VOTE FOR WHITESTONE REIT VOTE THE WHITE PROXY CARD VOTE NOW Please refer to the enclosed WHITE proxy card for information on how to vote by telephone or by Internet, or simply sign and date the WHITE proxy card and return it in the postage-paid envelope provided and vote “FOR” all of Whitestone’s trustees. If you have any questions, or need assistance in voting your shares, please call our proxy solicitor, Innisfree M&A Incorporated, toll-free at 877-750-0502.

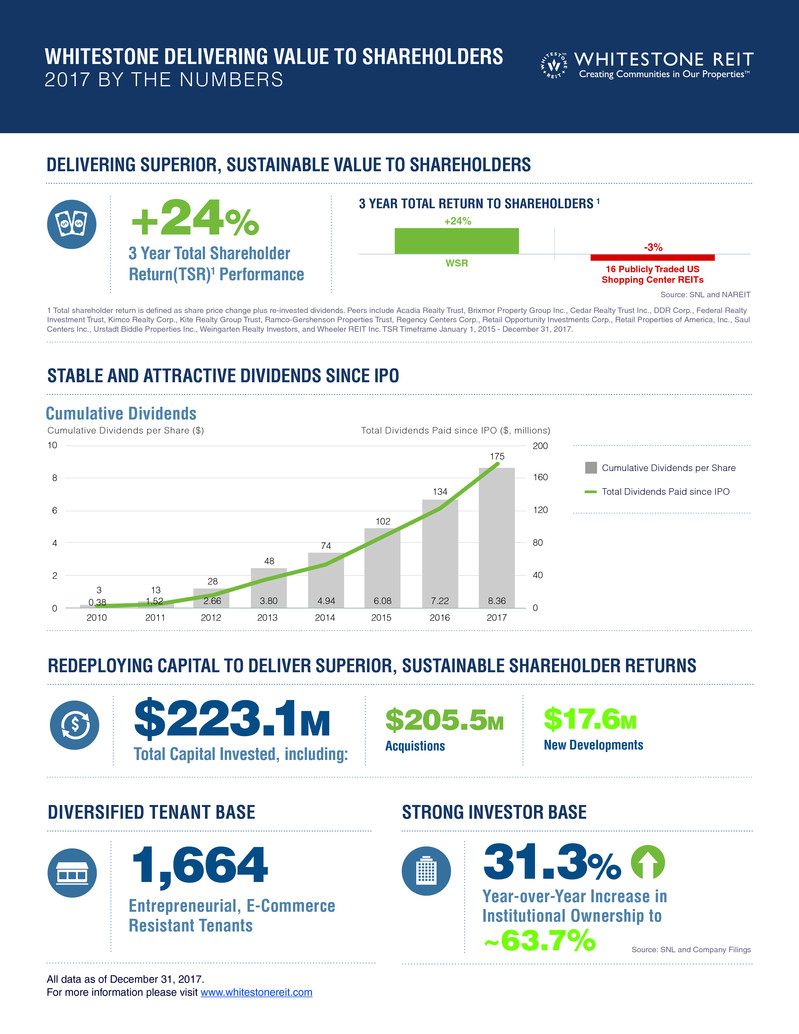

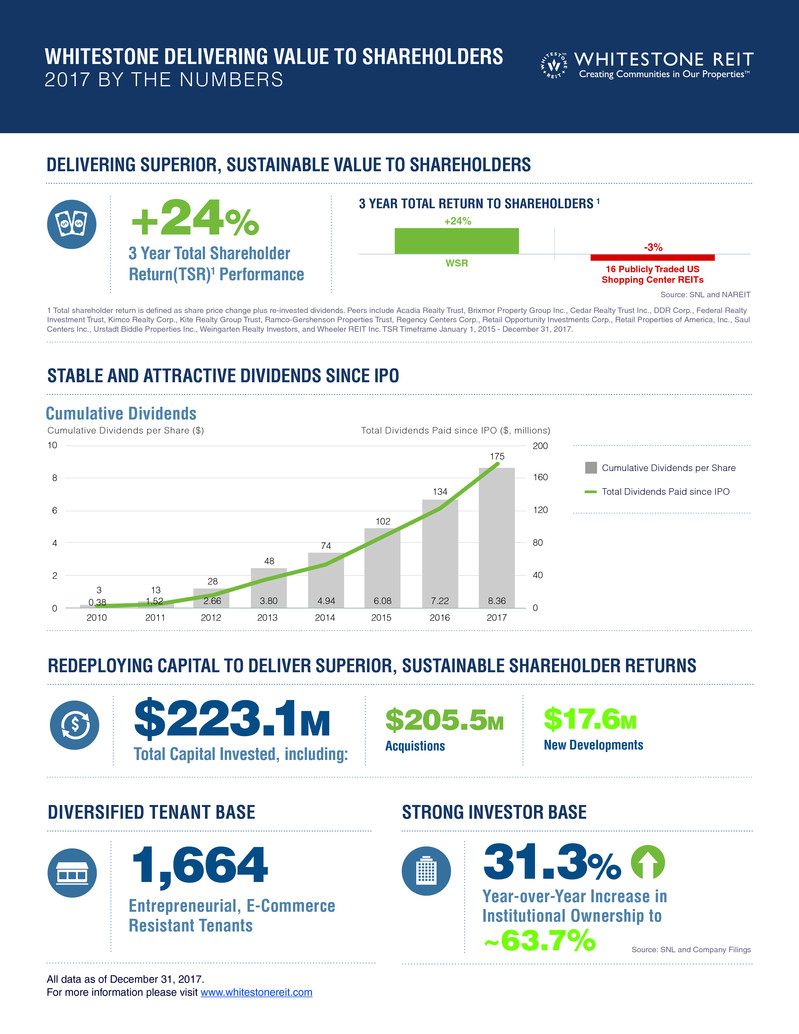

DELIVERING SUPERIOR, SUSTAINABLE VALUE TO SHAREHOLDERS WHITESTONE DELIVERING VALUE TO SHAREHOLDERS 2017 BY THE NUMBERS +24% 3 Year Total Shareholder Return(TSR)1 Performance STABLE AND ATTRACTIVE DIVIDENDS SINCE IPO Source: SNL and NAREIT 16 Publicly Traded US Shopping Center REITs WSR -3% +24% 3 YEAR TOTAL RETURN TO SHAREHOLDERS 1 1 Total shareholder return is defined as share price change plus re-invested dividends. Peers include Acadia Realty Trust, Brixmor Property Group Inc., Cedar Realty Trust Inc., DDR Corp., Federal Realty Investment Trust, Kimco Realty Corp., Kite Realty Group Trust, Ramco-Gershenson Properties Trust, Regency Centers Corp., Retail Opportunity Investments Corp., Retail Properties of America, Inc., Saul Centers Inc., Urstadt Biddle Properties Inc., Weingarten Realty Investors, and Wheeler REIT Inc. TSR Timeframe January 1, 2015 - December 31, 2017. Cumulative Dividends per Share ($) Total Dividends Paid since IPO ($, millions) Cumulative Dividends Cumulative Dividends per Share Total Dividends Paid since IPO 200 160 120 80 40 0 8.36 20172016201520142013201220112010 175 134 7.226.084.94 10 8 6 4 2 0 3.801.52 133 0.38 102 74 48 28 2.66 1,664 Entrepreneurial, E-Commerce Resistant Tenants 31.3% Year-over-Year Increase in Institutional Ownership to ~63.7% STRONG INVESTOR BASEDIVERSIFIED TENANT BASE Source: SNL and Company Filings All data as of December 31, 2017. For more information please visit www.whitestonereit.com $223.1M Total Capital Invested, including: REDEPLOYING CAPITAL TO DELIVER SUPERIOR, SUSTAINABLE SHAREHOLDER RETURNS $205.5M Acquistions $17.6M New Developments

YOUR BOARD AND MANAGEMENT TEAM HAVE A CAREFULLY CONSIDERED 5-YEAR PLAN TO HELP ENSURE THAT THE COMPANY WILL CONTINUE TO GENERATE SUPERIOR, SUSTAINABLE SHAREHOLDER VALUE. % of Tenants Servicing Daily Necessities Fr eq ue nc y o f C us to m er V is its Lo w Low Hi gh Resistant to E-Commerce Replaced by E-Commerce High Community Shopping Centers Urban Lifestyle Centers Power Centers Regional Centers/ Malls Neighborhood Shopping Centers Core Tenants & Daily Convenience Stores Grocery Anchored & Daily Convenience Stores Grocery & Destination Stores Big Box Stores w/ emphasis on hard goods Big Box & Department Stores w/ emphasis on hard goods Note: Definitions sourced from ULI WSR Owned Properties “E-Commerce Resistant” properties attract and retain customers by providing daily essential services and products not readily available online. We have taken the right steps to improve the business, drive growth and create superior, sustainable shareholder value. 2023 LONG-TERM GOALS E-COMMERCE RESISTANT BUSINESS STRATEGY Targeting reduced leverage Targeting an improved general and administrative expense-to-revenue ratio range Growing our cash flow target and improving dividend payout ratio Increasing market presence in our existing markets in the Sunbelt states Cultivating valuable, long-term relationships with our tenants and stakeholders

All data as of December 31, 2017. For more information please visit www.whitestonereit.com Certain statements contained in this brochure may constitute “forward-looking statements.” Shareholders should be aware that these forward-looking statements are subject to a number of risks and uncertainties, many of which are beyond our control. These risks and uncertainties could cause actual results to differ materially from such statements. Certain risks and uncertainties are disclosed from time to time in our filings with the Securities and Exchange Commission. Except as required by law, we undertake no obligation to update or revise any forward-looking statements. Whitestone REIT has filed a definitive proxy statement on Schedule 14A and form of associated WHITE proxy card with the Securities and Exchange Commission (“SEC”) in connection with the solicitation of proxies for its 2018 Annual Meeting of Shareholders (the “Definitive Proxy Statement”). Whitestone REIT, its trustees and its executive officers and Innisfree M&A Incorporated on their behalf will be participants in the solicitation of proxies from Company shareholders in connection with the matters to be considered at the Company’s 2018 Annual Meeting. Information regarding the names of the Company’s trustees and executive officers and their ownership in the Company’s common shares and other securities is set forth in the Definitive Proxy Statement. Details concerning the nominees of the Company’s Board of Trustees for election at the 2018 Annual Meeting of Shareholders are included in the definitive proxy statement. BEFORE MAKING ANY VOTING DECISION, SHAREHOLDERS OF THE COMPANY ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH OR FURNISHED TO THE SEC, INCLUDING THE COMPANY’S DEFINITIVE PROXY STATEMENT AND ANY SUPPLEMENTS THERETO AND ACCOMPANYING WHITE PROXY CARD, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Shareholders can obtain a copy of the Definitive Proxy Statement, any amendments or supplements thereto and other documents filed by the Company with the SEC for no charge at the SEC’s website at www.sec.gov. Copies will also be available at no charge at the Company’s website at www.whitestonereit.com. SAFE HARBOR STATEMENT ADDITIONAL INFORMATION Please refer to the enclosed WHITE proxy card for information on how to vote by telephone or by Internet, or simply sign and date the WHITE proxy card and return it in the postage-paid envelope provided and vote “FOR” all of Whitestone’s trustees. If you have any questions, or need assistance in voting your shares, please call our proxy solicitor, Innisfree M&A Incorporated, toll-free at 877-750-0502.