|

Exhibit 99.2

|

STP Acquisition Investor Presentation

March 15, 2016

Safe Harbor Provision

This press release contains forward-looking statements within the meaning of the federal securities laws. Statements that are not historical facts, including statements about FleetCor’s beliefs, expectations and future performance, are forward-looking statements. Forward-looking statements can be identified by the use of words such as “anticipate,” “intend,” “believe,” “estimate,” “plan,” “seek,” “project,” “expect,” “may,” “will,” “would,” “could” or “should,” the negative of these terms or other comparable terminology.

Examples of forward-looking statements in this press release include statements relating to the anticipated consummation of the acquisition, its accretiveness to earnings, operating synergies, and its impact on future opportunities and long-term grown in electronic toll payments, and the impact on our liquidity. These forward-looking statements are subject to a number of risks and uncertainties that could cause actual results to differ materially from those contained in any forward-looking statement, such as failure to complete, or delays in completing, this acquisition or other anticipated new partnership arrangements or acquisitions; failure to successfully integrate or otherwise achieve anticipated benefits from this acquisition or other partnerships or acquired businesses; the impact of foreign exchange rates on acquisition prices, operations, revenue and income; fuel price and spread volatility; changes in credit risk of customers and associated losses; the actions of regulators relating to payment cards or resulting from investigations; failure to maintain or renew key business relationships; failure to maintain competitive offerings; failure to maintain or renew sources of financing; the effects of general economic conditions on fueling patterns and the commercial activity of fleets, as well as the other risks and uncertainties identified under the caption “Risk Factors” in FleetCor’s Annual Report on Form 10-K for the year ended December 31, 2015, filed with the Securities and Exchange Commission on February 29, 2016. FleetCor believes these forward-looking statements are reasonable; however, forward-looking statements are not a guarantee of performance, and undue reliance should not be placed on such statements. The forward-looking statements included in this press release are made only as of the date hereof, and FleetCor does not undertake, and specifically disclaims, any obligation to update any such statements or to publicly announce the results of any revisions to any of such statements to reflect future events or developments.

You may get FleetCor’s Securities and Exchange Commission (“SEC”) Filings for free by visiting the SEC Web site at www.sec.gov or FleetCor’s investor relations website at investor.fleetcor.com. Trademarks which appear in this presentation belong to their respective owners.

2

Agenda

1 Transaction Overview

2 STP Description

3 Brazil Backdrop

4 Rationale

5 STP Financials

6 Leverage & Liquidity Implications

3

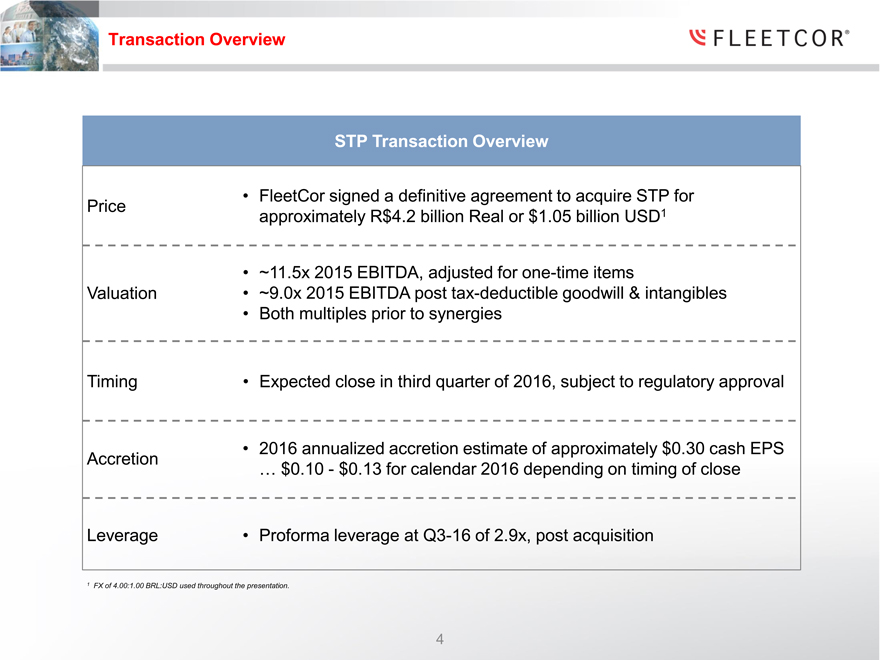

Transaction Overview

STP Transaction Overview

• FleetCor signed a definitive agreement to acquire STP for Price approximately R$4.2 billion Real or $1.05 billion USD1

• ~11.5x 2015 EBITDA, adjusted for one-time items

Valuation • ~9.0x 2015 EBITDA post tax-deductible goodwill & intangibles

• Both multiples prior to synergies

Timing • Expected close in third quarter of 2016, subject to regulatory approval

• 2016 annualized accretion estimate of approximately $0.30 cash EPS

Accretion

… $0.10—$0.13 for calendar 2016 depending on timing of close Leverage • Proforma leverage at Q3-16 of 2.9x, post acquisition

1 FX of 4.00:1.00 BRL:USD used throughout the presentation.

4

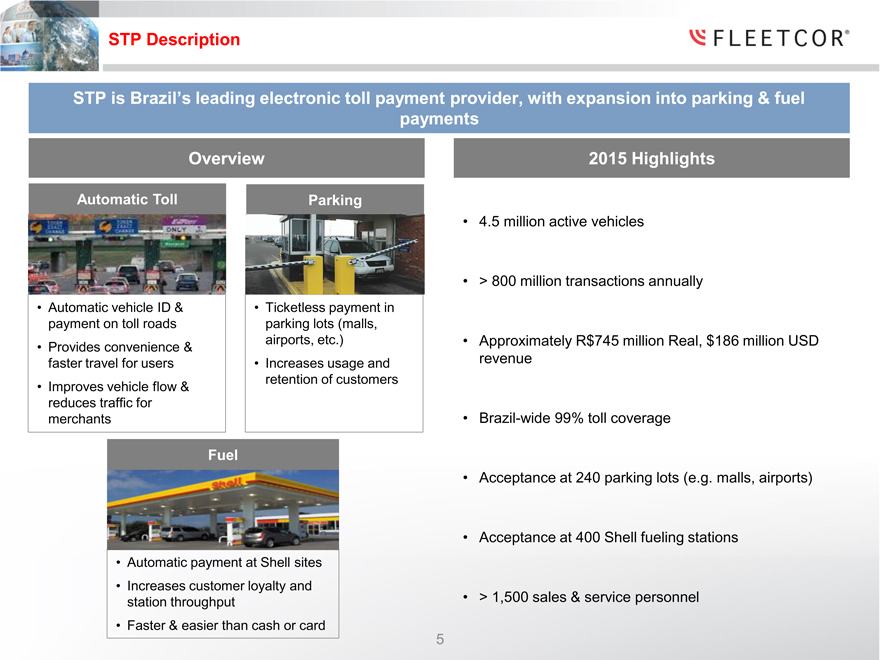

STP Description

STP is Brazil’s leading electronic toll payment provider, with expansion into parking & fuel payments

Overview

Automatic Toll Parking

• Automatic vehicle ID & • Ticketless payment in payment on toll roads parking lots (malls, airports, etc.)

• Provides convenience & faster travel for users • Increases usage and retention of customers

• Improves vehicle flow & reduces traffic for • Improves ingress / merchants egress & merchant costs

Fuel

• Automatic payment at Shell sites

• Increases customer loyalty and station throughput

• Faster & easier than cash or card

2015 Highlights

• 4.5 million active vehicles

• > 800 million transactions annually

• Approximately R$745 million Real, $186 million USD revenue

• Brazil-wide 99% toll coverage

• Acceptance at 240 parking lots (e.g. malls, airports)

• Acceptance at 400 Shell fueling stations

• > 1,500 sales & service personnel

5

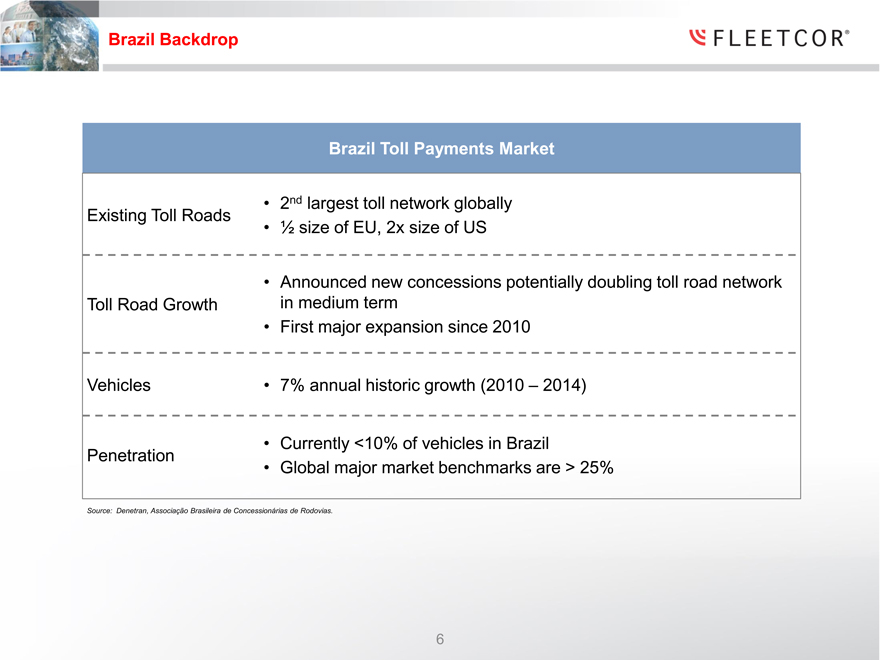

Brazil Backdrop

Brazil Toll Payments Market

• 2nd largest toll network globally Existing Toll Roads

• 1/2 size of EU, 2x size of US

• Announced new concessions potentially doubling toll road network Toll Road Growth in medium term

• First major expansion since 2010 Vehicles • 7% annual historic growth (2010 – 2014)

• Currently <10% of vehicles in Brazil Penetration

• Global major market benchmarks are > 25%

Source: Denetran, Associação Brasileira de Concessionárias de Rodovias.

6

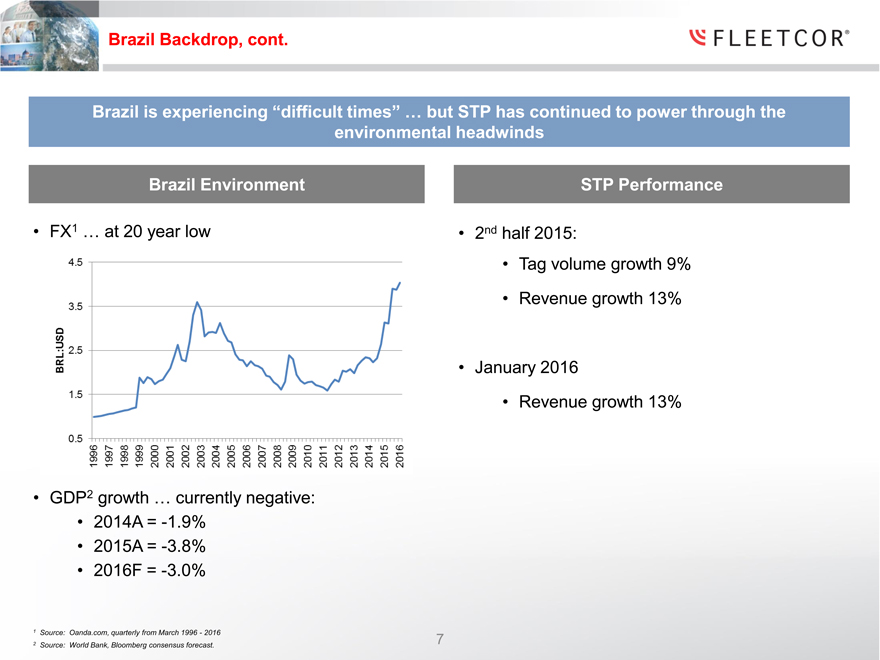

Brazil Backdrop, cont.

Brazil is experiencing “difficult times” … but STP has continued to power through the environmental headwinds

Brazil Environment

• FX1 … at 20 year low

• GDP2 growth … currently negative:

• 2014A = -1.9%

• 2015A = -3.8%

• 2016F = -3.0%

1 Source: Oanda.com, quarterly from March 1996—2016 2 Source: World Bank, Bloomberg consensus forecast.

STP Performance

• 2nd half 2015:

• Tag volume growth 9%

• Revenue growth 13%

• January 2016

• Revenue growth 13%

7

Brazil Backdrop, cont.

Brazil is a large economy, with “superior” historical growth, improving mid-term prospects and a “very attractive” workforce payments market

Brazil Economy – Large & “Improving”

• Comparative GDP (2014):

• Brazil – $2.35 trillion

• UK – $2.99 trillion

• Mexico – $1.29 trillion

• Historical GDP growth1:

20yr CAGR 10yr CAGR

World ex-China & US 2.5% 2.3% Brazil 3.0% 3.4%

• GDP2 growth forecast:

• 2016 = -3.0%

• 2017 = 1.0%

1 Source: US economic Resource Service, www.ers.usda.gov, 20yr ’94-’14, 10yr, ’04-’14. 2 Source: Bloomberg consensus forecast.

Attractive Workforce Payments Market

ü Many tax-advantaged workforce payment opportunities

- Fuel cards —Tolls —Payroll cards

- Food cards —Transport cards

ü Low penetration … “early days”

ü No major oil company commercial fuel cards

ü Favorable economics … merchant discount, working capital neutral

8

Rationale

FleetCor Strategic Rationale

• Immediate cash EPS accretion, with long term EPS growth

1. EPS accretion potential

• Enhanced scale in Brazil to support our broader ambitions in workforce payments

2. Brazil scale

• STP has >1 million commercial vehicles to cross-sell fuel cards, food cards, etc.

3. Innovative fuel

• An innovative, card-less fuel payments solution with FleetCor’s payments global partner, Shell scheme

9

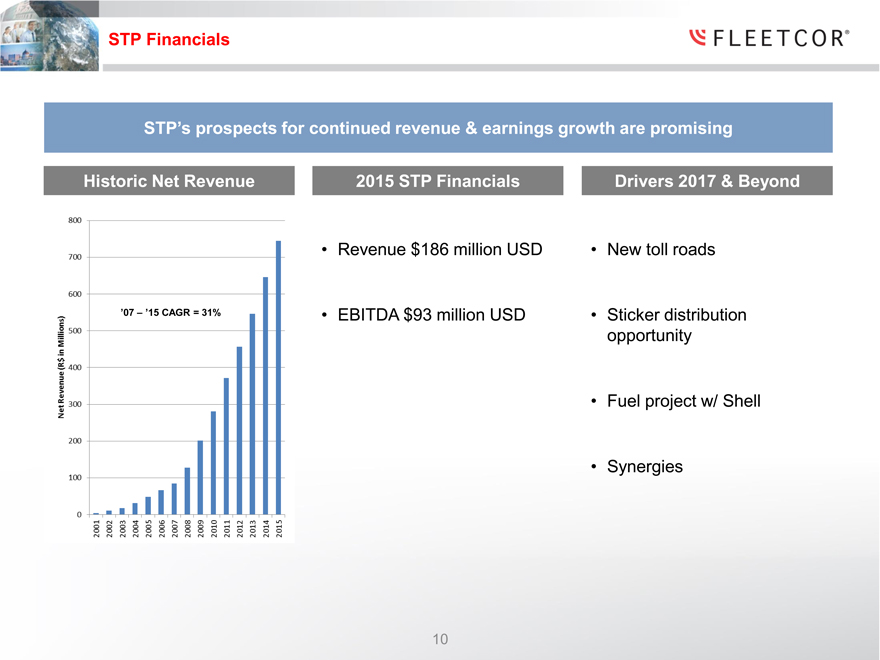

STP Financials

STP’s prospects for continued revenue & earnings growth are promising

Historic Net Revenue 2015 STP Financials Drivers 2017 & Beyond

• Revenue $186 million USD • New toll roads

’07 – ’15 CAGR = 31% • EBITDA $93 million USD • Sticker distribution opportunity

• Fuel project w/ Shell

• Synergies

Leverage & Liquidity Implications

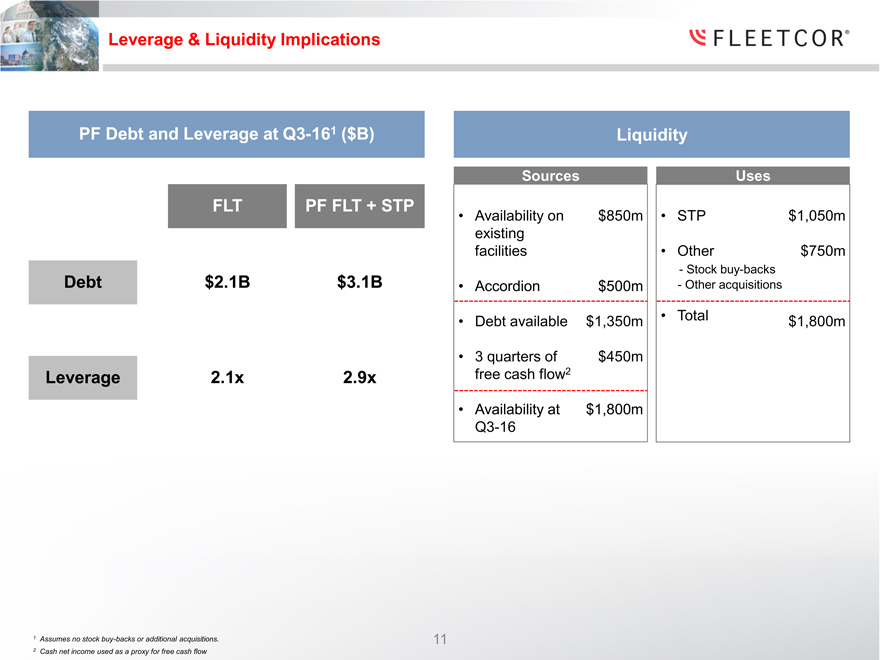

PF Debt and Leverage at Q3-161 ($B) Liquidity

Sources Uses

FLT PF FLT + STP

• Availability on $850m • STP $1,050m existing facilities • Other $750m

—Stock buy-backs

Debt $2.1B $3.1B • Accordion $500m —Other acquisitions

• Debt available $1,350m • Total $1,800m

• 3 quarters of $450m

Leverage 2.1x 2.9x free cash flow2

• Availability at $1,800m Q3-16

1 Assumes no stock buy-backs or additional acquisitions. 11 2 Cash net income used as a proxy for free cash flow