AMARC RESOURCES LTD.

MANAGEMENT'S DISCUSSION AND ANALYSIS

FOR THE SIX MONTHS ENDED SEPTEMBER 30, 2017

| AMARC RESOURCES LTD. |

| MANAGEMENT'S DISCUSSION AND ANALYSIS |

| |

| FOR THE SIX MONTHS ENDED SEPTEMBER 30, 2017 |

| |

| AMARC RESOURCES LTD. |

| MANAGEMENT'S DISCUSSION AND ANALYSIS |

| |

| FOR THE SIX MONTHS ENDED SEPTEMBER 30, 2017 |

| |

1.1 DATE

This Management's Discussion and Analysis ("MD&A") should be read in conjunction with the audited financial statements (the “Annual Financial Statements”) of Amarc Resources Ltd. (“Amarc”, or the “Company”) for the year ended March 31, 2017 and the unaudited financial statements (the “Interim Financial Statements”) of the Company for the three and six months ended September 30, 2017, both of which are publicly available on SEDAR atwww.sedar.com. All monetary amounts herein are expressed in Canadian Dollars ("CAD") unless otherwise stated.

The Company reports in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board ("IASB") and interpretations of the IFRS Interpretations Committee (together known as "IFRS"). The following disclosure and associated Financial Statements are presented in accordance with IFRS.

This MD&A is prepared as of November 27, 2017.

Cautionary Note to Investors Concerning Forward-looking Statements

|

This presentation includes certain statements that may be deemed "forward-looking statements". All such statements, other thanstatements of historical facts that address exploration drilling, exploitation activities and other related events or developmentsare forward-looking statements. Although the Company believes the expectations expressed in such forward-looking statementsare based on reasonable assumptions, such statements are not guarantees of future performance and actual results ordevelopments may differ materially from those in the forward-looking statements. Assumptions used by the Company to developforward-looking statements include the following: Amarc’s projects will obtain all required environmental and other permits andall land use and other licenses, studies and exploration of Amarc’s projects will continue to be positive, and no geological ortechnical problems will occur. Factors that could cause actual results to differ materially from those in forward-lookingstatements include market prices, potential environmental issues or liabilities associated with exploration, development andmining activities, exploitation and exploration successes, continuity of mineralization, uncertainties related to the ability toobtain necessary permits, licenses and tenure and delays due to third party opposition, changes in and the effect of governmentpolicies regarding mining and natural resource exploration and exploitation, the exploration and development of propertieslocated within Aboriginal groups asserted territories may affect or be perceived to affect asserted aboriginal rights and title,which may cause permitting delays or opposition by Aboriginal groups, continued availability of capital and financing, andgeneral economic, market or business conditions. Investors are cautioned that any such statements are not guarantees of futureperformance and actual results or developments may differ materially from those projected in the forward-looking statements.For more information on Amarc investors should review the Company's annual Form 20-F filing with the United StatesSecurities and Exchange Commission at www.sec.gov and its home jurisdiction filings that are available atwww.sedar.com. |

Cautionary Note to Investors Concerning Estimates of Inferred Resources:

|

This discussion uses the term "inferred resources". The Company advises investors that although this term is recognized andrequired by Canadian regulations, the U.S. Securities and Exchange Commission does not recognize it. "Inferred resources"have a great amount of uncertainty as to their existence, and as to their economic and legal feasibility. It cannot be assumed thatall or any part of a mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of InferredMineral Resources may not form the basis of economic studies, except in rare cases. Investors are cautioned not to assume thatany part or all of an inferred resource exists, or is economically or legally mineable. |

- 1 -

| AMARC RESOURCES LTD. |

| MANAGEMENT'S DISCUSSION AND ANALYSIS |

| |

| FOR THE SIX MONTHS ENDED SEPTEMBER 30, 2017 |

| |

1.2 OVERVIEW

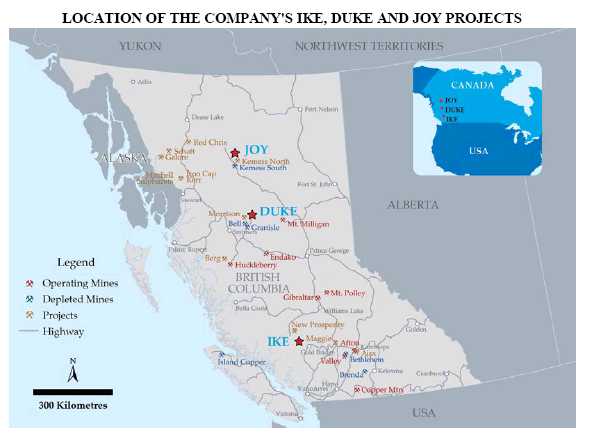

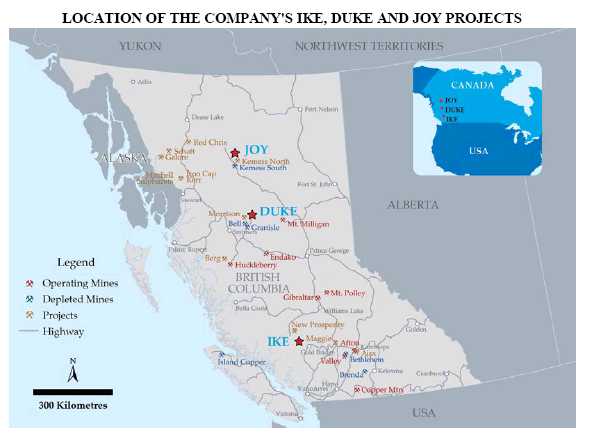

Amarc is a mineral exploration and development company with an experienced and successful management team focused on developing a new generation of British Columbia (“BC”) porphyry copper mines. By combining strong projects and funding with successful management, Amarc has created a solid platform to now commence value creation.

Through its 2017 work programs Amarc has substantially advanced its 100% owned IKE, DUKE, JOY porphyry copper deposit districts which are located in southern, central and northern BC, respectively. In addition, Amarc has acquired the right to purchase a 100% interest in its new PINE porphyry copper property located adjacent to the south of JOY. Each of these copper districts have proximity to industrial infrastructure, power, rail and highways. The IKE, DUKE, JOY and PINE represent significant potential for the discovery of important scale, porphyry copper-gold and copper-molybdenum deposits.

The 462 km2 IKE Project is located 33 km northwest of the historical mining community of Gold Bridge. Over the preceding three years, Amarc has made a significant new porphyry copper-molybdenum-silver discovery, completing over 12,000 metres of drilling in 21 wide-spaced core holes in the IKE deposit that indicate the potential for extensive resource volumes which remain open to expansion in all lateral directions and to depth. Extensive regional surveys have also identified numerous porphyry copper (±molybdenum±silver±gold) mineralized systems and deposit targets; all within 10 kilometres of IKE.

- 2 -

| AMARC RESOURCES LTD. |

| MANAGEMENT'S DISCUSSION AND ANALYSIS |

| |

| FOR THE SIX MONTHS ENDED SEPTEMBER 30, 2017 |

| |

Amarc believes the IKE Project has the potential to possess the grades and tonnages to develop into an important mining camp. Amarc timely received all required permits from the provincial government for its 2017 drilling season, and has completed the field components of the $3.3 million 2017 program at IKE. Fieldwork has included ground-based induced polarization (“IP”) geophysical, geological, and geochemical surveys and drilling. Assay work on core samples from drilling of nine wildcat holes throughout the region around the IKE deposit is still in progress.

Amarc has partnered with Hudbay Minerals Inc. (“Hudbay”) to efficiently advance the IKE Project. Under the terms of the agreement Hudbay can earn an initial 50% interest in the IKE Project by spending $40 million of expenditures before December 31, 2020. Amarc is the current operator.

Amarc’s DUKE deposit and an adjacent 190 km2 porphyry copper district is located 80 km northeast of Smithers, BC and 30 kilometres north of former mines (Bell and Granisle) operated by Noranda Mines. The DUKE Project area is logging road accessible from Smithers or Fort St. James. Historically, DUKE has been explored with surface geochemical and geophysical surveys, as well as 30 shallow diamond drill holes. Many of the holes drilled intersected significant lengths of porphyry copper-molybdenum-silver-gold mineralization which remains open both laterally and to depth. The surrounding district hosts multiple, second-order porphyry copper deposit targets. Amarc timely received all required permits from the provincial government and an approximate $0.4 million initial drilling program, comprised of two core holes targeting the DUKE deposit will be completed this year.

Amarc’s 72 km2 JOY mineral property is located 310 kilometres north of Mackenzie BC, and 25 kilometres north of the Kemess South Mine site, where AuRico Resources’ recently secured a BC EA Certificate for its Underground Project. Past operators conducted prospecting-style work on the JOY claims. Some 3,000 soil samples, 800 rock samples and 30 silt samples were collected, but no drilling was done. The surface surveys clearly indicate a number of substantial porphyry copper-gold and epithermal silver-gold deposit targets across the JOY property, which are considered by Amarc to be a northern extension to the prolific Kemess porphyry gold-copper district. Most importantly, historical soil and rock sampling, along with a recent Amarc soil survey, has revealed a regionally significant 9 km2 copper, gold, molybdenum, silver and zinc geochemical anomaly, which potentially reflects a large and shallowly buried porphyry copper-gold deposit. Amarc timely received all required permits from the provincial government and has completed the field components of the $1.9 million 2017 program at JOY. Fieldwork has included airborne magnetic and ground-based IP geophysical, geological, and geochemical surveys and drilling. Assay work on core samples from drilling of three holes at JOY is in progress. Amarc has also partnered with Hudbay to advance the JOY Project. Under the terms of this agreement Hudbay can earn an initial 50% interest in the JOY Project by spending $20 million of expenditures before December 31, 2020. Amarc is the current operator.

The 323 km2 PINE property is located adjacent to the south of Amarc’s JOY property and adjacent to the north of AuRico Metal’s Kemess District developments. Combining the JOY and PINE mineral claims along with recently staked adjoining claims creates a consolidated, 464 km2 mineral property. Amarc considers its JOY and PINE properties to be very underexplored and to potentially be the northern extension of the Kemess copper-gold district.

- 3 -

| AMARC RESOURCES LTD. |

| MANAGEMENT'S DISCUSSION AND ANALYSIS |

| |

| FOR THE SIX MONTHS ENDED SEPTEMBER 30, 2017 |

| |

Amarc has concluded agreements with each of Gold Fields Toodoggone Exploration Corporation (“GFTEC”) and Cascadero Copper Corporation (“Cascadero”) which enable Amarc to purchase 100% of the PINE property. Also it has an agreement to cap an underlying royalty with a former owner on that property Amarc is committed to working constructively with governments and stakeholders towards the responsible development it’s projects, while contributing to the sustainable development of local communities. Work programs are planned to achieve high levels of environmental performance and local benefits, including providing opportunities for employment, contracting and training for local people. The Company is working hard to support government's consultation duties to assist with timely and fair decision making. Amarc is committed to meaningful and constructive engagement with First Nation communities and favours comprehensive and progressive agreements at the early discovery-stage of project development. The Company believes that the best outcome is always achieved in the atmosphere of openness, constructive discussions, and mutual respect from all interested parties.

The IKE and the Granite, Juno and Galore District Properties (collectively the IKE Project)

Amarc has a 100% interest in the IKE, Granite, Juno and Galore Properties which make up the IKE Project.

The IKE deposit discovery, together with the surrounding district of additional prospective porphyry copper (±molybdenum±silver±gold) targets, have the potential to possess the grades and tonnages necessary to develop into an important new BC mining camp. In addition to the main IKE mineral property, Amarc has secured extensive mineral claims in the region to cover other compelling deposit targets, as well as potential infrastructure sites.

IKE Deposit

The IKE deposit is located approximately 33 kilometres northwest of the historical mining communities of Gold Bridge and Bralorne, in couth-central BC. Core drilling of the IKE deposit is located above tree line within large and barren cirques. Although current access to the site is by helicopter, there is good infrastructure in the region. Mainline logging roads leading northwest from Gold Bridge extend to within 13 km of the southern extent of the IKE property. Power, railways and highways are all available in the area of Gold Bridge and the regional towns of Lillooet and Pemberton.

At IKE, limited historical drilling indicated the presence of a mineral system with characteristics that are favorable for the development of a viable porphyry copper-molybdenum-silver deposit. Three key historical drill holes (81-2, 11-1 and 11-2) spaced over 220 metres apart intercepted long intervals of continuous, chalcopyrite and molybdenite mineralization with encouraging grades. These intersections include: 116 metres of 0.44% copper equivalent (CuEQ)1 comprising 0.29% Cu and 0.043% Mo; 182 metres of 0.41% CuEQ comprising 0.31% Cu, 0.022% Mo and 1.9 g/t Ag; and 64 metres of 0.51% CuEQ, comprising 0.37% Cu, 0.024% Mo and 4.7 g/t Ag. All three of these historical holes ended in mineralization.

Over the preceding three years, Amarc has made a significant new porphyry copper-molybdenum-silver discovery at IKE. All 21 wide-spaced core holes drilled by Amarc at IKE (2014-9 holes; 2015-9 holes; 2016-3 holes for a total of 12,360 metres) have intersected long intervals of chalcopyrite and molybdenite mineralization, with grades that compare favourably to the range of copper equivalent grades at operating BC porphyry copper mines. Copper, molybdenum and silver mineralization has been intersected over an increasingly broad area measuring 1,200 metres east-west by 1,000 metres north-south, and 875 metres vertically. The drilling indicates the potential for extensive resource volumes which remain open to expansion in all lateral directions and to depth. Notably the drilling completed to date has tested only a portion of the over plus 9 km2IKE hydrothermal system.

- 4 -

| AMARC RESOURCES LTD. |

| MANAGEMENT'S DISCUSSION AND ANALYSIS |

| |

| FOR THE SIX MONTHS ENDED SEPTEMBER 30, 2017 |

| |

Highlights from the 2014, 2015 and 2016 drill programs include:

| • | 247 metres of 0.41% CuEQ1@ 0.28% Cu, 0.030% Mo and 2.0 g/t Ag |

| • | 123 metres of 0.41% CuEQ @ 0.32% Cu, 0.017% Mo and 2.5 g/t Ag |

| • | 92 metres of 0.40% CuEQ @ 0.31% Cu, 0.020% Mo and 2.1 g/t Ag |

| • | 194 metres of 0.47% CuEQ @ 0.30% Cu, 0.046% Mo and 0.8 g/t Ag |

| • | 308 metres of 0.39% CuEQ @ 0.26% Cu, 0.032% Mo and 1.8 g/t Ag |

| • | 97 metres of 0.45% CuEQ @ 0.32% Cu, 0.030% Mo and 2.2 g/t Ag |

| • | 124 metres of 0.45% CuEQ @ 0.34% Cu, 0.022% Mo and 3.2 g/t Ag |

| • | 214 metres of 0.37% CuEQ @ 0.26% Cu, 0.023% Mo and 2.2 g/t Ag |

| • | 592 metres of 0.44% CuEQ @ 0.30% Cu, 0.032% Mo and 2.1 g/t Ag |

| • | 86 metres of 0.47% CuEQ @ 0.33% Cu, 0.032% Mo and 2.2 g/t Ag |

| • | 111 metres of 0.36% CuEQ @ 0.30% Cu, 0.010% Mo and 2.3 g/t Ag |

| • | 148 metres of 0.53% CuEQ @ 0.39% Cu, 0.030% Mo and 2.9 g/t Ag |

| • | 287 metres of 0.38% CuEQ @ 0.30% Cu, 0.017% Mo and 2.2 g/t Ag |

1Copper equivalent (CuEQ) calculations use metal prices: Cu US$2.25/lb, Mo US$8.00/lb and Ag US$17.00/oz. Metallurgical recoveries and net smelter returns are assumed to be 100%.

Assay results from all of Amarc's 2014, 2015 and 2016 drill holes are summarized in the table below. In addition, a drill plan, cross section, maps and further results are presented in the corporate presentation on the Amarc website athttp://www.amarcresources.com.

Like many major porphyry deposits, the IKE deposit formed in a very active, multi-stage hydrothermal system that was extensive and robust. Geological mapping and logging of diamond drill core at IKE indicate the deposit is hosted entirely by multi-phase intrusive rocks. Its overall geological setting is similar to that of many important porphyry belts along the Cordillera in North and South America.

At IKE, chalcopyrite and molybdenite mineralization occurs as fine to relatively coarse, mostly discrete grains, mainly as disseminations and less commonly in fractures and veins. Multi-element analyses have returned consistently and unusually low concentrations of metallurgically or environmentally deleterious elements. These characteristics, and the generally low concentrations of pyrite at IKE, suggest excellent potential to produce clean, good-grade copper and molybdenum concentrates by standard flotation processing.

- 5 -

| AMARC RESOURCES LTD. |

| MANAGEMENT'S DISCUSSION AND ANALYSIS |

| |

| FOR THE SIX MONTHS ENDED SEPTEMBER 30, 2017 |

| |

IKE DISCOVERY TABLE OF 2014, 2015 and 2016 DRILL CORE ASSAY RESULTS4

Drill

Hole

ID | Dip

(°) | Azim

(°) | EOH

(m) | Incl. | From

(m) | To

(m) | Int.1,2

(m) | CuEQ

(%) | Cu3

(%) | Mo

(%) | Ag

(g/t) |

| IK14001 | -45 | 0 | 742.2 | | 55.0 | 213.7 | 158.7 | 0.37 | 0.27 | 0.020 | 2.5 |

| | | | | | 242.0 | 489.0 | 247.0 | 0.41 | 0.28 | 0.030 | 2.0 |

| | | | | incl. | 242.0 | 275.0 | 33.0 | 0.43 | 0.35 | 0.011 | 4.1 |

| | | | | incl. | 284.6 | 362.5 | 77.9 | 0.43 | 0.31 | 0.027 | 2.0 |

| | | | | incl. | 372.9 | 395.2 | 22.3 | 0.43 | 0.25 | 0.045 | 1.7 |

| | | | | incl. | 404.1 | 489.0 | 84.9 | 0.48 | 0.30 | 0.045 | 1.7 |

| | | | | | 528.0 | 634.6 | 106.6 | 0.28 | 0.23 | 0.009 | 1.9 |

| IK14002 | -45 | 100 | 551.1 | | 57.3 | 180.1 | 122.8 | 0.41 | 0.32 | 0.017 | 2.5 |

| | | | | | 206.0 | 494.6 | 288.6 | 0.39 | 0.24 | 0.038 | 1.6 |

| | | | | incl. | 206.0 | 440.0 | 234.0 | 0.42 | 0.26 | 0.040 | 1.7 |

| | | | | and | 206.0 | 364.0 | 158.0 | 0.44 | 0.26 | 0.046 | 1.7 |

| | | | | and | 368.5 | 440.0 | 71.5 | 0.40 | 0.27 | 0.031 | 1.7 |

| | | | | | 521.7 | 551.1 | 29.4 | 0.42 | 0.15 | 0.076 | 0.6 |

| IK14003 | -60 | 180 | 419.4 | | 10.2 | 102.0 | 91.8 | 0.40 | 0.31 | 0.020 | 2.1 |

| | | | | | 282.0 | 365.0 | 83.0 | 0.19 | 0.08 | 0.029 | 0.7 |

| IK14004 | -50 | 90 | 388.6 | | 128.0 | 189.0 | 61.0 | 0.27 | 0.13 | 0.036 | 0.9 |

| IK14005 | -60 | 0 | 772.7 | | 32.0 | 80.0 | 48.0 | 0.27 | 0.23 | 0.007 | 1.4 |

| | | | | | 269.4 | 552.3 | 282.9 | 0.43 | 0.29 | 0.038 | 0.7 |

| | | | | incl. | 269.4 | 463.2 | 193.8 | 0.47 | 0.30 | 0.046 | 0.8 |

| | | | | | 602.9 | 616.1 | 13.2 | 0.33 | 0.29 | 0.009 | 0.6 |

| IK14006 | -45 | 90 | 681.8 | | 9.0 | 75.0 | 66.0 | 0.25 | 0.21 | 0.008 | 1.3 |

| | | | | | 124.0 | 574.3 | 450.3 | 0.36 | 0.24 | 0.028 | 1.7 |

| | | | | incl. | 124.0 | 432.2 | 308.2 | 0.39 | 0.26 | 0.032 | 1.8 |

| | | | | and | 124.0 | 207.8 | 83.8 | 0.42 | 0.31 | 0.026 | 2.2 |

| | | | | and | 216.4 | 258.0 | 41.6 | 0.42 | 0.30 | 0.024 | 2.8 |

| | | | | and | 381.9 | 432.2 | 50.4 | 0.69 | 0.35 | 0.088 | 1.8 |

| | | | | incl. | 441.9 | 490.0 | 48.1 | 0.44 | 0.27 | 0.044 | 1.8 |

| | | | | | 671.0 | 681.8 | 10.8 | 0.33 | 0.28 | 0.007 | 2.0 |

| IK14007 | -60 | 90 | 688.5 | | 7.9 | 24.9 | 17.0 | 0.30 | 0.22 | 0.020 | 1.1 |

| | | | | | 139.5 | 167.0 | 27.5 | 0.24 | 0.06 | 0.051 | 0.5 |

| | | | | | 223.0 | 274.0 | 51.0 | 0.22 | 0.05 | 0.048 | 0.5 |

| | | | | | 304.0 | 411.9 | 107.9 | 0.23 | 0.12 | 0.030 | 0.7 |

| IK14008 | -45 | 90 | 788.8 | | 135.4 | 168.0 | 32.6 | 0.30 | 0.24 | 0.009 | 2.0 |

| | | | | | 233.0 | 258.5 | 25.5 | 0.33 | 0.23 | 0.023 | 1.5 |

| | | | | | 278.1 | 567.0 | 288.9 | 0.36 | 0.27 | 0.022 | 1.6 |

| | | | | incl. | 287.7 | 384.3 | 96.6 | 0.45 | 0.32 | 0.030 | 2.2 |

| | | | | incl. | 418.7 | 462.8 | 44.0 | 0.38 | 0.31 | 0.015 | 1.8 |

| | | | | incl. | 484.0 | 564.0 | 80.0 | 0.38 | 0.30 | 0.018 | 1.6 |

| | | | | | 605.0 | 648.0 | 43.0 | 0.25 | 0.20 | 0.012 | 1.0 |

| IK14009 | -45 | 270 | 376.1 | | 10.5 | 200.0 | 189.5 | 0.23 | 0.16 | 0.018 | 1.1 |

| | | | | | 10.5 | 98.0 | 87.5 | 0.28 | 0.20 | 0.019 | 1.4 |

| IK15010 | -45 | 88 | 615.0 | | 207.0 | 417.0 | 210.0 | 0.40 | 0.30 | 0.018 | 2.9 |

| | | | | incl. | 207.0 | 268.0 | 61.0 | 0.40 | 0.31 | 0.016 | 2.9 |

| | | | | incl. | 293.0 | 417.0 | 124.0 | 0.45 | 0.34 | 0.022 | 3.2 |

- 6 -

| AMARC RESOURCES LTD. |

| MANAGEMENT'S DISCUSSION AND ANALYSIS |

| |

| FOR THE SIX MONTHS ENDED SEPTEMBER 30, 2017 |

| |

Drill

Hole

ID | Dip

(°) | Azim

(°) | EOH

(m) | Incl. | From

(m) | To

(m) | Int.1,2

(m) | CuEQ

(%) | Cu3

(%) | Mo

(%) | Ag

(g/t) |

| | | | | and | 293.0 | 358.0 | 65.0 | 0.53 | 0.39 | 0.028 | 3.7 |

| | | | | and | 378.0 | 417.0 | 39.0 | 0.41 | 0.32 | 0.016 | 2.9 |

| | | | | | 444.0 | 603.0 | 159.0 | 0.28 | 0.22 | 0.011 | 2.1 |

| IK15011 | -45 | 88 | 486.3 | | 20.1 | 60.0 | 40.0 | 0.42 | 0.31 | 0.023 | 2.5 |

| IK15012 | -45 | 88 | 675.0 | | 213.0 | 516.0 | 303.0 | 0.34 | 0.25 | 0.018 | 2.1 |

| | | | | incl. | 213.0 | 286.0 | 73.0 | 0.33 | 0.28 | 0.008 | 2.2 |

| | | | | incl. | 301.9 | 516.0 | 214.2 | 0.37 | 0.26 | 0.023 | 2.2 |

| | | | | and | 301.9 | 371.3 | 69.4 | 0.45 | 0.32 | 0.028 | 3.0 |

| | | | | and | 423.0 | 516.0 | 93.0 | 0.39 | 0.29 | 0.022 | 2.0 |

| | | | | | 549.5 | 558.0 | 8.5 | 0.47 | 0.35 | 0.026 | 3.0 |

| IK15013 | -45 | 88 | 693.3 | | 33.0 | 693.3 | 660.3 | 0.41 | 0.28 | 0.030 | 2.0 |

| | | | | incl. | 75.0 | 666.5 | 591.5 | 0.44 | 0.30 | 0.032 | 2.1 |

| | | | | and | 75.0 | 99.0 | 24.0 | 0.42 | 0.24 | 0.044 | 1.9 |

| | | | | and | 129.0 | 300.5 | 171.5 | 0.44 | 0.32 | 0.025 | 2.2 |

| | | | | and | 435.5 | 666.5 | 231.0 | 0.56 | 0.37 | 0.045 | 2.7 |

| IK15014 | -45 | 88 | 480.9 | | 249.7 | 335.2 | 85.5 | 0.47 | 0.33 | 0.032 | 2.2 |

| IK15015 | -50 | 268 | 423.3 | | 312.3 | 420.3 | 108.0 | 0.41 | 0.15 | 0.067 | 1.5 |

| | | | | incl. | 312.3 | 378.3 | 66.0 | 0.51 | 0.19 | 0.085 | 1.9 |

| IK15016 | -45 | 88 | 483.3 | | 243.0 | 369.3 | 126.3 | 0.27 | 0.14 | 0.031 | 1.5 |

| | | | | incl. | 285.0 | 360.3 | 75.3 | 0.29 | 0.17 | 0.029 | 1.7 |

| IK15017 | -45 | 88 | 441.3 | | 15.0 | 75.0 | 60.0 | 0.29 | 0.26 | 0.005 | 1.6 |

| | | | | | 201.0 | 355.7 | 154.7 | 0.30 | 0.17 | 0.031 | 1.1 |

| | | | | incl. | 240.0 | 355.7 | 115.7 | 0.33 | 0.18 | 0.039 | 1.2 |

| IK15018 | -45 | 88 | 441.3 | | 138.0 | 159.0 | 21.0 | 0.33 | 0.25 | 0.016 | 1.5 |

| | | | | | 201.0 | 312.4 | 111.4 | 0.36 | 0.30 | 0.010 | 2.3 |

| | | | | incl. | 216.0 | 288.3 | 72.3 | 0.43 | 0.35 | 0.013 | 2.5 |

| | | | | and | 216.0 | 243.3 | 27.3 | 0.51 | 0.42 | 0.015 | 2.6 |

| | | | | | 471.3 | 730.5 | 259.2 | 0.25 | 0.20 | 0.010 | 1.3 |

| | | | | incl. | 471.3 | 540.3 | 69.0 | 0.33 | 0.25 | 0.017 | 1.8 |

| | | | | and | 651.3 | 730.5 | 79.2 | 0.29 | 0.23 | 0.012 | 1.5 |

| IK16019 | -45 | 85 | 477.0 | | 201.9 | 222.0 | 20.1 | 0.27 | 0.16 | 0.022 | 1.9 |

| IK16020 | -45 | 85 | 699.0 | | 123.0 | 156.0 | 33.0 | 0.36 | 0.27 | 0.019 | 1.8 |

| | | | | | 314.5 | 462.0 | 147.5 | 0.53 | 0.39 | 0.030 | 2.9 |

| | | | | | 549.0 | 596.2 | 47.2 | 0.51 | 0.20 | 0.082 | 2.5 |

| IK16021 | -45 | 80 | 747.0 | | 81.0 | 126.0 | 45.0 | 0.26 | 0.24 | 0.003 | 1.2 |

| | | | | | 174.0 | 201.0 | 27.0 | 0.37 | 0.25 | 0.028 | 2.3 |

| | | | | | 219.8 | 288.0 | 68.3 | 0.32 | 0.22 | 0.019 | 2.5 |

| | | | | | 340.3 | 627.3 | 287.0 | 0.38 | 0.30 | 0.017 | 2.2 |

| | | | | incl. | 340.3 | 432.0 | 91.7 | 0.43 | 0.30 | 0.027 | 2.7 |

| | | | | incl. | 479.1 | 555.0 | 75.9 | 0.48 | 0.39 | 0.018 | 2.3 |

Notes:

1Widths reported are drill widths, such that the true thicknesses are unknown.

2All assay intervals represent length weighted averages.

3Copper equivalent (CuEQ) calculations use metal prices: Cu US$2.25/lb, Mo US$8.00/lb and Ag US$17.00/oz. Metallurgical recoveries and net smelter returns are assumed to be 100%.

4Some figures may not sum exactly due to rounding.

- 7 -

| AMARC RESOURCES LTD. |

| MANAGEMENT'S DISCUSSION AND ANALYSIS |

| |

| FOR THE SIX MONTHS ENDED SEPTEMBER 30, 2017 |

| |

IKE District Targets

Important-scale porphyry copper (± gold ± molybdenum ± silver) deposit targets proximal to the IKE discovery were indicated by Amarc’s exploration in 2014 and 2015, and reports from sporadic historical exploration in the region by previous operators. During the 2016 field season, these targets were evaluated by geochemical and geophysical surveys with the goal of establishing and prioritizing porphyry copper deposit targets for drilling. In addition, Amarc completed comprehensive regional geological mapping of the central 130 km2 of the IKE district in order to fully comprehend the overall mineral potential of the region.

The surveys have defined a number of significant porphyry copper deposit targets and, in addition, potential precious metal epithermal deposit targets. These deposit targets are located along, to a few km inboard of, the contact of the northeastern margin of the Coastal Plutonic Complex (“CPC”) with older volcano-sedimentary rocks. In general, porphyry, porphyry-related and epithermal mineralization located closer to the CPC contact tends to be more gold-bearing whereas deposits such as IKE that lie inboard of the CPC contact are copper-molybdenum-silver dominated.

Results from Amarc’s 2016 district-wide, geophysical, geochemical and geological surveys are presented in the Company’s corporate presentation on Amarc’s website. Summary descriptions of several district targets are provided below.

Mad Major

The Mad Major porphyry copper target, located 6 kilometres east of IKE, is associated with an approximately 10 km2 copper-molybdenum-tungsten geochemical anomaly, as compared to a similar style 9 km2anomaly at IKE. Within this target area, talus fines and rock chip geochemical sampling have collectively defined an anomaly characterized by high concentrations of copper and molybdenum, combined with anomalous concentrations of tungsten and extensive potassic alteration. Like the IKE deposit, copper mineralization is hosted by multiple intrusive phases. Notably, continuous talus fines samples collected over a length of 3.5 kilometres across the anomalous area returned copper concentrations in the range of 0.10% to 0.50%, and as high as 0.80%. Some 1 kilometre east of these talus fines, six reconnaissance composite chip samples, each collected over lengths of approximately 30 metres, returned copper results of 0.15% to 0.22%. The Mad Major porphyry copper-molybdenum target saw six wide-spaced wild cat exploration drill holes completed during 2017 with assay results pending.

OMG

The OMG porphyry copper deposit target is located just to the north of Mad Major, and 5 kilometers northeast of IKE. This covered target is characterized by a 4 kilometre by 3 kilometre oval-shaped magnetic low - a unique feature that stands out and disrupts the regional magnetic trend. A 4 km2 Induced Polarization (“IP”) chargeability anomaly is coincident with the magnetic low and remains open to expansion. This intriguing magnetic low may well represent a felsic intrusion or hydrothermal alteration; both features are prospective for porphyry-style mineralization, especially given the coincident IP chargeability anomaly, indicating the presence of sulphide mineralization.

- 8 -

| AMARC RESOURCES LTD. |

| MANAGEMENT'S DISCUSSION AND ANALYSIS |

| |

| FOR THE SIX MONTHS ENDED SEPTEMBER 30, 2017 |

| |

Reconnaissance geochemical samples collected over this IP chargeability anomaly have returned anomalous concentrations of copper, molybdenum and silver. There is no historical drilling reported in the OMG area and no rock outcrops have been noted. The geological setting, combined with the results of Amarc’s geophysical and geochemical surveys indicate an important-scale, covered porphyry copper target saw two exploration drill hole completed in 2017 with assay results pending.

Rowbottom

The Rowbottom porphyry deposit target is located 4.5 kilometres north-northwest of IKE and 2.5 kilometres south of the known Empress porphyry copper-gold deposit. An historical estimate, not categorized as prescribed by National Instrument 43-101, of about 10 million tonnes grading 0.61% Cu and 0.79 g/t Au was reported in 1991 for Empress. Sufficient work to classify the Empress estimate as a current mineral resource or mineral reserve has not been completed by a qualified person, and Amarc is not treating the historical estimate as current.

Eleven historical percussion holes have been drilled in the Rowbottom area and eight of these intercepted porphyry copper mineralization. All of these holes were shallow (generally ± 60 metres) with a number of holes terminating in mineralization. The best holes intersected 56 metres of 0.53% CuEQ5 @ 0.41% Cu and 0.034% Mo, 55 metres of 0.35% CuEQ @ 0.25% Cu and 0.028% Mo, and 88 metres of 0.38% CuEQ @ 0.36% Cu and 0.006% Mo. Notably, although the historical drill samples were analysed only for copper and molybdenum, the presence of gold in Amarc’s surface samples indicates the potential for the Rowbottom porphyry system to be gold-bearing.

In 2016 an IP survey confirmed a chargeability anomaly measuring 1.3 kilometres by 1 kilometre outwards from the mineralized historical percussion holes. This anomaly is unconstrained to the west. The Rowbottom porphyry deposit target saw one exploration drill hole completed in 2017 with assay results pending.Amarc has completed the field components of the $3.3 million 2017 program at IKE. Fieldwork has included 20 km2 of detailed geological mapping, collection of 616 talus fines geochemical samples, completion of 82-line kilometres of ground IP surveys over selected targets and drilling of nine wildcat exploration core holes totalling 2,702 metres in regional targets. Assay work on core samples from the drilling is in progress and once received Amarc will provide the results from drilling once the Company has the QA/QC’d assay data. This year’s IP geophysical work showed that the IKE deposit mineralized system is much larger than originally considered and now measures at least 3.6 kilometres by 1.5 kilometres.

Amarc is working with governments, First Nations and stakeholders toward the responsible development of the IKE Project, while protecting water and other natural resources in the project area and making contributions to the sustainability of local communities.

The Company is committed to progressive Health & Safety protocols to protect the well-being of its employees and contractors. It has a zero tolerance for alcohol and drugs. Amarc’s specialized consultant, Jim Douglas of Raven Rescue, contracted to review its Health & Safety program stated: “Amarc’s culture of safety is truly impressive. Project Managers, Supervisors, Contractors and Employees seem to be very well engaged.”

-------------------------------------------------

5Copper equivalent (CuEQ) calculations use metal prices: Cu US$2.25/lb and Mo US$8.00/lb. Metallurgical recoveries and net smelter returns are assumed to be 100%.

- 9 -

| AMARC RESOURCES LTD. |

| MANAGEMENT'S DISCUSSION AND ANALYSIS |

| |

| FOR THE SIX MONTHS ENDED SEPTEMBER 30, 2017 |

| |

The Company’s commitment to regulatory compliance and environmental responsibility informs every aspect of its exploration activities, from program planning and permitting, through to exploration program implementation and reclamation. The Company employs a range of progressive practices to ensure that any impacts associated with the exploration activities are minor, localized and temporary. These practices have included, for example, full helicopter-support of all field programs in order to avoid drill road-building and stream crossings, environmental monitoring systems, water quality sampling and the plugging of all drill holes. In addition, Amarc has voluntarily cleaned up historical exploration camps abandoned by previous operators in the IKE region, removing waste materials by helicopter.

Amarc manages an ongoing program of outreach to local communities, stakeholders and First Nations and advances an agenda that supports the delivery of shared prosperity. In addition to one-on-one and small group meetings, the Company’s efforts include the provision of jobs, training programs, contract opportunities, capacity funding and sponsorship of community events.

Engagement with local First Nations has contributed to the development of several capacity building programs consistent with Amarc’s Local Benefits Policy, including:

- Partnering with a First Nation to supply core boxes for the exploration program consistent with an Agreement signed between Amarc and a First Nation; and

- Collaboration on a Job Skills Workshop and a First Aid Training Certification initiative with another First Nation.

In addition, Aboriginal and local community members comprised about 40% and 80% of Amarc site team in 2016 and 2017, respectively while approximately 70% of contracts let were awarded to local and regional-based companies in both years. The Company also sponsored community events such as the Cariboo Aboriginal Youth Hockey Championship, and assisted with enhancements to the Bralorne community baseball field and a First Nations youth visit on an educational trip to the Britannia Mine Museum.

Amarc favours establishing progressive agreements with local First Nations that provide for shared decision making through project planning committees and participation in the Board, ownership possibilities, and meaningful economic benefits in relation to development of the IKE property. Amarc desires to advance these comprehensive partnership discussions at the earliest stages of project development based on a view that the best outcomes are achieved in a climate of respect and mutual understanding, constructive dialogue and common interest.

Amarc proactively supports government’s duty to consult First Nations, to contribute to meaningful engagement opportunities and facilitate timely, fair and defensible permitting. After providing draft applications to First Nations for a period of initial review and after a rigorous review process by the provincial government, the Company in 2017 timely received two five-year, area-based permits for exploration activities at the IKE Project prior to the field season. A 300-hole drill permit and deemed authorization for 250 line-kilometres of IP surveys, provide Amarc with regulatory certainty and operational flexibility at site.

- 10 -

| AMARC RESOURCES LTD. |

| MANAGEMENT'S DISCUSSION AND ANALYSIS |

| |

| FOR THE SIX MONTHS ENDED SEPTEMBER 30, 2017 |

| |

IKE District Property Agreements

The mineral claims comprising the Juno property were staked and are owned 100% by Amarc. The property acquisition agreement relating to the IKE, Galore and Granite properties, which together with the JUNO property comprise the IKE project, are outlined below.

The material terms of the former agreement with and the terms under which Thompson Creek Metals Inc. (“Thompson Creek”) relinquished its option to earn up to a 50% interest in the IKE Project, and the three mineral property acquisition agreements relating to the IKE and district properties are set out below. The remaining royalties held by the respective vendors referenced have been capped or can be purchased by Amarc (in the $2 million to $4 million range).

Agreement with Thompson Creek

On September 3, 2015 Amarc announced it entered into an agreement (the "Agreement") with Thompson Creek (now a wholly owned subsidiary of Centerra Gold Inc.) pursuant to which Thompson Creek could acquire, through a staged investment process within five years, a 30% ownership interest in mineral claims and crown grants covering the IKE copper-molybdenum-silver porphyry deposit and the surrounding district. Under the terms of the Agreement, Thompson Creek also received an option, after acquiring its 30% interest, to acquire an additional 20% interest in the IKE Project, subject to certain conditions, including the completion of a Feasibility Study.

Under the terms of the Agreement, Thompson Creek could earn an initial 30% interest in the Project under a Stage 1 Option by funding $15 million of expenditures before December 31, 2019, of which $3 million for 2015 and $2 million for 2016 were funded. For each $5 million of project expenditures funded, Thompson Creek would incrementally earn a 10% ownership interest. As of July 14, 2016, Thompson Creek had funded $5 million in project expenditures and as such had earned a 10% ownership interest in the IKE, Granite and Juno properties and the right to earn a 10% interest in the Galore Property (see below). Stage 1 Option expenditures could be accelerated by Thompson Creek at its discretion. Amarc remained as operator during the Stage 1 earn-in period.

If Thompson Creek fully exercised the Stage 1 Option, Thompson Creek would have a one-time right under a Stage 2 Option to elect to earn an additional 20% ownership interest in the IKE Project (for a total 50% ownership interest). To fulfill its obligations under the Stage 2 Option, Thompson Creek had to commit to fund and complete a Feasibility Study for the IKE Project that could serve as the basis for a decision by an internationally recognized financial institution to finance the development of a mining project. This Feasibility Study had to be completed within a two-year period, which could be extended to three years under certain conditions. While completing the Feasibility Study work under the Stage 2 Option, Thompson Creek would also be required to meet all other expenditures necessary to maintain and advance the Project.

Thompson Creek would become operator upon initiation of the Stage 2 Option period, and would remain operator so long as it holds a 50% interest. When Thompson Creek had concluded its’s earn-in period, the parties expected to form a joint venture to further develop the IKE Project provided that Thompson Creek earned a minimum 10% interest. Amarc would remain operator of the Project in the instance that Thompson Creek does not earn a 50% interest.

During both the Stage 1 and Stage 2 Option periods, Amarc retained a ‘co-expenditure right’, whereby it could fund at its discretion additional expenditures on the IKE Project. Thompson Creek may elect to pay its 30% or 50% share of these additional expenditures upon completion of its Stage 1 Option and Stage 2 Option periods as the case may be, failing which its ownership interest would be reduced. Under the ‘co-expenditure right’ provision of the Agreement, the maximum amount that Amarc could recover from Thompson Creek on completion of the Stage 1 Option is capped at $6 million (i.e. 30% of $20 million). The maximum amount that Amarc could recover from Thompson Creek on completion of the Stage 2 Option is capped at $10 million (i.e. 50% of $20 million).

- 11 -

| AMARC RESOURCES LTD. |

| MANAGEMENT'S DISCUSSION AND ANALYSIS |

| |

| FOR THE SIX MONTHS ENDED SEPTEMBER 30, 2017 |

| |

On January 11, 2017 Amarc announced that Thompson Creek, having been acquired by gold-focused Centerra Gold Inc., relinquished its option to earn up to a 50% interest in the IKE Project. Thompson Creek having acquired a 10% participating interest in the IKE Project by investing $6 million in exploration programs undertaken in 2015 and 2016, has elected to exchange its participating interest for a 1% Conversion Net Smelter Royalty from mine production; capped at a total of $5 million. As a result, Amarc has re-acquired 100% interest in the IKE Project.

Agreement with Hudbay

On July 6, 2017 Amarc announced it had entered into a Mineral Property Farm-In Agreement (the “Agreement”) with Hudbay, pursuant to which Hudbay may acquire, through a staged investment process, up to a 60% ownership in the IKE Project.

Under the terms of the Agreement, Hudbay can earn an initial 49% ownership interest in the IKE Project under a Stage 1 Farm-in Right by funding $25 million of expenditures before December 31, 2020, of which $3.3 million is committed for 2017.

Provided its Stage 1 Farm-in Right is exercised, Hudbay can, pursuant to a Stage 2 Farm-in Right, elect to earn an additional 1% interest in the Project (for a total 50% interest), by funding $15 million of additional expenditures (for a total of $40 million), also before December 31, 2020.

Stage 1 and Stage 2 Farm-in expenditures can be accelerated by Hudbay at its discretion. Amarc will be the operator during the Stage 1 and Stage 2 periods. A Joint Venture (“JV”) will be formed when Hudbay has acquired a 49% interest in the Project.

Provided that Hudbay has exercised its Stage 2 Farm-in Right and acquired a 50% interest in the IKE Project, it can then elect to go forward via one of two paths.

First, Hudbay can replace Amarc as operator of the JV after it funds all project expenditures and completes a Feasibility Study for the IKE Project by December 31, 2025. Having gained operatorship, Hudbay can then choose to either go forward with Amarc in a 50/50 participating JV, or can instead elect to continue with its Farm-in (the “Stage 3 Farm-in Right”) to acquire an additional 10% interest in the IKE Project (for a total 60% interest). To exercise its Stage 3 Farm-in Right, Hudbay must fund all project expenditures required to submit a British Columbia Environment Assessment (“EA”) application for the IKE Project and, if applicable, a Canadian EA application, with the application(s) being accepted for review by December 31, 2026. In addition, Hudbay must also continue to fund all project expenditures until the necessary EA Certificate(s) are received. Following receipt of the EA Certificate(s), all IKE Project expenditures going forward will be shared by Hudbay and Amarc on a pro rata basis (Hudbay 60%/Amarc 40%) under the JV.

As a second alternative path, Hudbay can elect, after exercising its Stage 2 Farm-in Right, to proceed directly to the Stage 3 Farm-in Right, so immediately becoming the operator, and acquire a further 10% interest (for a total 60% interest) by, as above, submitting and having accepted for review a British Columbia EA application and, if applicable, a Canadian EA application, by December 31, 2026. Again in this instance, Hudbay must also fund all project expenditures until receipt of the necessary EA Certificate(s). As with the first path, following receipt of the EA Certificate(s), all IKE Project expenditures going forward will be shared by Hudbay and Amarc on a pro rata basis (Hudbay 60%/Amarc 40%) under the JV.

- 12 -

| AMARC RESOURCES LTD. |

| MANAGEMENT'S DISCUSSION AND ANALYSIS |

| |

| FOR THE SIX MONTHS ENDED SEPTEMBER 30, 2017 |

| |

Hudbay has the right to defer either of its 2019 or 2020 expenditures, for a one-year period, subject to certain conditions. If this deferral occurs, Amarc will have a “co-expenditure right”, whereby it can incur and fund approved additional expenditures on the IKE Project up to the amount of the deferred expenditures. Hudbay may elect to reimburse Amarc for these additional expenditures, thereby retaining its interest in the Project. Under either path, If Hudbay does not submit the EA application(s) by December 31, 2026, then Amarc will become operator again.

Agreement with the Optionors

Amarc holds a 100% interest in the IKE property. In December 2013, the Company entered into an Option and Joint Venture Agreement (the "IKE Agreement") with Oxford Resources Inc. ("Oxford"), whereby the Company acquired the right to earn an 80% ownership interest in the IKE property by making cash payments totaling $125,000, issuing 300,000 shares, and by incurring approximately $1.86 million in exploration expenditures on or before November 30, 2015.

In July 2014 the IKE Agreement was amended and Oxford assigned all of its interest in the IKE property, and the underlying option agreement with respect to the IKE property, to Amarc and converted its ownership interest in the IKE property to a 1% Net Smelter Return (“NSR”) royalty in consideration of a $40,000 cash payment. The 1% NSR royalty can be purchased at any time for $2 million (payable in cash or common shares of Amarc at the Company’s sole election). The maximum aggregate amount payable under the NSR is $2 million.

As a result of the foregoing, Amarc had the right to acquire a 100% ownership interest in the IKE property directly from two unrelated individuals (formerly the underlying owners and now the “Optionors”) by making a cash payment of $40,000 (completed), issuing 100,000 shares (completed), and by incurring approximately $1.86 million in exploration expenditures (completed) on or before November 30, 2015.

The Optionors retain a 2% NSR royalty. Amarc has the right to purchase half of the royalty (1%) for $2 million ($1 million of which is payable in cash, Amarc common shares, or any such combination, at Amarc's discretion) at any time prior to commercial production. In addition, Amarc has the right to purchase the other half of the royalty (1%) for $2 million ($1 million of which is payable in cash, Amarc common shares, or any such combination, at Amarc's discretion) prior to December 31, 2018. Minimum advance royalty payments of $25,000 (payable in cash, Amarc common shares, or any such combination, at Amarc's discretion) to the Optionors annually commenced on December 31, 2015.

Amarc has agreed that upon completion of a positive feasibility study, Amarc will issue 500,000 common shares to the Optionors.

In May 2017, the Company amended the agreement with the Optionors whereby it has the right to purchase 1% of the above mentioned 2% NSR royalty originally purchasable for $2 million prior to December 31, 2018, where Amarc now has the right to purchase that 1% for $2 million ($1 million of which is payable in cash, and the balance in Amarc common shares, or any such combination of cash and shares, at Amarc's discretion) at any time on or before a commercial mine production decision has been made in respect of the IKE Property. In consideration of this amendment, beginning on December 31, 2017 the Company will make an additional Annual Advanced Royalty payment of $25,000 to the Optionors.

- 13 -

| AMARC RESOURCES LTD. |

| MANAGEMENT'S DISCUSSION AND ANALYSIS |

| |

| FOR THE SIX MONTHS ENDED SEPTEMBER 30, 2017 |

| |

Granite Property Agreement

In August 2014, the Company entered into a purchase agreement with Great Quest Fertilizers Ltd. ("Great Quest"), whereby the Company can purchase a 100% ownership interest in the Granite property on or before November 30, 2014 by making staged cash payments totalling $400,000 (completed).

Great Quest holds a 2% NSR royalty on the property which can be purchased for $2 million, on or before commercial production (payable in cash, Amarc common shares, or any such combination, at Amarc’s discretion). In addition, there is an underlying 2.5% NSR royalty on certain mineral claims, which can be purchased at any time for $1.5 million less any amount of royalty already paid.

Galore Property Agreement

In July 2014, the Company entered into an option and joint venture agreement (the “Galore Option Agreement”) with Galore Resources Inc. ("Galore"), whereby the Company acquired the right to earn an initial 51% ownership interest in the Galore property by incurring $3 million in exploration expenditures within five years ($1.5 million of which may be in recordable assessment credits not directly incurred on the property), and by making staged cash payments up to a maximum of $450,000 (50% of which may be payable in Amarc common shares). Amarc may thereafter acquire an additional 19% ownership interest, for a total 70% ownership interest, by incurring $2 million in exploration expenditures within two years. Upon exercise of the initial or additional option (collectively, the “Galore Option”), Galore and Amarc have agreed to form either a 51/49 or a 70/30 joint venture, as the case may be.

The Galore mineral tenure is comprised of five claim groups and is subject to five underlying option agreements, each of which provides the relevant underlying owner with a 1.5% NSR royalty (collectively, the “NSR Royalties”) each of which may be purchased for $250,000 on or before December 31, 2024, and a 10% net profits interest royalty (collectively, the “NPI Royalties”) each of which may be purchased at any time until December 31, 2024 for $400,000 less any amount of an NPI Royalty already paid.

In July 2016, the Company entered into a second option agreement (the “Second Option Agreement”) whereby the Company acquired the right, separate and apart from the Galore Option (the “Second Option”) to acquire 100% of Galore’s rights in and to the Galore property in consideration of the payment to Galore of $550,000 on a staged basis on or before January 16, 2018. Under the terms of the Second Option Agreement, upon exercise of the Second Option and the Company acquiring 100% of the Galore property, the Galore Option Agreement will terminate and be of no further force and effect.

In addition, in July 2016, the Company also reached an agreement with the underlying owners of the Galore property whereby the Company obtained the right to acquire all of the underlying owners’ residual interest in and to the Galore property, including the five NSR Royalties and the five NPI Royalties, in consideration of the payment of $100,000 ($80,000 completed) on a staged basis on or before January 16, 2018, subject to the Company exercising the Second Option.

During the Second Option exercise period, all cash payment and exploration expenditure requirements set out in the Galore Option Agreement shall cease to apply, including with respect to all cash payments payable to the underlying owners.

In January 2017 Amarc announced that it had exercised the Second Option and had acquired a 100% interest in the Galore property from Galore, clear of any royalties to Galore, by making a final payment of $280,000. This transaction marks the successful completion by Amarc of a series of property dealings to acquire 100% of mineral claims and crown grants making up the entire IKE Project, subject to the final payment to the underlying owners as noted above.

- 14 -

| AMARC RESOURCES LTD. |

| MANAGEMENT'S DISCUSSION AND ANALYSIS |

| |

| FOR THE SIX MONTHS ENDED SEPTEMBER 30, 2017 |

| |

The DUKE Property

Amarc has secured a 100% interest in the DUKE mineral property as well as extensive adjacent mineral claims over nearby second-order exploration targets. DUKE is located 80 kilometres northeast of Smithers BC, within the well-known Babine porphyry-copper district, 30 kilometres north of former mines (Bell and Granisle) operated by Noranda Minerals Inc. between 1966 and 1992, and producing a total of 1.1 billion pounds of copper, 634,000 ounces of gold and 3.5 million ounces of silver7. DUKE is also just 10 kilometres northeast of the Morrison Deposit, a 225 million tonne copper-gold-molybdenum porphyry deposit with a completed Feasibility Study8.

The property is accessible from Smithers by road and an industrial-scale barge crossing of Babine Lake from the town of Granisle. A longer, all-road commute is available from Fort St. James, 150 kilometres to the southeast. Power extends to the former Bell mine.

DUKE was intermittently explored between 1965 and 2010 with geochemical, IP and magnetometer surveys and 30 shallow diamond drill holes. Extensive glacial cover precludes geological surveys and hinders geochemical survey interpretation, but most of the holes drilled intersected significant lengths of porphyry-style mineralization that remains open both laterally and to depth. For example, DDH-14, intersected 87 metres of 0.40% Cu, 0.021% Mo, 2.2 g/t Ag and 0.05 g/t Au from 29 metres to the end of the hole. Another hole, DDH-02, located 430 metres southeast of DDH-14 intersected 107 metres of 0.30% Cu, 0.011% Mo, 1.2 g/t Ag, and 0.06 g/t Au from 30 metres. Porphyry mineralization was encountered by drill holes over an area of 800 metres by 400 metres which is open laterally in several directions. The average vertical depth of all holes drilled in this mineralized area is 90 metres, with the deepest being only 124 metres. Eighty percent of the holes drilled in this mineralized area bottomed in porphyry copper mineralization. Additionally, IP survey results indicate a significant area of prospective ground has yet to be drilled.

After providing draft applications to First Nations for a period of initial review and after a rigorous review process by the provincial government, the Company timely received in 2017 two five-year, area-based permits for 20 drill holes and 200 line-kilometers of IP survey work at the DUKE Project. Plans are to drill the DUKE deposit target in fall 2017. An approximate $0.6 million initial drilling program, comprised of two (± 500 metres) core holes totalling 1,046 metres targeting the DUKE deposit has been completed at site with core sample assays to be received before year end.

-------------------------------------------------

7. MINFILE Number 093L 146 and 093M 001 MINFILE Production Detail Report, BC Geological Survey, Ministry of Energy and Mines, BC.

8. Pacific Booker Minerals Inc. news release February 27, 2009.

- 15 -

| AMARC RESOURCES LTD. |

| MANAGEMENT'S DISCUSSION AND ANALYSIS |

| |

| FOR THE SIX MONTHS ENDED SEPTEMBER 30, 2017 |

| |

Duke Property Agreement

In November, 2016, the Company entered into a purchase agreement with a private company owned by director Robert A. Dickinson to purchase 100% of the DUKE property (16 mineral claims) at the vendor’s direct acquisition costs of $168,996.

There are no royalties associated with the DUKE property.

The JOY Property

Amarc has acquired 100% of the JOY mineral property, located 310 kilometres north-northwest of Mackenzie in an area of moderate topography in the Kemess District of north-central BC, which is one of BC’s best areas for the discovery of precious metals-rich porphyry deposits. The JOY property is accessed by helicopter from seasonal roads that come within 0.5 kilometres of the JOY property boundary, or from the Kemess mine site located 25 kilometres due south. Power also extends to the Kemess mine site and its 300-person camp.

The Kemess District is well-known to Amarc’s technical team, as Hunter Dickinson Inc. (“HDI”), with whom Amarc is associated, is credited as the first company to recognize its true porphyry potential – acquiring both the early-stage Kemess South and Kemess North prospects into their operated company, El Condor Resources, and developing them into significant porphyry copper-gold deposits before that company was taken over. Northgate Minerals went on to produce 3 million ounces of gold and 780 million pounds of copper over a 12-year period to 20109(Kemess South), and where current owner AuRico Metals recently secured a BC EA Certificate for its Kemess Underground Project (Kemess North) and also announced a 628 m intercept grading 0.53 g/t Au and 0.41% Cu2at its Kemess East Project. Amarc considers the JOY porphyry copper-gold deposit target to be an extension to the prolific Kemess porphyry gold-copper district.

Geological timing is key to making a discovery of a major copper-gold porphyry deposit in the Kemess region with a close overlap in time between porphyry copper-gold mineralization (ca. 203-194 Ma) and the Black Lake Intrusions (ca. 205-191 Ma). An ideal setting for discovery occurs at JOY with the Jock Creek Pluton, one of the Black Lake Intrusions, located in the north-central portion of the JOY property. The Jock Creek Pluton has been dated at 196.7 Ma, approximately the same age as the 199.6 Ma host of the Kemess South deposit, which hosted a 50,000 tonnes per day past producing mine.

Past operators conducted prospecting-style work on the JOY claims – collecting some 3,000 soil samples, 800 rock samples and 30 silt samples – but undertook no drilling. These surface surveys clearly indicate a number of substantial porphyry copper-gold and epithermal silver-gold deposit targets across the JOY property. The copper-gold deposit targets located at JOY are considered by Amarc to be a northern extension to the prolific Kemess porphyry copper-gold district. Most importantly, historical soil and rock sampling along with a recent soil survey, has revealed a regionally significant, 9 km2copper, gold, molybdenum, silver and zinc geochemical anomaly, which potentially reflects a large and shallowly buried, copper-gold porphyry deposit.

After providing draft applications to First Nations for a period of initial review and after a rigorous review process by the provincial government, the Company has in 2017 timely received two-year, area-based permits for 20 drill holes and 100 line-kilometers of IP survey work at the JOY Project. Amarc has completed the field component of the $1.9 million 2017 program at JOY. The 2017 field programs included 50 km2of geological mapping, collection of 638 talus fines samples, completion of 49 line-kilometres of ground IP and 470 line-kilometres of airborne geophysical surveys along with drilling of 1,527 metres in three core holes. The drilling tested a coincident IP geophysical and geochemical target, which extends onto the recently acquired PINE Property. Assay work on core samples from drilling JOY is still in progress and Amarc will provide the results from drilling once the Company has the QA/QC’d assay data.

-------------------------------------------------

9. MINFILE Number 094E 094, MINFILE Production Detail Report, BC Geological Survey, Ministry of Energy and Mines, BC.

10. Aurico Metals news release November 8, 2016.

- 16 -

| AMARC RESOURCES LTD. |

| MANAGEMENT'S DISCUSSION AND ANALYSIS |

| |

| FOR THE SIX MONTHS ENDED SEPTEMBER 30, 2017 |

| |

Joy Property Agreements

In November, 2016, the Company entered into a purchase agreement with a private company owned by director Robert A. Dickinson to purchase 100% of the JOY property (15 mineral claims) at the vendor’s direct acquisition costs of $335,299, which included required claim assessment work filings.

The property is subject to an underlying NSR royalty from production which is capped at $3.5 million.

Agreement with Hudbay

On August 22, 2017 Amarc announced it had entered into a Mineral Property Farm-In Agreement (the “Agreement”) with Hudbay, pursuant to which Hudbay may acquire, through a staged investment process, up to a 60% ownership in the JOY Project.

Under the terms of the Agreement Hudbay can earn an initial 49% interest in the JOY Project under a Stage 1 Farm-in Right by funding $15 million of expenditures before December 31, 2020, of which $1.9 million is committed for 2017.

When its Stage 1 Farm-in Right is exercised, Hudbay can, pursuant to a Stage 2 Farm-in Right, earn an additional 1% ownership interest in the Project (for a total 50% ownership interest) by funding $5 million of expenditures (for a total of $20 million) also before December 31, 2020.

Stage 1 and Stage 2 Farm-in expenditures can be accelerated by Hudbay at its discretion. Amarc will be the operator during the Stage 1 and Stage 2 periods. A Joint Venture (“JV”) will be formed when Hudbay has acquired a 49% interest in the Project.

Provided that Hudbay has exercised the Stage 2 Farm-in Right and acquired a 50% interest, it can then elect to go forward via one of two paths.

First, Hudbay can replace Amarc as operator of the JV after it funds all project expenditures and completes a Feasibility Study for the JOY Project by December 31, 2025. Having gained operatorship, Hudbay can then choose to either go forward with Amarc in a 50/50 participating JV or Hudbay can instead elect to continue with its Farm-in (the “Stage 3 Farm-in Right”) to acquire an additional 10% interest in the JOY Project (for a total 60% ownership interest). To exercise its Stage 3 Farm-in Right, Hudbay must fund all expenditures required to submit a British Columbia environmental assessment (“EA”) application for the JOY Project and, if applicable, a Canadian EA application, with the application(s) being accepted for review by December 31, 2026. In addition, Hudbay must also continue to fund all approved project expenditures until all necessary EA Certificates are received. Following receipt of the EA Certificate(s), all approved JOY Project expenditures going forward will be shared by Hudbay and Amarc on a pro rata basis (Hudbay 60%/Amarc 40%) under the JV.

- 17 -

| AMARC RESOURCES LTD. |

| MANAGEMENT'S DISCUSSION AND ANALYSIS |

| |

| FOR THE SIX MONTHS ENDED SEPTEMBER 30, 2017 |

| |

As a second alternative path, after exercising its Stage 2 Farm-in Right Hudbay can elect to proceed directly to the Stage 3 Farm-in Right, so immediately becoming the operator, and acquire a further 10% interest (for a total 60% ownership interest) by, like above, submitting a British Columbia EA application and, if applicable, a Canadian EA application by December 31, 2026. Again, in this instance, Hudbay must also fund all project expenditures until receipt of the necessary EA Certificate(s). Following receipt of project approvals from government, all approved JOY Project expenditures going forward will be shared by Hudbay and Amarc on a pro rata basis (Hudbay 60%/Amarc 40%) under the JV.

Hudbay has a one-time right to defer either of its 2019 or 2020 expenditures in the Stage 1 or Stage 2 Farm-in periods, for a one-year period, subject to certain conditions. If this deferral occurs, Amarc will have a “co-expenditure right”, whereby it can incur and fund approved additional expenditures on the JOY Project up to the amount of the deferred expenditures. Hudbay may elect to reimburse Amarc for these additional expenditures, thereby retaining its interest in the Project. Under either alternative path, if Hudbay does not submit the EA application(s) by December 31, 2026, then Amarc will become operator again.

The PINE Property

Amarc has concluded agreements with each of GFTEC and Cascadero Cascadero which enable Amarc to purchase 100% of the 323 km2 PINE mineral property. The PINE is located adjacent to the south of Amarc’s JOY property and adjacent to the north of AuRico Metal’s Kemess District developments in the Toodoggone, BC; a region considered to have high potential for the discovery of important scale, porphyry copper-gold deposits. Combining the JOY and PINE mineral claims along with additional recently staked adjoining claims creates a consolidated, 464 km2 mineral property.

Amarc considers its JOY and PINE properties to be very underexplored and to potentially be the northern extension of the Kemess copper-gold district. Highly favorable geology, combined with extensive surface sampling by past operators indicates a number of significant targets on the PINE. Most importantly, Deposit Target 1 on Amarc’s JOY property extends for some distance to the east onto the PINE property. Deposit Target 1 is a regionally significant, 9 km2copper, gold, molybdenum, silver and zinc soil geochemical anomaly that may reflect a large and shallowly buried, copper-gold porphyry deposit that is ready for drilling.

In addition, there are many known and incompletely tested porphyry copper occurrences, along with untested induced polarization, soil geochemical and magnetic anomalies located across the PINE property. One prime target area, the PINE Deposit is the subject of historical resource estimates that are not categorized as prescribed by National Instrument 43-101.

- 18 -

| AMARC RESOURCES LTD. |

| MANAGEMENT'S DISCUSSION AND ANALYSIS |

| |

| FOR THE SIX MONTHS ENDED SEPTEMBER 30, 2017 |

| |

PINE Property Agreements

In August, 2017 Amarc announced that it had concluded option agreements with each of GFTEC and Cascadero which enable Amarc to purchase 100% of the 323 km2PINE mineral property (the “Property”).

Agreement with Gold Fields

Amarc’s wholly-owned subsidiary (“Amarc Subco”) has entered into an option agreement with GFTEC (the "GFTEC Agreement") pursuant to which Amarc Subco obtained the option (the “Option”) to acquire all of GFTEC’s 51% interest in the Property.

Amarc Subco can exercise the Option at any time within four years from the date of the GFTEC Agreement (the “Option Period”) by completing the public listing of Amarc Subco on the TSX Venture Exchange and issuing to GFTEC securities in the capital of that Company so that GFTEC holds 15% of the shares and 15% of any warrants on issue (on a fully diluted basis) following completion of the listing. GFTEC has the right to maintain its 15% pro rata interest through participation in future fundraisings and other share issuances.

To maintain the right to exercise the Option at any time over up to the four-year Option Period, Amarc must conduct in stages, up to a total of $2.75 million of exploration expenditures on the Project. But no expenditures are required after the Option to acquire GFTEC’s 51% interest is exercised.

GFTEC will retain a 2.5% net profits interest royalty (“NPI”) on mineral claims comprising about 96% of the Property which are subject to a net smelter return royalty payable to a former owner (“Underlying NSR”) and a 1% net smelter returns royalty (“NSR”) on the balance of the claims that are not subject to the Underlying NSR. The NPI can be reduced to 1.25% at any time through the payment to GFTEC of $2.5 million in cash or shares. The NSR can be reduced to 0.50% through the payment to GFTEC of $2.5 million in cash or shares. If Amarc Subco does not exercise the Option or terminates the GFTEC Agreement at any time during the four years Option Period, then Amarc Subco may be required to make a termination payment to GFTEC. The level of termination payment, if any, varies with the year of termination and the amount of any exploration expenditures completed; varying over the four-year option from a low of no payment to an absolute maximum of $1,375,000 in the event no exploration work was done by Amarc.

Agreement with Cascadero

Amarc has also entered into an option agreement (the “Cascadero Agreement”) with Cascadero pursuant to which Amarc was granted an option (the “Cascadero Option”) to acquire all of Cascadero’s 49% interest in the Property. In order to exercise the Cascadero Option, Amarc is required to make staged cash payments to Cascadero in the aggregate amount of $1 million before October 31, 2018, and issue on a staged basis common shares in its capital to Cascadero having an aggregate value equal to $950,000 before October 31, 2018. In lieu of issuing any common shares, Amarc may elect to pay to Cascadero the value of the shares in cash.

- 19 -

| AMARC RESOURCES LTD. |

| MANAGEMENT'S DISCUSSION AND ANALYSIS |

| |

| FOR THE SIX MONTHS ENDED SEPTEMBER 30, 2017 |

| |

The PINE property is subject to a 3% Underlying NSR royalty payable to a former owner. Amarc has reached an agreement with the former owner to cap the 3% NSR at $5 million payable from production for consideration totaling $100,000 and 300,000 Amarc shares, payable in stages through to January 31, 2019 (the “Capped Royalty Agreement”).

The GFTEC Agreement, Cascadero Agreement and Capped Royalty Agreement were subject to TSX Venture Exchange approval which has been received.

Other Properties

Amarc’s focus with respect to its Newton and Galileo projects is to work towards venturing them out to third parties to further advance exploration.

Galileo – Blackwater District Property

Amarc owns a 100% interest in the Galileo property, which is located within the Blackwater district, 75 kilometres southwest of Vanderhoof, BC, and 176 kilometres southwest of northern BC's regional hub city of Prince George. The area is characterized by subdued topography and is well served by existing transportation and power infrastructure and a skilled workforce, which supports an active exploration and mining industry.

The Company has completed an approximately 5,120 line-kilometres of helicopter-borne, magnetic and electromagnetic geophysical survey over properties in the Blackwater district, from which epithermal gold-silver and porphyry gold-copper-type targets were identified for ground evaluation. At Galileo the results of more than 230 line-kilometres of IP ground geophysical surveys, combined with information from soil geochemical surveys and prospecting have identified four principle target areas with the potential to represent important sulphide systems for drill testing.

The Galileo property is located approximately 35 kilometres from New Gold's Blackwater gold deposit (Proven and Probable Reserves of 344.4 million tonnes at an average grade of 0.74 g/t gold containing 8.2 million gold ounces, and 5.5 g/t silver containing 60.8 million silver ounces; New Gold news release December 12, 2013).

Amarc has undertaken consultation with local First Nations. All parties worked together in a diligent manner in order to develop a positive working relationship.

The Newton Property

Amarc made a drill discovery at its 100% owned Newton bulk-tonnage gold-silver project in late 2009 and subsequently conducted exploration and delineation drilling at the deposit until June 2012.

An initial mineral resource estimate announced in September 2012, based on 24,513 metres of core drilling in 78 holes completed up to June 30, 2012, confirms that Newton is a significant bulk tonnage gold discovery that remains open to further expansion. At a 0.25 g/t gold cut-off, Inferred Mineral Resources comprise 111.5 million tonnes grading 0.44 g/t gold and 2.1 g/t silver, containing 1.6 million ounces of gold and 7.7 million ounces of silver.

Inferred Mineral Resources at various cut-off grades are summarized in the table below.

- 20 -

| AMARC RESOURCES LTD. |

| MANAGEMENT'S DISCUSSION AND ANALYSIS |

| |

| FOR THE SIX MONTHS ENDED SEPTEMBER 30, 2017 |

| |

NEWTON GOLD PROJECT – INFERRED MINERAL RESOURCES

| Cut-Off Grade | Size | Grade | Contained Metal |

| (g/t Au) | Tonnage

(000 t) | Gold

(g/t) | Silver

(g/t) | Gold

(000 oz) | Silver

(000 oz) |

| 0.20 | 147,069 | 0.38 | 1.9 | 1,818 | 8,833 |

| 0.25 | 111,460 | 0.44 | 2.1 | 1,571 | 7,694 |

| 0.30 | 85,239 | 0.49 | 2.4 | 1,334 | 6,495 |

| 0.35 | 65,384 | 0.54 | 2.7 | 1,130 | 5,635 |

| 0.40 | 49,502 | 0.59 | 2.9 | 938 | 4,596 |

Notes:

| 1. | CIM definitions were followed for this mineral resource estimate. An "Inferred Mineral Resource" is that part of a Mineral Resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes. |

| 2. | Inferred Mineral Resources were estimated using a long-term gold price of US$1,750 per ounce, a long-term silver price of US$25 per ounce, and a US$/C$ 1.00 exchange rate. |

| 3. | Bulk density is 2.71 tonnes per cubic metre. |

| 4. | Numbers may not add due to rounding. |

| 5. | The Effective Date of the Mineral Resource is July 4, 2012; the Effective Date being defined as the date when Roscoe Postle Associates Inc. was in receipt of full data which informed the resource. |

The Newton Inferred Mineral Resources was prepared using geostatistical methods by technical staff at Hunter Dickinson Inc. ("HDI") and audited by geological and mining consultants at Roscoe Postle Associates Inc. under the direction of Reno Pressacco, P. Geo., an independent Qualified Person. Sample preparation and analysis of drill core samples from Newton were completed at the ISO 9001:2008 accredited and ISO-IEC 17025:2005 accredited Acme Analytical Laboratories (Vancouver) Ltd. A technical report providing further details of the estimate has been filed onwww.sedar.com.

The current Newton resource extends over an area of approximately 800 metres by 800 metres and to a depth of 560 metres, and is open to expansion to the northwest, west and to depth. It is located within the southeast segment of an extensive seven square kilometre sulphide system that is characterized by widespread gold enrichment indicating good potential for the development of substantial additional resources. This large, fertile mineral system extends well beyond the limits of the current resource and is largely concealed under shallow cover.

Newton exhibits key characteristics that typify significant hydrothermal gold deposits. The deposit lies within a large, gold-enriched epithermal system that formed approximately 72 million years ago contemporaneously with felsic volcanic and intrusive rocks, which were emplaced into a structurally-active graben environment. Gold, silver and associated base metal mineralization was precipitated with extensive zones of strong quartz-sericite alteration. The alteration types, metal associations and geological setting at Newton are nearly identical to those which characterize several major intrusion-related epithermal gold deposits in BC – including the important Blackwater-Davidson, and Snowfields deposits.

Exploration and resource expansion potential are clearly indicated at Newton by the large scale of the hydrothermal system, the structurally- and magmatically-active nature of the geological setting at the time of mineralization, the intensity of the hydrothermal alteration and the strong, widespread metal anomalies that have been confirmed by widely-spaced wildcat drilling. In addition, the Newton deposit occupies only one portion of an extensive IP geophysics chargeability anomaly. It is important to note that, beyond the currently delineated Newton resource, anomalous concentrations of metals have been intersected in almost all exploration holes drilled on the property. Large portions of the system remain untested or have been tested only by widely-spaced reconnaissance drilling.

- 21 -

| AMARC RESOURCES LTD. |

| MANAGEMENT'S DISCUSSION AND ANALYSIS |

| |

| FOR THE SIX MONTHS ENDED SEPTEMBER 30, 2017 |

| |

Amarc's Newton property is located some 100 kilometres west of the City of Williams Lake, BC, in a region characterized by gently rolling hills and other characteristics favorable for project development. The district is well served by existing transportation and power infrastructure and a skilled workforce, which support a number of operating mines, as well as late-stage mineral development and exploration projects.

Amarc has undertaken significant consultation with local First Nations. All parties worked together in a diligent manner in order to develop a positive and respectful working relationship.

Newton Property Agreement

Amarc holds a 100% interest in the Newton Property. Newton Gold Corp. holds a 5% net profits interest royalty. In addition, the mineral claims defined in an underlying agreement are subject to a 2% NSR royalty, which royalty may be purchased by Amarc for $2 million at any time. Advance NSR royalty payments of $25,000 per annum commenced on January 1, 2011.

Market Trends

Average annual prices for copper, molybdenum, gold and silver during last 5 years are shown in the following table:

| | Average metal price (US$) |

| Calendar year | Copper | Molybdenum | Gold | Silver |

| 2012 | 3.61/lb | 12.81/lb | 1,670/oz | 31.17/oz |

| 2013 | 3.34/lb | 10.40/lb | 1,397/oz | 23.82/oz |

| 2014 | 3.11/lb | 11.59/lb | 1,264/oz | 19.09/oz |

| 2015 | 2.50/lb | 6.73/lb | 1,160/oz | 15.69/oz |

| 2016 | 2.21/lb | 6.56/lb | 1,251/oz | 17.14/oz |

| 2017 (to the date of this document) | 2.77/lb | 7.21/lb | 1,256/oz | 17.24/oz |

- 22 -

| AMARC RESOURCES LTD. |

| MANAGEMENT'S DISCUSSION AND ANALYSIS |

| |

| FOR THE SIX MONTHS ENDED SEPTEMBER 30, 2017 |

| |

1.3 SELECTED ANNUAL INFORMATION

Not required for the interim MD&A.

1.4 SUMMARY OF QUARTERLY RESULTS

These amounts are expressed in thousands of Canadian Dollars, except per share amounts. Minor differences are due to rounding.

| | | Fiscal Quarter Ended | |

| | | Sep 30, | | | Jun 30, | | | Mar 31, | | | Dec 31, | | | Sep 30, | | | Jun 30, | | | Mar 31, | | | Dec 31, | |

| ($ 000’s) | | 2017 | | | 2017 | | | 2017 | | | 2016 | | | 2016 | | | 2016 | | | 2016 | | | 2015 | |

| Net (income) loss | $ | (67 | ) | $ | 788 | | $ | 126 | | $ | 651 | | $ | 148 | | $ | 118 | | $ | (2,430 | ) | $ | 925 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Basic and diluted (income) loss per share | $ | (0.00 | ) | $ | 0.01 | | $ | 0.00 | | $ | 0.00 | | $ | 0.00 | | $ | 0.00 | | $ | (0.02 | ) | $ | 0.01 | |

The variations in net results over the fiscal quarters presented above were caused be the Company’s mineral exploration and evaluation activities, which typically ramp-up in the summer during the 3rd calendar quarters. See the following section of the MD&A for additional discussions.

1.5 RESULTS OF OPERATIONS

During the three and six months ended September 30, 2017, the Company recorded a net income of $66,663 and a net loss of $720,885, respectively. The net income recorded for the three months ended September 30, 2017 is due to the timing of expenditures incurred and cost recoveries recorded during the period.

The following table provides changes in expenditures and cost recoveries in the current periods compared to the prior periods:

| Expenditures/recoveries | | Three months ended | | | Six months ended | |

| | | September 30, 2017 | | | September 30, 2017 | |

| Increase in exploration and evaluation expenditures | | 1,950,000 | | | 2,128,000 | |

| Increase in administrative expenditures | | 110,000 | | | 160,000 | |

| Increase in cost recoveries | | 2,342,000 | | | 1,987,000 | |