- WSR Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Whitestone REIT (WSR) 8-KResults of Operations and Financial Condition

Filed: 28 Feb 11, 12:00am

| TABLE OF CONTENTS | |

| Page | |

| CORPORATE PROFILE | ||||||

| NYSE-Amex: WSR | Whitestone REIT (NYSE-Amex: WSR) is a fully integrated real estate investment trust that owns, | |||||

| Class B Common Shares | operates and re-develops Community Centered Properties TM, which are visibly located properties in | |||||

| Listed 8/25/2010 | established or developing, culturally diverse neighborhoods. As of December 31, 2010, we owned | |||||

38 Community Centered Properties TM with approximately 3.2 million square feet of leasable space, | ||||||

| 38 Community Centers | located in five of the top markets in the USA in terms of population growth: Houston, Dallas, San | |||||

| 3.2 Mi llion GLA | Antonio, Phoenix and Chicago. Headquartered in Houston, Texas, we were founded in 1998. | |||||

| 792 Tenants | ||||||

| We focus on value-creation in our properties, as we market, lease and manage our properties. We | ||||||

| 5 Top Growth Markets | invest in properties that are or can become Community Centered Properties TM from which our | |||||

| Houston | tenants deliver needed services to the surrounding community. We focus on niche properties with | |||||

| Dallas | smaller rental spaces that present opportunities for attractive returns. | |||||

| San Antonio | ||||||

| Phoenix | Our strateg ic efforts target entrepreneurial tenants at each property who provide services to their | |||||

| Chicago | respective surrounding community. Operations include an internal management structure, providing | |||||

| cost-effective service to locally-oriented smaller space tenants. Multi-cultural community focus sets | ||||||

| Fiscal Year-End | us apart from traditional commercial real estate operators. We value diversity on our team and maintain | |||||

| 12/31 | in-house leasing, property management, marketing, construction and maintenance departments with | |||||

| culturally diverse and multi-lingual associates who understand the particular needs of our tenants | ||||||

| Common Shares & | and neighborhoods. | |||||

| Units Outstanding: | ||||||

| Class B Common: 2.2 Million | We have a diverse tenant base concentrated on service offerings such as medical, education and | |||||

| Class A Common: 3.5 Million | casual dining. These tenants tend to occupy smaller s paces (less than 3,000 square feet) and, as of | |||||

| Operating Partnership Units: | December 31, 2010, provided a 57% premium rental rate compared to our larger space tenants. The | |||||

| 1.8 Million | largest of our 792 tenants comprises less than 2.0% of our revenues. | |||||

| Dividend (per share / unit): | ||||||

| Quarter $0.2850 | Investor Relations: | |||||

| Annualized $1.14 | Whitestone REIT | |||||

| Dividend Yield 7.7%* | Anne I. Gregory, Vice President, Investor Relations & Marketing | |||||

| 2600 South Gessner Suite 500, Houston, Texas 77036 | & nbsp; | |||||

| Board of Directors: | 713.435.2221 email: ir@whitestonereit.com | |||||

| James C. Mastandrea | ||||||

| Daryl J. Carter | ICR Inc. - Brad Cohen 203.682.8211 | |||||

| Daniel G. DeVos | ||||||

| Donald F. Keating | website: www.whitestonereit.com | |||||

| Jack L. Mahaffey | ||||||

| Analyst Coverage: | ||||||

| *Based on share price of $14.80 | BMO Capital Markets Corp. | J.J.B. Hilliard, W.LO. Lyons, LLC | Wunderlich Securities, Inc. | |||

| as of 12/31/2010 | Paul Adornato, CFA | Carol L. Kemple | Merril Ross | |||

| 212.885.4170 | 502.588.1839 | 703.669.9255 | ||||

| Paul.Adornato@bmo.com | ckemple@hilliard.com | mross@wundernet.com | ||||

| Newest Acquisitions: | ||||||

| • | FFO-Core increased 17.6%, or approximately $0.3 million, to $2.0 million versus $1.7 million for the same period in 2009. FFO-Core per diluted commo n share and OP unit was $0.28, as compared to $0.33 per diluted common share and OP unit, for the same period in 2009. FFO-Core per diluted common share and OP unit was impacted in 2010 by the issuance of 2.2 million shares in August 2010 in connection with the Company's initial public offering ("IPO"), and by the subsequent use of IPO proceeds for acquisitions. FFO-Core excludes the insurance settlement referenced above. Acquisition costs of approximately $35,000 and $15,000 were also excluded from FFO-Core in 2010 and 2009, respectively. |

| • | FFO was $2.6 million, or $0.35 per diluted common share and OP unit, as compared to $2.9 million or $0.57 per diluted common share and OP unit for the same period in 2009. This includes the income recognized from the insurance settlement referenced above. |

| • | Property net operating income (“NOI”) increased 4.3% to $4.9 million versus $4.7 million for the same period in 2009. The income recognized from the insurance settlement is not included in property NOI. |

| • | Net income attributable to Whitestone REIT was $0.5 million, or $0.10 per diluted common share, compared to $0.7 million or $0.21 per diluted common share for the same period in 2009. This includes the income from the insurance settlement referenced above. |

| • | The Company declared a quarterly cash dividend of $0.285 per common share and OP unit, paid in three equal installments of $0.095 in January, February and March 2011. The dividend rate has remained the same since the dividend paid on July 8, 2010. The Company has consistently declared dividends for 18 consecutive quarters since Whitestone became internally managed in October 2006. (Subsequent to the fourth quarter, the Company declared a q uarterly cash dividend of $0.285 per common share and OP unit, paid in three equal installments of $0.095 in April, May and June 2011. |

| • | a 41% increase in total lease value of new and renewal leases signed: $31.9 million in 2010 versus $22.7 million in 2009; |

| • | an 18% increase in the number of new and renewal leases signed: 298 in 2010 versus 252 in 2009; and |

| • | a 12% growth in the square footage of new and renewal leases signed: 716,000 for 2010 versus 639,000 in 2009. |

| December 31, | ||||||||

| 2010 | 2009 | |||||||

| ASSETS | ||||||||

| Real estate assets, at cost: | ||||||||

| Property | $ | 204,954 | $ | 192,832 | ||||

| Accumulated depreciation | (39,556 | ) | (34,434 | ) | ||||

| Total real estate assets | 165,398 | 158,398 | ||||||

| Cash and cash equival ents | 17,591 | 6,275 | ||||||

| Escrows and acquisition deposits | 4,385 | 8,155 | ||||||

| Accrued rent and accounts receivable, net of allowance for doubtful accounts | 4,726 | 4,514 | ||||||

| Unamortized lease commissions and loan costs | 3,598 | 3,973 | ||||||

| Prepaid expenses and other assets | 747 | 685 | ||||||

| Total assets | $ | 196,445 | $ | 182,000 | ||||

| LIABILITIES AND EQUITY | ||||||||

| Liabilities: | ||||||||

| Notes payable | $ | 100,941 | $ | 101,782 | ||||

| Accounts payable and accrued expenses | 7,292 | 9,954 | ||||||

| Tenants' security deposits | 1,796 | 1,630 | ||||||

| Dividends and distributions payable | 2,133 | 1,775 | ||||||

| Total liabilities | 112,162 | 115,141 | ||||||

| Commitments and Contingencies: | ||||||||

| Equity: | ||||||||

| Preferred shares, $0.001 par value per share; 50,000,000 shares authorized; none issued and | ||||||||

| outstanding at December 31, 2010 and December 31, 2009, respectively | — | — | ||||||

| Class A common shares, $0.001 par value per share; 50 ,000,000 shares authorized; 3,471,187 | ||||||||

| and 3,445,769 issued and outstanding as of December 31, 2010 and December 31, 2009, | ||||||||

| respectively | 3 | 10 | ||||||

| Class B common shares, $0.001 par value per share; 350,000,000 shares authorized; | ||||||||

| 2,200,000 and 0 issued and outstanding as of December 31, 2010 and December 31, 2009, | ||||||||

| respectively | 2 | — | ||||||

| Additional paid-in capital | 93,357 | 69,952 | ||||||

| Accumulated deficit | (30,654 | ) | (26,372 | ) | ||||

| Total Whitestone REIT shareholders' equity | 62,708 | 43,590 | ||||||

| Noncontrolling interest in subsidiary | 21,575 | 23,269 | ||||||

| Total equity | 84,283 | 66,859 | ||||||

| Total liabilities and eq uity | $ | 196,445 | $ | 182,000 | ||||

| Year Ended December 31, | ||||||||||||

| 2010 | 2009 | 2008 | ||||||||||

| Property revenues | ||||||||||||

| Rental revenues | $ | 25,901 | $ | 26,449 | $ | 24 ,999 | ||||||

| Other revenues | 5,632 | 6,236 | 6,202 | |||||||||

| Total property revenues | 31,533 | 32,685 | 31,201 | |||||||||

| Property expenses | ||||||||||||

| Property operation and maintenance | 8,358 | 8,519 | 8,862 | |||||||||

| Real estate taxes | 3,925 | 4,472 | 3,973 | |||||||||

| Total property expenses | 12,283 | 12,991 | 12,835 | |||||||||

| Other expenses (income) | ||||||||||||

| General and administrative | 4,992 | 6,072 | 6,708 | |||||||||

| Depreciation & amortization | 7,225 | 6,958 | 6,859 | |||||||||

| Involuntary conversion | (558 | ) | (1,542 | ) | 358 | |||||||

| Interest expense | 5,620 | 5,749 | 5,857 | |||||||||

| Interest income | (2 8 | ) | (36 | ) | (182 | ) | ||||||

| Total other expense | 17,251 | 17,201 | 19,600 | |||||||||

| Income (loss) from continuing operations before loss on disposal of assets | ||||||||||||

| and income taxes | 1,999 | 2,493 | (1,234 | ) | ||||||||

| Provision for income taxes | (264 | ) | (222 | ) | (219 | ) | ||||||

| Loss on sale or disposal of assets | (160 | ) | (196 | ) | (223 | ) | ||||||

| Income (loss) from continuing operations | 1,575 | 2,075 | (1,676 | ) | ||||||||

| Loss from discontinued operations | — | — | (188 | ) | ||||||||

| Gain on sale of properties from discontinued operations | — | — | 3,619 | |||||||||

| Net income | 1,575 | 2,075 | 1,755 | |||||||||

| Less: Net income attributable to noncontrolling interests | 470 | 733 | 621 | |||||||||

| &nbs p; | ||||||||||||

| Net income attributa ble to Whitestone REIT | $ | 1,105 | $ | 1,342 | $ | 1,134 | ||||||

| Year Ended December 31, | ||||||||||||

| 2010 | 2009 | 2008 | ||||||||||

| Earnings per share - basic | ||||||||||||

| Income (loss) from continuing operations attributable to Whitestone REIT | ||||||||||||

| excluding amounts attributable to unvested restricted shares | $ | 0.27 | $ | 0.41 | $ | (0.32 | ) | |||||

| Income from discontinued operations attributable to Whitestone REIT | — | — | 0.67 | |||||||||

| Net income attributable to common shareholders excluding amounts | ||||||||||||

| attributable to unvested restricted shares | $ | 0.27 | $ | 0.41 | $ | 0.35 | ||||||

| Earnings per share - diluted | ||||||||||||

| Income (loss) from continuing operations attributable to Whitestone REIT | ||||||||||||

| excluding amounts attributable to unvested restricted shares | $ | 0.27 | $ | 0. 40 | $ | (0.32 | ) | |||||

| Income from discontinued operations attributable to Whitestone REIT | — | — | 0.67 | |||||||||

| Net income attributable to common shareholders excluding amounts attributable | ||||||||||||

| to unvested restricted shares | $ | 0.27 | $ | 0.40 | $ | 0.35 | ||||||

| Weighted average number of common shares outstanding: | ||||||||||||

| Basic | 4,012 | 3,236 | 3,277 | |||||||||

| Diluted | 4,041 | 3,302 | 3,277 | |||||||||

| Dividends declared per Class A common share | $ | 1.19 | $ | 1.35 | $ | 1.59 | ||||||

Dividends declared per Class B common share (1) | 0.57 | — | — | |||||||||

| Condensed Consolidated Statements of Comprehensive Income | ||||||||||||

| Net income | $ | 1,575 | $ | 2,075 | $ | 1,755 | ||||||

| Other comprehensive gain | ||||||||||||

| Unrealized gain on cash flow hedging activities | — | — | 368 | |||||||||

| Comprehensive income | 1,575 | 2,075 | 2,123 | |||||||||

| Less: Comprehensive income attributable to noncontrolling interests | 470 | 733 | 759 | |||||||||

| Comprehensive income attributable to Whitestone REIT | $ | 1,105 | $ | 1,342 | $ | 1,364 | ||||||

| Three Months Ended December 31, | Twelve Months Ended December 31, | |||||||||||||||

| 2010 | 2009 | 2010 | 2009 | |||||||||||||

| Property revenues | ||||||||||||||||

| Rental revenues | $ | 6,601 | $ | 6,422 | $ | 25,901 | $ | 26,449 | ||||||||

| Other revenues | 1,458 | 1,532 | 5,632 | 6,236 | ||||||||||||

| Total property revenues | 8,059 | 7,954 | 31,533 | 32,685 | ||||||||||||

| Property expenses | ; | |||||||||||||||

| Property operation and maintenance | 2,285 | 1,977 | 8,358 | 8,519 | ||||||||||||

| Real estate taxes | 923 | 1,245 | 3,925 | 4,472 | ||||||||||||

| Total property expenses | 3,208 | 3,222 | 12,283 | 12,991 | ||||||||||||

| Other expenses (income) | ; | |||||||||||||||

| General and administrative | 1,257 | 1,469 | 4,992 | 6,072 | ||||||||||||

| Depreciation & amortization | 1,902 | 1,799 | 7,225 | 6,958 | ||||||||||||

| Involuntary conversion | (558 | ) | (1,243 | ) | (558 | ) | (1,542 | ) | ||||||||

| Interest expense | 1,410 | 1,414 | 5,620 | 5,749 | ||||||||||||

| Interest income | (9 | ) | (6 | ) | (28 | ) | (36 | ) | ||||||||

| Total other expense | 4,002 | 3,433 | 17,251 | 17,201 | ||||||||||||

| Income from continuing oper ations before loss on disposal | ||||||||||||||||

| of assets and income taxes | 849 | 1,299 | 1,999 | 2,493 | ||||||||||||

| Provision for income taxes | (51 | ) | (56 | ) | (264 | ) | (222 | ) | ||||||||

| Loss on sale or disposal of assets | (47 | ) | (138 | ) | (160 | ) | (196 | ) | ||||||||

| Net income | 751 | 1,105 | 1,575 | 2,075 | ||||||||||||

| Less: Net income (loss) attributable to noncontrolling interests | 206 | 390 | 470 | 733 | ||||||||||||

| Net income (loss) attributable to Whitestone REIT | $ | 545 | $ | 715 | $ | 1,105 | $ | 1,342 | ||||||||

| Three Months Ended December 31, | Twelve Months Ended December 31, | |||||||||||||||

| 2010 | 2009 | 2010 | 2009 | |||||||||||||

| Earnings per share - basic | ||||||||||||||||

| Net income attributable to common shareholders excluding | ||||||||||||||||

amounts attributable to unvested restricted shares (1) | $ | 0.10 | $ | 0.22 | $ | 0.27 | $ | 0.41 | ||||||||

| Earnings per share - dilu ted | & nbsp; | |||||||||||||||

| Net income attributable to common shareholders excluding | ||||||||||||||||

amounts attributable to unvested restricted shares (1) | $ | 0.10 | $ | 0.21 | $ | 0.27 | $ | 0.40 | ||||||||

| Weighted average number of common shares outstanding: | ||||||||||||||||

| Basic | 5,479 | 3,236 | 4,012 | 3,236 | ||||||||||||

| Diluted | 5,499 | 3,301 | 4,041 | 3,302 | ||||||||||||

| &nb sp; | ||||||||||||||||

| Dividends declared per Class A common share | $ | 0.2850 | $ | 0.3375 | $ | 1.1900 | $ | 1.3500 | ||||||||

Dividends declared per Class B common share (2) | 0.2850 | — | 0.5700 | — | ||||||||||||

| Year Ended December 31, | ||||||||||||

| 2010 | 2009 | 2008 | ||||||||||

| Cash flows from operating activities: | ||||||||||||

| Net income (loss) | $ | 1,575 | $ | 2,075 | $ | (1,676 | ) | |||||

| Net income from discontinued operations | — | — | 3,431 | |||||||||

| 1,575 | 2,075 | 1,755 | ||||||||||

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | &nbs p; | |||||||||||

| Depreciation and amortization | 7,225 | 6,958 | 6,859 | |||||||||

| Loss on sale or disposal of assets | 160 | 196 | 223 | |||||||||

| Bad debt expense | 536 | 877 | 731 | |||||||||

| Share-based compensation | 297 | 1,013 | — | |||||||||

| Change in fair value of derivative instrument | — | — | — | |||||||||

| Changes in operating assets and liabilities: | ||||||||||||

| Escrows and acquisition deposits | 3,840 | (3,700 | ) | (3,590 | ) | |||||||

| Accrued rent and accounts receivable | (748 | ) | (511 | ) | (225 | ) | ||||||

| Unamortized lease commissions and loan costs | (783 | ) | (634 | ) | (813 | ) | ||||||

| Prepaid expenses and other assets | 446 | 527 | 417 | |||||||||

| Accounts payable and accrued expenses | (2,319 | ) | 2,096 | 655 | ||||||||

| Tenants' security deposits | 166 | 1 | 31 | |||||||||

| Net cash provided by operating activities | 10,395 | 8,898 | 2,612 | |||||||||

| Net cash provided by operating activities of discontinued operations | — | — | 8 | |||||||||

| Cash flows from investing activities: | ||||||||||||

| Acquisitions of real estate | (8,625 | ) | (5,619 | ) | — | |||||||

| Additions to real estate | (4,143 | ) | (3,611 | ) | (5,153 | ) | ||||||

| Net cash used in investing activities | (12,768 | ) | (9,230 | ) | (5,153 | ) | ||||||

| Net cash used in investing activities of discontinued operations | — | — | (8 | ) | ||||||||

| Cash flows from financing activities: | ||||||||||||

| Dividends paid | (5,158 | ) | (4,645 | ) | (5,578 | ) | ||||||

| Distributions paid to OP unit holders | (2,249 | ) | (2, 281 | ) | (3,094 | ) | ||||||

| Proceeds from issuance of common shares | 22,970 | — | — | |||||||||

| Proceeds from notes payable | 1,430 | 9,557 | 95,053 | |||||||||

| Repayments of notes payable | (2,957 | ) | (8,725 | ) | (78,990 | ) | ||||||

| Payments of loan origination costs | (98 | ) | (288 | ) | (2,672 | ) | ||||||

| Repurchase of common stock | (249 | ) | — | — | ||||||||

| Net cash provided by (used in) financing activities | 13,689 | (6,382 | ) | 4,719 | ||||||||

| Net increase (decrease) in cash and cash equivalents | 11,316 | (6,714 | ) | 2,178 | ||||||||

| Cash and cash equivalents at beginning of period | 6,275 | 12,989 | 10,811 | |||||||||

| Cash and cash equivalents at end of period | $ | 17,591 | $ | 6,275 | $ | 12,989 | ||||||

| Supplemental disclosure of cash flow information: | &nbs p; | |||||||||||

| Cash paid for interest | $ | 5,621 | $ | 5,535 | $ | 5,189 | ||||||

| Cash paid for taxes | 262 | 223 | 224 | |||||||||

| Non cash Investing and financing activities: | ||||||||||||

| Disposal of fully depreciated real estate | $ | 598 | $ | 564 | $ | 698 | ||||||

| Financed insurance premiums | 616 | 568 | 476 | |||||||||

| Acquistion of real estate in exchange for OP units | — | 3,625 | &mdas h; | |||||||||

| Change in par value of Class A common shares | 7 | — | — | |||||||||

| Disposal of real estate in settlement of lawsuit | — | — | 7,844 | |||||||||

| Reclassification of dividend reinvestment shares with rescission rights | 606 | — | (606 | ) | ||||||||

| Three Months Ended December 31, | Twelve Months Ended December 31, | |||||||||||||||

| 2010 | 2009 | 2010 | 2009 | |||||||||||||

| FFO AND FFO-CORE | ||||||||||||||||

| Net income attributable to Whitestone REIT | $ | 545 | $ | 715 | $ | 1,105 | $ | 1,342 | ||||||||

| Depreciation and amortization of real estate assets | 1,767 | 1,659 | 6,697 | 6,347 | ||||||||||||

| Loss on disposal of assets | 47 | 138 | 160 | 196 | ||||||||||||

| Net income attributable to noncontrolling interests | 206 | 390 | 470 | 733 | ||||||||||||

| FFO | $ | 2,565 | $ | 2,902 | $ | 8,432 | $ | 8,618 | ||||||||

| Acquisition costs | $ | 35 | $ | 15 | $ | 46 | $ | 75 | ||||||||

Gain on insurance claim settlement (1) | (558 | ) | (1,243 | ) | (558 | ) | (1,934 | ) | ||||||||

| FFO-Core | $ | 2,042 | $ | 1,674 | $ | 7,920 | $ | 6,759 | ||||||||

| FFO PER SHARE AND OP UNIT CALCULATION: | ||||||||||||||||

| Numerator: | ||||||||||||||||

| FFO | $ | 2,565 | $ | 2,902 | $ | 8,432 | $ | 8,618 | ||||||||

| Dividends paid on unvested restricted Class A common shares | (6 | ) | (7 | ) | (27 | ) | (27 | ) | ||||||||

| FFO excluding amounts attributable to unvested restricted | ||||||||||||||||

| Class A common shares | 2,559 | 2,895 | 8,405 | 8,591 | ||||||||||||

| FFO-Core excluding amounts attributable to unvested restricted | ||||||||||||||||

| Class A common shares | 2,036 | 1,667 | 7,893 | 6,732 | ||||||||||||

| Denominator: | ||||||||||||||||

| Weighted average number of total common shares - basic | 5,479 | 3,236 | 4,012 | 3,236 | ||||||||||||

| Weighted average number of total noncontrolling | ||||||||||||||||

| OP units - basic | 1,815 | 1,815 | 1,815 | 1,815 | ||||||||||||

| Weighted average number of total commons sha res and | &n bsp; | ; | ||||||||||||||

| noncontrolling OP units - basic | 7,294 | 5,051 | 5,827 | 5,051 | ||||||||||||

| Effect of dilutive securities: | ||||||||||||||||

| Unvested restricted shares | 20 | 66 | 29 | 66 | & nbsp; | |||||||||||

| Weighted average number of total common shares and | ||||||||||||||||

| noncontrolling OP units - dilutive | 7,314 | 5,117 | 5,856 | 5,117 | ||||||||||||

| FFO per share and unit - basic | $ | 0.35 | $ | 0.57 | $ | 1.44 | $ | 1.70 | ||||||||

| FFO per share and unit - diluted | $ | 0.35 | $ | 0.57 | $ | 1.44 | $ | 1.68 | ||||||||

| FFO-Core per share and unit - basic | $ | 0.28 | $ | 0.33 | $ | 1.35 | $ | 1.33 | ||||||||

| FFO-Core per share and unit - diluted | $ | 0.28 | $ | 0.33 | $ | 1.35 | $ | 1.32 | ||||||||

| Three Months Ended December 31, | Twelve Months Ended December 31, | |||||||||||||||

| 2010 | 2009 | 2010 | 2009 | |||||||||||||

| PROPERTY NET OPERATING INCOME ("NOI") | ||||||||||||||||

| Net income attributable to Whitestone REIT | $ | 545 | $ | 715 | $ | 1,105 | $ | 1,342 | ||||||||

| General and administrative expenses | 1,257 | 1,469 | 4,992 | 6,072 | ||||||||||||

| Depreciatio n and amortization | 1,902 | 1,799 | 7,225 | 6,958 | ||||||||||||

| Involuntary conversion | (558 | ) | (1,243 | ) | (558 | ) | (1,542 | ) | ||||||||

| Interest expense | 1,410 | 1,414 | 5,620 | 5,749 | ||||||||||||

| Interest income | (9 | ) | (6 | ) | (28 | ) | (36 | ) | ||||||||

| Provision for income taxes | 51 | 56 | 264 | 222 | ||||||||||||

| Loss on disposal of assets | 47 | 138 | &n bsp; | 160 | 196 | |||||||||||

| Net income attributable to noncontrolling interests | 206 | 390 | 470 | 733 | ||||||||||||

| NOI | $ | 4,851 | $ | 4,732 | $ | 19,250 | $ | 19,694 | ||||||||

| EARNINGS BEFORE INTEREST, TAX, DEPRECIATION | ||||||||||||||||

| AND AMORTIZATION ("EBITDA") | ||||||||||||||||

| Net income attributable to Whitestone REIT | $ | 545 | $ | 715 | $ | 1,105 | $ | 1,342 | ||||||||

| Depreciation and amortization | 1,902 | 1,799 | 7,225 | 6,958 | ||||||||||||

| Involuntary conversion | (558 | ) | (1,243 | ) | (558 | ) | (1,542 | ) | ||||||||

| Interest expense | 1,410 | 1,414 | 5,620 | 5,749 | ||||||||||||

| Interest income | (9 | ) | (6 | ) | (28 | ) | (36 | ) | ||||||||

| Provision for income taxes | 51 | 56 | 264 | 222 | ||||||||||||

| Loss on disposal of assets | 47 | ; | 138 | 160 | 196 | |||||||||||

| Net income attributable to noncontrolling interests | 206 | 390 | 470 | 733 | ||||||||||||

| EBITDA | $ | 3,594 | $ | 3,263 | $ | 14,258 | $ | 13,622 | ||||||||

| Three Months Ended | ||||||||||||||||

| December 31, | &nb sp; | September 30, | June 30, | March 31, | ||||||||||||

| 2010 | 2010 | 2010 | 2010 | |||||||||||||

| Net income attributable to Whitestone REIT | $ | 545 | $ | 177 | $ | 166 | $ | 217 | ||||||||

| Depreciation and amortization | 1,902 | 1,830 | 1,759 | 1,734 | ||||||||||||

| Involuntary conversion | (558 | ) | — | — | — | |||||||||||

| Interest expense | 1,410 | 1,401 | 1,402 | 1,407 | ||||||||||||

| Interest income | (9 | ) | (7 | ) | (5 | ) | (7 | ) | ||||||||

| Provision for income taxes | 51 | 57 | 102 | 54 | ||||||||||||

| Loss on disposal of assets | 47 | 72 | 8 | 33 | ||||||||||||

| Net income attributable to noncontrolling interests | 206 | 57 | 89 | 118 | ||||||||||||

| EBITDA | $ | 3 ,594 | $ | 3,587 | $ | 3,521 | $ | 3,556 | ||||||||

| Three Months Ended December 31, | Twelve Months Ended December 31, | |||||||||||||||

| 2010 | 2009 | 2010 | 2009 | |||||||||||||

| Other Financial Information: | ||||||||||||||||

Tenant improvements (1) | $ | 233 | $ | 572 | $ | 1,404 | $ | 1,880 | ||||||||

Leasing commissions (1) | $ | 192 | $ | 119 | $ | 643 | $ | 604 | ||||||||

| Scheduled debt principal payments | $ | 594 | $ | 523 | $ | 2,303 | $ | 1,774 | ||||||||

| Straight line rent income (loss) | $ | 223 | $ | (100 | ) | $ | 275 | $ | 325 | |||||||

| Market rent amortization income (loss) from acquired leases | $ | 3 | $ | (3 | ) | $ | 16 | $ | (21 | ) | ||||||

| Non-cash share-based compensation expense | $ | 78 | $ | 252 | $ | 297 | $ | 1,011 | ||||||||

| Non-real estate depreciation and amortization | $ | 26 | $ | 37 | $ | 108 | $ | 171 | ||||||||

| Amortization of loan fees | $ | 109 | $ | 104 | $ | 420 | $ | 440 | ||||||||

| Acquisition costs | $ | 35 | $ | 15 | $ | 46 | $ | 75 | ||||||||

| Undepreciated value of unencumbered properties | $ | 55,277 | $ | 59,032 | $ | 55,277 | $ | 59,032 | ||||||||

| Number of unencumbered properties | 15 | 15 | 15 | 15 | ||||||||||||

| Full time employees | 53 | 49 | 53 | 49 | ||||||||||||

| As of December 31, 2010 | ||||||||||||

| Percent of Total Equity | Total Market Capitalization | Percent of Total Market Capitalization | ||||||||||

| Equity Capitalization: | ||||||||||||

| Class A common shares outstanding | 46.4 | % | 3,471 | |||||||||

| Class B common shares outstanding | 29.4 | % | 2,200 | |||||||||

| Operating partnership units outstanding | 24.2 | % | 1,815 | |||||||||

| Total | 100.0 | % | 7,486 | |||||||||

| Market price of Class B common shares as of | ||||||||||||

| December 31, 2010 | $ | 14.80 | ||||||||||

| Total equity capitalization | $ | 110,793 | 57 | % | ||||||||

| Debt Capitalization: | ||||||||||||

| Outstanding debt | $ | 100,941 | ||||||||||

| Less: cash and cash equivalents | (17,591 | ) | ||||||||||

| 83,350 | 43 | % | ||||||||||

| Total Market Capitalization as of | ||||||||||||

| December 31, 2010 | $ | 194,143 | 100 | % | ||||||||

| SELECTED RATIOS: | ||||||||||||||||

| Three Months Ended | ||||||||||||||||

| December 31, | September 30, | June 30, | March 31, | |||||||||||||

| 2010 | 2010 | 2010 | 2010 | |||||||||||||

| COVERAGE RATIO | ||||||||||||||||

| Interest cover ratio | ||||||||||||||||

| EBITDA | $ | 3,594 | $ | 3,587 | $ | 3,521 | $ | 3,556 | ||||||||

| Interest expense | 1,410 | 1,401 | 1,402 | 1,407 | ||||||||||||

| 2.5 | 2.6 | 2.5 | 2.5 | |||||||||||||

| LEVERAGE RATIO | ||||||||||||||||

| Debt/Undepreciated Book Value | ||||||||||||||||

| Undepreciated real estate assets | $ | 204,954 | $ | 196,877 | $ | 193,283 | $ | 193,268 | ||||||||

| Outstanding debt | $ | 100,941 | $ | 101,667 | $ | 100,837 | $ | 101,569 | ||||||||

| Less: Cash | (17,591 | ) | (26,617 | ) | (3,910 | ) | (4,762 | ) | ||||||||

| $ | 83,350 | $ | 75,050 | $ | 96,927 | $ | 96,807 | |||||||||

| 41 | % | 38 | % | 50 | % | 50 | % | |||||||||

| Description | Oustanding Amount | Percentage of Total Debt | |||||

| Fixed rate notes | |||||||

| $10.0 million 6.04% Note, due 2014 | $ | 9,498 | 9 | % | |||

| $1.5 million 6.50% Note, due 2014 | 1,496 | 1 | % | ||||

| $11.2 million 6.52% Note, due 2015 | 10,908 | 11 | % | ||||

| $21.4 million 6.53% Notes, due 2013 | 20,142 | 20 | % | ||||

| $24.5 million 6.56% Note, due 2013 | 24,030 | 24 | % | ||||

| $9.9 million 6.63% Notes, due 2014 | 9,498 | 10 | % | ||||

| $0.5 million 5.05% Notes, due 2011 and 2010 | 13 | — | % | ||||

| Floating rate note | |||||||

$26.9 million LIBOR + 2.86% Note, due 2013 (1) | 25,356 | 25 | % | ||||

| $ | 100,941 | 100 | % | ||||

| Year | Scheduled Amortization Payments | Scheduled Maturities | Total Scheduled Maturities | Percentage of Debt Maturing | |||||||||||

| 2011 | $ | 2,459 | $ | — | $ | 2,459 | 2 | % | |||||||

| 2012 | 2 ,579 | — | 2,579 | 3 | % | ||||||||||

| 2013 | 2,272 | 64,152 | 66,424 | 66 | % | ||||||||||

| 2014 | 260 | 18,949 | 19,209 | 19 | % | ||||||||||

| 2015 | 124 | 10,146 | 10,270 | 10 | % | ||||||||||

| 2016 and thereafter | — | — | — | — | % | ||||||||||

| Total | $ | 7,694 | $ | 93,247 | $ | 100,941 | 100 | % | |||||||

| Leasable Square Feet as of | Occupancy as of | ||||||||||||||

| Community Center Properties | December 31, 2010 | December 31, 2010 | September 31, 2010 | June 30, 2010 | March 31, 2010 | ||||||||||

| Retail | 1,188,830 | 88 | % | 80 | % | 82 | % | 81 | % | ||||||

| Office/Flex | 1,201,672 | 88 | % | 87 | % | 85 | % | 84 | % | ||||||

| Office | 631,841 | 79 | % | 78 | % | 76 | % | 78 | % | ||||||

| Total - Operating Portfolio | 3,022,343 | 86 | % | 83 | % | 82 | % | 82 | % | ||||||

Redevelopment, New Acquisitions (1) | 139,677 | 40 | % | 16 | % | N/A | N/A | ||||||||

| Total | 3,162,020 | 84 | % | 82 | % | 82 | % | 82 | % | ||||||

| Tenant Name | Location | Annualized Rental Revenue (in thousands) | Percentage of Total Annualized Base Rental Revenues (2) | Initial Lease Date | Year Expiring | ||||||||

| Sports Authority | San Antonio | $ | 495 | 1.9 | % | 1/1/2004 | 2015 | ||||||

| Compass Insurance | Dallas | 367 | 1.4 | % | 9/1/2005 | 2013 | |||||||

| Brockett Davis Drake Inc. | Dallas | 365 | 1.4 | % | 3/14/1994 | 2011 | |||||||

| Air Liquide America, L.P. | Dallas | 363 | 1.4 | % | 8/1/2001 | 2013 | |||||||

| Kroger | Houston | 265 | 1.0 | % | 9/1/1999 | 2011 | |||||||

| X-Ray X-Press Corporation | Houston | 262 | 1.0 | % | 7/1/1998 | 2019 | |||||||

| Petsmart, Inc | San Antonio | 255 | 1.0 | % | 1/1/2004 | 2013 | |||||||

| Marshall's | Houston | 248 | 0.9 | % | 5/12/1983 | 2013 | |||||||

| Rock Solid Images | Houston | 243 | 0.9 | % | 4/1/2004 | 2012 | |||||||

| Merrill Corporation | Dallas | 234 | 0.9 | % | 12/10/2001 | 2014 | |||||||

| Eligibility Services | Dallas | 224 | 0.9 | % | 6/6/2000 | 2012 | |||||||

| River Oaks L-M, Inc. | Houston | 199 | 0.8 | % | 10/15/1993 | 2011 | |||||||

| New Lifestyles, Inc. | Dallas | 192 | 0.7 | % | 5/5/1998 | 2013 | |||||||

| Landworks, Inc. | Houston | 178 | 0.7 | % | 6/1/2004 | 2013 | |||||||

| The University of Texas Health Science Center | Houston | 177 | 0.7 | % | 7/1/2007 | 2017 | |||||||

| $ | 4,067 | 15.6 | % | ||||||||||

| Twelve Months Ended December 31, | ||||||||

| 2010 | 2009 | |||||||

| RENEWALS | ||||||||

| Number of Leases | 144 | 149 | ||||||

| Total SF | 288,538 | 410,685 | ||||||

| Average SF | 2,004 | 2,756 | ||||||

| Total Lease Value | $ | 10,374,000 | $ | 12,339,000 | ||||

| NEW LEASES | ||||||||

| Number of Leases | 154 | 103 | ||||||

| Total SF | 427,620 | 228,136 | ||||||

| Average SF | 2,777 | 2,215 | ||||||

| Total Lease Value | $ | 21,492,000 | $ | 10,408,000 | ||||

| TOTAL LEASES | ||||||||

| Number of Leases | 298 | 252 | ||||||

| Total SF | 716,158 | 638,821 | ||||||

| Average SF | 2,403 | 2,535 | ||||||

| Total Lease Value | $ | 31,866,000 | $ | 22,747,000 | ||||

| SQUARE FEET | |||

| December 31, 2009 | 2,484,414 | ||

| + New leases | 427,620 | ||

| + Property acquisitions | 56,537 | ||

| + Lease renewals | 225,012 | ||

| - Expiring leases | (306,185 | ) | |

| - Early terminations | (228,750 | ) | |

| December 31, 2010 | 2,658,648 | ||

| Annualized Base Rent | ||||||||||||||||||||

| Gross Leasable Area | as of December 31, 2010 | |||||||||||||||||||

| Year | Number of Leases (1) | Approximate Square Feet | Percent of Total | Amount (in thousands)(2) | Percent of Total | Per Square Foot | ||||||||||||||

| 2011 | 251 | 670,660 | 21 | % | $ | 6,641 | 25.3 | % | $ | 9.90 | ||||||||||

| 2012 | 159 | 460,412 | 15 | % | 4,898 | 18.7 | % | 10.64 | ||||||||||||

| 2013 | 144 | 504,510 | 16 | % | 5,394 | 20.6 | % | 10.69 | & nbsp; | |||||||||||

| 2014 | 94 | &nb sp; | 327,413 | 10 | % | 3,492 | 13.3 | % | 10.67 | |||||||||||

| 2015 | 71 | 311,924 | 10 | % | 3,026 | 11.5 | % | 9.70 | ||||||||||||

| 2016 | 39 | 127,213 | 4 | % | 983 | 3.8 | % | 7.73 | ||||||||||||

| 2017 | 8 | 43,725 | 1 | % | 407 | 1.6 | % | 9.31 | ||||||||||||

| 2018 | 9 | 55,581 | 2 | % | 365 | 1.4 | % | 6.57 | ||||||||||||

| 2019 | 6 | 50,333 | 2 | % | 569 | 2.2 | % | 11.30 | ||||||||||||

| 2020 | 3 | 37,907 | 1 | % | 237 | 0.9 | % | 6.25 | ||||||||||||

| Total | 784 | 2,589,678 | 82 | % | $ | 26,012 | 99.3 | % | $ | 10.04 | ||||||||||

Community Name | Location | Year Built/ Renovated | Leasable Square Feet | Percent Occupied at 12/31/10 | Annualized Base Rental Revenue (in thousands) (1) | Average Base Rental Revenue Per Sq. Ft. (2) | ||||||||||||

| Retail Communities: | ||||||||||||||||||

| Bellnott Square | &nb sp; | Houston | 1982 | 73,930 | 35 | % | $ | 266 | $ | 10.28 | ||||||||

| Bissonnet/Beltway | Houston | 1978 | 29,205 | 95 | % | 256 | 9.23 | |||||||||||

| Centre South | Houston | 1974 | 39,134 | 82 | % | 312 | 9.72 | |||||||||||

| Greens Road | Houston | 1979 | 20,507 | 85 | % | 145 | 8.32 | |||||||||||

| Holly Knight | Houston | 1984 | 20,015 | 100 | % | 326 | 16.29 | |||||||||||

| Kempwood Plaza | Houston | 1974 | 101,008 | 100 | % | 876 | 8.67 | |||||||||||

| Lion Square | Houston | 1980 | 119,621 | 99 | % | 801 | 6.76 | |||||||||||

| Providence | Houston | 1980 | 90,327 | 99 | % | 786 | 8.79 | |||||||||||

| Shaver | Houston | 1978 | 21,926 | 98 | % | 239 | 11.12 | |||||||||||

| South Richey | Houston | 1980 | 69,928 | 94 | % | 548 | 8.34 | |||||||||||

| Spoerlein Commons | Chicago | 1987 | 41,455 | 90 | % | 733 | 19.65 | |||||||||||

| SugarPark Plaza | Houston | 1974 | 95,032 | 100 | % | 935 | 9.84 | |||||||||||

| Sunridge | Houston | 1979 | 49,359 | 89 | % | 429 | 9.77 | |||||||||||

| Torrey Square | Houston | 1983 | 105,766 | 88 | % | 694 | 7.46 | |||||||||||

| Town Park | Houston | 1978 | 43,526 | 100 | % | 758 | 17.41 | |||||||||||

| Webster Point | Houston | 1984 | 26,060 | 92 | % | 269 | 11.22 | |||||||||||

| Westchase | Houston | 1978 | 49,573 | 86 | % | 398 | 9.34 | |||||||||||

| Windsor Park | San Antonio | 1992 | 192,458 | 76 | % | 1,072 | 7.33 | |||||||||||

| 1,188,830 | 88 | % | $ | 9,843 | $ | 9.41 | ||||||||||||

| Office/Flex Communities: | ||||||||||||||||||

| Brookhill | Houston | 1979 | 74,757 | 89 | % | $ | 257 | $ | 3.86 | & nbsp; | ||||||||

| Corporate Park Northwest | Houston | 1981 | 185,627 | 70 | % | 1,373 | 10.57 | |||||||||||

| Corporate Park West | Houston | 1999 | 175,665 | 92 | % | 1,471 | 9.10 | |||||||||||

| Corporate Park Woodland | Houston | 2000 | 99,937 | 92 | % | 792 | 8.61 | |||||||||||

| Dairy Ashford | Houston | 1981 | 42,902 | 95 | % | 210 | 5.15 | |||||||||||

| Holly Hall | Houston | 1980 | 90 ,000 | 100 | % | 689 | 7.66 | |||||||||||

| Interstate 10 | Houston | 1980 | 151,000 | 95 | % | 693 | 4.83 | |||||||||||

| Main Park | Houston | 1982 | 113,410 | 100 | % | 660 | 5.82 | |||||||||||

| Plaza Park | Houston | 1982 | 105,530 | 74 | % | 650 | 8.32 | |||||||||||

| Westbelt Plaza | Houston | 1978 | 65,619 | 63 | % | 347 | 8.39 | |||||||||||

| Westgate | Houston | 1984 | 97,225 | 100 | % | 528 | 5.43 | |||||||||||

| 1,201,672 | 88 | % | $ | 7,670 | $ | 7.25 | ||||||||||||

| Office Communities: | ||||||||||||||||||

| 9101 LBJ Freeway | Dallas | 1985 | 125,874 | 71 | % | $ | 1,462 | $ | 16.36 | |||||||||

| Featherwood | Houston | 1983 | 49,760 | 87 | % | 755 | 17.44 | |||||||||||

| Pima Norte | Phoenix | 2007 | 33,417 | 17 | % | 85 | 14.96 | |||||||||||

| Royal Crest | Houston | 1984 | 24,900 | 70 | % | 218 | 12.51 | |||||||||||

| Uptown Tower | Dallas | 1982 | 253,981 | 88 | % | 3,918 | 17.53 | |||||||||||

| Woodlake Plaza | Houston | 1974 | 106,169 | 89 | % | 1,215 | 12.86 | |||||||||||

| Zeta Building | Houston | 1982 | 37,740 | 77 | % | 431 | 14.83 | |||||||||||

| 631,841 | 79 | % | $ | 8,084 | $ | 16.20 | ||||||||||||

| Total - Operating Portfolio | 3,022,343 | 86 | % | $ | 25,597 | $ | 9.85 | |||||||||||

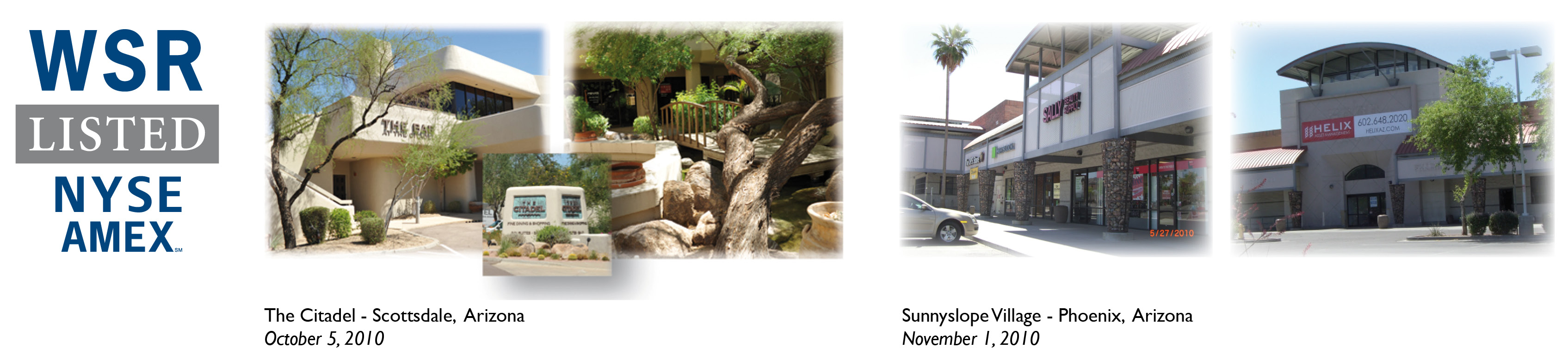

| The Citadel | Phoenix | 1985 | 28,547 | 16 | % | $ | 85 | $ | 18.61 | |||||||||

| Sunnyslope Village | Phoenix | 2000 | 111,130 | 47 | % | 527 | 10.09 | |||||||||||

| ; | 139,677 | 40 | % | 612 | 10.95 | |||||||||||||

| Grand Totals | 3,162,020 | 84 | % | $ | 26,209 | $ | 9.87 | |||||||||||