February 12, 2025 Fourth Quarter 2024 Earnings Summary MARTIN MIDSTREAM PARTNERS Exhibit 99.2

MMLP 4Q 2024 Adjusted EBITDA Reconciliation & Comparison to Guidance (in millions) Page 2 Terminalling & Storage 4Q24 Guidance 4Q24A Smackover Refinery $4.5 $3.5 Specialty Terminals $3.0 $2.0 Shore-Based Terminals $1.4 $1.3 Underground Storage $0.4 $0.5 Total Terminalling & Storage $9.4 $7.4 Specialty Products 4Q24 Guidance 4Q24A Lubricants $1.6 $1.9 Grease $1.9 $1.9 Propane $0.9 $0.4 Natural Gasoline $0.3 $0.3 Total Specialty Products $4.6 $4.5 Adjusted EBITDA* $32.8 $27.8 Unallocated SG&A $(3.8) $(4.4) Total Adjusted EBITDA $29.0 $23.3 Sulfur Services 4Q24 Guidance 4Q24A Fertilizer $3.2 $4.2 ELSA $0.9 $0.9 Sulfur $3.4 $4.4 Total Sulfur Services $7.6 $9.4 Transportation 4Q24 Guidance 4Q24A Land $6.2 $5.4 Marine $5.0 $1.1 Total Transportation $11.2 $6.5 Note: numbers may not add due to rounding *Pre-Unallocated SG&A Transportation Terminalling & Storage Sulfur Services Specialty Products SG&A Interest Expense 4Q 2024 Actual Net income (loss) $3.7 $1.5 $6.1 $3.7 $(9.1) $(14.9) $(8.9) Interest expense add back — — — — — $14.9 $14.9 Equity in loss of DSM Semichem LLC — — — — $0.3 — $0.3 Income tax expense — — — — $0.6 — $0.6 Operating Income (loss) $3.7 $1.5 $6.1 $3.7 $(8.2) — $6.8 Depreciation and amortization $3.0 $5.9 $3.1 $0.8 — — $12.8 Gain on sale or disposition of property, plant, and equipment $(0.2) — — — — — $(0.3) Transaction expenses related to the potential merger with Martin Resource Management Corporation — — — — $3.7 — $3.7 Non-cash contractual revenue deferral adjustment — — $0.2 — — — $0.2 Unit-based compensation — — — — — — — Adjusted EBITDA and Credit Adjusted EBITDA $6.5 $7.4 $9.4 $4.5 $(4.4) — $23.3

Page 3 MMLP Full-Year 2024 Adjusted EBITDA Comparison (in millions) Terminalling & Storage 2024E 1Q24A 2Q24A 3Q24A 4Q24A 2024A Smackover Refinery $15.5 $4.1 $3.1 $3.8 $3.5 $14.4 Specialty Terminals $11.9 $3.1 $2.9 $2.9 $2.0 $10.9 Shore-Based Terminals $5.9 $1.7 $1.5 $1.3 $1.3 $5.8 Underground Storage $1.5 $0.1 $0.6 $0.4 $0.5 $1.6 Total Terminalling & Storage $34.8 $9.0 $8.0 $8.4 $7.4 $32.8 Specialty Products 2024E 1Q24A 2Q24A 3Q24A 4Q24A 2024A Lubricants $7.8 $1.5 $2.5 $2.2 $1.9 $8.0 Grease $9.0 $2.5 $2.7 $1.9 $1.9 $9.1 Propane $2.7 $1.1 $0.3 $0.4 $0.4 $2.1 Natural Gasoline $1.0 $0.3 $0.3 $0.1 $0.3 $1.0 Total Specialty Products $20.4 $5.4 $5.7 $4.6 $4.5 $20.2 Sulfur Services 2024E 1Q24A 2Q24A 3Q24A 4Q24A 2024A Fertilizer $14.5 $4.2 $6.7 $0.4 $4.2 $15.5 ELSA $0.9 — — — $0.9 $0.9 Sulfur $13.4 $2.5 $3.8 $3.7 $4.4 $14.4 Total Sulfur Services $28.8 $6.7 $10.6 $4.2 $9.4 $30.8 Transportation 2024E 1Q24A 2Q24A 3Q24A 4Q24A 2024A Land $29.9 $9.0 $8.2 $6.5 $5.4 $29.1 Marine $17.2 $4.2 $2.9 $5.1 $1.1 $13.4 Total Transportation $47.2 $13.2 $11.2 $11.6 $6.5 $42.5 Adjusted EBITDA* $131.2 $34.2 $35.5 $28.8 $27.8 $126.3 Unallocated SG&A $(15.1) $(3.8) $(3.8) $(3.7) $(4.4) $(15.7) Total Adjusted EBITDA $116.1 $30.4 $31.7 $25.1 $23.3 $110.6 Included in maintenance capex is $10.9 million of turnaround costs. Included in growth capex is $20.3 million for ELSA. Note: numbers may not add due to rounding *Pre-Unallocated SG&A

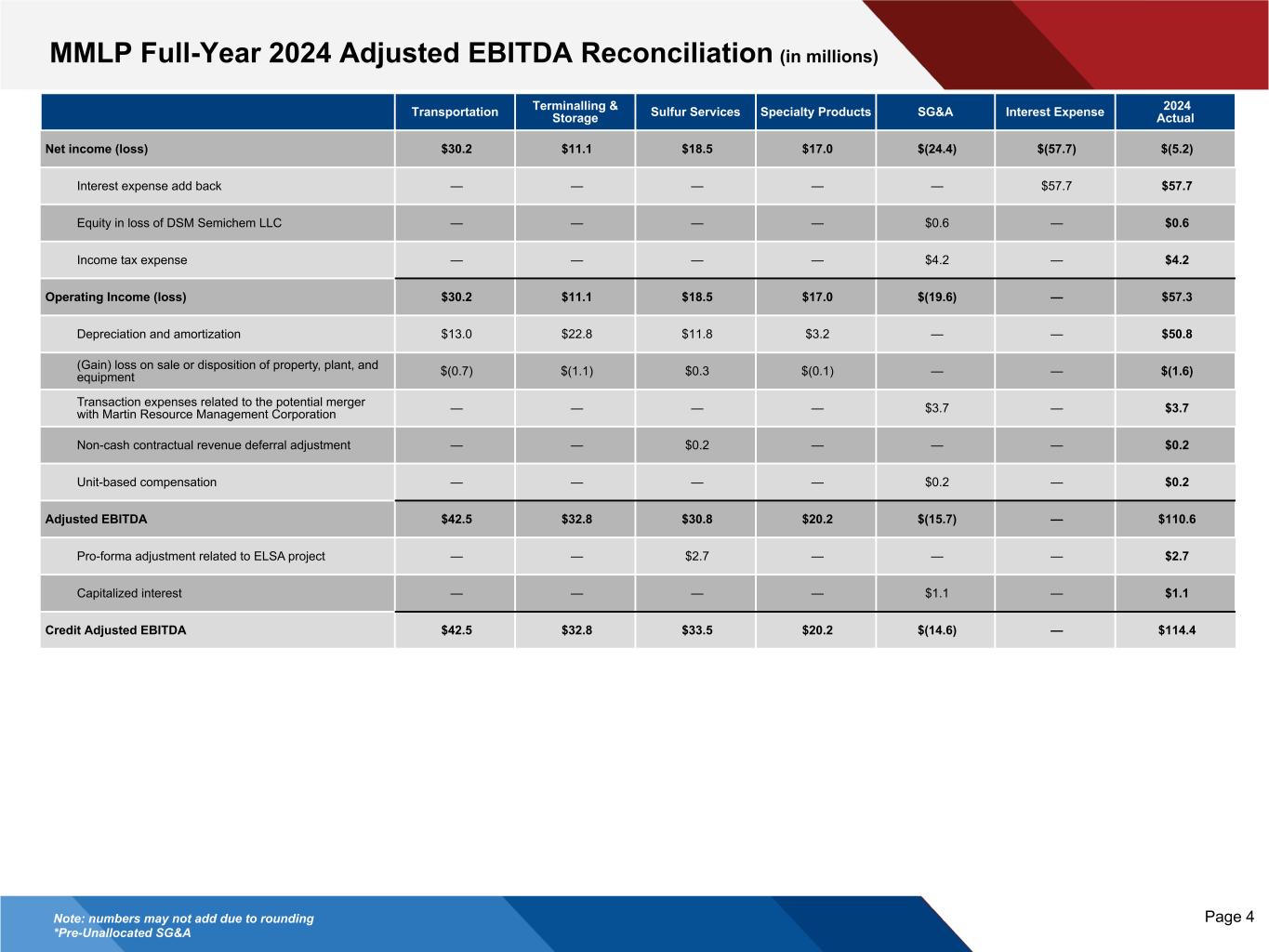

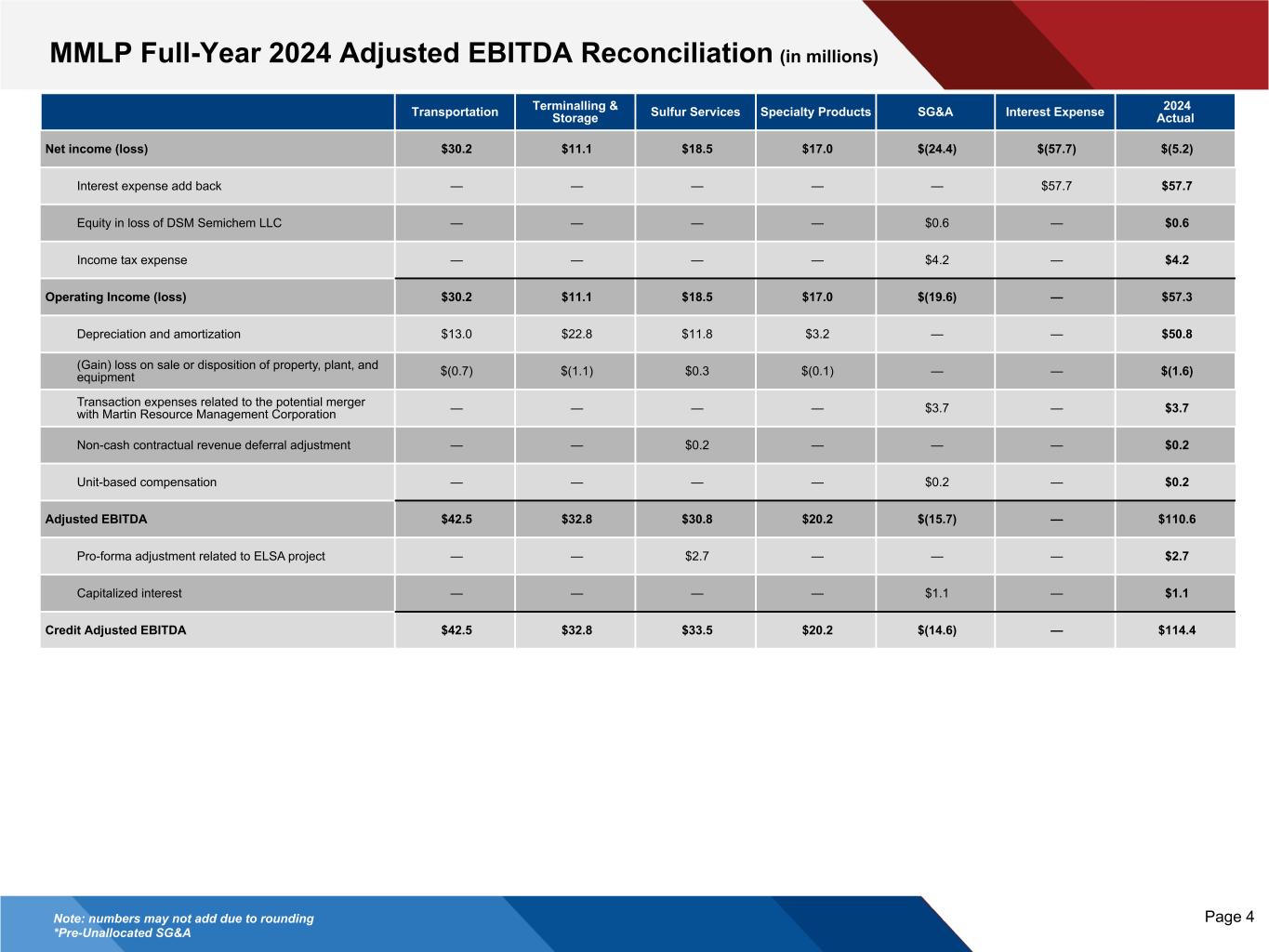

Page 4 Transportation Terminalling & Storage Sulfur Services Specialty Products SG&A Interest Expense 2024 Actual Net income (loss) $30.2 $11.1 $18.5 $17.0 $(24.4) $(57.7) $(5.2) Interest expense add back — — — — — $57.7 $57.7 Equity in loss of DSM Semichem LLC — — — — $0.6 — $0.6 Income tax expense — — — — $4.2 — $4.2 Operating Income (loss) $30.2 $11.1 $18.5 $17.0 $(19.6) — $57.3 Depreciation and amortization $13.0 $22.8 $11.8 $3.2 — — $50.8 (Gain) loss on sale or disposition of property, plant, and equipment $(0.7) $(1.1) $0.3 $(0.1) — — $(1.6) Transaction expenses related to the potential merger with Martin Resource Management Corporation — — — — $3.7 — $3.7 Non-cash contractual revenue deferral adjustment — — $0.2 — — — $0.2 Unit-based compensation — — — — $0.2 — $0.2 Adjusted EBITDA $42.5 $32.8 $30.8 $20.2 $(15.7) — $110.6 Pro-forma adjustment related to ELSA project — — $2.7 — — — $2.7 Capitalized interest — — — — $1.1 — $1.1 Credit Adjusted EBITDA $42.5 $32.8 $33.5 $20.2 $(14.6) — $114.4 Note: numbers may not add due to rounding *Pre-Unallocated SG&A MMLP Full-Year 2024 Adjusted EBITDA Reconciliation (in millions)

Page 5 Guidance Year Ending December 31, 2025 (Unaudited) Adjusted EBITDA by segment: Transportation Segment $35.4 Terminalling and Storage Segment $35.6 Sulfur Services Segment1 $31.9 Specialty Products Segment $20.8 Total segment adjusted EBITDA2 $123.8 Unallocated SG&A $(14.7) Total adjusted EBITDA $109.1 Maintenance capital expenditures and plant turnaround costs: Maintenance capital expenditures $(20.5) Plant turnaround costs $(5.4) Total maintenance capital expenditures and plant turnaround costs $(25.9) Interest expense, net of amortization of deferred debt issuance costs and discount on notes payable $(51.1) Income taxes, net of deferred $(4.2) Total distributable cash flow $27.8 Expansion capital expenditures $(9.0) Principal payments under finance lease obligations $— Total adjusted free cash flow $18.8 Note: numbers may not add due to rounding 1 Includes $2.8 million in adjusted EBITDA related to DSM Semichem LLC 2 Pre-Unallocated SG&A MMLP Full-Year 2025E Guidance (in millions) Included in maintenance capex is $5.4 million of turnaround costs

Page 6 Use of Non-GAAP Financial Measures Forward Looking Statements This presentation includes certain non-GAAP financial measures such as Adjusted EBITDA. These non-GAAP financial measures are not meant to be considered in isolation or as a substitute for results prepared in accordance with accounting principles generally accepted in the United States (GAAP). A reconciliation of non-GAAP financial measures included in this presentation to the most directly comparable financial measures calculated and presented in accordance with GAAP is set forth in the Appendix of this presentation or on our web site at www.MMLP.com. MMLP’s management believes that these non-GAAP financial measures may provide useful information to investors regarding MMLP’s financial condition and results of operations as they provide another measure of the profitability and ability to service its debt and are considered important measures by financial analysts covering MMLP and its peers. The Partnership has not provided comparable GAAP financial information on a forward-looking basis because it would require the Partnership to create estimated ranges on a GAAP basis, which would entail unreasonable effort. Adjustments required to reconcile forward-looking non-GAAP measures cannot be predicted with reasonable certainty but may include, among others, costs related to debt amendments and unusual charges, expenses and gains. Some or all of those adjustments could be significant. Statements about the Partnership’s outlook and all other statements in this release other than historical facts are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements and all references to financial estimates rely on a number of assumptions concerning future events and are subject to a number of uncertainties, including (i) the effects of the continued volatility of commodity prices and the related macroeconomic and political environment (ii) uncertainties relating to the Partnership’s future cash flows and operations, (iii) the Partnership’s ability to pay future distributions, (iv) future market conditions, (v) current and future governmental regulation, (vi) future taxation, and (vii) other factors, many of which are outside its control, which could cause actual results to differ materially from such statements. While the Partnership believes that the assumptions concerning future events are reasonable, it cautions that there are inherent difficulties in anticipating or predicting certain important factors. A discussion of these factors, including risks and uncertainties, is set forth in the Partnership’s annual and quarterly reports filed from time to time with the Securities and Exchange Commission. The Partnership disclaims any intention or obligation to revise any forward-looking statements, including financial estimates, whether as a result of new information, future events, or otherwise except where required to do so by law. Disclaimers

Martin Midstream Partners 4200 B Stone Road Kilgore, Texas 75662 903.983.6200 www.MMLP.com