Supplemental Operating and Financial Data

For the Quarter Ended June 30, 2015

About the Company

TIER REIT, Inc. is a self-managed, Dallas, Texas-based real estate investment trust whose goal is to maximize total return to stockholders through the combination of stock appreciation and income derived from a sustainable distribution. TIER’s investment strategy is to acquire, develop, and operate a portfolio of best-in-class office properties in select markets across the U.S. that consistently lead the nation in population and office-using employment growth. As of June 30, 2015, we owned interests in 31 operating office properties, one recently developed non-operating office property and one retail property, located in 16 markets throughout the United States with a total of 12.4 million rentable square feet.

Senior Management

|

| | |

| Scott W. Fordham | | Chief Executive Officer and President |

| Dallas E. Lucas | | Chief Financial Officer and Treasurer |

| William J. Reister | | Chief Investment Officer and Executive Vice President |

| Telisa Webb Schelin | | Chief Legal Officer, Executive Vice President and Secretary |

| James E. Sharp | | Chief Accounting Officer and Executive Vice President |

| R. Heath Johnson | | Managing Director - Asset Management |

| Dean R. Hook | | Senior Vice President - Information Systems |

Where to Get More Information: |

| | |

| Kelly Sargent | | Vice President - Investor Relations |

By Phone:

(972) 483-2400

By Email:

ir@tierreit.com

By Mail:

17300 Dallas Parkway, Suite 1010

Dallas, Texas 75248

as of September 14, 2015, please contact us at our new address:

5950 Sherry Lane, Suite 700

Dallas, Texas 75225

Website:

www.tierreit.com

Supplemental Operating and Financial Data

For the Quarter Ended June 30, 2015

Table of Contents:

|

| | |

| Overview and Highlights | |

| Overview | 1 |

|

| Financial Highlights | 2-3 |

|

| Consolidated Balance Sheets | 4 |

|

| Consolidated Statements of Operations | 5 |

|

| Consolidated Statements of Discontinued Operations | 6 |

|

| Calculation of FFO and FAD | 7 |

|

| Calculation of EBITDA | 8 |

|

| Joint Venture Financial Summary | 9 |

|

| Same Store Analysis | 10 |

|

| Schedule of Properties Owned | 11 |

|

| Net Operating Income by Market | 12 |

|

| Components of Net Asset Value | 13 |

|

| Selected Non-Stabilized Properties | 14 |

|

| Significant Tenants | 15 |

|

| Industry Diversification | 16 |

|

| | |

| Leasing | |

| Leasing Activity | 17-18 |

|

| Lease Expirations | 19-20 |

|

| Occupancy Trends | 21 |

|

| | |

| Capital Expenditures | |

| Leasing Cost Analysis | 22 |

|

| Leasing Cost Trend Analysis | 23 |

|

| Development, Leasing, and Capital Expenditures Summary | 24 |

|

| | |

| Other Information | |

| Potential Future Development Sites | 25 |

|

| Acquisition and Disposition Activities | 26 |

|

| Summary of Financing | 27 |

|

| Principal Payments by Year | 28 |

|

| Definitions of Non-GAAP Financial Measures | 29-30 |

|

Forward Looking Statements

This supplemental operating and financial data report contains forward-looking statements relating to the business and financial outlook of TIER REIT, Inc. that are based on current expectations, estimates, forecasts, and projections and are not guarantees of future performance. Statements contained herein may be impacted by a number of risks and uncertainties, including the company’s ability to rent space on favorable terms, its ability to address debt maturities and fund its capital requirements, the value of its assets, its anticipated capital expenditures, and other matters. Actual results may differ materially from those expressed in these forward-looking statements, and you should not place undue reliance on any such statements. A number of important factors could cause actual results to differ materially from the forward-looking statements contained in this document, as well as other factors described in the Risk Factors section of TIER REIT, Inc.’s Annual Report on Form 10-K for the year ended December 31, 2014, and subsequent Quarterly Report on Form 10-Q for the quarter ended June 30, 2015. Forward-looking statements in this document speak only as of the date on which such statements were made, and we undertake no obligation to update any such statements that may become untrue because of subsequent events.

Overview

For the Quarter Ended June 30, 2015

Quarterly Highlights and Financial Results

| |

| • | FFO attributable to common stockholders, excluding certain items for the second quarter of 2015 was $17.2 million, as compared to $17.4 million for the first quarter of 2015, a decrease of $0.2 million, or 1.1% |

| |

| • | Same Store GAAP NOI for the second quarter of 2015 was $31.5 million, as compared to $29.4 million for the second quarter of 2014, an increase of $2.1 million, or 7.1% |

| |

| • | Same Store Cash NOI for the second quarter of 2015 and 2014 were each $27.6 million. |

Property Results

| |

| • | Occupancy at June 30, 2015, was 89.0%, an increase of 60 basis points from March 31, 2015 |

| |

| • | Leased 857,000 square feet - 622,000 square feet of renewals, 91,000 square feet of expansion space, and 144,000 square feet of new leasing |

Real Estate Activities

| |

| • | Sold Fifth Third Center (Cleveland, Ohio) for $52.8 million, resulting in a $6.1 million gain |

| |

| • | Sold 1650 Arch Street and United Plaza (Philadelphia, Pennsylvania) for $190.8 million, resulting in a combined gain on sale of $27.5 million |

| |

| • | Sold Colorado Building and 1325 G Street (Washington, D.C.) for $202.0 million, to two separate entities in which we maintain a 10% ownership interest resulting in a combined gain on sale of $17.1 million |

| |

| • | Acquired a 95% interest in a land development project in the central business district of Austin,Texas, for $7.5 million |

| |

| • | Acquired a 95% interest in a land development project in the Legacy Town Center submarket of Plano (Dallas),Texas, for $6.2 million |

Capital Market Activities

| |

| • | Paid off $496.0 million of CMBS debt secured by six properties |

| |

| • | Amended credit facility adding a seven-year $275.0 million term loan that matures in June 2022, with an initial swapped-to-fixed interest rate of 3.67% |

| |

| • | Reduced our 2015 and 2016 debt maturities to $47.5 million and $237.4 million, respectively |

| |

| • | On July 23, 2015, we listed our common stock on the NYSE under the ticker symbol “TIER” |

|

| | |

Supplemental Operating and Financial Data | TIER REIT | 2nd Quarter Page 1 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Financial Highlights |

| (in thousands, except per share data, effective rent data, and number of properties) |

| | | | | | | | | | | | | | | |

| | 30-Jun-15 | | 30-Jun-14 | | | 30-Jun-15 | | 31-Mar-15 | | 31-Dec-14 | | 30-Sep-14 | | 30-Jun-14 |

| Portfolio Summary: | | | | | | | | | | | | | | |

| (at our ownership %, unless otherwise noted) | | | | | | | | | | | | | | |

| Total operating office properties | 31 |

| | 38 |

| | | 31 |

| | 34 |

| | 37 |

| | 37 |

| | 38 |

|

| Rentable square feet (100%) (operating properties) | 11,946 |

| | 15,501 |

| | | 11,946 |

| | 13,624 |

| | 14,304 |

| | 15,291 |

| | 15,501 |

|

| Rentable square feet (own %) (operating properties) | 10,418 |

| | 14,364 |

| | | 10,418 |

| | 12,487 |

| | 13,167 |

| | 14,154 |

| | 14,364 |

|

| Occupancy % | 89 | % | | 86 | % | | | 89 | % | | 88 | % | | 88 | % | | 87 | % | | 86 | % |

| Executed % SF leased | 89 | % | | 87 | % | | | 89 | % | | 90 | % | | 89 | % | | 89 | % | | 87 | % |

| Economic % SF leased | 82 | % | | 81 | % | | | 82 | % | | 82 | % | | 82 | % | | 82 | % | | 81 | % |

| Average effective rent/square feet | $ | 24.94 |

| | $ | 25.79 |

| | | $ | 24.94 |

| | $ | 25.95 |

| | $ | 26.02 |

| | $ | 26.13 |

| | $ | 25.79 |

|

| | | | | | | | | | | | | | | |

| | Six Months Ended | | | Three Months Ended |

| | 30-Jun-15 | | 30-Jun-14 | | | 30-Jun-15 | | 31-Mar-15 | | 31-Dec-14 | | 30-Sep-14 | | 30-Jun-14 |

| Financial Results: | | | | | | | | | | | | | | |

| Revenue | $ | 145,857 |

| | $ | 141,294 |

| | | $ | 70,038 |

| | $ | 75,819 |

| | $ | 74,616 |

| | $ | 72,157 |

| | $ | 71,234 |

|

| Base rent | $ | 108,259 |

| | $ | 104,343 |

| | | $ | 51,336 |

| | $ | 56,923 |

| | $ | 54,771 |

| | $ | 53,141 |

| | $ | 52,305 |

|

| Free rent | $ | (10,538 | ) | | $ | (5,085 | ) | | | $ | (5,365 | ) | | $ | (5,173 | ) | | $ | (3,717 | ) | | $ | (2,284 | ) | | $ | (2,518 | ) |

| NOI | $ | 73,522 |

| | $ | 68,153 |

| | | $ | 36,858 |

| | $ | 36,664 |

| | $ | 38,116 |

| | $ | 36,192 |

| | $ | 35,547 |

|

| Net income (loss) attributable to common stockholders (2) | $ | (7,043 | ) | | $ | (46,893 | ) | | | $ | (1,151 | ) | | $ | (5,892 | ) | | $ | 45,806 |

| | $ | (16,355 | ) | | $ | (17,279 | ) |

| Diluted earnings (loss) per common share (1) (2) | $ | (0.14 | ) | | $ | (0.94 | ) | | | $ | (0.02 | ) | | $ | (0.12 | ) | | $ | 0.92 |

| | $ | (0.33 | ) | | $ | (0.35 | ) |

| FFO attributable to common stockholders | $ | (1,147 | ) | | $ | 33,536 |

| | | $ | (18,051 | ) | | $ | 16,904 |

| | $ | 3,107 |

| | $ | 17,071 |

| | $ | 19,066 |

|

| Diluted FFO per common share (2) | $ | (0.02 | ) | | $ | 0.67 |

| | | $ | (0.36 | ) | | $ | 0.34 |

| | $ | 0.06 |

| | $ | 0.34 |

| | $ | 0.38 |

|

| FFO attributable to common stockholders, excluding certain items | $ | 34,625 |

| | $ | 33,536 |

| | | $ | 17,181 |

| | $ | 17,444 |

| | $ | 17,889 |

| | $ | 18,020 |

| | $ | 19,066 |

|

| Diluted FFO, excluding certain items per common share (2) | $ | 0.69 |

| | $ | 0.67 |

| | | $ | 0.34 |

| | $ | 0.35 |

| | $ | 0.36 |

| | $ | 0.36 |

| | $ | 0.38 |

|

| FAD attributable to common stockholders | $ | 380 |

| | $ | (3,992 | ) | | | $ | (1,176 | ) | | $ | 1,556 |

| | $ | (2,656 | ) | | $ | 1,958 |

| | $ | 1,505 |

|

| FAD per common share (2) | $ | 0.01 |

| | $ | (0.08 | ) | | | $ | (0.02 | ) | | $ | 0.03 |

| | $ | (0.05 | ) | | $ | 0.04 |

| | $ | 0.03 |

|

| Normalized EBITDA | $ | 70,511 |

| | $ | 77,449 |

| | | $ | 33,439 |

| | $ | 37,072 |

| | $ | 41,294 |

| | $ | 40,094 |

| | $ | 41,090 |

|

| Weighted average common shares outstanding - basic (2) | 49,892 |

| | 49,874 |

| | | 49,893 |

| | 49,891 |

| | 49,877 |

| | 49,877 |

| | 49,877 |

|

| Weighted average common shares outstanding - diluted (2) | 50,076 |

| | 50,001 |

| | | 50,085 |

| | 50,066 |

| | 49,996 |

| | 49,996 |

| | 49,937 |

|

| | | | | | | | | | | | | | | |

| Selected Additional Trend Information: | | | | | | | | | | | | | | |

| Renewal % based on square feet | 81 | % | | 58 | % | | | 83 | % | | 74 | % | | 89 | % | | 75 | % | | 49 | % |

| Distributions declared on common shares | $ | 9,011 |

| | $ | — |

| | | $ | 9,011 |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

|

| Annualized distribution yield (3) | 1.3 | % | | 0.0 | % | | | 2.7 | % | | 0.0 | % | | 0.0 | % | | 0.0 | % | | 0.0 | % |

(1) In periods of net loss from continuing operations or negative FFO attributable to common stockholders there are no dilutive securities and diluted earnings (loss) per common share or diluted FFO per common share is calculated using weighted average common shares outstanding - basic as the denominator.

(2) All periods presented have been adjusted to reflect the one-for-six reverse stock split that occurred on June 2, 2015.

(3) Based on the October 30, 2014, estimated per share value of our common stock.

Occupancy % represents the total square footage subject to commenced leases as of the reporting date as a percentage of the total rentable square feet (at our ownership interest).

Executed % SF leased represents the total square footage subject to commenced leases plus the square footage for currently vacant space that is subject to executed leases that have not commenced as of the reporting date as a percentage of the total rentable square feet (at our ownership interest).

Economic % SF leased represents the total square footage subject to commenced leases as of the reporting date adjusted to exclude the square footage associated with leases receiving rental abatements as a percentage of the total rentable square feet (at our ownership interest).

Average effective rent represents 12 times the sum of the monthly contractual amounts for base rent and the pro rata budgeted operating expense reimbursements, as of period end, related to leases in place as of period end, as reduced for free rent and excluding any scheduled future rent increases, as adjusted for our ownership interest.

This section includes non-GAAP financial measures, which are accompanied by what we consider the most directly comparable financial measures calculated and presented in accordance with GAAP. Quantitative reconciliations of the differences between the non-GAAP financial measures presented and the most directly comparable GAAP financial measures are shown on pages 7-8. A description of the non-GAAP financial measures we present and a statement of the reasons why management believes the non-GAAP measures provide useful information to investors about the Company’s financial condition and results of operations can be found on pages 29-30.

|

| | |

Supplemental Operating and Financial Data | TIER REIT | 2nd Quarter Page 2 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Financial Highlights (continued) |

| (in thousands) |

| | | | | | | |

| | 30-Jun-15 | | 30-Jun-14 | | | 30-Jun-15 | | 31-Mar-15 | | 31-Dec-14 | | 30-Sep-14 | | 30-Jun-14 |

| Selected Balance Sheet Items: | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Total book value of real estate (1) | $ | 1,488,373 |

| | $ | 2,029,715 |

| | | $ | 1,488,373 |

| | $ | 1,609,953 |

| | $ | 1,768,766 |

| | $ | 2,008,569 |

| | $ | 2,029,715 |

|

| | | | | | | | | | | | | | | |

| Cash and cash equivalents | $ | 153,158 |

| | $ | 1,183 |

| | | $ | 153,158 |

| | $ | 5,764 |

| | $ | 31,442 |

| | $ | 923 |

| | $ | 1,183 |

|

| | | | | | | | | | | | | | | |

| Unconsolidated cash and cash equivalents (at ownership %) | $ | 3,368 |

| | $ | 3,127 |

| | | $ | 3,368 |

| | $ | 2,480 |

| | $ | 3,355 |

| | $ | 3,621 |

| | $ | 3,127 |

|

| | | | | | | | | | | | | | | |

| Restricted cash | $ | 29,620 |

| | $ | 47,404 |

| | | $ | 29,620 |

| | $ | 32,761 |

| | $ | 35,324 |

| | $ | 49,654 |

| | $ | 47,404 |

|

| | | | | | | | | | | | | | | |

| Total assets | $ | 1,919,743 |

| | $ | 2,363,565 |

| | | $ | 1,919,743 |

| | $ | 2,116,165 |

| | $ | 2,211,183 |

| | $ | 2,340,502 |

| | $ | 2,363,565 |

|

| | | | | | | | | | | | | | | |

| Mortgage notes payable (1) | $ | 505,224 |

| | $ | 1,470,951 |

| | | $ | 505,224 |

| | $ | 903,475 |

| | $ | 1,069,085 |

| | $ | 1,445,017 |

| | $ | 1,470,951 |

|

| | | | | | | | | | | | | | | |

| Revolving credit facility and term loan | $ | 525,000 |

| | $ | — |

| | | $ | 525,000 |

| | $ | 221,000 |

| | $ | 125,000 |

| | $ | 20,000 |

| | $ | — |

|

| | | | | | | | | | | | | | | |

| Notes payable classified as held for sale | $ | — |

| | $ | — |

| | | $ | — |

| | $ | 96,824 |

| | $ | 97,257 |

| | $ | — |

| | $ | — |

|

| | | | | | | | | | | | | | | |

| Unconsolidated debt (at ownership %) | $ | 72,392 |

| | $ | 60,988 |

| | | $ | 72,392 |

| | $ | 59,870 |

| | $ | 60,253 |

| | $ | 60,625 |

| | $ | 60,988 |

|

| | | | | | | | | | | | | | | |

| Total liabilities | $ | 1,144,786 |

| | $ | 1,606,773 |

| | | $ | 1,144,786 |

| | $ | 1,338,198 |

| | $ | 1,423,023 |

| | $ | 1,599,724 |

| | $ | 1,606,773 |

|

| | | | | | | | | | | | | | | |

| Common stock outstanding (5) | 49,872 |

| | 49,877 |

| | | 49,872 |

| | 49,901 |

| | 49,877 |

| | 49,877 |

| | 49,877 |

|

| | | | | | | | | | | | | | | |

| OP units and vested restricted stock units outstanding (5) | 76 |

| | 72 |

| | | 76 |

| | 78 |

| | 78 |

| | 78 |

| | 72 |

|

| | | | | | | | | | | | | | | |

| Restricted stock outstanding (5) | 192 |

| | 119 |

| | | 192 |

| | 192 |

| | 119 |

| | 119 |

| | 119 |

|

| | | | | | | | | | | | | | | |

| Capitalization: |

| |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Market capitalization (2) | $ | 1,342,602 |

| | $ | 1,258,726 |

| | | $ | 1,342,602 |

| | $ | 1,343,444 |

| | $ | 1,342,808 |

| | $ | 1,258,883 |

| | $ | 1,258,726 |

|

| | | | | | | | | | | | | | | |

| Total debt (3) | $ | 1,102,616 |

| | $ | 1,531,939 |

| | | $ | 1,102,616 |

| | $ | 1,281,169 |

| | $ | 1,351,595 |

| | $ | 1,525,642 |

| | $ | 1,531,939 |

|

| | | | | | | | | | | | | | | |

| Net debt (4) | $ | 946,090 |

| | $ | 1,527,629 |

| | | $ | 946,090 |

| | $ | 1,272,925 |

| | $ | 1,316,798 |

| | $ | 1,521,098 |

| | $ | 1,527,629 |

|

| | | | | | | | | | | | | | | |

| Total capitalization | $ | 2,445,218 |

| | $ | 2,790,665 |

| | | $ | 2,445,218 |

| | $ | 2,624,613 |

| | $ | 2,694,403 |

| | $ | 2,784,525 |

| | $ | 2,790,665 |

|

| | | | | | | | | | | | | | | |

| Net debt/total capitalization | 39 | % | | 55 | % | | | 39 | % | | 48 | % | | 49 | % | | 55 | % | | 55 | % |

| | | | | | | | | | | | | | | |

| | Six Months Ended | | | Three Months Ended |

| | 30-Jun-15 | | 30-Jun-14 | | | 30-Jun-15 | | 31-Mar-15 | | 31-Dec-14 | | 30-Sep-14 | | 30-Jun-14 |

| Ratios: | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| NOI margin % | 50.4 | % | | 48.2 | % | | | 52.6 | % | | 48.4 | % | | 51.1 | % | | 50.2 | % | | 49.9 | % |

| | | | | | | | | | | | | | | |

| Normalized fixed charge coverage | 1.77 |

| | 1.42 |

| | | 1.78 |

| | 1.76 |

| | 1.54 |

| | 1.46 |

| | 1.51 |

|

| | | | | | | | | | | | | | | |

| Normalized interest coverage | 2.06 |

| | 1.74 |

| | | 2.05 |

| | 2.06 |

| | 1.90 |

| | 1.79 |

| | 1.83 |

|

| | | | | | | | | | | | | | | |

| Net debt/normalized annualized estimated full period EBITDA from properties owned at period end | N/A |

| | N/A |

| | | 7.75x |

| | 8.94x |

| | 8.43x |

| | 9.56x |

| | 9.30x |

|

| | | | | | | | | | | | | | | |

| (1) Excludes book value of real estate and notes payable classified as held for sale. | | | |

| (2) Market capitalization is equal to outstanding shares (common stock, OP units, and vested restricted stock units, as if converted) times our estimated stock value of $25.20 per share through October 2014 or $26.88 per share beginning in November 2014, as reported in Quarterly Reports on Form 10-Q filed on November 5, 2013, and November 3, 2014, respectively and reflect the one-for-six reverse stock split that occurred on June 2, 2015. |

| (3) Includes book value of mortgage notes payable, the revolving credit facility and term loan, notes payable classified as held for sale, and TIER REIT’s ownership share of unconsolidated debt. |

| (4) Total debt less cash and cash equivalents. |

| (5) All periods presented have been adjusted to reflect the one-for-six reverse stock split that occurred on June 2, 2015. |

|

| | |

Supplemental Operating and Financial Data | TIER REIT | 2nd Quarter Page 3 |

|

| | | | | | | | | | | | | | | | | | | | | | | |

| Consolidated Balance Sheets |

| (in thousands, except share and per share data) |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | 30-Jun-15 | | 31-Mar-15 | | 31-Dec-14 | | 30-Sep-14 | | 30-Jun-14 |

| Assets | | | | | | | | | | | |

| | Real estate | | | | | | | | | | |

| | Land | | | $ | 167,231 |

| | $ | 249,030 |

| | $ | 286,430 |

| | $ | 318,058 |

| | $ | 316,897 |

|

| | Land held for development | | 6,377 |

| | — |

| | — |

| | — |

| | — |

|

| | Buildings and improvements, net | | 1,314,765 |

| | 1,360,923 |

| | 1,482,336 |

| | 1,690,511 |

| | 1,644,088 |

|

| | Real estate under development | | — |

| | — |

| | — |

| | — |

| | 68,730 |

|

| | Total real estate | | 1,488,373 |

| | 1,609,953 |

| | 1,768,766 |

| | 2,008,569 |

| | 2,029,715 |

|

| | | | | | | | | | | | | | |

| | Cash and cash equivalents | | 153,158 |

| | 5,764 |

| | 31,442 |

| | 923 |

| | 1,183 |

|

| | Restricted cash | | 29,620 |

| | 32,761 |

| | 35,324 |

| | 49,654 |

| | 47,404 |

|

| | Accounts receivable, net | | 71,877 |

| | 75,466 |

| | 83,380 |

| | 100,601 |

| | 99,272 |

|

| | Prepaid expenses and other assets | | 31,890 |

| | 7,222 |

| | 7,129 |

| | 8,033 |

| | 7,234 |

|

| | Investments in unconsolidated entities | | 44,780 |

| | 39,422 |

| | 39,885 |

| | 41,420 |

| | 41,443 |

|

| | Deferred financing fees, net | | 13,292 |

| | 10,690 |

| | 10,783 |

| | 7,130 |

| | 8,101 |

|

| | Acquired above-market leases, net | | 1,619 |

| | 163 |

| | 2,019 |

| | 4,442 |

| | 5,229 |

|

| | Other lease intangibles, net | | 74,850 |

| | 77,480 |

| | 92,671 |

| | 117,556 |

| | 121,781 |

|

| | Other intangible assets, net | | 10,284 |

| | 2,114 |

| | 2,144 |

| | 2,174 |

| | 2,203 |

|

| | Assets associated with real estate held for sale | | — |

| | 255,130 |

| | 137,640 |

| | — |

| | — |

|

| Total assets | | $ | 1,919,743 |

| | $ | 2,116,165 |

| | $ | 2,211,183 |

| | $ | 2,340,502 |

| | $ | 2,363,565 |

|

| | | | | | | | | | | | | | |

| Liabilities and equity | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Liabilities: | | | | | | | | | | | |

| | Notes payable | | $ | 505,196 |

| | $ | 903,688 |

| | $ | 1,069,323 |

| | $ | 1,445,018 |

| | $ | 1,470,974 |

|

| | Term loan | | | 525,000 |

| | 125,000 |

| | 125,000 |

| | — |

| | — |

|

| | Revolving credit facility | | — |

| | 96,000 |

| | — |

| | 20,000 |

| | — |

|

| | Unamortized mark to market premium (discount) | | 28 |

| | (213 | ) | | (238 | ) | | (1 | ) | | (23 | ) |

| | Total notes payable | | 1,030,224 |

| | 1,124,475 |

| | 1,194,085 |

| | 1,465,017 |

| | 1,470,951 |

|

| | | | | | | | | | | | | | |

| | Accounts payable | | 2,192 |

| | 1,118 |

| | 2,790 |

| | 5,543 |

| | 6,549 |

|

| | Payables to related parties | | 794 |

| | 2,257 |

| | 2,041 |

| | 1,820 |

| | 1,650 |

|

| | Accrued liabilities | | 64,794 |

| | 65,713 |

| | 77,375 |

| | 86,174 |

| | 84,696 |

|

| | Acquired below-market leases, net | | 12,773 |

| | 14,381 |

| | 16,984 |

| | 19,618 |

| | 21,318 |

|

| | Deferred tax liabilities | | 2,507 |

| | 2,551 |

| | 2,880 |

| | 760 |

| | 923 |

|

| | Other liabilities | | 22,474 |

| | 23,246 |

| | 18,525 |

| | 20,792 |

| | 20,686 |

|

| | Distributions payable | | 9,028 |

| | — |

| | — |

| | — |

| | — |

|

| | Obligations associated with real estate held for sale | | — |

| | 104,457 |

| | 108,343 |

| | — |

| | — |

|

| Total liabilities | | 1,144,786 |

| | 1,338,198 |

| | 1,423,023 |

| | 1,599,724 |

| | 1,606,773 |

|

| Commitments and contingencies | | | | | | | | | | |

| Series A Convertible Preferred Stock | | 4,626 |

| | 4,626 |

| | 4,626 |

| | 2,700 |

| | 2,700 |

|

| Equity: | | | | | | | | | | | |

| | Preferred stock | | — |

| | — |

| | — |

| | — |

| | — |

|

| | Convertible stock | | — |

| | — |

| | — |

| | — |

| | — |

|

| | Common stock, $.0001 par value per share, 382,499,000 shares authorized (1) | 5 |

| | 5 |

| | 5 |

| | 5 |

| | 5 |

|

| | Additional paid-in capital (1) | | 2,645,825 |

| | 2,646,147 |

| | 2,645,927 |

| | 2,647,535 |

| | 2,647,215 |

|

| | Cumulative distributions and net loss attributable to common stockholders | (1,878,611 | ) | | (1,868,447 | ) | | (1,862,555 | ) | | (1,910,287 | ) | | (1,893,932 | ) |

| | Accumulated other comprehensive income (loss) | | 799 |

| | (5,336 | ) | | (788 | ) | | — |

| | — |

|

| | Stockholders’ equity | | 768,018 |

| | 772,369 |

| | 782,589 |

| | 737,253 |

| | 753,288 |

|

| | Noncontrolling interests | | 2,313 |

| | 972 |

| | 945 |

| | 825 |

| | 804 |

|

| Total equity | | 770,331 |

| | 773,341 |

| | 783,534 |

| | 738,078 |

| | 754,092 |

|

| Total liabilities and equity | | $ | 1,919,743 |

| | $ | 2,116,165 |

| | $ | 2,211,183 |

| | $ | 2,340,502 |

| | $ | 2,363,565 |

|

| | | | | | | | | | | | |

| Common stock, number of shares issued and outstanding (1) | | 49,871,776 |

| | 49,901,013 |

| | 49,877,350 |

| | 49,877,350 |

| | 49,877,350 |

|

| | | | | | | | | | | | | | |

| (1) All periods have been adjusted to reflect the one-for-six reverse stock split that occurred on June 2, 2015. |

|

| | |

Supplemental Operating and Financial Data | TIER REIT | 2nd Quarter Page 4 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Consolidated Statements of Operations |

| | (in thousands, except share and per share amounts) |

| | | | | | | | |

| | | | | | | | |

| | | Six Months Ended | | | Three Months Ended |

| | | 30-Jun-15 | | 30-Jun-14 | | | 30-Jun-15 | | 31-Mar-15 | | 31-Dec-14 | | 30-Sep-14 | | 30-Jun-14 |

| Revenue | | | | | | | | | | | | | | |

| | Rental income | $ | 135,557 |

| | $ | 135,653 |

| | | $ | 63,953 |

| | $ | 71,604 |

| | $ | 69,973 |

| | $ | 69,857 |

| | $ | 68,308 |

|

| | Straight-line rent revenue adjustment | 6,630 |

| | 2,940 |

| | | 4,339 |

| | 2,291 |

| | 2,618 |

| | 772 |

| | 1,312 |

|

| | Lease incentives | 478 |

| | 189 |

| | | 286 |

| | 192 |

| | 528 |

| | 77 |

| | 151 |

|

| | Above- and below-market rent amortization | 2,522 |

| | 1,816 |

| | | 1,335 |

| | 1,187 |

| | 955 |

| | 532 |

| | 887 |

|

| | Lease termination fees | 670 |

| | 696 |

| | | 125 |

| | 545 |

| | 542 |

| | 919 |

| | 576 |

|

| | Total revenue | 145,857 |

| | 141,294 |

| | | 70,038 |

| | 75,819 |

| | 74,616 |

| | 72,157 |

| | 71,234 |

|

| Expenses | | | | | | | | | | | | | | |

| | Property related expenses | 46,056 |

| | 48,634 |

| | | 20,877 |

| | 25,179 |

| | 24,358 |

| | 22,464 |

| | 23,283 |

|

| | Real estate taxes | 21,842 |

| | 20,256 |

| | | 10,198 |

| | 11,644 |

| | 9,944 |

| | 11,272 |

| | 10,276 |

|

| | Property management fees | 4,437 |

| | 4,251 |

| | | 2,105 |

| | 2,332 |

| | 2,198 |

| | 2,229 |

| | 2,128 |

|

| | Total property operating expenses | 72,335 |

| | 73,141 |

| | | 33,180 |

| | 39,155 |

| | 36,500 |

| | 35,965 |

| | 35,687 |

|

| | Interest expense | 30,232 |

| | 32,240 |

| | | 14,591 |

| | 15,641 |

| | 16,390 |

| | 16,033 |

| | 16,133 |

|

| | Amortization of deferred financing costs | 1,807 |

| | 1,136 |

| | | 899 |

| | 908 |

| | 782 |

| | 654 |

| | 666 |

|

| | Amortization of mark to market | (57 | ) | | 38 |

| | | (30 | ) | | (27 | ) | | 82 |

| | 19 |

| | 19 |

|

| | Total interest expense | 31,982 |

| | 33,414 |

| | | 15,460 |

| | 16,522 |

| | 17,254 |

| | 16,706 |

| | 16,818 |

|

| | General and administrative | 10,793 |

| | 8,646 |

| | | 5,412 |

| | 5,381 |

| | 4,695 |

| | 4,147 |

| | 4,300 |

|

| | BHT Advisors termination fee and HPT Management buyout fee | 10,200 |

| | — |

| | | 10,200 |

| | — |

| | — |

| | — |

| | — |

|

| | Listing costs | 2,991 |

| | — |

| | | 2,488 |

| | 503 |

| | 104 |

| | — |

| | — |

|

| | Amortization of restricted shares and units | 1,099 |

| | 665 |

| | | 564 |

| | 535 |

| | 363 |

| | 369 |

| | 311 |

|

| | Straight-line rent expense adjustment | (14 | ) | | (10 | ) | | | (7 | ) | | (7 | ) | | (6 | ) | | (5 | ) | | (5 | ) |

| | Acquisition expense | 815 |

| | — |

| | | 813 |

| | 2 |

| | 86 |

| | 4 |

| | — |

|

| | Asset impairment losses | 132 |

| | 8,225 |

| | | — |

| | 132 |

| | 4,940 |

| | — |

| | — |

|

| | Real estate depreciation and amortization | 61,103 |

| | 58,103 |

| | | 31,081 |

| | 30,022 |

| | 31,682 |

| | 29,885 |

| | 29,182 |

|

| | Total expenses | 191,436 |

| | 182,184 |

| | | 99,191 |

| | 92,245 |

| | 95,618 |

| | 87,071 |

| | 86,293 |

|

| | Interest and other income | 286 |

| | 344 |

| | | 141 |

| | 145 |

| | 81 |

| | 88 |

| | 96 |

|

| | Loss on early extinguishment of debt | (21,448 | ) | | — |

| | | (21,412 | ) | | (36 | ) | | (426 | ) | | — |

| | — |

|

| Loss from continuing operations before income taxes, equity | | | | | | | | | | | | | | |

| | in operations of investments, and gain on sale of assets | (66,741 | ) | | (40,546 | ) | | | (50,424 | ) | | (16,317 | ) | | (21,347 | ) | | (14,826 | ) | | (14,963 | ) |

| | Benefit (provision) for income taxes | (1,262 | ) | | (9 | ) | | | (1,338 | ) | | 76 |

| | 73 |

| | (36 | ) | | 59 |

|

| | Equity in operations of investments | 312 |

| | 883 |

| | | 69 |

| | 243 |

| | 522 |

| | 431 |

| | 795 |

|

| Loss from continuing operations before gain on sale of assets | (67,691 | ) | | (39,672 | ) | | | (51,693 | ) | | (15,998 | ) | | (20,752 | ) | | (14,431 | ) | | (14,109 | ) |

| Discontinued operations: | | | | | | | | | | | | | | |

| | Income (loss) from discontinued operations | 1,369 |

| | (7,285 | ) | | | (121 | ) | | 1,490 |

| | (17,634 | ) | | (5,975 | ) | | (3,191 | ) |

| | Gain on sale of discontinued operations | 14,683 |

| | — |

| | | 6,077 |

| | 8,606 |

| | 86,195 |

| | 4,026 |

| | — |

|

| Income (loss) from discontinued operations | 16,052 |

| | (7,285 | ) | | | 5,956 |

| | 10,096 |

| | 68,561 |

| | (1,949 | ) | | (3,191 | ) |

| Gain on sale of assets | 44,564 |

| | — |

| | | 44,564 |

| | — |

| | — |

| | — |

| | — |

|

| Net income (loss) | (7,075 | ) | | (46,957 | ) | | | (1,173 | ) | | (5,902 | ) | | 47,809 |

| | (16,380 | ) | | (17,300 | ) |

| | Noncontrolling interests - continuing operations | 60 |

| | 57 |

| | | 33 |

| | 27 |

| | 41 |

| | 34 |

| | 20 |

|

| | Noncontrolling interests - discontinued operations | (28 | ) | | 7 |

| | | (11 | ) | | (17 | ) | | (118 | ) | | (9 | ) | | 1 |

|

| | Accretion of Series A Convertible Preferred Stock | — |

| | — |

| | | — |

| | — |

| | (1,926 | ) | | — |

| | — |

|

| Net income (loss) attributable to common stockholders | $ | (7,043 | ) | | $ | (46,893 | ) | | | $ | (1,151 | ) | | $ | (5,892 | ) | | $ | 45,806 |

| | $ | (16,355 | ) | | $ | (17,279 | ) |

| | | | | | | | | | | | | | | |

| Basic and diluted weighted average common shares outstanding (1) | 49,892,390 |

| | 49,874,423 |

| | | 49,893,330 |

| | 49,891,436 |

| | 49,877,350 |

| | 49,877,350 |

| | 49,877,350 |

|

| Basic and diluted earnings (loss) per common share: | | | | | | | | | | | | | | |

| | Continuing operations (1) | $ | (0.46 | ) | | $ | (0.79 | ) | | | $ | (0.14 | ) | | $ | (0.32 | ) | | $ | (0.45 | ) | | $ | (0.29 | ) | | $ | (0.28 | ) |

| | Discontinued operations (1) | 0.32 |

| | (0.15 | ) | | | 0.12 |

| | 0.20 |

| | 1.37 |

| | (0.04 | ) | | (0.07 | ) |

| Basic and diluted earnings (loss) per common share (1) | $ | (0.14 | ) | | $ | (0.94 | ) | | | $ | (0.02 | ) | | $ | (0.12 | ) | | $ | 0.92 |

| | $ | (0.33 | ) | | $ | (0.35 | ) |

| Net income (loss) attributable to common stockholders: | | | | | | |

| | Continuing operations | $ | (23,067 | ) | | $ | (39,615 | ) | | | $ | (7,096 | ) | | $ | (15,971 | ) | | $ | (22,637 | ) | | $ | (14,397 | ) | | $ | (14,089 | ) |

| | Discontinued operations | 16,024 |

| | (7,278 | ) | | | 5,945 |

| | 10,079 |

| | 68,443 |

| | (1,958 | ) | | (3,190 | ) |

| Net income (loss) attributable to common stockholders | $ | (7,043 | ) | | $ | (46,893 | ) | | | $ | (1,151 | ) | | $ | (5,892 | ) | | $ | 45,806 |

| | $ | (16,355 | ) | | $ | (17,279 | ) |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| (1) All periods presented have been adjusted to reflect the one-for-six reverse stock split that occurred on June 2, 2015. |

|

| | |

Supplemental Operating and Financial Data | TIER REIT | 2nd Quarter Page 5 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Consolidated Statements of Discontinued Operations |

| (in thousands) |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | Six Months Ended | | | Three Months Ended |

| | | 30-Jun-15 | | 30-Jun-14 | | | 30-Jun-15 | | 31-Mar-15 | | 31-Dec-14 | | 30-Sep-14 | | 30-Jun-14 |

| | | | | | | | | | | | | | | | |

| Revenue | | | | | | | | | | | | | | |

| | Rental income | $ | 4,111 |

| | $ | 26,936 |

| | | $ | (92 | ) | | $ | 4,203 |

| | $ | 11,358 |

| | $ | 12,946 |

| | $ | 13,451 |

|

| | Straight-line rent revenue adjustment | 455 |

| | (11 | ) | | | (32 | ) | | 487 |

| | 454 |

| | (406 | ) | | 55 |

|

| | Lease incentives | — |

| | (207 | ) | | | — |

| | — |

| | (102 | ) | | (109 | ) | | (102 | ) |

| | Above- and below-market rent amortization | — |

| | 447 |

| | | — |

| | — |

| | 188 |

| | 195 |

| | 222 |

|

| | Lease termination fees | — |

| | 239 |

| | | — |

| | — |

| | 149 |

| | 116 |

| | 164 |

|

| | Total revenue | 4,566 |

| | 27,404 |

| | | (124 | ) | | 4,690 |

| | 12,047 |

| | 12,742 |

| | 13,790 |

|

| | | | | | | | | | | | | | | | |

| Expenses | | | | | | | | | | | | | | |

| | Property related expenses | 1,723 |

| | 8,359 |

| | | 22 |

| | 1,701 |

| | 3,909 |

| | 4,295 |

| | 3,833 |

|

| | Real estate taxes | 633 |

| | 4,869 |

| | | (83 | ) | | 716 |

| | 2,334 |

| | 2,171 |

| | 2,293 |

|

| | Property management fees | 121 |

| | 816 |

| | | 14 |

| | 107 |

| | 309 |

| | 374 |

| | 398 |

|

| | Total property operating expenses | 2,477 |

| | 14,044 |

| | | (47 | ) | | 2,524 |

| | 6,552 |

| | 6,840 |

| | 6,524 |

|

| | | | | | | | | | | | | | | | |

| | Interest expense | 707 |

| | 8,814 |

| | | 44 |

| | 663 |

| | 3,362 |

| | 4,455 |

| | 4,423 |

|

| | Amortization of deferred financing costs | 14 |

| | 187 |

| | | — |

| | 14 |

| | 75 |

| | 113 |

| | 93 |

|

| | Amortization of mark to market | (1 | ) | | 1 |

| | | — |

| | (1 | ) | | — |

| | 1 |

| | 1 |

|

| | Total interest expense | 720 |

| | 9,002 |

| | | 44 |

| | 676 |

| | 3,437 |

| | 4,569 |

| | 4,517 |

|

| | | | | | | | | | | | | | | | |

| | Real estate depreciation and amortization | — |

| | 11,639 |

| | | — |

| | — |

| | 5,499 |

| | 6,360 |

| | 5,938 |

|

| Total expenses | 3,197 |

| | 34,685 |

| | | (3 | ) | | 3,200 |

| | 15,488 |

| | 17,769 |

| | 16,979 |

|

| | | | | | | | | | | | | | | | |

| | Interest and other income (expense) | — |

| | (4 | ) | | | — |

| | — |

| | (3 | ) | | (2 | ) | | (2 | ) |

| | Loss on early extinguishment of debt | — |

| | — |

| | | — |

| | — |

| | (14,190 | ) | | (946 | ) | | — |

|

| Income (loss) before gain on sale | | | | | | | | | | | | | | |

| | of discontinued operations | 1,369 |

| | (7,285 | ) | | | (121 | ) | | 1,490 |

| | (17,634 | ) | | (5,975 | ) | | (3,191 | ) |

| | Gain on sale of discontinued operations | 14,683 |

| | — |

| | | 6,077 |

| | 8,606 |

| | 86,195 |

| | 4,026 |

| | — |

|

| Income (loss) from discontinued operations | $ | 16,052 |

| | $ | (7,285 | ) | | | $ | 5,956 |

| | $ | 10,096 |

| | $ | 68,561 |

| | $ | (1,949 | ) | | $ | (3,191 | ) |

|

| | |

Supplemental Operating and Financial Data | TIER REIT | 2nd Quarter Page 6 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Calculation of FFO and FAD |

| (in thousands, except per share data) |

| | | | | | | | |

| | | | | | | | |

| | | Six Months Ended | | | Three Months Ended |

| Funds from operations (FFO) | 30-Jun-15 | | 30-Jun-14 | | | 30-Jun-15 | | 31-Mar-15 | | 31-Dec-14 | | 30-Sep-14 | | 30-Jun-14 |

| | | | | | | | | | | | | | | | |

| Net income (loss) | $ | (7,075 | ) | | $ | (46,957 | ) | | | $ | (1,173 | ) | | $ | (5,902 | ) | | $ | 47,809 |

| | $ | (16,380 | ) | | $ | (17,300 | ) |

| Net (income) loss attributable to noncontrolling interests | 32 |

| | 64 |

| | | 22 |

| | 10 |

| | (77 | ) | | 25 |

| | 21 |

|

| Accretion of Series A Convertible Preferred Stock | — |

| | — |

| | | — |

| | — |

| | (1,926 | ) | | — |

| | — |

|

| Adjustments (1): | | | | | | | | | | | | | | |

| | Real estate depreciation and amortization - consolidated | 61,103 |

| | 69,742 |

| | | 31,081 |

| | 30,022 |

| | 37,181 |

| | 36,245 |

| | 35,120 |

|

| | Real estate depreciation and amortization - unconsolidated joint ventures | 2,654 |

| | 2,579 |

| | | 1,367 |

| | 1,287 |

| | 1,307 |

| | 1,275 |

| | 1,278 |

|

| | Impairment of depreciable real estate assets | 132 |

| | 8,225 |

| | | — |

| | 132 |

| | 4,940 |

| | — |

| | — |

|

| | Gain on sale of depreciable real estate | (59,247 | ) | | — |

| | | (50,641 | ) | | (8,606 | ) | | (86,195 | ) | | (4,026 | ) | | — |

|

| | Taxes associated with sale of depreciable assets | 1,264 |

| | — |

| | | 1,264 |

| | — |

| | — |

| | — |

| | — |

|

| | Noncontrolling interests (OP units & vested restricted stock units) share of above adjustments | (10 | ) | | (117 | ) | | | 29 |

| | (39 | ) | | 68 |

| | (68 | ) | | (53 | ) |

| FFO attributable to common stockholders | $ | (1,147 | ) | | $ | 33,536 |

| | | $ | (18,051 | ) | | $ | 16,904 |

| | $ | 3,107 |

| | $ | 17,071 |

| | $ | 19,066 |

|

| | | | | | | | | | | | | | | |

| FFO, excluding certain items | | | | | | | | | | | | | | |

| FFO attributable to common stockholders | $ | (1,147 | ) | | $ | 33,536 |

| | | $ | (18,051 | ) | | $ | 16,904 |

| | $ | 3,107 |

| | $ | 17,071 |

| | $ | 19,066 |

|

| Adjustments (1): | | | | | | | | | | | | | | |

| | Acquisition expenses | 1,195 |

| | — |

| | | 1,193 |

| | 2 |

| | 86 |

| | 4 |

| | — |

|

| | Listing costs | 2,991 |

| | — |

| | | 2,488 |

| | 503 |

| | 104 |

| | — |

| | — |

|

| | Loss on early extinguishment of debt | 21,448 |

| | — |

| | | 21,412 |

| | 36 |

| | 14,616 |

| | 946 |

| | — |

|

| | BHT Advisors termination fee and HPT Management buyout fee | 10,200 |

| | — |

| | | 10,200 |

| | — |

| | — |

| | — |

| | — |

|

| | Noncontrolling interests (OP units & vested restricted stock units) share of above adjustments | (62 | ) | | — |

| | | (61 | ) | | (1 | ) | | (24 | ) | | (1 | ) | | — |

|

| FFO attributable to common stock holders, excluding certain items | $ | 34,625 |

| | $ | 33,536 |

| | | $ | 17,181 |

| | $ | 17,444 |

| | $ | 17,889 |

| | $ | 18,020 |

| | $ | 19,066 |

|

| | | | | | | | | | | | | | | |

| Funds available for distribution (FAD) | | | | | | | | | | | | | | |

| FFO attributable to common stock holders | $ | (1,147 | ) | | $ | 33,536 |

| | | $ | (18,051 | ) | | $ | 16,904 |

| | $ | 3,107 |

| | $ | 17,071 |

| | $ | 19,066 |

|

| Adjustments (1): | | | | | | | | | | | | | | |

| | Recurring capital expenditures | (27,314 | ) | | (33,827 | ) | | | (14,067 | ) | | (13,247 | ) | | (19,468 | ) | | (16,056 | ) | | (15,864 | ) |

| | Straight-line rent adjustments | (7,219 | ) | | (3,411 | ) | | | (4,369 | ) | | (2,850 | ) | | (3,141 | ) | | (411 | ) | | (1,646 | ) |

| | Above- and below-market rent amortization | (2,722 | ) | | (2,460 | ) | | | (1,433 | ) | | (1,289 | ) | | (1,244 | ) | | (827 | ) | | (1,210 | ) |

| | Amortization of deferred financing fees and mark to market | 1,834 |

| | 1,451 |

| | | 898 |

| | 936 |

| | 982 |

| | 831 |

| | 823 |

|

| | Amortization of restricted shares and units | 1,099 |

| | 665 |

| | | 564 |

| | 535 |

| | 363 |

| | 369 |

| | 311 |

|

| | Acquisition expenses | 1,195 |

| | — |

| | | 1,193 |

| | 2 |

| | 86 |

| | 4 |

| | — |

|

| | Listing costs | 2,991 |

| | — |

| | | 2,488 |

| | 503 |

| | 104 |

| | — |

| | — |

|

| | Loss on early extinguishment of debt | 21,448 |

| | — |

| | | 21,412 |

| | 36 |

| | 14,616 |

| | 946 |

| | — |

|

| | BHT Advisors termination fee and HPT Management buyout fee | 10,200 |

| | — |

| | | 10,200 |

| | — |

| | — |

| | — |

| | — |

|

| | Noncontrolling interests (OP units & vested restricted stock units) share of above adjustments | 15 |

| | 54 |

| | | (11 | ) | | 26 |

| | 13 |

| | 31 |

| | 25 |

|

| | Accretion of Series A Convertible Preferred Stock | — |

| | — |

| | | — |

| | — |

| | 1,926 |

| | — |

| | — |

|

| FAD attributable to common stockholders | $ | 380 |

| | $ | (3,992 | ) | | | $ | (1,176 | ) | | $ | 1,556 |

| | $ | (2,656 | ) | | $ | 1,958 |

| | $ | 1,505 |

|

| | | | | | | | | | | | | | | |

| Weighted average common shares outstanding - basic (2) | 49,892 |

| | 49,874 |

| | | 49,893 |

| | 49,891 |

| | 49,877 |

| | 49,877 |

| | 49,877 |

|

| Weighted average common shares outstanding - diluted (2) | 50,076 |

| | 50,001 |

| | | 50,085 |

| | 50,066 |

| | 49,996 |

| | 49,996 |

| | 49,937 |

|

| | | | | | | | | | | | | | | |

| Diluted FFO per common share (2) (3) | $ | (0.02 | ) | | $ | 0.67 |

| | | $ | (0.36 | ) | | $ | 0.34 |

| | $ | 0.06 |

| | $ | 0.34 |

| | $ | 0.38 |

|

| Diluted FFO, excluding certain items per common share (2) (3) | $ | 0.69 |

| | $ | 0.67 |

| | | $ | 0.34 |

| | $ | 0.35 |

| | $ | 0.36 |

| | $ | 0.36 |

| | $ | 0.38 |

|

| Diluted FAD per common share (2) (3) | $ | 0.01 |

| | $ | (0.08 | ) | | | $ | (0.02 | ) | | $ | 0.03 |

| | $ | (0.05 | ) | | $ | 0.04 |

| | $ | 0.03 |

|

| | | | | | | | | | | | | | | | |

|

| | | | | | | | | | | | | |

| (1) Adjustments represent our pro rata share of consolidated and unconsolidated amounts, including discontinued operations. |

| (2) All periods presented have been adjusted to reflect the one-for-six reverse stock split that occurred on June 2, 2015. |

| (3) There are no dilutive securities for purposes of calculating diluted FFO per common share and diluted FAD per common share when FFO attributable to common stockholders or FAD attributable to common stockholders are negative. |

|

| | |

Supplemental Operating and Financial Data | TIER REIT | 2nd Quarter Page 7 |

|

| | | | | | | | | | | | | | | | | | | | |

| Calculation of EBITDA |

| (in thousands, except fixed charge coverage) |

| | | |

| | | Three Months Ended |

| | | 30-Jun-15 | | 31-Mar-15 | | 31-Dec-14 | | 30-Sep-14 | | 30-Jun-14 |

| | | | | | | | | | | |

| Net income (loss) attributable to common stockholders | $ | (1,151 | ) | | $ | (5,892 | ) | | $ | 45,806 |

| | $ | (16,355 | ) | | $ | (17,279 | ) |

| | | | | | | | | | | |

| Adjustments: | | | | | | | | | |

| | | | | | | | | | | |

| | Noncontrolling interests (OP units & vested restricted stock units) | (1 | ) | | (10 | ) | | 77 |

| | (36 | ) | | (25 | ) |

| | Accretion of Series A Convertible Preferred Stock | — |

| | — |

| | 1,926 |

| | — |

| | — |

|

| | | | | | | | | | | |

| | Interest expense - consolidated (including discontinued operations) | 14,635 |

| | 16,304 |

| | 19,752 |

| | 20,488 |

| | 20,933 |

|

| | Interest expense - unconsolidated joint ventures | 617 |

| | 615 |

| | 631 |

| | 635 |

| | 633 |

|

| | Amortization of deferred financing costs - consolidated (including discontinued operations) | 899 |

| | 922 |

| | 857 |

| | 767 |

| | 382 |

|

| | Amortization of deferred financing costs - unconsolidated joint ventures | 13 |

| | 13 |

| | 13 |

| | 13 |

| | 12 |

|

| | Mark to market - consolidated (including discontinued operations) | (30 | ) | | (28 | ) | | 82 |

| | 20 |

| | 20 |

|

| | Mark to market - unconsolidated joint ventures | 16 |

| | 17 |

| | 18 |

| | 19 |

| | 20 |

|

| | Total interest expense | 16,150 |

| | 17,843 |

| | 21,353 |

| | 21,942 |

| | 22,000 |

|

| | | | | | | | | | | |

| | Tax (benefit) provision - consolidated (including discontinued operations) | 1,338 |

| | (76 | ) | | (73 | ) | | 36 |

| | (59 | ) |

| | Tax (benefit) provision - unconsolidated joint ventures | 1 |

| | 2 |

| | 3 |

| | (1 | ) | | 1 |

|

| | | | | | | | | | | |

| | Depreciation and amortization - consolidated (including discontinued operations) | 31,081 |

| | 30,022 |

| | 37,181 |

| | 36,245 |

| | 35,120 |

|

| | Depreciation and amortization - unconsolidated joint ventures | 1,367 |

| | 1,287 |

| | 1,307 |

| | 1,275 |

| | 1,278 |

|

| | | | | | | | | | | |

| | Impairment losses | — |

| | 132 |

| | 4,940 |

| | — |

| | — |

|

| | Gain on sale of real estate | (50,641 | ) | | (8,606 | ) | | (86,195 | ) | | (4,026 | ) | | — |

|

| | Loss on early extinguishment of debt | 21,412 |

| | 36 |

| | 14,616 |

| | 946 |

| | — |

|

| EBITDA | 19,556 |

| | 34,738 |

| | 40,941 |

| | 40,026 |

| | 41,036 |

|

| | | | | | | | | | | |

| Adjustments: | | | | | | | | | |

| | Costs incurred in connection with listing activities | 2,488 |

| | 503 |

| | 104 |

| | — |

| | — |

|

| | Acquisition expenses | 1,193 |

| | 2 |

| | 86 |

| | 4 |

| | — |

|

| | Non-cash write-off of tenant receivables | 2 |

| | 1,829 |

| | 163 |

| | 64 |

| | 54 |

|

| | BHT Advisors termination fee and HPT Management buyout fee | 10,200 |

| | — |

| | — |

| | — |

| | — |

|

| Normalized EBITDA | 33,439 |

| | 37,072 |

| | 41,294 |

| | 40,094 |

| | 41,090 |

|

| | | | | | | | | | | |

| Adjustments: | | | | | | | | | |

| | EBITDA from properties disposed before period end | (2,933 | ) | | (1,488 | ) | | (2,974 | ) | | (336 | ) | | (16 | ) |

| | Full quarter adjustment for acquired properties | — |

| | — |

| | 723 |

| | — |

| | — |

|

| Normalized estimated full period EBITDA from properties owned at period end | $ | 30,506 |

| | $ | 35,584 |

| | $ | 39,043 |

| | $ | 39,758 |

| | $ | 41,074 |

|

| | | | | | | | | | | |

| Fixed charges | | | | | | | | | |

| | Interest expense | $ | 16,150 |

| | $ | 17,843 |

| | $ | 21,353 |

| | $ | 21,942 |

| | $ | 22,000 |

|

| | Capitalized interest incurred (1) | 132 |

| | 176 |

| | 338 |

| | 428 |

| | 427 |

|

| | Interest expense | 16,282 |

| | 18,019 |

| | 21,691 |

| | 22,370 |

| | 22,427 |

|

| | Principal payments (excludes debt payoff) | 2,498 |

| | 3,059 |

| | 5,038 |

| | 5,026 |

| | 4,867 |

|

| Fixed charges | $ | 18,780 |

| | $ | 21,078 |

| | $ | 26,729 |

| | $ | 27,396 |

| | $ | 27,294 |

|

| | | | | | | | | | | |

| Normalized Interest coverage | 2.05 |

| | 2.06 |

| | 1.9 |

| | 1.79 |

| | 1.83 |

|

| Normalized Fixed charge coverage | 1.78 |

| | 1.76 |

| | 1.54 |

| | 1.46 |

| | 1.51 |

|

______________________

(1) Excludes capitalized interest funded from Two BriarLake Plaza construction loan.

|

| | |

Supplemental Operating and Financial Data | TIER REIT | 2nd Quarter Page 8 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Joint Venture Financial Summary |

| As of and for the Quarter Ended June 30, 2015 |

| (dollars in thousands) |

| | | | | | | | | |

| | | Unconsolidated Joint Ventures at | | Consolidated Joint Ventures at |

| | | TIER REIT Ownership Share | | TIER REIT Ownership Share |

| | | Paces West | | Wanamaker Building | | 1325 G Street | | Colorado Building | | | | Legacy Land | | 208 Nueces Street | | |

| Ownership % during the period | 10.00% | | 60.00% | | 10.00% | | 10.00% | | | | 95% | | 95% | | |

| Ownership % at period end | 10.00% | | 60.00% | | 10.00% | | 10.00% | | Total | | 95% | | 95% | | Total |

| Results of Operations | | | | | | | | | | | | | | | |

| Rental income | $ | 296 |

| | $ | 3,821 |

| | $ | 2 |

| | $ | 1 |

| | $ | 4,120 |

| | — |

| | — |

| | — |

|

| Straight-line rent revenue adjustment | 21 |

| | 34 |

| | — |

| | — |

| | 55 |

| | — |

| | — |

| | — |

|

| Above- and below-market rent amortization | (3 | ) | | 101 |

| | — |

| | — |

| | 98 |

| | — |

| | — |

| | — |

|

| Lease termination fees | — |

| | — |

| | 36 |

| | — |

| | 36 |

| | — |

| | — |

| | — |

|

| Other income | 1 |

| | 41 |

| | — |

| | — |

| | 42 |

| | — |

| | — |

| | — |

|

| | Total revenue | 315 |

| | 3,997 |

| | 38 |

| | 1 |

| | 4,351 |

| | — |

| | — |

| | — |

|

| | | | | | | | | | | | | | | | | |

| Property related expenses | 100 |

| | 1,351 |

| | 1 |

| | 1 |

| | 1,453 |

| | — |

| | 13 |

| | 13 |

|

| Real estate taxes | 25 |

| | 377 |

| | — |

| | — |

| | 402 |

| | 1 |

| | 5 |

| | 6 |

|

| Property management fees | 9 |

| | 114 |

| | — |

| | — |

| | 123 |

| | — |

| | 5 |

| | 5 |

|

| | NOI | 181 |

| | 2,155 |

| | 37 |

| | — |

| | 2,373 |

| | (1 | ) | | (23 | ) | | (24 | ) |

| | | | | | | | | — |

| | | | | | | | |

| Interest expense | 89 |

| | 527 |

| | 1 |

| | — |

| | 617 |

| | — |

| | — |

| | — |

|

| Amortization of deferred financing costs | 3 |

| | 21 |

| | — |

| | — |

| | 24 |

| | — |

| | — |

| | — |

|

| Amortization of mark to market | — |

| | 16 |

| | — |

| | — |

| | 16 |

| | — |

| | — |

| | — |

|

| Real estate depreciation and amortization | 168 |

| | 1,199 |

| | — |

| | — |

| | 1,367 |

| | — |

| | — |

| | — |

|

| Interest income and other expense | — |

| | 7 |

| | — |

| | — |

| | 7 |

| | — |

| | — |

| | — |

|

| Acquisition expenses | — |

| | — |

| | 297 |

| | 102 |

| | 399 |

| | — |

| | 361 |

| | 361 |

|

| Provision for income taxes | — |

| | 1 |

| | — |

| | — |

| | 1 |

| | — |

| | — |

| | — |

|

| | Net income (loss) | (79 | ) | | 384 |

| | (261 | ) | | (102 | ) | | (58 | ) | | (1 | ) | | (384 | ) | | (385 | ) |

| | | | | | | — |

| | — |

| | | | | | | | |

| Intercompany eliminations | | | | | | | | | | | | | | | |

| Eliminate amortization of deferred financing costs | — |

| | 11 |

| | — |

| | — |

| | 11 |

| | — |

| | — |

| | — |

|

| Eliminate property management fees | 1 |

| | 114 |

| | — |

| | — |

| | 115 |

| | — |

| | — |

| | — |

|

| | Adjusted net income (loss) | (78 | ) | | 509 |

| | (261 | ) | | (102 | ) | | 68 |

| | (1 | ) | | (384 | ) | | (385 | ) |

| Adjustments: | | | | | — |

| | — |

| | | | | | | | |

| | Real estate depreciation and amortization | 168 |

| | 1,199 |

| | — |

| | — |

| | 1,367 |

| | — |

| | — |

| | — |

|

| Funds from operations | 90 |

| | 1,708 |

| | (261 | ) | | (102 | ) | | 1,435 |

| | (1 | ) | | (384 | ) | | (385 | ) |

| | | | | | | | | | | | | | | | |

| Balance Sheet Information | | | | | | | | | | | | | | | |

| Real estate book value | $ | 6,641 |

| | $ | 100,914 |

| | $ | 15,004 |

| | $ | 4,763 |

| | $ | 127,322 |

| | 6,058 |

| | 8,232 |

| | 14,290 |

|

| Accumulated depreciation | (670 | ) | | (22,637 | ) | | — |

| | — |

| | (23,307 | ) | | — |

| | — |

| | — |

|

| Real estate book value after depreciation | $ | 5,971 |

| | $ | 78,277 |

| | $ | 15,004 |

| | $ | 4,763 |

| | $ | 104,015 |

| | $ | 6,058 |

| | $ | 8,232 |

| | $ | 14,290 |

|

| | | | | | | | | | | | | | | | |

| Cash and cash equivalents | $ | 48 |

| | $ | 2,290 |

| | $ | 463 |

| | $ | 567 |

| | $ | 3,368 |

| | $ | 178 |

| | $ | 1,078 |

| | $ | 1,256 |

|

| Assets | $ | 8,085 |

| | $ | 99,284 |

| | $ | 15,599 |

| | $ | 5,373 |

| | $ | 128,341 |

| | $ | 6,237 |

| | $ | 10,289 |

| | $ | 16,526 |

|

| Debt (1) | $ | 6,500 |

| | $ | 51,763 |

| | $ | 9,500 |

| | $ | 3,400 |

| | $ | 71,163 |

| | $ | — |

| | $ | — |

| | $ | — |

|

| Equity (2) | $ | 1,161 |

| | $ | 37,978 |

| | $ | 4,612 |

| | $ | 1,029 |

| | $ | 44,780 |

| | $ | 6,174 |

| | $ | 10,065 |

| | $ | 16,239 |

|

| ______________________________ | | | | | | |

| (1) | All joint venture debt is non-recourse. Debt is shown net of mark to market adjustments. | | | | | | |

| (2) | Equity for 1325 G Street and Colorado Building have been reduced by $1.2 million and $0.6 million of deferred gain, respectively. |

|

| | |

Supplemental Operating and Financial Data | TIER REIT | 2nd Quarter Page 9 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Same Store Analysis |

| (in thousands, except property count) |

| | | | | | | | | | |

| | | Three Months Ended | | Six Months Ended | |

| Same Store GAAP NOI: | 30-Jun-15 | | 30-Jun-14 | | Favorable/ (Unfavorable) | | 30-Jun-15 | | 30-Jun-14 | | Favorable/ (Unfavorable) | |

| Revenues: | | | | | | | | | | | | |

| Total revenue | $ | 60,706 |

| | $ | 59,102 |

| | $ | 1,604 |

| | $ | 120,968 |

| | $ | 117,189 |

| | $ | 3,779 |

| |

| Less: Lease termination fees | 125 |

| | 576 |

| | (451 | ) | | 670 |

| | 696 |

| | (26 | ) | |

| | | 60,581 |

| | 58,526 |

| | 2,055 |

| 3.5 | % | 120,298 |

| | 116,493 |

| | 3,805 |

| 3.3 | % |

| Expenses: | | | | | | | | | | | | |

| Property operating expenses (less tenant improvement demolition costs) | 18,063 |

| | 18,731 |

| | 668 |

| 3.6 | % | 37,503 |

| | 37,608 |

| | 105 |

| 0.3 | % |

| Real estate taxes | 9,164 |

| | 8,634 |

| | (530 | ) | -6.1 | % | 18,382 |

| | 17,351 |

| | (1,031 | ) | -5.9 | % |

| Property management fees | 1,891 |

| | 1,788 |

| | (103 | ) | -5.8 | % | 3,825 |

| | 3,578 |

| | (247 | ) | -6.9 | % |

| Property expenses | 29,118 |

| | 29,153 |

| | 35 |

| 0.1 | % | 59,710 |

| | 58,537 |

| | (1,173 | ) | -2.0 | % |

| Same Store GAAP NOI | $ | 31,463 |

| | $ | 29,373 |

| | $ | 2,090 |

| 7.1 | % | $ | 60,588 |

| | $ | 57,956 |

| | $ | 2,632 |

| 4.5 | % |

| Same Store Cash NOI: | | | | | | | | | | | | |

| Less: | | | | | | | | | | | | |

| Straight-line rent adjustments | 2,673 |

| | 875 |

| | 1,798 |

| | 2,969 |

| | 2,067 |

| | 902 |

| |

| Above- and below-market rent amortization | 1,192 |

| | 926 |

| | 266 |

| | 2,275 |

| | 1,895 |

| | 380 |

| |

| Same Store Cash NOI | $ | 27,598 |

| | $ | 27,572 |

| | $ | 26 |

| 0.1 | % | $ | 55,344 |

| | $ | 53,994 |

| | $ | 1,350 |

| 2.5 | % |

| | | | | | | | | | | | | | |

| Occupancy % at period end (% owned) | 88.7 | % | | 85.8 | % | | | | 88.7 | % | | 85.8 | % | | | |

| | | | | | | | | | | | | | |

| Consolidated operating properties | 26 |

| | | | | | 26 |

| | | | | |

| Rentable square feet (% owned) | 9,278 |

| | | | | | 9,278 |

| | | | | |

| | | | | | | | | | | | | | |

| Same Store GAAP NOI and Same Store Cash NOI reconciliation: | | | | | | | | | | | | |

| Net loss | $ | (1,173 | ) | | $ | (17,300 | ) | | | | $ | (7,075 | ) | | $ | (46,957 | ) | | | |

| Adjustments: | | | | | | | | | | | | |

| Interest expense | 15,460 |

| | 16,818 |

| | | | 31,982 |

| | 33,414 |

| | | |

| Asset impairment losses | — |

| | — |

| | | | 132 |

| | 8,225 |

| | | |

| Tenant improvement demolition costs | — |

| | 245 |

| | | | 52 |

| | 989 |

| | | |

| General and administrative | 15,612 |

| | 4,300 |

| | | | 20,993 |

| | 8,646 |

| | | |

| Listing costs | 2,488 |

| | — |

| | | | 2,991 |

| | — |

| | | |

| Amortization of restricted shares and units | 564 |

| | 311 |

| | | | 1,099 |

| | 665 |

| | | |

| Straight-line rent expense adjustment | (7 | ) | | (5 | ) | | | | (14 | ) | | (10 | ) | | | |

| Acquisition expense | 813 |

| | — |

| | | | 815 |

| | — |

| | | |

| Real estate depreciation and amortization | 31,081 |

| | 29,182 |

| | | | 61,103 |

| | 58,103 |

| | | |

| Interest and other income | (141 | ) | | (96 | ) | | | | (286 | ) | | (344 | ) | | | |

| Loss on early extinguishment of debt | 21,412 |

| | — |

| | | | 21,448 |

| | — |

| | | |

| Provision (benefit) for income taxes | 1,338 |

| | (59 | ) | | | | 1,262 |

| | 9 |

| | | |

| Equity in operations of investments | (69 | ) | | (795 | ) | | | | (312 | ) | | (883 | ) | | | |

| (Income) loss from discontinued operations | 121 |

| | 3,191 |

| | | | (1,369 | ) | | 7,285 |

| | | |

| Gain on sale of discontinued operations | (6,077 | ) | | — |

| | | | (14,683 | ) | | — |

| | | |

| Gain on sale of assets | (44,564 | ) | | — |

| | | | (44,564 | ) | | — |

| | | |

| Net operating income of non-same store properties | (5,270 | ) | | (5,843 | ) | | | | (12,316 | ) | | (10,490 | ) | | | |

| Lease termination fees | (125 | ) | | (576 | ) | | | | (670 | ) | | (696 | ) | | | |

| Same Store GAAP NOI | 31,463 |

| | 29,373 |

| | | | 60,588 |

| | 57,956 |

| | | |

| Straight-line rent revenue adjustment | (2,673 | ) | | (875 | ) | | | | (2,969 | ) | | (2,067 | ) | | | |

| Above- and below-market rent amortization | (1,192 | ) | | (926 | ) | | | | (2,275 | ) | | (1,895 | ) | | | |

| Same Store Cash NOI | $ | 27,598 |

| | $ | 27,572 |

| | | | $ | 55,344 |

| | $ | 53,994 |

| | | |

|

| | |

Supplemental Operating and Financial Data | TIER REIT | 2nd Quarter Page 10 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Schedule of Properties Owned |

| as of June 30, 2015 |

| (in thousands, except average effective rent $/RSF) |

| | | | | | | | | | | | | | | |

| | | | | Rentable SF (100%) | | Rentable SF (own %) | | | | Average Effective Rent | | Average Effective Rent $/RSF | | | | % Average Effective Rent (own %) |

| | | | | | | Occupancy % | | | | % of NRA (own %) | |

| Property (% owned, if not 100%) | | Location | | | | | | | |

| Terrace Office Park | | Austin, TX | | 619 |

| | 619 |

| | 93.2 | % | | $ | 20,886 |

| | $ | 36.18 |

| | 5.9 | % | | 9.0 | % |

| Austin | | | | 619 |

| | 619 |

| | 93.2 | % | | 20,886 |

| | $ | 36.18 |

| | 5.9 | % | | 9.0 | % |

| | | | | | | | | | | | | | | | | |

| 5950 Sherry Lane | | Dallas, TX | | 197 |

| | 197 |

| | 72.6 | % | | 4,903 |

| | $ | 34.32 |

| | 1.9 | % | | 2.1 | % |

| Burnett Plaza | | Fort Worth, TX | | 1,025 |

| | 1,025 |

| | 85.4 | % | | 17,460 |

| | $ | 19.95 |

| | 9.8 | % | | 7.6 | % |

| Centreport Office Center | | Fort Worth, TX | | 133 |

| | 133 |

| | 100.0 | % | | 2,503 |

| | $ | 18.78 |

| | 1.3 | % | | 1.1 | % |

| Dallas/Fort Worth | | | | 1,355 |

| | 1,355 |

| | 84.9 | % | | 24,866 |

| | $ | 21.60 |

| | 13.0 | % | | 10.8 | % |

| | | | | | | | | | | | | | | | | |

| Loop Central | | Houston, TX | | 575 |

| | 575 |

| | 94.3 | % | | 9,392 |

| | $ | 17.32 |

| | 5.5 | % | | 4.1 | % |

| One & Two Eldridge Place | | Houston, TX | | 519 |

| | 519 |

| | 99.2 | % | | 17,082 |

| | $ | 33.14 |

| | 5.0 | % | | 7.4 | % |

| One BriarLake Plaza | | Houston, TX | | 502 |

| | 502 |

| | 97.2 | % | | 20,760 |

| | $ | 42.58 |

| | 4.8 | % | | 9.0 | % |

| Three Eldridge Place | | Houston, TX | | 305 |

| | 305 |

| | 80.3 | % | | 9,985 |

| | $ | 40.72 |

| | 2.9 | % | | 4.3 | % |

| Houston | | | | 1,901 |

| | 1,901 |

| | 94.2 | % | | 57,219 |

| | $ | 31.96 |

| | 18.2 | % | | 24.8 | % |

| | | | | | | | | | | | | | | | | |

| Paces West (10%) | | Atlanta, GA | | 646 |

| | 65 |

| | 83.1 | % | | 1,142 |

| | $ | 21.21 |

| | 0.6 | % | | 0.5 | % |

| Atlanta | | | | 646 |

| | 65 |

| | 83.1 | % | | 1,142 |

| | $ | 21.21 |

| | 0.6 | % | | 0.5 | % |

| | | | | | | | | | | | | | | | | |

| Bank of America Plaza | | Charlotte, NC | | 891 |

| | 891 |

| | 89.2 | % | | 18,002 |

| | $ | 22.66 |

| | 8.6 | % | | 7.8 | % |

| Charlotte | | | | 891 |

| | 891 |

| | 89.2 | % | | 18,002 |

| | $ | 22.66 |

| | 8.6 | % | | 7.8 | % |

| | | | | | | | | | | | | | | | | |

| Buena Vista Plaza | | Burbank, CA | | 115 |

| | 115 |

| | 100.0 | % | | 211 |

| | $ | 1.83 |

| | 1.1 | % | | 0.1 | % |

| Los Angeles | | | | 115 |

| | 115 |

| | 100.0 | % | | 211 |

| | $ | 1.83 |

| | 1.1 | % | | 0.1 | % |

| | | | | | | | | | | | | | | | | |

| Forum Office Park | | Louisville, KY | | 328 |

| | 328 |

| | 98.2 | % | | 5,813 |

| | $ | 18.06 |

| | 3.1 | % | | 2.5 | % |

| Hurstbourne Place | | Louisville, KY | | 235 |

| | 235 |

| | 81.7 | % | | 3,626 |

| | $ | 18.90 |

| | 2.3 | % | | 1.6 | % |

| One Oxmoor Place | | Louisville, KY | | 135 |

| | 135 |

| | 97.0 | % | | 2,904 |

| | $ | 22.09 |

| | 1.3 | % | | 1.3 | % |

| Hurstbourne Park | | Louisville, KY | | 104 |

| | 104 |

| | 99.0 | % | | 2,181 |

| | $ | 21.21 |

| | 1.00 | % | | 0.9 | % |

| Steeplechase Place | | Louisville, KY | | 77 |

| | 77 |

| | 90.9 | % | | 1,173 |

| | $ | 16.77 |

| | 0.7 | % | | 0.5 | % |

| Lakeview | | Louisville, KY | | 76 |

| | 76 |

| | 93.4 | % | | 1,399 |

| | $ | 19.71 |

| | 0.7 | % | | 0.6 | % |

| Hunnington | | Louisville, KY | | 62 |

| | 62 |

| | 85.5 | % | | 604 |

| | $ | 11.40 |

| | 0.6 | % | | 0.3 | % |

| Louisville | | | | 1,017 |

| | 1,017 |

| | 92.6 | % | | 17,700 |

| | $ | 18.79 |

| | 9.8 | % | | 7.7 | % |

| | | | | | | | | | | | | | | | | |

| Plaza at MetroCenter | | Nashville, TN | | 361 |

| | 361 |

| | 92.8 | % | | 5,567 |

| | $ | 16.62 |

| | 3.5 | % | | 2.4 | % |

| Nashville | | | | 361 |

| | 361 |

| | 92.8 | % | | 5,567 |

| | $ | 16.62 |

| | 3.5 | % | | 2.4 | % |

| | | | | | | | | | | | | | | | | |

| 5104 Eisenhower Blvd. | | Tampa, FL | | 130 |

| | 130 |

| | 100.0 | % | | 2,776 |

| | $ | 21.34 |

| | 1.2 | % | | 1.2 | % |

| Tampa | | | | 130 |

| | 130 |

| | 100.0 | % | | 2,776 |

| | $ | 21.34 |

| | 1.2 | % | | 1.2 | % |

| | | | | | | | | | | | | | | | | |

| 801 Thompson | | Rockville, MD | | 51 |

| | 51 |

| | 100.0 | % | | 1,656 |

| | $ | 32.52 |

| | 0.5 | % | | 0.7 | % |

| 1325 G Street (10%) | | Washington, D.C. | | 307 |

| | 31 |

| | 83.9 | % | | 1,022 |

| | $ | 39.30 |

| | 0.3 | % | | 0.4 | % |

| Colorado Building (10%) | | Washington, D.C. | | 128 |

| | 13 |

| | 92.3 | % | | 437 |

| | $ | 38.03 |

| | 0.1 | % | | 0.2 | % |

| Washington, D.C. | | | | 486 |

| | 95 |

| | 93.7 | % | | 3,115 |

| | $ | 35.24 |

| | 0.9 | % | | 1.3 | % |

| | | | | | | | | | | | | | | | | |

| Operating office properties in strategic markets | | | | 7,521 |

| | 6,549 |

| | 91.3 | % | | 151,484 |

| | $ | 25.76 |

| | 62.9 | % | | 65.5 | % |

| | | | | | | | | | | | | | | | | |

| 500 East Pratt | | Baltimore, MD | | 280 |

| | 280 |

| | 98.2 | % | | 9,165 |

| | $ | 33.32 |

| | 2.7 | % | | 4.0 | % |

| Woodcrest Corporate Center | | Cherry Hill, NJ | | 333 |

| | 333 |

| | 90.4 | % | | 6,933 |

| | $ | 23.07 |

| | 3.2 | % | | 3.0 | % |

| 111 Woodcrest | | Cherry Hill, NJ | | 53 |

| | 53 |

| | 84.9 | % | | 937 |

| | $ | 20.82 |

| | 0.5 | % | | 0.4 | % |

| FOUR40 | | Chicago, IL | | 1,041 |

| | 1,041 |

| | 69.2 | % | | 21,088 |

| | $ | 29.27 |

| | 10.0 | % | | 9.1 | % |

| Fifth Third Center | | Columbus, OH | | 331 |

| | 331 |

| | 69.2 | % | | 6,962 |

| | $ | 30.37 |

| | 3.2 | % | | 3.0 | % |

| Wanamaker Building (60%) | | Philadelphia, PA | | 1,390 |

| | 834 |

| | 96.4 | % | | 13,657 |

| | $ | 16.98 |

| | 8.0 | % | | 5.9 | % |

| Three Parkway | | Philadelphia, PA | | 561 |

| | 561 |

| | 93.8 | % | | 10,892 |

| | $ | 20.71 |

| | 5.4 | % | | 4.7 | % |

| Lawson Commons | | St. Paul, MN | | 436 |

| | 436 |

| | 89.2 | % | | 10,001 |

| | $ | 25.70 |

| | 4.2 | % | | 4.3 | % |

| Other operating office properties | | | | 4,425 |

| | 3,869 |

| | 85.0 | % | | 79,635 |

| | $ | 24.21 |

| | 37.1 | % | | 34.5 | % |

| Total operating office properties | | 11,946 |

| | 10,418 |

| | 89.0 | % | | $ | 231,119 |

| | $ | 24.94 |

| | 100.0 | % | | 100.0 | % |

| Non-operating retail property | | | | | | | | | | | | | | |

| Hurstbourne Plaza (1) | | Louisville, KY | | 79 |

| | 79 |

| | 52.0 | % | | | | | | | | |

| Office development property (2) | | | | | | | | | | | | | | |

| Two BriarLake Plaza | | Houston, TX | | 334 |

| | 334 |

| | 60.0 | % | | | | | | | | |

| Total Properties | | | | 12,359 |

| | 10,831 |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| (1) Hurstbourne Plaza is a retail property planned for redevelopment within the Hurstbourne Business Park. |

| (2) Development properties are classified as operating upon the sooner to occur of 90% commenced leasing or one year after major construction is completed. |

| | | | | | | | | | | | | | | | | |

Average effective rent represents 12 times the sum of the monthly contractual amounts for base rent and the pro rata budgeted operating expense reimbursements, as of period end, related to leases in place as of period end, as reduced for free rent and excluding any scheduled future rent increases, as adjusted for our ownership interest. |

|

| | |

Supplemental Operating and Financial Data | TIER REIT | 2nd Quarter Page 11 |

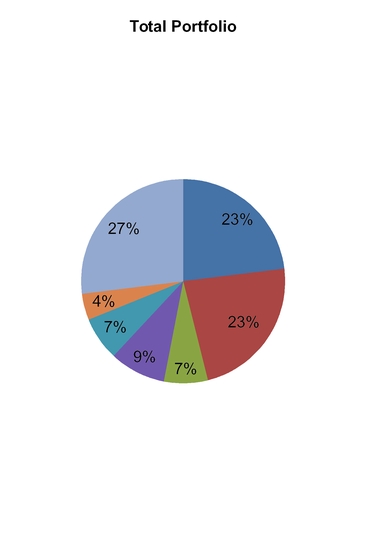

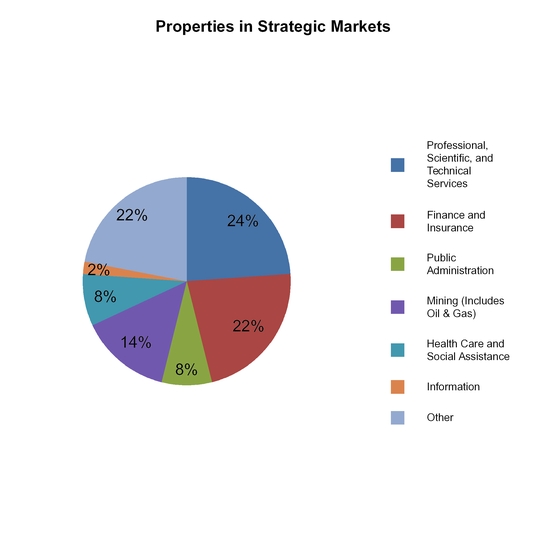

Net Operating Income by Market

|

| | | | | | | | | | | | | | | | |

| Represents TIER REIT’s % ownership of NOI during the current quarter from operating properties owned at period end by market as a % of TIER REIT’s % ownership of total NOI during the current quarter from operating properties owned at period end. |

|

| | |

Supplemental Operating and Financial Data | TIER REIT | 2nd Quarter Page 12 |

|

| | | | | | | |

| Components of Net Asset Value |

| (in thousands) |

| | | | | |

| | | | | Annualized Three Months Ended |

| | | | | 30-Jun-15 |

| Revenue (1) | | | $ | 279,656 |

|

| | Less: | | | |

| | GAAP rent adjustments | | (23,712 | ) |

| | Lease termination fees | | (500 | ) |

| | | | | 255,444 |

|

| Property operating expenses (1) | | (132,532 | ) |

| | Add: | | | |

| | Costs attributable to tenant improvement demolition | | 319 |

|

| | Property management fees (2) | | 6,926 |

|

| Adjusted cash NOI | | 130,157 |

|

| | Less: | | | |

| | Adjusted cash NOI from properties sold during the period | | (13,329 | ) |

| | Adjusted cash NOI from non-stabilized properties (3) | | (23,743 | ) |

| | Add: Adjusted cash NOI from unconsolidated real estate at ownership share | 8,763 |

|

| Total adjusted cash NOI at ownership share (4) | | $ | 101,848 |

|

| | | | | |

| | | | | 30-Jun-15 |

| Non-stabilized real estate properties and land development sites acquired (3) | | |

| | Value of non-stabilized properties as determined by third-party on 10/30/14 | | 567,400 |

|

| | Purchase price of 5950 Sherry Lane and land development sites acquired | | 76,676 |

|

| Total other real estate properties | | $ | 644,076 |

|

| Other tangible assets | | |

| | Cash and cash equivalents | | $ | 153,158 |

|

| | Restricted cash | | 29,620 |

|

| | Accounts receivable (excluding $65.1 million of straight-line rent receivable and deferred lease incentives) | 6,723 |

|

| | Prepaid expenses | | 31,890 |

|

| | Ownership share of other tangible assets in unconsolidated joint ventures | 9,603 |

|

| Total other tangible assets | | $ | 230,994 |

|

| Liabilities | | | |

| | Notes payable | | $ | 505,196 |

|

| | Credit facility | | 525,000 |

|

| | Other liabilities | | 101,789 |

|

| | Ownership share of other liabilities in unconsolidated joint ventures | | 3,371 |

|

| | Ownership share of unconsolidated debt | | 71,163 |

|

| Total liabilities | | $ | 1,206,519 |

|

| | | |

| Total common shares, OP units, and vested restricted stock units outstanding (5) | | 49,948 |

|

| (1 | ) | Includes consolidated operations | | |

| (2 | ) | Represents adjustment made for third-party property management services which was internalized 7/1/2015. | |