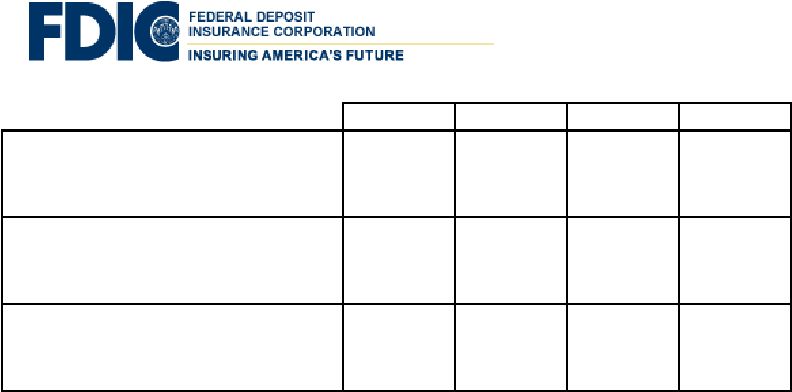

Company Name % Rank % Rank % Rank % Rank % Rank Square 1 Bank 78.85 1 79.01 1 12.93 17 0.00 1 8.05 2 North State Bancorp 27.08 2 16.11 12 52.22 1 17.34 3 14.32 6 Lumbee Guaranty Bank 24.25 3 39.19 3 15.58 13 34.34 8 10.89 4 Progressive State Bank 22.60 4 41.01 2 14.79 16 34.24 7 9.96 3 Heritage Bancshares, Inc. 18.93 5 38.25 4 15.30 14 39.90 11 6.55 1 Four Oaks Fincorp, Inc. 18.51 6 27.03 7 17.32 10 21.66 5 33.99 15 Paragon Commercial Corporation 17.76 7 20.97 10 17.29 11 0.88 2 60.87 17 Crescent Financial Corporation 16.94 8 29.39 5 16.23 12 19.21 4 35.17 16 M&F Bancorp, Inc. 16.13 9 28.88 6 32.89 2 25.14 6 13.08 5 New Century Bankcorp, Inc. 14.23 10 22.11 9 8.77 19 43.87 14 25.25 12 Capital Bank Corporation 11.56 11 22.14 8 22.96 6 36.55 9 18.34 10 KS Bancorp, Inc. 7.72 12 13.85 16 11.00 18 49.40 17 25.75 13 Mutual Community Savings Bank, Inc., SSB 7.23 13 14.13 14 20.91 9 42.37 13 22.59 11 Roanoke Rapids Savings Bank, SSB 6.15 14 19.99 11 24.04 5 38.80 10 17.17 8 First Federal Bank 3.78 15 15.23 13 15.00 15 NA NA NA NA Roxboro Savings Bank, SSB 3.37 16 14.07 15 26.84 4 41.33 12 17.76 9 Wake Forest FS&LA (MHC) 2.55 17 5.57 18 28.27 3 NA NA NA NA Roanoke Valley Savings Bank, SSB 0.27 18 0.27 20 22.95 7 47.38 15 29.40 14 New Republic Savings Bank, FSB 0.17 19 2.53 19 8.53 20 NA NA NA NA Tarboro Savings Bank, SSB 0.00 20 12.00 17 22.51 8 48.65 16 16.85 7 Median - Above 12.89 20.48 17.30 36.55 17.76 Source – Hovde North Carolina Community Bank Peer Comparison Analysis Jumbo CDs Noninterest Bearning Deposits Transaction/ NOW Accts MMDA & Savings Retail CDs North Carolina Community Bank Peer Comparison Analysis Community Banks & Thrifts Headquartered in the East Central Region with Assets under $1 Billion Data as of September 30, 2005, sorted by noninterest bearing deposits Deposit Composition - As a Percentage of Total Deposits |