors.

Non-Employee Director Compensation Table

The table below summarizes the total compensation awarded to, earned by or paid to each of the non-employee directors for the fiscal year ended December 31, 2013.

| Name | Fees Earned or Paid in Cash ($) | Option Awards ($) (1)(2) | All Other Compensation ($)(3) | Total ($) | ||||||||||||

John J. Hagenbuch | $ | 115,806 | $ | 252,064 | — | $ | 367,870 | |||||||||

Dr. Ray R. Irani | $ | 115,194 | $ | 252,064 | $ | 2,500 | $ | 369,758 | ||||||||

Robert J. Miller(4) | $ | 203,500 | $ | 252,064 | $ | 2,500 | $ | 458,064 | ||||||||

Alvin V. Shoemaker | $ | 121,500 | $ | 252,064 | $ | 2,500 | $ | 376,064 | ||||||||

J. Edward Virtue | $ | 118,806 | $ | 252,064 | — | $ | 370,870 | |||||||||

D. Boone Wayson | $ | 138,000 | $ | 252,064 | $ | 2,500 | $ | 392,564 | ||||||||

Elaine P. Wynn | $ | 73,500 | — | — | $ | 73,500 | ||||||||||

Kazuo Okada(5) | — | — | — | — | ||||||||||||

| (1) | The amounts set forth in this column reflect the aggregate grant date fair value of 6,300 stock option awards granted to Messrs. Hagenbuch, Irani, Miller, Shoemaker, Virtue and Wayson, on May 6, 2013. Ms. Elaine P. Wynn did not receive any awards. See our Annual Report on Form 10-K for the year ended December 31, 2013, Item 8, Note 14—“Benefit Plans” to our Consolidated Financial Statements for assumptions used in computing fair value. |

| (2) | The aggregate number of outstanding option awards held by each director at December 31, 2013, is as follows: Mr. Shoemaker 52,590, Dr. Irani and Mr. Wayson 42,590 each, Governor Miller 32,590, and Messrs. Hagenbuch and Virtue 16,300 each. |

| (3) | “All Other Compensation” consists of cash dividends accrued on non-vested stock, which is paid if and when the stock vests. Dividends that are accrued on non-vested stock are reported as compensation because the value of dividends was not previously reflected in the accounting expense for these awards when they were granted, as the Company did not regularly pay dividends at that time. |

| (4) | Governor Miller, as a member of the Board, receives a $50,000 annual retainer for his service as the Chairman of the Company’s Compliance Committee and a $20,000 annual retainer for his service as the Company’s Compliance Director. On February 27, 2014, the Board acted to combine these roles under Chairman of the Company’s Compliance Committee. The annual retainer for this role will be $70,000. |

| (5) | Kazuo Okada informed the Board of his resignation on February 21, 2013, and on February 22, 2013, the Company’s stockholders voted to remove Kazuo Okada from the Board. |

| Director Compensation | |

page 14

|

Our Executive Officers as of March 24, 2014 are as follows:

| Name | Age | Position | ||||

Stephen A. Wynn | 72 | Chairman of the Board and Chief Executive Officer | ||||

Matt Maddox | 38 | President and Chief Financial Officer | ||||

Linda Chen | 47 | President of Wynn International Marketing, Limited | ||||

Kim Sinatra | 53 | Executive Vice President, General Counsel and Secretary | ||||

John Strzemp | 62 | Executive Vice President and Chief Administrative Officer | ||||

Our executive officers are appointed by the Board and serve at the discretion of the Board, subject to applicable employment agreements.

Non-Director Executive Biographies

Matt Maddox. Mr. Maddox is the Company’s President and Chief Financial Officer. Mr. Maddox has been a Non-Executive Director of Wynn Macau, Limited, a majority owned subsidiary of the Company, since March 2013. From November 2013 through February 2014, Mr. Maddox was the Company’s President, Chief Financial Officer and Treasurer and from March 2008, to November 2013, Mr. Maddox was the Company’s Chief Financial Officer and Treasurer. Since joining Wynn Resorts in 2002, Mr. Maddox has served as the Company’s Senior Vice President of Business Development and Treasurer, as the Senior Vice President of Business Development for Wynn Las Vegas, LLC, as the Chief Financial Officer of Wynn Resorts (Macau), S.A., and as the Company’s Treasurer and Vice President—Investor Relations. Mr. Maddox also serves as an officer of several of the Company’s subsidiaries. Prior to joining Wynn Resorts in 2002, Mr. Maddox worked in Corporate Finance for Caesars Entertainment, Inc. (formerly Park Place Entertainment, Inc.). Before joining Park Place Entertainment, Mr. Maddox worked as an investment banker for Bank of America Securities in the Mergers and Acquisitions Department.

Linda Chen. Ms. Chen has been an Executive Director and Chief Operating Officer of Wynn Macau, Limited, a majority owned subsidiary of the Company, since September 2009. Ms. Chen serves as the President of Wynn International Marketing, Limited, a wholly owned indirect subsidiary of the Company, a position she has held since January 2005. In addition, Ms. Chen is the Chief Operating Officer of Wynn Resorts (Macau), S.A., a role she has served in since June 2002. Ms. Chen is responsible for the marketing and strategic development of Wynn Macau. Ms. Chen is a member of the Nanjing Committee of the Chinese People’s Political Consultative Conference (Macau). Ms. Chen served on the Board of the Company from October 2007 to December 2012.

Kim Sinatra. Ms. Sinatra is the General Counsel and Secretary of the Company, a position she has held since February 2006. She joined the Company in January 2004 as Senior Vice President and General Counsel of its development activities. She also serves as an officer of several of the Company’s subsidiaries. From 2000 to 2003, Ms. Sinatra served as Executive Vice President and Chief Legal Officer of Caesars Entertainment, Inc. (formerly Park Place Entertainment, Inc.). She has also served as General Counsel for The Griffin Group, Inc., Merv Griffin’s investment management company, and as a partner in the New York office of the law firm Gibson, Dunn & Crutcher LLP.

John Strzemp. Mr. Strzemp is the Executive Vice President and Chief Administrative Officer of the Company. Prior to his promotion in March 2008, Mr. Strzemp served as Executive Vice President and Chief Financial Officer of the Company, positions he held since September 2002. Mr. Strzemp served as the Company’s Treasurer from March 2003 to March 2006.

| Executive Officers | |

page 15

|

Certain Beneficial Ownership and Management

The following table sets forth, as of February 28, 2014, (unless otherwise indicated), certain information regarding the shares of the Company’s Common Stock beneficially owned by: (i) each director and nominee for director; (ii) each stockholder who is known by the Company to beneficially own in excess of 5% of the outstanding shares of the Company’s Common Stock based on information reported on Form 13D or 13G filed with the SEC; (iii) each of the executive officers named in the Summary Compensation Table; and (iv) all executive officers, directors and director nominees as a group. Each stockholder’s percentage is based on 101,232,217 shares of common stock outstanding as of March 1, 2014, and treating as outstanding all options held by that stockholder and exercisable within 60 days of March 1, 2014.

| Beneficial Ownership Of Shares (1) | ||||||||

| Name and Address of Beneficial Owner (2) | Number | Percentage | ||||||

Stephen A. Wynn(3) (4) | 10,031,708 | 9.9% | ||||||

Elaine P. Wynn(3) | 9,608,334 | 9.5% | ||||||

Waddell & Reed Financial, Inc.(5) | 8,659,889 | 8.6% | ||||||

6300 Lamar Avenue Overland Park, KS 66202 | ||||||||

BlackRock, Inc.(6) | 5,266,432 | 5.2% | ||||||

40 East 52nd Street New York, NY 10022 | ||||||||

John J. Hagenbuch(7) (8) | 10,300 | * | ||||||

Ray R. Irani(9) | 24,978 | * | ||||||

Robert J. Miller(10) | 12,478 | * | ||||||

Alvin V. Shoemaker(11) | 22,478 | * | ||||||

J. Edward Virtue(12) | 10,000 | * | ||||||

D. Boone Wayson(13) | 97,478 | * | ||||||

Matt Maddox(14) | 73,560 | * | ||||||

Linda Chen(15) | 110,000 | * | ||||||

Kim Sinatra(16) | 65,287 | * | ||||||

John Strzemp(17) (18) | 250,500 | * | ||||||

All Directors and Executive Officers as a Group (12 persons)(19) | 20,317,101 | 20.1% | ||||||

| * | Less than one percent |

| (1) | This table is based upon information supplied by officers, directors, nominees for director, principal stockholders and the Company’s transfer agent, and contained in Schedules 13D and 13G filed with the SEC. Unless otherwise indicated in the footnotes to this table and subject to community property laws, where applicable, the Company believes each of the stockholders named in this table has sole voting and investment power with respect to the shares indicated as beneficially owned. Executives and directors have voting power over shares of restricted stock, but cannot transfer such shares unless and until they vest. |

| (2) | Unless otherwise indicated, the address of each of the named parties in this table is: c/o Wynn Resorts, Limited, 3131 Las Vegas Boulevard South, Las Vegas, Nevada 89109. |

| (3) | Does not include shares that may be deemed to be beneficially owned by virtue of the Stockholders Agreement, to which Mr. Wynn and Ms. Elaine P. Wynn are parties and pursuant to which they have shared voting and dispositive power with respect to shares subject thereto. Each disclaims beneficial ownership of shares held by the other. As described above, Ms. Wynn has filed a cross-claim seeking to void the Stockholders Agreement. |

| (4) | Includes 5,000 shares owned by Mr. Wynn’s spouse in which Mr. Wynn disclaims beneficial ownership. |

| (5) | Waddell & Reed Financial, Inc. (“Waddell”) has beneficial ownership of these shares as of December 31, 2013. The information provided is based upon a Schedule 13G/A filed on February 7, 2014, filed by Waddell indicating that Waddell has sole voting and dispositive power as to 8,659,889 shares; Waddell & Reed Financial Services, Inc. a subsidiary of Waddell, has sole voting and dispositive power as to 2,194,138 shares; Waddell & Reed, Inc., a subsidiary of Waddell & Reed Financial Services, Inc. has sole voting and dispositive power as to 2,194,138 shares; Waddell & Reed Investment Management Company, a subsidiary of Waddell & Reed, Inc., has sole voting and dispositive power as to 2,194,138 shares; and Ivy Investment Management Company, a subsidiary of Waddell, has sole voting and dispositive power as to 6,465,751 shares. The number of common shares beneficially owned by Waddell may have changed since the filing of the Schedule 13G/A. |

| (6) | BlackRock, Inc. (“BlackRock”) has beneficial ownership of these shares as of December 31, 2013. BlackRock has sole dispositive power as to 5,266,432 shares and sole voting power as to 4,401,332 shares. The information provided is based upon a Schedule 13G/A, dated February 4, 2014, filed by BlackRock. The number of common shares beneficially owned by BlackRock may have changed since the filing of the Schedule 13G/A. |

| (7) | Includes 10,000 shares subject to immediately exercisable options to purchase Wynn Resorts Common Stock granted pursuant to Wynn Resorts 2002 Stock Incentive Plan. |

| (8) | Includes 250 shares held by Mr. Hagenbuch’s wife and 50 shares held by Mr. Hagenbuch’s son. |

| (9) | Includes 19,978 shares subject to an immediately exercisable option to purchase Wynn Resorts’ Common Stock granted pursuant to Wynn Resorts’ 2002 Stock Incentive Plan. |

| ||

page 16

|

Security Ownership

| (10) | Includes 9,978 shares subject to immediately exercisable options to purchase Wynn Resorts’ Common Stock granted pursuant to Wynn Resorts’ 2002 Stock Incentive Plan. |

| (11) | Includes 19,978 shares subject to immediately exercisable options to purchase Wynn Resorts’ Common Stock granted pursuant to Wynn Resorts’ 2002 Stock Incentive Plan. |

| (12) | Includes 10,000 shares subject to immediately exercisable options to purchase Wynn Resorts’ Common Stock granted pursuant to Wynn Resorts’ 2002 Stock Incentive Plan. |

| (13) | Includes 19,978 shares subject to immediately exercisable options to purchase Wynn Resorts’ Common Stock granted pursuant to Wynn Resorts’ 2002 Stock Incentive Plan. |

| (14) | Includes 50,000 shares of restricted stock granted pursuant to the Company’s 2002 Stock Incentive Plan and subject to a Restricted Stock Agreement which provides such grant will vest on December 5, 2016. |

| (15) | Includes: (i) 100,000 shares of restricted stock granted pursuant to the Company’s 2002 Stock Incentive Plan and subject to a Restricted Stock Agreement which provides such grant will vest on December 5, 2016; and (ii) 10,000 shares subject to immediately exercisable options to purchase Wynn Resorts Common Stock granted pursuant to Wynn Resorts 2002 Stock Incentive Plan. |

| (16) | Includes 25,000 shares of restricted stock granted pursuant to the Company’s 2002 Stock Plan and subject to a Restricted Stock Agreement which provides such grant will vest on December 5, 2016. |

| (17) | Includes 22,500 unvested shares of restricted stock of the Company’s common stock granted pursuant to the Company’s 2002 Stock Incentive Plan and subject to a Restricted Stock Agreement. |

| (18) | Includes 500 shares held by Mr. Strzemp’s mother. |

| (19) | Includes 99,912 shares subject to immediately exercisable stock options. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires the Company’s executive officers and directors and persons who own more than 10% of the Company’s Common Stock to file reports of ownership on Forms 3, 4 and 5 with the SEC. Executive officers, directors and greater than 10% beneficial owners are also required to furnish the Company with copies of all Forms 3, 4 and 5 they file. Based solely on the Company’s review of the copies of such forms it has received, the Company believes that all its executive officers, directors and greater than 10% beneficial owners complied with all the filing requirements applicable to them with respect to transactions during 2013.

| ||

page 17

|

Compensation Discussion and Analysis

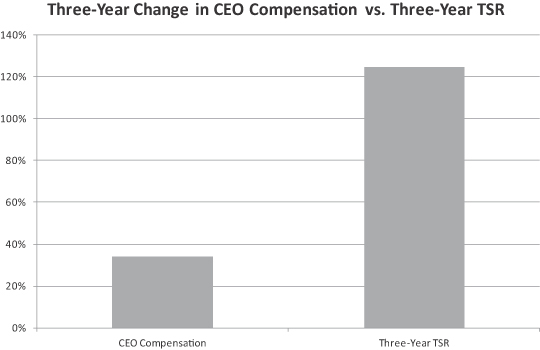

2013 was a record year for Wynn Resorts. In addition to delivering an 81% total return to stockholders and the best financial results in our history, we returned $704 million, or $7.00 per share, of cash to our stockholders through the payment of dividends. We achieved these results while continuing to build a foundation for future growth.

| • | Record Adjusted Property EBITDA at Wynn Las Vegas and Wynn Macau. For 2013, we reported Company record adjusted property EBITDA at both of our casino resorts. At Wynn Macau, adjusted property EBITDA increased to a record of $1.3 billion, which was 13% higher than 2012. Similarly, adjusted property EBITDA at Wynn Las Vegas reached an all-time record of $487 million, a 19% increase from 2012. See our Annual Report on Form 10-K for the year ended December 31, 2013, Item 8, Note 17—“Segment Information” to our Consolidated Financial Statements for the definition of “adjusted property EBITDA” and a reconciliation of adjusted property EBITDA to net income. |