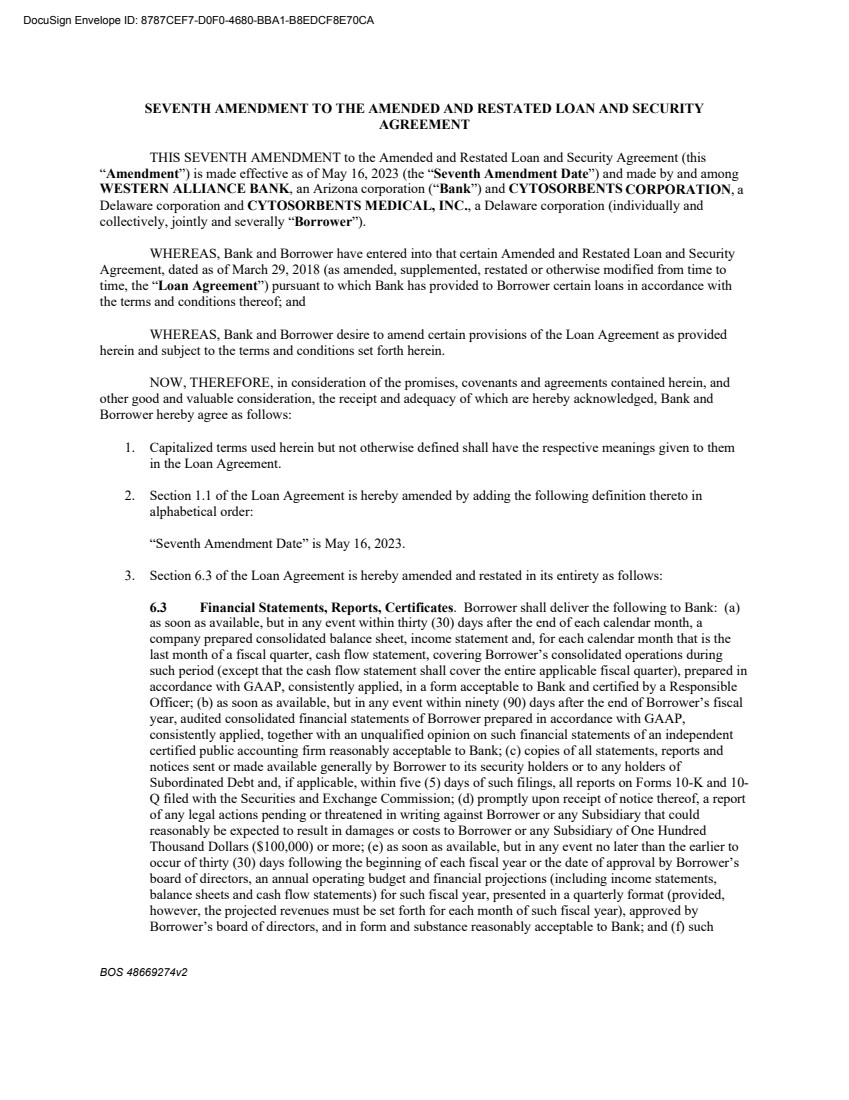

| BOS 48669274v2 SEVENTH AMENDMENT TO THE AMENDED AND RESTATED LOAN AND SECURITY AGREEMENT THIS SEVENTH AMENDMENT to the Amended and Restated Loan and Security Agreement (this “Amendment”) is made effective as of May 16, 2023 (the “Seventh Amendment Date”) and made by and among WESTERN ALLIANCE BANK, an Arizona corporation (“Bank”) and CYTOSORBENTS CORPORATION, a Delaware corporation and CYTOSORBENTS MEDICAL, INC., a Delaware corporation (individually and collectively, jointly and severally “Borrower”). WHEREAS, Bank and Borrower have entered into that certain Amended and Restated Loan and Security Agreement, dated as of March 29, 2018 (as amended, supplemented, restated or otherwise modified from time to time, the “Loan Agreement”) pursuant to which Bank has provided to Borrower certain loans in accordance with the terms and conditions thereof; and WHEREAS, Bank and Borrower desire to amend certain provisions of the Loan Agreement as provided herein and subject to the terms and conditions set forth herein. NOW, THEREFORE, in consideration of the promises, covenants and agreements contained herein, and other good and valuable consideration, the receipt and adequacy of which are hereby acknowledged, Bank and Borrower hereby agree as follows: 1. Capitalized terms used herein but not otherwise defined shall have the respective meanings given to them in the Loan Agreement. 2. Section 1.1 of the Loan Agreement is hereby amended by adding the following definition thereto in alphabetical order: “Seventh Amendment Date” is May 16, 2023. 3. Section 6.3 of the Loan Agreement is hereby amended and restated in its entirety as follows: 6.3 Financial Statements, Reports, Certificates. Borrower shall deliver the following to Bank: (a) as soon as available, but in any event within thirty (30) days after the end of each calendar month, a company prepared consolidated balance sheet, income statement and, for each calendar month that is the last month of a fiscal quarter, cash flow statement, covering Borrower’s consolidated operations during such period (except that the cash flow statement shall cover the entire applicable fiscal quarter), prepared in accordance with GAAP, consistently applied, in a form acceptable to Bank and certified by a Responsible Officer; (b) as soon as available, but in any event within ninety (90) days after the end of Borrower’s fiscal year, audited consolidated financial statements of Borrower prepared in accordance with GAAP, consistently applied, together with an unqualified opinion on such financial statements of an independent certified public accounting firm reasonably acceptable to Bank; (c) copies of all statements, reports and notices sent or made available generally by Borrower to its security holders or to any holders of Subordinated Debt and, if applicable, within five (5) days of such filings, all reports on Forms 10-K and 10- Q filed with the Securities and Exchange Commission; (d) promptly upon receipt of notice thereof, a report of any legal actions pending or threatened in writing against Borrower or any Subsidiary that could reasonably be expected to result in damages or costs to Borrower or any Subsidiary of One Hundred Thousand Dollars ($100,000) or more; (e) as soon as available, but in any event no later than the earlier to occur of thirty (30) days following the beginning of each fiscal year or the date of approval by Borrower’s board of directors, an annual operating budget and financial projections (including income statements, balance sheets and cash flow statements) for such fiscal year, presented in a quarterly format (provided, however, the projected revenues must be set forth for each month of such fiscal year), approved by Borrower’s board of directors, and in form and substance reasonably acceptable to Bank; and (f) such DocuSign Envelope ID: 8787CEF7-D0F0-4680-BBA1-B8EDCF8E70CA |