POOR CORPORATE GOVERNANCE: NO ACCOUNTABILITY

infoUSA’s Corporate Governance Regime Results In No Effective Accountability Over Mr. Vinod Gupta, In Particular

THE FAILED AND APPARENTLY ILLUSORY 2005 OFFER

| · | Three months after publicly stating that IUSA was worth more than $18 per share, and just five days after lowering earning estimates (knocking 20% off the stock price), Mr. Vinod Gupta offered to acquire all the unaffiliated shares at $11.75 per share. |

| · | Mr. Vinod Gupta stated that “he does not intend to vote in favor of any other change in control transaction of the Company.” |

| · | The full Board broadly established a Special Committee of “disinterested” directors. The Board resolution establishing the Committee empowered the Committee to “solicit, negotiate, approve or reject alternate proposals.” |

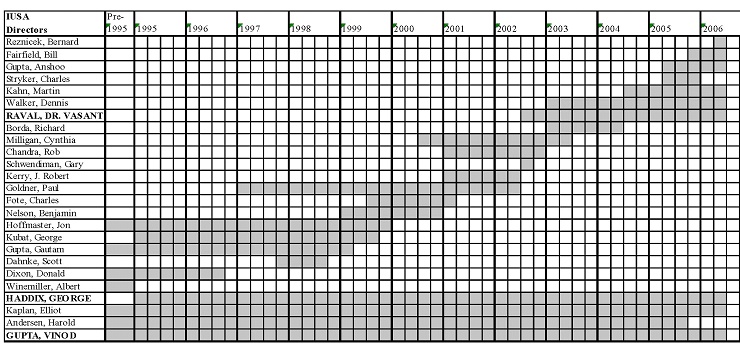

| · | The Committee, which retained Lazard Freres and Fried Frank, unanimously determined that Mr. Vinod Gupta’s offer undervalued the Company and would require a “market check”. Mr. Vinod Gupta then withdrew his offer. The Committee publicly stated“it is in the best interests of the company’s stockholders to continue to explore potential strategic alternatives.” The next day the full Board in a non-unanimous vote terminated the Committee. Directors Vinod Gupta, George Haddix, Harold Andersen, Dennis Walker and Elliott Kaplan voted to terminate the Committee. Each of these Directors have conflicts or have ties to Vinod Gupta. Director Raval abstained. Directors Stryker, Anshoo Gupta and Kahn voted against termination of the Committee. |

| · | On September 7, 2005 , Mr. Gupta wrote in a letter to the Board: |

“After we lowered our revenue guidance…, our stock got crushed. At that time I had no choice but to support the stock. That was the primary reason for offering $11.75 for the shares.”

“The role of the Special Committee was formed to review my offer. Once the offer is withdrawn, their job is done.”

Source: For all the relevant Board and Committee minutes, please see our website: www.iusaccountability.com.

POOR CORPORATE GOVERNANCE: NO ACCOUNTABILITY

infoUSA’s Corporate Governance Regime Results In No Effective Accountability Over Mr. Vinod Gupta, In Particular

MR. VINOD GUPTA’S EXEMPTION FROM THE POISON PILL HAS , IN DOLPHIN’S VIEW, HARMED ALL UNAFFILIATED SHAREHOLDERS

| · | Mr. Vinod Gupta and his affiliates are the only shareholders exempt from the poison pill. |

| · | The Board minutes concerning adoption of the poison pill contain no indication that the Board discussed Mr. Gupta’s exemption from the poison pill.* |

| · | Mr. Vinod Gupta is the one shareholder the poison pill should apply to given his recent opportunistic offer, as well as share purchases and option exercises. |

| · | As the result of this exemption, Mr. Vinod Gupta was permitted to increase his total direct ownership to 40%. |

| · | Given Mr. Vinod Gupta’s history and the full Board’s failure to rein him in, how will unaffiliated shareholders fare if Mr. Vinod Gupta’s ownership moves from extremely substantial influence to absolute control? |

*Minutes of the July 21, 1997 Board Meeting adopting the poison pill are available on our website: www.iusaccountability.com

POOR CORPORATE GOVERNANCE: NO ACCOUNTABILITY

infoUSA’s Corporate Governance Regime Results In No Effective Accountability Over Mr. Vinod Gupta, In Particular

RELATED PARTY TRANSACTIONS, MISUSE OF CORPORATE ASSETS

| · | Mr. Vinod Gupta and his affiliates have engaged in substantial related party transactions since 1998 and IUSA has also made direct and other payments related to the assets underlying these related party transactions: |

$16 million in reimbursements to related parties

$1 million in direct payments related to such assets

$11 million to acquire real property, private jet interests, yacht lease, the skybox and luxury cars

As disclosed in the Company’s proxy statements, in each of 1998 and 1999, Mr. Vinod Gupta received $48,000 in salary. In 1998 Mr. Gupta’s affiliates received $1.4 million for “travel and consulting services and related expenses.” In 1999 Mr. Gupta’s affiliates received $2.2 million for “executive travel expenses”, $1.3 million for “acquisition and other related expenses” and $500,000 for “investment advisory fees.”

| · | In a May 4, 2005 letter to shareholders, Mr. Vinod Gupta stated that “In fact, all of infoUSA’s past related party transactions were fully and properly disclosed in the Company’s filings.” |

The Company’s 2005 proxy statement discloses payment of $1.5 million to a Vinod Gupta affiliate for “usage of aircraft”. Numerous company records reviewed by Dolphin, however, indicate that $929,000 of that amount was for “aircraft usage”, $280,000 was for use of the 80 foot American Princess yacht, $120,000 related to residences, $192,000 for “service charges” and $39,000 in premium payments on a personal life insurance policy.

| · | The purported “in depth” investigation into related party transactions conducted by Dr. Raval: |

Failed to investigate $929,000 in reimbursement for private jet usage. Was this all legitimate business expenses?

Only dealt with 2004 reimbursements, and did not address the direct payments.

POOR CORPORATE GOVERNANCE: NO ACCOUNTABILITY

infoUSA’s Corporate Governance Regime Results In No Effective Accountability Over Mr. Vinod Gupta, In Particular

Determined that $632,000 in related party transactions “will be borne by Mr. Gupta”. Our review of the company’s public filings and the records do not show any confirmation that Mr. Gupta ever repaid this amount. This amount does not appear in the Company’s proxy statements as compensation or a related party transaction. No comment from the Company.

Revealed that former Director Harold Andersen, current Director Dennis Walker and Mr. Vinod Gupta’s company, Annapurna Corporation, have occupied infoUSA’s facilities apparently without charge.

| · | The Board’s apparent “fix” for these related-party transactions was simply to spend an additional $11 million of shareholder funds to acquire real property, the interests in private jets, the 80 foot American Princess yacht, a skybox, and luxury cars so that Mr. Vinod Gupta could continue to operate in the manner to which he had become accustomed -- without having to report any of it publicly. |

In October 2005, Mr. Vinod Gupta publicly stated that “However, given the heightened shareholder sensitivity to these transactions, the Board has decided to virtually eliminate such [related party] transactions going forward.”

Exemplary of this Board’s dysfunction is the skybox: As shown in documents reviewed by Dolphin, the Company signed an agreement to purchase the skybox from Vinod Gupta in April 2003; the Company cut the check to Vinod Gupta in May 2003; the Audit Committee asks for backup “supporting the price to be paid” in July 2003; and the Committee “approves” it in October 2003.

POOR CORPORATE GOVERNANCE: NO ACCOUNTABILITY

infoUSA’s Corporate Governance Regime Results In No Effective Accountability Over Mr. Vinod Gupta, In Particular

UNNECESSARY SIZABLE OPTION GRANTS TO MR. VINOD GUPTA HAVE ONLY SERVED TO MOVE HIM TOWARD ABSOLUTE CONTROL

| · | The Board has granted Mr. Vinod Gupta 3.2 million options (6%) since 1998: |

The Board’s Compensation Committee has never explained why it believes such option grants were appropriate. Director Nominee Haddix is a member of the Compensation Committee.

Dilution and control issues far outweigh any incentive value to such a sizable holder.

The Company’s 2005 proposal to add 3 million shares to the 1997 Compensation Plan barely passed with only 59% approval of those voting. Without Mr. Vinod Gupta’s shares, this proposal would have failed by a 2 to 1 margin.

ISS recommended its clients vote AGAINST the Compensation Plan in 2005 because it specifically permits the repricing of options.

Mr. Vinod Gupta has consistently failed to disclose fully his stock ownership - not until the 2006 proxy does he reveal that he has direct voting control over an additional 2.4 million shares held in various family trusts.

Mr. Gupta exercised 1.2 million options, or 2.2%, just before the record date for the 2006 Annual Meeting.

Any further increase in his ownership will surely damage the unaffiliated shareholders by giving him exclusivity in a change in control transaction.

While Mr. Vinod Gupta’s position is sizable, at 40%, it is not yet insurmountable.

POOR CORPORATE GOVERNANCE: NO ACCOUNTABILITY

infoUSA’s Corporate Governance Regime Results In No Effective Accountability Over Mr. Vinod Gupta, In Particular

IT APPEARS TO DOLPHIN THAT MOST CURRENT BOARD MEMBERS HAVE TIES TO MR. VINOD GUPTA AND LITTLE RELEVANT INDUSTRY EXPERIENCE

Director | Ties To Mr. Vinod Gupta | Current Employment | Relevant Experience |

Vinod K. Gupta* | YES | infoUSA CEO | YES |

Bill L. Fairfield | YES -- former IUSA employee; formerly Director of Sitel with Vinod Gupta and presently Trustee of Nebraska Foundation with Vinod Gupta. | Venture capital, footwear retailer, outsourced customer support | ??? |

Anshoo S. Gupta | NO | Management consulting; financial, marketing positions at Xerox | NO |

Dr. George F. Haddix * | YES -- Co-founder, former CEO and Director of CSG Systems, which IUSA invested in; Director of Creighton University. | CEO computer software company | NO |

Martin F. Kahn | NO | Former CEO of OneSource (acquired by IUSA) | YES |

Elliott S. Kaplan* | YES -- His law firm is IUSA’s outside counsel. | Lawyer | NO |

Dr. Vasant H. Raval* | YES -- Chairs Dept. of Acct. at Creighton U., Vinod Gupta School of Mgt at IIT has exchange program with Creighton. | Professor of accounting | NO |

* Voted to disband the Special Committee, except for Dr. Raval, who abstained.

POOR CORPORATE GOVERNANCE: NO ACCOUNTABILITY

infoUSA’s Corporate Governance Regime Results In No Effective Accountability Over Mr. Vinod Gupta, In Particular

IT APPEARS TO DOLPHIN THAT MOST CURRENT BOARD MEMBERS HAVE TIES TO MR. VINOD GUPTA AND LITTLE RELEVANT INDUSTRY EXPERIENCE

Director | Ties To Mr. Vinod Gupta | Current Employment | Relevant Experience |

Bernard W. Reznicek | YES -- serves on board of CSG Systems, in which IUSA invested; Former Dean of Bus. Admin. at Creighton U., Vinod Gupta School of Mgt at IIT has exchange program with Creighton. | CEO of real estate investment company | NO |

Dennis P. Walker* | YES -- President and CEO of Jet Linx Aviation, had free office space along with Everest, in infoUSA building. | CEO of jet fractional interest company | NO |

Directors Who Resigned Recently | | |

Harold W. Andersen* | YES -- Trustee with Vinod Gupta in Everest Funds; had free office space from IUSA; IUSA invested in Everest 3 Fund in 2001. | Former newspaper publisher | NO |

Dr. Charles W. Stryker | YES - Formerly Chairman and CEO of Naviant, Inc. IUSA signed $12mm licensing agreement with Naviant in 2001. | Founder of company that develops databases | YES |

* Voted to disband the Special Committee, except for Dr. Raval, who abstained.

POOR CORPORATE GOVERNANCE: NO ACCOUNTABILITY

The infoUSA’s Board has Never Acknowledged or Addressed the Serious Issues Dolphin Continually Raised Over the Last Ten Months

2005

August | 31 | Dolphin sends letter to non-management Directors, outlining issues, urging them “to put their own house in order.” |

September | 1 and 7 | Dolphin receives assurances from Directors Kahn and Anshoo Gupta that the issues Dolphin raised would be addressed. |

| | 19 | Dolphin makes books and records request. |

October | 7 | Counsel for Dolphin sends letter to infoUSA’s counsel protesting Company’s failure to comply with books and records request. |

| | 17 | Dolphin sends letter to non-management Directors urging Board again to take corrective measures. |

| | 20 and 21 | Board holds two-day meeting. Minutes of this meeting do not reflect discussion of any other matter Dolphin raised in its August 31 and October 17 letters. |

| | 24 | Dolphin files an action in Delaware Court of Chancery seeking to compel compliance with its September 19th request. |

| | 26 | Mr. Vinod Gupta makes public statement that “the Board has decided to virtually eliminate such [related party] transactions going forward.” |

November | 17 | Dolphin sends letter to Board, expressing its disappointment with the Board’s failure to act. |

December | 22 | Delaware Court of Chancery orders Company to comply with Dolphin’s books and records demand. |

2006 | | |

January | First week | Dolphin receives approximately 15,000 pages from infoUSA. |

POOR CORPORATE GOVERNANCE: NO ACCOUNTABILITY

The infoUSA’s Board has Never Addressed the Serious Issues Dolphin Continually Raised Over the Last Ten Months

2006

| | 18 | Dolphin offers to share preliminary findings with non-management Directors - never heard back. |

February | 7 | Dolphin challenges confidentiality of documents in Delaware Court of Chancery. |

March | 8 | Dolphin sends letter to non-management Directors asking the Board to publicly announce how it will deal with Mr. Vinod Gupta’s expiring standstill letter - the Board does nothing. |

| | 14 | Dolphin sends letter to the Company offering, on a consensual basis, a candidate to fill a vacancy created by Director Stryker’s departure. Dolphin asked for a decision by March 28th - No response. |

| | 17 | Pending the Board’s decision on the consensual offer, in order to be timely, Dolphin notified the Company of its intention to nominate three Directors. |

| | 29 | Dolphin publicly announces proxy contest. |

POOR CORPORATE GOVERNANCE: NO ACCOUNTABILITY

We Are Not Alone In Our View Of The Poor Corporate Governance Practices At infoUSA

Russell 3000: 22%

Software & Services Companies: 37%

| | 2. | Board Analyst (March 15, 2006) |

Board Effectiveness Rating: D

Board Risk Assessment: High

In its analyst reports on IUSA, Stephens routinely cites related party transactions as the # 1 risk factor.

OUR NOMINEES ARE COMMITTED TO BULIDING SHAREHOLDER VALUE THROUGH ACCOUNTABILITY

The Nominees Are Highly Qualified Strong Leaders and Independent of Dolphin, IUSA and its Management

Malcolm “Mick” M. Aslin served as President and Chief Executive Officer of Gold Banc Corporation, Inc. *(NASDAQ: GLDB), a $700 million market cap financial services holding company with commercial bank branches and trust offices located in Kansas, Oklahoma, Missouri and Florida, from March 2003 until its acquisition in March 2006 by Marshall & Ilsley. He was a member of Gold Banc’s board of directors beginning in February 1999. From February 1999 until March 2003, Mr. Aslin served as Gold Banc’s chief operating officer. Beginning in March 2003, Mr. Aslin served as chairman of the board and chief executive officer of Gold Bank, Gold Banc Corp.’s bank operating subsidiary. From October 1995 until February 1999, Mr. Aslin served as chairman of the board of Western National Bank and Unison Bancorporation, Inc. in Lenexa, Kansas and chairman and managing director of CompuNet Engineering, L.L.C., a Lenexa, Kansas computer service business that Gold Banc acquired in February 1999. From May 1994 until May 1995 Mr. Aslin served as President of Langley Optical Company, Inc., a wholesale optical laboratory located in Lenexa, Kansas. From January 1990 until April 1994 Mr. Aslin was a director of Visa USA. Before that time, Mr. Aslin spent more that 22 years in various positions with UMB Banks and United Missouri Financial Corporation, including president, chief operating officer and director of United Missouri Bancshares, Inc. and president of UMB’s Kansas City Bank, United Missouri Bank of Kansas City, N.A. Presently, Mr. Aslin serves as a director of Marshall & Ilsley, Corporation, a financial services company headquartered in Milwaukee, Wisconsin, LabConco Inc., a manufacturer of laboratory equipment and accessories, and ACT Teleconferencing Inc. a global provider of audio and video conferencing solutions. Mr. Aslin is currently a Trustee of the Midwest Research Institute and a Member of the Strategic Development Board, University of Missouri, Columbia, Business School. Mr. Aslin is also life director and first vice chairman of the board of governors, as well as past president, past chairman of the board of the American Royal Association, a not-for-profit organization charged with the mission of promoting agricultural advancement and developing future generations of leaders through agrarian values in the Midwest.

Karl L. Meyer, from February 2000 until December 2004, served as chairman of the board of Ermis Maritime Holdings Ltd., an owner and operator of ocean going tankers. Mr. Meyer served at the request of its bondholders to manage the company through its liquidation process, which was successfully completed in 2004. From May 2003 until May 2004, Mr. Meyer was a director of Computer Horizons (NASDAQ: CHRZ). He was re-elected to the board of CHRZ in October 2005 at a special meeting wherein the shareholders voted to replace the entire board. From the time of its initial public offering in March 2001 until December 2002, Mr. Meyer was a director, and chairman of the audit committee, of Stelmar Shipping Inc. (NYSE: SJH), which was acquired by Overseas Shipholding Group, Inc. (NYSE: OSG) in January 2005. From July 1992 until its sale to Seacoast Financial Services Corp. (NASDAQ: SCFS) in December 2000, Mr. Meyer was chairman of the board, chief executive officer and president of Home Port Bancorp, Inc. (NASDAQ: HPBC), the parent of Nantucket Bank. Mr. Meyer has also served from 1995 to 2004 as managing director of Diogenes Management Company, an investment advisor in the tanker shipping industry. From 1986 to 1989,

* Dolphin was a 13D holder of Goldbanc Corp. during Mr. Aslin’s tenure.

OUR NOMINEES ARE COMMITTED TO BULIDING SHAREHOLDER VALUE THROUGH ACCOUNTABILITY

The Nominees Are Highly Qualified Strong Leaders and Independent of Dolphin, IUSA and its Management

Mr. Meyer was the chairman of the board and chief executive officer of Marine Transport Lines, Inc., a commercial shipping company that was sold to private investors. Mr. Meyer served as a director of BT Shipping Limited (NASDAQ: BTBT) and in April 2005, Mr. Meyer was nominated to the board of directors of OfficeMax (NYSE: OMX) by its then third largest shareholder.

Robert A. Trevisani was a general partner of Gadsby Hannah LLP until 2004 when he became of counsel. He is a member of the bar of Massachusetts, New York and the District of Columbia. He has been an adjunct professor at Boston University Graduate School of Law (1977-1996) and Boston College Law School (1996-2005). From 1996 through 2000, Mr. Trevisani was a director of Home Port Bancorp (NASDAQ: HPBC) until its sale to Seacoast Financial Services Corp. (NASDAQ: SCFS) in December 2000. In 2004, he was nominated to the board of Computer Horizons (NASDAQ:CHRZ) in opposition to the nominees of management, and elected as a director for a one-year term. Mr. Trevisani was nominated to the board of CHRZ by Aquent Corporation, a private company that made an offer to acquire all of the outstanding capital stock of CHRZ. Aquent subsequently determined to withdraw its offer, and Mr. Trevisani was not nominated for a second term. Mr. Trevisani has been president and a director of the Commonwealth Charitable Fund, Inc., a non-profit membership company, since its founding in 1978. He was elected in 2005 to the board of Salary.com, a private company providing comparative compensation guidance and services to institutions and individuals, and serves on its Board and Audit Committee. At Mount Ida College, he served as a trustee (1988-2005), as a member of the executive and audit committees and recently acted as chairman of its physical resources committee. He has been a trustee or director of several other non-profit organizations.

OUR NOMINEES ARE COMMITTED TO BULIDING SHAREHOLDER VALUE THROUGH ACCOUNTABILITY

Our Program - Accountability Through Meaningful Corporate Governance Reform

| · | Adopt the by-law amendment to prohibit for three years the re-nomination or appointment by the Board of a Director who has been voted down by shareholders. |

| · | Reconstitute the Special Committee to analyze the best alternatives to maximize shareholder value. The Special Committee should explore all alternatives, including internal operational changes and capital structure and dividend policy; not just a sale of the Company. |

| · | Name a truly independent Chairman of the Board |

| · | End Mr. Vinod Gupta’s exemption from the poison pill |

| · | Strengthen the Nominating and Corporate Governance Committee by retaining an independent search firm to recruit independent candidates for vacancies. |

| · | Establish meaningful policies to curb abusive related party transactions and other payments and improper use of corporate assets - correcting abuses that violate the Company’s own code of conduct (available on IUSA’s website). |

| · | Review all related party transactions and other payments and instances of improper use of corporate assets and seek reimbursement from those found to have received improper benefits. |

| · | Strengthen the Compensation Committee by ensuring that all awards under the company’s equity incentive plans truly incentivize the creation of shareholder value and do not cause unnecessary dilution. |

| · | Eliminate the current plan provisions permitting the repricing of options. |

OUR NOMINEES ARE COMMITTED TO BULIDING SHAREHOLDER VALUE THROUGH ACCOUNTABILITY

Our Program - Accountability Through Meaningful Corporate Governance Reform

| · | Thorough, Annual Review of the Effectiveness of Senior Management, including management turnover. |

| · | Review All Current Business Strategies. |

| · | Explore New Business Strategies: |

Create value-added products, such as software tools that permit users to blend IUSA’s databases with customers’

existing databases and other decision support tools.

Partnering opportunities, such as Acxiom’s recent partnering with Accenture.

Exploit more effectively infoUSA’s database of small and mid-sized US companies, one of its most valuable and underutilized assets.

Explore other ways to reduce database maintenance and production costs (29% of 2005 sales).

CONCLUSION

IN DOLPHIN’S VIEW:

| · | A Board with continuous turnover and conflicts has been unable or unwilling to rein in Mr. Vinod Gupta and demand performance and accountability. |

| · | Mr. Vinod Gupta has persistently abused the trust of unaffiliated shareholders and should no longer serve as a Director. |

| · | Mr. Vinod Gupta appears to be seeking absolute control which surely will damage the value enhancing alternatives for unaffiliated shareholders. |

| · | This is the last chance for strong independent Directors to redress this situation. |

A VOTE FOR THE ELECTION OF MICK M. ASLIN,

KARL L. MEYER, ROBERT A. TREVISANI

AND FOR THE BYLAW

AMENDMENT

IS A VOTE

FOR BUILDING VALUE FOR ALL SHAREHOLDERS

THROUGH ACCOUNTABILITY

NOTES

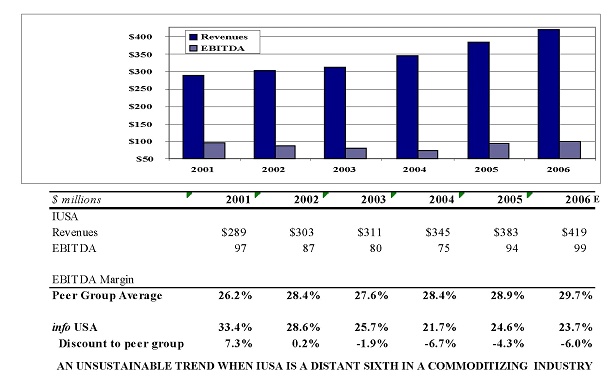

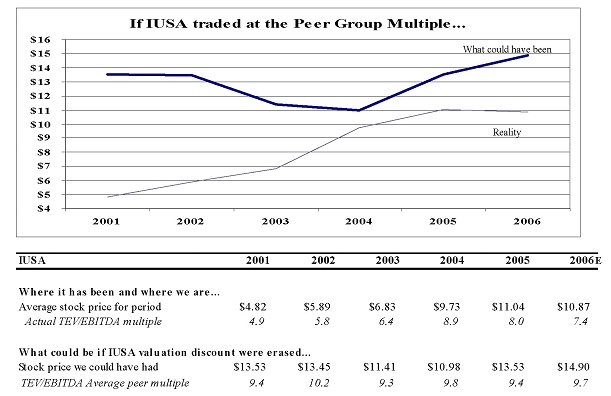

Note 1

Peer Group consists of IUSA’s public competitors it names in its 10-K: Equifax, Dun & Bradstreet, Acxiom and Harte-Hanks; as well as ChoicePoint, which is frequently referred to as a competitor by sell-side analysts.

For 2001-2005, revenues and EBITDA are historic. For 2006, revenues and EBITDA is consensus analyst estimate. For all years, source: Bloomberg.

See also, Dolphin’s proxy materials and other documents available on www.iusaccountability.com.

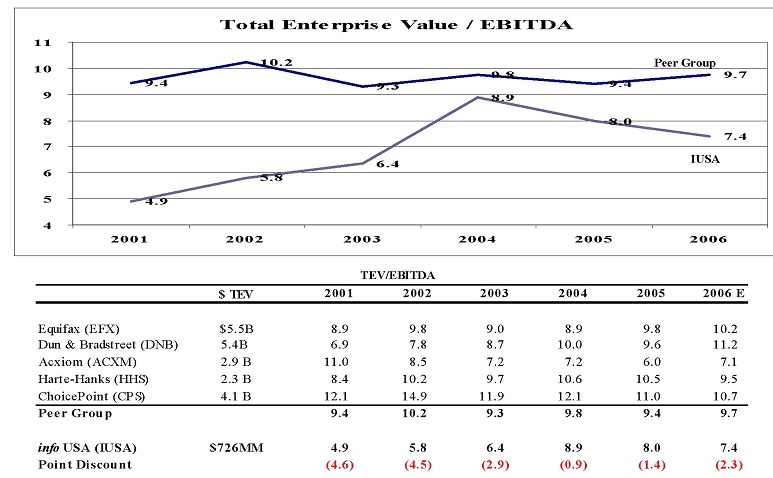

Note 2

Peer Group consists of IUSA’s public competitors it names in its 10-K: Equifax, Dun & Bradstreet, Acxiom and Harte-Hanks; as well as ChoicePoint, which is frequently referred to as a competitor by sell-side analysts.

For 2001-2005, EBITDA is historic and Total Enterprise Value (“TEV”) is based on the average trading stock price and average net debt for the respective period. For 2006, EBITDA is consensus analyst estimate and TEV is based on current trading stock price (through May 1, 2006) and net debt.

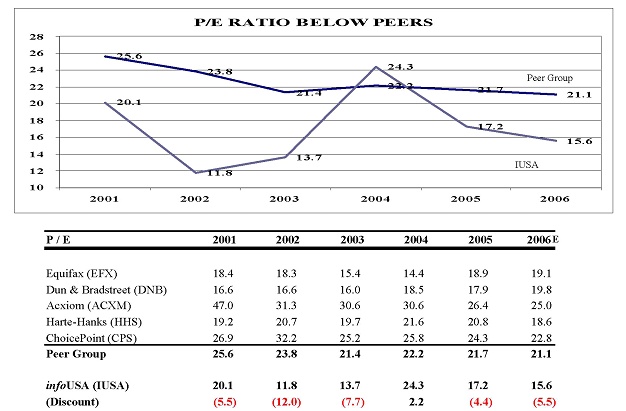

Note 3

Peer Group consists of IUSA’s public competitors it names in its 10-K: Equifax, Dun & Bradstreet, Acxiom and Harte-Hanks; as well as ChoicePoint, which is frequently referred to as a competitor by sell-side analysts.

For 2001-2005, EPS is historic and price is based on the average trading price for the respective period. For 2006, EPS is consensus analyst estimate and price is current (through May 1, 2006).

30