The following are some of the questions you, as a shareholder, may have and answers to those questions. The following is not meant to be a substitute for the information contained in the remainder of this document, and the information contained below is qualified by the more detailed descriptions and explanations contained elsewhere in this document. We urge you to read this entire document carefully prior to making any decision on whether to grant any consent hereunder.

In addition, the Hartman Parties believe that Mr. Mastandrea’s tactics are similar to his failed efforts to disenfranchise shareholders of First Union Real Estate Equity and Mortgage Investments (“First Union”). While Mr. Mastandrea was CEO of First Union, a major shareholder, Gotham Partners, LP (“Gotham”), initiated a proxy solicitation for the purpose of taking control of the board of trustees of First Union. First Union sued Gotham in the Court of Common Pleas of Ohio and attempted to use a bylaw provision to obtain an injunction prohibiting Gotham form voting its shares. Ultimately, First Union lost in its attempt to keep the shareholders from voting on Gotham’s proposal.

First Union, under Mastandrea’s leadership, incurred expenses of approximately $17.5 million in what the court described as an attempt to “totally disenfranchise Gotham.” The Merger & Acquisitions Report, dated June 22, 1988 and titled Proxy Fights - FUR Continues to Pay for Lost Battles, provides, in pertinent part, as follows:

The cost of failure can be high. Last week, First Union Real Estate Investment trust (FUR) announced an anticipated second quarter loss of $18.8 million, virtually all incurred by a failed effort to ward off a proxy fight and the subsequent change in board control.

The charges for the hard-fought contest, expected to total about $17.5 million, encompasses more than $6 million in proxy fees and expenses. That includes $3.2 million on the paired-share Real Estate Investment Trust side, and $3.1 million for the reimbursement for of shareholders Gotham Partners, LP, which completed its successful campaign for control of the board last month…”We were aware of the various costs, but the sheer scale is always shocking,” said William Ackman, president of Gotham… The $250 million market cap company’s stock took a on the expected loss news, falling 9% from $9.31 to $8.50….

Other expenses include a $3.4 million severance package for former Chairman and CEO James Mastandrea and the $5 million of lifting restraints on restricted shares, following FUR’s change in control.

FUR expects a total loss of about 60 cents per share for the quarter, which ended June 30, compared to the year-earlier income of three cents a share. The second quarter dividend on common shares will be suspended.

In denying First Union’s request to keep Gotham from being allowed to nominate directors and vote their shares, the court stated that:

First Union’s attempts to preclude the inevitable proxy contest and possible take over of its current Board and fear of change in management are understandable; however, actions that would deprive a shareholder of exercising right to a $30 million investment while also depriving other shareholders of the ability to consider valid options are unlikely to satisfy [the] requirement that the public interest be served.

. . .

First Union’s management’s efforts to disenfranchise Gotham do not appear to be designed to protect First Union’s REIT status but rather management. All the shareholders should have a fair opportunity to decide the direction of the corporation. . . (emphasis added)

The Hartman Parties believe that Mr. Mastandrea, and the other trustees of the REIT, have taken the Entrenchment Actions in response to the Preliminary Consent, and as the Court found in the First Union proxy battle, not to protect the REIT, but rather, to protect the current management.

The Hartman Parties believe it is in the best interest of the REIT and its shareholders for the shareholders to exercise their fundamental right to vote and decide who they want to serve on the be the trustees for their trust. Therefore, on January 30, 2007, the Hartman Parties filed a Counterclaim in Federal Court alleging that the Entrenchment Actions were not permitted by the REIT’s organizational documents, were not in the best interest of the REIT, and constituted violations of the fiduciary duties owed by the Board to the REIT, it’s shareholders, the operating partnership of which the REIT is general partner, and its limited partners. The Hartman Parties have requested that the Federal Court enjoin the REIT from enforcing the Entrenchment Actions. In addition, the Hartman Parties are seeking to obtain a declaration that (1) the consent solicitation statement is not materially false and misleading; (2) the recent changes to the REIT’s organizational documents and bylaws are invalid; and (3) the directors of the REIT may be removed from office by majority consent of the shareholders.

In the event that the Federal Court determines that the Entrenchment Actions are valid and enforceable, then any consent solicited pursuant to this consent solicitation will be of no effect. Please see “Consent Litigation” on page 15.

| Q: | WHAT IS THE BACKGROUND TO THE SOLICITATION? |

| A: | Since the REIT’s formation, Hartman Management has acted as the REIT’s advisor and manager of the REIT’s day-to-day operations and portfolio of properties. Hartman Management provided the advisory services to The Hartman REIT pursuant to an Advisory Agreement, dated as of August 31, 2004 (the “Advisory Agreement”), and a Property Management Agreement, dated as of September 1, 2004 (the “Management Agreement”). |

| | On October 2, 2006, the Board removed Mr. Hartman as Chairman and CEO. Under the direction of Mr. Mastandrea, the REIT commenced litigation against the Hartman Parties by filing its Original Petition against Hartman and Hartman Management in the 333rd Judicial District Court, Harris County, Texas complaining of the alleged conduct of Hartman and Hartman Management, in the litigation styled Hartman Commercial Properties REIT, et al, vs. Allen R. Hartman, et al, Cause No. 2006-63041, which lawsuit is pending in the District Court of Harris County, Texas (the “State Court Action”). As set forth in the Hartman Parties’ Original Counterclaim filed in the State Court Action, the Hartman Parties believe that REIT did incur material termination penalties and liabilities as a result of the termination of the Property Management Agreement and the Advisory Agreement as well as the conduct subsequent to such termination. A copy of the Hartman’s Amended Counterclaim is available online at Hartman Management’s website www.hartmanmgmt.com. For description of the State Court Action, please see “State Court Litigation” on page 25. |

| | On October 25, 2006, the REIT sent a letter to the shareholders informing the shareholders that Hartman had been removed as Chairman and CEO, that the Advisory Agreement between the REIT and Hartman Management was not renewed, and that the Management Agreement between the REIT and Hartman Management was terminated. Thereafter, Hartman resigned from the Board and commenced the process of pursuing a consent solicitation for purposes of removing the existing Board and electing new Trustees thereto. |

On November 29, 2006, Hartman and Hartman Management filed a preliminary consent solicitation (the “Preliminary Consent”) with the SEC. In the Preliminary Consent, Hartman and Hartman Management seek to remove the existing Board and propose a new slate of trustees. The REIT’s organizational documents, as in effect on November 29, 2006, expressly allowed that any shareholder action may be taken by written consent. See "Consent Litigation" on page 15.

On December 2, 2006, in response to the Preliminary Consent, the Board took the following actions:

| 1. | Repealing Article II, Section 13 of the Bylaws which permits shareholder action by written consent. |

| 2. | Repealing Article II, Section 14 of the Bylaws in an attempt to preclude Mr. Hartman from voting shares in the REIT acquired by him; |

| 3. | Electing that the REIT would be subject to Sections 3-803, 3-804(a) and (b) and 3-805 of Title 3, Subtitle 8 of the MGCL, providing for three (3) classes of Trustees with terms expiring on a staggered three year basis, requiring a two-thirds vote of shareholders to remove a Trustee and otherwise restricting the rights of the shareholders to exercise their right to vote their shares. |

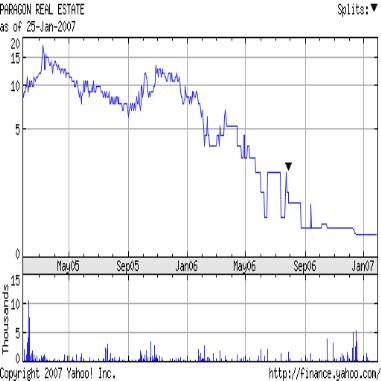

Additionally, on December 18, 2006, the REIT sent its shareholders a letter in response to the consent solicitation. Thereafter, on January 12, 2007, the REIT sent its shareholders another letter addressing, in greater detail, its response to the Preliminary Consent Statement. Neither the December 18, 2006, letter nor the January 12, 2007, letter (collectively, the “Statements in Opposition”) were filed with the SEC as solicitation materials pursuant to SEC Rule 14a. In addition, the Statements in Opposition fail to include the information required by SEC Rule 14a and include numerous misstatements and omissions, such as for example, a misrepresentation of stock performance of Paragon Real Estate Equity and Investment Trust, by failing to adjust comparative stock prices for a 75:1 reverse stock split.

| Q: | WHAT CONCERNS DO YOU HAVE ABOUT MR. MASTANDREA? |

| A: | The following examples from Mr. Mastandrea’s business record, among other things, support our concerns: |

| 1. | The Eagle Wings Bankruptcy. Eagle’s Wings Aviation Corporation, an aviation services business, where Mr. Mastandrea served as Chief Executive Officer, was placed into receivership in September 2001 and filed for protection under Chapter 11 of the federal bankruptcy laws, in March 2002. |

| 2. | Mastandrea’s concurrently serving as President & CEO of two public companies with potentially conflicting interests. The REIT’s October 4, 2006 press release provides that “Mr. Mastandrea also currently serves as Chief Executive Officer, President and Chairman of the Board of Paragon Real Estate Equity and Investment Trust (OTC BB: symbol PRLE.OB) (“Paragon”).” Paragon is headquartered in Cleveland, Ohio. The Hartman REIT is headquartered in Houston, Texas. With fiduciary duties of undivided loyalty to both the REIT and Paragon, the Hartman Parties believe that Mr. Mastandrea has a conflict of interest as supported by the facts detailed below. |

First, on the Paragon side, Mr. Mastandrea outlined a plan for Paragon that contemplate selling Paragon to another company. Specifically, in a Press Release, Mr. Mastandrea commented:“It has been very challenging and costly to operate Paragon as a public company…While Paragon is still trading on the Over the Counter securities market, we are looking for alternatives for the Company.” (emphasis added). Mr. Mastandrea disclosed that valuation differences may exist and that a failure to complete a transaction will materially and adversely affect the Company's (Paragon’s) ability to continue operations. In this regard, Note 3, Going Concern, to Paragon’s Form 10-QSB, for the quarterly period ended September 30, 2006, indicate the following:

Three independent trustees signed subscription agreements to purchase 125,000 Class C Convertible Preferred Shares for an aggregate contribution of $500,000 cash to maintain the Company as a corporate shell current in its SEC filings so that it may be used in the future for real estate deals or sold to another company. During the third quarter of 2006, the Company received the first quarterly installment of $125,000 from three trustees for payment of Class C Convertible Preferred Shares. There can be no assurance that we will be able to close a transaction or keep the Company currently filed with the SEC. Even if our management is successful in closing a transaction, investors may not value the transaction in the same manner as we did, and investors may not value the transaction as they would value other transactions or alternatives. Failure to obtain external sources of capital and complete a transaction will materially and adversely affect the Company's (Paragon's) ability to continue operations. (emphasis added)

Also, Mr. Mastandrea recently obtained Class C Convertible Preferred Stock that will be worth little should Paragon Fail to continue as a going concern and could be valuable upon a merger with the REIT.

On the Hartman REIT side, Mr. Mastandrea’ “Statements in Opposition” (please see Consent Litigation on page 15), details, under the heading “Positioning for Listing,” that: “The decision to list HCP publicly is important and should be made in 2007.” Paragon’s listing objective, as detailed by Mr. Mastandrea, can be accomplished through a merger of the REIT and Paragon.

With an investment in the Class C Convertible Preferred Shares of Paragon, coupled with the fact that a failure to complete a transaction “will materially and adversely affect the Company's (Paragon's) ability to continue operations” and the decision to “list” the REIT in 2007 creates the conflict of interest for Mr. Mastandrea, who owes fiduciary duties of undivided loyalty to both the REIT and Paragon.

The Hartman Parties believe, based upon the above facts, that Mr. Mastandrea’s fiduciary duty of undivided loyalty to Paragon would require him to seek a the “listing” of the Shares through a merger of the REIT and Paragon. For additional disclosure regarding Mr. Mastandrea’s conflicts, please see “State Court Litigation” on page 25.

| 3. | Mastandrea has been compensated to serve as Paragon’s Chairman of the Board, Chief Executive Officer and President until September 29, 2008. |

In a Current Report on Form 8-K, dated September 29, 2006, Paragon disclosed the “pre-payment” of Mr. Mastandrea’s services as an officer of Paragon:

James C. Mastandrea, Chairman of the Board, Chief Executive Officer and President of Paragon, signed a Subscription Agreement (the "Mastandrea Subscription Agreement") whereby he will purchase 44,444 restricted shares of Class C Preferred Shares. The consideration for the purchase will be Mr. Mastandrea's services as an officer of Paragon for the period beginning September 29, 2006 and ending September 29, 2008.

Each of the trustees of Paragon, namely Daryl J. Carter, John J. Dee, Daniel G. DeVos, Paul T. Lambert, James C. Mastandrea and Michael T. Oliver, signed a Restricted Share Agreement with Paragon, dated September 29, 2006, to receive a total of 12,500 restricted Class C Preferred Shares as of the date of the Restricted Share Agreement in lieu of receiving fees in cash for service as a trustee for the two years ending September 29, 2008. (emphasis added)

Mastandrea fails to report the historical stock prices for March 1, 2004, 2005 and 2006. Those prices were as follows:

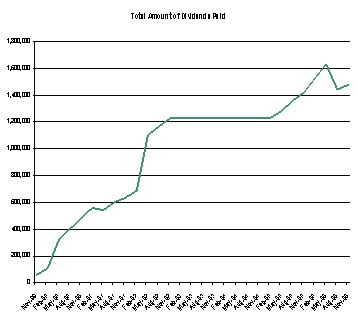

Since Allen R. Hartman founded The Hartman REIT in 1998, we have built a business that consists of the ownership of income-producing real properties. We executed a fundamental strategy of regional focus (Texas), diversification by property type and conservative capital management. Our principal objective was to invest in high quality properties in prime locations, then proactively manage, lease and develop with ongoing capital improvement programs to improve their long-term economic performance. We focused on providing The Hartman REIT shareholders with consistent cash distributions and increase their long-term shareholder value through assembling a diversified portfolio of quality properties.