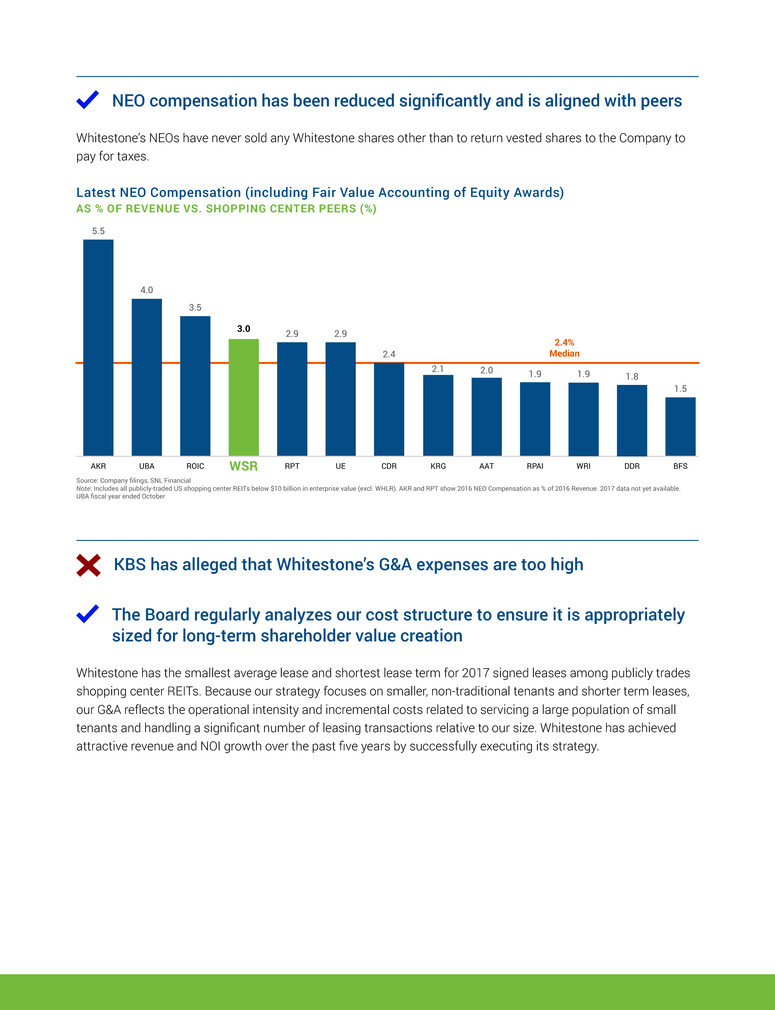

Dear Fellow Shareholder, Whitestone’s 2018 Annual Meeting of Shareholders is rapidly approaching, and your vote is critical to the future of the Company, no matter how many shares you own. The Board of Trustees unanimously recommends that you vote “FOR” the re-election of ALL of Whitestone’s highly qualified trustee nominees on the WHITE proxy card today. KBS HAS MISCHARACTERIZED THE FACTS TO DISTRACT AND CONFUSE SHAREHOLDERS KBS Strategic Opportunity REIT (“KBS”), an externally managed, non-traded real estate investment trust (“REIT”), is waging what we believe is a self-serving proxy contest in an effort to replace Whitestone’s highly qualified trustees with individuals who lack relevant experience and who have other business ties to KBS. We are writing this letter to provide you with facts that dispel KBS’s mischaracterizations, as well as more detail regarding the value that the Board and management team are creating for all Whitestone shareholders. April 24, 2018 KBS has alleged that Whitestone’s executive compensation is too high Whitestone’s executive compensation policies are aligned with shareholder interests and Named Executive Officer (“NEO”) compensation is in-line with Whitestone’s peers The Board’s Compensation Committee: • Intentionally structured executive compensation to be weighted toward equity with a low cash component so our NEOs are aligned with other shareholders in seeking stability of cash flows and dividends and appreciation in your and their investment over a long-term investment period; • Did not increase the Chief Executive Officer (“CEO”) and Chief Financial Officer (“CFO”) base salaries in 2017 for the fourth consecutive year; • Did not pay bonuses for the CEO and CFO for the fourth consecutive year; • Added a performance component in 2017 to further link NEO compensation to shareholder value creation; and • Reduced 2017 award fair values for the CEO and CFO by approximately 70% from the 2016 grant fair value. We ask you to vote your shares FOR ALL of the Company’s trustee nominees on the WHITE proxy card today.

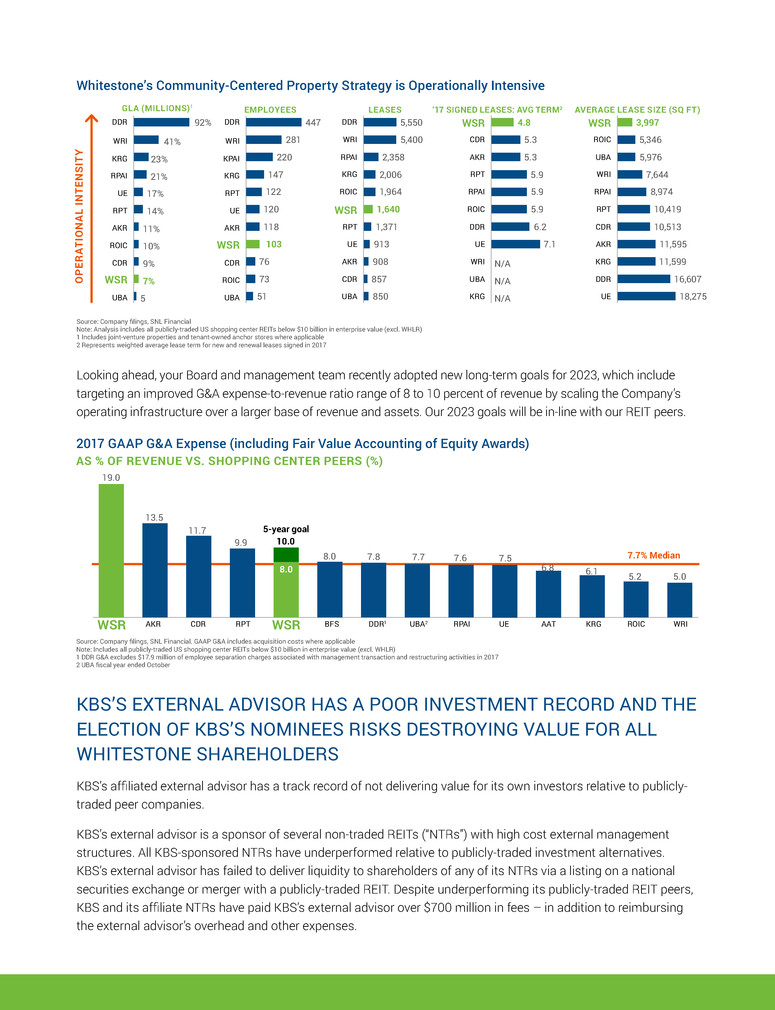

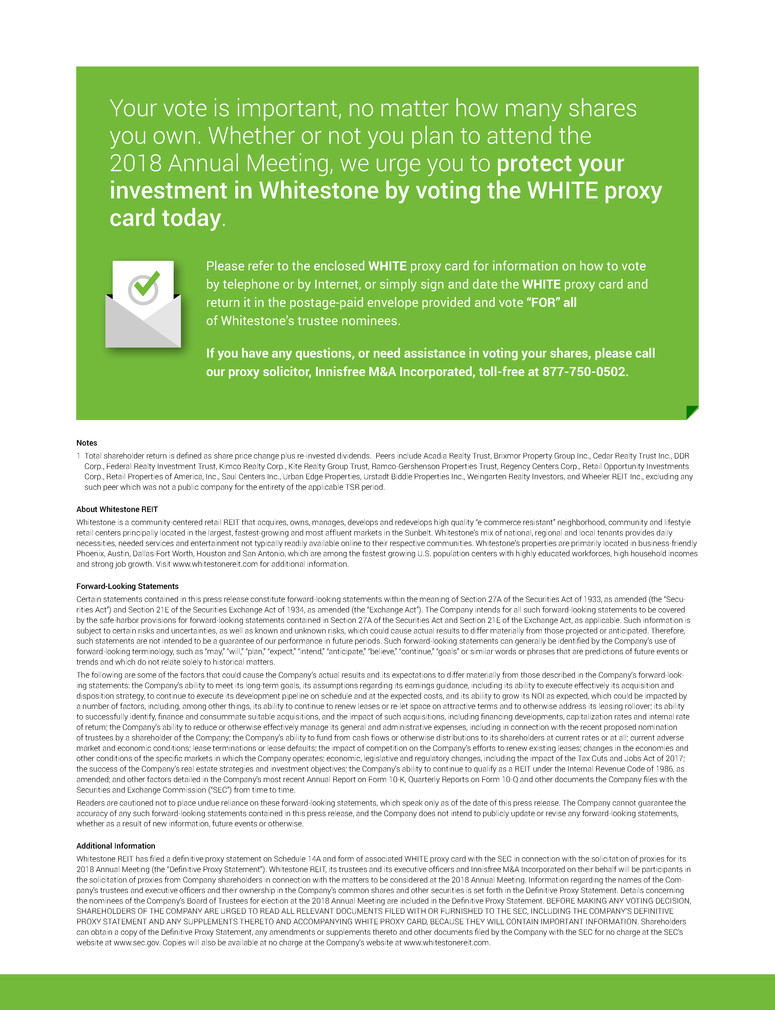

Looking ahead, your Board and management team recently adopted new long-term goals for 2023, which include targeting an improved G&A expense-to-revenue ratio range of 8 to 10 percent of revenue by scaling the Company’s operating infrastructure over a larger base of revenue and assets. Our 2023 goals will be in-line with our REIT peers. Source: Company filings, SNL Financial. GAAP G&A includes acquisition costs where applicable Note: Includes all publicly-traded US shopping center REITs below $10 billion in enterprise value (excl. WHLR) 1 DDR G&A excludes $17.9 million of employee separation charges associated with management transaction and restructuring activities in 2017 2 UBA fiscal year ended October 11.7 CDR 13.5 AKR 19.0 WSR WSR 10.0 BFS 8.0 DDR1 7.8 UBA2 7.7 RPAI 7.6 UE 7.5 AAT 6.8 KRG 6.1 ROIC 5.2 RPT 9.9 7.7% Median WRI 5.0 5-year goal 8.0 2017 GAAP G&A Expense (including Fair Value Accounting of Equity Awards) AS % OF REVENUE VS. SHOPPING CENTER PEERS (%) 7.1 ROIC DDR RPAI 4.8 5.3 5.3 5.9 5.9 5.9 6.2 N/A N/A N/A WSR ‘17 SIGNED LEASES: AVG TERM2 CDR AKR RPT WRI UBA KRG UE RPT AKR UE 92% 41% 23% 21% 17% 14% 11% 10% 9% 7% 5 DDR GLA (MILLIONS)1 WRI KRG RPAI CDR WSR UBA ROIC 447 UE AKR RPT 281 220 147 122 120 118 103 76 73 51 DDR EMPLOYEES WRI KPAI KRG CDR ROIC UBA WSR 5,550 5,400 WSR RPT ROIC 2,358 2,006 1,964 1,640 1,371 913 908 857 850 DDR LEASES WRI RPAI KRG AKR CDR UBA UE RPT CDR RPAI 3,997 5,346 5,976 7,644 8,974 10,419 10,513 11,595 11,599 16,607 18,275 WSR AVERAGE LEASE SIZE (SQ FT) ROIC UBA WRI KRG DDR UE AKR Source: Company filings, SNL Financial Note: Analysis includes all publicly-traded US shopping center REITs below $10 billion in enterprise value (excl. WHLR) 1 Includes joint-venture properties and tenant-owned anchor stores where applicable 2 Represents weighted average lease term for new and renewal leases signed in 2017 Whitestone’s Community-Centered Property Strategy is Operationally Intensive O P E R A T IO N A L IN T E N S IT Y KBS’S EXTERNAL ADVISOR HAS A POOR INVESTMENT RECORD AND THE ELECTION OF KBS’S NOMINEES RISKS DESTROYING VALUE FOR ALL WHITESTONE SHAREHOLDERS KBS’s affiliated external advisor has a track record of not delivering value for its own investors relative to publicly- traded peer companies. KBS’s external advisor is a sponsor of several non-traded REITs (“NTRs”) with high cost external management structures. All KBS-sponsored NTRs have underperformed relative to publicly-traded investment alternatives. KBS’s external advisor has failed to deliver liquidity to shareholders of any of its NTRs via a listing on a national securities exchange or merger with a publicly-traded REIT. Despite underperforming its publicly-traded REIT peers, KBS and its affiliate NTRs have paid KBS’s external advisor over $700 million in fees – in addition to reimbursing the external advisor’s overhead and other expenses.

In sharp contrast, Whitestone has made tremendous strides both financially and operationally to generate attractive returns for investors. In 2017, Whitestone distributed more than $40 million in dividends and ranked #1 in total shareholder return among the 17 U.S. Public Shopping Center REITs1. We believe our high quality properties, simple capital structure, forward-thinking strategy and well-aligned business model and infrastructure will allow us to continue to grow profitably and generate sustainable, long-term shareholder value. KBS HAS FAILED TO ARTICULATE A STRATEGIC PLAN FOR WHITESTONE The Whitestone Board and management team are receptive to ideas from shareholders that may help drive profitable growth and enhance shareholder value. Since KBS’s investment in Whitestone, we have sought to maintain an open dialogue and held discussions with representatives of KBS. However, KBS has not offered any actionable ideas or given any compelling rationale to warrant representation on Whitestone’s Board. Neither of KBS’s nominees possesses retail real estate experience comparable to Whitestone’s trustees, they are not familiar with Whitestone’s target markets and they have never operated or invested in retail real estate in Whitestone’s markets. KBS’s nominees have articulated no business or operating strategy and, in our view, would add no value to Whitestone or the Company’s ongoing strategic initiatives. We believe that Whitestone has the right strategy to create long-term shareholder value in a rapidly changing environment for retail real estate and is well-positioned to capitalize on the opportunities ahead. We are actively engaged in overseeing the Company’s successful investment strategy and have the experience and oversight to ensure Whitestone continues to achieve and surpass its objectives. The Board and management team are active, engaged and implementing the Company’s strategic plan to continue delivering financial and operational growth. PROTECT THE VALUE OF YOUR INVESTMENT AND DIVIDENDS; VOTE THE WHITE PROXY CARD TODAY “FOR” ALL OF WHITESTONE’S TRUSTEE NOMINEES. We urge you to support your Board, which is working hard on behalf of all shareholders to build on the Company’s track record of sustainable shareholder value creation. A vote on the WHITE proxy card is a vote to protect your investment, including your dividends.. Thank you for your continued support. Sincerely, James C. Mastandrea Chairman and CEO

Notes 1 Total shareholder return is defined as share price change plus re-invested dividends. Peers include Acadia Realty Trust, Brixmor Property Group Inc., Cedar Realty Trust Inc., DDR Corp., Federal Realty Investment Trust, Kimco Realty Corp., Kite Realty Group Trust, Ramco-Gershenson Properties Trust, Regency Centers Corp., Retail Opportunity Investments Corp., Retail Properties of America, Inc., Saul Centers Inc., Urban Edge Properties, Urstadt Biddle Properties Inc., Weingarten Realty Investors, and Wheeler REIT Inc., excluding any such peer which was not a public company for the entirety of the applicable TSR period. About Whitestone REIT Whitestone is a community-centered retail REIT that acquires, owns, manages, develops and redevelops high quality “e-commerce resistant” neighborhood, community and lifestyle retail centers principally located in the largest, fastest-growing and most affluent markets in the Sunbelt. Whitestone’s mix of national, regional and local tenants provides daily necessities, needed services and entertainment not typically readily available online to their respective communities. Whitestone’s properties are primarily located in business-friendly Phoenix, Austin, Dallas-Fort Worth, Houston and San Antonio, which are among the fastest growing U.S. population centers with highly educated workforces, high household incomes and strong job growth. Visit www.whitestonereit.com for additional information. Forward-Looking Statements Certain statements contained in this press release constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Secu- rities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Company intends for all such forward-looking statements to be covered by the safe-harbor provisions for forward-looking statements contained in Section 27A of the Securities Act and Section 21E of the Exchange Act, as applicable. Such information is subject to certain risks and uncertainties, as well as known and unknown risks, which could cause actual results to differ materially from those projected or anticipated. Therefore, such statements are not intended to be a guarantee of our performance in future periods. Such forward-looking statements can generally be identified by the Company’s use of forward-looking terminology, such as “may,” “will,” “plan,” “expect,” “intend,” “anticipate,” “believe,” “continue,” “goals” or similar words or phrases that are predictions of future events or trends and which do not relate solely to historical matters. The following are some of the factors that could cause the Company’s actual results and its expectations to differ materially from those described in the Company’s forward-look- ing statements: the Company’s ability to meet its long-term goals, its assumptions regarding its earnings guidance, including its ability to execute effectively its acquisition and disposition strategy, to continue to execute its development pipeline on schedule and at the expected costs, and its ability to grow its NOI as expected, which could be impacted by a number of factors, including, among other things, its ability to continue to renew leases or re-let space on attractive terms and to otherwise address its leasing rollover; its ability to successfully identify, finance and consummate suitable acquisitions, and the impact of such acquisitions, including financing developments, capitalization rates and internal rate of return; the Company’s ability to reduce or otherwise effectively manage its general and administrative expenses, including in connection with the recent proposed nomination of trustees by a shareholder of the Company; the Company’s ability to fund from cash flows or otherwise distributions to its shareholders at current rates or at all; current adverse market and economic conditions; lease terminations or lease defaults; the impact of competition on the Company’s efforts to renew existing leases; changes in the economies and other conditions of the specific markets in which the Company operates; economic, legislative and regulatory changes, including the impact of the Tax Cuts and Jobs Act of 2017; the success of the Company’s real estate strategies and investment objectives; the Company’s ability to continue to qualify as a REIT under the Internal Revenue Code of 1986, as amended; and other factors detailed in the Company’s most recent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and other documents the Company files with the Securities and Exchange Commission (“SEC”) from time to time. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. The Company cannot guarantee the accuracy of any such forward-looking statements contained in this press release, and the Company does not intend to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Additional Information Whitestone REIT has filed a definitive proxy statement on Schedule 14A and form of associated WHITE proxy card with the SEC in connection with the solicitation of proxies for its 2018 Annual Meeting (the “Definitive Proxy Statement”). Whitestone REIT, its trustees and its executive officers and Innisfree M&A Incorporated on their behalf will be participants in the solicitation of proxies from Company shareholders in connection with the matters to be considered at the 2018 Annual Meeting. Information regarding the names of the Com- pany’s trustees and executive officers and their ownership in the Company’s common shares and other securities is set forth in the Definitive Proxy Statement. Details concerning the nominees of the Company’s Board of Trustees for election at the 2018 Annual Meeting are included in the Definitive Proxy Statement. BEFORE MAKING ANY VOTING DECISION, SHAREHOLDERS OF THE COMPANY ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH OR FURNISHED TO THE SEC, INCLUDING THE COMPANY’S DEFINITIVE PROXY STATEMENT AND ANY SUPPLEMENTS THERETO AND ACCOMPANYING WHITE PROXY CARD, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Shareholders can obtain a copy of the Definitive Proxy Statement, any amendments or supplements thereto and other documents filed by the Company with the SEC for no charge at the SEC’s website at www.sec.gov. Copies will also be available at no charge at the Company’s website at www.whitestonereit.com. Your vote is important, no matter how many shares you own. Whether or not you plan to attend the 2018 Annual Meeting, we urge you to protect your investment in Whitestone by voting the WHITE proxy card today. Please refer to the enclosed WHITE proxy card for information on how to vote by telephone or by Internet, or simply sign and date the WHITE proxy card and return it in the postage-paid envelope provided and vote “FOR” all of Whitestone’s trustee nominees. If you have any questions, or need assistance in voting your shares, please call our proxy solicitor, Innisfree M&A Incorporated, toll-free at 877-750-0502.