U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

Annual Report under Section 13 or 15(d) of the

Securities Exchange Act of 1934

For the Fiscal Year ended December 31, 2007

OR

Transition Report under Section 13 or 15(d) of the

Securities Exchange Act of 1934

For the Transition Period from to

Commission File Number: 000-49898

North State Bancorp

(Exact name of registrant as specified in its charter)

| | |

| North Carolina | | 65-1177289 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

4270 The Circle at North Hills

Raleigh, North Carolina 27609

(Address of principal executive offices, including zip code)

(919) 787-9696

(Issuer’s telephone number)

Securities Registered under Section 12(b) of the Act: None

Securities Registered under Section 12(g) of the Act:

| | |

| Title of Each Class | | Name of Each Exchange On Which Registered |

| Common Stock, No Par Value | | None |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes¨ Nox

Indicate by check mark if the registrant is not required to file reports to Section 13 or Section 15(d) of the Act. Yes¨ Nox

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yesx No¨

Indicated by check mark if disclosure of delinquent filers in response to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes¨ Nox.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| | |

Large accelerated filer ¨ | | Accelerated filer ¨ |

Non-accelerated filer x | | Smaller reporting company ¨ |

(Do not check if a smaller reporting company)

The aggregate market value of the common stock held by non-affiliates was $62.1 million as of June 30, 2007, based on the average bid and ask price of the common stock as quoted on the over-the-counter Bulletin Board on that day.

As of March 7, 2008, the registrant had outstanding 7,157,747 shares of Common Stock, no par value.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement to be filed for its 2008 Annual Meeting of Shareholders to be held on May 29, 2008 to be mailed to shareholders within 120 days of December 31, 2007 are incorporated by reference into Part III of this report.

NORTH STATE BANCORP

ANNUAL REPORT ON FORM 10-K

Table of Contents

PART I

Item 1.Business.

Overview

We are a commercial bank holding company that was incorporated on June 5, 2002. We have one corporate subsidiary, North State Bank, which we acquired on June 28, 2002 as part of the Bank’s holding company reorganization. Our primary business is the ownership and operation of North State Bank. We also have three trust subsidiaries that we established to issue trust preferred securities and an approximately 5.6% equity interest in a title insurance agency.

North State Bank was incorporated under the laws of the State of North Carolina in May 2000 and opened for business on June 1, 2000. The Bank is not a member of the Federal Reserve System. Our main office and that of the Bank is located at 4270 The Circle at North Hills, Raleigh, North Carolina. The Bank also operates offices at 6200 Falls of Neuse Road in north Raleigh, 2413 Blue Ridge Road in west Raleigh, 14091 New Falls of Neuse Road in Raleigh, 835 Highway 70 West in Garner, North Carolina, 16 West Martin Street in downtown Raleigh and a loan production office at 1908 Eastwood Road in Wilmington, North Carolina which was replaced by a full service banking office in January 2008 located at 1411 Commonwealth Drive, Wilmington, North Carolina. The term “we” in this report refers interchangeably to North State Bancorp and North State Bank.

We focus on serving the total banking needs of professional firms, professionals, property management companies, churches and individuals who highly value a mutually beneficial banking relationship in the cities of Raleigh, Garner and Wilmington and the greater Wake County and New Hanover County market areas, by providing banking services including checking, savings and investment accounts; commercial, installment, mortgage, and personal loans; safe deposit boxes; savings bonds; wire transfer; and other associated services. We own approximately 5.6% of Beacon Title Agency, LLC, a title insurance agency. Through the Bank’s subsidiary, North State Bank Financial Services, Inc., we offer brokerage services.

Supervision and Regulation

Regulation of North State Bank

North State Bank is a North Carolina banking corporation whose deposits are insured by the Federal Deposit Insurance Corporation. As a commercial bank, we are subject to extensive regulation by the FDIC and the North Carolina Commissioner of Banks. The North Carolina Commissioner of Banks and the FDIC periodically examine our operations and require us to submit periodic reports regarding our financial condition and operations.

We are subject to various state and federal laws and regulations that restrict or otherwise apply to our lending, deposit-taking and other business activities. Additionally, federal law generally prohibits us from engaging as principal in activities that are not permitted for national banks unless the FDIC determines that the activity would pose no significant risk to the deposit insurance fund, and we are, and continue to be, in compliance with all applicable capital standards. In addition, we generally are not able to acquire or retain equity investments of a type, or in an amount, that is not permissible for a national bank.

A bank must obtain the prior approval of the North Carolina Commissioner of Banks for any of the following events:

| | • | | the merger with or purchase of substantially all the assets or assumption of liabilities of another financial institution; |

| | • | | the establishment of a branch office; and |

| | • | | the establishment or acquisition of a subsidiary corporation. |

The North Carolina Commissioner of Banks or the FDIC may sanction any insured bank not operated in accordance with or not conforming to their regulations, policies, and directives. Proceedings may be instituted against an insured bank or any director, officer or employee of a bank that engages in unsafe and unsound practices, including the violation of applicable laws and regulations. The FDIC can terminate insurance of accounts of any insured bank not operated in accordance with or not conforming to its regulations, policies, and directives.

All FDIC-insured banks must maintain average daily reserves against their transaction accounts. Because required reserves must be maintained in the form of vault cash or in a non-interest-bearing account at a Federal Reserve Bank, the effect of the reserve requirement is to reduce the amount of the Banks’ interest-earning assets.

1

The Bank is subject to the provisions of Section 23A of the Federal Reserve Act. Section 23A places limits on the amount of certain transactions with affiliate entities. The total amount of the transactions by the Bank with a single affiliate is limited to 10% of the Bank’s capital and surplus and, for all affiliates, to 20% of the Bank’s capital and surplus. Each of the transactions among affiliates must also meet specified collateral requirements and must comply with other provisions of Section 23A designed to avoid transfers of low-quality assets between affiliates. The Bank also is subject to the provisions of Section 23B of the Federal Reserve Act which, among other things, prohibits transactions with affiliates that are subject to Section 23A unless the transactions are on terms substantially the same, or at least as favorable to the Bank or its subsidiaries, as those prevailing at the time for comparable transactions with nonaffiliated companies.

The USA Patriot Act of 2001 is intended to strengthen the ability of U.S. law enforcement and the intelligence community to work cohesively to combat terrorism on a variety of fronts. The Patriot Act contains sweeping anti-money laundering and financial transparency laws which require various regulations, including standards for verifying customer identification at account opening, and rules to promote cooperation among financial institutions, regulators, and law enforcement entities in identifying parties that may be involved in terrorism or money laundering. The Patriot Act has required financial institutions to adopt new policies and procedures to combat money laundering, and it grants the Secretary of the Treasury broad authority to establish regulations and impose requirements and restrictions on financial institutions’ operations.

Community Reinvestment Act

We are subject to the provisions of the Community Reinvestment Act of 1977, which requires financial institutions to meet the credit needs of their local communities, including low and moderate income communities. In accordance with the Community Reinvestment Act, the FDIC periodically assesses our record of meeting the credit needs of our local communities by assigning one of the following ratings to our performance in that regard:

| | • | | substantial noncompliance. |

In addition, the FDIC will strongly consider our performance under the Community Reinvestment Act as a factor upon any application by us for any of the following:

| | • | | the establishment of a branch; |

| | • | | the relocation of a main office or branch; and |

| | • | | the merger or consolidation with or the acquisition of assets or assumption of liabilities of an insured depository institution. |

Capital Requirements

We must comply with the capital requirements imposed by the FDIC. Under the FDIC’s regulations, state-chartered, nonmember banks that receive the highest rating during the examination process have the following characteristics:

| | • | | no anticipated or significant current growth; |

| | • | | well-diversified risk (including no undue interest rate risk exposure), excellent asset quality, high liquidity and good earnings; and |

| | • | | in general, are considered strong banking organizations. |

The FDIC requires banks to maintain a minimum leverage ratio of 3% of Tier 1 capital, which is common stockholders’ equity less intangible assets, identified losses and other adjustments, to average total consolidated assets. The FDIC can require banks to maintain a ratio of 100 to 200 basis points above the stated minimum, and has generally set a minimum leverage ratio of not less than 4% for most banks.

To provide measurement of capital adequacy that is more sensitive to the individual risk profiles of financial institutions, the FDIC’s risk-based capital regulations provide that, in addition to maintaining their required leverage ratio, banks are expected to maintain a level of capital commensurate with risk profiles assigned to their assets. The regulations generally require a minimum ratio of Tier 1 capital to risk-weighted assets of 4%, and a minimum ratio of total capital to risk-weighted assets of 8%, of which at least one-half must be in the form of Tier 1 capital.

2

Dividends

The payment of any cash dividend is subject to the Bank’s board of directors’ evaluation of its operating results, financial condition, future growth plans, general business conditions, and to tax and other relevant considerations and regulatory limitations, including our minimum capital requirements. The Bank might not declare and pay any cash dividends, and if it were to do so, it might not continue to declare them or maintain them at the same level. As North State Bancorp owns all of the stock of North State Bank, any dividend declared would be paid to it.

In addition, other statutory and regulatory restrictions apply to the payment of cash dividends on our common stock. Under North Carolina law applicable to banks, our directors may declare a cash dividend in an amount equal to our undivided profits, as they deem appropriate, subject to the limitation that the bank’s capital surplus is at least 50% of its paid-in capital. Cash dividends may only be paid out of retained earnings. We cannot pay a cash dividend at any time that we are “undercapitalized” or insolvent, or when payment of the dividend would render us insolvent. Also, a FDIC-insured bank cannot pay a cash dividend while it is in default on any assessment due the FDIC.

Insurance Assessments

The FDIC insures our customers’ deposits. Under the Federal Deposit Insurance Reform Act of 2005, the FDIC uses a risk-based assessment system to determine the amount of a bank’s deposit insurance assessment based on an evaluation of the probability that the deposit insurance fund will incur a loss with respect to that bank. The evaluation considers risks attributable to different categories and concentrations of the bank’s assets and liabilities and other factors the FDIC considers to be relevant, including information obtained from the bank’s federal and state banking regulators. The FDIC is responsible for maintaining the adequacy of the deposit insurance fund, and the amount paid by a bank for deposit insurance is influenced not only by the assessment of the risk it poses to the deposit insurance fund, but also by the adequacy of the insurance fund to cover the risk posed by all insured institutions. FDIC insurance assessments could be increased substantially in the future if the FDIC finds such an increase to be necessary in order to adequately maintain the deposit insurance fund. The FDIC also may terminate a bank’s deposit insurance if it finds that the bank has engaged in unsafe and unsound practices, is in an unsafe or unsound condition to continue operations, or has violated applicable laws, regulations, rules, or orders.

Interstate Banking and Branching

Subject to state law, federal law permits adequately capitalized and managed bank holding companies to acquire control of a bank in any state. In addition, federal law permits banks to merge with banks located in other states and allows states to adopt legislation permitting out-of-state banks to open branch offices within that state’s borders. The North Carolina Reciprocal Interstate Banking Act permits banking organizations in any state with similar reciprocal legislation to acquire North Carolina banking organizations. In addition, subject to another state having similar laws, the North Carolina Interstate Branch Banking Act:

| | • | | permits North Carolina banks and out-of-state banks to merge; |

| | • | | authorizes North Carolina banks to establish or acquire branch offices in any other state; and |

| | • | | permits out-of-state banks to establish or acquire branch offices in North Carolina. |

Prompt Corrective Action

The Federal Deposit Insurance Corporation Improvement Act of 1991 establishes a system of prompt corrective action to resolve the problems of undercapitalized institutions. Under this system, the federal banking regulators must rate supervised institutions on a basis of five capital categories. The federal banking regulators also must take certain mandatory supervisory actions and are authorized to take all other discretionary actions with respect to institutions in the three undercapitalized categories, the severity of which will depend upon the capital category in which the institution is placed. Generally, subject to narrow exception, the Federal Deposit Insurance Corporation Improvement Act requires the primary or appropriate banking regulator to appoint a receiver or conservator for an institution that is critically undercapitalized. The federal banking agencies have specified by regulation the relevant capital level for each category.

Under the Federal Deposit Insurance Corporation Improvement Act, the FDIC adopted regulations setting forth a five-tier scheme for measuring the capital adequacy of FDIC-insured commercial banks. Under the regulations, a bank is placed in one of the following capital categories:

| | • | | Well Capitalized – a bank which has a total capital ratio of at least 10%, a Tier 1 capital ratio of at least 6%, and a Tier 1 leverage ratio of at least 5%; |

3

| | • | | Adequately Capitalized – a bank which has a total capital ratio of at least 8%, a Tier 1 capital ratio of at least 4%, and a Tier 1 leverage ratio of at least 4%; |

| | • | | Undercapitalized – a bank that has a total capital ratio of under 8%, a Tier 1 capital ratio of under 4%, or a Tier 1 leverage ratio of under 4%; |

| | • | | Significantly Undercapitalized – a bank that has a total capital ratio of under 6%, a Tier 1 capital ratio of under 3%, or a Tier 1 leverage ratio of under 3%; and |

| | • | | Critically Undercapitalized – a bank whose tangible equity is not greater than 2% of total tangible assets. |

The regulations permit the FDIC to downgrade a bank to the next lower category if the FDIC determines after notice and opportunity for hearing or response that the bank is in an unsafe or unsound condition or that the bank has received and not corrected a less-than-satisfactory rating for any of the categories of asset quality, management, earnings, or liquidity in its most recent examination. Supervisory actions by the appropriate federal banking regulator depend upon an institution’s classification within the five categories.

The Federal Deposit Insurance Corporation Improvement Act generally prohibits a depository institution from making any capital distribution including payment of a cash dividend if the depository institution would thereafter be undercapitalized. Undercapitalized depository institutions are subject to restrictions on borrowing from the Federal Reserve System. In addition, undercapitalized depository institutions are subject to growth limitations and are required to submit capital restoration plans. If a depository institution fails to submit an acceptable plan, it is treated as if it is significantly undercapitalized.

Significantly undercapitalized depository institutions might be subject to a number of requirements and restrictions including orders to sell sufficient voting stock to become adequately capitalized, requirements to reduce total assets, and cessation of receipt of deposits from correspondent banks. Critically undercapitalized depository institutions are subject to appointment of a receiver or conservator.

Safety and Soundness Standards

The Federal Deposit Insurance Act requires the federal bank regulatory agencies to prescribe standards relating to internal controls, information systems and internal audit systems, loan documentation, credit underwriting, interest rate risk exposure, asset growth, asset quality, earnings, stock valuation, and compensation, fees and benefits, and such other operational and managerial standards as the agencies deem appropriate. The federal bank regulatory agencies have adopted a set of guidelines prescribing safety and soundness standards under the Federal Deposit Insurance Corporation Improvement Act. In general, the guidelines require appropriate systems and practices to identify and manage the risks and exposures specified in the guidelines. The guidelines prohibit excessive compensation as an unsafe and unsound practice and describe compensation as excessive when the amounts paid are unreasonable or disproportionate to the services performed by the executive officer, employee, director or principal shareholder. In addition, the agencies adopted regulations that authorize, but do not require, an agency to order an institution that has been given notice by an agency that is not satisfying any of such safety and soundness standards to submit a compliance plan. If, after being so notified, an institution fails to submit an acceptable compliance plan, the agency must issue an order directing action to correct the deficiency and may issue an order directing other actions of the types to which an undercapitalized institution is subject under the prompt correction action provisions of the Federal Deposit Insurance Corporation Improvement Act. If an institution fails to comply with such an order, the agency may seek to enforce such order in judicial proceedings and to impose civil money penalties.

Financial Modernization Legislation

The Gramm-Leach-Bliley Act of 1999 permits bank holding companies meeting management, capital and Community Reinvestment Act standards, and that register as a “financial holding company,” to engage in a broad range of non-banking activities, including insurance underwriting and investment banking. The Act allows insurance companies and other financial services companies to acquire banks and allows bank holding companies to acquire securities firms and mutual fund advisory companies. The Act requires appropriate safeguards if a bank holding company wishes to engage in any of these activities. The Act also contains extensive customer privacy protection provisions which require banks to adopt and implement policies and procedures for the protection of the financial privacy of their customers, including procedures that allow customers to elect that certain financial information not be disclosed to certain persons.

4

A bank holding company may become a financial holding company under the Gramm-Leach-Bliley Act if each of its subsidiary banks is “well capitalized” under the Federal Deposit Insurance Corporation Improvement Act prompt corrective action provisions, is well managed and has at least a satisfactory rating under the Community Reinvestment Act. In addition, the bank holding company must file a declaration with the Federal Reserve Board that the bank holding company wishes to become a financial holding company. A bank holding company that falls out of compliance with these requirements may be required to cease engaging in some of its activities. We registered as a financial holding company in September 2007 in order to invest in Beacon Title Agency, LLC, a title insurance agency, as a means to generate non-interest income.

Regulation of North State Bancorp

As a registered bank holding company, we are subject to the supervision of, and to regular inspection by, the Board of Governors of the Federal Reserve System.

The Federal Reserve is authorized to adopt regulations affecting various aspects of bank holding companies. As a bank holding company, our activities, and those of companies which we control or in which we hold more than 5% of the voting stock, is limited to banking or managing or controlling banks or furnishing services to or performing services for our subsidiaries, or any other activity which the Federal Reserve determines to be so closely related to banking or managing or controlling banks as to be a proper incident thereto. In making such determinations, the Federal Reserve is required to consider whether the performance of such activities by a bank holding company or its subsidiaries can reasonably be expected to produce benefits to the public such as greater convenience, increased competition or gains in efficiency that outweigh possible adverse effects, such as undue concentration of resources, decreased or unfair competition, conflicts of interest or unsound banking practices.

Generally, bank holding companies are required to obtain prior approval of the Federal Reserve to engage in any new activity not previously approved by the Federal Reserve or acquire more than 5% of any class of voting stock of any company. Bank holding companies also must obtain the prior approval of the Federal Reserve before acquiring more than 5% of any class of voting stock of any bank that is not already majority-owned by the bank holding company. Similarly, an entity seeking to acquire more than 5% of the voting securities of a bank holding company such as our company must first receive Federal Reserve approval.

Bank holding companies are required to give the Federal Reserve Board prior written notice of any purchase or redemption of outstanding equity securities if the gross consideration for the purchase or redemption, when combined with the net consideration paid for all such purchases or redemptions during the preceding 12 months, is equal to 10% or more of the holding company’s consolidated net worth. The Federal Reserve Board may disapprove such a purchase or redemption if it determines that the proposal would constitute an unsafe and unsound practice, or would violate any law, regulation, Federal Reserve Board order or directive, or any condition imposed by, or written agreement with, the Federal Reserve Board. Such notice and approval is not required for a bank holding company that would be treated as “well capitalized” under applicable regulations of the Federal Reserve Board, that has received a composite “1” or “2” rating at its most recent bank holding company inspection by the Federal Reserve Board, and that is not the subject of any unresolved supervisory issues.

Bank holding companies are required to serve as a source of financial strength for their depository institution subsidiaries, and, if their depository institution subsidiaries become undercapitalized, bank holding companies may be required to guarantee the subsidiaries’ compliance with capital restoration plans filed with their bank regulators, subject to certain limits.

Bank holding companies must meet minimum capital requirements imposed by the Federal Reserve. These capital requirements generally are the same as those for banks imposed by the FDIC.

Dividends

As a bank holding company that does not, as an entity, currently engage in separate business activities of a material nature, our ability to pay cash dividends depends upon the cash dividends we receive from our subsidiary, North State Bank. At present, our only sources of income are cash dividends paid by the Bank and interest earned on any investment securities we hold. We must pay all of our operating expenses from funds we receive from the Bank. Therefore, shareholders may receive cash dividends from us only to the extent that funds are available after payment of our operating expenses and only in the event that the board decides to declare a dividend. In addition, the Federal Reserve Board generally prohibits bank holding companies from paying cash dividends except out of operating earnings where the prospective rate of earnings retention appears consistent with the bank holding company’s capital needs, asset quality and overall financial condition. To date, we have retained our earnings for use in the development of our business. As a relatively young bank holding company that expects to continue to expand its operations in Wake County, and other markets in North Carolina, we may or may not pay cash dividends on our common stock in the foreseeable future. We might not declare and pay any cash dividends, and if we were to do so, we might not continue to declare them or maintain them at the same

5

level. We expect that, for the foreseeable future, any cash dividends paid by the Bank to us will likely be limited to amounts needed to pay any separate expenses or to make required payments on our debt obligations, including the interest payments on our junior subordinated debt.

Competition

The banking laws of North Carolina allow banks located in North Carolina to develop branches throughout the state. In addition, out-of-state institutions may open branches in North Carolina as well as acquire or merge with institutions located in North Carolina. As a result of such laws, banking in North Carolina is highly competitive.

We have six full-service banking offices located in Wake County and one full-service banking office in Wilmington, New Hanover County. Both of these counties have numerous branches and corporate headquarters of money-center, super-regional, regional and statewide institutions, some of which have a major presence in Raleigh and/or Wilmington. In our market areas, we face competition from other banks, savings and loan associations, savings banks, credit unions, finance companies and major retail stores that offer competing financial services. Many of these competitors have greater resources, broader geographic coverage and higher lending limits than we do. As a result, we focus on our customer relationships to help us provide a competitive advantage in attracting and keeping customers.

Employees

As of December 31, 2007, we had 99 full time employees. We believe that our future success will depend in part on our continued ability to attract, hire, and retain qualified personnel. None of our employees are represented by a labor union. We have not experienced any work stoppages and consider our relations with our employees to be good.

Available Information

Our web site address is www.northstatebank.com. Information on our web site is not incorporated by reference herein. We make available free of charge through our web site our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments to those reports as soon as reasonably practicable after such material is electronically filed with or furnished to the Securities and Exchange Commission.

Item 1A.Risk Factors

Risks Related to Our Business

We may not be able to maintain and manage our growth, which may adversely affect our results of operations and financial condition and the value of our common stock.

Our strategy has been to increase the size of our company by opening new offices and aggressively pursuing business development opportunities. We have grown rapidly since we began operations. We can provide no assurance that we will continue to be successful in increasing the volume of loans and deposits at acceptable risk levels and upon acceptable terms while managing the costs and implementation risks associated with our growth strategy. There can be no assurance that our further expansion will be profitable or that we will continue to be able to sustain our historical rate of growth, either through internal growth or through expansion in our existing markets or into new markets, or that we will be able to maintain capital sufficient to support our continued growth. If we grow too quickly, however, and are not able to control costs and maintain asset quality, rapid growth also could adversely affect our financial performance. There are considerable costs involved in opening new banking offices. New banking offices generally do not generate sufficient revenues to offset their costs until they have been in operation for at least a year or more. Accordingly, we expect our new banking offices opened in late 2007 and early 2008 to negatively impact our earnings for some period of time until the offices reach economies of scale if ever. Also, we have no assurance these new or any future banking offices will be successful even after they are established.

Interest rate volatility could significantly harm our business.

Our results of operations may be significantly affected by the monetary and fiscal policies of the federal government and the regulatory policies of government authorities. A significant component of our earnings is our net interest income. Net interest income is the difference between income from interest-earning assets, such as loans, and the expense of interest-bearing liabilities, such as deposits and our borrowings. We may not be able to effectively manage changes in what we charge as interest on our earning assets and the expense we must pay on interest-bearing liabilities, which may significantly reduce our earnings. The Federal Reserve has made significant changes in interest rates during the last few years. Since rates charged on loans often tend to react to market

6

conditions faster than do rates paid on deposit accounts, these rate changes, especially decreasing rates, may have a negative impact on our earnings until we can make appropriate adjustments in our deposit rates. Fluctuations in interest rates are not predicable or controllable and therefore there can be no assurances of our ability to continue to maintain a consistent positive spread between the interest earned on our earning assets and the interest paid on our interest-bearing liabilities.

Our profitability depends significantly on economic conditions in our market area.

Our success depends to a large degree on the general economic conditions in Wake and New Hanover Counties and adjoining markets. The local economic conditions in these areas have a significant impact on the amount of loans that we make to our borrowers, the ability of our borrowers to repay these loans and the value of the collateral securing these loans. If the value of real estate in these areas were to decline materially, a significant portion of our loan portfolio could become under collateralized which could have a material adverse effect on us. A significant decline in general economic condition caused by inflation, recession, unemployment or other factors beyond our control would impact these local economic conditions and could negatively affect our financial condition and performance.

The lack of seasoning of our loan portfolio makes it difficult to assess the adequacy of our loan loss reserves accurately.

We attempt to maintain an appropriate allowance for loan losses to provide for probable losses in our loan portfolio. We periodically determine the amount of the allowance based on consideration of several factors, including:

| | • | | Historical loss rates through peer statistics and internal historical data; |

| | • | | Evaluation of general economic factors such as unemployment, inflation and interest rate environment; |

| | • | | Regulatory examination results and asset quality rating; |

| | • | | Regular reviews of loan delinquencies and overall loan portfolio quality; and |

| | • | | the levels of construction, development and non-owner occupied commercial real estate lending amount and quality of collateral, including guarantees, securing the loans and levels of highly leveraged transactions. |

There is no precise method of predicting credit losses, however, since any estimate of loan losses is necessarily subjective and the accuracy depends on the outcome of future events. In addition, due to our rapid growth over the past several years and our limited operating history, a large portion of the loans in our loan portfolio was originated recently. In general, loans do not begin to show signs of credit deterioration or default until they have been outstanding for some period of time, a process referred to as “seasoning.” As a result, a portfolio of older loans will usually perform more predictably than a newer portfolio. Because our loan portfolio is relatively new, the current level of delinquencies and defaults may not be representative of the level that will prevail when the portfolio becomes more seasoned, which may be higher than current levels. If charge-offs in future periods increase, we may be required to increase our provision for loan losses, which would decrease our net income and possibly our capital.

If we experience greater loan losses than anticipated, it would have an adverse effect on our net income.

While the risk of nonpayment of loans is inherent in banking, if we experience greater nonpayment levels than we anticipate, our earnings, would be adversely impacted, which could adversely affect our overall financial condition as well as the value of our common stock. We cannot assure you that our monitoring procedures and policies will reduce certain lending risks or that our allowance for loan losses will be adequate to cover actual losses. In addition, as a result of the rapid growth in our loan portfolio, loan losses may be greater than management’s estimates of the appropriate level for the allowance. Loan losses can cause insolvency and failure of a financial institution and, in such an event, our shareholders could lose their entire investment. In addition, future provisions for loan losses could materially and adversely affect our profitability. Any loan losses will reduce the loan loss allowance. A reduction in the loan loss allowance may require an increase in our provision for loan losses. This would reduce our earnings which could have an adverse effect on our stock price.

Liquidity is essential to our business and we rely, in part, on external sources to finance a significant portion of our operations.

Liquidity is essential to our business. Our liquidity could be substantially negatively affected by our inability to attract sufficient deposits; access secured lending markets, brokered deposit markets or raise funding in the long-term or short-term capital markets. Factors that we cannot control, such as disruption of the financial markets or negative views about the financial services industry generally, could impair our ability to raise funding. In addition, our ability to raise funding could be impaired if the Federal Home Loan Bank or deposit brokers develop a negative perception of our long-term or short-term financial prospects. Such negative

7

perceptions could be developed if we suffer a decline in the level of our business activity, regulatory authorities take significant action against us, or we discover employee misconduct or illegal activity, among other things. If we were unable to raise funds using the methods described above, we would likely need to liquidate unencumbered assets, such as our investment and loan portfolios, to meet maturing liabilities. We may be unable to sell some of our assets, or we may have to sell assets at a discount from market value, either of which could adversely affect our operations.

We rely heavily on the services of key personnel.

Larry D. Barbour, our president and chief executive officer, has substantial experience with our operations and has contributed significantly to our growth since our founding. The loss of the services of Mr. Barbour or of one or more members of our executive management team may have a material adverse effect on our operations. If Mr. Barbour or other members of our executive management team were no longer employed by us, our ability to implement our growth strategy could be impaired.

Our ability to retain and attract qualified employees is critical to the success of our business and the failure to do so may materially adversely affect our performance.

Our people are our most important resource and competition for qualified employees is intense. We may expand our banking network over the next several years, not just in our existing core market areas, but also in other community markets throughout central and eastern North Carolina and other contiguous markets. To expand into new markets successfully, we must identify and retain experienced key management members with local expertise and relationships in these markets. In order to attract and retain qualified employees, we must compensate such employees at market levels. Those levels have caused employee compensation to be our greatest expense as compensation is highly variable and moves with performance. If we are unable to continue to attract and retain qualified employees, or if compensation costs required to attract and retain employees become more expensive, our performance, including our competitive position, could be materially adversely affected.

New or acquired bank office facilities and other facilities may not be profitable.

We may not be able to identify profitable locations for new bank offices. In addition the costs to start up new bank office facilities or to acquire existing bank offices, and the additional costs to operate these facilities, may increase our noninterest expense and decrease earnings in the short term. If offices of other banks become available for sale, we may acquire those offices. It may be difficult to adequately and profitably manage our growth through the establishment or purchase of bank offices. In addition, we can provide no assurance that any such offices will successfully attract enough deposits and other business to offset the expenses of their operation.

We are subject to operational risk and an operational failure could materially adversely affect our businesses.

Operational risk refers to the risk of loss arising from inadequate or failed internal processes, people and/or systems. Operational risk also refers to the risk that external events, such as external changes (e.g., natural disasters, terrorist attacks and/or health epidemics), failures or frauds, will result in losses to our businesses.

Our business is highly dependent on our ability to process, on a daily basis, a large number of transactions and the transactions we process have become increasingly complex. We perform the functions required to operate our business either by ourselves or through agreements with third parties. We rely on the ability of our employees, our internal systems and systems at technology centers operated by third parties to process high numbers of transactions. In the event of a breakdown or improper operation of our or third-party’s systems or improper action by third parties or employees, we could suffer financial loss, an impairment to our liquidity, a disruption of our businesses, regulatory sanctions and damage to our reputation.

In order to be profitable, we must compete successfully with other financial institutions which have greater resources and capabilities than we do.

The banking business in North Carolina in general, and in Wake and New Hanover Counties in particular, in which we operate are extremely competitive. Most of our competitors are larger and have greater resources than we do and have been in existence a longer period of time. We will have to overcome historical bank-customer relationships to attract customers away from our competition. We compete with other commercial banks, savings banks, thrifts, credit unions and securities brokerage firms.

8

Some of our competitors are not regulated as extensively as we are and, therefore, may have greater flexibility in competing for business. Some of these competitors are subject to similar regulation but have the advantages of larger established customer bases, higher lending limits, extensive branch networks, numerous automated teller machines, greater advertising-marketing budgets or other factors.

Our legal lending limit is determined by law and is based on our capital levels. The size of the loans that we offer to our customers may be less than the size of the loans that larger competitors are able to offer. This limit may affect our success in establishing relationships with the larger businesses in our markets.

We are subject to extensive regulation that could limit or restrict our activities.

We operate in a highly regulated industry and are subject to examination, supervision, and comprehensive regulation by the North Carolina Office of the Commissioner of Banks, the FDIC, and the Federal Reserve Board. Our compliance with these regulations is costly and restricts certain of our current and possible future activities, including, investments, loans and interest rates charged, interest rates paid on deposits, locations of offices, payment of cash dividends, and mergers and acquisitions. We must also meet regulatory capital requirements. If we fail to meet these capital and other regulatory requirements, our financial condition, liquidity, and results of operations would be materially and adversely affected. Our failure to remain “well capitalized” and “well managed” for regulatory purposes could affect customer confidence, our ability to grow, the cost of our funds and FDIC insurance, our ability, should we decide, to pay cash dividends on our common stock, and our ability to make acquisitions.

The laws and regulations applicable to the banking industry could change at any time, and we cannot predict the effects of these changes on our business and profitability. For example, new legislation or regulation could limit the manner in which we may conduct our business, including our ability to obtain financing, attract deposits, and make loans. Many of these regulations are intended to protect depositors, the public, and the FDIC, not shareholders. In addition, the burden imposed by these regulations may place us at a competitive disadvantage compared to competitors who are larger or who are less regulated. The laws, regulations, interpretations, and enforcement policies that apply to us have been subject to significant change in recent years, sometimes retroactively applied, and may change significantly in the future. Our cost of compliance could adversely affect our ability to operate profitably.

Our growth may require us to raise additional capital that may not be available when it is needed, or at all.

We are required by regulatory authorities to maintain adequate levels of capital to support our operations. We anticipate that our capital resources will satisfy our capital requirements for the foreseeable future. We may at some point, however, need to raise additional capital to support our continued growth. Our ability to raise additional capital, if needed, will depend in part on conditions in the capital markets at that time, which are outside our control, and on our financial performance. Accordingly, we may be unable to raise additional capital, if and when needed, on terms acceptable to us, or at all. If we cannot raise additional capital when needed, our ability to further expand our operations through internal growth and acquisitions could be materially impaired. In addition, if we issue additional equity capital, the interests of existing shareholders would be diluted.

Investors could lose confidence in our financial reports, and our stock price might be adversely affected, if our internal controls over financial reporting are found not to be effective by management or by an independent registered public accounting firm or if we make disclosure of existing or potential significant deficiencies or material weaknesses in those controls.

As a non-accelerated filer with a fiscal year end of December 31, we had to report our management’s assessment of the effectiveness of our internal controls over financial reporting, as required by Section 404 of the Sarbanes-Oxley Act of 2002, for the first time for our fiscal year ended December 31, 2007. That report is included in this Annual Report on Form 10-K. We must provide our auditor’s attestation of our management’s assessment of the effectiveness of our internal controls over financial reporting for our fiscal year ending December 31, 2008. If our internal controls over financial reporting are found not to be effective by our independent registered public accounting firm or if we make disclosure of existing or potential significant deficiencies or material weaknesses in those controls, investors could lose confidence in our financial reports, and our stock price might be adversely affected. In addition, remedying any deficiencies, significant deficiencies or material weaknesses that we or our independent registered public accounting firm might identify, could require us to incur significant costs and expend significant time and management resources. We cannot assure you that any of the measures we might implement to remedy any such deficiencies would effectively mitigate or remedy such deficiencies.

9

Risks Related to Owning Our Common Stock

We have implemented anti-takeover devices that could make it more difficult for another company to acquire us, even though such an acquisition may increase shareholder value.

If we were to be acquired by another company, our shareholders may receive a premium for their shares. However, provisions in our articles of incorporation and bylaws could make it difficult for anyone to acquire us. Our articles of incorporation require a supermajority vote of two-thirds of our outstanding common stock in order to affect a sale or merger of the company, that has not been approved by our board of directors. Our articles of incorporation also provide for “blank check” preferred stock, which allows our board of directors, without shareholder approval, to issue preferred shares with rights and preferences superior to those of our common stock, including superior rights on voting and to cash dividends and liquidation proceeds. In addition, our articles of incorporation permit our board to consider constituents other than our shareholders in deciding on a merger or sale of the company. These constituents are our employees, depositors, customers, creditors and the communities in which we conduct business. This provision also allows the board to consider the competence, experience and integrity of any proposed acquirer as well as the prospects of success of any merger or sale proposal. All of these provisions may make a merger or sale of our company more difficult or prevent a merger or sale altogether even if the merger or sale is supported by our shareholders and would provide them a premium for their shares.

Our bylaws divide the board of directors into three classes of directors serving staggered three-year terms with approximately one-third of the board of directors elected at each annual meeting of shareholders. The classification of directors makes it more difficult for shareholders to change the composition of the board of directors. As a result, at least two annual meetings of shareholders would be required for the shareholders to change a majority of the directors, whether or not a change in the board of directors would be beneficial and whether or not a majority of shareholders believe that such a change would be desirable. Consequently, a takeover attempt may prove difficult, and shareholders may not realize the highest possible price for their shares.

Our common stock is quoted on the Over-the-Counter Bulletin Board and is not quoted on a stock exchange, the trading volume is low and the sale of a substantial amount of our common stock in the public market could depress the price of our common stock.

Our common stock is not traded on a national stock exchange, such as the NASDAQ. It is only quoted on the Over-the-Counter Bulletin Board. Consequently, our common stock is not as liquid as most stocks traded on an exchange. In addition, the average daily trading volume of our shares as quoted on the Over-the-Counter Bulletin Board for all of 2007 was approximately 1,800 shares, which means our stock is thinly traded. Thinly traded stock can be more volatile than stock trading on an exchange. We cannot predict the extent to which an active public market for our common stock will develop or be sustained. In recent years, the stock market has experienced a high level of price and volume volatility, and market prices for the stock of many companies have experienced wide price fluctuations that have not necessarily been related to their operating performance. Therefore, our shareholders may not be able to sell their shares at the volumes, prices, or times that they desire. We cannot predict the effect, if any, that future sales of our common stock in the market, or availability of shares of our common stock for sale in the market, will have on the market price of our common stock. We therefore can give no assurance that sales of substantial amounts of our common stock in the market, or the potential for large amounts of sales in the market, would not cause the price of our common stock to decline or impair our ability to raise capital through sales of our common stock.

We have never paid cash dividends and may not ever pay cash dividends.

We have never paid cash dividends on our common stock and may never do so. Consequently, any returns on an investment in our common stock in the foreseeable future will have to come from an increase in the value of the stock itself. As noted above, the lack of an active trading market for our common stock could make it difficult to sell shares of our common stock. The payment of cash dividends would be dependent on our operations, capital levels and needs and other factors.

Our securities are not FDIC insured.

Our common stock is not a savings or deposit account or other obligation of the bank, and is not insured by the Federal Deposit Insurance Corporation or any other governmental agency and is subject to investment risk, including the possible loss of principal.

10

The holders of our junior subordinated debentures have rights that are senior to those of our common shareholders.

We have supported our continued growth through the issuance of trust preferred securities from three special purpose trusts and an accompanying sale of $15.5 million junior subordinated debentures to these trusts. Payments of the principal and interest on the preferred securities of the trusts are conditionally guaranteed by us. Further, the accompanying junior subordinated debentures that we issued to the trusts are senior to our shares of common stock. As a result, we must make payments on the junior subordinated debentures before any cash dividends can be paid on our common stock and, in the event of our bankruptcy, dissolution or liquidation, the holder of the junior subordinated debentures must be satisfied before any distributions can be made on our common stock. We have the right to defer distributions on the junior subordinated debentures (and the related trust preferred securities) for up to five years, during which time no cash dividends may be paid on our common stock.

Item 1B.Unresolved Staff Comments

None.

Item 2.Properties.

Our headquarters are located in Raleigh, North Carolina, where we occupy approximately 12,000 square feet of office space in a stand-alone building under a lease extending through March 2015. We have an office and operations center in north Raleigh that consists of approximately 9,773 square feet of office space under a lease extending through April 2017. Beginning in May 2008, we will add another 1,756 square feet under lease in the same building. We own an office in west Raleigh that consists of approximately 10,000 square feet, approximately 5,200 square feet of which we occupy and the remainder of which is vacant. We have an office in Garner, North Carolina, where we own a building that has approximately 5,000 square feet of office space. We own an office in the Wakefield area of Raleigh which has approximately 10,000 square feet of office space. During 2007 we occupied under lease approximately 850 square feet of office space for our loan production office in Wilmington, North Carolina. In January 2008 our Wilmington office became a full service banking office and relocated to a new stand-alone building under lease where we occupy the entire first floor, approximately 9,440 square feet of office space. This lease runs through December 31, 2022. Upon opening of the new office in January 2008, we closed our loan production office in Wilmington. We leased approximately 3,700 square feet of office space in downtown Raleigh beginning in 2006 which we occupied and began operations as a full service banking office in December 2007. This lease runs through October 2011.

Item 3.Legal Proceedings.

From time to time, we are party to various legal proceedings or claims, either asserted or unasserted, which arise in the ordinary course of business. Although the ultimate outcome of these matters is not yet determined, we do not believe that the resolution of these matters will have a material effect upon our financial condition or results of operations in any interim or annual period.

Item 4.Submission of Matters to a Vote of Security Holders.

No matter was submitted to a vote of our shareholders during the fourth quarter of the year ended December 31, 2007.

11

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Stock Information

Our common stock is not traded on any exchange. Our stock is listed on the Over-the-Counter Bulletin Board. Set forth below for each quarter in 2007 and 2006 is information on the high and low bid and asked prices of our common stock as reported on the Over-the-Counter Bulletin Board. Prices have been adjusted for the 3-for-2 stock splits in the second quarter of 2007 and the third quarter of 2006.

| | | | | | |

| | | High | | Low |

Fiscal Year Ended December 31, 2007 | | | | | | |

January 1 through March 31, 2007 | | $ | 17.49 | | $ | 15.70 |

April 1 through June 30, 2007 | | | 17.20 | | | 15.67 |

July 1 through September 30, 2007 | | | 21.75 | | | 16.80 |

October 1 through December 31, 2007 | | | 17.25 | | | 12.00 |

| | |

Fiscal Year Ended December 31, 2006 | | | | | | |

January 1 through March 31, 2006 | | $ | 12.22 | | $ | 9.55 |

April 1 through June 30, 2006 | | | 11.33 | | | 9.78 |

July 1 through September 30, 2006 | | | 14.67 | | | 10.67 |

October 1 through December 31, 2006 | | | 16.66 | | | 14.17 |

As of March 7 2008, there were approximately 601 shareholders of record. We estimate that there were approximately 1,200 beneficial owners on March 7, 2008.

Dividends

To date, we have not paid any cash dividends. Our ability to pay cash dividends is dependent on the earnings of our subsidiary, North State Bank. Pursuant to the order of the North Carolina Commissioner of Banks approving the organization of North State Bank in 2000, North State Bank could not pay cash dividends for its first three years of operation. In the future, we expect that any earnings will be used for the development of our business as we seek to expand our operations in Wake County, North Carolina. Subject to these restrictions, the Board of Directors will consider the payment of cash dividends when it is deemed prudent to do so. Further, our ability to declare and pay cash dividends depends upon, among other things, restrictions imposed by the reserve and capital requirements of North Carolina and federal law, our income and fiscal condition, tax considerations, and general business conditions. Therefore, we may or may not pay cash dividends on our common stock in the foreseeable future, and it is possible we might never pay cash dividends.

On March 17, 2004, our trust subsidiary issued preferred securities in a private placement. On December 15, 2005 and on November 28, 2007, respectively, our second and third trust subsidiaries, respectively, issued preferred securities in a private placement. In each instance, we, in turn, issued unsecured subordinated debentures to each trust to serve as the income source for the trust’s payment of interest on its preferred securities. Pursuant to the terms of the indentures that govern our debentures, we are prohibited from paying cash dividends on our stock in the event we are in default on the terms of the debentures or the indentures.

12

Equity Compensation Plans

Set forth below is information on our equity compensation plans as of December 31, 2007.

| | | | | | |

Plan Category | | Number of securities to be issued upon exercise of

outstanding options,

warrants and rights | | Weighted-average exercise price of

outstanding options,

warrants and rights | | Number of securities remaining available for future issuance under equity compensation plans |

Equity compensation plans approved by our shareholders | | 597,780 | | $4.36 | | 493,586 |

Equity compensation plans not approved by our shareholders | | - | | - | | - |

Total | | 597,780 | | $4.36 | | 493,586 |

Our equity compensation plans consist of the 2000 Stock Option Plan for Employees, the 2000 Stock Option Plan for Non-Employee Directors and the 2003 Stock Plan, all of which were approved by our shareholders. We do not have any equity compensation plans or arrangements that have not been approved by our shareholders.

13

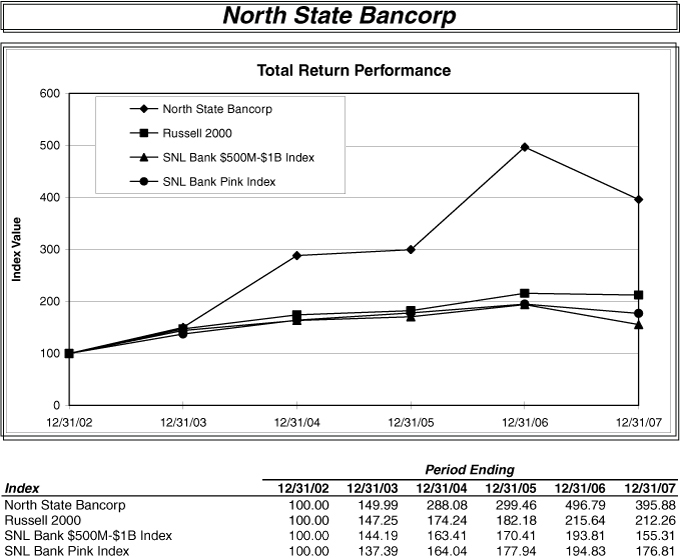

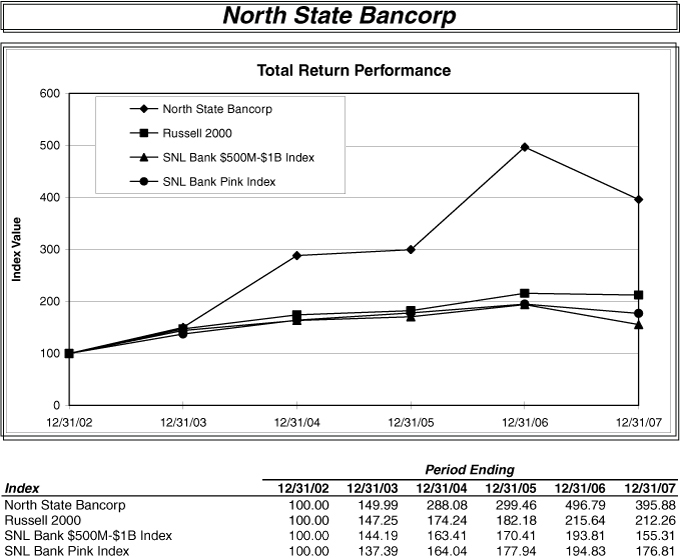

Comparison of Cumulative Total Return

The following graph compares the cumulative total shareholder return on our common stock over the five-year period ended December 31, 2007, with the cumulative total return for the same period on the Russell 2000 Index, the SNL $500M - $1B and SNL Bank Pink Banks Index. The graph assumes that at the beginning of the period indicated $100 was invested in our common stock and the stock of the companies comprising the Russell 2000 Index, the SNL $500M - $1B and SNL Bank Pink Banks Index, and that all dividends, if any, were reinvested. Prices are based on quotations for our common stock on the Over-the-Counter Bulletin Board from May 17 2002, the data on which our common stock was first quoted on the Bulletin Board. Prior to that, prices are based on private trades known to us.

Item 6.Selected Financial Data.

The following table sets forth selected consolidated financial information for our company as of and for the years ended December 31, 2007, 2006, 2005, 2004 and 2003. The data has been derived from our audited consolidated financial statements. The consolidated financial statements as of December 31, 2007 and 2006 and for the years ended December 31, 2007, 2006 and 2005 and the independent registered public accounting firm’s report thereon, are included elsewhere in this report. The following should also be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in Item 7 of this report.

14

| | | | | | | | | | | | | | | | | | | | |

| | | At or for the Year Ended December 31, | |

| | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| | | (Dollars in thousands, except per share data) | |

| | | | | |

Operating Data: | | | | | | | | | | | | | | | | | | | | |

Total interest income | | $ | 32,738 | | | $ | 26,412 | | | $ | 18,781 | | | $ | 12,599 | | | $ | 9,213 | |

Total interest expense | | | 15,439 | | | | 11,587 | | | | 6,497 | | | | 4,135 | | | | 3,251 | |

| | | | | | | | | | | | | | | | | | | | |

Net interest income | | | 17,299 | | | | 14,825 | | | | 12,284 | | | | 8,464 | | | | 5,962 | |

Provision for loan losses | | | 1,339 | | | | 69 | | | | 792 | | | | 920 | | | | 690 | |

| | | | | | | | | | | | | | | | | | | | |

Net interest income after provision for loan losses | | | 15,960 | | | | 14,756 | | | | 11,492 | | | | 7,544 | | | | 5,272 | |

Noninterest income | | | 1,121 | | | | 1,174 | | | | 1,310 | | | | 1,034 | | | | 996 | |

Noninterest expense | | | 12,033 | | | | 10,743 | | | | 8,901 | | | | 6,364 | | | | 4,853 | |

| | | | | | | | | | | | | | | | | | | | |

Income before income taxes | | | 5,048 | | | | 5,187 | | | | 3,901 | | | | 2,214 | | | | 1,415 | |

Provision for income taxes | | | 1,953 | | | | 1,915 | | | | 1,463 | | | | 838 | | | | 436 | |

| | | | | | | | | | | | | | | | | | | | |

Net income | | $ | 3,095 | | | $ | 3,272 | | | $ | 2,438 | | | $ | 1,376 | | | $ | 979 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Per Share Data: (1) | | | | | | | | | | | | | | | | | | | | |

Earnings per share - basic | | $ | 0.45 | | | $ | 0.49 | | | $ | 0.38 | | | $ | 0.22 | | | $ | 0.15 | |

Earnings per share - diluted | | | 0.42 | | | | 0.46 | | | | 0.35 | | | | 0.20 | | | | 0.15 | |

Market price: | | | | | | | | | | | | | | | | | | | | |

High | | | 21.75 | | | | 16.66 | | | | 10.00 | | | | 9.28 | | | | 5.64 | |

Low | | | 12.00 | | | | 9.55 | | | | 5.43 | | | | 4.69 | | | | 2.93 | |

Close | | | 12.75 | | | | 16.00 | | | | 9.64 | | | | 9.28 | | | | 4.83 | |

Book value | | | 4.52 | | | | 3.90 | | | | 3.31 | | | | 2.96 | | | | 2.75 | |

| | | | | |

Weighted average shares outstanding: | | | | | | | | | | | | | | | | | | | | |

Basic | | | 6,917,365 | | | | 6,617,228 | | | | 6,392,127 | | | | 6,379,555 | | | | 6,330,437 | |

Diluted | | | 7,301,377 | | | | 7,162,121 | | | | 6,944,169 | | | | 6,793,980 | | | | 6,584,711 | |

| | | | | |

Selected Year-End Balance Sheet Data: | | | | | | | | | | | | | | | | | | | | |

Total assets | | $ | 547,520 | | | $ | 455,477 | | | $ | 382,438 | | | $ | 309,542 | | | $ | 249,020 | |

Loans | | | 469,228 | | | | 345,943 | | | | 294,175 | | | | 244,620 | | | | 181,532 | |

Allowance for loan losses | | | 5,020 | | | | 3,983 | | | | 3,679 | | | | 3,053 | | | | 2,360 | |

Deposits | | | 457,310 | | | | 402,078 | | | | 337,371 | | | | 269,133 | | | | 208,548 | |

Short-term borrowings | | | 37,886 | | | | 10,670 | | | | 10,006 | | | | 14,273 | | | | 15,911 | |

Long-term debt | | | 16,332 | | | | 11,196 | | | | 11,215 | | | | 5,155 | | | | 6,000 | |

Shareholders’ equity | | | 31,557 | | | | 26,597 | | | | 21,140 | | | | 18,914 | | | | 17,514 | |

| | | | | |

Selected Average Balances: | | | | | | | | | | | | | | | | | | | | |

Total assets | | $ | 472,824 | | | $ | 398,097 | | | $ | 330,922 | | | $ | 271,694 | | | $ | 211,387 | |

Loans | | | 393,927 | | | | 316,620 | | | | 262,962 | | | | 212,127 | | | | 141,224 | |

Total interest-earning assets | | | 454,005 | | | | 382,899 | | | | 318,720 | | | | 261,559 | | | | 200,832 | |

Deposits | | | 412,125 | | | | 349,070 | | | | 293,565 | | | | 230,265 | | | | 179,973 | |

Short-term borrowings | | | 14,681 | | | | 10,784 | | | | 10,003 | | | | 15,699 | | | | 6,992 | |

Long-term debt | | | 11,666 | | | | 11,205 | | | | 5,166 | | | | 6,043 | | | | 6,000 | |

Total interest-bearing liabilities | | | 349,144 | | | | 284,504 | | | | 233,631 | | | | 194,680 | | | | 140,779 | |

Shareholders’ equity | | | 29,219 | | | | 23,944 | | | | 20,017 | | | | 18,338 | | | | 17,389 | |

| | | | | |

Selected Performance Ratios: | | | | | | | | | | | | | | | | | | | | |

Return on average assets | | | 0.65 | % | | | 0.82 | % | | | 0.74 | % | | | 0.51 | % | | | 0.46 | % |

Return on average equity | | | 10.59 | % | | | 13.67 | % | | | 12.18 | % | | | 7.50 | % | | | 5.63 | % |

Net interest spread | | | 2.79 | % | | | 2.83 | % | | | 3.11 | % | | | 2.69 | % | | | 2.33 | % |

Net interest margin | | | 3.81 | % | | | 3.87 | % | | | 3.85 | % | | | 3.24 | % | | | 2.97 | % |

Noninterest income to total revenue | | | 6.09 | % | | | 7.34 | % | | | 9.64 | % | | | 10.89 | % | | | 14.31 | % |

Noninterest income to average assets | | | 0.24 | % | | | 0.29 | % | | | 0.40 | % | | | 0.38 | % | | | 0.47 | % |

Noninterest expense to average assets | | | 2.54 | % | | | 2.70 | % | | | 2.69 | % | | | 2.34 | % | | | 2.30 | % |

Efficiency ratio | | | 65.33 | % | | | 67.15 | % | | | 65.48 | % | | | 67.00 | % | | | 69.75 | % |

| | | | | |

Asset Quality Ratios: | | | | | | | | | | | | | | | | | | | | |

Nonperforming loans to period-end loans | | | 0.66 | % | | | 0.11 | % | | | 0.00 | % | | | 0.11 | % | | | 0.55 | % |

Allowance for loan losses to period-end loans | | | 1.07 | % | | | 1.15 | % | | | 1.25 | % | | | 1.25 | % | | | 1.30 | % |

Ratio of allowance for loan losses to nonperforming loans | | | 1.62 | x | | | 10.03 | x | | | 0.00 | x | | | 11.74 | x | | | 2.36 | x |

Nonperforming assets to total assets | | | 0.57 | % | | | 0.09 | % | | | 0.00 | % | | | 0.25 | % | | | 0.40 | % |

Net loan charge-offs to average loans | | | -0.08 | % | | | 0.07 | % | | | -0.06 | % | | | -0.11 | % | | | -0.12 | % |

15

| | | | | | | | | | | | | | | |

| | | At or for the Year Ended December 31, | |

| | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| | | (Dollars in thousands, except per share data) | |

| | | | | |

Capital Ratios (2): | | | | | | | | | | | | | | | |

Total risk-based capital | | 10.32 | % | | 10.21 | % | | 10.30 | % | | 11.01 | % | | 10.85 | % |

Tier 1 risk-based capital | | 9.25 | % | | 9.09 | % | | 9.09 | % | | 9.76 | % | | 9.60 | % |

Leverage ratio | | 8.50 | % | | 7.58 | % | | 7.53 | % | | 7.94 | % | | 7.87 | % |

Equity to assets ratio | | 5.76 | % | | 5.84 | % | | 5.53 | % | | 6.11 | % | | 7.03 | % |

Average equity to average assets | | 6.18 | % | | 6.01 | % | | 6.05 | % | | 6.75 | % | | 8.23 | % |

| | | | | |

Other Data (3)(4): | | | | | | | | | | | | | | | |

Number of banking offices | | 7 | | | 6 | | | 5 | | | 4 | | | 3 | |

Number of full time equivalent employees | | 99 | | | 75 | | | 68 | | | 48 | | | 43 | |

| | (1) | Adjusted for the 3-for-2 stock splits in 2007 and 2006, the 6-for-5 stock split in 2005, the 23-for-20 stock split in 2004 and the 11-for-10 stock split in 2003. |

| | (2) | Capital ratios are for bank only. |

| | (3) | Includes one loan production office for each of the years 2007, 2006, 2005, 2004 and 2003. |

| | (4) | Year 2004 does not include our full-service main banking office in Raleigh that opened in March 2005. |

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

NOTE REGARDING FORWARD-LOOKING STATEMENTS

Statements contained in this report, which are not historical facts, are forward-looking statements, as that term is defined in the Private Securities Litigation Reform Act of 1995. Amounts herein could vary as a result of market and other factors. Such forward-looking statements are subject to risks and uncertainties which could cause actual results to differ materially from those currently anticipated due to a number of factors, which include, but are not limited to, factors discussed in documents we file with the U.S. Securities and Exchange Commission from time to time. Such forward-looking statements may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “might,” “planned,” “estimated,” and “potential.” Examples of forward-looking statements include, but are not limited to, estimates with respect to our financial condition, expected or anticipated revenue, results of operations and business that are subject to various factors which could cause actual results to differ materially from these estimates. These factors include, but are not limited to: changes in interest rates; changes in real estate values and real estate markets; our ability to manage growth; substantial changes in financial markets; loss of deposits and loan demand to other savings and financial institutions; general economic conditions; changes in accounting principles, policies, or guidelines; changes in legislation or regulation; and other economic, competitive, governmental, regulatory, and technological factors affecting our operations, pricing, products and services.

Management’s Discussion and Analysis

The following discussion and analysis is presented to assist in understanding our consolidated financial condition and results of operations for the years ended December 31, 2007 and 2006. You should read this discussion and the related financial data in conjunction with our audited consolidated financial statements and the related footnotes, which are included elsewhere in this report. In each of 2007 and 2006, we issued a three-for-two stock split in 2005 we issued a six-for-five stock split, in 2004. We issued a 23-for-20 stock split and in 2003 we issued an 11-for-10 stock split. All references in this report to per share results and weighted average common and potential common shares outstanding have been adjusted for the effects of these stock splits. Because we have no operations and our only significant business is the ownership of North State Bank, the following discussion concerns primarily the business of the Bank. However, for ease of reading and because the financial statements are presented on a consolidated basis, this discussion makes no distinction between our company and our bank unless otherwise noted.

Description of Business

We are a commercial bank holding company that was incorporated on June 5, 2002. We have one subsidiary, North State Bank, which we acquired on June 28, 2002 as part of our bank holding company reorganization. In March 2004, we established a subsidiary trust, North State Statutory Trust I, which we refer to as Trust I, to issue trust preferred securities. In December 2005, we established a second subsidiary trust, North State Statutory Trust II, which we refer to as Trust II and in November 2007 we established a third subsidiary trust, North State Statutory Trust III, which we refer to as Trust III. In October 2007, we acquired approximately 5.6% of Beacon Title Agency, LLC, a title insurance agency. Our only business is the ownership and operation of North State Bank and its three subsidiary trusts and our investment in Beacon Title Agency.

16

North State Bank is a North Carolina chartered banking corporation. The bank, which offers a full array of commercial and retail banking services, opened for business on June 1, 2000. Through the bank, we currently operate six full-service banking offices located in Raleigh and Garner, North Carolina and one loan production office located in Wilmington, North Carolina which began operations as a full-service banking office in January 2008. Our principal customers consist of professional firms, professionals, churches, property management companies and individuals who value a mutually beneficial banking relationship. The bank has a subsidiary, North State Financial Services, Inc., which offers brokerage services.

Financial Condition at December 31, 2007 and 2006

For the year 2007, good balance sheet growth continued with total assets surpassing $500 million during the second quarter 2007. At December 31, 2007, total assets had grown to $547.5 million from $455.5 million at December 31, 2006, an increase of $92.0 million or 20.2%. Our loan portfolio led our asset growth and ended the year 2007 at $469.2 million compared to loans of $345.9 million at December 31, 2006. The strong loan growth was principally funded by deposits, which grew $55.2 million or 13.7% to $457.3 million at December 31, 2007, and short-term borrowings which grew $27.2 million to $37.9 million at December 31, 2007 as well as a decline of $33.1 million or 37.9% to $54.2 million at December 31, 2007 in other earning assets, principally investments and federal funds sold.

All investments are accounted for as available for sale under Financial Accounting Standards Board, or FASB, No. 115 and are presented at their fair market value. The fair market value of the investment securities portfolio at December 31, 2007 was $34.8 million compared to $41.9 million at December 31, 2006 representing a net decrease of $7.1 million or 16.9% as funds from maturing investments were re-deployed into the loan portfolio. The investment portfolio at December 31, 2007 consisted of U.S. Government agency securities, mortgage-backed securities and municipal bonds. The net decrease in the portfolio during 2007 was attributed to an increase in fair value of $524,000 and purchases of $7.2 million offset by decreases in the portfolio of $14.8 million representing principal re-payments and maturities.

Federal Funds sold declined to $18.2 million at December 31, 2007 compared to $44.1 million at December 31, 2006 due to our strong loan growth. Interest-earning deposits held at correspondent banks decreased slightly by $110,000 to $1.1 million at December 31, 2007.

Loan production was up $123.3 million or 35.6% and the loan portfolio ended the year at $469.2 million compared to $345.9 million at December 31, 2006. The loan growth primarily occurred in commercial real estate and construction loans reflecting favorable market conditions in our markets during the year. Our loan production office in Wilmington, which opened in the second quarter of 2006, provided approximately 34% of the growth in loans for the year 2007. Favorable market conditions contributed to the substantial loan growth in this market as well as the experience of two senior commercial lenders who combined have worked and lived in the Wilmington area over 35 years. Our other markets provided favorable but more modest growth for the year. Commercial and real-estate construction loans provided most of the loan growth, increasing $81.4 million and $27.6 million, respectively for the year 2007 compared to December 31, 2006. These loan types represented approximately 88.5% of the loan portfolio at December 31, 2007. Other loans such as 1-4 family real estate mortgages were up $8.1 million and home equity lines of credit were up $5.7 million for the year 2007 compared to December 31, 2006. Installment loans to individuals remained flat for the year 2007. A substantial portion of our loan growth, approximately $82.1 million, occurred during the second half of the year, a time of declining interest rates. The prime interest rate fell from 8.25% at the beginning of the year through mid-September 2007 to 7.25% by year-end 2007. As of December 31, 2007, approximately 35.6% of our loans have variable interest rates that change with market conditions.

The allowance for loan losses was $5.0 million at December 31, 2007 compared to $4.0 million at December 31, 2006 representing 1.07% and 1.15% respectively, of loans outstanding at each date. The decrease in the level of the allowance relative to gross loans to 1.07% at December 31, 2007 resulted from the decrease in the actual impairment allocated to specific loans. Although impaired loans increased, the actual impairment decreased from $534,000 to $472,000, representing six basis points of the total eight basis point decrease in the allowance as a percentage of total loans outstanding. The allowance for loan losses is maintained at a level management considers adequate to provide for probable loan losses based on our assessment of our loan portfolio at December 31, 2007.